Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-209012

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 1, 2016)

5,000,000 Shares

Common Stock

$12.00 per share

We are selling 5,000,000 shares of our common stock in this offering.

We have granted the underwriters an option for a period of 30 days to purchase up to 750,000 additional shares.

Our common stock is quoted on The NASDAQ Global Market under the symbol “BLCM.” The last reported sale price of our common stock on The NASDAQ Global Market on March 22, 2017 was $14.37 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page S-5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price |

$ | 12.00 | $ | 60,000,000 | ||||

| Underwriting Discounts and Commissions(1) |

$ | 0.72 | $ | 3,600,000 | ||||

| Proceeds to Bellicum (before expenses) |

$ | 11.28 | $ | 56,400,000 | ||||

| (1) | The underwriters will also be reimbursed for certain expenses incurred in this offering. See “Underwriting” for details. |

The underwriters expect to deliver the shares to purchasers on or about March 29, 2017 through the book-entry facilities of The Depository Trust Company.

Joint Book-Running Managers

| Citigroup | Jefferies | |

Co-Managers

Guggenheim Securities

Ladenburg Thalmann

Raymond James

SunTrust Robinson Humphrey

March 23, 2017

Table of Contents

We are responsible for the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus and in any free-writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus is accurate as of any date other than its date.

Prospectus Supplement

| Page | ||||

| S-ii | ||||

| S-iv | ||||

| S-1 | ||||

| S-5 | ||||

| S-6 | ||||

| S-6 | ||||

| S-7 | ||||

| S-8 | ||||

| S-11 | ||||

| Certain U.S. Federal Income Tax Considerations for Non-U.S. Holders of Common Stock |

S-13 | |||

| S-17 | ||||

| S-22 | ||||

| S-22 | ||||

| S-22 | ||||

| Prospectus | ||||

| i | ||||

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 13 | ||||

| 20 | ||||

| 22 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| Disclosure of Commission’s Position of Indemnification for Securities Act Liability |

29 | |||

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated February 1, 2016, including the documents incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the Securities and Exchange Commission, or SEC, before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We have not, and the underwriters have not, authorized anyone to provide you with information different than or inconsistent with the information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents, regardless of the time of delivery of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the section of this prospectus supplement entitled “Incorporation of Certain Information by Reference.”

We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of our common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of our common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless otherwise stated, all references in this prospectus to “we,” “us,” “our,” “Bellicum,” “Bellicum Pharmaceuticals,” the “Company” and similar designations refer to Bellicum Pharmaceuticals, Inc. and its subsidiary on a consolidated basis. This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein contain common law, unregistered trademarks for Bellicum Pharmaceuticals based on use of the trademarks in the United States. Other trademarks referred to in this prospectus supplement or the accompanying prospectus or the information incorporated by reference herein and therein are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus supplement, the accompanying prospectus and the information incorporated by

S-ii

Table of Contents

reference herein and therein, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

S-iii

Table of Contents

This prospectus supplement, the accompanying prospectus, the documents incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering contain “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are subject to the “safe harbor” created by those sections. We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

| • | the success, cost and timing of our product development activities and clinical trials; |

| • | our ability to advance Chemical Induction of Dimerization, or CID, CID-based technologies, including CaspaCIDe and GoCAR-T; |

| • | our ability to obtain and maintain regulatory approval of BPX-501 and any other product candidates, and any related restrictions, limitations and/or warnings in the label of an approved product candidate; |

| • | our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates; |

| • | the commercialization of our product candidates, if approved; |

| • | our plans to research, develop and commercialize our product candidates; |

| • | our ability to attract collaborators with development, regulatory and commercialization expertise and the success of any such collaborations; |

| • | future agreements with third parties in connection with the commercialization of our product candidates and any other approved product; |

| • | the size and growth potential of the markets for our product candidates, and our ability to serve those markets; |

| • | the rate and degree of market acceptance of our product candidates; |

| • | regulatory developments in the United States, or U.S., and foreign countries; |

| • | our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately; |

| • | the success of competing therapies that are or may become available; |

| • | our ability to attract and retain key scientific or management personnel; |

| • | our ability to grow our organization and increase the size of our facilities to meet our anticipated growth; |

| • | the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| • | our expectations regarding the period during which we qualify as an emerging growth company under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act; |

| • | our use of cash and other resources; |

| • | our use of the net proceeds from this offering; and |

| • | our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates. |

These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this prospectus supplement and are subject to risks and uncertainties. We discuss many of these risks in greater detail under “Risk Factors.” Moreover, we operate in

S-iv

Table of Contents

a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this prospectus supplement and the accompanying prospectus together with the documents that we have filed with the SEC that are incorporated by reference and any free writing prospectus we have authorized for use in connection with a specific offering completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this prospectus supplement by these cautionary statements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

S-v

Table of Contents

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of our company and this offering, you should read and consider carefully the more detailed information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, including the risks described under the heading “Risk Factors,” as well as the information included in any free writing prospectus that we have authorized for use in connection with this offering.

Overview

We are a clinical stage biopharmaceutical company focused on discovering and developing novel cellular immunotherapies for various forms of cancer, including both hematological cancers and solid tumors, as well as orphan inherited blood disorders. We are using our proprietary CID technology platform to engineer our product candidates with switch technologies that are designed to control components of the immune system in real time. By incorporating our CID platform, our product candidates may offer better safety and efficacy outcomes than are seen with current cellular immunotherapies.

We are developing next-generation product candidates in some of the most important areas of cellular immunotherapy, including hematopoietic stem cell transplantation, or HSCT, chimeric antigen receptor T cell therapy, or CAR T, and T cell receptors, or TCRs. HSCT, also known as bone marrow transplantation, has for decades been curative for many patients with hematological cancers or orphan inherited blood disorders. However, adoption of HSCT to date has been limited by the risks of transplant-related morbidity and mortality from graft-versus-host-disease, or GvHD, and the potential for serious infections due to the lack of an effective immune system following a transplant. CAR T and TCR cell therapies are an innovative approach in which a patient’s T cells are genetically modified to carry chimeric antigen receptors, or CARs, or TCRs which redirect the T cells against cancer cells. While high objective response rates have been reported in some hematological malignancies, serious and sometimes fatal toxicities have arisen in patients treated with CAR T cell therapies. These toxicities include instances in which the CAR T cells have caused high levels of cytokines due to over-activation, referred to as “cytokine release syndrome,” or CRS, neurologic toxicities and cases in which they have attacked healthy organs. In each case, these toxicities have sometimes resulted in death. In solid tumors, where the behavior of CAR T cells is particularly unpredictable and results have been inconsistent, researchers are developing enhanced CAR T cell approaches that raise even greater safety concerns.

Our proprietary CID platform is designed to address these challenges. Events inside a cell are controlled by cascades of specialized signaling proteins. CID consists of molecular switches, modified forms of these signaling proteins, which are triggered inside the patient by infusion of a small molecule, rimiducid, instead of by natural upstream signals. We include these molecular switches in the appropriate immune cells and deliver the cells to the patient in the manner of conventional cellular immunotherapy. We have developed two such switches: a “safety switch,” designed to initiate programmed cell death, or apoptosis, of the immunotherapy cells, and an “activation switch,” designed to stimulate activation and in some cases proliferation and/or persistence of the immunotherapy cells. Each of our product candidates incorporates one of these switches, for enhanced, real time control of safety and efficacy:

| • | CaspaCIDe is our safety switch, incorporated into our HSCT and TCR product candidate, where it is inactive unless the patient experiences a serious side effect. In that event, rimiducid is administered to induce Caspase-9, or iCaspase, switch activation to fully or partially eliminate the cells, with the goal of terminating or attenuating the therapy and resolving the serious side effect. |

S-1

Table of Contents

| • | Our “Go” switch incorporated into our GoCAR-T product candidate, is an activation switch designed to allow control of the activation and proliferation of the T cells through the scheduled administration of a course of rimiducid infusions that may continue until the desired patient outcome is achieved. In the event of emergence of side effects, the level of activation of the GoCAR-T cells is designed to be attenuated by extending the interval between rimiducid doses, reducing the dosage per infusion, or suspending further rimiducid administration. |

In addition, we have an active research effort to develop other advanced molecular switch approaches, including a “dual-switch” that is designed to provide a system for managing persistence and safety of tumor antigen-specific CAR T cells.

By incorporating our novel switch technologies, we are developing product candidates with the potential to elicit positive clinical outcomes and ultimately change the treatment paradigm in various areas of cellular immunotherapy. Our lead clinical product candidate is described below:

| • | BPX-501 is a CaspaCIDe product candidate designed as an adjunct T cell therapy administered after allogeneic HSCT. BPX-501 is designed to improve transplant outcomes by enhancing the recovery of the immune system following an HSCT procedure. BPX-501 addresses the risk of infusing donor T cells by enabling the elimination of donor T cells through the activation of the CaspaCIDe safety switch if there is an emergence of uncontrolled GvHD. |

The European Commission has granted orphan drug designations to BPX-501 for treatment in HSCT, and for activator agent rimiducid for the treatment of GvHD. Additionally, BPX-501 and rimiducid have received orphan drug status from the U.S. Food and Drug Administration, or the FDA, as a combination replacement T-cell therapy for the treatment of immunodeficiency and GvHD after allogeneic HSCT.

During 2016, we discussed with the European Medicines Agency, or the EMA, clinical and regulatory plans to support the filing of Marketing Authorization Applications, or MAAs, for BPX-501 and rimiducid in Europe, initially for pediatric patients with certain orphan inherited blood disorders or treatment-refractory hematological cancers. Based on the regulatory discussions, we believe that data from the European arm of our BP-004 trial, expanded to enroll additional patients, with a primary endpoint of event-free survival, with events defined as transplant-related or non-relapse mortality, severe GvHD, and serious infection, at six months, could form the basis of MAAs for BPX-501 and rimiducid. In addition, the EMA’s Committee for Medicinal Products for Human Use, or the CHMP, has agreed that review and approval under “exceptional circumstances” may be suitable, recognizing that a randomized trial may not be feasible in the pediatric haploidentical hematopoeitic stem cell transplant setting. Exceptional circumstances may be granted for medicines that treat very rare diseases, or where controlled studies are impractical or not consistent with accepted principles of medical ethics. In place of a randomized trial, we intend to collect data from a concurrent observational study in the pediatric matched unrelated donor hematopoietic stem cell transplant setting, which will include both retrospective patients and prospective patients.

We have discussions ongoing with the FDA regarding the regulatory path to approval in the U.S. and we expect to provide updates in the first half of 2017.

In addition to BPX-501, our clinical stage product candidates which are designed to overcome limitations of CAR T and TCR therapies, include the following:

| • | BPX-701 is a CaspaCIDe-enabled natural high affinity TCR product candidate designed to target malignant cells expressing the preferentially-expressed antigen in melanoma, or PRAME. Initial planned indications for BPX-701 development are refractory or relapsed acute myeloid leukemia, or AML, and myelodysplastic syndromes, or MDS, with an additional study planned for metastatic uveal melanoma. Each of these is an orphan indication where PRAME is highly expressed and for which current treatment options are limited. A Phase 1 dose finding clinical trial in patients with relapsed or refractory myeloid neoplasms is being conducted at the Oregon Health & Science University Hospital in Portland, Oregon. |

S-2

Table of Contents

| • | BPX-601 is a GoCAR-T product candidate containing our proprietary inducible MyD88/CD40, or iMC, activation switch, designed to treat solid tumors expressing prostate stem cell antigen, or PSCA. Preclinical data shows enhanced T cell proliferation, persistence and in vivo anti-tumor activity compared to traditional CAR T therapies. A Phase 1 clinical trial in patients with non-resectable pancreatic cancer is being conducted at the Baylor Sammons Cancer Center in Dallas, Texas. |

We have developed an efficient and scalable process to manufacture genetically modified T cells of high quality, which is currently being used by our third-party contract manufacturers to produce BPX-501 for our clinical trials. We are leveraging this process, as well as our resources, capabilities and expertise for the manufacture of our CAR T and TCR product candidates.

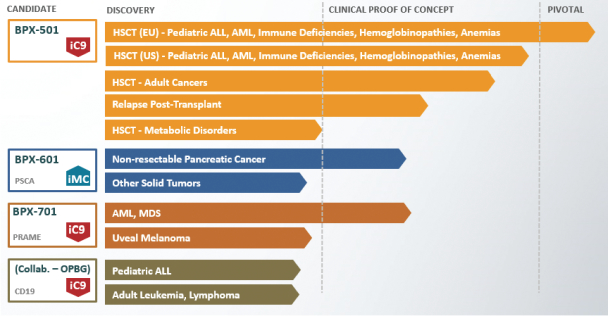

Pipeline

The following table summarizes our product candidate pipeline:

Corporate Information

We were incorporated in Delaware in July 2004. Our principal executive offices are located at 2130 W. Holcombe Blvd., Ste. 800, Houston, Texas and our telephone number is (832) 384-1100. Our corporate website address is www.bellicum.com. The contents of our website are not a part of, and are not incorporated into, this prospectus supplement or the accompanying prospectus, and you should not consider it part of this prospectus supplement or the accompanying prospectus and you should not rely on any such information in making any decisions of whether to purchase our securities. For further information regarding us and our financial information, you should refer to our recent filings with the SEC. See “Incorporation of Certain Information by Reference.”

We use various trademarks, service marks and trade names in our business, including without limitation “Bellicum Pharmaceuticals” and “Bellicum.” This prospectus supplement also contains trademarks, service marks and trade names of other businesses that are the property of their respective holders.

S-3

Table of Contents

THE OFFERING

| Issuer |

Bellicum Pharmaceuticals, Inc. |

| Common stock offered by us |

5,000,000 shares |

| Common stock to be outstanding after this offering |

32,155,565 shares |

| Underwriters’ option to purchase additional shares |

750,000 shares |

| Use of proceeds |

We intend to use the net proceeds from this offering, together with our existing capital resources, to fund ongoing and planned BPX-501 clinical trials in both the European Union and U.S., Phase 1 clinical trials of controllable CAR T (BPX-601) and TCR (BPX-701) product candidates, preparation activities for potential future commercialization of BPX-501, for our other research and development activities and to fund working capital, including general corporate purposes. See “Use of Proceeds.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” for a discussion of factors that you should consider before buying shares of our common stock. |

| Symbol on The NASDAQ Global Market |

BLCM |

The number of shares of common stock to be outstanding after this offering is based on 27,155,565 shares outstanding on December 31, 2016, and excludes as of that date:

| • | 4,532,120 shares of common stock issuable upon the exercise of outstanding stock options as of December 31, 2016, at a weighted-average exercise price of $12.37 per share of common stock; |

| • | 58,825 shares of common stock subject to repurchase by us as of December 31, 2016; |

| • | 560,911 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan, as of December 31, 2016; and |

| • | 494,681 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan, as of December 31, 2016. |

Except as otherwise noted, all information in this prospectus supplement assumes no exercise of the underwriters’ option to purchase additional shares and no exercise of the outstanding stock options described above.

S-4

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, those contained in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, which is incorporated herein by reference in its entirety, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC, all other information in this prospectus supplement, the accompanying prospectus, and the other documents incorporated by reference, and in any free writing prospectus that we have authorized for use in connection with this offering. The occurrence of any of these risks could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our common stock could decline and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Relating to this Offering

If you purchase shares of common stock in this offering, you will experience immediate and substantial dilution in your investment. You will experience further dilution if we issue additional equity or equity-linked securities in the future.

Since the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common stock, you will suffer immediate and substantial dilution with respect to the net tangible book value of the common stock you purchase in this offering. Based on the public offering price of $12.00 per share and our net tangible book value as of December 31, 2016, if you purchase shares of common stock in this offering, you will suffer immediate and substantial dilution of $7.26 per share with respect to the net tangible book value of the common stock. See the section entitled “Dilution” for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

If we issue additional shares of common stock, or securities convertible into or exchangeable or exercisable for shares of common stock, our stockholders, including investors who purchase shares of common stock in this offering, will experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock. We also cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

We will have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

We will have broad discretion in the use of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business, impair or delay our ability to develop our product candidates and cause the price of our common stock to decline. See the section entitled “Use of Proceeds.”

S-5

Table of Contents

We estimate that the net proceeds to us from the sale of shares of our common stock that we are offering will be approximately $56.0 million, or approximately $64.4 million if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering, together with our existing capital resources, to fund ongoing and planned BPX-501 clinical trials in both the European Union and U.S., Phase 1 clinical trials of controllable CAR T (BPX-601) and TCR (BPX-701) product candidates, preparation activities for potential future commercialization of BPX-501, for our other research and development activities and to fund working capital, including general corporate purposes.

We may also use a portion of the net proceeds from this offering to acquire or license new product candidates or technology that could result in other product candidates, although we do not have current plans to do so.

Our expected use of the net proceeds from this offering represents our current intentions based upon our present plans and business condition. As of the date of this prospectus supplement, we cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering, or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual use of the net proceeds will vary depending on numerous factors, including our ability to access additional financing, the relative success and cost of our research, preclinical and clinical development programs and whether we are able to enter into future licensing arrangements. As a result, our management will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding the application of the net proceeds of this offering. In addition, we might decide to postpone or not pursue clinical trials or preclinical activities if the net proceeds from this offering and any other sources of cash are less than expected.

Pending their use as described above, we plan to invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

We do not anticipate declaring or paying, in the foreseeable future, any cash dividends on our capital stock. In addition, the terms of our loan and security agreement with Hercules Capital restrict our ability to declare or pay any cash dividend or make a cash distribution on any class of stock or other equity interest. We currently intend to retain all available funds and any future earnings to support our operations and finance the growth and development of our business. Any future determination related to our dividend policy will be made at the discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, contractual restrictions, business prospects and other factors our board of directors may deem relevant.

S-6

Table of Contents

Our net tangible book value as of December 31, 2016 was approximately $96.6 million, or $3.56 per share. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of December 31, 2016. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the sale of 5,000,000 shares of our common stock in this offering at the public offering price of $12.00 per share and after deducting the underwriting discounts and commissions and our estimated offering expenses, our as adjusted net tangible book value as of December 31, 2016 would have been approximately $152.5 million, or $4.74 per share. This represents an immediate increase in net tangible book value of $1.18 per share to existing stockholders and immediate dilution in net tangible book value of $7.26 per share to new investors purchasing our common stock in this offering. The following table illustrates this dilution on a per share basis:

| Assumed public offering price per share |

$ | 12.00 | ||||||

| Net tangible book value per share as of December 31, 2016 |

$ | 3.56 | ||||||

| Increase in net tangible book value per share attributable to investors purchasing our common stock in this offering |

$ | 1.18 | ||||||

|

|

|

|||||||

| As adjusted net tangible book value per share as of December 31, 2016 after this offering |

$ | 4.74 | ||||||

|

|

|

|||||||

| Dilution per share to investors purchasing our common stock in this offering |

$ | 7.26 |

If the underwriters exercise their option in full to purchase up to 750,000 additional shares of common stock, the as adjusted net tangible book value after this offering would be $4.89 per share, representing an increase in net tangible book value of $1.33 per share to existing stockholders and immediate dilution in net tangible book value of $7.11 per share to new investors purchasing our common stock in this offering.

The number of shares of common stock to be outstanding after this offering is based on 27,155,565 shares outstanding on December 31, 2016, and excludes as of that date:

| • | 4,532,120 shares of common stock issuable upon the exercise of outstanding stock options as of December 31, 2016, at a weighted-average exercise price of $12.37 per share of common stock; |

| • | 58,825 shares of common stock subject to repurchase by us as of December 31, 2016; |

| • | 560,911 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan, as of December 31, 2016; and |

| • | 494,681 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan, as of December 31, 2016. |

To the extent that outstanding options are exercised, investors purchasing our common stock in this offering will experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

S-7

Table of Contents

EXECUTIVE OFFICERS AND DIRECTORS

The following table sets forth certain information regarding our current executive officers and directors as of March 17, 2016:

| NAME |

AGE | POSITION(S) | ||

| Richard A. Fair | 48 | President and Chief Executive Officer and Director | ||

| Alan A. Musso, C.P.A., C.M.A. | 55 | Chief Financial Officer and Treasurer | ||

| David M. Spencer, Ph.D. | 54 | Chief Scientific Officer | ||

| Annemarie Moseley, Ph.D., M.D. | 61 | Chief Operating Officer and Executive Vice President of Clinical Development | ||

| Ken Moseley, J.D. | 60 | Senior Vice President and General Counsel | ||

| James Brown | 52 | Director | ||

| James M. Daly | 55 | Director | ||

| Stephen R. Davis | 56 | Director | ||

| Reid M. Huber, Ph.D. | 45 | Director | ||

| Frank B. McGuyer | 65 | Director | ||

| Kevin M. Slawin, M.D. | 56 | Director | ||

| Jon P. Stonehouse | 56 | Director |

Executive Officers

Richard A. Fair, 48, has served as our President and Chief Executive Officer and a member of our Board of Directors since January 2017. Prior to joining Bellicum, Mr. Fair served as Senior Vice President, Therapeutic Head Oncology Global Product Strategy at Genentech, Inc., a private biotechnology company and subsidiary of Roche Holding AG. From April 2006 to January 2014, Mr. Fair held other positions at Genentech, including Vice President, Global Product Strategy Hematology & Signaling, from November 2012 through December 2013, and Vice President, Sales & Marketing, Oral Oncolytics, from May 2010 to November 2012. Prior to Genentech, Mr. Fair held positions at Johnson & Johnson, a public pharmaceutical and medical device company. Mr. Fair received his B.S. in computer science from the University of Michigan and his MBA, with a dual concentration in finance and management, from Columbia University.

Alan A. Musso, C.P.A., C.M.A., 55, has served as our Chief Financial Officer and Treasurer since November 2014. From February 2002 to November 2014, Mr. Musso served in various positions at Targacept, Inc., a public biopharmaceutical company, including as Senior Vice President of Finance and Administration from March 2010 to November 2014, Chief Financial Officer and Treasurer from February 2002 to November 2014, and Assistant Secretary from June 2007 to November 2014. Mr. Musso has over 25 years of biotechnology and pharmaceutical industry experience in both large and emerging growth companies. Mr. Musso received his B.S. degree from Saint Mary’s College of California and his graduate degree from the American Graduate School of International Management in Glendale, Arizona.

David M. Spencer, Ph.D., 54, founded Bellicum with Kevin M. Slawin, M.D. in July 2004 and served as a member of our Board until September 2004. He has served as a scientific advisor to the Company since our inception and has served as our Chief Scientific Officer since November 2011, a position that he also held part-time as a consultant since September 2004. From January 1996 to November 2011, Dr. Spencer served as professor in the department of Pathology and Immunology at Baylor College of Medicine and as Vice Chairman of the department from January 2010 to November 2011. Dr. Spencer is the original inventor of our CID technology, and together with Dr. Slawin, developed the first clinical applications of the technology, DeCIDe and CaspaCIDe. He received his B.A. degree in Chemistry from the University of California, San Diego and his Ph.D. in Biology at Massachusetts Institute of Technology and was a postdoctoral fellow at Stanford University.

S-8

Table of Contents

Annemarie Moseley, Ph.D., M.D., 61, has served as our Chief Operating Officer since November 2012 and as our Executive Vice President of Clinical Development since April 2015. Dr. Moseley also served as our Senior Vice President of Clinical Development and Regulatory Affairs from October 2011 until April 2015. Dr. Moseley has over 20 years of industry experience in translational medicine and clinical development of stem cell therapies, immunotherapies, biological devices and combination products, including overseeing the first late-stage Graft versus Host Disease study in patients who underwent hematopoietic stem cell transplant. She received her B.S. and M.S. from the University of Texas at Arlington, and received her Ph.D. in Physiology and Biochemistry from Utah State. She received her M.D. from Baylor College of Medicine where she completed an internal medicine residency and a genetics fellowship.

Ken Moseley, J.D., 60, has served as our Senior Vice President and General Counsel since January 2015 and as our Corporate Secretary since February 2012. Mr. Moseley also served as our Vice President of Intellectual Property and Legal Affairs from December 2011 to January 2015. Mr. Moseley received his B.S. degree from the University of Houston and his B.A. degree from Rice University. He received his J.D. from the University of Houston Law Center. Mr. Moseley is a registered U.S. patent attorney and is a member of the State Bars of Texas and California.

Non-Employee Directors

James F. Brown, 52, has served as a member of our Board of Directors since November 2011 and as Chairman of our Board of Directors since December 2014. Since July 2009 he has served as Managing Director of AVG Ventures, a private investment firm. From 2003 to 2009, Mr. Brown was an independent investor and served on a number of private company boards of directors. From 1999 to 2002, he served as Executive Vice President and General Manager of OpenTV, Inc., a technology and media company, where he co-founded and managed the company’s applications business unit, prior to its sale to Liberty Media in 2002. Earlier in his career, Mr. Brown was a partner in the law firms of McDermott, Will & Emery and Pillsbury Madison & Sutro. Mr. Brown is currently a director of Landmark Infrastructure Partners, LP, a public real estate management company, and Perk.com, Inc., a public company traded on the Toronto Stock Exchange. He received his B.S. in accounting from Weber State University and his J.D. from Brigham Young University School of Law. Our Board of Directors believes that Mr. Brown’s business experience and his success as an investor and entrepreneur qualify him to serve on our Board of Directors.

James M. Daly, 55, has served as a member of our Board of Directors since May 2016. Mr. Daly currently serves on the board of directors of three other biopharmaceutical companies, including ACADIA Pharmaceuticals, Inc., Halozyme Therapeutics, Inc. and Chimerix, Inc. From October 2012 to June 2015, Mr. Daly served as Executive Vice President and Chief Commercial Officer of Incyte Corporation, a public biotechnology company. From January 2002 to December 2011, Mr. Daly held various positions at Amgen, Inc., a public biopharmaceutical company, where he most recently served as Senior Vice President of North America Commercial Operations and Global Marketing/Commercial Development. Prior to his employment with Amgen, Mr. Daly served as Senior Vice President and General Manager of the Respiratory/Anti-infective business unit of GlaxoSmithKline, a public pharmaceutical company, where he was employed from June 1985 to December 2001. Mr. Daly received his B.S. in Pharmacy and an M.B.A. from the University at Buffalo, The State University of New York.

Stephen R. Davis, 56, has served as a member of our Board of Directors since July 2015. Since March 2015, Mr. Davis has served as President and Chief Executive Officer of ACADIA Pharmaceuticals, Inc., a public biotechnology company. Prior to that, Mr. Davis served as ACADIA’s Executive Vice President, Chief Financial Officer and Chief Business Officer from July 2014 through March 2015. From June 2012 to June 2015, Mr. Davis served as a member of the board of directors of Heron Therapeutics, Inc., a public biotechnology company, where he also served as Executive Vice President and Chief Operating Officer from May 2013 to July 2014. From April 2010 to December 2012, Mr. Davis served as Executive Vice President and Chief Operating Officer of Ardea Biosciences, Inc., a public biotechnology company which was acquired by AstraZeneca PLC in

S-9

Table of Contents

June 2012. He also recently served as a director of Synageva BioPharma Corp. Earlier in his career, Mr. Davis practiced as a certified public accountant with a major accounting firm and as a corporate and securities attorney with a Wall Street law firm. Mr. Davis received his B.S. degree in accounting from Southern Nazerene University and his J.D. degree from Vanderbilt University. Our Board of Directors believes that Mr. Davis’ experience as an executive at various public biotechnology companies, his background in law, finance and accounting and his experience as a director at public biotechnology companies qualify him to serve on our Board of Directors.

Reid M. Huber, Ph.D., 45, has served as a member of our Board of Directors since October 2014. Dr. Huber currently serves as the Executive Vice President and Chief Scientific Officer of Incyte Corporation, a public biotechnology company, where he has held various management positions since January 2002. From 1998 to 2002, Dr. Huber held scientific research positions at DuPont Pharmaceuticals Company, a private chemicals and healthcare company. Prior to DuPont Pharmaceuticals Company, from 1997 to 1998, Dr. Huber held intramural pre-doctoral and post-doctoral fellowships at the National Institutes of Health. Dr. Huber received his B.S. in biochemistry/molecular genetics from Murray State University and his Ph.D. in molecular genetics from Washington University. Our Board of Directors believes that Dr. Huber’s extensive background in the pharmaceutical industry and current management experience at a public biotechnology company qualify him to serve on our Board of Directors.

Frank B. McGuyer. 65, has served as a member of our Board of Directors since March 2009. He is the founder of, and since December 1988 has served as the chairman of the Board of Directors and Chief Executive Officer of, McGuyer Homebuilders Inc., a private homebuilding company. He received his B.B.A. with honors at Southern Methodist University. Our Board of Directors believes that Mr. McGuyer’s operational, business and investment experience qualifies him to serve on our Board of Directors.

Kevin M. Slawin, M.D., 56, founded Bellicum with David Spencer, Ph.D., in July 2004 and has served as a member of our Board of Directors since its founding. Dr. Slawin served as our Chief Technology Officer from February 2006 through December 2016 and as a member of our Board of Directors since February 2006. From February 2006 to April 2014, Dr. Slawin served as our Executive Chairman and from February 2006 until March 2015, he also served as our Chief Medical Officer. From September 2004 to February 2006, Dr. Slawin served as the Chairman of the Board, our Chief Executive Officer and Secretary, and from September 2004 to November 2011, Dr. Slawin served as our President. Dr. Slawin also has had a long tenure in academic medicine at Baylor College of Medicine, where he served as the Dan Duncan Professor in Prostate Cancer and Prostatic Diseases, and Director, The Baylor Prostate Center, until 2007. Dr. Slawin currently serves as Director of Vanguard Urologic Institute at Memorial Hermann Medical Group, Memorial Hermann Hospital, and Vanguard Urologic Research Foundation, as well as a clinical professor of Urology at Baylor College of Medicine. He received his B.A. and M.D. from Columbia University, where he was inducted into Phi Beta Kappa and Alpha Omega Alpha, and completed an American Foundation of Urologic Diseases Scholar Fellowship in Urologic Oncology at Baylor College of Medicine. Our Board of Directors believes that Dr. Slawin’s educational and professional experiences, as well as his experience as one of our founders, qualifies him to serve on our Board of Directors.

Jon P. Stonehouse, 56, has served as a member of our Board of Directors since December 2014. Since January 2007, Mr. Stonehouse has served as the Chief Executive Officer and a member of the Board of Directors of BioCryst Pharmaceuticals, Inc., a public biopharmaceutical company. Since July 2007, he has also served as President of BioCryst. From March 2002 to December 2006, Mr. Stonehouse served in various positions at Merck KGaA, a pharmaceutical Company, including as Senior Vice President of Corporate Development from July 2002 to December 2006, and Vice President of Global Licensing and Business Development and Integration from March 2002 to December 2006. Since November 2008, Mr. Stonehouse has also served as a member of the Advisory Board of Precision Biosciences, Inc., a private biotechnology company. Mr. Stonehouse received his B.S. in Chemistry from the University of Minnesota. Our Board of Directors believes that Mr. Stonehouse’s management background, experience as a director at a public pharmaceutical company and extensive history as an advisory board member in the pharmaceutical industry qualify him to serve on our Board of Directors.

S-10

Table of Contents

TRANSACTIONS WITH RELATED PERSONS

The following includes a description of transactions since January 1, 2016, in which we were a participant and the amount involved exceeded $120,000, and in which any of our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our capital stock, or any member of the immediate family of any of the foregoing persons, had or will have a direct or indirect material interest.

Investor Agreements

On January 15, 2016, we entered into a registration rights agreement with Baker Brothers Life Sciences, L.P., 667, L.P. and 14159, L.P., or Baker Brothers, a beneficial owner of more than 5% of our common stock, pursuant to which Baker Brothers is entitled to certain resale registration rights with respect to shares of our common stock held by Baker Brothers. Under the agreement, following a demand by Baker Brothers, we are obligated to file a resale registration statement on Form S-3, or other appropriate form, covering such common stock held by Baker Brothers, and to keep such registration statement effective until the earlier of (i) all registrable securities covered by the registration statement have been sold or may be sold freely without limitations or restrictions as to volume or manner of sale pursuant to Rule 144 of the Securities Act of 1933, as amended, or Rule 144, or (ii) all registrable securities covered by the registration statement otherwise cease to be considered registrable securities pursuant to the terms of the agreement. Under the agreement, Baker Brothers has the right to one underwritten public offering per calendar year, but no more than three underwritten public offerings in total, to effect the sale or distribution of its registrable securities, subject to specified exceptions, conditions and limitations. The agreement requires us to bear expenses incurred by us in effecting any registration pursuant to the agreement, and up to $50,000 of expenses per underwritten public offering for counsel for Baker Brothers, and also includes customary indemnification obligations in connection with registrations conducted pursuant to the agreement. The rights of Baker Brothers under the agreement terminate automatically upon the earlier to occur of the following events: (i) all registrable securities covered by the agreement have been sold pursuant to an effective registration statement; (ii) all registrable securities covered by the agreement have been sold by pursuant to Rule 144, or other similar rule; (iii) all registrable securities covered by the agreement may be resold without limitations as to volume or manner of sale pursuant to Rule 144; or (iv) 10 years after the date of the agreement.

As a condition to our execution and delivery of this agreement, Baker Brothers irrevocably waived any and all registration rights accruing or attributable to Baker Brothers and its affiliated entities and/or any other entity controlled by, controlling or under common control with any of the preceding persons, under that certain Second Amended and Restated Investor Rights Agreement, dated August 22, 2014, by and among us and the investors set forth therein.

Agreements with Current and Former Officers and Directors

On March 31, 2016, our Board of Directors approved a six-month extension of the employment of Kevin M. Slawin, M.D., a current member of our Board of Directors and previously our Chief Technology Officer, through December 31, 2016. In connection with this extension, our Board of Directors approved the terms of a six month consulting agreement between Dr. Slawin and us, effective January 1, 2017 through June 30, 2017. In March 2017, the Compensation Committee of our Board of Directors approved a nine month extension of Dr. Slawin’s consulting agreement through March 30, 2018. Pursuant to the terms of Dr. Slawin’s consulting agreement, Dr. Slawin agreed to serve as a special advisor to the Science Committee of our Board of Directors, undertaking special projects as requested by the Science Committee or our Board of Directors. Dr. Slawin’s consulting agreement provides that Dr. Slawin will be paid a monthly consulting fee of $25,000 during the term of the agreement. In addition, Dr. Slawin will be entitled to receive payments covering healthcare benefit premiums during the term of the consulting agreement and will be entitled to reimbursement for documented expenses under the Company’s reimbursement policy.

S-11

Table of Contents

Effective January 30, 2017, Thomas J. Farrell resigned from his position as a member of our Board of Directors and our President and Chief Executive Officer. In connection with Mr. Farrell’s resignation, we entered into a letter agreement with Mr. Farrell that provides for certain separation benefits in the form of continued payment of base salary for 12 months, a lump sum amount equal to Mr. Farrell’s pro-rated target performance bonus for 2017, and reimbursement of COBRA premiums for up to 12 months. In addition, we agreed to retain Mr. Farrell as a consultant at a rate of $5,000 per month, for a term of up to 18 months measured from January 30, 2017. In exchange for Mr. Farrell’s consulting services, we also agreed to extend the separation benefits specified above for an additional six months following the initial 12 month period, subject to Mr. Farrell’s continuous service and other terms and conditions specified in the agreement.

Effective March 14, 2017, Peter L. Hoang was terminated from his position as Senior Vice President of Business Development and Strategy. In connection with Mr. Hoang’s termination, his employment agreement provides for certain separation benefits in the form of continued payment of base salary for 12 months, a lump sum amount equal to Mr. Hoang’s pro-rated target performance bonus for 2017, and reimbursement of COBRA premiums for up to 12 months.

Employment Arrangements

We currently have written employment agreements with our executive officers, including Ken Moseley, an executive officer and our Senior Vice President and General Counsel, who is the spouse of Dr. Annemarie Moseley, Ph.D., M.D., our Chief Operating Officer and Executive Vice President of Clinical Development.

Dr. Tsvetelina P. Hoang, Ph.D., a scientist at Bellicum, is the spouse of Peter L. Hoang, our former Senior Vice President of Business Development and Strategy. Dr. Hoang’s compensation was determined in accordance with employee levels previously approved by our Compensation Committee, and is commensurate with the compensation of other comparable employees. Dr. Hoang received an aggregate of $254,747 in total compensation for the year ended December 31, 2016, which amount includes salary, bonus, option awards and all other compensation (including life insurance premiums and parking subsidies). In accordance with SEC rules, the value of option awards included in the total compensation for Dr. Hoang set forth in this paragraph reflect the aggregate grant date fair value of the option awards granted during the applicable fiscal year, computed in accordance with ASC 718. Assumptions used in the calculation of these amounts are included in Note 9 to our audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2016. These amounts do not reflect the actual economic value that will be realized by the employee upon the vesting of the stock options, the exercise of the stock options, or the sale of the common stock underlying such stock options.

S-12

Table of Contents

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF COMMON STOCK

The following describes the material U.S. federal income tax consequences to non-U.S. holders (as defined below) of the acquisition, ownership and disposition of our common stock issued pursuant to this offering. This discussion is not a complete analysis of all potential U.S. federal income tax consequences relating thereto, does not address the potential application of the Medicare contribution tax and does not address any estate or gift tax consequences or any tax consequences arising under any state, local or foreign tax laws, or any other U.S. federal tax laws. This discussion is based on the Internal Revenue Code of 1986, as amended, or the Code, Treasury Regulations promulgated thereunder, judicial decisions and published rulings and administrative pronouncements of the Internal Revenue Service, or IRS, all as in effect as of the date of this prospectus supplement. These authorities may change, possibly retroactively, resulting in U.S. federal income tax consequences different from those discussed below. We have not requested a ruling from the U.S. Internal Revenue Service, or IRS, with respect to the statements made and the conclusions reached in the following description, and there can be no assurance that the IRS will agree with such statements and conclusions.

This discussion is limited to non-U.S. holders who purchase our common stock issued pursuant to this offering and who hold our common stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all of the U.S. federal income tax consequences that may be relevant to a particular holder in light of such holder’s particular circumstances. This discussion also does not consider any specific facts or circumstances that may be relevant to holders subject to special rules under the U.S. federal income tax laws, including, without limitation, certain former citizens or long-term residents of the United States, partnerships or other pass-through entities, non-U.S. governmental or sovereign entities or any entities qualifying under Section 892 of the Code, “controlled foreign corporations,” “passive foreign investment companies,” corporations that accumulate earnings to avoid U.S. federal income tax, banks, financial institutions, investment funds, insurance companies, brokers, dealers or traders in securities, tax-exempt organizations, tax-qualified retirement plans, persons subject to the alternative minimum tax, persons that own, or have owned, actually or constructively, more than 5% of our common stock and persons holding our common stock as part of a hedging or conversion transaction or straddle, or a constructive sale, or other risk reduction strategy.

If an entity or arrangement that is classified as a partnership for U.S. federal income tax purposes holds our common stock, the U.S. federal income tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. Partnerships holding our common stock and the partners in such partnerships are urged to consult their tax advisors as to particular U.S. federal income tax consequences to them of holding and disposing of our common stock.

PROSPECTIVE INVESTORS SHOULD CONSULT THEIR TAX ADVISORS REGARDING THE PARTICULAR U.S. FEDERAL INCOME TAX CONSEQUENCES TO THEM OF ACQUIRING, OWNING AND DISPOSING OF OUR COMMON STOCK, AS WELL AS ANY TAX CONSEQUENCES ARISING UNDER ANY STATE, LOCAL OR FOREIGN TAX LAWS AND ANY OTHER U.S. FEDERAL TAX LAWS.

Definition of non-U.S. holder

For purposes of this discussion, a non-U.S. holder is any beneficial owner of our common stock that is not a “U.S. person” or a partnership (including any entity or arrangement treated as a partnership) for U.S. federal income tax purposes. A beneficial owner is a U.S. person if the owner is, for U.S. federal income tax purposes, any of the following:

| • | an individual citizen or resident of the United States; |

| • | a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized under the laws of the United States, any state thereof or the District of Columbia; |

S-13

Table of Contents

| • | an estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

| • | a trust (1) whose administration is subject to the primary supervision of a U.S. court and which has one or more U.S. persons who have the authority to control all substantial decisions of the trust, or (2) that has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person. |

Distributions on our common stock

If we make cash or other property distributions on our common stock, such distributions will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Amounts not treated as dividends for U.S. federal income tax purposes will constitute a return of capital and will first be applied against and reduce a holder’s tax basis in our common stock, but not below zero. Any excess will be treated as gain realized on the sale or other disposition of our common stock and will be treated as described under the section of this prospectus supplement titled “Gain on disposition of our common stock” below.

Subject to the discussion below regarding backup withholding and FATCA, dividends (out of earnings and profits) paid to a non-U.S. holder of our common stock generally will be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of the dividends, or such lower rate specified by an applicable income tax treaty. To receive the benefit of a reduced treaty rate, a non-U.S. holder must furnish to us or our paying agent a valid IRS Form W-8BEN or IRS Form W-8BEN-E (or applicable successor form) including a U.S. taxpayer identification number and certifying such holder’s qualification for the reduced rate. This certification must be provided to us or our paying agent prior to the payment of dividends and must be updated periodically. If the non-U.S. holder holds the stock through a financial institution or other agent acting on the non-U.S. holder’s behalf, the non-U.S. holder will be required to provide appropriate documentation to the agent, which then will be required to provide certification to us or our paying agent, either directly or through other intermediaries.

Non-U.S. holders that do not timely provide the required certification, but that qualify for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

If a non-U.S. holder holds our common stock in connection with the conduct of a trade or business in the United States, and dividends paid on our common stock are effectively connected with such holder’s U.S. trade or business (and are attributable to such holder’s permanent establishment in the United States if required by an applicable tax treaty), the non-U.S. holder will be exempt from U.S. federal withholding tax. To claim the exemption, the non-U.S. holder must generally furnish a properly executed IRS Form W-8ECI (or applicable successor form).

Any dividends paid on our common stock that are effectively connected with a non-U.S. holder’s U.S. trade or business (and if required by an applicable income tax treaty, are attributable to a permanent establishment maintained by the non-U.S. holder in the United States) generally will be subject to U.S. federal income tax on a net income basis at the regular graduated U.S. federal income tax rates in the same manner as if such holder were a resident of the United States. A non-U.S. holder that is a foreign corporation also may be subject to an additional branch profits tax equal to 30% (or such lower rate specified by an applicable income tax treaty) of its effectively connected earnings and profits for the taxable year, as adjusted for certain items.

Non-U.S. holders should consult their tax advisors regarding any applicable income tax treaties that may provide for different rules, reduced rates of withholding on dividends, or branch profits tax.

S-14

Table of Contents

Gain on disposition of our common stock

Subject to the discussion below regarding backup withholding and FATCA, a non-U.S. holder generally will not be subject to U.S. federal income tax on any gain realized upon the sale or other disposition of our common stock, unless:

| • | the gain is effectively connected with the non-U.S. holder’s conduct of a trade or business in the United States, and if required by an applicable income tax treaty, is attributable to a permanent establishment maintained by the non-U.S. holder in the United States; |

| • | the non-U.S. holder is a nonresident alien individual present in the United States for 183 days or more during the taxable year of the disposition, and certain other requirements are met; or |

| • | our common stock constitutes stock in a United States real property holding corporation, or USRPHC, for U.S. federal income tax purposes at any time within the shorter of the five-year period preceding the disposition or the non-U.S. holder’s holding period for our common stock, and we either cease to be regularly traded on an established securities market or the disposing non-U.S. holder owned, at any time during that five-year or shorter period, more than 5% of our common stock, directly or indirectly by attribution. |

The determination of whether we are a USRPHC depends on the fair market value of our U.S. real property interests relative to the fair market value of our other trade or business assets and our foreign real property interests. We believe we are not currently and do not anticipate becoming a USRPHC for U.S. federal income tax purposes.

Gain described in the first bullet point above generally will be subject to U.S. federal income tax on a net income basis at the regular graduated U.S. federal income tax rates in the same manner as if such holder were a resident of the United States. A non-U.S. holder that is a foreign corporation also may be subject to an additional branch profits tax equal to 30% (or such lower rate specified by an applicable income tax treaty) of its effectively connected earnings and profits for the taxable year, as adjusted for certain items. Non-U.S. holders should consult their tax advisors regarding any applicable income tax treaties that may provide for different rules. Gain described in the second bullet point above will be subject to U.S. federal income tax at a flat 30% rate (or such lower rate specified by an applicable income tax treaty), but may be offset by certain U.S.-source capital losses (even though the individual is not considered a resident of the United States), provided that the non-U.S. holder has timely filed U.S. federal income tax returns with respect to such losses.

Information reporting and backup withholding

Annual reports are required to be filed with the IRS and provided to each non-U.S. holder indicating the amount of dividends on our common stock paid to such holder and the amount of any tax withheld with respect to those dividends. These information reporting requirements apply even if no withholding was required because the dividends were effectively connected with the holder’s conduct of a U.S. trade or business, or withholding was reduced or eliminated by an applicable income tax treaty. This information also may be made available under a specific treaty or agreement with the tax authorities in the country in which the non-U.S. holder resides or is established. Backup withholding, currently at a 28% rate, generally will not apply to payments to a non-U.S. holder of dividends on or the gross proceeds of a disposition of our common stock provided the non-U.S. holder furnishes the required certification as to its non-U.S. status, such as by providing a valid IRS Form W-8BEN, IRS Form W-8BEN-E or IRS Form W-8ECI, or certain other requirements are met. Notwithstanding the foregoing, backup withholding may apply if the payor has actual knowledge, or reason to know, that the holder is a U.S. person who is not an exempt recipient.

Backup withholding is not an additional tax. If any amount is withheld under the backup withholding rules, the non-U.S. holder should consult with a U.S. tax advisor regarding the possibility of and procedure for obtaining a refund or a credit against the non-U.S. holder’s U.S. federal income tax liability, if any.

S-15

Table of Contents

Withholding on foreign entities

Sections 1471 through 1474 of the Code (commonly referred to as FATCA) impose a U.S. federal withholding tax of 30% on certain payments made to a “foreign financial institution” (as specially defined under these rules) unless such institution enters into an agreement with the U.S. government to withhold on certain payments and to collect and provide to the U.S. tax authorities substantial information regarding U.S. account holders of such institution (which includes certain equity and debt holders of such institution, as well as certain account holders that are foreign entities with U.S. owners) or an exemption applies. FATCA also generally will impose a U.S. federal withholding tax of 30% on certain payments made to a non-financial foreign entity unless such entity provides the withholding agent a certification identifying the direct and indirect U.S. owners of the entity or an exemption applies. An intergovernmental agreement between the United States and an applicable foreign country may modify these requirements. Under certain circumstances, a non-U.S. holder might be eligible for refunds or credits of such taxes. FATCA currently applies to dividends paid on our common stock. FATCA will also apply to gross proceeds from sales or other dispositions of our common stock after December 31, 2018.

Prospective investors are encouraged to consult with their own tax advisors regarding the possible implications of this legislation on their investment in our common stock.

S-16

Table of Contents

Citigroup Global Markets Inc. and Jefferies LLC are acting as joint book-running managers of the offering and as representatives of the underwriters named below. Subject to the terms and conditions stated in the underwriting agreement, dated March 23, 2017, each underwriter named below has severally agreed to purchase, and we have agreed to sell to that underwriter, the number of shares set forth opposite the underwriter’s name.

| Underwriter |

Number of Shares |

|||

| Citigroup Global Markets Inc. |

1,750,000 | |||

| Jefferies LLC |

1,550,000 | |||

| Guggenheim Securities, LLC |

700,000 | |||

| Ladenburg Thalmann & Co. Inc. |

333,334 | |||

| Raymond James & Associates, Inc. |

333,333 | |||

| SunTrust Robinson Humphrey, Inc. |

333,333 | |||

|

|

|

|||

| Total |

5,000,000 | |||

|

|

|

|||

The underwriting agreement provides that the obligations of the underwriters to purchase the shares included in this offering are subject to approval of legal matters by counsel and to other conditions. The underwriters are obligated to purchase all the shares (other than those covered by the underwriters’ option to purchase additional shares described below) if they purchase any of the shares.

Shares sold by the underwriters to the public will initially be offered at the initial public offering price set forth on the cover of this prospectus supplement. Any shares sold by the underwriters to securities dealers may be sold at a discount from the initial public offering price not to exceed $0.432 per share. If all the shares are not sold at the initial offering price, the underwriters may change the offering price and the other selling terms.

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 750,000 additional shares at the public offering price less the underwriting discount. To the extent the option is exercised, each underwriter must purchase a number of additional shares approximately proportionate to that underwriter’s initial purchase commitment. Any shares issued or sold under the option will be issued and sold on the same terms and conditions as the other shares that are the subject of this offering.

We and our officers and directors have agreed that, for a period of 90 days from the date of this prospectus supplement, we and they will not, without the prior written consent of Citigroup and Jefferies, dispose of or hedge any shares or any securities convertible into or exchangeable for our common stock. Citigroup and Jefferies in their sole discretion may release any of the securities subject to these lock-up agreements at any time without notice.

The shares are listed on The NASDAQ Global Market under the symbol “BLCM.”

The following table shows the underwriting discounts and commissions that we are to pay to the underwriters in connection with this offering. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase additional shares.

| Paid by Bellicum | ||||||||

| No Exercise | Full Exercise | |||||||

| Per share |

$ | 0.72 | $ | 0.72 | ||||

| Total |

$ | 3,600,000 | $ | 4,140,000 | ||||

S-17

Table of Contents

We estimate that our portion of the total expenses of this offering will be approximately $430,000. We have also agreed to reimburse the underwriters for up to $35,000 for their FINRA counsel fee. In accordance with FINRA Rule 5110, the reimbursed fee is deemed underwriting compensation for this offering.

In connection with the offering, the underwriters may purchase and sell shares in the open market. Purchases and sales in the open market may include short sales, purchases to cover short positions, which may include purchases pursuant to the underwriters’ option to purchase additional shares, and stabilizing purchases.

| • | Short sales involve secondary market sales by the underwriters of a greater number of shares than they are required to purchase in the offering. |

| ¡ | “Covered” short sales are sales of shares in an amount up to the number of shares represented by the underwriters’ option to purchase additional shares. |

| ¡ | “Naked” short sales are sales of shares in an amount in excess of the number of shares represented by the underwriters’ option to purchase additional shares. |

| • | Covering transactions involve purchases of shares either pursuant to the underwriters’ option to purchase additional shares or in the open market in order to cover short positions. |

| ¡ | To close a naked short position, the underwriters must purchase shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering. |

| ¡ | To close a covered short position, the underwriters must purchase shares in the open market or must exercise the underwriters’ option to purchase additional shares. In determining the source of shares to close the covered short position, the underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the underwriters’ option to purchase additional shares. |

| • | Stabilizing transactions involve bids to purchase shares so long as the stabilizing bids do not exceed a specified maximum. |

Purchases to cover short positions and stabilizing purchases, as well as other purchases by the underwriters for their own accounts, may have the effect of preventing or retarding a decline in the market price of the shares. They may also cause the price of the shares to be higher than the price that would otherwise exist in the open market in the absence of these transactions. The underwriters may conduct these transactions on The NASDAQ Global Market, in the over-the-counter market or otherwise. If the underwriters commence any of these transactions, they may discontinue them at any time.