UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21897

Manager Directed Portfolios

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Douglas J. Neilson, President

Manager Directed Portfolios

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 5th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(414) 287-3101

Registrant's telephone number, including area code

Date of fiscal year end: March 31, 2017

Date of reporting period: March 31, 2017

Item 1. Reports to Stockholders.

Pemberwick Fund

Annual Report

March 31, 2017

Pemberwick Fund

Table of Contents

|

Letter to Shareholders/Commentary

|

3

|

|

Sector Allocation of Portfolio Assets

|

6

|

|

Schedule of Investments

|

7

|

|

Statement of Assets and Liabilities

|

23

|

|

Statements of Operations

|

24

|

|

Statements of Changes in Net Assets

|

25

|

|

Financial Highlights

|

26

|

|

Notes to the Financial Statements

|

27

|

|

Report of Independent Registered Public Accounting Firm

|

37

|

|

Expense Example

|

38

|

|

Notice to Shareholders

|

40

|

|

Trustees and Officers

|

41

|

|

Approval of the Pemberwick Fund’s Investment Advisory Agreement

|

|

|

and Sub-Advisory Agreement

|

43

|

|

Privacy Notice

|

46

|

Pemberwick Fund

We are pleased to present the Pemberwick Fund annual report covering the period from May 1, 2016 through March 31, 2017. Portfolio performance information, market commentary and our outlook for the period ended March 31, 2017 follows. We encourage you to carefully review the enclosed information to stay informed.

PORTFOLIO PERFORMANCE AND MARKET REVIEW:

For the eleven months ended March 31, 2017 Pemberwick Fund (“Pemberwick”) generated a periodic total investment return of 0.68%, net of expenses. The Portfolio’s primary benchmark, the Bloomberg Barclays 1-3 Year US Government/Credit Index returned 0.57% during the same period. Since its inception on February 1, 2010 Pemberwick has generated a return net of expenses of 1.16% vs. Pemberwick’s benchmark return of 1.21% for the same period. Pemberwick’s annualized performance for the 1 year and 5 year return were 0.87% and 1.07%, respectively, vs. Pemberwick’s benchmark return of 0.71% and 0.93%, respectively. The benchmark index does not reflect any expenses or transaction costs. Pemberwick generated a return before expenses but after transaction costs of 1.24% for the eleven months ended March 31, 2017 and 1.56% since inception.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will change so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-893-4491. The gross expense ratio of the fund is 0.45%.

During the eleven months ended March 31, 2017, Pemberwick continued its strategy of building a portfolio of investment grade bonds with laddered maturities, therefore generating favorable returns without taking on significant duration or interest rate risk. In addition, Pemberwick has continued to concentrate its investments in investment grade floating and fixed rate bonds issued by financial institutions with assets greater than $200 billion and securities issued by the US Treasury and Agencies. Current yields on bonds issued by said financial institutions, which made up approximately 83% of the Pemberwick portfolio as of March 31, 2017, have been relatively flat year over year. In addition, short term yields in general remained at historically low levels as of March 31, 2017. We are pleased with Pemberwick’s performance given these circumstances.

PORTFOLIO POSITIONING:

Pemberwick Fund continues to be invested primarily in investment grade fixed and floating rate securities issued by financial institutions with assets greater than $200 billion and securities issued by the US Treasury and Agencies. In addition, Pemberwick currently has approximately 3% of its assets invested in short-term securities with maturities of approximately 30 days. Pemberwick’s net assets have increased by approximately 4% during the eleven months ended March 31, 2017: net assets have increased from approximately $177.8 million as of April 30, 2016 to approximately $184.1 million as of March 31, 2017.

3

Pemberwick Fund

This letter is intended to assist shareholders in understanding how the Fund performed during the eleven months ended March 31, 2017 and reflects the views of the investment advisor at the time of this writing. Of course, these views may change and do not guarantee the future performance of the Fund or the markets. Portfolio composition is subject to change. The current and future portfolio holdings of the Fund are subject to investment risk.

Pemberwick Investment Advisors LLC

Must be preceded or accompanied by a prospectus.

The Pemberwick Fund is distributed by Quasar Distributors, LLC.

Mutual fund investing involves risk. Principal loss is possible. Fixed-income securities are or may be subject to interest rate, credit, liquidity, prepayment and extension risks. By concentrating its assets in the banking industry, the Fund is subject to the risk that economic, business, political or other conditions that have a negative effect on the banking industry will negatively impact the Fund to a greater extent than if the Fund’s assets were diversified across different industries or sectors. The municipal market is volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities.

The Bloomberg Barclays 1-3 Year US Government/Credit Index is an unmanaged market index and should not be considered indicative of any Pemberwick investment. It is not possible to invest directly in an index.

Duration is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates.

Pemberwick Fund changed its fiscal year from April 30 to March 31.

4

Pemberwick Fund

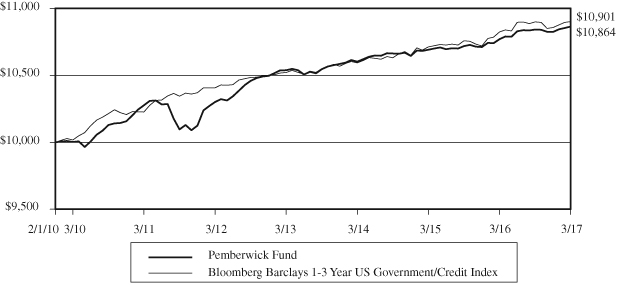

Comparison of the Change in Value of a Hypothetical $10,000 Investment

in the Pemberwick Fund and

Bloomberg Barclays 1-3 Year US Government/Credit Index

(Unaudited)

|

Eleven

|

Annualized

|

||||

|

Total Return Periods

|

Months Ended

|

Since Inception

|

|||

|

Ended March 31, 2017*:

|

3/31/2017

|

1 Year

|

3 Year

|

5 Year

|

(2/1/2010)

|

|

Pemberwick Fund (No Load)

|

0.68%

|

0.87%

|

0.82%

|

1.07%

|

1.16%

|

|

Bloomberg Barclays 1-3 Year

|

|||||

|

US Government/Credit Index

|

0.57%

|

0.71%

|

0.96%

|

0.93%

|

1.21%

|

Total Annual Fund Operating Expenses: 0.45%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-893-4491.

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on February 1, 2010, the Fund’s inception date. Returns reflect the reinvestment of dividends and capital gain distributions. The performance data shown reflects a voluntary waiver made by the Adviser. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder may pay on dividends, capital gain distributions, or redemption of Fund shares.

The Bloomberg Barclays 1-3 Year US Government/Credit Index is an unmanaged market index and should not be considered indicative of any Pemberwick investment. One cannot invest directly in an index.

* Periods greater than one year are average annual returns.

5

Pemberwick Fund

|

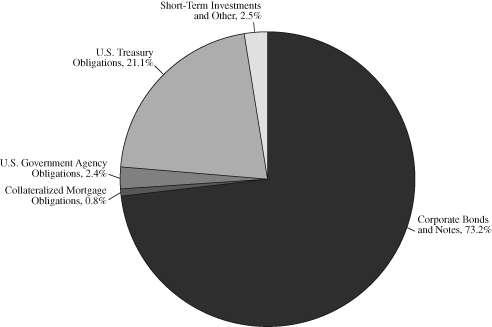

SECTOR ALLOCATION OF PORTFOLIO ASSETS

|

|

at March 31, 2017 (Unaudited)

|

Percentages represent market value as a percentage of net assets.

6

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

CORPORATE BONDS AND NOTES – 73.2%

|

Value

|

Value

|

||||||

|

Basic Materials – 0.0%

|

||||||||

|

Praxair, Inc.

|

||||||||

|

1.050%, 11/07/2017

|

$

|

15,000

|

$

|

14,978

|

||||

|

1.250%, 11/07/2018

|

30,000

|

29,887

|

||||||

|

44,865

|

||||||||

|

Communications – 3.4%

|

||||||||

|

AT&T, Inc.

|

||||||||

|

1.400%, 12/01/2017

|

15,000

|

14,990

|

||||||

|

1.962%, 11/27/2018 (a)

|

2,000,000

|

2,018,762

|

||||||

|

Cisco Systems, Inc.

|

||||||||

|

4.950%, 02/15/2019

|

25,000

|

26,545

|

||||||

|

2.125%, 03/01/2019

|

105,000

|

106,117

|

||||||

|

eBay, Inc.

|

||||||||

|

1.350%, 07/15/2017

|

50,000

|

49,981

|

||||||

|

The Walt Disney Co.

|

||||||||

|

0.875%, 05/30/2017

|

17,000

|

16,996

|

||||||

|

5.875%, 12/15/2017

|

30,000

|

30,923

|

||||||

|

1.650%, 01/08/2019

|

17,000

|

17,037

|

||||||

|

1.364%, 05/30/2019 (a)

|

1,000,000

|

1,005,254

|

||||||

|

Verizon Communications, Inc.

|

||||||||

|

1.918%, 06/17/2019 (a)

|

3,000,000

|

3,022,398

|

||||||

|

6,309,003

|

||||||||

|

Consumer, Cyclical – 2.1%

|

||||||||

|

American Honda Finance Corp.

|

||||||||

|

1.875%, 02/22/2019 (a)

|

500,000

|

506,792

|

||||||

|

Daimler Finance North America LLC

|

||||||||

|

1.375%, 08/01/2017

|

||||||||

|

(Acquired 07/24/2014, Cost $999,165) (b)(e)

|

1,000,000

|

999,939

|

||||||

|

McDonald’s Corp.

|

||||||||

|

5.350%, 03/01/2018

|

10,000

|

10,343

|

||||||

|

PACCAR Financial Corp.

|

||||||||

|

1.400%, 11/17/2017

|

30,000

|

30,009

|

||||||

|

1.300%, 05/10/2019

|

12,000

|

11,902

|

||||||

|

The Home Depot, Inc.

|

||||||||

|

2.000%, 06/15/2019

|

30,000

|

30,239

|

||||||

The accompanying notes are an integral part of these financial statements.

7

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Consumer, Cyclical – 2.1% (Continued)

|

||||||||

|

Toyota Motor Credit Corp.

|

||||||||

|

1.375%, 01/10/2018

|

$

|

30,000

|

$

|

29,999

|

||||

|

2.000%, 10/24/2018

|

25,000

|

25,128

|

||||||

|

2.100%, 01/17/2019

|

68,000

|

68,592

|

||||||

|

2.125%, 07/18/2019

|

40,000

|

40,296

|

||||||

|

VF Corp.

|

||||||||

|

5.950%, 11/01/2017

|

35,000

|

35,904

|

||||||

|

Volkswagen International Finance NV

|

||||||||

|

1.600%, 11/20/2017 (Acquired 02/23/2015,

|

||||||||

|

Cost $2,002,446) (b)(e)(f)

|

2,000,000

|

1,998,476

|

||||||

|

Wal-Mart Stores, Inc.

|

||||||||

|

1.000%, 04/21/2017

|

30,000

|

29,995

|

||||||

|

1.125%, 04/11/2018

|

40,000

|

39,934

|

||||||

|

3,857,548

|

||||||||

|

Consumer, Non-cyclical – 4.3%

|

||||||||

|

AbbVie, Inc.

|

||||||||

|

1.800%, 05/14/2018

|

2,000,000

|

2,002,708

|

||||||

|

Amgen, Inc.

|

||||||||

|

1.250%, 05/22/2017

|

1,000,000

|

999,997

|

||||||

|

AstraZeneca PLC

|

||||||||

|

5.900%, 09/15/2017 (f)

|

2,000,000

|

2,039,076

|

||||||

|

Danaher Corp.

|

||||||||

|

2.400%, 09/15/2020

|

25,000

|

25,271

|

||||||

|

Diageo Capital PLC

|

||||||||

|

5.750%, 10/23/2017 (f)

|

2,000,000

|

2,046,828

|

||||||

|

GlaxoSmithKline Capital PLC

|

||||||||

|

1.500%, 05/08/2017 (f)

|

15,000

|

15,005

|

||||||

|

GlaxoSmithKline Capital, Inc.

|

||||||||

|

5.650%, 05/15/2018

|

15,000

|

15,695

|

||||||

|

Johnson & Johnson

|

||||||||

|

1.125%, 03/01/2019

|

30,000

|

29,872

|

||||||

|

2.250%, 03/03/2022

|

60,000

|

60,088

|

||||||

|

Merck & Co., Inc.

|

||||||||

|

1.100%, 01/31/2018

|

488,000

|

487,067

|

||||||

|

1.850%, 02/10/2020

|

14,000

|

14,033

|

||||||

The accompanying notes are an integral part of these financial statements.

8

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Consumer, Non-cyclical – 4.3% (Continued)

|

||||||||

|

PepsiCo, Inc.

|

||||||||

|

1.000%, 10/13/2017

|

$

|

30,000

|

$

|

29,960

|

||||

|

1.500%, 02/22/2019

|

15,000

|

15,004

|

||||||

|

2.150%, 10/14/2020

|

60,000

|

60,365

|

||||||

|

The Coca-Cola Co.

|

||||||||

|

1.650%, 03/14/2018

|

30,000

|

30,084

|

||||||

|

1.375%, 05/30/2019

|

20,000

|

19,915

|

||||||

|

The Procter & Gamble Co.

|

||||||||

|

1.700%, 11/03/2021

|

60,000

|

58,919

|

||||||

|

7,949,887

|

||||||||

|

Energy – 2.1%

|

||||||||

|

BP Capital Markets PLC

|

||||||||

|

1.846%, 05/05/2017 (f)

|

3,150,000

|

3,151,572

|

||||||

|

Chevron Corp.

|

||||||||

|

1.104%, 12/05/2017

|

15,000

|

14,976

|

||||||

|

1.365%, 03/02/2018

|

90,000

|

89,961

|

||||||

|

1.718%, 06/24/2018

|

35,000

|

35,119

|

||||||

|

1.790%, 11/16/2018

|

50,000

|

50,153

|

||||||

|

4.950%, 03/03/2019

|

20,000

|

21,218

|

||||||

|

ConocoPhillips Co.

|

||||||||

|

6.650%, 07/15/2018

|

25,000

|

26,573

|

||||||

|

6.000%, 01/15/2020

|

20,000

|

22,134

|

||||||

|

ConocoPhillips Co.

|

||||||||

|

1.500%, 05/15/2018

|

30,000

|

29,948

|

||||||

|

EOG Resources, Inc.

|

||||||||

|

5.625%, 06/01/2019

|

15,000

|

16,125

|

||||||

|

Exxon Mobil Corp

|

||||||||

|

1.305%, 03/06/2018

|

50,000

|

49,967

|

||||||

|

1.819%, 03/15/2019

|

100,000

|

100,569

|

||||||

|

Occidental Petroleum Corp.

|

||||||||

|

1.500%, 02/15/2018

|

60,000

|

59,988

|

||||||

|

Phillips 66

|

||||||||

|

2.950%, 05/01/2017

|

25,000

|

25,029

|

||||||

The accompanying notes are an integral part of these financial statements.

9

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Energy – 2.1% (Continued)

|

||||||||

|

Statoil ASA

|

||||||||

|

1.250%, 11/09/2017 (f)

|

$

|

30,000

|

$

|

29,966

|

||||

|

6.700%, 01/15/2018 (f)

|

10,000

|

10,396

|

||||||

|

1.950%, 11/08/2018 (f)

|

10,000

|

10,041

|

||||||

|

5.250%, 04/15/2019 (f)

|

15,000

|

15,992

|

||||||

|

3,759,727

|

||||||||

|

Financial – 54.9%

|

||||||||

|

American Express Bank FSB

|

||||||||

|

1.181%, 06/12/2017 (a)

|

405,000

|

405,114

|

||||||

|

6.000%, 09/13/2017

|

950,000

|

968,939

|

||||||

|

American Express Credit Corp.

|

||||||||

|

1.125%, 06/05/2017

|

2,025,000

|

2,025,130

|

||||||

|

1.814%, 11/05/2018 (a)

|

500,000

|

503,787

|

||||||

|

1.529%, 08/15/2019 (a)

|

3,118,000

|

3,128,604

|

||||||

|

2.250%, 08/15/2019

|

95,000

|

95,773

|

||||||

|

1.609%, 10/30/2019 (a)

|

1,000,000

|

1,002,530

|

||||||

|

Bank of America Corp.

|

||||||||

|

1.700%, 08/25/2017

|

1,055,000

|

1,056,999

|

||||||

|

6.400%, 08/28/2017

|

50,000

|

50,976

|

||||||

|

5.750%, 12/01/2017

|

1,625,000

|

1,668,149

|

||||||

|

2.600%, 01/15/2019

|

2,000,000

|

2,021,554

|

||||||

|

2.650%, 04/01/2019

|

60,000

|

60,720

|

||||||

|

2.445%, 04/19/2021 (a)

|

3,500,000

|

3,607,366

|

||||||

|

2.221%, 10/21/2022 (a)

|

500,000

|

508,236

|

||||||

|

BB&T Corp.

|

||||||||

|

1.802%, 04/01/2022 (a)

|

1,600,000

|

1,602,131

|

||||||

|

Berkshire Hathaway Finance Corp.

|

||||||||

|

1.300%, 05/15/2018

|

8,000

|

7,998

|

||||||

|

5.400%, 05/15/2018

|

60,000

|

62,665

|

||||||

|

Berkshire Hathaway, Inc.

|

||||||||

|

1.550%, 02/09/2018

|

100,000

|

100,081

|

||||||

|

BlackRock, Inc.

|

||||||||

|

5.000%, 12/10/2019

|

75,000

|

81,222

|

||||||

|

Boston Properties LP

|

||||||||

|

3.700%, 11/15/2018

|

15,000

|

15,378

|

||||||

The accompanying notes are an integral part of these financial statements.

10

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Financial – 54.9% (Continued)

|

||||||||

|

Capital One Bank USA, N.A.

|

||||||||

|

2.150%, 11/21/2018

|

$

|

1,000,000

|

$

|

1,002,146

|

||||

|

Capital One Financial Corp.

|

||||||||

|

2.056%, 03/09/2022 (a)

|

3,000,000

|

3,003,630

|

||||||

|

Capital One, N.A.

|

||||||||

|

1.500%, 03/22/2018

|

1,000,000

|

997,858

|

||||||

|

2.192%, 08/17/2018 (a)

|

500,000

|

504,991

|

||||||

|

2.400%, 09/05/2019

|

515,000

|

516,862

|

||||||

|

2.189%, 01/30/2023 (a)

|

3,000,000

|

3,016,038

|

||||||

|

Citigroup, Inc.

|

||||||||

|

2.500%, 09/26/2018

|

3,000,000

|

3,027,729

|

||||||

|

2.532%, 03/30/2021 (a)

|

550,000

|

563,476

|

||||||

|

2.225%, 08/02/2021 (a)

|

570,000

|

579,226

|

||||||

|

2.176%, 12/08/2021 (a)

|

5,000,000

|

5,048,040

|

||||||

|

Credit Suisse AG

|

||||||||

|

1.542%, 05/26/2017 (a)(f)

|

1,000,000

|

1,000,671

|

||||||

|

1.729%, 01/29/2018 (a)(f)

|

3,900,000

|

3,916,091

|

||||||

|

1.750%, 01/29/2018 (f)

|

1,000,000

|

1,000,876

|

||||||

|

1.700%, 04/27/2018 (f)

|

1,000,000

|

998,792

|

||||||

|

1.717%, 04/27/2018 (a)(f)

|

1,000,000

|

1,000,935

|

||||||

|

Deutsche Bank AG

|

||||||||

|

6.000%, 09/01/2017 (f)

|

709,000

|

721,417

|

||||||

|

HSBC USA, Inc.

|

||||||||

|

1.500%, 11/13/2017

|

2,000,000

|

2,000,380

|

||||||

|

1.700%, 03/05/2018

|

1,000,000

|

1,000,646

|

||||||

|

1.804%, 08/07/2018 (a)

|

1,000,000

|

1,003,745

|

||||||

|

JPMorgan Chase & Co.

|

||||||||

|

1.588%, 04/25/2018 (a)

|

830,000

|

833,562

|

||||||

|

Morgan Stanley

|

||||||||

|

6.250%, 08/28/2017

|

4,000,000

|

4,077,044

|

||||||

|

2.318%, 04/25/2018 (a)

|

2,725,000

|

2,753,697

|

||||||

|

1.781%, 07/23/2019 (a)

|

1,000,000

|

1,005,866

|

||||||

|

1.842%, 02/14/2020 (a)

|

300,000

|

300,735

|

||||||

|

2.210%, 01/20/2022 (a)

|

400,000

|

404,142

|

||||||

|

National City Bank

|

||||||||

|

1.472%, 06/07/2017 (a)

|

2,075,000

|

2,075,089

|

||||||

The accompanying notes are an integral part of these financial statements.

11

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Financial – 54.9% (Continued)

|

||||||||

|

National Rural Utilities Cooperative Finance Corp.

|

||||||||

|

5.450%, 02/01/2018

|

$

|

50,000

|

$

|

51,615

|

||||

|

Novartis Capital Corp.

|

||||||||

|

1.800%, 02/14/2020

|

70,000

|

70,090

|

||||||

|

PNC Bank, N.A.

|

||||||||

|

4.875%, 09/21/2017

|

2,500,000

|

2,536,423

|

||||||

|

State Street Corp.

|

||||||||

|

5.375%, 04/30/2017

|

15,000

|

15,042

|

||||||

|

1.350%, 05/15/2018

|

92,000

|

91,812

|

||||||

|

1.950%, 05/19/2021

|

25,000

|

24,576

|

||||||

|

SunTrust Banks, Inc.

|

||||||||

|

2.350%, 11/01/2018

|

1,456,000

|

1,465,816

|

||||||

|

The Bank of New York Mellon Corp.

|

||||||||

|

2.200%, 03/04/2019

|

59,000

|

59,486

|

||||||

|

4.600%, 01/15/2020

|

30,000

|

32,030

|

||||||

|

2.450%, 11/27/2020

|

35,000

|

35,210

|

||||||

|

The Bank of Nova Scotia

|

||||||||

|

1.300%, 07/21/2017 (f)

|

325,000

|

325,111

|

||||||

|

1.450%, 04/25/2018 (f)

|

2,000,000

|

1,997,012

|

||||||

|

1.853%, 01/15/2019 (a)(f)

|

1,000,000

|

1,009,371

|

||||||

|

1.742%, 03/07/2022 (a)(f)

|

5,900,000

|

5,904,814

|

||||||

|

The Charles Schwab Corp.

|

||||||||

|

2.200%, 07/25/2018

|

40,000

|

40,258

|

||||||

|

The Chubb Corp.

|

||||||||

|

5.750%, 05/15/2018

|

35,000

|

36,625

|

||||||

|

The Goldman Sachs Group, Inc.

|

||||||||

|

6.250%, 09/01/2017

|

950,000

|

968,385

|

||||||

|

6.150%, 04/01/2018

|

30,000

|

31,260

|

||||||

|

7.500%, 02/15/2019

|

2,130,000

|

2,338,446

|

||||||

|

2.300%, 12/13/2019

|

2,000,000

|

2,002,268

|

||||||

|

2.398%, 04/23/2021 (a)

|

1,000,000

|

1,022,568

|

||||||

|

2.209%, 11/15/2021 (a)

|

2,000,000

|

2,023,978

|

||||||

|

2.142%, 04/26/2022 (a)

|

1,141,000

|

1,151,103

|

||||||

|

The Travelers Companies, Inc.

|

||||||||

|

3.900%, 11/01/2020

|

50,000

|

52,963

|

||||||

The accompanying notes are an integral part of these financial statements.

12

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Financial – 54.9% (Continued)

|

||||||||

|

UBS AG

|

||||||||

|

1.375%, 08/14/2017 (f)

|

$

|

2,000,000

|

$

|

2,000,666

|

||||

|

1.853%, 03/26/2018 (a)(f)

|

2,750,000

|

2,761,459

|

||||||

|

U.S. Bancorp

|

||||||||

|

2.200%, 04/25/2019 (g)

|

75,000

|

75,615

|

||||||

|

U.S. Bank, N.A.

|

||||||||

|

1.350%, 01/26/2018 (g)

|

2,368,000

|

2,365,409

|

||||||

|

Wachovia Corp.

|

||||||||

|

5.750%, 02/01/2018

|

440,000

|

453,886

|

||||||

|

Wells Fargo & Co.

|

||||||||

|

5.625%, 12/11/2017

|

50,000

|

51,374

|

||||||

|

1.671%, 04/23/2018 (a)

|

127,000

|

127,614

|

||||||

|

1.719%, 01/30/2020 (a)

|

2,000,000

|

2,009,276

|

||||||

|

2.150%, 01/30/2020

|

200,000

|

200,482

|

||||||

|

1.921%, 07/22/2020 (a)

|

1,626,000

|

1,641,149

|

||||||

|

2.600%, 07/22/2020

|

90,000

|

90,921

|

||||||

|

2.440%, 03/04/2021 (a)

|

2,500,000

|

2,565,053

|

||||||

|

4.600%, 04/01/2021

|

60,000

|

64,534

|

||||||

|

2.100%, 07/26/2021

|

50,000

|

49,039

|

||||||

|

Wells Fargo Bank, N.A.

|

||||||||

|

1.781%, 01/22/2018 (a)

|

2,000,000

|

2,010,424

|

||||||

|

101,080,199

|

||||||||

|

Industrial – 3.4%

|

||||||||

|

Caterpillar Financial Services Corp.

|

||||||||

|

1.500%, 02/23/2018

|

20,000

|

19,974

|

||||||

|

1.800%, 11/13/2018

|

25,000

|

25,055

|

||||||

|

2.100%, 06/09/2019

|

15,000

|

15,071

|

||||||

|

2.250%, 12/01/2019

|

20,000

|

20,161

|

||||||

|

Emerson Electric Co.

|

||||||||

|

4.875%, 10/15/2019

|

45,000

|

48,446

|

||||||

|

General Dynamics Corp.

|

||||||||

|

1.000%, 11/15/2017

|

2,030,000

|

2,026,535

|

||||||

The accompanying notes are an integral part of these financial statements.

13

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Industrial – 3.4% (Continued)

|

||||||||

|

General Electric Co.

|

||||||||

|

5.625%, 05/01/2018

|

$

|

80,000

|

$

|

83,653

|

||||

|

6.000%, 08/07/2019

|

50,000

|

54,935

|

||||||

|

5.500%, 01/08/2020

|

20,000

|

21,926

|

||||||

|

4.000%, 12/29/2049, Callable 06/15/2022 at $100 (a)(b)

|

1,234,000

|

1,213,947

|

||||||

|

Illinois Tool Works, Inc.

|

||||||||

|

1.950%, 03/01/2019

|

50,000

|

50,361

|

||||||

|

John Deere Capital Corp.

|

||||||||

|

1.550%, 12/15/2017

|

40,000

|

40,044

|

||||||

|

1.600%, 07/13/2018

|

18,000

|

18,023

|

||||||

|

1.750%, 08/10/2018

|

20,000

|

20,056

|

||||||

|

1.579%, 01/08/2019 (a)

|

500,000

|

503,314

|

||||||

|

Precision Castparts Corp.

|

||||||||

|

1.250%, 01/15/2018

|

45,000

|

44,977

|

||||||

|

Stanley Black & Decker, Inc.

|

||||||||

|

2.451%, 11/17/2018

|

1,000,000

|

1,010,752

|

||||||

|

The Boeing Co.

|

||||||||

|

0.950%, 05/15/2018

|

50,000

|

49,849

|

||||||

|

United Parcel Service, Inc.

|

||||||||

|

1.125%, 10/01/2017

|

30,000

|

29,963

|

||||||

|

United Technologies Corp.

|

||||||||

|

1.778%, 05/04/2018 (a)(c)

|

1,000,000

|

999,939

|

||||||

|

6,296,981

|

||||||||

|

Technology – 2.6%

|

||||||||

|

Apple, Inc.

|

||||||||

|

0.900%, 05/12/2017

|

18,000

|

17,998

|

||||||

|

1.000%, 05/03/2018

|

41,000

|

40,881

|

||||||

|

1.873%, 02/22/2019 (a)

|

1,000,000

|

1,015,432

|

||||||

|

1.550%, 02/07/2020

|

10,000

|

9,943

|

||||||

|

1.900%, 02/07/2020

|

45,000

|

45,137

|

||||||

|

2.250%, 02/23/2021

|

13,000

|

13,045

|

||||||

|

1.550%, 08/04/2021

|

97,000

|

94,126

|

||||||

|

HP, Inc.

|

||||||||

|

1.963%, 01/14/2019 (a)

|

1,500,000

|

1,504,740

|

||||||

|

2.750%, 01/14/2019

|

1,500,000

|

1,518,365

|

||||||

The accompanying notes are an integral part of these financial statements.

14

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Technology – 2.6% (Continued)

|

||||||||

|

Intel Corp.

|

||||||||

|

3.300%, 10/01/2021

|

$

|

50,000

|

$

|

52,008

|

||||

|

Microsoft Corp.

|

||||||||

|

1.000%, 05/01/2018

|

60,000

|

59,802

|

||||||

|

1.300%, 11/03/2018

|

34,000

|

33,998

|

||||||

|

4.200%, 06/01/2019

|

30,000

|

31,744

|

||||||

|

1.550%, 08/08/2021

|

45,000

|

43,900

|

||||||

|

National Semiconductor Corp.

|

||||||||

|

6.600%, 06/15/2017

|

25,000

|

25,267

|

||||||

|

Oracle Corp.

|

||||||||

|

2.375%, 01/15/2019

|

15,000

|

15,209

|

||||||

|

5.000%, 07/08/2019

|

30,000

|

32,177

|

||||||

|

1.900%, 09/15/2021

|

130,000

|

127,856

|

||||||

|

4,681,628

|

||||||||

|

Utilities – 0.4%

|

||||||||

|

DTE Electric Co.

|

||||||||

|

3.900%, 06/01/2021

|

55,000

|

57,977

|

||||||

|

Duke Energy Carolinas LLC

|

||||||||

|

5.250%, 01/15/2018

|

35,000

|

36,021

|

||||||

|

4.300%, 06/15/2020

|

25,000

|

26,714

|

||||||

|

3.900%, 06/15/2021

|

25,000

|

26,460

|

||||||

|

Duke Energy Florida LLC

|

||||||||

|

5.650%, 06/15/2018

|

25,000

|

26,187

|

||||||

|

Entergy Gulf States Louisiana LLC

|

||||||||

|

3.950%, 10/01/2020

|

50,000

|

52,493

|

||||||

|

Florida Power & Light Co.

|

||||||||

|

5.550%, 11/01/2017

|

35,000

|

35,800

|

||||||

|

Kansas City Power & Light Co.

|

||||||||

|

7.150%, 04/01/2019

|

20,000

|

22,007

|

||||||

|

Kentucky Utilities Co.

|

||||||||

|

3.250%, 11/01/2020

|

30,000

|

30,947

|

||||||

|

MidAmerican Energy Co.

|

||||||||

|

5.300%, 03/15/2018

|

30,000

|

31,067

|

||||||

|

Northern States Power Co.

|

||||||||

|

2.200%, 08/15/2020

|

30,000

|

30,105

|

||||||

The accompanying notes are an integral part of these financial statements.

15

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Utilities – 0.4% (Continued)

|

||||||||

|

PacifiCorp

|

||||||||

|

5.650%, 07/15/2018

|

$

|

25,000

|

$

|

26,268

|

||||

|

Public Service Co. of Colorado

|

||||||||

|

3.200%, 11/15/2020

|

30,000

|

31,016

|

||||||

|

Public Service Electric & Gas Co.

|

||||||||

|

1.800%, 06/01/2019

|

25,000

|

24,982

|

||||||

|

2.000%, 08/15/2019

|

75,000

|

75,030

|

||||||

|

San Diego Gas & Electric Co.

|

||||||||

|

3.000%, 08/15/2021

|

30,000

|

30,720

|

||||||

|

Southern California Edison Co.

|

||||||||

|

1.125%, 05/01/2017

|

7,000

|

7,000

|

||||||

|

5.500%, 08/15/2018

|

45,000

|

47,316

|

||||||

|

3.875%, 06/01/2021

|

40,000

|

42,303

|

||||||

|

Wisconsin Electric Power Co.

|

||||||||

|

1.700%, 06/15/2018

|

25,000

|

25,037

|

||||||

|

Wisconsin Power & Light Co.

|

||||||||

|

5.000%, 07/15/2019

|

25,000

|

26,614

|

||||||

|

712,064

|

||||||||

|

TOTAL CORPORATE BONDS AND NOTES

|

||||||||

|

(Cost $134,393,533)

|

134,691,902

|

|||||||

|

COLLATERALIZED

|

||||||||

|

MORTGAGE OBLIGATIONS – 0.8%

|

||||||||

|

Federal Home Loan Mortgage

|

||||||||

|

Corporation REMICS – 0.3%

|

||||||||

|

Series 2542, Class ES

|

||||||||

|

5.000%, 12/15/2017

|

2,521

|

2,560

|

||||||

|

Series 2564, Class HJ

|

||||||||

|

5.000%, 02/15/2018

|

1,989

|

2,023

|

||||||

|

Series 2611, Class UH

|

||||||||

|

4.500%, 05/15/2018

|

4,490

|

4,548

|

||||||

|

Series 2617, Class GR

|

||||||||

|

4.500%, 05/15/2018

|

5,249

|

5,309

|

||||||

|

Series 2617, Class TK

|

||||||||

|

4.500%, 05/15/2018

|

9,067

|

9,183

|

||||||

|

Series 2627, Class MC

|

||||||||

|

4.500%, 06/15/2018

|

9,363

|

9,482

|

||||||

The accompanying notes are an integral part of these financial statements.

16

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Federal Home Loan Mortgage

|

||||||||

|

Corporation REMICS – 0.3% (Continued)

|

||||||||

|

Series 2649, Class KA

|

||||||||

|

4.500%, 07/15/2018

|

$

|

6,676

|

$

|

6,757

|

||||

|

Series 2693, Class PE

|

||||||||

|

4.500%, 10/15/2018

|

9,306

|

9,524

|

||||||

|

Series 2746, Class EG

|

||||||||

|

4.500%, 02/15/2019

|

10,475

|

10,722

|

||||||

|

Series 2814, Class GB

|

||||||||

|

5.000%, 06/15/2019

|

1,944

|

1,973

|

||||||

|

Series 2989, Class TG

|

||||||||

|

5.000%, 06/15/2025

|

35,112

|

37,595

|

||||||

|

Series 3002, Class YD

|

||||||||

|

4.500%, 07/15/2025

|

14,233

|

15,189

|

||||||

|

Series 2526, Class FI

|

||||||||

|

1.912%, 02/15/2032 (a)

|

68,684

|

70,406

|

||||||

|

Series 2881, Class AE

|

||||||||

|

5.000%, 08/15/2034

|

11,940

|

12,587

|

||||||

|

Series 2933, Class HD

|

||||||||

|

5.500%, 02/15/2035

|

20,615

|

22,637

|

||||||

|

Series 4305, Class KA

|

||||||||

|

3.000%, 03/15/2038

|

74,453

|

75,822

|

||||||

|

Series 3843, Class GH

|

||||||||

|

3.750%, 10/15/2039

|

51,228

|

53,357

|

||||||

|

Series 3786, Class NA

|

||||||||

|

4.500%, 07/15/2040

|

92,772

|

99,029

|

||||||

|

Series 4305, Class A

|

||||||||

|

3.500%, 06/15/2048

|

113,891

|

118,104

|

||||||

|

566,807

|

||||||||

|

Federal National Mortgage

|

||||||||

|

Association REMICS – 0.3%

|

||||||||

|

Series 2003-92, Class PE

|

||||||||

|

4.500%, 09/25/2018

|

8,342

|

8,543

|

||||||

|

Series 2003-80, Class YE

|

||||||||

|

4.000%, 06/25/2023

|

750

|

750

|

||||||

|

Series 2005-40, Class YG

|

||||||||

|

5.000%, 05/25/2025

|

30,737

|

32,929

|

||||||

The accompanying notes are an integral part of these financial statements.

17

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Federal National Mortgage

|

||||||||

|

Association REMICS – 0.3% (Continued)

|

||||||||

|

Series 2011-122, Class A

|

||||||||

|

3.000%, 12/25/2025

|

$

|

62,022

|

$

|

63,018

|

||||

|

Series 2007-27, Class MQ

|

||||||||

|

5.500%, 04/25/2027

|

8,800

|

9,765

|

||||||

|

Series 2005-16, Class PE

|

||||||||

|

5.000%, 03/25/2034

|

340

|

340

|

||||||

|

Series 2005-48, Class AR

|

||||||||

|

5.500%, 02/25/2035

|

16,866

|

17,570

|

||||||

|

Series 2005-62, Class CQ

|

||||||||

|

4.750%, 07/25/2035

|

7,645

|

7,953

|

||||||

|

Series 2005-64, Class PL

|

||||||||

|

5.500%, 07/25/2035

|

49,060

|

54,252

|

||||||

|

Series 2005-68, Class PG

|

||||||||

|

5.500%, 08/25/2035

|

34,726

|

38,517

|

||||||

|

Series 2005-83A, Class LA

|

||||||||

|

5.500%, 10/25/2035

|

19,915

|

22,001

|

||||||

|

Series 2006-57, Class AD

|

||||||||

|

5.750%, 06/25/2036

|

97,144

|

103,789

|

||||||

|

Series 2014-23, Class PA

|

||||||||

|

3.500%, 08/25/2036

|

108,145

|

112,362

|

||||||

|

Series 2007-39, Class NA

|

||||||||

|

4.250%, 01/25/2037

|

4,395

|

4,460

|

||||||

|

Series 2013-83, Class CA

|

||||||||

|

3.500%, 10/25/2037

|

89,794

|

93,287

|

||||||

|

Series 2009-47, Class PA

|

||||||||

|

4.500%, 07/25/2039

|

11,455

|

11,903

|

||||||

|

Series 2011-113, Class NE

|

||||||||

|

4.000%, 03/25/2040

|

32,837

|

33,400

|

||||||

|

614,839

|

||||||||

|

Government National Mortgage Association – 0.2%

|

||||||||

|

Series 2013-88, Class WA

|

||||||||

|

5.009%, 06/20/2030 (a)

|

64,215

|

68,731

|

||||||

|

Series 2002-22, Class GF

|

||||||||

|

6.500%, 03/20/2032

|

39,827

|

46,169

|

||||||

The accompanying notes are an integral part of these financial statements.

18

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Government National Mortgage

|

||||||||

|

Association – 0.2% (Continued)

|

||||||||

|

Series 2002-51, Class D

|

||||||||

|

6.000%, 07/20/2032

|

$

|

46,531

|

$

|

51,857

|

||||

|

Series 2008-50, Class NA

|

||||||||

|

5.500%, 03/16/2037

|

9,684

|

10,076

|

||||||

|

Series 2007-11, Class PE

|

||||||||

|

5.500%, 03/20/2037

|

24,663

|

27,647

|

||||||

|

Series 2013-113, Class UB

|

||||||||

|

3.000%, 11/20/2038

|

68,777

|

69,740

|

||||||

|

274,220

|

||||||||

|

TOTAL COLLATERALIZED

|

||||||||

|

MORTGAGE OBLIGATIONS

|

||||||||

|

(Cost $1,442,046)

|

1,455,866

|

|||||||

|

U.S. GOVERNMENT AGENCY OBLIGATIONS – 2.4%

|

||||||||

|

Federal Home Loan Bank – 1.2%

|

||||||||

|

0.875%, 03/19/2018

|

400,000

|

399,111

|

||||||

|

1.250%, 06/08/2018

|

340,000

|

340,322

|

||||||

|

2.000%, 09/14/2018

|

75,000

|

75,835

|

||||||

|

1.750%, 12/14/2018

|

595,000

|

600,018

|

||||||

|

1.250%, 01/16/2019

|

200,000

|

199,823

|

||||||

|

1.000%, 09/26/2019

|

300,000

|

296,804

|

||||||

|

1.875%, 11/29/2021

|

250,000

|

249,270

|

||||||

|

2,161,183

|

||||||||

|

Federal Home Loan Mortgage Corp. – 0.4%

|

||||||||

|

0.875%, 10/12/2018

|

125,000

|

124,330

|

||||||

|

1.500%, 01/17/2020

|

355,000

|

354,540

|

||||||

|

5.500%, 04/01/2021, Gold Pool #G11941

|

22,083

|

23,243

|

||||||

|

5.500%, 11/01/2021, Gold Pool #G12454

|

10,791

|

11,425

|

||||||

|

5.500%, 04/01/2023, Gold Pool #G13145

|

21,219

|

22,658

|

||||||

|

4.000%, 02/01/2026, Gold Pool #J14494

|

53,953

|

56,847

|

||||||

|

4.000%, 06/01/2026, Gold Pool #J15974

|

17,746

|

18,609

|

||||||

|

4.500%, 06/01/2029, Gold Pool #C91251

|

16,186

|

17,358

|

||||||

|

4.500%, 12/01/2029, Gold Pool #C91281

|

32,138

|

34,463

|

||||||

|

4.500%, 04/01/2030, Gold Pool #C91295

|

17,236

|

18,479

|

||||||

|

681,952

|

||||||||

The accompanying notes are an integral part of these financial statements.

19

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

Federal National Mortgage Association – 0.8%

|

||||||||

|

5.375%, 06/12/2017

|

$

|

550,000

|

$

|

554,800

|

||||

|

1.125%, 07/20/2018

|

390,000

|

389,786

|

||||||

|

1.375%, 10/07/2021

|

210,000

|

204,972

|

||||||

|

2.000%, 01/05/2022

|

150,000

|

150,169

|

||||||

|

6.000%, 09/01/2019, Pool #735439

|

963

|

987

|

||||||

|

5.500%, 06/01/2020, Pool #888601

|

2,827

|

2,900

|

||||||

|

5.000%, 05/01/2023, Pool #254762

|

13,585

|

14,836

|

||||||

|

5.500%, 01/01/2024, Pool #AD0471

|

11,339

|

12,009

|

||||||

|

5.000%, 12/01/2025, Pool #256045

|

27,584

|

30,126

|

||||||

|

5.500%, 05/01/2028, Pool #257204

|

23,073

|

25,624

|

||||||

|

4.000%, 08/01/2029, Pool #MA0142

|

27,665

|

29,231

|

||||||

|

5.500%, 04/01/2037, Pool #AD0249

|

32,809

|

36,763

|

||||||

|

7.000%, 04/01/2037, Pool #888366

|

8,850

|

10,379

|

||||||

|

5.000%, 10/01/2039, Pool #AC3237

|

67,768

|

74,954

|

||||||

|

1,537,536

|

||||||||

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS

|

||||||||

|

(Cost $4,375,362)

|

4,380,671

|

|||||||

|

U.S. TREASURY OBLIGATIONS – 21.1%

|

||||||||

|

U.S. Treasury Notes – 21.1%

|

||||||||

|

0.750%, 06/30/2017

|

500,000

|

499,895

|

||||||

|

0.625%, 09/30/2017

|

720,000

|

719,044

|

||||||

|

1.875%, 09/30/2017

|

1,350,000

|

1,356,342

|

||||||

|

0.750%, 10/31/2017

|

1,405,000

|

1,403,463

|

||||||

|

1.875%, 10/31/2017

|

790,000

|

794,120

|

||||||

|

0.625%, 11/30/2017

|

1,100,000

|

1,097,444

|

||||||

|

0.750%, 12/31/2017

|

2,000,000

|

1,996,094

|

||||||

|

0.750%, 01/31/2018

|

490,000

|

488,851

|

||||||

|

0.875%, 01/31/2018

|

920,000

|

918,782

|

||||||

|

0.750%, 02/28/2018

|

450,000

|

448,743

|

||||||

|

0.625%, 04/30/2018

|

2,140,000

|

2,129,050

|

||||||

|

1.000%, 05/31/2018

|

1,115,000

|

1,113,476

|

||||||

|

0.875%, 07/15/2018

|

505,000

|

503,304

|

||||||

|

1.375%, 07/31/2018

|

1,200,000

|

1,203,586

|

||||||

The accompanying notes are an integral part of these financial statements.

20

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

U.S. Treasury Notes – 21.1% (Continued)

|

||||||||

|

1.500%, 08/31/2018

|

$

|

430,000

|

$

|

431,965

|

||||

|

1.250%, 10/31/2018

|

1,915,000

|

1,916,645

|

||||||

|

1.250%, 11/30/2018

|

700,000

|

700,479

|

||||||

|

1.500%, 12/31/2018

|

460,000

|

462,192

|

||||||

|

1.250%, 01/31/2019

|

1,585,000

|

1,585,558

|

||||||

|

1.500%, 01/31/2019

|

1,150,000

|

1,155,436

|

||||||

|

1.375%, 02/28/2019

|

380,000

|

380,920

|

||||||

|

1.500%, 02/28/2019

|

355,000

|

356,692

|

||||||

|

1.625%, 03/31/2019

|

740,000

|

745,232

|

||||||

|

1.625%, 04/30/2019

|

1,695,000

|

1,706,785

|

||||||

|

0.875%, 05/15/2019

|

180,000

|

178,421

|

||||||

|

1.500%, 05/31/2019

|

1,395,000

|

1,400,912

|

||||||

|

1.000%, 06/30/2019

|

380,000

|

377,313

|

||||||

|

1.625%, 06/30/2019

|

200,000

|

201,305

|

||||||

|

0.875%, 07/31/2019

|

755,000

|

747,007

|

||||||

|

1.625%, 07/31/2019

|

180,000

|

181,146

|

||||||

|

1.000%, 08/31/2019

|

815,000

|

807,789

|

||||||

|

1.000%, 09/30/2019

|

740,000

|

732,889

|

||||||

|

1.750%, 09/30/2019

|

300,000

|

302,660

|

||||||

|

1.500%, 10/31/2019

|

200,000

|

200,398

|

||||||

|

1.500%, 11/30/2019

|

410,000

|

410,681

|

||||||

|

1.125%, 12/31/2019

|

640,000

|

634,500

|

||||||

|

1.625%, 12/31/2019

|

220,000

|

221,005

|

||||||

|

1.250%, 01/31/2020

|

850,000

|

844,571

|

||||||

|

1.375%, 01/31/2020

|

250,000

|

249,346

|

||||||

|

1.375%, 02/29/2020

|

380,000

|

378,560

|

||||||

|

1.125%, 03/31/2020

|

300,000

|

296,555

|

||||||

|

1.375%, 04/30/2020

|

1,520,000

|

1,511,926

|

||||||

|

1.500%, 05/31/2020

|

1,460,000

|

1,456,379

|

||||||

|

1.625%, 06/30/2020

|

220,000

|

220,198

|

||||||

|

1.875%, 06/30/2020

|

200,000

|

201,832

|

||||||

|

2.000%, 07/31/2020

|

150,000

|

151,890

|

||||||

|

1.375%, 08/31/2020

|

455,000

|

450,823

|

||||||

|

1.375%, 09/30/2020

|

350,000

|

346,521

|

||||||

|

1.750%, 10/31/2020

|

250,000

|

250,591

|

||||||

|

2.000%, 11/30/2020

|

390,000

|

394,037

|

||||||

|

2.250%, 07/31/2018

|

180,000

|

182,612

|

||||||

The accompanying notes are an integral part of these financial statements.

21

Pemberwick Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at March 31, 2017

|

|

Par

|

||||||||

|

Value

|

Value

|

|||||||

|

U.S. Treasury Notes – 21.1% (Continued)

|

||||||||

|

1.375%, 01/31/2021

|

$

|

590,000

|

$

|

581,761

|

||||

|

2.125%, 01/31/2021

|

345,000

|

349,764

|

||||||

|

1.250%, 03/31/2021

|

350,000

|

342,774

|

||||||

|

1.375%, 05/31/2021

|

180,000

|

176,804

|

||||||

|

TOTAL U.S. TREASURY OBLIGATIONS

|

||||||||

|

(Cost $38,998,705)

|

38,897,068

|

|||||||

|

SHORT-TERM INVESTMENTS – 2.2%

|

Shares

|

|||||||

|

Fidelity Government Portfolio – Class I, 0.56% (d)

|

4,055,803

|

4,055,803

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

||||||||

|

(Cost $4,055,803)

|

4,055,803

|

|||||||

|

TOTAL INVESTMENTS

|

||||||||

|

(Cost $183,265,449) – 99.7%

|

183,481,310

|

|||||||

|

Other Assets in Excess of Liabilities – 0.3%

|

617,158

|

|||||||

|

TOTAL NET ASSETS – 100.0%

|

$

|

184,098,468

|

||||||

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

REMICS – Real Estate Mortgage Investment Conduits

|

(a)

|

Variable or Floating Rate Security. The rate shown represents the rate at March 31, 2017.

|

|

(b)

|

Security is a perpetual bond and has no definite maturity date.

|

|

(c)

|

Multi-Step Coupon. Rate disclosed is as of March 31, 2017.

|

|

(d)

|

The rate shown represents the Fund’s 7-day yield as of March 31, 2017.

|

|

(e)

|

Restricted security as defined in Rule 144(a) under the Securities Act of 1933 and determined to be liquid. Purchased in private placement transaction; resale to the public may require registration or may extend only to qualified institutional buyers. At March 31, 2017, the market value of these securities total $2,998,415 which represents 1.6% of total net assets.

|

|

(f)

|

U.S. traded security of a foreign issuer or corporation.

|

|

(g)

|

Investment in affiliated security. Quasar Distributors, LLC, which serves as the Fund’s distributor, is a subsidiary of U.S. Bancorp. Details of transactions with this affiliated company for the eleven months ended March 31, 2017 were as follows:

|

|

Change in

|

Net

|

|||||||||||||||||||||||||||||||

|

Unrealized

|

Realized

|

|||||||||||||||||||||||||||||||

|

4/30/2016

|

Amorti-

|

Appreciation

|

Gains

|

Market

|

Interest

|

|||||||||||||||||||||||||||

|

Issuer

|

Value

|

Purchases

|

Sales

|

zation

|

(Depreciation)

|

(Losses)

|

Value

|

Income

|

||||||||||||||||||||||||

|

U.S. Bancorp1

|

$

|

—

|

$

|

76,327

|

$

|

0

|

$

|

(233

|

)

|

$

|

(479

|

)

|

$

|

0

|

$

|

75,615

|

$

|

707

|

||||||||||||||

|

U.S. Bank, N.A.2

|

$

|

2,377,394

|

$

|

0

|

$

|

0

|

$

|

(239

|

)

|

$

|

(11,746

|

)

|

$

|

0

|

$

|

2,365,409

|

$

|

29,364

|

||||||||||||||

|

$

|

(472

|

)

|

$

|

(12,225

|

)

|

$

|

2,441,024

|

$

|

30,071

|

|||||||||||||||||||||||

|

1

|

Par values were $0 and $75,000 at 4/30/16 and 3/31/17, respectively.

|

|

2

|

Par values were $2,368,000 and $2,368,000 at 4/30/16 and 3/31/17, respectively.

|

The accompanying notes are an integral part of these financial statements.

22

Pemberwick Fund

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

at March 31, 2017

|

|

Assets:

|

||||

|

Investments in unaffiliated securities, at value (cost of $180,821,141)

|

$

|

181,040,286

|

||

|

Investments in affiliated securities, at value (cost of $2,444,308)

|

2,441,024

|

|||

|

Total investments, at value (cost of $183,265,449)

|

183,481,310

|

|||

|

Receivables:

|

||||

|

Dividends and interest

|

698,542

|

|||

|

Advisor

|

3,996

|

|||

|

Prepaid expenses and other assets

|

2,570

|

|||

|

Total assets

|

184,186,418

|

|||

|

Liabilities:

|

||||

|

Payables:

|

||||

|

Advisory fee

|

21,677

|

|||

|

Administration and accounting fees

|

26,683

|

|||

|

Reports to shareholders

|

2,387

|

|||

|

Custody fees

|

3,180

|

|||

|

Transfer agent fees and expenses

|

6,755

|

|||

|

Other accrued expenses

|

27,268

|

|||

|

Total liabilities

|

87,950

|

|||

|

Net assets

|

$

|

184,098,468

|

||

|

Net assets consist of:

|

||||

|

Capital stock

|

$

|

184,537,909

|

||

|

Accumulated net realized loss on investments

|

(655,302

|

)

|

||

|

Net unrealized appreciation on investments

|

215,861

|

|||

|

Net assets

|

$

|

184,098,468

|

||

|

Shares issued (Unlimited number of beneficial

|

||||

|

interest authorized, $0.01 par value)

|

18,361,154

|

|||

|

Net asset value, offering price and redemption price per share

|

$

|

10.03

|

||

The accompanying notes are an integral part of these financial statements.

23

Pemberwick Fund

|

STATEMENTS OF OPERATIONS

|

|

Eleven

|

||||||||

|

Months Ended

|

Year Ended

|

|||||||

|

March 31, 2017*

|

April 30, 2016

|

|||||||

|

Investment income:

|

||||||||

|

Interest income from unaffiliated securities

|

$

|

2,019,264

|

$

|

2,154,650

|

||||

|

Interest income from affiliated securities

|

30,071

|

—

|

||||||

|

Total investment income

|

2,049,335

|

2,154,650

|

||||||

|

Expenses:

|

||||||||

|

Advisory fees (Note 4)

|

639,059

|

821,157

|

||||||

|

Administration and accounting fees (Note 4)

|

185,943

|

198,425

|

||||||

|

Transfer agent fees and expenses

|

46,844

|

49,971

|

||||||

|

Federal and state registration fees

|

5,682

|

1,854

|

||||||

|

Audit fees

|

26,855

|

29,426

|

||||||

|

Compliance expense

|

34,038

|

22,900

|

||||||

|

Legal fees

|

24,815

|

26,597

|

||||||

|

Reports to shareholders

|

15,601

|

22,271

|

||||||

|

Trustees’ fees and expenses

|

15,855

|

7,329

|

||||||

|

Custody fees

|

17,256

|

24,989

|

||||||

|

Other

|

10,141

|

11,657

|

||||||

|

Total expenses before reimbursement from advisor

|

1,022,089

|

1,216,576

|

||||||

|

Expense waived (Note 4)

|

(408,525

|

)

|

(574,850

|

)

|

||||

|

Net expenses

|

613,564

|

641,726

|

||||||

|

Net investment income

|

1,435,771

|

1,512,924

|

||||||

|

Realized and unrealized gain (loss) on investments:

|

||||||||

|

Net realized gain on unaffiliated investments

|

$

|

61,360

|

$

|

355,030

|

||||

|

Net change in unrealized appreciation

|

||||||||

|

(depreciation) on unaffiliated investments

|

(391,147

|

)

|

(586,839

|

)

|

||||

|

Net change in unrealized appreciation

|

||||||||

|

(depreciation) on affiliated investments

|

(12,225

|

)

|

—

|

|||||

|

Net realized and unrealized loss on investments

|

(342,012

|

)

|

(231,809

|

)

|

||||

|

Net increase in net assets resulting from operations

|

$

|

1,093,759

|

$

|

1,281,115

|

||||

* Fund changed its fiscal year from April 30 to March 31.

The accompanying notes are an integral part of these financial statements.

24

Pemberwick Fund

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Eleven

|

||||||||||||

|

Months Ended

|

Year Ended

|

Year Ended

|

||||||||||

|

March 31, 2017*

|

April 30, 2016

|

April 30, 2015

|

||||||||||

|

Operations:

|

||||||||||||

|

Net investment income

|

$

|

1,435,771

|

$

|

1,512,924

|

$

|

1,567,887

|

||||||

|

Net realized gain on investments

|

61,360

|

355,030

|

100,557

|

|||||||||

|

Net change in unrealized appreciation

|

||||||||||||

|

(depreciation) on investments

|

(403,372

|

)

|

(586,839

|

)

|

(346,071

|

)

|

||||||

|

Net increase in net assets

|

||||||||||||

|

resulting from operations

|

1,093,759

|

1,281,115

|

1,322,373

|

|||||||||

|

Distributions to Shareholders From:

|

||||||||||||

|

Net investment income

|

(1,482,522

|

)

|

(1,543,193

|

)

|

(1,629,122

|

)

|

||||||

|

Total distributions

|

(1,482,522

|

)

|

(1,543,193

|

)

|

(1,629,122

|

)

|

||||||

|

Capital Share Transactions:

|

||||||||||||

|

Proceeds from shares sold

|

52,333,765

|

51,730,683

|

63,908,851

|

|||||||||

|

Proceeds from shares issued to holders

|

||||||||||||

|

in reinvestment of dividends

|

1,483,418

|

1,542,964

|

1,622,818

|

|||||||||

|

Cost of shares redeemed

|

(47,137,981

|

)

|

(45,183,230

|

)

|

(63,133,072

|

)

|

||||||

|

Net increase in net assets from

|

||||||||||||

|

capital share transactions

|

6,679,202

|

8,090,417

|

2,398,597

|

|||||||||

|

Total increase in net assets

|

6,290,439

|

7,828,339

|

2,091,848

|

|||||||||

|

Net Assets:

|

||||||||||||

|

Beginning of period

|

177,808,029

|

169,979,690

|

167,887,842

|

|||||||||

|

End of period

|

$

|

184,098,468

|

$

|

177,808,029

|

$

|

169,979,690

|

||||||

|

Accumulated net investment income (loss)

|

$

|

—

|

$

|

17,190

|

$

|

(573

|

)

|

|||||

|

Changes in Shares Outstanding:

|

||||||||||||

|

Shares sold

|

5,214,316

|

5,157,961

|

6,348,311

|

|||||||||

|

Proceeds from shares issued to holders

|

||||||||||||

|

in reinvestment of dividends

|

147,694

|

153,755

|

161,124

|

|||||||||

|

Shares redeemed

|

(4,694,355

|

)

|

(4,506,685

|

)

|

(6,271,648

|

)

|

||||||

|

Net increase in shares outstanding

|

667,655

|

805,031

|

237,787

|

|||||||||

* Fund changed its fiscal year from April 30 to March 31.

The accompanying notes are an integral part of these financial statements.

25

Pemberwick Fund

|

FINANCIAL HIGHLIGHTS

|

|

For a capital share outstanding throughout each period

|

|

Eleven

|

||||||||||||||||||||||||

|

Months

|

||||||||||||||||||||||||

|

Ended

|

||||||||||||||||||||||||

|

March 31,

|

Year Ended April 30,

|

|||||||||||||||||||||||

|

2017*

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||||

|

Net Asset Value –

|

||||||||||||||||||||||||

|

Beginning of Period

|

$

|

10.05

|

$

|

10.06

|

$

|

10.08

|

$

|

10.12

|

$

|

10.03

|

$

|

10.16

|

||||||||||||

|

Income from

|

||||||||||||||||||||||||

|

Investment Operations:

|

||||||||||||||||||||||||

|

Net investment income