Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 | |

Mavenir Systems, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per share price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

April 29, 2014

Dear Mavenir Stockholder:

You are cordially invited to attend the 2014 Annual Meeting of Mavenir Systems, Inc. to be held on June 18, 2014, beginning at 9:00 a.m. local time at the Hyatt Regency North Dallas, 701 East Campbell Road, Richardson, Texas 75081.

We take advantage of Securities and Exchange Commission rules that allows companies to furnish proxy materials primarily over the internet. On April 29, 2014, we mailed to our stockholders a Notice Regarding the Availability of Proxy Materials that includes instructions on how to access our proxy materials, including our proxy statement and 2013 Annual Report, over the internet. The notice also provides instructions on how to obtain paper copies of our proxy materials and how to vote online or by telephone. If you receive annual meeting materials by mail, the Notice of Annual Meeting of Stockholders, proxy statement, proxy card and 2013 Annual Report will be enclosed.

At the Annual Meeting, you will be asked to consider and vote on:

| (1) | the election of two Class I directors to serve until the 2017 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| (2) | the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| (3) | the transaction of any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors unanimously recommends that you (i) approve the election of the individuals nominated to serve as Class I directors and (ii) ratify the appointment of BDO USA, LLP as our independent registered public accounting firm.

Your vote is important to us and our business. We hope you will find it convenient to attend the Annual Meeting in person. Even if you plan to attend the meeting, you are requested to sign, date and return your proxy card in the envelope provided, if you received printed materials by mail, or to vote by internet or telephone pursuant to the instructions set forth in the notice you received by mail. If you attend the meeting after having returned a proxy card or having voted by internet or telephone, you may revoke your proxy, if you wish, and vote in person. A proxy may also be revoked at any time before it is voted by (i) returning a properly completed proxy card with a later date, (ii) granting a subsequent proxy by internet or telephone or (iii) giving written notice to, or filing a duly exercised proxy bearing a later date with, our General Counsel and Secretary. If you would like to attend and your stock is not registered in your own name, please ask the broker, trust, bank or other nominee that holds the stock to provide you with evidence of your stock ownership.

We appreciate your continued support of Mavenir and look forward to either greeting you personally at the meeting or receiving your proxy.

| Sincerely, |

|

|

| Pardeep Kohli |

| President and Chief Executive Officer |

| Mavenir Systems, Inc. |

Table of Contents

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of the Stockholders of Mavenir Systems, Inc. will be held on June 18, 2014, at 9:00 a.m. local time at the Hyatt Regency North Dallas, 701 East Campbell Road, Richardson, Texas 75081, for the following purposes:

| (1) | the election of two Class I directors to serve until the 2017 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| (2) | the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| (3) | the transaction of any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on April 22, 2014, are entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof. A list of such stockholders will be available for examination, during regular business hours, by any stockholder for at least ten days prior to the Annual Meeting, at our offices at 1700 International Parkway, Suite 200, Richardson, TX 75081. Stockholders holding at least a majority of the outstanding shares of our common stock are required to be present or represented by proxy at the Annual Meeting to constitute a quorum.

YOUR VOTE IS IMPORTANT

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, you are requested to read the accompanying proxy statement and to vote by mail by marking, signing, dating and returning the accompanying proxy card as soon as possible or by voting over the internet or by telephone pursuant to the instructions in the Notice of Internet Availability that was mailed to you. Your broker cannot vote your shares on your behalf with respect to the election of directors until it receives your voting instructions. If you do not provide voting instructions over the internet, by telephone, or by returning a proxy card or voter instruction form, your shares will not be voted with respect to the election of directors, but your shares that are held by a broker may be voted on your behalf with respect to the ratification of BDO USA, LLP without instruction.

If you do attend the meeting and prefer to vote in person, you may do so.

| By Order of the Board of Directors, |

|

|

| Sam Garrett |

| General Counsel and Secretary |

| Mavenir Systems, Inc. |

Richardson, Texas

April 29, 2014

The proxy statement and Annual Report to Stockholders are available at http://investor.mavenir.com or http://www.proxydocs.com/MVNR

Table of Contents

Proxy Statement for the

Annual Meeting of Stockholders of

MAVENIR SYSTEMS, INC.

To Be Held on June 18, 2014

| 1 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| INFORMATION ABOUT OUR BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

13 | |||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| PROPOSAL 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

21 | |||

| Fees Paid to Our Independent Registered Public Accounting Firm |

21 | |||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 29 | ||||

| 32 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 |

i

Table of Contents

| 45 | ||||

| 45 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

47 | |||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 55 |

ii

Table of Contents

PROXY STATEMENT

FOR THE 2014 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 18, 2014

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

This proxy statement and the enclosed form of proxy are furnished in connection with solicitation of proxies by our Board of Directors for use at the Annual Meeting of Stockholders to be held on June 18, 2014, and any adjournments or postponements thereof. The Annual Meeting will be held at the Hyatt Regency North Dallas, 701 East Campbell Road, Richardson, Texas 75081 on June 18, 2014 at 9:00 a.m., Central time.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You are encouraged to read this entire proxy statement carefully before deciding how to vote.

Unless otherwise indicated, the terms “company,” “Mavenir”, “Mavenir Systems”, “we,” “our,” and “us” are used in this proxy statement to refer to Mavenir Systems, Inc. together with its subsidiaries. The terms “Board” and “Board of Directors” refer to our Board of Directors.

Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

We take advantage of SEC rules permitting us to furnish our proxy materials to our stockholders primarily over the internet instead of mailing printed copies of our proxy materials. On April 29, 2014, we mailed to our stockholders a Notice Regarding the Availability of Proxy Materials directing our stockholders to a website where they can access our proxy materials. Any stockholder preferring to receive a paper copy of our proxy materials can follow the instructions included in the notice to request one.

We sent you the notice because the Board is soliciting your proxy to vote at the 2014 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instructions on how to vote your shares by mail, by telephone or over the internet can be found below.

If you are reviewing a printed copy of our proxy materials, you may view and also download our proxy materials, including our 2013 Annual Report to Stockholders, at http://investor.mavenir.com or http://www.proxydocs.com/MVNR.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 22, 2014, which is the date our Board of Directors has set as the record date for voting, will be entitled to vote at the Annual Meeting. On this record date, there were 24,028,688 shares of common stock outstanding and entitled to vote. Stockholders are not permitted to cumulate their votes in the election of directors.

1

Table of Contents

Stockholder of Record: Shares Registered in Your Name

If on April 22, 2014, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted if you later decide not to attend the meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank (“Street Name”)

If on April 22, 2014, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization rather than in your name, then you are the beneficial owner of shares held in “street name” and our proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of the proxy materials by mail, your broker or nominee should provide a voting instruction card for you to use.

What am I being asked to vote on?

There are two matters scheduled to be considered and voted on at the Annual Meeting:

| • | Election of Mr. Jeffrey P. McCarthy and Mr. Vivek Mehra, the two Class I directors nominated by the Board, to serve until the 2017 Annual Meeting of Stockholders; and |

| • | Ratification of the appointment by the audit committee of our Board of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. |

How does the Board recommend that I vote?

The Board of Directors unanimously recommends that all stockholders vote

| • | “FOR” the election of Messrs. McCarthy and Mehra as Class I members of the Board of Directors; and |

| • | “FOR” the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. |

What if another matter is properly brought before the meeting?

We will also consider other business that properly comes before the meeting in accordance with Delaware law and our bylaws. As of the record date, our Board knows of no other matters that will be presented for consideration at the 2014 Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “FOR” all the nominees to serve as Class I members the Board of Directors or you may “WITHHOLD” your vote for any nominee you specify. You may vote “FOR” the ratification of the appointment by the audit committee of our Board of BDO USA, LLP as Mavenir’s independent registered public accounting firm for its fiscal year ending December 31, 2014, or you may vote “AGAINST” or select “ABSTAIN” from voting.

2

Table of Contents

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, over the internet, by telephone or by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted in accordance with your wishes if you later decide not to attend the meeting. You may still attend the meeting and vote in person even if you have already voted by proxy.

| • | To vote in person, come to the Annual Meeting and you will receive a ballot when you arrive. |

| • | If you received printed proxy materials, you may submit your proxy by completing, signing and dating the proxy card and returning it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

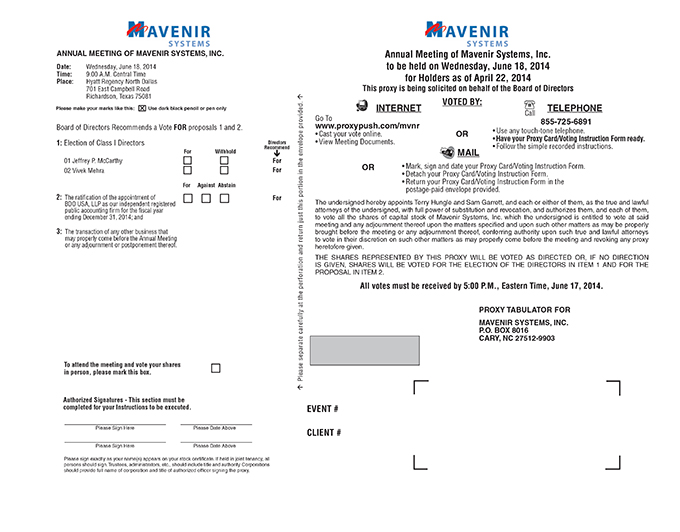

| • | To submit your proxy by telephone, dial toll-free 855-725-6891 using a touch-tone phone, with your proxy card ready, and follow the recorded instructions. |

| • | To submit your proxy over the internet, go to http://www.proxypush.com/MVNR to view proxy materials online and complete an electronic proxy card. |

If you do not attend the Annual Meeting and instead vote by returning your proxy card, by telephone or by internet using the instructions above, your vote must be received by 4:00 p.m., Central time on June 17, 2014 to be counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank (“Street Name”)

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in those materials to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

What do I need to do to attend the Annual Meeting?

If you are a registered stockholder or a “street name” stockholder as of April 22, 2014 (the record date), you are invited to attend the Annual Meeting.

In order to enter the Annual Meeting, you must present a form of photo identification acceptable to us, such as a valid driver’s license or passport. As noted above, since a “street name” stockholder is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker, bank’s or agent’s procedures for obtaining a legal proxy.

How many votes do I have?

On each matter to be voted upon, each stockholder will have one vote for each share of common stock owned by that stockholder as of April 22, 2014, which is the record date for the 2014 Annual Meeting of Stockholders.

3

Table of Contents

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, over the internet or in person at the Annual Meeting, your shares will not be voted, and your shares will not be counted as “present” for purposes of determining whether a quorum is present at the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank (“Street Name”)

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (NYSE) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested) and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposal 1 without your instructions, and these “broker non-votes” will not count toward the vote totals for these proposals and will not count for or against these proposals. Your broker or nominee may vote your shares on Proposal 2, as the ratification of our independent registered public accounting firm is considered a “routine” matter under NYSE rules.

What if I sign and return a proxy card or otherwise vote but do not make specific choices?

Messrs. Terry Hungle and Sam Garrett are officers of the company and were named by our Board of Directors as proxy holders. If you return a signed and dated proxy card or otherwise vote without marking voting selections, Mr. Hungle and Mr. Garrett will vote your shares, as applicable, “FOR” the election of the nominees to serve as Class I members of the Board, and “FOR” the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. If any other matter is properly presented at the meeting, these proxy holders will vote your shares using their best judgment. Our bylaws set forth requirements for advance notice of nominations and agenda items for the Annual Meeting, and we have not received timely notice of any such matters that may be properly presented for voting at the Annual Meeting, other than the items from the Board of Directors described in this proxy statement.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies, although we expect to reimburse them for their reasonable out-of-pocket expenses. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or through the internet. |

4

Table of Contents

| • | You may send a timely written notice that you are revoking your proxy to Mavenir’s General Counsel and Secretary at 1700 International Parkway, Suite 200, Richardson, Texas 75081, Attention: Sam Garrett, General Counsel and Secretary. |

| • | You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank (“Street Name”)

If your shares are held by broker, bank or nominee, you should follow the instructions provided by your broker, bank or nominee.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for Proposal 1, to elect Class I directors, votes “FOR,” “WITHHOLD” and broker non-votes; and, with respect to Proposal 2, the proposal to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for fiscal 2014, votes “FOR” and “AGAINST” as well as abstentions. Broker non-votes have no effect and will not be counted towards the vote total for Proposal 1 or Proposal 2. There is not a choice to abstain on Proposal 1 — the choices are to vote “FOR” the Class I director nominees or “WITHHOLD” your vote — and abstentions will have no effect on Proposal 2.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote. Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals and elections of directors (even if not contested). Proposal 1 is a “non-routine” matter and Proposal 2 is a “routine” matter.

How many votes are needed to approve each proposal?

| • | For Proposal 1, the election of directors, the two nominees to serve until the 2017 Annual Meeting of Stockholders receiving the most “FOR” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “FOR” or “WITHHELD” will affect the outcome. Broker non-votes will have no effect. |

| • | To be approved, Proposal 2, ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014, must receive “FOR” votes from a majority of the votes cast by the holders of shares represented in person or by proxy at the meeting and entitled to vote thereon to be approved. Abstentions and broker non-votes will have no effect; however, Proposal 2 is considered a routine matter, and therefore no broker non-votes are expected to exist in connection with Proposal 2. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares of our common stock entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 24,028,688 shares of common stock outstanding and entitled to vote.

5

Table of Contents

Abstentions, withheld votes and broker non-votes are counted for determining whether a quorum is present. If there is no quorum, the chairperson or the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

When are stockholder proposals and director nominations due for next year’s annual meeting?

Please refer to “Other Matters — Stockholder Proposals and Director Nominations.”

What does it mean if I receive more than one notice or more than one set of proxy materials?

If you receive more than one copy of the notice or more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. You should vote separately for each set of shares to ensure that all of your shares are voted.

You may consider registering all of your brokerage accounts in the same name and address. If you wish to do so, you should contact your broker, bank or nominee for more information. Additionally, our transfer agent, American Stock Transfer & Trust Company, LLC, can assist you if you want to consolidate multiple accounts registered in your name by contacting our transfer agent at 6201 15th Avenue, Brooklyn, New York 11219, Telephone: (800) 937-5449.

I share an address with another stockholder, and we received only one set of proxy materials. How may I obtain an additional set of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we are permitted to deliver a single copy of the proxy materials and 2013 Annual Report to multiple stockholders who share the same address and do not participate in electronic delivery of proxy materials unless we receive contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the proxy materials and 2013 Annual Report to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of the proxy materials and annual reports in the future, stockholders may contact us as follows:

Mavenir Systems, Inc.

Attention: Investor Relations

1700 International Parkway

Suite 200

Richardson, TX 75081

Stockholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding, and can also access a printable copy via our website at http://investor.mavenir.com or http://www.proxydocs.com/MVNR.

6

Table of Contents

Whom should I contact if I have additional questions or would like additional copies of the proxy materials?

If you would like additional copies of this proxy statement (which copies will be provided to you without charge) or if you have questions, including the procedures for voting your shares, you should contact:

Mavenir Systems, Inc.

Attention: Investor Relations

1700 International Parkway

Suite 200

Richardson, TX 75081

You can also access a printable copy via our website at http://investor.mavenir.com or http://www.proxydocs.com/MVNR, and can request a printed copy by following the instructions on the notice that was mailed to you.

7

Table of Contents

ELECTION OF DIRECTORS

Composition of Our Board of Directors

Our Board of Directors currently consists of seven members. In accordance with our amended and restated certificate of incorporation and our amended and restated bylaws, our Board of Directors is divided into three classes, Class I, Class II, and Class III, with each class containing, as nearly as possible, one-third of the total number of directors and serving staggered three-year terms. Directors in a particular class are elected for three-year terms at the annual meeting of stockholders in the year in which their terms expire, and the other classes continue for the remainder of their respective three-year terms. The classification of our Board of Directors may have the effect of delaying or preventing changes in our management or a change in control of our company.

The authorized number of directors may be changed only by our Board of Directors. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. Any director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, is elected to serve for the remainder of the full term of that class or until the director’s successor is duly elected and qualified. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Our directors may be removed only for cause by the affirmative vote of the holders of two thirds of our outstanding voting stock.

The following table sets forth the names and certain other information for each of the nominees for election as a director and for each of the continuing members of the Board of Directors as of the date of this proxy statement. Key biographical information for each of these individuals is set forth below the following table.

8

Table of Contents

| Class | Age | Position |

Director Since |

Current Term Expires |

Expiration of Term for which Nominated |

|||||||||||||||

| Nominees |

||||||||||||||||||||

| Jeffrey P. McCarthy(1) |

I | 59 | Director | 2006 | 2014 | 2017 | ||||||||||||||

| Vivek Mehra(1) |

I | 50 | Director | 2011 | 2014 | 2017 | ||||||||||||||

| Continuing Directors |

||||||||||||||||||||

| Ammar H. Hanafi(2)(3) |

II | 47 | Director | 2007 | 2015 | — | ||||||||||||||

| Venu Shamapant(2) |

II | 47 | Director | 2006 | 2015 | — | ||||||||||||||

| Hubert de Pesquidoux(1)(3) |

III | 48 | Director | 2012 | 2016 | — | ||||||||||||||

| Pardeep Kohli |

III | 48 | President, Chief Executive Officer and Director | 2006 | 2016 | — | ||||||||||||||

| Benjamin L. Scott(2)(3) |

III | 64 | Chairman of the Board of Directors | 2006 | 2016 | — | ||||||||||||||

| (1) | Member of our audit committee |

| (2) | Member of our compensation committee |

| (3) | Member of our nominating and corporate governance committee |

Jeffrey P. McCarthy has been a member of our Board since April 2006. Since December 1998, Mr. McCarthy has served as a General Partner of North Bridge Venture Partners, a venture capital firm. Prior to joining North Bridge Venture Partners, Mr. McCarthy was Chief Executive Officer of New Oak Communications, a privately-held leading provider of virtual private network (VPN) switches that was acquired by Bay Networks. He previously held senior management positions at Cadia Networks, a developer of ATM concentrator products for the service provider marketplace, and Wellfleet Communications, an internet router company. Mr. McCarthy also served on the board of A123 Systems (AONE), a publicly-traded developer and manufacturer of lithium ion phosphate batteries and systems, from December 2001 until October 2012 and he serves on the boards of directors of several private companies. Mr. McCarthy holds a B.S. in Business Administration from Northeastern University and an M.B.A. from Bentley University.

We believe that Mr. McCarthy is qualified to serve on our Board of Directors because of his extensive management experience in the communications technology industry as well as his substantial experience as a venture capitalist and as a director of a number of public and privately-held technology companies.

Vivek Mehra has served on our Board of Directors since May 2011. Since February 2003, Mr. Mehra has been a partner with August Capital, a venture capital firm. Prior to joining August Capital, Mr. Mehra co-founded Cobalt Networks, a provider of server appliances, in 1996, where he served as Chief Technology Officer and Vice President, Products. Cobalt Networks completed its initial public offering in November 1999 and was subsequently sold to Sun Microsystems, Inc., a computer products and software company, in December 2000. Mr. Mehra continued to serve with Sun Microsystems after the acquisition as Chief Technology Officer and General Manager of Sun’s Cobalt Business Unit until August 2002. Mr. Mehra serves and has served on the boards and board committees of a number of private companies. Mr. Mehra earned a B.S. in Electronics from Punjab University in India and an M.S. in Computer Engineering from Iowa State University.

We believe Mr. Mehra is qualified to serve on our Board of Directors because of his professional experience in building and scaling startups, including founding and taking a company public, as well as his substantial experience as a venture capitalist and as a director of a number of privately-held information technology companies.

9

Table of Contents

Pardeep Kohli has been our President and Chief Executive Officer and a member of our Board of Directors since joining us in July 2006. Mr. Kohli brings to Mavenir over 20 years of experience in the wireless industry. Prior to joining Mavenir, Mr. Kohli served as co-founder, President and Chief Executive Officer of Spatial Communications Technologies, Inc. (known as Spatial Wireless), a privately owned developer of software-based mobile switching solutions, from January 2001 until Spatial Wireless was acquired by Alcatel (now Alcatel-Lucent) in December 2004. Following the acquisition of Spatial Wireless by Alcatel, Mr. Kohli led the continued expansion and success of the Spatial Wireless product as Senior Vice President of Alcatel’s Mobile Next Generation Network (NGN) business until June 2006. Mr. Kohli began his career at Siemens India and has served in various roles at NEC Corporation of America, a provider of network and communications products and solutions, DSC Corporation, a manufacturer of telecom products, Pacific Bell Mobile Services and Alcatel USA. Mr. Kohli holds a Bachelor’s degree in Electronics and Electrical Communications and a Master’s degree in Computer Science.

Mr. Kohli was selected to serve as a member of our Board of Directors because of his extensive professional experience in the wireless communications industry and his substantial experience founding and leading the growth of wireless businesses, including in particular his accomplishments and leadership as our President and Chief Executive Officer since 2006.

Ammar H. Hanafi has been a member of our Board since February 2007 and has been a General Partner of Alloy Ventures, a venture capital firm where he has focused on investments in cloud computing infrastructure and services, since February 2005. Mr. Hanafi joined Alloy Ventures from Cisco Systems, Inc., a multinational manufacturer of networking equipment, where he had been Vice President of New Business Ventures leading new product efforts in the enterprise data market since October 2002. Mr. Hanafi joined Cisco Systems in 1997 as a member of the Corporate Business Development Group and from 2000 to 2002, he was Vice President of Corporate Business Development at Cisco Systems, where he was responsible for Cisco’s acquisitions, acquisition integration, investment and joint venture activity on a global basis. Prior to Cisco, Mr. Hanafi held positions at PanAmSat Corporation, a global satellite services provider, and the investment banking firms of Morgan Stanley and Donaldson, Lufkin & Jenrette. Mr. Hanafi serves on the board of directors of the San Jose Education Foundation and on the boards of several privately held companies in the internet media and network resources businesses. Mr. Hanafi holds a B.S. in Applied and Engineering Physics from Cornell University and an M.B.A. from Stanford University.

Mr. Hanafi was selected to serve on our Board of Directors because of his professional and business development experience in the communications industry, as well as his substantial experience as a venture capitalist and as a director of a number of privately-held information technology companies.

Hubert de Pesquidoux has served on our Board of Directors since January 2012. Most recently, Mr. de Pesquidoux served as Executive Partner at Siris Capital, a U.S.-based private equity firm. Mr. de Pesquidoux was Chief Financial Officer of Alcatel-Lucent from November 2007 to December 2008 and the President and Chief Executive Officer of the Enterprise Business Group of Alcatel-Lucent from November 2006 to December 2008. In his nearly 20-year career at Alcatel-Lucent (and its predecessor, Alcatel), Mr. de Pesquidoux’s executive positions included President and Chief Executive Officer of Alcatel North America (from June 2003 to November 2006); Chief Operating Officer of Alcatel USA; President and Chief Executive Officer of Alcatel Canada; Chief Financial Officer of Alcatel USA and Treasurer of Alcatel Alsthom. He joined Alcatel in 1991 after several years in the banking industry. Mr. de Pesquidoux has served as a member of the board of directors and chairman of the audit committee of Sequans Communications, a French telecommunications chip equipment maker traded on the NYSE, since March 2011, as director and member of the audit committee of Radisys Corporation, a publicly-traded provider of embedded wireless infrastructure solutions, since April 2012 and as a director and chairman of the audit committee of Criteo S.A., a publicly-traded online advertising solutions company, since October 2012. Mr. de Pesquidoux also previously served as Chairman of the Board and a member of the audit committee at Tekelec, a publicly-traded provider of multimedia and mobile traffic solutions that was taken private in January 2012, and serves or has served on the boards of a number of private companies. Mr. de Pesquidoux holds a master’s degree in law from Nancy Law University, an MBA from the Institute for Political Studies (Sciences Po) in Paris and a DESS in International Affairs from Paris Dauphine University.

10

Table of Contents

Mr. de Pesquidoux was selected to serve as a member of our Board of Directors because of his extensive financial and operational experience in our industry and his experience on the boards of directors and audit committees of multiple public companies.

Benjamin L. Scott has served as a member of our Board since August 2006 and as Chairman of the Board since October 2007. During 2009, Mr. Scott co-founded LiveOak Venture Partners, a venture capital firm where he is a General Partner. Prior to this, Mr. Scott served as a Venture Partner with Austin Ventures, a venture capital firm, from May 2002 until June 2009. From January 2000 to May 2002, Mr. Scott served as a Partner with Quadrant Management, a venture capital firm. From October 1997 to November 1999, Mr. Scott served as the Chairman and Chief Executive Officer of IXC Communications, a public provider of data and voice communications services that is now known as Broadwing Communications. In the past, Mr. Scott has served as a senior executive with AT&T, PrimeCo and Bell Atlantic. Mr. Scott also served on the board of Active Power, Inc., a publicly-traded designer and manufacturer of continuous power and infrastructure solutions from March 2002 until May 2013, including service as Chairman of the Board from February 2007 and service as chairman of the compensation committee and member of the nominating and corporate governance committee. He also serves on the boards of directors of several private companies. He holds a B.S. in Psychology from Virginia Polytechnic Institute and State University.

Mr. Scott was chosen to serve on our Board of Directors because of his extensive general management experience with large and with rapidly growing technology companies, including his past service as Chairman of mobile solutions providers Spatial Wireless and Navini Networks, as well as more than 10 years of experience in the venture capital industry, where he provides strategic and financial guidance to technology companies.

Venu Shamapant has been a member of our Board since April 2006, and is a General Partner with LiveOak Venture Partners. Prior to co-founding LiveOak Venture Partners, Mr. Shamapant had been a General Partner with Austin Ventures since 2005, having joined Austin Ventures in 1999. He has previously worked with and served on the boards of directors of several private companies in the sectors of enterprise solutions, communications infrastructure, semiconductors, technology-enabled services and infrastructure and mobile software. Mr. Shamapant began his career as a software developer and engineering lead at Mentor Graphics, a design automation company, and, prior to joining Austin Ventures, was with McKinsey & Co. serving clients in the enterprise systems and software markets. Mr. Shamapant holds an M.B.A. from Harvard Business School, an M.S. in Computer Engineering from the University of Texas at Austin and a B.S. in Electronics and Communications Engineering from Osmania University in India.

Mr. Shamapant was selected to serve on our Board of Directors because of his professional experience, including his professional experience in building and scaling startups, as well as his substantial experience as a venture capitalist.

There are no family relationships between or among any of our executive officers, directors or director nominees.

11

Table of Contents

Vote Required and Board Recommendation

The nominees to serve as Class I directors will be elected by a plurality of the votes cast in person or represented by proxy at the Annual Meeting.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Messrs. McCarthy and Mehra. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as may be nominated by our Board of Directors. Each person nominated for election has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve. If you hold your shares in street name and you do not give voting instructions to your broker, your broker will leave your shares unvoted on this matter.

Our Board of Directors unanimously recommends a vote “FOR” the election of each of Jeffrey P. McCarthy and Vivek Mehra to serve as Class I Directors.

12

Table of Contents

INFORMATION ABOUT OUR BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

We completed our initial public offering in November 2013, and our common stock trades on the New York Stock Exchange (the NYSE). Under NYSE rules, a majority of a listed company’s board of directors must consist of independent directors within twelve months from the date of the listed company’s initial public offering. In addition, NYSE rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent within twelve months from the date of the listed company’s initial public offering. Audit committee members must also satisfy additional independence criteria, including those set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act). Under NYSE rules, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a material relationship with the company. In order to be considered independent for purposes of Rule 10A-3 under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the Board of Directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries, other than compensation for board service; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Our Board of Directors has undertaken a review of its composition and that of its committees as well as the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, our Board of Directors has determined that none of our non-employee directors — Messrs. Scott, Hanafi, McCarthy, Mehra, de Pesquidoux and Shamapant — has a material relationship with us and that each of these directors is “independent” in accordance with the rules of the NYSE and the Securities and Exchange Commission (SEC). In making that determination, our Board of Directors considered the relationships that each of those non-employee directors has with us and all other facts and circumstances the Board of Directors deemed relevant in determining independence, including the potential deemed beneficial ownership of our common stock by each non-employee director, including non-employee directors that are affiliated with certain of our major stockholders.

Our Board of Directors currently consists of our President and Chief Executive Officer, Pardeep Kohli, and six non-employee directors. Benjamin L. Scott, an independent non-employee director, is the Chairman of our Board of Directors. As Chairman, Mr. Scott is generally responsible for presiding at and directing the meetings of the Board of Directors.

The Board does not have a policy requiring that the positions of the Chairman of the Board and the Chief Executive Officer be separate or that they be occupied by the same individual. The Board believes that it should be free to determine the structure that is best for our company and its stockholders at any given time. If the roles of Chairman of the Board and Chief Executive Officer are not separate at any given point in time, the Board may designate one of the independent directors as a “Lead Independent Director” who, if designated, will generally be responsible for coordinating the actions of the independent directors.

We believe our current Board leadership structure contributes to the effectiveness of the Board as a whole by, among other things, enhancing the independent and objective assessment of risk by the Board, freeing our President and Chief Executive Officer to focus on company operations instead of Board administration and increasing the independent oversight of the company. As a result, we believe our current structure is the most appropriate structure for us at the present time.

Our Board of Directors has an audit committee, a compensation committee and a nominating and corporate governance committee.

13

Table of Contents

Audit Committee

Our audit committee consists of Hubert de Pesquidoux (chairman), Jeffrey P. McCarthy and Vivek Mehra. The functions of the audit committee include:

| • | appointing our independent registered public accounting firm and being directly responsible for the compensation, retention and oversight of the independent registered public accounting firm, who will report directly to the audit committee; |

| • | reviewing and pre-approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services, including the fees to be paid for those services; |

| • | reviewing our annual and quarterly financial statements and reports and discussing the financial statements and reports with our independent registered public accounting firm and management; |

| • | reviewing and approving all related person transactions; |

| • | reviewing with our independent registered public accounting firm and management significant issues that may arise regarding accounting principles and financial statement presentation, as well as matters concerning the scope, adequacy and effectiveness of our internal controls over financial reporting; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding internal controls over financial reporting, accounting or auditing matters; and |

| • | preparing the audit committee report for inclusion in our proxy statement for our annual meeting. |

All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our Board of Directors has determined that Mr. de Pesquidoux, an independent director, qualifies as an audit committee financial expert within the meaning of applicable SEC regulations. In making this determination, our Board of Directors considered the nature and scope of experience that Mr. de Pesquidoux has with public reporting companies, including service as Chief Financial Officer of a large public company and service on public company audit committees. Our Board of Directors has determined that all of the current members of our audit committee satisfy the relevant independence requirements for service on the audit committee set forth in the applicable rules of the NYSE and the SEC. Both our independent registered public accounting firm and management periodically meet privately with our audit committee.

Mr. de Pesquidoux currently serves on the audit committees of three other publicly-traded companies in addition to ours. Pursuant to applicable NYSE rules, our Board of Directors has determined that Mr. de Pesquidoux’s service on these other audit committees does not impair his ability to effectively serve as the chairman of our audit committee.

Our Board of Directors has adopted an audit committee charter. We believe that the composition of our audit committee, and our audit committee’s charter and functioning, comply with the applicable requirements of the NYSE and SEC rules and regulations. We intend to comply with future requirements to the extent they become applicable to us.

The full text of our audit committee charter can be found on the investor relations portion of our website at http://investor.mavenir.com under the heading “Corporate Governance.” Information contained in, or accessible through, our website is not a part of this proxy statement.

14

Table of Contents

Compensation Committee

Our compensation committee consists of Benjamin L. Scott (chairman), Ammar H. Hanafi and Venu Shamapant. The functions of the compensation committee include:

| • | determining the compensation and other terms of employment of our Chief Executive Officer and other executive officers and reviewing, developing and recommending to our Board of Directors our performance goals and objectives relevant to that compensation; |

| • | administering and implementing our incentive compensations plans and equity-based plans, including approving option grants, restricted stock and other awards for non-executive officer employees and recommending to our Board of Directors such plans and awards for executive officers; |

| • | evaluating and recommending to our Board of Directors incentive compensation plans, equity-based plans and similar programs advisable for us, as well as modifications or terminations of our existing plans and programs; |

| • | reviewing, developing and recommending to our Board of Directors the terms of any employment-related agreements, severance arrangements, change-in-control and similar agreements or provisions with our Chief Executive Officer and other executive officers; |

| • | reviewing and discussing the Compensation Discussion & Analysis required in our annual report and proxy statement with management and determining whether to recommend to our Board of Directors the inclusion of the Compensation Discussion & Analysis in the annual report or proxy, to the extent that the Compensation Discussion & Analysis is required by SEC rules; and |

| • | preparing a report on executive compensation for inclusion in our proxy statement for our annual meeting, to the extent required by SEC rules. |

Each member of our compensation committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986. Furthermore, our Board of Directors has determined that each of Messrs. Scott, Hanafi and Shamapant satisfy the independence standards for compensation committee membership established by the SEC and the listing rules of the NYSE, as applicable.

Our Board of Directors has adopted a compensation committee charter. We believe that the composition of our compensation committee, and our compensation committee’s charter and functioning, comply with the applicable requirements of the NYSE and SEC rules and regulations. We intend to comply with future requirements to the extent they become applicable to us.

The full text of our compensation committee charter can be found on the investor relations portion of our website at http://investor.mavenir.com under the heading “Corporate Governance.” Information contained in, or accessible through, our website is not a part of this proxy statement.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Ammar H. Hanafi (chairman), Hubert de Pesquidoux and Benjamin L. Scott. The functions of the nominating and corporate governance committee include:

| • | evaluating director performance on the Board of Directors and applicable committees of the Board of Directors; |

15

Table of Contents

| • | reviewing, developing and recommending to our Board of Directors the cash and equity compensation to be paid to our non-employee directors; |

| • | identifying, recruiting, evaluating and recommending individuals for membership on our Board of Directors, the audit committee and the compensation committee; |

| • | considering questions of independence or possible conflicts of interest (other than related person transactions) of members of our Board of Directors or our executive officers; |

| • | evaluating nominations by stockholders of candidates for election to our Board of Directors; |

| • | reviewing and recommending to our Board of Directors any amendments to our corporate governance documents; and |

| • | making recommendations to the Board of Directors regarding management succession planning. |

Our Board of Directors has determined that Messrs. Hanafi, de Pesquidoux and Scott each satisfy the independence standards for nominating and corporate governance committee members established by the SEC and the listing standards of the NYSE, as applicable.

Our Board of Directors has adopted a nominating and corporate governance committee charter. We believe that the composition of our nominating and corporate governance committee, and our nominating and corporate governance committee’s charter and functioning, comply with the applicable requirements of the NYSE and SEC rules and regulations. We intend to comply with future requirements to the extent they become applicable to us.

The full text of our nominating and corporate governance committee charter can be found on the investor relations portion of our website at http://investor.mavenir.com under the heading “Corporate Governance.” Information contained in, or accessible through, our website is not a part of this proxy statement.

Meetings of the Board of Directors and its Committees

During the fiscal year ended December 31, 2013, our Board of Directors held nine meetings. Our audit committee met ten times, our compensation committee met seven times, and the nominating and corporate governance committee met three times during 2013. Each of our directors attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board on which such member served.

The Board of Directors does not have a formal policy regarding the attendance of directors at meetings of stockholders, but it encourages directors to attend each meeting of stockholders. We completed our initial public offering in November 2013 and did not have an annual meeting of our public stockholders in 2013.

Role of the Board in Risk Oversight

Risk is inherent in our business, and we face strategic, financial, accounting and control, economic, business, operational, technological, competitive, legal, reputational and other risks. Our management is responsible for the day-to-day management of our risks, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

One of the Board’s key functions is informed oversight of our company’s risk management process. The Board administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of

16

Table of Contents

risk appropriate for our company and evaluating the risks inherent in significant transactions. Our audit committee has the responsibility under NYSE rules to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with financial- and accounting-related legal and regulatory requirements, in addition to oversight of the performance of our accounting controls and procedures, and our internal audit function. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines. Our compensation committee assesses and monitors our compensation policies and programs.

Nomination Process

Our nominating and corporate governance committee is responsible for identifying, recruiting, evaluating and recommending to the Board nominees for membership on the Board and committees of the Board. The goal of this process is to maintain and further develop a highly qualified Board of Directors consisting of members with experience and expertise in areas of importance to our company. Candidates may come to our attention through current members of our Board, professional search firms, stockholders or other persons.

The nominating and corporate governance committee will recommend to the Board for selection all nominees to be proposed by the Board for election by the stockholders, including approval or recommendation of a slate of director nominees to be proposed by the Board for election at each annual or special meeting of stockholders, and will recommend all director nominees to be appointed by the Board to fill director vacancies. The Board is responsible for nominating members for election to the Board and for filling vacancies on the Board that may occur between annual meetings of stockholders.

Evaluation of Director Candidates

In its evaluation of director candidates, the nominating and corporate governance committee will consider a candidate’s skills, characteristics and experience taking into account a variety of factors, including the candidate’s:

| • | understanding of our business, industry and technology; |

| • | history with our company; |

| • | personal and professional integrity; |

| • | general understanding of marketing, finance and other disciplines relevant to the success of a publicly-traded company generally; |

| • | ability and willingness to devote the time and effort necessary to be an effective Board member; |

| • | commitment to acting in the best interest of our company and its stockholders; and |

| • | educational and professional background. |

The nominating and corporate governance committee will also consider the current size and composition of the Board of Directors, the needs of the Board of Directors and its committees and the potential independence of director candidates under relevant NYSE and SEC rules.

Although the Board of Directors does not maintain a specific policy with respect to board diversity, the nominating and corporate governance committee considers each candidate in the context of the membership of the Board as a whole, with the objective of including an appropriate mix of viewpoints and experience among members

17

Table of Contents

of the Board reflecting differences in professional background, education, skill and other individual qualities and attributes. In making determinations regarding nominations of directors, the nominating and corporate governance committee may take into account the benefits of diverse viewpoints to the extent it deems appropriate.

Stockholder Recommendations for Nomination to the Board of Directors

The nominating and corporate governance committee will consider properly submitted stockholder recommendations for candidates for our Board. The nominating and corporate governance committee does not intend to alter the manner in which it evaluates candidates, including the criteria described above, based on whether or not the candidate was recommended by a stockholder.

Any stockholder recommendations proposed for consideration by the nominating and corporate governance committee should be in writing and delivered to Mavenir Systems, Inc., Attn: General Counsel and Secretary, 1700 International Parkway, Suite 200, Richardson, TX 75081. Submissions must include the following information, among other information described more specifically in our bylaws, with respect to each candidate:

| • | full name and address of the proposed nominee; |

| • | the number and class of our shares beneficially owned, directly or indirectly, by the proposed nominee; |

| • | all information regarding the proposed nominee required to be disclosed in a proxy statement pursuant to Section 14(a) of the Securities Exchange Act of 1934, as amended; |

| • | the consent of the nominee to be named in the proxy statement and consent to serve as a director if elected; and |

| • | a description of all material relationships, including (i) compensation and other material monetary agreements, arrangements and understandings during the past three years, between the proposed nominee and the stockholder making the proposal and (ii) any relationship between the proposing stockholder and the proposed nominee that would be required to be disclosed under the SEC’s related party transactions disclosure rules if the proposing stockholder were a “registrant” under those rules. |

In addition, any stockholder wishing to recommend a nominee to our Board of Directors must provide a questionnaire regarding the proposed nominee, information regarding any arrangement or agreement with respect to such nominee’s voting while a member of our Board of Directors and information regarding equity ownership of the company (including derivative ownership) by the proposing stockholder and the proposed nominee.

All proposals of stockholders that are intended to be presented by such stockholder at the Annual Meeting of Stockholders must be in writing and received by us between 90 and 120 calendar days in advance of the first anniversary of the preceding year’s annual meeting, except that proposals for the calendar year 2014 Annual Meeting must be received by the tenth day following the day on which public announcement of the date of the 2014 Annual Meeting was first made.

The above description of the procedure required for a stockholder to propose nominees to our Board of Directors is a summary only, and stockholders wishing to propose a nominee to our Board are advised to review our bylaws in detail, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations. Please also see “Other Matters — Stockholder Proposals and Director Nominations.”

Compensation Committee Interlocks and Insider Participation

During 2013, our compensation committee consisted of Benjamin L. Scott (chairman), Ammar H. Hanafi and Venu Shamapant. None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or our compensation committee.

18

Table of Contents

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics applies to all of our employees, officers, agents and representatives, including directors and consultants.

Our Board of Directors has also adopted an additional Code of Ethics for our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer. This Code of Ethics, applicable to the specified officers, contains additional requirements including a prohibition on personal loans from the company (except where permitted by, and disclosed pursuant to, applicable law), and a requirement to review reports to be filed with the SEC.

We intend to disclose any future amendments to certain provisions of our Code of Business Conduct and Ethics and our Code of Ethics for our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, or waivers of those provisions, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions or our directors on our website identified below. The full text of our Code of Business Conduct and Ethics and our Code of Ethics for our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer can be found in the Investor Relations section of our website at http://investor.mavenir.com under the heading “Corporate Governance.” Information contained in, or accessible through, our website is not a part of this proxy statement.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect to Board composition and selection, Board meetings, responsibilities of directors, chief executive officer performance evaluation and succession planning, Board self-evaluation and Board committees and compensation. The Board expects to review, in consultation with our nominating and corporate governance committee, these guidelines as it deems necessary and appropriate.

The Corporate Governance Guidelines, as well as the charters for each committee of the Board, may be viewed at http://investor.mavenir.com under the heading “Corporate Governance.” Information contained in, or accessible through, our website is not a part of this proxy statement.

Director Stock Ownership Guidelines

Our Board of Directors has adopted stock ownership guidelines applicable to our non-employee directors. These guidelines require each non-employee director to own shares of our common stock having a value of at least three times that non-employee director’s regular cash retainer within five years from the later of (i) the completion of our initial public offering in November 2013 or (ii) the director’s initial election to our Board. Shares held by a stockholder with whom a director is employed or affiliated as well as vested and exercised equity awards and shares held in entities for the benefit of a director or his or her immediately family will count towards this requirement.

Compensation of Non-Employee Directors

Prior to our November 2013 initial public offering ,we did not compensate non-employee directors that are affiliated with our stockholders for their service on our Board of Directors. We also have not previously, and do not now, provide separate compensation to any director who is also our employee, including Mr. Kohli, our President and Chief Executive Officer.

19

Table of Contents

Following our initial public offering, each non-employee director receives an annual fee of $20,000, and the Chairman of the Board will receive an additional annual fee of $20,000. Independent non-employee directors will receive an additional $5,000 annually for serving on the audit committee of our Board of Directors and an additional $3,000 annually for serving on the compensation committee or the nominating and corporate governance committee of our Board of Directors. The chairman of our audit committee will receive an additional $12,000 annually, the chairman of our compensation committee will receive an additional $10,000 annually and the chairman of our nominating and corporate governance committee will receive an additional $7,500 annually. Our independent non-employee directors also receive equity awards as described under “Executive Compensation — Benefit Plans — 2013 Equity Incentive Plan — Automatic Director Awards.”

The compensation paid to each of our non-employee directors in 2013 is set forth below. Pardeep Kohli, our President and Chief Executive Officer, receives no separate compensation for serving as a director.

| Name |

Fees earned or paid in cash ($)(1) |

Option Awards ($)(2)(3) |

All Other Compensation ($) |

Total ($) |

||||||||||||

| Benjamin L. Scott (Chairman) |

$ | 8,556 | $ | 192,500 | $ | 75,000 | (4) | $ | 276,056 | |||||||

| Ammar H. Hanafi |

5,118 | 192,500 | — | 197,618 | ||||||||||||

| Jeffrey P. McCarthy |

3,819 | 192,500 | — | 196,319 | ||||||||||||

| Vivek Mehra |

3,819 | 192,500 | — | 196,319 | ||||||||||||

| Hubert de Pesquidoux |

6,111 | 37,856 | — | 43,967 | ||||||||||||

| Venu Shamapant |

3,513 | 192,500 | — | 196,013 | ||||||||||||

| (1) | Cash fees paid for Board and/or committee service reflect a partial year of service beginning upon the completion of our initial public offering in November 2013. |

| (2) | Amounts represent the aggregate grant date fair market value of stock options granted during 2013, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification ASC Topic 718, Compensation — Stock Compensation (FASB ASC Topic 718). Assumptions used in calculating the grant date fair value of the stock options reported in this column are set forth in Note 11 to the consolidated financial statements of Mavenir Systems, Inc. and subsidiaries, included in our Annual Report on Form 10-K for the year ended December 31, 2013 filed with the SEC on February 21, 2014. |

| (3) | As of December 31, 2013, the aggregate number of shares subject to outstanding equity awards held by our non-employee directors was: |

| Name |

Stock Options | |||

| Benjamin L. Scott (Chairman) |

56,428 | |||

| Ammar H. Hanafi |

35,000 | |||

| Jeffrey P. McCarthy |

35,000 | |||

| Vivek Mehra |

35,000 | |||

| Hubert de Pesquidoux |

42,023 | |||

| Venu Shamapant |

35,000 | |||

| (4) | Prior to our initial public offering in November 2013, Mr. Scott received a monthly retainer of $7,500 for service as Chairman of our Board of Directors. The amount above reflects monthly payments under this arrangement for the first ten months of 2013 prior to our initial public offering. This arrangement was terminated upon our initial public offering and was replaced by the director compensation program described above. |

We provide reimbursement to our non-employee directors for their reasonable expenses incurred in attending meetings of our Board of Directors and committees of our Board of Directors. Directors are also entitled to the protection provided by their indemnification agreements and the indemnification provisions in our amended and restated certificate of incorporation and bylaws.

20

Table of Contents

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee has selected BDO USA, LLP as our independent registered public accountants and to audit our consolidated financial statements for the fiscal year ending December 31, 2014, and the Board of Directors has determined that it would be desirable to request that the stockholders ratify such appointment. BDO USA, LLP was our independent registered public accounting firm for our 2013, 2012 and 2011 audits.

The audit committee’s policy is to pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm, including the fees for those services, subject to the de minimis exception for non-audit services provided by SEC rules. These services provided may include audit services, audit-related services, and other services. Pre-approval is detailed as to the specific service or category of service and is subject to a specific approval.

Before selecting BDO USA, LLP, the audit committee considered the firm’s qualifications as independent registered public accountants and concluded that based on its prior performance for us and its reputation for integrity and competence, it was qualified. The audit committee also considered whether any non-audit services performed for us by BDO USA, LLP would impair BDO USA, LLP’s independence and concluded that they did not. If the stockholders do not ratify the selection of BDO USA, LLP, the audit committee may reconsider its selection. Even if the selection is ratified, the audit committee, in its sole discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of our company and its stockholders.

A representative of BDO USA, LLP will attend our Annual Meeting. The representative will have the opportunity to make a statement if he or she desires to do so and to respond to appropriate questions.

Fees Paid to Our Independent Registered Public Accounting Firm

The aggregate fees for professional services rendered by our principal accountants, BDO USA, LLP, for the years ended December 31, 2013 and 2012 were:

| Year Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| Audit Fees(1) |

$ | 1,567,199 | $ | 3,524,840 | ||||

| Audit-Related Fees(2) |

— | 312,984 | ||||||

| Tax Fees(3) |

129,835 | 428,107 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,697,034 | $ | 4,265,932 | ||||

|

|

|

|

|

|||||