SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

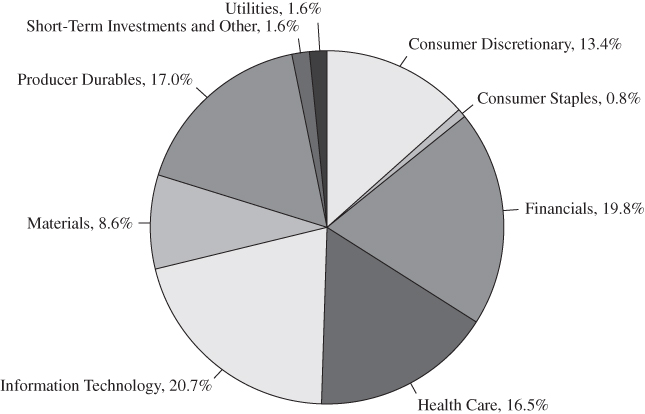

Sector Allocation of Portfolio Assets

|

3

|

|

|

Schedule of Investments

|

4

|

|

|

Statement of Assets and Liabilities

|

7

|

|

|

Statement of Operations

|

8

|

|

|

Statements of Changes in Net Assets

|

9

|

|

|

Financial Highlights

|

10

|

|

|

Notes to Financial Statements

|

11

|

|

|

Expense Example

|

20

|

|

|

Notice to Shareholders

|

22

|

|

|

Notice of Privacy Policy and Practices

|

23

|

|

SECTOR ALLOCATION OF PORTFOLIO ASSETS

|

|

at June 30, 2020 (Unaudited)

|

|

SCHEDULE OF INVESTMENTS

|

|

at June 30, 2020 (Unaudited)

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.4%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary – 13.4%

|

||||||||

|

America’s Car-Mart, Inc. (a)

|

7,400

|

$

|

650,238

|

|||||

|

Helen of Troy Ltd. (a)(c)

|

3,775

|

711,814

|

||||||

|

IAA Inc. (a)

|

7,075

|

272,883

|

||||||

|

Johnson Outdoors, Inc.

|

8,500

|

773,670

|

||||||

|

LCI Industries

|

6,325

|

727,248

|

||||||

|

Murphy USA, Inc. (a)

|

4,450

|

501,026

|

||||||

|

Ollie’s Bargain Outlet Holdings, Inc.

|

6,925

|

676,226

|

||||||

|

Skyline Champion Corp. (a)

|

16,750

|

407,695

|

||||||

|

4,720,800

|

||||||||

|

Consumer Staples – 0.8%

|

||||||||

|

John B. Sanfilippo & Son, Inc. (a)

|

3,325

|

283,722

|

||||||

|

Financials – 19.8%

|

||||||||

|

CareTrust REIT, Inc.

|

25,242

|

433,153

|

||||||

|

Colliers International Group, Inc. (c)

|

9,445

|

541,293

|

||||||

|

First Service Corp. (c)

|

7,245

|

729,934

|

||||||

|

Glacier Bancorp, Inc.

|

8,250

|

291,143

|

||||||

|

Houlihan Lokey, Inc. (a)

|

16,125

|

897,195

|

||||||

|

OneMain Holdings, Inc.

|

33,550

|

823,317

|

||||||

|

PRA Group, Inc. (a)

|

24,725

|

955,869

|

||||||

|

Pacific Premier Bancorp, Inc. (a)

|

14,125

|

306,230

|

||||||

|

RLI Corp.

|

8,775

|

720,427

|

||||||

|

Summit Financial Group, Inc.

|

19,023

|

313,499

|

||||||

|

Veritex Holdings, Inc.

|

15,225

|

269,482

|

||||||

|

Victory Capital Holdings, Inc.

|

17,402

|

299,140

|

||||||

|

Walker & Dunlop, Inc.

|

7,100

|

360,751

|

||||||

|

6,941,433

|

||||||||

|

Health Care – 16.5%

|

||||||||

|

Addus Homecare Corp. (a)

|

9,725

|

900,146

|

||||||

|

BioTelementry, Inc. (a)

|

9,775

|

441,732

|

||||||

|

Change Healthcare, Inc. (a)

|

51,875

|

581,000

|

||||||

|

Globus Medical, Inc. (a)

|

10,225

|

487,835

|

||||||

|

Medpace Holdings, Inc. (a)

|

11,820

|

1,099,496

|

||||||

|

Omnicell, Inc. (a)

|

8,425

|

594,974

|

||||||

|

PetIQ, Inc. (a)

|

31,405

|

1,094,150

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.4% (Continued)

|

Shares

|

Value

|

||||||

|

Health Care – 16.5% (Continued)

|

||||||||

|

Select Medical Holdings Corp. (a)

|

40,500

|

$

|

596,565

|

|||||

|

5,795,898

|

||||||||

|

Information Technology – 20.7%

|

||||||||

|

ACI Worldwide, Inc. (a)

|

20,400

|

550,596

|

||||||

|

Alarm.com Holdings, Inc. (a)

|

9,250

|

599,493

|

||||||

|

Cabot Microelectronics Corp.

|

2,550

|

355,827

|

||||||

|

Envestnet, Inc. (a)

|

8,900

|

654,506

|

||||||

|

ePlus, Inc. (a)

|

12,250

|

865,830

|

||||||

|

Fortinet, Inc. (a)

|

9,324

|

1,279,905

|

||||||

|

Lumentum Holdings Inc. (a)

|

11,650

|

948,660

|

||||||

|

Methode Electronics, Inc.

|

15,505

|

484,686

|

||||||

|

Qualys, Inc. (a)

|

6,425

|

668,328

|

||||||

|

Upland Software, Inc. (a)

|

25,075

|

871,607

|

||||||

|

7,279,438

|

||||||||

|

Materials – 8.6%

|

||||||||

|

Gibraltar Industries, Inc. (a)

|

16,100

|

772,961

|

||||||

|

Installed Building Products, Inc.

|

5,225

|

359,375

|

||||||

|

UFP Industries, Inc.

|

17,850

|

883,753

|

||||||

|

UFP Technologies, Inc. (a)

|

22,442

|

988,795

|

||||||

|

3,004,884

|

||||||||

|

Producer Durables – 17.0%

|

||||||||

|

ASGN, Inc. (a)

|

14,150

|

943,522

|

||||||

|

Allied Motion Technologies, Inc

|

10,000

|

353,000

|

||||||

|

Applied Industrial Technologies, Inc.

|

7,745

|

483,211

|

||||||

|

Atkore International Group, Inc. (a)

|

20,275

|

554,521

|

||||||

|

Colfax Corp. (a)

|

19,325

|

539,167

|

||||||

|

Exponent, Inc. (a)

|

6,175

|

499,743

|

||||||

|

KBR, Inc.

|

30,725

|

692,849

|

||||||

|

Marten Transport, Ltd.

|

24,950

|

627,742

|

||||||

|

Simpson Manufacturing Co., Inc. (a)

|

5,101

|

430,320

|

||||||

|

TriNet Group, Inc.

|

5,700

|

347,358

|

||||||

|

Willdan Group, Inc.

|

20,225

|

505,827

|

||||||

|

5,977,260

|

||||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.4% (Continued)

|

Shares

|

Value

|

||||||

|

Utilities – 1.6%

|

||||||||

|

Chesapeake Utilities Corp.

|

1,300

|

$

|

109,200

|

|||||

|

MGE Energy, Inc.

|

3,150

|

203,207

|

||||||

|

Middlesex Water Co.

|

3,565

|

239,497

|

||||||

|

551,904

|

||||||||

|

TOTAL COMMON STOCKS

|

||||||||

|

(Cost $30,474,123)

|

34,555,339

|

|||||||

|

SHORT-TERM INVESTMENTS – 3.0%

|

||||||||

|

Money Market Funds – 3.0%

|

||||||||

|

First American Government Obligations

|

||||||||

|

Fund – Class X, 0.09% (b)

|

1,056,754

|

1,056,754

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

||||||||

|

(Cost $1,056,754)

|

1,056,754

|

|||||||

|

TOTAL INVESTMENTS

|

||||||||

|

(Cost $31,530,877) – 101.4%

|

35,612,093

|

|||||||

|

Liabilities in Excess of Other Assets – (1.4)%

|

(496,346

|

)

|

||||||

|

TOTAL NET ASSETS – 100.0%

|

$

|

35,115,747

|

||||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

The rate shown represents the fund’s 7-day yield as of June 30, 2020.

|

|

(c)

|

U.S traded security of a foreign issuer or corporation.

|

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

at June 30, 2020 (Unaudited)

|

|

Assets:

|

||||

|

Investments, at value (cost of $31,530,877)

|

$

|

35,612,093

|

||

|

Receivables:

|

||||

|

Securities sold

|

2,400,486

|

|||

|

Dividends and interest

|

11,097

|

|||

|

Prepaid expenses

|

10,690

|

|||

|

Total assets

|

38,034,366

|

|||

|

Liabilities:

|

||||

|

Payables:

|

||||

|

Securities purchased

|

2,873,075

|

|||

|

Advisory fee

|

3,615

|

|||

|

Administration and fund accounting fees

|

12,733

|

|||

|

Reports to shareholders

|

5,564

|

|||

|

Compliance expense

|

2,064

|

|||

|

Custody fees

|

2,133

|

|||

|

Trustee fees

|

2,527

|

|||

|

Transfer agent fees and expenses

|

7,823

|

|||

|

Other accrued expenses

|

9,085

|

|||

|

Total liabilities

|

2,918,619

|

|||

|

Net assets

|

$

|

35,115,747

|

||

|

Net assets consist of:

|

||||

|

Paid in capital

|

$

|

54,551,527

|

||

|

Total distributable earnings

|

(19,435,780

|

)

|

||

|

Net assets

|

$

|

35,115,747

|

||

|

Institutional Shares:

|

||||

|

Net assets applicable to outstanding Institutional Shares

|

$

|

35,115,747

|

||

|

Shares issued (Unlimited number of beneficial

|

||||

|

interest authorized, $0.01 par value)

|

192,867

|

|||

|

Net asset value, offering price and redemption price per share

|

$

|

182.07

|

||

|

STATEMENT OF OPERATIONS

|

|

For the Six Months Ended June 30, 2020 (Unaudited)

|

|

Investment income:

|

||||

|

Dividends

|

$

|

475,877

|

||

|

Interest

|

5,914

|

|||

|

Total investment income

|

481,791

|

|||

|

Expenses:

|

||||

|

Investment advisory fees (Note 4)

|

220,579

|

|||

|

Administration and fund accounting fees (Note 4)

|

44,376

|

|||

|

Transfer agent fees and expenses

|

22,659

|

|||

|

Federal and state registration fees

|

13,650

|

|||

|

Legal fees

|

8,190

|

|||

|

Audit fees

|

7,480

|

|||

|

Compliance expense

|

6,399

|

|||

|

Custody fees

|

7,098

|

|||

|

Trustees’ fees and expenses

|

5,041

|

|||

|

Reports to shareholders

|

2,821

|

|||

|

Other

|

7,020

|

|||

|

Total expenses before reimbursement from advisor

|

345,313

|

|||

|

Expense reimbursement from advisor (Note 4)

|

(56,864

|

)

|

||

|

Net expenses

|

288,449

|

|||

|

Net investment income

|

193,342

|

|||

|

Realized and unrealized gain (loss):

|

||||

|

Net realized loss on transactions from:

|

||||

|

Investments

|

(21,725,354

|

)

|

||

|

Net change in unrealized loss on:

|

||||

|

Investments

|

(18,926,222

|

)

|

||

|

Net realized and unrealized loss

|

(40,651,576

|

)

|

||

|

Net decrease in net assets resulting from operations

|

$

|

(40,458,234

|

)

|

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Six Months Ended

|

||||||||

|

June 30, 2020

|

Year Ended

|

|||||||

|

(Unaudited)

|

December 31, 2019

|

|||||||

|

Operations:

|

||||||||

|

Net investment income

|

$

|

193,342

|

$

|

166,641

|

||||

|

Net realized loss on investments

|

(21,725,354

|

)

|

(244,214

|

)

|

||||

|

Net change in unrealized

|

||||||||

|

gain (loss) on investments

|

(18,926,222

|

)

|

24,745,199

|

|||||

|

Net increase (decrease) in net assets

|

||||||||

|

resulting from operations

|

(40,458,234

|

)

|

24,667,626

|

|||||

|

Distributions:

|

||||||||

|

Distributable earnings

|

—

|

(176,034

|

)

|

|||||

|

Total distributable earnings

|

—

|

(176,034

|

)

|

|||||

|

Capital Share Transactions:

|

||||||||

|

Proceeds from shares sold

|

5,793,178

|

3,017,128

|

||||||

|

Proceeds from shares issued to

|

||||||||

|

holders in reinvestment of dividends

|

—

|

60,868

|

||||||

|

Cost of shares redeemed

|

(52,856,284

|

)

|

(7,606,098

|

)

|

||||

|

Net decrease in net assets

|

||||||||

|

from capital share transactions

|

(47,063,106

|

)

|

(4,528,102

|

)

|

||||

|

Total increase (decrease) in net assets

|

(87,521,340

|

)

|

19,963,490

|

|||||

|

Net Assets:

|

||||||||

|

Beginning of period

|

122,637,087

|

102,673,597

|

||||||

|

End of period

|

$

|

35,115,747

|

$

|

122,637,087

|

||||

|

Changes in Shares Outstanding:

|

||||||||

|

Shares sold

|

33,855

|

13,647

|

||||||

|

Shares issued to holders in

|

||||||||

|

reinvestment of dividends

|

—

|

259

|

||||||

|

Shares redeemed

|

(359,081

|

)

|

(35,189

|

)

|

||||

|

Net decrease in shares outstanding

|

(325,226

|

)

|

(21,283

|

)

|

||||

|

FINANCIAL HIGHLIGHTS

|

|

Institutional Shares

|

||||||||||||

|

Six Months Ended

|

September 28, 2018*

|

|||||||||||

|

June 30, 2020

|

Year Ended

|

through

|

||||||||||

|

(Unaudited)

|

December 31, 2019

|

December 31, 2018

|

||||||||||

|

Net Asset Value –

|

||||||||||||

|

Beginning of Period

|

$

|

236.71

|

$

|

190.36

|

$

|

256.71

|

||||||

|

Income from

|

||||||||||||

|

Investment Operations:

|

||||||||||||

|

Net investment income/(loss)1

|

0.57

|

0.33

|

(0.14

|

)

|

||||||||

|

Net realized and unrealized

|

||||||||||||

|

gain (loss) on investments

|

(55.21

|

)

|

46.35

|

(65.29

|

)

|

|||||||

|

Total from investment operations

|

(54.64

|

)

|

46.68

|

(65.43

|

)

|

|||||||

|

Less Distributions:

|

||||||||||||

|

Dividends from net investment income

|

—

|

(0.33

|

)

|

—

|

||||||||

|

Dividends from net realized gains

|

—

|

—

|

(0.92

|

)

|

||||||||

|

Total distributions

|

—

|

(0.33

|

)

|

(0.92

|

)

|

|||||||

|

Net Asset Value – End of Period

|

$

|

182.07

|

$

|

236.71

|

$

|

190.36

|

||||||

|

Total Return

|

(23.09

|

)%^ |

24.52

|

%

|

(25.51

|

)%^ | ||||||

|

Ratios and Supplemental Data:

|

||||||||||||

|

Net assets, end of period (thousands)

|

$

|

35,116

|

$

|

122,637

|

$

|

102,674

|

||||||

|

Ratio of operating expenses

|

||||||||||||

|

to average net assets:

|

||||||||||||

|

Before reimbursements

|

1.02

|

%+

|

0.88

|

%

|

0.91

|

%+

|

||||||

|

After reimbursements

|

0.85

|

%+

|

0.85

|

%

|

0.85

|

%+

|

||||||

|

Ratio of net investment

|

||||||||||||

|

income (loss) to average net assets:

|

||||||||||||

|

Before reimbursements

|

0.40

|

%+

|

0.12

|

%

|

(0.31

|

)%+

|

||||||

|

After reimbursements

|

0.57

|

%+

|

0.15

|

%

|

(0.25

|

)%+

|

||||||

|

Portfolio turnover rate

|

85

|

%^ |

53

|

%

|

9

|

%^ | ||||||

|

*

|

Commencement of operations for Institutional Shares was September 28, 2018.

|

|

+

|

Annualized

|

|

^

|

Not Annualized

|

|

1

|

The net investment income (loss) per share was calculated using the average shares outstanding method.

|

|

NOTES TO FINANCIAL STATEMENTS

|

|

at June 30, 2020 (Unaudited)

|

|

A.

|

Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3.

|

|

|

B.

|

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated

investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required.

|

|

|

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has

analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken on a tax return. The tax

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

returns for the prior three fiscal years are open for examination. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware.

|

||

|

C.

|

Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities

sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Withholding taxes on foreign dividends have been

provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

|

|

|

The Fund distributes substantially all of its net investment income, if any, and net realized capital gains, if any, annually. Distributions from net realized gains for book purposes may

include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is

determined in accordance with federal income tax regulations, which may differ from GAAP. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment.

|

||

|

The Fund is charged for those expenses that are directly attributable to it, such as investment advisory, custody and transfer agent fees. Expenses that are not attributable to a Fund are

typically allocated among the funds in the Trust proportionately based on allocation methods approved by the Board of Trustees (the “Board”). Common expenses of the Trust are typically allocated among the funds in the Trust based on a fund’s

respective net assets, or by other equitable means.

|

||

|

D.

|

Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates.

|

|

|

E.

|

Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between

financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

|

|

|

F.

|

Events Subsequent to the Fiscal Period End: In preparing the financial statements as of June 30, 2020, management considered the impact of subsequent

events for potential recognition or disclosure in the financial statements.

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

Level 1 –

|

Unadjusted, quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the date of measurement.

|

|

|

Level 2 –

|

Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar

instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data).

|

|

|

Level 3 –

|

Significant unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market

participant would use in valuing the asset or liability, and would be based on the best information available.

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Common Stocks

|

||||||||||||||||

|

Consumer Discretionary

|

$

|

4,720,800

|

$

|

—

|

$

|

—

|

$

|

4,720,800

|

||||||||

|

Consumer Staples

|

283,722

|

—

|

—

|

283,722

|

||||||||||||

|

Financials

|

6,941,433

|

—

|

—

|

6,941,433

|

||||||||||||

|

Health Care

|

5,795,898

|

—

|

—

|

5,795,898

|

||||||||||||

|

Information Technology

|

7,279,438

|

—

|

—

|

7,279,438

|

||||||||||||

|

Materials

|

3,004,884

|

—

|

—

|

3,004,884

|

||||||||||||

|

Producer Durables

|

5,977,260

|

—

|

—

|

5,977,260

|

||||||||||||

|

Utilities

|

551,904

|

—

|

—

|

551,904

|

||||||||||||

|

Total Common Stocks

|

34,555,339

|

—

|

—

|

34,555,339

|

||||||||||||

|

Short-Term Investments

|

1,056,754

|

—

|

—

|

1,056,754

|

||||||||||||

|

Total Investments in Securities

|

$

|

35,612,093

|

$

|

—

|

$

|

—

|

$

|

35,612,093

|

||||||||

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

Argent Small Cap Fund

|

|||

|

Institutional Shares

|

0.85%

|

||

|

Amount

|

Expiration

|

||||

|

$

|

17,593

|

12/31/2021

|

|||

|

30,319

|

12/31/2022

|

||||

|

56,864

|

6/30/2023

|

||||

| $ |

104,776

|

|

|||

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

Administration & fund accounting

|

$44,376

|

||

|

Custody

|

$ 7,098

|

||

|

Transfer agency(a)

|

$12,194

|

||

|

(a) Does not include out-of-pocket expenses.

|

|

Administration & fund accounting

|

$12,733

|

||

|

Custody

|

$ 2,133

|

||

|

Transfer agency(a)

|

$ 4,055

|

||

|

(a) Does not include out-of-pocket expenses.

|

|

Purchases

|

Sales

|

|||

|

Argent Small Cap Fund

|

$56,535,181

|

$101,713,509

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

Cost of investments

|

$

|

102,630,693

|

|||

|

Gross unrealized appreciation

|

25,153,848

|

||||

|

Gross unrealized depreciation

|

(2,142,488

|

)

|

|||

|

Net unrealized appreciation

|

23,011,360

|

||||

|

Undistributed ordinary income

|

—

|

||||

|

Undistributed long-term capital gain

|

—

|

||||

|

Total distributable earnings

|

—

|

||||

|

Other accumulated gains/(losses)

|

(1,988,910

|

)

|

|||

|

Total accumulated earnings/(losses)

|

$

|

21,022,450

|

|

Six Months Ended

|

|||||||||

|

June 30, 2020

|

Fiscal Year Ended

|

||||||||

|

(Unaudited)

|

December 31, 2019

|

||||||||

|

Ordinary Income

|

$

|

—

|

$

|

176,034

|

|||||

|

Long-Term Capital Gains

|

—

|

—

|

|||||||

|

Total

|

$

|

—

|

$

|

176,034

|

|||||

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at June 30, 2020 (Unaudited)

|

|

EXPENSE EXAMPLE

|

|

June 30, 2020 (Unaudited)

|

|

EXPENSE EXAMPLE (Continued)

|

|

June 30, 2020 (Unaudited)

|

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period

|

|

|

1/1/2020

|

6/30/2020

|

1/1/2020-6/30/2020(1)

|

|

|

Actual

|

|||

|

Institutional Shares

|

$1,000.00

|

$ 769.10

|

$3.74

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

|||

|

Institutional Shares

|

$1,000.00

|

$1,020.64

|

$4.27

|

|

(1)

|

Expenses are equal to the Institutional Shares’ annualized expense ratios of 0.85% multiplied by the average account value over the period, multiplied by 182/366 (to reflect the period).

|

|

NOTICE TO SHAREHOLDERS

|

|

at June 30, 2020 (Unaudited)

|

|

NOTICE OF PRIVACY POLICY AND PRACTICES

|

|

(a)

|

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

|

|

(b)

|

Not Applicable.

|

|

(a)

|

The Registrant’s President/Principal Executive Officer and Treasurer/Principal Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940,

as amended, (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such

officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by

others within the Registrant and by the Registrant’s service provider.

|

|

(b)

|

There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially

affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting.

|

|

(a)

|

(1) Any code of ethics or amendment thereto, that is subject to the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit.

Not applicable.

|