EXHIBIT 99.1

ANNUAL

INFORMATION FORM

ALEXCO

RESOURCE CORP.

Suite 1225, Two Bentall Centre, 555 Burrard

Street, Box 216

Vancouver, British Columbia, V7X 1M9

Telephone: (604) 633-4888

Facsimile: (604) 633-4887

E-Mail: info@alexcoresource.com

Website: www.alexcoresource.com

For the year ended December 31, 2017

Dated March 14, 2018

TABLE OF CONTENTS

| |

Page |

| |

|

| PRELIMINARY NOTES |

3 |

| GLOSSARY OF TECHNICAL TERMS |

5 |

| CORPORATE STRUCTURE |

9 |

| GENERAL DEVELOPMENT OF THE BUSINESS |

9 |

| Formation of the Corporation |

9 |

| Three Year History and Significant Acquisitions |

9 |

| DESCRIPTION OF THE BUSINESS |

12 |

| Mining Business |

12 |

| KHSD Property |

13 |

| Environmental Services |

13 |

| General |

13 |

| Keno Hill Project |

14 |

| Social and Environmental Policies |

15 |

| Risk Factors |

15 |

| Negative Cash Flow From Operating Activities |

15 |

| Forward-Looking Statements May Prove Inaccurate |

15 |

| Dilution |

15 |

| Exploration, Evaluation and Development |

16 |

| Figures for the Corporation's Resources are Estimates Based on Interpretation and Assumptions and May Yield Less Mineral Production Under Actual Conditions than is Currently Estimated |

16 |

| Amendments to Share Purchase Agreement with Wheaton |

16 |

| Keno Hill District |

17 |

| Mining Operations |

17 |

| Employee Recruitment and Retention |

17 |

| Permitting and Environmental Risks and Other Regulatory Requirements |

18 |

| Environmental Services |

18 |

| Potential Profitability of Mineral Properties Depends Upon Factors Beyond the Control of the Corporation |

19 |

| First Nation Rights and Title |

19 |

| Title to Mineral Properties |

19 |

| Capitalization and Commercial Viability |

19 |

| General Economic Conditions May Adversely Affect the Corporation’s Growth and Profitability |

19 |

| Operating Hazards and Risks |

20 |

| Competition |

20 |

| Certain of the Corporation’s Directors and Officers are Involved with Other Natural Resource Companies, Which May Create Conflicts of Interest from Time to Time |

20 |

| The Corporation May Fail to Maintain Adequate Internal Control Over Financial Reporting Pursuant to the Requirements of the Sarbanes-Oxley Act |

20 |

| DIVIDENDS |

21 |

| DESCRIPTION OF CAPITAL STRUCTURE |

21 |

| MARKET FOR SECURITIES |

22 |

| Trading Price and Volume |

22 |

| Securities Not Listed or Quoted |

22 |

| DIRECTORS AND OFFICERS |

23 |

| Name, Occupation and Security Holding |

23 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions |

24 |

| Conflicts of Interest |

25 |

| AUDIT COMMITTEE INFORMATION |

26 |

| Audit Committee Charter |

26 |

| Composition of the Audit Committee |

30 |

| Reliance on Certain Exemptions |

31 |

| Audit Committee Oversight |

31 |

| Pre-Approval Policies and Procedures |

31 |

| External Auditor Service Fees (By Category) |

32 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

32 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

32 |

| TRANSFER AGENTS AND REGISTRARS |

32 |

| MATERIAL CONTRACTS |

32 |

| INTERESTS OF EXPERTS |

33 |

| Names of Experts |

33 |

| Interests of Experts |

33 |

| ADDITIONAL INFORMATION |

33 |

| SCHEDULE "A" |

34 |

PRELIMINARY NOTES

In this Annual Information Form (“AIF”),

Alexco Resource Corp. is referred to as the “Corporation” or “Alexco”. All information contained

herein is as at and for the year ended December 31, 2017, unless otherwise specified. All dollar amounts in this AIF are expressed

in Canadian dollars unless otherwise indicated.

Cautionary Statement Regarding Forward-Looking

Statements

This AIF contains

forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking

information within the meaning of applicable Canadian securities laws (together, “forward-looking statements”)

concerning the Corporation's business plans, including but not limited to anticipated results and developments in the Corporation’s

operations in future periods, planned exploration and development of its mineral properties, plans related to its business and

other matters that may occur in the future, made as of the date of this AIF. Forward-looking statements may include, but are not

limited to, statements with respect to amendments to the silver purchase agreement (“SPA” or the “Silver

Purchase Agreement”) with Wheaton Precious Metals Corp. (“Wheaton”) and its impact on the Corporation,

the resulting effect on pricing and other terms of the SPA, additional capital requirements to

fund further exploration and development work on the Corporation's properties, future remediation and reclamation activities, future

mineral exploration, the estimation of mineral reserves and mineral resources, the realization of mineral reserve and mineral resource

estimates, future mine construction and development activities, future mine operation and production, the timing of activities,

the amount of estimated revenues and expenses, the success of exploration activities, permitting time lines, requirements for additional

capital and sources and uses of funds. Any statements that express or involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases

such as “expects”, “anticipates”, “plans”, “estimates”, “intends”,

“strategy”, “goals”, “objectives” or stating that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative

of any of these terms and similar expressions) are not statements of historical fact and may be “forward-looking statements”.

Forward-looking

statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events

or results to differ from those expressed or implied by the forward-looking statements. Such factors include, but are not limited

to, risks related to actual results and timing of exploration and development activities; actual results and timing of mining activities;

actual results and timing of environmental services operations; actual results and timing of remediation and reclamation activities;

conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of silver, gold,

lead, zinc and other commodities; possible variations in resources, grade or recovery rates; failure of plant, equipment or processes

to operate as anticipated; accidents, labour disputes and other risks of the mining industry; First Nation rights and title; continued

capitalization and commercial viability; global economic conditions; competition; delays in obtaining governmental approvals or

financing or in the completion of development activities, and inability of the Company to obtain additional financing needed to

fund certain contingent payment obligations on reasonable terms or at all. Furthermore, forward-looking

statements are statements about the future and are inherently uncertain, and actual achievements of the Corporation or other future

events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties

and other factors, including but not limited to those referred to in this AIF under the heading “Risk Factors”

and elsewhere.

Forward-looking

statements are based on certain assumptions that management believes are reasonable at the time they are made. In making the forward-looking

statements included in this AIF, the Corporation has applied several material assumptions, including, but not limited to, the assumption

that: (1) additional financing needed to fund certain contingent payment obligations to Wheaton; (2) additional financing needed

for the capacity related refund under the SPA with Wheaton will be available on reasonable terms; (3) additional financing needed

for further exploration and development work on the Corporation's properties will be available on reasonable terms; (4) the proposed

development of its mineral projects will be viable operationally and economically and proceed as planned; (5) market fundamentals

will result in sustained silver, gold, lead and zinc demand and prices, and such prices will not be materially lower than those

estimated by management in preparing the annual financial statements for the year ended December 31, 2017; (6) market fundamentals

will result in sustained silver, gold, lead and zinc demand and prices, and such prices will be materially consistent with or more

favourable than those anticipated in the Preliminary Economic Assessment (“PEA”) (as defined under "Description

of the Business – KHSD Property"); (7) the actual nature, size and grade of its mineral resources are materially consistent

with the resource estimates reported in the supporting technical reports; (8) labor and other industry services will be available

to the Corporation at prices consistent with internal estimates; (9) the continuances of existing and, in certain circumstances,

proposed tax and royalty regimes; and (10) that other parties will continue to meet and satisfy their contractual obligations to

the Corporation. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking

information to the extent that they involve estimates of the mineralization that will be encountered if the property is developed.

Other material factors and assumptions are discussed throughout this AIF and, in particular, under the heading “Risk

Factors”.

The Corporation's forward-looking statements

are based on the beliefs, expectations and opinions of management on the date the statements are made and should not be relied

on as representing the Corporation's views on any subsequent date. While the Corporation anticipates that subsequent events may

cause its views to change, the Corporation specifically disclaims any intention or any obligation to update forward-looking statements

if circumstances or management's beliefs, expectations or opinions should change, except as required by applicable law. For the

reasons set forth above, investors should not place undue reliance on forward-looking statements.

Cautionary Note to U.S. Investors –

Information Concerning Preparation of Resource Estimates

This AIF has been prepared in accordance

with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities

laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve”

are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure

for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”)

– CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These

definitions differ materially from the definitions in the United States Securities and Exchange Commission’s (“SEC”)

Industry Guide 7 under the United States Securities Act of 1933, as amended. Under SEC Industry Guide 7 standards, mineralization

cannot be classified as a “reserve” unless the determination has been made that the mineralization could be economically

and legally extracted at the time the reserve determination is made. As applied under SEC Industry Guide 7, a “final”

or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in

any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the

appropriate governmental authority.

In addition, the terms “mineral resource”,

“measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are

defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and

are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to

assume that all or any part of a mineral deposit in these categories will ever be converted into SEC Industry Guide 7 reserves.

“Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded

to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility

studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists

or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under

Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves”

by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information concerning mineral

deposits contained in this AIF may not be comparable to similar information made public by U.S. companies subject to the reporting

and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder, including

SEC Industry Guide 7.

Qualified Person Under NI 43-101

Except where

specifically indicated otherwise, the disclosure in this AIF of scientific and technical information regarding exploration projects

on Alexco’s mineral properties has been reviewed and approved by Alan McOnie, FAusIMM, Vice President, Exploration, while

that regarding mine development and operations has been reviewed and approved by Scott Smith, P.Eng., Mine Manager,

both of whom are Qualified Persons as defined by NI 43-101.

GLOSSARY OF TECHNICAL TERMS

The following is a glossary of certain mining terms used in

this AIF:

| Acre |

|

An area of 4,840 square yards or 43,560 square feet. |

| |

|

|

| Ag |

|

Silver. |

| |

|

|

| Assay |

|

In economic geology, to analyze the proportions of metal in a rock or overburden sample; to test an ore or mineral for composition, purity, weight or other properties of commercial interest. |

| |

|

|

| Au |

|

Gold. |

| |

|

|

| CIM |

|

Canadian Institute of Mining and Metallurgy. |

| |

|

|

| Deposit |

|

A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures; such a deposit does not qualify as a commercially mineable ore body or as containing ore reserves, until final legal, technical, and economic factors have been resolved. |

| |

|

|

| Dip |

|

The angle at which a stratum or vein is inclined from the horizontal. |

| |

|

|

| Fold |

|

A bend in strata or any planar structure. |

| |

|

|

| g/t |

|

Grams per tonne |

| |

|

|

| Grade |

|

The amount of valuable metal in each tonne of mineralized rock, expressed as grams per tonne (“g/t”) for precious metals, as percent (%) for copper, lead and zinc. |

| |

|

|

| Hectare |

|

An area equal to 100 meters by 100 meters. |

| |

|

|

| km |

|

Kilometers. |

| |

|

|

| m |

|

Meters. |

| |

|

|

| Mineral Reserve, Proven Mineral Reserve, Probable Mineral Reserve |

|

Under CIM standards, a Mineral Reserve

is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by a preliminary feasibility study or

feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant

factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting

materials and allowances for losses that may occur when the material is mined.

The terms “Mineral Reserve”,

“Proven Mineral Reserve” and “Probable Mineral Reserve” used in this AIF are mining terms defined under

CIM standards and used in accordance with NI 43-101. Mineral Reserves, Proven Mineral Reserves and Probable Mineral Reserves presented

under CIM standards may not conform with the definitions of “reserves” or “proven reserves” or “probable

reserves” under United States Industry Guide 7. See “Preliminary Notes – Cautionary Note to U.S. Investors –

Information Concerning Preparation of Resource Estimates”. |

| |

|

Mineral Reserves under CIM standards are

those parts of Mineral Resources which, after the application of all mining factors, result in an estimated tonnage and grade which,

in the opinion of the qualified person(s) making the estimates, is the basis of an economically viable project after taking account

of all relevant processing, metallurgical, economic, marketing, legal, environment, socio-economic and government factors. Mineral

Reserves are inclusive of diluting material that will be mined in conjunction with the Mineral Reserves and delivered to the treatment

plant or equivalent facility. The term ‘Mineral Reserve’ needs not necessarily signify that extraction facilities are

in place or operative or that all governmental approvals have been received. It does signify that there are reasonable expectations

of such approvals.

Under CIM standards, Mineral Reserves are

sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. A Probable Mineral Reserve

has a lower level of confidence than a Proven Mineral Reserve.

Proven Mineral Reserve: A Proven

Mineral Reserve is the economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility

study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors

that demonstrate, at the time of reporting, that the economic extraction can be justified.

Probable Mineral Reserve: A Probable

Mineral Reserve is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated

by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical,

economic, and other relevant factors that demonstrate, at the time of reporting, that the economic extraction can be justified. |

| |

|

|

| Mineral Resource, Measured Mineral Resource, Indicated Mineral Resource, Inferred Mineral Resource |

|

Under CIM standards, Mineral Resource is

a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form

and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade,

geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence

and knowledge.

The terms “mineral resource”,

“measured mineral resource”, “indicated mineral resource”, and “inferred mineral resource”

used in this AIF are mining terms defined under CIM standards and used in accordance with NI 43-101. They are not defined terms

under United States Industry Guide 7 and generally may not be used in documents filed with the SEC by U.S. companies. See “Preliminary

Notes – Cautionary Note to U.S. Investors – Information Concerning Preparation of Resource Estimates”.

A mineral resource estimate is based on

information on the geology of the deposit and the continuity of mineralization. Assumptions concerning economic and operating parameters,

including cut-off grades and economic mining widths, based on factors typical for the type of deposit, may be used if these factors

have not been specifically established for the deposit at the time of the mineral resource estimate. A mineral resource is categorized

on the basis of the degree of confidence in the estimate of quantity and grade or quality of the deposit, as follows: |

| |

|

Inferred Mineral Resource: Under

CIM standards, an Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality can be estimated

on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity.

The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops,

trenches, pits, workings and drill holes.

Indicated Mineral Resource: Under

CIM standards, an Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities,

shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application

of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate

is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such

as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be

reasonably assumed.

Measured Mineral Resource: Under

CIM standards, a Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities,

shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate

application of technical and economic parameters, to support production planning and evaluation of the economic viability of the

deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate

techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm

both geological and grade continuity. |

| |

|

|

| Mineralization |

|

The concentration of metals and their chemical compounds within a body of rock. |

| |

|

|

| Ore |

|

A metal or mineral or a combination of these of sufficient value as to quality and quantity to enable it to be mined at a profit. |

| |

|

|

| Ounce or oz |

|

A troy ounce or twenty penny weights or 480 grains or 31.103 grams. |

| |

|

|

| Outcrop |

|

An exposure of bedrock at the surface. |

| |

|

|

| Pb |

|

Lead. |

| |

|

|

| Quartz |

|

A mineral composed of silicon dioxide. |

| |

|

|

| Strike |

|

Direction or trend of a geologic structure as it intersects the horizontal. |

| |

|

|

| Ton |

|

Also referred to as “short ton”, a United States unit of weight equivalent to 2,000 pounds. |

| |

|

|

| Tonne |

|

A metric unit of weight equivalent to volume multiplied by specific gravity; equivalent to 1.102 tons or 1,000 kilograms (2,204.6 pounds). |

| |

|

|

| Tpd |

|

Tonnes per day |

| |

|

|

| Vein |

|

Thin sheet-like intrusion into a fissure or crack, commonly bearing quartz. |

| |

|

|

| Zn |

|

Zinc. |

Metric Equivalents

The following table sets forth the factors

for converting between Imperial measurements and metric equivalents:

| To Convert From |

|

To |

|

Multiply By |

| Feet |

|

Meters |

|

0.3048 |

| Meters |

|

Feet |

|

3.281 |

| Miles |

|

Kilometers (“km”) |

|

1.609 |

| Kilometers |

|

Miles |

|

0.6214 |

| Acres |

|

Hectares (“ha”) |

|

0.405 |

| Hectares |

|

Acres |

|

2.471 |

| Grams |

|

Ounces (Troy) |

|

0.03215 |

| Grams/Tonnes |

|

Ounces (Troy)/Short Ton |

|

0.02917 |

| Tonnes (metric) |

|

Pounds |

|

2,205 |

| Tonnes (metric) |

|

Short Tons |

|

1.1023 |

CORPORATE STRUCTURE

The Corporation was incorporated under

the Business Corporations Act (Yukon) on December 3, 2004 under the name “Alexco Resource Corp.” Effective December

28, 2007, it was continued under the Business Corporations Act (British Columbia).

The Corporation's head office is located

at Suite 1225, Two Bentall Centre, 555 Burrard Street, Box 216, Vancouver, British Columbia, V7X 1M9, Canada, and its registered

and records office is located at 10th Floor, 595 Howe Street, Vancouver, British Columbia, V6C 2T5, Canada.

At the end of its most recently completed

financial year, the Corporation had the following wholly-owned subsidiaries:

| · | Alexco Keno Hill Mining Corp., organized

under the laws of British Columbia (“AKHM”); |

| · | Alexco Exploration Canada Corp., organized

under the laws of British Columbia (“AECC”); |

| · | Elsa Reclamation & Development Company

Ltd., organized under the laws of Yukon (“ERDC”); |

| · | Alexco Environmental Group Inc. (formerly

Access Mining Consultants Ltd.), organized under the laws of Yukon (“AEG Canada”); |

| · | Alexco Water and Environment Inc., organized

under the laws of Colorado (“AWE”); and |

| · | Alexco Environmental Group Holdings Inc.,

organized under the laws of British Columbia (“AEG Holdings”); |

Unless otherwise indicated or the context

otherwise requires, reference to the term the “Corporation” or “Alexco” in this AIF includes Alexco Resource

Corp. and its subsidiaries.

GENERAL DEVELOPMENT OF THE BUSINESS

Formation of the

Corporation

In 2005, the Corporation completed a series

of transactions pursuant to which it acquired a number of mineral property interests and rights to certain operating contracts

in Yukon Territory and British Columbia, the most significant of which properties are located in Yukon Territory’s Keno Hill

Silver District.

Alexco operates two principal businesses:

(i) a mining business, comprised of mineral exploration and mine development and operation in Canada, primarily in Yukon Territory;

and (ii) through its Alexco Environmental Group Division (through AEG Canada and AWE), provision of a variety of mine and industrial

site related environmental services including management of the regulatory and environmental permitting process, environmental

assessments, and reclamation and closure planning in Canada, the United States and elsewhere.

Three Year History

and Significant Acquisitions

In June 2005, the Corporation was selected

as the preferred purchaser of the assets of United Keno Hill Mines Limited and UKH Minerals Limited (collectively, “UKHM”)

by a court appointed interim receiver and receiver-manager of UKHM. In February 2006, following negotiation of a subsidiary agreement

(the “Subsidiary Agreement”) between the Government of Canada, the Government of Yukon (collectively, the “Government

Group”) and the Corporation, the Supreme Court of Yukon conditionally approved the purchase of the assets of UKHM by

Alexco through its wholly-owned subsidiary, ERDC, final closing of which acquisition was effected in December 2007. Under the terms

of the Subsidiary Agreement, the Corporation is indemnified by the Government of Canada for all liabilities, including environmental

liabilities, arising directly or indirectly as a result of the pre-existing condition of the Keno Hill mineral rights and other

assets acquired from UKHM. The Subsidiary Agreement provides that ERDC may bring any mine into production on the UKHM Mineral Rights

(as hereinafter defined) by designating a production unit from the mineral rights relevant to that purpose and then assuming responsibility

for all costs of the production unit’s water related care and maintenance and water related components of closure reclamation.

The Subsidiary Agreement further requires ERDC to pay into a separate reclamation trust a 1.5% net smelter return royalty, up to

an aggregate maximum of $4 million for all production units, from any future production from the UKHM Mineral Rights, commencing

once earnings from mining before interest, taxes and depreciation exceed actual exploration costs, up to a maximum of $6.2 million,

plus actual development and construction capital.

Also under the Subsidiary Agreement, ERDC

is retained through the Government Group as a paid contractor responsible on a continuing basis for the environmental care and

maintenance and ultimate closure reclamation of the former UKHM Mineral Rights. The original Subsidiary Agreement provided that

ERDC was responsible for the development of the ultimate closure reclamation plan for fees of 65% of agreed commercial contractor

rates, and this plan development is currently ongoing. Upon acceptance and regulatory approval, the closure reclamation plan will

be implemented by ERDC at full agreed commercial contractor rates. During the period required to develop the plan, the original

Subsidiary Agreement also provided that ERDC was responsible for carrying out the environmental care and maintenance of the UKHM

Mineral Rights for a reducing fixed annual fee adjusted each year for certain operating and inflationary factors.

In July 2013, an amended and restated Subsidiary

Agreement (the “ARSA”) was executed with the Government of Canada. Recognizing that developing the closure reclamation

plan is more complicated than originally anticipated, the ARSA provides for the Government of Canada to contribute a higher proportion

of closure plan development costs than provided for under the Subsidiary Agreement, retroactive to 2009. Going forward, ERDC will

receive 95% of agreed commercial contractor rates for ongoing development of the closure reclamation plan. Furthermore, with respect

to care and maintenance activity during the closure reclamation planning phase, the original reducing fee scale is replaced by

a fixed fee of $850,000 per year, representing approximately 50% of estimated fully-billable care and maintenance fees.

Since 2006, the Corporation has carried

out exploration activities on several of its properties within the Keno Hill District, with a significant component of that activity

having been focused on the Bellekeno property and the Bellekeno mine, which commenced commercial production effective January 1,

2011.

Under terms of the original Silver Purchase

Agreement (entered into on October 2, 2008 and subsequently amended on October 20, 2008, December 10, 2008, December 22, 2009,

March 31, 2010, January 15, 2013, March 11, 2014 and June 16, 2014, respectively):

| · | the Corporation and certain of its subsidiaries

received up-front deposit payments from Wheaton totaling US$50 million, and received further payments of the lesser of US $3.90

(increasing by 1% per annum after the third year of full production) and the prevailing market price for each ounce of payable

silver delivered, if as and when delivered; |

| · | Wheaton would receive 25% of the life

of mine silver produced by the Corporation from its Keno Hill Silver District properties; and |

| · | the initial silver deliveries were to

come from the Bellekeno mine. |

In light of a sharply reduced silver price

environment, Bellekeno mining operations were suspended as of September 30, 2013.

On March 29, 2017 the Corporation and certain

of its subsidiaries and Wheaton entered into an amendment agreement to the Silver Purchase Agreement (the “Amended SPA”)

pursuant to which, among other things, the following amendments were made to the Silver Purchase Agreement:

| · | Wheaton will continue to receive 25% of

the life of mine payable silver from the KHSD. The production payment (originally US$3.90 per ounce) will be based on monthly average

silver head grade from the mill and monthly average silver spot price: |

| · | The actual monthly production payment

will fall within a defined grade and pricing range governed by upper and lower numeric criteria (ceiling grade/price and floor

grade/price) according to the following formula: |

(Ceiling Grade – Deemed

Shipment Head Grade) |

X |

(Ceiling Price – Deemed

Shipment Silver Price) |

X |

Market

Price |

| (Ceiling Grade – Floor Grade) |

(Ceiling Price – Floor Price) |

| Floor Grade |

= |

|

600 g/t Ag |

| Floor Price |

= |

|

US$13/oz Ag |

| Ceiling Grade |

= |

|

1,400 g/t Ag |

| Ceiling Price |

= |

|

US$25/oz Ag |

| Deemed Shipment Head Grade |

= |

|

Calculated monthly mill silver head grade |

| Deemed Shipment Silver Price |

= |

|

Average monthly silver price |

| Market Price |

= |

|

Spot silver price prior to day of sale |

| · | The date for completion of the 400 tonne

per day mine and mill completion test date was extended to December 31, 2019; |

| · | The Wheaton area of interest remains one

(1) km around existing Alexco holdings in the KHSD. |

In consideration

of the foregoing amendments, the Corporation issued 3,000,000 shares to Wheaton with a fair value of US$4,934,948.

In addition to the mining business described

above, the Corporation also operates an environmental services business through its Alexco Environmental Group division (“AEG”).

Primarily through AEG Canada, AWE and ERDC, AEG provides a variety of mine and industrial site related environmental services including

management of the regulatory and environmental permitting process, environmental assessments and reclamation and closure planning.

AEG operations also include the care and maintenance and closure reclamation activities being conducted by the Corporation in the

Keno Hill District under the Subsidiary Agreement. Alexco also owns certain patents (the “Patents”) registered

or in the process of being registered in the U.S., Canada and various other countries around the world, with terms that expire

variously between 2017 and 2020. The Patents generally pertain to the in-situ immobilization of metals, and are specifically suited

to mine closure related remediation.

Further particulars relating to the business

of AEG, including activities being conducted under the Subsidiary Agreement, are described below under “Description of the

Business – Environmental Services”.

On December 8, 2015, the Corporation completed

an underwritten private placement of 5,662,500 flow-through common shares at a price of C$0.53 per share for gross proceeds of

$3,001,125. The underwriter, Canaccord Genuity Corp., received a cash commission of $195,073 representing 6.5% of the gross proceeds,

as well as 368,062 underwriter’s warrants, with each underwriter’s warrant entitling the holder to purchase one common

share at a price of C$0.53 until December 8, 2017. These warrants were exercised in full prior to expiry.

On December 8, 2015, the Corporation also

completed a concurrent non-brokered private placement of 2,000,000 common shares at a price of $0.48 per share for gross proceeds

of $960,000, for which the Corporation paid a finder’s fee of $57,600.

On May 17, 2016, the Corporation completed

a non-brokered private placement of 10,839,972 units at a price of $1.20 per unit for aggregate gross proceeds of $13,007,966.

Each unit consisted of one common share and one-half of one non-transferable common share purchase warrant, each whole such warrant

entitling the holder to purchase one additional common share of the Corporation at a price of $1.75 per share until May 17, 2018.

If, following September 18, 2016, the closing price of Corporation’s common shares on the Toronto Stock Exchange is higher

than $2.50 for a period of 10 consecutive trading days (the “Trigger Date”), the expiry date of these warrants

may be accelerated to the date that is 10 trading days after the Trigger Date by the issuance of a news release within two trading

days of the Trigger Date announcing such acceleration (the “Acceleration Provision”). The Corporation paid Sprott

Private Wealth LP and certain of its affiliates a cash commission equal to the 5% of the gross proceeds from the sale of 7.51 million

units and issued an aggregate of 225,300 finder’s warrants, each of which is exercisable for one common share of the Corporation

at a price of $1.49 until May 17, 2018, subject to the Acceleration Provision. The Corporation also paid finder’s fees in

the aggregate amount of $176,110 to other arm’s length finders, representing a cash commission equal to 5% of the gross proceeds

received in respect of the sale of 2.94 million units to purchasers introduced to the Corporation by such finders.

On May 30, 2017, the Corporation completed

an underwritten private placement of 4,205,820 “flow-through” common shares at a price of $2.15 per share for gross

proceeds of $9,042,513. The underwriter, Canaccord Genuity Corp., received a cash commission of $542,550 representing 6% of the

gross proceeds, as well as 126,174 underwriter’s warrants, with each underwriter’s warrant entitling the holder to

purchase one common share at a price of $2.15 until May 30, 2019.

On February 26, 2018, the Corporation announced

that it had entered into a credit agreement with Sprott Private Resource Lending (Collector), L.P. to provide a US$15,000,000 credit

facility to be used for the development of the Keno Hill Project. The facility is available for drawdown for a period of 12 months

and matures February 23, 2021 and bears an interest rate on the funds drawn down equal to the greater of (a) a fixed rate

of 8% per annum, calculated daily and compounded monthly; and (b) a floating rate equal to 7% per annum plus LIBOR, calculated

and compounded monthly. In consideration for providing the credit facility, the Corporation issued to the lender 1,000,000 warrants,

each warrant exercisable for one common share of the Corporation at an exercise price of $2.25 until February 23, 2023, subject

to the Corporation’s right to accelerate the expiry date of the warrants on not less than 30 days’ notice in the event

that the closing price of the Corporation’s common shares on the Toronto Stock Exchange is greater than $5.625 for a period

of more than 20 consecutive trading days.

DESCRIPTION OF THE BUSINESS

The Corporation operates two principal

businesses: a mining business, comprised of mineral exploration and mine development and operation in Canada, primarily in Yukon

Territory; and through AEG an environmental services business, providing consulting, remediation solutions and project management

services in respect of environmental permitting and compliance and site remediation, in Canada, the United States and elsewhere.

At December 31, 2017, the Corporation had

79 permanent and seasonal employees. A total of 31 were employed in the care and maintenance of the Bellekeno mine and mill site

care and maintenance, a further 8 were employed in mineral exploration and evaluation activities. A total of 31 were employed in

the environmental services business, with the remaining 9 employed in respect of executive management and administrative support.

Significant aspects of both the mining business and the environmental services business require specialized skills and knowledge

in areas that include geology, mining, metallurgy, engineering, environmental contamination treatment, permitting and regulatory

compliance, as well as environmental and social policy issues. Any re-start of Alexco’s mining operations will necessitate

the hiring of additional mine and mill personnel.

Mining Business

The Corporation's principal mining business

activities are currently being carried out within the Keno Hill District in Yukon Territory. The Keno Hill District (the "District")

is a storied silver mining region in Canada, encompassing over 35 former mines that produced variously from approximately 1918

through 1988, with published information from the Yukon Government’s Minfile database reporting more than 217 million ounces

of silver produced at average grades of 44.7 ounces per tonne silver, 5.6% lead and 3.1% zinc.

The Corporation’s mineral property

holdings within the Keno Hill district cover the most prospective geological areas to host silver mineralization, including all

of the significant historic producing former mines and most of the other mineral occurrences. In addition to the deposits described

below that are within the Keno Hill Silver District (“KHSD”) as detailed in the PEA, the Corporation holds several

other less advanced property interests within the District, including but not limited to the Silver King, Elsa, Husky, Sadie Ladue

and McQuesten properties, which potentially could become material properties depending on the results of exploration programs the

Corporation may carry out on them in the future, as well as the separate Elsa Tailings Property (see technical report dated

June 16, 2010, entitled “Mineral Resource Estimation, Elsa Tailings Project ,Yukon, Canada”). In aggregate,

Alexco’s mineral rights and holdings within the Keno Hill District currently comprise 725 surveyed quartz mining leases,

846 unsurveyed quartz mining claims, eight (8) placer claims and two (2) crown grants, in addition to five (5) fee simple lots

and seven (7) surface leases. Of those, the mineral rights acquired from UKHM (the “UKHM Mineral Rights”)

and therefore subject to the capped 1.5% net smelter return royalty provided for under the Subsidiary Agreement (see “General

Development of the Business – Three Year History and Significant Acquisitions”) total 676 quartz mining leases, 121

quartz mining claims and two crown grants.

Other non-material mineral property interests

of the Corporation include Harlan properties in the Yukon, and certain net smelter return royalties in respect of the Brewery Creek,

Ida-Oro (formerly Klondike) and Sprogge properties in the Yukon and the Telegraph Creek, Iskut River, Kiniskan Lake and Manson

Creek properties in British Columbia.

KHSD Property

The Corporation’s KHSD property

(as detailed in the PEA) encompasses the Flame & Moth, Bermingham, Lucky Queen, Bellekeno and Onek deposits and comprises

703 surveyed quartz mining leases and 866 unsurveyed quartz mining claims and two Crown Grants, of which about half of the tenements

are UKHM derived rights.

An independent technical report dated March

29, 2017 with an effective date of January 3, 2017 prepared by Roscoe Postle Associates Inc. ("RPA") entitled

"Preliminary Economic Assessment of the Keno Hill Silver District Project, Yukon, Canada" (the "PEA")

was filed and is available on SEDAR under the Corporation's profile at www.sedar.com.

Attached as Schedule "A" to this

AIF is the summary contained in the PEA, which summary has been updated and conformed to be consistent with other disclosure

within this AIF.

The detailed disclosure contained in the

PEA is hereby incorporated by reference. It is noted that the PEA contains references and/or assumptions relating to the dates

for re-starting or continuing mining operations or development work at certain of Alexco's mineral properties. Notwithstanding

the incorporation by reference herein of the PEA and reproduction of the summary section in Schedule “A” hereto, such

dates were projections made at the time the PEA was prepared and are not necessarily reflective of Alexco's current plans. Re-start

of mining operations and/or development work is dependent on a number of factors, including sustained improvements in silver markets

and the effectiveness of cost structure reduction measures. Accordingly, there is no certainty as to when these factors will be

achieved.

Environmental Services

General

The Corporation’s environmental services

division, AEG, is in the business of managing risk and unlocking value at mature, closed or abandoned sites through integration

and implementation of the Corporation's core competencies, which include management of environmental services, implementation of

innovative treatment technologies, execution of site reclamation and closure operations, and, if appropriate, rejuvenation of exploration

and development activity. The Corporation’s principal markets for these services are in Canada, the United States and the

Americas, with the Canadian market serviced primarily through AEG Canada and ERDC, the U.S. market through AWE, and the balance

of the Americas through either AEG Canada or AWE. The Corporation provides its services to a range of industrial sectors, but with

a particular focus on current and former mine sites.

The Corporation offers its clients a unique

combination of environmental remediation expertise in the area of site reclamation and closure, an ability to manage complex permitting

and regulatory programs on a turnkey basis, and strong operations management. In addition, the Corporation seeks to strategically

leverage off its environmental services group, accessing opportunities to enhance asset value through effective liability risk

management and efficient site operations. This is accomplished through unlocking potential exploration and development opportunities

at contaminated or abandoned sites through cost effective and responsible environmental remediation and liability transfer.

The Corporation executes its environmental

services business plan by using and applying the intellectual property assets, including the Patents, and the specialized skill

sets and knowledge it maintains in-house. While there are a significant number of firms providing environmental services in North

America, these assets, skill sets and knowledge provide Alexco with a strong competitive advantage. Consolidated revenue from environmental

services for the year ended December 31, 2017 totaled $10,732,000, compared to $11,361,000 in 2016, all of which was derived from

sales to external unrelated parties. During the year ended December 31, 2017, the Corporation recorded revenues from three customers

representing 10% or more of total environmental services revenue, in the amounts of $3,419,000, $1,702,000 and $1,473,000. During

2016, AEG had three customers representing 10% or more of total revenue, in the amounts of $3,220,000, 3,044,000 and $1,746,000.

AEG’s largest single customer is the Government of Canada, with a substantial component of Government revenues earned from

the Government of Canada’s Indian and Northern Affairs Canada.

Keno Hill Project

As described above (see “General

Development of the Business – Three Year History and Significant Acquisitions”), under the Subsidiary Agreement, Alexco’s

subsidiary ERDC was retained through the Government Group as a paid contractor responsible on a continuing basis for the environmental

care and maintenance and ultimate closure reclamation of the former UKHM Mineral Rights.

Pursuant to the Subsidiary Agreement, ERDC

shares the responsibility for the development of the ultimate closure reclamation plan with the Government of Canada, for which

it would receive fees of 65% of agreed commercial contractor rates, and this plan development is currently ongoing. Upon acceptance

and regulatory approval, the closure reclamation plan will be implemented by ERDC at full agreed contractor rates. During the period

required to develop the plan and until the closure plan is executed, ERDC is also responsible for carrying out the environmental

care and maintenance at various sites within the UKHM Mineral Rights, for a fixed annual fee adjusted each year for certain operating

and inflationary factors and determined on a site-by-site basis. Under the Subsidiary Agreement, the portion of the annual fee

amount so determined which was billable by ERDC in respect of each site reduced by 15% each year until all site-specific care and

maintenance activities were replaced by closure reclamation activities; provided however that should a closure reclamation plan

be prepared but not accepted and approved, the portion of annual fees billable by ERDC would revert to 85% until the Subsidiary

Agreement was either amended or terminated. ERDC receives agreed commercial contractor rates when retained by the Government Group

to provide environmental services in the Keno Hill District outside the scope of care and maintenance and closure reclamation planning

under the Subsidiary Agreement. As a result of these terms, the Corporation has previously recognized an environmental services

contract loss provision to reflect aggregate future losses estimated to be realized with respect to care and maintenance activity

during the closure planning phase.

In July 2013, the Corporation executed

an amended and restated Subsidiary Agreement, the ARSA, with the Government of Canada. Recognizing that developing the closure

reclamation plan is more complicated than originally anticipated, the ARSA provides for the Government of Canada to contribute

a higher proportion of those costs than provided for under the Subsidiary Agreement. Going forward, ERDC receives 95% of agreed

commercial contractor rates for ongoing development of the closure reclamation plan. Furthermore, with respect to care and maintenance

activity during the closure planning phase, the original reducing fee scale was replaced by a fixed fee of $850,000 per year, representing

approximately 50% of estimated fully-billable fees.

Social and Environmental

Policies

The Corporation maintains a written Code

of Business Conduct and Ethics (the “Code”), compliance with which is mandatory for all directors, officers

and employees, and the full text of which may be viewed at the Corporation’s web site. Included within the Code is a requirement

that all directors, officers and employees comply with all laws and governmental regulations applicable to Alexco’s activities,

including but not limited to maintaining a safe and healthy work environment, promoting a workplace that is free from discrimination

or harassment and conducting all activities in full compliance with all applicable environmental laws. All directors, officers

and employees are required to certify in writing their acknowledgement of and compliance with the Code, at the time of hiring and

at least annually thereafter. A senior executive of the Corporation is formally appointed the role of Company Ethics Officer, responsible

for ensuring adherence to the Code, investigating any reported violations, and ensuring appropriate responses, including corrective

action and preventative measures, are taken when required.

Risk Factors

The following are major risk factors management

has identified which relate to the Corporation’s business activities. Such risk factors could materially affect the Corporation's

future financial results, and could cause events to differ materially from those described in forward-looking statements relating

to the Corporation. Though the following are major risk factors identified by management, they do not comprise a definitive list

of all risk factors related to the Corporation's business and operations. Other specific risk factors are discussed elsewhere in

this AIF, as well as in the Corporation’s consolidated financial statements (under the headings “Description of Business

and Nature of Operations”, “Significant Accounting Policies” and “Financial Instruments” and elsewhere

within that document) and in management’s discussion and analysis (under the headings “Critical Accounting Estimates”

and “Risk Factors” and elsewhere within that document) for its most recently completed financial year, being the year

ended December 31, 2017, and its other disclosure documents, all as filed on the SEDAR website at www.sedar.com.

Negative Cash Flow

From Operating Activities

The Corporation has not yet consistently

achieved positive operating cash flow, and there are no assurances that the Corporation will not experience negative cash flow

from operations in the future. The Corporation has incurred net losses in the past and may incur losses in the future and will

continue to incur losses until and unless it can derive sufficient revenues from its mineral projects. Such future losses could

have an adverse effect on the market price of the Corporation's common shares, which could cause investors to lose part or all

of their investment.

Forward-Looking

Statements May Prove Inaccurate

Readers are cautioned not to place undue

reliance on forward-looking statements. By their nature, forward-looking statements involve numerous assumptions, known and unknown

risks and uncertainties, of both a general and specific nature, that could cause actual results to differ materially from those

suggested by the forward-looking statements. See "Preliminary Notes – Cautionary Statement Regarding Forward-Looking

Statements".

Dilution

The Corporation expects to require additional

funds to finance its growth and development strategy. If the Corporation elects to raise additional funds by issuing additional

equity securities, such financing may substantially dilute the interests of the Corporation's shareholders. The Corporation may

also issue additional securities in the future pursuant to existing and new agreements in respect of its projects or other acquisitions

and pursuant to existing securities of the Corporation.

Exploration, Evaluation

and Development

Mineral exploration, evaluation and development

involves a high degree of risk and few properties which are explored are ultimately developed into producing mines. With respect

to the Corporation’s properties, should any ore reserves exist, substantial expenditures will be required to confirm ore

reserves which are sufficient to commercially mine, and to obtain the required environmental approvals and permitting required

to commence commercial operations. Should any mineral resource be defined on such properties there can be no assurance that the

mineral resource on such properties can be commercially mined or that the metallurgical processing will produce economically viable

and saleable products. The decision as to whether a property contains a commercial mineral deposit and should be brought into production

will depend upon the results of exploration programs and/or technical studies, and the recommendations of duly qualified engineers

and/or geologists, all of which involves significant expense. This decision will involve consideration and evaluation of several

significant factors including, but not limited to: (1) costs of bringing a property into production, including exploration and

development work, preparation of appropriate technical studies and construction of production facilities; (2) availability and

costs of financing; (3) ongoing costs of production; (4) market prices for the minerals to be produced; (5) environmental compliance

regulations and restraints (including potential environmental liabilities associated with historical exploration activities); and

(6) political climate and/or governmental regulation and control.

The ability of the Corporation to sell,

and profit from the sale of any eventual production from any of the Corporation’s properties will be subject to the prevailing

conditions in the marketplace at the time of sale. Many of these factors are beyond the control of the Corporation and therefore

represent a market risk which could impact the long term viability of the Corporation and its operations.

Figures for the

Corporation's Resources are Estimates Based on Interpretation and Assumptions and May Yield Less Mineral Production Under Actual

Conditions than is Currently Estimated

In making determinations about whether

to advance any of its projects to development, the Corporation must rely upon estimated calculations as to the mineral resources

and grades of mineralization on its properties. Until ore is actually mined and processed, mineral resources and grades of mineralization

must be considered as estimates only. Mineral resource estimates are imprecise and depend upon geological interpretation and statistical

inferences drawn from drilling and sampling which may prove to be unreliable. Alexco cannot be certain that:

| · | reserve, resource or other mineralization

estimates will be accurate; or |

| · | mineralization can be mined or processed

profitably. |

Any material changes in mineral resource

estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s

return on capital. The Corporation's resource estimates have been determined and valued based on assumed future prices, cut-off

grades and operating costs that may prove to be inaccurate. Extended declines in market prices for silver, gold, lead, zinc and

other commodities may render portions of the Corporation’s mineralization uneconomic and result in reduced reported mineral

resources.

Amendments to Share

Purchase Agreement with Wheaton

The March 29, 2017 amendments to the SPA

with Wheaton, requires that to satisfy the completion test under the Amended SPA, the Corporation will need to recommence operations

on the KHSD Property and operate the mine and mill at 400 tonnes per day on or before December 31, 2019. If the completion test

is not satisfied by December 31, 2019, the outcome could materially adversely affect the Corporation as it would be required to

pay a capacity related refund to Wheaton in the maximum amount of US$8.8 million. The Corporation would need to raise additional

capital to finance the capacity related refund and there is no guarantee that the Corporation will be able to raise such additional

capital. In the event that the Corporation cannot raise such additional capital, the Corporation will default under the terms of

the Amended SPA.

Keno Hill District

While the Corporation has conducted exploration

activities in the Keno Hill District, further review of historical records and/or additional exploration and geological testing

will be required to determine whether any of the mineral deposits it contains are economically recoverable. There is no assurance

that such exploration and testing will result in favourable results. The history of the Keno Hill District has been one of fluctuating

fortunes, with new technologies and concepts reviving the District numerous times from probable closure until 1989, when it did

ultimately close down for a variety of economic and technical reasons. Many or all of these economic and technical issues will

need to be addressed prior to the commencement of any future production on the Keno Hill properties.

Mining Operations

Decisions by the Corporation to proceed

with the construction and development of mines, including Bellekeno, are based on development plans which include estimates for

metal production and capital and operating costs. Until completely mined and processed, no assurance can be given that such estimates

will be achieved. Failure to achieve such production and capital and operating cost estimates or material increases in costs could

have an adverse impact on the Corporation’s future cash flows, profitability, results of operations and financial condition.

The Corporation’s actual production and capital and operating costs may vary from estimates for a variety of reasons, including:

actual resources mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; short-term

operating factors, such as the need for sequential development of resource bodies and the processing of new or different resource

grades; revisions to mine plans; risks and hazards associated with mining; natural phenomena, such as inclement weather conditions,

water availability, floods fire, rock falls and earthquakes, equipment failure and failure of retaining dams around tailings disposal

areas which may result in, among other adverse effects, environmental pollution and consequent liability; and unexpected labour

shortages or strikes. Costs of production may also be affected by a variety of factors, including changing waste ratios, metallurgical

recoveries, labour costs, commodity costs, general inflationary pressures and currency rates. In addition, the risks arising from

these factors are further increased while any such mine is progressing through the ramp-up phase of its operations and has not

yet established a consistent production track record.

Furthermore, mining operations at the Bellekeno

mine project were suspended as of early September 2013 as a result of sharp and significant declines in precious metals prices

during the second quarter of 2013. Re-start of mining operations is dependent on a number of factors, including sustained improvements

in silver markets and the effectiveness of cost structure reduction measures, and the uncertainties around the achievement of these

factors are significant.

Employee Recruitment

and Retention

Recruitment and retention of skilled and

experienced employees is a challenge facing the mining sector as a whole. During the late 1990s and early 2000s, with unprecedented

growth in the technology sector and an extended cyclical downturn in the mining sector, the number of new workers entering the

mining sector was depressed and significant number of existing workers departed, leading to a so-called “generational gap”

within the industry. Since the mid-2000s, this factor was exacerbated by competitive pressures as the mining sector experienced

an extended cyclical upturn. Additional exacerbating factors specific to Alexco include competitive pressures in labour force demand

from the oil sands sector in northern Alberta and the mining and oil & gas sectors in British Columbia, and the fact that Alexco’s

Keno Hill District is a fly-in/fly-out operation. Alexco has experienced employee recruitment and retention challenges, particularly

with respect to mill operators in 2011 and through the first three quarters of 2012. There can be no assurance that such challenges

won’t continue or resurface, not only with respect to the mill but in other District operational areas as well including

mining and exploration. Furthermore, any re-start of mining operations will necessitate the re-hiring of mine and mill personnel.

Permitting and Environmental

Risks and Other Regulatory Requirements

The current or future operations of the

Corporation, including development activities, commencement of production on its properties and activities associated with the

Corporation's mine reclamation and remediation business, require permits or licenses from various federal, territorial and other

governmental authorities, and such operations are and will be governed by laws, regulations and agreements governing prospecting,

development, mining, production, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental

protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities and

in mine reclamation and remediation activities generally experience increased costs and delays as a result of the need to comply

with the applicable laws, regulations and permits. There can be no assurance that all permits and permit modifications which the

Corporation may require for the conduct of its operations will be obtainable on reasonable terms or that such laws and regulations

would not have an adverse effect on any project which the Corporation might undertake.

Any failure by the Corporation to comply

with applicable laws, regulations and permitting requirements may result in enforcement actions including orders issued by regulatory

or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures,

installation of additional equipment or remedial actions against the Corporation. The Corporation may be required to compensate

those suffering loss or damage by reason of the Corporation’s mining operations or mine reclamation and remediation activities

and may have civil or criminal fines or penalties imposed upon it for violation of applicable laws or regulations.

Amendments to current laws, regulations

and permits governing operations and activities of mining companies and mine reclamation and remediation activities could have

a material adverse impact on the Corporation. As well, policy changes and political pressures within and on federal, territorial

and First Nation governments having jurisdiction over or dealings with the Corporation could change the implementation and interpretation

of such laws, regulations and permits, also having a material adverse impact on the Corporation. Such impacts could result in one

or more of increases in capital expenditures or production costs, reductions in levels of production at producing properties or

abandonment or delays in the development of new mining properties.

Environmental Services

A material decline in the level of activity

or reduction in industry willingness to spend capital on mine reclamation, remediation or environmental services could adversely

affect demand for AEG's environmental services. Likewise, a material change in mining product commodity prices, the ability of

mining companies to raise capital or changes in domestic or international political, regulatory and economic conditions could adversely

affect demand for AEG's services.

One of AEG’s customers accounted

for 32% of environmental services revenues in the 2017 fiscal year. The loss of, or a significant reduction in the volume of business

conducted with this customer could have a significant detrimental effect on AEG’s environmental services business and the

Corporation.

The patents which the Corporation owns

or has access to or other proprietary technology may not prevent AEG's competitors from developing substantially similar technology,

which may reduce AEG's competitive advantage. Similarly, the loss of access to any of such patents or other proprietary technology

or claims from third parties that such patents or other proprietary technology infringe upon proprietary rights which they may

claim or hold would be detrimental to AEG's reclamation and remediation business and a material adverse impact on the Corporation.

AEG may not be able to keep pace with continual

and rapid technological developments that characterize the market for AEG's environmental services, and AEG’s failure to

do so may result in a loss of its market share. Similarly, changes in existing regulations relating to mine reclamation and remediation

activities could require AEG to change the way it conducts its business.

AEG is dependent on the professional skill

sets of its employees, some of whom would be difficult to replace. The loss of any such employees could significantly affect AEG’s

ability to service existing clients, its profitability and its ability to grow its business.

Potential Profitability

of Mineral Properties Depends Upon Factors Beyond the Control of the Corporation

The potential profitability of mineral

properties is dependent upon many factors beyond the Corporation’s control. For instance, world prices of and markets for

gold, silver, lead and zinc are unpredictable, highly volatile, potentially subject to governmental fixing, pegging and/or controls

and respond to changes in domestic, international, political, social and economic environments. Another factor is that rates of

recovery may vary from the rate experienced in tests and a reduction in the recovery rate will adversely affect profitability and,

possibly, the economic viability of a property. Profitability also depends on the costs of operations, including costs of labour,

materials, equipment, electricity, environmental compliance or other production inputs. Such costs will fluctuate in ways the Corporation

cannot predict and are beyond the Corporation’s control, and such fluctuations will impact on profitability and may eliminate

profitability altogether. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for development

and other costs have become increasingly difficult, if not impossible, to project. These changes and events may materially affect

the financial performance of the Corporation.

First Nation Rights

and Title

The nature and extent of First Nation rights

and title remains the subject of active debate, claims and litigation in Canada, including in the Yukon and including with respect

to intergovernmental relations between First Nation authorities and federal, provincial and territorial authorities. There can

be no guarantee that such claims will not cause permitting delays, unexpected interruptions or additional costs for the Corporation’s

projects. These risks may have increased after the Supreme Court of Canada decision of June 26, 2014 in Tsilhqot'in Nation

v. British Columbia.

Title to Mineral

Properties

The acquisition of title to mineral properties

is a complicated and uncertain process. The properties may be subject to prior unregistered agreements of transfer or land claims,

and title may be affected by undetected defects. Although the Corporation has made efforts to ensure that legal title to its properties

is properly recorded in the name of the Corporation, there can be no assurance that such title will ultimately be secured. As a

result, the Corporation be constrained in its ability to operate its mineral properties or unable to enforce its rights with respect

to its mineral properties. An impairment to or defect in the Corporation’s title to its mineral properties would adversely

affect the Corporation’ business and financial condition.

Capitalization and

Commercial Viability

The Corporation will require additional

funds to further explore, develop and mine its properties. The Corporation has limited financial resources, and there is no assurance

that additional funding will be available to the Corporation to carry out the completion of all proposed activities, for additional

exploration or for the substantial capital that is typically required in order to place a property into commercial production.

Although the Corporation has been successful in the past in obtaining financing through the sale of equity securities, there can

be no assurance that the Corporation will be able to obtain adequate financing in the future or that the terms of such financing

will be favourable. Failure to obtain such additional financing could result in the delay or indefinite postponement of further

exploration and development of its properties.

General Economic

Conditions May Adversely Affect the Corporation’s Growth and Profitability

The unprecedented events in global financial

markets since 2008 have had a profound impact on the global economy and led to increased levels of volatility. Many industries,

including the mining industry, are impacted by these market conditions. Some of the impacts of the current financial market turmoil

include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity,

commodity, foreign currency exchange and precious metal markets, and a lack of market liquidity. If the current turmoil and volatility

levels continue they may adversely affect the Corporation's growth and profitability. Specifically:

| • | a global credit/liquidity or foreign currency

exchange crisis could impact the cost and availability of financing and the Corporation’s overall liquidity; |

| • | the volatility of silver and other commodity

prices would impact the Corporation’s revenues, profits, losses and cash flow; |

| • | volatile energy prices, commodity and

consumables prices and currency exchange rates would impact the Corporation’s operating costs; and |

| • | the devaluation and volatility of global

stock markets could impact the valuation of the Corporation’s equity and other securities. |

These factors could have a material adverse

effect on Alexco’s financial condition and results of operations.

Operating Hazards

and Risks

In the course of exploration, development

and production of mineral properties, certain risks, particularly including but not limited to unexpected or unusual geological

operating conditions including rock bursts, cave-ins, fires, flooding and earthquakes, may occur. It is not always possible to

fully insure against such risks and the Corporation may decide not to insure against such risks as a result of high premiums or

other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing

costs and a decline in the value of the securities of the Corporation.

Adverse weather conditions could also disrupt

the Corporation’s environmental services business and/or reduce demand for the Corporation’s services.

Competition

Significant and increasing competition

exists for mining opportunities internationally. There are a number of large established mining companies with substantial capabilities

and far greater financial and technical resources than the Corporation. The Corporation may be unable to acquire additional attractive

mining properties on terms it considers acceptable and there can be no assurance that the Corporation’s exploration and acquisition

programs will yield any reserves or result in any commercial mining operation.

Certain of the Corporation’s

Directors and Officers are Involved with Other Natural Resource Companies, Which May Create Conflicts of Interest from Time to

Time

Some of the Corporation’s directors

and officers are directors or officers of other natural resource or mining-related companies. These associations may give rise

to conflicts of interest from time to time. As a result of these conflicts of interest, the Corporation may miss the opportunity

to participate in certain transactions.

The Corporation

May Fail to Maintain Adequate Internal Control Over Financial Reporting Pursuant to the Requirements of the Sarbanes-Oxley Act

Section 404 of the Sarbanes-Oxley Act (“SOX”)

requires an annual assessment by management of the effectiveness of the Corporation’s internal control over financial reporting.

The Corporation may fail to maintain the adequacy of its internal control over financial reporting as such standards are modified,

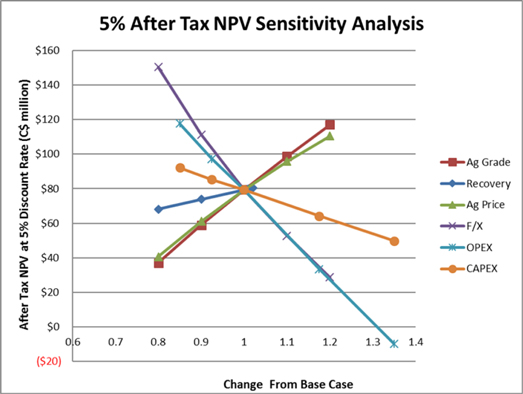

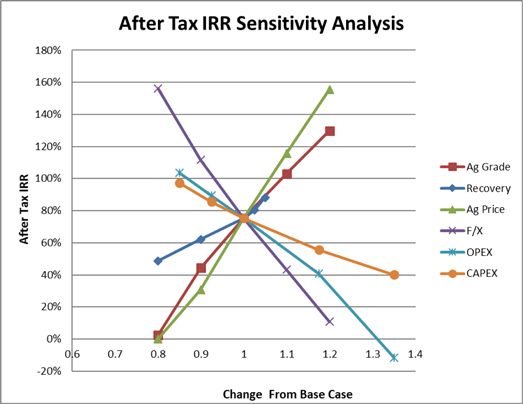

supplemented or amended from time to time, and the Corporation may not be able to ensure that it can conclude, on an ongoing basis,