esgr-20240331Enstar Group LTDfalse00013638292024Q1FALSE--12-31http://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherLiabilitieshttp://fasb.org/us-gaap/2023#OtherLiabilities00013638292024-01-012024-03-310001363829us-gaap:CommonStockMember2024-01-012024-03-310001363829esgr:SeriesDPreferredStockDepositaryShareMember2024-01-012024-03-310001363829esgr:SeriesEPreferredStockDepositaryShareMember2024-01-012024-03-3100013638292024-05-01xbrli:shares0001363829us-gaap:ShortTermInvestmentsMember2024-03-31iso4217:USD0001363829us-gaap:ShortTermInvestmentsMember2023-12-310001363829us-gaap:FixedMaturitiesMember2024-03-310001363829us-gaap:FixedMaturitiesMember2023-12-3100013638292024-03-3100013638292023-12-310001363829us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-03-310001363829us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001363829esgr:VotingCommonStockMember2024-03-31iso4217:USDxbrli:shares0001363829esgr:VotingCommonStockMember2023-12-310001363829us-gaap:SeriesCPreferredStockMember2023-12-310001363829us-gaap:SeriesCPreferredStockMember2024-03-310001363829us-gaap:SeriesDPreferredStockMember2024-03-310001363829us-gaap:SeriesDPreferredStockMember2023-12-310001363829us-gaap:SeriesEPreferredStockMember2023-12-310001363829us-gaap:SeriesEPreferredStockMember2024-03-3100013638292023-01-012023-03-310001363829us-gaap:CommonStockMemberesgr:VotingCommonStockMember2023-12-310001363829us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-12-310001363829us-gaap:CommonStockMemberesgr:CommonClassEMember2023-12-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2023-12-310001363829us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2023-12-310001363829us-gaap:SeriesEPreferredStockMemberus-gaap:PreferredStockMember2023-12-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:TreasuryStockPreferredMember2023-12-310001363829esgr:JointOwnershipPlanVotingOrdinarySharesMember2023-12-310001363829us-gaap:AdditionalPaidInCapitalMember2023-12-310001363829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001363829us-gaap:RetainedEarningsMember2023-12-310001363829us-gaap:ParentMember2023-12-310001363829us-gaap:NoncontrollingInterestMember2023-12-310001363829us-gaap:RetainedEarningsMember2024-01-012024-03-310001363829us-gaap:ParentMember2024-01-012024-03-310001363829us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001363829us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001363829us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001363829us-gaap:CommonStockMemberesgr:VotingCommonStockMember2024-03-310001363829us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-03-310001363829us-gaap:CommonStockMemberesgr:CommonClassEMember2024-03-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2024-03-310001363829us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2024-03-310001363829us-gaap:SeriesEPreferredStockMemberus-gaap:PreferredStockMember2024-03-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:TreasuryStockPreferredMember2024-03-310001363829esgr:JointOwnershipPlanVotingOrdinarySharesMember2024-03-310001363829us-gaap:AdditionalPaidInCapitalMember2024-03-310001363829us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001363829us-gaap:RetainedEarningsMember2024-03-310001363829us-gaap:ParentMember2024-03-310001363829us-gaap:NoncontrollingInterestMember2024-03-310001363829us-gaap:CommonStockMemberesgr:VotingCommonStockMember2022-12-310001363829us-gaap:CommonStockMemberus-gaap:CommonClassCMember2022-12-310001363829us-gaap:CommonStockMemberesgr:CommonClassEMember2022-12-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2022-12-310001363829us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2022-12-310001363829us-gaap:SeriesEPreferredStockMemberus-gaap:PreferredStockMember2022-12-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:TreasuryStockPreferredMember2022-12-310001363829esgr:JointOwnershipPlanVotingOrdinarySharesMember2022-12-310001363829us-gaap:AdditionalPaidInCapitalMember2022-12-310001363829us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001363829us-gaap:RetainedEarningsMember2022-12-310001363829us-gaap:ParentMember2022-12-310001363829us-gaap:NoncontrollingInterestMember2022-12-3100013638292022-12-310001363829us-gaap:RetainedEarningsMember2023-01-012023-03-310001363829us-gaap:ParentMember2023-01-012023-03-310001363829us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-01-012023-03-310001363829us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001363829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001363829us-gaap:CommonStockMemberesgr:VotingCommonStockMember2023-03-310001363829us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-03-310001363829us-gaap:CommonStockMemberesgr:CommonClassEMember2023-03-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2023-03-310001363829us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2023-03-310001363829us-gaap:SeriesEPreferredStockMemberus-gaap:PreferredStockMember2023-03-310001363829us-gaap:SeriesCPreferredStockMemberus-gaap:TreasuryStockPreferredMember2023-03-310001363829esgr:JointOwnershipPlanVotingOrdinarySharesMember2023-03-310001363829us-gaap:AdditionalPaidInCapitalMember2023-03-310001363829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001363829us-gaap:RetainedEarningsMember2023-03-310001363829us-gaap:ParentMember2023-03-310001363829us-gaap:NoncontrollingInterestMember2023-03-3100013638292023-03-31esgr:segmentxbrli:pure0001363829esgr:RunOffMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001363829esgr:RunOffMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001363829esgr:InvestmentSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001363829esgr:InvestmentSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001363829us-gaap:OperatingSegmentsMemberesgr:AssumedLifeSegmentMember2024-01-012024-03-310001363829us-gaap:OperatingSegmentsMemberesgr:AssumedLifeSegmentMember2023-01-012023-03-310001363829us-gaap:OperatingSegmentsMember2024-01-012024-03-310001363829us-gaap:OperatingSegmentsMember2023-01-012023-03-310001363829us-gaap:CorporateNonSegmentMember2024-01-012024-03-310001363829us-gaap:CorporateNonSegmentMember2023-01-012023-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:ShortTermInvestmentsMember2024-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FixedMaturitiesMember2024-03-310001363829us-gaap:USTreasuryAndGovernmentMember2024-03-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-03-310001363829us-gaap:FixedMaturitiesMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-03-310001363829us-gaap:ForeignGovernmentDebtSecuritiesMember2024-03-310001363829us-gaap:ShortTermInvestmentsMemberesgr:OtherGovernmentAgenciesDebtSecuritiesMember2024-03-310001363829esgr:OtherGovernmentAgenciesDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2024-03-310001363829esgr:OtherGovernmentAgenciesDebtSecuritiesMember2024-03-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2024-03-310001363829us-gaap:FixedMaturitiesMemberus-gaap:CorporateDebtSecuritiesMember2024-03-310001363829us-gaap:CorporateDebtSecuritiesMember2024-03-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:MunicipalBondsMember2024-03-310001363829us-gaap:MunicipalBondsMemberus-gaap:FixedMaturitiesMember2024-03-310001363829us-gaap:MunicipalBondsMember2024-03-310001363829us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2024-03-310001363829us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FixedMaturitiesMember2024-03-310001363829us-gaap:ResidentialMortgageBackedSecuritiesMember2024-03-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:CommercialMortgageBackedSecuritiesMember2024-03-310001363829us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FixedMaturitiesMember2024-03-310001363829us-gaap:CommercialMortgageBackedSecuritiesMember2024-03-310001363829us-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2024-03-310001363829us-gaap:AssetBackedSecuritiesMemberus-gaap:FixedMaturitiesMember2024-03-310001363829us-gaap:AssetBackedSecuritiesMember2024-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:ShortTermInvestmentsMember2023-12-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FixedMaturitiesMember2023-12-310001363829us-gaap:USTreasuryAndGovernmentMember2023-12-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001363829us-gaap:FixedMaturitiesMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001363829us-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001363829us-gaap:ShortTermInvestmentsMemberesgr:OtherGovernmentAgenciesDebtSecuritiesMember2023-12-310001363829esgr:OtherGovernmentAgenciesDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2023-12-310001363829esgr:OtherGovernmentAgenciesDebtSecuritiesMember2023-12-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001363829us-gaap:FixedMaturitiesMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001363829us-gaap:CorporateDebtSecuritiesMember2023-12-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:MunicipalBondsMember2023-12-310001363829us-gaap:MunicipalBondsMemberus-gaap:FixedMaturitiesMember2023-12-310001363829us-gaap:MunicipalBondsMember2023-12-310001363829us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001363829us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FixedMaturitiesMember2023-12-310001363829us-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001363829us-gaap:ShortTermInvestmentsMemberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001363829us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FixedMaturitiesMember2023-12-310001363829us-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001363829us-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001363829us-gaap:AssetBackedSecuritiesMemberus-gaap:FixedMaturitiesMember2023-12-310001363829us-gaap:AssetBackedSecuritiesMember2023-12-310001363829us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2024-03-310001363829us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2023-12-310001363829esgr:CommercialMortgageBackedSecuritiesIssuedByUSGovernmentAgenciesMember2024-03-310001363829esgr:CommercialMortgageBackedSecuritiesIssuedByUSGovernmentAgenciesMember2023-12-31esgr:Security0001363829esgr:OtherGovernmentAgenciesDebtSecuritiesMember2022-12-310001363829us-gaap:CorporateDebtSecuritiesMember2022-12-310001363829us-gaap:CorporateDebtSecuritiesMember2024-01-012024-03-310001363829us-gaap:CommercialMortgageBackedSecuritiesMember2024-01-012024-03-310001363829esgr:OtherGovernmentAgenciesDebtSecuritiesMember2023-01-012023-03-310001363829us-gaap:CorporateDebtSecuritiesMember2023-01-012023-03-310001363829esgr:OtherGovernmentAgenciesDebtSecuritiesMember2023-03-310001363829us-gaap:CorporateDebtSecuritiesMember2023-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:ExchangeTradedMember2023-12-310001363829us-gaap:ExchangeTradedFundsMember2024-03-310001363829us-gaap:ExchangeTradedFundsMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2023-12-310001363829us-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:PrivateEquityFundsMember2023-12-310001363829esgr:PrivateCreditFundsMember2024-03-310001363829esgr:PrivateCreditFundsMember2023-12-310001363829us-gaap:HedgeFundsMember2024-03-310001363829us-gaap:HedgeFundsMember2023-12-310001363829us-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FixedIncomeFundsMember2023-12-310001363829us-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:RealEstateFundsMember2023-12-310001363829esgr:CLOEquityFundsMember2024-03-310001363829esgr:CLOEquityFundsMember2023-12-310001363829esgr:CLOEquityMember2024-03-310001363829esgr:CLOEquityMember2023-12-310001363829us-gaap:EquityFundsMember2024-03-310001363829us-gaap:EquityFundsMember2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMemberesgr:RestrictionPeriodLessThanOneYearMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberesgr:RestrictionPeriodTwoToThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMemberesgr:RestrictionPeriodMoreThanThreeYearsMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodLessThanOneYearMemberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMemberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMemberesgr:RestrictionPeriodTwoToThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodMoreThanThreeYearsMemberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:HedgeFundsMemberesgr:RestrictionPeriodLessThanOneYearMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMemberus-gaap:HedgeFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:HedgeFundsMemberesgr:RestrictionPeriodTwoToThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:HedgeFundsMemberesgr:RestrictionPeriodMoreThanThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:HedgeFundsMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:HedgeFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodLessThanOneYearMemberus-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMemberus-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeFundsMemberesgr:RestrictionPeriodTwoToThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeFundsMemberesgr:RestrictionPeriodMoreThanThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeFundsMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodLessThanOneYearMemberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMemberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:PrivateCreditFundsMemberesgr:RestrictionPeriodTwoToThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodMoreThanThreeYearsMemberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:PrivateCreditFundsMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodLessThanOneYearMemberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMemberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodTwoToThreeYearsMemberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodMoreThanThreeYearsMemberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:RealEstateFundsMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodLessThanOneYearMemberesgr:CLOEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMemberesgr:CLOEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:CLOEquityFundsMemberesgr:RestrictionPeriodTwoToThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:CLOEquityFundsMemberesgr:RestrictionPeriodMoreThanThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:CLOEquityFundsMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:CLOEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodLessThanOneYearMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodOneToTwoYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodTwoToThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodMoreThanThreeYearsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberesgr:RestrictionPeriodNotEligibleRestrictedMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-03-310001363829us-gaap:CommonStockMemberesgr:MonumentMember2024-03-310001363829esgr:MonumentMember2024-03-310001363829us-gaap:CommonStockMemberesgr:MonumentMember2023-12-310001363829esgr:MonumentMember2023-12-310001363829esgr:CoreSpecialtyMember2024-03-310001363829esgr:CoreSpecialtyMember2023-12-310001363829esgr:OtherEquityMethodInvestmentsMember2024-03-310001363829esgr:OtherEquityMethodInvestmentsMember2023-12-310001363829us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2024-03-310001363829us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2023-12-310001363829us-gaap:FixedMaturitiesMember2024-01-012024-03-310001363829us-gaap:FixedMaturitiesMember2023-01-012023-03-310001363829esgr:ShortTermInvestmentsAndCashEquivalentsMember2024-01-012024-03-310001363829esgr:ShortTermInvestmentsAndCashEquivalentsMember2023-01-012023-03-310001363829esgr:FundsHeldByReinsuredCompaniesMember2024-01-012024-03-310001363829esgr:FundsHeldByReinsuredCompaniesMember2023-01-012023-03-310001363829esgr:FixedMaturitiesandCashandCashEquivalentsMember2024-01-012024-03-310001363829esgr:FixedMaturitiesandCashandCashEquivalentsMember2023-01-012023-03-310001363829us-gaap:EquitySecuritiesMember2024-01-012024-03-310001363829us-gaap:EquitySecuritiesMember2023-01-012023-03-310001363829us-gaap:OtherInvestmentsMember2024-01-012024-03-310001363829us-gaap:OtherInvestmentsMember2023-01-012023-03-310001363829esgr:EquitiesandOtherInvestmentsMember2024-01-012024-03-310001363829esgr:EquitiesandOtherInvestmentsMember2023-01-012023-03-310001363829esgr:FundsHeldDirectlyManagedMember2024-01-012024-03-310001363829esgr:FundsHeldDirectlyManagedMember2023-01-012023-03-310001363829us-gaap:AssetPledgedAsCollateralMember2024-03-310001363829us-gaap:AssetPledgedAsCollateralMember2023-12-31esgr:syndicate00013638292023-01-012023-12-310001363829us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2023-02-012023-02-280001363829us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2023-02-280001363829us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2023-04-012023-04-300001363829us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001363829us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001363829us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-03-310001363829us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-12-310001363829us-gaap:OtherContractMemberus-gaap:NondesignatedMember2024-03-310001363829us-gaap:OtherContractMemberus-gaap:NondesignatedMember2023-12-310001363829us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-03-310001363829us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-03-310001363829us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-01-012024-03-310001363829us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-01-012023-03-310001363829us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2024-01-012024-03-310001363829us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2023-01-012023-03-310001363829esgr:RunOffMemberesgr:AsbestosMember2024-01-012024-03-310001363829esgr:RunOffMemberesgr:AsbestosMember2023-01-012023-03-310001363829esgr:RunOffMemberesgr:EnvironmentalMember2024-01-012024-03-310001363829esgr:RunOffMemberesgr:EnvironmentalMember2023-01-012023-03-310001363829esgr:RunOffMemberesgr:GeneralCasualtyInsuranceProductLineMember2024-01-012024-03-310001363829esgr:RunOffMemberesgr:GeneralCasualtyInsuranceProductLineMember2023-01-012023-03-310001363829us-gaap:WorkersCompensationInsuranceMemberesgr:RunOffMember2024-01-012024-03-310001363829us-gaap:WorkersCompensationInsuranceMemberesgr:RunOffMember2023-01-012023-03-310001363829esgr:RunOffMemberesgr:MarineAviationandTransitExposureMember2024-01-012024-03-310001363829esgr:RunOffMemberesgr:MarineAviationandTransitExposureMember2023-01-012023-03-310001363829esgr:RunOffMemberesgr:ConstructionDefectExposureMember2024-01-012024-03-310001363829esgr:RunOffMemberesgr:ConstructionDefectExposureMember2023-01-012023-03-310001363829us-gaap:DirectorsAndOfficersLiabilityInsuranceMemberesgr:RunOffMember2024-01-012024-03-310001363829us-gaap:DirectorsAndOfficersLiabilityInsuranceMemberesgr:RunOffMember2023-01-012023-03-310001363829esgr:MotorMemberesgr:RunOffMember2024-01-012024-03-310001363829esgr:MotorMemberesgr:RunOffMember2023-01-012023-03-310001363829esgr:RunOffMemberus-gaap:PropertyInsuranceProductLineMember2024-01-012024-03-310001363829esgr:RunOffMemberus-gaap:PropertyInsuranceProductLineMember2023-01-012023-03-310001363829us-gaap:OtherShortdurationInsuranceProductLineMemberesgr:RunOffMember2024-01-012024-03-310001363829us-gaap:OtherShortdurationInsuranceProductLineMemberesgr:RunOffMember2023-01-012023-03-310001363829esgr:RunOffMember2024-01-012024-03-310001363829esgr:RunOffMember2023-01-012023-03-3100013638292022-11-012022-11-300001363829esgr:AllianzMemberesgr:EnhanzedReMember2022-11-300001363829esgr:MonumentMember2022-11-300001363829us-gaap:CommonStockMemberesgr:MonumentMember2023-03-310001363829esgr:MonumentMember2023-03-310001363829esgr:AllianzMemberesgr:EnhanzedReMember2023-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CommercialMortgageBackedSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:PrivateCreditFundsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:PrivateCreditFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:HedgeFundsFixedIncomeMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberesgr:HedgeFundsFixedIncomeMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:HedgeFundsFixedIncomeMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:HedgeFundsFixedIncomeMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:HedgeFundsFixedIncomeMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:CLOEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberesgr:CLOEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityFundsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:CLOEquityMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel1Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:NondesignatedMember2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel2Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2024-03-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:DebtSecurityGovernmentOtherMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MunicipalBondsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMember2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ExchangeTradedMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ExchangeTradedMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ExchangeTradedMember2023-12-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OverTheCounterMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OverTheCounterMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OverTheCounterMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OverTheCounterMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PrivateEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivateEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrivateEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrivateEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:PrivateCreditFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberesgr:PrivateCreditFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:PrivateCreditFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:PrivateCreditFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:PrivateCreditFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:HedgeFundsFixedIncomeMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberesgr:HedgeFundsFixedIncomeMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:HedgeFundsFixedIncomeMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:HedgeFundsFixedIncomeMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:HedgeFundsFixedIncomeMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:RealEstateFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:RealEstateFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:CLOEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberesgr:CLOEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberesgr:CLOEquityMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:CLOEquityMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquityFundsMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:NondesignatedMember2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel2Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel3Member2023-12-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:ExchangeTradedMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2022-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2024-01-012024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2023-01-012023-03-310001363829us-gaap:FixedMaturitiesMemberus-gaap:CorporateDebtSecuritiesMember2024-01-012024-03-310001363829us-gaap:AssetBackedSecuritiesMemberus-gaap:FixedMaturitiesMember2024-01-012024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2023-03-310001363829us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberesgr:MeasurementInputYieldToMaturityMemberus-gaap:FixedMaturitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:ValuationTechniqueDiscountedCashFlowMemberesgr:MeasurementInputYieldToMaturityMembersrt:MaximumMemberus-gaap:FixedMaturitiesMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:AssetBackedSecuritiesMembersrt:MinimumMemberesgr:MeasurementInputYieldToMaturityMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:AssetBackedSecuritiesMemberesgr:MeasurementInputYieldToMaturityMembersrt:MaximumMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:CostApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationTechniqueGuidelineCompanyMethodologyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationTechniqueGuidelineCompanyMethodologyMembersrt:MinimumMemberesgr:MeasurementInputPBVMultipleMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationTechniqueGuidelineCompanyMethodologyMembersrt:MaximumMemberesgr:MeasurementInputPBVMultipleMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationTechniqueGuidelineCompanyMethodologyMembersrt:MinimumMemberesgr:MeasurementInputPBVMultipleExcludingAOCIMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationTechniqueGuidelineCompanyMethodologyMemberesgr:MeasurementInputPBVMultipleExcludingAOCIMembersrt:MaximumMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationTechniqueGuidelineCompanyMethodologyMembersrt:MinimumMemberus-gaap:MeasurementInputExpectedTermMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationTechniqueGuidelineCompanyMethodologyMemberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberesgr:ValuationApproachDividendDiscountModelAndGuidelineCompaniesMethodMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829srt:MinimumMemberesgr:MeasurementInputPBVMultipleMemberus-gaap:OverTheCounterMemberesgr:ValuationApproachDividendDiscountModelAndGuidelineCompaniesMethodMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829srt:MaximumMemberesgr:MeasurementInputPBVMultipleMemberus-gaap:OverTheCounterMemberesgr:ValuationApproachDividendDiscountModelAndGuidelineCompaniesMethodMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:MeasurementInputPrice2024EarningsMembersrt:MinimumMemberus-gaap:OverTheCounterMemberesgr:ValuationApproachDividendDiscountModelAndGuidelineCompaniesMethodMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:MeasurementInputPrice2024EarningsMembersrt:MaximumMemberus-gaap:OverTheCounterMemberesgr:ValuationApproachDividendDiscountModelAndGuidelineCompaniesMethodMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberesgr:ValuationApproachGuidelineCompaniesMethodAndEarningsMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationApproachGuidelineCompaniesMethodAndEarningsMembersrt:MinimumMemberesgr:MeasurementInputLTMEnterpriseValueEBITDAMultiplesMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:ValuationApproachGuidelineCompaniesMethodAndEarningsMemberesgr:MeasurementInputLTMEnterpriseValueEBITDAMultiplesMembersrt:MaximumMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:MeasurementInputLTMEVRevenueMultiplesMemberesgr:ValuationApproachGuidelineCompaniesMethodAndEarningsMembersrt:MinimumMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:MeasurementInputLTMEVRevenueMultiplesMemberesgr:ValuationApproachGuidelineCompaniesMethodAndEarningsMembersrt:MaximumMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829srt:ArithmeticAverageMemberesgr:ValuationApproachGuidelineCompaniesMethodAndEarningsMemberus-gaap:OverTheCounterMemberesgr:MeasurementInputMultipleOnEarningsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:IncomeApproachValuationTechniqueMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:MeasurementInputDiscountRateMembersrt:ArithmeticAverageMemberus-gaap:IncomeApproachValuationTechniqueMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:ArithmeticAverageMemberesgr:MeasurementInputImpliedTotalYieldMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-12-310001363829us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2024-01-012024-03-310001363829us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2023-01-012023-03-310001363829us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2023-03-310001363829esgr:ValuationTechniqueMonteCarloSimulationModelAndDiscountedCashFlowAnalysisMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829srt:ArithmeticAverageMemberus-gaap:MeasurementInputPriceVolatilityMemberesgr:ValuationTechniqueMonteCarloSimulationModelAndDiscountedCashFlowAnalysisMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829srt:ArithmeticAverageMemberesgr:MeasurementInputExpectedLossPaymentMemberesgr:ValuationTechniqueMonteCarloSimulationModelAndDiscountedCashFlowAnalysisMemberus-gaap:FairValueInputsLevel3Member2024-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMember2023-12-310001363829us-gaap:ReinsuranceRecoverableMember2023-12-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMember2022-12-310001363829us-gaap:ReinsuranceRecoverableMember2022-12-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMember2024-01-012024-03-310001363829us-gaap:ReinsuranceRecoverableMember2024-01-012024-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMember2023-01-012023-03-310001363829us-gaap:ReinsuranceRecoverableMember2023-01-012023-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberesgr:MeasurementInputAveragePayoutMember2024-01-012024-03-310001363829esgr:MeasurementInputAveragePayoutMemberus-gaap:ReinsuranceRecoverableMember2024-01-012024-03-310001363829esgr:MeasurementInputAveragePayoutMember2024-01-012024-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberesgr:MeasurementInputAveragePayoutMember2023-01-012023-03-310001363829esgr:MeasurementInputAveragePayoutMemberus-gaap:ReinsuranceRecoverableMember2023-01-012023-03-310001363829esgr:MeasurementInputAveragePayoutMember2023-01-012023-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberesgr:MeasurementInputCorporateBondYieldMember2024-01-012024-03-310001363829esgr:MeasurementInputCorporateBondYieldMemberus-gaap:ReinsuranceRecoverableMember2024-01-012024-03-310001363829esgr:MeasurementInputCorporateBondYieldMember2024-01-012024-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberesgr:MeasurementInputCorporateBondYieldMember2023-01-012023-03-310001363829esgr:MeasurementInputCorporateBondYieldMemberus-gaap:ReinsuranceRecoverableMember2023-01-012023-03-310001363829esgr:MeasurementInputCorporateBondYieldMember2023-01-012023-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberesgr:MeasurementInputRiskCostOfCapitalMember2024-01-012024-03-310001363829esgr:MeasurementInputRiskCostOfCapitalMemberus-gaap:ReinsuranceRecoverableMember2024-01-012024-03-310001363829esgr:MeasurementInputRiskCostOfCapitalMember2024-01-012024-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberesgr:MeasurementInputRiskCostOfCapitalMember2023-01-012023-03-310001363829esgr:MeasurementInputRiskCostOfCapitalMemberus-gaap:ReinsuranceRecoverableMember2023-01-012023-03-310001363829esgr:MeasurementInputRiskCostOfCapitalMember2023-01-012023-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMember2024-03-310001363829us-gaap:ReinsuranceRecoverableMember2024-03-310001363829esgr:LossesAndLossAdjustmentExpenseLiabilitiesMember2023-03-310001363829us-gaap:ReinsuranceRecoverableMember2023-03-310001363829us-gaap:MeasurementInputEntityCreditRiskMemberesgr:InternalModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ReinsuranceRecoverableMember2024-01-012024-03-310001363829us-gaap:MeasurementInputEntityCreditRiskMemberesgr:InternalModelMemberesgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-01-012024-03-310001363829us-gaap:MeasurementInputEntityCreditRiskMemberesgr:InternalModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ReinsuranceRecoverableMember2023-01-012023-12-310001363829us-gaap:MeasurementInputEntityCreditRiskMemberesgr:InternalModelMemberesgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310001363829esgr:InternalModelMemberesgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-01-012024-03-310001363829esgr:InternalModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ReinsuranceRecoverableMember2024-01-012024-03-310001363829esgr:InternalModelMemberesgr:LossesAndLossAdjustmentExpenseLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310001363829esgr:InternalModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ReinsuranceRecoverableMember2023-01-012023-12-310001363829us-gaap:SeniorNotesMemberesgr:SeniorNotesDue2029Member2024-03-310001363829esgr:SeniorNotesDue2031Memberus-gaap:SeniorNotesMember2024-03-310001363829us-gaap:SeniorNotesMember2024-03-310001363829esgr:JuniorSubordinatedNotesDue2040Memberus-gaap:JuniorSubordinatedDebtMember2024-03-310001363829us-gaap:JuniorSubordinatedDebtMemberesgr:JuniorSubordinatedNotesDue2042Member2024-03-310001363829us-gaap:SubordinatedDebtMember2024-03-310001363829us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberesgr:GCMFundMember2022-07-310001363829us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberesgr:GCMFundMember2024-01-012024-03-310001363829us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberesgr:GCMFundMember2024-03-310001363829us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberesgr:GCMFundMember2023-01-012023-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:ExchangeTradedMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:ExchangeTradedMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829us-gaap:EquitySecuritiesMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829us-gaap:HedgeFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829us-gaap:HedgeFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829us-gaap:FixedIncomeFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829us-gaap:FixedIncomeFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:PrivateEquityFundsMember2024-03-310001363829us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:PrivateEquityFundsMember2023-12-310001363829esgr:CLOEquityFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829esgr:CLOEquityFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829esgr:PrivateCreditFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829esgr:PrivateCreditFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829us-gaap:RealEstateFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829us-gaap:RealEstateFundsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829us-gaap:OtherThanSecuritiesInvestmentMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829us-gaap:OtherThanSecuritiesInvestmentMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-03-310001363829us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001363829esgr:AllianzMemberesgr:EnhanzedReMember2022-12-310001363829esgr:AllianzMemberesgr:EnhanzedReMember2022-12-012022-12-310001363829esgr:SharesHeldByCanadaPensionMember2023-03-012023-03-31esgr:day0001363829us-gaap:SeriesDPreferredStockMember2024-01-012024-03-310001363829us-gaap:SeriesDPreferredStockMember2023-01-012023-03-310001363829us-gaap:SeriesEPreferredStockMember2023-01-012023-03-310001363829us-gaap:SeriesEPreferredStockMember2024-01-012024-03-310001363829us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001363829us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001363829us-gaap:AociMarketRiskBenefitInstrumentSpecificCreditRiskParentMember2023-12-310001363829us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-03-310001363829us-gaap:AociGainLossDebtSecuritiesAvailableForSaleWithAllowanceForCreditLossIncludingNoncontrollingInterestMember2024-01-012024-03-310001363829us-gaap:AociGainLossDebtSecuritiesAvailableForSaleWithoutAllowanceForCreditLossIncludingNoncontrollingInterestMember2024-01-012024-03-310001363829us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-03-310001363829us-gaap:AociMarketRiskBenefitInstrumentSpecificCreditRiskIncludingNoncontrollingInterestMember2024-01-012024-03-310001363829us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-03-310001363829us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001363829us-gaap:AociMarketRiskBenefitInstrumentSpecificCreditRiskParentMember2024-03-310001363829us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001363829us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001363829us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2022-12-310001363829us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AociGainLossDebtSecuritiesAvailableForSaleWithAllowanceForCreditLossIncludingNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AociGainLossDebtSecuritiesAvailableForSaleWithoutAllowanceForCreditLossIncludingNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AociLiabilityForFuturePolicyBenefitIncludingNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AccumulatedNetInvestmentGainLossAttributableToNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AccumulatedForeignCurrencyAdjustmentAttributableToNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AociLiabilityForFuturePolicyBenefitNoncontrollingInterestMember2023-01-012023-03-310001363829us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-03-310001363829us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001363829us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2023-03-310001363829us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001363829us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001363829us-gaap:AociLiabilityForFuturePolicyBenefitIncludingNoncontrollingInterestMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001363829us-gaap:AociLiabilityForFuturePolicyBenefitIncludingNoncontrollingInterestMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001363829us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001363829us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001363829us-gaap:FixedMaturitiesMemberus-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMember2024-03-310001363829us-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMember2024-03-310001363829us-gaap:InvesteeMemberesgr:AmTrustFinancialServicesInc.Member2024-03-310001363829us-gaap:InvesteeMemberesgr:CoreSpecialtyMember2024-03-310001363829us-gaap:InvesteeMemberesgr:OtherCounterpartiesMember2024-03-310001363829us-gaap:InvesteeMemberesgr:MonumentMember2024-03-310001363829us-gaap:InvesteeMemberesgr:CitcoIIILimitedMember2024-03-310001363829esgr:EnstarMemberesgr:StonePointMemberus-gaap:InvestorMember2024-01-012024-03-310001363829esgr:EnstarMemberesgr:StonePointMemberus-gaap:InvestorMember2024-03-310001363829us-gaap:OtherInvestmentsMemberus-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMember2024-03-310001363829us-gaap:EquitySecuritiesMemberus-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:FixedMaturitiesMemberus-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMember2023-12-310001363829us-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMember2023-12-310001363829us-gaap:InvesteeMemberesgr:AmTrustFinancialServicesInc.Member2023-12-310001363829us-gaap:InvesteeMemberesgr:CoreSpecialtyMember2023-12-310001363829us-gaap:InvesteeMemberesgr:OtherCounterpartiesMember2023-12-310001363829us-gaap:InvesteeMemberesgr:MonumentMember2023-12-310001363829us-gaap:InvesteeMemberesgr:CitcoIIILimitedMember2023-12-310001363829us-gaap:InvesteeMemberesgr:CoreSpecialtyMember2024-01-012024-03-310001363829us-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMember2024-01-012024-03-310001363829us-gaap:InvesteeMemberesgr:AmTrustFinancialServicesInc.Member2024-01-012024-03-310001363829us-gaap:InvesteeMemberesgr:CitcoIIILimitedMember2024-01-012024-03-310001363829us-gaap:InvesteeMemberesgr:OtherCounterpartiesMember2024-01-012024-03-310001363829us-gaap:InvesteeMemberesgr:MonumentMember2024-01-012024-03-310001363829us-gaap:InvestorMemberesgr:StonePointAndAffiliatedEntitiesMember2023-01-012023-03-310001363829us-gaap:InvesteeMemberesgr:AmTrustFinancialServicesInc.Member2023-01-012023-03-310001363829us-gaap:InvesteeMemberesgr:OtherCounterpartiesMember2023-01-012023-03-310001363829us-gaap:InvesteeMemberesgr:MonumentMember2023-01-012023-03-310001363829us-gaap:InvesteeMemberesgr:CitcoIIILimitedMember2023-01-012023-03-310001363829us-gaap:InvesteeMemberesgr:CoreSpecialtyMember2023-01-012023-03-310001363829us-gaap:ReinsurerConcentrationRiskMember2024-01-012024-03-310001363829us-gaap:ReinsurerConcentrationRiskMember2023-01-012023-12-310001363829us-gaap:USTreasuryAndGovernmentMember2024-01-012024-03-310001363829us-gaap:USTreasuryAndGovernmentMember2023-01-012023-12-310001363829us-gaap:OtherInvestmentsMemberesgr:UnfundedInvestmentCommitmentsMember2024-03-310001363829esgr:UnfundedInvestmentCommitmentsMemberus-gaap:EquitySecuritiesMemberus-gaap:OverTheCounterMember2024-03-310001363829us-gaap:PerformanceGuaranteeMember2023-12-310001363829us-gaap:PerformanceGuaranteeMember2024-03-310001363829us-gaap:JuniorSubordinatedDebtMember2024-03-310001363829us-gaap:JuniorSubordinatedDebtMember2023-12-310001363829us-gaap:SubsequentEventMemberesgr:SiriusPointLtd.Member2024-04-302024-04-300001363829us-gaap:SubsequentEventMemberesgr:SiriusPointLtd.Member2024-04-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

Commission File Number 001-33289

ENSTAR GROUP LIMITED

(Exact name of Registrant as specified in its charter)

| | | | | |

| BERMUDA | N/A |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

A.S. Cooper Building, 4th Floor, 26 Reid Street, Hamilton HM 11, Bermuda

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (441) 292-3645

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Ordinary shares, par value $1.00 per share | ESGR | The NASDAQ Stock Market | LLC |

| Depositary Shares, Each Representing a 1/1,000th Interest in a 7.00% | ESGRP | The NASDAQ Stock Market | LLC |

| Fixed-to-Floating Rate Perpetual Non-Cumulative Preferred Share, Series D, Par Value $1.00 Per Share | | | |

| Depositary Shares, Each Representing a 1/1,000th Interest in a 7.00% | ESGRO | The NASDAQ Stock Market | LLC |

| Perpetual Non-Cumulative Preferred Share, Series E, Par Value $1.00 Per Share | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As at May 1, 2024, the registrant had outstanding 15,229,358 voting ordinary shares, par value $1.00 per share.

Enstar Group Limited

Quarterly Report on Form 10-Q

For the Period Ended March 31, 2024

Table of Contents

| | | | | | | | |

| | | Page |

| | |

| | |

| PART I | |

| | |

| Item 1. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

GLOSSARY OF KEY TERMS

| | | | | | | | |

| | |

| A&E | | Asbestos and environmental |

| | |

| Acquisition costs | | Costs that are directly related to the successful efforts of acquiring new insurance contracts or renewing existing insurance contracts, and which principally consist of incremental costs such as: commissions, brokerage expenses, premium taxes and other fees incurred at the time that a contract or policy is issued. |

| | |

| ADC | | Adverse development cover – A retrospective reinsurance arrangement that will insure losses in excess of an established reserve and provide protection up to a contractually agreed amount. |

| | |

| Adjusted RLE | | Adjusted run-off liability earnings - Non-GAAP financial measure calculated by dividing adjusted prior period development by average adjusted net loss reserves. See “Non-GAAP Financial Measures” for reconciliation. |

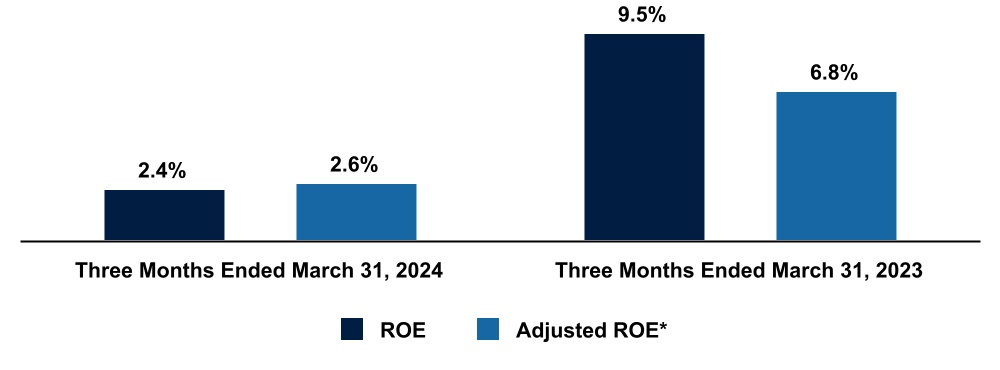

| Adjusted ROE | | Adjusted return on equity - Non-GAAP financial measure calculated by dividing adjusted operating income (loss) attributable to Enstar ordinary shareholders by adjusted opening Enstar ordinary shareholders’ equity. See “Non-GAAP Financial Measures” for reconciliation. |

| Adjusted TIR | | Adjusted total investment return - Non-GAAP financial measure calculated by dividing adjusted total investment return by average adjusted total investable assets. See “Non-GAAP Financial Measures” for reconciliation. |

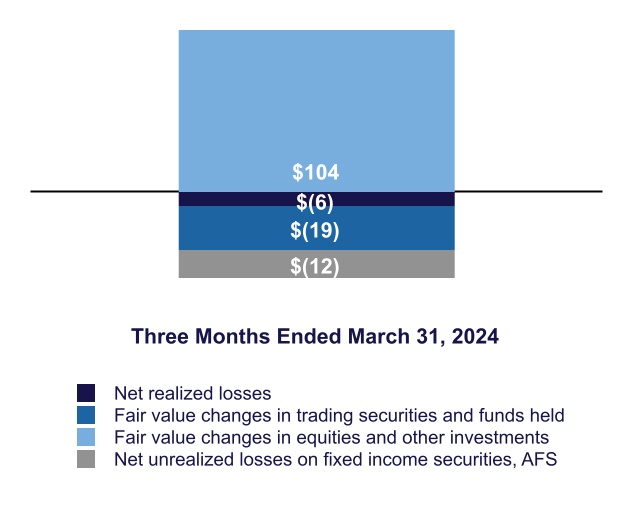

| AFS | | Available-for-sale |

| | |

| | |

| Allianz | | Allianz SE |

| AmTrust | | AmTrust Financial Services, Inc. |

Annualized | | Calculation of the quarterly result or year-to-date result multiplied by four and then divided by the number of quarters elapsed within the applicable year-to-date period. |

| AOCI | | Accumulated other comprehensive income |

APIC | | Additional Paid-in Capital |

| | |

| | |

| ASC | | Accounting Standards Codification |

| ASU | | Accounting Standards Update |

| Arden | | Arden Reinsurance Company Ltd. |

| | |

| | |

| | |

| | |

| | |

| Atrium | | Atrium Underwriting Group Limited |

bps | | Basis point(s) |

| BMA | | Bermuda Monetary Authority |

| | |

| | |

| BSCR | | Bermuda Solvency Capital Requirement |

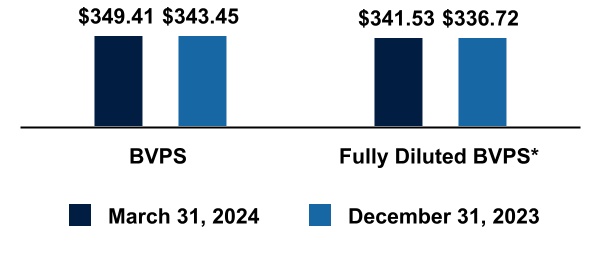

| BVPS | | Book value per ordinary share - GAAP financial measure calculated by dividing Enstar ordinary shareholders’ equity by the number of ordinary shares outstanding. |

| Cavello | | Cavello Bay Reinsurance Limited, a wholly-owned subsidiary |

| | |

| | |

| | |

| Citco | | Citco III Limited |

| CLO | | Collateralized loan obligation |

| | |

| | |

| | |

| | |

| | |

| Core Specialty | | Core Specialty Insurance Holdings, Inc. |

| | |

| DCo | | DCo LLC |

| | |

| Defendant A&E liabilities | | Defendant asbestos and environmental liabilities - Non-insurance liabilities relating to amounts for indemnity and defense costs for pending and future claims, as well as amounts for environmental liabilities associated with properties. |

| DCA | | Deferred charge asset - The amount by which estimated ultimate losses payable exceed the consideration received at the inception of a retroactive reinsurance agreement and that are subsequently amortized over the estimated loss settlement period. |

| | |

| | |

| | |

DGL | | Deferred gain liability - The amount by which consideration received exceeds estimated ultimate losses payable at the inception of a retroactive reinsurance agreement and that are subsequently amortized over the estimated loss settlement period. |

| | |

| | |

| EB Trust | | Enstar Group Limited Employee Benefit Trust |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Enhanzed Re | | Enhanzed Reinsurance Ltd. |

| Enstar | | Enstar Group Limited and its consolidated subsidiaries |

| | | | | | | | |