WESTERN COPPER AND GOLD CORPORATION

ANNUAL INFORMATION FORM

For the year ended

December 31, 2017

15th floor – 1040 West Georgia Street

Vancouver,

British Columbia

V6E 4H1

Dated: March 22, 2018

TABLE OF CONTENTS

- i -

PRELIMINARY NOTES

This document is the Annual Information Form (the “AIF”) of Western Copper and Gold Corporation for the year ended December 31, 2017. Unless the context indicates otherwise, references in this AIF to “Western”, the “Company” or “we” include all subsidiaries of Western Copper and Gold Corporation. All information contained herein is as at December 31, 2017 unless otherwise stated.

Financial Statements

The financial statements included in this AIF are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

This AIF should be read in conjunction with the Company’s audited annual consolidated financial statements and notes thereto, as well as with the management’s discussion and analysis for the year ended December 31, 2017. The financial statements and management’s discussion and analysis are available at www.westerncopperandgold.com, under the Company’s profile on the SEDAR website at www.sedar.com, and under the Company’s profile on the EDGAR website at www.sec.gov/edgar.shtml.

Currency

All sums of money which are referred to in this AIF are expressed in lawful money of Canada, unless otherwise specified.

Disclosure of Mineral Resources

Disclosure about our exploration properties in this AIF uses the terms “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are Canadian geological and mining terms as defined in accordance with National Instrument 43-101, standards of disclosure for mineral projects of the Canadian Securities Administrators, set out in the Canadian Institute of Mining (CIM) Standards. All disclosure about our exploration properties conforms to the standards of U.S. Securities and Exchange Commission Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” which are discussed below.

Cautionary Note to U.S. Investors concerning estimates of Measured Mineral Resources and Indicated Mineral Resources

This AIF may use the terms “Measured Mineral Resource” and “Indicated Mineral Resource”. We advise U.S. investors that while such terms are recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of the Mineral Resources in these categories will ever be converted into Mineral Reserves.

- 2 -

Cautionary Note to U.S. Investors concerning estimates of Inferred Mineral Resources

This AIF may use the term “Inferred Mineral Resources”. We advise U.S. investors that while such term is recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that any part or all of an Inferred Mineral Resource exists, or is economically or legally mineable.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this AIF and the documents incorporated by reference herein that are not historical facts are forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements with respect to the future price of metals; the estimation of mineral reserves and resources, the realization of mineral reserve estimates; the timing and amount of any estimated future production, costs of production, and capital expenditures; project schedules; the Company’s proposed plan for its properties; recommended work programs; costs and timing of the development of new deposits; success of exploration and permitting activities; permitting timelines; currency fluctuations; requirements for additional capital; government regulation of mineral exploration or mining operations; environmental risks; unanticipated reclamation expenses; title disputes or claims; limitations on insurance coverage; and the timing and possible outcome of potential litigation. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Such statements are included, among other places, in this AIF under the headings “Development of the Business”, “Risk Factors” and “Mineral Properties” and in the documents incorporated by reference herein.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Western to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, risks related to the integration of acquisitions; risks related to operations; risks related to the feasibility study and the possibility that future exploration and development will not be consistent with the Company’s expectations; risks related to joint venture operations; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the sections entitled “Risk Factors” in this AIF.

- 3 -

Although Western has attempted to identify important factors that could affect it and may cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Forward-looking statements may prove to be inaccurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Western does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events unless required by applicable securities law.

The material factors or assumptions used to develop forward-looking statements include prevailing and projected market prices and foreign exchange rates, exploitation and exploration estimates and results, continued availability of capital and financing, availability of equipment and personnel for required operations, the Company not experiencing unforeseen delays, unexpected geological or other effects, equipment failures, permitting delays, and general economic, market or business conditions and as more specifically disclosed throughout this document. Assumptions relating to the mineral resource and reserve estimates, development, and future economic benefit reported in respect of the Casino Project are discussed in the 2013 Feasibility Study (as defined herein). Forward-looking statements and other information contained herein concerning mineral exploration and our general expectations concerning mineral exploration are based on estimates prepared by us using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which we believe to be reasonable. The industries involve risks and uncertainties and are subject to change based on various factors.

CORPORATE STRUCTURE

Name, Address, and Incorporation

Western Copper Corporation was incorporated under the Business Corporations Act (British Columbia) on March 18, 2006. It changed its name to Western Copper and Gold Corporation on October 17, 2011.

The Company’s head office is located at 15th floor – 1040 West Georgia Street, Vancouver, BC V6E 4H1. Its registered office address is 10th floor, 595 Howe Street, Vancouver, BC V6C 2T5.

Intercorporate Relationships

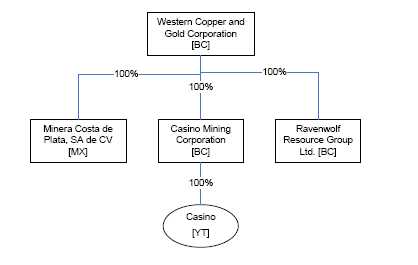

The Company has the following subsidiaries:

- 4 -

DESCRIPTION AND GENERAL DEVELOPMENT OF THE BUSINESS

General

Western, and its wholly-owned subsidiary Casino Mining Corp., are focused on advancing the Casino mineral property (“Casino” or “Casino Project”) towards production. The Casino Project is located in Yukon, Canada and hosts one of the largest undeveloped copper-gold deposits in Canada.

The Company does not have any producing properties and consequently has no current operating income or cash flow. Western is an exploration stage company and has not generated any revenues to date. Commercially viable mineral deposits may not exist on any of the Company’s properties.

Trends

Other than noted above, we are not aware of any trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on our operations, liquidity or capital resources, or that would cause reported financial information to not necessarily be indicative of our financial condition.

RISK FACTORS

The following is a brief description of those distinctive or special characteristics of the Company’s operations and industry, which may have a material impact on, or constitute risk factors in respect of the Company’s financial performance, business and operations.

History of Net Losses; Uncertainty of Additional Financing; Negative Operating Cash Flow

The Company has received no revenue to date from the exploration activities on its properties and has negative cash flow from operating activities. The Company incurred the following losses: (i) $2,088,400 for the year ended December 31, 2016 and (ii) $2,661,589 for the year ended December 31, 2017. As of December 31, 2017, the Company had an accumulated deficit of $96,232,408. In the event the Company undertakes development activity on any of its properties, there is no certainty that the Company will produce revenue, operate profitably or provide a return on investment in the future.

The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration and development programs will result in profitable mining operations. The Company has no source of revenue, and has significant cash requirements to meet its exploration and development commitments, to fund administrative overhead and to maintain its mineral interests. The Company will need to raise sufficient funds to meet these obligations as well as fund ongoing exploration, advance detailed engineering, and provide for capital costs of building its mining facilities.

- 5 -

Mineral Exploration and Development Activities Inherently Risky

The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into mineral deposits with significant value. Unusual or unexpected ground conditions, geological formation pressures, fires, power outages, labour disruptions, flooding, earthquakes, explorations, cave-ins, landslides and the inability to obtain suitable machinery, equipment or labour are other risks involved in the operation of mines and the conduct of exploration programs. Substantial expenditures are required to establish ore reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. No assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. The economics of developing copper, gold and other mineral properties is affected by many factors including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. The remoteness and restrictions on access of certain of the properties in which the Company has an interest could have an adverse effect on profitability in that infrastructure costs would be higher.

In addition, previous mining operations may have caused environmental damage at certain of the Company’s properties. It may be difficult or impossible to assess the extent to which such damage was caused by the Company or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective.

Uncertainty of Mineral Resources and Mineral Reserves

The figures for Mineral Resources and Mineral Reserves with respect to the Casino Project disclosed in this AIF are estimates and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. Market fluctuations and the prices of metals may render Resources and Reserves uneconomic. Moreover, short-term operating factors relating to the mineral deposits, such as the need for orderly development of the deposits or the processing of new or different grades of ore, may cause any mining operation to be unprofitable in any particular accounting period. Additionally, estimates may change over time as new information becomes available. If the Company encounters mineralization or geological formations different from those predicted by past drilling, sampling and interpretations, any estimates may need to be altered in a way that could adversely affect the Company’s operations or proposed operations.

Possible Loss of Interests in Exploration Properties; Possible Failure to Obtain Applicable Licenses

The regulations pursuant to which the Company holds its interests in certain of its properties provide that the Company must make a series of payments over certain time periods or expend certain minimum amounts on the exploration of the properties. If the Company fails to make such payments or expenditures in a timely fashion, the Company may lose its interest in those properties. Further, even if the Company does complete exploration activities, it may not be able to obtain the necessary licenses or permits to conduct mining operations on the properties, and thus would realize no benefit from its exploration activities on the properties. There is no assurance that further applications will be successful.

- 6 -

Title Risks

Although title to its mineral properties and surface rights has been reviewed by or on behalf of the Company, no assurances can be given that there are no title defects affecting such properties. Title insurance generally is not available for mining claims in Canada, and the Company’s ability to ensure that it has obtained secure claim to individual mineral properties may be severely constrained. The Company has not conducted surveys of all of the claims in which it holds direct or indirect interests; therefore, the precise area and location of such properties may be in doubt. Accordingly, the properties may be subject to prior unregistered liens, agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, the Company may be unable to conduct work on the properties as permitted or to enforce its rights with respect to its properties.

Risks Associated with Joint Venture Agreements

In the event that any of the Company’s properties become subject to a joint venture, the existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on the Company’s profitability or the viability of its interests held through joint ventures, which could have a material adverse impact on the Company’s business prospects, results of operations and financial condition: (i) disagreements with joint venture partners on how to conduct exploration; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) disputes or litigation between joint venture partners regarding budgets, development activities, reporting requirements and other joint venture matters.

Risks Relating to Statutory and Regulatory Compliance

The current and future operations of the Company, from exploration through development activities and commercial production, if any, are and will be governed by applicable laws and regulations governing mineral claims acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities, generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. The Company has received all necessary permits for the exploration work it is presently conducting; however, there can be no assurance that all permits which the Company may require for future exploration, construction of mining facilities and conduct of mining operations, if any, will be obtainable on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any project which the Company may undertake.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. The Company is not currently covered by any form of environmental liability insurance. See “Insurance Risk”, below.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or require abandonment or delays in exploration.

- 7 -

Environmental Laws and Regulations That May Increase Costs and Restrict Operations

All of the Company’s exploration and potential development and production activities are subject to regulation by Canadian governmental agencies under various environmental laws. To the extent that the Company conducts exploration activities or new mining activities in other countries, it will also be subject to the laws and regulations of those jurisdictions, including environmental laws and regulations. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Environmental legislation in many countries is evolving and the trend has been towards stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on our behalf and may cause material changes or delays in the Company’s intended activities. Future changes in these laws or regulations could have a significant adverse impact on some portion of the Company’s business, causing it to re-evaluate those activities at that time.

Costs of Land Reclamation

It is difficult to determine the exact amounts that will be required to complete all land reclamation activities in connection with the properties in which the Company holds an interest. Reclamation bonds and other forms of financial assurance represent only a portion of the total amount of money that will be spent on reclamation activities over the life of a mine. Accordingly, it may be necessary to revise planned expenditures and operating plans in order to fund reclamation activities. Such costs may have a material adverse impact upon the financial condition and results of operations of the Company.

Assets in remote locations

The costs, timing and complexities of mine construction and development are increased by the remote location of the Company’s mineral projects. It is common in new mining operations to experience unexpected problems and delays during development, construction and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that the Company’s activities will result in profitable mining operations or that the Company will successfully establish mining operations or profitably produce metals at any of its properties. Climate change or prolonged periods of inclement weather may severely limit the length of time in which exploration programs and development activities may be undertaken.

Infrastructure

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. The lack of availability on acceptable terms or the delay in the availability of any one or more of these items could prevent or delay exploitation and or development of the Company’s properties. If adequate infrastructure is not available in a timely manner, there can be no assurance that the exploitation and or development of the Company’s properties will be commenced or completed on a timely basis, if at all; that the resulting operations will achieve the anticipated production volume; or that the construction costs and ongoing operating costs associated with the exploitation and or development of the Company’s properties will not be higher than anticipated. In addition, unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company’s operations and profitability.

- 8 -

High Metal Prices May the Demand For, and Cost Of, Exploration, Development and Construction Services and Equipment

An increase in metal prices may lead to increases in mining exploration, development and construction activities around the world, which could result in increased demand for, and cost of, exploration, development and construction services and equipment. Increased demand for services and equipment could result in increased costs. It may also lead to delays if services or equipment cannot be obtained in a timely manner due to an inadequate availability, and may cause scheduling difficulties due to the need to coordinate the availability of services or equipment, any of which could materially increase project exploration, development and/or construction costs.

First Nations

Consultation with First Nations groups is required of the Company in the environmental assessment, subsequent permitting, development, and operation stages of its proposed projects. Certain First Nations groups may oppose certain proposed projects at any given stage and such opposition may adversely affect the project(s) in question, the Company’s public image, or the Company’s share performance.

Canadian law related to aboriginal rights, including aboriginal title rights, is in a period of change. There is a risk that future changes to the law may adversely affect the Company’s rights to its Canadian projects.

Price Fluctuations: Share Price Volatility

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly those considered exploration stage companies, including the Company, have experienced wide fluctuations which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. From January 1, 2017 to December 31, 2017, the price of the Company’s shares has ranged from $1.10 to $2.24 on the TSX. There can be no assurance that continual and significant fluctuations in the price of the common shares of the Company will not occur.

Changes in the Market Price of Common Shares may be Unrelated to its Results of Operations and Could Have an Adverse Impact on the Company

The Company’s common shares are listed on the TSX and the NYSE American. The price of the Company’s common shares is likely to be significantly affected by short-term changes in copper and gold prices or in its financial condition or results of operations. Other factors unrelated to the Company’s performance that may have an effect on the price of the Company’s shares include the following: a reduction in analytical coverage by investment banks with research capabilities; a drop in trading volume and general market interest in the Company’s securities may adversely affect an investors’ ability to liquidate an investment and consequently an investor’s interest in acquiring a significant stake in the Company; a failure to meet the reporting and other obligations under relevant securities laws or imposed by applicable stock exchanges could result in a delisting of the Company’s common shares and a substantial decline in the price of the common shares that persists for a significant period of time.

As a result of any of these factors, the market price of the Company’s common shares at any given point in time may not accurately reflect their long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Company may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

- 9 -

Metal Price Volatility

Factors beyond the control of the Company may affect the marketability of any ore or minerals discovered at and extracted from the Company’s properties. Resource prices have fluctuated widely, particularly in recent years, and are affected by numerous factors beyond the Company’s control including international economic and political trends, inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and increased production due to new and improved extraction and production methods. The effect of these factors cannot accurately be predicted.

The price of each of copper and gold has a history of extreme volatility. The price of the Company’s common shares and the Company’s financial results may be significantly adversely affected by a decline in the price of copper or gold. The price of each of copper and gold fluctuates widely, especially in recent years, and is affected by numerous factors beyond the Company’s control such as the sale or purchase of gold by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, by-product production levels from base-metal mines, and the political and economic conditions of major copper and gold-producing countries throughout the world.

During the 2017 calendar year, the price of gold ranged between US$1,150 per ounce and US$1,350 per ounce. Some factors that affect the price of gold include: industrial and jewelry demand; central bank lending or purchases or sales of gold bullion; forward or short sales of gold by producers and speculators; future levels of gold production; and rapid short-term changes in supply and demand due to speculative or hedging activities by producers, individuals or funds. Gold prices are also affected by macroeconomic factors including: confidence in the global monetary system; expectations of the future rate of inflation; the availability and attractiveness of alternative investment vehicles; the general level of interest rates; the strength of, and confidence in, the U.S. dollar, the currency in which the price of gold is generally quoted, and other major currencies; global political or economic events; and costs of production of other gold producing companies whose costs are denominated in currencies other than the U.S. dollar. All of the above factors can, through their interaction, affect the price of gold by increasing or decreasing the demand for or supply of gold.

During the 2017 calendar year, the price of copper on the London Metal Exchange (“LME”) ranged from slightly below US$2.50 per pound to approximately US$3.30 per pound. Some factors that affect the price of copper include: industrial demand; forward or short sales of copper by producers and speculators; future levels of copper production; and rapid short-term changes in supply and demand due to speculative or hedging activities by producers, individuals or funds. Copper prices are also affected by macroeconomic factors including: confidence in the global economy; expectations of the future rate of inflation; the availability and attractiveness of alternative investment vehicles; the strength of, and confidence in, the U.S. dollar, the currency in which the price of copper is generally quoted, and other major currencies; global political or economic events; and costs of production of other copper producing companies whose costs are denominated in currencies other than the U.S. dollar. All of the above factors can, through their interaction, affect the price of copper by increasing or decreasing the demand for or supply of copper.

- 10 -

Currency Fluctuations May Affect the Costs of Doing Business

The Company’s activities and offices are currently located in Canada. Copper and gold are sold in international markets at prices denominated in U.S. dollars. However, some of the costs associated with the Company’s activities in Canada may be denominated in currencies other than the U.S. dollar. Any appreciation of these currencies vis-à-vis the U.S. dollar could increase the Company’s cost of doing business. In addition, the U.S. dollar is subject to fluctuation in value compared to the Canadian dollar. The Company does not utilize hedging programs to any degree to mitigate the effect of currency movements.

Future issuances of securities will dilute shareholder interests

Issuances of additional securities including, but not limited to, common stock pursuant to any financing and otherwise, could result in a substantial dilution of the equity interests of our shareholders.

Dependence on Management

The success of the operations and activities of the Company is dependent to a significant extent on the efforts and abilities of its management team. See “Directors and Officers” in this AIF for details of the Company’s current management. Investors must be willing to rely to a significant extent on their discretion and judgment. The Company does not maintain key employee insurance on any of its employees. The Company depends on key personnel and cannot provide assurance that it will be able to retain such personnel. Failure to retain such key personnel could have a material adverse effect on the Company’s business and financial condition.

Competition

Significant and increasing competition exists for mineral deposits in each of the jurisdictions in which the Company conducts operations. As a result of this competition, much of which is with large established mining companies with substantially greater financial and technical resources than the Company, the Company may be unable to acquire additional attractive mining claims or financing on terms it considers acceptable. The Company also competes with other mining companies in the recruitment and retention of qualified directors, officers and employees.

Insurance Risk

The mining industry is subject to significant risks that could result in damage to or destruction of property and facilities, personal injury or death, environmental damage and pollution, delays in production, expropriation of assets and loss of title to mining claims. No assurance can be given that insurance to cover the risks to which the Company’s activities are subject will be available at all or at commercially reasonable premiums. The Company currently maintains insurance within ranges of coverage that it believes to be consistent with industry practice for companies at a similar stage of development. The Company carries liability insurance with respect to its mineral exploration operations, but is not currently covered by any form of environmental liability insurance, since insurance against environmental risks (including liability for pollution) or other hazards resulting from exploration and development activities is unavailable or prohibitively expensive. The payment of any such liabilities would reduce the funds available to the Company. If the Company is unable to fully fund the cost of remedying an environmental problem, it might be required to suspend operations or enter into costly interim compliance measures pending completion of a permanent remedy.

- 11 -

Conflicts of Interest

The Company’s directors and officers may serve as directors or officers of other resource companies or have significant shareholdings in other resource companies and, to the extent that such other companies may participate in ventures in which the Company may participate, the directors of the Company may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of the Company’s directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms in accordance with the Business Corporations Act (British Columbia). From time to time several companies may participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participation in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program. It may also occur that a particular company will assign all or a portion of its interest in a particular program to another of these companies due to the financial position of the company making the assignment. In accordance with the laws of British Columbia, the directors of the Company are required to act honestly, in good faith and in the best interests of the Company. In determining whether or not the Company will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time. For a detailed list of roles played by directors and officers in other companies, see “Directors and Officers” in this AIF.

Increased Costs and Compliance Risks as a Result of Being a Public Company

Legal, accounting and other expenses associated with public company reporting requirements have increased significantly in the past few years. The Company anticipates that costs may continue to increase with corporate governance related requirements, including, without limitation, requirements under National Instrument 52-109 – Certification of Disclosure in Issuers’ Annual and Interim Filings, National Instrument 52-110 – Audit Committees, and National Instrument 58-101 – Disclosure of Corporate Governance Practices.

The Company also expects these rules and regulations may make it more difficult and more expensive for it to obtain director and officer liability insurance, and it may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for the Company to attract and retain qualified individuals to serve on its board of directors or as executive officers.

We expect to be a “passive foreign investment company” for the current taxable year, which would likely result in materially adverse U.S. federal income tax consequences for shareholders who are U.S. persons.

We generally will be a “passive foreign investment company” (a “PFIC”) under the meaning of Section 1297 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), if (a) 75% or more of our gross income is “passive income” (generally, dividends, interest, rents, royalties, and gains from the disposition of assets producing passive income) in any taxable year, or (b) if at least 50% or more of the quarterly average value of our assets produce, or are held for the production of, passive income in any taxable year. A shareholder who is a “U.S. person” (as such term is defined in the Code) should be aware that we believe that we were a PFIC during one or more prior taxable years, and based on current business plans and financial projections, we expect to be a PFIC for the current taxable year and for the foreseeable future. If we are a PFIC for any taxable year during which a U.S. person holds common shares of the Company, it would likely result in materially adverse U.S. federal income tax consequences for such U.S. person, including, but not limited to, any gain from the sale of our common shares would be taxed as ordinary income, as opposed to capital gain, and such gain and certain distributions on our common shares would be subject to an interest charge, except in certain circumstances. It may be possible for U.S. persons to fully or partially mitigate such tax consequences by making a “qualified electing fund election,” as defined

- 12 -

in the Code (a “QEF Election”). We currently intend to make available to shareholders who are U.S. persons, upon their written request: (a) information as to our status as a PFIC, and (b) for each year in which we are a PFIC, all information and documentation that a shareholder making a QEF Election with respect to us is required to obtain for U.S. federal income tax purposes. However, there is no assurance that the Company will satisfy the record keeping requirements that apply to a PFIC, or that the Company will continue to supply shareholders with the information that the shareholder is required to report under the rules applicable to making a QEF Election. Therefore, if the Company is a PFIC in any taxable year, there is no assurance that the shareholder will be able to make a QEF Election in respect of the Company’s common shares. The PFIC rules are extremely complex. A U.S. person holding the Company’s common shares is encouraged to consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of common shares.

Capital Costs

The Company prepares budgets and estimates of cash costs and capital costs for its operations. Despite the Company’s best efforts to budget and estimate such costs, the costs required by the Company’s projects may be significantly higher than anticipated. The Company’s actual costs may vary from estimates for a variety of reasons, including: short-term operating factors; risk and hazards associated with mining; natural phenomena, such as inclement weather conditions and unexpected labour shortages or strikes. Operational costs may also be affected by a variety of factors, including: ore grade metallurgy, labour costs, the cost of commodities, general inflationary pressures and currency exchange rates. Many of these factors are beyond the Company’s control. Failure to achieve estimates or material increases in costs could have an adverse impact on the Company’s business, results of operations and financial condition. Furthermore, delays in mining projects or other technical difficulties may result in even further capital expenditures being required. Any delays or costs overruns or operational difficulties could have a material adverse effect on the Company’s business, results of operations and financial condition.

Funding Risk

The Company’s ability to effectively implement its business and operation plans in the future, to take advantage of opportunities for acquisitions, joint ventures or other business opportunities and to meet any unanticipated liabilities or expenses which the Company may incur may depend in part on its ability to raise additional funds. The Company may seek to raise further funds through equity or debt financings, joint ventures, production sharing arrangements or other means. Failure to obtain sufficient financing for the Company’s activities and future projects may result in delay and indefinite postponement of exploration, development or production on the properties. There can be no assurance that additional financing will be available when needed or, if available, the terms of the financing might not be favourable to the Company and might involve substantial dilution to shareholders.

- 13 -

MINERAL PROPERTIES

Casino Project (Yukon, Canada)

Western acquired the Casino Project in 2006 through its acquisition of Lumina Resources Corp. The Casino Project is a material property for the purposes of National Instrument 43-101. The following is the summary from the technical report entitled “Casino Project, Form 43-101F1 Technical Report Feasibility Study, Yukon, Canada – Revision 1” (the “2013 Feasibility Study”) dated January 25, 2013 and prepared by Conrad E. Huss, P. E., Thomas L. Drielick, P.E., Jeff Austin, P. Eng., Gary Giroux, P. Eng., Scott Casselman, P.Geo. Graham Greenaway, P. Eng., Michael G. Hester, FAus IMM, and Jesse Duke, P. Geo.; each of whom is a qualified person pursuant to National Instrument 43-101.

The 2013 Feasibility Study is incorporated by reference in this AIF. The complete 2013 Feasibility Study may be viewed under the Company’s profile at www.sedar.com or on its website at www.westerncopperandgold.com. The executive summary of the 2013 Feasibility Study has been included, verbatim, below. For updates relating to Property Description and Ownership, and the current development schedule, please refer to the Recent Developments section that follows the executive summary.

| 1 |

Summary |

This report has been prepared by M3 Engineering & Technology Corporation (“M3”) of Tucson, Arizona to summarize the work performed in the preparation of a feasibility study, supplementary to the Canadian Standard NI 43-101, previously issued for the development of the Casino property (the “Property”) in the Yukon Territory in northern Canada for Casino Mining Corporation (“CMC”), a 100% owned subsidiary of Western Copper and Gold Corporation (“WCGC”).

| 1.1 |

Key Data |

The key details about this project are as follows:

| 1. |

Casino is primarily a copper and gold project that is expected to process 120,000 dry tonnes of material per day (t/d) or 43.8 million dry tonnes per year (t/y). Metals to be recovered are copper, gold, molybdenum and silver. | |

| 2. |

There are a total of 965 million tonnes of proven and probable mill ore reserves and 157 million tonnes of proven and probable heap leach reserves. Based on the economic analysis, the Property will produce the following over the life of the mine from heap leach and flotation: |

| a. |

Gold – 5.72 million ounces | |

| b. |

Silver – 30.26 million ounces | |

| c. |

Copper – 3.58 billion pounds | |

| d. |

Molybdenum – 325 million pounds |

| 3. |

The process will include a conventional single-line SAG mill circuit (Semi-Autogenous Ball Mill Crushing, or SABC) followed by conventional flotation to produce concentrate for sale. In addition to the concentrator, there will be a separate carbon-in-column facility to recover precious metals from oxide ore. Gold and silver bullion (doré) produced will be shipped by truck to metal refineries. |

| 4. | The Property will require the construction of a power plant and will generate its own electrical power using LNG to fuel the generator drivers. Additionally, the mine haulage vehicles and over-the-highway tractors which haul concentrates and LNG will utilize LNG as fuel. |

- 14 -

| 5. |

The Property has several routes of access, including by the Yukon River, by aircraft, winter roads, and existing trails. A network of paved highways provides access to the region from the Port of Skagway, Whitehorse and northern British Columbia. Paved roads to the Property currently exist up to Carmacks. A new, all weather, gravel road will be constructed by the project to connect Casino to Carmacks via the existing Freegold Road. The new access road will, in general, follow the existing Casino Trail that will be upgraded to support trucking from Carmacks to Casino. | |

| 6. |

Fresh water will be sourced from the Yukon River. | |

| 7. |

The major milestones in the schedule are as follows*: |

| a. |

Full Notice to Proceed and construction start-up – first quarter 2016 | |

| b. |

Heap Leach operation start-up – fourth quarter 2017 | |

| c. |

Mill operation start-up – fourth quarter 2019 | |

| d. |

Commercial Production – first quarter 2020 |

* Major milestone schedule from the 2013 Feasibility Study is no longer valid. Please refer to the discussion in the Recent Developments section that follows the executive summary.

| 1.2 |

Property Description and Ownership |

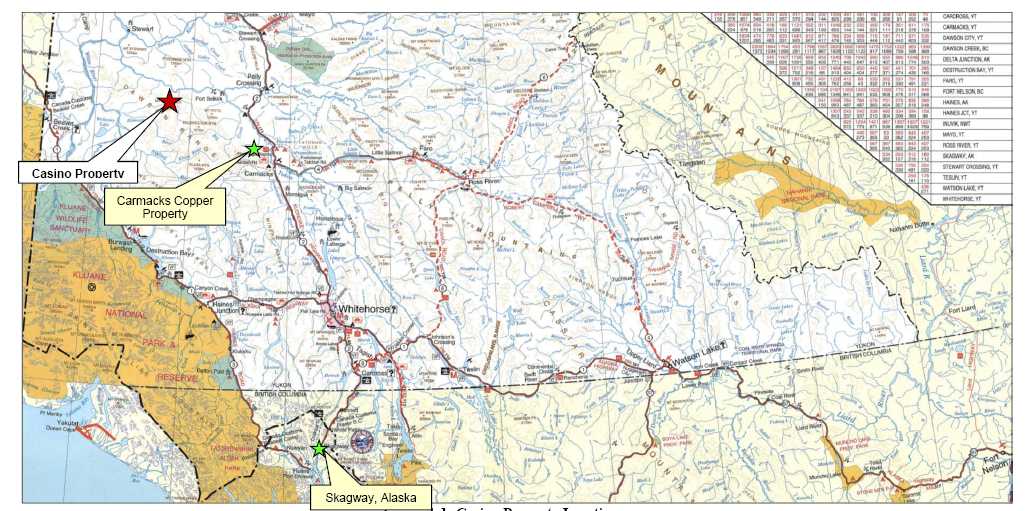

The Casino porphyry copper-gold-molybdenum deposit is located at latitude 62° 44’N and longitude 138° 50’W (NTS map sheet 115J/10), in west central Yukon, in the northwest trending Dawson Range mountains, 300 km northwest of the territorial capital of Whitehorse.

The area around Casino has been subject to increasing staking and exploration activity over the past few years. Two properties have defined reserves, the Carmacks Copper Project and the Minto Mine, both of which are discussed in Section 23, Adjacent Properties.

The project is located on Crown land administered by the Yukon Government and is within the Selkirk First Nation traditional territory and the Tr’ondek Hwechin First Nation traditional territory lies to the north. The proposed access road crosses into Little Salmon Carmacks First Nation traditional territory to the south.

The Casino Property lies within the Whitehorse Mining District and consists of 723 full and partial Quartz Claims and 85 Placer Leases acquired in accordance with the Yukon Quartz Mining Act. The total area covered by Casino Quartz Claims is 13,339.17 ha. The total area covered by Casino Placer Leases is 747.45 ha. CMC is the registered owner of all claims, although certain portions of the Casino property remain subject to royalty agreements. The claims covering the Casino property are discussed further in Section 4 of this document.

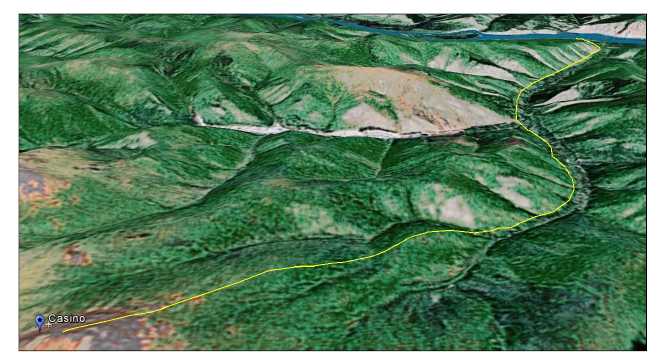

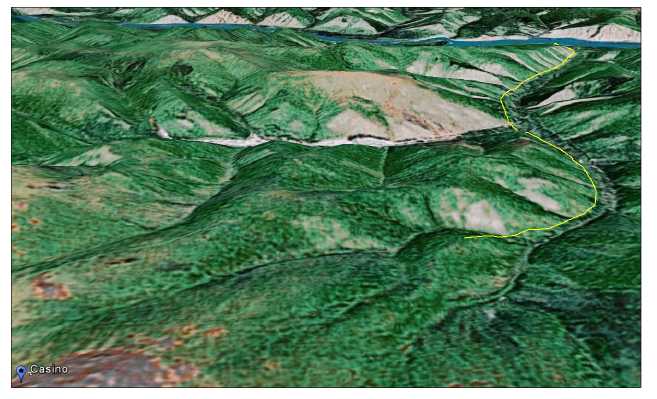

Figure 1-1 at the end of this section shows the site’s location in Yukon Territory as well as other points of interest relevant to this Report. Figure 1-2 and Figure 1-3 show the roadway paths from the Yukon River to the proposed site facilities.

- 15 -

| 1.3 |

Geology |

The geology of the Casino deposit is typical of many porphyry copper deposits. The deposit is centered on an Upper Cretaceous-age (72-74 Ma), east-west elongated porphyry stock, the Patton Porphyry, which intrudes Mesozoic granitoids of the Dawson Range Batholith and Paleozoic schists and gneisses of the Yukon Crystalline Complex. Intrusion of the Patton Porphyry into the older rocks caused brecciation of both the intrusive and the surrounding country rocks along the northern, southern and eastern contact of the stock. Brecciation is best developed in the eastern end of the stock where the breccia can be up to 400 metres wide in plan view. To the west, along the north and south contact, the breccias narrow gradually to less than 100 metres. The overall dimensions of the intrusive complex are approximately 1.8 by 1.0 kilometres.

The main body of the Patton Porphyry is a relatively small, locally mineralized, stock measuring approximately 300 by 800 metres and is surrounded by a potassically-altered Intrusion Breccia in contact with rocks of the Dawson Range. Elsewhere, the Patton Porphyry forms discontinuous dikes ranging from less than one to tens of metres wide, cutting both the Patton Porphyry Plug and the Dawson Range Batholith. The overall composition of the Patton Porphyry is rhyodacite, with phenocrysts falling into a dacite composition and the matrix being of quartz latite composition. It is more commonly made up of distinct phenocrysts of abundant plagioclase and lesser biotite, hornblende, quartz and opaques.

The Intrusion Breccia surrounding the main Patton Porphyry body consists of granodiorite, diorite, and metamorphic fragments in a fine-grained Patton Porphyry matrix. It may have formed along the margins, in part, by the stoping of blocks of wall rocks. An abundance of Dawson Range inclusions are prominent at the southern contact of the main plug, Wolverine Creek metamorphic rocks increase along the northern contact, and bleached diorite increases at the eastern contact of the main plug. Strong potassic alteration locally destroys primary textures.

| 1.4 |

Mineralization |

Primary copper, gold and molybdenum mineralization was deposited from hydrothermal fluids that exploited the contact breccias and fractured wall rocks. Better grades occur in the breccias and gradually decrease outwards away from the contact zone both towards the centre of the stock and outward into the granitoids and schists. The main mineralization types are:

| • |

Leached Cap Mineralization (CAP) – This oxide gold zone is gold-enriched and copper- depleted due to supergene alteration processes as well as the lower specific gravity of this zone relative to the other supergene zones. Weathering has replaced most minerals with clay. The weathering is most intense at the surface and decreases with depth. | |

| • |

Supergene Oxide Mineralization (SOX) – This zone is copper-enriched, with trace molybdenite. It generally occurs as a thin layer above the Supergene Sulphide zone. Where present, the supergene oxide zone averages 10 metres thick, and can contain chalcanthite, malachite and brocanthite, with minor azurite, tenorite, cuprite and neotocite. | |

| • |

Supergene Sulphide Mineralization (SUS) – Supergene copper mineralization occurs in an up to 200 metre-deep weathered zone below the leached cap and above the hypogene. It has an average thickness of 60 metres. Grades of the Supergene sulphide zone vary widely, but are highest in fractured and highly pyritic zones, due to their ability to promote leaching and chalcocite precipitation. The copper grades in the Supergene Sulphide zone are almost double the copper grades in the Hypogene (0.43% Cu versus 0.23% Cu). |

- 16 -

| • |

Hypogene Mineralization – Hypogene mineralization occurs throughout the various alteration zones of the Casino Porphyry deposit, as mineralized stock-work veins and breccias. Significant Cu-Mo mineralization is related to the potassically-altered breccia surrounding the core Patton Porphyry, as well as in the adjacent phyllically-altered host rocks of the Dawson Range Batholith. The pyrite halo in this mineralization is host to the highest Cu values on the property. |

Native gold can occur as free grains in quartz (50 to 70 microns) and as inclusions in pyrite and/or chalcopyrite grains (1 to 15 microns). High grade smoky quartz veins with numerous specks of visible gold are also reported to exist.

| 1.5 |

Exploration Status |

In 2009, Quantec Geoscience Limited of Toronto, Ontario performed Titan-24 Galvanic Direct Current Resistivity and Induced Polarization (DC/IP) surveys as well as a Magnetotelluric Tensor Resistivity (MT) survey over the entire grid. Magnetotelluric Resistivity results in high resolution and deep penetration (to 1 km) and the Titan DC Resistivity & Induced polarization provides reasonable depth coverage to 750 m.

In 2010, all Pacific Sentinel’s historic drill core stored at the Casino Property was re-logged. The purpose of the re-logging was to provide data for the new lithology and new alteration models.

In 2011 and 2012, WCGC focused on geotechnical, metallurgical and baseline environmental studies, however certain of the drill holes were also drilled, logged and sampled for exploration purposes. In 2011, the program involved 41 drill holes for a total of 3,163.26 m. In 2012, six holes (228.07 m) were drilled for geotechnical purposes and 5 holes (1,507.63 m) were drilled for metallurgical sampling.

| 1.6 |

Development and Operations |

| 1.6.1 |

Mining and Processing |

A mine plan was developed to supply ore to a conventional copper sulphide flotation plant with the capacity to process ore at a nominal rate of 120,000 tonnes per day, or 43.8 million tonnes per year. Actual annual throughput will vary depending on the ore hardness encountered during the period. The mine is scheduled to operate two 12 hour shifts per day, 365 days per year.

Both sulphide copper-molybdenum ore and oxide gold ore will be processed. Copper-molybdenum ore will be transported from the mine to the concentrator facility and oxide gold ore will be transported from the mine to a crushing facility ahead of a heap leaching facility and a gold recovery facility.

Copper-molybdenum ore will be processed by crushing, grinding, and flotation to produce copper and molybdenum sulphide mineral concentrates. Copper concentrate will be loaded into highway haul trucks and transported to the Port of Skagway for ocean shipment to market. Molybdenum concentrate will be bagged and loaded onto highway haul trucks for shipment to market.

Oxide gold ore will be leached with an aqueous leach solution. Gold in the enriched (or pregnant) leach solution which will extracted by using carbon absorption technology to produce gold doré bars. The enriched leach solution will also be treated to recover copper and cyanide and produce a copper sulphide precipitate. The copper sulphide precipitate will be bagged and loaded onto highway haul trucks for shipment to market. Recovery methods are discussed more in depth in Section 17.

- 17 -

| 1.6.2 |

Metallurgical Testing and Metal Recoveries |

Recent test work by METCON Research on the oxide cap material showed that good recoveries of gold and acceptable cyanide consumptions could be obtained by integrating the cyanide heap leach with the SART process. This process has been adopted for this feasibility study.

Flotation testing by G&T Metallurgical from 2008 to 2012 indicated that copper concentrate grades of 28% copper could be routinely achieved at good copper recoveries with a primary grind size of 80% passing 200 µm and a regrind of 80% passing 25 µm. Gold and silver will be recovered with the copper concentrate. Molybdenum will be recovered to a molybdenum concentrate in a separate flotation circuit.

The average metal recoveries expected from mill processing following the planned mill feed schedule are noted below:

|

• |

Copper recovery to copper concentrate, percent | 86 | |

|

• |

Gold recovery to copper concentrate, percent | 67 | |

|

• |

Silver recovery to copper concentrate, percent | 53 | |

|

• |

Molybdenum recovery to molybdenum concentrate, percent | 71 |

The metal recoveries expected from oxide cap heap leach processing are based on:

|

• |

Gold recovery, percent | 66 | |

|

• |

Silver recovery, percent | 26 | |

|

• |

Copper recovery to SART precipitate, percent | 18 |

| 1.6.3 |

Infrastructure |

The region is serviced by paved all-weather roads connecting the towns of Carmacks and Whitehorse in the Yukon with the Port of Skagway Alaska. With the completion of the 132 km Casino access road, the project will have an all-weather access route through Carmacks to Whitehorse (approx. 380 km) and to the Port of Skagway (550 km). The Port of Skagway has existing facilities to store and load-out concentrates as well as facilities to receive bulk commodity shipments, fuels and connection to the Alaska Marine Highway. The Port of Skagway is developing plans to expand these facilities to better serve the expanding mining activity in the Yukon and Alaska.

The City of Whitehorse is the government, financial and commercial hub of the Yukon with numerous business and service entities to support the project, and represents a major resource to staff the project. Whitehorse has an international airport and provides commercial passenger and freight services for the region. The proposed new access road alignment is shown in Section 18.2 of this report.

A new airstrip will be constructed at the mine to accommodate appropriately sized aircraft. The existing airstrip will be razed in preparation for grading for process facilities.

| 1.6.3.1 |

Power |

Electrical power to the mine will be developed in two phases. An initial power plant designated the Supplementary Power Plant will be constructed near the main workforce housing complex to provide power to the camp, to construction activities, and to the heap leach facilities that go into operation before the concentrator facility is operational.

The Supplementary Power Plant will consist of three internal combustion engines (ICE), dual fuel driven generators (capable of using both LNG and diesel) with a combined power output of 20.1 MW.

- 18 -

A Main Power Plant will be constructed at the Casino concentrator complex and will supply the electrical energy required for operation of the mine, concentrator, oxide ore treatment facilities and all infrastructure facilities. The primary electrical power generation will be provided by two gas turbine driven generators and a steam generator, operating in combined cycle mode (CCGT) to nominally produce 125 MW. Two internal combustion engine (ICE) driven generators will provide another 18.6 MW of power for black start capability, emergency power, and to complement the gas turbine generation when required. The gas turbines and the ICEs will be fueled by natural gas (supplied as liquefied natural gas, or LNG).

LNG will be transported to the site from Fort Nelson, British Columbia via tanker trucks and stored on-site in a large, 10,000 m3 site-fabricated storage tank to supply the power plant. In addition to providing fuel for the power plants, the LNG facility will provide fuel for the mine haulage fleet and over the highway tractors used for hauling concentrates and LNG tankers. Distribution to the vehicles will be by two portable fueling stations and two mobile refuelers.

| 1.6.3.2 |

Water |

The main fresh water supply will be supplied from the Yukon River. The water will be collected in a riverbank caisson and radial well system (Ranney Well) and pumped through an above-ground insulated 36” diameter by 17.4 km long pipeline with four booster stations to the 22,000 m3 capacity freshwater pond near the concentrator. The design capacity of the fresh water collection and transfer system will be approximately 3,400 cubic meters per hour.

The fire water requirement is 341 m3/h for two hours. This demand is satisfied by a fire reserve capacity of 682 m3 in the lower portion of the freshwater pond that will be unavailable for other uses.

Potable water will be produced by filtering and chlorinating fresh water and will be stored and distributed separately.

Process water reclaimed from the tailings pond and from the plant will be collected in a 63,700 m3 process water pond. The total process water supply to the plant required at design tonnage is 11,191 m3/h. The total feed to the pond consists of 7,122 m3/h combined thickener overflow, 3,228 m3/h reclaim water from the tailings pond and 841 m3/h fresh water makeup. Assuming the reclaim water system is not operating the plant can run for 19.7 hours with all other feed streams operating at the design rates.

- 19 -

| 1.6.4 |

Permits |

The Yukon Socioeconomic Assessment Board (YESAB) will assess the Casino Project for environmental and socio-economic effects under the Yukon Environmental and Socioeconomic Assessment Act (YESAA). At the conclusion of the assessment, YESAB issues its recommendations to a decision body for consideration. For the Casino Project, it is expected that the designated decision body will be the Yukon Government.

After assessment, the project must secure certain permits and licenses. Mining related projects in the Yukon are regulated through territorial and federal legislation by various agencies, including government departments and independent quasi-judicial boards. The regulatory permitting and licensing processes are separate from YESAA. There is no single-window application process for regulatory permitting. Separate applications and information packages are required for each authorization and agency. The main pieces of legislation that will govern mining related activities for the Casino properties include:

|

• |

Quartz Mining Act; | |

|

• |

Waters Act; | |

|

• |

Territorial Lands (Yukon) Act; | |

|

• |

Environment Act; | |

|

• |

Highways Act; | |

|

• |

Dangerous Goods Transportation Act; | |

|

• |

Fisheries Act; | |

|

• |

Yukon Occupational Health and Safety Act. |

Work on these permits is in progress. Environmental study results are detailed in Section 20 of this report.

| 1.7 |

Mineral Resource and Mineral Reserve Estimates |

| 1.7.1 |

Metal Pricing |

Table 1-1 shows a summary of metal pricing that has been used for this report. Long-term metal prices used in the financial model were converted from US dollars using a long term exchange rate of C$:US$ = 0.95 and are shown in Canadian dollars.

Table 1-1: Summary of Metal Pricing

| Copper | Gold | Molybdenum | Silver | |

| Resources | $2.00/lb | $875.00/oz | $11.25/lb | $11.25/oz |

| Reserves | $2.75/lb | $1,300.00/oz | $14.50/lb | $23.00/oz |

| Financial Model | $3.16/lb | $1,473.68/oz | $14.74/lb | $26.32/oz |

- 20 -

| 1.7.2 |

Mineral Resource |

Table 1-2 summarizes the mineral resources for the Casino Project.

Table 1-2: Mineral Resource-Inclusive of Mineral Reserve

| Supergene and Hypogene Zones (Mill Resource) |

Cutoff CuEq (%) |

Ore Mtonnes |

Copper (%) |

Gold (g/t) |

Moly (%) |

Silver (g/t) |

CuEq (%) |

| Measured Mineral Resource | |||||||

| Supergene Oxide | 0.25 | 25 | 0.28 | 0.52 | 0.026 | 2.38 | 0.77 |

| Supergene Sulphide | 0.25 | 36 | 0.39 | 0.41 | 0.029 | 2.34 | 0.84 |

| Hypogene | 0.25 | 32 | 0.32 | 0.38 | 0.026 | 1.94 | 0.73 |

| Total Measured Resource | 0.25 | 93 | 0.34 | 0.43 | 0.027 | 2.21 | 0.78 |

| Indicated Mineral Resource | |||||||

| Supergene Oxide | 0.25 | 36 | 0.23 | 0.21 | 0.019 | 1.44 | 0.46 |

| Supergene Sulphide | 0.25 | 216 | 0.24 | 0.22 | 0.019 | 1.72 | 0.50 |

| Hypogene | 0.25 | 711 | 0.17 | 0.21 | 0.023 | 1.65 | 0.45 |

| Total Indicated Resource | 0.25 | 963.6 | 0.19 | 0.21 | 0.022 | 1.66 | 0.46 |

| Measured/Indicated Mineral Resource | |||||||

| Supergene Oxide | 0.25 | 61 | 0.25 | 0.34 | 0.022 | 1.83 | 0.59 |

| Supergene Sulphide | 0.25 | 252 | 0.26 | 0.25 | 0.021 | 1.81 | 0.55 |

| Hypogene | 0.25 | 743 | 0.17 | 0.22 | 0.023 | 1.66 | 0.46 |

| Total Measured/Indicated Resource | 0.25 | 1057 | 0.20 | 0.23 | 0.022 | 1.71 | 0.49 |

| Inferred Mineral Resource | |||||||

| Supergene Oxide | 0.25 | 26 | 0.26 | 0.17 | 0.010 | 1.43 | 0.41 |

| Supergene Sulphide | 0.25 | 102 | 0.20 | 0.19 | 0.010 | 1.49 | 0.38 |

| Hypogene | 0.25 | 1568 | 0.14 | 0.16 | 0.020 | 1.36 | 0.37 |

| Total Inferred Resource | 0.25 | 1696 | 0.14 | 0.16 | 0.019 | 1.37 | 0.37 |

| Leached Cap/Oxide Gold Zone | Cutoff | Ore | Copper | Gold | Moly | Silver | CuEq |

| (Heap Leach Resource) | Gold (g/t) | Mtonnes | (%) | (g/t) | (%) | (g/t) | (%) |

| Measured Mineral Resource | 0.25 | 31 | 0.05 | 0.52 | 0.025 | 2.94 | N.A. |

| Indicated Mineral Resource | 0.25 | 53 | 0.03 | 0.33 | 0.017 | 2.36 | N.A. |

| Measured/Indicated Resource | 0.25 | 84 | 0.04 | 0.40 | 0.020 | 2.57 | N.A. |

| Inferred Mineral Resource | 0.25 | 17 | 0.01 | 0.31 | 0.008 | 1.93 | N.A. |

| CuEq is based on metal prices of US$2.00/lb copper, $US875/oz gold, US$11.25/lb molybdenum, and US$11.25/oz silver and assumes 100% metal recovery. | |||||||

The supergene oxide, supergene sulphide, and hypogene zones are mill resources and are tabulated at a 0.25% copper equivalent cutoff grade. Measured and indicated supergene and hypogene resources amount to 1.06 billion tonnes at 0.20% copper, 0.23 g/t gold, 0.022% molybdenum, and 1.71 g/t silver. Inferred resources are an additional 1.7 billion tonnes at 0.14% copper, 0.16 g/t gold, 0.019% molybdenum, and 1.37 g/t silver.

The leach cap contains potential heap leach ore and is tabulated at a 0.25 g/t gold cutoff grade. Measured and indicated heap leach ore amounts to 84.0 million tonnes at 0.04% copper, 0.40 g/t gold, and 2.57 g/t silver. Inferred resources are an additional 17 million tonnes at 0.01% copper, 0.31 g/t gold, and 1.93 g/t silver.

- 21 -

| 1.7.3 |

Mineral Reserve |

The mill ore reserve amounts to 965.2 million tonnes at 0.204% copper, 0.240 g/t gold, 0.0227% molybdenum, and 1.74 g/t silver. Heap leach reserve is an additional 157.5 million tonnes at 0.292 g/t gold and 0.036% copper. Table 1-3 presents the mineral reserve for the Casino Project.

Table 1-3: Mineral Reserve

Mill Ore Reserve: |

Ore Ktonnes |

Tot Cu (%) |

Gold (g/t) |

Moly (%) |

Silver

(g/t) |

| Proven Mineral Reserve: | |||||

| Mill Ore | 91,602 | 0.336 | 0.437 | 0.0275 | 2.23 |

| Probable Mineral Reserve: | |||||

| Mill Ore | 729,777 | 0.203 | 0.235 | 0.0240 | 1.78 |

| Low Grade Stockpile | 143,828 | 0.122 | 0.139 | 0.0133 | 1.19 |

| Total Probable Reserve | 873,605 | 0.190 | 0.219 | 0.0222 | 1.68 |

| Proven/Probable Reserve | |||||

| Mill Ore | 821,379 | 0.218 | 0.258 | 0.0244 | 1.83 |

| Low Grade Stockpile | 143,828 | 0.122 | 0.139 | 0.0133 | 1.19 |

| Total Mill Ore Reserve | 965,207 | 0.204 | 0.240 | 0.0227 | 1.74 |

Heap Leach Reserve: |

Ore ktonnes |

Gold (g/t) |

Tot Cu (%) |

Moly (%) |

Silver (g/t) |

| Proven Mineral Reserve | 31,760 | 0.480 | 0.051 | N/A | 2.79 |

| Probable Mineral Reserve | 125,694 | 0.244 | 0.032 | N/A | 2.06 |

| Total Heap Leach Reserve | 157,454 | 0.292 | 0.036 | N/A | 2.21 |

| 1.8 |

Costs and Financial Data |

| 1.8.1 |

Capital Cost Estimate |

The initial capital investment for complete development of the project is estimated to be $2.456 billion total direct and indirect cost. Table 1-4 shows the capital cost breakdown.

Table 1-4: Capital Cost Estimate Summary

| (millions) | |

| Direct Costs | |

| Mining Equipment & Mine Development | $454 |

| Concentrator (including related facilities) | $904 |

| Heap Leach Operation | $139 |

| Camp | $70 |

| Sub-Total | $1,566 |

| Indirect Costs | $295 |

| Infrastructure Costs | |

| Power Plant | $209 |

| Access Road | $99 |

| Airstrip | $24 |

| Subtotal Infrastructure | $332 |

| Contingency | $218 |

| Owner’s Costs | $44 |

| Grand Total | $2,456 |

- 22 -

In addition to the above, the total life of mine sustaining capital is estimated to be $361.7 million. This capital will be expended during a 22 year period.

| 1.8.2 |

Operating Cost Estimate |

Life of mine average operating cost is $8.52 per tonne for sulphide ore, which includes mining, concentrator plant and general and administrative costs. The life of mine average operating cost is $4.04 per tonne for oxide ore which includes processing only.

| 1.8.3 |

Financial Analysis |

Net Income after Tax amounts to $6.7 billion for the life of the mine. The base case economic analysis (Table 1-5) indicates that the project has an Internal Rate of Return (IRR) of 20.1% after taxes with a payback period of 3.0 years.

Table 1-5 compares the base case project financial indicators with the financial indicators for other cases when the sales price, the amount of capital expenditure, operating cost, and copper recovery are varied from the base case values. By comparing the results of this sensitivity study, it can be seen that the project IRR’s sensitivity to variation in metal sales price has the most impact, while variation of operating cost, variation of mill recovery, and variation of capital cost are approximately equal.

Table 1-5: Sensitivity Analysis (After tax figures)

NPV @ 0% |

NPV @ 5% |

NPV @ 8% |

NPV @ 10% |

IRR |

Payback Years | |

| Base Case (LTP) | $6,651 | $2,986 | $1,830 | $1,296 | 20.1% | 3.0 |

| SEC Prices | $7,848 | $3,621 | $2,287 | $1,669 | 22.5% | 2.7 |

| Spot Prices* | $7,744 | $3,597 | $2,282 | $1,672 | 22.7% | 2.6 |

| Base-Case Sensitivities | ||||||

| Metals Price +10% | $8,157 | $3,786 | $2,407 | $1,768 | 23.1% | 2.6 |

| Metals Price -10% | $5,146 | $2,186 | $1,253 | $824 | 16.7% | 3.5 |

| Capex +10% | $6,499 | $2,840 | $1,689 | $1,158 | 18.4% | 3.2 |

| Capex -10% | $6,804 | $3,133 | $1,972 | $1,434 | 22.1% | 2.7 |

| Opex +10% | $6,103 | $2,705 | $1,631 | $1,135 | 19.0% | 3.1 |

| Opex -10% | $7,200 | $3,268 | $2,029 | $1,457 | 21.1% | 2.9 |

| Mill Recovery +5% | $7,304 | $3,329 | $2,075 | $1,495 | 21.3% | 2.8 |

| Mill Recovery -5% | $5,998 | $2,644 | $1,585 | $1,096 | 18.7% | 3.1 |

| $ in millions | ||||||

| *Spot prices are on the last | Base Case | SEC Prices | Spot Prices* | |||

| day of December 2012 |

Copper |

$3.16 |

Copper |

$3.67 | Copper | $3.57 |

|

Molybdenum |

$14.74 |

Molybdenum |

$14.67 | Molybdenum | $11.80 | |

|

Gold |

$1,473.68 |

Gold |

$1.487.85 | Gold | $1,657.50 | |

|

Silver |

$26.32 |

Silver |

$28.80 | Silver | $29.95 | |

- 23 -

| 1.9 |

Conclusions and Recommendations |

The Casino mineral occurrence can be successfully and economically exploited by proven and conventional mining and processing methods under the conditions and assumptions outlined in this report. Overall, the main risk and key metric for financial success is metal pricing.

Opportunities exist to enhance the project economics including:

|

• |

Conversion of some of the inferred resource into measured and indicated. | |

|

• |

Sharing of infrastructure development costs with other parties. | |

|

• |

Optimize the process during the basic and detailed engineering phases. |

To further enhance the project, M3 recommends that CMC perform the following:

| • |

CMC should continue to further define the resource through exploration drilling, particularly in the more sparsely drilled area west of the main zone and deep drilling adjacent to the microbreccia pipe (approximately $2 million required). | |

|

|

||

| • |

CMC should continue with the environmental studies and permitting efforts now underway (approximately $5 million required). | |

|

|

||

| • |

CMC should continue with the engineering effort in support of permitting (approximately $1 million required). | |

|

|

||

| • |

CMC should continue to monitor developments in the Yukon, northern British Columbia, and Alaska to be in a position to share infrastructure development (approximately $200,000 required). |

- 24 -

Figure 1-1: Casino Property Location

(Source: Yukon Highway Map, Yukoninfo. com)

- 25 -

Figure 1-2: Road to Casino Concentrator Site from the Yukon River

(Source: M3)

Figure 1-3: Path from Yukon River to Proposed Fresh Water Pond

(Source: M3)

- 26 -

Royalties and Production Payments

All claims comprising the Casino Project are subject to a 2.75% net smelter returns royalty (the “NSR Royalty”) on the future sale of any metals and minerals derived therefrom.

As part of a separate agreement, Western is required to make a payment of $1 million upon achieving commercial production at the Casino Project.

Recent Developments

Expenditures

Western’s recent activities have focused on permitting and engineering of the Casino Project. Capitalized expenditures for 2016 and 2017 were as follows:

| For the year ended December 31, | 2017 | 2016 | ||||

| $ | $ | |||||

| Acquisition costs | - | 617,767 | ||||

| Claims maintenance | 10,605 | 21,314 | ||||

| Engineering | 183,165 | 337,039 | ||||

| Permitting | 1,317,578 | 766,263 | ||||

| Salary and wages | 347,887 | 540,744 | ||||

| Share-based payments | 68,994 | 49,396 | ||||

| CASINO EXPENDITURES | 1,928,229 | 2,332,523 |

Excluding the acquisition cost of the Casino B claims acquired by the Company in 2016, Casino-related expenditures increased slightly during the year ended December 31, 2017. Permitting activities were limited in 2016 as the Company awaited the ESE Statement Guidelines from YESAB for the first half of the year and spent the next few months planning its approach to meet these requirements in its updated project proposal. In 2017, Western focused its efforst on the on the Best Available Tailing Technology review.

Permitting

The assessment process in the Yukon involves several steps after the submission of the Project Proposal concluding with the issuance of a Decision Document by the Yukon Environmental and Socioeconomic Assessment Board (“YESAB”). Once a project receives the Decision Document, the next step is obtaining a Quartz Mining License (“QML”). The QML would allow the Company to begin construction of the mine. The final significant permit following the issue of the QML is the Yukon Water License.

The Company is advancing certain key permitting activities required to prepare its Environmental and Socio-Economic Statement (“ESE Statement”). A large part of the initiative has been the Best Available Tailing Technology (“BATT”) review process relating to the design of the tailings and waste management facility. In this regard, Western is following the roadmap identified by the British Columbia Government, and being contemplated by the Yukon Government, to receive and consider feedback from key stakeholders. The goal is to come to a tailings management facility design that uses the best available tailings and mine waste deposition technology incorporating input from the community, First Nations, and regulatory authorities.

- 27 -

Infrastructure

In September 2017, the Yukon Government and the Federal Government announced their commitment to fund the upgrade of the existing access road and 30% of the new access road to the Casino Project as part of the Yukon Resource Gateway Application. Recent discussions with the Yukon Government indicate that work towards building these roads is underway, starting with preparation of permitting documentation for the first section of the road, a by-pass that will allow mining-related traffic to avoid the town of Carmacks.

Price Review of 2013 Feasibility Study

In September 2017, the Company completed a pricing review (the “Review”) of the 2013 Feasibility Study in association with M3 Engineering & Technology Corp. The Review indicates that the Casino Project’s economic metrics, such as internal rate of return and net present value, at current (May 2017) commodity prices and exchange rates are comparable to the base case metrics in the Feasibility Study. Capital and operating costs were updated as part of the Review, including updated costs for mining and major process equipment, power plant costs, major bulk materials (e.g. structural steel), and construction and operating labour rates. There was no change to the mineral resource or reserve estimate or to other technical information contained in the Feasibility Study.

DIVIDENDS

The Company has not paid any dividends on its common shares since its incorporation, nor has it any present intention of doing so. The Company anticipates that all available funds will be used to undertake exploration and development programs on its mineral properties.

DESCRIPTION OF CAPITAL STRUCTURE

Authorized Capital

The authorized capital of the Company consists of the following:

| 1. |

Unlimited number of common shares without par value. As of March 22, 2018, the Company had 99,559,001 common shares outstanding. |

|