UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21897

Manager Directed Portfolios

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Douglas J. Neilson, President

Manager Directed Portfolios

c/o U.S. Bank Global Fund Services

811 East Wisconsin Avenue, 8th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(414) 287-3101

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2019

Date of reporting period: December 31, 2019

Item 1. Reports to Stockholders.

Argent Small Cap Fund

Annual Report

December 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be

sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website,

www.argentcapitalfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other

communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 888-898-5288, sending an e-mail request to

argentcapitalfundsinquiry@argentcapital.com, or by enrolling at www.argentcapitalfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive

paper copies of your shareholder reports. If you invest directly with the Fund, you can call 888-898-5288 or send an email request to argentcapitalfundsinquiry@argentcapital.com to let the Fund know you wish to continue receiving paper copies of

your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Argent Small Cap Fund

Table of Contents

|

Letter to Shareholders

|

3

|

|

|

Investment Highlights

|

6

|

|

|

Sector Allocation of Portfolio Assets

|

7

|

|

|

Schedule of Investments

|

8

|

|

|

Statement of Assets and Liabilities

|

11

|

|

|

Statement of Operations

|

12

|

|

|

Statements of Changes in Net Assets

|

13

|

|

|

Financial Highlights

|

14

|

|

|

Notes to Financial Statements

|

15

|

|

|

Report of Independent Registered Public Accounting Firm

|

24

|

|

|

Expense Example

|

25

|

|

|

Notice to Shareholders

|

27

|

|

|

Trustees and Officers

|

28

|

|

|

Approval of the Investment Advisory Agreement

|

31

|

|

|

Notice of Privacy Policy and Practices

|

35

|

Argent Small Cap Fund

Letter to Shareholders

Dear Shareholders:

After watching markets decline precipitously to end 2018, investors were rewarded in 2019 with a banner year for the domestic equity markets. It was an interesting year for investors as they witnessed

the global economy slow, tensions rise on the trade war between the United States and China, the Federal Reserve cut interest rates a handful of times, renewed tensions in the Middle East, and the unemployment rate in the United States reach a fifty

year low. The first half of 2019 was marked by outsized returns in the Russell 2000 Index, followed by a 2.4% sell off in the third quarter, and a return to positive gains in the fourth quarter with the Russell 2000 Index advancing almost 10%.

The Argent Small Cap Fund (the “Fund”) Institutional Class participated in the gains the equity markets experienced in 2019 returning 24.52% as of the one-year period ending December 31, 2019. That

result trailed the Russell 2000 Index (the Fund’s benchmark) return of 25.52% for the same time period. We are proud that stock selection over the course of the year was a net positive for the Fund. Unfortunately, that was offset by some sector

movements that negatively impacted performance. The underweight to the health care sector, and in particular the biotechnology and pharmaceuticals industry group, was a drag on performance. The Fund typically shies away from those types of industries

given the binary nature of outcomes. We prefer businesses with a track record of generating above average returns through thoughtful and opportunistic capital allocation. The fund experienced encouraging stock selection results across the energy,

financial services, producer durables, technology, and materials & processing sectors. Over the course of 2019, the Fund shifted to investing in businesses that we believe are higher quality in nature. To us, that means companies that have a

history of generating returns that are accelerating and in excess of their cost of capital, and are on the path to continue to do so. We favor businesses that have balance sheets that are in good shape and don’t require large amounts of capital to

sustain and grow their operations.

Fund review

Contributors to the portfolio for the year included Atkore International Group, Fortinet, and World Fuel Services which all remain current holdings of the portfolio at December 31, 2019. Atkore is an

industrial manufacturing company that operates through two segments that supply products to the construction, health care, alternative power generation, data centers and diversified industrial end markets. Atkore’s management champions what they call

Atkore Business Systems- which encompasses people, strategy, and process- to run their business with the ultimate goal of driving portfolio enhancement and margin expansion throughout the company. Atkore was rewarded throughout 2019 for producing

operating results well in excess of expectations. Fortinet is a cybersecurity solutions business that caters to the enterprise and small and medium sized business markets. The addressable market for their products is north of $100 billion and a

substantial amount of Fortinet’s revenue is recurring in nature. Spending patterns on cybersecurity are well positioned for further growth as it’s viewed as critical in nature in an environment that continues to become more complex and rife

3

Argent Small Cap Fund

with security threats. Fortinet remains well positioned to benefit from these trends moving forward. World Fuel Services is a fuel logistics company that provides their customers in the land, marine

and aviation markets with help in fuel procurement, supply fulfillment and payment needs. They sit in the middle between suppliers and end users and collect a fee for these services. The global fuel supply chain is very large and highly fragmented,

which allows World Fuel the opportunity to grow both organically and via acquisition. During 2019, management opportunistically struck a deal for Universal Weather and Aviation’s fuel business, a transaction that we believe will nicely add to

earnings over time.

Detractors to the portfolio for the year included Merit Medical Systems, Carbonite, and Vonage. Merit Medical Systems is a manufacturer of disposable medical devices used in interventional, diagnostic

and therapeutic procedures, particularly in cardiology, radiology, oncology, critical care, and endoscopy. The company has been a consistent acquirer of businesses and has historically done an admirable job of integrating acquired assets. During the

summer, management reported softer than expected operating results and also relayed to investors that they would be taking on more lower margin business moving forward, which would negatively impact the company’s profitability profile. As a result,

we decided to sell the position. Carbonite is a data protection company that specializes in backup and disaster recovery services. The company was founded with a focus on serving consumers, but that end market became very competitive and management

pivoted their strategy towards catering to small and mid-sized businesses. Carbonite went on acquisition spree in order to enter the SMB market. Unfortunately, a few of the larger deals they undertook became an albatross, and the CEO decided to

pursue other opportunities in the summer of 2019. We exited our position upon this disappointing confluence of events. Vonage provides cloud communication services for businesses and consumers. Their services transform the way people work and

businesses operate through a portfolio of communication solutions that allow internal collaboration among employees, while also keeping companies closely connected with their customers, across any mode of communication, on any closed connected

device. Vonage has been in a tricky spot as they rotate their efforts from their declining consumer segment to their growing mid-market and enterprise focused segment. Management’s renewed focus on revenue growth at the expense of cash flow and

earnings led us to liquidate our position in late 2019.

Looking ahead

Looking forward into 2020, we believe that our portfolio contains a collection of investments that have attractive valuations and a bright outlook. The equity markets have come a long way over the past

year, but we remain optimistic that the setting remains conducive for further economic growth and one where well managed companies can continue to thrive. Interest rates that remain low, persistent consumer confidence, healthy capital markets, and

progress on the trade talks front provide a buoyant environment for equities as we start the year. We will continue to spend our time seeking out investments

4

Argent Small Cap Fund

for inclusion in the portfolio that exhibit good growth prospects, sound capital allocation, and mindful management teams. We believe that these types of companies should be able to prosper, regardless

of the economic environment. Thank you for your continued investment in the Argent Small Cap Fund.

Sincerely,

Peter Roy, CFA and Eddie Vigil

Portfolio Managers

Past performance does not guarantee future results. Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Must be proceeded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investing in small-cap companies may involve greater risk than investing in larger companies, including limited

liquidity and greater volatility.

The Russell 2000 index is an index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. It is not

possible to invest directly in an index.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to

risk. Please refer to the Schedule of Investments for complete fund holdings.

Argent Capital Management, Inc. is the adviser to the Argent Small Cap Fund which is distributed by Quasar Distributors, LLC.

5

Argent Small Cap Fund

Investment Highlights (Unaudited)

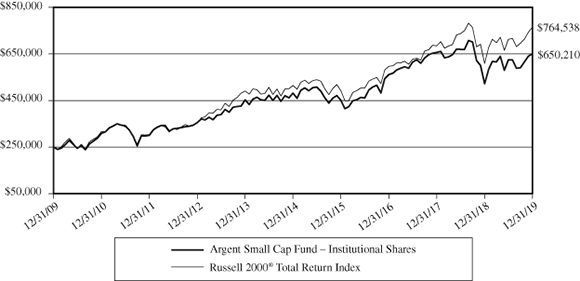

Comparison of the Change in Value of a Hypothetical $250,000 Investment

in the Argent Small Cap Fund – Institutional Shares and

Russell 2000® Total Return Index

Annualized Total Return Periods Ended December 31, 2019:

|

Since

|

||||

|

One

|

Five

|

Ten

|

Inception

|

|

|

Year

|

Year

|

Year

|

(7/25/2008)

|

|

|

Argent Small Cap Fund – Institutional Shares(1)(2)

|

24.52%

|

6.19%

|

10.03%

|

7.88%

|

|

Russell 2000® Total Return Index

|

25.52%

|

8.23%

|

11.83%

|

9.27%

|

Expense ratios*: Gross 0.92%, Net 0.86% (Institutional Shares)

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling 1-888-898-5288.

This chart illustrates the performance of a hypothetical $250,000 investment made in the Fund. Returns reflect the reinvestment of dividends and capital gain distributions. The performance data and

expense ratios shown reflect a contractual fee waiver made by the Adviser, currently, through September 28, 2021. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a

shareholder may pay on dividends, capital gain distributions, or redemption of Fund shares. This chart does not imply any future performance.

|

*

|

The expense ratios presented are from the most recent prospectus.

|

|

|

(1)

|

Fund commenced operations on September 28, 2018.

|

|

|

(2)

|

The performance data quoted for periods prior to September 28, 2018 is that of the Argent Limited Partnership (the ÒPartnershipÓ). The Partnership commenced operations on July 25, 2008. The

Partnership was not a registered mutual fund and was not subject to the same investments and tax restrictions as the Fund. If it had been, the Partnership’s performance might have been lower.

|

6

Argent Small Cap Fund

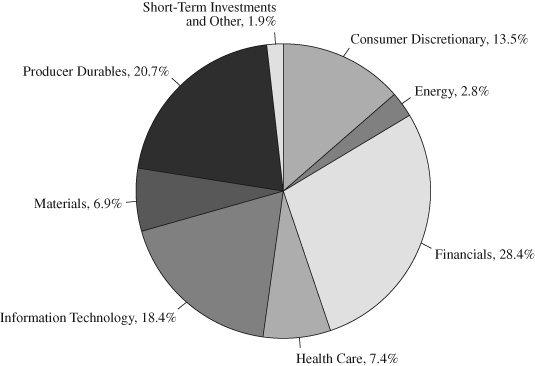

|

SECTOR ALLOCATION OF PORTFOLIO ASSETS

|

|

at December 31, 2019 (Unaudited)

|

Percentages represent market value as a percentage of net assets.

Note: For Presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940,

as amended, the Fund uses more specific industry classifications.

7

Argent Small Cap Fund

|

SCHEDULE OF INVESTMENTS

|

|

at December 31, 2019

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.1%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary – 13.5%

|

||||||||

|

Callaway Golf

|

151,100

|

$

|

3,203,320

|

|||||

|

Clarus Corp.

|

148,495

|

2,013,592

|

||||||

|

Columbia Sportswear Co.

|

19,500

|

1,953,705

|

||||||

|

Johnson Outdoors, Inc.

|

24,200

|

1,856,140

|

||||||

|

Kar Auction Services, Inc.

|

33,850

|

737,592

|

||||||

|

Lindblad Expeditions Holdings, Inc. (a)

|

95,350

|

1,558,973

|

||||||

|

Lithia Motors, Inc. – Class A

|

13,550

|

1,991,850

|

||||||

|

Marcus Corp.

|

33,850

|

1,075,415

|

||||||

|

Skyline Champion Corp. (a)

|

70,575

|

2,237,228

|

||||||

|

16,627,815

|

||||||||

|

Energy – 2.8%

|

||||||||

|

World Fuel Services

|

78,650

|

3,414,983

|

||||||

|

Financials – 28.4%

|

||||||||

|

B. Riley Financial, Inc.

|

91,003

|

2,291,456

|

||||||

|

Cardtronics, Inc. (a)

|

67,175

|

2,999,364

|

||||||

|

CareTrust REIT, Inc.

|

59,375

|

1,224,906

|

||||||

|

Civista Bancshares, Inc.

|

51,750

|

1,242,000

|

||||||

|

Colliers International Group, Inc. (c)

|

26,925

|

2,099,342

|

||||||

|

Consolidated-Tomoka Land Co.

|

29,650

|

1,788,488

|

||||||

|

Cousins Properties, Inc.

|

48,581

|

2,001,537

|

||||||

|

Federal Agricultural Mortgage Corp.

|

27,086

|

2,261,681

|

||||||

|

First Service Corp. (c)

|

20,600

|

1,916,624

|

||||||

|

OneMain Holdings, Inc.

|

77,650

|

3,272,948

|

||||||

|

RLI Corp.

|

10,175

|

915,953

|

||||||

|

Regional Management Corp. (a)

|

47,445

|

1,424,773

|

||||||

|

Sterling Bancorp

|

130,150

|

2,743,562

|

||||||

|

Summit Financial Group, Inc.

|

67,378

|

1,825,270

|

||||||

|

TCF Financial Corp.

|

32,215

|

1,507,662

|

||||||

|

Tristate Capital Holdings, Inc. (a)

|

16,440

|

429,413

|

||||||

|

Walker & Dunlop, Inc.

|

37,850

|

2,448,138

|

||||||

|

Wintrust Financial Corp.

|

34,998

|

2,481,358

|

||||||

|

34,874,475

|

||||||||

The accompanying notes are an integral part of these financial statements.

8

Argent Small Cap Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at December 31, 2019

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.1% (Continued)

|

Shares

|

Value

|

||||||

|

Health Care – 7.4%

|

||||||||

|

BioTelementry, Inc. (a)

|

27,775

|

$

|

1,285,983

|

|||||

|

Globus Medical, Inc. (a)

|

28,975

|

1,706,048

|

||||||

|

Omnicell, Inc. (a)

|

24,275

|

1,983,753

|

||||||

|

PetIQ, Inc. (a)

|

67,345

|

1,686,992

|

||||||

|

Premier, Inc. (a)

|

65,136

|

2,467,352

|

||||||

|

9,130,128

|

||||||||

|

Information Technology – 18.4%

|

||||||||

|

ACI Worldwide, Inc. (a)

|

43,250

|

1,638,526

|

||||||

|

Alarm.com Holdings, Inc. (a)

|

21,450

|

921,707

|

||||||

|

DIGI International, Inc. (a)

|

126,275

|

2,237,593

|

||||||

|

Diodes Incorporated (a)

|

39,490

|

2,226,051

|

||||||

|

Envestnet, Inc. (a)

|

25,975

|

1,808,639

|

||||||

|

ePlus, Inc. (a)

|

11,075

|

933,512

|

||||||

|

Fortinet, Inc. (a)

|

34,874

|

3,723,148

|

||||||

|

Insight Enterprises, Inc. (a)

|

28,025

|

1,969,877

|

||||||

|

Lumentum Holdings Inc. (a)

|

33,750

|

2,676,375

|

||||||

|

Methode Electronics, Inc.

|

46,750

|

1,839,613

|

||||||

|

Upland Software, Inc. (a)

|

72,675

|

2,595,224

|

||||||

|

22,570,265

|

||||||||

|

Materials – 6.9%

|

||||||||

|

Gibraltar Industries, Inc. (a)

|

42,820

|

2,159,841

|

||||||

|

Ingevity Corp. (a)

|

10,250

|

895,645

|

||||||

|

UFP Technologies, Inc. (a)

|

65,022

|

3,225,741

|

||||||

|

Universal Forest Products, Inc.

|

45,300

|

2,160,810

|

||||||

|

8,442,037

|

||||||||

|

Producer Durables – 20.7%

|

||||||||

|

ASGN, Inc. (a)

|

26,775

|

1,900,222

|

||||||

|

Allied Motion Technologies, Inc.

|

18,342

|

889,587

|

||||||

|

Applied Motion Technologies, Inc.

|

14,200

|

946,998

|

||||||

|

Atkore International Group, Inc. (a)

|

88,525

|

3,581,721

|

||||||

|

CECO Environmental Corp. (a)

|

246,904

|

1,891,285

|

||||||

|

Colfax Corp. (a)

|

71,100

|

2,586,618

|

||||||

|

Ducommun Incorporated (a)

|

36,861

|

1,862,586

|

||||||

The accompanying notes are an integral part of these financial statements.

9

Argent Small Cap Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at December 31, 2019

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.1% (Continued)

|

Shares

|

Value

|

||||||

|

Producer Durables – 20.7% (Continued)

|

||||||||

|

John Bean Technologies Corp.

|

14,125

|

$

|

1,591,322

|

|||||

|

KBR, Inc.

|

68,225

|

2,080,862

|

||||||

|

Marten Transport, Ltd.

|

72,600

|

1,560,174

|

||||||

|

MasTec, Inc. (a)

|

28,165

|

1,807,066

|

||||||

|

Sterling Construction Company, Inc. – Class C (a)

|

170,045

|

2,394,234

|

||||||

|

Universal Logistics Holdings, Inc.

|

55,875

|

1,059,390

|

||||||

|

Willdan Group, Inc. (a)

|

36,925

|

1,173,476

|

||||||

|

25,325,541

|

||||||||

|

TOTAL COMMON STOCKS

|

||||||||

|

(Cost $97,373,884)

|

120,385,244

|

|||||||

|

SHORT-TERM INVESTMENTS – 4.3%

|

||||||||

|

Money Market Funds – 4.3%

|

||||||||

|

First American Government Obligations

|

||||||||

|

Fund – Class X, 1.51% (b)

|

5,256,809

|

5,256,809

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

||||||||

|

(Cost $5,256,809)

|

5,256,809

|

|||||||

|

TOTAL INVESTMENTS

|

||||||||

|

(Cost $102,630,693) – 102.4%

|

125,642,053

|

|||||||

|

Liabilities in Excess of Other Assets – (2.4)%

|

(3,004,966

|

)

|

||||||

|

TOTAL NET ASSETS – 100.0%

|

$

|

122,637,087

|

||||||

Percentages are stated as a percent of net assets.

|

(a)

|

Non-income producing security.

|

|

(b)

|

The rate shown represents the fund's 7-day yield as of December 31, 2019.

|

|

(c)

|

U.S traded security of a foreign issuer or corporation.

|

The accompanying notes are an integral part of these financial statements.

10

Argent Small Cap Fund

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

at December 31, 2019

|

|

Assets:

|

||||

|

Investments, at value (cost of $102,630,693)

|

$

|

125,642,053

|

||

|

Cash

|

—

|

|||

|

Receivables:

|

||||

|

Fund shares sold

|

2,418

|

|||

|

Dividends and interest

|

51,403

|

|||

|

Prepaid expenses

|

17,904

|

|||

|

Total assets

|

125,713,778

|

|||

|

Liabilities:

|

||||

|

Payables:

|

||||

|

Securities purchased

|

2,967,981

|

|||

|

Advisory fee

|

61,804

|

|||

|

Administration and fund accounting fees

|

15,614

|

|||

|

Reports to shareholders

|

2,796

|

|||

|

Custody fees

|

2,290

|

|||

|

Trustee fees

|

2,708

|

|||

|

Transfer agent fees and expenses

|

7,812

|

|||

|

Other accrued expenses

|

15,686

|

|||

|

Total liabilities

|

3,076,691

|

|||

|

Net assets

|

$

|

122,637,087

|

||

|

Net assets consist of:

|

||||

|

Paid in capital

|

$

|

101,614,637

|

||

|

Total distributable earnings

|

21,022,450

|

|||

|

Net assets

|

$

|

122,637,087

|

||

|

Institutional Shares:

|

||||

|

Net assets applicable to outstanding Institutional Shares

|

$

|

122,637,087

|

||

|

Shares issued (Unlimited number of beneficial

|

||||

|

interest authorized, $0.01 par value)

|

518,093

|

|||

|

Net asset value, offering price and redemption price per share

|

$

|

236.71

|

||

The accompanying notes are an integral part of these financial statements.

11

Argent Small Cap Fund

|

STATEMENT OF OPERATIONS

|

|

For the Year Ended December 31, 2019

|

|

Investment income:

|

||||

|

Dividends

|

$

|

1,098,540

|

||

|

Interest

|

71,323

|

|||

|

Total investment income

|

1,169,863

|

|||

|

Expenses:

|

||||

|

Investment advisory fees (Note 4)

|

767,170

|

|||

|

Administration and fund accounting fees (Note 4)

|

86,619

|

|||

|

Transfer agent fees and expenses

|

48,483

|

|||

|

Federal and state registration fees

|

44,257

|

|||

|

Legal fees

|

21,501

|

|||

|

Audit fees

|

15,001

|

|||

|

Compliance expense

|

13,655

|

|||

|

Custody fees

|

12,449

|

|||

|

Trustees’ fees and expenses

|

11,717

|

|||

|

Reports to shareholders

|

4,773

|

|||

|

Other

|

7,916

|

|||

|

Total expenses before reimbursement from advisor

|

1,033,541

|

|||

|

Expense reimbursement from advisor (Note 4)

|

(30,319

|

)

|

||

|

Net expenses

|

1,003,222

|

|||

|

Net investment income

|

166,641

|

|||

|

Realized and unrealized gain (loss):

|

||||

|

Net realized loss on transactions from:

|

||||

|

Investments

|

(244,214

|

)

|

||

|

Net change in unrealized gain on:

|

||||

|

Investments

|

24,745,199

|

|||

|

Net realized and unrealized gain

|

24,500,985

|

|||

|

Net increase in net assets resulting from operations

|

$

|

24,667,626

|

||

The accompanying notes are an integral part of these financial statements.

12

Argent Small Cap Fund

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

|

Year Ended

|

Period Ended

|

|||||||

|

December 31, 2019

|

December 31, 2018*

|

|||||||

|

Operations:

|

||||||||

|

Net investment income (loss)

|

$

|

166,641

|

$

|

(75,275

|

)

|

|||

|

Net realized loss on investments

|

(244,214

|

)

|

(1,257,183

|

)

|

||||

|

Net change in unrealized gain (loss) on investments

|

24,745,199

|

(34,012,427

|

)

|

|||||

|

Net increase (decrease) in net assets

|

||||||||

|

resulting from operations

|

24,667,626

|

(35,344,885

|

)

|

|||||

|

Distributions:

|

||||||||

|

Distributable earnings

|

(176,034

|

)

|

(494,708

|

)

|

||||

|

Total distributable earnings

|

(176,034

|

)

|

(494,708

|

)

|

||||

|

Capital Share Transactions:

|

||||||||

|

Proceeds from transfer-in-kind

|

—

|

138,456,646

|

||||||

|

Proceeds from shares sold

|

3,017,128

|

1,004,800

|

||||||

|

Proceeds from shares issued to

|

||||||||

|

holders in reinvestment of dividends

|

60,868

|

202,182

|

||||||

|

Cost of shares redeemed

|

(7,606,098

|

)

|

(1,150,438

|

)

|

||||

|

Net increase (decrease) in net assets from

|

||||||||

|

capital share transactions

|

(4,528,102

|

)

|

138,513,190

|

|||||

|

Total increase in net assets

|

19,963,490

|

102,673,597

|

||||||

|

Net Assets:

|

||||||||

|

Beginning of period

|

102,673,597

|

—

|

||||||

|

End of period

|

$

|

122,637,087

|

$

|

102,673,597

|

||||

|

Changes in Shares Outstanding:

|

||||||||

|

Shares issued in connection with transfer-in-kind

|

—

|

539,346

|

||||||

|

Shares sold

|

13,647

|

4,897

|

||||||

|

Shares issued to holders

|

||||||||

|

in reinvestment of dividends

|

259

|

988

|

||||||

|

Shares redeemed

|

(35,189

|

)

|

(5,855

|

)

|

||||

|

Net increase (decrease) in shares outstanding

|

(21,283

|

)

|

539,376

|

|||||

|

*

|

The Argent Small Cap Fund commenced operations on September 28, 2018.

|

The accompanying notes are an integral part of these financial statements.

13

Argent Small Cap Fund

|

FINANCIAL HIGHLIGHTS

|

For a capital share outstanding throughout each period

Institutional Shares

|

September 28, 2018*

|

||||||||

|

Year Ended

|

through

|

|||||||

|

December 31, 2019

|

December 31, 2018

|

|||||||

|

Net Asset Value – Beginning of Period

|

$

|

190.36

|

$

|

256.71

|

||||

|

Income from Investment Operations:

|

||||||||

|

Net investment income/(loss)1

|

0.33

|

(0.14

|

)

|

|||||

|

Net realized and unrealized

|

||||||||

|

gain (loss) on investments

|

46.35

|

(65.29

|

)

|

|||||

|

Total from investment operations

|

46.68

|

(65.43

|

)

|

|||||

|

Less Distributions:

|

||||||||

|

Dividends from net investment income

|

(0.33

|

)

|

—

|

|||||

|

Dividends from net realized gains

|

—

|

(0.92

|

)

|

|||||

|

Total distributions

|

(0.33

|

)

|

(0.92

|

)

|

||||

|

Net Asset Value – End of Period

|

$

|

236.71

|

$

|

190.36

|

||||

|

Total Return

|

24.52

|

%

|

(25.51)%^

|

|||||

|

Ratios and Supplemental Data:

|

||||||||

|

Net assets, end of period (thousands)

|

$

|

122,637

|

$

|

102,674

|

||||

|

Ratio of operating expenses

|

||||||||

|

to average net assets:

|

||||||||

|

Before reimbursements

|

0.88

|

%

|

0.91

|

%+

|

||||

|

After reimbursements

|

0.85

|

%

|

0.85

|

%+

|

||||

|

Ratio of net investment income (loss)

|

||||||||

|

to average net assets:

|

||||||||

|

Before reimbursements

|

0.12

|

%

|

(0.31

|

)%+

|

||||

|

After reimbursements

|

0.15

|

%

|

(0.25

|

)%+

|

||||

|

Portfolio turnover rate

|

53

|

%

|

9%^

|

|||||

|

*

|

Commencement of operations for Institutional Shares was September 28, 2018.

|

|

+

|

Annualized

|

|

^

|

Not Annualized

|

|

1

|

The net investment income (loss) per share was calculated using the average shares outstanding method.

|

The accompanying notes are an integral part of these financial statements.

14

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS

|

|

at December 31, 2019

|

NOTE 1 – ORGANIZATION

The Argent Small Cap Fund (the “Fund”) is a series of Manager Directed Portfolios (the “Trust”). The Trust is registered under the Investment Company Act of 1940, as amended (the

“1940 Act”), and was organized as a Delaware statutory trust on April 4, 2006. The Fund is an open-end investment management company and is a diversified series of the Trust. The Fund acquired the assets of Argent Small Cap Core Fund, LLC, a Missouri

Limited Liability Company (the “Predecessor Private Fund”), in a tax-free conversion completed at the close of business on September 28, 2018. The Fund did not have any operations prior to September 28, 2018 other than those relating to

organizational matters and registration of its shares under applicable securities law. The Fund commenced operations on September 28, 2018, and currently only offers Institutional Shares. The Predecessor Private Fund had an investment objective and

investment policies that were, in all material respects, equivalent to those of the Fund. However, the Predecessor Private Fund was not registered as an investment company under the 1940 Act, and was not subject to certain investment limitations,

diversification requirements, liquidity requirements and other restrictions imposed by the 1940 Act and Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Upon completion of the conversion, the net assets of the Fund were

$138,456,646. The number of shares of the Fund issued in connection with the conversion was 539,346, and the amount of net unrealized gains on the portfolio securities transferred to the Fund was $32,278,589. Argent Capital Management LLC (the

“Advisor”) serves as the investment advisor to the Fund. As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic

946 Financial Services – Investment Companies. The investment objective of the Fund is to seek long term capital appreciation.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles

(“GAAP”).

|

A.

|

Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3.

|

|

|

B.

|

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated

investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required.

|

|

|

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has

analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s 2018 and 2019 tax returns. The Fund identifies its

major tax jurisdictions as U.S. Federal and the state of Delaware.

|

15

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

|

C.

|

Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities

sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Withholding taxes on foreign dividends have been

provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

|

|

|

The Fund distributes substantially all of its net investment income, if any, and net realized capital gains, if any, annually. Distributions from net realized gains for book purposes may

include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is

determined in accordance with federal income tax regulations, which may differ from GAAP. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment.

|

||

|

The Fund is charged for those expenses that are directly attributable to it, such as investment advisory, custody and transfer agent fees. Expenses that are not attributable to a Fund are

typically allocated among the funds in the Trust proportionately based on allocation methods approved by the Board of Trustees (the “Board”). Common expenses of the Trust are typically allocated among the funds in the Trust based on a fund’s

respective net assets, or by other equitable means.

|

||

|

D.

|

Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates.

|

|

|

E.

|

Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between

financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the most recent fiscal period ended December 31, 2019, the Fund made the following permanent tax adjustments on the

Statements of Assets and Liabilities:

|

|

Total Distributable Earnings

|

Capital Stock

|

||

|

$16,588

|

$(16,588)

|

|

F.

|

Events Subsequent to the Fiscal Year End: In preparing the financial statements as of December 31, 2019, management considered the impact of subsequent

events for potential recognition or disclosure in the financial statements. On November 25, 2019, U.S. Bancorp, the parent company of Quasar Distributors, LLC, the Fund’s distributor, announced that it had signed a purchase agreement to

|

16

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

|

sell Quasar to Foreside Financial Group, LLC such that Quasar will become a wholly-owned broker-dealer subsidiary of Foreside. The transaction is expected to close by the end of March 2020.

Quasar will remain the Fund’s distributor at the close of the transaction, subject to Board approval.

|

||

|

G.

|

Recent Accounting Pronouncements and Rule Issuances: In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure

Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements. The changes affect all

companies that are required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15,

2019. An entity is permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date.

Management has evaluated the impact of this change in guidance, and due to the permissibility of early adoption, modified the Fund’s fair value disclosures for the current reporting period.

|

NOTE 3 – SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These

standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period, and expanded disclosure

of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

|

Level 1 –

|

Unadjusted, quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the date of measurement.

|

|

|

Level 2 –

|

Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar

instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data).

|

|

|

Level 3 –

|

Significant unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market

participant would use in valuing the asset or liability, and would be based on the best information available.

|

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

17

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

Equity Securities: Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds,

closed-end mutual funds and real estate investment trusts (REITs), that are primarily traded on a national securities exchange shall be valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if

there has been no sale on such day, at the mean between the bid and asked prices. Securities primarily traded in the NASDAQ Global Market System for which market quotations are readily available shall be valued using the NASDAQ Official Closing

Price (“NOCP”). If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and asked prices. Over-the-counter securities that

are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. Over-the-counter securities which are not traded in the NASDAQ Global Market System shall be valued at the mean between the bid and asked prices.

To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Registered Investment Companies: Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV

provided by the applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy.

Short-Term Debt Securities: Debt securities, including short-term debt instruments having a maturity of less than 60 days, are valued at

the evaluated mean price supplied by an approved pricing service. Pricing services may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. In the

absence of prices from a pricing service, the securities will be priced in accordance with the procedures adopted by the Board. Short-term securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs

used and market activity levels for specific securities.

The Board has delegated day-to-day valuation issues to a Valuation Committee of the Trust which, as of December 31, 2019, was comprised of officers of the Trust. The function of the

Valuation Committee is to value securities where current and reliable market quotations are not readily available, or the closing price does not represent fair value, by following procedures approved by the Board. These procedures consider many

factors, including the type of security, size of holding, trading volume and news events. All actions taken by the Valuation Committee are subsequently reviewed and ratified by the Board.

Depending on the relative significance of the valuation inputs, fair valued securities may be classified in either level 2 or level 3 of the fair value hierarchy.

18

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the fair

valuation hierarchy of the Fund’s securities as of December 31, 2019:

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Common Stocks

|

||||||||||||||||

|

Consumer Discretionary

|

$

|

16,627,815

|

$

|

—

|

$

|

—

|

$

|

16,627,815

|

||||||||

|

Energy

|

3,414,983

|

—

|

—

|

3,414,983

|

||||||||||||

|

Financials

|

34,874,475

|

—

|

—

|

34,874,475

|

||||||||||||

|

Health Care

|

9,130,128

|

—

|

—

|

9,130,128

|

||||||||||||

|

Information Technology

|

22,570,265

|

—

|

—

|

22,570,265

|

||||||||||||

|

Materials

|

8,442,037

|

—

|

—

|

8,442,037

|

||||||||||||

|

Producer Durables

|

25,325,541

|

—

|

—

|

25,325,541

|

||||||||||||

|

Total Common Stocks

|

120,385,244

|

—

|

—

|

120,385,244

|

||||||||||||

|

Short-Term Investments

|

5,256,809

|

—

|

—

|

5,256,809

|

||||||||||||

|

Total Investments in Securities

|

$

|

125,642,053

|

$

|

—

|

$

|

—

|

$

|

125,642,053

|

||||||||

NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

For the fiscal year ended December 31, 2019, the Advisor provided the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all

investment advice, office space, and facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee at an annual rate of 0.65% of the average daily net assets of the

Fund. For the fiscal year ended December 31, 2019, the Fund incurred $767,170 in advisory fees.

The Fund is responsible for its own operating expenses. The Advisor has contractually agreed to waive its management fees and/or absorb expenses of the Fund to ensure that the

total annual operating expenses [excluding front-end or contingent deferred loads, Rule 12b-1 plan fees, shareholder servicing plan fees, taxes, leverage, interest, brokerage commissions and other transactional expenses, expenses in connection with a

merger or reorganization, dividends or interest on short positions, acquired fund fees and expenses or extraordinary expenses (collectively, “Excludable Expenses”)] do not exceed the following amounts of the average daily net assets for the

Institutional Shares:

|

Argent Small Cap Fund

|

|||

|

Institutional Shares

|

0.85%

|

||

For the fiscal year ended December 31, 2019, the Advisor reduced its fees and absorbed Fund expenses in the amount of $30,319 for the Fund. The waivers and reimbursements will

remain in effect through September 28, 2021 unless terminated sooner by, or with the consent of, the Board.

19

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

The Advisor may request recoupment of previously waived fees and paid expenses in any subsequent month in the three-year period from the date of the management fee reduction and

expense payment if the aggregate amount actually paid by the Fund toward the operating expenses for such fiscal year (taking into account the reimbursement) will not cause the Fund to exceed the lesser of: (1) the expense limitation in place at the

time of the management fee reduction and expense payment; or (2) the expense limitation in place at the time of the reimbursement. Any such reimbursement is also contingent upon Board of Trustees review and approval at the time the reimbursement is

made. Such reimbursement may not be paid prior to the Fund’s payment of current ordinary operating expenses. Cumulative expenses subject to recapture pursuant to the aforementioned conditions expire as follows:

|

Amount

|

Expiration

|

||

|

$17,593

|

12/31/2021

|

||

| |

30,319

|

12/31/2022

|

|

|

$47,912

|

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, LLC (“Fund Services” or the “Administrator”) acts as the Fund’s Administrator under an

Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian,

transfer agent and accountants; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. Fund Services also serves as the fund accountant and transfer agent to the Fund. Vigilant Compliance, LLC serves

as the Chief Compliance Officer to the Fund. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. For the fiscal year ended December 31, 2019, the Fund incurred the following expenses for administration, fund accounting,

transfer agency and custody fees:

|

Administration & fund accounting

|

$86,619

|

||

|

Custody

|

$12,449

|

||

|

Transfer agency(a)

|

$24,572

|

||

|

(a) Does not include out-of-pocket expenses.

|

At December 31, 2019, the Fund had payables due to Fund Services for administration, fund accounting and transfer agency fees and to U.S. Bank N.A. for custody fees in the following

amounts:

|

Administration & fund accounting

|

$15,614

|

||

|

Custody

|

$ 2,290

|

||

|

Transfer agency(a)

|

$ 4,053

|

||

|

(a) Does not include out-of-pocket expenses.

|

20

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of the

Administrator. A Trustee of the Trust is deemed to be an interested person of the Trust due to his former position with the Distributor.

Certain officers of the Fund are employees of the Administrator and are not paid any fees by the Fund for serving in such capacities.

NOTE 5 – SECURITIES TRANSACTIONS

For the fiscal year ended December 31, 2019, the cost of purchases and the proceeds from sales of securities, excluding short-term securities, were as follows:

|

Purchases

|

Sales

|

|||

|

Argent Small Cap Fund

|

$60,790,343

|

$61,888,542

|

There were no purchases or sales of long-term U.S. Government securities.

NOTE 6 – INCOME TAXES AND DISTRIBUTIONS TO SHAREHOLDERS

As of December 31, 2019, the components of accumulated earnings/(losses) on a tax basis were as follows:

|

Cost of investments

|

$

|

102,630,693

|

|||

|

Gross unrealized appreciation

|

25,153,848

|

||||

|

Gross unrealized depreciation

|

(2,142,488

|

)

|

|||

|

Net unrealized appreciation

|

23,011,360

|

||||

|

Undistributed ordinary income

|

—

|

||||

|

Undistributed long-term capital gain

|

—

|

||||

|

Total distributable earnings

|

—

|

||||

|

Other accumulated gains/(losses)

|

(1,988,910

|

)

|

|||

|

Total accumulated earnings/(losses)

|

$

|

21,022,450

|

As of December 31, 2019, the Fund had short-term tax basis capital losses with no expiration date of $1,988,910.

The tax character of distributions paid during the fiscal year ended December 31, 2019 and fiscal period ended December 31, 2018 was as follows:

|

Fiscal Year Ended

|

Fiscal Period Ended

|

||||||||

|

December 31, 2019

|

December 31, 2018

|

||||||||

|

Ordinary Income

|

$

|

176,034

|

$

|

—

|

|||||

|

Long-Term Capital Gains

|

—

|

494,708

|

|||||||

|

Total

|

$

|

176,034

|

$

|

494,708

|

|||||

21

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

NOTE 7 – PRINCIPAL RISKS

Below are summaries of some, but not all, of the principal risks of investing in the Fund, each of which could adversely affect the Fund’s NAV, market price, yield, and total

return. Further information about investment risks is available in the Fund’s prospectus and Statement of Additional Information.

Common Stock Risk: Equity securities are susceptible to general stock market fluctuations due to economic, market, political and

issuer-specific considerations and to potential volatile increases and decreases in value as market confidence in and perceptions of their issuers change.

Small-Cap Company Risk: Companies in which the Fund invests may be more vulnerable than larger companies to adverse business or economic

developments. Small-cap companies may also have limited product lines, markets, or financial resources, may be dependent on relatively small or inexperienced management groups, and may operate in industries characterized by rapid technological

obsolescence. Securities of such companies may be less liquid, more volatile and more difficult to value than securities of larger companies and therefore may involve greater risk than investing in large companies.

Growth-Style Investing Risk: An investment in a growth-oriented fund may be more volatile than the rest of the U.S. market as a whole. If

the investment adviser’s assessment of a company’s prospects for earnings growth or how other investors will value the company’s earnings growth is incorrect, the stock may fail to reach the value that the adviser has placed on it. Growth stock

prices tend to fluctuate more dramatically than the overall stock market.

Management Risk: The ability of the Fund to meet its investment objective is directly related to the Advisor’s management of the Fund. The

value of your investment in the Fund may vary with the effectiveness of the Advisor’s research, analysis and asset allocation among portfolio securities. If the investment strategies do not produce the expected results, the value of your investment

could be diminished or even lost entirely.

New Fund Risk: There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board may

determine to liquidate the Fund. Liquidation of the Fund can be initiated without shareholder approval by the Board if it determines that liquidation is in the best interest of shareholders. As a result, the timing of the Fund’s liquidation may not

be favorable.

Value-Style Investing Risk: Value stocks can perform differently from the market as a whole and from other types of stocks. Value

investing seeks to identify stocks that have depressed valuations, based upon a number of factors which are thought to be temporary in nature, and to sell them at superior profits should their prices rise in response to resolution of the issues which

caused the valuation of the stock to be depressed. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

22

Argent Small Cap Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

NOTE 8 – GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s

maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

NOTE 9 – CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of

the 1940 Act. As of December 31, 2019, Mori & Co. held 61% of the outstanding Institutional Shares of the Fund. The Fund has no knowledge as to whether all or any portion of the shares owned of record by Mori & Co. are also owned

beneficially.

23

Argent Small Cap Fund

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

To the Board of Trustees of Manager Directed Portfolios

and the Shareholders of Argent Small Cap Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Argent Small Cap Fund, a series of shares of beneficial interest in Manager Directed Portfolios (the “Fund”), including the schedule of investments, as of December 31, 2019, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for

the year then ended and for the period from September 28, 2018 (commencement of operations) through December 31, 2018, and the related notes (collectively referred to as the “financial statements”).

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2019, and the results of its operations for the year then ended, and the changes in its net assets and its

financial highlights for the year then ended and for the period from September 28, 2018 through December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting

firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal

securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements

are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an

understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks.

Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019 by correspondence with the custodian and

brokers and by other appropriate auditing procedures where replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall

presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Manager Directed Portfolios since 2007.

Philadelphia, Pennsylvania

February 28, 2020

24

Argent Small Cap Fund

|

EXPENSE EXAMPLE

|

|

December 31, 2019 (Unaudited)

|

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs including sales charges (loads) and redemption fees, if applicable; and (2) ongoing costs,

including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period indicated and held for the entire period from July 1, 2019 to December 31, 2019 for the

Institutional Shares.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns together

with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the row

entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. There are some account fees that are charged to certain types of accounts, such as Individual Retirement Accounts (generally, a $15 fee is

charged to the account annually) that would increase the amount of expenses paid on your account. The example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally

accepted accounting principles.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on

the Fund’s actual expense ratio and assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses

you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of

the other funds. As noted above, there are some account fees that are charged to certain types of accounts that would increase the amount of expense paid on your account.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption

fees, or exchange fees. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In

addition, if these transactional costs were included, your costs would have been higher.

25

Argent Small Cap Fund

|

EXPENSE EXAMPLE (Continued)

|

|

December 31, 2019 (Unaudited)

|

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period

|

|

|

7/1/2019

|

12/31/2019

|

7/1/2019-12/31/2019(1)

|

|

|

Actual

|

|||

|

Institutional Shares

|

$1,000.00

|

$1,041.60

|

$4.37

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

|||

|

Institutional Shares

|

$1,000.00

|

$1,020.92

|

$4.33

|

|

(1)

|

Expenses are equal to the Institutional Shares’ annualized expense ratios of 0.85% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the period).

|

26

Argent Small Cap Fund

|

NOTICE TO SHAREHOLDERS

|

|

at December 31, 2019 (Unaudited)

|

How to Obtain a Copy of the Fund’s Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by

calling 1-888-898-5288 or on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

How to Obtain a Copy of the Fund’s Proxy Voting Records for the most recent 12-Month Period Ended June 30

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available no later than August 31 without

charge, upon request, by 1-888-898-5288. Furthermore, you can obtain the Fund’s proxy voting records on the SEC’s website at http://www.sec.gov.

Quarterly Filings on Form N-Q

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q or Part F of Form N-PORT (beginning with

filings after March 31, 2020). The Fund’s Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2020) is available on the SEC’s website at http://www.sec.gov. Information included in the Fund’s Form N-Q or Part F of Form N-PORT

(beginning with filings after March 31, 2020) is also available, upon request, by calling 1-888-898-5288.

Householding

In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses and annual and semi-annual reports you receive by sending only one copy of each to

those addresses shared by two or more accounts and to shareholders the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free

at 1-888-898-5288 to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not

apply to account statements.

27

Argent Small Cap Fund

|

TRUSTEES AND OFFICERS

|

|

(Unaudited)

|

The business and affairs of the Trust are managed under the oversight of the Board, subject to the laws of the State of Delaware and the Trust’s Agreement and Declaration of Trust.

The Board is currently comprised of three trustees who are not interested persons of the Trust within the meaning of the 1940 Act (the “Independent Trustees”) and one interested person of the Trust (the “Interested Trustee”). The Trustees are

responsible for deciding matters of overall policy and overseeing the actions of the Trust’s service providers. The officers of the Trust conduct and supervise the Trust’s daily business operations.

|

Number of

|

||||

|

Funds

|

Other

|

|||

|

Position(s) Held

|

in Fund

|

Directorships

|

||

|

Name,

|

with the Trust

|

Complex

|

Held by Trustee

|

|

|

(Year of Birth)

|

and Length of

|

Principal Occupation(s)

|

Overseen by

|

During the

|

|

and Address(1)

|

Time Served(3)

|

During the Past Five Years

|

Trustee

|

Past Five Years

|

|

INTERESTED TRUSTEE

|

||||

|

James R. Schoenike(2)

|

Trustee and

|

Distribution Consultant; since

|

9

|

None

|

|

(Born 1959)

|

Chairman

|

2018, President and CEO, Board

|

||

|

since July 2016

|

of Managers, Quasar Distributors,

|

|||

|

LLC (2013 – 2018).

|

||||

|

INDEPENDENT TRUSTEES

|

||||

|

Gaylord B. Lyman

|

Trustee and

|

Senior Portfolio Manager,

|

9

|

None

|

|

(Born 1962)

|

Audit

|

Affinity Investment Advisors,

|

||

|

Committee

|

LLC, since 2017; Managing

|

|||

|

Chairman

|

Director of Kohala Capital

|

|||

|

since April 2015

|

Partners, LLC (2011 – 2016).

|

|||

|

Scott Craven Jones

|

Trustee

|

Managing Director, Carne

|

9

|

Trustee, Madison

|

|

(Born 1962)

|

since July 2016

|

Global Financial Services (US)

|

Funds; since 2019

|

|

|

and Lead

|

LLC (a provider of independent

|

(18 portfolios);

|

||

|

Independent

|

governance and distribution

|

Director,

|

||

|

Trustee

|

support for the asset management

|

Guestlogix Inc.

|

||

|

since May 2017

|

industry), since 2013.

|

(a provider of

|

||

|

ancillary-focused

|

||||

|

technology to the

|

||||

|

travel industry)

|

||||

|

(2015-2016);

|

||||

|

Trustee, XAI

|

||||

|

Octagon Floating

|

||||

|

Rate &

|

||||

|