UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21897

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Scott M. Ostrowski, President

Manager Directed Portfolios

c/o

U.S. Bank Global Fund Services

777 East Wisconsin Avenue, 6th Floor

Milwaukee,

WI 53202

(Name and address of agent for service)

(414) 516-3087

Registrant’s telephone number, including area code

Date of fiscal year end: June 30, 2024

Date

of reporting period:

Item 1. Reports to Stockholders.

| (a) |

|

|

|

|

|

||

|

Annual Shareholder Report |

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$

|

|

|

Top Contributors

|

|

|

↑

|

FTAI Aviation Ltd.

|

|

↑

|

Vertiv Holdings Co.

|

|

↑

|

Comfort Systems USA, Inc.

|

|

↑

|

Onto Innovcation, Inc.

|

|

↑

|

FormFactor, Inc.

|

|

Top Detractors

|

|

|

↓

|

DocGo, Inc.

|

|

↓

|

MasTec, Inc.

|

|

↓

|

Applied Digital Corporation

|

|

↓

|

Five9, Inc.

|

|

↓

|

Harmonic, Inc.

|

| Hood River Small-Cap Growth Fund | PAGE 1 | TSR_AR_56170L208 |

|

|

1 Year

|

5 Year

|

10 Year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

Net Assets

|

$

|

|

Number of Holdings

|

|

|

Net Advisory Fee

|

$

|

|

Portfolio Turnover Rate

|

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Mount Vernon Liquid Assets Portfolio, LLC

|

|

|

FTAI Aviation Ltd.

|

|

|

First American Treasury Obligations Fund

|

|

|

MasTec, Inc.

|

|

|

Rambus, Inc.

|

|

|

Clean Harbors, Inc.

|

|

|

Comfort Systems USA, Inc.

|

|

|

FormFactor, Inc.

|

|

|

Coherent Corp.

|

|

|

Kirby Corp.

|

|

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| Hood River Small-Cap Growth Fund | PAGE 2 | TSR_AR_56170L208 |

| Hood River Small-Cap Growth Fund | PAGE 3 | TSR_AR_56170L208 |

|

|

|

|

|

||

|

Annual Shareholder Report |

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$

|

|

|

Top Contributors

|

|

|

↑

|

FTAI Aviation Ltd.

|

|

↑

|

Vertiv Holdings Co.

|

|

↑

|

Comfort Systems USA, Inc.

|

|

↑

|

Onto Innovcation, Inc.

|

|

↑

|

FormFactor, Inc.

|

|

Top Detractors

|

|

|

↓

|

DocGo, Inc.

|

|

↓

|

MasTec, Inc.

|

|

↓

|

Applied Digital Corporation

|

|

↓

|

Five9, Inc.

|

|

↓

|

Harmonic, Inc.

|

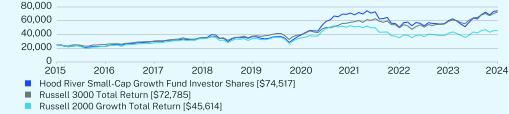

| Hood River Small-Cap Growth Fund | PAGE 1 | TSR_AR_56170L109 |

|

|

1 Year

|

5 Year

|

Since Inception

(07/07/2015) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

Net Assets

|

$

|

|

Number of Holdings

|

|

|

Net Advisory Fee

|

$

|

|

Portfolio Turnover Rate

|

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Mount Vernon Liquid Assets Portfolio, LLC

|

|

|

FTAI Aviation Ltd.

|

|

|

First American Treasury Obligations Fund

|

|

|

MasTec, Inc.

|

|

|

Rambus, Inc.

|

|

|

Clean Harbors, Inc.

|

|

|

Comfort Systems USA, Inc.

|

|

|

FormFactor, Inc.

|

|

|

Coherent Corp.

|

|

|

Kirby Corp.

|

|

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| Hood River Small-Cap Growth Fund | PAGE 2 | TSR_AR_56170L109 |

| Hood River Small-Cap Growth Fund | PAGE 3 | TSR_AR_56170L109 |

|

|

|

|

|

||

|

Annual Shareholder Report |

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Retirement Shares

|

$

|

|

|

Top Contributors

|

|

|

↑

|

FTAI Aviation Ltd.

|

|

↑

|

Vertiv Holdings Co.

|

|

↑

|

Comfort Systems USA, Inc.

|

|

↑

|

Onto Innovcation, Inc.

|

|

↑

|

FormFactor, Inc.

|

|

Top Detractors

|

|

|

↓

|

DocGo, Inc.

|

|

↓

|

MasTec, Inc.

|

|

↓

|

Applied Digital Corporation

|

|

↓

|

Five9, Inc.

|

|

↓

|

Harmonic, Inc.

|

| Hood River Small-Cap Growth Fund | PAGE 1 | TSR_AR_56170L505 |

|

|

1 Year

|

5 Year

|

Since Inception

(03/03/2017) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

Net Assets

|

$

|

|

Number of Holdings

|

|

|

Net Advisory Fee

|

$

|

|

Portfolio Turnover Rate

|

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Mount Vernon Liquid Assets Portfolio, LLC

|

|

|

FTAI Aviation Ltd.

|

|

|

First American Treasury Obligations Fund

|

|

|

MasTec, Inc.

|

|

|

Rambus, Inc.

|

|

|

Clean Harbors, Inc.

|

|

|

Comfort Systems USA, Inc.

|

|

|

FormFactor, Inc.

|

|

|

Coherent Corp.

|

|

|

Kirby Corp.

|

|

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| Hood River Small-Cap Growth Fund | PAGE 2 | TSR_AR_56170L505 |

| Hood River Small-Cap Growth Fund | PAGE 3 | TSR_AR_56170L505 |

|

|

|

|

|

||

|

Annual Shareholder Report |

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$

|

|

|

Top Contributors

|

|

|

↑

|

FTAI Aviation Ltd.

|

|

↑

|

Micronics Japan Co., Ltd.

|

|

↑

|

Camtek Ltd

|

|

↑

|

Applied Digital Corporation

|

|

↑

|

Voltamp Transformers Limited

|

|

Top Detractors

|

|

|

↓

|

Establishment Labs Holdings, Inc.

|

|

↓

|

Inspired Entertainment, Inc.

|

|

↓

|

ODDITY Tech Ltd.

|

|

↓

|

Lilium N.V.

|

|

↓

|

Toyo Gosei Co., Ltd.

|

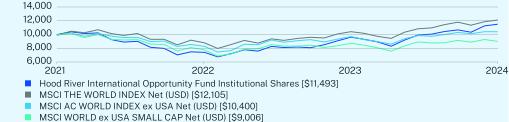

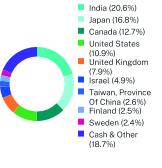

| Hood River International Opportunity Fund | PAGE 1 | TSR_AR_56170L778 |

|

|

1 Year

|

Since Inception

(09/28/2021) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

| * |

|

Net Assets

|

$

|

|

Number of Holdings

|

|

|

Net Advisory Fee

|

$

|

|

Portfolio Turnover Rate

|

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Applied Digital Corp.

|

|

|

Marubeni Corp.

|

|

|

GFL Environmental, Inc.

|

|

|

First American Treasury Obligations Fund

|

|

|

Voltamp Transformers Ltd.

|

|

|

Camtek Ltd./Israel

|

|

|

Denison Mines Corp.

|

|

|

Alphawave IP Group PLC

|

|

|

VIKING HOLDINGS Ltd. ORD SHS

|

|

|

Munters Group AB

|

|

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| Hood River International Opportunity Fund | PAGE 2 | TSR_AR_56170L778 |

| Hood River International Opportunity Fund | PAGE 3 | TSR_AR_56170L778 |

|

|

|

|

|

||

|

Annual Shareholder Report |

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$

|

|

|

Top Contributors

|

|

|

↑

|

FTAI Aviation Ltd.

|

|

↑

|

Micronics Japan Co., Ltd.

|

|

↑

|

Camtek Ltd

|

|

↑

|

Applied Digital Corporation

|

|

↑

|

Voltamp Transformers Limited

|

|

Top Detractors

|

|

|

↓

|

Establishment Labs Holdings, Inc.

|

|

↓

|

Inspired Entertainment, Inc.

|

|

↓

|

ODDITY Tech Ltd.

|

|

↓

|

Lilium N.V.

|

|

↓

|

Toyo Gosei Co., Ltd.

|

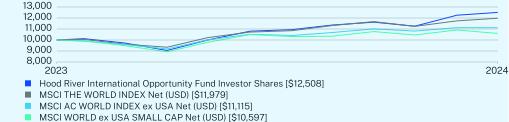

| Hood River International Opportunity Fund | PAGE 1 | TSR_AR_56170L760 |

|

|

Since Inception

(08/11/2023) |

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

Net Assets

|

$

|

|

Number of Holdings

|

|

|

Net Advisory Fee

|

$

|

|

Portfolio Turnover Rate

|

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Applied Digital Corp.

|

|

|

Marubeni Corp.

|

|

|

GFL Environmental, Inc.

|

|

|

First American Treasury Obligations Fund

|

|

|

Voltamp Transformers Ltd.

|

|

|

Camtek Ltd./Israel

|

|

|

Denison Mines Corp.

|

|

|

Alphawave IP Group PLC

|

|

|

VIKING HOLDINGS Ltd. ORD SHS

|

|

|

Munters Group AB

|

|

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| Hood River International Opportunity Fund | PAGE 2 | TSR_AR_56170L760 |

| Hood River International Opportunity Fund | PAGE 3 | TSR_AR_56170L760 |

|

|

|

|

|

||

|

Annual Shareholder Report |

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Retirement Shares

|

$

|

|

|

Top Contributors

|

|

|

↑

|

FTAI Aviation Ltd.

|

|

↑

|

Micronics Japan Co., Ltd.

|

|

↑

|

Camtek Ltd

|

|

↑

|

Applied Digital Corporation

|

|

↑

|

Voltamp Transformers Limited

|

|

Top Detractors

|

|

|

↓

|

Establishment Labs Holdings, Inc.

|

|

↓

|

Inspired Entertainment, Inc.

|

|

↓

|

ODDITY Tech Ltd.

|

|

↓

|

Lilium N.V.

|

|

↓

|

Toyo Gosei Co., Ltd.

|

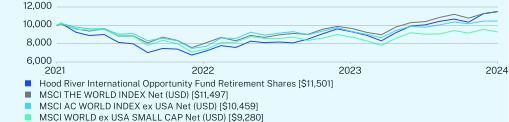

| Hood River International Opportunity Fund | PAGE 1 | TSR_AR_56170L752 |

|

|

1 Year

|

Since Inception

(12/22/2021) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

| * |

|

Net Assets

|

$

|

|

Number of Holdings

|

|

|

Net Advisory Fee

|

$

|

|

Portfolio Turnover Rate

|

|

|

Top 10 Holdings

|

(% of Net Assets)

|

|

Applied Digital Corp.

|

|

|

Marubeni Corp.

|

|

|

GFL Environmental, Inc.

|

|

|

First American Treasury Obligations Fund

|

|

|

Voltamp Transformers Ltd.

|

|

|

Camtek Ltd./Israel

|

|

|

Denison Mines Corp.

|

|

|

Alphawave IP Group PLC

|

|

|

VIKING HOLDINGS Ltd. ORD SHS

|

|

|

Munters Group AB

|

|

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| Hood River International Opportunity Fund | PAGE 2 | TSR_AR_56170L752 |

| Hood River International Opportunity Fund | PAGE 3 | TSR_AR_56170L752 |

| (b) | Not applicable. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that there are at least two audit committee financial experts serving on its audit committee. Messrs. Gaylord B. Lyman and Scott C. Jones are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services and tax services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| FYE 6/30/2024 | FYE 6/30/2023 | |

| Audit Fees | $28,150 | $26,000 |

| Audit-Related Fees | N/A | N/A |

| Tax Fees | $7,000 | $6,500 |

| All Other Fees | N/A | N/A |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, as well as non-audit services provided to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant relating to the operations and financial reporting of the registrant.

The percentage of fees billed by Cohen & Company Ltd. applicable to non-audit services pursuant to waiver of the pre-approval requirement were as follows for each of the Hood River Small-Cap Growth Fund and the Hood River International Opportunity Fund:

| FYE 6/30/2024 | FYE 6/30/2023 | |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 6/30/2024 | FYE 6/30/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the financial statements filed under Item 7 of this Form. |

| (b) | Not applicable. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

| (a) |

|

|

|

|

|

|

|

|

|

Page |

|

Schedule

of Investments |

|

|

|

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

Financial

Highlights |

|

|

|

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - 95.4% | ||||||

|

COMMUNICATION

SERVICES - 1.2% |

|

|

|

|

||

|

Diversified

Telecommunication Services - 1.0% |

|

|

|

|

||

|

Cogent

Communications Holdings, Inc.(a) |

|

|

467,731 |

|

|

$ 26,398,738

|

|

Media

& Entertainment – 0.2% |

|

|

|

|

||

|

Webtoon

Entertainment, Inc.(b) |

|

|

268,357 |

|

|

6,126,590

|

|

TOTAL

COMMUNICATION SERVICES |

|

|

|

|

32,525,328

| |

|

CONSUMER

DISCRETIONARY - 8.6% |

|

|

|

|

||

|

Broadline

Retail - 1.1% |

|

|

|

|

||

|

Global-e

Online Ltd.(a)(b) |

|

|

478,491 |

|

|

17,354,868

|

|

Ollie’s

Bargain Outlet Holdings, Inc.(a)(b) |

|

|

124,204 |

|

|

12,193,107

|

|

|

|

|

|

29,547,975

| ||

|

Diversified

Consumer Services - 0.5% |

|

|

|

|

||

|

Duolingo,

Inc.(a)(b) |

|

|

67,490 |

|

|

14,083,138

|

|

Hotels,

Restaurants & Leisure - 4.1% |

|

|

|

|

||

|

Caesars

Entertainment, Inc.(b) |

|

|

549,198 |

|

|

21,825,128

|

|

Cava

Group, Inc.(a)(b) |

|

|

346,437 |

|

|

32,132,032

|

|

Genius

Sports Ltd.(b) |

|

|

960,031 |

|

|

5,232,169

|

|

Life

Time Group Holdings, Inc.(a)(b) |

|

|

1,009,323 |

|

|

19,005,552

|

|

Sweetgreen,

Inc. - Class A(a)(b) |

|

|

971,235 |

|

|

29,273,023

|

|

|

|

|

|

107,467,904

| ||

|

Household

Durables - 1.5% |

|

|

|

|

||

|

Lovesac

Co.(a)(b) |

|

|

454,265 |

|

|

10,257,304

|

|

SharkNinja,

Inc. |

|

|

379,769 |

|

|

28,539,640

|

|

|

|

|

|

38,796,944

| ||

|

Specialty

Retail - 0.4% |

|

|

|

|

||

|

Arhaus,

Inc.(a) |

|

|

606,673 |

|

|

10,277,041

|

|

Textiles,

Apparel & Luxury Goods - 1.0% |

|

|

|

|

||

|

Amer

Sports, Inc.(a)(b) |

|

|

2,027,384 |

|

|

25,484,217

|

|

TOTAL

CONSUMER DISCRETIONARY |

|

|

|

|

225,657,219

| |

|

CONSUMER

STAPLES - 0.5% |

|

|

|

|

||

|

Personal

Care Products - 0.5% |

|

|

|

|

||

|

Oddity

Tech Ltd. - Class A(a)(b) |

|

|

349,749 |

|

|

13,731,146

|

|

TOTAL

CONSUMER STAPLES |

|

|

|

|

13,731,146

| |

|

ENERGY

- 2.0% |

|

|

|

|

||

|

Oil,

Gas & Consumable Fuels - 2.0% |

|

|

|

|

||

|

Denison

Mines Corp.(b) |

|

|

14,843,478 |

|

|

29,538,521

|

|

Northern

Oil & Gas, Inc.(a) |

|

|

504,994 |

|

|

18,770,627

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

ENERGY

- (Continued) | ||||||

|

Oil,

Gas & Consumable Fuels - (Continued) | ||||||

|

Scorpio

Tankers, Inc. |

|

|

64,399 |

|

|

$ 5,234,995

|

|

|

|

|

|

53,544,143

| ||

|

TOTAL

ENERGY |

|

|

|

|

53,544,143

| |

|

FINANCIALS

- 5.1% |

|

|

|

|

||

|

Banks

- 1.4% |

|

|

|

|

||

|

Customers

Bancorp, Inc.(b) |

|

|

329,557 |

|

|

15,812,145

|

|

Western

Alliance Bancorp |

|

|

334,191 |

|

|

20,993,879

|

|

|

|

|

|

36,806,024

| ||

|

Consumer

Finance - 1.3% |

|

|

|

|

||

|

FirstCash

Holdings, Inc. |

|

|

326,942 |

|

|

34,289,677

|

|

Financial

Services - 0.6% |

|

|

|

|

||

|

I3

Verticals, Inc. - Class A(a)(b) |

|

|

695,931 |

|

|

15,366,156

|

|

Insurance

- 1.8% |

|

|

|

|

||

|

HCI

Group, Inc.(a) |

|

|

453,999 |

|

|

41,845,088

|

|

Root,

Inc.(a)(b) |

|

|

112,463 |

|

|

5,804,215

|

|

|

|

|

|

47,649,303

| ||

|

TOTAL

FINANCIALS |

|

|

|

|

134,111,160

| |

|

HEALTH

CARE - 18.6% |

|

|

|

|

||

|

Biotechnology

- 9.4% |

|

|

|

|

||

|

Biohaven

Ltd.(a)(b) |

|

|

193,464 |

|

|

6,715,135

|

|

Blueprint

Medicines Corp.(a)(b) |

|

|

263,633 |

|

|

28,414,365

|

|

Crinetics

Pharmaceuticals, Inc.(b) |

|

|

212,313 |

|

|

9,509,499

|

|

Cytokinetics,

Inc.(a)(b) |

|

|

390,280 |

|

|

21,145,370

|

|

Insmed,

Inc.(a)(b) |

|

|

693,112 |

|

|

46,438,504

|

|

Iovance

Biotherapeutics, Inc.(a)(b) |

|

|

1,408,584 |

|

|

11,296,844

|

|

Krystal

Biotech, Inc.(a)(b) |

|

|

275,426 |

|

|

50,579,231

|

|

Neurocrine

Biosciences, Inc.(b) |

|

|

126,422 |

|

|

17,404,517

|

|

REVOLUTION

Medicines, Inc.(b) |

|

|

476,913 |

|

|

18,508,993

|

|

Scholar

Rock Holding Corp.(a)(b) |

|

|

420,114 |

|

|

3,499,549

|

|

TG

Therapeutics, Inc.(a)(b) |

|

|

815,949 |

|

|

14,515,733

|

|

Viking

Therapeutics, Inc.(a)(b) |

|

|

373,563 |

|

|

19,802,575

|

|

|

|

|

|

247,830,315

| ||

|

Health

Care Equipment & Supplies - 3.6% |

|

|

|

|

||

|

AtriCure,

Inc.(a)(b) |

|

|

935,154 |

|

|

21,293,456

|

|

Haemonetics

Corp.(a)(b) |

|

|

144,030 |

|

|

11,915,602

|

|

Inspire

Medical Systems, Inc.(a)(b) |

|

|

48,982 |

|

|

6,555,261

|

|

Lantheus

Holdings, Inc.(b) |

|

|

571,727 |

|

|

45,903,961

|

|

TransMedics

Group, Inc.(b) |

|

|

66,293 |

|

|

9,985,052

|

|

|

|

|

|

95,653,332

| ||

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

HEALTH

CARE - (Continued) | ||||||

|

Health

Care Providers & Services - 3.1% |

|

|

|

|

||

|

Alignment

Healthcare, Inc.(a)(b) |

|

|

1,821,926 |

|

|

$ 14,247,461

|

|

Option

Care Health, Inc.(b) |

|

|

920,147 |

|

|

25,488,072

|

|

RadNet,

Inc.(a)(b) |

|

|

589,519 |

|

|

34,734,460

|

|

Select

Medical Holdings Corp. |

|

|

223,501 |

|

|

7,835,945

|

|

|

|

|

|

82,305,938

| ||

|

Health

Care Technology - 0.6% |

|

|

|

|

||

|

Evolent

Health, Inc. - Class A(a)(b) |

|

|

849,221 |

|

|

16,237,106

|

|

Pharmaceuticals

- 1.9% |

|

|

|

|

||

|

Axsome

Therapeutics, Inc.(a)(b) |

|

|

286,036 |

|

|

23,025,898

|

|

Intra-Cellular

Therapies, Inc.(b) |

|

|

252,695 |

|

|

17,307,081

|

|

Verona

Pharma PLC - ADR(a)(b) |

|

|

550,651 |

|

|

7,962,413

|

|

|

|

|

|

48,295,392

| ||

|

TOTAL

HEALTH CARE |

|

|

|

|

490,322,083

| |

|

INDUSTRIALS

- 28.8%(c) |

|

|

|

|

||

|

Aerospace

& Defense - 2.4% |

|

|

|

|

||

|

Axon

Enterprise, Inc.(b) |

|

|

117,944 |

|

|

34,703,843

|

|

Kratos

Defense & Security Solutions, Inc.(a)(b) |

|

|

1,406,028 |

|

|

28,134,620

|

|

|

|

|

|

62,838,463

| ||

|

Commercial

Services & Supplies - 2.5% |

|

|

|

|

||

|

CECO

Environmental Corp.(b) |

|

|

320,223 |

|

|

9,238,433

|

|

Clean

Harbors, Inc.(b) |

|

|

256,867 |

|

|

58,090,472

|

|

|

|

|

|

67,328,905

| ||

|

Construction

& Engineering - 8.2% |

|

|

|

|

||

|

API

Group Corp.(b) |

|

|

598,893 |

|

|

22,536,344

|

|

Comfort

Systems USA, Inc. |

|

|

190,275 |

|

|

57,866,433

|

|

Construction

Partners, Inc. - Class A(b) |

|

|

280,199 |

|

|

15,469,787

|

|

Fluor

Corp.(b) |

|

|

576,262 |

|

|

25,096,210

|

|

Granite

Construction, Inc.(a) |

|

|

248,648 |

|

|

15,408,716

|

|

MasTec,

Inc.(a)(b) |

|

|

631,407 |

|

|

67,554,235

|

|

MDU

Resources Group, Inc. |

|

|

513,139 |

|

|

12,879,789

|

|

|

|

|

|

216,811,514

| ||

|

Electrical

Equipment - 2.2% |

|

|

|

|

||

|

American

Superconductor Corp.(a)(b) |

|

|

1,016,506 |

|

|

23,776,075

|

|

Vertiv

Holdings Co. - Class A |

|

|

407,919 |

|

|

35,313,548

|

|

|

|

|

|

59,089,623

| ||

|

Ground

Transportation - 3.5% |

|

|

|

|

||

|

FTAI

Infrastructure, Inc. |

|

|

1,756,852 |

|

|

15,161,632

|

|

RXO,

Inc.(b) |

|

|

966,459 |

|

|

25,272,903

|

|

TFI

International, Inc.(a) |

|

|

127,005 |

|

|

18,436,046

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

INDUSTRIALS

- (Continued) | ||||||

|

Ground

Transportation - (Continued) | ||||||

|

XPO,

Inc.(a)(b) |

|

|

308,046 |

|

|

$ 32,699,083

|

|

|

|

|

|

91,569,664

| ||

|

Machinery

- 1.0% |

|

|

|

|

||

|

Flowserve

Corp.(a) |

|

|

259,370 |

|

|

12,475,697

|

|

SPX

Technologies, Inc.(b) |

|

|

97,713 |

|

|

13,888,926

|

|

|

|

|

|

26,364,623

| ||

|

Marine

Transportation - 2.0% |

|

|

|

|

||

|

Kirby

Corp.(b) |

|

|

431,660 |

|

|

51,682,652

|

|

Trading

Companies & Distributors - 7.0% |

|

|

|

|

||

|

FTAI

Aviation Ltd.(a) |

|

|

1,648,164 |

|

|

170,139,970

|

|

Transcat,

Inc.(a)(b) |

|

|

116,312 |

|

|

13,920,220

|

|

|

|

|

|

184,060,190

| ||

|

TOTAL

INDUSTRIALS |

|

|

|

|

759,745,634

| |

|

INFORMATION

TECHNOLOGY - 27.4%(c) |

|

|

|

|

||

|

Communications

Equipment - 0.9% |

|

|

|

|

||

|

Applied

Optoelectronics, Inc.(a)(b) |

|

|

811,963 |

|

|

6,731,173

|

|

Infinera

Corp.(a)(b) |

|

|

2,798,887 |

|

|

17,045,222

|

|

|

|

|

|

23,776,395 | ||

|

Electronic

Equipment, Instruments & Components - 3.7% |

|

|

|

|

||

|

Coherent

Corp.(b) |

|

|

756,786 |

|

|

54,836,714

|

|

Itron,

Inc.(b) |

|

|

119,991 |

|

|

11,874,309

|

|

OSI

Systems, Inc.(b) |

|

|

187,582 |

|

|

25,796,277

|

|

TTM

Technologies, Inc.(b) |

|

|

268,649 |

|

|

5,219,850

|

|

|

|

|

|

97,727,150

| ||

|

IT

Services - 2.3% |

|

|

|

|

||

|

Applied

Digital Corp.(b) |

|

|

4,848,159 |

|

|

28,846,546

|

|

Couchbase,

Inc.(b) |

|

|

963,776 |

|

|

17,598,550

|

|

DigitalOcean

Holdings, Inc.(a)(b) |

|

|

427,147 |

|

|

14,843,358

|

|

|

|

|

|

61,288,454

| ||

|

Semiconductors

& Semiconductor Equipment - 12.5% |

|

|

|

|

||

|

Camtek

Ltd./Israel(a) |

|

|

347,803 |

|

|

43,558,848

|

|

FormFactor,

Inc.(a)(b) |

|

|

943,770 |

|

|

57,126,398

|

|

Ichor

Holdings Ltd.(b) |

|

|

655,264 |

|

|

25,260,427

|

|

indie

Semiconductor, Inc. - Class A(a)(b) |

|

|

2,041,279 |

|

|

12,594,691

|

|

MACOM

Technology Solutions Holdings, Inc.(a)(b) |

|

|

370,728 |

|

|

41,325,050

|

|

MaxLinear,

Inc.(b) |

|

|

714,558 |

|

|

14,391,198

|

|

Onto

Innovation, Inc.(b) |

|

|

210,042 |

|

|

46,116,822

|

|

Rambus,

Inc.(b) |

|

|

1,136,944 |

|

|

66,806,830

|

|

Silicon

Motion Technology Corp. - ADR |

|

|

155,834 |

|

|

12,620,996

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

INFORMATION

TECHNOLOGY - (Continued) | ||||||

|

Semiconductors

& Semiconductor Equipment - (Continued) | ||||||

|

Ultra

Clean Holdings, Inc.(b) |

|

|

215,697 |

|

|

$ 10,569,153

|

|

|

|

|

|

330,370,413

| ||

|

Software

- 8.0% |

|

|

|

|

||

|

ACI

Worldwide, Inc.(b) |

|

|

1,276,840 |

|

|

50,550,096

|

|

Clearwater

Analytics Holdings, Inc. - Class A(b) |

|

|

1,252,653 |

|

|

23,199,134

|

|

CyberArk

Software Ltd.(b) |

|

|

122,083 |

|

|

33,379,934

|

|

Intapp,

Inc.(a)(b) |

|

|

126,384 |

|

|

4,634,501

|

|

Iris

Energy Ltd.(a)(b) |

|

|

712,174 |

|

|

8,040,444

|

|

Q2

Holdings, Inc.(a)(b) |

|

|

659,825 |

|

|

39,807,242

|

|

Terawulf,

Inc.(a)(b) |

|

|

2,753,463 |

|

|

12,252,910

|

|

Varonis

Systems, Inc.(b) |

|

|

799,431 |

|

|

38,348,705

|

|

|

|

|

|

210,212,966

| ||

|

TOTAL

INFORMATION TECHNOLOGY |

|

|

|

|

723,375,378

| |

|

MATERIALS

- 3.2% |

|

|

|

|

||

|

Chemicals

- 0.9% |

|

|

|

|

||

|

Aspen

Aerogels, Inc.(b) |

|

|

1,048,847 |

|

|

25,015,001

|

|

Construction

Materials - 2.3% |

|

|

|

|

||

|

Eagle

Materials, Inc. |

|

|

146,797 |

|

|

31,922,475

|

|

Knife

River Corp.(b) |

|

|

395,184 |

|

|

27,718,206

|

|

|

|

|

|

59,640,681

| ||

|

TOTAL

MATERIALS |

|

|

|

|

84,655,682

| |

|

TOTAL

COMMON STOCKS

(Cost

$1,832,065,402) |

|

|

|

|

2,517,667,773

| |

|

REAL

ESTATE INVESTMENT TRUSTS - 0.7% |

|

|

|

|

||

|

Financial

Services - 0.7% |

|

|

|

|

||

|

Hannon

Armstrong Sustainable Infrastructure Capital, Inc.(a) |

|

|

588,628 |

|

|

17,423,389

|

|

TOTAL

REAL ESTATE INVESTMENT TRUSTS

(Cost

$13,885,411) |

|

|

|

|

17,423,389

| |

|

|

|

Units |

|

|

||

|

SHORT-TERM

INVESTMENTS - 17.6% | ||||||

|

Investments

Purchased with Proceeds from Securities Lending - 13.9% | ||||||

|

Mount

Vernon Liquid Assets Portfolio, LLC |

|

|

367,137,073 |

|

|

367,137,073

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

SHORT-TERM

INVESTMENTS - (Continued) | ||||||

|

Money

Market Funds - 3.7% | ||||||

|

First

American Treasury Obligations Fund - Class Z, 5.17%(d) |

|

|

97,498,087 |

|

|

$97,498,087

|

|

TOTAL

SHORT-TERM INVESTMENTS

(Cost

$464,635,160) |

|

|

|

|

464,635,160

| |

|

TOTAL

INVESTMENTS - 113.7%

(Cost

$2,310,585,973) |

|

|

|

|

$2,999,726,322

| |

|

Liabilities

in Excess of Other Assets - (13.7)% |

|

|

|

|

(362,062,495)

| |

|

TOTAL

NET ASSETS - 100.0% |

|

|

|

|

$2,637,663,827 | |

|

|

|

|

|

|

|

|

|

(a) |

All or a portion

of this security is on loan as of June 30, 2024. The total market value of these securities was $359,741,377 which represented 13.6%

of net assets. |

|

(b) |

Non-income producing

security. |

|

(c) |

To the extent that

the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments

that significantly affect those industries or sectors. |

|

(d) |

The rate shown represents

the 7-day effective yield as of June 30, 2024. |

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - 95.2% | ||||||

|

COMMUNICATION

SERVICES - 0.8% | ||||||

|

Media

& Entertainment - 0.8% | ||||||

|

Webtoon

Entertainment, Inc. |

|

|

5,300 |

|

|

$ 120,999

|

|

TOTAL

COMMUNICATION SERVICES |

|

|

|

|

120,999

| |

|

CONSUMER

DISCRETIONARY - 12.6% | ||||||

|

Automobile

Components - 3.8% | ||||||

|

Aisan

Industry Co. Ltd. |

|

|

4,486 |

|

|

39,246

|

|

MRF

Ltd. |

|

|

106 |

|

|

164,459

|

|

Nifco,

Inc. |

|

|

2,838 |

|

|

68,041

|

|

Niterra

Co. Ltd. |

|

|

4,800 |

|

|

139,971

|

|

Sumitomo

Rubber Industries Ltd. |

|

|

8,800 |

|

|

88,290

|

|

Toyoda

Gosei Co. Ltd. |

|

|

2,293 |

|

|

40,521

|

|

|

|

|

|

540,528 | ||

|

Broadline

Retail - 0.6% | ||||||

|

Jumia

Technologies AG - ADR(a) |

|

|

13,225 |

|

|

92,840

|

|

Hotels,

Restaurants & Leisure - 4.1% | ||||||

|

Basic-Fit

NV(a)(b) |

|

|

2,263 |

|

|

48,760

|

|

Despegar.com

Corp.(a) |

|

|

14,461 |

|

|

191,319

|

|

eDreams

ODIGEO SA(a) |

|

|

22,046 |

|

|

153,466

|

|

Genius

Sports Ltd.(a) |

|

|

27,015 |

|

|

147,232

|

|

HomeToGo

SE(a) |

|

|

28,129 |

|

|

55,279

|

|

|

|

|

|

596,056

| ||

|

Household

Durables - 1.0% | ||||||

|

Nikon

Corp. |

|

|

13,700 |

|

|

139,032

|

|

Management

of Companies and Enterprises - 1.7% | ||||||

|

Viking

Holdings Ltd. ORD SHS(a) |

|

|

7,234 |

|

|

245,522

|

|

Textiles,

Apparel & Luxury Goods - 1.4% | ||||||

|

Amer

Sports, Inc.(a) |

|

|

10,227 |

|

|

128,553

|

|

Asics

Corp. |

|

|

4,400 |

|

|

67,840

|

|

|

|

|

|

196,393

| ||

|

TOTAL

CONSUMER DISCRETIONARY |

|

|

|

|

1,810,371

| |

|

CONSUMER

STAPLES - 2.7% | ||||||

|

Consumer

Staples Distribution & Retail - 1.1% | ||||||

|

BBB

Foods, Inc. - Class A(a) |

|

|

4,958 |

|

|

118,298

|

|

Redcare

Pharmacy NV(a)(b) |

|

|

322 |

|

|

39,279

|

|

|

|

|

|

157,577

| ||

|

Personal

Care Products - 1.6% | ||||||

|

Oddity

Tech Ltd. - Class A(a) |

|

|

4,020 |

|

|

157,825

|

|

Warpaint

London PLC |

|

|

9,025 |

|

|

70,504

|

|

|

|

|

|

228,329

| ||

|

TOTAL

CONSUMER STAPLES |

|

|

|

|

385,906

| |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

ENERGY

- 5.7% | ||||||

|

Energy

Equipment & Services - 0.7% | ||||||

|

Secure

Energy Services, Inc. |

|

|

10,554 |

|

|

$ 93,424

|

|

Oil,

Gas & Consumable Fuels - 5.0% | ||||||

|

Denison

Mines Corp.(a) |

|

|

139,465 |

|

|

277,536

|

|

Great

Eastern Shipping Co. Ltd. |

|

|

14,079 |

|

|

206,451

|

|

NexGen

Energy Ltd.(a) |

|

|

33,396 |

|

|

233,104

|

|

|

|

|

|

717,091

| ||

|

TOTAL

ENERGY |

|

|

|

|

810,515

| |

|

FINANCIALS

- 8.4% | ||||||

|

Banks

- 1.0% | ||||||

|

Sumitomo

Mitsui Trust Holdings, Inc. |

|

|

6,431 |

|

|

147,792

|

|

Capital

Markets - 1.0% | ||||||

|

Plus500

Ltd. |

|

|

5,135 |

|

|

147,626

|

|

Consumer

Finance - 2.8% | ||||||

|

Kaspi.KZ

JSC - ADR |

|

|

1,310 |

|

|

169,003

|

|

Sundaram

Finance Ltd. |

|

|

3,996 |

|

|

224,583

|

|

|

|

|

|

393,586

| ||

|

Financial

Services - 1.2% | ||||||

|

Payfare,

Inc.(a) |

|

|

39,137 |

|

|

177,655

|

|

Insurance

- 2.4% | ||||||

|

Just

Group PLC |

|

|

136,748 |

|

|

181,515

|

|

Revo

Insurance SpA |

|

|

16,717 |

|

|

162,560

|

|

|

|

|

|

344,075

| ||

|

TOTAL

FINANCIALS |

|

|

|

|

1,210,734

| |

|

HEALTH

CARE - 4.3% | ||||||

|

Biotechnology

- 0.1% | ||||||

|

Exscientia

PLC - ADR(a) |

|

|

2,680 |

|

|

13,668

|

|

Electronic

Equipment, Instruments & Components - 1.1% | ||||||

|

Jeol

Ltd. |

|

|

3,500 |

|

|

158,944

|

|

Health

Care Equipment & Supplies - 1.9% | ||||||

|

Establishment

Labs Holdings, Inc.(a) |

|

|

950 |

|

|

43,168

|

|

Implantica

AG(a) |

|

|

72,597 |

|

|

226,031

|

|

|

|

|

|

269,199

| ||

|

Health

Care Technology - 0.4% | ||||||

|

Craneware

PLC |

|

|

1,743 |

|

|

50,896

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

HEALTH

CARE - (Continued) | ||||||

|

Pharmaceuticals

- 0.8% | ||||||

|

Dr

Reddy’s Laboratories Ltd. |

|

|

1,160 |

|

|

$ 88,977

|

|

Verona

Pharma PLC - ADR(a) |

|

|

1,898 |

|

|

27,445

|

|

|

|

|

|

116,422

| ||

|

TOTAL

HEALTH CARE |

|

|

|

|

609,129

| |

|

INDUSTRIALS

- 30.7%(d) | ||||||

|

Aerospace

& Defense - 3.7% | ||||||

|

Bharat

Electronics Ltd. |

|

|

43,516 |

|

|

159,253

|

|

Bombardier,

Inc. - Class B(a) |

|

|

2,897 |

|

|

185,778

|

|

Hindustan

Aeronautics Ltd. |

|

|

2,881 |

|

|

181,709

|

|

|

|

|

|

526,740

| ||

|

Building

Products - 3.5% | ||||||

|

Grupo

Rotoplas SAB de CV |

|

|

42,595 |

|

|

63,677

|

|

Munters

Group AB(b) |

|

|

12,664 |

|

|

238,511

|

|

Nitto

Boseki Co. Ltd. |

|

|

4,800 |

|

|

195,505

|

|

|

|

|

|

497,693

| ||

|

Commercial

Services & Supplies - 4.0% | ||||||

|

DO

& CO AG |

|

|

402 |

|

|

71,562

|

|

GFL

Environmental, Inc. |

|

|

10,696 |

|

|

416,395

|

|

ION

Exchange India Ltd. |

|

|

13,700 |

|

|

94,219

|

|

|

|

|

|

582,176

| ||

|

Construction

& Engineering - 1.8% | ||||||

|

Ahluwalia

Contracts India Ltd. |

|

|

5,762 |

|

|

85,957

|

|

Larsen

& Toubro Ltd. |

|

|

3,992 |

|

|

169,571

|

|

|

|

|

|

255,528

| ||

|

Electrical

Equipment - 4.3% | ||||||

|

CG

Power & Industrial Solutions Ltd. |

|

|

11,800 |

|

|

99,599

|

|

Triveni

Turbine Ltd. |

|

|

28,733 |

|

|

213,599

|

|

Voltamp

Transformers Ltd. |

|

|

2,325 |

|

|

306,334

|

|

|

|

|

|

619,532

| ||

|

Ground

Transportation - 1.5% | ||||||

|

Grupo

Traxion SAB de CV(a)(b) |

|

|

31,567 |

|

|

46,932

|

|

TFI

International, Inc. |

|

|

1,207 |

|

|

175,208

|

|

|

|

|

|

222,140

| ||

|

Machinery

- 6.3% | ||||||

|

AIA

Engineering Ltd. |

|

|

1,113 |

|

|

55,671

|

|

Alfa

Laval AB |

|

|

2,287 |

|

|

100,151

|

|

Cummins

India Ltd. |

|

|

2,900 |

|

|

137,705

|

|

Elgi

Equipments Ltd. |

|

|

7,904 |

|

|

67,969

|

|

Kurita

Water Industries Ltd. |

|

|

2,000 |

|

|

84,984

|

|

Mitsubishi

Heavy Industries Ltd. |

|

|

10,707 |

|

|

115,262

|

|

Nomura

Micro Science Co. Ltd. |

|

|

1,600 |

|

|

43,187

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

INDUSTRIALS

- (Continued) | ||||||

|

Machinery

- (Continued) | ||||||

|

Pentair

PLC |

|

|

1,271 |

|

|

$ 97,448

|

|

Silex

Systems Ltd.(a) |

|

|

5,360 |

|

|

18,915

|

|

Thermax

Ltd. |

|

|

1,475 |

|

|

94,615

|

|

VAT

Group AG(b) |

|

|

147 |

|

|

83,004

|

|

|

|

|

|

898,911

| ||

|

Trading

Companies & Distributors - 5.6% | ||||||

|

FTAI

Aviation Ltd. |

|

|

2,228 |

|

|

229,996

|

|

Marubeni

Corp. |

|

|

30,773 |

|

|

570,611

|

|

|

|

|

|

800,607

| ||

|

TOTAL

INDUSTRIALS |

|

|

|

|

4,403,327

| |

|

INFORMATION

TECHNOLOGY - 22.1% | ||||||

|

Electronic

Equipment, Instruments & Components - 1.6% | ||||||

|

Kaynes

Technology India Ltd.(a) |

|

|

2,412 |

|

|

111,362

|

|

Nayax

Ltd.(a) |

|

|

5,313 |

|

|

113,698

|

|

|

|

|

|

225,060

| ||

|

IT

Services - 6.9% | ||||||

|

Applied

Digital Corp.(a) |

|

|

150,637 |

|

|

896,290

|

|

Globant

SA(a) |

|

|

570 |

|

|

101,608

|

|

|

|

|

|

997,898

| ||

|

Semiconductors

& Semiconductor Equipment - 10.0% | ||||||

|

Alphawave

IP Group PLC(a) |

|

|

143,503 |

|

|

260,538

|

|

ASMPT

Ltd. |

|

|

5,800 |

|

|

80,321

|

|

BE

Semiconductor Industries NV |

|

|

477 |

|

|

79,683

|

|

Camtek

Ltd./Israel |

|

|

2,243 |

|

|

280,913

|

|

Kokusai

Electric Corp. |

|

|

2,293 |

|

|

67,422

|

|

Powertech

Technology, Inc. |

|

|

39,000 |

|

|

225,507

|

|

Renesas

Electronics Corp. |

|

|

5,542 |

|

|

105,102

|

|

Shibaura

Mechatronics Corp. |

|

|

3,004 |

|

|

158,858

|

|

SPEL

Semiconductor Ltd.(a) |

|

|

42,795 |

|

|

110,211

|

|

WONIK

IPS Co. Ltd.(a) |

|

|

2,428 |

|

|

60,887

|

|

|

|

|

|

1,429,442

| ||

|

Software

- 2.6% | ||||||

|

Iris

Energy Ltd.(a) |

|

|

11,138 |

|

|

125,748

|

|

Sylogist

Ltd. |

|

|

9,377 |

|

|

69,366

|

|

Zoo

Digital Group PLC(a) |

|

|

219,891 |

|

|

179,286

|

|

|

|

|

|

374,400

| ||

|

Technology

Hardware, Storage & Peripherals - 1.0% | ||||||

|

Asia

Vital Components Co. Ltd. |

|

|

6,231 |

|

|

145,906

|

|

TOTAL

INFORMATION TECHNOLOGY |

|

|

|

|

3,172,706

| |

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

COMMON

STOCKS - (Continued) | ||||||

|

MATERIALS

- 4.0% | ||||||

|

Chemicals

- 1.6% | ||||||

|

Kemira

Oyj |

|

|

9,252 |

|

|

$ 225,289

|

|

Metals

& Mining - 2.4% | ||||||

|

Ferroglobe

PLC |

|

|

20,816 |

|

|

111,574

|

|

Jindal

Saw Ltd. |

|

|

19,999 |

|

|

129,974

|

|

Vedanta

Ltd. |

|

|

18,600 |

|

|

101,177

|

|

|

|

|

|

342,725

| ||

|

TOTAL

MATERIALS |

|

|

|

|

568,014

| |

|

REAL

ESTATE - 1.6% | ||||||

|

Real

Estate Management & Development - 1.6% | ||||||

|

Lavvi

Empreendimentos Imobiliarios SA |

|

|

47,649 |

|

|

73,219

|

|

Tosei

Corp. |

|

|

10,725 |

|

|

162,727

|

|

|

|

|

|

235,946

| ||

|

TOTAL

REAL ESTATE |

|

|

|

|

235,946

| |

|

UTILITIES

- 2.3% | ||||||

|

Multi-Utilities

- 1.3% | ||||||

|

Veolia

Environnement SA |

|

|

5,917 |

|

|

177,231

|

|

Water

Utilities - 1.0% | ||||||

|

VA

Tech Wabag Ltd.(a) |

|

|

9,600 |

|

|

146,928

|

|

TOTAL

UTILITIES |

|

|

|

|

324,159

| |

|

TOTAL

COMMON STOCKS | ||||||

|

(Cost

$11,892,125) |

|

|

|

|

13,651,806

| |

|

CLOSED

END INVESTMENT TRUSTS - 1.4% | ||||||

|

Sprott

Physical Uranium Trust(a) |

|

|

11,127 |

|

|

206,517

|

|

TOTAL

CLOSED END INVESTMENT TRUSTS

(Cost

$196,369) |

|

|

|

|

206,517

| |

|

REAL

ESTATE INVESTMENT TRUSTS - 0.5% | ||||||

|

Industrial

REITs - 0.5% | ||||||

|

FIBRA

Macquarie Mexico(b) |

|

|

45,171 |

|

|

76,688

|

|

TOTAL

REAL ESTATE INVESTMENT TRUSTS

(Cost

$73,225) |

|

|

|

|

76,688

| |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Value |

|

SHORT-TERM

INVESTMENTS - 2.3% | ||||||

|

Money

Market Funds - 2.3% | ||||||

|

First

American Treasury Obligations Fund - Class X, 5.21%(c) |

|

|

326,838 |

|

|

$326,838

|

|

TOTAL

SHORT-TERM INVESTMENTS

(Cost

$326,838) |

|

|

|

|

326,838

| |

|

TOTAL

INVESTMENTS - 99.4%

(Cost

$12,488,557) |

|

|

|

|

$14,261,849

| |

|

Other

Assets in Excess of Liabilities - 0.6% |

|

|

|

|

79,579

| |

|

TOTAL

NET ASSETS - 100.0% |

|

|

|

|

$14,341,428 | |

|

|

|

|

|

|

|

|

|

(a) |

Non-income producing

security. |

|

(b) |

Security is exempt

from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions

exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $533,174

or 3.7% of the Fund’s net assets. |

|

(c) |

The rate shown represents

the 7-day effective yield as of June 30, 2024. |

|

(d) |

To the extent that

the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments

that significantly affect those industries or sectors. |

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hood River

Small-Cap

Growth Fund |

|

|

Hood River

International

Opportunity

Fund |

|

Assets: | ||||||

|

Investments

at value* (Including securities on loan valued at $359,741,377 and $0, respectively) |

|

|

$2,999,726,322 |

|

|

$14,261,849

|

|

Foreign

Currency at value ** |

|

|

— |

|

|

391

|

|

Cash |

|

|

25,760 |

|

|

— |

|

Receivables: | ||||||

|

Securities

sold |

|

|

45,636,701 |

|

|

196,874

|

|

Fund

shares sold |

|

|

3,355,596 |

|

|

70,000

|

|

Dividends

and interest |

|

|

730,657 |

|

|

8,039

|

|

Securities

lending income |

|

|

42,046 |

|

|

—

|

|

Due

From Advisor |

|

|

— |

|

|

15,075

|

|

Prepaid

expenses |

|

|

187,130 |

|

|

39,236

|

|

Total

assets |

|

|

3,049,704,212 |

|

|

14,591,464

|

|

Liabilities: | ||||||

|

Payables: | ||||||

|

Payable

upon return of collateral for securities loaned |

|

|

367,137,073 |

|

|

—

|

|

Securities

purchased |

|

|

41,142,086 |

|

|

200,319

|

|

Advisory

fee |

|

|

1,857,463 |

|

|

—

|

|

Fund

shares redeemed |

|

|

1,028,596 |

|

|

—

|

|

Service

fees |

|

|

308,943 |

|

|

1,817

|

|

Distribution

fees |

|

|

195,433 |

|

|

331

|

|

Administration

and fund accounting fees |

|

|

164,963 |

|

|

4,237

|

|

Transfer

agent fees and expenses |

|

|

40,616 |

|

|

9,599

|

|

Printing

and Mailing Fees |

|

|

30,521 |

|

|

5,219

|

|

Custody

fees |

|

|

23,757 |

|

|

4,414

|

|

Audit

Fees |

|

|

16,739 |

|

|

18,096

|

|

Compliance

fees |

|

|

2,092 |

|

|

2,032

|

|

Other

accrued expenses |

|

|

92,103 |

|

|

3,972

|

|

Total

liabilities |

|

|

412,040,385 |

|

|

250,036

|

|

Net

assets |

|

|

$2,637,663,827 |

|

|

$14,341,428

|

|

Net

Assets Consist of: |

|

|

|

|

||

|

Capital

stock |

|

|

$1,971,542,106 |

|

|

$13,053,405

|

|

Total

distributable earnings |

|

|

666,121,721 |

|

|

1,288,023

|

|

Net

Assets |

|

|

$2,637,663,827 |

|

|

$14,341,428

|

|

*

Investments at cost |

|

|

$2,310,585,973 |

|

|

$12,488,557

|

|

**

Foreign currency at cost |

|

|

$— |

|

|

$391

|

|

Investor

Shares: |

|

|

|

|

||

|

Net

assets applicable to outstanding Investor Shares |

|

|

$185,678,997 |

|

|

$411,609

|

|

Shares

issued (Unlimited number of beneficial interest authorized, $0.01 par value) |

|

|

2,853,801 |

|

|

$36,513

|

|

Net

asset value, offering price and redemption price per share |

|

|

$65.06 |

|

|

$11.27

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hood River

Small-Cap

Growth Fund |

|

|

Hood River

International

Opportunity

Fund |

|

Institutional

Shares: | ||||||

|

Net

assets applicable to outstanding Institutional Shares |

|

|

$1,392,826,265 |

|

|

$11,446,079

|

|

Shares

issued (Unlimited number of beneficial interest authorized, $0.01 par value) |

|

|

20,936,932 |

|

|

1,013,362

|

|

Net

asset value, offering price and redemption price per share |

|

|

$66.52 |

|

|

$11.30

|

|

Retirement

Shares: | ||||||

|

Net

assets applicable to outstanding Retirement Shares |

|

|

$1,059,158,565 |

|

|

$2,483,740

|

|

Shares

issued (Unlimited number of beneficial interest authorized, $0.01 par value) |

|

|

15,822,529 |

|

|

219,439

|

|

Net

asset value, offering price and redemption price per share |

|

|

$66.94 |

|

|

$11.32 |

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hood River

Small-Cap

Growth Fund |

|

|

Hood River

International

Opportunity

Fund |

|

Investment

income: | ||||||

|

Dividends

(net of foreign taxes withheld of $131,504 and $9,422, respectively) |

|

|

$7,827,994 |

|

|

$60,780

|

|

Interest |

|

|

2,557,892 |

|

|

21,583

|

|

Securities

lending income |

|

|

856,197 |

|

|

—

|

|

Total

investment income |

|

|

11,242,083 |

|

|

82,363

|

|

Expenses: | ||||||

|

Investment

advisory fees (Note 4) |

|

|

17,110,292 |

|

|

69,715

|

|

Administration

and fund accounting fees (Note 4) |

|

|

830,554 |

|

|

24,099

|

|

Service

fees (Note 6) |

|

|

|

|

||

|

Service

fees - Investor Shares |

|

|

126,453 |

|

|

97

|

|

Service

fees - Institutional Shares |

|

|

768,529 |

|

|

2,774

|

|

Distribution

fees (Note 5) |

|

|

|

|

||

|

Distribution

fees - Investor Shares |

|

|

312,341 |

|

|

331

|

|

Transfer

agent fees and expenses |

|

|

244,536 |

|

|

75,078

|

|

Federal

and state registration fees |

|

|

219,572 |

|

|

40,556

|

|

Reports

to shareholders |

|

|

126,540 |

|

|

4,178

|

|

Custody

fees |

|

|

114,034 |

|

|

17,564

|

|

Trustees’

fees and expenses |

|

|

30,000 |

|

|

29,908

|

|

Legal

fees |

|

|

27,238 |

|

|

34,362

|

|

Audit

fees |

|

|

16,746 |

|

|

22,398

|

|

Compliance

expense |

|

|

12,352 |

|

|

12,354

|

|

Other |

|

|

37,401 |

|

|

15,334

|

|

Total

expenses before reimbursement from advisor |

|

|

19,976,588 |

|

|

348,748

|

|

Expense

recoupment to (reimbursement from) Advisor (Note 4) |

|

|

56,290 |

|

|

(269,486)

|

|

Net

expenses |

|

|

20,032,878 |

|

|

79,262

|

|

Net

investment income (loss) |

|

|

$(8,790,795) |

|

|

$3,101

|

|

Realized

and unrealized gain (loss) on investments: | ||||||

|

Net

realized gain (loss) on transactions from: |

|

|

|

|

||

|

Investments |

|

|

$114,205,889 |

|

|

$209,418

|

|

Foreign

currency related transactions |

|

|

— |

|

|

(13,875)

|

|

Net

change in unrealized appreciation on: |

|

|

|

|

||

|

Investments |

|

|

355,795,924 |

|

|

1,452,007

|

|

Foreign

currency related translations |

|

|

— |

|

|

11,253

|

|

Net

realized and unrealized gain on investments |

|

|

470,001,813 |

|

|

1,658,803

|

|

Net

increase in net assets resulting from operations |

|

|

$461,211,018 |

|

|

$1,661,904 |

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

| |||

|

|

|

|

Hood River

Small-Cap Growth Fund | |||

|

|

|

|

Year Ended

June 30, | |||

|

|

|

|

2024 |

|

|

2023 |

|

Operations: | ||||||

|

Net

investment loss |

|

|

$(8,790,795) |

|

|

$(6,294,777)

|

|

Net

realized gain (loss) on investments |

|

|

114,205,889 |

|

|

(107,293,666)

|

|

Net

change in unrealized appreciation on investments |

|

|

355,795,924 |

|

|

330,954,691

|

|

Net

increase in net assets resulting from operations |

|