UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

|

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

OR

|

|

☒

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For fiscal year ended December 31, 2015

|

|

OR

|

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ____ to ______

|

|

OR

|

|

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Date of event requiring this shell company report:

|

Commission file number: 001-33621

ALEXCO RESOURCE CORP.

(Exact name of Registrant as specified in its charter)

Province of British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 1225, Two Bentall Centre, 555 Burrard Street, Box 216

Vancouver, British Columbia, Canada V7X 1M9

(Address of principal executive offices)

Michael Clark, CFO

Suite 1225, Two Bentall Centre, 555 Burrard Street, Box 216

Vancouver, British Columbia, Canada V7X 1M9

Tel: (604) 633-4888

Email: info@alexcoresources.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of Exchange

Common Shares, no par value NYSE MKT LLC

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the Registrant's classes of capital or common stock as of the close of the period covered by the annual report: As at December 31, 2015, 77,346,022 common shares of the Registrant were issued and outstanding

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☐ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer ☐Accelerated filer ☐Non-accelerated filer ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued ☒ Other ☐

by the International Accounting Standards Board

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

|

INTRODUCTION

|

4 |

|

CURRENCY

|

4

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

4

|

|

CAUTIONARY NOTE TO UNITED STATES INVESTORS

|

6

|

|

REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES

|

6

|

|

EXPLANATORY NOTE REGARDING PRESENTATION OF FINANCIAL INFORMATION

|

6

|

|

GLOSSARY OF MINING TERMS

|

6

|

|

PART I

|

9 |

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

9 |

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE |

9 |

|

ITEM 3.

|

KEY INFORMATION |

9 |

|

ITEM 4.

|

INFORMATION ON THE COMPANY |

21 |

|

ITEM 5.

|

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

45 |

|

ITEM 6.

|

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

51 |

|

ITEM 7.

|

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

67 |

|

ITEM 8.

|

FINANCIAL INFORMATION |

68 |

|

ITEM 9.

|

THE OFFER AND LISTING |

69 |

|

ITEM 10.

|

ADDITIONAL INFORMATION

|

70

|

|

ITEM 11.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

79

|

|

ITEM 12.

|

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

81

|

|

PART II

|

|

81

|

|

ITEM 13.

|

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

|

81

|

|

ITEM 14

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

81 |

|

ITEM 15

|

CONTROLS AND PROCEDURES

|

81

|

|

ITEM 16A

|

AUDIT COMMITTEE FINANCIAL EXPERT

|

82

|

|

ITEM 16B

|

CODE OF ETHICS

|

83

|

|

ITEM 16C

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

83 |

|

ITEM 16D

|

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

|

90 |

|

ITEM 16E

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

|

90

|

|

ITEM 16F

|

CHANGES IN REGISTRANTS CERTIFYING ACCOUNTANT

|

90

|

|

ITEM 16G

|

CORPORATE GOVERNANCE

|

90

|

|

ITEM 16H

|

MINE SAFETY DISCLOSURE.

|

90

|

|

PART III

|

91 |

|

ITEM 17

|

FINANCIAL STATEMENTS

|

91

|

|

ITEM 18

|

FINANCIAL STATEMENTS

|

91

|

|

ITEM 19

|

EXHIBITS

|

91

|

INTRODUCTION

In this Annual Report on Form 20-F, except as otherwise indicated or as the context otherwise requires, the "Company", "we", "our" or "us" or "Alexco" refers to Alexco Resource Corp. and its consolidated subsidiaries, as applicable.

CURRENCY

Unless we otherwise indicate in this Annual Report on Form 20-F, all references to "Canadian Dollars", "CDN$" or "$" are to the lawful currency of Canada and all references to "U.S. Dollars" or "US $" are to the lawful currency of the United States.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws (together, "forward-looking statements") concerning the Company's business plans, including but not limited to anticipated results and developments in the Company's operations in future periods, planned exploration and development of its mineral properties, plans related to its business and other matters that may occur in the future, made as of the date of this Form 20-F. Forward-looking statements may include, but are not limited to, statements with respect to the amendments to the Silver Streaming Agreement with Silver Wheaton Corp. ("Silver Wheaton") and its impact on the Company, the potential payment of US$20 million by Alexco to Silver Wheaton and the resulting effect on pricing and other terms of the Silver Streaming Agreement, additional capital requirements to finance the capacity related refund under the Silver Streaming Agreement with Silver Wheaton, additional capital requirements to fund further exploration and development work on the Company's properties, future remediation and reclamation activities, future mineral exploration, the estimation of mineral reserves and mineral resources, the realization of mineral reserve and mineral resource estimates, future mine construction and development activities, future mine operation and production, the timing of activities, the amount of estimated revenues and expenses, the success of exploration activities, permitting time lines, requirements for additional capital and sources and uses of funds. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "plans", "estimates", "intends", "strategy", "goals", "objectives" or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be "forward-looking statements".

While the Company has based these forward-looking statements on its expectations about future events as at the date that such statements were prepared, the statements are not a guarantee of the Company's future performance and are subject to risks, uncertainties, assumptions and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors and assumptions include, amongst others, the effects of general economic conditions, changing foreign exchange rates and actions by government authorities, uncertainties associated with negotiations and misjudgments in the course of preparing forward-looking statements. In addition, there are also known and unknown risk factors which may cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

|

·

|

risks related to a lack of cash flow sufficient to sustain operations;

|

|

·

|

risks related to the Company's need for further capitalization in order to maintain commercial viability

|

|

·

|

risks related to being in default of the Silver Streaming Agreement with Silver Wheaton;

|

|

·

|

risks related to the Company's potential inability to re-start mining operations at the Bellekeno Deposit;

|

|

·

|

risks related to operating in the resource industry, which is highly speculative, and has certain inherent exploration risks which could have a negative effect on the Company's operations;

|

|

·

|

risks related to the Company's estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated;

|

|

·

|

risks related to the uncertainty of the mineral deposits contained in Keno Hill District being economically recoverable;

|

|

|

· |

risks related to failing to achieve production and capital and operating cost estimates or material increases in costs, which could have an adverse impact on the Company's future cash flows, profitability, results of operations and financial condition; |

|

· |

risks related to employee recruitment and retention problems, which could negatively impact the operations of the Company; |

|

· |

risks related to environmental and regulatory requirements which could cause a restriction or suspension of Company operations; |

|

· |

risks related to market forces outside of the Company's control which could negatively impact the Company's operations; |

|

· |

risks related to the loss of title and ownership of its properties which would have a negative effect on the Company's operations and valuation; |

|

· |

risks related to the inherently dangerous activities of mining exploration, development and production; |

|

· |

risks related to the Company failing to maintain insurance, which could negatively impact future profitability; |

|

· |

risks related to the natural resource industry being highly competitive, which could restrict the Company's growth; |

|

· |

risks related to a potential shortage in equipment and supplies; |

|

· |

risks related to the volatility of silver and other metal prices; |

|

· |

risks related to land reclamation requirements; |

|

· |

risks related to legislation regarding climate change; |

|

· |

risks related to the environmental services business associated with the Company being highly dependent upon key customers and employees; |

|

· |

risks related to the Company's plans to raise additional funds, which would likely substantially dilute the interest of the Company's shareholders; |

|

· |

risks related to general economic conditions that may adversely affect the Company's growth and profitability; |

|

· |

risks related to certain of the Company's directors and officers being involved with other natural resource companies, which may create conflicts of interest; |

|

· |

risks related to the Company intending not to pay dividends; |

|

· |

risks related to failure to maintain adequate internal control over financial reporting pursuant to the requirements of the Sarbanes-Oxley Act; |

|

· |

risks related to the market for the Company's common shares, which has been subject to volume and price volatility; |

|

· |

risks related to the differences in United States and Canadian reporting of reserves and resources; |

|

· |

risks related to U.S. investors not being able to enforce their civil liabilities against the Company or its directors, controlling persons and officers; and |

|

· |

risks related to the Company's classification as "foreign private issuer" and exemption from Section 14 proxy rules and Section 16 of the Securities Exchange Act of 1934. |

The above list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section heading "Item 3. Key Information – D. Risk Factors" and "Item 5. Operating and Financial Review and Prospects" below in this Annual Report on Form 20-F. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statement.

The Company qualifies all the forward-looking statements contained in this Annual Report on Form 20-F by the foregoing cautionary statements.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES

As used in this Annual Report on Form 20-F, the terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101—Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM")—CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the SEC's Industry Guide 7 ("SEC Industry Guide 7") under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"). Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and governmental authorizations must be filed with the appropriate governmental authority.

In addition, the terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report on Form 20-F and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

EXPLANATORY NOTE REGARDING PRESENTATION OF FINANCIAL INFORMATION

The annual audited consolidated financial statements contained in this Annual Report on Form 20-F are reported in Canadian dollars. For the years ended December 31, 2015, 2014 and 2013, as presented in the annual audited consolidated financials contained in this Annual Report on Form 20-F, we prepared our consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS"). Statements prepared in accordance with IFRS are not comparable in all respects with financial statements that are prepared in accordance with U.S. generally accepted accounting principles ("US GAAP").

GLOSSARY OF MINING TERMS

|

Ag

|

Silver.

|

|

Assay

|

In economic geology, to analyze the proportions of metal in a rock or overburden sample; to test an ore or mineral for composition, purity, weight or other properties of commercial interest.

|

|

Au

|

Gold.

|

|

CIM

|

Canadian Institute of Mining and Metallurgy.

|

|

Deposit

|

A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures; such a deposit does not qualify as a commercially mineable ore body or as containing ore reserves, until final legal, technical, and economic factors have been resolved.

|

|

Dip

|

The angle at which a stratum is inclined from the horizontal.

|

|

Fold

|

A bend in strata or any planar structure.

|

|

g/t

|

Grams per tonne.

|

|

Grade

|

The amount of valuable metal in each tonne of ore, expressed as grams per tonne (g/t) for precious metals, as percent (%) for copper, lead, zinc and nickel.

|

|

Hectare

|

An area equal to 100 meters by 100 meters.

|

|

km

|

Kilometers.

|

|

m

|

Meters.

|

|

Mineral Reserve, Proven Mineral Reserve, Probable Mineral Reserve

|

Under CIM standards, a Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by a preliminary feasibility study or feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

The terms "Mineral Reserve", "Proven Mineral Reserve" and "Probable Mineral Reserve" used in this Form 20-F are mining terms defined under CIM standards and used in accordance with NI 43-101. Mineral Reserves, Proven Mineral Reserves and Probable Mineral Reserves presented under CIM standards may not conform with the definitions of "reserves" or "proven reserves" or "probable reserves" under SEC Industry Guide 7. See "Cautionary Note to United States Investors Regarding Mineral Reserve and Resource Estimates".

Mineral Reserves under CIM standards are those parts of Mineral Resources which, after the application of all mining factors, result in an estimated tonnage and grade which, in the opinion of the qualified person(s) making the estimates, is the basis of an economically viable project after taking account of all relevant processing, metallurgical, economic, marketing, legal, environment, socio-economic and government factors. Mineral Reserves are inclusive of diluting material that will be mined in conjunction with the Mineral Reserves and delivered to the treatment plant or equivalent facility. The term 'Mineral Reserve' needs not necessarily signify that extraction facilities are in place or operative or that all governmental approvals have been received. It does signify that there are reasonable expectations of such approvals.

Under CIM standards, Mineral Reserves are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. A Probable Mineral Reserve has a lower level of confidence than a Proven Mineral Reserve.

Proven Mineral Reserve: A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that the economic extraction can be justified.

Probable Mineral Reserve: A Probable Mineral Reserve is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that the economic extraction can be justified.

|

|

Mineral Resource,

Measured Mineral

Resource, Indicated

Mineral Resource,

Inferred Mineral

Resource

|

Under CIM standards, Mineral Resource is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

The terms "mineral resource", "measured mineral resource", "indicated mineral resource", and "inferred mineral resource" used in this Form 20-F are mining terms defined under CIM standards and used in accordance with NI 43-101. They are not defined terms under SEC Industry Guide 7. See "Cautionary Note to United States Investors Regarding Mineral Reserve and Resource Estimates".

A mineral resource estimate is based on information on the geology of the deposit and the continuity of mineralization. Assumptions concerning economic and operating parameters, including cut-off grades and economic mining widths, based on factors typical for the type of deposit, may be used if these factors have not been specifically established for the deposit at the time of the mineral resource estimate. A mineral resource is categorized on the basis of the degree of confidence in the estimate of quantity and grade or quality of the deposit, as follows:

Inferred Mineral Resource: Under CIM standards, an Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

Indicated Mineral Resource: Under CIM standards, an Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Measured Mineral Resource: Under CIM standards, a Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

|

|

Mineralization

|

The concentration of metals and their chemical compounds within a body of rock.

|

|

Ore

|

A metal or mineral or a combination of these of sufficient value as to quality and quantity to enable it to be mined at a profit.

|

|

Ounce or oz

|

A troy ounce or twenty penny weights or 480 grains or 31.103 grams.

|

|

Outcrop

|

An exposure of bedrock at the surface.

|

|

Pb

|

Lead.

|

|

Quartz

|

A mineral composed of silicon dioxide.

|

|

Strike

|

Direction or trend of a geologic structure as it intersects the horizontal.

|

|

Ton

|

Also referred to as "short ton", a United States unit of weight equivalent to 2000 pounds.

|

|

Tonne

|

A metric unit of weight equivalent to volume multiplied by specific gravity; equivalent to 1.102 tons or 1,000 kilograms (2,204.6 pounds).

|

|

Vein

|

Thin sheet-like intrusion into a fissure or crack, commonly bearing quartz.

|

|

Zn

|

Zinc.

|

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not Applicable.

Item 2. Offer Statistics and Expected Timetable

Not Applicable.

Item 3. Key Information

A. Selected Financial Data

The selected financial data and the information in the following table of the Company as at and for the years ended December 31, 2015, 2014, and 2013, 2012 and the six month transitional year ended December 31, 2011 were derived from the audited consolidated financial statements of the Company.

The selected historical consolidated financial information presented below is condensed and may not contain all of the information that you should consider. This selected financial data should be read in conjunction with our annual audited consolidated financial statements, the notes thereto and the sections entitled "Item 3D. Key Information –Risk Factors" and ''Item 5 — Operating and Financial Review and Prospects.''

|

(expressed in thousands of dollars, except per share amounts)

|

As at and for the

year ended

December 31, 2015

|

As at and for the

year ended

December 31, 2014

|

As at and for the

year ended

December 31, 2013

|

As at and for the

year ended

December 31, 2012

|

As at and for the six month transitional year ended December 31, 2011

|

|

Revenue from mining operations

|

-

|

361

|

43,114

|

76,725

|

38,639

|

|

Gross profit (loss) from mining operations

|

-

|

361

|

(29)

|

15,034

|

9,869

|

|

Revenue from environmental services

|

14,662

|

14,925

|

16,319

|

7,983

|

3,876

|

|

Gross profit from environmental services

|

3,251

|

4,888

|

8,849

|

2,886

|

279

|

|

Revenue from all operations

|

14,662

|

15,286

|

59,433

|

84,708

|

42,515

|

|

Gross profit from all operations

|

3,251

|

5,249

|

8,820

|

17,920

|

10,148

|

|

Net income (loss)

|

(5,509)

|

(32,772)

|

(50,450)

|

3,420

|

1,723

|

|

Earnings (loss) per share –

|

|

|

|

|

|

|

Basic

|

($0.08)

|

($0.50)

|

($0.81)

|

$0.06

|

$0.03

|

|

Diluted

|

($0.08)

|

($0.50)

|

($0.81)

|

$0.06

|

$0.03

|

|

Total assets

|

102,542

|

105,195

|

131,213

|

212,300

|

210,668

|

|

Total long-term liabilities

|

24,496

|

24,363

|

26,114

|

49,355

|

57,997

|

|

Net assets

|

75,033

|

77,037

|

101,179

|

146,545

|

139,060

|

|

Capital stock

|

168,585

|

164,708

|

157,983

|

155,042

|

154,154

|

|

Dividends declared

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Non-IFRS Measures

Adjusted Loss

Adjusted loss excludes amounts recorded with respect to impairment charges, and within this MD&A is provided before tax, net of tax and on a per-share basis. These measures are used by management to facilitate comparability between periods, and are believed to be relevant to external users for the same reason. They are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

These adjusted loss measures are reconciled to financial statement loss measures for the years ending December 31, 2015, 2014 and 2013 as follows (dollar amounts in thousands, and denominated in Canadian dollars), with adjusted loss per share calculated using the same weighted average number of shares outstanding as used for the financial statement measure:

| |

|

|

|

|

|

|

|

|

|

| |

|

2015

|

|

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

Loss before taxes

|

|

$

|

(6,616

|

)

|

|

$

|

(35,608

|

)

|

|

$

|

(62,079

|

)

|

|

Subtract:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Write-down of mineral properties

|

|

|

-

|

|

|

|

25,103

|

|

|

|

51,840

|

|

|

Write-down of property, plant and equipment

|

|

|

-

|

|

|

|

4,828

|

|

|

|

3,501

|

|

|

Write-down of long-term investments

|

|

|

-

|

|

|

|

-

|

|

|

|

1,785

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted loss before taxes

|

|

|

(6,616

|

)

|

|

|

(5,677

|

)

|

|

|

(4,953

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net recovery of income taxes, excluding deferred tax effect of above-noted write-downs

|

|

|

1,107

|

|

|

|

314

|

|

|

|

640

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net loss

|

|

$

|

(5,509

|

)

|

|

$

|

(5,363

|

)

|

|

$

|

(4,313

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted loss per share (basic and diluted)

|

|

$

|

(0.08

|

)

|

|

$

|

(0.08

|

)

|

|

$

|

(0.07

|

)

|

Exchange Rates

The following tables set out the exchange rates for one United States dollar ("US$") expressed in terms of Canadian dollars ("Cdn$") for (i) the average exchange rates (based on the average of the exchange rates on the last day of each month) in each of the years 2011 to 2015 and the low rate in each of those years, and (ii) the range of high and low exchange rates in each of the months October 2015 to April 2016.

The following table sets forth, for the periods indicated, the high, low, end of period and average for period noon buying rates as published by the Bank of Canada, as expressed in the amount of one United States Dollar equal to Canadian dollars.

| |

2016 (to Apr 20)

|

2015

|

2014

|

2013

|

2012

|

2011

|

|

High for period

|

1.4589

|

1.3990

|

1.1643

|

1.0697

|

1.0418

|

1.0604

|

|

Low for period

|

1.2627

|

1.1728

|

1.0614

|

0.9839

|

0.9710

|

0.9449

|

|

End of period

|

1.2627

|

1.3840

|

1.1601

|

1.0636

|

0.9949

|

1.0170

|

|

Average for period

|

1.3581

|

1.2787

|

1.1045

|

1.0299

|

0.9996

|

0.9891

|

The following table sets forth, for each period indicated, the high and low exchange rates for one United States dollar expressed in Canadian dollars on the last day of each month during such period, based on the noon buying rate.

| |

October

|

November

|

December

|

January

|

February

|

March

|

| |

2015

|

2015

|

2015

|

2016

|

2016

|

2016

|

|

High

|

1.3242

|

1.3360

|

1.3990

|

1.4589

|

1.4040

|

1.3468

|

|

Low

|

1.2904

|

1.3095

|

1.3360

|

1.3969

|

1.3523

|

1.2962

|

Exchange rates are based on the Bank of Canada nominal noon exchange rates. The nominal noon exchange rate on April 20, 2016 as reported by the Bank of Canada for the conversion of one United States dollar into Canadian dollars was US$1.00 = Cdn$1.2627.

| B. |

Capitalization and Indebtedness |

Not Applicable.

| C. |

Reasons for the Offer and Use of Proceeds |

Not Applicable.

D. Risk Factors

In addition to the other information presented in this Annual Report on Form 20-F, the following should be considered carefully in evaluating us and our business. This Annual Report on Form 20-F contains forward-looking statements that involve risk and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed below and elsewhere in this Annual Report on Form 20-F.

The activities of the Company are subject to the high risk nature of its business which is the acquisition, financing, exploration, development and operation of mining properties. The following risk factors, which are not exhaustive, could materially affect the Company's business, financial condition or results of operations and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. These risks include but are not limited to the following:

Financing Risks

The Company has a lack of cash flow sufficient to sustain operations and may not begin receiving operating revenue in the foreseeable future.

The Company has not yet consistently achieved positive operating cash flow, and there are no assurances that the Company will not experience negative cash flow from operations in the future. The Company has incurred net losses in the past and may incur losses in the future and will continue to incur losses until and unless it can derive sufficient revenues from its mineral projects. Such future losses could have an adverse effect on the market price of the Company's common shares, which could cause investors to lose part or all of their investment (see Note 1 in the Company financial statements for the year ended December 31, 2015 and 2014).

The Company requires further capitalization in order to maintain commercial viability.

The Company will require additional funds to further explore, develop and mine its properties. The Company has limited financial resources, and there is no assurance that additional funding will be available to the Company to carry out the completion of all proposed activities, for additional exploration or for the substantial capital that is typically required in order to place a property into commercial production. Although the Company has been successful in the past in obtaining financing through the sale of equity securities, there can be no assurance that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional financing could result in the delay or indefinite postponement of further exploration and development of its properties.

Risks Related to the Company's Mining Business

The Company is at risk of not completing the completion test and exposed to capacity related refund in 2017 under the Silver Streaming Agreement with Silver Wheaton.

The June 16, 2014 amendments under the Silver Streaming Agreement with Silver Wheaton (other than an extension of the 400 tonne per day mine and mill completion test date and certain subscription rights of Silver Wheaton to participate in financings) are subject to the Company making a US$20 million payment to Silver Wheaton by December 31, 2016. The Company would need to raise additional capital to finance this payment. There is no guarantee that the Company will be able to raise such additional capital. In the event that the Company cannot raise such additional capital, such amendments will not take effect. Without making the US$20 million payment to Silver Wheaton, to satisfy the completion test, the Company would need to recommence operations on the Keno Hill District property and operate the mine and mill at 400 tonnes per day on or before December 31, 2017. If the completion test is not satisfied by December 31, 2017, the Company would be required to pay a capacity related refund to Silver Wheaton in the maximum amount of US$9.75 million. The Company will need to raise additional capital to finance the capacity related refund and there is no guarantee that the Company will be able to raise such additional capital. In the event that the Company cannot raise such additional capital, the Company will be in default under the terms of the Silver Streaming Agreement.

The Company may not be able to re-start mining operations at the Bellekeno Deposit.

Mining operations at the Company's Bellekeno deposit were suspended as of early September 2013 as a result of sharp and significant declines in precious metals prices during the second quarter of 2013. Re-start of mining operations is dependent on a number of factors, including sustained improvements in silver and other commodity markets and the effectiveness of cost structure reduction measures, and the uncertainties around the achievement of these factors are significant. There is no guarantee that these factors will be achieved and mining operations will re-start.

The Company operates in the resource industry, which is highly speculative, and has certain inherent exploration risks which could have a negative effect on the Company's operations.

Mineral exploration, evaluation and development involves a high degree of risk and few properties which are explored are ultimately developed into producing mines. With respect to the Company's properties, should any ore reserves exist, substantial expenditures will be required to confirm ore reserves which are sufficient to commercially mine, and to obtain the required environmental approvals and permitting required to commence commercial operations. Should any mineral resource be defined on such properties there can be no assurance that the mineral resource on such properties can be commercially mined or that the metallurgical processing will produce economically viable and saleable products. The decision as to whether a property contains a commercial mineral deposit and should be brought into production will depend upon the results of exploration programs and/or technical studies, and the recommendations of duly qualified engineers and/or geologists, all of which involves significant expense. This decision will involve consideration and evaluation of several significant factors including, but not limited to: (1) costs of bringing a property into production, including exploration and development work, preparation of appropriate technical studies and construction of production facilities; (2) availability and costs of financing; (3) ongoing costs of production; (4) market prices for the minerals to be produced; (5) environmental compliance regulations and restraints (including potential environmental liabilities associated with historical exploration activities); and (6) political climate and/or governmental regulation and control.

The ability of the Company to sell, and profit from the sale of any eventual production from any of the Company's properties will be subject to the prevailing conditions in the marketplace at the time of sale. Many of these factors are beyond the control of the Company and therefore represent a market risk which could impact the long term viability of the Company and its operations.

Figures for the Company's resources are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

In making determinations about whether to advance any of its projects to development, the Company must rely upon estimated calculations as to the mineral resources and grades of mineralization on its properties. Until ore is actually mined and processed, mineral resources and grades of mineralization must be considered as estimates only. Mineral resource estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling which may prove to be unreliable. The Company cannot be certain that:

|

· |

reserve, resource or other mineralization estimates will be accurate; or |

|

· |

mineralization can be mined or processed profitably. |

Any material changes in mineral resource estimates and grades of mineralization will affect the economic viability of placing a property into production and a property's return on capital. The Company's resource estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for silver, gold, lead, zinc and other commodities may render portions of the Company's mineralization uneconomic and result in reduced reported mineral resources.

The Company cannot guarantee that the mineral deposits contained in the Keno Hill District are economically recoverable.

While the Company has conducted exploration activities in the Keno Hill District, other than with respect to Bellekeno, Lucky Queen and Flame & Moth, further review of historical records and additional exploration and geological testing will be required to determine whether any of the mineral deposits it contains are economically recoverable. There is no assurance that such exploration and testing will result in favourable results. The history of the Keno Hill District has been one of fluctuating fortunes, with new technologies and concepts reviving the District numerous times from probable closure until 1989, when it did ultimately close down for a variety of economic and technical reasons. Many or all of these economic and technical issues will need to be addressed prior to the commencement of any future production on the Keno Hill properties.

Failure to achieve production and capital and operating cost estimates or material increases in costs could have an adverse impact on the Company's future cash flows, profitability, results of operations and financial condition.

Decisions by the Company to proceed with the construction and development of mines, including Bellekeno, are based on development plans which include estimates for metal production and capital and operating costs. Until completely mined and processed, no assurance can be given that such estimates will be achieved. Failure to achieve such production and capital and operating cost estimates or material increases in costs could have an adverse impact on the Company's future cash flows, profitability, results of operations and financial condition. The Company's actual production and capital and operating costs may vary from estimates for a variety of reasons, including: actual resources mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; short-term operating factors relating to the mineable resources, such as the need for sequential development of resource bodies and the processing of new or different resource grades; revisions to mine plans; risks and hazards associated with mining; natural phenomena, such as inclement weather conditions, water availability, floods and earthquakes; and unexpected labor shortages or strikes. Costs of production may also be affected by a variety of factors, including changing waste ratios, metallurgical recoveries, labor costs, commodity costs, general inflationary pressures and currency rates. In addition, the risks arising from these factors are further increased while any such mine is progressing through the ramp-up phase of its operations and has not yet established a consistent production track record. See also "The Company may not be able to re-start mining operations at the Bellekeno Deposit" above.

The Company may face employee recruitment and retention problems, which could negatively impact the operations of the Company.

Recruitment and retention of skilled and experienced employees is a challenge facing the mining sector as a whole. During the late 1990s and early 2000s, with unprecedented growth in the technology sector and an extended cyclical downturn in the mining sector, the number of new workers entering the mining sector was depressed and significant number of existing workers departed, leading to a so-called "generational gap" within the industry. Since the mid-2000s, this factor was exacerbated by competitive pressures as the mining sector experienced an extended cyclical upturn. Additional exacerbating factors specific to the Company include the fact that the Company's Keno Hill District is a fly-in/fly-out operation. The Company has experienced employee recruitment and retention challenges, particularly with respect to mill operators in 2011 and through the first three quarters of 2012. There can be no assurance that such challenges won't continue or resurface, not only with respect to the mill but in other District operational areas as well including mining and exploration. Furthermore, any re-start of mining operations will necessitate the re-hiring of mine and mill personnel.

The Company is subject to substantial environmental and regulatory requirements which could cause a restriction or suspension of Company operations.

The current or future operations of the Company, including development activities, commencement of production on its properties and activities associated with the Company's mine reclamation and remediation business, require permits or licences from various federal, territorial and other governmental authorities, and such operations are and will be governed by laws, regulations and agreements governing prospecting, development, mining, production, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities and in mine reclamation and remediation activities generally experience increased costs and delays as a result of the need to comply with the applicable laws, regulations and permits. There can be no assurance that all permits and permit modifications which the Company may require for the conduct of its operations will be obtainable on reasonable terms or that such laws and regulations would not have an adverse effect on any project which the Company might undertake, including but not limited to the Bellekeno mine project.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations or in mine reclamation and remediation activities may be required to compensate those suffering loss or damage by reason of such activities and may have civil or criminal fines or penalties imposed upon them for violation of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining companies and mine reclamation and remediation activities could have a material adverse impact on the Company. As well, policy changes and political pressures within and on federal, territorial and First Nation governments having jurisdiction over or dealings with the Company could change the implementation and interpretation of such laws, regulations and permits, also having a material adverse impact on the Company. Such impacts could result in one or more of increases in capital expenditures or production costs, reductions in levels of production at producing properties or abandonment or delays in the development of new mining properties.

Mineral operations are subject to market forces outside of the Company's control which could negatively impact the Company's operations.

The potential profitability of mineral properties is dependent upon many factors beyond the Company's control. For instance, world prices of and markets for gold, silver, lead and zinc are unpredictable, highly volatile, potentially subject to governmental fixing, pegging and/or controls and respond to changes in domestic, international, political, social and economic environments. Another factor is that rates of recovery of mined ore may vary from the rate experienced in tests and a reduction in the recovery rate will adversely affect profitability and, possibly, the economic viability of a property. Profitability also depends on the costs of operations, including costs of labor, materials, equipment, electricity, environmental compliance or other production inputs. Such costs will fluctuate in ways the Company cannot predict and are beyond the Company's control, and such fluctuations will impact on profitability and may eliminate profitability altogether. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for development and other costs have become increasingly difficult, if not impossible, to project. These changes and events may materially affect the financial performance of the Company.

The Company has no guarantee of clear title to its mineral properties and the Company could lose title and ownership of its properties which would have a negative effect on the Company's operations and valuation.

The acquisition of title to mineral properties is a complicated and uncertain process. The properties may be subject to prior unregistered agreements of transfer or land claims, and title may be affected by undetected defects. The Company has taken steps, in accordance with industry standards, to verify mineral properties in which it has an interest. Although the Company has made efforts to ensure that legal title to its properties is properly recorded in the name of the Company, there can be no assurance that such title will ultimately be secured.

The Company's mineral properties could be subject to the rights and title of First Nations which would have a negative effect on the Company's operations and valuation.

The nature and extent of First Nation rights and title remains the subject of active debate, claims and litigation in Canada, including in the Yukon and including with respect to intergovernmental relations between First Nation authorities and federal, provincial and territorial authorities. There can be no guarantee that such claims will not cause permitting delays, unexpected interruptions or additional costs for the Company's projects. These risks may have increased after the Supreme Court of Canada decision of June 26, 2014 in Tsilhqot'in Nation v. British Columbia.

The Company's operations are subject to the inherent risk associated with mineral exploration, development and production activities.

Mineral exploration development and production activities generally involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Environmental hazards, industrial accidents, unusual or unexpected geological formations, fires, power outages, labor disruptions, flooding, explosions, cave-ins, land-slides and the inability to obtain suitable or adequate machinery, equipment or labor are other risks involved in the operation of mines and the conduct of exploration, development and production programs. Operations and activities in which we have a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of precious and base metals, any of which could result in work stoppages, damage to or destruction of mines, if any, and other producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damage. The occurrence of such risks could cause significant delays or cancelation in the conduct of the Company's activities which could negatively impact profitability.

The Company's operations contain significant uninsured risks which could negatively impact future profitability.

In the course of exploration, development and production of mineral properties, certain risks, particularly including but not limited to unexpected or unusual geological operating conditions including rock bursts, cave-ins, fires, flooding and earthquakes, may occur. It is not always possible to fully insure against such risks and the Company may decide not to insure against such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the securities of the Company.

The natural resource industry is highly competitive, which could restrict the Company's growth.

Significant and increasing competition exists for mining opportunities internationally. There are a number of large established mining companies with substantial capabilities and far greater financial and technical resources than the Company. The Company may be unable to acquire additional attractive mining properties on terms it considers acceptable and there can be no assurance that the Company's exploration and acquisition programs will yield any new reserves or result in any commercial mining operation.

A shortage of equipment and supplies could adversely affect the Company's ability to operate its business.

The Company is dependent on various supplies and equipment to carry out its mineral exploration and, if warranted, development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on the Company's ability to carry out its operations and therefore limit or increase the cost of potential future production.

Changes in the market price of silver and other metals, which in the past has fluctuated widely, would affect the future profitability of the Company's planned operations and financial condition.

The Company's long-term viability and future profitability depend, in large part, upon the market price of silver and other metals and minerals from potential future production from its mineral properties. The market price of silver is volatile and is impacted by numerous factors beyond the Company's control, including:

|

§ |

expectations with respect to the rate of inflation; |

|

§ |

the relative strength of the U.S. dollar and certain other currencies; |

|

§ |

global or regional political or economic conditions; |

|

§ |

supply and demand for jewelry and industrial products containing metals; |

|

§ |

sales by central banks and other holders, speculators and producers of silver other metals in response to any of the above factors; and |

|

§ |

any executive order curtailing the production or sale of silver. |

The Company cannot predict the effect of these factors on metal prices. A decrease in the market price of silver and other metals could affect the commercial viability of the Company's properties and its anticipated development of such properties in the future. Lower silver and other commodity prices could also adversely affect the Company's ability to finance exploration and development of its properties.

Land reclamation requirements for the Company's properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

|

§ |

control dispersion of potentially deleterious effluents; |

|

§ |

treat ground and surface water to drinking water standards; and |

|

§ |

reasonably re-establish pre-disturbance land forms and vegetation. |

In order to carry out reclamation obligations imposed on the Company in connection with its potential development activities, the Company must allocate financial resources that might otherwise be spent on further exploration and development programs. If the Company is required to carry out unanticipated reclamation work, its financial position could be adversely affected.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on the Company's business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on the Company, and its suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact the Company's ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, the Company cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by the Company or other companies in its industry could harm its reputation. The potential physical impacts of climate change on the Company's operations are highly uncertain, and would be particular to the geographic circumstances in areas in which it operates. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, potential production and financial performance of the Company's operations.

Risks Related to the Company's Environmental Services Business

The environmental services business associated with the Company is highly dependent upon key customers and employees, the loss of either could have a significant detrimental effect of the Company.

A material decline in the level of activity or reduction in industry willingness to spend capital on mine reclamation, remediation or environmental services could adversely affect demand for AEG's environmental services. Likewise, a material change in mining product commodity prices, the ability of mining companies to raise capital or changes in domestic or international political, regulatory and economic conditions could adversely affect demand for AEG's services.

Two of AEG's customers accounted for 32.3% and 17.4%, respectively, of environmental services revenues in the 2015 fiscal year. The loss of, or a significant reduction in the volume of business conducted with, either of these customers could have a significant detrimental effect on the Company's environmental services business.

The patents which the Company owns or has access to or other proprietary technology may not prevent AEG's competitors from developing substantially similar technology, which may reduce AEG's competitive advantage. Similarly, the loss of access to any of such patents or other proprietary technology or claims from third parties that such patents or other proprietary technology infringe upon proprietary rights which they may claim or hold would be detrimental to AEG's reclamation and remediation business.

The Company may not be able to keep pace with continual and rapid technological developments that characterize the market for AEG's environmental services, and the Company's failure to do so may result in a loss of its market share. Similarly, changes in existing regulations relating to mine reclamation and remediation activities could require the Company to change the way it conducts its business.

AEG is dependent on the professional skill sets of its employees, some of whom would be difficult to replace. The loss of any such employees could significantly affect AEG's ability to service existing clients, its profitability and its ability to grow its business.

The Company's environmental services business could be disrupted by adverse weather conditions, which could negatively affect revenue derived from that segment of the Company's business.

The Company's environmental services business is dependent upon certain weather conditions at the sites where its customer's operate and require services. Adverse weather conditions could inhibit the Company from performing its services or decrease the demand for such services from the Company's environmental services client base. Such adverse weather conditions could disrupt the Company's environmental services business and/or reduce demand for the Company's services which could reduce revenue.

Risks Relating to an Investment in the Common Shares of the Company

The Company plans on raising additional funds, which would likely substantially dilute the interest of the Company's shareholders.

The Company expects to require additional funds to finance its growth and development strategy. In particular, the Company will require additional funds to satisfy its obligations under the amendments to the Silver Streaming Agreement with Silver Wheaton. If the Company elects to raise additional funds by issuing additional equity securities, such financing may substantially dilute the interests of the Company's shareholders. The Company may also issue additional securities in the future pursuant to existing and new agreements in respect of its projects or other acquisitions and pursuant to existing securities of the Company.

General economic conditions may adversely affect the Company's growth and profitability.

The unprecedented events in global financial markets since 2008 have had a profound impact on the global economy and led to increased levels of volatility. Many industries, including the mining industry, are impacted by these market conditions. Some of the impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign currency exchange and precious metal markets, and a lack of market liquidity. If the current turmoil and volatility levels continue they may adversely affect the Company's growth and profitability. Specifically:

|

• |

a global credit/liquidity or foreign currency exchange crisis could impact the cost and availability of financing and the Company's overall liquidity; |

|

• |

the volatility of silver and other commodity prices would impact the Company's revenues, profits, losses and cash flow; |

|

• |

volatile energy prices, commodity and consumables prices and currency exchange rates would impact the Company's operating costs; and |

|

• |

the devaluation and volatility of global stock markets could impact the valuation of the Company's equity and other securities. |

These factors could have a material adverse effect on Alexco's financial condition and results of operations.

Certain of the Company's directors and officers are involved with other natural resource companies, which may create conflicts of interest.

Some of the Company's directors and officers are directors or officers of other natural resource or mining-related companies. These associations may give rise to conflicts of interest from time to time. As a result of these conflicts of interest, the Company may miss the opportunity to participate in certain transactions.

The Company does not intend to pay dividends.

The Company has not paid out any cash dividends to date and has no plans to do so in the immediate future. As a result, an investor's return on investment will be solely determined by his or her ability to sell common shares in the secondary market.

The Company may fail to maintain adequate internal control over financial reporting pursuant to the requirements of the Sarbanes-Oxley Act.

Section 404 of the Sarbanes-Oxley Act ("SOX") requires an annual assessment by management of the effectiveness of the Company's internal control over financial reporting. The Company may fail to maintain the adequacy of its internal control over financial reporting as such standards are modified, supplemented or amended from time to time, and the Company may not be able to ensure that it can conclude, on an ongoing basis, that it has effective internal control over financial reporting in accordance with Section 404 of SOX. The Company's failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of its financial statements, which in turn could harm the Company's business and negatively impact the trading price or the market value of its securities. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm the Company's operating results or cause it to fail to meet its reporting obligations. Future acquisitions of companies, if any, may provide the Company with challenges in implementing the required processes, procedures and controls in its acquired operations. No evaluation can provide complete assurance that the Company's internal control over financial reporting will detect or uncover all failures of persons within the Company to disclose material information otherwise required to be reported. The effectiveness of the Company's processes, procedures and controls could also be limited by simple errors or faulty judgments. Although the Company intends to expend substantial time and incur substantial costs, as necessary, to ensure ongoing compliance, there is no certainty that it will be successful in complying with Section 404 of SOX.

The market for the Company's common shares has been subject to volume and price volatility which could negatively affect a shareholder's ability to buy or sell the Company's common shares.

The market for the common shares of the Company may be highly volatile for reasons both related to the performance of the Company, or events pertaining to the industry (i.e. mineral price fluctuation/high production costs/accidents) as well as factors unrelated to the Company or its industry such as economic recessions and changes to legislation in the countries in which it operates. In particular, market demand for products incorporating minerals in their manufacture fluctuates from one business cycle to the next, resulting in change in demand for the mineral and an attendant change in the price for the mineral. The Company's common shares can be expected to continue to be subject to volatility in both price and volume arising from market expectations, announcements and press releases regarding the Company's business, and changes in estimates and evaluations by securities analysts or other events or factors. In recent years the securities markets in the U.S. and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small-capitalization companies such as the Company, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, the Company's common shares can also be subject to volatility resulting from purely market forces over which the Company will have no control such as that experienced recently resulting from the economic downturn due to the on-going credit crisis centred in the United States and Europe. Further, despite the existence of a market for trading the Company's common shares in Canada and U.S., shareholders of the Company may be unable to sell significant quantities of common shares in the public trading markets without a significant reduction in the price of the common shares.

Item 4. Information on the Company

A. History and Development of the Company

General

The Company was incorporated under the Business Corporations Act (Yukon) on December 3, 2004 under the name "Alexco Resource Corp." Effective December 28, 2007, it was continued under the Business Corporations Act (British Columbia). The Company's head office is located at Suite 1225, Two Bentall Centre, 555 Burrard Street, Box 216, Vancouver, British Columbia, V7X 1M9, Canada, and its registered and records office is located at 10th Floor, 595 Howe Street, Vancouver, British Columbia, V6C 2T5, Canada.

At the end of its most recently completed financial year, the Company had the following wholly-owned subsidiaries:

|

· |

Alexco Keno Hill Mining Corp., organized under the laws of British Columbia; |

|

· |

Alexco Exploration Canada Corp., organized under the laws of British Columbia; |

|

· |

Elsa Reclamation & Development Company Ltd., organized under the laws of Yukon ("ERDC"); |

|

· |

Alexco Environmental Group Inc. (formerly Access Mining Consultants Ltd.), organized under the laws of Yukon ("AEG Canada"); |

|

· |

Alexco Environmental Group (US) Inc. (formerly Alexco Resource U.S. Corp.), organized under the laws of Colorado ("AEG US"); and |

|

· |

Alexco Financial Guaranty Corp., organized under the laws of Colorado. |

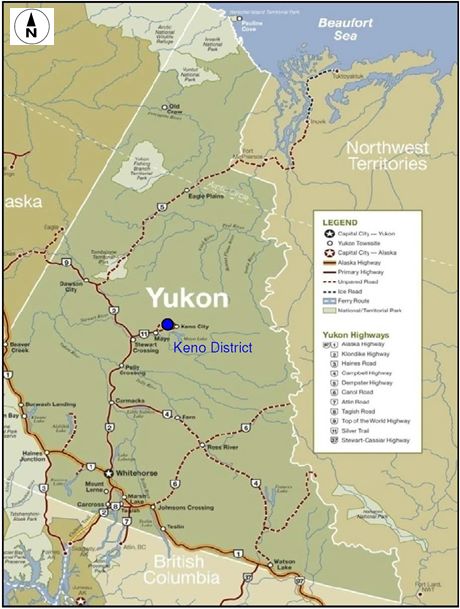

In 2005, the Company completed a series of transactions pursuant to which it acquired a number of mineral property interests and rights to certain operating contracts in Yukon Territory and British Columbia, the most significant of which properties are located in Yukon Territory's Keno Hill Silver District ("KHSD" or the "District").

Alexco operates two principal businesses: (i) a mining business, comprised of mineral exploration and mine development and operation in Canada, primarily in Yukon Territory; and (ii) through its Alexco Environmental Group Division (through AEG Canada and AEG US), provision of a variety of mine and industrial site related environmental services including management of the regulatory and environmental permitting process, environmental assessments, and reclamation and closure planning in Canada, the United States and elsewhere.

Three Year History

The Company's business development over the last three years is described in the following paragraphs. The Company's current Vice President, Exploration is, and has been through its most recently completed financial year, Alan McOnie, FAusIMM, a "qualified person" as defined in NI 43-101. Until October 2013, the Company's Bellekeno Mine Manager was Scott Smith, P. Eng., and from October 2013 and continuing through the date hereof Scott Smith has acted as a consulting engineer to the Company. Scott Smith is a "qualified person" as defined in NI 43-101. Except where specifically indicated otherwise, during its most recently completed financial year and through the date hereof, disclosures by the Company of scientific and technical information regarding exploration projects on the Company's mineral properties have been approved by Alan McOnie, while those regarding mine development and operations have been approved by Scott Smith.