United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21904

(Investment Company Act File Number)

Federated Hermes MDT Series

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 07/31/22

Date of Reporting Period: 07/31/22

| Item 1. | Reports to Stockholders |

|

Share Class | Ticker

|

A | QAACX

|

C | QCACX

|

Institutional | QIACX

|

R6 | QKACX

|

Federated Hermes MDT All Cap Core Fund

A Portfolio of Federated Hermes MDT Series

|

|

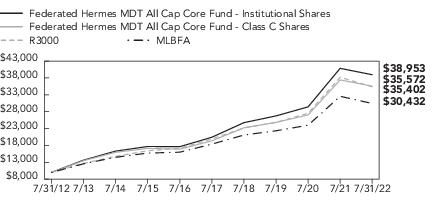

1 Year

|

5 Years

|

10 Years

|

|

Class A Shares

|

-10.18%

|

12.16%

|

13.59%

|

|

Class C Shares

|

-6.45%

|

12.59%

|

13.53%

|

|

Institutional Shares

|

-4.67%

|

13.77%

|

14.57%

|

|

Class R6 Shares4

|

-4.66%

|

13.78%

|

14.22%

|

|

R3000

|

-7.35%

|

12.18%

|

13.48%

|

|

MLBFA

|

-6.36%

|

11.16%

|

12.42%

|

|

Sector Composition

|

Percentage of

Total Net Assets

|

|

Information Technology

|

24.9%

|

|

Health Care

|

15.0%

|

|

Financials

|

12.2%

|

|

Consumer Discretionary

|

9.7%

|

|

Communication Services

|

8.5%

|

|

Industrials

|

7.9%

|

|

Consumer Staples

|

6.5%

|

|

Energy

|

5.4%

|

|

Materials

|

3.3%

|

|

Real Estate

|

2.7%

|

|

Utilities

|

1.8%

|

|

Securities Lending Collateral2

|

0.3%

|

|

Cash Equivalents3

|

2.0%

|

|

Other Assets and Liabilities—Net4

|

(0.2)%

|

|

TOTAL

|

100%

|

|

1

|

Except for Cash Equivalents and Other Assets and Liabilities, sector classifications are based

upon, and individual portfolio securities are assigned to, the classifications of the Global Industry

Classification Standard (GICS) except that the Adviser assigns a classification to securities not

classified by the GICS and to securities for which the Adviser does not have access to the

classification made by the GICS.

|

|

2

|

Represents cash collateral received for portfolio securities on loan that may be invested in

affiliated money market funds, other money market instruments and/or repurchase agreements.

|

|

3

|

Cash Equivalents include any investments in money market mutual funds and/or overnight

repurchase agreements other than those representing cash collateral for securities lending.

|

|

4

|

Assets, other than investments in securities, less liabilities. See Statement of Assets and

Liabilities.

|

|

Shares

|

|

|

Value

|

|

|

|

COMMON STOCKS— 97.9%

|

|

|

|

|

Communication Services— 8.5%

|

|

|

69,080

|

1

|

Alphabet, Inc., Class A

|

$ 8,035,386

|

|

341,396

|

1

|

Altice USA, Inc.

|

3,588,072

|

|

65,486

|

1

|

Cars.com, Inc.

|

770,115

|

|

39,077

|

1

|

Meta Platforms, Inc.

|

6,217,151

|

|

10,869

|

1

|

Netflix, Inc.

|

2,444,438

|

|

132,030

|

1

|

Pinterest, Inc.

|

2,571,944

|

|

7,128

|

1

|

T-Mobile USA, Inc.

|

1,019,732

|

|

28,070

|

1

|

TripAdvisor, Inc.

|

533,611

|

|

120,496

|

|

Walt Disney Co.

|

12,784,625

|

|

|

|

TOTAL

|

37,965,074

|

|

|

|

Consumer Discretionary— 9.7%

|

|

|

1,511

|

|

Advance Auto Parts, Inc.

|

292,560

|

|

4,502

|

1

|

Amazon.com, Inc.

|

607,545

|

|

21,502

|

2

|

American Eagle Outfitters, Inc.

|

258,884

|

|

564

|

1

|

AutoZone, Inc.

|

1,205,488

|

|

18,660

|

|

Big Lots, Inc.

|

376,745

|

|

24,415

|

1

|

Bright Horizons Family Solutions, Inc.

|

2,286,953

|

|

136,713

|

1

|

Chegg, Inc.

|

2,911,987

|

|

8,073

|

|

Domino’s Pizza, Inc.

|

3,165,504

|

|

85,234

|

1

|

Expedia Group, Inc.

|

9,039,065

|

|

312,671

|

|

Gap (The), Inc.

|

3,007,895

|

|

5,958

|

|

Garmin Ltd.

|

581,620

|

|

53,197

|

1

|

Goodyear Tire & Rubber Co.

|

653,259

|

|

23,097

|

1,2

|

Groupon, Inc.

|

244,828

|

|

15,487

|

|

Home Depot, Inc.

|

4,660,658

|

|

138,355

|

|

Macy’s, Inc.

|

2,441,966

|

|

42,129

|

|

Nordstrom, Inc.

|

990,453

|

|

1,439

|

|

Target Corp.

|

235,104

|

|

1,713

|

1

|

Tesla, Inc.

|

1,527,054

|

|

10,296

|

1

|

Ulta Beauty, Inc.

|

4,004,217

|

|

39,026

|

1

|

Under Armour, Inc., Class A

|

361,381

|

|

61,479

|

|

V.F. Corp.

|

2,746,882

|

|

15,873

|

1,2

|

Wayfair, Inc.

|

855,713

|

|

19,618

|

1

|

YETI Holdings, Inc.

|

996,006

|

|

|

|

TOTAL

|

43,451,767

|

|

|

|

Consumer Staples— 6.5%

|

|

|

56,627

|

|

Albertsons Cos., Inc.

|

1,520,435

|

|

12,477

|

|

Costco Wholesale Corp.

|

6,753,800

|

|

26,337

|

|

Hershey Foods Corp.

|

6,003,783

|

|

89,728

|

|

Kroger Co.

|

4,166,968

|

|

Shares

|

|

|

Value

|

|

|

|

COMMON STOCKS— continued

|

|

|

|

|

Consumer Staples— continued

|

|

|

26,177

|

|

PepsiCo, Inc.

|

$ 4,579,928

|

|

15,001

|

1

|

The Boston Beer Co., Inc., Class A

|

5,706,831

|

|

3,666

|

|

The Coca-Cola Co.

|

235,247

|

|

|

|

TOTAL

|

28,966,992

|

|

|

|

Energy— 5.4%

|

|

|

6,402

|

|

Cheniere Energy, Inc.

|

957,611

|

|

13,526

|

|

Chevron Corp.

|

2,215,288

|

|

4,911

|

|

ConocoPhillips

|

478,479

|

|

3,531

|

|

Diamondback Energy, Inc.

|

452,039

|

|

10,428

|

|

EOG Resources, Inc.

|

1,159,802

|

|

25,639

|

|

Exxon Mobil Corp.

|

2,485,188

|

|

63,055

|

|

Marathon Oil Corp.

|

1,563,764

|

|

99,970

|

|

Marathon Petroleum Corp.

|

9,163,250

|

|

58,493

|

|

Occidental Petroleum Corp.

|

3,845,915

|

|

25,984

|

|

Targa Resources, Inc.

|

1,795,754

|

|

|

|

TOTAL

|

24,117,090

|

|

|

|

Financials— 12.2%

|

|

|

103,312

|

|

Bank of New York Mellon Corp.

|

4,489,939

|

|

87,204

|

|

Berkley, W. R. Corp.

|

5,452,866

|

|

31,963

|

|

Carlyle Group LP/The

|

1,243,680

|

|

8,468

|

|

Cboe Global Markets, Inc.

|

1,044,782

|

|

6,758

|

|

CME Group, Inc.

|

1,348,086

|

|

15,752

|

|

Gallagher (Arthur J.) & Co.

|

2,819,450

|

|

22,626

|

1

|

Green Dot Corp.

|

635,791

|

|

26,160

|

|

Houlihan Lokey, Inc.

|

2,212,090

|

|

35,342

|

|

Interactive Brokers Group, Inc., Class A

|

2,074,222

|

|

7,637

|

|

JPMorgan Chase & Co.

|

881,004

|

|

310

|

1

|

Markel Corp.

|

402,113

|

|

16,827

|

|

Marketaxess Holdings, Inc.

|

4,556,415

|

|

25,152

|

|

NASDAQ, Inc.

|

4,549,997

|

|

43,356

|

|

Northern Trust Corp.

|

4,326,062

|

|

26,509

|

1

|

PROG Holdings, Inc.

|

488,296

|

|

31,698

|

|

State Street Corp.

|

2,251,826

|

|

34,803

|

|

T. Rowe Price Group, Inc.

|

4,297,126

|

|

38,409

|

|

The Travelers Cos., Inc.

|

6,095,508

|

|

142,729

|

|

Virtu Financial, Inc.

|

3,329,868

|

|

38,383

|

|

Zions Bancorporation, N.A.

|

2,093,793

|

|

|

|

TOTAL

|

54,592,914

|

|

|

|

Health Care— 15.0%

|

|

|

28,357

|

|

AbbVie, Inc.

|

4,069,513

|

|

30,236

|

1

|

Align Technology, Inc.

|

8,495,409

|

|

9,876

|

|

Amgen, Inc.

|

2,444,014

|

|

34,701

|

1,2

|

AnaptysBio, Inc.

|

726,639

|

|

40,925

|

1

|

Biogen, Inc.

|

8,801,330

|

|

Shares

|

|

|

Value

|

|

|

|

COMMON STOCKS— continued

|

|

|

|

|

Health Care— continued

|

|

|

53,530

|

|

Bristol-Myers Squibb Co.

|

$ 3,949,443

|

|

7,819

|

|

CVS Health Corp.

|

748,122

|

|

15,877

|

|

Eli Lilly & Co.

|

5,234,488

|

|

55,866

|

1

|

Enovis Corp.

|

3,336,318

|

|

52,572

|

|

Gilead Sciences, Inc.

|

3,141,177

|

|

810

|

1

|

Illumina, Inc.

|

175,511

|

|

8,388

|

|

McKesson Corp.

|

2,865,173

|

|

52,895

|

|

Merck & Co., Inc.

|

4,725,639

|

|

9,635

|

1

|

Moderna, Inc.

|

1,581,007

|

|

37,635

|

1

|

Myriad Genetics, Inc.

|

992,811

|

|

75,540

|

1

|

Nevro Corp.

|

3,274,659

|

|

84,000

|

|

Pfizer, Inc.

|

4,242,840

|

|

3,995

|

1

|

United Therapeutics Corp.

|

923,125

|

|

8,928

|

|

UnitedHealth Group, Inc.

|

4,842,012

|

|

8,007

|

1

|

Vertex Pharmaceuticals, Inc.

|

2,245,243

|

|

|

|

TOTAL

|

66,814,473

|

|

|

|

Industrials— 7.9%

|

|

|

10,871

|

|

AGCO Corp.

|

1,184,069

|

|

22,011

|

1

|

Alaska Air Group, Inc.

|

975,748

|

|

18,086

|

|

Allegion PLC

|

1,911,690

|

|

18,699

|

1

|

Astronics Corp.

|

209,803

|

|

28,412

|

1

|

CIRCOR International, Inc.

|

494,653

|

|

28,069

|

|

Emerson Electric Co.

|

2,528,175

|

|

12,843

|

|

Expeditors International Washington, Inc.

|

1,364,569

|

|

6,043

|

|

Fortune Brands Home & Security, Inc.

|

421,076

|

|

11,207

|

|

General Electric Co.

|

828,310

|

|

28,990

|

1

|

KAR Auction Services, Inc.

|

495,729

|

|

5,425

|

|

Lennox International, Inc.

|

1,299,450

|

|

114,028

|

1

|

Lyft, Inc.

|

1,580,428

|

|

14,625

|

|

Manpower, Inc.

|

1,146,746

|

|

30,808

|

|

Masco Corp.

|

1,706,147

|

|

14,135

|

|

Robert Half International, Inc.

|

1,118,644

|

|

37,735

|

|

Ryder System, Inc.

|

2,955,405

|

|

3,475

|

1

|

Southwest Airlines Co.

|

132,467

|

|

11,956

|

1

|

SPX Corp.

|

706,958

|

|

18,447

|

|

Trane Technologies PLC

|

2,711,525

|

|

17,402

|

1

|

Trex Co., Inc.

|

1,122,777

|

|

9,980

|

|

Union Pacific Corp.

|

2,268,454

|

|

14,272

|

|

Waste Management, Inc.

|

2,348,600

|

|

83,080

|

1

|

XPO Logistics, Inc.

|

4,963,199

|

|

9,392

|

|

Xylem, Inc.

|

864,346

|

|

|

|

TOTAL

|

35,338,968

|

|

|

|

Information Technology— 24.9%

|

|

|

4,193

|

|

Accenture PLC

|

1,284,148

|

|

Shares

|

|

|

Value

|

|

|

|

COMMON STOCKS— continued

|

|

|

|

|

Information Technology— continued

|

|

|

434

|

1

|

Adobe, Inc.

|

$ 177,992

|

|

107,414

|

|

Apple, Inc.

|

17,455,849

|

|

51,424

|

1

|

Arista Networks, Inc.

|

5,997,581

|

|

35,739

|

1

|

Arrow Electronics, Inc.

|

4,580,668

|

|

1,036

|

|

Automatic Data Processing, Inc.

|

249,800

|

|

10,106

|

1

|

Box, Inc.

|

287,415

|

|

16,358

|

|

Bread Financial Holdings, Inc.

|

647,940

|

|

1,551

|

|

Broadcom, Inc.

|

830,529

|

|

12,917

|

1

|

Cerence, Inc.

|

363,872

|

|

21,864

|

1

|

Cirrus Logic, Inc.

|

1,868,497

|

|

9,243

|

1

|

Commvault Systems, Inc.

|

518,440

|

|

164,148

|

|

Dell Technologies, Inc.

|

7,396,509

|

|

11,645

|

1

|

DocuSign, Inc.

|

745,047

|

|

81,019

|

1

|

DXC Technology Co.

|

2,560,200

|

|

25,554

|

|

Fidelity National Information Services, Inc.

|

2,610,597

|

|

1,816

|

1

|

Gartner, Inc., Class A

|

482,112

|

|

17,451

|

|

Hewlett Packard Enterprise Co.

|

248,502

|

|

5,499

|

|

HP, Inc.

|

183,612

|

|

15,825

|

|

Intel Corp.

|

574,606

|

|

91,877

|

1

|

IPG Photonics Corp.

|

9,792,251

|

|

8,352

|

1

|

MA-COM Technology Solutions Holdings, Inc.

|

483,915

|

|

45,750

|

|

Microsoft Corp.

|

12,843,855

|

|

43,390

|

|

Oracle Corp.

|

3,377,478

|

|

32,095

|

|

Paychex, Inc.

|

4,117,146

|

|

150,672

|

1

|

PayPal Holdings, Inc.

|

13,037,648

|

|

39,375

|

|

Pegasystems, Inc.

|

1,580,906

|

|

144,041

|

1

|

Pure Storage, Inc.

|

4,083,562

|

|

45,542

|

1

|

Qorvo, Inc.

|

4,739,556

|

|

17,952

|

|

Qualcomm, Inc.

|

2,604,117

|

|

7,271

|

|

Universal Display Corp.

|

839,510

|

|

66,109

|

|

Western Union Co.

|

1,125,175

|

|

22,778

|

1

|

Wix.com Ltd.

|

1,351,419

|

|

19,682

|

|

Xerox Holdings Corp.

|

337,153

|

|

16,807

|

1

|

Zoom Video Communications, Inc.

|

1,745,575

|

|

|

|

TOTAL

|

111,123,182

|

|

|

|

Materials— 3.3%

|

|

|

47,046

|

|

Alcoa Corp.

|

2,394,171

|

|

55,896

|

1

|

Berry Global Group, Inc.

|

3,222,404

|

|

4,282

|

|

CF Industries Holdings, Inc.

|

408,888

|

|

9,403

|

|

Chemours Co./The

|

334,653

|

|

32,594

|

|

Mosaic Co./The

|

1,716,400

|

|

38,652

|

|

Newmont Corp.

|

1,750,162

|

|

22,647

|

|

Nucor Corp.

|

3,075,463

|

|

15,653

|

|

Steel Dynamics, Inc.

|

1,219,056

|

|

Shares

|

|

|

Value

|

|

|

|

COMMON STOCKS— continued

|

|

|

|

|

Materials— continued

|

|

|

28,058

|

|

United States Steel Corp.

|

$ 663,572

|

|

|

|

TOTAL

|

14,784,769

|

|

|

|

Real Estate— 2.7%

|

|

|

5,612

|

|

Crown Castle International Corp.

|

1,013,864

|

|

27,575

|

|

Extra Space Storage, Inc.

|

5,226,014

|

|

76,810

|

|

Macerich Co. (The)

|

814,954

|

|

9,192

|

|

SBA Communications, Corp.

|

3,086,582

|

|

8,112

|

|

SL Green Realty Corp.

|

402,761

|

|

46,776

|

1

|

Zillow Group, Inc.

|

1,637,160

|

|

|

|

TOTAL

|

12,181,335

|

|

|

|

Utilities— 1.8%

|

|

|

8,369

|

|

CMS Energy Corp.

|

575,202

|

|

2,309

|

|

Entergy Corp.

|

265,835

|

|

74,682

|

|

Exelon Corp.

|

3,471,966

|

|

10,943

|

|

NRG Energy, Inc.

|

413,098

|

|

37,132

|

|

OGE Energy Corp.

|

1,525,383

|

|

18,422

|

|

Public Service Enterprises Group, Inc.

|

1,209,773

|

|

7,488

|

|

WEC Energy Group, Inc.

|

777,329

|

|

|

|

TOTAL

|

8,238,586

|

|

|

|

TOTAL COMMON STOCKS

(IDENTIFIED COST $397,238,689)

|

437,575,150

|

|

|

|

INVESTMENT COMPANIES— 2.3%

|

|

|

1,540,198

|

|

Federated Hermes Government Obligations Fund, Premier Shares, 1.82%3

|

1,540,198

|

|

8,862,667

|

|

Federated Hermes Institutional Prime Value Obligations Fund, Institutional

Shares, 1.84%3

|

8,858,235

|

|

|

|

TOTAL INVESTMENT COMPANIES

(IDENTIFIED COST $10,398,135)

|

10,398,433

|

|

|

|

TOTAL INVESTMENT IN SECURITIES—100.2%

(IDENTIFIED COST $407,636,824)4

|

447,973,583

|

|

|

|

OTHER ASSETS AND LIABILITIES - NET—(0.2)%5

|

(894,114)

|

|

|

|

TOTAL NET ASSETS—100%

|

$447,079,469

|

|

Affiliated

|

Value as of

7/31/2021

|

Purchases

at Cost*

|

Proceeds

from Sales*

|

|

Health Care:

|

|

|

|

|

AnaptysBio, Inc.

|

$928,300

|

$—

|

$(129,160)

|

|

Affiliated issuers no longer in the portfolio at period end

|

$142,873

|

$136,013

|

$(203,499)

|

|

TOTAL OF AFFILIATED COMPANIES TRANSACTIONS

|

$1,071,173

|

$136,013

|

$(332,659)

|

|

Change in

Unrealized

Appreciation/

Depreciation*

|

Net

Realized Gain/

(Loss)*

|

Value as of

7/31/2022

|

Shares

Held as of

7/31/2022

|

Dividend

Income*

|

|

|

|

|

|

|

|

$(86,706)

|

$14,205

|

$726,639

|

34,701

|

$—

|

|

$(29,271)

|

$(46,116)

|

$—

|

—

|

$681

|

|

$(115,977)

|

$(31,911)

|

$726,639

|

34,701

|

$681

|

|

*

|

A portion of the amount shown may have been recorded when the Fund no longer had

ownership of at least 5% of the voting shares.

|

|

|

Federated Hermes

Government

Obligations Fund

Premier Shares*

|

Federated Hermes

Institutional

Prime Value

Obligations Fund

Institutional Shares

|

Total of

Affiliated

Transactions

|

|

Value as of 7/31/2021

|

$—

|

$7,662,074

|

$7,662,074

|

|

Purchases at Cost

|

$40,444,074

|

$122,236,173

|

$162,680,247

|

|

Proceeds from Sales

|

$(38,903,876)

|

$(121,033,849)

|

$(159,937,725)

|

|

Change in Unrealized Appreciation/

Depreciation

|

N/A

|

$298

|

$298

|

|

Net Realized Gain/(Loss)

|

N/A

|

$(6,461)

|

$(6,461)

|

|

Value as of 7/31/2022

|

$1,540,198

|

$8,858,235

|

$10,398,433

|

|

Shares Held as of 7/31/2022

|

1,540,198

|

8,862,667

|

10,402,865

|

|

Dividend Income

|

$6,026

|

$26,296

|

$32,322

|

|

Gain Distributions Received

|

$—

|

$1,383

|

$1,383

|

|

*

|

All or a portion of the balance/activity for the fund relates to cash collateral received on

securities lending transactions.

|

|

1

|

Non-income-producing security.

|

|

2

|

All or a portion of these securities are temporarily on loan to unaffiliated broker/dealers.

|

|

3

|

7-day net yield.

|

|

4

|

The cost of investments for federal tax purposes amounts to $412,539,093.

|

|

5

|

Assets, other than investments in securities, less liabilities. See Statement of Assets and

Liabilities.

|

|

|

Year Ended July 31,

|

||||

|

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Net Asset Value, Beginning of Period

|

$42.75

|

$31.77

|

$29.90

|

$30.01

|

$24.95

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)1

|

0.08

|

0.08

|

0.13

|

0.16

|

0.09

|

|

Net realized and unrealized gain (loss)

|

(1.60)

|

11.90

|

2.69

|

1.81

|

5.08

|

|

Total From Investment Operations

|

(1.52)

|

11.98

|

2.82

|

1.97

|

5.17

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.04)

|

(0.12)

|

(0.11)

|

(0.07)

|

(0.11)

|

|

Distributions from net realized gain

|

(6.87)

|

(0.88)

|

(0.84)

|

(2.01)

|

—

|

|

Total Distributions

|

(6.91)

|

(1.00)

|

(0.95)

|

(2.08)

|

(0.11)

|

|

Net Asset Value, End of Period

|

$34.32

|

$42.75

|

$31.77

|

$29.90

|

$30.01

|

|

Total Return2

|

(4.95)%

|

38.40%

|

9.66%

|

7.80%

|

20.78%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses3

|

1.04%

|

1.04%

|

1.04%

|

1.08%

|

1.36%

|

|

Net investment income

|

0.22%

|

0.23%

|

0.44%

|

0.57%

|

0.31%

|

|

Expense waiver/reimbursement4

|

0.16%

|

0.17%

|

0.20%

|

0.24%

|

0.00%5

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$105,590

|

$109,747

|

$79,301

|

$69,221

|

$40,539

|

|

Portfolio turnover6

|

133%

|

63%

|

160%

|

87%

|

82%

|

|

1

|

Per share numbers have been calculated using the average shares method.

|

|

2

|

Based on net asset value, which does not reflect the sales charge, redemption fee or contingent

deferred sales charge, if applicable.

|

|

3

|

Amount does not reflect net expenses incurred by investment companies in which the Fund

may invest.

|

|

4

|

This expense decrease is reflected in both the net expense and the net investment income

(loss) ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by

investment companies in which the Fund may invest.

|

|

5

|

Represents less than 0.01%.

|

|

6

|

Securities that mature are considered sales for purposes of this calculation.

|

|

|

Year Ended July 31,

|

||||

|

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Net Asset Value, Beginning of Period

|

$39.55

|

$29.57

|

$27.99

|

$28.37

|

$23.66

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)1

|

(0.19)

|

(0.18)

|

(0.08)

|

(0.05)

|

(0.11)

|

|

Net realized and unrealized gain (loss)

|

(1.43)

|

11.04

|

2.50

|

1.68

|

4.82

|

|

Total From Investment Operations

|

(1.62)

|

10.86

|

2.42

|

1.63

|

4.71

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net realized gain

|

(6.87)

|

(0.88)

|

(0.84)

|

(2.01)

|

—

|

|

Net Asset Value, End of Period

|

$31.06

|

$39.55

|

$29.57

|

$27.99

|

$28.37

|

|

Total Return2

|

(5.67)%

|

37.37%

|

8.86%

|

6.96%

|

19.91%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses3

|

1.81%

|

1.79%

|

1.79%

|

1.85%

|

2.09%

|

|

Net investment income (loss)

|

(0.55)%

|

(0.52)%

|

(0.31)%

|

(0.20)%

|

(0.41)%

|

|

Expense waiver/reimbursement4

|

0.14%

|

0.16%

|

0.21%

|

0.24%

|

0.00%5

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$33,256

|

$38,028

|

$31,030

|

$32,178

|

$39,625

|

|

Portfolio turnover6

|

133%

|

63%

|

160%

|

87%

|

82%

|

|

1

|

Per share numbers have been calculated using the average shares method.

|

|

2

|

Based on net asset value, which does not reflect the sales charge, redemption fee or contingent

deferred sales charge, if applicable.

|

|

3

|

Amount does not reflect net expenses incurred by investment companies in which the Fund

may invest.

|

|

4

|

This expense decrease is reflected in both the net expense and the net investment income

(loss) ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by

investment companies in which the Fund may invest.

|

|

5

|

Represents less than 0.01%.

|

|

6

|

Securities that mature are considered sales for purposes of this calculation.

|

|

|

Year Ended July 31,

|

||||

|

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Net Asset Value, Beginning of Period

|

$43.40

|

$32.22

|

$30.29

|

$30.37

|

$25.24

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)1

|

0.20

|

0.19

|

0.22

|

0.25

|

0.16

|

|

Net realized and unrealized gain (loss)

|

(1.63)

|

12.08

|

2.74

|

1.81

|

5.16

|

|

Total From Investment Operations

|

(1.43)

|

12.27

|

2.96

|

2.06

|

5.32

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.14)

|

(0.21)

|

(0.19)

|

(0.13)

|

(0.19)

|

|

Distributions from net realized gain

|

(6.87)

|

(0.88)

|

(0.84)

|

(2.01)

|

—

|

|

Total Distributions

|

(7.01)

|

(1.09)

|

(1.03)

|

(2.14)

|

(0.19)

|

|

Net Asset Value, End of Period

|

$34.96

|

$43.40

|

$32.22

|

$30.29

|

$30.37

|

|

Total Return2

|

(4.67)%

|

38.83%

|

10.01%

|

8.08%

|

21.15%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses3

|

0.74%

|

0.74%

|

0.74%

|

0.78%

|

1.07%

|

|

Net investment income

|

0.52%

|

0.52%

|

0.73%

|

0.87%

|

0.57%

|

|

Expense waiver/reimbursement4

|

0.20%

|

0.21%

|

0.25%

|

0.29%

|

0.00%5

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$291,517

|

$283,822

|

$243,490

|

$215,799

|

$95,290

|

|

Portfolio turnover6

|

133%

|

63%

|

160%

|

87%

|

82%

|

|

1

|

Per share numbers have been calculated using the average shares method.

|

|

2

|

Based on net asset value.

|

|

3

|

Amount does not reflect net expenses incurred by investment companies in which the Fund

may invest.

|

|

4

|

This expense decrease is reflected in both the net expense and the net investment income

(loss) ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by

investment companies in which the Fund may invest.

|

|

5

|

Represents less than 0.01%.

|

|

6

|

Securities that mature are considered sales for purposes of this calculation.

|

|

|

Year Ended July 31,

|

||||

|

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Net Asset Value, Beginning of Period

|

$42.56

|

$31.62

|

$29.75

|

$29.89

|

$24.85

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)1

|

0.20

|

0.20

|

0.21

|

0.23

|

0.18

|

|

Net realized and unrealized gain (loss)

|

(1.59)

|

11.84

|

2.69

|

1.79

|

5.06

|

|

Total From Investment Operations

|

(1.39)

|

12.04

|

2.90

|

2.02

|

5.24

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.14)

|

(0.22)

|

(0.19)

|

(0.15)

|

(0.20)

|

|

Distributions from net realized gain

|

(6.87)

|

(0.88)

|

(0.84)

|

(2.01)

|

—

|

|

Total Distributions

|

(7.01)

|

(1.10)

|

(1.03)

|

(2.16)

|

(0.20)

|

|

Net Asset Value, End of Period

|

$34.16

|

$42.56

|

$31.62

|

$29.75

|

$29.89

|

|

Total Return2

|

(4.66)%

|

38.84%

|

10.00%

|

8.08%

|

21.17%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses3

|

0.73%

|

0.73%

|

0.73%

|

0.81%

|

1.02%

|

|

Net investment income

|

0.53%

|

0.54%

|

0.75%

|

0.78%

|

0.65%

|

|

Expense waiver/reimbursement4

|

0.13%

|

0.15%

|

0.17%

|

0.18%

|

0.00%5

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$16,717

|

$11,513

|

$8,571

|

$9,183

|

$20,425

|

|

Portfolio turnover6

|

133%

|

63%

|

160%

|

87%

|

82%

|

|

1

|

Per share numbers have been calculated using the average shares method.

|

|

2

|

Based on net asset value.

|

|

3

|

Amount does not reflect net expenses incurred by investment companies in which the Fund

may invest.

|

|

4

|

This expense decrease is reflected in both the net expense and the net investment income

(loss) ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by

investment companies in which the Fund may invest.

|

|

5

|

Represents less than 0.01%.

|

|

6

|

Securities that mature are considered sales for purposes of this calculation.

|

July 31, 2022

|

Assets:

|

|

|

Investment in securities, at value including $1,519,484 of securities loaned,

$10,398,433 of investments in affiliated holdings and $726,639 of investments in

affiliated companies* (identified cost $407,636,824)

|

$447,973,583

|

|

Income receivable

|

200,805

|

|

Income receivable from affiliated holdings

|

10,143

|

|

Receivable for investments sold

|

6,442,551

|

|

Receivable for shares sold

|

1,164,856

|

|

Total Assets

|

455,791,938

|

|

Liabilities:

|

|

|

Payable for investments purchased

|

6,436,224

|

|

Payable for shares redeemed

|

481,264

|

|

Payable for collateral due to broker for securities lending (Note 2)

|

1,540,198

|

|

Payable for investment adviser fee (Note 5)

|

20,086

|

|

Payable for administrative fee (Note 5)

|

2,858

|

|

Payable for distribution services fee (Note 5)

|

20,066

|

|

Payable for other service fees (Notes 2 and 5)

|

38,189

|

|

Accrued expenses (Note 5)

|

173,584

|

|

Total Liabilities

|

8,712,469

|

|

Net assets for 12,975,372 shares outstanding

|

$447,079,469

|

|

Net Assets Consist of:

|

|

|

Paid-in capital

|

$372,457,077

|

|

Total distributable earnings (loss)

|

74,622,392

|

|

Total Net Assets

|

$447,079,469

|

|

Net Asset Value, Offering Price and Redemption Proceeds Per Share:

|

|

|

Class A Shares:

|

|

|

Net asset value per share ($105,589,538 ÷ 3,076,970 shares outstanding), no par value,

unlimited shares authorized

|

$34.32

|

|

Offering price per share (100/94.50 of $34.32)

|

$36.32

|

|

Redemption proceeds per share

|

$34.32

|

|

Class C Shares:

|

|

|

Net asset value per share ($33,256,307 ÷ 1,070,687 shares outstanding), no par value,

unlimited shares authorized

|

$31.06

|

|

Offering price per share

|

$31.06

|

|

Redemption proceeds per share (99.00/100 of $31.06)

|

$30.75

|

|

Institutional Shares:

|

|

|

Net asset value per share ($291,517,003 ÷ 8,338,405 shares outstanding), no par value,

unlimited shares authorized

|

$34.96

|

|

Offering price per share

|

$34.96

|

|

Redemption proceeds per share

|

$34.96

|

|

Class R6 Shares:

|

|

|

Net asset value per share ($16,716,621 ÷ 489,310 shares outstanding), no par value,

unlimited shares authorized

|

$34.16

|

|

Offering price per share

|

$34.16

|

|

Redemption proceeds per share

|

$34.16

|

|

*

|

See information listed after the Fund’s Portfolio of Investments.

|

Year Ended July 31, 2022

|

Investment Income:

|

|

|

Dividends (including $26,977 received from affiliated companies and holdings*)

|

$5,881,851

|

|

Net income on securities loaned (includes $6,026 earned from affiliated holdings

related to cash collateral balances*) (Note 2)

|

2,248

|

|

TOTAL INCOME

|

5,884,099

|

|

Expenses:

|

|

|

Investment adviser fee (Note 5)

|

3,251,922

|

|

Administrative fee (Note 5)

|

365,413

|

|

Custodian fees

|

32,812

|

|

Transfer agent fees (Note 2)

|

418,335

|

|

Directors’/Trustees’ fees (Note 5)

|

4,019

|

|

Auditing fees

|

26,299

|

|

Legal fees

|

7,423

|

|

Portfolio accounting fees

|

134,219

|

|

Distribution services fee (Note 5)

|

286,157

|

|

Other service fees (Notes 2 and 5)

|

373,797

|

|

Share registration costs

|

78,548

|

|

Printing and postage

|

31,453

|

|

Miscellaneous (Note 5)

|

33,046

|

|

TOTAL EXPENSES

|

5,043,443

|

|

Waiver and Reimbursements:

|

|

|

Waiver/reimbursement of investment adviser fee (Note 5)

|

(621,778)

|

|

Reimbursement of other operating expenses (Notes 2 and 5)

|

(222,245)

|

|

TOTAL WAIVER AND REIMBURSEMENTS

|

(844,023)

|

|

Net expenses

|

4,199,420

|

|

Net investment income

|

1,684,679

|

|

Realized and Unrealized Gain (Loss) on Investments:

|

|

|

Net realized gain on investments (including net realized loss of $(38,372) on sales of

investments in affiliated companies and holdings*)

|

53,221,210

|

|

Realized gain distribution from affiliated investment company shares*

|

1,383

|

|

Net change in unrealized appreciation of investments (including net change in

unrealized appreciation of $(115,679) of investments in affiliated companies and

holdings*)

|

(78,884,076)

|

|

Net realized and unrealized gain (loss) on investments

|

(25,661,483)

|

|

Change in net assets resulting from operations

|

$(23,976,804)

|

|

*

|

See information listed after the Fund’s Portfolio of Investments.

|

|

Year Ended July 31

|

2022

|

2021

|

|

Increase (Decrease) in Net Assets

|

|

|

|

Operations:

|

|

|

|

Net investment income

|

$1,684,679

|

$1,500,049

|

|

Net realized gain (loss)

|

53,222,593

|

65,974,347

|

|

Net change in unrealized appreciation/depreciation

|

(78,884,076)

|

66,920,393

|

|

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS

|

(23,976,804)

|

134,394,789

|

|

Distributions to Shareholders:

|

|

|

|

Class A Shares

|

(18,050,522)

|

(2,423,144)

|

|

Class C Shares

|

(6,734,957)

|

(882,794)

|

|

Institutional Shares

|

(48,461,721)

|

(8,071,148)

|

|

Class R6 Shares

|

(2,859,720)

|

(290,075)

|

|

CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS

TO SHAREHOLDERS

|

(76,106,920)

|

(11,667,161)

|

|

Share Transactions:

|

|

|

|

Proceeds from sale of shares

|

160,200,101

|

138,525,280

|

|

Net asset value of shares issued to shareholders in payment of

distributions declared

|

70,184,727

|

10,673,152

|

|

Cost of shares redeemed

|

(126,331,790)

|

(191,208,255)

|

|

CHANGE IN NET ASSETS RESULTING FROM

SHARE TRANSACTIONS

|

104,053,038

|

(42,009,823)

|

|

Change in net assets

|

3,969,314

|

80,717,805

|

|

Net Assets:

|

|

|

|

Beginning of period

|

443,110,155

|

362,392,350

|

|

End of period

|

$447,079,469

|

$443,110,155

|

|

|

Transfer Agent

Fees Incurred

|

Transfer Agent

Fees Reimbursed

|

|

Class A Shares

|

$111,910

|

$(28,164)

|

|

Class C Shares

|

35,791

|

(1,237)

|

|

Institutional Shares

|

268,111

|

(192,844)

|

|

Class R6 Shares

|

2,523

|

—

|

|

TOTAL

|

$418,335

|

$(222,245)

|

|

|

Other Service

Fees Incurred

|

|

Class A Shares

|

$278,412

|

|

Class C Shares

|

95,385

|

|

TOTAL

|

$373,797

|

|

Market Value of

Securities Loaned

|

Collateral

Received

|

|

$1,519,484

|

$1,540,198

|

|

|

Year Ended

7/31/2022

|

Year Ended

7/31/2021

|

||

|

Class A Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

612,974

|

$23,328,431

|

516,489

|

$19,262,460

|

|

Shares issued to shareholders in payment of

distributions declared

|

454,940

|

17,088,464

|

65,002

|

2,282,814

|

|

Shares redeemed

|

(558,368)

|

(20,790,823)

|

(510,501)

|

(18,302,996)

|

|

NET CHANGE RESULTING FROM CLASS A

SHARE TRANSACTIONS

|

509,546

|

$19,626,072

|

70,990

|

$3,242,278

|

|

|

Year Ended

7/31/2022

|

Year Ended

7/31/2021

|

||

|

Class C Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

267,652

|

$9,556,354

|

150,210

|

$5,136,189

|

|

Shares issued to shareholders in payment of

distributions declared

|

188,752

|

6,442,116

|

25,498

|

828,435

|

|

Shares redeemed

|

(347,147)

|

(11,592,509)

|

(263,607)

|

(8,987,701)

|

|

NET CHANGE RESULTING FROM CLASS C

SHARE TRANSACTIONS

|

109,257

|

$4,405,961

|

(87,899)

|

$(3,023,077)

|

|

|

Year Ended

7/31/2022

|

Year Ended

7/31/2021

|

||

|

Institutional Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

2,935,348

|

$114,520,154

|

3,029,771

|

$110,406,642

|

|

Shares issued to shareholders in payment of

distributions declared

|

1,163,096

|

44,573,724

|

206,534

|

7,372,239

|

|

Shares redeemed

|

(2,299,780)

|

(88,189,501)

|

(4,253,413)

|

(160,052,945)

|

|

NET CHANGE RESULTING FROM

INSTITUTIONAL SHARE TRANSACTIONS

|

1,798,664

|

$70,904,377

|

(1,017,108)

|

$(42,274,064)

|

|

|

Year Ended

7/31/2022

|

Year Ended

7/31/2021

|

||

|

Class R6 Shares:

|

Shares

|

Amount

|

Shares

|

Amount

|

|

Shares sold

|

320,616

|

$12,795,162

|

101,756

|

$3,719,989

|

|

Shares issued to shareholders in payment of

distributions declared

|

55,550

|

2,080,423

|

5,416

|

189,664

|

|

Shares redeemed

|

(157,356)

|

(5,758,957)

|

(107,736)

|

(3,864,613)

|

|

NET CHANGE RESULTING FROM CLASS R6

SHARE TRANSACTIONS

|

218,810

|

$9,116,628

|

(564)

|

$45,040

|

|

NET CHANGE RESULTING FROM TOTAL

FUND SHARE TRANSACTIONS

|

2,636,277

|

$104,053,038

|

(1,034,581)

|

$(42,009,823)

|

|

|

2022

|

2021

|

|

Ordinary income1

|

$40,467,734

|

$7,381,835

|

|

Long-term capital gains

|

$35,639,186

|

$4,285,326

|

|

1

|

For tax purposes, short-term capital gain distributions are considered ordinary

income distributions.

|

|

Undistributed ordinary income

|

$1,048,096

|

|

Net unrealized appreciation

|

$35,434,490

|

|

Undistributed long-term capital gains

|

$38,139,806

|

|

Administrative Fee

|

Average Daily Net Assets

of the Investment Complex

|

|

0.100%

|

on assets up to $50 billion

|

|

0.075%

|

on assets over $50 billion

|

|

|

Percentage of Average Daily

Net Assets of Class

|

|

Class A Shares

|

0.05%

|

|

Class C Shares

|

0.75%

|

|

|

Distribution Services

Fees Incurred

|

|

Class C Shares

|

$286,157

|

|

Purchases

|

$634,975,583

|

|

Sales

|

$606,210,083

|

September 23, 2022

|

|

Beginning

Account Value

2/1/2022

|

Ending

Account Value

7/31/2022

|

Expenses Paid

During Period1

|

|

Actual:

|

|

|

|

|

Class A Shares

|

$1,000

|

$929.80

|

$4.98

|

|

Class C Shares

|

$1,000

|

$926.30

|

$8.64

|

|

Institutional Shares

|

$1,000

|

$931.00

|

$3.54

|

|

Class R6 Shares

|

$1,000

|

$931.30

|

$3.50

|

|

Hypothetical (assuming a 5% return

before expenses):

|

|

|

|

|

Class A Shares

|

$1,000

|

$1,019.64

|

$5.21

|

|

Class C Shares

|

$1,000

|

$1,015.82

|

$9.05

|

|

Institutional Shares

|

$1,000

|

$1,021.12

|

$3.71

|

|

Class R6 Shares

|

$1,000

|

$1,021.17

|

$3.66

|

|

1

|

Expenses are equal to the Fund’s annualized net expense ratios, multiplied by the average

account value over the period, multiplied by 181/365 (to reflect the one-half-year period). The

annualized net expense ratios are as follows:

|

|

Class A Shares

|

1.04%

|

|

Class C Shares

|

1.81%

|

|

Institutional Shares

|

0.74%

|

|

Class R6 Shares

|

0.73%

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s)

|

|

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Trustee

Indefinite Term

Began serving: May 2006

|

Principal Occupations: Principal Executive Officer and President of

certain of the Funds in the Federated Hermes Fund Family; Director or

Trustee of the Funds in the Federated Hermes Fund Family; President,

Chief Executive Officer and Director, Federated Hermes, Inc.;

Chairman and Trustee, Federated Investment Management Company;

Trustee, Federated Investment Counseling; Chairman and Director,

Federated Global Investment Management Corp.; Chairman and

Trustee, Federated Equity Management Company of Pennsylvania;

Trustee, Federated Shareholder Services Company; Director,

Federated Services Company.

Previous Positions: President, Federated Investment Counseling;

President and Chief Executive Officer, Federated Investment

Management Company, Federated Global Investment Management

Corp. and Passport Research, Ltd; Chairman, Passport Research, Ltd.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s)

|

|

John B. Fisher*

Birth Date: May 16, 1956

Trustee

Indefinite Term

Began serving: May 2016

|

Principal Occupations: Principal Executive Officer and President of

certain of the Funds in the Federated Hermes Fund Family; Director or

Trustee of certain of the Funds in the Federated Hermes Fund Family;

Director and Vice President, Federated Hermes, Inc.; President,

Director/Trustee and CEO, Federated Advisory Services Company,

Federated Equity Management Company of Pennsylvania, Federated

Global Investment Management Corp., Federated Investment

Counseling, Federated Investment Management Company; President

of some of the Funds in the Federated Hermes Fund Family and

Director, Federated Investors Trust Company.

Previous Positions: President and Director of the Institutional Sales

Division of Federated Securities Corp.; President and Director of

Federated Investment Counseling; President and CEO of Passport

Research, Ltd.; Director, Edgewood Securities Corp.; Director,

Federated Services Company; Chairman and Director, Southpointe

Distribution Services, Inc. and President, Technology, Federated

Services Company.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

John T. Collins

Birth Date: January 24, 1947

Trustee

Indefinite Term

Began serving: October 2013

|

Principal Occupations: Director or Trustee, and Chair of the Board

of Directors or Trustees, of the Federated Hermes Fund Family;

formerly, Chairman and CEO, The Collins Group, Inc. (a private equity

firm) (Retired).

Other Directorships Held: Director, KLX Energy Services Holdings,

Inc. (oilfield services); former Director of KLX Corp. (aerospace).

Qualifications: Mr. Collins has served in several business and financial

management roles and directorship positions throughout his career.

Mr. Collins previously served as Chairman and CEO of The Collins

Group, Inc. (a private equity firm) and as a Director of KLX Corp.

Mr. Collins serves as Chairman Emeriti, Bentley University. Mr. Collins

previously served as Director and Audit Committee Member, Bank of

America Corp.; Director, FleetBoston Financial Corp.; and Director,

Beth Israel Deaconess Medical Center (Harvard University

Affiliate Hospital).

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

G. Thomas Hough

Birth Date: February 28, 1955

Trustee

Indefinite Term

Began serving: August 2015

|

Principal Occupations: Director or Trustee, Chair of the Audit

Committee of the Federated Hermes Fund Family; formerly, Vice

Chair, Ernst & Young LLP (public accounting firm) (Retired).

Other Directorships Held: Director, Chair of the Audit Committee,

Equifax, Inc.; Lead Director, Member of the Audit and Nominating and

Corporate Governance Committees, Haverty Furniture Companies,

Inc.; formerly, Director, Member of Governance and Compensation

Committees, Publix Super Markets, Inc.

Qualifications: Mr. Hough has served in accounting, business

management and directorship positions throughout his career.

Mr. Hough most recently held the position of Americas Vice Chair of

Assurance with Ernst & Young LLP (public accounting firm). Mr. Hough

serves on the President’s Cabinet and Business School Board of

Visitors for the University of Alabama. Mr. Hough previously served on

the Business School Board of Visitors for Wake Forest University, and

he previously served as an Executive Committee member of the

United States Golf Association.

|

|

Maureen Lally-Green

Birth Date: July 5, 1949

Trustee

Indefinite Term

Began serving: August 2009

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Adjunct Professor Emerita of Law, Duquesne University

School of Law; formerly, Dean of the Duquesne University School of

Law and Professor of Law and Interim Dean of the Duquesne

University School of Law; formerly, Associate General Secretary and

Director, Office of Church Relations, Diocese of Pittsburgh.

Other Directorships Held: Director, CNX Resources Corporation

(formerly known as CONSOL Energy Inc.).

Qualifications: Judge Lally-Green has served in various legal and

business roles and directorship positions throughout her career. Judge

Lally-Green previously held the position of Dean of the School of Law

of Duquesne University (as well as Interim Dean). Judge Lally-Green

previously served as a member of the Superior Court of Pennsylvania

and as a Professor of Law, Duquesne University School of Law. Judge

Lally-Green was appointed by the Supreme Court of Pennsylvania to

serve on the Supreme Court’s Board of Continuing Judicial Education

and the Supreme Court’s Appellate Court Procedural Rules

Committee. Judge Lally-Green also currently holds the positions on

not for profit or for profit boards of directors as follows: Director

and Chair, UPMC Mercy Hospital; Regent, Saint Vincent Seminary;

Member, Pennsylvania State Board of Education (public); Director,

Catholic Charities, Pittsburgh; and Director CNX Resources

Corporation (formerly known as CONSOL Energy Inc.). Judge

Lally-Green has held the positions of: Director, Auberle; Director,

Epilepsy Foundation of Western and Central Pennsylvania; Director,

Ireland Institute of Pittsburgh; Director, Saint Thomas More Society;

Director and Chair, Catholic High Schools of the Diocese of

Pittsburgh, Inc.; Director, Pennsylvania Bar Institute; Director,

St. Vincent College; Director and Chair, North Catholic High

School, Inc.; Director and Vice Chair, Our Campaign for the Church

Alive!, Inc.; and Director, Saint Francis University.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

Thomas M. O’Neill

Birth Date: June 14, 1951

Trustee

Indefinite Term

Began serving: August 2006

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Sole Proprietor, Navigator Management Company

(investment and strategic consulting).

Other Directorships Held: None.

Qualifications: Mr. O’Neill has served in several business, mutual fund

and financial management roles and directorship positions throughout

his career. Mr. O’Neill serves as Director, Medicines for Humanity.

Mr. O’Neill previously served as Chief Executive Officer and President,

Managing Director and Chief Investment Officer, Fleet Investment

Advisors; President and Chief Executive Officer, Aeltus Investment

Management, Inc.; General Partner, Hellman, Jordan Management

Co., Boston, MA; Chief Investment Officer, The Putnam Companies,

Boston, MA; Credit Analyst and Lending Officer, Fleet Bank; Director

and Consultant, EZE Castle Software (investment order management

software); Director, The Golisano Children’s Museum of Naples,

Florida; and Director, Midway Pacific (lumber).

|

|

Madelyn A. Reilly

Birth Date: February 2, 1956

Trustee

Indefinite Term

Began serving:

November 2020

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; formerly, Executive Vice President for Legal Affairs,

General Counsel and Secretary to the Board of Directors, Duquesne

University (Retired).

Other Directorships Held: None.

Qualifications: Ms. Reilly has served in various business and legal

management roles throughout her career. Ms. Reilly previously served

as Senior Vice President for Legal Affairs, General Counsel and

Secretary to the Board of Directors and Assistant General Counsel and

Director of Risk Management, Duquesne University. Prior to her work

at Duquesne University, Ms. Reilly served as Assistant General

Counsel of Compliance and Enterprise Risk as well as Senior Counsel

of Environment, Health and Safety, PPG Industries. Ms. Reilly currently

serves as a member of the Board of Directors of UPMC

Mercy Hospital.

|

|

Name

Birth Date

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications

|

|

P. Jerome Richey

Birth Date: February 23, 1949

Trustee

Indefinite Term

Began serving: October 2013

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; Management Consultant; Retired; formerly, Senior Vice

Chancellor and Chief Legal Officer, University of Pittsburgh and

Executive Vice President and Chief Legal Officer, CONSOL Energy Inc.

(now split into two separate publicly traded companies known as

CONSOL Energy Inc. and CNX Resources Corp.).

Other Directorships Held: None.

Qualifications: Mr. Richey has served in several business and legal

management roles and directorship positions throughout his career.

Mr. Richey most recently held the positions of Senior Vice Chancellor

and Chief Legal Officer, University of Pittsburgh. Mr. Richey previously

served as Chairman of the Board, Epilepsy Foundation of Western

Pennsylvania and Chairman of the Board, World Affairs Council of

Pittsburgh. Mr. Richey previously served as Chief Legal Officer and

Executive Vice President, CONSOL Energy Inc. and CNX Gas

Company; and Board Member, Ethics Counsel and Shareholder,

Buchanan Ingersoll & Rooney PC (a law firm).

|

|

John S. Walsh

Birth Date:

November 28, 1957

Trustee

Indefinite Term

Began serving: June 2006

|

Principal Occupations: Director or Trustee of the Federated Hermes

Fund Family; President and Director, Heat Wagon, Inc. (manufacturer

of construction temporary heaters); President and Director,

Manufacturers Products, Inc. (distributor of portable construction

heaters); President, Portable Heater Parts, a division of Manufacturers

Products, Inc.

Other Directorships Held: None.

Qualifications: Mr. Walsh has served in several business management

roles and directorship positions throughout his career. Mr. Walsh

previously served as Vice President, Walsh & Kelly, Inc.

(paving contractors).

|

|

Name

Birth Date

Address

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Lori A. Hensler

Birth Date: January 6, 1967

TREASURER

Officer since: April 2013

|

Principal Occupations: Principal Financial Officer and Treasurer of the

Federated Hermes Fund Family; Senior Vice President, Federated

Administrative Services; Financial and Operations Principal for

Federated Securities Corp.; and Assistant Treasurer, Federated

Investors Trust Company. Ms. Hensler has received the Certified

Public Accountant designation.

Previous Positions: Controller of Federated Hermes, Inc.; Senior Vice

President and Assistant Treasurer, Federated Investors Management

Company; Treasurer, Federated Investors Trust Company; Assistant

Treasurer, Federated Administrative Services, Federated

Administrative Services, Inc., Federated Securities Corp., Edgewood

Services, Inc., Federated Advisory Services Company, Federated

Equity Management Company of Pennsylvania, Federated Global

Investment Management Corp., Federated Investment Counseling,

Federated Investment Management Company, Passport Research,

Ltd., and Federated MDTA, LLC; Financial and Operations Principal for

Federated Securities Corp., Edgewood Services, Inc. and Southpointe

Distribution Services, Inc.

|

|

Peter J. Germain

Birth Date:

September 3, 1959

CHIEF LEGAL OFFICER,

SECRETARY and EXECUTIVE

VICE PRESIDENT

Officer since: June 2006

|

Principal Occupations: Mr. Germain is Chief Legal Officer, Secretary

and Executive Vice President of the Federated Hermes Fund Family.

He is General Counsel, Chief Legal Officer, Secretary and Executive

Vice President, Federated Hermes, Inc.; Trustee and Senior Vice

President, Federated Investors Management Company; Trustee and

President, Federated Administrative Services; Director and President,

Federated Administrative Services, Inc.; Director and Vice President,

Federated Securities Corp.; Director and Secretary, Federated Private

Asset Management, Inc.; Secretary, Federated Shareholder Services

Company; and Secretary, Retirement Plan Service Company of

America. Mr. Germain joined Federated Hermes, Inc. in 1984 and is a

member of the Pennsylvania Bar Association.

Previous Positions: Deputy General Counsel, Special Counsel,

Managing Director of Mutual Fund Services, Federated Hermes, Inc.;

Senior Vice President, Federated Services Company; and Senior

Corporate Counsel, Federated Hermes, Inc.

|

|

Stephen F. Auth

Birth Date:

September 13, 1956

101 Park Avenue

41st Floor

New York, NY 10178

CHIEF INVESTMENT OFFICER

Officer since: June 2012

|

Principal Occupations: Stephen F. Auth is Chief Investment Officer of

various Funds in the Federated Hermes Fund Family; Executive Vice

President, Federated Investment Counseling, Federated Global

Investment Management Corp. and Federated Equity Management

Company of Pennsylvania.

Previous Positions: Executive Vice President, Federated Investment

Management Company and Passport Research, Ltd. (investment

advisory subsidiary of Federated); Senior Vice President, Global

Portfolio Management Services Division; Senior Vice President,

Federated Investment Management Company and Passport

Research, Ltd.; Senior Managing Director and Portfolio Manager,

Prudential Investments.

|

|

Name

Birth Date

Address

Positions Held with Trust

Date Service Began

|

Principal Occupation(s) for Past Five Years

and Previous Position(s)

|

|

Stephen Van Meter

Birth Date: June 5, 1975

CHIEF COMPLIANCE

OFFICER AND SENIOR

VICE PRESIDENT

Officer since: July 2015

|

Principal Occupations: Senior Vice President and Chief Compliance

Officer of the Federated Hermes Fund Family; Vice President and

Chief Compliance Officer of Federated Hermes, Inc. and Chief

Compliance Officer of certain of its subsidiaries. Mr. Van Meter joined

Federated Hermes, Inc. in October 2011. He holds FINRA licenses

under Series 3, 7, 24 and 66.

Previous Positions: Mr. Van Meter previously held the position of

Compliance Operating Officer, Federated Hermes, Inc. Prior to joining

Federated Hermes, Inc., Mr. Van Meter served at the United States

Securities and Exchange Commission in the positions of Senior

Counsel, Office of Chief Counsel, Division of Investment Management

and Senior Counsel, Division of Enforcement.

|

Annual Evaluation of Adequacy and Effectiveness

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

CUSIP 31421R205

CUSIP 31421R304

CUSIP 31421R718

|

Share Class | Ticker

|

A | QABGX

|

C | QCBGX

|

Institutional | QIBGX

|

R6 | QKBGX

|

Federated Hermes MDT Balanced Fund

A Portfolio of Federated Hermes MDT Series

|

|

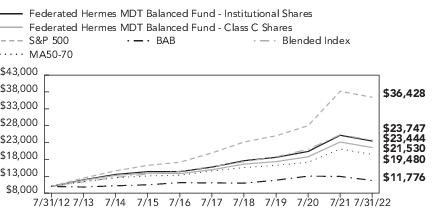

1 Year

|

5 Years

|

10 Years

|

|

Class A Shares

|

-12.17%

|

6.84%

|

8.01%

|

|

Class C Shares

|

-8.60%

|

7.25%

|

7.97%

|

|

Institutional Shares

|

-6.82%

|

8.32%

|

8.89%

|

|

Class R6 Shares5

|

-6.81%

|

8.34%

|

8.66%

|

|

S&P 500

|

-4.64%

|

12.83%

|

13.80%

|

|

BAB

|

-9.12%

|

1.28%

|

1.65%

|

|

Blended Index

|

-6.16%

|

8.43%

|

9.03%

|

|

MA50-70

|

-7.35%

|

6.07%

|