EXECUTION VERSION 734109631 19632855 MASTER RECEIVABLES PURCHASE AGREEMENT among HANESBRANDS INC., KNIGHTS APPAREL LLC, GFSI LLC, CC PRODUCTS LLC and ALTERNATIVE APPAREL, INC., as Sellers and Servicers, THE OTHER SELLERS AND SERVICERS FROM TIME TO TIME PARTY HERETO and MUFG BANK, LTD., as Buyer Dated as of December 11, 2019

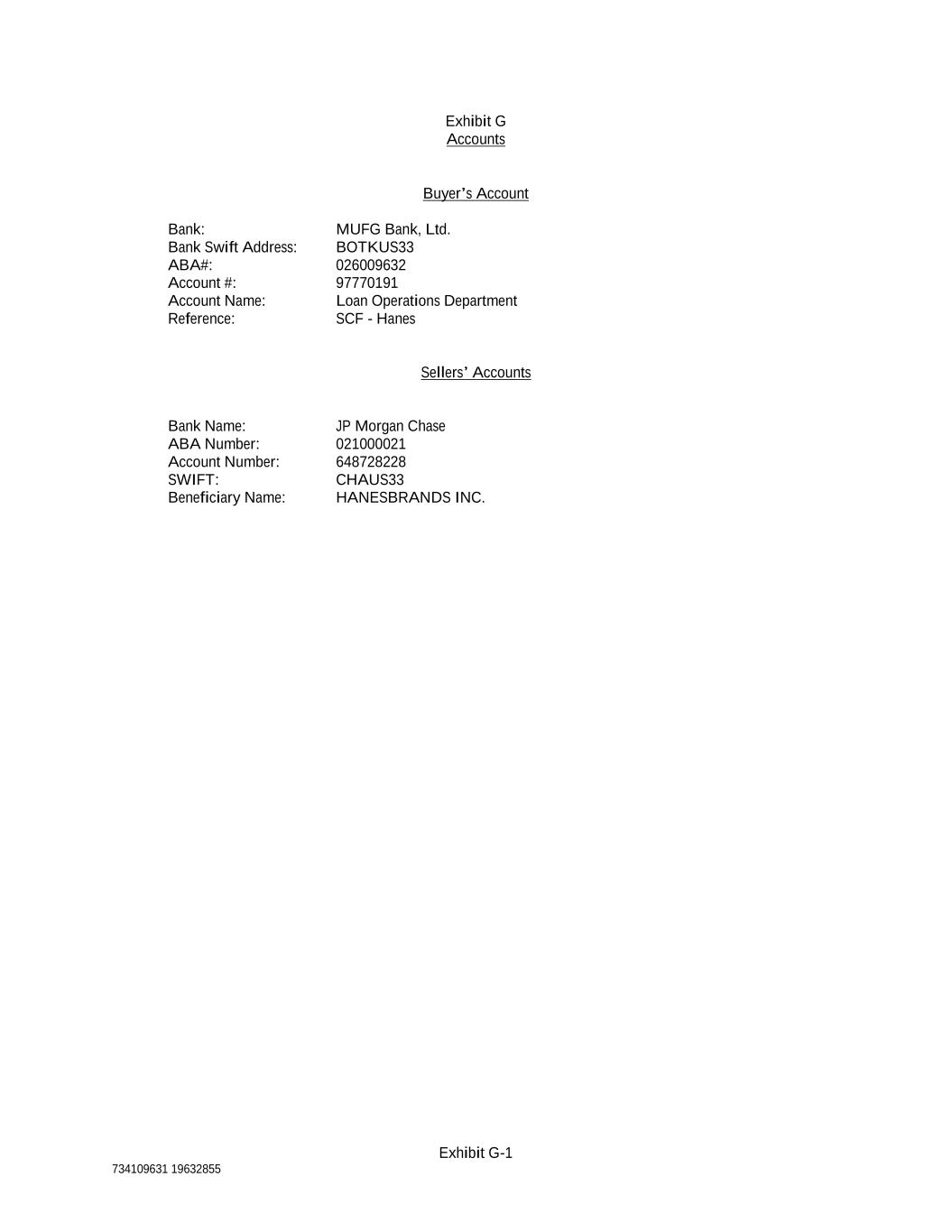

TABLE OF CONTENTS Page -i- 734109631 19632855 1. Sale and Purchase. ......................................................................................................................................... 1 2. Representations and Warranties .................................................................................................................... 3 3. Covenants ...................................................................................................................................................... 3 4. Servicing Activities. ...................................................................................................................................... 3 5. Deemed Collections; Repurchase Events; Indemnities and Set-Off. ............................................................. 5 6. Notices........................................................................................................................................................... 7 7. Expenses ........................................................................................................................................................ 8 8. Interest on Overdue Amounts ........................................................................................................................ 9 9. Governing Law .............................................................................................................................................. 9 10. No Non-Direct Damages ............................................................................................................................... 9 11. Joinder of Additional Sellers ......................................................................................................................... 9 12. Joint and Several Obligations ........................................................................................................................ 9 13. General Provisions ...................................................................................................................................... 10 Schedule I - Form of Purchase Request Schedule II - Account Debtors Exhibit A - Certain Defined Terms Exhibit B - Conditions Precedent for Effectiveness Exhibit C - Representations and Warranties Exhibit D - Covenants Exhibit E - Eligibility Criteria Exhibit F - Servicer Termination Events Exhibit G - Accounts

1 734109631 19632855 MASTER RECEIVABLES PURCHASE AGREEMENT This MASTER RECEIVABLES PURCHASE AGREEMENT (this “Agreement”) is entered into as of December 11, 2019, by and among HANESBRANDS INC., a Maryland corporation (“Hanes”), KNIGHTS APPAREL LLC, a Delaware limited liability company (“Knights”), GFSI LLC, a Delaware limited liability company (“GFSI”), CC PRODUCTS LLC, a Delaware limited liability company (“CC Products”), ALTERNATIVE APPAREL, INC., a Delaware corporation (“Alternative”), and any other seller from time to time party hereto (each, in such capacity, a “Seller” and collectively, the “Sellers”), and as servicers (each, in such capacity, a “Servicer” and collectively, the “Servicers”), and MUFG BANK, LTD. (“MUFG Bank”), as buyer (the “Buyer”). RECITALS Each Seller desires to sell certain of its Receivables from time to time, and the Buyer may be willing to purchase from each Seller such Receivables, in which case the terms set forth herein shall apply to such purchase. Each capitalized term used but not defined herein shall have the meaning set forth in, or by reference in, Exhibit A hereto, and the interpretive provisions set out in Exhibit A hereto shall be applied in the interpretation of this Agreement. Accordingly, the parties hereto agree as follows: 1. Sale and Purchase. (a) Sales of Receivables. From time to time during the term of this Agreement, one or more Sellers may submit to the Buyer a request (a “Purchase Request”) via the MUFG Platform that the Buyer purchase from such Seller or Sellers the Proposed Receivables described in such Purchase Request as well as the proposed Purchase Date thereof, which Purchase Date shall be a Settlement Date (or such other Business Day that Buyer may agree to with respect to any Purchase Request); provided, however, and notwithstanding anything herein to the contrary, if (i) the MUFG Platform is not operational or is otherwise offline or (ii) the Buyer has, in its discretion, instructed the Sellers that the MUFG Platform is no longer available for use, then such Seller or Sellers may deliver a Purchase Request to the Buyer in substantially the form of Schedule I attached hereto, and this Agreement shall be construed and interpreted accordingly, mutatis mutandis. If the Buyer, in its sole and absolute discretion, accepts a Purchase Request, then the Buyer shall purchase, and such Seller or Sellers shall sell, all of each applicable Seller’s right, title and interest (but none of such Seller’s underlying obligations to the applicable Account Debtor) with respect to such Proposed Receivables as of the Purchase Date (all such Proposed Receivables, once sold and purchased or purported to be sold and purchased, hereunder, collectively the “Purchased Receivables”). (b) UNCOMMITTED ARRANGEMENT. EACH OF THE SELLERS ACKNOWLEDGES THAT THIS IS AN UNCOMMITTED ARRANGEMENT, THAT NO SELLER HAS PAID, OR IS REQUIRED TO PAY, A COMMITMENT FEE OR COMPARABLE FEE TO THE BUYER. NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THIS AGREEMENT, EACH SELLER EXPRESSLY AGREES THAT THE BUYER WILL NOT BE OBLIGATED TO PURCHASE ANY RECEIVABLE FROM ANY SELLER, AND THE BUYER MAY REFUSE, FOR ANY REASON OR FOR NO REASON, TO PURCHASE ANY RECEIVABLE OFFERED FOR PURCHASE BY ANY SELLER REGARDLESS OF WHETHER THE VARIOUS CONDITIONS TO PURCHASE SET FORTH IN THIS AGREEMENT HAVE BEEN SATISFIED. (c) Conditions to Effectiveness. This Agreement shall become effective at such time as each of the conditions precedent set forth on Exhibit B to this Agreement has been satisfied to the reasonable satisfaction of the Buyer. (d) Conditions Precedent to Each Purchase. Without limiting the uncommitted nature of the Buyer’s obligations as discussed in Section 1(b), the Buyer shall not purchase the Proposed Receivables described in such Purchase Request unless:

2 734109631 19632855 (i) the Buyer has received a Purchase Request via the MUFG Platform (or, if applicable, in physical form in substantially the form of Schedule I attached hereto) with respect to the Proposed Receivables at least two (2) Business Days (or such shorter amount of time that Buyer may agree to, in its sole discretion, with respect to any Purchase Request) prior to the applicable Purchase Date, together with any such additional supporting documentation that the Buyer may have reasonably requested; (ii) the Buyer has accepted such Purchase Request and notified the applicable Sellers thereof (either via the MUFG Platform or otherwise); (iii) each of the representations and warranties made by each Seller, Servicer and any Performance Guarantor in this Agreement and each of the other Transaction Documents is true and correct in all material respects as of such Purchase Date or, in the case of any representation or warranty that speaks as to a particular date or period, as of that particular date or period; (iv) each Proposed Receivable described in such Purchase Request is an Eligible Receivable; and (v) immediately following the sale and purchase of the Proposed Receivables set forth in the related Purchase Request, (A) the Outstanding Purchase Amount will not exceed the Maximum Outstanding Purchase Amount and (B) the Outstanding Purchase Amount with respect to the Purchased Receivables payable by any Account Debtor will not exceed such Account Debtor’s Purchase Sublimit. Each Purchase Request submitted by any Seller shall constitute a representation and warranty that each of the conditions outlined in this Section 1(d) has been satisfied. (e) Purchase Price. The purchase price for each Purchased Receivable purchased on any Purchase Date shall equal (i) the Net Invoice Amount of such Purchased Receivable, minus (ii) the Discount (such amount herein referred to as the “Purchase Price”). The Buyer shall pay the Purchase Price minus the Dilution Reserve applicable to such Purchased Receivable (the “Funded Amount”) with respect to each Purchased Receivable by depositing such Funded Amount thereof into the Sellers’ Account in immediately available funds denominated in Dollars on the applicable Purchase Date. For avoidance of doubt and not in limitation of any other provision of this Agreement, it is understood and agreed that the Dilution Reserve is the property of the Seller and represents part of the Purchase Price of the related Purchased Receivable, payable either as of the Settlement Date for a Purchased Receivable or in connection with the offset by Buyer of any obligations of the Sellers against such reserve as provided in Section 4(c) herein. (f) True Sale; No Recourse. Except as otherwise provided in this Agreement, each purchase of the Purchased Receivables is made without recourse to any Seller and no Seller shall have liability to the Buyer for the failure of any Account Debtor to pay any Purchased Receivable when it is due and payable under the terms applicable thereto. The Buyer and each Seller have structured the transactions contemplated by this Agreement as an absolute and irrevocable sale, and the Buyer and each Seller agree to treat each such transaction as a “true sale” for all purposes under Applicable Law and accounting principles, including, without limitation, in their respective books, records, computer files, tax returns (federal, state and local), regulatory and governmental filings (and shall reflect such sale in their respective financial statements). Each Seller will advise all Persons inquiring about the ownership of any Purchased Receivable that all Purchased Receivables have been sold to the Buyer. In the event that, contrary to the mutual intent of the parties hereto, any purchase of Purchased Receivables is not characterized as a sale, each Seller shall, effective as of the date hereof, be deemed to have granted to the Buyer (and each Seller hereby does grant to the Buyer), in addition to and not in substitution for the rights and remedies described in Section 5(g) hereof, a first priority security interest in and to any and all present and future Purchased Receivables and the proceeds thereof to secure all obligations of such Seller arising in connection with this Agreement and each of the other Transaction Documents, whether now or hereafter existing, due or to become due, direct or indirect, absolute or contingent. This Agreement shall be deemed to be a security agreement under Applicable Law. The Buyer may, at its discretion, file one or more UCC financing statements (or, if applicable, any foreign law equivalent thereof) evidencing the sale of the Purchased Receivables as well as the foregoing grant of security. With respect to such grant of a security interest, the Buyer may at its option, at any time following a Servicer Termination Event or a material breach by any Seller or Servicer of any of its representations, warranties or covenants under any

3 734109631 19632855 Transaction Document, exercise from time to time any and all rights and remedies available to it hereunder, under the UCC or otherwise. Each Seller agrees that five (5) Business Days shall be reasonable prior notice to such Seller of the date of any public or private sale or other disposition of all or any of the Purchased Receivables. 2. Representations and Warranties. Each Seller and each Servicer represents and warrants to the Buyer on each Purchase Date that (i) the representations and warranties set forth on Exhibit C hereto are true and correct in all material respects as of such Purchase Date or, in the case of any representation or warranty that speaks as to a particular date or period, as of that particular date or period and (ii) each Proposed Receivable proposed to be purchased on such Purchase Date is an Eligible Receivable. 3. Covenants. Each Seller and each Servicer agrees to perform each of the covenants set forth on Exhibit D hereto 4. Servicing Activities. (a) Appointment of Servicer. The Buyer appoints each Seller as its servicer and agent (each, in such capacity, the “Servicer” and collectively, the “Servicers”) for the administration and servicing of its Purchased Receivables sold by such Seller to the Buyer hereunder, and each Seller hereby accepts such appointment and agrees to assume the duties and the administration and servicing obligations as a Servicer, and perform all commercially reasonable and appropriate commercial servicing and collection activities in arranging the timely payment of amounts due and owing by any Account Debtor (including the identification of the proceeds of the Purchased Receivables and related record-keeping that shall be made available to the Buyer upon its reasonable request) all in accordance with Applicable Laws, with commercially reasonable care and diligence, including, without limitation, diligently and faithfully performing all servicing and collection actions in accordance with the terms hereof; provided, however, that such appointment as Servicer shall not release Seller from any of its duties, responsibilities, liabilities and obligations resulting from or arising hereunder. In connection with its servicing obligations, each Servicer will perform its duties under the Contract related to the Purchased Receivables with the same care and applying the same policies as it applies to its own Receivables generally and would exercise and apply if it owned the Purchased Receivables and shall act to maximize Collections thereon. (b) [Reserved]. (c) Transfer of Collections to the Buyer. Subject to Sections 4(d), 4(e) and 5(a) below, each Seller and Servicer covenant and agree to deposit in the Buyer’s Account all Collections and other amounts received by any Seller or Servicer (or any of their respective Affiliates) with respect to Purchased Receivables without adjustment, setoff or deduction of any kind or nature no later than the first Settlement Date occurring at least three Business Days after such Collections are received; provided that on any Settlement Date for a Purchased Receivable, the Sellers may, with respect to any Purchased Receivable, deduct any remaining and unused Dilution Reserve with respect to such Purchased Receivable from the amounts transferred to the Buyer. Until remitted to the Buyer’s Account, such Seller or Servicer will hold such funds in trust as the Buyer’s exclusive property and safeguard such funds for the benefit of the Buyer. (d) Misdirected Payments. If the Buyer receives any payment from an Account Debtor not representing a Collection on a Purchased Receivable, the Buyer will return such payment to the applicable Seller upon receipt of satisfactory evidence that such amounts do not constitute Collections on Purchased Receivables. (e) Identifying Collections. Pursuant to its servicing obligations under Section 4(a) hereof, each Servicer shall be responsible for identifying, matching and reconciling any payments received from Account Debtors with the Receivable associated with such payment. If any payment is received from an Account Debtor, and such payment is not identified by such Account Debtor as relating to a particular Receivable and cannot otherwise be reasonably identified as relating to a particular Receivable within three Business Days of receipt thereof, such payment shall be applied first to the unpaid Purchased Receivables with respect to such Account Debtor in chronological order (beginning with the oldest unpaid Purchased Receivable), and then to Receivables with respect to such Account Debtor that are not Purchased Receivables, also in chronological order.

4 734109631 19632855 (f) No Changes to Receivables. No Servicer shall compromise or settle any Purchased Receivable or extend the Due Date with respect thereto without the consent of the Buyer except as otherwise expressly provided for in Section 5(a) hereof; provided, that if the applicable Account Debtor so requests, the applicable Servicer may in its reasonable discretion allow such Account Debtor to make payment on such Purchased Receivable after such Due Date, but no later than the Adjusted Maturity Date thereof; provided, further, that the foregoing provision shall not be understood to grant to any Servicer the right to re-classify any delinquent Receivables as current. (g) Reconciliation Report; Dilution Reserve Report. Concurrently with (a) each transfer of funds by any Seller to the Buyer’s Account pursuant to Sections 4 and 5 hereof and (b) each request by any Seller for a return of payments received by the Buyer that do not represent Collections on Purchased Receivables in accordance with Section 4(d), the Servicers shall provide to the Buyer, in form and substance reasonably satisfactory to the Buyer, a full reconciliation of all Collections and adjustments (including repurchases thereof, indemnifications and setoffs with respect thereto, if any) with respect to each Purchased Receivable of an Account Debtor for which Collections were received (each, a “Reconciliation Report”) together with a written report describing the status and amount of the Dilution Reserve for both each outstanding Purchased Receivable and each collected Purchased Receivable described in such Reconciliation Report (each a “Dilution Reserve Report”). The Servicers shall submit each Reconciliation Report and each Dilution Reserve Report to the Buyer via the MUFG Platform; provided, however, and notwithstanding anything herein to the contrary, if (i) the MUFG Platform is not operational or is otherwise offline or (ii) the Buyer has, in its discretion, instructed the Servicers that the MUFG Platform is no longer available for use, then the Servicers may deliver a written Reconciliation Report and Dilution Reserve Report to the Buyer, and this Agreement shall be construed and interpreted accordingly, mutatis mutandis. (h) Non-Payment Report. If a Purchased Receivable remains unpaid, in part or in full, past the date that is thirty (30) Business Days after the applicable Adjusted Due Date therefor (an “Overdue Receivable”), the applicable Servicer shall report to the Buyer in a written report describing in reasonable detail the cause of such non-payment, including whether a Dispute or Insolvency Event exists with respect to the applicable Account Debtor (each a “Non-Payment Report”) and if the reason for such non-payment is not a Dispute or an Insolvency Event, the Buyer may in its sole discretion, upon at least five (5) Business Days’ prior notice to the applicable Servicer, (i) contact such Account Debtor by phone or in person to discuss the status of such Purchased Receivable and to inquire whether such payment delay or non-payment is due to a Dispute or Insolvency Event and when payment can be expected and/or (ii) take any other lawful action to collect such Purchased Receivable directly from such Account Debtor and/or (iii) terminate the appointment of the relevant Seller as Servicer with respect to such Purchased Receivable. Notwithstanding the foregoing, in the event a Purchased Receivable has not been paid in full by the date that is thirty-five (35) Business Days after the Adjusted Due Date therefor, and the applicable Servicer has not provided to the Buyer a certification that the missed payment on such Overdue Receivable is a result of an Insolvency Event or other condition with the applicable Account Debtor which has caused the applicable Account Debtor to not have the financial ability to make payment on such Purchased Receivable (a “Credit Default Certification”), together with evidence reasonably satisfactory to the Buyer that such Credit Default Certification is true and accurate, a Dispute shall be deemed to exist with respect to such Overdue Receivable. (i) Servicer Indemnification. Each Servicer hereby agrees to indemnify and hold harmless the Buyer and its officers, directors, agents, representatives, shareholders, counsel, employees and each of their respective Affiliates, successors and assigns (each, an “Indemnified Person”) from and against any and all damages, claims, losses, costs, expenses and liabilities (including, without limitation, reasonable attorneys’ fees and expenses of one firm of counsel to the Buyer and any participant in connection therewith, and if reasonably necessary, one local counsel in any relevant jurisdiction and, solely in the case of an actual or potential conflict of interest, of one additional counsel for any such participant and, if reasonably necessary, one additional local counsel in any relevant jurisdiction) (all of the foregoing being collectively referred to as “Indemnified Amounts”) arising out of or resulting from or related to (i) any failure by any Servicer to perform its duties or obligations as Servicer hereunder in accordance with this Agreement or to comply with any Applicable Law, (ii) any breach of any Servicer’s representations, warranties or covenants under any Transaction Document or (iii) any claim brought by any Person other than an Indemnified Person arising from any Servicer’s servicing or collection activities with respect to the Purchased Receivables; provided, however, that in all events there shall be excluded from the foregoing indemnification any damages, claims, losses, costs, expenses or liabilities to the extent resulting solely from (x) the gross negligence or willful misconduct of an Indemnified Person as determined in a final judgment by a court of

5 734109631 19632855 competent jurisdiction or (y) the failure of an Account Debtor to pay any sum due under its Purchased Receivables by reason of the financial or credit condition of such Account Debtor (including, without limitation, the occurrence of an Insolvency Event with respect to the applicable Account Debtor). Any amount due and payable pursuant to this section shall be paid to the Buyer’s Account in immediately available funds by no later than the fifth (5th) Business Day following demand therefor delivered by the Buyer. (j) Replacement of Servicers. Following the occurrence of a Servicer Termination Event with respect to a Servicer other than Hanes, the Buyer may, at its discretion, upon at least five (5) Business Days’ prior notice to the applicable Servicer, replace such Servicer with itself or any agent for the Buyer with respect to any and all Purchased Receivables. Following the occurrence of a Servicer Termination Event with respect to Hanes, the Buyer may, at its discretion, upon at least five (5) Business Days’ prior notice to the applicable Servicers, replace any or all Servicers with itself or any agent for the Buyer with respect to any and all Purchased Receivables Sellers shall be responsible for all reasonable costs and expenses incurred in connection with such replacement and shall promptly reimburse the Buyer with respect to same. (k) The Buyer as Attorney-in-Fact. Sellers hereby appoint the Buyer as the true and lawful attorney-in-fact of Sellers, with full power of substitution, coupled with an interest, and hereby authorizes and empowers the Buyer in the name and on behalf of Sellers at any time following removal of any Seller as Servicer following the occurrence of a Servicer Termination Event, upon at least five (5) Business Days’ prior notice to the applicable Servicer, to take such actions, and execute and deliver such documents, as the Buyer deems necessary or advisable in connection with any applicable Purchased Receivable (i) to perfect the purchase and sale of such Purchased Receivable, including, without limitation, to send a notice of such purchase and sale to the Account Debtor of the transfers contemplated hereby and the sale of such Purchased Receivable or (ii) to make collection of and otherwise realize the benefits of such Purchased Receivable. At any time following removal of any Seller as Servicer following the occurrence of a Servicer Termination Event and upon at least five (5) Business Days’ prior notice to the applicable Servicer, the Buyer shall have the right to bring suit, in the Buyer’s or any Seller’s name, and generally have all other rights of an owner and holder respecting each applicable Purchased Receivable, including without limitation the right to accelerate or extend the time of payment, settle, compromise, release in whole or in part any amounts owing on such Purchased Receivables and issue credits in its own name or the name of such Seller. At any time following removal of any Seller as Servicer following the occurrence of a Servicer Termination Event, the Buyer may endorse or sign the Buyer’s or any Seller’s name on any checks or other instruments with respect to any applicable Purchased Receivables or the goods covered thereby. The Buyer shall not be liable for any actions taken by it in accordance with this Section unless such actions constitute the gross negligence or willful misconduct of the Buyer as determined by a court of competent jurisdiction in a final judgment. This power of attorney, being coupled with an interest, is irrevocable and shall not expire until the Final Collection Date. 5. Deemed Collections; Repurchase Events; Indemnities and Set-Off. (a) Deemed Collections. If, on any day, the outstanding balance of a Purchased Receivable is reduced (but not cancelled) as a result of any Dilution (other than any Dilutions specifically taken into account in determining the Purchase Price for such Receivable), the applicable Seller shall be deemed to have received on such day a Collection of such Purchased Receivable in the amount of such reduction. If on any day a Purchased Receivable is cancelled (or reduced to zero) as a result of any Dilution (other than any Dilutions specifically taken into account in determining the Purchase Price for such Receivable), the applicable Seller shall be deemed to have received on such day a Collection of such Purchased Receivable in the amount of the Outstanding Purchase Amount of such Purchased Receivable (as determined immediately prior to such Dilution). Any amount deemed to have been received under this Section 5(a) shall constitute a “Deemed Collection”; provided, however, to the extent any Purchased Receivable for which a Deemed Collection is deemed to have been received has an existing Dilution Reserve that is greater than $0, no payment shall be required by any Seller with respect to any Deemed Collections on such Purchased Receivables until such time as the aggregate Deemed Collections on such Purchased Receivable exceed such Purchased Receivable’s Dilution Reserve (which shall be reduced on a dollar for dollar basis equal to the amount of such Deemed Collection until reduced to zero), and then only in the amount of such excess. The aggregate Dilution Reserve payable to a Seller in accordance with the terms hereof on any Settlement Date and the aggregate Deemed Collections payable on such Settlement Date may be netted against each other in making the determination as to what payments are required on such day.

6 734109631 19632855 (b) Repurchase Events. If any of the following events (each, an “Repurchase Event”) occurs with respect to a Purchased Receivable: (i) such Purchased Receivable was not an Eligible Receivable on the Purchase Date thereof; (ii) any Seller or Servicer fails to perform or observe any other term, covenant or agreement with respect to such Purchased Receivable set forth in any Transaction Document or any related Contract and such failure shall or could reasonably be expected to have a material adverse effect on the ability to collect the Net Invoice Amount of such Purchased Receivable on the Adjusted Due Date thereof; or (iii) a Dispute has arisen with respect to any Purchased Receivable, then, the applicable Seller shall, upon obtaining knowledge thereof, immediately deliver notice thereof to the Buyer and, at the time, in the manner and otherwise as hereinafter set forth, repurchase such Purchased Receivable at the Buyer’s option and demand. The repurchase price for a Purchased Receivable shall be the amount equal to (i) the Purchase Price for such Purchased Receivable, net of any Collections or other payments received by the Buyer with respect to such Purchased Receivable, plus (ii) the Discount applicable to such Purchased Receivable and accrued for the period from the applicable Purchase Date to the date on which such Purchased Receivable is repurchased, plus (iii) all other amounts then payable by the applicable Seller under the Transaction Documents with respect to such Purchased Receivable as of the date on which such Purchased Receivable is repurchased (such amount herein referred to as the “Repurchase Price”). The Repurchase Price for any Purchased Receivable shall be paid to the Buyer’s Account in immediately available funds by no later than the fifth (5th) Business Day following demand therefor by the Buyer. Upon the payment in full of the repurchase price with respect to a Purchased Receivable, such Purchased Receivable shall hereby be, and be deemed to be, repurchased by such Seller from the Buyer without recourse to or warranty by the Buyer. To the extent an affected Purchased Receivable has an existing Dilution Reserve that is greater than $0, the applicable Seller shall receive a credit against the Repurchase Price of such Purchased Receivable on a dollar for dollar basis (which credit will also reduce such Dilution Reserve on the same basis). (c) Seller Indemnification. Each Seller hereby agrees jointly and severally to indemnify each Indemnified Person and hold each Indemnified Person harmless from and against any and all Indemnified Amounts arising out of or resulting from or related to this Agreement or any other Transaction Document or the ownership, maintenance or funding, directly or indirectly, of the Purchased Receivable (or any of them) or otherwise arising out of or resulting from the actions or inactions of any Seller or any of its Affiliates, including, without limitation, any of the following: (i) any representation or warranty made or deemed made by such Seller (or any of its officers) under or in connection with this Agreement or any other Transaction Document that shall have been incorrect when made; (ii) the failure by any Seller to perform any of its covenants or obligations under any Transaction Document; (iii) the failure by any Seller or any Purchased Receivable or Contract to comply with any Applicable Law; (iv) the failure to vest in the Buyer ownership of, and a first-priority perfected security interest (within the meaning of the UCC) in, each Purchased Receivable and all Collections in respect thereof, free and clear of any Adverse Claim; (v) any Dispute, Dilution or any other claim resulting from the services performed or merchandise furnished in connection with any Purchased Receivable or the furnishing or failure to furnish such services or merchandise or relating to collection activities with respect to any Purchased Receivable; (vi) any suit or claim related to any Receivable, any Contract or any Transaction Document; (vii) the commingling by any Seller of Collections at any time with other funds of such Seller or any other Person or (viii) any civil penalty or fine assessed by OFAC or any other Governmental Authority administering any Anti-Terrorism Law, Anti-Corruption Law or Sanctions, and all reasonable costs and expenses (including reasonable documented legal fees and disbursements) incurred in connection with defense thereof by, any Indemnified Person in connection with the Transaction Documents as a result of any action of the Seller or any of its respective Affiliates; provided, however, that in all events there shall be excluded from the foregoing indemnification any Indemnified Amounts to the extent resulting solely from (x) the gross negligence or willful misconduct of an Indemnified Person as determined in a final judgment by a court of competent jurisdiction or (y) the failure of an Account Debtor to pay any sum due under its Purchased Receivables by reason of the financial or credit condition of such Account Debtor (including, without limitation, the occurrence

7 734109631 19632855 of an Insolvency Event with respect to the applicable Account Debtor). Any amount due and payable pursuant to this section shall be paid to the Buyer’s Account in immediately available funds by no later than the fifth (5th) Business Day following demand therefor by the Buyer. (d) Tax Indemnification. All payments on the Purchased Receivables from the Account Debtors and Sellers will be made free and clear of any present or future taxes, withholdings or other deductions whatsoever that arise by reason of the sale of the Purchased Receivables to the Buyer (“Sale Transaction Taxes”) or relating to the underlying transactions between the applicable Seller and the related Account Debtors that gave rise to such Purchased Receivables (“Prior Transaction Taxes”) or arise by reason of the imposition of any withholding taxes on amounts paid by such Account Debtors or Seller to the Buyer with respect to a Purchased Receivable pursuant to this Agreement (“Payment Transaction Taxes”), except as required by Applicable Law. If any applicable Law (as determined in the good faith discretion of the Account Debtor) requires the deduction or withholding of any Sale Transaction Taxes or Prior Transaction Taxes or Payment Transaction Taxes from any such payments, then the Seller or the related Account Debtors shall be entitled to make such deduction or withholding and shall timely pay the full amount deducted or withheld to the relevant Governmental Authority in accordance with applicable Law. Each Seller jointly and severally will indemnify the Buyer and hold the Buyer harmless from any Sale Transaction Taxes, Prior Transaction Taxes, and Payment Transaction Taxes other than any such taxes that are imposed as a result of the failure of the Buyer to deliver any forms reasonably requested by Sellers, where the Buyer is legally able to deliver such forms without undue burden or expense. Further, each Seller shall pay and indemnify and hold the Buyer harmless from and against, any Sale Transaction Taxes or Prior Transaction Taxes or Payment Transaction Taxes that may at any time be asserted (including any sales, occupational, excise, gross receipts, personal property, privilege or license taxes, or withholdings, but not including taxes imposed upon the Buyer with respect to its overall net income or taxes excluded pursuant to the proviso in the immediately preceding sentence) and costs, expenses and reasonable attorneys’ fees and expenses in defending against the same, whether arising by reason of the acts to be performed by any Seller hereunder or otherwise. Any amount due and payable pursuant to this section shall be paid to the Buyer’s Account in immediately available funds by no later than the fifteenth (15th) Business Day following demand therefor delivered by the Buyer to the Sellers together with reasonable evidence of such amount being due and payable. (e) Set-Off. Each Seller and Servicer hereby irrevocably instruct and authorize the Buyer to setoff, appropriate and apply (without presentment, demand, protest or other notice which are hereby expressly waived) any deposits and any other indebtedness held or owing by the Buyer or any branch, agency, representative office or Subsidiary thereof, including the payment of the Purchase Price for any Proposed Receivables, to, or for the account of, any Seller or any Servicer or any Performance Guarantor against amounts owing by each Seller or Servicer hereunder or under any other Transaction Document (even if contingent or unmatured). (f) UCC. The rights granted to the Buyer hereunder are in addition to all other rights and remedies afforded to the Buyer as a secured party under the UCC. 6. Notices. Unless otherwise provided herein, all communications by any party to any other party hereunder or any other Transaction Document shall be in a writing personally delivered or sent by a recognized overnight delivery service, or certified mail, postage prepaid, return receipt requested, or by email to such party, as the case may be, at its address set forth below: If to Hanes, Knights, GFSI, CC Products, or Alternative, as a Seller or Servicer: 1000 East Hanes Mill Road Winston-Salem, North Carolina 27105 Attention: Jodie F. Covington Tel: (336) 519-4930 Email: Jodie.covington@hanes.com

8 734109631 19632855 With a copy to: 1000 East Hanes Mill Road Winston-Salem, North Carolina 27105 Attention: Elizabeth C. Southern Tel: (336) 519-6661 Email: Beth.Southern@hanes.com If to the Buyer (other than Purchase Requests): MUFG Bank, Ltd. 1221 Avenue of the Americas New York, New York 10020 Attention: Greg Hurst Tel: 212-782-6963 Email: rhurst@us.mufg.jp With a copy to: MUFG Bank, Ltd. 1251 Avenue of the Americas New York, New York 10020-1104 Attention: Amy Mellon Grandis Tel: 212-782-4638 Email: amellon@us.mufg.jp If to the Buyer (Purchase Requests only) also add: MUFG Bank, Ltd. 1221 Avenue of the Americas New York, New York 10020 Attention: Yumi Motai, Elizabeth Colon Tel: 212-782-5554, 212-782-5716 Email: ymotai@us.mufg.jp, ecolon@us.mufg.jp Each Seller and Servicer agree that the Buyer may presume the authenticity, genuineness, accuracy, completeness and due execution of any email bearing a facsimile or scanned signature resembling a signature of an authorized Person of such Seller or Servicer without further verification or inquiry by the Buyer. Notwithstanding the foregoing, the Buyer in its reasonable discretion may elect not to act or rely upon such a communication and shall be entitled (but not obligated) to make inquiries or require further Seller or Servicer action to authenticate any such communication. Any Purchase Request, and any supporting documentation in connection herewith or therewith, such as copies of invoices, not submitted via the MUFG Platform may be sent by any Seller or Servicer by electronic mail attachment in portable document format (.pdf). A party may change the address at which it is to receive notices hereunder by written notice in the foregoing manner given to the other parties hereto. 7. Expenses. Each Seller hereby agrees, jointly and severally, to reimburse the Buyer on demand for: (a) all actual and reasonable costs and expenses (including due diligence expenses) incurred by the Buyer in connection with the negotiation, preparation and execution of the Transaction Documents (including this Agreement), including all reasonable expenses and accountants’, consultants’ and attorneys’ fees of one firm of counsel to the Buyer and any participant in connection therewith (and if reasonably necessary, one local counsel in any relevant jurisdiction) and, solely in the case of an actual or potential conflict of interest, of one additional counsel for such participant (and, if reasonably necessary, one additional local counsel in any relevant jurisdiction); (b) the administration (including periodic auditing as provided for herein) of this Agreement and the other Transaction Documents and the transactions contemplated thereby, including all reasonable expenses

9 734109631 19632855 and accountants’, consultants’ and attorneys’ fees incurred in connection with the administration and maintenance of this Agreement and the other Transaction Documents and the transactions contemplated thereby; (c) all reasonable and documented costs and expenses (including reasonable attorneys’ fees and expenses of one firm of counsel to the Buyer and any participant in connection therewith (and if reasonably necessary, one local counsel in any relevant jurisdiction) and, solely in the case of an actual or potential conflict of interest, of one additional counsel for such participant (and, if reasonably necessary, one additional local counsel in any relevant jurisdiction)) the Buyer incurs in connection with the enforcement of this Section 7, or any of its other rights under this Agreement or any of the other Transaction Documents by such Seller (including all such expenses incurred during any work-out or negotiation in respect of the obligations of such Seller hereunder); and (d) all stamp and other similar taxes and fees payable or determined to be payable in connection with the execution, delivery, filing and recording of this Agreement or the other Transaction Documents. 8. Interest on Overdue Amounts. All amounts due for payment by any Seller or Servicer to the Buyer pursuant to this Agreement shall accrue interest at the Overdue Payment Rate from the date on which payment thereof is due until the date on which payment thereof is made in accordance with the terms of this Agreement. 9. Governing Law. THIS AGREEMENT, INCLUDING THE RIGHTS AND DUTIES OF THE PARTIES HERETO, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK (INCLUDING SECTIONS 5-1401 AND 5-1402 OF THE GENERAL OBLIGATIONS LAW OF THE STATE OF NEW YORK, BUT WITHOUT REGARD TO ANY OTHER CONFLICTS OF LAW PROVISIONS THEREOF, EXCEPT TO THE EXTENT THAT THE PERFECTION, THE EFFECT OF PERFECTION OR PRIORITY OF THE INTERESTS OF THE BUYER IN THE PURCHASED RECEIVABLES IS GOVERNED BY THE LAWS OF A JURISDICTION OTHER THAN THE STATE OF NEW YORK). 10. No Non-Direct Damages. To the fullest extent permitted by Applicable Law, Seller and the Servicer shall not assert, and each Seller hereby waives, any claim against any Indemnified Person, and Buyer shall not assert, and Buyer hereby waives, any claim against Seller, Servicer or Performance Guarantor on any theory of liability, for special, indirect, consequential or punitive damages (as opposed to direct or actual damages) arising out of, in connection with, or as a result of, this Agreement, any other Transaction Document or any agreement or instrument contemplated hereby, the transactions contemplated hereby or thereby. No Seller, Servicer, or Indemnified Person shall be liable for any damages arising from the use by unintended recipients of any information or other materials distributed by it through telecommunications, electronic or other information transmission systems in connection with this Agreement or the other Transaction Documents or the transactions contemplated hereby or thereby; provided that the waiver provided for in this sentence shall not apply to damages resulting directly from such Person’s own gross negligence or willful misconduct as determined by a court of competent jurisdiction in a final judgment. 11. Joinder of Additional Sellers. At any time during the term of this Agreement, with the written consent of the Buyer in its sole and absolute discretion, one or more additional U.S. subsidiaries of Hanes (each, an “Additional Seller”), may join this Agreement as a Seller in all respects by delivering a Joinder Agreement to the Buyer along with such other approvals, certificates, legal opinions and other documents as the Buyer may reasonably request, in each case, generally consistent with the documents delivered on the Closing Date, in form and substance reasonably acceptable to the Buyer. Upon receipt of such Joinder Agreement and such other documents, such Additional Seller shall become a Seller hereunder, subject to the rights, duties and obligations of a Seller in all respects. 12. Joint and Several Obligations. The obligations of the Sellers hereunder are joint and several. To the maximum extent permitted by Applicable Law, until the Final Collection Date, each Seller hereby waives any claim, right or remedy that such Seller now has or hereafter acquires against any other Seller that arises hereunder including, without limitation, any claim, remedy or right of subrogation, reimbursement, exoneration, contribution, indemnification, or participation in any claim, right or remedy of the Buyer against any Seller or any of its property which the Buyer now has or hereafter acquires, whether or not such claim, right or remedy arises in equity, under

10 734109631 19632855 contract, by statute, under common law or otherwise. In addition, until the Final Collection Date, each Seller hereby waives any right to proceed against the other Sellers, now or hereafter, for contribution, indemnity, reimbursement, and any other suretyship rights and claims, whether direct or indirect, liquidated or contingent, whether arising under express or implied contract or by operation of law, which any Seller may now have or hereafter have as against the other Seller with respect to the transactions contemplated by this Agreement. 13. General Provisions. (a) Final Agreement. This Agreement represents the final agreement of the parties hereto with respect to the subject matter hereof and supersedes all prior and contemporaneous understandings and agreements with respect to such subject matter. No provision of this Agreement may be amended or waived except by a writing signed by the parties hereto. This Agreement shall bind and inure to the benefit of the respective successors and permitted assigns of each of the parties; provided, however, that no Seller or Servicer may assign any of its rights hereunder without the Buyer’s prior written consent, given or withheld in the Buyer’s sole discretion. The Buyer shall have the right to sell, transfer, negotiate, or grant participations in all or any part of, or any interest in, the Buyer’s obligations, rights and benefits hereunder (including in any Purchased Receivables); provided, that, other than with respect to any such sale, transfer, negotiation, or participation in any Purchased Receivable (for which no consent shall be required but prompt notice thereof shall be delivered to Hanes), the Buyer shall, unless a Servicer Termination Event has occurred, obtain the prior written consent of Hanes to any such sale, transfer, negotiation, or participation (which consent shall not be unreasonably withheld, conditioned or delayed). (b) Severability. Any provisions of this Agreement that are prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. (c) Execution; Counterparts. This Agreement may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement by electronic mail attachment in portable document format (.pdf) shall be effective as delivery of a manually executed counterpart of this Agreement. (d) Termination. The term of this Agreement shall last from the initial effective date hereof until terminated by either the Buyer or the Sellers convenience at any time by thirty (30) days’ prior written notice to the other party. Notwithstanding the foregoing, this Agreement, including all covenants, representations and warranties, repurchase obligations and indemnities made herein shall continue in full force and effect until the Final Collection Date. Each Seller’s and Servicer’s obligations to indemnify the Buyer with respect to the expenses, damages, losses, costs and liabilities shall survive until the later of (x) the Final Collection Date and (y) all applicable statute of limitations periods with respect to actions that may be brought by the Buyer under the Transaction Documents have run. (e) LIBO Rate Cessation. Anything in this Agreement to the contrary notwithstanding, if the Buyer determines (which determination shall be binding and conclusive) that quotations of interest rates for the relevant deposits in the definition of LIBO Rate in Exhibit A are not being provided in the relevant amounts or for the relevant maturities for purposes of determining the appropriate Account Debtor Discount Rates applicable to the Proposed Receivables included on any Purchase Request (whether by reason of circumstances affecting the London interbank Eurodollar market or otherwise) or adequate and reasonable means do not exist for ascertaining the LIBO Rate or the LIBO Rate does not adequately and fairly reflect the cost to the Buyer of funding a Purchase Request, then the Buyer shall give the Sellers prompt notice thereof, and so long as such condition remains in effect, (i) no Purchase Request shall be funded using the LIBO Rate as a component of the Discount and (ii) all outstanding and future Purchase Requests shall be funded using a Discount that is calculated based on the Prime Rate plus a margin, which margin shall have the effect of approximating the return to the Buyer that was expected prior to the existence of such condition. If (i) the foregoing unavailability or inadequacy with respect to the LIBO Rate is not of a temporary nature or (ii) the Buyer determines that (A) the administrator of the LIBO Rate or a Governmental Authority having jurisdiction over such administrator or the Buyer (or any other Person on behalf of such administrator or Governmental Authority) has made or published a public statement announcing that (1) the

11 734109631 19632855 administrator of the LIBO Rate has ceased or will cease to provide the LIBO Rate, permanently or indefinitely (provided that, at the time of such statement or publication, no successor administrator will continue to provide the LIBO Rate), or (2) the LIBO Rate is no longer representative or (B) non-recourse and limited recourse accounts receivable purchase facilities that include similar language to that contained in this Section 1(e) are being executed or amended to incorporate or adopt a new benchmark interest rate (including any mathematical or other adjustments to the benchmark (if any) incorporated therein) to replace the LIBO Rate, then the Buyer and the Sellers shall negotiate in good faith with a view to agreeing upon another mutually acceptable benchmark interest rate (including any mathematical or other adjustments to such benchmark) for the Purchase Requests and such other related changes to this Agreement as may be applicable. For the avoidance of doubt, if such alternate benchmark interest rate as so determined would be less than zero, such rate shall be deemed to be zero for the purposes of this Agreement. Each determination by the Buyer shall be conclusive absent manifest error. (f) Calculation of Interest. All interest amounts calculated on a per annum basis hereunder are calculated on the basis of a year of three hundred and sixty (360) days. (g) WAIVER OF JURY TRIAL. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES ANY RIGHT THAT IT MAY HAVE TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION BASED UPON OR ARISING OUT OF ANY OF THE TRANSACTIONS CONTEMPLATED HEREIN, INCLUDING CONTRACT CLAIMS, TORT CLAIMS, BREACH OF DUTY CLAIMS AND ALL OTHER COMMON LAW OR STATUTORY CLAIMS. (h) CONSENT TO JURISDICTION. EACH PARTY HERETO HEREBY ACKNOWLEDGES AND AGREES THAT IT IRREVOCABLY (i) SUBMITS TO THE JURISDICTION, FIRST, OF ANY UNITED STATES FEDERAL COURT, AND SECOND, IF FEDERAL JURISDICTION IS NOT AVAILABLE, OF ANY NEW YORK STATE COURT, IN EITHER CASE SITTING IN NEW YORK CITY, NEW YORK, IN ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT AND ANY OTHER TRANSACTION DOCUMENT, (ii) AGREES THAT ALL CLAIMS IN RESPECT OF SUCH ACTION OR PROCEEDING MAY BE HEARD AND DETERMINED ONLY IN SUCH NEW YORK STATE OR FEDERAL COURT AND NOT IN ANY OTHER COURT, AND (iii) WAIVES, TO THE FULLEST EXTENT IT MAY EFFECTIVELY DO SO, THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE OF SUCH ACTION OR PROCEEDING. (i) WAIVER OF IMMUNITIES. EACH PARTY HERETO HEREBY ACKNOWLEDGES AND AGREES THAT TO THE EXTENT THAT IT HAS OR HEREAFTER MAY ACQUIRE ANY IMMUNITY FROM THE JURISDICTION OF ANY COURT OR FROM ANY LEGAL PROCESS (WHETHER THROUGH SERVICE OR NOTICE, ATTACHMENT PRIOR TO JUDGMENT, ATTACHMENT IN AID TO EXECUTION, EXECUTION OR OTHERWISE) WITH RESPECT TO ITSELF OR ITS PROPERTY, IT HEREBY IRREVOCABLY WAIVES SUCH IMMUNITY IN RESPECT OF ITS OBLIGATIONS UNDER OR IN CONNECTION WITH THIS AGREEMENT. (j) Captions and Cross References. The various captions in this Agreement are provided solely for convenience of reference and shall not affect the meaning or interpretation of any provision of this Agreement. Unless otherwise indicated, references in this Agreement to any Section, Schedule or Exhibit are to such Section of or Schedule or Exhibit to this Agreement, as the case may be, and references in any Section, subsection, or clause to any subsection, clause or subclause are to such subsection, clause or subclause of such Section, subsection or clause. (k) No Party Deemed Drafter. Each Servicer, Seller and the Buyer agree that no party hereto shall be deemed to be the drafter of this Agreement. (l) PATRIOT Act. The Buyer hereby notifies each other party hereto that pursuant to the requirements of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (Title III of Pub. L. 107-56 (signed into law October 26, 2001)) (the “PATRIOT Act”), it is required to obtain, verify and record information that identifies each such party, which information includes the name, address, tax identification number and other information that will allow the Buyer to identify such party in accordance with the PATRIOT Act. This notice is given in accordance with the requirements of the

12 734109631 19632855 PATRIOT Act. Promptly following any request therefor, each party to this Agreement shall deliver to the Buyer all documentation and other information required by bank regulatory authorities requested by the Buyer for purposes of compliance with applicable “know your customer” requirements under the PATRIOT Act, the Beneficial Ownership Rule or other applicable anti-money laundering laws, rules and regulations. (m) Divisions. For all purposes under the Transaction Documents, in connection with any division or plan of division under Delaware law (or any comparable event under a different jurisdiction’s laws): (i) if any asset, right, obligation or liability of any Person becomes the asset, right, obligation or liability of a different Person, then it shall be deemed to have been transferred from the original Person to the subsequent Person, and (ii) if any new Person comes into existence, such new Person shall be deemed to have been organized on the first date of its existence by the holders of its Capital Stock at such time. (n) Accounting Treatment; Non-Reliance. Each Seller and each Servicer agrees and acknowledges that (i) it is a sophisticated party in relation to this Agreement; (ii) it has made its own independent decision to enter into the Agreement, the other Transaction Documents to which it is a party and the transactions contemplated hereby and thereby and, in connection therewith, has obtained such independent accounting, legal, tax, financial and other advice as it deems necessary and appropriate (including, without limitation, as to the appropriate treatment of such transactions for accounting, legal, tax and other purposes) and (iii) it has not relied upon any representation or advice from the Buyer, any of their affiliates or any of their respective directors, officers, employees, contractors, counsel, advisors or other representatives in this regard. (o) Confidentiality. Each party hereto agrees to hold the Transaction Documents, the transactions contemplated thereby and all non-public information received by it in connection therewith from any other party hereto or its agents or representatives in confidence and agrees not to provide any Person with copies of this Agreement or such non-public information other than to (i) its affiliates and any officers, directors, members, managers, employees or outside accountants, auditors or attorneys of such party or its affiliates, (ii) any prospective or actual assignee or participant which (in each case) has signed a confidentiality agreement containing provisions substantively identical to this Section 13(o) or has agreed to be subject to the terms of this Section 13(o), (iii) credit support providers if they agree to hold it confidential pursuant to customary commercial terms, (iv) Governmental Authorities with appropriate jurisdiction (including filings required under securities Laws) and (v) appropriate filings under the UCC. Notwithstanding the above stated obligations, the parties hereto will not be liable for disclosure or use of such information which: (i) was required by Applicable Law, including pursuant to a valid subpoena or other legal process, (ii) is disclosed or used in connection with the exercise of any remedies hereunder or any suit, action or proceeding relating to this Agreement or any other Transaction Document or the enforcement of rights hereunder or thereunder, (iii) was in such Person’s possession or known to such Person prior to receipt or (iv) is or becomes known to the public through disclosure in a printed publication (without breach of any of such Person’s obligations hereunder). [Signatures Commence on the Following Page]

734109631 19632855 Schedule I-1 Schedule I Form of Purchase Request [date] MUFG Bank, Ltd. 1221 Avenue of the Americas New York, New York 10020 Attention: Yumi Motai, Elizabeth Colon Email: ymotai@us.mufg.jp, ecolon@us.mufg.jp Reference is hereby made to that certain Master Receivables Purchase Agreement, dated as of December 11, 2019, by and among HANESBRANDS INC., a Maryland corporation, KNIGHTS APPAREL LLC, a Delaware limited liability company, GFSI LLC, a Delaware limited liability company, CC PRODUCTS LLC, a Delaware limited liability company, ALTERNATIVE APPAREL, INC., a Delaware corporation, and any other seller from time to time party thereto (each, in such capacity, a “Seller” and collectively, the “Sellers”), and as servicers (each, in such capacity, a “Servicer” and collectively, the “Servicers”), and MUFG BANK, LTD., as buyer (the “Buyer”) (as it may be amended, restated, modified or supplemented from time to time, the “Agreement”; capitalized terms not otherwise defined herein shall have the meanings set forth in, or by reference in, the Agreement). Pursuant to the terms of the Agreement, the Sellers party hereto hereby request that the Buyer purchase from such Sellers on ___________ ____, 20____, the Proposed Receivables listed on the exhibit attached hereto with an aggregate Net Invoice Amount of $_____________. Each Seller party hereto represents and warrants that each of the conditions precedent outlined in Section 1(c) of the Agreement will be satisfied in connection with such proposed purchase. Upon acceptance by the Buyer of this Purchase Request and payment of the aggregate Purchase Price, the Buyer hereby purchases, and the Sellers party hereto hereby sell, all of such Sellers’ right, title and interest (but none of Sellers’ underlying obligations to the applicable Account Debtor) with respect to the Proposed Receivables set forth on the attached exhibit as of the date hereof, and such Proposed Receivables shall become Purchased Receivables in the manner set forth in the Agreement. [HANESBRANDS INC. By:______________________________________ Name: Title:] [KNIGHTS APPAREL LLC By:______________________________________ Name: Title:] [GFSI LLC By:______________________________________

Schedule I-2 734109631 19632855 Name: Title:] [CC PRODUCTS LLC By:______________________________________ Name: Title:] [ALTERNATIVE APPAREL, INC. By:______________________________________ Name: Title:] REQUEST ACCEPTED: MUFG BANK, LTD. By:______________________________________ Title:_____________________________________

Schedule I-3 734109631 19632855 List of Accounts Receivable for Account Debtor(s): [____________] Proposed for Sale as of ____________, 20__ CALCULATION OF PURCHASE SUBLIMIT (all amounts in Dollars) FOR ACCOUNT DEBTOR: _____________________________________ Outstanding Purchase Amount with respect to applicable Account Debtor (excluding Proposed Receivables): $ Net Invoice Amount for Proposed Receivables: $ Total Outstanding Purchase Amount for applicable Account Debtor (not to exceed applicable Purchase Sublimit for such Account Debtor): $ CALCULATION OF PURCHASE SUBLIMIT (all amounts in Dollars) FOR ACCOUNT DEBTOR: _____________________________________ Outstanding Purchase Amount with respect to applicable Account Debtor (excluding Proposed Receivables): $ Net Invoice Amount for Proposed Receivables: $ Total Outstanding Purchase Amount for applicable Account Debtor (not to exceed applicable Purchase Sublimit for such Account Debtor): $ CALCULATION OF TOTAL OUTSTANDING PURCHASE AMOUNT (all amounts in Dollars) Outstanding Purchase Amount with respect to all Account Debtors (excluding Proposed Receivables): $ Net Invoice Amount for Proposed Receivables: $ Total Outstanding Purchase Amount (not to exceed $__________________): $ Seller Account Debtor Invoice Number Net Invoice Amount Due Date [Default Rate of Interest or Fees (if any)]

Schedule II-1 734109631 19632855 Schedule II Account Debtors ACCOUNT DEBTOR NAME ACCOUNT DEBTOR PURCHASE SUBLIMIT ACCOUNT DEBTOR DISCOUNT RATE DILUTION RESERVE PERCENTAGE ACCOUNT DEBTOR BUFFER PERIOD MAXIMUM TENOR Kohl’s Corporation $95,000,000 LIBO Rate + 0.85% 0% 15 days Ninety (90) days

Exhibit A-1 734109631 19632855 Exhibit A Certain Defined Terms A. Defined Terms. As used herein, the following terms shall have the following meanings: “Account Debtor” means a Person listed as an account debtor on Schedule II to this Agreement, as such Schedule may be modified or supplemented from time to time, as agreed to in writing by the Sellers and the Buyer in their respective sole and absolute discretion. “Account Debtor Buffer Period” means for each Account Debtor, the number of days set forth under the heading “Account Debtor Buffer Period” for such Account Debtor on Schedule II to this Agreement, as such Schedule may be modified or supplemented from time to time, as agreed to in writing by the Sellers and the Buyer in their respective sole and absolute discretion. “Account Debtor Discount Rate” means with respect to any Account Debtor, the “Account Debtor Discount Rate” specified for such Account Debtor on Schedule II to this Agreement, as such Schedule may be modified or supplemented from time to time, as agreed to in writing by the Sellers and the Buyer in their respective sole and absolute discretion. “Additional Seller” has the meaning set forth in Section 11 hereof. “Adjusted Due Date” means, with respect to any Purchased Receivable, the date that corresponds to the Due Date with respect to such Purchased Receivable plus the Account Debtor Buffer Period for the Account Debtor of such Purchased Receivable. “Adverse Claim” means any ownership interest or claim, mortgage, deed of trust, pledge, lien, security interest, hypothecation, charge or other encumbrance or security arrangement of any nature whatsoever, whether voluntarily or involuntarily given, including, but not limited to, any conditional sale or title retention arrangement, and any assignment, deposit arrangement or lease intended as, or having the effect of, security; it being understood that any thereof in favor of, or assigned to, the Buyer shall not constitute an Adverse Claim. “Affiliate” when used with respect to a Person means any other current or future Person controlling, controlled by, or under common control with, such Person. For the purposes of this definition, “control” of a Person means the possession, directly or indirectly, of the power to direct or cause the direction of its management and policies, whether through the ownership of voting securities, by contract or otherwise. “Agreement” has the meaning set forth in the preamble hereto. “Anti-Corruption Laws” means all laws, rules, and regulations of any jurisdiction applicable to any Seller or any of its Affiliates from time to time relating to bribery or corruption. “Anti-Terrorism Laws” means each of: (a) the Executive Order; (b) the PATRIOT Act; (c) the Money Laundering Control Act of 1986, 18 U.S.C. Sect. 1956 and any successor statute thereto; (d) the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada); (e) the Bank Secrecy Act, and the rules and regulations promulgated thereunder; and (f) any other Applicable Law of the United States, Canada or any member state of the European Union now or hereafter enacted to monitor, deter or otherwise prevent: (i) terrorism or (ii) the funding or support of terrorism or (iii) money laundering. “Applicable Law” means any law (including common law), constitution, statute, treaty, regulation, rule, ordinance, order, injunction, writ, decree, judgment, award or similar item of or by a Governmental Authority or any interpretation, implementation or application thereof. “Beneficial Ownership Rule” means 31 C.F.R. § 1010.230.

Exhibit A-2 734109631 19632855 “Business Day” means any day that is not a Saturday, Sunday or other day on which banks in New York City are required or permitted to close; provided, when used in connection with determining the LIBO Rate, the term “Business Day” shall also exclude any day on which banks are not open for dealings in dollar deposits in the London interbank market. “Buyer” has the meaning set forth in the preamble hereto. “Buyer’s Account” means the account specified as such in Exhibit G hereto, or such other bank account identified in writing by the Buyer to Seller from time to time. “Capital Stock” means, with respect to any Person, any and all common shares, preferred shares, interests, participations, rights in or other equivalents (however designated) of such Person’s capital stock, partnership interests, limited liability company interests, membership interests or other equivalent interests and any rights (other than debt securities convertible into or exchangeable for capital stock), warrants or options exchangeable for or convertible into such capital stock or other equity interests. “Certification of Beneficial Owner(s)” means a certification regarding beneficial ownership of a Seller as required by the Beneficial Ownership Rule. “Change of Control” means Hanes, at any time, (i) ceasing to own, directly or indirectly, free and clear of any Adverse Claim and on a fully diluted basis, one hundred percent (100%) of the Capital Stock of each Seller (other than Hanes) or (ii) ceasing to control each Seller (other than Hanes). For the purposes of this definition, “control” of a Person means the possession, directly or indirectly, of the power to direct or cause the direction of its management and policies, whether through the ownership of voting securities, by contract or otherwise. “Closing Date” means the date of this Agreement. “Collections” means, with respect to any Receivable: (a) all funds that are received by any Seller or Servicer or any Affiliate on their behalf in payment of any amounts owed in respect of such Receivable (including purchase price, finance charges, interest and all other charges), or applied to amounts owed in respect of such Receivable (including insurance payments and net proceeds of the sale or other disposition of repossessed goods or other collateral or property of the related Account Debtor of such Receivable or any other Person directly or indirectly liable for the payment of such Receivable and available to be applied thereon), (b) all Deemed Collections, (c) all proceeds of all Related Security with respect to such Receivable and (d) all other proceeds of such Receivable. “Contract” means, for each Receivable, the invoice therefor and any other agreement or documentation between the applicable Seller and the applicable Account Debtor giving rise to, and/or setting forth terms and conditions related to the creation and payment of, such Receivable, including in each case any amendments. “Cost of Funds Rate” means the rate per annum quoted from time to time as such by the Buyer, which rate shall be determined and calculated by the Buyer in its sole discretion, taking into account factors including, but not limited to, the Buyer’s external and internal funding costs and prevailing interbank market rates and conditions. Notwithstanding the foregoing, if the Cost of Funds Rate shall be less than 0%, such rate shall be deemed 0% for purposes of this Agreement. “Credit and Collection Policy” means, as the context may require, those receivables credit and collection policies and practices of each Seller and Servicer in effect on the date hereof as modified in compliance with this Agreement. “Deemed Collection” has the meaning set forth in Section 5(a) hereof. “Dilution” means on any date after the date of the related Purchase Date with respect to a Purchased Receivable, an amount equal to the sum, without duplication, of the aggregate reduction effected on such day in the outstanding balance of such Purchased Receivable attributable to any non-cash items including credits, rebates,

Exhibit A-3 734109631 19632855 billing errors, sales or similar taxes, cash discounts, volume discounts, allowances, chargebacks, returned or repossessed goods, sales and marketing discounts, warranties, any unapplied credit memos and other non-cash adjustments or reductions that are made in respect of Account Debtors; provided, however, that (a) writeoffs to the extent related to the financial or credit condition of an Account Debtor (including the occurrence of an Insolvency Event with respect to the applicable Account Debtor) and (b) Disputes, in each case, shall not constitute Dilution. “Dilution Reserve” means with respect to any Purchased Receivable, initially, the Net Invoice Amount of such Purchased Receivable multiplied by the Dilution Reserve Percentage applicable to such Purchased Receivable, as such amount is reduced through the payment to Seller or application to any Dilutions from time to time after the Purchase Date for such Purchased Receivable in accordance with the terms of this Agreement. “Dilution Reserve Percentage” means, with respect to Purchased Receivables owed by an Account Debtor, the percentage forth under the heading “Dilution Reserve Percentage” for such Account Debtor on Schedule II to this Agreement, as such Schedule may be modified or supplemented from time to time, as agreed to in writing by the Sellers and the Buyer in their respective sole and absolute discretion. “Dilution Reserve Report” has the meaning set forth in Section 4(g). “Discount” means, with respect to each Purchased Receivable purchased on a Purchase Date related to a specific Account Debtor, the discount cost applied by the Buyer to such Purchased Receivable, equal to the product of (a)(i) if the Purchase Request for such Purchased Receivable was not received at least two (2) Business Days’ prior to the applicable Purchase Date in accordance with Section 1(d)(i), the Cost of Funds Rate and, (ii) otherwise, the applicable Account Debtor Discount Rate per annum, determined as of the Purchase Date for such Purchased Receivables, multiplied by (b) the result of (i) the applicable Discount Period, divided by (ii) 360. “Discount Period” means, with respect to any Purchased Receivable, the sum of the number of days from and including (i) the Purchase Date for such Purchased Receivable and to, but not including, (ii) the first Settlement Date occurring after the Adjusted Due Date for such Purchased Receivable. “Dispute” means any dispute, discount, deduction, claim, offset, defense, or counterclaim or similar position asserted of any kind relating to one or more Receivables (x) arising on account of the goods relating to such Receivables having been lost or damaged prior to receipt thereof by the related Account Debtor or otherwise not delivered to such Account Debtor in accordance with the Contract related thereto; (y) arising on account of the return of goods by an Account Debtor to any Seller, Servicer, any of their respective Affiliates or successors or assigns (including the Buyer) relating to its obligation to pay an amount due with respect to a Purchased Receivable, or (z) otherwise asserted by the related Account Debtor as being a basis for non-payment in full of the Receivable (other than (1) any Dilutions specifically taken into account in determining the Purchase Price for such Receivable and (2) disputes due only to the applicable Account Debtor’s financial or credit condition (including, without limitation, the occurrence of an Insolvency Event with respect to the applicable Account Debtor)); regardless of whether the same (i) is in an amount greater than, equal to or less than the applicable Purchased Receivable concerned or (ii) arises by reason of an act of God, civil strife, war, currency restrictions, foreign political restrictions or regulations, or any other circumstance or event beyond the control of such Seller or the applicable Account Debtor. “Dollars” means United States Dollars, the lawful currency of the United States of America. “Due Date” means, with respect to any Purchased Receivable, the date the related Contract provides for timely payment in full of the amounts owing thereunder. “Eligible Receivable” means a Receivable with respect to which each of the Eligibility Criteria set forth in Exhibit E is satisfied. “Repurchase Events” has the meaning set forth in Section 5(b) hereof.

Exhibit A-4 734109631 19632855 “Executive Order” means Executive Order No. 13224 on Terrorist Financings: Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten To Commit, or Support Terrorism issued on September 23, 2001. “Final Collection Date” means the date following the termination of this Agreement on which the Buyer has received (i) all Collections owing on the Purchased Receivables and (ii) all payments, if any, required to be paid by any Seller or Servicer under this Agreement or any other Transaction Document, including with respect to Repurchase Events and Indemnified Amounts. “GAAP” means generally accepted accounting principles in the United States of America, applied on a consistent basis as set forth in Opinions of the Accounting Principles Board of the American Institute of Certified Public Accountants and/or in statements of the Financial Accounting Standards Board or the rules and regulations of the U.S. Securities and Exchange Commission and/or their respective successors and that are applied in the circumstances as of the date in question. “Governmental Authority” means any government or political subdivision or any agency, authority, bureau, regulatory body, central bank, commission, department or instrumentality of any such government or political subdivision, or any other entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government or any court, tribunal, grand jury or arbitrator, or any accounting board or authority (whether or not part of a government) that is responsible for the establishment or interpretation of national or international accounting principles, in each case whether foreign or domestic. “Indemnified Amounts” has the meaning set forth in Section 4(i) hereof. “Indemnified Person” has the meaning set forth in Section 4(i) hereof. “Interpolated Rate” means, with respect to any Discount Period, at any time, the rate per annum (rounded to the same number of decimal places as the LIBO Rate) determined by the Buyer (which determination shall be conclusive and binding absent manifest error) to be equal to the rate that results from interpolating on a linear basis between: (a) the LIBO Rate for the longest period for which the LIBO Rate is available that is shorter than the applicable Discount Period; and (b) the LIBO Rate for the shortest period for which the LIBO Rate is available that exceeds the applicable Discount Period, in each case, at such time. “Insolvency Event” shall mean (i) with respect to an Account Debtor, the inability of such Account Debtor to pay any amount owed when due in respect of a Purchased Receivable as a result of the bankruptcy, insolvency or other financial inability of such Account Debtor to make such payment and (ii) with respect to any Person (including an Account Debtor), such Person shall fail to pay its debts as such debts become due, or shall admit in writing its inability to pay its debts generally, or shall make a general assignment for the benefit of creditors; or any proceeding shall be instituted by or against such Person seeking to adjudicate it a bankrupt or insolvent, or seeking liquidation, winding up, reorganization, arrangement, adjustment, protection, relief, or composition of it or its debts under any Applicable Law relating to bankruptcy, insolvency or reorganization or relief of debtors, or seeking the entry of an order for relief or the appointment of a receiver, trustee, custodian or other similar official for it or for any substantial part of its property and, in the case of any such proceeding instituted against it (but not instituted by it), either such proceeding shall remain undismissed or unstayed for a period of thirty (30) days (or, when used with respect to any Seller, Servicer or the Performance Guarantor), forty-five (45) days), or any of the actions sought in such proceeding (including the entry of an order for relief against, or the appointment of a receiver, trustee, custodian or other similar official for, it or for any substantial part of its property) shall occur; or such Person shall take any action to authorize any of the actions set forth above in this clause (ii). “Internal Revenue Code” means the Internal Revenue Code of 1986, as amended, reformed or otherwise modified from time to time. “Joinder Agreement” means a joinder agreement in form and substance satisfactory to the Buyer in all respects.