UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For the fiscal year ended

OR

For the transition period from __________to__________

OR

Date of event requiring this shell company report ___________

Commission file number

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

| Name of each exchange on which registered |

Not Applicable |

| Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ YES ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ YES ☒

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “accelerated filer”, “large accelerated filer”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ | Accelerated filer ☐ |

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

2

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

|

| Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ YES ☐ NO

3

Explanatory Note

Except as described above, this Amendment No. 1 does not, and does not purport to, amend, modify, update or restate any information set forth in the Original 20-F, and the Company has not updated disclosures included therein to reflect any events that occurred subsequent to May 31, 2023.

4

TABLE OF CONTENTS

5 | |

|

|

8 | |

|

|

8 | |

|

|

10 | |

|

|

Item 1 Identity of Directors, Senior Management and Advisers | 10 |

10 | |

10 | |

17 | |

44 | |

44 | |

48 | |

54 | |

55 | |

56 | |

56 | |

Item 11 Quantitative and Qualitative Disclosures About Market Risk | 62 |

Item 12 Description of Securities Other than Equity Securities | 63 |

|

|

64 | |

|

|

64 | |

Item 14 Material Modifications to the Rights of Security Holders and Use of Proceeds. | 64 |

64 | |

65 | |

|

|

67 | |

|

|

67 | |

67 | |

68 | |

|

|

69 |

5

GLOSSARY OF TECHNICAL TERMS

Term |

| Meaning |

| Term |

| Meaning |

AEM |

| Airborne Electromagnetic |

| Na |

| sodium |

Ag |

| Silver |

| Na2O |

| sodium oxide |

Al |

| Aluminum |

| NE |

| northeast |

Al2O3 |

| aluminum oxide |

| NI |

| National Instrument |

AW |

| apparent width |

| Ni |

| nickel |

As |

| Arsenic |

| NSR |

| net smelter return |

Au |

| Gold |

| NTS |

| National Topographic System |

Ba |

| Barium |

| P |

| phosphorous |

Be |

| Beryllium |

| P2O5 |

| phosphorous oxide |

Bi |

| Bismuth |

| Pb |

| Lead |

C |

| carbon dioxide |

| Pd |

| Palladium |

Ca |

| Calcium |

| pH |

| Acidity |

CaO |

| calcium oxide |

| Pt |

| platinum |

Cd |

| Cadmium |

| QA/QC |

| Quality Assurance/Quality Control |

Co |

| Cobalt |

| S |

| south |

CO2 |

| carbon dioxide |

| S |

| sulfur |

Cr |

| Chromium |

| Sb |

| antimony |

Cr2O3 |

| chromium oxide |

| SE |

| southeast |

Cu |

| Copper |

| Se |

| selenium |

DDH |

| diamond drill hole |

| SiO2 |

| silicon oxide |

DW |

| drilled width |

| Sn |

| tin |

E |

| East |

| SO2 |

| sulphur dioxide |

EM |

| electromagnetic |

| Sr |

| strontium |

Fe |

| Iron |

| Sum |

| summation |

Fe2O3 |

| iron oxide (ferric oxide-hematite) |

| SW |

| southwest |

Fe3O4 |

| iron oxide (ferrous oxide-magnetite) |

| Ti |

| titanium |

HLEM |

| horizontal loop electromagnetic |

| TiO2 |

| titanium oxide |

H2O |

| hydrogen oxide (water) |

| Tl |

| thallium |

IP |

| induced polarization |

| TW |

| true width |

K |

| Potassium |

| U |

| uranium |

K2O |

| potassium oxide |

| U3O8 |

| uranium oxide (yellowcake) |

Li |

| Lithium |

| UTM |

| Universal Transverse Mercator |

LOI |

| loss on ignition (total H2O, CO2 and SO2 content) |

| V |

| vanadium |

Mg |

| Magnesium |

| V2O5 |

| vanadium oxide |

MgO |

| magnesium oxide |

| VLF |

| very low frequency |

Mn |

| Manganese |

| VLF-EM |

| very low frequency-electromagnetic |

MnO |

| manganese oxide |

| W |

| west |

Mo |

| Molybdenum |

| Y |

| yttrium |

Mt |

| millions of tonnes |

| Zn |

| zinc |

N |

| North |

|

|

|

|

NE |

| Northeast |

|

|

|

|

NW |

| Northwest |

|

|

|

|

S |

| South |

|

|

|

|

6

Units of Measure

Units of Measure |

| Abbreviation |

| Units of Measure |

| Abbreviation |

Above mean sea level |

| amsl |

| Litre |

| L |

Ampere |

| A |

| Litres per minute |

| L/m |

Annum (year) |

| a |

| Megabytes per second |

| Mb/s |

Billion years ago |

| Ga |

| Megapascal |

| MPa |

British thermal unit |

| Btu |

| Megavolt-ampere |

| MVA |

Candela |

| cd |

| Megawatt |

| MW |

Carat |

| ct |

| Metre |

| m |

Carats per hundred tonnes |

| cpht |

| Metres above sea level |

| masl |

Carats per tonne |

| cpt |

| Metres per minute |

| m/min |

Centimetre |

| cm |

| Metres per second |

| m/s |

Cubic centimetre |

| cm3 |

| Metric ton (tonne) |

| t |

Cubic feet per second |

| ft3/s or cfs |

| Micrometre (micron) |

| μm |

Cubic foot |

| ft3 |

| Microsiemens (electrical) |

| μs |

Cubic inch |

| in3 |

| Miles per hour |

| mph |

Cubic metre |

| m3 |

| Milliamperes |

| mA |

Cubic yard |

| yd3 |

| Milligram |

| mg |

Day |

| d |

| Milligrams per litre |

| mg/L |

Days per week |

| d/wk |

| Millilitre |

| mL |

Days per year (annum) |

| d/a |

| Millimetre |

| mm |

Dead weight tonnes |

| DWT |

| Million |

| M |

Decibel adjusted |

| dBa |

| Million tonnes |

| Mt |

Decibel |

| dB |

| Minute (plane angle) |

| ‘ |

Degree |

| ° |

| Minute (time) |

| min |

Degrees Celsius |

| °C |

| Month |

| mo |

Degrees Fahrenheit |

| °F |

| Newton |

| N |

Diameter |

| ø |

| Newtons per metre |

| N/m |

Dry metric ton |

| dmt |

| Ohm (electrical) |

| Ω |

Foot |

| ft |

| Ounce |

| oz |

Gallon |

| gal |

| Parts per billion |

| ppb |

Gallons per minute (US) |

| gpm |

| Parts per million |

| ppm |

Gigajoule |

| GJ |

| Pascal |

| Pa |

Gram |

| g |

| Pascals per second |

| Pa/s |

Grams per litre |

| g/L |

| Percent |

| % |

Grams per tonne |

| g/t |

| Percent moisture (relative humidity) |

| % RH |

Greater than |

| > |

| Phase (electrical) |

| Ph |

Hectare (10,000 m2) |

| ha |

| Pound(s) |

| lb |

Hertz |

| Hz |

| Pounds per square inch |

| psi |

Horsepower |

| hp |

| Power factor |

| pF |

Hour |

| h (not hr) |

| Quart |

| qt |

Hours per day |

| h/d |

| Revolutions per minute |

| rpm |

Hours per week |

| h/wk |

| Second (plane angle) |

| “ |

Hours per year |

| h/a |

| Second (time) |

| s |

Inch |

| “(symbol, not “) |

| Short ton (2,000 lb) |

| st |

Joule |

| J |

| Short ton (US) |

| t |

Joules per kilowatt-hour |

| J/kWh |

| Short tons per day (US) |

| tpd |

Kelvin |

| K |

| Short tons per hour (US) |

| tph |

Kilo (thousand) |

| k |

| Short tons per year (US) |

| tpy |

Kilocalorie |

| kcal |

| Specific gravity (g/cm3) |

| SG |

Kilogram |

| kg |

| Square centimetre |

| cm2 |

7

Units of Measure |

| Abbreviation |

| Units of Measure |

| Abbreviation |

Kilograms per cubic metre |

| kg/m3 |

| Square foot |

| ft2 |

Kilograms per hour |

| kg/h |

| Square inch |

| in2 |

Kilograms per square metre |

| kg/m2 |

| Square kilometre |

| km2 |

Kilojoule |

| kJ |

| Square metre |

| m2 |

Kilometre |

| km |

| Thousand tonnes |

| kt |

Kilometres per hour |

| km/h |

| Tonne (1,000kg) |

| t |

Kilonewton |

| kN |

| Tonnes per day |

| t/d |

Kilopascal |

| kPa |

| Tonnes per hour |

| t/h |

Kilovolt |

| kV |

| Tonnes per year |

| t/a |

Kilovolt-ampere |

| kVA |

| Total dissolved solids |

| TDS |

Kilovolts |

| kV |

| Total suspended solids |

| TSS |

Kilowatt |

| kW |

| Volt |

| V |

Kilowatt hour |

| kWh |

| Week |

| wk |

Kilowatt hours per short ton (US) |

| kWh/st |

| Weight/weight |

| w/w |

Kilowatt hours per tonne (metric ton) |

| kWh/t |

| Wet metric ton |

| wmt |

Kilowatt hours per year |

| kWh/a |

| Yard |

| yd |

Kilowatts adjusted for motor efficiency |

| kWe |

| Year (annum) |

| a |

Less than |

| < |

| Year |

| yr |

The term grams/tonne (g/t) is expressed as “grams per tonne” where 1 gram/tonne = 1 ppm (parts per million) = 1000 ppb (parts per billion). Other abbreviations include oz/t = ounce per short ton; Moz = million ounces; Mt = million tonnes; t = tonne (1000 kilograms); SG = specific gravity; lb/t = pound/ton; and st = short ton (2000 pounds).

8

FORWARD-LOOKING STATEMENTS

Except for statements of historical fact relating to the Company, certain statements in this Annual Report, including the documents incorporated by reference herein, may constitute forward-looking information, future oriented financial information, or financial outlooks (collectively, “forward-looking information”) within the meaning of Canadian securities laws. Forward-looking information may relate to this Annual Report, the Company’s future outlook and anticipated events or results and, in some cases, can be identified by terminology such as “may”, “could”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “projects”, “predict”, “potential”, “targeted”, “possible”, “continue” or other similar expressions concerning matters that are not historical facts and include, but are not limited in any manner to, those with respect to commodity prices, mineral resources, mineral reserves, realization of mineral reserves, existence or realization of mineral resource estimates, the timing and amount of future production, the timing of construction of any proposed mine and process facilities, capital and operating expenditures, the timing of receipt of permits, rights and authorizations, and any and all other timing, development, operational, financial, economic, legal, regulatory and political factors that may influence future events or conditions, as such matters may be applicable. In particular, this Annual Report contains forward-looking statements pertaining to the following:

·expenditures for general and administrative expenses;

·expectations regarding revenue, expenses and operations;

·the Company having sufficient working capital and being able to secure additional funding necessary for the continued exploration of the Company’s mineral interests;

·expectations regarding the potential mineralization, geological merit and economic feasibility of the Company’s projects;

·expectations regarding drill programs and potential impacts thereof;

·mineral exploration and exploration program cost estimates;

·expectations regarding any environmental issues that may affect planned or future exploration programs and the potential impact of complying with existing and proposed environmental laws and regulations;

·treatment under applicable governmental regimes for permitting and approvals; and

·key personnel continuing their employment with the Company. See “Risk Factors”.

Such forward-looking statements are based on a number of material factors and assumptions, and include the ultimate determination of mineral reserves, if any, the availability and final receipt of required approvals, licenses and permits, sufficient working capital to develop and operate any proposed mine, access to adequate services and supplies, economic conditions, commodity prices, foreign currency exchange rates, interest rates, access to capital and debt markets and associated costs of funds, availability of a qualified work force, and the ultimate ability to mine, process and sell mineral products on economically favorable terms. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. Actual results may vary from such forward-looking information for a variety of reasons, including but not limited to risks and uncertainties disclosed in this Annual Report. Forward-looking statements are based upon management’s beliefs, estimates and opinions on the date the statements are made and, other than as required by law, the Company does not intend, and undertakes no obligation to update any forward-looking information to reflect, among other things, new information or future events.

Investors are cautioned against placing undue reliance on forward-looking statements.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

Unless otherwise indicated, all mineral resource estimates included in this Annual Report on Form 20-F have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”), and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits the disclosure of a historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 using the historical terminology if the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) states whether the historical estimate uses categories other than those prescribed by NI 43-101 and, if so, includes an explanation of the differences; and (d) includes any more recent estimates or data available.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission (the “SEC”), and reserve and resource information contained in this Annual Report on Form 20-F may

9

not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by our company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

Foreign Private Issuer Filings

We are considered a “foreign private issuer” pursuant to Rule 405 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In our capacity as a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our common shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information.

For as long as we are a “foreign private issuer” we intend to file our annual financial statements on Form 20-F and furnish our quarterly financial statements on Form 6-K to the SEC for so long as we are subject to the reporting requirements of Section 13(g) or15(d) of the Exchange Act. However, the information we file or furnish will not be the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a domestic issuer. We will continue to file our Forms 20-F or 6-K until we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by United States residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are United States citizens or residents; (2) more than 50% of our assets are located in the United States; or (3) our business is administered principally in the United States. If we lose our “foreign private issuer status” we will be required to comply with Exchange Act reporting and other requirements applicable to U.S. domestic issuers, which are more detailed and extensive than the requirement for “foreign private issuers”.

10

PART I

FINANCIAL INFORMATION AND ACCOUNTING PRINCIPLES

The financial statements and summaries of financial information contained in this Annual Report on Form 20-F are reported in Canadian dollars (“$”) unless otherwise stated. A “tonne” is one metric ton or 2,204.6 pounds.

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

General

The Company is in the business of exploring and, if warranted, developing mineral properties, which is a highly speculative endeavor. A purchase of any of the Common Shares involves a high degree of risk and should be undertaken only by purchasers whose financial resources are sufficient to enable them to assume such risks and who have no need for immediate liquidity in their investment. An investment in the Common Shares should not constitute a significant portion of an individual’s investment portfolio and should be made only by persons who can afford a total loss of their investment. Prospective shareholders should evaluate carefully the following risk factors associated with an investment in the Common Shares.

The following risks and uncertainties could materially adversely affect the Company’s business, financial condition and results of operations. Additional risks and uncertainties not presently known to management of the Company or that are currently deemed immaterial may also impair the Company’s operations and financial condition.

Risks Relating to our Conversion and Continuation

We continue to be treated as a U.S. corporation and taxed on our worldwide income after the conversion and continuation.

The conversion and continuation of our company from the State of Nevada to the Province of British Columbia, Canada is considered a migration of our company from the State of Nevada to the Province of British Columbia, Canada. Certain transactions whereby a U.S. corporation migrates to a foreign jurisdiction can be considered by the United States Congress to be an abuse of the U.S. tax rules because thereafter the foreign entity is not subject to U.S. tax on its worldwide income. Section 7874(b) of the Internal Revenue Code of 1986, as amended (the “Code”), was enacted in 2004 to address this potential abuse. Section 7874(b) of the Code provides generally that certain corporations that migrate from the United States will nonetheless remain subject to U.S. tax on their worldwide income unless the migrating entity has substantial business activities in the foreign country to which it is migrating when compared to its total business activities.

11

We have determined that Section 7874(b) of the Code applies to the migration of our company from the State of Nevada to the Province of British Columbia, Canada, and therefore we continue to be subject to United States federal income taxation on our worldwide income.

We may be classified as a Passive Foreign Investment Company as a result of the merger and continuation.

Sections 1291 to 1298 of the Code contain the Passive Foreign Investment Company (“PFIC”) rules. These rules generally provide for punitive treatment of “U.S. holders” of PFICs. A foreign corporation is classified as a PFIC if more than 75% of its gross income is passive income or more than 50% of its assets produce passive income or are held for the production of passive income.

Because most of our assets after the conversion and continuation are in cash or cash equivalents and shares of our wholly-owned subsidiary, Minera Polymet SpA, we may in the future be classified as a PFIC. If we are classified as a PFIC, then the holders of shares of our company who are U.S. taxpayers may be subject to PFIC provisions which may impose U.S. taxes, in addition to those normally applicable, on the sale of their shares of our company or on distribution from our company.

Holders of shares of the Company who are U.S. taxpayers should consult their own tax advisors with respect to the application of the PFIC rules in their particular circumstances.

Negative Operating Cash Flow

During the years ended January 31, 2023, 2022, and 2021 the Company earned no revenue while the net loss from operations totaled $1,769,501, $1,622,000, and $210,654, respectively. If the Company does not find sources of financing as and when needed, it may be required to cease its operations.

Mineral exploration and development are very expensive. During the fiscal year ended January 31, 2023, the Company had no revenue from its operations and its operating expenses totaled $1,582,113 (2022 - $1,520,118; 2021 - $357,570). These expenses were further increased by $162,724 (2022 - $118,144; 2021 - $105,766) in interest we accrued on our notes payable and $24,664 loss on foreign exchange fluctuation (2022 - $2,404 gain; 2021 - $2,811 loss). During the years ended January 31, 2022 and 2021, these expenses were in part offset by $13,858 and $255,493 gain we recorded on forgiveness of debt, respectively. Since inception, we have supported our operations through equity and debt financing and, to a minor extent, through option payments received on our option or joint venture agreements, and royalty payments from third-party vendors, who we allowed to mine our claims. Our ability to continue our operations, including exploring and developing our properties, will depend on our ability to generate operating revenue, obtain additional financing, or enter into joint venture agreements. Until we earn enough revenue to support our operations, which may never happen, we will continue to be dependent on loans and sales of our equity or debt securities to continue our development and exploration activities. If we do not find sources of financing as and when we need them, we may be required to severely curtail, or even to cease, our operations.

Insufficient Capital

The Company was incorporated on January 10, 2005, and to date has been involved primarily in organizational activities, acquiring and exploring mineral claims and obtaining financing. The Company’s financial statements have been prepared assuming that it will continue as a going concern. From the Company’s inception on January 10, 2005, the Company has accumulated losses of $13,914,265. As a result, the Company’s management has expressed substantial doubt about the Company’s ability to continue as a going concern. The continuation of the Company’s operations depends on its ability to complete equity or debt financings as needed or generate capital from profitable operations. Such financings may not be available or may not be available on reasonable terms. The Company’s financial statements do not include any adjustments that could result from the outcome of this uncertainty. Whether the Company will be successful as a mining company must be considered in light of the costs, difficulties, complications and delays associated with its proposed exploration programs. These potential problems include, but are not limited to, finding claims with mineral deposits that can be cost-effectively mined, the costs associated with acquiring such properties and the unavailability of human or equipment resources. The Company cannot provide assurance it will ever generate significant revenue from its operations or realize a profit. The Company expects to continue to incur operating losses during the next 12 months.

12

Debt Owing to Related Parties

As of January 31, 2023, the Company owed $443,071 to related parties that were due in the next 12-month period for the services and reimbursable expenses they have provided; in addition, the Company owed its related parties $2,202,540 on account of notes payable that became due and payable on January 31, 2023. The Company does not have the cash resources to pay its debt to related parties; therefore it may decide to partially pay these individuals by issuing shares of the Company’s common stock. Because of the low market value of the Company’s common stock, the issuance of shares will result in substantial dilution to the percentage of the outstanding common stock owned by current shareholders.

Financing Risks

The Company has no history of significant earnings and, due to the nature of its business, there can be no assurance that the Company will be profitable. The Company has paid no dividends on its shares since incorporation and does not anticipate doing so in the foreseeable future. The only present source of funds available to the Company is through the sale of its securities. Even if the results of any future exploration are encouraging, the Company may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists on the Properties. While the Company may generate additional working capital through equity offerings or through the sale or possible syndication of the Properties, there is no assurance that any such funds will be available. If available, future equity financing may result in substantial dilution to shareholders

Speculative Nature of Mineral Exploration

Resource exploration is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

There is no assurance that the Company’s mineral exploration and development activities will result in any discoveries of commercial bodies of ore. The long-term profitability of the Company’s operations will, in part, be directly related to the costs and success of its exploration programs, which may be affected by a number of factors. Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis.

No Known Mineral Reserves

It is unknown whether the Properties contain viable mineral reserves. If the Company does not find a viable mineral reserve, or if it cannot exploit the mineral reserve, either because the Company does not have the money to do it or because it will not be economically feasible to do so, the Company may have to cease operations and you may lose your investment. Mineral exploration is a highly speculative endeavor. It involves many risks and is often non-productive. Even if mineral reserves are discovered on the Properties, the Company’s production capabilities will be subject to further risks and uncertainties including:

·Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which the Company has not budgeted for;

·Availability and costs of financing;

·Ongoing costs of production; and

·Environmental compliance regulations and restraints.

13

Market Factors May Affect Ability to Market Any Minerals Found

Even if the Company discovers minerals that can be extracted in a cost-effective manner, it may not be able to find a ready market for its minerals. Many factors beyond the Company’s control affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting minerals and environmental protection. The Company cannot accurately predict the effect of these factors, but any combination of these factors could result in an inadequate return on invested capital.

Mineral Exploration is Hazardous

The search for minerals is hazardous. In the course of exploration, development and production of mineral properties, the Company could incur liability or damages as it conducts its business due to the dangers inherent in mineral exploration, including pollution, cave-ins, fires, flooding, earthquakes and other hazards. It is not always possible to fully insure against such risks or against which the Company may elect not to insure. The Company has no insurance for these types of hazards, nor does it expect to obtain such insurance for the foreseeable future. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the securities of the Company.

Government Regulations

The mining business is subject to various levels of government control and regulation, which are supplemented and revised from time to time. The Company cannot predict what legislation or revisions might be proposed that could affect its business or when any such proposals, if enacted, might become effective. The Company’s exploration activities are subject to laws and regulations governing worker safety, and, if it explores within the national park that is part of its Farellón property, protection of endangered and other special status species as well as protection of significant archeological remains, if there are any, will likely require compliance with additional laws and regulations. The cost of complying with these regulations has not been burdensome to date, but if the Company mines the Properties and processes more than 5,000 tonnes of ore monthly, it will be required to submit an environmental impact study for review and approval by the federal environmental agency. The Company anticipates that the cost of such a study will be significant and, if the study were to show too great an adverse impact on the environment, the Company might be unable to develop the property or it might have to engage in expensive remedial measures during or after developing the property, which could make production unprofitable. This requirement could materially adversely affect the Company’s business, the results of its operations and its financial condition if it were to proceed to mine a property or process ore on the property. The Company has no immediate or intermediate plans to process ore on any of the Properties.

If the Company does not comply with applicable environmental and health and safety laws and regulations, it could be fined, enjoined from continuing its operations, and suffer other penalties. Although the Company makes every attempt to comply with these laws and regulations, it cannot provide assurance that it has fully complied or will always fully comply with them.

Environmental and Safety Regulations and Risks

Environmental laws and regulations may affect the operations of the Company. These laws and regulations set various standards regulating certain aspects of health and environmental quality. They provide for penalties and other liabilities for the violation of such standards and establish, in certain circumstances, obligations to rehabilitate current and former facilities and locations where operations are or were conducted. The permission to operate can be withdrawn temporarily where there is evidence of serious breaches of health and safety standards, or even permanently in the case of extreme breaches. Significant liabilities could be imposed on the Company for damages, clean-up costs or penalties in the event of certain discharges into the environment, environmental damage caused by previous owners of acquired properties or noncompliance with environmental laws or regulations. In all major developments, the Company generally relies on recognized designers and development contractors from which the Company will, in the first instance, seek indemnities. The Company minimizes risks by taking steps to ensure compliance with environmental, health and safety laws and regulations and operating to applicable environmental standards. There is a risk that environmental laws and regulations may become more onerous, making the Company’s operations more expensive.

14

Competition

The mining industry is intensely competitive in all its phases. The Company competes for the acquisition of mineral properties, claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees with many companies possessing greater financial resources and technical facilities than the Company. The competition in the mineral exploration and development business could have an adverse effect on the Company’s ability to acquire suitable properties or prospects for mineral exploration in the future.

Stress in the Global Economy

Negative fluctuations in a state of global economy may cause general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, and lower business spending, all of which may have a negative effect on the Company’s business, results of operations, financial condition and liquidity. The Company’s suppliers may not be able to supply it with needed raw materials on a timely basis, may increase prices or go out of business, which could result in the inability of the Company to carry out its planned exploration programs. Furthermore, it may become difficult to locate other mineral exploration companies with available funds willing to engage in risky ventures such as the exploration of the Properties.

Such conditions may make it very difficult to forecast operating results, make business decisions and identify and address material business risks. As a result, the Company’s operating results, financial condition and business could be adversely affected.

The Company conducts operations in a foreign jurisdiction and is subject to certain risks that may limit or disrupt its business operations.

The Company’s head office is in Canada and its mining operations are in Chile. Mining investments are subject to the risks normally associated with the conduct of any business in foreign countries including uncertain political and economic environments; wars, terrorism and civil disturbances; changes in laws or policies, including those relating to imports, exports, duties and currency; cancellation or renegotiation of contracts; royalty and tax increases or other claims by government entities, including retroactive claims; risk of expropriation and nationalization; delays in obtaining or the inability to obtain or maintain necessary governmental permits; currency fluctuations; restrictions on the ability of local operating companies to sell gold, copper or other minerals offshore for US dollars, and on the ability of such companies to hold US dollars or other foreign currencies in offshore bank accounts; import and export regulations, including restrictions on the export of gold, copper or other minerals; limitations on the repatriation of earnings; and increased financing costs.

These risks could limit or disrupt the Company’s exploration programs, cause it to lose its interests in its mineral claims, restrict the movement of funds, cause it to spend more than it expected, deprive it of contract rights or result in its operations being nationalized or expropriated without fair compensation, and could materially adversely affect the Company’s financial position or the results of its operations. If a dispute arises from the Company’s activities in Chile, the Company could be subject to the exclusive jurisdiction of courts outside North America, which could adversely affect the outcome of the dispute.

While the Company takes steps it believes are necessary to maintain legal ownership of its claims, title to mineral claims may be invalidated for a number of reasons, including errors in the transfer history or acquisition of a claim the Company believed, after appropriate due diligence investigation, to be valid, but in fact, wasn’t. If ownership of the Company’s claims was ultimately determined to be invalid, the Company’s business and prospects would likely be materially and adversely affected.

The Company’s ability to realize a return on its investment in mineral claims depends upon whether it maintains the legal ownership of the claims. Title to mineral claims involves risks inherent in the process of determining the validity of claims and the ambiguous transfer history characteristic of many mineral claims. The Company takes a number of steps to protect the legal ownership of its claims, including having its contracts and deeds notarized, recording these documents with the registry of mines and publishing them in the mining bulletin. The Company also reviews the mining bulletin regularly to determine whether other parties have staked claims over its ground. However, none of these steps guarantees that another party could not challenge the Company’s right to a claim. Any such challenge could be costly to defend and, if the Company lost its claim, its business and prospects would likely be materially and adversely affected.

15

No Anticipation of Payment of Dividends

A dividend has never been declared or paid in cash on the Common Shares. The Company does not anticipate such a declaration or payment for the foreseeable future. The Company intends to retain any earnings to develop, carry on, and expand its business.

Price Volatility of Publicly Traded Securities

In recent years, the securities markets in Canada have experienced a high level of price and volume volatility, and the market prices of securities of many companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. There can be no assurance that continual fluctuations in price will not occur. It may be anticipated that any quoted market for the Common Shares will be subject to market trends generally, notwithstanding any potential success of the Company in creating revenues, cash flows or earnings. The value of Common Shares will be affected by such volatility.

Fluctuating Mineral Prices and Currency Risk

The Company’s revenues, if any, are expected to be in large part derived from the extraction and sale of precious and base minerals and metals. Factors beyond the control of the Company may affect the marketability of metals discovered, if any. Metal prices have fluctuated widely, particularly in recent years. Consequently, the economic viability of any of the Company’s exploration projects cannot be accurately predicted and may be adversely affected by fluctuations in mineral prices.

The Company sometimes holds a significant portion of its cash in US dollars. Currency exchange rate fluctuations can result in conversion gains and losses and diminish the value of its US dollars. If the US dollar declined significantly against the Canadian dollar or the Chilean peso, its US dollar purchasing power in Canadian dollars and Chilean pesos would also significantly decline and that could make it more difficult for the Company to conduct its business operations. The Company has not entered into derivative instruments to offset the impact of foreign exchange fluctuations.

Management

The success of the Company is currently largely dependent on the performance of its directors and officers. The loss of the services of any of these persons could have a materially adverse effect on the Company’s business and prospects. There is no assurance the Company can maintain the services of its directors, officers or other qualified personnel required to operate its business.

Key Person Insurance

The Company does not maintain key person insurance on any of its directors or officers, and as result the Company would bear the full loss and expense of hiring and replacing any director or officer in the event the loss of any such persons by their resignation, retirement, incapacity, or death, as well as any loss of business opportunity or other costs suffered by the Company from such loss of any director or officer.

Difficulty for United States Investors to Effect Services of Process Against the Company.

The Company is incorporated under the laws of the Province of British Columbia, Canada. Consequently, it will be difficult for United States investors to affect service of process in the United States upon the directors or officers of the Company, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the Exchange Act. The majority of the Company’s directors and officers are residents of Canada and all of the Company’s material assets are located outside of the United States. A judgment of a United States court predicated solely upon such civil liabilities would probably be enforceable in Canada by a Canadian court if the United States court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities.

16

Conflicts of Interest

Some of the directors and officers are engaged and will continue to be engaged in the search for additional business opportunities on behalf of other corporations, and situations may arise where these directors and officers will be in direct competition with the Company. Conflicts, if any, will be dealt with in accordance with the relevant provisions of the Business Corporations Act (British Columbia). Some of the directors and officers of the Company are or may become directors or officers of other companies engaged in other business ventures. In order to avoid the possible conflict of interest which may arise between the directors’ duties to the Company and their duties to the other companies on whose boards they serve, the directors and officers of the Company have agreed to the following:

·Participation in other business ventures offered to the directors will be allocated between the various companies and on the basis of prudent business judgment and the relative financial abilities and needs of the companies to participate;

·No commissions or other extraordinary consideration will be paid to such directors and officers; and

·Business opportunities formulated by or through other companies in which the directors and officers are involved will not be offered to the Company except on the same or better terms than the basis on which they are offered to third party participants.

“Penny Stock” Rules May Make Buying or Selling Our Common Stock Difficult, and Severely Limit its Marketability and Liquidity

Because the Company’s securities are considered a penny stock, shareholders will be more limited in their ability to sell their shares. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than USD$5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. Because the Company’s securities constitute “penny stocks” within the meaning of the rules, the rules apply to the Company and to its securities. The rules may further affect the ability of owners of shares to sell the Company’s securities in any market that might develop for them. As long as the trading price of the Common Shares is less than USD$5.00 per share, the Common Shares will be subject to Rule 15g-9 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

·Contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

·Contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws;

·Contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;

·Contains a toll-free telephone number for inquiries on disciplinary actions;

·Defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and

·Contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such shares; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for the Common Shares.

17

Tax Issues

Income tax consequences in relation to the Common Shares will vary according to circumstances of each investor. Prospective investors should seek independent advice from their own tax and legal advisers prior to investing in Common Shares of the Company.

Other Risks and Uncertainties

Although the Company has tried to identify all significant risks, it may not have identified all risks. There may be other risks.

The Company has sought to identify what it believes to be the most significant risks to its business, but it cannot predict whether, or to what extent, any of such risks may be realized nor can it guarantee that it has identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to the Company’s Common Shares.

Item 4. Information on the Company

A. History and Development of the Company

Company Name

The legal and commercial name of the company is Red Metal Resources Ltd.

Principal Office

The Company’s head office is located at 1130 West Pender Street, Suite 820, Vancouver, British Columbia, V6E 4A4. Its registered office address is 595 Burrard Street, Suite 700, Vancouver, British Columbia, V7X 1S8.We do not have an agent in the United States. The Company’s mailing address is 278 Bay Street, Suite 102, Thunder Bay, Ontario, P7B 1R8

Corporate Information and Important Events

Red Metal Resources Ltd. was incorporated under the Nevada Business Corporations Act on January 10, 2005. On February 10, 2021, the Company changed its corporate jurisdiction from the State of Nevada to the Province of British Columbia by means of a process called a “conversion” under the Nevada Revised Statutes and a “continuation” under the Business Corporations Act (British Columbia). Upon the Company’s continuation to British Columbia, the Articles of Incorporation and Bylaws of the Company, under the Nevada Revised Statutes, were replaced with the Articles of the Company, under the Business Corporations Act (British Columbia). The authorized capital of the Company was amended to an unlimited number of common shares without par value.

On November 18, 2021, the Company filed a final non-offering prospectus with the B.C. Securities Commission and became a reporting issuer in the province of British Columbia. The common shares of the Company were approved for listing on the Canadian Securities Exchange (the “CSE”) and began trading under the symbol “RMES” as of market open on November 25, 2021, and the Company consequently became a reporting issuer in the province of Ontario. The Company’s common shares continue to trade on the OTC Link alternative trading system on the OTC PINK marketplace under the symbol “RMESF”.

On August 21, 2007, the Company formed Minera Polymet Limitada (“Polymet”) as a limited liability company, under the laws of the Republic of Chile. On September 28, 2015, the Company changed Polymet’s incorporation from Limited Liability Company to a Closed Stock Corporation (“SpA”). As of the date of this Form 20-F the Company owns 100% of Polymet, which holds its Chilean mineral property interests.

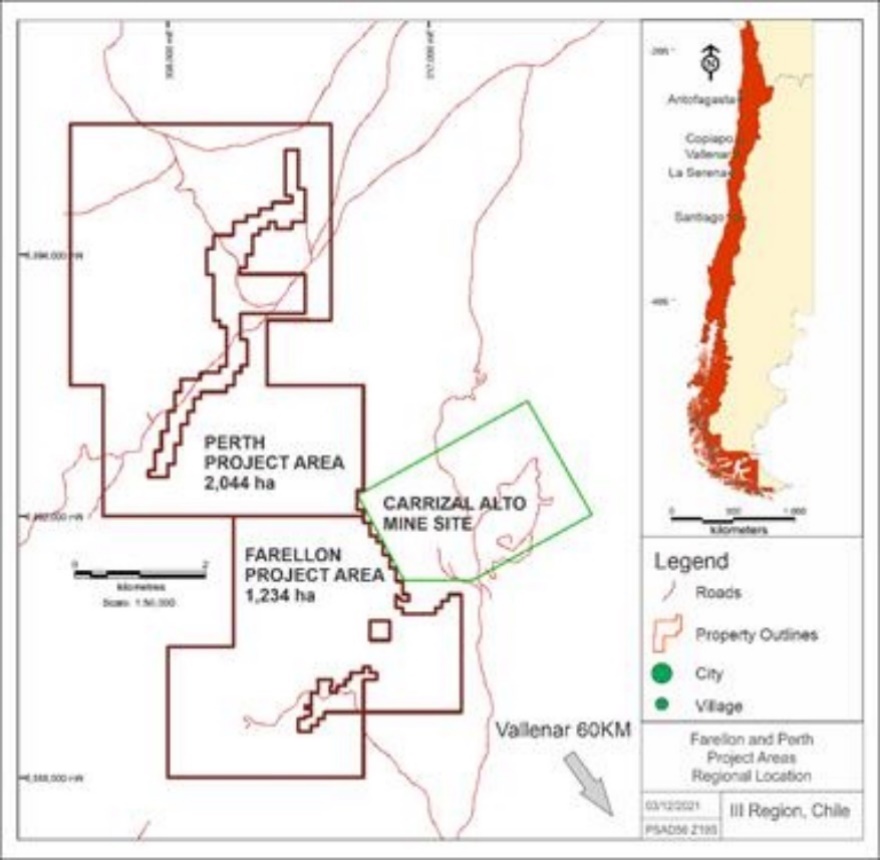

The Company is engaged in the business of mineral exploration in Chile with the objective to explore and, if warranted, develop mineral properties. All of the Company’s mineral concessions are located in the Candelaria iron oxide copper-gold (IOCG) belt of the coastal cordillera, in the Carrizal Alto Mining District, III Region of Atacama, Chile. The Company has three active copper-gold projects on two properties, namely the Farellón and Perth Projects both located on the Carrizal Property, and the Mateo Project located on the Mateo Property. In addition to holding these active

18

properties, as an exploration company, the Company periodically stakes, purchases or options claims to allow time and access to fully consider the geological potential of claims.

The Company’s flagship project, the Farellón Project, is an early-stage exploration property consisting of eight mining concessions totaling 1,234 hectares.

Consistent with the Company’ historical practices, the Company’s management continues to monitor its costs in Chile by reviewing the Company’s mineral claims to determine whether they possess the geological indicators to economically justify the capital to maintain or explore them. As at the time of this Form 20-F, Polymet has one employee and engages independent consultants on as needed basis. Most of the Company’s support - such as vehicles, office, and equipment - is supplied under short-term contracts. The only long-term commitments that the Company has are for royalty payments on four of its mineral concessions - Farellón Alto 1 - 8, Quina 1 - 56, Exeter 1 - 54, and Che. These royalties are payable once exploitation begins. The Company is also required to pay property taxes that are due annually on all the concessions that are included in its properties.

The cost and timing of all planned exploration programs are subject to the availability of qualified mining personnel, such as consulting geologists, geo-technicians and drillers, and drilling equipment. Although Chile has a well-trained and qualified mining workforce from which to draw and few early-stage companies such as Red Metal are competing for the available resources, if the Company is unable to find the personnel and equipment needed at the prices that were budgeted for the programs, the Company might have to revise or postpone its exploration plans.

Capital Expenditures

Due to a lack of operating capital, during the fiscal years ended January 31, 2021 and 2020, the Company conducted no material exploratory operations on any of its mineral properties; and it also did not increase its land holdings in Chile.

During the years ended January 31, 2022 and 2023, the Company raised sufficient capital to continue exploration work on its Farellón Property, In the short to medium term, based on the positive results from multiple past exploration programs on the Farellón Project, the Company planned to carry out a two-phase drill program. The first phase of the drill program commenced on January 25, 2022, and was completed in the early March of 2022; it consisted of a nine-hole 2,010m drill program that tested the primary mineralization at depth that has, thus far, only been intersected in a few drill holes, and determine the potential of the cobalt mineralization in the sulfide zone.

The highlights of the first phase included the following:

·First hole on new zone intercepted six meters of vein with strong visible copper sulphides; further 1.5 km of untested strike length;

·All holes have intercepted visible copper sulphide mineralization and alteration associated with IOCG deposits; and

·Diamond drill core provided valuable alteration and structural information not seen in previous RC drilling.

As of the date of this Annual Report on Form 20-F sampling is ongoing for drillholes and no visual estimates of grade have been made.

Diamond Drilling

First five drillholes were focused at the northern end of the previously drilled Farellón project close to the artisanal mine workings. All five drill holes intercepted zones of sulphide mineralization including chalcopyrite and chalcocite, zones of strong alteration associated with IOCG deposits and breccia zones up to 20m in width. Significant elements noted in initial observations included widespread potassic and argillic alteration and significant amounts of iron oxides transitioning from hematite into magnetite at depth.

The final four drillholes of the program targeted the south and north end of the Farellón zone and tested a previously undrilled structure parallel to the Farellón zone. These four drillholes intercepted zones of sulphide mineralization including chalcopyrite and chalcocite and zones of strong alteration associated with IOCG deposits.

19

New Zone Drill Tested

The newly tested parallel structure lies approximately 250 metres west of the Farellón vein and was mapped and sampled on surface in 2012. Mapping completed in 2012 traced the vein continuously over approximately 1.5km. All six surface samples taken along the structure in 2012 are listed below and all samples returned significant copper, gold and cobalt. The structure was tested with one drillhole and a six-metre quartz calcite vein was intercepted from 142m to 142.6m with visible chalcopyrite mineralization, intense pyrrhotite, albite and actinolite alteration.

Mapping Program

The 2022 mapping and prospecting program on Farellón project focused on detailed mapping of veins along strike of, and to the east of the main Farellón structure with the goal of developing new drill targets. New veins mapped and sampled include the Gorda vein which was drilled in Hole FAR-22-020. The Gorda vein lies 250 metres east of the Farellón structure which was mapped and sampled along strike for a full kilometre. A further five veins were mapped and sampled in detail to develop future drill targets throughout the property.

During the year ended January 31, 2023, the Company spent a total of $728,697 (2022 - $238,744; 2021 - $1,550) on the Farellón Property Project.

Takeover Offers

The Company is not aware of any indication of any public takeover offers by third parties in respect of our common shares during our current and two last financial years.

The U.S. Securities and Exchange Commission (SEC) maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is http://www.sec.gov.

Additional information can be found at the Company’s website at http://www.redmetalresources.com/

B. Business Overview

Nature of Operations and Principal Activities

The Company is engaged in the business of mineral exploration in Chile with the objective to explore and, if warranted, develop mineral properties. All of the Company’s mineral claims are located in the Candelaria iron oxide copper-gold (IOCG) belt of the coastal cordillera in the Carrizal Alto Mining District, III Region of Atacama, Chile. The Company has three active copper-gold projects on two properties, namely the Farellón and Perth Projects both located on the Carrizal Property, and the Mateo Project located on the Mateo Property. In addition to holding these active properties, as an exploration company, the Company periodically stakes, purchases or option claims to allow time and access to fully consider the geological potential of claims.

The Company’s flagship project, the Farellón Project, is an early-stage exploration project consisting of eight exploitation concessions totaling 1,234 hectares.

The Company acquired the initial mining claim for the Farellón Project pursuant to an assignment agreement between Polymet and Minera Farellón Limitada (“Minera Farellón”) dated September 25, 2007, and amended on November 20, 2007. Under the terms of the assignment agreement, Minera Farellón agreed to assign to Polymet its option to buy the Farellón 1 Al 8 mining concession. Polymet acquired the option on April 25, 2008, and concurrently assumed all of Minera Farellón’s rights and obligations under the Farellón option agreement. Polymet exercised the option and bought the property from the vendor on April 25, 2008. The patented mining concessions are registered in the name of and owned 100% by Polymet.

On September 17, 2008, the Company acquired the Cecil 1 - 49, Cecil 1 - 40 and Burghley 1 - 60 claims for an aggregate purchase price of $27,676. On December 1, 2009, the Company initiated the manifestacion process by applying to convert the Cecil 1 - 40 and Burghley 1 - 60 exploration (pedimento) claims to mining (mensura) claims. In January 2013, the Company abandoned the manifestacion process for the Cecil 1-40 and Burghley 1-60 claims as the Company discovered that the most prospective ground, as outlined in the Company’s prospecting and mapping program completed in April 2012, was covered by several mensuras underlying both claims.

20

On August 21, 2012, the Company acquired four mineral claims - Azucar 6-25, Kahuna 1-40, Stamford 61-101, and Teresita - through the government auction for a total price of $19,784.

On December 15, 2014, the Company entered into an option agreement with David Marcus Mitchell to earn 100% interest in a Quina 1-56 clam (the “Quina Claim”). The Quina Claim covers 251 hectares and is centered at 310,063 east and 6,890,435 south UTM PSAD56 Zone 19 and is contiguous to the Farellón Property. Acquisition of the Quina Claim added approximately 2 kilometers of strike length of the Farellón Veins. In order to acquire the 100% interest in the Quina Claim the Company paid a total of $150,000 in combined stock and cash payments and completed the acquisition on December 15, 2018.

On June 3, 2015, the Company entered into an option agreement, made effective on June 15, 2015, with Minera Stamford S.A., to earn 100% interest in a mining claim known as “Exeter 1-54” (the “Exeter claim”). The Exeter claim totals 235 hectares and is contiguous to the Farellón Property, which is located in the Carrizal Alto mining district, located approximately 75 kilometers northwest of the city of Vallenar, 150 kilometers south of Copiapo and 20 kilometers west of the Pan American Highway. In order to acquire 100% interest in the Exeter claim, the Company paid a total of $150,000 and completed the transaction on May 12, 2019.

These properties form substantial land holdings in a historical mining district, which was a prolific past producer, shut down due to economic conditions, rather than exhaustion of deposits. The Company’s Carrizal Property, adjacent and contiguous to the Carrizal Alto Mine, has undergone only limited modern exploration, which has so far demonstrated the potential of the property to host a mineralized deposit.

The Company’s Perth and Mateo Projects are both early-stage exploration projects. The Perth Project is composed of 13 mining concessions covering 2,044 hectares and the Mateo Project is composed of 5 mineral concessions covering 182 hectares. Both projects are 100% owned by Polymet.

To date the Company has not determined whether its claims contain mineral reserves that are economically recoverable and it has not produced revenues from its principal business.

Principal Market and Revenues

The Company does not currently have any market, as it has not yet identified any mineral resource on any of the Company’s properties that is of a commercially exploitable quantity. If the Company’s succeeds in identifying a mineral resource in commercially exploitable quantities, its principal markets would consist of metals refineries and base metal traders and dealers. The Company’s first customer likely will be ENAMI, the Chilean national mining company, which refines and smelts copper from the ore that it buys from Chile’s small- and medium-scale miners. ENAMI is located in Vallenar. The Company could also sell its ore to the Dos Amigos heap leach facility located approximately fifty kilometers south of Vallenar in Domeyko.

To date the Company has not generated any revenues from any of its properties.

Seasonality of our Business

The Company’s mineral exploration activities are not subject to seasonal variation due to the year-round favorable weather conditions in Chile.

Sources and Availability of Raw Materials

The raw materials for our exploration programs include camp equipment, hand exploration tools, sample bags, first aid supplies, groceries and propane. All of these types of materials are readily available from a variety of local suppliers.

Marketing Channels

We do not currently have any market, as we have not yet identified any mineral resource on any of our properties that is of a commercially exploitable quantity, and therefore do not currently engage in marketing activities.

21

Patents and Licenses; Industrial, Commercial and Financial Contracts; and New Manufacturing Processes

In conducting our business operations, we are not dependent on any patented or license processes, technology, industrial, commercial or financial contract or new manufacturing processes.

Competitive Conditions

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are one of the smallest exploration companies and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other similar companies for financing and joint venture partners, and for resources such as professional geologists, camp staff, helicopters and mineral exploration contractors and supplies. We do not represent a competitive presence in the industry.

Governmental Regulations

The mining business is subject to various levels of government control and regulation, which are supplemented and revised from time to time. The Company cannot predict what legislation or revisions might be proposed that could affect its business or when any such proposals, if enacted, might become effective. The Company’s exploration activities are subject to laws and regulations governing worker safety, and, if it explores within the national park that is part of its Farellón property, protection of endangered and other special status species as well as protection of significant archeological remains, if there are any, will likely require compliance with additional laws and regulations. The cost of complying with these regulations has not been burdensome to date, but if the Company mines the Properties and processes more than 5,000 tonnes of ore monthly, it will be required to submit an environmental impact study for review and approval by the federal environmental agency. The Company anticipates that the cost of such a study will be significant and, if the study were to show too great an adverse impact on the environment, the Company might be unable to develop the property or it might have to engage in expensive remedial measures during or after developing the property, which could make production unprofitable. This requirement could materially adversely affect the Company’s business, the results of its operations and its financial condition if it were to proceed to mine a property or process ore on the property. The Company has no immediate or intermediate plans to process ore on any of the Properties.

If the Company does not comply with applicable environmental and health and safety laws and regulations, it could be fined, enjoined from continuing its operations, and suffer other penalties. Although the Company makes every attempt to comply with these laws and regulations, it cannot provide assurance that it has fully complied or will always fully comply with them.

Environmental and Safety Regulations and Risks

Environmental laws and regulations may affect the operations of the Company. These laws and regulations set various standards regulating certain aspects of health and environmental quality. They provide for penalties and other liabilities for the violation of such standards and establish, in certain circumstances, obligations to rehabilitate current and former facilities and locations where operations are or were conducted. The permission to operate can be withdrawn temporarily where there is evidence of serious breaches of health and safety standards, or even permanently in the case of extreme breaches. Significant liabilities could be imposed on the Company for damages, clean-up costs or penalties in the event of certain discharges into the environment, environmental damage caused by previous owners of acquired properties or noncompliance with environmental laws or regulations. In all major developments, the Company generally relies on recognized designers and development contractors from which the Company will, in the first instance, seek indemnities. The Company minimizes risks by taking steps to ensure compliance with environmental, health and safety laws and regulations and operating to applicable environmental standards. There is a risk that environmental laws and regulations may become more onerous, making the Company’s operations more expensive.

C. Organizational Structure

The Company owns 100% of Minera Polymet SpA (“Polymet”), a corporation organized under the laws of the Republic of Chile on August 21, 2007. Polymet holds the Company’s Chilean mineral property interests and, to comply with Chilean legal requirements, Polymet has appointed a legal representative in Chile. Polymet’s head office is located in Vallenar, III Region of Atacama, Chile.

22

D. Property, Plant and Equipment

The Company’s executive office is located at 1130 West Pender Street, Suite 820, Vancouver, British Columbia V6E 4A4, Canada. The Company rents this location from its CFO at no cost. This space accommodates our finance and administrative department.

The Company’s secondary office is located at 278 Bay Street, Suite 102, Thunder Bay, ON P7B 1R8. The Company rents this location from Fladgate Exploration Consulting Corporation (“Fladgate”), a company owned by Ms. Caitlin Jeffs and Mr. Michael Thompson, who each hold 33% of Fladgate. During the nine-month period ended October 31, 2021, the Company paid $1,000 per month for this office. At October 31, 2021, Fladgate agreed to forgive the accrued office rent fees, and as of the date of this Annual Report on Form 20-F, the Thunder Bay office is provided to the Company free of charge. This space acts as the Company’s mailing address, and accommodates our CEO and VP of Exploration, as well as provides geological support to the Chilean operations.

Our Chilean office is located in Vallenar, III Region of Atacama, Chile. This office is provided to the Company free of charge by Mr. Jeffs, the Company’s major shareholder and father of our CEO, Caitlin Jeffs.

The Company believes that the existing space is adequate for the Company’s current needs. Should the Company require additional space, the Company believes that such space can be secured on commercially reasonable terms.

Overview of Mineral Properties

Active Properties

Through a number of transactions since 2007, the Company has assembled its active mineral properties identified and further detailed in Table 1, respectively, below as the Carrizal Property, containing the Farellón and Perth Project areas, and the Mateo Property:

Table 1 - Active Properties

|

| Percentage, |

| Hectares | ||

Property |

| type of claim |

| Gross area |

| Net area(a) |

Farellón |

|

|

|

|

|

|

Farellón Alto 1 - 8 |

| 100%, mensura |

| 66 |

|

|

Quina 1 - 56 |

| 100%, mensura |

| 251 |

|

|

Exeter 1 - 54 |

| 100%, mensura |

| 235 |

|

|

Cecil 1 - 49 |

| 100%, mensura |

| 228 |

|

|

Teresita |

| 100%, mensura |

| 1 |

|

|

Azucar 6 - 25 |

| 100%, mensura |

| 88 |

|

|

Stamford 61 - 101 |

| 100%, mensura |

| 165 |

|

|

Kahuna 1 - 40 |

| 100%, mensura |

| 200 |

|

|

|

|

|

| 1,234 |

| 1,234 |

Perth |

|

|

|

|

|

|

Perth 1-36 |

| 100%, mensura |

| 109 |

|

|

Rey Arturo 1-30 |

| 100%, mensura |

| 276 |

|

|

Lancelot 1 1-27 |

| 100%, mensura |

| 260 |

|

|

Galahad IA 1 44 |

| 100%, mensura |

| 217 |

|

|

Camelot 1 53 |

| 100%, mensura |

| 227 |

|

|

Percival 4 1 60 |

| 100%, mensura |

| 300 |

|

|

Tristan II A 1 55 |

| 100%, mensura |