SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

Letter to Shareholders/Commentary

|

3

|

||

|

Sector Allocation of Portfolio Assets

|

6

|

||

|

Schedule of Investments

|

7

|

||

|

Statement of Assets and Liabilities

|

22

|

||

|

Statement of Operations

|

23

|

||

|

Statements of Changes in Net Assets

|

24

|

||

|

Financial Highlights

|

25

|

||

|

Notes to the Financial Statements

|

26

|

||

|

Report of Independent Registered Public Accounting Firm

|

35

|

||

|

Expense Example

|

36

|

||

|

Notice to Shareholders

|

38

|

||

|

Trustees and Officers

|

39

|

||

|

Privacy Notice

|

41

|

|

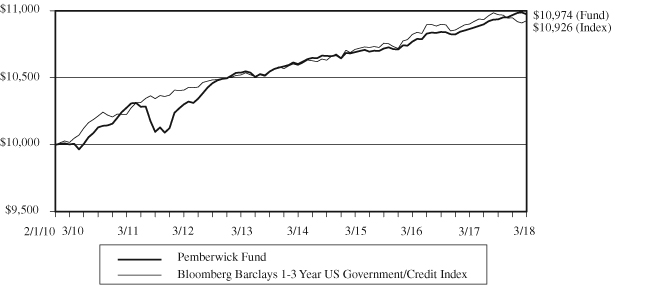

Average Annual Return Periods

|

Since Inception

|

|||

|

Ended March 31, 2018:

|

1 Year

|

3 Year

|

5 Year

|

(2/1/2010)

|

|

Pemberwick Fund (No Load)

|

1.02%

|

0.87%

|

0.81%

|

1.15%

|

|

Bloomberg Barclays 1-3 Year

|

||||

|

US Government/Credit Index

|

0.24%

|

0.66%

|

0.76%

|

1.09%

|

|

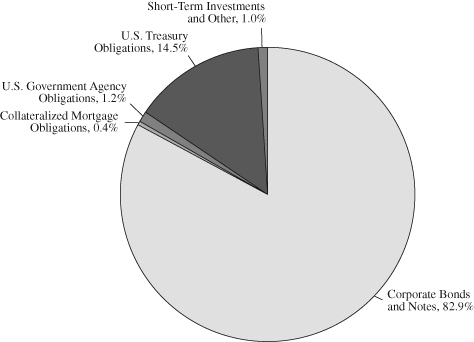

SECTOR ALLOCATION OF PORTFOLIO ASSETS

|

|

at March 31, 2018 (Unaudited)

|

|

SCHEDULE OF INVESTMENTS

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

CORPORATE BONDS AND NOTES – 82.9%

|

Value

|

Value

|

||||||

|

Basic Materials – 0.0%

|

||||||||

|

Praxair, Inc.

|

||||||||

|

1.250%, 11/07/2018

|

$

|

30,000

|

$

|

29,781

|

||||

|

Communications – 4.0%

|

||||||||

|

AT&T, Inc.

|

||||||||

|

2.866% (3 Month LIBOR USD + 0.910%), 11/27/2018 (a)

|

2,000,000

|

2,008,498

|

||||||

|

2.672% (3 Month LIBOR USD + 0.950%), 07/15/2021 (a)

|

5,000,000

|

5,055,273

|

||||||

|

Cisco Systems, Inc.

|

||||||||

|

4.950%, 02/15/2019

|

25,000

|

25,539

|

||||||

|

2.125%, 03/01/2019

|

105,000

|

104,744

|

||||||

|

The Walt Disney Co.

|

||||||||

|

1.650%, 01/08/2019

|

17,000

|

16,904

|

||||||

|

2.294% (3 Month LIBOR USD + 0.310%), 05/30/2019 (a)

|

1,000,000

|

1,002,738

|

||||||

|

1.800%, 06/05/2020

|

30,000

|

29,399

|

||||||

|

Verizon Communications, Inc.

|

||||||||

|

2.948% (3 Month LIBOR USD + 0.770%), 06/17/2019 (a)

|

3,000,000

|

3,022,445

|

||||||

|

11,265,540

|

||||||||

|

Consumer, Cyclical – 1.1%

|

||||||||

|

American Honda Finance Corp.

|

||||||||

|

2.729% (3 Month LIBOR USD + 0.830%), 02/22/2019 (a)

|

500,000

|

503,173

|

||||||

|

1.950%, 07/20/2020

|

100,000

|

97,881

|

||||||

|

Costco Wholesale Corp.

|

||||||||

|

2.150%, 05/18/2021

|

50,000

|

49,134

|

||||||

|

General Motors Financial Co., Inc.

|

||||||||

|

3.612% (3 Month LIBOR USD + 1.310%), 06/30/2022 (a)

|

2,000,000

|

2,030,155

|

||||||

|

Home Depot, Inc.

|

||||||||

|

2.000%, 06/15/2019

|

30,000

|

29,849

|

||||||

|

PACCAR Financial Corp.

|

||||||||

|

1.300%, 05/10/2019

|

12,000

|

11,836

|

||||||

|

Toyota Motor Credit Corp.

|

||||||||

|

2.000%, 10/24/2018

|

25,000

|

24,919

|

||||||

|

2.100%, 01/17/2019

|

68,000

|

67,676

|

||||||

|

2.125%, 07/18/2019

|

40,000

|

39,759

|

||||||

|

2.200%, 01/10/2020

|

40,000

|

39,653

|

||||||

|

2.150%, 09/08/2022

|

30,000

|

28,881

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Consumer, Cyclical – 1.1% (Continued)

|

||||||||

|

Walmart, Inc.

|

||||||||

|

1.125%, 04/11/2018

|

$

|

40,000

|

$

|

39,989

|

||||

|

1.900%, 12/15/2020

|

30,000

|

29,422

|

||||||

|

2,992,327

|

||||||||

|

Consumer, Non-cyclical – 2.8%

|

||||||||

|

AbbVie, Inc.

|

||||||||

|

1.800%, 05/14/2018

|

2,000,000

|

1,998,599

|

||||||

|

AstraZeneca PLC

|

||||||||

|

2.691% (3 Month LIBOR USD + 0.620%), 06/10/2022 (a)(f)

|

2,000,000

|

2,008,852

|

||||||

|

Bristol-Myers Squibb Co.

|

||||||||

|

1.750%, 03/01/2019

|

50,000

|

49,667

|

||||||

|

Colgate-Palmolive Co.

|

||||||||

|

2.250%, 11/15/2022

|

75,000

|

72,556

|

||||||

|

Danaher Corp.

|

||||||||

|

2.400%, 09/15/2020

|

25,000

|

24,789

|

||||||

|

Eli Lilly & Co.

|

||||||||

|

2.350%, 05/15/2022

|

70,000

|

68,389

|

||||||

|

GlaxoSmithKline Capital, Inc.

|

||||||||

|

5.650%, 05/15/2018

|

15,000

|

15,056

|

||||||

|

Johnson & Johnson

|

||||||||

|

1.125%, 03/01/2019

|

30,000

|

29,678

|

||||||

|

2.250%, 03/03/2022

|

60,000

|

58,739

|

||||||

|

Merck & Co., Inc.

|

||||||||

|

1.850%, 02/10/2020

|

14,000

|

13,826

|

||||||

|

Novartis Capital Corp.

|

||||||||

|

1.800%, 02/14/2020

|

70,000

|

68,944

|

||||||

|

PepsiCo, Inc.

|

||||||||

|

1.500%, 02/22/2019

|

15,000

|

14,879

|

||||||

|

1.550%, 05/02/2019

|

50,000

|

49,527

|

||||||

|

2.150%, 10/14/2020

|

60,000

|

59,244

|

||||||

|

Pfizer, Inc.

|

||||||||

|

1.700%, 12/15/2019

|

50,000

|

49,343

|

||||||

|

Reckitt Benckiser Treasury Services PLC

|

||||||||

|

2.846% (3 Month LIBOR USD + 0.560%), 06/24/2022

|

||||||||

|

(Acquired 02/15/2018, Cost $2,995,170) (a)(e)(f)

|

3,000,000

|

2,986,141

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Consumer, Non-cyclical – 2.8% (Continued)

|

||||||||

|

The Coca-Cola Co.

|

||||||||

|

1.375%, 05/30/2019

|

$

|

20,000

|

$

|

19,756

|

||||

|

2.200%, 05/25/2022

|

50,000

|

48,563

|

||||||

|

The Procter & Gamble Co.

|

||||||||

|

1.850%, 02/02/2021

|

15,000

|

14,660

|

||||||

|

1.700%, 11/03/2021

|

60,000

|

57,825

|

||||||

|

Unilever Capital Corp.

|

||||||||

|

2.750%, 03/22/2021

|

100,000

|

99,778

|

||||||

|

7,808,811

|

||||||||

|

Energy – 0.1%

|

||||||||

|

Chevron Corp.

|

||||||||

|

1.718%, 06/24/2018

|

35,000

|

34,947

|

||||||

|

1.790%, 11/16/2018

|

50,000

|

49,795

|

||||||

|

4.950%, 03/03/2019

|

20,000

|

20,433

|

||||||

|

EOG Resources, Inc.

|

||||||||

|

5.625%, 06/01/2019

|

15,000

|

15,448

|

||||||

|

Exxon Mobil Corp.

|

||||||||

|

1.819%, 03/15/2019

|

100,000

|

99,426

|

||||||

|

220,049

|

||||||||

|

Financial – 71.5%

|

||||||||

|

American Express Co.

|

||||||||

|

2.383% (3 Month LIBOR USD + 0.610%), 08/01/2022 (a)

|

3,391,000

|

3,389,012

|

||||||

|

2.606% (3 Month LIBOR USD + 0.650%), 02/27/2023 (a)

|

2,700,000

|

2,693,173

|

||||||

|

American Express Credit Corp.

|

||||||||

|

2.567% (3 Month LIBOR USD + 0.780%), 11/05/2018 (a)

|

500,000

|

501,387

|

||||||

|

2.250%, 08/15/2019

|

95,000

|

94,457

|

||||||

|

2.329% (3 Month LIBOR USD + 0.490%), 08/15/2019 (a)

|

3,118,000

|

3,129,798

|

||||||

|

2.337% (3 Month LIBOR USD + 0.570%), 10/30/2019 (a)

|

1,000,000

|

1,004,506

|

||||||

|

2.725% (3 Month LIBOR USD + 0.700%), 03/03/2022 (a)

|

1,990,000

|

2,009,154

|

||||||

|

Athene Global Funding

|

||||||||

|

3.538% (3 Month LIBOR USD + 1.230%), 07/01/2022

|

||||||||

|

(Acquired 02/22/2018, Cost $3,060,040) (a)(e)

|

3,000,000

|

3,051,741

|

||||||

|

Banco Santander SA

|

||||||||

|

3.265% (3 Month LIBOR USD + 1.560%), 04/11/2022 (a)(f)

|

600,000

|

616,074

|

||||||

|

3.010% (3 Month LIBOR USD + 1.090%), 02/23/2023 (a)(f)

|

13,250,000

|

13,366,730

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Financial – 71.5% (Continued)

|

||||||||

|

Bank of America Corp.

|

||||||||

|

2.600%, 01/15/2019

|

$

|

2,000,000

|

$

|

2,002,208

|

||||

|

2.650%, 04/01/2019

|

60,000

|

59,974

|

||||||

|

3.159% (3 Month LIBOR USD + 1.420%), 04/19/2021 (a)

|

3,500,000

|

3,602,175

|

||||||

|

2.405% (3 Month LIBOR USD + 0.660%), 07/21/2021 (a)

|

1,000,000

|

1,003,548

|

||||||

|

2.958% (3 Month LIBOR USD + 0.650%), 10/01/2021 (a)

|

1,000,000

|

1,002,805

|

||||||

|

2.925% (3 Month LIBOR USD + 1.180%), 10/21/2022 (a)

|

4,400,000

|

4,470,000

|

||||||

|

2.905% (3 Month LIBOR USD + 1.160%), 01/20/2023 (a)

|

850,000

|

861,135

|

||||||

|

Bank of Montreal

|

||||||||

|

2.701% (3 Month LIBOR USD + 0.630%), 09/11/2022 (a)(f)

|

4,300,000

|

4,309,315

|

||||||

|

BB&T Corp.

|

||||||||

|

2.958% (3 Month LIBOR USD + 0.650%), 04/01/2022 (a)

|

3,600,000

|

3,615,289

|

||||||

|

Berkshire Hathaway Finance Corp.

|

||||||||

|

1.300%, 05/15/2018

|

8,000

|

7,989

|

||||||

|

5.400%, 05/15/2018

|

60,000

|

60,190

|

||||||

|

BlackRock, Inc.

|

||||||||

|

5.000%, 12/10/2019

|

75,000

|

77,901

|

||||||

|

Canadian Imperial Bank of Commerce

|

||||||||

|

2.865% (3 Month LIBOR USD + 0.720%), 06/16/2022 (a)(f)

|

3,496,000

|

3,519,764

|

||||||

|

Capital One Bank USA, N.A.

|

||||||||

|

2.150%, 11/21/2018

|

1,000,000

|

996,706

|

||||||

|

Capital One Financial Corp.

|

||||||||

|

3.007% (3 Month LIBOR USD + 0.950%), 03/09/2022 (a)

|

3,000,000

|

3,006,075

|

||||||

|

2.487% (3 Month LIBOR USD + 0.720%), 01/30/2023 (a)

|

2,678,000

|

2,660,388

|

||||||

|

Capital One, N.A.

|

||||||||

|

2.611% (3 Month LIBOR USD + 0.820%), 08/08/2022 (a)

|

3,385,000

|

3,392,208

|

||||||

|

2.917% (3 Month LIBOR USD + 1.150%), 01/30/2023 (a)

|

3,500,000

|

3,515,287

|

||||||

|

Citigroup, Inc.

|

||||||||

|

3.682% (3 Month LIBOR USD + 1.380%), 03/30/2021 (a)

|

550,000

|

563,318

|

||||||

|

2.968% (3 Month LIBOR USD + 1.190%), 08/02/2021 (a)

|

570,000

|

580,447

|

||||||

|

3.117% (3 Month LIBOR USD + 1.070%), 12/08/2021 (a)

|

5,000,000

|

5,072,780

|

||||||

|

2.705% (3 Month LIBOR USD + 0.960%), 04/25/2022 (a)

|

690,000

|

694,368

|

||||||

|

2.450% (3 Month LIBOR USD + 0.690%), 10/27/2022 (a)

|

2,700,000

|

2,688,711

|

||||||

|

2.691% (3 Month LIBOR USD + 0.950%), 07/24/2023 (a)

|

4,350,000

|

4,369,707

|

||||||

|

Credit Suisse AG/New York NY

|

||||||||

|

1.700%, 04/27/2018 (f)

|

1,000,000

|

999,660

|

||||||

|

2.440% (3 Month LIBOR USD + 0.680%), 04/27/2018 (a)(f)

|

1,000,000

|

1,000,225

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Financial – 71.5% (Continued)

|

||||||||

|

Credit Suisse Group AG

|

||||||||

|

3.307% (3 Month LIBOR USD + 1.200%), 12/14/2023

|

||||||||

|

(Acquired 09/11/2017, Cost $10,480,511) (a)(e)(f)

|

$

|

10,300,000

|

$

|

10,448,343

|

||||

|

Deutsche Bank AG/New York NY

|

||||||||

|

2.692% (3 Month LIBOR USD + 0.970%), 07/13/2020 (a)(f)

|

8,000,000

|

8,023,808

|

||||||

|

HSBC Holdings PLC

|

||||||||

|

3.196% (3 Month LIBOR USD + 1.500%), 01/05/2022 (a)(f)

|

9,400,000

|

9,685,389

|

||||||

|

HSBC USA, Inc.

|

||||||||

|

2.564% (3 Month LIBOR USD + 0.770%), 08/07/2018 (a)

|

1,000,000

|

1,001,740

|

||||||

|

JPMorgan Chase & Co.

|

||||||||

|

2.295% (3 Month LIBOR USD + 0.550%), 04/25/2018 (a)

|

830,000

|

830,159

|

||||||

|

Manufacturers & Traders Trust Co.

|

||||||||

|

2.646% (3 Month LIBOR USD + 0.640%), 12/01/2021 (a)

|

5,000,000

|

4,993,471

|

||||||

|

Mitsubishi UFJ Financial Group, Inc.

|

||||||||

|

2.757% (3 Month LIBOR USD + 0.740%), 03/02/2023 (a)(f)

|

2,000,000

|

1,998,349

|

||||||

|

Mizuho Financial Group, Inc.

|

||||||||

|

2.815% (3 Month LIBOR USD + 0.790%), 03/05/2023 (a)(f)

|

3,900,000

|

3,897,201

|

||||||

|

Morgan Stanley

|

||||||||

|

3.025% (3 Month LIBOR USD + 1.280%), 04/25/2018 (a)

|

2,725,000

|

2,726,594

|

||||||

|

2.485% (3 Month LIBOR USD + 0.740%), 07/23/2019 (a)

|

1,000,000

|

1,004,558

|

||||||

|

2.633% (3 Month LIBOR USD + 0.800%), 02/14/2020 (a)

|

300,000

|

300,949

|

||||||

|

2.925% (3 Month LIBOR USD + 1.180%), 01/20/2022 (a)

|

1,900,000

|

1,923,712

|

||||||

|

2.675% (3 Month LIBOR USD + 0.930%), 07/22/2022 (a)

|

1,720,000

|

1,727,328

|

||||||

|

3.141% (3 Month LIBOR USD + 1.400%), 10/24/2023 (a)

|

4,900,000

|

5,014,329

|

||||||

|

3.011% (3 Month LIBOR USD + 1.220%), 05/08/2024 (a)

|

1,029,000

|

1,046,235

|

||||||

|

National Rural Utilities Cooperative Finance Corp.

|

||||||||

|

2.300%, 11/15/2019

|

25,000

|

24,841

|

||||||

|

Northern Trust Corp.

|

||||||||

|

3.450%, 11/04/2020

|

25,000

|

25,418

|

||||||

|

3.375%, 08/23/2021

|

25,000

|

25,440

|

||||||

|

PNC Bank, N.A.

|

||||||||

|

2.400%, 10/18/2019

|

3,000,000

|

2,981,707

|

||||||

|

Public Storage

|

||||||||

|

2.370%, 09/15/2022

|

50,000

|

48,160

|

||||||

|

Royal Bank of Canada

|

||||||||

|

2.503% (3 Month LIBOR USD + 0.730%), 02/01/2022 (a)(f)

|

5,355,000

|

5,402,555

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Financial – 71.5% (Continued)

|

||||||||

|

State Street Corp.

|

||||||||

|

1.350%, 05/15/2018

|

$

|

92,000

|

$

|

91,868

|

||||

|

1.950%, 05/19/2021

|

25,000

|

24,264

|

||||||

|

Sumitomo Mitsui Financial Group, Inc.

|

||||||||

|

2.832% (3 Month LIBOR USD + 1.110%), 07/14/2021 (a)(f)

|

3,013,000

|

3,060,031

|

||||||

|

SunTrust Banks, Inc.

|

||||||||

|

2.350%, 11/01/2018

|

1,456,000

|

1,453,258

|

||||||

|

The Bank of New York Mellon Corp.

|

||||||||

|

2.200%, 03/04/2019

|

59,000

|

58,791

|

||||||

|

4.600%, 01/15/2020

|

30,000

|

30,911

|

||||||

|

2.450%, 11/27/2020

|

35,000

|

34,481

|

||||||

|

2.817% (3 Month LIBOR USD + 1.050%), 10/30/2023 (a)

|

11,036,000

|

11,223,964

|

||||||

|

The Bank of Nova Scotia

|

||||||||

|

1.450%, 04/25/2018 (f)

|

2,000,000

|

1,998,769

|

||||||

|

2.552% (3 Month LIBOR USD + 0.830%), 01/15/2019 (a)(f)

|

1,000,000

|

1,004,639

|

||||||

|

2.112% (3 Month LIBOR USD + 0.390%), 07/14/2020 (a)(f)

|

1,000,000

|

1,001,259

|

||||||

|

2.675% (3 Month LIBOR USD + 0.640%), 03/07/2022 (a)(f)

|

5,900,000

|

5,928,445

|

||||||

|

The Charles Schwab Corp.

|

||||||||

|

2.200%, 07/25/2018

|

40,000

|

39,989

|

||||||

|

The Chubb Corp.

|

||||||||

|

5.750%, 05/15/2018

|

35,000

|

35,131

|

||||||

|

The Goldman Sachs Group, Inc.

|

||||||||

|

6.150%, 04/01/2018

|

30,000

|

30,000

|

||||||

|

7.500%, 02/15/2019

|

130,000

|

135,252

|

||||||

|

2.905% (3 Month LIBOR USD + 1.160%), 04/23/2020 (a)

|

1,444,000

|

1,464,637

|

||||||

|

3.105% (3 Month LIBOR USD + 1.360%), 04/23/2021 (a)

|

1,000,000

|

1,022,777

|

||||||

|

3.009% (3 Month LIBOR USD + 1.170%), 11/15/2021 (a)

|

2,000,000

|

2,025,200

|

||||||

|

2.863% (3 Month LIBOR USD + 1.110%), 04/26/2022 (a)

|

1,941,000

|

1,958,623

|

||||||

|

2.552% (3 Month LIBOR USD + 0.780%), 10/31/2022 (a)

|

1,100,000

|

1,098,683

|

||||||

|

2.741% (3 Month LIBOR USD + 1.000%), 07/24/2023 (a)

|

550,000

|

550,330

|

||||||

|

3.584% (3 Month LIBOR USD + 1.600%), 11/29/2023 (a)

|

5,600,000

|

5,779,390

|

||||||

|

The Travelers Companies, Inc.

|

||||||||

|

3.900%, 11/01/2020

|

50,000

|

51,260

|

||||||

|

U.S. Bancorp

|

||||||||

|

2.200%, 04/25/2019 (g)

|

75,000

|

74,602

|

||||||

|

Visa, Inc.

|

||||||||

|

2.150%, 09/15/2022

|

50,000

|

48,196

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Financial – 71.5% (Continued)

|

||||||||

|

Wells Fargo & Co.

|

||||||||

|

2.375% (3 Month LIBOR USD + 0.630%), 04/23/2018 (a)

|

$

|

127,000

|

$

|

127,015

|

||||

|

2.150%, 01/30/2020

|

200,000

|

196,905

|

||||||

|

2.447% (3 Month LIBOR USD + 0.680%), 01/30/2020 (a)

|

2,000,000

|

2,010,626

|

||||||

|

2.500%, 03/04/2021

|

30,000

|

29,462

|

||||||

|

3.365% (3 Month LIBOR USD + 1.340%), 03/04/2021 (a)

|

2,500,000

|

2,561,832

|

||||||

|

4.600%, 04/01/2021

|

60,000

|

62,309

|

||||||

|

2.100%, 07/26/2021

|

110,000

|

106,258

|

||||||

|

2.741% (3 Month LIBOR USD + 0.930%), 02/11/2022 (a)

|

1,000,000

|

1,006,670

|

||||||

|

2.851% (3 Month LIBOR USD + 1.110%), 01/24/2023 (a)

|

6,890,000

|

6,988,077

|

||||||

|

200,432,395

|

||||||||

|

Industrial – 1.5%

|

||||||||

|

Caterpillar Financial Services Corp.

|

||||||||

|

1.800%, 11/13/2018

|

25,000

|

24,912

|

||||||

|

2.100%, 06/09/2019

|

15,000

|

14,916

|

||||||

|

2.250%, 12/01/2019

|

20,000

|

19,844

|

||||||

|

2.900%, 03/15/2021

|

15,000

|

14,950

|

||||||

|

Emerson Electric Co.

|

||||||||

|

4.875%, 10/15/2019

|

45,000

|

46,303

|

||||||

|

General Electric Co.

|

||||||||

|

5.625%, 05/01/2018

|

80,000

|

80,185

|

||||||

|

6.000%, 08/07/2019

|

50,000

|

51,840

|

||||||

|

5.500%, 01/08/2020

|

20,000

|

20,804

|

||||||

|

4.000% (3 Month LIBOR USD + 2.280%),

|

||||||||

|

12/29/2049, Callable 06/15/2022 at $100.0 (a)(b)

|

1,234,000

|

1,124,482

|

||||||

|

Honeywell International, Inc.

|

||||||||

|

1.800%, 10/30/2019

|

60,000

|

59,220

|

||||||

|

Illinois Tool Works, Inc.

|

||||||||

|

1.950%, 03/01/2019

|

50,000

|

49,732

|

||||||

|

John Deere Capital Corp.

|

||||||||

|

1.600%, 07/13/2018

|

18,000

|

17,964

|

||||||

|

1.750%, 08/10/2018

|

20,000

|

19,944

|

||||||

|

2.274% (3 Month LIBOR USD + 0.570%), 01/08/2019 (a)

|

500,000

|

501,898

|

||||||

|

1.950%, 06/22/2020

|

75,000

|

73,584

|

||||||

|

Stanley Black & Decker, Inc.

|

||||||||

|

2.451%, 11/17/2018

|

1,000,000

|

998,123

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Industrial – 1.5% (Continued)

|

||||||||

|

The Boeing Co.

|

||||||||

|

0.950%, 05/15/2018

|

$

|

50,000

|

$

|

49,913

|

||||

|

United Parcel Service, Inc.

|

||||||||

|

2.350%, 05/16/2022

|

50,000

|

48,800

|

||||||

|

United Technologies Corp.

|

||||||||

|

1.778%, 05/04/2018 (a)(c)

|

1,000,000

|

999,166

|

||||||

|

4,216,580

|

||||||||

|

Technology – 1.7%

|

||||||||

|

Apple, Inc.

|

||||||||

|

2.740% (3 Month LIBOR USD + 0.820%), 02/22/2019 (a)

|

1,000,000

|

1,007,227

|

||||||

|

1.550%, 02/07/2020

|

10,000

|

9,817

|

||||||

|

1.900%, 02/07/2020

|

45,000

|

44,491

|

||||||

|

1.800%, 05/11/2020

|

50,000

|

49,204

|

||||||

|

2.250%, 02/23/2021

|

13,000

|

12,808

|

||||||

|

1.550%, 08/04/2021

|

155,000

|

148,583

|

||||||

|

HP, Inc.

|

||||||||

|

2.662% (3 Month LIBOR USD + 0.940%), 01/14/2019 (a)

|

1,500,000

|

1,505,698

|

||||||

|

2.750%, 01/14/2019

|

1,500,000

|

1,500,111

|

||||||

|

Intel Corp.

|

||||||||

|

3.300%, 10/01/2021

|

33,000

|

33,529

|

||||||

|

Microsoft Corp.

|

||||||||

|

1.000%, 05/01/2018

|

60,000

|

59,936

|

||||||

|

1.300%, 11/03/2018

|

34,000

|

33,819

|

||||||

|

4.200%, 06/01/2019

|

30,000

|

30,723

|

||||||

|

1.550%, 08/08/2021

|

45,000

|

43,223

|

||||||

|

Oracle Corp.

|

||||||||

|

2.375%, 01/15/2019

|

15,000

|

15,001

|

||||||

|

5.000%, 07/08/2019

|

30,000

|

30,930

|

||||||

|

2.500%, 05/15/2022

|

130,000

|

127,484

|

||||||

|

QUALCOMM, Inc.

|

||||||||

|

2.100%, 05/20/2020

|

50,000

|

49,439

|

||||||

|

4,702,023

|

||||||||

|

Utilities – 0.2%

|

||||||||

|

DTE Electric Co.

|

||||||||

|

3.900%, 06/01/2021

|

55,000

|

56,014

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Utilities – 0.2% (Continued)

|

||||||||

|

Duke Energy Carolinas LLC

|

||||||||

|

4.300%, 06/15/2020

|

$

|

25,000

|

$

|

25,677

|

||||

|

3.900%, 06/15/2021

|

25,000

|

25,719

|

||||||

|

Duke Energy Florida LLC

|

||||||||

|

5.650%, 06/15/2018

|

25,000

|

25,149

|

||||||

|

Entergy Gulf States Louisiana LLC

|

||||||||

|

3.950%, 10/01/2020

|

50,000

|

51,033

|

||||||

|

Kansas City Power & Light Co.

|

||||||||

|

7.150%, 04/01/2019

|

20,000

|

20,901

|

||||||

|

Kentucky Utilities Co.

|

||||||||

|

3.250%, 11/01/2020

|

30,000

|

30,070

|

||||||

|

Northern States Power Co.

|

||||||||

|

2.200%, 08/15/2020

|

30,000

|

29,645

|

||||||

|

PacifiCorp

|

||||||||

|

5.650%, 07/15/2018

|

25,000

|

25,264

|

||||||

|

Public Service Co. of Colorado

|

||||||||

|

3.200%, 11/15/2020

|

30,000

|

30,240

|

||||||

|

Public Service Electric & Gas Co.

|

||||||||

|

1.800%, 06/01/2019

|

25,000

|

24,691

|

||||||

|

2.000%, 08/15/2019

|

75,000

|

74,112

|

||||||

|

San Diego Gas & Electric Co.

|

||||||||

|

3.000%, 08/15/2021

|

30,000

|

29,982

|

||||||

|

Southern California Edison Co.

|

||||||||

|

5.500%, 08/15/2018

|

45,000

|

45,485

|

||||||

|

3.875%, 06/01/2021

|

40,000

|

41,043

|

||||||

|

Westar Energy, Inc.

|

||||||||

|

5.100%, 07/15/2020

|

20,000

|

20,961

|

||||||

|

Wisconsin Electric Power Co.

|

||||||||

|

1.700%, 06/15/2018

|

25,000

|

24,956

|

||||||

|

Wisconsin Power & Light Co.

|

||||||||

|

5.000%, 07/15/2019

|

25,000

|

25,728

|

||||||

|

606,670

|

||||||||

|

TOTAL CORPORATE BONDS AND NOTES

|

||||||||

|

(Cost $232,611,196)

|

232,274,176

|

|||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

COLLATERALIZED

|

||||||||

|

MORTGAGE OBLIGATIONS – 0.4%

|

||||||||

|

Federal Home Loan Mortgage Corporation REMICS – 0.2%

|

||||||||

|

Series 2617, Class TK

|

||||||||

|

4.500%, 05/15/2018

|

$

|

540

|

$

|

540

|

||||

|

Series 2611, Class UH

|

||||||||

|

4.500%, 05/15/2018

|

262

|

262

|

||||||

|

Series 2617, Class GR

|

||||||||

|

4.500%, 05/15/2018

|

278

|

278

|

||||||

|

Series 2627, Class MC

|

||||||||

|

4.500%, 06/15/2018

|

831

|

831

|

||||||

|

Series 2649, Class KA

|

||||||||

|

4.500%, 07/15/2018

|

382

|

383

|

||||||

|

Series 2693, Class PE

|

||||||||

|

4.500%, 10/15/2018

|

1,694

|

1,696

|

||||||

|

Series 2746, Class EG

|

||||||||

|

4.500%, 02/15/2019

|

2,318

|

2,321

|

||||||

|

Series 2989, Class TG

|

||||||||

|

5.000%, 06/15/2025

|

27,200

|

28,702

|

||||||

|

Series 3002, Class YD

|

||||||||

|

4.500%, 07/15/2025

|

10,885

|

11,373

|

||||||

|

Series 3917, Class AB

|

||||||||

|

1.750%, 07/15/2026

|

124,282

|

121,582

|

||||||

|

Series 2526, Class FI

|

||||||||

|

2.777% (1 Month LIBOR USD + 1.000%), 02/15/2032 (a)

|

56,037

|

57,393

|

||||||

|

Series 2881, Class AE

|

||||||||

|

5.000%, 08/15/2034

|

8,303

|

8,564

|

||||||

|

Series 2933, Class HD

|

||||||||

|

5.500%, 02/15/2035

|

15,146

|

16,208

|

||||||

|

Series 4305, Class KA

|

||||||||

|

3.000%, 03/15/2038

|

47,755

|

47,804

|

||||||

|

Series 3843, Class GH

|

||||||||

|

3.750%, 10/15/2039

|

37,699

|

38,554

|

||||||

|

Series 3786, Class NA

|

||||||||

|

4.500%, 07/15/2040

|

70,071

|

73,000

|

||||||

|

Series 4305, Class A

|

||||||||

|

3.500%, 06/15/2048

|

94,428

|

95,822

|

||||||

|

505,313

|

||||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Federal National Mortgage Association REMICS – 0.1%

|

||||||||

|

Series 2003-92, Class PE

|

||||||||

|

4.500%, 09/25/2018

|

$

|

1,304

|

$

|

1,304

|

||||

|

Series 2005-40, Class YG

|

||||||||

|

5.000%, 05/25/2025

|

23,476

|

24,534

|

||||||

|

Series 2011-122, Class A

|

||||||||

|

3.000%, 12/25/2025

|

39,382

|

39,477

|

||||||

|

Series 2007-27, Class MQ

|

||||||||

|

5.500%, 04/25/2027

|

6,942

|

7,537

|

||||||

|

Series 2005-48, Class AR

|

||||||||

|

5.500%, 02/25/2035

|

8,892

|

9,062

|

||||||

|

Series 2005-62, Class CQ

|

||||||||

|

4.750%, 07/25/2035

|

4,497

|

4,593

|

||||||

|

Series 2005-64, Class PL

|

||||||||

|

5.500%, 07/25/2035

|

36,808

|

39,628

|

||||||

|

Series 2005-68, Class PG

|

||||||||

|

5.500%, 08/25/2035

|

27,721

|

29,874

|

||||||

|

Series 2005-83A, Class LA

|

||||||||

|

5.500%, 10/25/2035

|

15,385

|

16,604

|

||||||

|

Series 2006-57, Class AD

|

||||||||

|

5.750%, 06/25/2036

|

64,425

|

67,299

|

||||||

|

Series 2014-23, Class PA

|

||||||||

|

3.500%, 08/25/2036

|

83,245

|

84,717

|

||||||

|

Series 2007-39, Class NA

|

||||||||

|

4.250%, 01/25/2037

|

1,793

|

1,797

|

||||||

|

Series 2013-83, Class CA

|

||||||||

|

3.500%, 10/25/2037

|

62,415

|

63,267

|

||||||

|

Series 2009-47, Class PA

|

||||||||

|

4.500%, 07/25/2039

|

4,829

|

4,960

|

||||||

|

Series 2011-113, Class NE

|

||||||||

|

4.000%, 03/25/2040

|

11,932

|

11,954

|

||||||

|

406,607

|

||||||||

|

Government National Mortgage

|

||||||||

|

Association REMICS – 0.1%

|

||||||||

|

Series 2013-88, Class WA

|

||||||||

|

5.009%, 06/20/2030 (a)

|

97,408

|

101,721

|

||||||

|

Series 2002-22, Class GF

|

||||||||

|

6.500%, 03/20/2032

|

32,777

|

36,924

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Government National Mortgage

|

||||||||

|

Association REMICS – 0.1% (Continued)

|

||||||||

|

Series 2002-51, Class D

|

||||||||

|

6.000%, 07/20/2032

|

$

|

37,617

|

$

|

41,566

|

||||

|

Series 2008-50, Class NA

|

||||||||

|

5.500%, 03/16/2037

|

4,471

|

4,550

|

||||||

|

Series 2007-11, Class PE

|

||||||||

|

5.500%, 03/20/2037

|

19,595

|

21,705

|

||||||

|

Series 2013-113, Class UB

|

||||||||

|

3.000%, 11/20/2038

|

48,112

|

48,036

|

||||||

|

254,502

|

||||||||

|

TOTAL COLLATERALIZED

|

||||||||

|

MORTGAGE OBLIGATIONS

|

||||||||

|

(Cost $1,168,496)

|

1,166,422

|

|||||||

|

U.S. GOVERNMENT AGENCY OBLIGATIONS – 1.2%

|

||||||||

|

Federal Home Loan Bank – 0.6%

|

||||||||

|

1.250%, 06/08/2018

|

340,000

|

339,671

|

||||||

|

2.000%, 09/14/2018

|

75,000

|

75,005

|

||||||

|

1.750%, 12/14/2018

|

595,000

|

593,573

|

||||||

|

1.250%, 01/16/2019

|

200,000

|

198,668

|

||||||

|

1.000%, 09/26/2019

|

300,000

|

294,579

|

||||||

|

1,501,496

|

||||||||

|

Federal Home Loan Mortgage Corp. – 0.2%

|

||||||||

|

0.875%, 10/12/2018

|

125,000

|

124,282

|

||||||

|

1.500%, 01/17/2020

|

355,000

|

350,103

|

||||||

|

5.500%, 04/01/2021, Gold Pool #G11941

|

13,352

|

13,735

|

||||||

|

5.500%, 11/01/2021, Gold Pool #G12454

|

7,052

|

7,291

|

||||||

|

5.500%, 04/01/2023, Gold Pool #G13145

|

15,070

|

15,700

|

||||||

|

4.000%, 02/01/2026, Gold Pool #J14494

|

40,141

|

41,397

|

||||||

|

4.000%, 06/01/2026, Gold Pool #J15974

|

13,925

|

14,407

|

||||||

|

4.500%, 06/01/2029, Gold Pool #C91251

|

13,051

|

13,671

|

||||||

|

4.500%, 12/01/2029, Gold Pool #C91281

|

25,366

|

26,592

|

||||||

|

4.500%, 04/01/2030, Gold Pool #C91295

|

13,711

|

14,376

|

||||||

|

621,554

|

||||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Federal National Mortgage Association – 0.4%

|

||||||||

|

1.125%, 07/20/2018

|

$

|

390,000

|

$

|

389,154

|

||||

|

2.000%, 01/05/2022

|

610,000

|

597,746

|

||||||

|

6.000%, 09/01/2019, Pool #735439

|

272

|

275

|

||||||

|

5.500%, 06/01/2020, Pool #888601

|

825

|

834

|

||||||

|

5.000%, 05/01/2023, Pool #254762

|

9,772

|

10,450

|

||||||

|

5.500%, 01/01/2024, Pool #AD0471

|

7,493

|

7,750

|

||||||

|

5.000%, 12/01/2025, Pool #256045

|

21,075

|

22,536

|

||||||

|

5.500%, 05/01/2028, Pool #257204

|

18,485

|

20,079

|

||||||

|

4.000%, 08/01/2029, Pool #MA0142

|

22,529

|

23,135

|

||||||

|

5.500%, 04/01/2037, Pool #AD0249

|

26,158

|

28,719

|

||||||

|

7.000%, 04/01/2037, Pool #888366

|

6,926

|

7,837

|

||||||

|

5.000%, 10/01/2039, Pool #AC3237

|

54,253

|

58,805

|

||||||

|

1,167,320

|

||||||||

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS

|

||||||||

|

(Cost $3,312,666)

|

3,290,370

|

|||||||

|

U.S. TREASURY OBLIGATIONS – 14.5%

|

||||||||

|

U.S. Treasury Notes – 14.5%

|

||||||||

|

1.375%, 07/31/2018

|

370,000

|

369,477

|

||||||

|

1.500%, 08/31/2018

|

430,000

|

429,324

|

||||||

|

0.750%, 09/30/2018

|

505,000

|

502,085

|

||||||

|

1.250%, 10/31/2018

|

1,915,000

|

1,906,955

|

||||||

|

1.250%, 11/30/2018

|

700,000

|

696,518

|

||||||

|

1.500%, 12/31/2018

|

460,000

|

458,039

|

||||||

|

1.250%, 01/31/2019

|

1,585,000

|

1,574,109

|

||||||

|

1.500%, 01/31/2019

|

1,150,000

|

1,144,254

|

||||||

|

1.375%, 02/28/2019

|

380,000

|

377,466

|

||||||

|

1.500%, 02/28/2019

|

355,000

|

353,063

|

||||||

|

1.625%, 03/31/2019

|

740,000

|

736,343

|

||||||

|

1.625%, 04/30/2019

|

1,875,000

|

1,864,566

|

||||||

|

1.500%, 05/31/2019

|

1,395,000

|

1,384,242

|

||||||

|

1.000%, 06/30/2019

|

380,000

|

374,413

|

||||||

|

1.625%, 06/30/2019

|

650,000

|

645,623

|

||||||

|

0.875%, 07/31/2019

|

755,000

|

742,099

|

||||||

|

1.625%, 07/31/2019

|

180,000

|

178,668

|

||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

U.S. Treasury Notes – 14.5% (Continued)

|

||||||||

|

1.000%, 08/31/2019

|

$

|

1,015,000

|

$

|

997,932

|

||||

|

1.750%, 09/30/2019

|

1,040,000

|

1,032,678

|

||||||

|

1.500%, 10/31/2019

|

200,000

|

197,664

|

||||||

|

1.500%, 11/30/2019

|

410,000

|

404,974

|

||||||

|

1.125%, 12/31/2019

|

640,000

|

627,697

|

||||||

|

1.625%, 12/31/2019

|

220,000

|

217,614

|

||||||

|

1.250%, 01/31/2020

|

850,000

|

834,445

|

||||||

|

1.375%, 01/31/2020

|

250,000

|

246,089

|

||||||

|

1.375%, 02/29/2020

|

380,000

|

373,568

|

||||||

|

1.125%, 03/31/2020

|

300,000

|

293,148

|

||||||

|

1.375%, 04/30/2020

|

2,330,000

|

2,285,420

|

||||||

|

1.500%, 05/31/2020

|

1,460,000

|

1,434,568

|

||||||

|

1.625%, 06/30/2020

|

220,000

|

216,601

|

||||||

|

1.875%, 06/30/2020

|

200,000

|

197,992

|

||||||

|

1.625%, 07/31/2020

|

2,030,000

|

1,997,396

|

||||||

|

2.000%, 07/31/2020

|

310,000

|

307,648

|

||||||

|

1.375%, 08/31/2020

|

1,230,000

|

1,201,832

|

||||||

|

1.375%, 09/30/2020

|

1,625,000

|

1,586,192

|

||||||

|

1.375%, 10/31/2020

|

1,650,000

|

1,609,106

|

||||||

|

1.750%, 10/31/2020

|

450,000

|

443,065

|

||||||

|

1.625%, 11/30/2020

|

490,000

|

480,542

|

||||||

|

2.000%, 11/30/2020

|

390,000

|

386,266

|

||||||

|

1.750%, 12/31/2020

|

650,000

|

639,191

|

||||||

|

1.375%, 01/31/2021

|

2,620,000

|

2,547,151

|

||||||

|

2.125%, 01/31/2021

|

345,000

|

342,495

|

||||||

|

1.125%, 02/28/2021

|

1,165,000

|

1,123,456

|

||||||

|

1.250%, 03/31/2021

|

2,435,000

|

2,354,245

|

||||||

|

1.375%, 04/30/2021

|

1,095,000

|

1,061,396

|

||||||

|

3.125%, 05/15/2021

|

500,000

|

510,403

|

||||||

|

1.375%, 05/31/2021

|

600,000

|

580,705

|

||||||

|

2.250%, 07/31/2021

|

260,000

|

258,354

|

||||||

|

2.000%, 10/31/2021

|

150,000

|

147,578

|

||||||

|

TOTAL U.S. TREASURY OBLIGATIONS

|

||||||||

|

(Cost $41,211,188)

|

40,674,655

|

|||||||

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2018

|

|

Shares

|

Value

|

|||||||

|

SHORT-TERM INVESTMENTS – 0.6%

|

||||||||

|

Money Market Funds – 0.6%

|

||||||||

|

Fidelity Government Portfolio – Class I, 0.60% (d)

|

||||||||

|

(Cost $1,799,804)

|

1,799,804

|

$

|

1,799,804

|

|||||

|

TOTAL SHORT-TERM INVESTMENTS – 0.6%

|

1,799,804

|

|||||||

|

TOTAL INVESTMENTS

|

||||||||

|

(Cost $280,103,350) – 99.6%

|

279,205,427

|

|||||||

|

Other Assets in Excess of Liabilities – 0.4%

|

1,114,294

|

|||||||

|

TOTAL NET ASSETS – 100.0%

|

$

|

280,319,721

|

||||||

|

(a)

|

Variable or Floating Rate Security. The rate shown represents the rate at March 31, 2018.

|

|

(b)

|

Security is a perpetual bond and has no definite maturity date.

|

|

(c)

|

Multi-Step Coupon. Rate disclosed is as of March 31, 2018.

|

|

(d)

|

The rate shown represents the fund’s 7-day yield as of March 31, 2018.

|

|

(e)

|

Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. At March 31, 2018, the market value of these securities total $16,486,225 which represents 5.9% of total net assets.

|

|

(f)

|

U.S. traded security of a foreign issuer or corporation.

|

|

(g)

|

Investment in affiliated security. Quasar Distributors, LLC, which serves as the Fund’s distributor, is a subsidiary of U.S. Bancorp. Details of transactions with this affiliated company for the fiscal year ended March 31, 2018 were as follows:

|

|

Issuer

|

U.S. Bancorp1

|

U.S. Bank, N.A.2

|

Total

|

||||||||||

|

Market Value at 3/31/17

|

$

|

75,615

|

$

|

2,365,409

|

$

|

2,441,024

|

|||||||

|

Purchases

|

$

|

0

|

$

|

0

|

$

|

0

|

|||||||

|

Sales

|

$

|

0

|

$

|

(2,368,000

|

)

|

$

|

(2,368,000

|

)

|

|||||

|

Amortization

|

$

|

(548

|

)

|

$

|

(213

|

)

|

$

|

(761

|

)

|

||||

|

Change in Unrealized

|

|||||||||||||

|

Appreciation (Depreciation)

|

$

|

(465

|

)

|

$

|

2,804

|

$

|

2,339

|

||||||

|

Net Realized Gains (Losses)

|

$

|

0

|

$

|

0

|

$

|

0

|

|||||||

|

Market Value at 3/31/18

|

$

|

74,602

|

$

|

0

|

$

|

74,602

|

|||||||

|

Interest Income

|

$

|

1,650

|

$

|

23,564

|

$

|

25,214

|

|||||||

|

1

|

Par values were $75,000 and $75,000 at 3/31/17 and 3/31/18, respectively.

|

|

|

2

|

Par values were $2,368,000 and $0 at 3/31/17 and 3/31/18, respectively.

|

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

at March 31, 2018

|

|

Assets:

|

||||

|

Investments in unaffiliated securities, at value (cost of $280,027,803)

|

$

|

279,130,825

|

||

|

Investments in affiliated securities, at value (cost of $75,547)

|

74,602

|

|||

|

Cash

|

19,296

|

|||

|

Receivables:

|

||||

|

Dividends and interest

|

1,198,217

|

|||

|

Prepaid expenses and other assets

|

1,154

|

|||

|

Total assets

|

280,424,094

|

|||

|

Liabilities:

|

||||

|

Payables:

|

||||

|

Advisory fee

|

33,714

|

|||

|

Administration and accounting fees

|

36,793

|

|||

|

Reports to shareholders

|

1,978

|

|||

|

Custody fees

|

3,130

|

|||

|

Trustee fees

|

1,565

|

|||

|

Transfer agent fees and expenses

|

7,662

|

|||

|

Other accrued expenses

|

19,531

|

|||

|

Total liabilities

|

104,373

|

|||

|

Net assets

|

$

|

280,319,721

|

||

|

Net assets consist of:

|

||||

|

Capital stock

|

$

|

281,889,772

|

||

|

Accumulated net realized loss on investments

|

(672,128

|

)

|

||

|

Net unrealized depreciation on investments

|

(897,923

|

)

|

||

|

Net assets

|

$

|

280,319,721

|

||

|

Shares issued (Unlimited number of beneficial interest

|

||||

|

authorized, $0.01 par value)

|

28,084,457

|

|||

|

Net asset value, offering price and redemption price per share

|

$

|

9.98

|

||

|

STATEMENT OF OPERATIONS

|

|

Year Ended March 31, 2018

|

|

Investment income:

|

||||

|

Interest income from unaffiliated securities

|

$

|

3,791,998

|

||

|

Interest income from affiliated securities

|

24,453

|

|||

|

Total investment income

|

3,816,451

|

|||

|

Expenses:

|

||||

|

Advisory fees (Note 4)

|

517,989

|

|||

|

Administration and accounting fees (Note 4)

|

217,568

|

|||

|

Transfer agent fees and expenses

|

42,476

|

|||

|

Federal and state registration fees

|

9,727

|

|||

|

Audit fees

|

15,101

|

|||

|

Compliance expense

|

17,673

|

|||

|

Legal fees

|

13,564

|

|||

|

Reports to shareholders

|

2,996

|

|||

|

Trustees’ fees and expenses

|

9,501

|

|||

|

Custody fees

|

19,511

|

|||

|

Other

|

9,429

|

|||

|

Total expenses before reimbursement from advisor

|

875,535

|

|||

|

Expense reimbursement from advisor (Note 4)

|

(207,196

|

)

|

||

|

Net expenses

|

668,339

|

|||

|

Net investment income

|

3,148,112

|

|||

|

Realized and unrealized gain (loss) on investments:

|

||||

|

Net realized loss on unaffiliated investments

|

(8,467

|

)

|

||

|

Net realized gain (loss) on affiliated investments

|

—

|

|||

|

Net change in unrealized depreciation on unaffiliated investments

|

(1,116,123

|

)

|

||

|

Net change in unrealized depreciation on affiliated investments

|

2,339

|

|||

|

Net realized and unrealized loss on investments

|

(1,122,251

|

)

|

||

|

Net increase in net assets resulting from operations

|

$

|

2,025,861

|

||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Eleven

|

||||||||||||

|

Year Ended

|

Months Ended

|

Year Ended

|

||||||||||

|

March 31, 2018

|

March 31, 2017*

|

April 30, 2016

|

||||||||||

|

Operations:

|

||||||||||||

|

Net investment income

|

$

|

3,148,112

|

$

|

1,435,771$

|

1,512,924

|

|||||||

|

Net realized gain (loss) on investments

|

(8,467

|

)

|

61,360

|

355,030

|

||||||||

|

Net change in unrealized depreciation

|

||||||||||||

|

on investments

|

(1,113,784

|

)

|

(403,372

|

)

|

(586,839

|

)

|

||||||

|

Net increase in net assets

|

||||||||||||

|

resulting from operations

|

2,025,861

|

1,093,759

|

1,281,115

|

|||||||||

|

Distributions to Shareholders From:

|

||||||||||||

|

Net investment income

|

(3,195,328

|

)

|

(1,482,522

|

)

|

(1,543,193

|

)

|

||||||

|

Total distributions

|

(3,195,328

|

)

|

(1,482,522

|

)

|

(1,543,193

|

)

|

||||||

|

Capital Share Transactions:

|

||||||||||||

|

Proceeds from shares sold

|

133,860,651

|

52,333,765

|

51,730,683

|

|||||||||

|

Proceeds from shares issued to holders

|

||||||||||||

|

in reinvestment of dividends

|

3,190,364

|

1,483,418

|

1,542,964

|

|||||||||

|

Cost of shares redeemed

|

(39,660,295

|

)

|

(47,137,981

|

)

|

(45,183,230

|

)

|

||||||

|

Net increase in net assets from

|

||||||||||||

|

capital share transactions

|

97,390,720

|

6,679,202

|

8,090,417

|

|||||||||

|

Total increase in net assets

|

96,221,253

|

6,290,439

|

7,828,339

|

|||||||||

|

Net Assets:

|

||||||||||||

|

Beginning of year

|

184,098,468

|

177,808,029

|

169,979,690

|

|||||||||

|

End of year

|

$

|

280,319,721

|

$

|

184,098,468

|

$

|

177,808,029

|

||||||

|

Accumulated net investment income (loss)

|

$

|

—

|

$

|

—

|

$

|

17,190

|

||||||

|

Changes in Shares Outstanding:

|

||||||||||||

|

Shares sold

|

13,360,376

|

5,214,316

|

5,157,961

|

|||||||||

|

Proceeds from shares issued to holders

|

||||||||||||

|

in reinvestment of dividends

|

318,422

|

147,694

|

153,755

|

|||||||||

|

Shares redeemed

|

(3,955,495

|

)

|

(4,694,355

|

)

|

(4,506,685

|

)

|

||||||

|

Net increase in shares outstanding

|

9,723,303

|

667,655

|

805,031

|

|||||||||

|

*

|

Fund changed its fiscal year from April 30 to March 31.

|

|

FINANCIAL HIGHLIGHTS

|

| For a capital share outstanding throughout each period |

|

Eleven

|

||||||||||||||||||||||||

|

Year

|

Months

|

|||||||||||||||||||||||

|

Ended

|

Ended

|

|||||||||||||||||||||||

|

March 31,

|

March 31,

|

Year Ended April 30,

|

||||||||||||||||||||||

|

2018

|

2017*

|

2016

|

2015

|

2014

|

2013

|

|||||||||||||||||||

|

Net Asset Value –

|

||||||||||||||||||||||||

|

Beginning of Period

|

$

|

10.03

|

$

|

10.05

|

$

|

10.06

|

$

|

10.08

|

$

|

10.12

|

$

|

10.03

|

||||||||||||

|

Income from

|

||||||||||||||||||||||||

|

Investment Operations:

|

||||||||||||||||||||||||

|

Net investment income

|

0.15

|

0.09

|

0.09

|

1

|

0.09

|

1

|

0.10

|

1

|

0.11

|

1

|

||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||||||

|

gain (loss) on investments

|

(0.05

|

)

|

(0.02

|

)

|

(0.01

|

)

|

(0.02

|

)

|

(0.03

|

)

|

0.11

|

|||||||||||||

|

Total from

|

||||||||||||||||||||||||

|

investment operations

|

0.10

|

0.07

|

0.08

|

0.07

|

0.07

|

0.22

|

||||||||||||||||||

|

Less Distributions:

|

||||||||||||||||||||||||

|

Dividends from net

|

||||||||||||||||||||||||

|

investment income

|

(0.15

|

)

|

(0.09

|

)

|

(0.09

|

)

|

(0.09

|

)

|

(0.11

|

)

|

(0.13

|

)

|

||||||||||||

|

Total distributions

|

(0.15

|

)

|

(0.09

|

)

|

(0.09

|

)

|

(0.09

|

)

|

(0.11

|

)

|

(0.13

|

)

|

||||||||||||

|

Net Asset Value –

|

||||||||||||||||||||||||

|

End of Period

|

$

|

9.98

|

$

|

10.03

|

$

|

10.05

|

$

|

10.06

|

$

|

10.08

|

$

|

10.12

|

||||||||||||

|

Total Return2

|

1.02

|

%

|

0.68

|

%^ |

0.85

|

%

|

0.74

|

%

|

0.68

|

%

|

2.19

|

%

|

||||||||||||

|

Ratios and Supplemental Data:

|

||||||||||||||||||||||||

|

Net assets, end

|

||||||||||||||||||||||||

|

of period (thousands)

|

$

|

280,320

|

$

|

184,098

|

$

|

177,808

|

$

|

169,980

|

$

|

167,888

|

$

|

119,793

|

||||||||||||

|

Ratio of operating expenses

|

||||||||||||||||||||||||

|

to average net assets3:

|

||||||||||||||||||||||||

|

Before Reimbursements

|

0.42

|

%

|

0.67

|

%+

|

0.74

|

%

|

0.74

|

%

|

0.76

|

%

|

0.80

|

%

|

||||||||||||

|

After Reimbursements

|

0.32

|

%

|

0.40

|

%+

|

0.39

|

%

|

0.39

|

%

|

0.41

|

%

|

0.45

|

%

|

||||||||||||

|

Ratio of net investment

|

||||||||||||||||||||||||

|

income to average net assets3:

|

||||||||||||||||||||||||

|

Before Reimbursements

|

1.42

|

%

|

0.68

|

%+

|

0.57

|

%

|

0.56

|

%

|

0.65

|

%

|

0.75

|

%

|

||||||||||||

|

After Reimbursements

|

1.52

|

%

|

0.95

|

%+

|

0.92

|

%

|

0.91

|

%

|

1.00

|

%

|

1.10

|

%

|

||||||||||||

|

Portfolio turnover rate

|

38

|

%

|

17

|

%^ |

45

|

%

|

35

|

%

|

35

|

%

|

28

|

%

|

||||||||||||

|

+

|

Annualized

|

|

^

|

Not Annualized

|

|

1

|

The net investment income per share was calculated using the average shares outstanding method.

|

|

2

|

Total investment return is calculated assuming a purchase of shares on the first day and a sale of shares on the last day of each period reported and includes reinvestment of dividends and distributions, if any.

|

|

3

|

During the period, certain fees were waived. If such fee waivers had not occurred, the ratios would have been as indicated (See Note 4).

|

|

*

|

Fund changed its fiscal year from April 30 to March 31.

|

|

NOTES TO FINANCIAL STATEMENTS

|

|

March 31, 2018

|

|

A.

|

Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3.

|

|

|

B.

|

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required.

|

|

|

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions to be taken or expected to be taken on a tax return. The tax returns for the Fund for the prior three fiscal years, when applicable, are open for examination. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware.

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

March 31, 2018

|

|

C.

|

Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Discounts and premiums on fixed income securities are amortized using the effective interest method.

|

|

|

The Fund distributes substantially all of its net investment income, if any, daily, and net realized capital gains, if any, annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which differ from GAAP. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment.

|

||

|

The Fund is charged for those expenses that are directly attributable to it, such as investment advisory, custody and transfer agent fees. Expenses that are not attributable to a Fund are typically allocated among the funds in the Trust proportionately based on allocation methods approved by the Board of Trustees (the “Board”). Common expenses of the Trust are typically allocated among the funds in the Trust based on a fund’s respective net assets, or by other equitable means.

|

||

|

D.

|

Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates.

|

|

|

E.

|

Redemption Fees: The Fund does not charge redemption fees to shareholders.

|

|

|

F.

|

Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the fiscal year ended March 31, 2018, the Fund made the following permanent tax adjustments on the Statement of Assets and Liabilities:

|

|

Accumulated

|

Accumulated

|

|||

|

Net Investment

|

Net Realized

|

Capital

|

||

|

Income/(Loss)

|

Gain/(Loss)

|

Stock

|

||

|

$47,216

|

$(8,359)

|

$(38,857)

|

|

G.

|

Events Subsequent to the Fiscal Year End: In preparing the financial statements as of March 31, 2018, management considered the impact of subsequent events for potential recognition or disclosure in the financial statements and had concluded that no additional disclosures are necessary.

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

March 31, 2018

|

|

H.

|

Recent Accounting Pronouncements: In March 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2017-08, Receivables—Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities. The amendments in the ASU shorten the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. The ASU does not require an accounting change for securities held at a discount; which continues to be amortized to maturity. The ASU is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018. Management is currently evaluating the impact, if any, of applying this provision.

|

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

|

|

Level 2 –

|

Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

|

|

|

Level 3 –

|

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

|

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

March 31, 2018

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Corporate Bonds and Notes

|

$

|

—

|

$

|

232,274,176

|

$

|

—

|

$

|