Document

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2019

Commission file number: 001-33106

Douglas Emmett, Inc.

(Exact name of registrant as specified in its charter)

|

| |

Maryland | 20-3073047 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

| |

1299 Ocean Avenue, Suite 1000, Santa Monica, California | 90401 |

(Address of principal executive offices) | (Zip Code) |

(310) 255-7700

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer", "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer x | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

Emerging growth company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value per share | | DEI | | New York Stock Exchange |

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | | |

Class | | Outstanding at | April 29, 2019 |

Common Stock, $0.01 par value per share | | 170,284,515 | shares |

DOUGLAS EMMETT, INC. FORM 10-Q

|

| | |

Table of Contents |

| | |

| | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Consolidated Statements of Equity | |

| | |

| | |

| | |

| | |

| Ground Lease | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Abbreviations used in this Report:

|

| |

AOCI | Accumulated Other Comprehensive Income (Loss) |

ASC | Accounting Standards Codification |

ASU | Accounting Standards Update |

ATM | At-the-Market |

BOMA | Building Owners and Managers Association |

CEO | Chief Executive Officer |

CFO | Chief Financial Officer |

Code | Internal Revenue Code of 1986, as amended |

DEI | Douglas Emmett, Inc. |

EPS | Earnings Per Share |

Exchange Act | Securities Exchange Act of 1934, as amended |

FASB | Financial Accounting Standards Board |

FDIC | Federal Deposit Insurance Corporation |

FFO | Funds from Operations |

Fund X | Douglas Emmett Fund X, LLC |

Funds | Unconsolidated institutional real estate funds (Fund X, Partnership X and Opportunity Fund) |

GAAP | Generally Accepted Accounting Principles (United States) |

JV | Joint Venture |

LIBOR | London Interbank Offered Rate |

LTIP Units | Long-Term Incentive Plan Units |

NAREIT | National Association of Real Estate Investment Trusts |

OCI | Other Comprehensive Income (Loss) |

OP Units | Operating Partnership Units |

Operating Partnership | Douglas Emmett Properties, LP |

Opportunity Fund | Fund X Opportunity Fund, LLC |

Partnership X | Douglas Emmett Partnership X, LP |

PCAOB | Public Company Accounting Oversight Board (United States) |

REIT | Real Estate Investment Trust |

Report | Quarterly Report on Form 10-Q |

SEC | Securities and Exchange Commission |

Securities Act | Securities Act of 1933, as amended |

TRS | Taxable REIT subsidiary(ies) |

US | United States |

USD | United States Dollar |

VIE | Variable Interest Entity(ies) |

Defined terms used in this Report:

|

| |

Annualized Rent | Annualized cash base rent (excluding tenant reimbursements, parking and other income) before abatements under leases commenced as of the reporting date. Annualized rent for our triple net office leases is calculated by adding expense reimbursements and estimates of normal building expenses paid by tenants to base rent. Annualized rent does not include lost rent recovered from insurance and rent for building management use. |

Consolidated Portfolio | Includes the properties in our consolidated results, which includes the properties owned by our consolidated JVs. |

Funds From Operations (FFO)

| We calculate FFO in accordance with the standards established by NAREIT by excluding gains (or losses) on sales of investments in real estate, gains (or losses) from changes in control of investments in real estate, real estate depreciation and amortization (other than amortization of right-of-use assets for which we are the lessee and amortization of deferred loan costs) from our net income (including adjusting for the effect of such items attributable to consolidated joint ventures and unconsolidated real estate funds, but not for noncontrolling interests included in our Operating Partnership). FFO is a non-GAAP supplemental financial measure that we report because it is useful to our investors. See Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 2 of this Report for a discussion of FFO. |

Net Operating Income (NOI)

| We calculate NOI as revenue less operating expenses attributable to the properties that we own and operate. NOI is calculated by excluding the following from our net income: general and administrative expense, depreciation and amortization expense, other income, other expense, income, including depreciation, from unconsolidated real estate funds, interest expense, gains (or losses) on sales of investments in real estate and net income attributable to noncontrolling interests. NOI is a non-GAAP supplemental financial measure that we report because it is useful to our investors. See Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 2 of this Report for a discussion of our Same Property NOI. |

Occupancy Rate | The percentage leased, excluding signed leases not yet commenced, as of the reporting date. Management space is considered leased and occupied, while space taken out of service during a repositioning is excluded from both the numerator and denominator for calculating percentage leased and occupied. |

Recurring Capital Expenditures | Building improvements required to maintain revenues once a property has been stabilized, and excludes capital expenditures for (i) acquired buildings being stabilized, (ii) newly developed space, (iii) upgrades to improve revenues or operating expenses, (iv) casualty damage or (v) bringing the property into compliance with governmental requirements. |

Rentable Square Feet

| Based on the BOMA remeasurement and consists of leased square feet (including square feet with respect to signed leases not commenced as of the reporting date), available square feet, building management use square feet and square feet of the BOMA adjustment on leased space. |

Same Properties | Our consolidated properties that have been owned and operated by us in a consistent manner, and reported in our consolidated results during the entire span of both periods being compared. We exclude from our same property subset any properties (i) acquired during the comparative periods; (ii) sold, held for sale, contributed or otherwise removed from our consolidated financial statements during the comparative periods; or (iii) that underwent a major repositioning project that we believed significantly affected its results during the comparative periods. |

Short-Term Leases | Represents leases that expired on or before the reporting date or had a term of less than one year, including hold over tenancies, month to month leases and other short term occupancies. |

Total Portfolio | Includes our Consolidated Portfolio plus the properties owned by our Funds. |

Forward Looking Statements

This Report contains forward-looking statements within the meaning of the Section 27A of the Securities Act and Section 21E of the Exchange Act. You can find many (but not all) of these statements by looking for words such as “believe”, “expect”, “anticipate”, “estimate”, “approximate”, “intend”, “plan”, “would”, “could”, “may”, “future” or other similar expressions in this Report. We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements used in this Report, or those that we make orally or in writing from time to time, are based on our beliefs and assumptions, as well as information currently available to us. Actual outcomes will be affected by known and unknown risks, trends, uncertainties and factors beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution when relying on previously reported forward-looking statements, which were based on results and trends at the time they were made, to anticipate future results or trends. Some of the risks and uncertainties that could cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| |

• | adverse economic or real estate developments affecting Southern California or Honolulu, Hawaii; |

| |

• | competition from other real estate investors in our markets; |

| |

• | decreasing rental rates or increasing tenant incentive and vacancy rates; |

| |

• | defaults on, early terminations of, or non-renewal of leases by tenants; |

| |

• | increases in interest rates or operating costs; |

| |

• | insufficient cash flows to service our outstanding debt or pay rent on ground leases; |

| |

• | difficulties in raising capital; |

| |

• | inability to liquidate real estate or other investments quickly; |

| |

• | adverse changes to rent control laws and regulations; |

| |

• | environmental uncertainties; |

| |

• | insufficient insurance, or increases in insurance costs; |

| |

• | inability to successfully expand into new markets and submarkets; |

| |

• | difficulties in identifying properties to acquire and failure to complete acquisitions successfully; |

| |

• | failure to successfully operate acquired properties; |

| |

• | risks associated with property development; |

| |

• | risks associated with JVs; |

| |

• | conflicts of interest with our officers and reliance on key personnel; |

| |

• | changes in zoning and other land use laws; |

| |

• | adverse results of litigation or governmental proceedings; |

| |

• | failure to comply with laws, regulations and covenants that are applicable to our properties; |

| |

• | possible terrorist attacks or wars; |

| |

• | possible cyber attacks or intrusions; |

| |

• | adverse changes to accounting rules; |

| |

• | weaknesses in our internal controls over financial reporting; |

| |

• | failure to maintain our REIT status under federal tax laws; and |

| |

• | adverse changes to tax laws, including those related to property taxes. |

For further discussion of these and other risk factors see Item 1A. "Risk Factors” in our 2018 Annual Report on Form 10-K for the fiscal year ended December 31, 2018. This Report and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date of this Report.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Douglas Emmett, Inc. Consolidated Balance Sheets (In thousands, except share data) |

| | | | | | | |

| | | |

| March 31, 2019 | | December 31, 2018 |

| | | |

| Unaudited | | |

Assets | |

| | |

|

Investment in real estate: | |

| | |

|

Land | $ | 1,067,639 |

| | $ | 1,065,099 |

|

Buildings and improvements | 8,088,899 |

| | 7,995,203 |

|

Tenant improvements and lease intangibles | 847,471 |

| | 840,653 |

|

Property under development | 57,527 |

| | 129,753 |

|

Investment in real estate, gross | 10,061,536 |

| | 10,030,708 |

|

Less: accumulated depreciation and amortization | (2,309,901 | ) | | (2,246,887 | ) |

Investment in real estate, net | 7,751,635 |

| | 7,783,821 |

|

Ground lease right-of-use asset | 7,483 |

| | — |

|

Cash and cash equivalents | 149,722 |

| | 146,227 |

|

Tenant receivables, net | 5,281 |

| | 4,371 |

|

Deferred rent receivables, net | 129,203 |

| | 124,834 |

|

Acquired lease intangible assets, net | 3,092 |

| | 3,251 |

|

Interest rate contract assets | 46,880 |

| | 73,414 |

|

Investment in unconsolidated real estate funds | 105,526 |

| | 111,032 |

|

Other assets | 17,087 |

| | 14,759 |

|

Total Assets | $ | 8,215,909 |

| | $ | 8,261,709 |

|

| | | |

Liabilities | |

| | |

|

Secured notes payable and revolving credit facility, net | $ | 4,129,271 |

| | $ | 4,134,030 |

|

Ground lease liability | 10,887 |

| | — |

|

Interest payable, accounts payable and deferred revenue | 142,339 |

| | 130,154 |

|

Security deposits | 50,802 |

| | 50,733 |

|

Acquired lease intangible liabilities, net | 44,883 |

| | 52,569 |

|

Interest rate contract liabilities | 5,283 |

| | 1,530 |

|

Dividends payable | 44,262 |

| | 44,263 |

|

Total liabilities | 4,427,727 |

| | 4,413,279 |

|

| | | |

Equity | |

| | |

|

Douglas Emmett, Inc. stockholders' equity: | |

| | |

|

Common Stock, $0.01 par value, 750,000,000 authorized, 170,237,122 and 170,214,809 outstanding at March 31, 2019 and December 31, 2018, respectively | 1,702 |

| | 1,702 |

|

Additional paid-in capital | 3,282,388 |

| | 3,282,316 |

|

Accumulated other comprehensive income | 30,943 |

| | 53,944 |

|

Accumulated deficit | (953,335 | ) | | (935,630 | ) |

Total Douglas Emmett, Inc. stockholders' equity | 2,361,698 |

| | 2,402,332 |

|

Noncontrolling interests | 1,426,484 |

| | 1,446,098 |

|

Total equity | 3,788,182 |

| | 3,848,430 |

|

Total Liabilities and Equity | $ | 8,215,909 |

| | $ | 8,261,709 |

|

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Operations

(Unaudited; in thousands, except per share data)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

| | | |

Revenues | |

| | |

|

Office rental | |

| | |

|

Rental revenues and tenant recoveries | $ | 167,235 |

| | $ | 158,824 |

|

Parking and other income | 30,055 |

| | 28,509 |

|

Total office revenues | 197,290 |

| | 187,333 |

|

| | | |

Multifamily rental | |

| | |

|

Rental revenues | 24,893 |

| | 23,061 |

|

Parking and other income | 2,003 |

| | 1,853 |

|

Total multifamily revenues | 26,896 |

| | 24,914 |

|

| | | |

Total revenues | 224,186 |

| | 212,247 |

|

| | | |

Operating Expenses | |

| | |

|

Office expenses | 63,449 |

| | 60,356 |

|

Multifamily expenses | 7,555 |

| | 6,698 |

|

General and administrative expenses | 9,832 |

| | 9,567 |

|

Depreciation and amortization | 79,873 |

| | 72,498 |

|

Total operating expenses | 160,709 |

| | 149,119 |

|

| | | |

Operating income | 63,477 |

| | 63,128 |

|

| | | |

Other income | 2,898 |

| | 2,630 |

|

Other expenses | (1,845 | ) | | (1,733 | ) |

Income, including depreciation, from unconsolidated real estate funds | 1,551 |

| | 1,506 |

|

Interest expense | (33,293 | ) | | (32,900 | ) |

Net income | 32,788 |

| | 32,631 |

|

Less: Net income attributable to noncontrolling interests | (4,087 | ) | | (4,425 | ) |

Net income attributable to common stockholders | $ | 28,701 |

| | $ | 28,206 |

|

| | | |

Net income attributable to common stockholders per share – basic | $ | 0.17 |

| | $ | 0.17 |

|

Net income attributable to common stockholders per share – diluted | $ | 0.17 |

| | $ | 0.17 |

|

| | | |

Dividends declared per common share | $ | 0.26 |

| | $ | 0.25 |

|

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Comprehensive Income

(Unaudited and in thousands)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

| | | |

Net income | $ | 32,788 |

| | $ | 32,631 |

|

Other comprehensive (loss) income: cash flow hedges | (33,308 | ) | | 44,369 |

|

Comprehensive (loss) income | (520 | ) | | 77,000 |

|

Less: Comprehensive loss (income) attributable to noncontrolling interests | 6,220 |

| | (17,872 | ) |

Comprehensive income attributable to common stockholders | $ | 5,700 |

| | $ | 59,128 |

|

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Equity

(Unaudited and in thousands)

|

| | | | | | | | |

| | Three Months Ended March 31, |

| | 2019 | | 2018 |

| | | | |

Shares of Common Stock | Beginning balance | 170,215 |

| | 169,565 |

|

| Exchange of OP units for common stock | 22 |

| | 322 |

|

| Exercise of stock options | — |

| | 14 |

|

| Ending balance | 170,237 |

| | 169,901 |

|

| | | | |

|

Common Stock | Beginning balance | $ | 1,702 |

| | $ | 1,696 |

|

| Exchange of OP units for common stock | — |

| | 3 |

|

| Ending balance | $ | 1,702 |

| | $ | 1,699 |

|

| | | | |

|

Additional Paid-in Capital | Beginning balance | $ | 3,282,316 |

| | $ | 3,272,539 |

|

| Exchange of OP units for common stock | 363 |

| | 5,196 |

|

| Repurchase of OP Units with cash | (291 | ) | | — |

|

| Taxes paid on exercise of stock options | — |

| | (314 | ) |

| Ending balance | $ | 3,282,388 |

| | $ | 3,277,421 |

|

| | | | |

|

AOCI | Beginning balance | $ | 53,944 |

| | $ | 43,099 |

|

| Cash flow hedge fair value adjustments | (23,001 | ) | | 30,922 |

|

| Ending balance | $ | 30,943 |

| | $ | 74,021 |

|

| | | | |

|

Accumulated Deficit | Beginning balance | $ | (935,630 | ) | | $ | (879,810 | ) |

| Beginning balance adjustment - ASU 2016-02 adoption | (2,144 | ) | | — |

|

| Beginning balance adjustment - ASU 2017-12 adoption | — |

| | (211 | ) |

| Net income attributable to common stockholders | 28,701 |

| | 28,206 |

|

| Dividends | (44,262 | ) | | (42,474 | ) |

| Ending balance | $ | (953,335 | ) | | $ | (894,289 | ) |

| | | | |

Noncontrolling Interests | Beginning balance | $ | 1,446,098 |

| | $ | 1,464,525 |

|

| Beginning balance adjustment - ASU 2016-02 adoption | (355 | ) | | — |

|

| Net income attributable to noncontrolling interests | 4,087 |

| | 4,425 |

|

| Cash flow hedge fair value adjustments | (10,307 | ) | | 13,447 |

|

| Distributions | (15,760 | ) | | (13,086 | ) |

| Exchange of OP units for common stock | (363 | ) | | (5,199 | ) |

| Repurchase of OP Units with cash | (216 | ) | | — |

|

| Stock-based compensation | 3,300 |

| | 3,503 |

|

| Ending balance | $ | 1,426,484 |

| | $ | 1,467,615 |

|

| | | | |

|

Total Equity | Beginning balance | $ | 3,848,430 |

| | $ | 3,902,049 |

|

| Beginning balance adjustment - ASU 2016-02 adoption | (2,499 | ) | | — |

|

| Beginning balance adjustment - ASU 2017-12 adoption | — |

| | (211 | ) |

| Net income | 32,788 |

| | 32,631 |

|

| Cash flow hedge fair value adjustments | (33,308 | ) | | 44,369 |

|

| Repurchase of OP Units with cash | (507 | ) | | — |

|

| Taxes paid on exercise of stock options | — |

| | (314 | ) |

| Dividends | (44,262 | ) | | (42,474 | ) |

| Distributions | (15,760 | ) | | (13,086 | ) |

| Stock-based compensation | 3,300 |

| | 3,503 |

|

| Ending balance | $ | 3,788,182 |

| | $ | 3,926,467 |

|

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Cash Flows

(Unaudited and in thousands)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Operating Activities | |

| | |

|

Net income | $ | 32,788 |

| | $ | 32,631 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | |

|

Income, including depreciation, from unconsolidated real estate funds | (1,551 | ) | | (1,506 | ) |

Depreciation and amortization | 79,873 |

| | 72,498 |

|

Net accretion of acquired lease intangibles | (4,120 | ) | | (6,152 | ) |

Straight-line rent | (4,369 | ) | | (5,172 | ) |

Increase in the allowance for doubtful accounts | 1,688 |

| | 1,691 |

|

Deferred loan costs amortized and written off | 1,917 |

| | 2,309 |

|

Amortization of loan premium | (51 | ) | | (51 | ) |

Amortization of stock-based compensation | 2,630 |

| | 3,051 |

|

Operating distributions from unconsolidated real estate funds | 1,551 |

| | 1,506 |

|

Change in working capital components: | |

| | |

|

Tenant receivables | (2,598 | ) | | (1,582 | ) |

Interest payable, accounts payable and deferred revenue | 25,369 |

| | 16,944 |

|

Security deposits | 69 |

| | (471 | ) |

Other assets | (707 | ) | | 1,921 |

|

Net cash provided by operating activities | 132,489 |

| | 117,617 |

|

| | | |

Investing Activities | |

| | |

|

Capital expenditures for improvements to real estate | (46,498 | ) | | (25,259 | ) |

Capital expenditures for developments | (17,565 | ) | | (11,018 | ) |

Capital distributions from unconsolidated real estate funds | 2,225 |

| | 1,953 |

|

Net cash used in investing activities | (61,838 | ) | | (34,324 | ) |

| | | |

Financing Activities | |

| | |

|

Proceeds from borrowings | 72,318 |

| | 485,000 |

|

Repayment of borrowings | (77,495 | ) | | (502,808 | ) |

Loan cost payments | (1,449 | ) | | (2,785 | ) |

Distributions paid to noncontrolling interests | (15,760 | ) | | (13,085 | ) |

Dividends paid to common stockholders | (44,263 | ) | | (42,391 | ) |

Taxes paid on exercise of stock options | — |

| | (313 | ) |

Repurchase of OP Units | (507 | ) | | — |

|

Net cash used in financing activities | (67,156 | ) | | (76,382 | ) |

| | | |

Increase in cash and cash equivalents and restricted cash | 3,495 |

| | 6,911 |

|

Cash and cash equivalents and restricted cash - beginning balance | 146,348 |

| | 176,766 |

|

Cash and cash equivalents and restricted cash - ending balance | $ | 149,843 |

| | $ | 183,677 |

|

Douglas Emmett, Inc.

Consolidated Statements of Cash Flows

(Unaudited and in thousands)

Supplemental Cash Flows Information

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Operating Activities | | | |

Cash paid for interest, net of capitalized interest | $ | 31,060 |

| | $ | 29,937 |

|

Capitalized interest paid | $ | 838 |

| | $ | 773 |

|

| | | |

Non-cash Investing Transactions | | | |

Accrual for additions to real estate and developments | $ | 17,070 |

| | $ | 15,995 |

|

Capitalized stock-based compensation for improvements to real estate and developments | $ | 670 |

| | $ | 452 |

|

Removal of fully depreciated and amortized tenant improvements and lease intangibles | $ | 16,805 |

| | $ | 10,630 |

|

Removal of fully amortized acquired lease intangible assets | $ | 1,786 |

| | $ | 206 |

|

Removal of fully accreted acquired lease intangible liabilities | $ | 873 |

| | $ | 6,038 |

|

Recognition of ground lease right-of-use asset - Adoption of ASU 2016-02 | $ | 10,887 |

| | $ | — |

|

Above-market ground lease intangible liability offset against right-of-use asset - Adoption of ASU 2016-02 | $ | 3,408 |

| | $ | — |

|

Recognition of ground lease liability - Adoption of ASU 2016-02 | $ | 10,887 |

| | $ | — |

|

| | | |

Non-cash Financing Transactions | | | |

Gain recorded in AOCI - Adoption of ASU 2017-12 - consolidated derivatives | $ | — |

| | $ | 211 |

|

(Loss) gain recorded in AOCI - consolidated derivatives | $ | (21,563 | ) | | $ | 39,731 |

|

(Loss) gain recorded in AOCI - unconsolidated Funds' derivatives (our share) | $ | (2,405 | ) | | $ | 4,475 |

|

Dividends declared | $ | 44,262 |

| | $ | 42,474 |

|

Exchange of OP units for common stock | $ | 363 |

| | $ | 5,199 |

|

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited)

1. Overview

Organization and Business Description

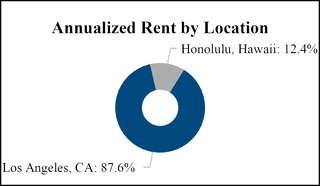

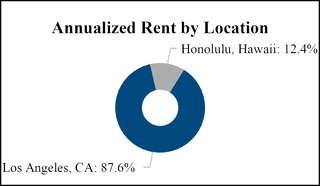

Douglas Emmett, Inc. is a fully integrated, self-administered and self-managed REIT. We are one of the largest owners and operators of high-quality office and multifamily properties in Los Angeles County, California and Honolulu, Hawaii. Through our interest in our Operating Partnership and its subsidiaries, consolidated JVs and unconsolidated Funds, we focus on owning, acquiring, developing and managing a significant market share of top-tier office properties and premier multifamily communities in neighborhoods that possess significant supply constraints, high-end executive housing and key lifestyle amenities. The terms "us," "we" and "our" as used in the financial statements refer to Douglas Emmett, Inc. and its subsidiaries on a consolidated basis. At March 31, 2019, our Consolidated Portfolio consisted of (i) a 16.5 million square foot office portfolio, (ii) 3,642 multifamily apartment units and (iii) fee interests in two parcels of land from which we receive rent under ground leases. We also manage and own equity interests in unconsolidated Funds which, at March 31, 2019, owned an additional 1.8 million square feet of office space. We manage our unconsolidated Funds alongside our Consolidated Portfolio, and we therefore present the statistics for our office portfolio on a Total Portfolio basis. As of March 31, 2019, our portfolio (not including two parcels of land from which we receive rent under ground leases), consisted of the following office and multifamily properties (both of which include ancillary retail space):

|

| | | |

| Consolidated Portfolio | | Total Portfolio |

Office | | | |

Wholly-owned properties | 53 | | 53 |

Consolidated JV properties | 10 | | 10 |

Unconsolidated Fund properties | — | | 8 |

| 63 | | 71 |

| | | |

Multifamily | | | |

Wholly-owned properties | 10 | | 10 |

| | | |

Total | 73 | | 81 |

Basis of Presentation

The accompanying financial statements are the consolidated financial statements of Douglas Emmett, Inc. and its subsidiaries, including our Operating Partnership and our consolidated JVs. All significant intercompany balances and transactions have been eliminated in our consolidated financial statements. Our Operating Partnership and consolidated JVs are VIEs of which we are the primary beneficiary. As of March 31, 2019, the total consolidated assets, liabilities and equity of the VIEs was $8.22 billion (of which $7.75 billion related to investment in real estate), $4.43 billion and $3.79 billion (of which $1.43 billion related to noncontrolling interests), respectively.

We report our office rental revenues and tenant recoveries on a combined basis as office Rental revenues and tenant recoveries in our consolidated statements of operations, and we reclassified the comparable periods to conform to the current period presentation.

The accompanying unaudited interim financial statements have been prepared pursuant to the rules and regulations of the SEC. Certain information and footnote disclosures normally included in the financial statements prepared in conformity with GAAP may have been condensed or omitted pursuant to SEC rules and regulations, although we believe that the disclosures are adequate to make their presentation not misleading. The accompanying unaudited interim financial statements include, in our opinion, all adjustments, consisting of normal recurring adjustments, necessary to present fairly the financial information set forth therein. The results of operations for the interim periods are not necessarily indicative of the results that may be expected for the year ending December 31, 2019. The interim financial statements should be read in conjunction with the consolidated financial statements in our 2018 Annual Report on Form 10-K and the notes thereto. Any references to the number or class of properties, square footage, per square footage amounts, apartment units and geography, are outside the scope of our independent registered public accounting firm’s review of our financial statements in accordance with the standards of the PCAOB.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

2. Summary of Significant Accounting Policies

On January 1, 2019, we adopted ASUs that changed our accounting policy for leases. See "New Accounting Pronouncements" below. We have not made any other changes to our significant accounting policies disclosed in our 2018 Annual Report on Form 10-K.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make certain estimates that affect the reported amounts in the consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates.

Revenue Recognition

Office parking revenues, which are included in office Parking and other income in our consolidated statements of operations, are within the scope of Topic 606 (Revenue from Contracts with Customers). Our lease contracts generally make a specified number of parking spaces available to the tenant, and we bill and recognize parking revenues on a monthly basis in accordance with the lease agreements, generally using the monthly parking rates in effect at the time of billing. Office parking revenues were $26.4 million and $25.2 million for the three months ended March 31, 2019 and 2018, respectively. Office parking receivables were $1.2 million and $1.1 million as of March 31, 2019 and December 31, 2018, respectively, and are included in Tenant receivables in our consolidated balance sheets.

Income Taxes

We have elected to be taxed as a REIT under the Code. Provided that we qualify for taxation as a REIT, we are generally not subject to corporate-level income tax on the earnings distributed currently to our stockholders that we derive from our REIT qualifying activities. We are subject to corporate-level tax on the earnings that we derive through our TRS.

New Accounting Pronouncements

Changes to GAAP are implemented by the FASB in the form of ASUs. We consider the applicability and impact of all ASUs. Other than the ASUs discussed below, the FASB has not issued any other ASUs that we expect to be applicable and have a material impact on our financial statements.

ASUs Adopted

ASU 2016-02 (Topic 842 - "Leases")

In February 2016, the FASB issued ASU No. 2016-02, (Topic 842 - "Leases"). The primary impact of the ASU is the recognition of lease assets and liabilities on the balance sheet by lessees for leases classified as operating leases. The accounting applied by lessors is largely unchanged. For example, the vast majority of operating leases remain classified as operating leases, and lessors continue to recognize lease payments for those leases on a straight-line basis over the lease term.

We adopted the ASU on January 1, 2019 using the modified retrospective transition method. We recorded a cumulative adjustment of $2.5 million to the opening balance of retained earnings (accumulated deficit) for leasing expenses related to leases that were entered into before the adoption date but commenced after the adoption date. The ASU provides a practical expedient package, which we elected to use, that allows entities (a) not to reassess whether any expired or existing contracts as of the adoption date are considered or contain leases; (b) not to reassess the lease classification for any expired or existing leases as of the adoption date; and (c) not to reassess initial direct costs for any existing leases as of the adoption date. All leases entered into on or after the adoption date were accounted for under the ASU.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

We lease space to tenants at our office and multifamily properties. Under the ASU, all of our tenant leases continue to be classified as operating leases. The ASU continues to require that lease payments for operating leases be recognized over the lease term on a straight-line basis unless another systematic and rational basis is more representative of the pattern in which benefit is expected to be derived from the use of the underlying asset. If collectability of the lease payments is not probable at the commencement date, then the lease income should be limited to the lesser of the income recognized on a straight-line basis or cash basis. If the assessment of collectibility changes after the commencement date, any difference between the lease income that would have been recognized on a straight-line basis and cash basis must be recognized as a current-period adjustment to lease income.

The ASU requires separation of the lease from the non-lease components (for example, maintenance services or other activities that transfer a good or service to the customer) in a contract. Only the lease components are accounted for in accordance with the ASU. The consideration in the contract is allocated to the lease and non-lease components on a relative standalone selling price basis and the non-lease component would be accounted for in accordance with ASC 606 ("Revenue from Contracts with Customers"). In July 2018, the FASB issued ASU No. 2018-11 which includes an optional practical expedient for lessors to elect, by class of underlying asset, to not separate the lease from the non-lease components if certain criteria are met. Our office tenant leases include a lease component for the rental income and a non-lease component for the related tenant recoveries. We determined that our office tenant leases qualify for the single component presentation and we adopted the practical expedient. We account for the combined components under the ASU.

Rental revenues and tenant recoveries from our office tenant leases is included in office Rental revenues and tenant recoveries in our consolidated statements of operations. Rental revenues from our multifamily tenant leases is included in multifamily Rental revenues in our consolidated statements of operations. Rental revenue recognized on a straight-line basis in excess of billed rents is included in Deferred rent receivables in our consolidated balance sheets. See Note 14 for more information regarding the future lease rental receipts from our operating leases.

The ASU defines initial direct costs of a lease, which may be capitalized, as costs that would not have been incurred had the lease not been executed. Costs to negotiate a lease that would have been incurred regardless of whether the lease was executed, such as employee salaries, are not considered to be initial direct costs, and may not be capitalized. We historically capitalized most of our leasing costs. During the three months ended March 31, 2019, we expensed $1.1 million of leasing costs related to our tenant leases that did not qualify as initial direct costs of a lease, which are included in General and administrative expenses in our consolidated statements of operations.

We pay rent under a ground lease which expires on December 31, 2086. Upon adoption of the ASU, we continued to classify the lease as an operating lease, and we recognized a right-of-use asset for the land and a lease liability for the future lease payments of $10.9 million. We calculated the carrying value of the right-of-use asset and lease liability by discounting the future lease payments using our incremental borrowing rate. We adjusted the right-of-use asset carrying value for a related above-market ground lease liability of $3.4 million, which reduced the carrying value of the asset to $7.5 million. We continued to recognize the lease payments as expense, which is included in Office expenses in our Consolidated Statements of Operations. See Note 3 for more information regarding this ground lease. See Note 12 for the fair value disclosures related to the ground lease liability.

In December 2018, the FASB issued ASU 2018-20, an update to ASU 2016-02, which provides guidance on accounting for sales and other similar taxes collected from lessees, certain lessor costs, and recognition of variable payments for contracts with lease and nonlease components. We adopted the ASU and it did not have a material impact on our financial statements.

In March 2019, the FASB issued ASU 2019-01, an update to ASU 2016-02, which provides guidance on transition disclosures related to Topic 250 "Accounting Changes and Error Corrections" and other technical updates. We adopted the ASU and it did not have a material impact on our financial statements.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

3. Ground Lease

We pay rent under a ground lease located in Honolulu, Hawaii, which expires on December 31, 2086. The rent is fixed at $733 thousand per year until February 28, 2029, after which it will reset to the greater of the existing ground rent or market. As of March 31, 2019, the right-of-use asset carrying value of this ground lease was $7.5 million and the ground lease liability was $10.9 million. We incurred ground rent expense of $180 thousand and $183 thousand for the three months ended March 31, 2019 and 2018, respectively, which is included in Office expenses in our Consolidated Statements of Operations. The table below, which assumes that the ground rent payments will continue to be $733 thousand per year after February 28, 2029, presents the future minimum ground lease payments as of March 31, 2019:

|

| | | |

Twelve months ending March 31: | (In thousands) |

| |

2020 | $ | 733 |

|

2021 | 733 |

|

2022 | 733 |

|

2023 | 733 |

|

2024 | 733 |

|

Thereafter | 45,995 |

|

Total future minimum lease payments | $ | 49,660 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

4. Acquired Lease Intangibles

Summary of our Acquired Lease Intangibles

|

| | | | | | | |

(In thousands) | March 31, 2019 | | December 31, 2018 |

| | | |

Above-market tenant leases | $ | 3,809 |

| | $ | 5,595 |

|

Above-market tenant leases - accumulated amortization | (1,658 | ) | | (3,289 | ) |

Above-market ground lease where we are the lessor | 1,152 |

| | 1,152 |

|

Above-market ground lease - accumulated amortization | (211 | ) | | (207 | ) |

Acquired lease intangible assets, net | $ | 3,092 |

| | $ | 3,251 |

|

| | | |

Below-market tenant leases | $ | 111,302 |

| | $ | 112,175 |

|

Below-market tenant leases - accumulated accretion | (66,419 | ) | | (63,013 | ) |

Above-market ground lease where we are the tenant(1) | — |

| | 4,017 |

|

Above-market ground lease - accumulated accretion(1) | — |

| | (610 | ) |

Acquired lease intangible liabilities, net | $ | 44,883 |

| | $ | 52,569 |

|

______________________________________________

(1) Upon adoption of ASU 2016-02 on January 1, 2019 we adjusted the ground lease right-of-use asset carrying value for the carrying value of the above-market ground lease - see Notes 2 and 3.

Impact on the Consolidated Statements of Operations

The table below summarizes the net amortization/accretion related to our above- and below-market leases:

|

| | | | | | | |

| Three Months Ended March 31, |

(In thousands) | 2019 | | 2018 |

| | | |

Net accretion of above- and below-market tenant lease assets and liabilities(1) | $ | 4,124 |

| | $ | 6,144 |

|

Amortization of an above-market ground lease asset(2) | (4 | ) | | (4 | ) |

Accretion of an above-market ground lease liability(3) | — |

| | 12 |

|

Total | $ | 4,120 |

| | $ | 6,152 |

|

______________________________________________

| |

(1) | Recorded as a net increase to office and multifamily rental revenues. |

| |

(2) | Recorded as a decrease to office parking and other income. |

| |

(3) | Recorded as a decrease to office expense. Upon adoption of ASU 2016-02 on January 1, 2019 we adjusted the ground lease right-of-use asset carrying value with the carrying value of the above-market ground lease - see Notes 2 and 3. |

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

5. Investments in Unconsolidated Real Estate Funds

Description of our Funds

We manage and own equity interests in three unconsolidated Funds, the Opportunity Fund, Fund X and Partnership X, through which we and investors own eight office properties totaling 1.8 million square feet. At March 31, 2019, we held direct and indirect equity interests of 6.2% of the Opportunity Fund, 71.3% of Fund X and 24.5% of Partnership X. Our Funds pay us fees and reimburse us for certain expenses related to property management and other services we provide, which are included in Other income in our consolidated statements of operations. We also receive distributions based on invested capital and on any profits that exceed certain specified cash returns to the investors. The table below presents cash distributions we received from our Funds:

|

| | | | | | | |

| Three Months Ended March 31, |

(In thousands) | 2019 | | 2018 |

| | | |

Operating distributions received | $ | 1,551 |

| | $ | 1,506 |

|

Capital distributions received | 2,225 |

| | 1,953 |

|

Total distributions received | $ | 3,776 |

| | $ | 3,459 |

|

Summarized Financial Information for our Funds

The tables below present selected financial information for the Funds on a combined basis. The amounts presented reflect 100% (not our pro-rata share) of amounts related to the Funds, and are based upon historical acquired book value:

|

| | | | | | | |

(In thousands) | March 31, 2019 | | December 31, 2018 |

| | | |

Total assets | $ | 688,590 |

| | $ | 694,713 |

|

Total liabilities | $ | 528,032 |

| | $ | 525,483 |

|

Total equity | $ | 160,558 |

| | $ | 169,230 |

|

|

| | | | | | | |

| Three Months Ended March 31, |

(In thousands) | 2019 | | 2018 |

| | | |

Total revenues | $ | 20,159 |

| | $ | 19,147 |

|

Operating income | $ | 5,395 |

| | $ | 5,566 |

|

Net income | $ | 1,332 |

| | $ | 1,434 |

|

6. Other Assets

|

| | | | | | | |

(In thousands) | March 31, 2019 | | December 31, 2018 |

| | | |

Restricted cash | $ | 121 |

| | $ | 121 |

|

Prepaid expenses | 8,383 |

| | 7,830 |

|

Other indefinite-lived intangibles | 1,988 |

| | 1,988 |

|

Furniture, fixtures and equipment, net | 2,441 |

| | 1,101 |

|

Other | 4,154 |

| | 3,719 |

|

Total other assets | $ | 17,087 |

| | $ | 14,759 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

7. Secured Notes Payable and Revolving Credit Facility, Net

|

| | | | | | | | | | | | | | | | |

Description | | Maturity Date(1) | | Principal Balance as of March 31, 2019 | | Principal Balance as of December 31, 2018 | | Variable Interest Rate | | Fixed Interest Rate(2) | | Swap Maturity Date |

| | | | | | | | | | | | |

| | | | (In thousands) | | | | | | |

| | | | | | | | | | | | |

Wholly Owned Subsidiaries |

Fannie Mae loan | | 10/1/2019 | | $ | 145,000 |

| | $ | 145,000 |

| | LIBOR + 1.25% | | N/A | | N/A |

Term loan(3) | | 4/15/2022 | | 340,000 |

| | 340,000 |

| | LIBOR + 1.40% | | 2.77% | | 4/1/2020 |

Term loan(3) | | 7/27/2022 | | 180,000 |

| | 180,000 |

| | LIBOR + 1.45% | | 3.06% | | 7/1/2020 |

Term loan(3) | | 11/1/2022 | | 400,000 |

| | 400,000 |

| | LIBOR + 1.35% | | 2.64% | | 11/1/2020 |

Term loan(3) | | 6/23/2023 | | 360,000 |

| | 360,000 |

| | LIBOR + 1.55% | | 2.57% | | 7/1/2021 |

Term loan(3) | | 12/23/2023 | | 220,000 |

| | 220,000 |

| | LIBOR + 1.70% | | 3.62% | | 12/23/2021 |

Term loan(3) | | 1/1/2024 | | 300,000 |

| | 300,000 |

| | LIBOR + 1.55% | | 3.46% | | 1/1/2022 |

Term loan(3) | | 3/3/2025 | | 335,000 |

| | 335,000 |

| | LIBOR + 1.30% | | 3.84% | | 3/1/2023 |

Fannie Mae loan(3) | | 4/1/2025 | | 102,400 |

| | 102,400 |

| | LIBOR + 1.25% | | 2.84% | | 3/1/2020 |

Fannie Mae loan(3) | | 12/1/2025 | | 115,000 |

| | 115,000 |

| | LIBOR + 1.25% | | 2.76% | | 12/1/2020 |

Fannie Mae loan(3) | | 6/1/2027 | | 550,000 |

| | 550,000 |

| | LIBOR + 1.37% | | 3.16% | | 6/1/2022 |

Term loan(4) | | 6/1/2038 | | 31,406 |

| | 31,582 |

| | N/A | | 4.55% | | N/A |

Revolving credit facility(3)(5) | | 8/21/2023 | | 100,000 |

| | 105,000 |

| | LIBOR + 1.15% | | N/A | | N/A |

Total Wholly Owned Subsidiary Debt | 3,178,806 |

| | 3,183,982 |

| | | | | | |

| | | | | | | | | | | | |

Consolidated JVs |

Term loan(3) | | 2/28/2023 | | 580,000 |

| | 580,000 |

| | LIBOR + 1.40% | | 2.37% | | 3/1/2021 |

Term loan(3) | | 12/19/2024 | | 400,000 |

| | 400,000 |

| | LIBOR + 1.30% | | 3.47% | | 1/1/2023 |

Total Consolidated Debt(6) | 4,158,806 |

| | 4,163,982 |

| | | | | | |

Unamortized loan premium, net | | 3,935 |

| | 3,986 |

| | | | | | |

Unamortized deferred loan costs, net | | (33,470 | ) | | (33,938 | ) | | | | | | |

Total Consolidated Debt, net | $ | 4,129,271 |

| | $ | 4,134,030 |

| | | | | | |

___________________________________________________

Except as noted below, each loan (including our revolving credit facility) is non-recourse and secured by one or more separate collateral pools consisting of one or more properties, and requires monthly payments of interest only with the outstanding principal due upon maturity.

| |

(1) | Maturity dates include the effect of extension options. |

| |

(2) | Includes the effect of interest rate swaps and excludes the effect of prepaid loan fees. See Note 9 for details of our interest rate swaps. See below for details of our loan costs. |

| |

(3) | Loan agreement includes a zero-percent LIBOR floor. The corresponding swaps do not include such a floor. |

| |

(4) | Requires monthly payments of principal and interest. Principal amortization is based upon a 30-year amortization schedule. |

| |

(5) | In March 2019, we renewed our $400.0 million revolving credit facility, releasing two previously encumbered properties, lowering the borrowing rate and unused facility fees, and extending the maturity date. Unused commitment fees range from 0.10% to 0.15%. |

| |

(6) | See Note 12 for our fair value disclosures. |

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

Debt Statistics

The following table summarizes our fixed and floating rate debt:

|

| | | | | | | | |

(In thousands) | | Principal Balance as of March 31, 2019 | | Principal Balance as of December 31, 2018 |

| | | | |

Aggregate swapped to fixed rate loans | | $ | 3,882,400 |

| | $ | 3,882,400 |

|

Aggregate fixed rate loans | | 31,406 |

| | 31,582 |

|

Aggregate floating rate loans | | 245,000 |

| | 250,000 |

|

Total Debt | | $ | 4,158,806 |

| | $ | 4,163,982 |

|

The following table summarizes certain debt statistics as of March 31, 2019:

|

| |

Statistics for consolidated loans with interest fixed under the terms of the loan or a swap |

| |

Principal balance (in billions) | $3.91 |

Weighted average remaining life (including extension options) | 5.2 years |

Weighted average remaining fixed interest period | 2.5 years |

Weighted average annual interest rate | 3.07% |

Future Principal Payments

At March 31, 2019, the minimum future principal payments due on our secured notes payable and revolving credit facility were as follows:

|

| | | | | | | | |

Twelve months ending March 31: | | Excluding Maturity Extension Options | | Including Maturity Extension Options(1) |

| | | | |

| | (In thousands) |

| | | | |

2020 | | $ | 145,727 |

| | $ | 145,727 |

|

2021 | | 295,760 |

| | 760 |

|

2022 | | 300,796 |

| | 796 |

|

2023 | | 1,655,833 |

| | 1,500,833 |

|

2024 | | 680,871 |

| | 980,871 |

|

Thereafter | | 1,079,819 |

| | 1,529,819 |

|

Total future principal payments | | $ | 4,158,806 |

| | $ | 4,158,806 |

|

____________________________________________

| |

(1) | Our loan agreements generally require that we meet certain minimum financial thresholds to be able to extend the loan maturity. |

Loan Costs

Deferred loan costs are net of accumulated amortization of $26.1 million and $24.2 million at March 31, 2019 and December 31, 2018, respectively. The table below presents loan costs, which are included in Interest expense in our consolidated statements of operations:

|

| | | | | | | |

| Three Months Ended March 31, |

(In thousands) | 2019 | | 2018 |

| | | |

Loan costs expensed | $ | — |

| | $ | 404 |

|

Deferred loan cost amortization | 1,917 |

| | 1,905 |

|

Total | $ | 1,917 |

| | $ | 2,309 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

8. Interest Payable, Accounts Payable and Deferred Revenue

|

| | | | | | | |

(In thousands) | March 31, 2019 | | December 31, 2018 |

| | | |

Interest payable | $ | 11,023 |

| | $ | 10,657 |

|

Accounts payable and accrued liabilities | 88,585 |

| | 75,111 |

|

Deferred revenue | 42,731 |

| | 44,386 |

|

Total interest payable, accounts payable and deferred revenue | $ | 142,339 |

| | $ | 130,154 |

|

9. Derivative Contracts

We make use of interest rate swap and cap contracts to manage the risk associated with changes in interest rates on our floating-rate debt. When we enter into a floating-rate term loan, we generally enter into an interest rate swap agreement for the equivalent principal amount, for a period covering the majority of the loan term, which effectively converts our floating-rate debt to a fixed-rate basis during that time. In limited instances, we also make use of interest rate caps to limit our exposure to interest rate increases on our floating-rate debt. We do not speculate in derivatives and we do not make use of any other derivative instruments. See Note 7 regarding our debt, and our consolidated JVs debt, that is hedged. See Note 15 regarding our unconsolidated Funds debt that is hedged.

Derivative Summary

As of March 31, 2019, all of our interest rate swaps, which include the interest rate swaps of our consolidated JVs and our unconsolidated Funds, were designated as cash flow hedges:

|

| | | | | |

| Number of Interest Rate Swaps | | Notional (In thousands) |

| | | |

Consolidated derivatives(1)(3) | 27 | | $ | 3,882,400 |

|

Unconsolidated Funds' derivatives(2)(3) | 4 | | $ | 510,000 |

|

___________________________________________________

| |

(1) | The notional amount reflects 100%, not our pro-rata share, of our consolidated JVs' derivatives. |

| |

(2) | The notional amount reflects 100%, not our pro-rata share, of our unconsolidated Funds' derivatives. |

| |

(3) | See Note 12 for our derivative fair value disclosures. |

Credit-risk-related Contingent Features

We have agreements with each of our interest rate swap counterparties that contain a provision under which we could also be declared in default on our derivative obligations if we default on the underlying indebtedness that we are hedging. As of March 31, 2019, there have been no events of default with respect to our interest rate swaps or our consolidated JVs' or unconsolidated Funds' interest rate swaps. We do not post collateral for our interest rate swap contract liabilities. The fair value of our interest rate swap contract liabilities, including accrued interest and excluding credit risk adjustments, were as follows:

|

| | | | | | | | |

(In thousands) | | March 31, 2019 | | December 31, 2018 |

| | | | |

Consolidated derivatives(1) | | $ | 5,422 |

| | $ | 1,681 |

|

Unconsolidated Funds' derivatives(2) | | — |

| | — |

|

___________________________________________________

| |

(1) | Includes 100%, not our pro-rata share, of our consolidated JVs' derivatives. |

| |

(2) | Our unconsolidated Funds' did not have any derivatives in a liability position. |

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

Counterparty Credit Risk

We are subject to credit risk from the counterparties on our interest rate swap contract assets because we do not receive collateral. We seek to minimize that risk by entering into agreements with a variety of high quality counterparties with investment grade ratings. The fair value of our interest rate swap contract assets, including accrued interest and excluding credit risk adjustments, were as follows:

|

| | | | | | | |

(In thousands) | March 31, 2019 | | December 31, 2018 |

| | | |

Consolidated derivatives(1) | $ | 49,807 |

| | $ | 76,021 |

|

Unconsolidated Funds' derivatives(2) | $ | 7,804 |

| | $ | 12,576 |

|

___________________________________________________

| |

(1) | The amounts reflect 100%, not our pro-rata share, of our consolidated JVs' derivatives. |

| |

(2) | The amounts reflect 100%, not our pro-rata share, of our unconsolidated Funds' derivatives. |

Impact of Hedges on AOCI and the Consolidated Statements of Operations

The table below presents the effect of our derivatives on our AOCI and the consolidated statements of operations:

|

| | | | | | | |

(In thousands) | Three Months Ended March 31, |

| 2019 | | 2018 |

Derivatives Designated as Cash Flow Hedges: | | | |

| | | |

Consolidated derivatives: | | | |

Gain recorded in AOCI - adoption of ASU 2017-12(1) | $ | — |

| | $ | 211 |

|

(Loss) gain recorded in AOCI before reclassifications(1) | $ | (21,563 | ) | | $ | 39,731 |

|

(Gain) loss reclassified from AOCI to Interest Expense(1) | $ | (8,724 | ) | | $ | (131 | ) |

Interest Expense presented in the consolidated statements of operations | $ | (33,293 | ) | | $ | (32,900 | ) |

Unconsolidated Funds' derivatives (our share)(2): | | | |

(Loss) gain recorded in AOCI before reclassifications(1) | $ | (2,405 | ) | | $ | 4,475 |

|

(Gain) loss reclassified from AOCI to Income, including depreciation, from unconsolidated real estate funds(1) | $ | (616 | ) | | $ | 83 |

|

Income, including depreciation, from unconsolidated real estate funds presented in the consolidated statements of operations | $ | 1,551 |

| | $ | 1,506 |

|

___________________________________________________

| |

(1) | See Note 10 for our AOCI reconciliation. |

| |

(2) | We calculate our share by multiplying the total amount for each Fund by our equity interest in the respective Fund. |

Future Reclassifications from AOCI

At March 31, 2019, our estimate of the AOCI related to derivatives designated as cash flow hedges that will be reclassified to earnings during the next twelve months as interest rate swap payments are made is as follows:

|

| | | |

| (In thousands) |

| |

Consolidated derivatives: | |

Gains to be reclassified from AOCI to Interest Expense | $ | 30,188 |

|

Unconsolidated Funds' derivatives (our share): | |

Gains to be reclassified from AOCI to Income, including depreciation, from unconsolidated real estate funds | $ | 2,090 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

10. Equity

Transactions

During the three months ended March 31, 2019, we (i) acquired 22 thousand OP Units in exchange for issuing an equal number of shares of our common stock to the holders of the OP Units and (ii) acquired 13 thousand OP Units for $507 thousand in cash.

During the three months ended March 31, 2018, we (i) acquired 322 thousand OP Units in exchange for issuing an equal number of shares of our common stock to the holders of the OP Units and (ii) issued 14 thousand shares of our common stock for the exercise of 32 thousand stock options on a net settlement basis (net of the exercise price and related taxes).

Noncontrolling Interests

Our noncontrolling interests consist of interests in our Operating Partnership and consolidated JVs which are not owned by us. Noncontrolling interests in our Operating Partnership consist of OP Units and fully-vested LTIP Units, and represented approximately 14% of our Operating Partnership's total interests as of March 31, 2019 when we and our Operating Partnership had 170.2 million shares of common stock and 28.2 million OP Units and fully-vested LTIP Units outstanding, respectively. A share of our common stock, an OP Unit and an LTIP Unit (once vested and booked up) have essentially the same economic characteristics, sharing equally in the distributions from our Operating Partnership. Investors who own OP Units have the right to cause our Operating Partnership to acquire their OP Units for an amount of cash per unit equal to the market value of one share of our common stock at the date of acquisition, or, at our election, exchange their OP Units for shares of our common stock on a one-for-one basis. LTIP Units have been granted to our key employees and non-employee directors as part of their compensation. These awards generally vest over a service period and once vested can generally be converted to OP Units provided our stock price increases by more than a specified hurdle.

Changes in our Ownership Interest in our Operating Partnership

The table below presents the effect on our equity from net income attributable to common stockholders and changes in our ownership interest in our Operating Partnership:

|

| | | | | | | |

| Three Months Ended March 31, |

(In thousands) | 2019 | | 2018 |

| | | |

Net income attributable to common stockholders | $ | 28,701 |

| | $ | 28,206 |

|

| | | |

Transfers from noncontrolling interests: | | | |

Exchange of OP Units with noncontrolling interests | 363 |

| | 5,199 |

|

Repurchase of OP Units from noncontrolling interests | (291 | ) | | — |

|

Net transfers from noncontrolling interests | 72 |

| | 5,199 |

|

| | | |

Change from net income attributable to common stockholders and transfers from noncontrolling interests | $ | 28,773 |

| | $ | 33,405 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

AOCI Reconciliation(1)

The table below presents a reconciliation of our AOCI, which consists solely of adjustments related to derivatives designated as cash flow hedges:

|

| | | | | | | |

| Three Months Ended March 31, |

(In thousands) | 2019 | | 2018 |

| | | |

Beginning balance | $ | 53,944 |

| | $ | 43,099 |

|

Adoption of ASU 2017-12 - cumulative opening balance adjustment | — |

| | 211 |

|

Consolidated derivatives: | | | |

Other comprehensive (loss) income before reclassifications | (21,563 | ) | | 39,731 |

|

Reclassification of gains from AOCI to Interest Expense | (8,724 | ) | | (131 | ) |

Unconsolidated Funds' derivatives (our share)(2): | | | |

Other comprehensive (loss) income before reclassifications | (2,405 | ) | | 4,475 |

|

Reclassification of (gains) losses from AOCI to Income, including depreciation, from unconsolidated real estate funds | (616 | ) | | 83 |

|

Net current period OCI | (33,308 | ) | | 44,369 |

|

OCI attributable to noncontrolling interests | 10,307 |

| | (13,447 | ) |

OCI attributable to common stockholders | (23,001 | ) | | 30,922 |

|

| | | |

Ending balance | $ | 30,943 |

| | $ | 74,021 |

|

___________________________________________________

| |

(1) | See Note 9 for the details of our derivatives and Note 12 for our derivative fair value disclosures. |

| |

(2) | We calculate our share by multiplying the total amount for each Fund by our equity interest in the respective Fund. |

Equity Compensation

On June 2, 2016, the Douglas Emmett 2016 Omnibus Stock Incentive Plan ("2016 Plan") became effective after receiving stockholder approval, superseding our prior plan, the Douglas Emmett 2006 Omnibus Stock Incentive Plan ("2006 Plan"), both of which allow for awards to our directors, officers, employees and consultants. The key terms of the two plans are substantially identical, except for the date of expiration, the number of shares authorized for grants and various technical provisions. Grants after June 2, 2016 were awarded under the 2016 Plan, while grants prior to that date were awarded under the 2006 Plan (grants under the 2006 Plan remain outstanding according to their terms). Both plans are administered by the compensation committee of our board of directors.

Total net stock-based compensation expense was $2.6 million and $3.1 million for the three months ended March 31, 2019 and 2018, respectively. These amounts are net of capitalized stock-based compensation of $670 thousand and $452 thousand for the three months ended March 31, 2019 and 2018, respectively. There were no outstanding options during the three months ended March 31, 2019. The intrinsic value of options exercised was $0.8 million for the three months ended March 31, 2018.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

11. EPS

We calculate basic EPS by dividing the net income attributable to common stockholders for the period by the weighted average number of common shares outstanding during the period. We calculate diluted EPS by dividing the net income attributable to common stockholders for the period by the weighted average number of common shares and dilutive instruments outstanding during the period using the treasury stock method. We account for unvested LTIP awards that contain nonforfeitable rights to dividends as participating securities and include these securities in the computation of basic and diluted EPS using the two-class method. The table below presents the calculation of basic and diluted EPS:

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 |

| 2018 |

Numerator (In thousands): | |

| | |

|

Net income attributable to common stockholders | $ | 28,701 |

| | $ | 28,206 |

|

Allocation to participating securities: Unvested LTIP Units | (126 | ) | | (117 | ) |

Numerator for basic and diluted net income attributable to common stockholders | $ | 28,575 |

| | $ | 28,089 |

|

| | | |

Denominator (In thousands): | | | |

Weighted average shares of common stock outstanding - basic | 170,221 |

| | 169,601 |

|

Effect of dilutive securities: Stock options(1) | — |

| | 24 |

|

Weighted average shares of common stock and common stock equivalents outstanding - diluted | 170,221 |

| | 169,625 |

|

| | | |

Basic EPS: | | | |

Net income attributable to common stockholders per share | $ | 0.17 |

| | $ | 0.17 |

|

| | | |

Diluted EPS: | | | |

Net income attributable to common stockholders per share | $ | 0.17 |

| | $ | 0.17 |

|

____________________________________________________

| |

(1) | There were no outstanding options during the three months ended March 31, 2019. The following securities were excluded from the calculation of diluted EPS because including them would be anti-dilutive to the calculation: |

|

| | | | | |

| Three Months Ended March 31, |

(In thousands) | 2019 | | 2018 |

| | | |

OP Units | 26,340 |

| | 26,943 |

|

Vested LTIP Units | 1,831 |

| | 800 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

12. Fair Value of Financial Instruments

Our estimates of the fair value of financial instruments were determined using available market information and widely used valuation methods. Considerable judgment is necessary to interpret market data and determine an estimated fair value. The use of different market assumptions or valuation methods may have a material effect on the estimated fair values. The FASB fair value framework hierarchy distinguishes between assumptions based on market data obtained from sources independent of the reporting entity, and the reporting entity’s own assumptions about market-based inputs. The hierarchy is as follows:

Level 1 - inputs utilize unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 - inputs are observable either directly or indirectly for similar assets and liabilities in active markets.

Level 3 - inputs are unobservable assumptions generated by the reporting entity

As of March 31, 2019, we did not have any fair value estimates of financial instruments using Level 3 inputs.

Financial instruments disclosed at fair value

Short term financial instruments: The carrying amounts for cash and cash equivalents, tenant receivables, revolving credit line, interest payable, accounts payable, security deposits and dividends payable approximate fair value because of the short-term nature of these instruments.

Secured notes payable: See Note 7 for the details of our secured notes payable. We estimate the fair value of our consolidated secured notes payable by calculating the credit-adjusted present value of the principal and interest payments for each secured note payable. The calculation incorporates observable market interest rates which we consider to be Level 2 inputs, assumes that the loans will be outstanding through maturity, and excludes any maturity extension options. The table below presents the estimated fair value and carrying value of our secured notes payable (excluding our revolving credit facility), the carrying value includes unamortized loan premium and excludes unamortized deferred loan fees:

|

| | | | | | | |

(In thousands) | March 31, 2019 | | December 31, 2018 |

| | | |

Fair value | $ | 4,100,464 |

| | $ | 4,087,979 |

|

Carrying value | $ | 4,062,741 |

| | $ | 4,062,968 |

|

Ground lease liability: See Note 3 for the details of our ground lease. We estimate the fair value of our ground lease liability by calculating the present value of the future lease payments disclosed in Note 3 using our incremental borrowing rate. The calculation incorporates observable market interest rates which we consider to be Level 2 inputs. The table below presents the estimated fair value and carrying value of our ground lease liability:

|

| | |

(In thousands) | March 31, 2019 |

| |

Fair value | 11,350 |

|

Carrying value | 10,887 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

Financial instruments measured at fair value

Derivative instruments: See Note 9 for the details of our derivatives. We present our derivatives on the balance sheet at fair value, on a gross basis, excluding accrued interest. We estimate the fair value of our derivative instruments by calculating the credit-adjusted present value of the expected future cash flows of each derivative. The calculation incorporates the contractual terms of the derivatives, observable market interest rates which we consider to be Level 2 inputs, and credit risk adjustments to reflect the counterparty's as well as our own nonperformance risk. Our derivatives are not subject to master netting arrangements. The table below presents the estimated fair value of our derivatives:

|

| | | | | | | |

(In thousands) | March 31, 2019 | | December 31, 2018 |

Derivative Assets: | | | |

Fair value - consolidated derivatives(1) | $ | 46,880 |

| | $ | 73,414 |

|

Fair value - unconsolidated Funds' derivatives(2) | $ | 7,416 |

| | $ | 12,228 |

|

| | | |

Derivative Liabilities: | | | |

Fair value - consolidated derivatives(1) | $ | 5,283 |

| | $ | 1,530 |

|

Fair value - unconsolidated Funds' derivatives(2) | $ | — |

| | $ | — |

|

____________________________________________________

| |

(1) | Consolidated derivatives, which include 100%, not our pro-rata share, of our consolidated JVs' derivatives, are included in interest rate contracts in our consolidated balance sheets. The fair values exclude accrued interest which is included in interest payable in the consolidated balance sheets. |

| |

(2) | Reflects 100%, not our pro-rata share, of our unconsolidated Funds' derivatives. Our pro-rata share of the amounts related to the unconsolidated Funds' derivatives is included in our Investment in unconsolidated real estate funds in our consolidated balance sheets. See Note 15 regarding our unconsolidated Funds debt and derivatives. |

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

13. Segment Reporting

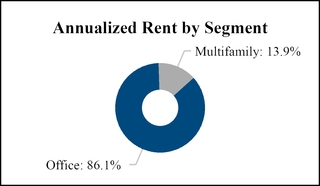

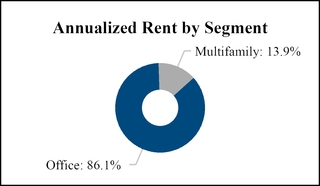

Segment information is prepared on the same basis that our management reviews information for operational decision-making purposes. We operate in two business segments: (i) the acquisition, development, ownership and management of office real estate and (ii) the acquisition, development, ownership and management of multifamily real estate. The services for our office segment primarily include rental of office space and other tenant services, including parking and storage space rental. The services for our multifamily segment include rental of apartments and other tenant services, including parking and storage space rental. Asset information by segment is not reported because we do not use this measure to assess performance or make decisions to allocate resources. Therefore, depreciation and amortization expense is not allocated among segments. General and administrative expenses and interest expense are not included in segment profit as our internal reporting addresses these items on a corporate level. The table below presents the operating activity of our reportable segments:

|

| | | | | | | |

(In thousands) | Three Months Ended March 31, |

| 2019 | | 2018 |

Office Segment | | | |

Total office revenues | $ | 197,290 |

| | $ | 187,333 |

|

Office expenses | (63,449 | ) | | (60,356 | ) |

Office segment profit | 133,841 |

| | 126,977 |

|

| | | |

Multifamily Segment | | | |

Total multifamily revenues | 26,896 |

| | 24,914 |

|

Multifamily expenses | (7,555 | ) | | (6,698 | ) |

Multifamily segment profit | 19,341 |

| | 18,216 |

|

| | | |

Total profit from all segments | $ | 153,182 |

| | $ | 145,193 |

|

The table below presents a reconciliation of the total profit from all segments to net income attributable to common stockholders:

|

| | | | | | | |

(In thousands) | Three Months Ended March 31, |

| 2019 | | 2018 |

| | | |

Total profit from all segments | $ | 153,182 |

| | $ | 145,193 |

|

General and administrative expenses | (9,832 | ) | | (9,567 | ) |

Depreciation and amortization | (79,873 | ) | | (72,498 | ) |

Other income | 2,898 |

| | 2,630 |

|

Other expenses | (1,845 | ) | | (1,733 | ) |

Income, including depreciation, from unconsolidated real estate funds | 1,551 |

| | 1,506 |

|

Interest expense | (33,293 | ) | | (32,900 | ) |

Net income | 32,788 |

| | 32,631 |

|

Less: Net income attributable to noncontrolling interests | (4,087 | ) | | (4,425 | ) |

Net income attributable to common stockholders | $ | 28,701 |

| | $ | 28,206 |

|

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

14. Future Minimum Lease Rental Receipts

We lease space to tenants primarily under non-cancelable operating leases that generally contain provisions for a base rent plus reimbursement of certain operating expenses, and we own fee interests in two parcels of land from which we receive rent under ground leases. The table below presents the future minimum base rentals on our non-cancelable office tenant and ground leases at March 31, 2019:

|

| | | |

Twelve months ending March 31: | (In thousands) |

| |

2020 | $ | 648,328 |

|

2021 | 579,740 |

|

2022 | 476,073 |

|