UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2013 |

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _____________to ______________ |

Commission file number 001-34577

ORIENT PAPER, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 20-4158835 |

| State or other jurisdiction of | (I.R.S. Employer |

| Incorporation or organization | Identification No.) |

Science Park, Juli Road,

Xushui County, Baoding City

Hebei Province, The People’s Republic of China 072550

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 011- (86) 312-8698215

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock | NYSE MKT LLC |

Securities registered pursuant to section 12(g) of the Act:

Common Stock

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Ac t). ¨ Yes x No

The aggregate market value of the voting and non-voting common stock of the issuer held by non-affiliates as of June 30, 2013 was approximately $20,185,416 (13,205,825 shares of common stock held by non-affiliates) based upon a closing price of the common stock of $1.51 as quoted by the NYSE MKT LLC on June 30, 2013.

As of March 15, 2014, there were 18,753,900 shares of common stock, par value $0.001, issued and outstanding.

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | BUSINESS | 1 |

| Item 1A. | RISK FACTORS | 12 |

| Item 1B. | UNRESOLVED STAFF COMMENTS | 25 |

| Item 2. | PROPERTIES | 25 |

| Item 3. | LEGAL PROCEEDINGS | 26 |

| Item 4. | MINE SAFETY DISCLOSURES | 26 |

| PART II | ||

| Item 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 26 |

| Item 6. | SELECTED FINANCIAL DATA | 28 |

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 30 |

| Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 48 |

| Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 48 |

| Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 49 |

| Item 9A. | CONTROLS AND PROCEDURES | 49 |

| Item 9B. | OTHER INFORMATION | 49 |

| PART III | ||

| Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 49 |

| Item 11. | EXECUTIVE COMPENSATION | 52 |

| Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 54 |

| Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 56 |

| Item 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 57 |

| PART IV | ||

| Item 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 58 |

| SIGNATURES | 60 | |

INTRODUCTION

In this annual report, “Orient Paper,” “the Company,” “we,” “our” or “us” refer to Orient Paper, Inc., and unless the context requires otherwise, includes its subsidiaries and its controlled entity, Hebei Baoding Orient Paper Milling Company Limited. “Orient Paper Shengde” means our PRC subsidiary Baoding Shengde Paper Co., Ltd. “Orient Paper HB” means Hebei Baoding Orient Paper Milling Company Limited.

All references to “RMB” or “Renminbi” refer to the legal currency of China; all references to “US$,” “dollars,” “U.S. dollars” and “$” refer to the legal currency of the United States.

This annual report on Form 10-K includes our audited consolidated statements of income and comprehensive income for the years ended December 31, 2011, 2012 and 2013 and audited consolidated balance sheets as of December 31, 2012 and 2013.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terms such as “may,” “will,” “expects,” “anticipates,” “future,” “intend,” “plan,” “believe,” “estimate,” “is/are likely to” and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, our anticipated revenues from the digital photo paper business segment and household/tissue paper business, our ability to introduce new products, our ability to implement the planned capacity expansion of corrugate medium paper, market acceptance of new products, general economic and business conditions, the ability to attract or retain qualified senior management personnel and research and development staff and those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The forward-looking statements made in this annual report relate only to events as of the date on which the statements are made. We undertake no obligation, beyond any than as required by law, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made, even though our situation will change in the future.

We operate in an emerging and evolving environment. New risk factors emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

PART I

| Item 1. | Business |

Corporate History

Orient Paper, Inc. was incorporated in the State of Nevada on December 9, 2005, under the name “Carlateral, Inc.” Through the steps described immediately below, we became the holding company for Hebei Baoding Orient Paper Milling Company Limited (“Orient Paper HB”), a producer and distributor of paper products in China, on October 29, 2007, and effective December 21, 2007, we changed our name to “Orient Paper, Inc.” to more accurately describe our business.

On November 13, 2006, Dongfang Zhiye Holding Limited (“Dongfang Holding”) was formed as a holding corporation with no operations under the laws of the British Virgin Islands. On July 16, 2007, Dongfang Holding entered an agreement to acquire all of the issued and outstanding stock and ownership of Orient Paper HB and placed such shares in trust with Zhenyong Liu, Xiaodong Liu, and Shuangxi Zhao pursuant to a trust agreement executed as of the same date. Under the terms of the trust agreement, Mr. Liu, Mr. Liu and Mr. Zhao (the original shareholders of Orient Paper HB) would exercise control over the disposition of Dongfang Holding’s shares in Orient Paper HB on Dongfang Holding’s behalf until Dongfang Holding successfully completed the change in registration of Orient Paper HB’s capital with the relevant PRC Administration of Industry and Commerce as the 100% owner of Orient Paper HB’s shares.

On October 29, 2007, Orient Paper entered into an agreement and plan of merger (the “Merger Agreement”) with (i) its own wholly owned subsidiary, CARZ Merger Sub, Inc., (ii) Dongfang Holding and (iii) each of Dongfang Holding shareholders (Zhenyong Liu, Xiaodong Liu, Chen Li, Ning Liu, Jie Liu, Shenzhen Huayin Guaranty & Investment Company Limited, Top Good International Limited, Total Giant Group Limited, Total Shine Group Limited, Victory High Investment Limited, Think Big Trading Limited, Huge Step Enterprises Limited, and Sure Believe Enterprise Limited) (the “Dongfang Holding Shareholders”).

Pursuant to the Merger Agreement, Dongfang Holding merged with CARZ Merger Sub, Inc. via a share exchange, with Dongfang Holding as the surviving entity (the “Merger Transaction”). In exchange for their shares in Dongfang Holding, the Dongfang Holding Shareholders received an aggregate of 7,450,497 (as adjusted for a four-for-one reverse stock split effected in November 2009) newly-issued shares of our common stock, which shares were distributed pro ratably among the Dongfang Holding Shareholders in accordance with their respective ownership interests in Dongfang Holding.

| 1 |

As a result of the merger transaction, Dongfang Holding became a wholly owned subsidiary of Orient Paper, which, in turn, made Orient Paper the indirect owner of Dongfang Holding’s operating company subsidiary, Orient Paper HB. Orient Paper HB, the entity through which we operate our business, currently has no subsidiaries, either wholly or partially-owned.

Due to Dongfang Holding’s inability, as the 100% owner of Orient Paper HB, to complete the registration of Orient Paper HB’s capital under its name within the proper time limits set forth under PRC law, it was not recorded as the registered owner of Orient Paper HB in PRC. As such, Dongfang Holding’s ownership of Orient Paper HB was deemed to be held in trust by Zhenyong Liu, Xiaodong Liu, and Shuangxi Zhao. In connection with the consummation of the restructuring transactions described below, Dongfang Holding directed its trustees to return its shares in Orient Paper HB to their original shareholders, and the Orient Paper HB shareholders entered into certain agreements with Baoding Shengde Paper Co., Ltd. (“Orient Paper Shengde”) to transfer the control of Orient Paper HB over to Orient Paper Shengde.

On June 24, 2009, the Company consummated a number of restructuring transactions pursuant to which it acquired all of the issued and outstanding shares of Shengde Holdings, Inc., a Nevada corporation. Shengde Holdings Inc. was incorporated in the State of Nevada on February 25, 2009. On June 1, 2009, Shengde Holdings Inc. incorporated Orient Paper Shengde, a limited liability company organized under the laws of the PRC. Because Orient Paper Shengde is a wholly-owned subsidiary of Shengde Holdings, Inc., it is regarded as a wholly foreign-owned entity under PRC law.

Effective June 24, 2009 Orient Paper Shengde entered into a number of contractual arrangements with Orient Paper HB and the original shareholders of Orient Paper HB, which were amended on February 10, 2010, pursuant to which Orient Paper Shengde acts as the management company for Orient Paper HB, and Orient Paper HB conducts the principal operations of the business. The contractual agreements, as amended, effectively transferred the preponderance of the economic benefits of Orient Paper HB over to Orient Paper Shengde, and Orient Paper Shengde assumed effective control and management over Orient Paper HB. The contractual agreements, as amended, include the following:

| (i) | Exclusive Technical Service and Business Consulting Agreement |

The exclusive technical service and business consulting agreement, entered into by and between Orient Paper Shengde and Orient Paper HB, provides that Orient Paper Shengde shall provide exclusive technical, business and management consulting services to Orient Paper HB, in exchange for service fees including a fee equivalent to 80% of Orient Paper HB’s total annual net profits. The agreement is terminable upon mutual written agreement.

| (ii) | Call Option Agreement |

The call option agreement, entered into by and between Orient Paper Shengde, Orient Paper HB and the shareholders of Orient Paper HB, provides that the shareholders of Orient Paper HB irrevocably grant to Orient Paper Shengde an option to purchase all or part of each shareholder’s equity interest in Orient Paper HB. The exercise price for the options shall be RMB1 yuan for each of the shareholders’ equity interests, or if at any time there are PRC laws regulating the minimum price of such options, then to the extent permitted under PRC Law. The call option agreement contains covenants from Orient Paper HB and its shareholders that they will refrain from taking certain actions without Orient Paper Shengde’s consent that would materially affect Orient Paper HB’s operations and asset value, including (i) supplementing or amending its articles of association or bylaws, (ii) changing Orient Paper HB’s registered capital or shareholding structure, (iii) selling, transferring, mortgaging or disposing of any interests in Orient Paper HB’s assets or income, or encumbering Orient Paper HB’s assets or income in a way that would approve a security interest on such assets, (iv) incurring or guaranteeing any debts not incurred in its normal business operations, (v) entering into any material contract or urging Orient Paper HB management to dispose of any Orient Paper HB assets, unless it is within the company’s normal business operations; (vi) providing any loan or guarantee to any third party; (vii) appointing or removing any management personnel or directors that can be changed upon Orient Paper HB shareholder approval; (viii) declaring or distributing any dividends to the stockholders. The agreement will remain effective until Orient Paper Shengde or its designees have acquired 100% of the equity interests of Orient Paper HB underlying the options.

| (iii) | Share Pledge Agreement |

The share pledge agreement entered into by and between Orient Paper Shengde, Orient Paper HB and the shareholders of Orient Paper HB, provides that the Orient Paper HB shareholders will pledge all of their equity interests in Orient Paper HB to Orient Paper Shengde as security for their obligations under the other management agreements described in this section. Specifically, Orient Paper Shengde is entitled to dispose of the pledged equity interests in the event that the Orient Paper HB shareholders or Orient Paper HB fails to pay the service fees to Orient Paper Shengde pursuant to the exclusive technical service and business consulting agreement or fails to perform their other obligations under the other management agreement. The agreement contains promises from Orient Paper HB’s shareholders that they will refrain from taking certain actions without Orient Paper Shengde’s prior written consent, such as transferring or assigning their equity interests, or creating or permitting the creation of any pledges which may have an adverse effect on the rights or benefits of Orient Paper Shengde under the agreement. The Orient Paper HB shareholders also promise to comply with the laws and regulations relevant to the pledges under the agreement and to facilitate in good faith the protection of the ability of Orient Paper Shengde to exercise its rights under the agreement. The terms of the share pledge agreement shall remain in effect until all the obligations under the other management agreements have been fulfilled, whether or not the terms of the other management agreements have expired.

| 2 |

| (iv) | Proxy Agreement |

The proxy agreement, entered into by and between Orient Paper Shengde, Orient Paper HB and the shareholders of Orient Paper HB, provides that the Orient Paper HB shareholders shall irrevocably entrust a designee of Orient Paper Shengde with such shareholder’s voting rights and the right to represent such shareholder to exercise such shareholder’s rights at any shareholder’s meeting of Orient Paper HB or with respect to any shareholder action to be taken in accordance with the laws and Orient Paper HB’s Articles of Association. The terms of the agreement are binding on the parties for as long as the Orient Paper HB shareholders continue to hold any equity interest in Orient Paper HB. An Orient Paper HB shareholder will cease to be a party to the agreement once it transfers its equity interests with the prior approval of Orient Paper Shengde.

On June 24, 2009, Zhao Tianqing, the sole shareholder of Shengde Holdings Inc., assigned to Orient Paper, for good and valuable consideration, 100 shares representing 100% of the issued and outstanding shares of Shengde Holdings Inc. As a result of this assignment and the restructuring transactions described above, Shengde Holdings Inc., Orient Paper Shengde, and Orient Paper HB became directly and indirectly controlled by Orient Paper, and Orient Paper HB continued to function as the Company’s operating entity.

In addition to controlling the operations and beneficial ownership of Orient Paper HB, Orient Paper Shengde also acquired a digital photo paper production line (including two photo paper coating lines and ancillary equipments) in an asset acquisition transaction as of November 25, 2009 and began conducting business in the PRC.

As part of the restructuring transaction described above, Orient Paper Shengde also entered into a loan agreement with the Orient Paper HB shareholders on June 24, 2009. Because of Company’s decision to fund future business expansions through Orient Paper Shengde instead of Orient Paper HB, such loan agreement was terminated on February 10, 2010. The $10,000,000 loan contemplated under the loan agreement was never made prior to its termination. The parties believe the termination of the loan agreement does not in itself compromise the effective control of the Company over Orient Paper HB and its businesses in the PRC.

An agreement was entered into among Orient Paper Shengde, Orient Paper HB and the Orient Paper HB Equity Owners on December 31, 2010, reiterating that Orient Paper Shengde is fully entitled to the distributable profit of Orient Paper HB, pursuant to the above mentioned Exclusive Technical Service and Business Consulting Agreement. In addition, Orient Paper HB and the Orient Paper HB Equity Owners agree that they shall not declare any of Orient Paper HB’s unappropriated earnings, including any earnings of Orient Paper HB from its establishment to 2010 and thereafter, as dividend.

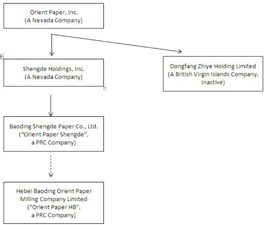

The following diagram sets forth the current corporate structure of Orient Paper:

|

100% ownership |

|

Controlled by contractual agreements |

| 3 |

Our Business

We engages mainly in production and distribution of packaging and printing paper products such as corrugating medium paper, offset printing paper, digital photo paper and other paper and packaging related products.

Our principal executive offices are located at Science Park, Juli Road, Xushui County, Baoding City, Hebei Province, People’s Republic of China. Our telephone number is (86) 312-869-8215. Our website is located at http://www.orientpaperinc.com

Manufacturing Process

Our current products (excluding digital photo paper) generally undergo two stages of manufacturing: (1) creating pulp from recycled paper products, and (2) treating the pulp and molding it into the desired types of paper product. A brief overview of the pulp and papermaking process is described below.

Pulping

The recycled waste paper is first sorted by hand and machine, and then broken down and beaten or smashed into small pieces using water and mechanical energy. It is then put through a course screening drum, followed by a fine screening drum to produce different grades of pulp. In order to purify the pulp further, an approach flow system is used to filter out any impurities or inconsistencies, such as sand, in the pulp. Bleaching agents are added to lighten the color of the pulp.

Paper Making

The pulp is then sieved to remove the excess water and molded into size. The moisture content is further reduced by applying hydraulic pressure to the pulp. The pulp then enters the drying section where it is run over heated cylinders. The dried paper is then coated with a mixture of clay, white pigment, and binder to produce a surface on which ink can sit without being fully absorbed, enabling crisper, more consistent print quality.

The paper goes through a process called calendaring, which flattens and smoothens the paper into long sheets. The paper is then wound onto a reel that is mounted in a roll-slitting machine for rewinding, during which cutters are used to cut the paper into the desired widths. Upon completion, the rolls are fitted with sleeves, labeled, and then moved to quality control before shipment or storage.

| 4 |

Digital Photo Paper Making

The manufacturing process for making digital photo paper involves multiple steps of coating, drying and calendaring. The major raw material, digital photo base paper, is loaded into the main production line for (1) coating, (2) drying, (3) calendaring, (4) recoating, (5) drying, and (6) reeling for finished products. We make both glossy and semi-matt digital photo papers. Many of the products that we sell through our digital photo paper division at Orient Paper Shengde come in various sizes from A3 to A6 and 3R to 5R sheets, while other sizes and reels of paper roll are also produced and sold. We have special cutting machine to take reels of digital photo paper rolls and cut the paper into customer-specified sizes before packaging for shipment.

Products

Corrugating medium paper

Corrugating medium paper is used in the manufacturing of cardboards. After the launch of our new 360,000 tonnes/year PM6, corrugating medium paper becomes a major product of the Company and comprises approximately 78% of our total paper production quantities and roughly 64% of our total revenue for the year ended December 31, 2013. Raw materials used in the production of corrugating medium paper include recycled paper board (or Old Corrugated Cardboard, “OCC”) and certain supplementary agents. In January 2013 we removed PM1, which was previously used to produce corrugating medium paper, from production. We are currently in the process of renovating and converting PM1. We expect PM1 to produce up to 50,000 tonnes/year of insulation liner paper upon the completion of the renovation, which is scheduled for early second quarter of 2014. We currently have only one production line (PM6) that produces corrugating medium paper.

Offset printing paper

Offset printing paper is used for offset printing. Our medium-grade offset printing paper comprises approximately 21% of our total paper production quantities and approximately 32% of our total sales revenue for the year ended December 31, 2013. The offset printing paper we manufacture is typically coated and brightened. Raw materials used in the production of offset printing paper may include recycled white scrap paper, wood pulp, fluorescent whitening agent, sizing agent and pulvis talc. We have not produced any high-grade offset printing paper and have not used wood pulp as a source of raw material since the fourth quarter of year 2009. We currently have two production lines, PM2 and PM3 for the production of offset printing paper.

Digital photo paper

Starting in March 2010, Orient Paper Shengde began producing digital photo papers that are cast-coating, and water-proof. These digital photo papers are sold to printing companies and paper distributors, who eventually sell to advertising companies and printing companies which use photo-quality paper for multiple-color printing or local photo studios for production of special event printouts or personal home printing use. Our digital photo paper comprises approximately 1% of our total paper production quantities and approximately 4% of our total sales revenue for the year ended December 31, 2013. We have two photo paper coating lines, PM4 and PM5, that produce digital photo paper products.

| 5 |

Market for our Products

The PRC Paper Making Industry

According to the most recent 2012 China Paper Industry Annual Report, issued by the China Paper Association, there were approximately 3,500 paper and paper board manufacturers (down from 3,700 as of year 2010) in the People’s Republic of China, with a total output of 102.5 million tonnes, up 3.22% from 99.30 million tonnes in 2011. Total domestic consumption was 100.48 million tonnes in 2012, up 3.04% from 97.52 million tonnes a year before.

Compared with year 2003, output in 2012 had increased by approximately 238.37% and consumption grew by approximately 209.074%. The output of paper and paper board maintained an average growth rate of approximately 10.13% during the ten-year period of 2003-2012, while consumption increased at an annual rate of 8.54%, both higher than the GDP growth rate of the same period. The growth rate is expected to continue. It is believed that the People’s Republic of China is currently the largest country in the world in terms of output and consumption of paper and paper board products (Wikipedia: Pulp and Paper Industries).

Data source: 2012 Annual Report of China Paper Manufacturing, May 2013, China Paper Association

Domestic corrugating medium paper production in 2012 totaled 20.20 million tonnes, a 2.02% increase from year 2011. Domestic consumption of corrugating medium paper amounted to 20.27 million tonnes, an increase of 1.81% as compared to year 2011.

Domestic coated offset printing paper production in 2012 totaled 7.80 million tonnes, a 7.59% increase from year 2011. Domestic consumption of coated offset printing paper amounted to 6.38 million tonnes, an increase of 6.51% as compared to year 2011.

The paper making industry in China is concentrated in eastern, coastal provinces. The largest paper production capacities by province during the years of 2011 and 2012 are summarized as follows. Except for Sichuan, Henan and Hunan provinces, most of the major provinces with large capacities saw at least some moderate increases in paper production capacities.

| 2011 Capacity | 2012 Capacity | Change | ||||||||||||||

| Province | (‘000 tonnes) | (‘000 tonnes) | (‘000 tonnes) | % Change | ||||||||||||

| Shandong | 16,300 | 17,090 | 790 | 4.85 | % | |||||||||||

| Guangdong | 14,960 | 15,790 | 830 | 5.55 | % | |||||||||||

| Zhejiang | 14,770 | 15,360 | 590 | 3.99 | % | |||||||||||

| Jiangsu | 10,510 | 12,060 | 1,550 | 14.75 | % | |||||||||||

| Henan | 8,280 | 7,800 | (480 | ) | -5.80 | % | ||||||||||

| Fujian | 4,800 | 5,390 | 590 | 12.29 | % | |||||||||||

| Hebei | 4,010 | 4,240 | 230 | 5.74 | % | |||||||||||

| Hunan | 3,720 | 3,550 | (170 | ) | -4.57 | % | ||||||||||

| Guangxi | 1,940 | 2,580 | 640 | 32.99 | % | |||||||||||

| Sichuan | 3,400 | 2,320 | (1,080 | ) | -31.76 | % | ||||||||||

Data Sources: 2012 Annual Report of China Paper Manufacturing, May 2013, China Paper Association

| 6 |

Industry Consolidation

Historically the paper and pulp industry in China was comprised of numerous small-scale production enterprises, many of which used low-tech production processes that were highly polluting. In 1996, China’s State Council issued “Decisions on Environmental Protection Issues”, setting forth strict rules and regulations intended to reduce pollution, including a directive for the closure of all paper plants with an annual output of less than 50,000 tonnes. Recognizing that China constitutes one of the largest markets for paper consumption in the world with potential for continued expansion, the PRC government continues its efforts to consolidate, modernize, and promote the environmental sustainability of the industry. As part of its 11th “Five Year Economic Development Plan,” the PRC State Council announced on May 5, 2010 that up to 530,000 tonnes of inefficient/polluting paper production capacity was to be eliminated or shut down in year 2010. On August 5, 2010, the Ministry of Industry and Information Technology published a list of mandatory capacity closures and ordered the shutdown of a total of 4.6 million tonnes by September 2010.

Following the first wave of large scale mandatory capacity closure in 2010, the Ministry of Industry and Information Technology (the “MIIT”) announced on July 11, 2011 that 8.2 million tonnes of outdated paper milling capacities located in 599 paper companies across China will be further forced to close down in year 2011 (the “2011 Mandatory Closure”). Of all of the paper mills affected by the 2011 Mandatory Closure, 72 companies with total capacities of 1.07 million tonnes (or 13% of total closure) are located in the province of Hebei, where many of the old paper mills only have capacities under 50,000 tonnes.

According to “The Twelfth ‘Five-Year Plan’ for the Chinese Paper Industry,” published jointly by the National Development and Reform Commission, the Ministry of Industry and Information Technology, and the National Forestry Bureau in December 2011, the central government of China has determined that during the five-year period ending year 2015, the government will seek to further eliminate more than 10 million tonnes of current paper production capacity. The goal is, through mandatory capacity elimination and industry consolidation, to transform the paper industry landscape into one where there are more than 20 one-million-tonnes-and-above manufacturers. As of year 2010, only the top-10 paper manufacturers in China have annual production capacity of over one million tonnes. According to the MIIT announcement on September 6, 2012, 9.9 million tonnes of paper production capacity was ordered to shut down in year 2012. The MIIT has again announced on July 25, 2013 the list of outdated paper capacities for the first phase of the mandatory closure of year 2013. A total of 6.21 million tonnes of paper manufacturing capacities across the country are required to be shut down in the July 25, 2013 list (the “2013 Mandatory Closure”), including 930,800 tonnes in the province of Hebei, the area hardest hit two years in a row. Unlike the mandatory closure programs in the previous years when most of the capacities shutdown related to small-scale local mills usually with less 50,000 tonnes of production capability without proper water treatment practice, the 2013 Mandatory Closure includes a number of large capacity paper machines (up to 226,000 tonnes per line) and six large public-traded paper manufacturing companies in China.

It is the industry consensus in China that mandatory closures initiated by the government will continue in the next few years and that the paper industry will witness a more severe competition and higher standards for environmental protection measures. See “Risk Factors – Risks Related to Our Business –We might be negatively affected by the industry capacity elimination mandated by the government.”

Customers

We generally sell our products to companies making corrugated cardboards (in the case of our packaging products like corrugating medium paper) and to printing companies (in the case of our printing paper products). We also sell digital photo paper mainly to distributors and advertising/printing companies. We sold corrugating medium paper and offset printing paper to about 97 customers in year 2013. We had 17 customers buying digital photo paper from us during year 2013. Five of our top 10 customers in year 2013 are printing companies, with the largest customer being a packaging company in Tianjin. 82% of our total corrugating medium and offset printing paper revenue in 2013 was derived from customers in Beijing, Tianjin or Hebei Province.

For the year ended December 31, 2013, nine (9) major customers individually accounting for more than 3% of our total sales revenue were as follows:

| 2013 Sales Amount | ||||||||

| ($USD, net of | % of Total | |||||||

| applicable VAT) | Revenue | |||||||

| Company A (Tianjin) | 6,298,711 | 5.01 | % | |||||

| Company B (Beijing) | 6,187,024 | 4.92 | % | |||||

| Company C (Baoding) | 5,794,109 | 4.61 | % | |||||

| Company D (Baoding) | 5,752,651 | 4.58 | % | |||||

| Company E (Baoding) | 5,481,114 | 4.36 | % | |||||

| Company F (Shanghai) | 5,465,174 | 4.35 | % | |||||

| Company G (Tianjin) | 5,270,771 | 4.19 | % | |||||

| Company H (Baoding) | 4,177,207 | 3.32 | % | |||||

| Company I (Baoding) | 4,042,378 | 3.22 | % | |||||

| Total Major Customers | 48,469,139 | 38.56 | % | |||||

| 7 |

Out of the top-10 customers of year 2013, seven (representing 77.6% of the 2012 top-10 customer sales) were in the same list for the year ended December 31, 2012. Three of the top-10 customers for the year ended December 31, 2012 fell out of the top customers list in year 2013.

Marketing Strategy

We target corporate customers in the middle range of the marketplace, where products such as corrugating medium paper and mid-grade offset printing paper with reasonable quality and competitive pricing have potential for high volume growth. Our primary market has been the region of North China, especially in the province of Hebei.

Expand Production Capacity

During the year ended December 31, 2013, we had five Paper Machines (PMs) in operation and are in the process of launching three more production lines that are tentatively designated as PM7 through PM9. These production lines include the followings:

| PM# | Paper Product Produced |

Designed Capacity (tonnes/year) |

Owned by | Operated by | Status as of December 31, 2013 | |||||

| PM1* | Insulation liner paper | 50,000 | Orient Paper HB | Orient Paper HB | Undergoing renovation since January 2013 and being converted from a corrugating medium paper production to one that produces insulation liner paper (which is used to make wall insulation paper for building construction). Slated for test production in Q2 2014. | |||||

| PM2 | Offset printing paper | 50,000 | Orient Paper HB | Orient Paper HB | In production

| |||||

| PM3 | Offset printing paper | 40,000 | Orient Paper HB | Orient Paper HB | In production

| |||||

| PM4 | Digital photo paper | 2,500 | Orient Paper Shengde | Orient Paper Shengde | Main photo paper coating line, in production

| |||||

| PM5 | Digital photo paper | 2,500 | ** | Orient Paper Shengde | Orient Paper Shengde | Special photo paper coating line, in production

| ||||

| PM6 | Corrugating medium paper | 360,000 | Orient Paper Shengde | Orient Paper HB*** | In production

| |||||

| PM7* | Specialty paper | 10,000 | To be determined | To be determined | Under renovation and preparing for launch by the end of 2014.

| |||||

| PM8* | Tissue paper | 15,000 | To be determined | To be determined | Undergoing construction and preparing for launch in Q4 2014. | |||||

| PM9* | Tissue paper | 15,000 | To be determined | To be determined | Paper machine construction agreement expected to be signed in 2014. |

*: Paper machines under renovation, under construction, or in the planning stage.

**: PM4 and PM5 have a total coating capacity of 2,500 tonnes per year.

***: The cost of the paper machine is funded and owned by Orient Paper Shengde, while all of the ancillary facilities that support the PM5 corrugating medium paper manufacturing operation are built and owned by Orient Paper HB. For the year ended December 31, 2013, Orient Paper Shengde charges Orient Paper HB an equipment lease that was approximately $1,903,363 for the use of the new corrugating medium paper machine.

| 8 |

On December 31, 2009, we acquired a digital photo paper production line, including two coating lines that are designated as PM4 and PM5 and ancillary equipment, in an asset acquisition transaction for a total purchase price of approximately $13.6 million. The estimated capacity of the entire digital photo paper facility is 2,500 tonnes per year.

In order to meet the growing domestic demand for paper, which we believe is currently exceeding domestic supply in the case of corrugating medium paper especially in our region of North China, we installed a brand new corrugating medium paper production line PM6 with an estimated capacity of 360,000 tonnes per year. We completed the installation of the new production line in November 2011 and went into commercial production in December 2011.

In the spring of 2010, we initiated the process of acquiring approximately 667,000 square meters of land adjacent to our current facilities and have received governmental approval for our capacity expansion plan. However, since the acquisition process started, we have met significant opposition by certain local residents over the price that we offered for their land. On April 13, 2012, we closed our acquisition of 58,566 square meters of land and secured all associated land use right permits. For the 58,566 square meters of land acquired, we paid a total of $7.5 million in various payments, taxes and recording fees to the sellers and the local government.

We have implemented a plan to renovate one of the old production lines that have been idle since the end of year 2007. We previously made papers with anti-counterfeit features from that production line. When the renovation is completed, we intend to produce the base paper (a high quality white graphic paper) that we currently procured from outside supplier for the production of our digital photo paper from the renovated production line. Eventually we plan to produce other high-profit margin specialty papers from the renovated production line. Our currently plan is to complete the renovation project, install a new production and marketing team, and launch the specialty paper production line as PM7 by the end of year 2014.

We have commenced our expansion into the household/tissue paper market by announcing in January 2013 that we signed a 15-year lease on some 49.4 acres of land in the Economic Development Zone in Wei County, Hebei Province, China on November 27, 2012 for the purpose of developing a new tissue paper production plant. We plan to build two tissue paper production lines, each with 15,000 tonnes/year capacity, and other packaging facilities and infrastructures on the leased land. In December 2012, we signed a contract with an equipment contractor in Shanghai to build the first of our two tissue paper production lines (PM8) in Wei County. Construction period for PM8 is expected to end in the third quarter of 2014 to be readied for the test operations in the fourth quarter of 2014. Total estimated cost of the PM8 tissue paper project (not including our construction cost of infrastructures in the Wei County Industrial Park) is estimated to be up to $56.8 million.

We have decided to take voluntary action to renovate our 150,000 tonnes/year corrugating medium PM1 in anticipation of increased regulatory concerns on energy efficiencies and to further upgrade the quality of our corrugating medium products. Rather than converting PM1 to a corrugating medium paper machine with expanded 250,000 tonnes/year capacity as original planned, the Company decided in 2013 that the best solution to the renovation, given the market condition and the effect on our waste water treatment capability, appears to be converting PM1 to a produce insulation liner paper with a designed capacity of 50,000 tonnes/year. We intend to produce insulation liner paper and sell it to manufacturers of wall insulation paper, which is used as a construction material for building wall and flooring insulation. The manufacturing process of insulation liner paper is similar to that of the corrugating medium paper and also uses recycled paper boards as a major source of raw material. The renovation has started in January 2013 and is expected to cost approximately $6.8 million. We expect the renovated PM1 to come online for test production in the early second quarter of 2014.

Raw Materials and Principal Suppliers

The supplies used in our production processes are comprised mainly of recycled paper board (or Old Corrugating Cardboard or “OCC,” as commonly referred to in the United States) and printed and unprinted recycled white scrap paper, all of which are readily available items for which there are multiple domestic and foreign sources. We currently purchase all of our recycled paper supplies from domestic recycling stations and do not rely on any imported recycled paper. We also purchase coal and chemical agents from nearby suppliers. Ongoing inflationary pressures and higher demand for recycled paper could lead to an increase in our costs of raw materials and production, which we may or may not be able to pass to our customers.

We sign annual raw materials supplier contracts with our suppliers. Although we have supplier contracts with our suppliers, these contracts do not lock-in the purchase price of our raw materials or provide hedge against the fluctuation in the market price of these raw materials. For the year ended December 31, 2013, we had three large suppliers which accounted for approximately 75%, 10% and 7% of total major purchases, respectively.

| 9 |

For the years ended December 31, 2013 and 2012, our top suppliers were as follows:

| 2013 Purchase | 2012 Purchase | |||||||

| Amount ($USD, | Amount ($USD, | |||||||

| net of applicable | net of applicable | |||||||

| VAT) | VAT) | |||||||

| Company A | 60,060,370 | 83,761,279 | ||||||

| Company B | 7,689,003 | 8,373,473 | ||||||

| Company C | 5,330,481 | - | ||||||

Competition

Orient Paper HB's main competitors are: Chenming Paper Group Limited; Huatai Group Limited; Nine Dragons Paper (Holdings) Limited; and Sun Paper Group Limited. In addition to these competitors, there are numerous smaller family operations in Hebei and neighboring provinces serving the greater-Beijing and Tianjin area printing company customers or competing with us for our corrugating medium paper market in Hebei. A number of our competitors are larger public entities with larger capacities, broader customer bases and greater financial resources than those available to us. The business of our primary competitors is briefly described below:

Chenming Paper Group, Ltd. (“Chenming”), based in Shandong Province (located in northeast China), produces primarily newsprint paper and art paper (high quality, heavy, two-side coated printing paper). Chenming is believed to be the first company to have all three types of public listings available in China: renminbi A-shares and foreign currency B-shares in Shenzhen, the smaller of the mainland’s two stock exchanges, and H-shares in Hong Kong. Chenming has annual production capacity of 6 million tonnes for its coated wood-free paper product and is believed to rank among the top 500 enterprises in China.

Huatai Group, Ltd. (“Huatai”), based in Shandong Province (located in the northern part of the eastern coastal region of China), primarily produces newsprint, fine paper, special printing papers, coated board, and tissue paper. Huatai is the first Shandong papermaker to publicly list its stock and has become a famous brand in China. Its annual paper production volume is estimated to have reached 4 million tonnes.

Nine Dragons Paper (Holdings) Limited (“ND Paper”), based in Guangdong Province (located in southern China), is the largest paper manufacturer in China and primarily produces kraft paper and high-strength corrugating medium paper with annual capacity of 13.5 million tonnes. ND Paper has reported that it has five production lines in the city of Tianjin with a total designed capacity of 2.15 million tonnes, producing products of karft paper, high strength corrugating medium paper, and grey-back duplex board.

Sun Paper Group, Ltd., based in Shandong Province, primarily produces card paper, whiteboard paper, and art paper. It also produces alkaline peroxide mechanical pulp, sourced in part from woodchips harvested by the company’s poplar plantations. The company has reported that it has an annual production capacity of paper and pulp of approximately 4 million tonnes and has been listed on the Shenzhen Stock Exchange since 2006.

With the exceptions of Chenming and ND Paper, which may compete directly with us in the coated printing paper market and the corrugating medium paper market, respectively, of the Beijing/Tianjin/greater Hebei regions, we believe that we face only indirect competition from the above-listed companies, either because we have a different product assortment from these companies, or because, to the extent they do offer products similar to ours, the transportation costs and storage costs make it difficult for these companies to compete effectively with us on price in our markets.

Our Competitive Edge

Regional advantage (North China). We believe that Orient Paper HB is one of the leading papermaking enterprises in Hebei Province. Our proximity to large urban centers in northern China, Beijing and Tianjin, gives us a large market in which to sell our products.

| 10 |

There are other paper manufacturers that are also located in Hebei Province (and close to metropolitan Beijing and Tianjin areas), but most of these other manufacturers are small in scale and are unable to compete with us effectively. We do compete with other large printing paper manufacturers for Beijing printing company customers. We believe we do have cost and other advantages over our larger competitors.

Cost advantage. Unlike some of our out-of-province competitors who must set up interim warehouses and ship products from their production base to such interim warehouses close to customer base in Beijing, because we are approximately 60 miles (100 kilometers) from Beijing, the cultural center of China and our largest target market, there is no need for us to set up interim warehouses. While we don’t separately pay for transportation cost on raw material purchases, the transportation cost included in the raw material purchase price from our recycled paper suppliers is lower than the transportation cost paid by our competitors in the province of Shandong. We also enjoy lower transportation cost for coal, a major source of energy used in our production process. Similarly, our customers pay trucking companies to pick up their orders from our finished goods warehouse in Baoding. The trucking cost our customers pay is lower than what they would pay if they had to pick up goods from offsite locations further away from Beijing. Tianjin, another large urban center, is also approximately 60 miles from our facilities. Baoding city itself is also home to numerous printing and packaging companies. We therefore have lower freight costs and other associated costs of sales, enabling us to charge lower prices, if necessary, for our products. Our geographical advantage and easy access to cheaper raw materials allow us to implement a more flexible inventory purchase policy, improve inventory management, lower our purchase price and reduce our production cost. Additionally, because we buy all recycled paper raw materials from Beijing and Tianjin, rather than from the United States or Japan, our purchase lead time is shorter as compared to manufacturers which reply on import recycled papers.

Research and Development

Our R&D activities are carried out by a task force led by a group of 5 senior managers (in charge of product development and quality control) and by a group of selected engineers and technicians. The Company charged the time spent on the R&D projects (manufacturing waste discharge recycling and digital photo paper manufacturing) to R&D expenses and incurred $25,125 and $21,636 in R&D expenses for the years ended December 31, 2013 and 2012, respectively. Our R&D efforts in year 2013 has focused on evaluating and developing new products that are in the pipeline for year 2014, including the production and packaging technology of tissue paper and the manufacturing process of insulation liner paper.

In addition to PM1, which is being converted to produce insulation liner paper, we have another idle production line that is under renovation. Since the fourth quarter of year 2010, we have spent approximately $1.57 million in machine parts and new components to renovate one smaller white paper production line, which we expect will be able to produce certain specialty papers, including wood-grain deco and furniture paper, wallpaper, and paper with security features (for anti-counterfeiting purposes). While we are optimistic about the prospect of the renovation project, we cannot guarantee the launch of the specialty paper production (which is tentatively scheduled for the fourth quarter of 2014) and the success of such renovation.

Intellectual Property

Orient Paper HB has registered one trademark with the Trademark Bureau under the State of Administration for Industry & Commerce, which remains effective through April 6, 2014. We have applied for a renewal as of March 7, 2014.

| Certificate | ||||||||

| Trademark | No. | Category | Registrant | Valid Term | ||||

| Shuangxing | 3298963 | Fax paper, thermal paper, blueprint paper, sensitized paper, spectrum sensitized paper, blueprint cloth, photographic paper, cyanotype solution, diazo paper | Orient Paper HB | April 4, 2004 through April 6, 2014 |

Domain names

Orient Paper owns the rights to the internet domain name, www.orientpaperinc.com.

Government Regulation

The testing, approval, manufacturing, labeling, advertising and marketing, post-approval safety reporting, and export of our products are extensively regulated by governmental authorities in the PRC. We are also subject to various other regulations and permit systems by the Chinese government. These regulations and their impact on our business are set forth in more detail below.

Environmental Regulation

Our operations and facilities are subject to environmental laws and regulations stipulated by the national and the local environment protection bureaus in the PRC.

| 11 |

Since the implementation of the State Council’s “Decisions on Environmental Protection Issues” in 1996, the PRC paper industry has been subject to more rigorous environmental standards. We believe that we are one of the few major paper manufacturers in Hebei Province to obtain a Pollution Discharge Permit, which enables us to operate in compliance with PRC environmental regulations. We were first issued the permit in September 1996 and since we have remained in line with the PRC’s restrictions on carbon dioxide and sulfur oxide byproducts, have successfully renewed the permit each year. Our last renewal of the Pollution Discharge Permit was issued in January 10, 2014, and is effective until January 9, 2015.

Waste Water Treatment

Orient Paper HB uses a multi-level water recycling process. Waste water from the pulping process is fed into collection pools, where it is divided into two parts, namely water and recovered pulp fiber. The latter is returned into the pulping process.

Chemical agents are added to the waste water, and the waste water is fed into a biogas reactor and filtering pools, producing purified water and depositing sludge. The purified water is released and the sludge is pumped into a sludge pool, condensed and dehydrated. We then use the sludge as an ingredient in the manufacture of corrugating medium paper.

We maintain controls at our production facilities on a 24-hour basis to facilitate compliance with environmental rules and regulations. We are not aware of any investigations, prosecutions, disputes, claims or other proceedings with respect to environmental protection, nor have we been subject to any action by any environmental administration authorities of the PRC. To our knowledge, our operations meet or exceed the existing requirements of the PRC.

In April 2012 we had one incident where the biological treatment process of our new water treatment plant failed to function properly. We voluntarily shut down the water treatment and all paper machine operations without any government intervention. As of May 8, 2012, the water treatment plant had resumed normal operation. We have not experienced any other water treatment malfunction since the April 2012 incident.

Employees

As of December 31, 2013, we have approximately 583 full time employees. The Company provides private insurance coverage for any workplace accident or injury for all operators of paper milling machinery in the workshops. These employees are organized into a labor union under the labor laws of the PRC and can bargain collectively with us. We generally maintain good relations with our employees and the labor union.

Available Information

We are required to file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (“SEC”). The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are also available free of charge on our Internet site at http://www.orientpaperinc.com as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The information on our website is not, and shall not be deemed to be, a part hereof or incorporated into this or any of our other filings with the SEC.

Item 1A. Risk Factors

Risks Relating to our Business

Our liquidity position poses risk to our operations, especially our capacity expansion projects.

As of December 31, 2013, we had current assets of approximately $26.0 million and current liabilities of approximately $28.4 million (including amounts due to related parties for approximately $2.3 million), resulting in a working capital deficiency of approximately $2.4 million. We are currently seeking to restructure the term of our liabilities by raising funds through long-term loans to pay off liabilities with shorter terms. Our ability to continue as a going concern is dependent upon obtaining the necessary financing or negotiating the terms of the existing short-term liabilities to meet our current and future liquidity needs. In the event that we fail to raise funds or negotiate terms of the current liabilities sufficient to meet our liquidity needs, we may be forced to substantially curtail our operations or otherwise take measures that would materially and adversely affect our business, results of operations and business prospects.

| 12 |

Of all of our current liabilities, the largest item is the semi-annual principal installment repayment obligations for $8.3 million under the sale-lease back agreement that we entered into in June 2013. We obtained approximately $24 million from the three-year sale-lease back financing transaction and used the proceeds to pay for part of the construction cost of the tissue paper facilities in the Wei County Industrial Park.

On March 3, 2014 we obtained a revolving line of credit facility under which we may draw notes payable for approximately $3.3 million from Shanghai Pudong Development Bank. Hebei Fangsheng Real Estate Development Co. Ltd., which is controlled by our Chairman and CEO Mr. Zhenyong Liu, unconditionally provides certain land use rights that it owns as collateral to secure its guarantee of the notes.

On March 25, 2014, our Chairman and CEO Mr. Zhenyong Liu agrees in writing to permit the Company to continue to postpone the repayment of the accrued interest on his loan to Orient Paper HB until the Company is able to pay its other creditors in the normal course of business. The accrued interest owned to Mr. Liu was approximately $566,343 and was recorded as part of the current liabilities as of December 31, 2013.

In addition to the working capital deficit, we had entered into contracts (mostly related to the construction of new tissue paper facilities and infrastructures at the Wei County Industrial Park) with capital expenditure commitments for approximately $51,673,158 as of December 31, 2013. We intend to pay for these capital expenditure commitments with cash flows from operating activities and additional debt financing in next 12 months. We generated approximately $30 million of cash from operating activities in the year of 2013 and expect to be able to generate at least the same amount of cash in year 2014. On March 7, 2014, Hebei Tengsheng Paper Co. Ltd., which owns the land use rights of about 330 acres (or 1.33 million square meters) of land in the Wei County Industrial Park and leases about one-fourth of the premises to Orient Paper HB as our production base of tissue paper and other future facilities, agreed in writing to unconditionally provide the 330 acres of land use right as third party collateral for additional bank borrowings in 2014 by Orient Paper HB. Based on the current market value of the land use rights and a 50%-60% loan out ratio, we estimate the maximum amount of debt financing with the entire 330 acres of Wei Country land will be between $36.6 million and $44.0 million.

On March 21, 2014 the provincial branch of the Industrial & Commercial Bank of China (“ICBC”) approved a new maximum total banking credit facility for Orient Paper HB for approximately $24.5 million in the year of 2014. We already had various working capital loans for a total of $6.5 million from ICBC as of December 31, 2013, which means that we may be able to draw additional financing under the maximum ICBC facility for up to $18 million. We expect the ICBC may tap into some of the above 330 acres of land use rights as security. If we are unable to obtain sufficient banking facilities or generate sufficient operating cash flow internally, the progress of the construction or renovation may be slowed down. We may also have to curtail the scope of the capital expenditure projects or to shelf some components of the projects (for example, delay the installation of PM9 until additional capital resources are available).

Our loan-to-equity ratio was 30.10% as of December 31, 2013. Our debt-asset ratio was 23.13% as of December 31, 2013. According to a search conducted by www.chinadiaoyan.com, the industry average of debt-asset ratio was 53.06% as of September 30, 2013 for the 20 large paper mills that are publicly listed in China. Of the 20 paper mill companies publicly listed in the Chinese stock exchanges, the top 6 (ranked by total revenue) all had debt-asset ratio exceeding 60%. Aside from the short-term liquidity situation, we believe that our overall financial condition, compared to our Chinese peers, is reasonably healthy and should allow us to reasonably expand our financial debt leverage to provide capital for future growth.

As management believes it can secure financial resources to satisfy the Company’s current liabilities and the capital expenditure needs in the next 12 months, our consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern. Should the going concern assumption not be appropriate and we are not able to realize our assets and settle our liabilities, commitments and contingencies in the normal course of operations, adjustments would be required to our consolidated financial statements to the amounts and classifications of assets and liabilities, and these adjustments could be significant.

In order to comply with PRC regulatory requirements, we operate our businesses through companies with which we have contractual relationships but in which we do not have controlling ownership. If the PRC government determines that our agreements with these companies are not in compliance with applicable regulations, our business in the PRC could be materially adversely affected.

We do not have direct or indirect equity ownership of Orient Paper HB which operates our main business in China. At the same time, however, we have entered into contractual arrangements with Orient Paper HB and its individual owners pursuant to which we received an economic interest in, and exert a controlling influence over Orient Paper HB, in a manner substantially similar to a controlling equity interest.

Although we believe the restructuring transaction and our current business operations are in compliance with the current laws in China, we cannot be sure that the PRC government would view our operating arrangements to be in compliance with PRC regulations that may be adopted in the future. If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business. As a result, our business in the PRC could be materially adversely affected.

| 13 |

We rely on contractual arrangements with Orient Paper HB for our operations, which may not be as effective in providing control over these entities as direct ownership.

Our operations and financial results are dependent on Orient Paper HB in which we have no equity ownership interest and must rely on contractual arrangements to control and operate the businesses of Orient Paper HB. These contractual arrangements are not as effective in providing control over Orient Paper HB as direct ownership. For example, Orient Paper HB may be unwilling or unable to perform their contractual obligations under our commercial agreements, including payment of consulting fees under the Exclusive Technical Service and Business Consulting Agreement as they become due. Consequently, we will not be able to conduct our operations in the manner currently planned. In addition, Orient Paper HB may seek to renew their agreements on terms that are disadvantageous to us. Although we have entered into a series of agreements that provide us with substantial ability to control Orient Paper HB, we may not succeed in enforcing our rights under them insofar as our contractual rights and legal remedies under Chinese law are inadequate. In addition, if we are unable to renew these agreements on favorable terms when these agreements expire, or to enter into similar agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly increase.

The shareholders of Orient Paper HB may have potential conflicts of interests with us, which may adversely affect our business.

We operate our businesses in China though Orient Paper HB. Our chairman, CEO and 27.94% shareholder, Zhenyong Liu owns 93.26% of the equity interest in Orient Paper HB. Conflicts of interests between his duties to us and to Orient Paper HB may arise. We cannot assure you that when conflicts of interest arise, he will act in the best interests of our company or that any conflict of interest will be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations and potentially result in the loss of opportunities.

Our arrangements with Orient Paper HB and its shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses.

We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with Orient Paper HB and its shareholders were not entered into based on arm’s length negotiations. Although our contractual arrangements are similar to other companies conducting similar operations in China, if the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

The exercise of our option to purchase part or all of the equity interests in Orient Paper HB under the Call Option Agreement might be subject to approval by the PRC government. Our failure to obtain this approval may impair our ability to substantially control Orient Paper HB and could result in actions by Orient Paper HB that conflict with our interests.

Our Call Option Agreement with Orient Paper HB and its shareholders gives our Chinese subsidiary, Orient Paper Shengde or its designated entity or natural person, the option to purchase all or part of the equity interests in Orient Paper HB. The option may not be exercised by Orient Paper Shengde if the exercise would violate any applicable laws and regulations in China or cause any license or permit held by, and necessary for the operation of Orient Paper HB, to be cancelled or invalidated. Under the laws of China, if a foreign entity, through a foreign investment company that it invests in, acquires a domestic related company, China’s regulations regarding mergers and acquisitions may technically apply to the transaction. If these regulations apply, an examination and approval of the transaction by China’s Ministry of Commerce (“MOFCOM”), or its local counterparts would be required. In addition, an appraisal of the equity interest or the assets to be acquired would also be mandatory. Since the scope of business activities (making of digital photo paper and other cultural paper products) as defined in the business license of Orient Paper Shengde does not involve the MOFCOM approval and monitoring, we do not believe at this time that an approval or an appraisal is required for Orient Paper Shengde to exercise its option to acquire Orient Paper HB. In light of the different views on this issue, however, it is possible that the central MOFCOM office in Beijing will issue a standardized opinion imposing the approval and appraisal requirement. If we are not able to purchase the equity of Orient Paper HB, then we will lose a substantial portion of our ability to control Orient Paper HB and our ability to ensure that Orient Paper HB will act in our interests.

We anticipate to incur significant capital expenditures in 2014.

We have been implementing significant capital expenditure projects of tissue paper and PM1 renovation since the end of year 2012 and will continue to invest in capital-intensive capacity expansion projects in 2014. We have substantially increased our debt leverage to fund these projects. As of December 31, 2013, we had approximately $51,673,158 in capital expenditure commitments that were mainly related to the construction costs of manufacturing equipment and other facilities in a new industrial park in Wei County of Hebei, China, where we will eventually build two tissue paper production lines PM8 and PM9 and install other paper production machineries in the future. If we cannot fund or effectively manage our capital expenditures or if our capital expenditures do not lead to the results we anticipate, our business, financial position and operating performance may be materially and adversely affected. An increased debt burden may also materially and adversely affect our liquidity, financial condition and our business. If we are unable to obtain sufficient funding through bank borrowings or generate sufficient operating cash flows internally, the progress of the construction or renovation may be slowed down. We may also have to curtail the scope of the capital expenditure projects or to shelf some components of the projects (for example, delay the installation of PM9 until additional capital resources are available).

| 14 |

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Orient Paper HB commenced its current line of business operations in 1996 and received its initial Pollution Discharge Permit in September 1996, which must be renewed every year for Orient Paper HB to stay in business. Although we have never had problem renewing the Pollution Discharge Permit, we cannot guarantee automatic renewal every year. Our operating history may not provide a meaningful basis on which to evaluate its business. We cannot assure you that Orient Paper HB will maintain its profitability or that we will not incur net losses in the future. We expect that Orient Paper HB’s operating expenses will increase as it expands. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| • | raise adequate capital for expansion and operations; |

| • | implement our business model and strategy and adapt and modify them as needed; |

| • | increase awareness of our brand name, protect our reputation and develop customer loyalty; |

| • | manage our expanding operations and service offerings, including the integration of any future acquisitions; |

| • | maintain adequate control of our expenses; or |

| • | anticipate and adapt to changing conditions in paper markets in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

Orient Paper HB’s failure to compete effectively may adversely affect our ability to generate revenue.

Through Orient Paper HB, we compete in a highly developed market with companies that have significantly greater experience and history in our industry. If we do not compete effectively, we could lose market share and experience falling prices, adversely affecting our financial results. Our competitors will expand in the key markets and implement new technologies making them more competitive. There is also the possibility that competitors will be able to offer additional products, services, lower prices, or other incentives that we cannot or will not offer or that will make our products less profitable. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

We might be negatively affected by the industry capacity elimination mandated by the government.

According to “The Twelfth ‘Five-Year Plan’ for the Chinese Paper Industry,” published jointly by the National Development and Reform Commission, the Ministry of Industry and Information Technology, and the National Forestry Bureau in December 2011, the central government of China has determined that during the five-year period ending year 2015, the government will seek to further eliminate more than 10 million tonnes of current paper production capacity. The goal is, through mandatory capacity elimination and industry consolidation, to transform the paper industry landscape into one where there are more than 20 one-million-tonnes-and-above manufacturers. As of year 2010, only the top-10 paper manufacturers in China have annual production capacity of over one million tonnes. According to the MIIT announcement on September 6, 2012, 9.9 million tonnes of paper production capacity was ordered to shut down in year 2012. The MIIT has again announced on July 25, 2013 the list of outdated paper capacities for the first phase of the mandatory closure of year 2013. A total of 6.21 million tonnes of paper manufacturing capacities across the country are required to be shut down in the July 25, 2013 list (the “2013 Mandatory Closure”), including 930,800 tonnes in the province of Hebei, the area hardest hit two years in a row. Unlike the mandatory closure programs in the previous years when most of the capacities shutdown related to small-scale local mills usually with less 50,000 tonnes of production capability without proper water treatment practice, the 2013 Mandatory Closure includes a number of large capacities (up to 226,000 tonnes per line) owned by six large public-traded paper manufacturing companies in China.

We have continued to focus on updating our production facilities to improve the operating and energy efficiency and reduce pollution. Based on our discussions with the regulators, we believe that none of our production facilities are currently targeted for mandatory capacity reduction. Based on information currently available to us, we do not expect that we would be ordered to reduce or shut down our production capacities. However, the Chinese government has broad discretion in determining the facilities subject to its production elimination mandate, and we cannot assure you that the government would not require us to shut down some or all of our production capacities. If we were forced to shut down one or more of our production facilities, our business, prospectus, financial condition and results of operations may materially and adversely affected. Depending on the scope of the government capacity elimination order, we could be forced to cease some or all of our operations.

Our digital photo paper operations will be relocated in the next few years due to an upcoming land use zoning change

Under a Xushui County urban redevelopment plan, the location of our digital photo paper operations will be converted from industrial use to commercial and residential use. As of December 31, 2013, there has been no executive order from the local government setting the deadline for the relocation. However, we have been under increasing pressure from the neighboring residents and the local government to relocate from our current location, which is increasingly surrounded by residential buildings. In addition, we expect the government will require the relocation be implemented within the next 4 years. While we are exploring different possibilities of moving the digital photo paper facilities to other locations that the Company owns or leases, including the new Industrial Park in Wei County, Hebei, China, we cannot assure you that the Company will be able to identify an ideal new location before the local county government orders us to implement the relocation.

| 15 |

Before we are able to relocate the digital photo paper operation to a new industrial area, the current 16-hour per day production schedule may be further limited

Because our digital photo paper operation is in a location increasingly surrounded by newly developed residential projects, the nightly operation of our current manufacturing schedule at the digital photo paper plant may be further restricted by the local County government, which has received numerous complaints about noises and disturbance by community residents. Although we have operated under the curtailed but stable daily operational schedule for more than one year, we are unable to predict the degree to which such restriction will affect our production, but we do expect some reductions in production activities in the next few years.

If Orient Paper HB fails to comply with covenants in its loan agreements, its lenders may allege a breach of a covenant and seek to accelerate the loan or exercise other remedies, which could strain our cash flow and harm our business, liquidity and financial condition.