UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-21903 | |||||

|

| ||||||

|

Nuveen Global Value Opportunities Fund | ||||||

|

(Exact name of registrant as specified in charter) | ||||||

|

| ||||||

|

Nuveen Investments | ||||||

|

(Address of principal executive offices) (Zip code) | ||||||

|

| ||||||

|

Kevin J. McCarthy Nuveen Investments 333 West Wacker Drive Chicago, IL 60606 | ||||||

|

(Name and address of agent for service) | ||||||

|

| ||||||

|

Registrant’s telephone number, including area code: |

(312) 917-7700 |

| ||||

|

| ||||||

|

Date of fiscal year end: |

December 31 |

| ||||

|

| ||||||

|

Date of reporting period: |

December 31, 2012 |

| ||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO SHAREHOLDERS

Closed-End Funds

Nuveen Investments

Closed-End Funds

Potential for a High Level of Total Return from a Diversified Global

Portfolio Primarily Invested in Equity and Debt Securities.

Annual Report

December 31, 2012

Nuveen Global Value

Opportunities Fund

JGV

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you'll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Table of Contents

|

Chairman's Letter to Shareholders |

4 |

||||||

|

Portfolio Managers' Comments |

5 |

||||||

|

Share Distribution and Price Information |

11 |

||||||

|

Performance Overview |

13 |

||||||

|

Report of Independent Registered Public Accounting Firm |

14 |

||||||

|

Portfolio of Investments |

15 |

||||||

|

Statement of Assets & Liabilities |

22 |

||||||

|

Statement of Operations |

23 |

||||||

|

Statement of Changes in Net Assets |

24 |

||||||

|

Financial Highlights |

26 |

||||||

|

Notes to Financial Statements |

28 |

||||||

|

Board Members & Officers |

38 |

||||||

|

Glossary of Terms Used in this Report |

43 |

||||||

|

Additional Fund Information |

47 |

||||||

Chairman's

Letter to Shareholders

Dear Shareholders,

Despite the global economy's ability to muddle through the many economic headwinds of 2012, investors continue to have good reasons to remain cautious. The European Central Bank's decisions to extend intermediate term financing to major European banks and to support sovereign debt markets have begun to show signs of a stabilized euro area financial market. The larger member states of the European Union (EU) are working diligently to strengthen the framework for a tighter financial and banking union and meaningful progress has been made by agreeing to centralize large bank regulation under the European Central Bank. However, economic conditions in the southern tier members are not improving and the pressures on their political leadership remain intense. The jury is out on whether the respective populations will support the continuing austerity measures that are needed to meet the EU fiscal targets.

In the U.S., the Fed remains committed to low interest rates into 2015 through its third program of Quantitative Easing (QE3). Inflation remains low but a growing number of economists are expressing concern about the economic distortions resulting from negative real interest rates. The highly partisan atmosphere in Congress led to a disappointingly modest solution for dealing with the end-of-year tax and spending issues. Early indications for the new Congressional term have not given much encouragement that the atmosphere for dealing with the sequestration legislation and the debt ceiling issues, let alone a more encompassing "grand bargain," will be any better than the last Congress. Over the longer term, there are some encouraging trends for the U.S. economy: house prices are beginning to recover, banks and corporations continue to strengthen their financial positions and incentives for capital investment in the U.S. by domestic and foreign corporations are increasing due to more competitive energy and labor costs.

During 2012 U.S. investors have benefited from strong returns in the domestic equity markets and solid returns in most fixed income markets. However, many of the macroeconomic risks of 2012 remain unresolved, including negotiating through the many U.S. fiscal issues, managing the risks of another year of abnormally low U.S. interest rates, sustaining the progress being made in the euro area and reducing the potential economic impact of geopolitical issues, particularly in the Middle East. In the face of these uncertainties, the experienced investment professionals at Nuveen Investments seek out investments that are enjoying positive economic conditions. At the same time they are always on the alert for risks in markets subject to excessive optimism or for opportunities in markets experiencing undue pessimism. Monitoring this process is a critical function for the Fund Board as it oversees your Nuveen Fund on your behalf.

As always, I encourage you to communicate with your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

February 22, 2013

Nuveen Investments

4

Portfolio Managers' Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's Group, Moody's Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Nuveen Global Value Opportunities Fund (JGV)

The Fund's investment portfolio is managed by Tradewinds Global Investors, LLC, an affiliate of Nuveen Investments. Effective April 1, 2012, Michael Hart, CFA and Ariane Mahler were named portfolio managers of the Fund, and David Iben no longer serves as portfolio manager.

During the reporting period, Tradewinds announced that Dave Iben, Co-President and Chief Investment Officer of Tradewinds, decided to leave the firm during the second calendar quarter. Emily Alejos and Drew Thelen, CFA, assumed investment leadership and oversight responsibilities, serving as Co-Chief Investment Officers for Tradewinds.

The portfolio manager change did not result in any changes to the principles followed in managing the Fund's investments. These principles are designed to create portfolios built of companies with sustainable franchises which we believe to be trading at a discount to their intrinsic worth. The characteristics of the Fund's portfolios tend to differ significantly from those of its benchmarks, given the bottom-up nature of the process. The Fund generally underperformed its benchmarks by a wide margin during the reporting period. Because of widespread fear driven by economic uncertainty, investors during the period were more focused on buying companies with strong short term earnings visibility, even if those companies were trading at elevated valuation levels, rather than those companies we believe offer good long term prospects and are undervalued in the market place. Notwithstanding the resulting poor performance of our investment strategies over the period, we remain committed to our long held value philosophy and research-centric process. We constantly reassess our holdings to determine sustainability of their business franchises, so we believe our companies have defensible market positions that will allow us to maintain our investment in them to a time when their compelling characteristics become more broadly accepted.

Here the portfolio managers discuss the general market conditions, their management strategy and performance of the Fund for the twelve-month period ending December 31, 2012.

What were the general market conditions and trends over the course of this reporting period?

During this period, the U.S. economy's progress toward recovery from recession continued at a moderate pace. The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. The central bank decided during its December 2012 meeting to keep the fed funds rate at "exceptionally low levels"

Nuveen Investments

5

until either the unemployment rate reaches 6.5% or expected inflation goes above 2.5%. The Fed also affirmed its decision, announced in September 2012, to purchase $40 billion of mortgage-backed securities each month in an effort to stimulate the housing market. In addition to this new, open-ended stimulus program, the Fed plans to continue its program to extend the average maturity of its holdings of U.S. Treasury securities through the end of December 2012. The goals of these actions, which together will increase the Fed's holdings of longer-term securities by approximately $85 billion a month through the end of the year, are to put downward pressure on longer-term interest rates, make broader financial conditions more accommodative and support a stronger economic recovery as well as continued progress toward the Fed's mandates of maximum employment and price stability.

In the fourth quarter 2012, the U.S. economy, as measured by the U.S. gross domestic product (GDP), decreased at an estimated annualized rate of 0.1%, down from a 3.1% increase in the third quarter. This slight decline was due to lower inventory investment, federal spending and net exports. The Consumer Price Index (CPI) rose 1.7% year-over-year as of December 2012, after a 3.0% increase in 2011. The core CPI (which excludes food and energy) increased 1.9% during the period, staying just within the Fed's unofficial objective of 2.0% or lower for this inflation measure. As of January 2013, the national unemployment rate was 7.9%, slightly higher than the 7.8% unemployment rate for December 2012 but below the 8.3% level recorded in January 2012. The housing market continued to show signs of improvement, with the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rising 5.5% for the twelve months ended November 2012 (most recent data available at the time this report was prepared). This was the largest year-over-year price gain since August 2006. The outlook for the U.S. economy remained clouded by uncertainty about global financial markets and the continued negotiations by Congress regarding potential spending cuts and tax policy reform.

Over the past year, equity investment performance was largely defined by exposure to companies benefiting from momentum, with little regard for price or value. Indeed, 2012 was the first year since 1979 that the S&P 500® Index never entered negative returns on a year-to-date basis. Similarly, the MSCI All Country World Index had only three trading days of negative year-to-date returns, which we found remarkable given a disrupted Europe, a lackluster Japan and a slowing China.

The year was characterized by stress and high volatility, caused in large part by the European debt situation. This situation highlighted the challenges that exist in many developed countries, challenges of high levels of indebtedness, sluggish economic growth and aging populations. To combat this financial stress which overwhelmed capital markets during the first half of 2012, governments and their central bankers loosened monetary policies, implemented bond buying programs to calm debt markets and pursued expansionary fiscal policies.

In our view, this environment was positive for certain assets, particularly the equities of companies that met or exceeded earnings expectations. We believe large portions of the market were left ignored, however, which severely discounted even select high quality assets like those owned by the businesses we favor. Considering the promises of

Nuveen Investments

6

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares.

For additional information, see the Performance Overview page in this report.

* Since inception returns are from 7/24/06.

** Refer to Glossary of Terms Used in this Report for definitions. Indexes and Benchmarks are not available for direct investment.

relatively unlimited liquidity from multiple global central banks, we are happy to own these firms even in difficult short-term environments in a considered effort to help protect and build long-term purchasing power.

What key strategies were used to manage the Fund during this reporting period?

The Fund seeks a high level of total return by investing primarily in a diversified global portfolio of value equity securities, as well as corporate and governmental debt securities, and by opportunistically using leverage, primarily via writing (selling) options and shorting a small position in equities.

Under normal circumstances, the Fund will invest approximately 80% of its managed assets in equities and the remainder in debt. This mix will be actively managed based on market conditions, and the portfolio can range from substantially all equity to substantially all debt as circumstances warrant. Our basic investment philosophy continues to be to search for good or improving business franchises around the globe whose securities are selling at levels that we believe are below their intrinsic value.

During the period, our basic investment philosophy continued to focus on buying good or improving business franchises around the globe whose securities were selling below their intrinsic value, maintaining a disciplined and opportunistic investing approach in this unique environment. We found the best value opportunities in the securities of those businesses that were the most leveraged to the growth of the global economy. We continued to focus on the materials, food, agriculture and energy sectors, which benefited from increased global demand, while we remained significantly underweight in the financials sector. During the period we maintained both our long and short equity exposures, and continued to write covered calls on select long equity positions to enhance yield and expected total return.

How did the Fund perform during this twelve-month reporting period ended December 31, 2012?

The performance of the Fund, as well as for a comparative benchmark and general market index, is presented in the accompanying table.

Average Annual Total Returns on Net Asset Value

For periods ended 12/31/12

|

1-Year |

5-Year |

Since Inception* |

|||||||||||||

|

JGV |

2.03 |

% |

3.83 |

% |

5.41 |

% |

|||||||||

|

Comparative Benchmark** |

14.94 |

% |

1.20 |

% |

4.66 |

% |

|||||||||

|

MSCI All Country World Index** |

16.80 |

% |

-0.61 |

% |

3.70 |

% |

|||||||||

For the twelve-month period ended December 31, 2012, the Fund generated positive absolute returns but underperformed its comparative benchmark and the MSCI All Country World Index.

This reporting period was a particularly challenging year for JGV. The Fund's bottom-up, fundamental value style was out of favor for much of the period, and this difficulty was

Nuveen Investments

7

compounded by the March announcement that the Fund's portfolio manager would be departing from Tradewinds. That announcement triggered a high degree of selling pressure on many of the Fund's holdings through May, and we believe opportunistic shorting by other investors likely added to those pressures.

Utilities and materials holdings led the Fund's net asset value (NAV) underperformance relative to the 80% MSCI ACWI/15% Barclays U.S. Aggregate Bond Index/5% Barclays U.S. High Yield Index benchmark during the period. These results were driven by company specific headwinds and gold price weakness, respectively. Country allocation effects were largely driven by the sector and industry detraction described above. This was exemplified in the United States, Brazil and Russia with detraction being led by utilities companies, and Canada detraction being led by gold mining companies. All four of these countries were top sources of annual underperformance. Positive contribution from companies domiciled in Italy and India, particularly, offered light offsetting effects.

Major Brazilian electric utility Centrais Elétricas Brasileiras SA (Eletrobrás) was the top relative detractor during the period. The Brazilian government, in an attempt to drive down electricity costs, made an unprecedented move by proposing uneconomic concessions for mandated tariffs to major electricity suppliers. Investors appeared to perceive the measure as endangering Eletrobras' profitability, with the possibility of impairing assets, resulting in a partial sell-off of the stock during the last quarter of the year.

Électricité De France SA (EDF), the world's largest nuclear utility, was another detracting holding on a relative basis. The company has suffered from lower increases in retail tariffs than have been seen in the past. We continue to believe that EDF's market position is underappreciated, as the company enjoys a virtual monopoly in France. Despite disappointing tariff increases in the short-term, we believe EDF is poised to belie long-term pessimism.

Gold mining firm Turquoise Hill Resources Ltd. (formerly Ivanhoe Mines Ltd.) was a major source of relative detraction in the materials sector. The company's primary asset is the Oyu Tolgoi project in Mongolia, the world's largest undeveloped copper/gold resource. After five years of negotiations, Ivanhoe seemed to come to a taxation and regulation agreement with the Mongolian government regarding Oyu Tolgoi in October of 2009. However, the government began to demand a larger stake thereafter, and this negotiating position has periodically threatened to delay or derail the project. These political uncertainties combined with range-bound spot gold prices caused stock price declines for the company over the year.

Major gold producer Barrick Gold Corp. was another leading relative detractor in the materials sector. Barrick disappointed investors in November by reporting a higher-than-expected capital expenditure estimate for its Pascua-Lama project in Argentina. As with many of its peers, Barrick continues to underperform gold spot prices, which in turn have been weak for long periods within the year. Though these companies have had to grapple with increased costs and lower production, we believe they represent compelling values at current multiples. This is particularly the case considering the various signs of their improving capital discipline, including senior management personnel changes across the industry.

Nuveen Investments

8

Downward pressures were mitigated by various appreciating holdings, including Nexen Incorporated, the Fund's top contributor to performance. Nexen is an oil and gas company based in Canada. The company has operations around the world, including the North Sea in Europe, offshore West Africa, the Gulf of Mexico and Western Canada. In July, China's CNOOC Limited proposed to purchase Nexen for $15.1 billion in value. If completed, this deal promises to be the largest overseas acquisition ever made by a Chinese company. The proposed purchase price represented over a 60% premium to Nexen's stock price before the bid was announced. Nexen shareholders have approved the deal which is expected to complete in the first quarter of 2013 at the earliest.

The Fund's overall short equity position detracted slightly from performance for the period. Amongst this group, Chipotle Mexican Grill Incorporated contributed most to absolute performance; however, its gains were more than offset by the position in Salesforce.com Incorporated. Our covered call writing strategy contributed to the Fund's performance. During this period we also held a put option on a single stock to benefit in the event its price declined which had a slightly negative impact on performance.

The Fund's fixed income positions contributed positively to performance during the period. Bond yields remained at relatively low levels and the Fund's fixed income contributions came in the form of individual selections. While overall fixed income exposure did not change much, a slight corporate bond exposure increase was offset by a slight decrease in asset-backed securities, and by the sales of a structured note and an emerging market government bond. As spreads have tightened considerably since March 2009, it continues to be difficult to find value opportunities in this asset class.

RISK CONSIDERATIONS

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the corporate securities owned by the Fund, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like the Fund frequently trade at a discount to NAV. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations. This is particularly true for funds employing a managed distribution program.

Common Stock Risk. Common stock returns often have experienced significant volatility.

Issuer Credit Risk. This is the risk that a security in a Fund's portfolio will fail to make dividend or interest payments when due.

Nuveen Investments

9

Call Option Risks. The value of call options sold (written) by the Fund will fluctuate. The Fund may not participate in any appreciation of its equity portfolio as fully as it would if the Fund did not sell call options. In addition, the Fund will continue to bear the risk of declines in the value of the equity portfolio.

Derivatives Strategy Risk. Derivative securities, such as calls, puts, warrants, swaps and forwards, carry risks different from, and possibly greater than, the risks associated with the underlying investments.

Interest Rate Risk. Fixed-income securities such as bonds, preferred, convertible and other debt securities will decline in value if market interest rates rise.

Value Stock Risks. Value stocks are securities that the manager believes to be undervalued, or mispriced. If the manager's assessment of a company's prospects is wrong, the price of the company's common stock or other equity securities may fall, or may not approach the value that the manager has placed on them.

Convertible Securities Risk. Convertible securities generally offer lower interest or dividend yields than non-convertible fixed-income securities of similar credit quality.

Counterparty Risk. To the extent that a Fund's derivative investments are purchased or sold in over-the-counter transactions, the Fund will be exposed to the risk that counterparties to these transactions will be unable to meet their obligations.

Currency Risk. Changes in exchange rates will affect the value of a Fund's investments.

Warrants and Rights Risks. Warrants and rights are subject to the same market risks as common stocks, but are more volatile in price.

Non-U.S. Securities Risk. Investments in non-U.S securities involve special risks not typically associated with domestic investments including currency risk and adverse political, social and economic development. These risks often are magnified in emerging markets.

Reinvestment Risk. If market interest rates decline, income earned from the Fund's portfolio may be reinvested at rates below that of the original bond that generated the income.

Leverage Risk. The Fund's use of leverage creates the possibility of higher volatility for the Fund's per share NAV, market price and distributions. Leverage risk can be introduced through regulatory leverage (issuing preferred shares or debt borrowings at the Fund level) or through certain derivative investments held in the Fund's portfolio. Leverage typically magnifies the total return of the Fund's portfolio, whether that return is positive or negative. The use of leverage creates an opportunity for increased common share net income, but there is no assurance that the Fund's leveraging strategy will be successful.

Nuveen Investments

10

Share Distribution

and Price Information

Distribution Information

The following information regarding the Fund's distributions is current as of December 31, 2012, and likely will vary over time based on the Fund's investment activities and portfolio investment value changes.

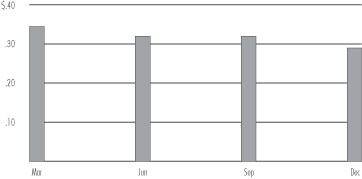

During the current reporting period, the Fund's quarterly distribution to shareholders decreased in June and again in December. Some of the factors affecting the amount and composition of these distributions are summarized below.

The Fund has a managed distribution program. The goal of this program is to provide shareholders with relatively consistent and predictable cash flow by systematically converting the Fund's expected long-term return potential into regular distributions. As a result, regular distributions throughout the year are likely to include a portion of expected long-term gains (both realized and unrealized), along with net investment income.

Important points to understand about the managed distribution program are:

• The Fund seeks to establish a relatively stable distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about the Fund's past or future investment performance from its current distribution rate.

• Actual returns will differ from projected long-term returns (and therefore the Fund's distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value.

• Each distribution is expected to be paid from some or all of the following sources:

• net investment income (regular interest and dividends),

• realized capital gains, and

• unrealized gains, or, in certain cases, a return of principal (non-taxable distributions).

• A non-taxable distribution is a payment of a portion of the Fund's capital. When the Fund's returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when the Fund's returns fall short of distributions, the shortfall will represent a portion of your original principal, unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund's total return exceeds distributions.

Nuveen Investments

11

*** The Fund elected to retain a portion of its realized long-term capital gains for the tax year ended December 31, 2007, and pay required federal corporate income taxes on this amount. As reported on Form 2439, shareholders on record date must include their pro-rata share of these gains on their applicable federal tax returns, and are entitled to take offsetting tax credits, for their pro-rata share of the taxes paid by the Fund. The total returns "Including retained gain tax credit/refund" include the economic benefit to shareholders on record date of these tax credits/refunds. The Fund had no retained capital gains for the tax years ended December 31, 2012 through December 31, 2008 or for the tax year ended December 31, 2006.

• Because distribution source estimates are updated during the year based on the Fund's performance and forecast for its current fiscal year (which is the calendar year for the Fund), estimates on the nature of your distribution provided at the time the distributions are paid may differ from both the tax information reported to you in your Fund's IRS Form 1099 statement provided at year end, as well as the ultimate economic sources of distributions over the life of your investment.

The following table provides information regarding the Fund's distributions and total return performance for the year ended December 31, 2012. This information is intended to help you better understand whether the Fund's returns for the specified time period were sufficient to meet the Fund's distributions.

|

As of 12/31/12 |

JGV |

||||||

|

Inception date |

7/24/06 |

||||||

|

Fiscal year (calendar year) ended December 31, 2012: |

|||||||

|

Per share distribution: |

|||||||

|

From net investment income |

$ |

0.49 |

|||||

|

From long-term capital gains |

0.00 |

||||||

|

From short-term capital gains |

0.33 |

||||||

|

Return of capital |

0.45 |

||||||

|

Total per share distribution |

$ |

1.27 |

|||||

|

Distribution rate on NAV |

7.96 |

% |

|||||

|

Average annual total returns: |

|||||||

|

Excluding retained gain tax credit/refund***: |

|||||||

| 1-Year on NAV |

2.03 |

% |

|||||

| 5-Year on NAV |

3.83 |

% |

|||||

|

Since inception on NAV |

5.41 |

% |

|||||

|

Including retained gain tax credit/refund***: |

|||||||

| 1-Year on NAV |

2.03 |

% |

|||||

| 5-Year on NAV |

3.83 |

% |

|||||

|

Since inception on NAV |

5.53 |

% |

|||||

Share Repurchases and Price Information

During November 2012, the Nuveen Funds Board of Directors/Trustees reauthorized the Fund's open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of December 31, 2012, and since the inception of the Fund's repurchase program, the Fund has cumulatively repurchased and retired 191,600 shares, representing approximately 1.0% of its shares outstanding.

During the current reporting period, the Fund repurchased and retired 2,500 of its shares at a weighted average price and weighted average discount per share of $13.40 and -12.53%, respectively.

As of December 31, 2012, the Fund's share price was trading at a -6.58% discount to its NAV, compared with an average discount of -6.66% for the entire twelve-month period.

Nuveen Investments

12

JGV

Performance

OVERVIEW

Nuveen Global Value Opportunities Fund

December 31, 2012

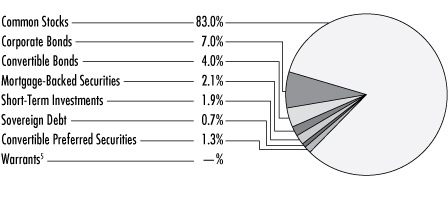

Portfolio Allocation (as a % of total investments)2,4

2012 Quarterly Distributions Per Share

Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms used in this Report for further definition of the terms used within this Fund's Performance Overview Page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a tax return of capital.

2 Excluding common stocks sold short and investments in derivatives.

3 As previously explained in the Share Distribution and Price Information section of this report, the Fund elected to retain a portion of its realized long-term capital gains for the tax year ended December 31, 2007, and pay required federal corporate income taxes on these amounts. These standardized total returns include the economic benefit to shareholders of record of this tax credit/refund. The Fund had no retained capital gains for the tax years ended December 31, 2012 through December 31, 2008 or for the tax year ended December 31, 2006.

4 Holdings are subject to change.

5 Rounds to less than 0.1%

Fund Snapshot

|

Share Price |

$ |

14.91 |

|||||

|

Net Asset Value (NAV) |

$ |

15.96 |

|||||

|

Premium/(Discount) to NAV |

-6.58 |

% |

|||||

| Current Distribution Rate1 |

7.78 |

% |

|||||

|

Net Assets ($000) |

$ |

306,591 |

|||||

Average Annual Total Returns

(Inception 7/24/06)

|

On Share Price |

On NAV |

||||||||||

| 1-Year |

-3.29 |

% |

2.03 |

% |

|||||||

| 5-Year |

4.64 |

% |

3.83 |

% |

|||||||

|

Since Inception |

4.16 |

% |

5.41 |

% |

|||||||

Average Annual Total Returns3

(Including retained gain tax credit/refund)

|

On Share Price |

On NAV |

||||||||||

| 1-Year |

-3.29 |

% |

2.03 |

% |

|||||||

| 5-Year |

4.64 |

% |

3.83 |

% |

|||||||

|

Since Inception |

4.29 |

% |

5.53 |

% |

|||||||

Country Allocation

(as a % of total investments)2,4

|

United States |

25.9 |

% |

|||||

|

Canada |

13.3 |

% |

|||||

|

France |

9.2 |

% |

|||||

|

Italy |

6.3 |

% |

|||||

|

Japan |

5.3 |

% |

|||||

|

South Africa |

4.4 |

% |

|||||

|

Russia |

4.3 |

% |

|||||

|

Egypt |

3.7 |

% |

|||||

|

Brazil |

2.9 |

% |

|||||

|

India |

2.8 |

% |

|||||

|

United Kingdom |

2.4 |

% |

|||||

|

Switzerland |

2.3 |

% |

|||||

|

Finland |

2.2 |

% |

|||||

|

Portugal |

1.8 |

% |

|||||

|

Hong Kong |

1.4 |

% |

|||||

|

Venezuela |

1.3 |

% |

|||||

|

Luxembourg |

1.3 |

% |

|||||

|

Australia |

1.2 |

% |

|||||

|

Ukraine |

1.1 |

% |

|||||

|

Mexico |

1.1 |

% |

|||||

|

Belgium |

1.0 |

% |

|||||

|

Other |

4.8 |

% |

|||||

Portfolio Composition

(as a % of total investments)2,4

|

Metals & Mining |

17.8 |

% |

|||||

|

Oil, Gas & Consumable Fuels |

15.3 |

% |

|||||

|

Electric Utilities |

11.5 |

% |

|||||

|

Diversified Telecommunication Services |

6.4 |

% |

|||||

|

Wireless Telecommunication Services |

6.0 |

% |

|||||

|

Communications Equipment |

5.0 |

% |

|||||

|

Food Products |

4.1 |

% |

|||||

|

Capital Markets |

3.5 |

% |

|||||

|

Aerospace & Defense |

3.5 |

% |

|||||

|

Commercial Banks |

2.6 |

% |

|||||

|

Construction Materials |

2.4 |

% |

|||||

|

Residentials |

2.1 |

% |

|||||

|

Short-Term Investments |

1.9 |

% |

|||||

|

Other |

17.9 |

% |

|||||

Nuveen Investments

13

Report of INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of

Nuveen Global Value Opportunities Fund:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Global Value Opportunities Fund (hereinafter referred to as the "Fund") at December 31, 2012, the results of its operations for the year then ended, the changes in its net assets each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, IL

February 28, 2013

Nuveen Investments

14

JGV

Nuveen Global Value Opportunities Fund

Portfolio of Investments

December 31, 2012

| Shares |

Description (1) |

Value |

|||||||||

|

Common Stocks – 83.4% |

|||||||||||

|

Aerospace & Defense – 3.5% |

|||||||||||

| 990,000 |

Finmeccanica SPA, (3) |

$ |

5,729,337 |

||||||||

| 140,850 |

Thales S.A., (3) |

4,907,583 |

|||||||||

|

Total Aerospace & Defense |

10,636,920 |

||||||||||

|

Capital Markets – 3.6% |

|||||||||||

| 175,000 |

Credit Suisse Group, Sponsored ADR |

4,298,000 |

|||||||||

| 1,333,437 |

EFG-Hermes Holdings SAE |

2,310,452 |

|||||||||

| 525,000 |

GP Investments Ltd, BDR |

1,353,846 |

|||||||||

| 139,000 |

Guoco Group Ltd, (3) |

1,683,850 |

|||||||||

| 235,000 |

Uranium Participation Corporation |

1,275,762 |

|||||||||

|

Total Capital Markets |

10,921,910 |

||||||||||

|

Commercial Banks – 2.1% |

|||||||||||

| 650,000 |

Bank Leumi le-Israel B.M. |

2,204,806 |

|||||||||

| 1,180,000 |

Sumitomo Mitsui Trust Holdings Incorporated, (3) |

4,157,502 |

|||||||||

|

Total Commercial Banks |

6,362,308 |

||||||||||

|

Communications Equipment – 1.7% |

|||||||||||

| 1,305,000 |

Nokia Corporation, Sponsored ADR |

5,154,750 |

|||||||||

|

Construction Materials – 1.4% |

|||||||||||

| 929,000 |

Asia Cement China Holdings Corporation, (3) |

466,422 |

|||||||||

| 1,533,000 |

India Cements Limited, GDR, Reg S, 144A, (3) |

2,587,016 |

|||||||||

| 5,214,000 |

Luks Group Vietnam Holdings Company Limited, (3) |

1,198,689 |

|||||||||

|

Total Construction Materials |

4,252,127 |

||||||||||

|

Diversified Telecommunication Services – 6.4% |

|||||||||||

| 104,000 |

Belgacom S.A., (3) |

3,058,802 |

|||||||||

| 117,500 |

Nippon Telegraph and Telephone Corporation, ADR |

2,471,025 |

|||||||||

| 575,000 |

Singapore Telecommunications Limited, (3) |

1,562,278 |

|||||||||

| 1,394,920 |

Telecom Egypt SAE |

3,099,091 |

|||||||||

| 8,200,000 |

Telecom Italia S.p.A., WI/DD, (3) |

6,526,293 |

|||||||||

| 650,000 |

Telkom S.A. Ltd, (3) |

1,295,971 |

|||||||||

| 76,000 |

Vivendi S.A., (3) |

1,718,811 |

|||||||||

|

Total Diversified Telecommunication Services |

19,732,271 |

||||||||||

|

Electric Utilities – 11.6% |

|||||||||||

| 383,542 |

Centrais Eletricas Brasileiras S.A. PFD B ADR |

1,921,545 |

|||||||||

| 36,306 |

Centrais Eletricas Brasileiras S.A., ADR |

113,275 |

|||||||||

| 636,000 |

Centrais Eletricas Brasileiras S.A., Class B |

3,255,326 |

|||||||||

| 475,003 |

Centrais Eletricas Brasileiras S.A. |

1,468,507 |

|||||||||

| 1,800,000 |

EDP-Energias de Portugal, S.A., (3) |

5,475,212 |

|||||||||

| 553,000 |

Electricite de France S.A., (3) |

10,247,369 |

|||||||||

| 239,000 |

Exelon Corporation |

7,107,860 |

|||||||||

| 124,400 |

Korea Electric Power Corporation, Sponsored ADR |

1,737,868 |

|||||||||

| 1,777,000 |

RusHydro, GDR, (3) |

4,217,601 |

|||||||||

|

Total Electric Utilities |

35,544,563 |

||||||||||

Nuveen Investments

15

JGV

Nuveen Global Value Opportunities Fund (continued)

Portfolio of Investments December 31, 2012

| Shares |

Description (1) |

Value |

|||||||||

|

Electrical Equipment – 0.4% |

|||||||||||

| 72,390 |

Areva S.A., (3) |

$ |

1,236,243 |

||||||||

|

Energy Equipment & Services – 1.1% |

|||||||||||

| 308,000 |

Weatherford International Ltd, (2) |

3,446,520 |

|||||||||

|

Food Products – 3.5% |

|||||||||||

| 98,000 |

Archer-Daniels-Midland Company |

2,684,220 |

|||||||||

| 48,800 |

BrasilAgro Companhia Brasileira de Propriedades Agricolas |

238,339 |

|||||||||

| 190,000 |

Smithfield Foods, Inc. |

4,098,300 |

|||||||||

| 191,000 |

Tyson Foods, Inc., Class A |

3,705,400 |

|||||||||

|

Total Food Products |

10,726,259 |

||||||||||

|

Health Care Providers & Services – 0.8% |

|||||||||||

| 68,000 |

Health Net Inc., (2) |

1,652,400 |

|||||||||

| 97,400 |

Profarma Distribuidora de Produtos Farmaceuticos S.A. |

689,768 |

|||||||||

|

Total Health Care Providers & Services |

2,342,168 |

||||||||||

|

Health Care Technology – 0.5% |

|||||||||||

| 170,000 |

Allscripts Healthcare Solutions Inc., (2) |

1,601,400 |

|||||||||

|

Hotels, Restaurants & Leisure – 0.9% |

|||||||||||

| 201,000 |

Orascom Development Holding AG |

2,779,916 |

|||||||||

|

Household Durables – 1.1% |

|||||||||||

| 868,000 |

Oriental Weavers Group |

3,411,950 |

|||||||||

|

Insurance – 1.5% |

|||||||||||

| 92,331 |

American International Group, (2) |

3,259,284 |

|||||||||

| 70,000 |

MS&AD Insurance Group Holdings, Inc., (3) |

1,396,988 |

|||||||||

|

Total Insurance |

4,656,272 |

||||||||||

|

Leisure Equipment & Products – 0.2% |

|||||||||||

| 16,600 |

Sankyo Company Ltd, (3) |

658,687 |

|||||||||

|

Marine – 0.8% |

|||||||||||

| 120,000 |

Stolt-Nielsen Limited |

2,483,019 |

|||||||||

|

Metals & Mining – 16.7% |

|||||||||||

| 71,000 |

AngloGold Ashanti Limited, Sponsored ADR |

2,227,270 |

|||||||||

| 337,500 |

Barrick Gold Corporation |

11,815,877 |

|||||||||

| 239,815 |

Eastern Platinum Limited |

39,780 |

|||||||||

| 38,320 |

First Uranium Corporation |

2,504 |

|||||||||

| 195,000 |

Gold Fields Limited, Sponsored ADR |

2,435,550 |

|||||||||

| 330,000 |

Impala Platinum Holdings Limited, (3) |

6,599,709 |

|||||||||

| 748,000 |

Kinross Gold Corporation |

7,270,560 |

|||||||||

| 160,000 |

Newcrest Mining Limited, (3) |

3,742,828 |

|||||||||

| 100,000 |

Newmont Mining Corporation |

4,644,000 |

|||||||||

| 540,000 |

NovaGold Resources Inc., (2) |

2,435,400 |

|||||||||

| 1,191,000 |

Polyus Gold International Limited, (3) |

4,009,867 |

|||||||||

| 654,717 |

Turquoise Hill Resources Limited |

4,982,396 |

|||||||||

| 6,150,387 |

Village Main Reef Limited, (3) |

902,266 |

|||||||||

|

Total Metals & Mining |

51,108,007 |

||||||||||

|

Oil, Gas & Consumable Fuels – 12.5% |

|||||||||||

| 477,000 |

Arch Coal Inc. |

3,491,640 |

|||||||||

| 515,000 |

Cameco Corporation |

10,155,800 |

|||||||||

Nuveen Investments

16

| Shares |

Description (1) |

Value |

|||||||||

| Oil, Gas & Consumable Fuels (continued) | |||||||||||

| 160,000 |

Chesapeake Energy Corporation |

$ |

2,659,200 |

||||||||

| 428,439 |

ERG S.P.A., (3) |

4,356,328 |

|||||||||

| 2,145 |

Gazprom OAO, Sponsored ADR, (3) |

20,871 |

|||||||||

| 529,800 |

Gazprom OAO, Sponsored GDR, (3) |

5,120,751 |

|||||||||

| 74,000 |

Hess Corporation |

3,919,040 |

|||||||||

| 15,168 |

Niko Resources Limited |

162,400 |

|||||||||

| 105,000 |

Peabody Energy Corporation |

2,794,050 |

|||||||||

| 10,423,000 |

PT Medco Energi Internasional TBK, (3) |

1,772,127 |

|||||||||

| 121,500 |

Suncor Energy, Inc. |

4,007,070 |

|||||||||

|

Total Oil, Gas & Consumable Fuels |

38,459,277 |

||||||||||

|

Paper & Forest Products – 0.6% |

|||||||||||

| 245,000 |

Stora Enso Oyj, Class R Shares, (3) |

1,714,854 |

|||||||||

|

Pharmaceuticals – 1.3% |

|||||||||||

| 7,352 |

EGIS Pharmaceuticals PLC, (3) |

586,674 |

|||||||||

| 60,433 |

Ipsen S.A., (3) |

1,823,275 |

|||||||||

| 2,975,000 |

United Laboratories International Holdings Ltd, (3) |

1,439,183 |

|||||||||

|

Total Pharmaceuticals |

3,849,132 |

||||||||||

|

Real Estate Management & Development – 0.8% |

|||||||||||

| 13,205 |

Cresud S.A., Sponsored ADR |

109,866 |

|||||||||

| 980,000 |

Emaar Properties PJSC, (3) |

1,012,463 |

|||||||||

| 108,623 |

Solidere, GDR, 144A, (3) |

1,412,099 |

|||||||||

|

Total Real Estate Management & Development |

2,534,428 |

||||||||||

|

Road & Rail – 1.7% |

|||||||||||

| 44,200 |

East Japan Railway Company, (3) |

2,858,154 |

|||||||||

| 64,000 |

West Japan Railway Company, (3) |

2,521,385 |

|||||||||

|

Total Road & Rail |

5,379,539 |

||||||||||

|

Semiconductors & Equipment – 1.4% |

|||||||||||

| 211,000 |

Intel Corporation |

4,352,930 |

|||||||||

|

Software – 1.0% |

|||||||||||

| 110,000 |

Microsoft Corporation |

2,940,300 |

|||||||||

|

Specialty Retail – 1.1% |

|||||||||||

| 285,000 |

Best Buy Co., Inc. |

3,377,250 |

|||||||||

|

Textiles, Apparel & Luxury Goods – 0.0% |

|||||||||||

| 2,506,000 |

China Hongxing Sports Limited, (4) |

14,750 |

|||||||||

|

Tobacco – 0.9% |

|||||||||||

| 170,000 |

Eastern Tobacco Co. |

2,672,956 |

|||||||||

|

Wireless Telecommunication Services – 4.3% |

|||||||||||

| 1,045,000 |

Bharti AirTel Limited, (3) |

6,099,567 |

|||||||||

| 24,900 |

Millicom International Cellular S.A., (3) |

2,161,343 |

|||||||||

| 1,470 |

NTT Docomo, Inc., (3) |

2,119,035 |

|||||||||

| 143,000 |

TIM Participacoes S.A., ADR |

2,834,260 |

|||||||||

|

Total Wireless Telecommunication Services |

13,214,205 |

||||||||||

|

Total Common Stocks (cost $292,951,015) |

255,564,911 |

||||||||||

Nuveen Investments

17

JGV

Nuveen Global Value Opportunities Fund (continued)

Portfolio of Investments December 31, 2012

|

Principal Amount (000) |

Description (1) |

Coupon |

Maturity |

Ratings (5) |

Value |

||||||||||||||||||

|

Mortgage-Backed Securities – 2.1% |

|||||||||||||||||||||||

|

Residentials – 2.1% |

|||||||||||||||||||||||

|

$ |

12,749 |

Fannie Mae Guaranteed REMIC Pass Through Certificates, Series 2011-16, (I/O) |

4.000 |

% |

3/25/26 |

Aaa |

$ |

869,382 |

|||||||||||||||

|

6,630 |

Fannie Mae Mortgage Interest Strips, Series 345-17, (I/O) |

4.500 |

% |

5/01/20 |

Aaa |

451,991 |

|||||||||||||||||

|

84 |

Fannie Mae Mortgage Pool 100195 |

2.703 |

% |

8/20/22 |

Aaa |

84,441 |

|||||||||||||||||

|

52 |

Fannie Mae Mortgage Pool 713939 |

2.295 |

% |

4/01/33 |

Aaa |

54,652 |

|||||||||||||||||

|

14 |

Fannie Mae Mortgage Pool 708743 |

2.285 |

% |

6/01/33 |

Aaa |

14,792 |

|||||||||||||||||

|

108 |

Fannie Mae Mortgage Pool 776486 |

2.300 |

% |

3/01/34 |

Aaa |

114,748 |

|||||||||||||||||

|

393 |

Fannie Mae Mortgage Pool 816594 |

2.287 |

% |

2/01/35 |

Aaa |

416,642 |

|||||||||||||||||

|

1,607 |

Fannie Mae Real Estate Mortgage Investment Conduit, Pass Through Certificates Series 2011-81, (I/O) |

3.500 |

% |

8/25/26 |

Aaa |

180,235 |

|||||||||||||||||

|

270 |

Fannie Mae, Collateralized Mortgage Obligations, Series 2004-86, Class KI, (I/O) |

4.500 |

% |

5/25/19 |

Aaa |

9,384 |

|||||||||||||||||

|

643 |

Federal Home Loan Mortgage Corporation, Collateralized Mortgage Obligation, Pool FH 780184 |

2.377 |

% |

1/01/33 |

Aaa |

684,426 |

|||||||||||||||||

|

45 |

Federal Home Loan Mortgage Corporation, Collateralized Mortgage Obligation, Pool 780284 |

2.453 |

% |

2/01/33 |

Aaa |

45,050 |

|||||||||||||||||

|

— |

(10) |

Federal Home Loan Mortgage Corporation, Mortgage Pool 2640, (I/O) |

4.500 |

% |

8/15/17 |

Aaa |

— |

||||||||||||||||

|

124 |

Federal Home Loan Mortgage Corporation, Mortgage Pool 2890, Class KI, (I/O) |

4.500 |

% |

2/15/19 |

Aaa |

3,396 |

|||||||||||||||||

|

296 |

Federal Home Loan Mortgage Corporation, Mortgage Pool, FHR 2906 EI, (I/O) |

4.500 |

% |

1/15/19 |

Aaa |

10,438 |

|||||||||||||||||

|

121 |

Federal Home Loan Mortgage Corporation, Mortgage Pool, Series 2627 JI, (I/O) |

4.500 |

% |

5/15/18 |

Aaa |

8,062 |

|||||||||||||||||

|

45 |

Federal Home Loan Mortgage Corporation, Pool 789045 |

2.375 |

% |

2/01/32 |

Aaa |

46,613 |

|||||||||||||||||

|

12,219 |

Federal Home Loan Mortgage Corporation, REMIC, Series 3766, (I/O) |

3.500 |

% |

11/15/20 |

Aaa |

989,421 |

|||||||||||||||||

|

8,587 |

Federal Home Loan Mortgage Corporation, REMIC, Series 3879, (I/O) |

3.500 |

% |

3/15/26 |

Aaa |

768,018 |

|||||||||||||||||

|

1,363 |

Federal Home Loan Mortgage Corporation, REMIC, Series 3906, Class EI, (I/O) |

3.500 |

% |

5/15/26 |

Aaa |

153,733 |

|||||||||||||||||

|

2,776 |

Freddie Mac Multiclass Certificates, Series 3804, (I/O) |

3.500 |

% |

2/15/25 |

Aaa |

190,548 |

|||||||||||||||||

|

2,944 |

Freddie Mac Multiclass Certificates, Series 3855, (I/O) |

3.500 |

% |

1/15/25 |

Aaa |

175,109 |

|||||||||||||||||

|

1,040 |

GNMA Mortgage Pool G2 81832 |

2.000 |

% |

1/20/37 |

Aaa |

1,080,968 |

|||||||||||||||||

|

52,110 |

Total Residentials |

6,352,049 |

|||||||||||||||||||||

|

$ |

52,110 |

Total Mortgage-Backed Securities (cost $7,989,656) |

6,352,049 |

||||||||||||||||||||

|

Shares |

Description (1) |

Coupon |

Ratings (5) |

Value |

|||||||||||||||||||

|

Convertible Preferred Securities – 1.3% |

|||||||||||||||||||||||

|

Communications Equipment – 1.3% |

|||||||||||||||||||||||

|

4,800 |

Lucent Technologies Capital Trust I |

7.750 |

% |

CCC |

$ |

3,960,000 |

|||||||||||||||||

|

Total Convertible Preferred Securities (cost $2,911,198) |

3,960,000 |

||||||||||||||||||||||

|

Principal Amount (000) |

Description (1) |

Coupon |

Maturity |

Ratings (5) |

Value |

||||||||||||||||||

|

Convertible Bonds – 4.1% |

|||||||||||||||||||||||

|

Biotechnology – 1.0% |

|||||||||||||||||||||||

|

$ |

4,200 |

Dendreon Corporation, Convertible Bond |

2.875 |

% |

1/15/16 |

N/R |

$ |

3,171,000 |

|||||||||||||||

|

Communications Equipment – 2.1% |

|||||||||||||||||||||||

|

6,250 |

Lucent Technologies Inc., Series B |

2.750 |

% |

6/15/25 |

CCC+ |

6,273,437 |

|||||||||||||||||

|

Metals & Mining – 0.1% |

|||||||||||||||||||||||

|

192 |

First Uranium Corporation, Reg S, (4), (6) |

4.250 |

% |

10/29/49 |

N/R |

128,723 |

|||||||||||||||||

|

Oil, Gas & Consumable Fuels – 0.9% |

|||||||||||||||||||||||

|

1,400 |

Magnolia Finance, Convertible to MOL Hungarian Oil & Gas |

4.000 |

% |

12/31/49 |

B+ |

1,313,879 |

|||||||||||||||||

|

3,950 |

USEC Inc., Convertible Bond |

3.000 |

% |

10/01/14 |

Caa2 |

1,501,000 |

|||||||||||||||||

|

5,350 |

Total Oil, Gas & Consumable Fuels |

2,814,879 |

|||||||||||||||||||||

|

$ |

15,992 |

Total Convertible Bonds (cost $14,186,332) |

12,388,039 |

||||||||||||||||||||

Nuveen Investments

18

|

Principal Amount (000) |

Description (1) |

Coupon |

Maturity |

Ratings (5) |

Value |

||||||||||||||||||

|

Corporate Bonds – 7.0% |

|||||||||||||||||||||||

|

Commercial Banks – 0.5% |

|||||||||||||||||||||||

|

$ |

900 |

The State Export-Import Bank of the Ukraine, Loan Participations, Series 2010, Reg S |

8.375 |

% |

4/27/15 |

B |

$ |

893,250 |

|||||||||||||||

| 900 |

Ukraine Export-Import Bank Loan Participation with Credit Suisse International |

8.400 |

% |

2/09/16 |

Caa1 |

738,000 |

|||||||||||||||||

| 1,800 |

Total Commercial Banks |

1,631,250 |

|||||||||||||||||||||

|

Construction Materials – 1.1% |

|||||||||||||||||||||||

| 1,300 |

C10 Capital (SPV) Limited, 144A |

6.722 |

% |

N/A (7) |

B+ |

1,001,000 |

|||||||||||||||||

| 3,650 |

Cemex C5 Capitol (SPV) Limited, Series 2006, 144A |

0.349 |

% |

N/A (7) |

B+ |

2,281,250 |

|||||||||||||||||

| 4,950 |

Total Construction Materials |

3,282,250 |

|||||||||||||||||||||

|

Food Products – 0.6% |

|||||||||||||||||||||||

| 1,800 |

MHP S.A., 144A |

10.250 |

% |

4/29/15 |

B |

1,894,500 |

|||||||||||||||||

|

Metals & Mining – 1.2% |

|||||||||||||||||||||||

| 4,400 |

Banro Corporation, 144A |

10.000 |

% |

3/01/17 |

N/R |

3,652,000 |

|||||||||||||||||

|

Oil, Gas & Consumable Fuels – 1.9% |

|||||||||||||||||||||||

| 1,540 |

Arch Coal Inc. |

8.750 |

% |

8/01/16 |

B |

1,601,600 |

|||||||||||||||||

| 4,500 |

Petroleos de Venezuela S.A. |

5.000 |

% |

10/28/15 |

B+ |

4,128,750 |

|||||||||||||||||

| 6,040 |

Total Oil, Gas & Consumable Fuels |

5,730,350 |

|||||||||||||||||||||

|

Wireless Telecommunication Services – 1.7% |

|||||||||||||||||||||||

| 7,100 |

NII Capital Corporation |

7.625 |

% |

4/01/21 |

B2 |

5,378,250 |

|||||||||||||||||

|

$ |

26,090 |

Total Corporate Bonds (cost $21,501,988) |

21,568,600 |

||||||||||||||||||||

|

Principal Amount (000) |

Description (1) |

Coupon |

Maturity |

Ratings (5) |

Value |

||||||||||||||||||

|

Sovereign Debt – 0.7% |

|||||||||||||||||||||||

|

Argentina – 0.7% |

|||||||||||||||||||||||

|

$ |

3,000 |

Province of Buenos Aires, 144A |

10.875 |

% |

1/26/21 |

B- |

$ |

2,220,000 |

|||||||||||||||

|

Total Sovereign Debt (cost $2,881,370) |

2,220,000 |

||||||||||||||||||||||

| Shares |

Description (1) |

Value |

|||||||||||||||||||||

|

Warrants – 0.0% |

|||||||||||||||||||||||

|

Metals & Mining – 0.0% |

|||||||||||||||||||||||

| 89,280 |

Banro Corporation, 144A, (3) |

$ |

25,891 |

||||||||||||||||||||

|

Total Warrants (cost $–) |

25,891 |

||||||||||||||||||||||

|

Principal Amount (000) |

Description (1) |

Coupon |

Maturity |

Value |

|||||||||||||||||||

|

Short-Term Investments – 1.9% |

|||||||||||||||||||||||

|

$ |

5,917 |

Repurchase Agreement with State Street Bank, dated 12/31/12, repurchase price $5,916,667, collateralized by $5,790,000 U.S. Treasury Notes, 1.500%, due 7/31/16, value $6,038,709 |

0.010 |

% |

1/02/13 |

$ |

5,916,664 |

||||||||||||||||

|

Total Short-Term Investments (cost $5,916,664) |

5,916,664 |

||||||||||||||||||||||

|

Total Investments (cost $348,338,223) – 100.5% |

307,996,154 |

||||||||||||||||||||||

Nuveen Investments

19

JGV

Nuveen Global Value Opportunities Fund (continued)

Portfolio of Investments December 31, 2012

| Shares |

Description (1) |

Value |

|||||||||

|

Common Stocks Sold Short – (3.6)% |

|||||||||||

|

Chemicals – (0.6)% |

|||||||||||

| (24,500 |

) |

Sigma-Aldrich Corporation |

$ |

(1,802,710 |

) |

||||||

|

Hotels, Restaurants & Leisure – (2.1)% |

|||||||||||

| (4,400 |

) |

Chipotle Mexican Grill, Inc. |

(1,308,824 |

) |

|||||||

| (20,700 |

) |

Panera Bread Company, Class A, (2) |

(3,287,781 |

) |

|||||||

| (36,500 |

) |

Starbucks Corporation |

(1,957,130 |

) |

|||||||

|

Total Hotels, Restaurants & Leisure |

(6,553,735 |

) |

|||||||||

|

Software – (0.5)% |

|||||||||||

| (8,300 |

) |

Salesforce.com, Inc., (2) |

(1,395,230 |

) |

|||||||

|

Textiles, Apparel & Luxury Goods – (0.4)% |

|||||||||||

| (16,500 |

) |

Lululemon Athletica Inc. |

(1,257,795 |

) |

|||||||

|

Total Common Stocks Sold Short (proceeds $6,784,423) |

(11,009,470 |

) |

|||||||||

|

Other Assets Less Liabilities – 3.1% (8) |

9,604,763 |

||||||||||

|

Net Assets – 100% |

$ |

306,591,447 |

|||||||||

Investments in Derivatives as of December 31, 2012

Call Options Written outstanding:

|

Number of Contracts |

Type |

Notional Amount (9) |

Expiration Date |

Strike Price |

Value (8) |

||||||||||||||||||

|

Call Options Written – (0.8)% |

|||||||||||||||||||||||

| (1,700 |

) |

Allscripts Healthcare Solutions Inc. |

$ |

(1,700,000 |

) |

6/22/13 |

$ |

10.0 |

$ |

(165,750 |

) |

||||||||||||

| (700 |

) |

American International Group |

(2,450,000 |

) |

1/19/13 |

35.0 |

(77,000 |

) |

|||||||||||||||

| (223 |

) |

American International Group |

(825,100 |

) |

5/18/13 |

37.0 |

(48,726 |

) |

|||||||||||||||

| (2,385 |

) |

Arch Coal Inc. |

(2,146,500 |

) |

1/19/13 |

9.0 |

(8,348 |

) |

|||||||||||||||

| (615 |

) |

Best Buy Co., Inc. |

(1,168,500 |

) |

1/19/13 |

19.0 |

(922 |

) |

|||||||||||||||

| (615 |

) |

Best Buy Co., Inc. |

(1,230,000 |

) |

1/19/13 |

20.0 |

(307 |

) |

|||||||||||||||

| (1,600 |

) |

Chesapeake Energy Corporation |

(3,520,000 |

) |

1/19/13 |

22.0 |

(2,400 |

) |

|||||||||||||||

| (680 |

) |

Health Net Inc. |

(1,700,000 |

) |

4/20/13 |

25.0 |

(142,800 |

) |

|||||||||||||||

| (740 |

) |

Hess Corporation |

(3,885,000 |

) |

5/18/13 |

52.5 |

(344,100 |

) |

|||||||||||||||

| (3,230 |

) |

Kinross Gold Corporation |

(3,553,000 |

) |

5/18/13 |

11.0 |

(161,500 |

) |

|||||||||||||||

| (500 |

) |

Newmont Mining Corporation |

(2,875,000 |

) |

1/19/13 |

57.5 |

(1,500 |

) |

|||||||||||||||

| (6,525 |

) |

Nokia Corporation, ADR |

(1,957,500 |

) |

4/20/13 |

3.0 |

(714,488 |

) |

|||||||||||||||

| (525 |

) |

Peabody Energy Corporation |

(1,522,500 |

) |

1/19/13 |

29.0 |

(13,650 |

) |

|||||||||||||||

| (950 |

) |

Smithfield Foods, Inc. |

(1,900,000 |

) |

1/19/13 |

20.0 |

(168,625 |

) |

|||||||||||||||

| (950 |

) |

Smithfield Foods, Inc. |

(2,137,500 |

) |

1/19/13 |

22.5 |

(21,375 |

) |

|||||||||||||||

| (1,910 |

) |

Tyson Foods, Inc., Class A |

(3,438,000 |

) |

4/20/13 |

18.0 |

(382,000 |

) |

|||||||||||||||

| (1,540 |

) |

Weatherford International Ltd. |

(1,848,000 |

) |

1/19/14 |

12.0 |

(254,100 |

) |

|||||||||||||||

| (25,388 |

) |

Total Call Options Written (premiums received $3,123,363) |

$ |

(37,856,600 |

) |

$ |

(2,507,591 |

) |

|||||||||||||||

Nuveen Investments

20

For Fund portfolio compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

(1) All percentages in the Portfolio of Investments are based on net assets.

(2) Non-income producing; issuer has not declared a dividend within the past twelve months.

(3) For fair value measurement disclosure purposes, Common Stock and Warrant classified as Level 2. See Notes to Financial Statements, Footnote 1—General Information and Significant Accounting Policies, Investment Valuation for more information.

(4) Investment valued at fair value using methods determined in good faith by, or at the discretion of, the Board of Trustees. For fair value disclosure purposes, investment classified as Level 3. See Notes to Financial Statements, Footnote 1—General Information and Significant Accounting Policies, Investment Valuation for more information.

(5) Ratings (not covered by the report of independent registered public accounting firm): Using the highest of Standard & Poor's Group ("Standard & Poor's"), Moody's Investors Service, Inc. ("Moody's") or Fitch, Inc. ("Fitch") rating. Ratings below BBB by Standard & Poor's, Baa by Moody's or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies.

(6) At or subsequent to the end of the reporting period, this security is non-income producing. Non-income producing security, in the case of a bond, generally denotes that the issuer has (1) defaulted on the payment of principal or interest, (2) is under the protection of the Federal Bankruptcy Court or (3) the Fund's Adviser has concluded that the issue is not likely to meet its future interest payment obligations and has directed the Fund's custodian to cease accruing additional income on the Fund's records.

(7) Perpetual security. Maturity date is not applicable.

(8) Other Assets Less Liabilities includes the Value of derivative instruments as listed within Investments in Derivatives as of the end of the reporting period.

(9) For disclosure purposes, Notional Amount is calculated by multiplying the Number of Contracts by the Strike Price by 100.

(10) Principal Amount (000) rounds to less than $1,000.

144A Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers.

WI/DD Investment, or portion of investment, purchased on a when-issued or delayed delivery basis.

Reg S Regulation S allows U.S. companies to sell securities to persons or entities located outside of the United States without registering those securities with the Securities and Exchange Commission. Specifically, Regulation S provides a safe harbor from the registration requirements of the Securities Act for the offers and sales of securities by both foreign and domestic issuers that are made outside the United States.

ADR American Depositary Receipt.

BDR Brazilian Depositary Receipt.

GDR Global Depositary Receipt.

SPV Special Purpose Vehicle

I/O Interest only security.

N/A Not applicable.

N/R Not rated.

See accompanying notes to financial statements.

Nuveen Investments

21

Statement of

ASSETS & LIABILITIES

December 31, 2012

|

Assets |

|||||||

|

Investments, at value (cost $348,338,223) |

$ |

307,996,154 |

|||||

|

Cash |

86,946 |

||||||

|

Cash denominated in foreign currencies (cost $1,043,934) |

1,043,934 |

||||||

|

Deposits with brokers |

11,785,263 |

||||||

|

Receivables: |

|||||||

|

Dividends |

91,213 |

||||||

|

Interest |

842,560 |

||||||

|

Investments sold |

91,156 |

||||||

|

Paydowns |

2,649 |

||||||

|

Reclaims |

35,783 |

||||||

|

Other assets |

21,924 |

||||||

|

Total assets |

321,997,582 |

||||||

|

Liabilities |

|||||||

|

Securities sold short, at value (proceeds $6,784,423) |

11,009,470 |

||||||

|

Call options written, at value (premiums received $3,123,363) |

2,507,591 |

||||||

|

Payable for investments purchased |

1,466,513 |

||||||

|

Accrued expenses: |

|||||||

|

Management fees |

247,483 |

||||||

|

Trustees fees |

21,630 |

||||||

|

Other |

153,448 |

||||||

|

Total liabilities |

15,406,135 |

||||||

|

Net assets |

$ |

306,591,447 |

|||||

|

Shares outstanding |

19,210,609 |

||||||

|

Net asset value per share outstanding |

$ |

15.96 |

|||||

|

Net assets consist of: |

|||||||

|

Shares, $.01 par value per share |

$ |

192,106 |

|||||

|

Paid-in surplus |

352,494,757 |

||||||

|

Undistributed (Over-distribution of) net investment income |

(1,766,575 |

) |

|||||

|

Accumulated net realized gain (loss) |

(377,819 |

) |

|||||

|

Net unrealized appreciation (depreciation) |

(43,951,022 |

) |

|||||

|

Net assets |

$ |

306,591,447 |

|||||

|

Authorized shares |

Unlimited |

||||||

See accompanying notes to financial statements.

Nuveen Investments

22

Statement of

OPERATIONS

Year Ended December 31, 2012

|

Investment Income |

|||||||

|

Dividends (net of foreign tax withheld of $745,511) |

$ |

7,279,065 |

|||||

|

Interest |

4,624,193 |

||||||

|

Total investment income |

11,903,258 |

||||||

|

Expenses |

|||||||

|

Management fees |

3,040,374 |

||||||

|

Dividends on securities sold short |

73,211 |

||||||

|

Shareholder servicing agent fees and expenses |

835 |

||||||

|

Custodian fees and expenses |

267,506 |

||||||

|

Trustees fees and expenses |

8,676 |

||||||

|

Professional fees |

62,603 |

||||||

|

Shareholder reporting expenses |

121,689 |

||||||

|

Stock exchange listing fees |

8,453 |

||||||

|

Investor relations expense |

111,776 |

||||||

|

Other expenses |

44,124 |

||||||

|

Total expenses |

3,739,247 |

||||||

|

Net investment income (loss) |

8,164,011 |

||||||

|

Realized and Unrealized Gain (Loss) |

|||||||

|

Net realized gain (loss) from: |

|||||||

|

Investments and foreign currency |

3,184,706 |

||||||

|

Call options written |

8,688,621 |

||||||

|

Put options purchased |

(150,006 |

) |

|||||

|

Securities sold short |

(2,876,552 |

) |

|||||

|

Change in net unrealized appreciation (depreciation) of: |

|||||||

|

Investments and foreign currency |

(9,617,925 |

) |

|||||

|

Call options written |

(1,946,915 |

) |

|||||

|

Put options purchased |

149,336 |

||||||

|

Securities sold short |

568,589 |

||||||

|

Net realized and unrealized gain (loss) |

(2,000,146 |

) |

|||||

|

Net increase (decrease) in net assets from operations |

$ |

6,163,865 |

|||||

See accompanying notes to financial statements.

Nuveen Investments

23

Statement of

CHANGES in NET ASSETS

|

Year Ended 12/31/12 |

Year Ended 12/31/11 |

||||||||||

|

Operations |

|||||||||||

|

Net investment income (loss) |

$ |

8,164,011 |

$ |

8,848,109 |

|||||||

|

Net realized gain (loss) from: |

|||||||||||

|

Investments and foreign currency |

3,184,706 |

8,532,867 |

|||||||||

|

Call options written |