UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________to ______________

Commission file number 001-34577

IT Tech Packaging, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 20-4158835 | |

| State or other jurisdiction of | (I.R.S. Employer | |

| Incorporation or organization | Identification No.) |

Science Park, Juli Road,

Xushui District, Baoding City

Hebei Province, The People’s Republic of China 072550

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (86) 312-8698215

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | ITP | NYSE American |

Securities registered pursuant to section 12(g) of the Act:

Common Stock

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the voting and non-voting common stock of the registrant held by non-affiliates as of June 30, 2020 was approximately $14,089,570 based upon 23,097,655 shares of common stock held by non-affiliates and the closing price of the common stock of $0.61 on June 30, 2020.

As of March 23, 2021, there were 99,045,900 shares of the registrant’s common stock, par value $0.001, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None.

EXPLANATORY NOTE

This Amendment to Form 10-K (this “Amendment”) amends the Annual Report for the period ended December 31, 2020 filed on March 23, 2021 (the “Original 10-K”) of IT Tech Packaging, Inc. (the “Company”).

For convenience, this Amendment sets forth the original filing in its entirety as amended where necessary to reflect the Amendment. The following sections were revised to reflect the amendment:

Common Stock

| · | Updated to correct the number of outstanding shares as of March 23, 2021, |

Part II, Item 8. Financial Statements and Supplementary Data

| · |

Notes to Consolidated Financial Statements, Note (12) Common Stock Updated to correct the typo of the exercising price of warrants issued in the 2020 registered direct offering, |

Part II, Item 9A. CONTROLS AND PROCEDURES

| · | Changes were made to include the disclosure under the Controls and Procedures for the year ended December 31, 2020, which was inadvertently omitted in the Original 10-K. |

This Amendment should be read in conjunction with the Original 10-K, and the Company’s other filings made with the U.S. Securities and Exchange Commission subsequent to the filing of the Original 10-K on March 23, 2021. The Original 10-K has not been amended or updated to reflect events occurring after March 23, 2021, except as specifically set forth in this Amendment.

TABLE OF CONTENTS

i

INTRODUCTION

In this annual report, “IT Tech Packaging,” “the Company,” “we,” “our,” or “us” refer to IT Tech Packaging, Inc., and unless the context requires otherwise, includes its subsidiaries and its controlled entity, Hebei Baoding Dongfang Paper Milling Company Limited (“Dongfang Paper”). “Baoding Shengde” means our PRC subsidiary Baoding Shengde Paper Co., Ltd.

All references to “RMB” or “Renminbi” refer to the legal currency of China; all references to “US$,” “dollars,” “U.S. dollars” and “$” refer to the legal currency of the United States.

This annual report on Form 10-K includes our audited consolidated statements of income and comprehensive income and our audited consolidated balance sheets as of December 31, 2019 and 2020.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terms such as “may,” “will,” “expects,” “anticipates,” “future,” “intend,” “plan,” “believe,” “estimate,” “is/are likely to” and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, COVID-19 outbreak, our anticipated revenues from the corrugating medium paper business segment and offset printing paper business, our ability to implement the planned capacity expansion of tissue paper, our ability to introduce new products, market acceptance of new products, general economic and business conditions, the ability to attract or retain qualified senior management personnel and research and development staff, and those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The forward-looking statements made in this annual report relate only to events as of the date on which the statements are made. We undertake no obligation, beyond any than as required by law, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made, even though our situation changes in the future.

We operate in an emerging and evolving environment. New risk factors emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

ii

Corporate History

IT Tech Packaging, Inc. (the “Company”) was incorporated in the State of Nevada on December 9, 2005, under the name “Carlateral, Inc.” Through the steps described below, we became the holding company for Hebei Baoding Dongfang Paper Milling Company Limited (“Dongfang Paper”), a producer and distributor of paper products in China, on October 29, 2007, and effective December 21, 2007, we changed our name to “Orient Paper, Inc.”.

Effective on August 1, 2018, we changed our corporate name to IT Tech Packaging, Inc. The name change was effected through a parent/subsidiary short-form merger of IT Tech Packaging, Inc., our wholly-owned Nevada subsidiary formed solely for the purpose of the name change, with and into us. We were the surviving entity. In connection with the name change, our common stock began being traded under a new NYSE symbol, “ITP,” at such time.

On October 29, 2007, pursuant to an agreement and plan of merger (the “Merger Agreement”), the Company acquired Dongfang Zhiye Holding Limited (“Dongfang Holding”), a corporation formed on November 13, 2006 under the laws of the British Virgin Islands, and issued the shareholders of Dongfang Holding an aggregate of 7,450,497 (as adjusted for a four-for-one reverse stock split effected in November 2009) shares of our common stock, which shares were distributed pro-rata to the shareholders of Dongfang Holding in accordance with their respective ownership interests in Dongfang Holding. At the time of the Merger Agreement, Dongfang Holding owned all of the issued and outstanding stock and ownership of Dongfang Paper and such shares of Dongfang Paper were held in trust with Zhenyong Liu, Xiaodong Liu and Shuangxi Zhao, for Mr. Liu, Mr. Liu and Mr. Zhao (the original shareholders of Dongfang Paper) to exercise control over the disposition of Dongfang Holding’s shares in Dongfang Paper on Dongfang Holding’s behalf until Dongfang Holding successfully completed the change in registration of Dongfang Paper’s capital with the relevant PRC Administration of Industry and Commerce as the 100% owner of Dongfang Paper’s shares. As a result of the merger transaction, Dongfang Holding became a wholly owned subsidiary of the Company, and Dongfang Holding’s wholly owned subsidiary, Dongfang Paper, became an indirectly owned subsidiary of the Company.

Dongfang Holding, as the 100% owner of Dongfang Paper, was unable to complete the registration of Dongfang Paper’s capital under its name within the proper time limits set forth under PRC law. In connection with the consummation of the restructuring transactions described below, Dongfang Holding directed the trustees to return the shares of Dongfang Paper to their original shareholders, and the original Dongfang Paper shareholders entered into certain agreements with Baoding Shengde Paper Co., Ltd. (“Baoding Shengde”) to transfer the control of Dongfang Paper over to Baoding Shengde.

On June 24, 2009, the Company consummated a number of restructuring transactions pursuant to which it acquired all of the issued and outstanding shares of Shengde Holdings Inc., a Nevada corporation. Shengde Holdings Inc. was incorporated in the State of Nevada on February 25, 2009, and holds a wholly-owned subsidiary, Baoding Shengde, a limited liability company organized under the laws of the PRC on June 1, 2009. Because Baoding Shengde is a wholly-owned subsidiary of Shengde Holdings Inc., it is regarded as a wholly foreign-owned entity under PRC law.

Effective June 24, 2009, Baoding Shengde, Dongfang Paper and the original shareholders of Dongfang Paper entered into a number of contractual arrangements, as subsequently amended on February 10, 2010, pursuant to which Baoding Shengde acts as the management company for Dongfang Paper, and Dongfang Paper conducts the principal operations of the business. The contractual arrangements, as amended, effectively transferred the preponderance of the economic benefits of Dongfang Paper to Baoding Shengde, and Baoding Shengde assumed effective control and management over Dongfang Paper. The contractual arrangements, as amended, include the following:

| (i) | Exclusive Technical Service and Business Consulting Agreement |

The exclusive technical service and business consulting agreement, entered into by and between Baoding Shengde and Dongfang Paper, provides that Baoding Shengde shall provide exclusive technical, business and management consulting services to Dongfang Paper, in exchange for service fees including a fee equivalent to 80% of Dongfang Paper’s total annual net profits. The agreement is terminable upon mutual written agreement.

1

| (ii) | Call Option Agreement |

The call option agreement, entered into by and between Baoding Shengde, Dongfang Paper and the shareholders of Dongfang Paper, provides that the shareholders of Dongfang Paper irrevocably grant to Baoding Shengde an option to purchase all or part of each shareholder’s equity interest in Dongfang Paper. The exercise price for the options shall be RMB yuan for each of the shareholders’ equity interests, or if at any time there are PRC laws regulating the minimum exercise price of such options, then to the extent permitted under PRC Law. The call option agreement contains covenants from Dongfang Paper and its shareholders that they will refrain from taking certain actions without Baoding Shengde’s consent that would materially affect Dongfang Paper’s operations and asset value, including (i) supplementing or amending its articles of association or bylaws, (ii) changing Dongfang Paper’s registered capital or shareholding structure, (iii) selling, transferring, mortgaging or disposing of any interests in Dongfang Paper’s assets or income, or encumbering Dongfang Paper’s assets or income in a way that would approve a security interest on such assets, (iv) incurring or guaranteeing any debts not incurred in its normal business operations, (v) entering into any material contract or urging Dongfang Paper management to dispose of any Dongfang Paper assets, unless it is within the company’s normal business operations; (vi) providing any loan or guarantee to any third party; (vii) appointing or removing any management personnel or directors that can be changed upon Dongfang Paper shareholder approval; (viii) declaring or distributing any dividends to the stockholders. The agreement remains effective until Baoding Shengde or its designees have acquired 100% of the equity interests of Dongfang Paper underlying the options.

| (iii) | Share Pledge Agreement |

The share pledge agreement entered into by and between Baoding Shengde, Dongfang Paper and the shareholders of Dongfang Paper, provides that the Dongfang Paper shareholders will pledge all of their equity interests in Dongfang Paper to Baoding Shengde as security for their obligations under the other management agreements described in this section. Specifically, Baoding Shengde is entitled to dispose of the pledged equity interests in the event that the Dongfang Paper shareholders or Dongfang Paper fails to pay the service fees to Baoding Shengde pursuant to the exclusive technical service and business consulting agreement or fails to perform their other obligations under the other management agreement. The agreement contains covenants from Dongfang Paper’s shareholders that they will refrain from taking certain actions without Baoding Shengde’s prior written consent, such as transferring or assigning their equity interests, or creating or permitting the creation of any pledges which may have an adverse effect on the rights or benefits of Baoding Shengde under the agreement. The Dongfang Paper shareholders also promise to comply with the laws and regulations relevant to the pledges under the agreement and to facilitate in good faith the protection of the ability of Baoding Shengde to exercise its rights under the agreement. The terms of the share pledge agreement remains in effect until all the obligations under the other management agreements have been fulfilled, whether or not the terms of the other management agreements have expired.

| (iv) | Proxy Agreement |

The proxy agreement, entered into by and between Baoding Shengde, Dongfang Paper and the shareholders of Dongfang Paper, provides that the Dongfang Paper shareholders shall irrevocably entrust a designee of Baoding Shengde with such shareholder’s voting rights and the right to represent such shareholder to exercise his or her rights at any shareholder’s meeting of Dongfang Paper or with respect to any shareholder action to be taken in accordance with the laws and Dongfang Paper’s Articles of Association. The terms of the agreement are binding on the parties for as long as the Dongfang Paper shareholders continue to hold any equity interest in Dongfang Paper. An Dongfang Paper shareholder will cease to be a party to the agreement once it transfers its equity interests with the prior approval of Baoding Shengde.

On June 24, 2009, Zhao Tianqing, the sole shareholder of Shengde Holdings Inc., assigned to the Company, for good and valuable consideration, 100 shares representing 100% of the issued and outstanding shares of Shengde Holdings Inc. As a result of this assignment and the restructuring transactions described above, Shengde Holdings Inc., Baoding Shengde, and Dongfang Paper became directly and indirectly controlled by the Company, and Dongfang Paper continued to function as the Company’s operating entity.

2

In addition to controlling the operations and beneficial ownership of Dongfang Paper, Baoding Shengde also acquired a digital photo paper production line (including two photo paper coating lines and ancillary equipment) in an asset acquisition transaction on November 25, 2009 and began directly conducting business in the PRC. We suspended production of photo paper in June 2016 and now are upgrading the production line to produce more competitive photo paper products. We expect to resume our digital photo paper production in the near future.

An agreement was entered into among Baoding Shengde, Dongfang Paper and the shareholders of Dongfang Paper on December 31, 2010, reiterating that Baoding Shengde is entitled to the distributable profit of Dongfang Paper, pursuant to the above mentioned Exclusive Technical Service and Business Consulting Agreement. In addition, Dongfang Paper and the shareholders of Dongfang Paper agreed that they would not declare any of Dongfang Paper’s unappropriated earnings, including any earnings of Dongfang Paper from its establishment to 2010 and thereafter, as dividend.

The following diagram sets forth the current corporate structure of IT Tech Packaging:

100% ownership

Controlled by contractual arrangements

3

Recent Developments

March 2021 Public Offering

On March 1, 2021, the Company offered and sold to the public investors an aggregate of 29,277,866 shares of common stock and 14,638,933 warrants to purchase up to 14,638,933 shares of common stock in a firm commitment underwritten public offering for gross proceeds of approximately $21.9 million. The purchase price for each share of common stock and accompanying warrant sold in the offering was $0.75. The warrants are exercisable commencing on March 1, 2021 at an exercise price of $0.75 and will expire on March 1, 2026. In the event of a stock split, stock dividend, combination, subsequent right offering or reclassification of the outstanding shares of Common Stock, the exercise price and the number of shares issuable upon exercise of the warrants shall be proportionately adjusted. The Company intends to use the net proceeds from the offering for general corporate and working capital purposes.

January 2021 Public Offering

On January 20, 2021, the Company offered and sold to certain institutional investors an aggregate of 26,181,818 shares of common stock and 26,181,818 warrants to purchase up to 26,181,818 shares of common stock in a best-efforts public offering for gross proceeds of approximately $14.4 million. The purchase price for each share of common stock and the corresponding warrant sold in the offering was $0.55. The warrants are exercisable commencing on January 20, 2021 at an exercise price of $0.55 and will expire on January 20, 2026. In the event of a stock split, stock dividend, combination, subsequent right offering or reclassification of the outstanding shares of Common Stock, the exercise price and the number of shares issuable upon exercise of the warrants shall be proportionately adjusted. The Company intends to use the net proceeds from the offering for general corporate and working capital purposes.

Cogenerating Project

In November 2020, we completed inviting bids for the 75 tonne per hour biomass boiler procurement for our biomass cogeneration project. Multiple well-known enterprises in the biomass industry participated in tendering opening bids. In February 2021, we completed evaluation on the bidding proposals and announced that Tai Shan Group Co., Ltd., a top manufacturer in the biomass industry in China, has won the bid. Installation of the boilers is expected to commence in the near future. We expect to participate in the bidding process for urban central heating projects.

Summary of Risk Factors

Investing in our securities involves significant risks and uncertainties. You should carefully consider all of the information in this prospectus before making an investment in our securities. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors.”

Risks Related to Our Business

Risks and uncertainties related to our business include, but are not limited to, the following:

| ● | Our business, financial condition and results of operations may be materially adversely affected by global health epidemics, including the recent COVID-19 outbreak; |

| ● | In order to comply with PRC regulatory requirements, we operate our businesses through companies with which we have contractual relationships but in which we do not have controlling ownership; |

| ● | Because we rely on the consulting services agreement with Dongfang Paper for essentially all of our revenue and cash flows, any difficulty for Dongfang Paper to pay consulting fees to Baoding Shengde under the consulting agreement may have a material adverse effect on our operations.; |

| ● | If the PRC government determines that our agreements with these companies are not in compliance with applicable regulations, our business in the PRC could be materially adversely affected; |

| ● | Our arrangements with Dongfang Paper and its shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses; |

| ● | The exercise of our option to purchase part or all of the equity interests in Dongfang Paper under the Call Option Agreement might be subject to approval by the PRC government. Our failure to obtain this approval may impair our ability to substantially control Dongfang Paper and could result in actions by Dongfang Paper that conflict with our interests; |

4

| ● | We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations; |

| ● | Our certificates, permits, and licenses related to our paper making operations are subject to governmental control and renewal and failure to obtain renewal will cause all or part of our operations to be terminated; |

| ● | Compliance with environmental regulations is expensive, and noncompliance may result in adverse publicity and potentially significant monetary damages and fines or suspension of our business operations. |

| ● | Our failure to protect our intellectual property rights may undermine our competitive position, and external infringements of our intellectual property rights may adversely affect our business; |

| ● | We may be subject to intellectual property infringement claims or other allegations, which may materially and adversely affect our business, financial condition and prospects; |

| ● | We may have to bear unanticipated tax liabilities which may cause serious adverse effects to our financial conditions and business operations. |

Risks Related to Doing Business in the PRC

We face risks and uncertainties related to doing business in China in general, including, but not limited to, the following:

| ● | Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business; |

| ● | The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm our business; |

| ● | A slowdown, inflation or other adverse developments in the PRC economy may harm our customers and the demand for our services and products; |

| ● | Governmental control of currency conversion may affect the value of your investment and the fluctuation of the Renminbi may harm your investment; |

| ● | Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may materially adversely affect us; |

| ● | The PRC’s legal and judicial system may not adequately protect our business and operations and the rights of foreign investors; |

| ● | It may be difficult for overseas regulators to conduct investigation or collect evidence within China; |

| ● | The current tensions in international trade and rising political tensions, particularly between U.S. and China, may adversely impact our business, financial condition, and results of operations. |

Risks Related to Our Corporate Structure

We are also subject to risks and uncertainties related to our corporate structure, including, but not limited to, the following:

| ● | Our current corporate structure and business operations may be affected by the newly enacted Foreign Investment Law; |

| ● | Any failure by our consolidated VIEs or their shareholders to perform their obligations under our contractual arrangements with them would have a material adverse effect on our business; |

| ● | We may lose the ability to use and enjoy assets held by our consolidated VIEs that are material to the operation of our business if the entity goes bankrupt or becomes subject to a dissolution or liquidation proceeding. |

5

General Risks Related to Our Common Stock

In addition to the risks described above, we are subject to general risks and uncertainties related to our common stock, including, but not limited to, the following:

| ● | If we fail to comply with Section 404 of the Sarbanes-Oxley Act of 2002 in a timely manner, our business could be harmed and our stock price could decline; |

| ● | Our common stock may be affected by limited trading volume and may fluctuate significantly; |

| ● | If we become directly subject to the scrutiny involving U.S. listed Chinese companies, we may have to expend significant resources to investigate and/or defend the matter, which could harm our business operations, stock price and reputation. |

Impact of COVID-19 on Our Operations and Financial Performance

Outbreaks of epidemic, pandemic, or contagious diseases such as COVID-19, could have an adverse effect on our business, financial condition, and results of operations. The spread of COVID-19 has resulted in the World Health Organization declaring the outbreak of COVID-19 as a global pandemic. Substantially all of our revenues and workforce are concentrated in China. In response to the intensifying efforts to contain the spread of COVID-19, the Chinese government took a number of actions, which included extending the Chinese New Year holiday, quarantining individuals suspected of having COVID-19, asking residents in China to stay at home and to avoid public gathering, among other things. During the early part of 2020, COVID-19 caused temporary closure of our CMP production, and as a result, our revenue of CMP decreased by 49.89 % in the first quarter of 2020. It is, however, still unclear how the pandemic will evolve going forward, and we cannot assure you whether the COVID-19 pandemic will again bring about significant negative impact on our business operations, financial condition and operating results, including but not limited to negative impact to our total revenues.

While we have resumed business operations, there remain significant uncertainties surrounding the COVID-19 outbreak and its further development as a global pandemic. Hence, the extent of the business disruption and the related impact on our financial results and outlook for 2021 cannot be reasonably estimated at this time. The extent to which the COVID-19 impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions taken globally to contain the coronavirus or treat its impact, among others. Existing insurance coverage may not provide protection for all costs that may arise from all such possible events. We are still assessing our business operations and the total impact COVID-19 may have on our results and financial condition, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally.

Our Business

We engage in production and distribution of three categories of paper products: corrugating medium paper, offset printing paper, tissue paper products and non-medical face masks.

Our principal executive offices are located at Science Park, Juli Road, Xushui District, Baoding City, Hebei Province, People’s Republic of China.

Our telephone number is (86) 312-869-8215. Our website is located at http://www.itpackaging.cn.

Manufacturing Process

Corrugating Medium Paper and Offset Printing Paper

Our current products (excluding tissue paper products) generally undergo two stages of manufacturing: (1) creating pulp from recycled paper products, and (2) treating the pulp and molding it into the desired types of paper products. A brief overview of the pulp and papermaking process is provided below.

Pulping

The recycled waste paper is first sorted by machine, and then broken down and beaten or smashed into small pieces using water and mechanical energy. It is then put through a course screening drum, followed by a fine screening drum to separate different grades of pulp, a process that we refer as “concentration”. In order to purify the pulp further, an approach flow system is used to filter out any impurities or inconsistencies, such as sand, in the pulp.

Paper Making

The pulp is sieved to remove the excess water and molded into a specific size. The moisture content is further reduced by applying hydraulic pressure to the pulp. The pulp then enters the drying section where it is rolled over by heated cylinders. The dried paper is then coated with a mixture of clay, white pigment and binder to produce a surface on which ink can sit without being fully absorbed, enabling crisper, more consistent print quality.

6

The paper goes through a process called calendaring, which flattens and smoothens the paper into long sheets. The paper is then wound onto a reel that is mounted in a roll-slitting machine for rewinding, during which cutters are used to cut the paper into the desired widths. Upon completion, the rolls are fitted with sleeves and labeled, and then sent to quality control before shipment or storage.

Base Tissue Paper

While we make tissue paper products, we currently purchase paper pulp from suppliers and use it to manufacture base tissue paper directly.

Products

Corrugating medium paper

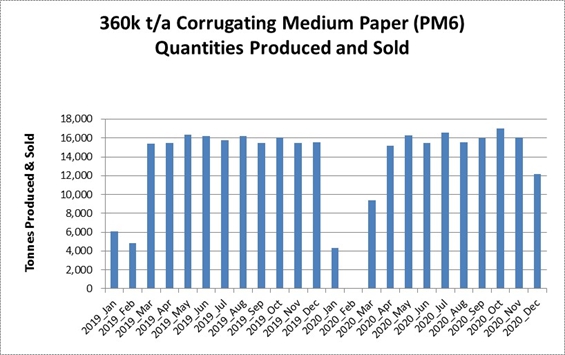

Corrugating medium paper, or CMP is used in the manufacturing of cardboard. Since the launch of our new Paper Machine (“PM6”) production line in December 2011, corrugating medium paper has become a major product of the Company. For the year ended December 31, 2020, corrugating medium paper comprised approximately 86.61% of our total paper production quantities and roughly 78.42% of our total revenue. Raw materials used in the production of corrugating medium paper include recycled paper board (or Old Corrugating Cardboard or “OCC,” as it is commonly referred to in the United States) and certain supplementary agents. In January 2013, we suspended the operation of our PM1 production line for renovation, which was then used to produce corrugating medium paper. In May 2014, we launched the commercial production of a renovated PM1 production line. The renovated PM1 production line produces light-weight corrugating medium paper with a specification of 40 to 80 grams per square meter (“g/s/m”). PM1’s light-weight corrugating medium paper products have a wide range of commercial applications. For example, they can be used as a construction material for wall and floor insulation or to manufacture moisture-proof packaging materials for the transportation of books and magazines by the publishing industry. It can also be used as corrugating medium to make corrugating cardboard for packaging that requires light-weight boxes. The manufacturing process of light-weight corrugating medium paper is similar to that of the regular corrugating medium paper and also uses recycled paper boards as a major source of raw material. We now have two corrugating medium paper production lines, PM6 and PM1. We refer to products produced from the PM6 production line as Regular CMP and products produced from the PM1 production line as Light-Weight CMP.

Offset printing paper

Offset printing paper is used for offset printing in the publishing industry. Offset printing paper comprised approximately 8.96% of our total paper production quantities and approximately 12.15% of our total sales revenue for the year ended December 31, 2020. Raw materials used in making offset printing paper include recycled white scrap paper, fluorescent whitening agent and sizing agent. We currently have two production lines, PM2 and PM3, for the production of offset printing paper.

Tissue Paper Products

We began the commercial production of tissue paper products in Wei County Industry Park in June 2015. We process base tissue paper purchased from long-term cooperative third party and produce finished tissue paper products, including toilet paper, boxed and soft-packed tissues, handkerchief tissues and paper napkins, as well as bathroom and kitchen paper towels that are marketed and sold under the Dongfang Paper brand. In December 2018 and November 2019, we completed the construction, installation and test of operation of PM8 and PM9, respectively, and commercially launched tissue paper production of PM8 and PM9 at such time. On May 5, 2020, the Company announced it planned the commercial launch of a new tissue paper production line PM10 and the Company signed an agreement to purchase paper machine with paper machine supplier. The Company expected the new tissue paper production line to be launched after the completion of trial run. Tissue paper products comprised approximately 4.43% of our total paper production quantities and approximately 8.34% of our total sales revenue for the year ended December 31, 2020.

7

Face Masks

On April 29, 2020, we launched a production line of non-medical single-use face masks, following the completion of raw materials preparation, trial run of the equipment and the sample products inspection. In January 2021, the Company announced it has submitted an application for the license for its new single-use surgical masks from local food and drug administration in Hebei province.

Market for our Products

The PRC Paper Making Industry

According to the 2019 China Paper Industry Annual Report, issued by the China Paper Association, there were approximately 2,700 paper and paper board manufacturers (down from 3,700 in 2010) in China, with a total output of 107.65 million tonnes, up by 3.16% from 104.35 million tonnes in 2018. Total domestic consumption was 107.04 million tonnes in 2019, up by 2.54% from 104.39 million tonnes in 2018.

Compared with 2010, output in 2019 increased by approximately 3.16% and consumption grew by approximately 2.54%. The output of paper and paper board maintained an average growth rate of approximately 1.68% during the ten-year period from 2010 to 2019, while consumption increased at an average annual rate of 1.73%. The growth is expected to continue. It is estimated that China currently has the largest paper and paper board products output and consumption in the world. (Data source: 2019 Annual Report of China Paper Manufacturing, May 2020, China Paper Association)

Data source: 2019Annual Report of China’s Paper Industry, May 2020, China Paper Association

Corrugating medium paper production in China totaled 22.20 million tonnes in 2019, a 5.46% increase from 2018. Consumption of corrugating medium paper in China amounted to 23.74 million tonnes in 2019, an increase of 7.28% as compared to 2018.

Uncoated offset printing paper production in China totaled 17.80 million tonnes in 2019, a 1.71% increase from 2018. Consumption of uncoated offset printing paper in China amounted to 17.49 million tonnes in 2019, a decrease of 0.11% as compared to 2018.

The paper making industry in China is concentrated in the east coast provinces. The largest paper production capacities by province for 2018 and 2019 (the most recent year for which relevant information is available) are summarized in the table below. The three provinces with largest capacities showed moderate increases in paper production capacities; provinces with smaller capacities, such as, Chongqing, Hubei and Fujian, showed noticeable increases as well.

| Province | 2018 Capacity (10k tonnes) | 2019 Capacity (10k tonnes) | % Change | |||||||||

| Guangdong | 1,815 | 1,864 | 2.70 | |||||||||

| Shandong | 1,810 | 1,830 | 1.10 | |||||||||

| Zhejiang | 1,510 | 1,429 | (5.36 | ) | ||||||||

| Jiangsu | 1,141 | 1,312 | 14.99 | |||||||||

| Fujian | 750 | 784 | 7.53 | |||||||||

| Henan | 490 | 498 | 1.63 | |||||||||

| Hubei | 325 | 355 | 9.23 | |||||||||

| Anhui | 305 | 325 | 6.56 | |||||||||

| Chongqing | 288 | 301 | 4.51 | |||||||||

| Sichuan | 245 | 260 | 6.12 | |||||||||

Data Sources: 2019 Annual Report of China’s Paper Industry, May 2020, China Paper Association

8

Customers

We generally sell our corrugating medium paper to companies making corrugating cardboards and offset printing paper to printing companies. Our largest customer is a packaging company in Tianjin City. Our total corrugating medium and offset printing paper revenue in 2020 was primarily derived from customers in Tianjin, Hebei Province and Shandong Province.

For the year ended December 31, 2020, five major customers who individually accounted for more than 5% of our total sales revenue are as follows:

| 2020 | ||||||||

| Sales Amount | ||||||||

| (USD$, net of | % of | |||||||

| applicable | Total | |||||||

| VAT) | Revenue | |||||||

| Company A (Baoding) | 5,867,306 | 5.81 | % | |||||

| Company B (Tianjin) | 5,556,350 | 5.50 | % | |||||

| Company C (Tianjin) | 5,519,641 | 5.47 | % | |||||

| Company D (Hebei) | 5,189,873 | 5.14 | % | |||||

| Company E(Shandong) | 5,050,769 | 5.00 | % | |||||

| Total Major Customers | 27,183,939 | 26.92 | ||||||

Eight of our top-ten customers of 2020 are also in the top-ten customer list in 2019, representing 78.6% of the 2019 top-ten customer sales.

Target Market

We target corporate customers in the middle range of the marketplace, where, with solid quality and competitive pricing, we see potential for high volume growth for corrugating medium paper and offset printing paper. Our primary market has been the region of North China, especially in the province of Hebei.

Our Production Lines

During the year ended December 31, 2020, we had six PM production lines in operation and are in the process of launching one more that are designated as PM7. These production lines include the followings:

| Designed | ||||||||||||

| Paper Product | Capacity | |||||||||||

| PM# | Produced | (tonnes/year) | Owned by | Operated by | Status as of December 31, 2020 | |||||||

| PM1 | Corrugating Medium | 60,000 | Dongfang Paper | Dongfang Paper | In production | |||||||

| Paper | ||||||||||||

| PM2 | Offset Printing Paper | 50,000 | Dongfang Paper | Dongfang Paper | In production | |||||||

| PM3 | Offset Printing Paper | 40,000 | Dongfang Paper | Dongfang Paper | In production | |||||||

| PM4 | Digital Photo Paper | ** | Baoding Shengde | Baoding Shengde | Suspended in June 2016 due to low market | |||||||

| demand | ||||||||||||

| PM5 | Digital Photo Paper | ** | Baoding Shengde | Baoding Shengde | Suspended in June 2016 due to low market | |||||||

| demand | ||||||||||||

| PM6 | Corrugating Medium | 360,000 | Baoding Shengde | Dongfang Paper*** | In production | |||||||

| Paper | ||||||||||||

| PM7* | Specialty paper | 10,000 | Dongfang Paper | Dongfang Paper | Under renovation and preparing for launch by the | |||||||

| end of 2021 | ||||||||||||

| PM8 | Tissue paper | 15,000 | Dongfang Paper | Dongfang Paper | In production | |||||||

| PM9 | Tissue paper | 15,000 | Dongfang Paper | Dongfang Paper | In production. | |||||||

| PM10 | Tissue paper | 20,000 | Dongfang Paper | Dongfang Paper | In construction | |||||||

*: Paper machines under renovation, under construction, or in the planning stage.

***: PM6 is funded and owned by Baoding Shengde; ancillary facilities that support the PM6 operation are built and owned by Dongfang Paper.

9

On December 31, 2009, we acquired a digital photo paper production line, including two coating lines that are designated as PM4 and PM5 and ancillary equipment, for a total purchase price of approximately $13.6 million. We suspended production of photo paper in June 2016.

In order to meet the growing domestic demand for paper, which we believe currently exceeds domestic supply in the case of corrugating medium paper, especially in the region of North China, we installed a corrugating medium paper production line (PM6) with a designed capacity of 360,000 tonnes per year. We completed the installation of the PM6 production line in November 2011 and began commercial production in December 2011.

We have implemented a plan to renovate one of the old production lines that has been idle since the end of 2007. We previously made paper with anti-counterfeit features from that production line. When the renovation is completed, we intend to use the renovated production line to produce high-profit margin specialty papers. Our current plan is to complete the renovation project, put in place a new production and marketing team and launch the renovated production line as PM7 by the end of 2021.

On November 27, 2012, we signed a 15-year lease relating to approximately 49.4 acres of land in the Economic Development Zone in Wei County, Hebei Province, China for the purpose of developing a new tissue paper production plant. We planned to build two tissue paper production lines, each with 15,000 tonnes/year capacity, and other packaging facilities and infrastructures on the leased land. In December 2012, we signed a contract with an equipment contractor in Shanghai to build PM8, the first of our two tissue paper production lines in Wei County. In December 2018 and November 2019, we completed the construction, installation and test of operation of PM8 and PM9, respectively and commercially launched tissue paper productions of PM8 and PM9 at such time. On May 5, 2020, the Company announced it planned the commercial launch of a new tissue paper production line PM10 and the Company signed an agreement to purchase paper machine with paper machine supplier. The Company expected the new tissue paper production line to be launched after the completion of trial run.

We voluntarily renovated our 150,000 tonnes/year corrugating medium paper PM1 in anticipation of increased regulatory concerns on energy efficiencies as well as to improve the quality of our corrugating medium products. Rather than converting PM1 to a regular corrugating medium paper machine, we decided in 2013 that, based on the market conditions and our waste water treatment capability, the better option was to convert PM1 to produce Light-Weight CMP with a specification of 40 to 80 grams per square meter (“g/s/m”) with a designed capacity of 60,000 tonnes/year. We started the renovation in January 2013 and launched commercial production of the renovated PM1 production line in May 2014.

Raw Materials and Principal Suppliers

The supplies used in our production processes are comprised mainly of recycled paper board and unprinted recycled white scrap paper, both of which are ready-to-use items and available from multiple domestic and foreign sources. We currently purchase all of our recycled paper supplies from some domestic recycling stations and do not rely on imported recycled paper. We also purchase coal and chemical agents from nearby suppliers. Ongoing inflationary pressures and higher demand for recycled paper could lead to an increase in our costs of raw materials and production, which we may or may not be able to pass to our customers.

We sign annual raw materials supplier contracts with our suppliers. Although we have contracts with our suppliers, these contracts do not lock-in the purchase price of our raw materials or provide hedge against the fluctuation in the market price of these raw materials. For the year ended December 31, 2020, we had two large suppliers which accounted for approximately 72% and 12% of our total purchases, respectively.

10

For the year ended December 31, 2020, two major suppliers who individually accounted for more than 5% of our total purchase are as follows:

| 2020 | ||||||||

| Purchase | ||||||||

| Amount | ||||||||

| (USD$, net of | % of | |||||||

| applicable | Total | |||||||

| VAT) | Purchase | |||||||

| Company A (Baoding) | 62,920,272 | 72 | % | |||||

| Company B (Baoding) | 10,788,138 | 12 | % | |||||

| Total Major Suppliers | 73,708,410 | 84 | % | |||||

Competition

Dongfang Paper’s main competitors are: Chenming Paper Group Limited, Huatai Group Limited, Nine Dragons Paper (Holdings) Limited and Sun Paper Group Limited. A number of our competitors are public entities with larger capacities, broader customer bases and greater financial resources than those available to us. The businesses of our primary competitors are briefly described below:

Chenming Paper Group, Ltd. (“Chenming”), based in Shandong Province (located in northeast China), produces primarily news print paper and art paper (high quality, heavy and two-side coated printing paper). Chenming is believed to be the first company to have listed on all three stock exchanges in China: Renminbi A-shares and foreign currency B-shares in Shenzhen, the smaller of the mainland’s two stock exchanges, and H-shares in Hong Kong. Chenming has annual production capacity of 8.5 million tonnes for its coated wood-free paper product and is believed to rank among the top 500 enterprises in China.

Huatai Group, Ltd. (“Huatai”), based in Shandong Province (located in the northern part of the eastern coastal region of China), primarily produces newsprint, fine paper, special printing paper, coated board and tissue paper. Huatai is the first Shandong papermaker to publicly list its stock and has become a famous brand in China. Its annual paper production is estimated to have reached 4 million tonnes.

Nine Dragons Paper (Holdings) Limited (“ND Paper”), based in Guangdong Province (located in southern China), is the largest paper manufacturer in China and primarily produces kraft paper and high-strength corrugating medium paper with annual capacity of 13 million tonnes. ND Paper has reported that it has five production lines in the city of Tianjin with a total designed capacity of 2.15 million tonnes, producing products such as kraft paper, high strength corrugating medium paper and grey-back duplex board.

Sun Paper Group, Ltd., based in Shandong Province, primarily produces card paper, whiteboard paper and art paper. It also produces alkaline peroxide mechanical pulp, sourced in part from wood chips harvested by the company’s poplar plantations. This company has reported that it has an aggregate annual production capacity of paper and pulp of approximately 5.7 million tonnes and has been listed on the Shenzhen Stock Exchange since 2006.

With the exceptions of Chenming and ND Paper, which may compete directly with us in the offset printing paper market and the corrugating medium paper market, respectively, in the Beijing/Tianjin/greater Hebei regions, we believe that we face only indirect competition from the above-listed companies, either because we have a different product assortment from these companies, or because, to the extent they do offer products similar to ours, the transportation costs and storage costs make it difficult for these companies to compete effectively with us on pricing.

Our Competitive Edge

Regional advantage (Northern China). We believe that Dongfang Paper is one of the leading papermaking enterprises in Hebei Province. Our proximity to large urban centers in northern China, Beijing and Tianjin, gives us access to a large market to sell our products.

There are other paper manufacturers that are also located in Hebei Province (and close to metropolitan Beijing and Tianjin areas), but most of these other manufacturers are small in scale and unable to compete with us effectively. We also compete with other large printing paper manufacturers for Beijing printing company customers. We believe that we have cost and geographical advantages over these larger competitors.

11

Cost advantage. Unlike some of our out-of-province competitors who must set up interim warehouses and ship products from their production base to such interim warehouses close to their customer base in Beijing, there is no need for us to set up interim warehouses, because we are approximately 60 miles (100 kilometers) from Beijing, the cultural center of China and our largest target market. While we do not separately pay for transportation cost on raw material purchases, the transportation cost included in the raw material purchase prices from our recycled paper suppliers is lower than the transportation cost paid by our competitors in the province of Shandong. We also enjoy lower transportation costs for coal, a major source of energy used in our production process. Similarly, our customers pay lower transportation cost to pick up their orders from our finished goods warehouse in Baoding than what they would pay if they had to pick up goods from locations further away from Beijing. Tianjin, another large urban center, is also approximately 60 miles from our facilities. Baoding city itself is also home to numerous printing and packaging companies. Our geographical advantage and easy access to low-cost raw materials allow us to implement a more flexible inventory purchase policy, lower our purchase prices and inventory management expenses and reduce our production cost. As such, we have lower freight costs and other associated costs of sales, which enable us to charge lower prices, if necessary, for our products. Additionally, because we buy all recycled paper raw materials from Beijing and Tianjin, rather than from the United States or Japan, our purchase lead time is shorter as compared to manufacturers who rely on imported recycled paper.

Research and Development

Our R&D activities are carried out by a task force led by a group of senior managers (in charge of product development and quality control) and by a group of selected engineers and technicians. The Company charged the time spent on the R&D projects (manufacturing waste discharge recycling, digital photo paper and tissue paper manufacturing) to R&D expenses. Our R&D efforts in 2020 has focused on evaluating and developing new products that are in the pipeline for 2020 and included developing and improving the manufacturing process of Light-Weight CMP and the production and packaging technology of tissue paper.

One of our production lines, PM7, is under renovation. Since the fourth quarter of 2010, we have spent approximately $1.57 million in machine parts and new components to renovate this production line, with which we expect to produce certain specialty papers, including wood-grain deco and furniture paper, wallpaper and paper with security features (for anti-counterfeiting purposes). While we are optimistic about the prospect of the specialty papers, we cannot guarantee the launch of the specialty paper production (which is tentatively scheduled by the end of 2020) or the success of such renovation.

Intellectual Property

The company has registered nine trademarks with the Trademark Bureau under the State of Administration for Industry & Commerce.

| Trademark | Certificate No. | Category | Registrant | Valid Term | ||||

| Shuangxing | 3298963 | Fax paper, thermal paper, blueprint paper, sensitized paper, spectrum sensitized paper, blueprint cloth, photographic paper, cyanotype solution, diazo paper | Dongfang Paper | April 7, 2014 through April 6, 2024 | ||||

| Fangmenglai | 12955328 | Toilet paper, handkerchief tissues, tissues, paper napkins, paper mats, beer mats, paper place mats, printing paper (including offset paper, newsprint, books paper, bond paper, plate paper and halftone paper), coated paper | Dongfang Paper | December 28, 2014 through December 27, 2024 | ||||

| Fangqingxin | 12955235 | Toilet paper, handkerchief tissues, tissues for makeup remover, paper napkin, tissues, paper duster cloth, paper face towels, paper table cloth, paper tablecloths, drawer liner (with or without flavor) | Dongfang Paper | December 28, 2014 through December 27, 2024 | ||||

| Kaimeilai | 20212149 | Xuan Paper (for traditional Chinese painting and calligraphy), Paper, tissue paper, watercolor paper, writing paper, printing publications, ink, painting brush, packaging plastic film, color box, | Baoding Shengde | July 28, 2017 through July 27, 2027 | ||||

| Shadow | 8349821 | Drying blueprint solution, diazo paper, photographic paper, sensitive paper, blueprint paper, blueprint canvas, spectral photographic plate, heliographic paper | Baoding Shengde | June 14, 2011 through June 13, 2021 | ||||

| Lanmeier | 15635879 | Paper table cover, paper pinafore, drawer lining (with flavor or not) | Hebei Tengsheng | November 21, 2016 through November 20, 2026 | ||||

| Qingmu | 15635916 | Tissue paper, paper handkerchief, paper napkin, facial paper, grained paper, cardboard, white board, container board, kraft liner, corrugated medium paper (board) | Hebei Tengsheng | January 7, 2016 through January 6, 2026 | ||||

| Rongou | 20063034 | Paper, tissue paper, paper handkerchief, paper napkin, facial paper, paper billboard, cleansing tissue, packaging paper or plastic bag (envelop, sachet), carton, paper box | Hebei Tengsheng | July 14, 2017 through July 13, 2027 | ||||

| Weizun | 15636093 | Coasters, paper table cover, paper costers, cleansing paper | Hebei Tengsheng | February 28, 2016 through February 27, 2026 |

Domain names

IT Tech Packaging has registered the internet domain name, http://www.itpackaging.cn.

12

Government Regulation

The testing, approval, manufacturing, labeling, advertising and marketing, post-approval safety reporting and export of our products are extensively regulated by governmental authorities in the PRC. We are also subject to various other regulations and permit requirements by the Chinese government. These regulations and their impact on our business are set forth in more details below.

Environmental Regulation

Our operations and facilities are subject to environmental laws and regulations stipulated by the national and the local environment protection bureaus in the PRC.

Since the implementation of the State Council’s “Decisions on Environmental Protection Issues” in 1996, the PRC paper industry has been subject to more rigorous environmental standards. Effective January 1, 2015, a new law promulgated by the National People’s Congress of the People’s Republic of China makes certain violations of the environmental laws a criminal offense. We believe that we are one of the few major paper manufacturers in Hebei Province that have obtained a Pollution Discharge Permit. We initially received the permit in September 1996 and, we have successfully renewed the permit each year by complying with applicable environmental requirements.

Waste Water Treatment

Dongfang Paper uses a multi-level water recycling process. Waste water from the pulping process is fed into collection pools, where it is divided into two parts, water and recovered pulp fiber. The latter is returned to the pulping process.

Chemical agents are added to the waste water, and the waste water is fed into a biogas reactor and filtering pools, producing purified water and depositing sludge. Most of the purified water is recycled to produce corrugating medium paper and the sludge is pumped into a sludge pool, condensed and dehydrated. We then use the sludge as a raw material in the manufacture of corrugating medium paper.

We maintain computerized controls at our production facilities on a 24-hour basis to monitor compliance with environmental rules and regulations. We are not aware of any environmental investigations, prosecutions, disputes, claims or other environmental proceedings, nor have we been subject to any action by any environmental administration authorities of the PRC. To our knowledge, our operations meet or exceed the existing environmental requirements of the PRC.

Human Capital Resources

Employee Profiles

As of December 31, 2020, we have approximately 333 full time employees, all of whom were based in PRC. As of December 31, 2020, approximately 24.3% of our current workforce is female and 75.7% male. These employees are organized into a labor union under the labor laws of the PRC and have collective bargain power against us. We generally maintain good relations with our employees and the labor union.

Total Rewards

Our compensation program is designed to attract and reward talented individuals who possess the skills necessary to support our business objectives, assist in the achievement of our strategic goals and create long-term value for our stockholders. We provide employees with compensation packages that include base salary and annual incentive bonuses. We also provide private insurance coverage for any workplace accident or injury for all the operators of paper milling machinery in the workshops.

13

Health and Safety

The success of our business is fundamentally connected to the well-being of our people. Accordingly, we are committed to the health, safety and wellness of our employees. We provide our employees and their families with access to a variety of flexible and convenient health and welfare programs, including benefits that support their physical and mental health by providing tools and resources to help them improve or maintain their health status; and that offer choice where possible so they can customize their benefits to meet their needs and the needs of their families. In response to the COVID-19 pandemic, we implemented significant operating environment changes that we determined were in the best interest of our employees, as well as the communities in which we operate, and which comply with government regulations. This includes having the vast majority of our employees work from home, while implementing additional safety measures for employees continuing critical on-site work.

Talent

A core tenet of our talent system is to both develop talent from within and supplement with external hires. This approach has yielded loyalty and commitment in our employee base which in turn grows our business, our products, and our customers, while adding new employees and external ideas supports a continuous improvement mindset and our goals of a diverse and inclusive workforce. Our human resources team uses internal and external resources to recruit highly skilled and talented workers in the PRC, and we encourage employee referrals for open positions.

Available Information

We are required to file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (“SEC”). The public may read and copy any materials that we file with the SEC. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers like our Company that file electronically with the SEC at http://www.sec.gov.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those reports (including exhibits) filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are also available free of charge on our Internet site at http://www.itpackaging.cn as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The information on our website is not, and shall not be deemed to be, a part hereof or incorporated into this or any of our other filings with the SEC.

Executive Officers

For information regarding our executive officers as of March 23, 2021, see Part III, Item 10, “Directors, Executive Officers and Corporate Governance.”

14

Risks Relating to our Business

Our business, financial condition and results of operations may be materially adversely affected by global health epidemics, including the COVID-19 outbreak.

Outbreaks of epidemic, pandemic, or contagious diseases such as COVID-19, could have an adverse effect on our business, financial condition, and results of operations. The spread of COVID-19 has resulted in the World Health Organization declaring the outbreak of COVID-19 as a global pandemic. Substantially all of our revenues and workforce are concentrated in China. In response to the intensifying efforts to contain the spread of COVID-19, the Chinese government took a number of actions, which included extending the Chinese New Year holiday, quarantining individuals suspected of having COVID-19, asking residents in China to stay at home and to avoid public gathering, among other things. During the early part of 2020, COVID-19 caused temporary closure of our CMP production, and as a result, our revenue of CMP decreased by 49.89%.in the first quarter of 2020. It is, however, still unclear how the pandemic will evolve going forward, and we cannot assure you whether the COVID-19 pandemic will again bring about significant negative impact on our business operations, financial condition and operating results, including but not limited to negative impact to our total revenues.

While we have resumed business operations, there remain significant uncertainties surrounding the COVID-19 outbreak and its further development as a global pandemic. Hence, the extent of the business disruption and the related impact on our financial results and outlook for 2021 cannot be reasonably estimated at this time. The extent to which the COVID-19 impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions taken globally to contain the coronavirus or treat its impact, among others. Existing insurance coverage may not provide protection for all costs that may arise from all such possible events. We are still assessing our business operations and the total impact COVID-19 may have on our results and financial condition, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally.

In order to comply with PRC regulatory requirements, we operate our businesses through companies with which we have contractual relationships but in which we do not have controlling ownership.

We do not have direct or indirect equity ownership of Dongfang Paper which operates a majority of our business. Although we have entered into contractual arrangements with Dongfang Paper and its individual owners pursuant to which we receive an economic interest in Dongfang Paper, and exert a controlling influence over Dongfang Paper, in a manner substantially similar to a controlling equity interest, these contractual arrangements are not as effective in providing control over Dongfang Paper as direct ownership. For example, Dongfang Paper may be unwilling or unable to perform their contractual obligations under our commercial agreements, including payment of consulting fees under the Exclusive Technical Service and Business Consulting Agreement as they become due. If that were to occur, we would not be able to conduct our operations in the manner currently planned. In addition, we may not succeed in enforcing our rights under the contractual arrangements insofar as our contractual rights and legal remedies under Chinese law may be inadequate. Furthermore, Dongfang Paper may seek to renew their agreements on terms that are disadvantageous to us. If we are unable to renew these agreements on favorable terms when these agreements expire, or to enter into similar agreements with other parties, we will lose control of Dongfang Paper.

Because we rely on the consulting services agreement with Dongfang Paper for essentially all of our revenue and cash flows, any difficulty for Dongfang Paper to pay consulting fees to Baoding Shengde under the consulting agreement may have a material adverse effect on our operations.

We are a holding company and currently conduct business through Dongfang Paper. As a result, we rely on payments from the consulting services agreement which forms a part of the contractual arrangements between Baoding Shengde and Dongfang Paper. Since Baoding Shengde is not a legal shareholder of Dongfang Paper under PRC statutes, the arrangement for Dongfang Paper to pay a substantial portion of its net income to Baoding Shengde may be challenged by the PRC government, which could prevent us from receiving required funds or making required payments to some of our service providers.

15

If the PRC government determines that our agreements with these companies are not in compliance with applicable regulations, our business in the PRC could be materially adversely affected.

Although we believe the restructuring transaction and our current business operations are in compliance with the current laws in China, we cannot be sure that the PRC government would share the same view. If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business. As a result, our business in the PRC could be materially adversely affected.

The shareholders of Dongfang Paper may have potential conflicts of interests with us, which may adversely affect our business.

We operate most of our businesses through Dongfang Paper. Our Chairman, Chief Executive Officer and 4.7% shareholder, Zhenyong Liu, owns 93.39% of the equity interest in Dongfang Paper. Conflicts of interests between his duties to us and to Dongfang Paper may arise. We cannot assure you that when conflicts of interest arise, he will act in the best interests of our Company or that any conflict of interest will be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations and potentially result in the loss of opportunities.

Our arrangements with Dongfang Paper and its shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses.

We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with Dongfang Paper and its shareholders were not entered into based on arm’s length negotiations. If the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

The exercise of our option to purchase part or all of the equity interests in Dongfang Paper under the Call Option Agreement might be subject to approval by the PRC government. Our failure to obtain this approval may impair our ability to substantially control Dongfang Paper and could result in actions by Dongfang Paper that conflict with our interests.

Our Call Option Agreement with Dongfang Paper and its shareholders gives our Chinese subsidiary, Baoding Shengde or its designated entity or natural person, the option to purchase all or part of the equity interests in Dongfang Paper. The option may not be exercised by Baoding Shengde if the exercise would violate any applicable laws and regulations in China or cause any license or permit held by, and necessary for the operation of Dongfang Paper, to be cancelled or invalidated. Under the laws of China, if a foreign entity, through a foreign investment company that it invests in, acquires a domestic related company, China’s regulations regarding mergers and acquisitions may technically apply to the transaction. If these regulations apply, an examination and approval of the transaction by China’s Ministry of Commerce (“MOFCOM”), or its local counterparts would be required. In addition, an appraisal of the equity interest or the assets to be acquired would also be mandatory. Since the scope of business activities (making of cultural paper products) as defined in the business license of Baoding Shengde does not involve the MOFCOM approval and monitoring, we do not believe at this time that an approval or an appraisal is required for Baoding Shengde to exercise its option to acquire Dongfang Paper. In light of the different views on this issue, however, it is possible that the central MOFCOM office in Beijing will issue a standardized opinion imposing the approval and appraisal requirement. If we are not able to purchase the equity of Dongfang Paper, then we will lose a substantial portion of our ability to control Dongfang Paper and our ability to ensure that Dongfang Paper will act in our interests.

16

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Dongfang Paper commenced its current line of business operations in 1996 and received its initial Pollution Discharge Permit in September 1996, which must be renewed every year for Dongfang Paper to stay in business. Although we have never had problem renewing the Pollution Discharge Permit, we cannot guarantee automatic renewal every year. In addition, Baoding Shengde commenced its current line of business operations in 2009. Therefore, our operating history may not provide a more meaningful basis on which to evaluate its business. We cannot assure you that Dongfang Paper or Baoding Shengde will not incur net losses in the future. We expect that operating expenses of Dongfang Paper and Baoding Shengde will increase as they expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| ● | raise adequate capital for expansion and operations; |

| ● | implement our business model and strategy and adapt and modify them as needed; |

| ● | increase awareness of our brand name, protect our reputation and develop customer loyalty; |

| ● | manage our expanding operations and service offerings, including the integration of any future acquisitions; |

| ● | maintain adequate control of our expenses; or |

| ● | anticipate and adapt to changing conditions in paper markets in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

Dongfang Paper and Baoding Shengde’s failure to compete effectively may adversely affect our ability to generate revenue.

Through Dongfang Paper and Baoding Shengde, we compete in a highly developed market with companies that have significantly greater experience and history in our industry. If we do not compete effectively, we could lose market share and experience reduced selling prices, adversely affecting our financial results. Our competitors will expand in the key markets and implement new technologies making them more competitive. There is also the possibility that competitors will be able to offer additional products, services, lower prices, or other incentives that we cannot or will not offer or that will make our products less profitable. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. An expansion would increase demands on existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect our operations and cause delay in production and delivery of our paper products, as well as administrative inefficiencies.

We, through our subsidiaries, may engage in future acquisitions that could dilute the ownership interests of our stockholders and cause us to incur debt and assume contingent liabilities.

We, through our subsidiaries, may review acquisition and strategic investment prospects that we believe would complement the current product offerings of Dongfang Paper, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time we review investments in new businesses and we, through our subsidiaries, expect to make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor while the proceeds will be forwarded to Dongfang Paper. In the event of any future acquisitions, we could:

| ● | issue equity securities which would dilute current stockholders’ percentage ownership; |

| ● | incur substantial debt; |

17

| ● | assume contingent liabilities; or |

| ● | expend significant cash. |

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

| ● | difficulties in the assimilation of acquired operations, technologies and/or products; |

| ● | unanticipated costs associated with the acquisition or investment transaction; |

| ● | the diversion of management’s attention from other business concerns; |

| ● | adverse effects on existing business relationships with suppliers and customers; |

| ● | risks associated with entering markets in which Dongfang Paper has no or limited prior experience; |

| ● | the potential loss of key employees of acquired organizations; and |

| ● | substantial charges for the amortization of certain purchased intangible assets, deferred stock compensation or similar items. |

We cannot ensure that we will be able to successfully integrate any businesses, products, technology, or personnel that we might acquire in the future and our failure to do so could have a material adverse effect on our and/or Dongfang Paper’s business, operating results and financial condition.

We are responsible for the indemnification of our officers and directors.

Our Articles of Incorporation provides for the indemnification and/or exculpation of our directors, officers, employees, agents and other entities which deal with us to the maximum extent provided, and under the terms provided, by the laws and decisions of the courts of the state of Nevada. Although we do maintain professional error and omission insurance for the officers and directors, due to limitations of the insurance coverage these indemnification provisions could still result in substantial expenditures which we may be unable to recoup through the insurance and could adversely affect our business and financial conditions. Zhenyong Liu, our Chairman of the Board and Chief Executive Officer, Jing Hao, our Chief Financial Officer, Dahong Zhou, our Secretary, and Marco Ku Hon Wai, Wenbing Christopher Wang, Lusha Niu, and Fuzeng Liu, our directors, are key personnel with rights to indemnification under our Articles of Incorporation.