As filed with the Securities and Exchange Commission on August 3, 2017.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MICRO FOCUS INTERNATIONAL PLC

(Exact Name of Registrant as Specified in its Charter)

|

England and Wales

|

7372

|

Not Applicable

|

|

(State or Other Jurisdiction of

Incorporation or Organization) |

(Primary Standard Industrial

Classification Code Number) |

(IRS Employer Identification Number)

|

The Lawn, 22-30 Old Bath Road

Newbury, Berkshire

RG14 1QN

United Kingdom

+44 (0) 1635-565-459

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mike Phillips

Chief Financial Officer

The Lawn, 22-30 Old Bath Road

Newbury, Berkshire

RG14 1QN

United Kingdom

+44 (0) 1635-565-459

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

|

Richard B. Aftanas, P.C.

David A. Curtiss Kirkland & Ellis LLP 601 Lexington Avenue New York, NY 10022 |

Spencer Summerfield

Jon Reddington Travers Smith LLP 10 Snow Hill London EC1A 2AL United Kingdom |

Andrew R. Brownstein

Benjamin M. Roth Wachtell, Lipton, Rosen & Katz 51 West 52nd Street New York, NY 10019 |

Julian Pritchard

Freshfields Bruckhaus Deringer LLP 65 Fleet Street London EC4Y 1HS United Kingdom |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective and upon completion of the merger described in the enclosed document.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the “Securities Act”), check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

|

|

Non-accelerated filer ☒ (Do not check if a smaller reporting company)

|

Smaller reporting companyo

|

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered(1)

|

Amount to be

registered(2) |

Proposed maximum offering price per share

|

Proposed maximum aggregate offering price(3)

|

Amount of

registration fee(4) |

||||||

|

Ordinary Shares

|

|

222,390,000

|

|

N/A

|

$

|

6,061,000,000

|

|

$

|

702,469.90

|

|

| (1) | The securities being offered hereby will be issued in the form of American Depositary Shares of the registrant, referred to as Micro Focus ADSs. Each Micro Focus ADS represents one ordinary share, par value £0.10 per share, of the registrant, referred to as ordinary shares. The Micro Focus ADSs will be issuable upon deposit of ordinary shares with Deutsche Bank Trust Company Americas, acting as the depositary, and will be registered under a registration statement on Form F-6 (Registration No. 333- ). |

| (2) | Represents an estimate as of July 27, 2017 of the maximum number of ordinary shares of the registrant issuable upon completion of the transactions contemplated by the Agreement and Plan of Merger dated as of September 7, 2016, among the registrant, Hewlett Packard Enterprise Company, Seattle SpinCo, Inc., Seattle Holdings, Inc. and Seattle MergerSub, Inc., as described in this registration statement. The estimated number of ordinary shares of the registrant is calculated pursuant to the following formula: an estimate of the registrant's outstanding ordinary shares on a fully diluted basis immediately prior to the closing of the merger, multiplied by the quotient of 50.1% divided by 49.9%, such that the amount of ordinary shares registered pursuant to this registration statement represents 50.1% of all outstanding ordinary shares of the registrant on a fully diluted basis after giving effect to the issuance. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers an indeterminate number of additional shares of the registrant as may be issuable as a result of stock splits, stock dividends or similar transactions. |

| (3) | Calculated pursuant to Rule 457(f)(2) under the Securities Act, based on the book value, as of April 30, 2017 (which is the most recent date for which such information is available) of all of the Seattle SpinCo, Inc. securities to be received by the registrant in exchange for the securities to be issued hereunder. |

| (4) | Determined in accordance with Section 6(b) of the Securities Act at a rate equal to $115.90 per $1,000,000 of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

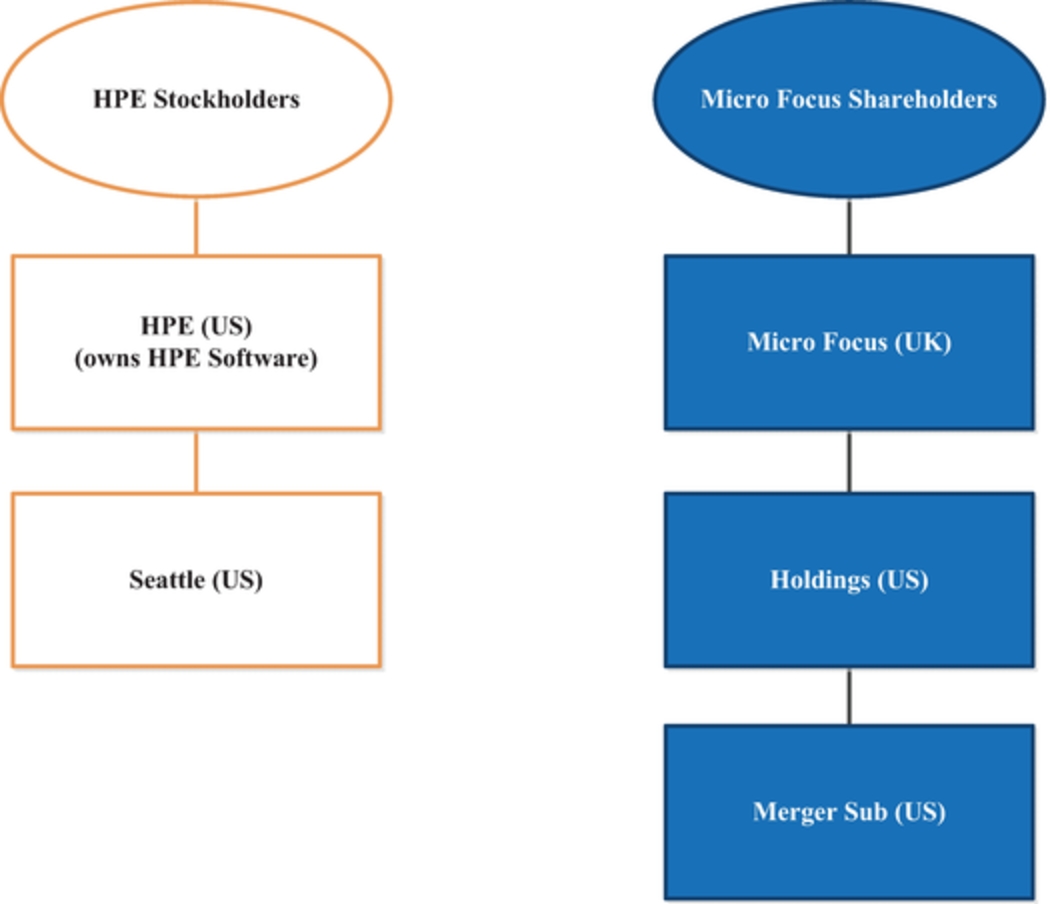

On September 7, 2016, Micro Focus International plc (“Micro Focus”) announced that it had entered into an Agreement and Plan of Merger (the “Merger Agreement”), dated September 7, 2016, with Hewlett Packard Enterprise Company (“HPE”), Seattle SpinCo, Inc. (“Seattle”), a Delaware corporation and wholly owned subsidiary of HPE, Seattle Holdings, Inc. (“Holdings”), a Delaware corporation and wholly owned subsidiary of Micro Focus, and Seattle MergerSub, Inc. (“Merger Sub”), a Delaware corporation and direct wholly owned subsidiary of Holdings, pursuant to which Micro Focus will combine with the software business segment of HPE, as further described herein.

Micro Focus is filing this registration statement on Form F-4 (Reg. No. 333- ) to register the exchange of all of the outstanding shares of Seattle Class A common stock, par value $0.01 per share (the “Seattle Shares”), for ordinary shares, par value £0.10 per share issued by Micro Focus (the “Micro Focus Shares”), all of which will be deposited with Deutsche Bank Trust Company Americas (the “Depositary”). The Depositary will issue American Depositary Shares (the “Micro Focus ADSs”) representing the Micro Focus Shares that will be issued as merger consideration in connection with the merger of Merger Sub with and into Seattle pursuant to the Merger Agreement, whereby the separate corporate existence of Merger Sub will cease and Seattle will continue as the surviving corporation and become an indirect wholly owned subsidiary of Micro Focus. At Closing (as defined herein), each Seattle Share distributed to HPE Stockholders (as defined herein) as further described herein will be automatically converted into the right to receive a number of Micro Focus ADSs determined in accordance with the Merger Agreement. Each Micro Focus ADS will represent one Micro Focus Share, unless another ratio is agreed by Micro Focus and HPE. The Depositary will file a registration statement on Form F-6 (Reg. No. 333- ) with respect to the Micro Focus ADSs. Seattle has filed a registration statement on Form 10 (Reg. No. 000- ) with respect to the Seattle Shares being distributed by HPE to HPE Stockholders in connection with the separation of Seattle from HPE.

Information contained herein is preliminary and subject to completion or amendment. The securities described herein may not be issued until the registration statement filed by Micro Focus International plc and the registration statement to be filed by Seattle SpinCo, Inc., as applicable, with the U.S. Securities and Exchange Commission are effective. This information statement/prospectus does not constitute an offer to sell or a solicitation to buy any securities in any state or jurisdiction in which such offer or solicitation is not permitted.

PRELIMINARY AND SUBJECT TO COMPLETION, DATED AUGUST 3, 2017

Seattle SpinCo, Inc.

which will be merged with Seattle MergerSub, Inc., an indirect wholly owned subsidiary of

Micro Focus International plc

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Hewlett Packard Enterprise Company (“HPE”) intends to distribute to its stockholders all of the outstanding shares of Class A common stock (the “Seattle Shares”) of Seattle SpinCo, Inc. (“Seattle”), a wholly owned subsidiary of HPE that will hold, directly or indirectly, the assets and liabilities of HPE’s software business segment (“HPE Software”) on a pro rata basis in a distribution that is intended to be tax-free to HPE and to HPE Stockholders (as defined below) for U.S. federal income tax purposes (the “Distribution”). Following the Distribution, pursuant to the merger of Seattle MergerSub, Inc. (“Merger Sub”) with and into Seattle (the “Merger”), with Seattle continuing as the surviving corporation and a direct wholly owned subsidiary of Seattle Holdings, Inc. (“Holdings”), and an indirect wholly owned subsidiary of Micro Focus International plc (“Micro Focus”), the Seattle Shares will be automatically converted into the right to receive American Depositary Shares (“Micro Focus ADSs”), issued by Deutsche Bank Trust Company Americas (the “Depositary”), representing ordinary shares of Micro Focus (“Micro Focus Shares”) that will be issued as consideration in the Merger. This information statement/prospectus forms a part of (a) the registration statement on Form F-4 filed by Micro Focus (Reg. No. 333- ) to register the exchange of the Seattle Shares for Micro Focus Shares which will be deposited with the Depositary and (b) the registration statement on Form 10 to be filed by Seattle (Reg. No. 000- ) to register the Seattle Shares (which will automatically be converted into the right to receive Micro Focus ADSs upon consummation of the Merger) to be distributed by HPE to HPE Stockholders in the Distribution. We expect that Seattle Shares will be distributed by HPE to HPE Stockholders on September 1, 2017. We refer to the date on which the effective time of the Distribution of the Seattle Shares to HPE Stockholders occurs as the “Distribution Date.”

For every one share of HPE common stock (each, an “HPE Share”) held of record as of the close of business on August 21, 2017, which is the Distribution Record Date, HPE Stockholders will receive one Seattle Share for each HPE Share held as of such time. All such Seattle Shares will then be automatically converted into the right to receive a number of Micro Focus ADSs determined in accordance with the Merger Agreement. Each Micro Focus ADS will represent one Micro Focus Share, unless another ratio is agreed by Micro Focus and HPE. You will not receive any fractional Micro Focus ADSs. Instead, you will receive cash in lieu of any fractional Micro Focus ADSs that you would otherwise have received in connection with the Merger.

No vote of HPE Stockholders is required for the Distribution or the Merger. HPE, as sole stockholder of Seattle prior to the Distribution, has approved the Merger. Therefore, you are not being asked for a proxy, and you are requested not to send HPE a proxy, in connection with the Distribution or the Merger. You do not need to pay any consideration, exchange or surrender your existing HPE Shares or take any other action to receive your Seattle Shares or to have your Seattle Shares converted into Micro Focus ADSs as described herein.

No trading market currently exists or will ever exist for Seattle Shares. You will not be able to trade the Seattle Shares before they are converted into Micro Focus ADSs. We have applied to list the Micro Focus ADSs on the New York Stock Exchange (the “NYSE”) under the symbol “MFGP.” We expect trading of the Micro Focus ADSs to begin on September 1, 2017. Micro Focus Shares are, and after the Merger are expected to continue to be, listed on the London Stock Exchange (the “LSE”) under the symbol “MCRO.” There can be no assurances regarding the prices at which Micro Focus ADSs issued hereby will trade following the Merger, including whether the Micro Focus ADSs will trade at the equivalent prices at which Micro Focus Shares traded prior to the Merger or at which Micro Focus Shares may trade following the Merger.

In reviewing this information statement/prospectus, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 36.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved these securities or determined if this information statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this information statement/prospectus is August , 2017.

Neither Micro Focus nor Seattle has previously filed reports, statements or other information with the SEC. All important business and financial information about Micro Focus and Seattle has been included in or delivered with this information statement/prospectus. We are not incorporating by reference any information with respect to Micro Focus or Seattle into this information statement/prospectus other than the exhibits filed with the registration statement on Form F-4 of Micro Focus and the registration statement on Form 10 of Seattle of which this information statement/prospectus forms a part.

You also may ask any questions about this transaction or request copies of documents relating to this transaction, without charge, upon oral or written request to Micro Focus or HPE at +44-(0)-1635-565-459 or investors@microfocus.com and (650) 687-5817 or investor.relations@hpe.com, respectively.

All information contained in this information statement/prospectus with respect to Micro Focus and its subsidiaries has been provided by Micro Focus. All information contained or incorporated by reference in this information statement/prospectus with respect to HPE and Seattle and their respective subsidiaries has been provided by HPE. Micro Focus and HPE have both contributed information contained in this information statement/prospectus relating to the Distribution, the Merger and the other proposed transactions.

The information contained on any website referenced in this information statement/prospectus is not incorporated by reference into this information statement/prospectus and should not be considered part of this information statement/prospectus.

This information statement/prospectus is not an offer to sell or exchange, and it is not a solicitation of an offer to buy, any HPE Shares, Seattle Shares, Micro Focus ADSs or Micro Focus Shares in any jurisdiction in which an offer, sale or exchange is not permitted.

TRADEMARKS AND SERVICE MARKS

Micro Focus, HPE, Seattle and their respective subsidiaries own or have rights to various trademarks, logos, service marks and trade names that each uses in connection with the operation of its business. Micro Focus, HPE, Seattle and their respective subsidiaries each also own or have the rights to copyrights that protect the content of their respective products. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this information statement/prospectus are listed without the ™, ® and © symbols, but such references do not constitute a waiver of any rights that might be associated with the respective trademarks, service marks, trade names and copyrights included or referred to in this information statement/prospectus.

In this information statement/prospectus:

“$,” “U.S. dollar” and “dollar” means the United States Dollar.

“£,” “GBP,” “pound,” “sterling” and “pound sterling” means the British pound sterling.

“€,” and “euros” means the single currency of participating member states of the European Union.

“Adjusted Earnings Per Share” means the earnings attributable to Micro Focus Shareholders before the post-tax impact of exceptional items, amortization of purchased intangibles and share based compensation on a per Micro Focus Share basis.

“Adjusted EBITDA” means the operating profit before exceptional items, share based compensation and amortization of purchased intangibles, net finance costs, depreciation of property, plant and equipment and amortization of purchased software intangibles.

“Admission” means the admission of the new Micro Focus Shares (or, if the Share Capital Consolidation is not implemented, the existing Micro Focus Shares) and/or, as relevant, the admission of the Consideration Shares to the premium listing segment of the Official List becoming effective in accordance with the U.K. Listing Rules and to trading on the LSE’s main market for listed securities becoming effective in accordance with the Admission and Disclosure Standards, which is expected to occur on September 1, 2017.

“Admission and Disclosure Standards” means the requirements contained in the publication entitled “Admission and Disclosure Standards” dated April 2013 containing, among other things, the admission requirements to be observed by companies seeking admission to trading on the LSE’s main market for listed securities.

“ADRs” means American Depositary Receipts, evidencing Micro Focus ADSs.

“Audit Committee” means the audit committee of Micro Focus established by the Micro Focus Board.

“B Shares” means the redeemable B shares in the capital of Micro Focus to be issued and redeemed as part of the Micro Focus Return of Value.

“Closing” means the effective time of the Merger, which is expected to be 3:00 a.m., New York City time, on September 1, 2017.

“Closing Date” means the date on which Closing occurs, which is expected to be September 1, 2017.

“Code” means the Internal Revenue Code of 1986, as amended.

“Companies Act 2006” means the U.K. Companies Act 2006, as amended.

“Company Secretary” means the company secretary of Micro Focus from time to time, with Jane Smithard being the Company Secretary as of the date of this information statement/prospectus.

“Consideration Shares” means the Micro Focus Shares underlying the Micro Focus ADSs to be issued to the holders of Seattle Shares as consideration in the Merger pursuant to the Merger Agreement.

“Contribution” means the contribution by HPE of HPE Software to Seattle pursuant to the terms of the Separation and Distribution Agreement.

“CREST” means the relevant system (as defined in the CREST Regulations) in respect of which Euroclear is the operator (as defined in the CREST Regulations).

“CREST Regulations” means the Uncertificated Securities Regulations 2001 (SI 2001 No. 3755), as amended from time to time.

“Debt Financing” means the debt financing entered into in connection with the Transactions, as further described in the section entitled “Debt Financing.”

“Deferred Shares” means the deferred shares of 10 pence each in the capital of Micro Focus to be issued as part of the Micro Focus Return of Value.

1

“Deposit Agreement” means the deposit agreement to be entered into between Micro Focus and the Depositary governing the terms and conditions pursuant to which the Micro Focus ADSs will be issued, as it may be amended from time to time.

“Depositary” means Deutsche Bank Trust Company Americas, acting as (i) depositary for Micro Focus ADSs representing Consideration Shares and (ii) issuer of ADRs representing those Micro Focus ADSs (if applicable).

“DGCL” means the General Corporation Law of the State of Delaware.

“Distribution” means the pro rata distribution by HPE of all of the outstanding Seattle Shares to HPE Stockholders pursuant to and subject to the terms and conditions of the Separation and Distribution Agreement.

“Distribution Date” means the date on which the effective time of the Distribution occurs, which is expected to be 2:59 a.m. New York City time on September 1, 2017.

“Distribution Record Date” means August 21, 2017.

“Employee Matters Agreement” means the Employee Matters Agreement dated September 7, 2016, entered into by HPE, Seattle and Micro Focus, as it may be amended from time to time, and a summary of the principal terms and conditions of which is set out in the section entitled “Other Agreements—Employee Matters Agreement.”

“Enlarged Group” means the Micro Focus Group, as of and from Closing, as enlarged by the Merger.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Executive Directors” means the executive directors of Micro Focus from time to time, which as of Closing are expected to be the directors whose names are set out in the section entitled “Board of Directors and Management of Micro Focus After the Merger—Profiles of the Executive Directors.”

“Existing Facilities Agreement” means the New York law governed credit agreement documenting the Facility B-2 and the Existing RCF.

“Existing RCF” means the $375 million revolving credit facility available to Micro Focus pursuant to the Existing Facilities Agreement.

“Euro Facility” means the €470 million term loan facility provided to the Micro Focus Borrower pursuant to an escrow credit agreement.

“Facility B-2” means the $1,515 million tranche B-2 term loan facility provided to the Micro Focus Borrower pursuant to the Existing Term Facility.

“Facility B-3” means the $385 million tranche B-3 term loan facility provided to the Micro Focus Borrower pursuant to an escrow credit agreement.

“Facility C” means the existing $412 million tranche C term loan facility provided to the Micro Focus Borrower.

“Facility EBITDA” means Adjusted EBITDA before amortization of capitalized development costs.

“FSMA” means the Financial Services and Markets Act 2000 (United Kingdom), as amended.

“Holdings” means Seattle Holdings Inc., a Delaware corporation and wholly owned direct subsidiary of Micro Focus.

“HPE” means Hewlett Packard Enterprise Company, a Delaware corporation.

“HPE Board” means the board of directors of HPE.

“HPE Group” means HPE and its subsidiaries (which include the Seattle Group prior to the Distribution and exclude the Seattle Group from and after the Distribution).

“HPE Nominated Director” means a director nominated to the Micro Focus Board by HPE.

“HPE Shares” means shares of HPE common stock, par value $0.01 per share.

2

“HPE Software” means HPE’s software business segment, which will be transferred to (or retained by, as applicable) the Seattle Group, in accordance with the terms and conditions of the Separation and Distribution Agreement prior to the Distribution.

“HPE Stockholder” means a holder of an HPE Share.

“HPE Tax Opinion” means an opinion of Skadden, Arps, Slate, Meagher & Flom LLP (“Skadden”) in form and substance reasonably acceptable to HPE, dated as of the Distribution Date, regarding certain aspects of the U.S. federal income tax treatment of the Distribution and certain related transactions and the Merger.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“IFRS” means the International Financial Reporting Standards as adopted by the European Union.

“Intellectual Property Matters Agreement” means the Intellectual Property Matters Agreement among HPE, Hewlett Packard Enterprise Development LP and Seattle, to be entered into by such parties on or prior to the Distribution Date, as it may be amended from time to time, and a summary of the principal terms and conditions of which is set out in the section entitled “Other Agreements—Intellectual Property Matters Agreement.”

“IRS” means the U.S. Internal Revenue Service.

“IRS Ruling” means a ruling from the IRS regarding certain issues relevant to the U.S. federal income tax consequences of the Distribution and certain other aspects of the Separation.

“LSE” means the London Stock Exchange.

“Merger” means the merger of Merger Sub with and into Seattle on the terms and subject to the conditions set out in the Merger Agreement.

“Merger Agreement” means the Agreement and Plan of Merger dated September 7, 2016 entered into by Micro Focus, HPE, Merger Sub, Holdings and Seattle, as it may be amended from time to time, and a summary of the principal terms and conditions of which is set out in the section entitled “The Merger Agreement.”

“Merger Sub” means Seattle MergerSub, Inc., a Delaware corporation and an indirect wholly owned subsidiary of Micro Focus.

“Micro Focus” means Micro Focus International plc, a public limited company incorporated in England and Wales.

“Micro Focus ADSs” means American Depositary Shares issued by the Depositary, each representing one Micro Focus Share, unless another ratio is agreed by Micro Focus and HPE.

“Micro Focus Articles” means the articles of association of Micro Focus, as they may be amended from time to time.

“Micro Focus ASG Awards” means additional share grant awards with respect to Micro Focus Shares granted in accordance with the terms set out in the prospectus issued by Micro Focus on October 8, 2014 or granted in accordance with the authority obtained from Micro Focus Shareholders at its annual general meeting convened on September 22, 2016.

“Micro Focus Board” means the board of directors of Micro Focus.

“Micro Focus Borrower” means MA FinanceCo, LLC, a wholly owned subsidiary of Holdings.

“Micro Focus Commitment Letter” means the commitment letter, dated September 7, 2016, entered into by JPMorgan Chase Bank, N.A., Micro Focus Group Limited, and the Micro Focus Borrower (as amended from time to time) and relating to the Micro Focus Facilities.

“Micro Focus Escrow Borrower” means Miami Escrow Borrower, LLC, a Delaware limited liability company.

“Micro Focus Facilities” means the Micro Focus Term Loan Facilities and the Revolving Credit Facility.

“Micro Focus Fully Diluted Shares” means the aggregate number of Micro Focus Shares on a fully-diluted, as converted and as exercised basis in accordance with the treasury stock method, including Micro Focus Shares underlying outstanding Micro Focus Options, Micro Focus ASG Awards and any other securities convertible into

3

or exercisable for Micro Focus Shares, excluding, for purposes of the Micro Focus Fully Diluted Shares immediately following Closing, any Micro Focus Shares to be issued pursuant to a de minimis number of replacement awards to be granted to HPE Software employees at Closing under their existing employee incentive arrangements.

“Micro Focus General Meeting” means the general meeting of Micro Focus held at 2:00 p.m. U.K. time on May 26, 2017 at which the Micro Focus Shareholders approved the Resolutions.

“Micro Focus Group” means Micro Focus and its subsidiaries from time to time.

“Micro Focus Options” means an option to purchase Micro Focus Shares with an exercise price at or greater than zero granted pursuant to a Micro Focus plan providing for awards of options to employees, as amended from time to time.

“Micro Focus Return of Value” means the proposed transactions comprising the return of value by way of the issuance of the B Shares and the Share Capital Consolidation, as further described in the section entitled “The Transactions—Micro Focus Return of Value.”

“Micro Focus Shareholder” means a holder of a Micro Focus Share.

“Micro Focus Shares” means, as the context requires, the existing ordinary shares of Micro Focus and/or the new ordinary shares of Micro Focus issued in connection with the Transactions, in each case, par value £0.10.

“Micro Focus Term Loan Facilities” means the $2.4 billion term loan facilities to be provided to the Micro Focus Borrower pursuant to the New Micro Focus Facility Agreement, it being understood that (i) the borrower with respect to a $885 million tranche B facility (which will consist of a combination of €470 million (equivalent to approximately $500 million) euro-denominated term loans and $385 of U.S. dollar-denominated term loans) will initially be a newly formed domestic subsidiary of the Micro Focus Borrower (the Micro Focus Escrow Borrower), to be merged with and into Micro Focus Borrower prior to Closing and (ii) a $1,515 million tranche B facility will be provided through an amendment to Facility B-2.

“New Facilities” means the Micro Focus Term Loan Facilities, the Revolving Credit Facility and the Seattle Term Loan Facility.

“New Micro Focus Facility Agreement” means the New York law governed credit agreement to become effective at or prior to the Merger to document the Micro Focus Facilities. The New Micro Focus Facility Agreement will be effected through an amendment to the Existing Facilities Agreement.

“New Seattle Facility Agreement” means the New York law governed credit agreement to be entered into or deemed entered into at or prior to the Merger to document the Seattle Term Loan Facility.

“Nomination Committee” means the nomination committee of Micro Focus established by the Micro Focus Board.

“Non-Executive Directors” means the non-executive directors of Micro Focus from time to time, which as of Closing are expected to be the non-executive directors whose names are set out in the section entitled “Board of Directors and Management of Micro Focus After the Merger—Profiles of the Non-Executive Directors.”

“NYSE” means the New York Stock Exchange.

“OEM” means original equipment manufacturers.

“Official List” means the Official List of the U.K. Listing Authority.

“Real Estate Matters Agreement” means the Real Estate Matters Agreement between HPE and Seattle, to be entered into by such parties on or prior to the Distribution Date, as it may be amended from time to time, and a summary of the principal terms and conditions of which is set out in the section entitled “Other Agreements—Real Estate Matters Agreement.”

“Remuneration Committee” means the remuneration committee of Micro Focus established by the Micro Focus Board.

“Reorganization” means the transfer of HPE Software assets that are not already owned by members of the Seattle Group to members of the Seattle Group and the assumption of HPE Software liabilities that are not

4

already obligations of members of the Seattle Group by members of the Seattle Group, and the transfer of certain excluded assets that are not already owned by members of the HPE Group (excluding the Seattle Group) to members of the HPE Group (excluding the Seattle Group) and the assumption of certain excluded liabilities that are not already obligations of members of the HPE Group (excluding the Seattle Group) by the HPE Group (excluding the Seattle Group), in each case, in accordance with the Separation and Distribution Agreement.

“Resolutions” means the resolutions proposed and approved at the Micro Focus General Meeting relating to the approval of the Merger, the issuance of the Consideration Shares, the Micro Focus Return of Value and the amendments to the Micro Focus Articles.

“Revolving Credit Facility” means the new revolving credit facility of up to $500 million to be provided to the Micro Focus Borrower pursuant to the New Micro Focus Facility Agreement.

“RIS” means any of the services authorized by the U.K. FCA from time to time for the purpose of disseminating regulatory announcements.

“SaaS” means software as a service.

“SDRT” means U.K. stamp duty reserve tax.

“Seattle” means Seattle SpinCo, Inc., a Delaware corporation and, prior to the Distribution, a direct wholly owned subsidiary of HPE.

“Seattle Borrower” means, initially, Seattle Escrow Borrower LLC, a Delaware limited libility company and a wholly owned subsidiary of Seattle, prior to the Effective Date (as defined in the New Seattle Facility Agreement), and thereafter, Seattle.

“Seattle Commitment Letter” means the commitment letter dated September 7, 2016 entered into by JPMorgan Chase Bank, N.A., Micro Focus Group Limited and the Micro Focus Borrower (as amended from time to time) and relating to the Seattle Term Loan Facility.

“Seattle Group” means Seattle and its subsidiaries from time to time.

“Seattle Payment” means the $2.5 billion in cash that Seattle will pay to HPE in connection with the Contribution, subject to adjustment in limited circumstances, pursuant to and in accordance with the Separation and Distribution Agreement.

“Seattle Shares” means shares of Class A common stock, par value $0.01 per share, of Seattle.

“Seattle Term Loan Facility” means the $2.6 billion term loan facility to be provided to the Seattle Borrower pursuant to the New Seattle Facility Agreement.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Separation” means the Reorganization and the Distribution, in each case, in accordance with the terms and conditions of the Separation and Distribution Agreement.

“Separation and Distribution Agreement” means the Separation and Distribution Agreement dated September 7, 2016 entered into between HPE and Seattle, as it may be amended from time to time, and a summary of the principal terms and conditions of which is set out in the section entitled “The Separation and Distribution Agreement.”

“Share Capital Consolidation” means the proposed consolidation, subdivision and redesignation of Micro Focus’ share capital, as further described in the section entitled “The Transactions—Share Capital Consolidation.”

“SUSE” means the SUSE open source product portfolio and SUSE brand.

“Tax Matters Agreement” means the Tax Matters Agreement among HPE, Seattle and Micro Focus, to be entered into by such parties on or prior to the Distribution Date, as it may be amended from time to time, and a summary of the principal terms and conditions of which is set out in the section entitled “Other Agreements—Tax Matters Agreement.”

5

“Total Shareholder Returns” means the value to a Micro Focus Shareholder over a period of time of the increase in the price of Micro Focus Shares from the beginning to the end of such period, if any, as well as any cash received in such period from normal dividend payments.

“Transaction Documents” means the Merger Agreement, the Separation and Distribution Agreement, the Employee Matters Agreement, the Tax Matters Agreement, the Transition Services Agreement, the Real Estate Matters Agreement and the Intellectual Property Matters Agreement, including, in each case, all annexes, exhibits, schedules, attachments and appendices thereto, and any certificate or other instrument delivered by any party to any other party pursuant to any of the foregoing.

“Transactions” means the transactions contemplated by the Merger Agreement and the Separation and Distribution Agreement, including the Merger, on the terms and subject to the conditions set out in the Merger Agreement and the Separation and Distribution Agreement.

“Transition Services Agreement” means the Transition Services Agreement between HPE and Seattle, to be entered into on or prior to the Distribution Date, as it may be amended from time to time, and a summary of the principal terms and conditions of which is set out in the section entitled “Other Agreements—Transition Services Agreement.”

“Treasury Regulations” means the Treasury Regulations promulgated under the Code.

“U.K. Circular” means the Micro Focus circular dated May 9, 2017 and made available to Micro Focus Shareholders in connection with the Merger, the Micro Focus Return of Value, and the convening of the Micro Focus General Meeting at which the Resolutions were passed.

“U.K. Corporate Governance Code” means the U.K. Corporate Governance Code published by the Financial Reporting Council, as amended from time to time.

“U.K. FCA” means the United Kingdom Financial Conduct Authority.

“U.K. Listing Authority” means the Financial Conduct Authority acting in its capacity as the competent authority for the purposes of Part VI of FSMA.

“U.K. Listing Rules” means the listing rules produced by the U.K. FCA under part VI of FSMA.

“U.K. Prospectus” means the final prospectus dated July 28, 2017, which was approved by the U.K. FCA as a prospectus and prepared in accordance with the U.K. Prospectus Rules in connection with the Merger.

“U.K. Prospectus Rules” means the prospectus rules produced by the U.K. FCA under part VI of FSMA.

“U.S. GAAP” means generally accepted accounting principles in the United States.

“we,” “us” and “our” mean Micro Focus, unless the context requires otherwise.

6

QUESTIONS AND ANSWERS ABOUT THE TRANSACTIONS

The following are some of the questions that you may have about the Transactions, and answers to those questions. These questions and answers, as well as the following summary, are not meant to be a substitute for the information contained in the remainder of this information statement/prospectus, and these questions and answers are qualified in their entirety by the more detailed descriptions and explanations contained elsewhere in this information statement/prospectus. You are urged to read this information statement/prospectus in its entirety, as well as the registration statements (including the exhibits thereto) of which this information statement/prospectus forms a part, as they contain important information about Micro Focus, HPE, Seattle, the Seattle Shares, the Micro Focus Shares and the Micro Focus ADSs. See the section entitled “Where You Can Find Additional Information.”

Q: What are the key steps of the Transactions?

A: Below is a summary of the key steps of the Transactions. A step-by-step description of material events relating to the Transactions is set forth in the section entitled “The Transactions.”

| • | HPE will transfer HPE Software to Seattle in the Contribution pursuant to the terms and conditions set forth in the Separation and Distribution Agreement. |

| • | In connection with the Contribution, Seattle will issue to HPE additional Seattle Shares and pay to HPE the Seattle Payment. Seattle Borrower will incur new indebtedness in an aggregate principal amount of $2.6 billion pursuant to the Seattle Term Loan Facility. The majority of the proceeds of this loan will be used by Seattle to pay to HPE the Seattle Payment. |

| • | Prior to Closing, the Micro Focus Borrower will incur new indebtedness in the form of (i) the $2.4 billion Micro Focus Term Loan Facility, including $1,515.2 million of Facility B-2 repriced, amended and extended pursuant to an amendment to the Existing Facilities Agreement and $884.8 million of term loans incurred by the Micro Focus Escrow Borrower pursuant to an escrow credit agreement (which term loans will automatically be deemed issued under the Micro Focus Term Loan Facilities upon the merger of the Micro Focus Escrow Borrower with and into the Micro Focus Borrower prior to the Merger) and (ii) the $500 million Revolving Credit Facility. The proceeds received by the Micro Focus Borrower will be used to fund (i) the Micro Focus Return of Value of an aggregate principal amount in sterling equivalent to $500 million (inclusive of any currency hedging costs or proceeds) to the Micro Focus Shareholders, (ii) the partial repayment of the indebtedness pursuant to the Existing Facilities Agreement, dated as of November 20, 2014, by and among Micro Focus, Micro Focus Group Limited, the Micro Focus Borrower, the lenders from time to time party thereto, and Bank of America, N.A., as administrative agent, collateral agent and swingline lender, (iii) fees and expenses incurred in connection with the Transactions and (iv) working capital and general corporate purposes of the Micro Focus Group. |

| • | HPE will distribute all of the outstanding Seattle Shares on a pro rata basis to HPE Stockholders in a distribution that is intended to be tax-free to HPE and to HPE Stockholders for U.S. federal income tax purposes. |

| • | After the Distribution, Merger Sub will merge with and into Seattle, whereby the separate corporate existence of Merger Sub will cease and Seattle will continue as the surviving corporation and as an indirect wholly owned subsidiary of Micro Focus. In the Merger, each Seattle Share will be automatically converted into the right to receive a number of Micro Focus ADSs determined in accordance with the Merger Agreement, each representing one Micro Focus Share, unless another ratio is agreed by Micro Focus and HPE. The Micro Focus Shares issued as Consideration Shares in connection with the Merger will be deposited with the Depositary. |

| • | Immediately following Closing, pre-Merger HPE Stockholders will hold Micro Focus ADSs representing 50.1% of the Micro Focus Fully Diluted Shares and the balance of the then-outstanding Micro Focus Shares will be held by pre-Merger Micro Focus Shareholders. |

Q: What is Seattle and why is HPE separating HPE Software and distributing Seattle Shares?

A: Seattle is a wholly owned subsidiary of HPE that was formed in connection with the Transactions to hold HPE Software. The separation of Seattle from HPE and the Distribution are intended to effectuate the separation

7

of HPE Software from HPE, which will be followed by the acquisition of HPE Software by Micro Focus by way of a merger of Merger Sub with and into Seattle with Seattle continuing as the surviving corporation and a wholly owned subsidiary of Micro Focus. For more information, see the sections entitled “The Transactions—HPE’s Reasons for the Separation, the Distribution and the Merger” and “The Separation and Distribution Agreement.”

Q: What will happen in the Separation?

A: Pursuant to and in accordance with the terms and conditions of the Separation and Distribution Agreement, HPE will engage in a series of transactions to transfer certain entities, assets and liabilities relating to HPE Software to Seattle in the Contribution. As consideration for such contribution of HPE Software, Seattle will issue to HPE additional Seattle Shares and pay to HPE the Seattle Payment.

Q: What will happen in the Distribution and what is the Distribution Record Date?

A: Pursuant to and in accordance with the terms and conditions of the Separation and Distribution Agreement, after the Contribution, HPE will distribute all of the outstanding Seattle Shares on a pro rata basis to HPE Stockholders as of the close of business on August 21, 2017, which is the Distribution Record Date, in accordance with a distribution ratio of one Seattle Share for each HPE Share held as of such time. Seattle Shares will be distributed in book-entry form. HPE Stockholders of record will receive additional information from HPE’s distribution agent shortly after Closing. Beneficial holders will receive information from their brokerage firms or other nominees.

Q: What will happen in the Merger?

A: Pursuant to and in accordance with the terms and conditions of the Merger Agreement, Merger Sub will merge with and into Seattle, with Seattle continuing as the surviving corporation and as a direct wholly owned subsidiary of Holdings and an indirect wholly owned subsidiary of Micro Focus. Immediately following Closing, pre-Merger HPE Stockholders will hold Micro Focus ADSs representing 50.1% of the Micro Focus Fully Diluted Shares, and the balance of the then-outstanding Micro Focus Shares will be held by pre-Merger Micro Focus Shareholders. In the Merger, each Seattle Share will be automatically converted into the right to receive a number of Micro Focus ADSs determined in accordance with the Merger Agreement, each representing one Micro Focus Share, unless another ratio is agreed by Micro Focus and HPE. See the section entitled “The Merger Agreement—Merger Consideration.”

Q: What shareholder approvals are needed in connection with the Transactions?

A: Micro Focus Shareholders approved the proposal relating to the Merger, including the issuance of the Consideration Shares, by the affirmative vote of a majority of votes cast by Micro Focus Shareholders on the proposal at the Micro Focus General Meeting held on May 26, 2017. HPE Stockholders are not required and are not being asked to approve the Transactions. HPE, as sole stockholder of Seattle prior to the Distribution, has approved the Merger. For more information regarding the HPE Board’s reasons for approving the Separation, the Distribution and the Merger, see the section entitled “The Transactions—HPE’s Reasons for the Separation, the Distribution and the Merger.”

Q: What will Seattle’s relationship be with HPE following the Transactions?

A: Seattle and Micro Focus will continue to have certain relationships with HPE following the Transactions, including with respect to specified transition services for an interim period. Seattle has entered into the Separation and Distribution Agreement with HPE to effect the Separation. Seattle and HPE will also enter into (to the extent they have not done so already) certain other agreements, including among others the Tax Matters Agreement, the Employee Matters Agreement, the Transition Services Agreement, the Real Estate Matters Agreement and the Intellectual Property Matters Agreement. These agreements will provide for the allocation between Seattle and HPE of HPE’s assets, employees, liabilities and obligations (including its investments, property and employee benefits and tax-related assets and liabilities). For additional information regarding the Separation and Distribution Agreement and other Transaction Documents and the continuing contractual obligations the parties will have under these agreements following the completion of the Transactions, see the sections entitled “The Separation and Distribution Agreement” and “Other Agreements.”

8

Q: Who will manage Seattle after the Transactions?

A: Micro Focus will own, operate and manage Seattle after the Transactions.

Kevin Loosemore and Mike Phillips will continue as Executive Chairman and Chief Financial Officer, respectively, of the Enlarged Group. Chris Hsu, who is currently Executive Vice President and General Manager of HPE Software as well as Chief Operating Officer at HPE, will become the Chief Executive Officer of the Enlarged Group at Closing, and Stephen Murdoch, who is the current Chief Executive Officer of Micro Focus, will become the Chief Operating Officer of the Enlarged Group. Nils Brauckmann will continue as the Chief Executive Officer of SUSE following Closing.

With effect from Closing until the second annual general meeting of the Micro Focus Shareholders that occurs after Closing, HPE will have the right to nominate (i) one new Non-Executive Director who is a serving executive of HPE to the Micro Focus Board and (ii) one-half of the Micro Focus Board’s independent Non-Executive Directors, in each case, subject to approval of the Nomination Committee. The current Nomination Committee has approved the appointments of John Schultz (as the HPE Nominated Director who is a serving executive of HPE and is not independent) with effect from Closing, and Silke Scheiber and Darren Roos as independent Non-Executive Directors with effect from May 15, 2017. In accordance with the Merger Agreement, a further independent HPE Nominated Director will be appointed following Closing.

As a result of the proposed appointments to the Micro Focus Board, at Closing, it is expected that the Micro Focus Board will comprise 10 directors, five of whom will be independent under the U.K. Corporate Governance Code. Once an additional independent HPE Nominated Director is appointed following Closing, this will increase the total number of directors to 11 and the number of independent Non-Executive Directors to six.

Q: What will Micro Focus Shareholders receive in connection with the Transactions?

A: Prior to the Merger, Micro Focus will implement the Micro Focus Return of Value. After the Micro Focus Return of Value, and disregarding the dilutive effect of the Merger if and when completed, existing Micro Focus Shareholders will own the same proportion of Micro Focus as they did immediately prior to the implementation of the Micro Focus Return of Value, subject only to fractional roundings. Immediately after Closing, pre-Merger Micro Focus Shareholders and pre-Merger holders of Micro Focus equity awards will collectively hold 49.9% of the Micro Focus Fully Diluted Shares.

Micro Focus Shareholders will not receive separate consideration as part of the Merger and no additional Micro Focus Shares or Micro Focus ADSs will be issued to pre-Merger Micro Focus Shareholders pursuant to the Merger. Micro Focus Shareholders will receive the commercial benefit of owning an equity interest in Seattle, which will include HPE Software as it exists following the Separation. Micro Focus Shareholders will thus hold an interest in a company with expanded opportunities in the software industry and software infrastructure market, a substantial recurring revenue base, access to important new growth drivers and new revenue models, accelerated operational effectiveness and operational efficiencies. See the section entitled “The Transactions—Micro Focus’ Reasons for Engaging in the Transactions.”

As a result of the Transactions, Micro Focus Shareholders’ ownership of Micro Focus Shares will also mean that they own an interest in a company with increased levels of indebtedness. In connection with the Transactions, Micro Focus will incur new indebtedness of $2.9 billion in the form of the Micro Focus Facilities, which is expected to have $500 million of unused availability immediately following consummation of the Transactions. In addition, following Closing, Micro Focus will guarantee the indebtedness that Seattle Borrower will incur in connection with the Transactions, consisting of $2.6 billion in the form of the Seattle Term Loan Facility. See the section entitled “Debt Financing.”

Q: What is the Micro Focus Return of Value?

A: Micro Focus will issue one B Share for each existing Micro Focus Share to the holders of record of Micro Focus Shares as of one business day prior to the expected Closing Date. Micro Focus will, shortly following such issuance, redeem each B Share in issue for its nominal value and these B Shares will be subsequently cancelled. HPE Stockholders will not be entitled to receive the Micro Focus Return of Value since the record date will be prior to the Closing Date. For more information on the Micro Focus Return of Value, see the section entitled “The Transactions—Micro Focus Return of Value.”

9

Q: What is the estimated enterprise value of HPE Software and the consideration to be received by holders of Seattle Shares in the Merger?

A: The estimated $6.6 billion market value of the Micro Focus ADSs to be issued to holders of Seattle Shares (calculated for the purposes of this information statement/prospectus by reference to the closing mid-market price of a Micro Focus Share as of the close of business on July 27, 2017) and the $2.5 billion Seattle Payment imply an enterprise value for HPE Software of approximately $9.1 billion. The actual value of the Micro Focus Shares to be issued in the Merger and the Micro Focus ADSs to be issued by the Depositary will depend on the market price of Micro Focus Shares as of Closing.

Q: How will the Transactions impact the future liquidity and capital resources of Micro Focus and Seattle?

A: Micro Focus will incur indebtedness of $2.4 billion in connection with the Transactions pursuant to the Micro Focus Term Loan Facilities and will also enter into the Revolving Credit Facility which is expected to have $500 million of unused availability immediately after Closing.

Seattle Borrower will incur indebtedness of $2.6 billion in connection with the Transactions pursuant to the Seattle Term Loan Facility.

Although, in the opinion of Micro Focus, the Enlarged Group’s expected available liquidity and working capital will be sufficient for not less than the next 12 months following the date of this information statement/prospectus, in the longer term these financings could materially and adversely affect the liquidity, results of operations and financial condition of Micro Focus. Micro Focus also expects to incur significant one-time costs in connection with the Transactions, which may have an adverse impact on Micro Focus’ liquidity, cash flows and operating results in the periods in which they are incurred.

Following Closing, the indebtedness to be incurred by Micro Focus is expected to be guaranteed by Seattle and its subsidiaries and the indebtedness to be incurred by Seattle is expected to be guaranteed by Micro Focus and its subsidiaries. As a result of the increased borrowing, the Micro Focus Board estimates that the initial pro forma net debt to Facility EBITDA ratio of the Enlarged Group as of Closing will be approximately 3.3x Facility EBITDA and is targeting to reduce this to its stated target of 2.5x Facility EBITDA within two years following Closing. See the section entitled “Debt Financing.”

As a result of the Transactions, Micro Focus will incur a number of one-time costs in respect of due diligence, financing and other advisor fees. Transaction-related costs payable to advisors are expected to be $60.0 million, of which $41.2 million have been paid within the year ended April 30, 2017. Financing fees in respect of the Transactions are estimated to be $206.5 million, all of which are expected to be capitalized and amortized over the life of the financing agreements. Micro Focus also anticipates $150.0 million in costs to implement certain IT upgrades and to migrate the Enlarged Group on to a single system. All remaining costs are expected to be incurred prior to October 31, 2018, with the exception of $50.0 million of costs related to the migration on to a single system, which are expected to be incurred in the first half of the year ending October 31, 2019. In addition, Micro Focus anticipates that the Enlarged Group will incur further one-off integration and restructuring costs in relation to headcount reductions and property rationalization which have yet to be quantified.

Q: When will the Transactions occur?

A: It is expected that all of the outstanding Seattle Shares will be distributed by HPE on September 1, 2017 to HPE Stockholders of record as of the close of business on August 21, 2017, which is the Distribution Record Date. The Reorganization will occur prior to the Distribution. The Merger is expected to occur immediately following the Distribution on September 1, 2017. Substantially concurrently with Closing, Micro Focus will issue to the Depositary the Micro Focus Shares underlying the Micro Focus ADSs to be issued to holders of Seattle Shares and immediately following Closing, the Depositary will issue Micro Focus ADSs to the holders of Seattle Shares.

However, no assurance can be provided as to the timing of the Transactions or that all conditions to the Transactions will be met by the dates set forth herein, or at all. The Merger Agreement provides that either HPE or Micro Focus may terminate the Merger Agreement if the Merger is not consummated on or before March 7, 2018. For a discussion of the conditions to the Transactions and the circumstances under which the Merger Agreement may be terminated by the parties, see the sections entitled “The Merger Agreement—Conditions to the Merger” and “The Merger Agreement—Termination,” respectively.

10

Q: Are there any conditions to the consummation of the Transactions?

A: Yes. The consummation of the Transactions is subject to a number of conditions, including:

| • | the expiration or termination of any applicable waiting period under the HSR Act, and the receipt of applicable consents, authorizations, orders, or approvals required under the antitrust or competition laws of certain specified jurisdictions, including merger control approval from the European Commission, all of which have been received and which condition has been satisfied; |

| • | the consummation of the Reorganization and the Distribution in all material respects in accordance with the Separation and Distribution Agreement; |

| • | the effectiveness of the registration statement of Micro Focus of which this information statement/prospectus forms a part, the registration statement of Seattle on Form 10 of which this information statement/prospectus forms a part, the Form F-6 filed with the SEC by the Depositary with respect to the Micro Focus ADSs and the Form 8-A filed with the SEC by Micro Focus, and the absence of any stop order issued by the SEC or any pending proceeding before the SEC seeking a stop order with respect thereto; |

| • | the approval of the U.K. Prospectus by the U.K. Listing Authority and the U.K. Prospectus having been made publicly available, which condition has been satisfied; |

| • | the approval of the U.K. Circular by the U.K. Listing Authority and the U.K. Circular having been made available to Micro Focus Shareholders, which condition has been satisfied; |

| • | Admission occurring; |

| • | the approval for listing on the NYSE of the Micro Focus ADSs issuable pursuant to the Merger; |

| • | the approval by Micro Focus Shareholders of the Merger and specified related matters, which condition has been satisfied; |

| • | the receipt by HPE of the HPE Tax Opinion; and |

| • | the absence of any law or action by a governmental authority that enjoins, restrains or prohibits the consummation of the Reorganization, the Distribution or the Merger. |

To the extent permitted by applicable law, HPE, on the one hand, and Micro Focus, on the other hand, may waive the satisfaction of the conditions to their respective obligations to consummate the Transactions. In addition, the waiver by HPE or Seattle of conditions to their respective obligations under the Separation and Distribution Agreement requires the consent of Micro Focus, not to be unreasonably withheld, conditioned or delayed.

See the section entitled “The Merger Agreement—Conditions to the Merger.”

Q: Are there risks associated with the Transactions?

A: Yes. The material risks and uncertainties associated with the Transactions are discussed in the section entitled “Risk Factors” and the section entitled “Cautionary Statement on Forward-Looking Statements.” Those risks include, among others, the possibility that the Transactions may not be completed or may not achieve the intended benefits, the possibility that Micro Focus may fail to realize the anticipated benefits of the Merger, the possibility that Micro Focus will not be able to integrate HPE Software successfully, the possibility that Micro Focus may be unable to provide benefits and services to, or access to equivalent financial strength and resources to HPE Software that historically have been provided to HPE Software by HPE, the possibility that the Distribution may be taxable to HPE and HPE Stockholders, the risks resulting from the additional long-term indebtedness and liabilities that Micro Focus and its subsidiaries will have following consummation of the Transactions and the risks associated with the substantial dilution to the ownership interest of current Micro Focus Shareholders following consummation of the Merger.

Q: How do the Transactions impact Micro Focus’ dividend policy?

A: In connection with the Transactions, Micro Focus will implement the Micro Focus Return of Value. The Micro Focus Return of Value will be funded by the Micro Focus Facilities. With the exception of the Micro Focus Return of Value, the Transactions are not expected to affect Micro Focus’ stated dividend policy.

11

Following Closing and subject to the Enlarged Group’s performance (and, in particular, Micro Focus being able to comply with the restrictions on paying dividends imposed by the Micro Focus Facilities), the Micro Focus Board intends to continue its stated dividend policy of paying an annual dividend that is approximately twice covered by Adjusted Earnings Per Share. In addition to certain other exceptions, the Micro Focus Facilities permit the payment of dividends provided that no event of default is continuing under such agreements and, taking into account such payment, the ratio of secured debt (net of free cash) of the Enlarged Group to its consolidated EBITDA (as defined in the New Micro Focus Facility Agreement) is less than 3.0:1. Until that financial metric is achieved, under the Micro Focus Facilities, Micro Focus will have access to the available amount basket of $100 million plus an additional basket for restricted payments of $250 million, providing $350 million of dividend payment capacity. See the sections entitled “The Transactions—Micro Focus Return of Value” and “Historical Per Share Data, Market Price and Dividend Policies.”

Q: What are the U.S. federal income tax consequences to HPE, Micro Focus and their respective shareholders resulting from the Distribution and the Merger?

A: The consummation of the Transactions is conditioned upon the receipt by HPE of the HPE Tax Opinion from its tax counsel, Skadden, substantially to the effect that, among other items, for U.S. federal income tax purposes (i) the Distribution, taken together with the Contribution, should qualify as a “reorganization” under Sections 368(a)(1)(D), 361 and 355 of the Code, upon which no income, gain or loss should be recognized by HPE or Seattle (except for certain items required to be recognized under Treasury Regulations regarding consolidated federal income tax returns) and (ii) the Merger should qualify as a “reorganization” under Section 368(a) of the Code. Provided that the Distribution and Contribution so qualify, HPE and HPE Stockholders will generally not recognize any taxable income, gain or loss as a result of the Distribution for U.S. federal income tax purposes.

The Merger is intended to qualify as a “reorganization” under Section 368(a) of the Code. However, pursuant to certain rules contained in Section 367(a) of the Code and the Treasury Regulations promulgated thereunder, U.S. Holders (as defined in the section entitled “U.S. Federal Income Tax Consequences of the Distribution and the Merger”) will generally recognize gain, if any, but not loss, on the exchange of Seattle Shares for Micro Focus ADSs pursuant to the Merger.

The consummation of the Transactions is conditioned upon the receipt by HPE of the HPE Tax Opinion. An opinion of counsel neither binds the IRS nor precludes the IRS or the courts from adopting a contrary position. HPE intends to request a ruling from the IRS on certain issues related to the U.S. federal income tax consequences of the Distribution. The receipt of any such ruling is not a condition to HPE’s and Seattle’s obligation to consummate the Transactions and there can be no assurance that any or all of such requested rulings will be received. If the Distribution or certain related transactions fail to qualify for the intended tax treatment, HPE and/or HPE Stockholders may be subject to substantial U.S. federal income taxes.

Following Closing, Micro Focus is expected to continue to be treated as a foreign corporation for U.S. federal income tax purposes, but under Section 7874 of the Code, Micro Focus’ U.S. affiliates likely will be subject to certain adverse U.S. federal income tax rules as a result of the Merger. See the section entitled “U.S. Federal Income Tax Consequences Relating to Section 7874 of the Code” below for more information.

Because Micro Focus Shareholders will not participate in the Distribution or the Merger, Micro Focus Shareholders in their capacity as such will not recognize gain or loss upon either the Distribution or the Merger.

The U.S. federal income tax consequences of the Distribution and the Merger are described in more detail in the section entitled “U.S. Federal Income Tax Consequences of the Distribution and the Merger.” The tax consequences to you of the Distribution and the Merger will depend on your particular circumstances. You should consult your own tax advisor regarding the particular tax consequences to you of the Transactions.

12

Q: Where can I find more information about HPE, Seattle and Micro Focus?

Before the Transactions, if you have any questions relating to HPE’s or Seattle’s business performance, you should contact:

Hewlett Packard Enterprise Company

3000 Hanover Street

Palo Alto, CA 94304

Attn: Investor Relations

(650) 687-5817

investor.relations@hpe.com

HPE’s investor website is http://investors.hpe.com. The information contained on HPE’s investor website is not incorporated by reference into this information statement/prospectus and should not be considered part of this information statement/prospectus.

After the Transactions, holders of Micro Focus Shares or Micro Focus ADSs who have any questions relating to Seattle’s or Micro Focus’ business performance should contact Micro Focus at:

Micro Focus International plc

The Lawn, 22-30 Old Bath Road

Berkshire, RG14 1QN

United Kingdom

+44 (0) 1635-565-459

investors@microfocus.com

Micro Focus’ investor website is http://investors.microfocus.com/. The information contained on Micro Focus’ investor website is not incorporated by reference into this information statement/prospectus and should not be considered part of this information statement/prospectus.

QUESTIONS AND ANSWERS FOR HPE STOCKHOLDERS

For the purposes of this section, “I,” “my,” “mine,” “you” and “your” refer to each HPE Stockholder as of the close of business on the Distribution Record Date, each of whom will be entitled to receive Seattle Shares in the Distribution, with such Seattle Shares being converted into Micro Focus ADSs in the Merger, as further described elsewhere in this information statement/prospectus.

Q: Why am I receiving this document?

A: You are receiving this information statement/prospectus because you are a holder of HPE Shares. If you are a holder of HPE Shares as of the close of business on August 21, 2017, which is the Distribution Record Date, you will be entitled to receive a number of Seattle Shares with respect to each HPE Share that you held as of the close of business on such date, in accordance with a distribution ratio of one Seattle Share for each HPE Share held as of such time. Your Seattle Shares will then be automatically converted into the right to receive Micro Focus ADSs representing Micro Focus Shares in connection with the Merger. Each Micro Focus Share issued in connection with the Merger will be issued directly to the Depositary. The Depositary will issue one Micro Focus ADS for each Micro Focus Share, unless another ratio is agreed by Micro Focus and HPE. This information statement/prospectus will help you understand the Transactions and your investment in Micro Focus after the Merger.

Q: What do HPE Stockholders need to do to participate in the Transactions?

A: HPE Stockholders as of the close of business on the Distribution Record Date will not be required to take any action to receive Seattle Shares in the Distribution or receive Micro Focus ADSs in the Merger, but you are urged to read this entire information statement/prospectus carefully. No vote of HPE Stockholders is required for the Distribution or the Merger. HPE, as sole stockholder of Seattle prior to the Distribution, has approved the Merger. Therefore, you are not being asked for a proxy, and you are requested not to send HPE a proxy, in connection with the Distribution or the Merger. You do not need to pay any consideration, exchange or surrender your existing HPE Shares or take any other action to receive Micro Focus ADSs in the Merger. Please do not send in any HPE stock certificates. The Transactions will not affect the number of outstanding HPE Shares or any rights of HPE Stockholders, although it is expected to affect the market value of each outstanding HPE Share.

13

Q: How many Micro Focus ADSs will I receive in the Transactions?

A: In the Distribution, HPE will distribute all of the outstanding Seattle Shares on a pro rata basis to HPE Stockholders as of the close of business on the Distribution Record Date. One Seattle Share will be distributed with respect to each HPE Share held as of the close of business on the Distribution Record Date. Each Seattle Share will be automatically converted into the right to receive a number of Micro Focus ADSs determined in accordance with the Merger Agreement. Each Micro Focus ADS will represent one Micro Focus Share issued pursuant to the Merger to the Depositary, unless another ratio is agreed by Micro Focus and HPE.

Q: Will fractional Micro Focus ADSs be issued in the Transactions?

A: No. The Depositary will not issue fractional Micro Focus ADSs. You will receive cash in lieu of any fractional Micro Focus ADSs that you would have otherwise received following the Transactions.

Q: Where will I be able to trade Micro Focus ADSs?

A: We expect trading of Micro Focus ADSs to begin September 1, 2017. We have applied to list the Micro Focus ADSs on the NYSE under the symbol “MFGP.” Micro Focus Shares are currently listed on the LSE under the symbol “MCRO.”

Q: What will happen to the listing of HPE Shares?

A: HPE Shares will continue to trade on the NYSE after the Distribution under the symbol “HPE.”

Q: Will the number of HPE Shares that I own change as a result of the Transactions?

A: No. The number of HPE Shares that you own will not change as a result of the Transactions.

Q: Will the Transactions affect the market price of my HPE Shares?

A: Yes. As a result of the Transactions, it is expected that the trading price of HPE Shares immediately following the Transactions will be lower than the trading price of such shares immediately prior to the Transactions because the trading price will no longer reflect the value of HPE Software, which is being transferred to Micro Focus as part of the Transactions.

Q: Will HPE Stockholders who sell their HPE Shares shortly before the completion of the Distribution and the Merger still be entitled to receive Micro Focus ADSs with respect to the HPE Shares that were sold?

A: It is currently expected that beginning on or about August 17, 2017, which is two business days before the Distribution Record Date, and continuing through the close of trading on August 31, 2017, which is the last business day prior to September 1, 2017, the expected Closing Date, there will be two markets in HPE Shares on the NYSE: a “regular way” market and an “ex-distribution” market.

If an HPE Stockholder sells HPE Shares in the “regular way” market under the ticker symbol “HPE” during this time period, that HPE Stockholder will be selling both his HPE Shares and the right (represented by a “due-bill”) to receive Seattle Shares that will be converted into the right to receive Micro Focus ADSs, and cash in lieu of fractional shares (if any), at Closing. HPE Stockholders should consult their brokers before selling their HPE Shares in the “regular way” market during this time period to be sure they understand the effect of the NYSE “due-bill” procedures. The “due-bill” process is not managed, operated or controlled by HPE, Seattle or Micro Focus.

If an HPE Stockholder sells HPE Shares in the “ex-distribution” market during this time period, that HPE Stockholder will be selling only his HPE Shares, and will retain the right to receive Seattle Shares that will be converted into the right to receive Micro Focus ADSs, and cash in lieu of fractional shares (if any), at Closing. It is currently expected that “ex-distribution” trades of HPE Shares will settle within three business days after the Closing Date and that if the Merger is not completed all trades in this “ex-distribution” market will be cancelled.

After the close of trading on August 31, 2017, HPE Shares will no longer trade in this “ex-distribution” market, and HPE Shares that are sold in the “regular way” market will no longer reflect the right to receive Seattle Shares that will be converted into the right to receive Micro Focus ADSs, and cash in lieu of fractional shares (if any), at Closing.

14

Q: How may HPE Stockholders sell the Micro Focus ADSs that they will be entitled to receive in the Merger prior to receiving those Micro Focus ADSs?

A: It is currently expected that beginning on or about August 17, 2017, which is two business days before the Distribution Record Date, and continuing through the close of trading on August 31, 2017, which is the business day prior to September 1, 2017, the expected Closing Date), there will be a “when issued” market in Micro Focus ADSs on the NYSE.

The “when issued” market will be a market for the Micro Focus ADSs that will be issued to holders of Seattle Shares at Closing. If an HPE Stockholder sells Micro Focus ADSs in the “when issued” market during this time period, that HPE Stockholder will be required to deliver the number of Micro Focus ADSs so sold in settlement of the sale after Micro Focus ADSs are issued upon Closing. It is currently expected that “when issued” trades of Micro Focus ADSs will settle within three business days after the Closing Date and that if the Merger is not completed, all trades in this “when issued” market will be cancelled. After the close of trading on August 31, 2017, Micro Focus ADSs will no longer trade in this “when issued” market.

Q: What are the implications to HPE Stockholders of Micro Focus being a “foreign private issuer?”

A: Following completion of the Transactions, Micro Focus will be subject to the reporting requirements under the Exchange Act applicable to foreign private issuers. Micro Focus will be required to file an annual report on Form 20-F with the SEC within four months after the end of each fiscal year. Micro Focus’ current fiscal year begins on May 1 and ends on April 30. However, as described further below, Micro Focus intends to align its accounting year end with HPE Software’s accounting year end of October 31 upon Closing. In addition, Micro Focus will be required to furnish reports on Form 6-K to the SEC regarding certain information required to be publicly disclosed by Micro Focus by way of a Regulatory News Service, referred to as an RNS, in the United Kingdom or filed with the LSE or U.K. Companies House, or regarding information distributed or required to be distributed by Micro Focus to Micro Focus Shareholders under English law and/or regulations. Micro Focus will be exempt from certain rules under the Exchange Act, including the proxy rules, which impose certain disclosure and procedural requirements for proxy solicitations under Section 14 of the Exchange Act, and will not be required to comply with Regulation FD, which addresses certain restrictions on the selective disclosure of material information. In addition, among other matters, Micro Focus’ officers, directors and principal shareholders will be exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of Micro Focus Shares. If Micro Focus loses its status as a foreign private issuer, it will no longer be exempt from such rules and, among other things, will be required to file periodic reports and financial statements as if it were a domestic U.S. issuer.

Q: What is the effect of Micro Focus aligning its accounting year end with HPE Software in connection with Closing?

A: At and conditional upon Closing, Micro Focus will align its accounting year end with HPE Software’s accounting year end of October 31, with the first accounting period to be audited after Closing being for the 18 months ended October 31, 2018. During this extended accounting period and in order to comply with the U.K. Listing Rules, Micro Focus will publish an unaudited interim report for the six months ended October 31, 2017 and a second unaudited interim report for the six months ended April 30, 2018.

QUESTIONS AND ANSWERS ABOUT AMERICAN DEPOSITARY SHARES

For the purposes of this section, “I,” “my,” “you” and “your” refer to each HPE Stockholder as of the close of business on the Distribution Record Date, each of whom will be entitled to receive Seattle Shares in the Distribution, with such Seattle Shares being converted into Micro Focus ADSs in the Merger, as further described elsewhere herein.

The following is only a summary of the questions and answers you may have relating to the Micro Focus ADSs that you will become entitled to receive in the Merger upon conversion of the Seattle Shares distributed to you in the Distribution. Your rights as a Micro Focus ADS holder will be governed by, among other things, the terms of the Deposit Agreement with the Depositary. You should read the section below in conjunction with the section entitled “Description of the Micro Focus American Depositary Shares” and the Deposit Agreement, which is included as an exhibit to the registration statement on Form F-4 of Micro Focus of which this information statement/prospectus forms a part.

15

Q: What is an ADS and will the Micro Focus ADSs be listed?