United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered

Management Investment Companies

811-21904

(Investment Company Act File Number)

Federated MDT Series

_______________________________________________________________

(Exact Name of Registrant as Specified in

Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 07/31/19

Date of Reporting Period: 07/31/19

| Item 1. | Reports to Stockholders |

Annual Shareholder

Report

July 31, 2019

| Share Class | Ticker

| A | QAACX

| C | QCACX

| Institutional | QIACX

| R6 | QKACX

|

Federated MDT All Cap

Core Fund

Fund Established 2002

A Portfolio of Federated MDT

Series

IMPORTANT NOTICE

REGARDING REPORT DELIVERY

Beginning on January 1,

2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper

copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report

is posted and provided with a website link to access the report.

If you already elected

to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your

financial intermediary electronically by contacting your financial intermediary (such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4.

You may elect to receive

all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting your financial intermediary

(such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4. Your election to receive reports in paper will apply to all funds held with the Fund complex or your financial

intermediary.

Not FDIC Insured ■ May Lose Value ■ No

Bank Guarantee

J. Christopher

Donahue

President

Federated MDT All Cap Core

Fund

Letter from the

President

Dear Valued

Shareholder,

I am pleased to present

the Annual Shareholder Report for your fund covering the period from August 1, 2018 through July 31, 2019. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings,

performance information and financial statements along with other important fund information.

In addition, our website,

FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools.

Thank you for investing

with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue,

President

CONTENTS

| 1

|

| 6

|

| 7

|

| 14

|

| 18

|

| 20

|

| 21

|

| 22

|

| 32

|

| 34

|

| 36

|

| 42

|

| 50

|

| 50

|

Management's Discussion

of Fund Performance (unaudited)

The total return of

Federated MDT All Cap Core Fund (the “Fund”), based on net asset value, for the 12-month reporting period ended July 31, 2019, was 7.80% for Class A Shares, 6.96% for Class C Shares, 8.08% for

Institutional Shares and 8.08% for Class R6 Shares. The total return for the Russell 3000® Index (R3000),1 the Fund's broad-based securities market index, was 7.05% for the same period. The total return of the Morningstar Large

Blend Funds Average (MLBFA),2 a peer group average for the Fund, was 6.02% during the same period. The Fund's and MLBFA's total returns for the most

recently completed fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of the R3000.

During

the reporting period, the Fund's investment strategy focused on stock selection. This was the most significant factor affecting the Fund's performance relative to the R3000 during the period.

The

following discussion will focus on the performance of the Fund's Class R6 Shares.

Market Overview

During

the reporting period, overall domestic equity market performance was moderately strong as evidenced by the 7.05% return of the whole-market R3000. Larger cap stocks had a much better year than small cap stocks.3 The Russell Top 200® Index4 returned 8.51% and the Russell Midcap® Index5 returned 6.71%, but both the small-cap Russell 2000® Index6 and the very small-cap Russell Microcap® Index7 fell (returns of -4.42% and -11.55%, respectively). For style, this was the third fiscal year in a row that growth stocks

led value stocks by a substantial margin. During the reporting period, the Russell 3000® Growth Index8 returned 9.88% and the Russell 3000® Value Index9 returned 4.23%. The widest difference between the growth and value styles was in the midcap range, where the Russell

Midcap® Growth Index10 returned 14.15%, and the Russell Midcap Value Index11 returned 1.78%.

The

best performing sectors in the R3000 during the reporting period were Information Technology (17.06%), Utilities (16.65%) and Real Estate (13.24%). Underperforming sectors during the same period included Energy

(-19.42%), Materials (-3.94%) and Financials (2.77%).

Annual Shareholder Report

STOCK SELECTION

When looking at the

Fund's outperformance in terms of fundamental and technical characteristics during this growth-oriented period, most of the Fund's outperformance relative to the R3000 was driven by growth-oriented stocks with neutral

to high analyst conviction and weaker value characteristics. Stocks with strong value characteristics, particularly high structural earnings (a measure of earnings repeatability), detracted from performance. The

Fund's sector exposures remained close to R3000 weights at the end of the period except for an underweight in the Real Estate sector (the Fund did not invest in the Real Estate sector during the period). Strong stock

selection in the Information Technology, Energy and Consumer Discretionary sectors contributed the most to the Fund's outperformance. There was a small offset created by the Fund's underweight in the Real Estate

sector.

Individual stocks enhancing the Fund's performance during the reporting period included Global Payments Inc., Veeva Systems Inc., Stryker Corporation and Live Nation Entertainment, Inc.

Individual stocks detracting from the Fund's performance during the reporting period included Microsoft Corporation and Align Technology, Inc. Microsoft outperformed the R3000 but was underweighted by the Fund, and

Align Technology underperformed the R3000 and was overweighted by the Fund. Align Technology had been the top contributor to performance during the year ended July 31, 2018.

| 1

| Please see the footnotes to the line graphs below for definitions of, and further information about, the Russell 3000® Index.

|

| 2

| Morningstar has assigned the Fund to the Morningstar Large Cap Value Funds Average peer group, however, the MLBFA is being used for comparison purposes. The Fund invests in both value and growth stocks and therefore

the Fund's Adviser believes that the MLBFA is more reflective of the Fund's investment style. Please see the footnotes to the line graphs below for definitions of, and further information about, the MLBFA.

|

| 3

| Small-cap stocks may be less liquid and subject to greater price volatility than large-cap stocks.

|

| 4

| The Russell Top 200® Index measures the performance of the largest cap segment of the U.S. equity universe. The Russell Top 200® Index is a subset of the Russell 3000® Index. It includes approximately 200 of the largest securities based on a combination of their market cap and current

index membership and represents approximately 68% of the U.S. market. The Russell Top 200® Index is constructed to provide a comprehensive and unbiased barometer for this very large cap segment and is

completely reconstituted annually to ensure new and growing equities are reflected.*

|

| 5

| The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current

index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000® companies. The Russell Midcap® Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The Russell Midcap

Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap opportunity set.*

|

| 6

| The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000

of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000®

|

Annual Shareholder Report

|

| Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true

small-cap opportunity set.*

|

| 7

| The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. Microcap stocks make up less than 3%

of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small-cap Russell 2000® Index, plus the next 1,000 smallest eligible securities by market cap. The Russell Microcap® Index is constructed to provide a comprehensive and unbiased barometer for the microcap segment trading on national

exchanges and is completely reconstituted annually to ensure new and growing equities are reflected and companies continue to reflect appropriate capitalization and value characteristics.*

|

| 8

| The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those

Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000® Growth Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad growth market. The

Russell 3000® Growth Index is completely reconstituted annually to ensure new and growing equities are included and that the

represented companies continue to reflect growth characteristics.*

|

| 9

| The Russell 3000® Value Index measures the performance of the broad value segment of U.S. equity value universe. It includes those

Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000® Value Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad value market. The

Russell 3000® Value Index is completely reconstituted annually to ensure new and growing equities are included and that the

represented companies continue to reflect value characteristics.*

|

| 10

| The Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those

Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market and is

completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market.*

|

| 11

| The Russell Midcap® Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those

Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Value Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap value market and is

completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap value market.*

|

| *

| The index is unmanaged, and it is not possible to invest directly in an index.

|

Annual Shareholder Report

FUND PERFORMANCE AND GROWTH OF A

$10,000 INVESTMENT

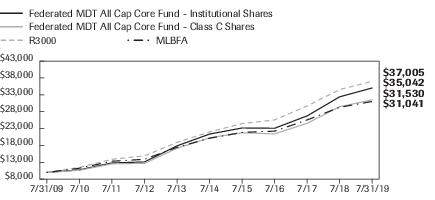

The graph below

illustrates the hypothetical investment of $10,0001 in the Federated MDT All Cap Core Fund (the “Fund”) from July 31, 2009 to July 31, 2019, compared to the Russell

3000® Index (R3000)2 and the Morningstar Large Blend Funds Average (MLBFA).3 The Average Annual Total Return table below shows returns for each class averaged over the stated periods.

Growth of a $10,000 Investment

Growth of $10,000 as of July 31,

2019

| ■

| Total returns shown for the Class C Shares include the maximum contingent deferred sales charge of 1.00% as applicable.

|

The Fund offers multiple

share classes whose performance may be greater than or less than its other share class(es) due to differences in sales charges and expenses. See the Average Annual Total Return table below for the returns of

additional classes not shown in the line graph above.

Average Annual Total Returns for the Period Ended 7/31/2019

(returns reflect all

applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

|

| 1 Year

| 5 Years

| 10 Years

|

| Class A Shares

| 1.86%

| 8.85%

| 12.41%

|

| Class C Shares

| 5.97%

| 9.25%

| 12.17%

|

| Institutional Shares

| 8.08%

| 10.40%

| 13.36%

|

| Class R6 Shares4

| 8.08%

| 10.07%

| 12.77%

|

| R3000

| 7.05%

| 10.96%

| 13.98%

|

| MLBFA

| 6.02%

| 9.42%

| 12.52%

|

Annual Shareholder Report

Performance data quoted

represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original

cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit

FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations

of or guaranteed by any bank and are not federally insured.

| 1

| Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: for Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for

Class C Shares a 1.00% contingent deferred sales charge would be applied on any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions.

The R3000 and MLBFA have been adjusted to reflect reinvestment of dividends of securities.

|

| 2

| The R3000 measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The R3000 is constructed to provide a comprehensive, unbiased, and stable

barometer of the broad market and is completely reconstituted annually to ensure new and growing equities are reflected. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible

to invest directly in an index. The R3000 is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund's performance.

|

| 3

| Morningstar figures represent the average of the total returns reported by all the funds designated by Morningstar as falling into the respective category indicated. They do not reflect sales charges. The

Morningstar figures in the Growth of $10,000 line graph are based on historical return information published by Morningstar and reflect the return of the funds comprising the category in the year of publication.

Because the funds designated by Morningstar as falling into the category can change over time, the Morningstar figures in the line graph may not match the Morningstar figures in the Average Annual Total Returns table,

which reflect the return of the funds that currently comprise the category.

|

| 4

| Prior to September 1, 2016, Class R6 Shares were known as Class R Shares and included 12b-1 fees and certain other expenses. As of September 1, 2016, Class R6 does not include such

12b-1 fees and certain other expenses, and the performance shown above for Class R6 prior to September 1, 2016, reflects the higher Class R expenses.

|

Annual Shareholder Report

Portfolio of Investments

Summary Table (unaudited)

At July 31, 2019, the

Fund's index composition1 was as follows:

| Sector Composition

| Percentage of

Total Net Assets

|

| Information Technology

| 21.4%

|

| Financials

| 14.4%

|

| Health Care

| 13.1%

|

| Consumer Discretionary

| 11.4%

|

| Industrials

| 10.6%

|

| Communication Services

| 8.2%

|

| Consumer Staples

| 7.3%

|

| Energy

| 5.5%

|

| Materials

| 3.2%

|

| Utilities

| 2.7%

|

| Securities Lending Collateral2

| 0.1%

|

| Cash Equivalents3

| 2.4%

|

| Other Assets and Liabilities—Net4

| (0.3)%

|

| TOTAL

| 100.0%

|

| 1

| Except for Cash Equivalents and Other Assets and Liabilities, sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification

Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS.

|

| 2

| Represents cash collateral received for portfolio securities on loan that may be invested in affiliated money market funds, other money market instruments and/or repurchase agreements.

|

| 3

| Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements other than those representing cash collateral for securities lending.

|

| 4

| Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

|

Annual Shareholder Report

Portfolio of

Investments

July 31, 2019

| Shares

|

|

| Value

|

|

|

| COMMON STOCKS—97.8%

|

|

|

|

| Communication Services—8.2%

|

|

| 4,370

| 1

| AMC Networks, Inc.

| $233,271

|

| 24,694

|

| AT&T, Inc.

| 840,831

|

| 1,284

| 1

| Alphabet, Inc., Class A

| 1,564,169

|

| 110

|

| Cable One, Inc.

| 133,848

|

| 21,466

| 1

| Charter Communications, Inc.

| 8,272,567

|

| 20,698

| 1

| Facebook, Inc.

| 4,020,172

|

| 2,119

| 1

| IAC Interactive Corp.

| 506,547

|

| 107,822

| 1

| Live Nation Entertainment, Inc.

| 7,769,653

|

| 43,653

| 1

| MSG Networks, Inc.

| 828,970

|

| 35,402

|

| Verizon Communications, Inc.

| 1,956,669

|

| 16,508

|

| Viacom, Inc., Class B

| 501,018

|

|

|

| TOTAL

| 26,627,715

|

|

|

| Consumer Discretionary—11.4%

|

|

| 8,000

|

| Abercrombie & Fitch Co., Class A

| 151,440

|

| 490

| 1

| Amazon.com, Inc.

| 914,722

|

| 8,712

| 1

| American Outdoor Brands Corp.

| 83,984

|

| 2,347

| 1

| AutoZone, Inc.

| 2,635,775

|

| 16,403

| 2

| Bed Bath & Beyond, Inc.

| 159,273

|

| 12,101

| 1

| Burlington Stores, Inc.

| 2,187,256

|

| 1,875

| 1

| Chipotle Mexican Grill, Inc.

| 1,491,619

|

| 3,520

| 2

| Dillards, Inc., Class A

| 256,186

|

| 17,549

|

| Dunkin' Brands Group, Inc.

| 1,406,728

|

| 79,965

|

| eBay, Inc.

| 3,293,758

|

| 35,142

|

| Expedia Group, Inc.

| 4,664,749

|

| 35,900

|

| Ford Motor Co.

| 342,127

|

| 9,671

| 1

| Fossil, Inc.

| 106,768

|

| 15,062

|

| Goodyear Tire & Rubber Co.

| 206,801

|

| 15,827

|

| Harley-Davidson, Inc.

| 566,290

|

| 13,204

|

| Hilton Worldwide Holdings, Inc.

| 1,274,846

|

| 18,331

|

| Home Depot, Inc.

| 3,917,151

|

| 4,881

|

| Kohl's Corp.

| 262,891

|

| 3,400

| 1

| Libbey, Inc.

| 5,746

|

| 32,501

|

| Lowe's Cos., Inc.

| 3,295,601

|

| 8,145

| 1

| Lululemon Athletica, Inc.

| 1,556,428

|

| 6,306

| 1

| Planet Fitness, Inc.

| 496,030

|

Annual Shareholder Report

| Shares

|

|

| Value

|

|

|

| COMMON STOCKS—continued

|

|

|

|

| Consumer Discretionary—continued

|

|

| 13,397

|

| Ralph Lauren Corp.

| $1,396,369

|

| 6,512

| 1

| Skechers USA, Inc., Class A

| 247,065

|

| 13,563

| 2

| Tailored Brands, Inc.

| 66,052

|

| 7,692

|

| Target Corp.

| 664,589

|

| 7,454

| 1

| Tempur Sealy International, Inc.

| 597,960

|

| 8,419

|

| Toll Brothers, Inc.

| 302,831

|

| 7,554

|

| Tupperware Brands Corp.

| 115,652

|

| 31,450

|

| Wyndham Destinations, Inc.

| 1,480,037

|

| 26,311

|

| Yum! Brands, Inc.

| 2,960,514

|

|

|

| TOTAL

| 37,107,238

|

|

|

| Consumer Staples—7.3%

|

|

| 4,837

|

| Colgate-Palmolive Co.

| 347,006

|

| 4,773

|

| Costco Wholesale Corp.

| 1,315,582

|

| 20,347

| 1

| Dean Foods Co.

| 29,503

|

| 33,620

|

| Estee Lauder Cos., Inc., Class A

| 6,192,468

|

| 7,300

|

| Fresh Del Monte Produce, Inc.

| 221,409

|

| 28,034

| 1

| Herbalife Ltd.

| 1,149,955

|

| 2,069

|

| Ingredion, Inc.

| 159,913

|

| 40,237

|

| Kimberly-Clark Corp.

| 5,458,149

|

| 16,514

|

| Lamb Weston Holdings, Inc.

| 1,108,420

|

| 46,008

|

| PepsiCo, Inc.

| 5,880,282

|

| 9,509

| 1

| Post Holdings, Inc.

| 1,019,555

|

| 1,236

|

| Procter & Gamble Co.

| 145,897

|

| 12,745

|

| Sysco Corp.

| 873,925

|

|

|

| TOTAL

| 23,902,064

|

|

|

| Energy—5.5%

|

|

| 60,069

|

| Chevron Corp.

| 7,395,095

|

| 14,890

|

| Continental Resources, Inc.

| 553,461

|

| 70,560

|

| EOG Resources, Inc.

| 6,057,576

|

| 39,101

|

| Exxon Mobil Corp.

| 2,907,550

|

| 16,659

|

| HollyFrontier Corp.

| 829,118

|

| 42,289

| 1

| Noble Corp. PLC

| 94,305

|

|

|

| TOTAL

| 17,837,105

|

|

|

| Financials—14.4%

|

|

| 76,245

|

| Allstate Corp.

| 8,188,713

|

| 32,960

|

| American International Group, Inc.

| 1,845,430

|

| 13,800

|

| Ameriprise Financial, Inc.

| 2,008,038

|

| 12,621

| 1

| Athene Holding Ltd.

| 515,694

|

Annual Shareholder Report

| Shares

|

|

| Value

|

|

|

| COMMON STOCKS—continued

|

|

|

|

| Financials—continued

|

|

| 19,891

|

| Bank of America Corp.

| $610,256

|

| 65,596

|

| Citigroup, Inc.

| 4,667,811

|

| 30,146

|

| Citizens Financial Group, Inc.

| 1,123,240

|

| 15,016

|

| Everest Re Group Ltd.

| 3,703,546

|

| 29,600

|

| Fifth Third Bancorp

| 878,824

|

| 8,201

| 1

| Green Dot Corp.

| 415,709

|

| 17,200

|

| Huntington Bancshares, Inc.

| 245,100

|

| 35,447

|

| JPMorgan Chase & Co.

| 4,111,852

|

| 30,200

|

| KeyCorp

| 554,774

|

| 11,250

|

| LPL Investment Holdings, Inc.

| 943,538

|

| 29,651

|

| M & T Bank Corp.

| 4,870,177

|

| 7,153

|

| MSCI, Inc., Class A

| 1,625,448

|

| 357

|

| Marketaxess Holdings, Inc.

| 120,323

|

| 25,900

|

| Navient Corp.

| 366,485

|

| 3,442

|

| PNC Financial Services Group

| 491,862

|

| 30,652

|

| Popular, Inc.

| 1,764,329

|

| 34,021

|

| Progressive Corp., OH

| 2,755,021

|

| 28,531

|

| Prudential Financial, Inc.

| 2,890,476

|

| 12,989

|

| RenaissanceRe Holdings Ltd.

| 2,352,957

|

| 2,673

|

| Synchrony Financial

| 95,907

|

|

|

| TOTAL

| 47,145,510

|

|

|

| Health Care—13.1%

|

|

| 13,462

| 1

| Alexion Pharmaceuticals, Inc.

| 1,525,110

|

| 1,153

| 1

| Amedisys, Inc.

| 158,987

|

| 1,152

|

| AmerisourceBergen Corp.

| 100,397

|

| 7,102

|

| Anthem, Inc.

| 2,092,320

|

| 21,989

| 1

| Biogen, Inc.

| 5,229,424

|

| 10,836

|

| Bristol-Myers Squibb Co.

| 481,227

|

| 464

|

| Chemed Corp.

| 188,101

|

| 20,834

| 1,2

| Community Health Systems, Inc.

| 42,710

|

| 14,675

|

| Eli Lilly & Co.

| 1,598,841

|

| 61,040

|

| HCA Healthcare, Inc.

| 8,149,450

|

| 3,749

| 1

| IDEXX Laboratories, Inc.

| 1,057,405

|

| 15,052

| 1

| Incyte Genomics, Inc.

| 1,278,216

|

| 7,440

| 1

| Ionis Pharmaceuticals, Inc.

| 489,998

|

| 14,274

| 1

| Jazz Pharmaceuticals PLC.

| 1,989,510

|

| 1,434

|

| McKesson Corp.

| 199,254

|

| 1,231

| 1

| Mettler-Toledo International, Inc.

| 931,559

|

Annual Shareholder Report

| Shares

|

|

| Value

|

|

|

| COMMON STOCKS—continued

|

|

|

|

| Health Care—continued

|

|

| 3,360

| 1

| Mirati Therapeutics, Inc.

| $355,488

|

| 4,765

| 1

| Molina Healthcare, Inc.

| 632,697

|

| 1,633

| 1

| Orthofix Medical, Inc.

| 87,284

|

| 34,827

|

| Stryker Corp.

| 7,306,008

|

| 552

|

| UnitedHealth Group, Inc.

| 137,454

|

| 34,899

| 1

| Veeva Systems, Inc.

| 5,789,744

|

| 17,446

| 1

| Vertex Pharmaceuticals, Inc.

| 2,906,853

|

|

|

| TOTAL

| 42,728,037

|

|

|

| Industrials—10.6%

|

|

| 9,100

|

| AGCO Corp.

| 700,700

|

| 6,465

|

| Allison Transmission Holdings, Inc.

| 297,067

|

| 12,535

|

| Boeing Co.

| 4,276,691

|

| 20,059

|

| CSX Corp.

| 1,412,154

|

| 2,140

|

| Caterpillar, Inc.

| 281,774

|

| 3,243

| 1

| CoStar Group, Inc.

| 1,995,742

|

| 11,779

|

| Delta Air Lines, Inc.

| 718,990

|

| 5,086

|

| Deluxe Corp.

| 226,937

|

| 4,916

|

| Fortune Brands Home & Security, Inc.

| 270,085

|

| 1,696

|

| GATX Corp.

| 130,355

|

| 359

|

| Grainger (W.W.), Inc.

| 104,480

|

| 25,860

|

| Heico Corp.

| 3,536,355

|

| 6,610

|

| Insperity, Inc.

| 702,973

|

| 21,800

| 1

| Jet Blue Airways Corp.

| 419,214

|

| 6,829

|

| Kennametal, Inc.

| 236,147

|

| 3,362

|

| L3Harris Technologies, Inc.

| 697,951

|

| 15,298

|

| Lennox International, Inc.

| 3,923,631

|

| 25,327

|

| Lockheed Martin Corp.

| 9,172,680

|

| 52,571

|

| PACCAR, Inc.

| 3,687,330

|

| 14,360

| 1

| SPX Corp.

| 501,164

|

| 3,016

|

| SkyWest, Inc.

| 183,101

|

| 11,499

| 1

| United Airlines Holdings, Inc.

| 1,056,873

|

| 3,060

| 1

| WESCO International, Inc.

| 155,264

|

|

|

| TOTAL

| 34,687,658

|

|

|

| Information Technology—21.4%

|

|

| 10,542

| 1

| Adobe, Inc.

| 3,150,582

|

| 7,796

| 1

| Ansys, Inc.

| 1,583,524

|

| 12,790

|

| Apple, Inc.

| 2,724,782

|

| 8,424

| 1

| Atlassian Corp. PLC

| 1,180,371

|

Annual Shareholder Report

| Shares

|

|

| Value

|

|

|

| COMMON STOCKS—continued

|

|

|

|

| Information Technology—continued

|

|

| 31,765

| 1

| Autodesk, Inc.

| $4,960,740

|

| 51,107

|

| Automatic Data Processing, Inc.

| 8,510,338

|

| 12,897

|

| Booz Allen Hamilton Holding Corp.

| 886,669

|

| 2,396

|

| CDW Corp.

| 283,111

|

| 68,779

| 1

| Cadence Design Systems, Inc.

| 5,083,456

|

| 9,670

|

| DXC Technology Co.

| 539,296

|

| 1,827

| 1

| Fair Isaac & Co., Inc.

| 634,736

|

| 3,770

| 1

| FleetCor Technologies, Inc.

| 1,071,321

|

| 30,100

| 1

| Fortinet Inc.

| 2,417,331

|

| 45,446

|

| Global Payments, Inc.

| 7,631,292

|

| 44,378

|

| Hewlett-Packard Co.

| 933,713

|

| 7,884

| 1

| HubSpot, Inc.

| 1,409,029

|

| 17,267

|

| Intel Corp.

| 872,847

|

| 11,765

|

| Intuit, Inc.

| 3,262,552

|

| 3,745

| 1

| Keysight Technologies, Inc.

| 335,252

|

| 27,375

|

| Mastercard, Inc.

| 7,453,391

|

| 24,457

|

| Microsoft Corp.

| 3,332,755

|

| 16,514

|

| NetApp, Inc.

| 965,904

|

| 7,224

| 1

| Paycom Software, Inc.

| 1,739,178

|

| 7,818

| 1

| PayPal, Inc.

| 863,107

|

| 9,338

| 1

| Salesforce.com, Inc.

| 1,442,721

|

| 4,200

| 1

| Sanmina Corp.

| 133,350

|

| 5,468

| 1

| ServiceNow, Inc.

| 1,516,769

|

| 2,404

|

| Universal Display Corp.

| 507,436

|

| 27,428

|

| Vishay Intertechnology, Inc.

| 466,276

|

| 11,900

| 1

| WEX, Inc.

| 2,595,033

|

| 18,900

|

| Western Union Co.

| 396,900

|

| 2,493

|

| Xilinx, Inc.

| 284,726

|

| 7,946

| 1

| Zscaler, Inc.

| 669,609

|

|

|

| TOTAL

| 69,838,097

|

|

|

| Materials—3.2%

|

|

| 40,800

|

| Domtar, Corp.

| 1,731,960

|

| 104,611

|

| DuPont de Nemours, Inc.

| 7,548,730

|

| 37,454

|

| Mosaic Co./The

| 943,466

|

| 2,471

|

| Reliance Steel & Aluminum Co.

| 246,977

|

|

|

| TOTAL

| 10,471,133

|

|

|

| Utilities—2.7%

|

|

| 24,600

|

| AES Corp.

| 413,034

|

Annual Shareholder Report

| Shares

|

|

| Value

|

|

|

| COMMON STOCKS—continued

|

|

|

|

| Utilities—continued

|

|

| 44,605

|

| Consolidated Edison Co.

| $3,789,641

|

| 33,353

|

| Edison International

| 2,486,132

|

| 28,304

|

| Exelon Corp.

| 1,275,378

|

| 18,501

|

| NiSource, Inc.

| 549,295

|

| 2,481

|

| Pinnacle West Capital Corp.

| 226,317

|

|

|

| TOTAL

| 8,739,797

|

|

|

| TOTAL COMMON STOCKS

(IDENTIFIED COST $291,497,344)

| 319,084,354

|

|

|

| INVESTMENT COMPANIES—2.5%

|

|

| 491,528

|

| Federated Government Obligations Fund, Premier Shares, 2.25%3

| 491,528

|

| 7,701,438

|

| Federated Institutional Prime Value Obligations Fund, Institutional Shares, 2.39%3

| 7,703,749

|

|

|

| TOTAL INVESTMENT COMPANIES

(IDENTIFIED COST $8,195,277)

| 8,195,277

|

|

|

| TOTAL INVESTMENT IN SECURITIES—100.3%

(IDENTIFIED COST $299,692,621)4

| 327,279,631

|

|

|

| OTHER ASSETS AND LIABILITIES - NET—(0.3)%5

| (898,266)

|

|

|

| TOTAL NET ASSETS—100%

| $326,381,365

|

Affiliated fund holdings are

investment companies which are managed by the Adviser or an affiliate of the Adviser. Transactions with affiliated fund holdings during the period ended July 31, 2019, were as follows:

|

| Federated

Government

Obligations Fund,

Premier Shares*

| Federated

Institutional

Prime Value

Obligations Fund,

Institutional Shares

| Total of

Affiliated

Transactions

|

| Balance of Shares Held 7/31/2018

| 740,143

| 4,824,255

| 5,564,398

|

| Purchases/Additions

| 22,320,512

| 85,456,752

| 107,777,264

|

| Sales/Reductions

| (22,569,127)

| (82,579,569)

| (105,148,696)

|

| Balance of Shares Held 7/31/2019

| 491,528

| 7,701,438

| 8,192,966

|

| Value

| $491,528

| $7,703,749

| $8,195,277

|

| Change in Unrealized Appreciation/Depreciation

| N/A

| $(81)

| $(81)

|

| Net Realized Gain/(Loss)

| N/A

| $186

| $186

|

| Dividend Income

| $23,165

| $172,914

| $ 196,079

|

| *

| All or a portion of the balance/activity for the fund relates to cash collateral received on securities lending transactions.

|

| 1

| Non-income-producing security.

|

| 2

| All or a portion of these securities are temporarily on loan to unaffiliated broker/dealers.

|

| 3

| 7-day net yield.

|

| 4

| The cost of investments for federal tax purposes amounts to $299,797,409.

|

| 5

| Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

|

Annual Shareholder Report

Note: The categories of investments

are shown as a percentage of total net assets at July 31, 2019.

Various inputs are used in

determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level

1—quoted prices in active markets for identical securities.

Level

2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level

3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for

valuing securities are not an indication of the risk associated with investing in those securities.

As of July 31, 2019, all investments

of the Fund utilized Level 1 inputs in valuing the Fund's assets carried at fair value.

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding

Throughout Each Period)

| Year Ended July 31

| 2019

| 2018

| 2017

| 2016

| 2015

|

| Net Asset Value, Beginning of Period

| $30.01

| $24.95

| $21.77

| $22.10

| $20.47

|

| Income From Investment Operations:

|

|

|

|

|

|

| Net investment income

| 0.161

| 0.091

| 0.26

| 0.191

| 0.111

|

| Net realized and unrealized gain (loss)

| 1.81

| 5.08

| 3.11

| (0.33)

| 1.55

|

| TOTAL FROM INVESTMENT OPERATIONS

| 1.97

| 5.17

| 3.37

| (0.14)

| 1.66

|

| Less Distributions:

|

|

|

|

|

|

| Distributions from net investment income

| (0.07)

| (0.11)

| (0.19)

| (0.19)

| (0.03)

|

| Distributions from net realized gain

| (2.01)

| —

| —

| —

| —

|

| TOTAL DISTRIBUTIONS

| (2.08)

| (0.11)

| (0.19)

| (0.19)

| (0.03)

|

| Net Asset Value, End of Period

| $29.90

| $30.01

| $24.95

| $21.77

| $22.10

|

| Total Return2

| 7.80%

| 20.78%

| 15.56%

| (0.61)%

| 8.10%

|

| Ratios to Average Net Assets:

|

|

|

|

|

|

| Net expenses

| 1.08%

| 1.36%

| 1.38%

| 1.35%

| 1.35%

|

| Net investment income

| 0.57%

| 0.31%

| 0.69%

| 0.94%

| 0.51%

|

| Expense waiver/reimbursement3

| 0.24%

| 0.00%4

| 0.00%4

| 0.03%

| 0.00%4

|

| Supplemental Data:

|

|

|

|

|

|

| Net assets, end of period (000 omitted)

| $69,221

| $40,539

| $33,799

| $33,753

| $40,433

|

| Portfolio turnover

| 87%

| 82%

| 77%

| 62%

| 76%

|

| 1

| Per share numbers have been calculated using the average shares method.

|

| 2

| Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable.

|

| 3

| This expense decrease is reflected in both the net expense and the net investment income ratios shown above.

|

| 4

| Represents less than 0.01%.

|

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class C Shares

(For a Share Outstanding

Throughout Each Period)

| Year Ended July 31

| 2019

| 2018

| 2017

| 2016

| 2015

|

| Net Asset Value, Beginning of Period

| $28.37

| $23.66

| $20.66

| $21.00

| $19.57

|

| Income From Investment Operations:

|

|

|

|

|

|

| Net investment income (loss)

| (0.05)1

| (0.11)1

| (0.19)

| 0.031

| (0.05)1

|

| Net realized and unrealized gain (loss)

| 1.68

| 4.82

| 3.23

| (0.33)

| 1.48

|

| TOTAL FROM INVESTMENT OPERATIONS

| 1.63

| 4.71

| 3.04

| (0.30)

| 1.43

|

| Less Distributions:

|

|

|

|

|

|

| Distributions from net investment income

| —

| —

| (0.04)

| (0.04)

| —

|

| Distributions from net realized gain

| (2.01)

| —

| —

| —

| —

|

| TOTAL DISTRIBUTIONS

| (2.01)

| —

| (0.04)

| (0.04)

| —

|

| Net Asset Value, End of Period

| $27.99

| $28.37

| $23.66

| $20.66

| $21.00

|

| Total Return2

| 6.96%

| 19.91%

| 14.72%

| (1.43)%

| 7.31%

|

| Ratios to Average Net Assets:

|

|

|

|

|

|

| Net expenses

| 1.85%

| 2.09%

| 2.13%

| 2.14%

| 2.11%

|

| Net investment income (loss)

| (0.20)%

| (0.41)%

| (0.06)%

| 0.15%

| (0.26)%

|

| Expense waiver/reimbursement3

| 0.24%

| 0.00%4

| 0.00%4

| 0.00%4

| 0.00%4

|

| Supplemental Data:

|

|

|

|

|

|

| Net assets, end of period (000 omitted)

| $32,178

| $39,625

| $36,440

| $36,846

| $41,509

|

| Portfolio turnover

| 87%

| 82%

| 77%

| 62%

| 76%

|

| 1

| Per share numbers have been calculated using the average shares method.

|

| 2

| Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable.

|

| 3

| This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above.

|

| 4

| Represents less than 0.01%.

|

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Financial Highlights–Institutional Shares

(For a Share Outstanding

Throughout Each Period)

| Year Ended July 31

| 2019

| 2018

| 2017

| 2016

| 2015

|

| Net Asset Value, Beginning of Period

| $30.37

| $25.24

| $22.02

| $22.37

| $20.71

|

| Income From Investment Operations:

|

|

|

|

|

|

| Net investment income

| 0.251

| 0.161

| 0.39

| 0.251

| 0.181

|

| Net realized and unrealized gain (loss)

| 1.81

| 5.16

| 3.09

| (0.34)

| 1.57

|

| TOTAL FROM INVESTMENT OPERATIONS

| 2.06

| 5.32

| 3.48

| (0.09)

| 1.75

|

| Less Distributions:

|

|

|

|

|

|

| Distributions from net investment income

| (0.13)

| (0.19)

| (0.26)

| (0.26)

| (0.09)

|

| Distributions from net realized gain

| (2.01)

| —

| —

| —

| —

|

| TOTAL DISTRIBUTIONS

| (2.14)

| (0.19)

| (0.26)

| (0.26)

| (0.09)

|

| Net Asset Value, End of Period

| $30.29

| $30.37

| $25.24

| $22.02

| $22.37

|

| Total Return2

| 8.08%

| 21.15%

| 15.90%

| (0.34)%

| 8.45%

|

| Ratios to Average Net Assets:

|

|

|

|

|

|

| Net expenses

| 0.78%

| 1.07%

| 1.08%

| 1.07%

| 1.05%

|

| Net investment income

| 0.87%

| 0.57%

| 1.01%

| 1.22%

| 0.80%

|

| Expense waiver/reimbursement3

| 0.29%

| 0.00%4

| 0.00%4

| 0.00%4

| 0.00%4

|

| Supplemental Data:

|

|

|

|

|

|

| Net assets, end of period (000 omitted)

| $215,799

| $95,290

| $52,169

| $65,435

| $76,242

|

| Portfolio turnover

| 87%

| 82%

| 77%

| 62%

| 76%

|

| 1

| Per share numbers have been calculated using the average shares method.

|

| 2

| Based on net asset value.

|

| 3

| This expense decrease is reflected in both the net expense and the net investment income ratios shown above.

|

| 4

| Represents less than 0.01%.

|

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class R6 Shares1

(For a Share Outstanding

Throughout Each Period)

| Year Ended July 31

| 2019

| 2018

| 2017

| 2016

| 2015

|

| Net Asset Value, Beginning of Period

| $29.89

| $24.85

| $21.46

| $21.80

| $20.25

|

| Income From Investment Operations:

|

|

|

|

|

|

| Net investment income

| 0.232

| 0.182

| 0.21

| 0.102

| 0.022

|

| Net realized and unrealized gain (loss)

| 1.79

| 5.06

| 3.18

| (0.33)

| 1.53

|

| TOTAL FROM INVESTMENT OPERATIONS

| 2.02

| 5.24

| 3.39

| (0.23)

| 1.55

|

| Less Distributions:

|

|

|

|

|

|

| Distributions from net investment income

| (0.15)

| (0.20)

| —

| (0.11)

| —

|

| Distributions from net realized gain

| (2.01)

| —

| —

| —

| —

|

| TOTAL DISTRIBUTIONS

| (2.16)

| (0.20)

| —

| (0.11)

| —

|

| Net Asset Value, End of Period

| $29.75

| $29.89

| $24.85

| $21.46

| $21.80

|

| Total Return3

| 8.08%

| 21.17%

| 15.80%

| (1.05)%

| 7.65%

|

| Ratios to Average Net Assets:

|

|

|

|

|

|

| Net expenses

| 0.81%

| 1.02%

| 1.07%

| 1.80%

| 1.76%

|

| Net investment income

| 0.78%

| 0.65%

| 0.95%

| 0.49%

| 0.09%

|

| Expense waiver/reimbursement4

| 0.18%

| 0.00%5

| 0.00%5

| 0.00%5

| 0.00%5

|

| Supplemental Data:

|

|

|

|

|

|

| Net assets, end of period (000 omitted)

| $9,183

| $20,425

| $17,363

| $5,717

| $6,300

|

| Portfolio turnover

| 87%

| 82%

| 77%

| 62%

| 76%

|

| 1

| Prior to September 1, 2016, the Fund's Class R6 Shares were designated as Class R Shares.

|

| 2

| Per share numbers have been calculated using the average shares method.

|

| 3

| Based on net asset value.

|

| 4

| This expense decrease is reflected in both the net expense and the net investment income ratios shown above.

|

| 5

| Represents less than 0.01%.

|

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Statement of Assets and Liabilities

July 31, 2019

| Assets:

|

|

|

| Investment in securities, at value including $479,249 of securities loaned and $8,195,277 of investment in affiliated

holdings (identified cost $299,692,621)

|

| $327,279,631

|

| Income receivable

|

| 129,480

|

| Income receivable from affiliated holdings

|

| 36,990

|

| Receivable for investments sold

|

| 1,585,100

|

| Receivable for shares sold

|

| 1,996,017

|

| TOTAL ASSETS

|

| 331,027,218

|

| Liabilities:

|

|

|

| Payable for investments purchased

| $2,367,233

|

|

| Payable for shares redeemed

| 1,609,220

|

|

| Bank overdraft

| 4,404

|

|

| Payable for collateral due to broker for securities lending

| 491,528

|

|

| Payable for investment adviser fee (Note 5)

| 4,407

|

|

| Payable for administrative fees (Note 5)

| 716

|

|

| Payable for distribution services fee (Note 5)

| 20,704

|

|

| Payable for other service fees (Notes 2 and 5)

| 24,754

|

|

| Accrued expenses (Note 5)

| 122,887

|

|

| TOTAL LIABILITIES

|

| 4,645,853

|

| Net assets for 10,896,863 shares outstanding

|

| $326,381,365

|

| Net Assets Consist of:

|

|

|

| Paid-in capital

|

| $297,868,865

|

| Total distributable earnings

|

| 28,512,500

|

| TOTAL NET ASSETS

|

| $326,381,365

|

Annual Shareholder Report

Statement of Assets and

Liabilities–continued

| Net Asset Value, Offering Price and Redemption Proceeds Per Share

|

|

|

| Class A Shares:

|

|

|

Net asset value per share ($69,221,049 ÷ 2,315,413 shares outstanding),

no par value, unlimited shares authorized

|

| $29.90

|

| Offering price per share (100/94.50 of $29.90)

|

| $31.64

|

| Redemption proceeds per share

|

| $29.90

|

| Class C Shares:

|

|

|

Net asset value per share ($32,178,093 ÷ 1,149,445 shares outstanding),

no par value, unlimited shares authorized

|

| $27.99

|

| Offering price per share

|

| $27.99

|

| Redemption proceeds per share (99.00/100 of $27.99)

|

| $27.71

|

| Institutional Shares:

|

|

|

Net asset value per share ($215,799,181 ÷ 7,123,317 shares outstanding),

no par value, unlimited shares authorized

|

| $30.29

|

| Offering price per share

|

| $30.29

|

| Redemption proceeds per share

|

| $30.29

|

| Class R6 Shares:

|

|

|

Net asset value per share ($9,183,042 ÷ 308,688 shares outstanding),

no par value, unlimited shares authorized

|

| $29.75

|

| Offering price per share

|

| $29.75

|

| Redemption proceeds per share

|

| $29.75

|

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Statement of Operations

Year Ended July 31, 2019

| Investment Income:

|

|

|

|

| Dividends (including $172,914 received from an affiliated holding* and net of foreign taxes withheld of $2,294)

|

|

| $4,290,562

|

| Net income on securities loaned (includes $23,165 earned from an affiliated holding related to cash collateral

balances*)(Note 2)

|

|

| 27,984

|

| TOTAL INCOME

|

|

| 4,318,546

|

| Expenses:

|

|

|

|

| Investment adviser fee (Note 5)

|

| $1,953,546

|

|

| Administrative fee (Note 5)

|

| 210,065

|

|

| Custodian fees

|

| 35,916

|

|

| Transfer agent fee (Note 2)

|

| 237,299

|

|

| Directors'/Trustees' fees (Note 5)

|

| 3,176

|

|

| Auditing fees

|

| 27,199

|

|

| Legal fees

|

| 11,915

|

|

| Portfolio accounting fees

|

| 109,734

|

|

| Distribution services fee (Note 5)

|

| 213,192

|

|

| Other service fees (Notes 2 and 5)

|

| 214,159

|

|

| Share registration costs

|

| 141,938

|

|

| Printing and postage

|

| 35,785

|

|

| Miscellaneous (Note 5)

|

| 32,267

|

|

| TOTAL EXPENSES

|

| 3,226,191

|

|

| Waiver and Reimbursements:

|

|

|

|

| Waiver/reimbursement of investment adviser fee (Note 5)

| $(600,220)

|

|

|

| Reimbursement of other operating expenses (Notes 2 and 5)

| (106,934)

|

|

|

| TOTAL WAIVER AND REIMBURSEMENTS

|

| (707,154)

|

|

| Net expenses

|

|

| 2,519,037

|

| Net investment income

|

|

| 1,799,509

|

| Realized and Unrealized Gain (Loss) on Investments:

|

|

|

|

| Net realized gain on investments (including net realized gain of $186 on sales of investments in an affiliated holding*)

|

|

| 12,196,355

|

| Net change in unrealized appreciation of investments (including net change in unrealized depreciation of $(81) on

investments in an affiliated an holding*)

|

|

| 7,975,426

|

| Net realized and unrealized gain on investments

|

|

| 20,171,781

|

| Change in net assets resulting from operations

|

|

| $21,971,290

|

| *

| See information listed after the Fund's Portfolio of Investments.

|

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| Year Ended July 31

| 2019

| 2018

|

| Increase (Decrease) in Net Assets

|

|

|

| Operations:

|

|

|

| Net investment income

| $1,799,509

| $420,985

|

| Net realized gain

| 12,196,355

| 17,219,025

|

| Net change in unrealized appreciation/depreciation

| 7,975,426

| 10,538,220

|

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS

| 21,971,290

| 28,178,230

|

| Distributions to Shareholders:

|

|

|

| Class A Shares

| (3,882,027)

| (150,867)

|

| Class C Shares

| (1,891,738)

| —

|

| Institutional Shares

| (12,178,410)

| (353,878)

|

| Class R6 Shares

| (604,361)

| (139,150)

|

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS

| (18,556,536)

| (643,895)

|

| Share Transactions:

|

|

|

| Proceeds from sale of shares

| 256,926,172

| 67,281,847

|

| Net asset value of shares issued to shareholders in payment of distributions declared

| 17,409,881

| 596,689

|

| Cost of shares redeemed

| (147,248,399)

| (39,304,708)

|

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS

| 127,087,654

| 28,573,828

|

| Change in net assets

| 130,502,408

| 56,108,163

|

| Net Assets:

|

|

|

| Beginning of period

| 195,878,957

| 139,770,794

|

| End of period

| $326,381,365

| $195,878,957

|

See Notes which are an integral part

of the Financial Statements

Annual Shareholder Report

Notes to Financial

Statements

July 31, 2019

1. ORGANIZATION

Federated MDT Series (the

“Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of five portfolios. The financial

statements included herein are only those of Federated MDT All Cap Core Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of

each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers four classes of shares: Class A Shares, Class C

Shares, Institutional Shares and Class R6 Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is long-term capital

appreciation.

On March 30, 2017,

the Fund's T Share Class became effective with the Securities and Exchange Commission (SEC), but is not yet offered for sale.

Effective August

1, 2018, an automatic conversion feature for Class C Shares was implemented. Pursuant to this automatic conversion feature, after Class C Shares have been held for ten years from the date of purchase, they will

automatically convert to Class A Shares on the next monthly conversion processing date.

2. SIGNIFICANT ACCOUNTING

POLICIES

The following is a summary of

significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value

(NAV), the Fund generally values investments as follows:

| ■

| Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market.

|

| ■

| Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs.

|

| ■

| Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Fund's Board of Trustees (the “Trustees”).

|

| ■

| Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations.

|

| ■

| Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees.

|

| ■

| For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered, such as: the last traded or

purchase price of the security, information obtained by contacting the issuer or dealers, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and

duration of restrictions on disposition, the movement of the market in which the security is normally traded, public trading in similar securities or derivative contracts of the issuer or comparable issuers, movement

of a relevant index, or other factors including but not limited to industry changes and relevant government actions.

|

Annual Shareholder Report

If any price, quotation, price

evaluation or other pricing source is not readily available when the NAV is calculated, if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a

reasonable period of time as set forth in the Fund's valuation policies and procedures, or if information furnished by a pricing service, in the opinion of the valuation committee (“Valuation Committee”),

is deemed not representative of the fair value of such security, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund

could obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share.

Fair Valuation Procedures

The Trustees have ultimate

responsibility for determining the fair value of investments for which market quotations are not readily available. The Trustees have appointed a Valuation Committee comprised of officers of the Fund, Federated MDTA

LLC (the “Adviser”) and certain of the Adviser's affiliated companies to assist in determining fair value and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing

services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for

reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services' policies, procedures and valuation methods (including key inputs, methods, models and assumptions),

transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price

evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve

the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered

by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions,

indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation).

Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid

evaluations for any U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for any other types of fixed-income securities and any OTC

derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the

Trustees.

Repurchase Agreements

The Fund may invest in repurchase

agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a

market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which

the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value

of the transferred securities and requiring the transfer of

Annual Shareholder Report

additional eligible securities if necessary to

equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in

exchange for other eligible securities of equivalent market value.

The insolvency of

the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase

agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter

into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser

and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of

proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses

and Distributions

Investment transactions are

accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions

to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income, if any, are

declared and paid annually. Non-cash dividends included in dividend income, if any, are recorded at fair value. Amortization/accretion of premium and discount is included in investment income. Investment income,

realized gains and unrealized gains losses, and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that select classes will bear certain expenses unique to those

classes. The detail of the total fund expense waiver and reimbursements of $707,154 is disclosed in Note 2 and Note 5. For the year ended July 31, 2019, transfer agent fees for the Fund were as follows:

|

| Transfer Agent

Fees Incurred

| Transfer Agent

Fees Reimbursed

|

| Class A Shares

| $57,393

| $(10,779)

|

| Class C Shares

| 31,757

| (5,643)

|

| Institutional Shares

| 145,557

| (90,512)

|

| Class R6 Shares

| 2,592

| —

|

| TOTAL

| $237,299

| $(106,934)

|

Dividends are declared separately

for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses. All distributions as indicated on the Statement of

Changes in Net Assets for the year ended July 31, 2018, were from net investment income. Undistributed net investment income at July 31, 2018, was $161,935.

Annual Shareholder Report

Other Service Fees

The Fund may pay other service fees

up to 0.25% of the average daily net assets of the Fund's Class A Shares and Class C Shares to unaffiliated financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to

shareholders and maintaining shareholder accounts. Subject to the terms described in the Expense Limitation note, FSSC may voluntarily reimburse the Fund for other service fees. For the year ended July 31, 2019, other

service fees for the Fund were as follows:

|

| Other Service

Fees Incurred

|

| Class A Shares

| $143,095

|

| Class C Shares

| 71,064

|

| TOTAL

| $214,159

|

Federal Taxes

It is the Fund's policy to comply

with the Subchapter M provision of the Internal Revenue Code and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during

the year ended July 31, 2019, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of

Operations. As of July 31, 2019, tax years 2016 through 2019 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be

subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment

income, net realized gains and net unrealized gains as income and/or gains are earned.

When-Issued and Delayed-Delivery

Transactions

The Fund may engage in when-issued

or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities

purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market

conditions or the failure of counterparties to perform under the contract.

Securities Lending

The Fund participates in a

securities lending program providing for the lending of equity securities to qualified brokers. The term of the loans within the program is one year or less. The Fund normally receives cash collateral for securities

loaned that is invested in affiliated money market funds, other money market instruments and/or repurchase agreements. Investments in money market funds may include funds with a “floating” NAV that can

impose redemption fees and liquidity gates, impose certain operational impediments to investing cash collateral, and, if the investee fund's NAV decreases, result in the Fund recognizing losses and being required to

cover the decrease in the value of the cash collateral. Collateral is maintained at a minimum level of 100% of the market value of investments loaned, plus interest, if applicable. In accordance with the Fund's

securities lending agreement, the market value of securities on loan is determined each day at the close of business and any additional collateral required to cover the value of securities on loan is delivered to the

Fund on the next

Annual Shareholder Report

business day. Earnings on collateral are allocated

between the borrower of the security, the securities lending agent, as a fee for its services under the program and the Fund, according to agreed-upon rates. The Fund will not have the right to vote on securities

while they are on loan. However, the Fund will attempt to terminate a loan in an effort to reacquire the securities in time to vote on matters that are deemed to be material by the Adviser. There can be no assurance

that the Fund will have sufficient notice of such matters to be able to terminate the loan in time to vote thereon.

Securities lending

transactions are subject to Master Netting Agreements which are agreements between the Fund and its counterparties that provide for the net settlement of all transactions and collateral with the Fund, through a single

payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross. As indicated below, the cash

collateral received by the Fund exceeds the market value of the securities loaned reducing the net settlement amount to zero. The chart below identifies the amount of collateral received as well as the market value of

securities on loan. Additionally, the securities lending agreement executed by the Fund includes an indemnification clause. This clause stipulates that the borrower will reimburse the Fund for any losses as a result

of any failure of the borrower to return equivalent securities to the Fund.

As of July 31,

2019, securities subject to this type of arrangement and related collateral were as follows:

Market Value of

Securities Loaned

| Collateral

Received

|

| $479,249

| $491,528

|

Other

The preparation of financial

statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could

differ from those estimated. The Fund applies investment company accounting and reporting guidance.

3. SHARES OF BENEFICIAL

INTEREST

The following tables summarize share

activity:

| Year Ended July 31

| 2019

| 2018

|

| Class A Shares:

| Shares

| Amount

| Shares

| Amount

|

| Shares sold

| 1,197,944

| $35,149,177

| 239,832

| $6,766,765

|

| Shares issued to shareholders in payment of distributions declared

| 143,909

| 3,662,745

| 5,033

| 139,021

|

| Shares redeemed

| (377,081)

| (10,640,181)

| (248,870)

| (6,806,136)

|

NET CHANGE RESULTING FROM

CLASS A SHARE TRANSACTIONS

| 964,772

| $28,171,741

| (4,005)

| $99,650

|

Annual Shareholder Report

| Year Ended July 31

| 2019

| 2018

|

| Class C Shares:

| Shares

| Amount

| Shares

| Amount

|

| Shares sold

| 486,557

| $12,740,476

| 261,516

| $7,009,390

|

| Shares issued to shareholders in payment of distributions declared

| 73,190

| 1,749,965

| —

| —

|

| Shares redeemed

| (806,777)

| (22,501,025)

| (405,082)

| (10,646,392)

|

NET CHANGE RESULTING FROM

CLASS C SHARE TRANSACTIONS

| (247,030)

| $(8,010,584)

| (143,566)

| $(3,637,002)

|

| Year Ended July 31

| 2019

| 2018

|

| Institutional Shares:

| Shares

| Amount

| Shares

| Amount

|

| Shares sold

| 6,734,928

| $195,716,816

| 1,752,574

| $51,491,570

|

| Shares issued to shareholders in payment of distributions declared

| 442,206

| 11,395,972

| 11,422

| 318,781

|

| Shares redeemed