UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2019

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-51872

JERRICK MEDIA HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 87-0645394 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer |

2050 Center Avenue, Suite 640

Fort Lee, NJ 07024

(Address of principal executive offices)

(201) 258-3770

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 28, 2019, based on a closing price of $3.00 was $19 million. As of March 30, 2020, the registrant had 9,185,187 shares of its common stock, par value $0.001 per share, outstanding.

Documents Incorporated By Reference: None.

TABLE OF CONTENTS

-i-

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Included in this Annual Report on Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

-ii-

Overview

Jerrick Media Holdings, Inc. (“JMDA” or “the Company”) is the parent company and creator of the Vocal platform. The Company develops technology-based solutions to solve problems for the creator community, connecting creators with their ideal audiences and with the brands that want to access those audiences. Through a combination of data analysis, design, and development, the Company conceptualizes, creates, and maintains a suite of technology products and provides services that influence a global audience.

Jerrick is committed to identifying and leveraging opportunities within the digital platform and content monetization space. Its technology is built to organically sustain and scale multiple lines of revenue. In addition, the Company has successfully acquired and integrated complimentary technology platforms and media assets into Vocal’s existing infrastructure, and will continue to make targeted acquisitions of public and private companies. The Vocal technology platform, trademark, and related intellectual property are wholly owned and operated by Jerrick.

Our operations are organized into the following business segments:

| ● | Executive Team: Decades of combined experience spanning the finance, technology, and creative industries are fundamental to the team’s core strengths. The Jerrick team, whose optimal headcount is approximately 25 employees, comprises a collective of generalist and specialist professionals. The Company’s mentality is a hybrid of a hedge fund leveraging data and analytics to generate alpha, and a technology company’s development, design, and integration capabilities. Together, these core competencies provide a foundation for optimizing platform expansion, revenues, and cost reduction. |

| ● | Platform Compliance: Moderation of user-submitted content and onboarding of creators onto the Vocal platform utilizes a combination of human touch and data-driven judgements that ensure adherence with our Community Guidelines and breed trust and safety within the Vocal ecosystem. |

| ● | Control and Risk Management: Jerrick’s corporate governance is centrally managed by its internal operating committee, consisting of representatives from each of the Company’s core business units–finance, operations, business intelligence, product design, and corporate communications. The team leverages the Company’s resources, and applies them horizontally across its portfolio of businesses and assets. This agile operational infrastructure allows for a feedback loop of applicable data for achieving its business risk management, regulatory, and compliance responsibilities. |

| ● | Design and Development: Jerrick partners with external segment specialists in development and data analysis in connection with future applications and white labeling opportunities that leverage Vocal’s underlying technology architecture. The Company is exploring application opportunities on a global scale, particularly in foreign language installations of the product. Localized franchises and bespoke development ventures provide white-labeling opportunities in industries such as health and wellness, education, and sports. These industries can utilize Vocal’s underlying technology and operational resources at reduced capital expenditures. |

| ● | Marketing and Sales: Jerrick’s business intelligence and marketing teams identify and target individual creators, communities, and brands, utilizing empirical data harnessed from the Vocal platform. The team’s ability to apply first-party data works to reduce acquisition costs for new creators and to help provide brands with conversions and an ideal targeted audience. Jerrick’s internal design team produces unique branded content experiences on the Vocal platform, including branded content campaigns and brand-sponsored creator challenges, and promotes them across multiple distribution channels. Our ability to collaborate with and acquire external agencies and specific media libraries creates opportunities to scale revenues both horizontally and vertically through Vocal’s digital ecosystem. |

-1-

Vocal

Vocal is Jerrick’s proprietary flagship technology platform that provides creators with storytelling tools, engaged communities, and opportunities to monetize their content. Vocal’s architecture was engineered to support a scalable and easy-to-update platform that could adapt its capacity to meet the current and growing demand for digital resources and technologies that foster virtual connection and community.

When the Jerrick team first ideated the Vocal platform, we determined that our primary constituents should be creators, and placed them at the center of our mission. We identified their pain points and created a blueprint to solve them.

There are over 4.5 billion internet users; of that, 83% publish some form of content on a monthly basis (blogs, photos, videos, and more), and 3.8 billion of them are active on social media (according to a report published by GlobalWebIndex). In 2020, the internet has become the linchpin of the modern information society, as well as the modern social society. Digital platforms like Vocal exist to help the world find order in a vast ocean of opportunity.

A global crisis like the current COVID-19 coronavirus pandemic only further emphasizes how critical a role digital platforms play in society, as governmental bodies are encouraging social distancing and restricting travel, and employers are widely implementing work-from-home policies. Vocal was born in an environment in which the total addressable market (TAM) for our platform is growing exponentially. With the emerging effects of COVID-19 and other global events, we expect that our TAM will only continue to expand.

Vocal’s proprietary technology was developed with the help of Thinkmill, our Sydney-based development partners. We used Thinkmill’s open-source content management framework, Keystone, as a foundation for our proprietary technology, which enables us to provide rapid updates and cost effective agile development. Together with Thinkmill, our internal product design and quantitative groups are able to quickly distribute product improvements, updates, and new features to improve our users’ experience.

We believe that the Vocal platform and its underlying technology allows us to maintain a capital-light infrastructure. By using cloud service providers, we are able to focus on platform and revenue growth rather than building and maintaining the costly internal infrastructures that have materially affected so many legacy media platforms. Vocal’s technology has been specifically designed and built to scale without a material corresponding increase in operational costs. While our users can embed rich media, such as video, audio, and product links, into their Vocal stories, the rich media content is hosted elsewhere (such as YouTube, Vimeo, Shopify, Spotify, etc.). Thus, our platform can accommodate rich media content of all kinds without bearing the financial or operational costs associated with hosting the rich media itself.

Maintaining a sustainable and capital light infrastructure is particularly important in tighter capital markets caused by external events that impact liquidity and credit, such as the current COVID-19 pandemic. Our technology is built to scale, while the rate of growth can be modulated through limits on capital expenditure. This creates a predictive environment in which the Company can continually reassess its capital needs and adjust its course when faced with unforeseen developments.

Since its 2016 launch, Vocal has amassed over 565,000 content creators across a wide range of mediums and backgrounds, such as bloggers, journalists, influencers, musicians, artists, podcasters, gamers, entrepreneurs, and more. Vocal creators provide a steady stream of user-generated, which can be monetized through reads, as well as through tips received from audiences. Vocal helps creators fund their creativity and build their personal brand.

-1-

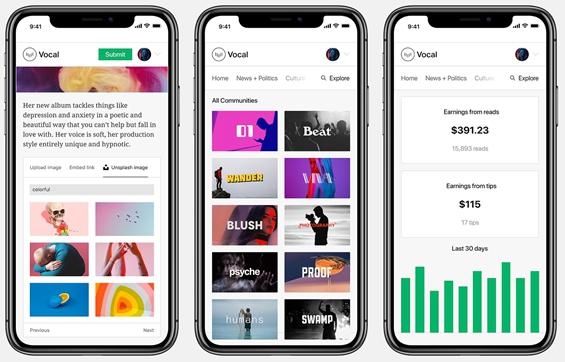

The Vocal content creation process can be broken down into three key steps:

1. Create: Vocal’s storytelling tools make it easy for creators of all kinds to produce beautiful, engaging, rich-media content.

2. Share: Creators share stories on one of Vocal’s 34 genre-specific communities to get discovered and connect with like-minded creators and readers.

3. Earn: Creators can earn money every time their story is read, through participation in Challenges, and through tips received from fans.

Importantly, Jerrick does not see Vocal as a substitute or competitor to segment-specific content platforms, such as Vimeo, YouTube, or SoundCloud. Instead, Vocal is a supplementary tool with which to leverage the vast number of fragmented content creation tools that exist in the digital sphere and to give creators on those platforms the means to monetize. We believe that Vocal is well positioned between the content creation tools and the various distribution channels that creators depend on to publish and amplify their content.

Vocal employs a number of strategies to collect first-party data around our users’ behavioral activity on the platform. The data is processed and analyzed by our internal business intelligence team with the goal of improving our product, services and users’ experience. Vocal’s growth and marketing strategies make use of these first-party data insights, resulting in a lower creator acquisition cost and reduced subscription churn when targeting third-party networks, such as the big social media platforms. Importantly, we do not sell our users’ information. We utilize data to optimize the success of our creators, and generate revenue when our creators monetize their content and brands reach the right audience. Additionally, unlike traditional publishing platforms, we do not charge the audience for consuming content.

-2-

Key User Demographics:

| ● | 59% of Vocal’s creators and audience are 18-34 years old. |

| ● | The split of gender is relatively balanced; 55% of Vocal users are female and 45% are male. |

| ● | The United States represents 57% of Vocal’s traffic, and an additional 20% of traffic is split between the United Kingdom, Canada, and Australia. |

| ● | As a mobile-first platform, 75% of users access Vocal from a mobile device. |

| ● | There are 34 active communities on the Vocal platform, with genres ranging from health and wellness, beauty, and mental health, to food, politics, pop culture, and more. |

Vocal’s Value for Creators:

Vocal is a proprietary technology platform, built to expand its digital audience through content distribution while providing an environment for creators to be rewarded for their content. We believe that digital audiences have become increasingly wary of traditional display and programmatic advertising tactics–intrusive ads like pop-ups that disrupt the consumer experience. The Company is therefore focused on building a network of user generated content communities that emphasize discovery, creator monetization, and non-interruptive branded storytelling.

In response to what we recognize as the growing shift away from interruptive ads, brand marketing teams actively seek partners like Vocal, that can deliver key performance metrics in an authentic and safe network. By utilizing Vocal’s first-party behavioral data, we can effectively pair content creators with the right brands to produce predictive strategies and successful non-interruptive marketing campaigns.

Trust and safety are paramount to the Vocal ecosystem. We follow best practices when handling personally identifiable information, with guidance from the European Union’s General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Digital Millennium Copyright Act (DMCA).

Platform Compliance Policies include:

| ● | Human-led, technology assisted moderation of every story submitted; |

| ● | Algorithmic detection of hate speech, nudity, and copyright infringement; |

| ● | Brand, creator, and audience safety enforced through community watch; and |

| ● | The rejection of what we consider toxic content, with the understanding that diverse opinions are encouraged. |

-3-

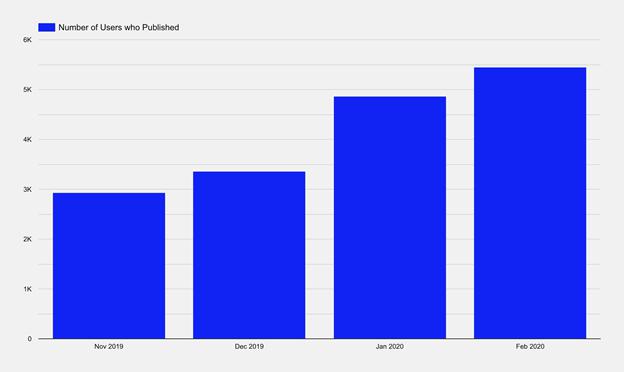

Vocal Users: Stories Published

Based on our internal data collected over the last four months, there has been a steady increase in creators who are publishing on our platform, which we believe is a result of the introduction of features like Challenges, which further incentivize content submissions and improve the moderation feedback loop.

Figure 1 - # of Users who Published

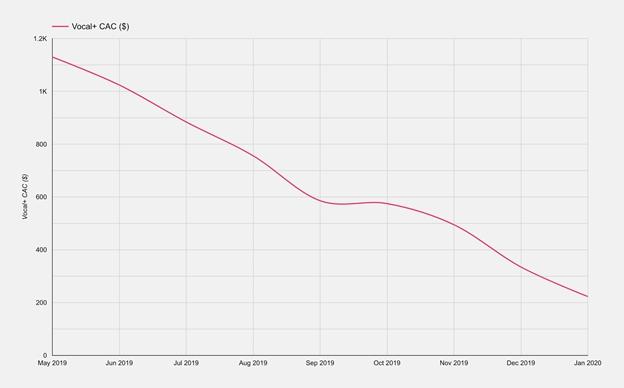

Vocal Users: Creator Acquisition Cost

As we continue to collect platform data, we are able to further refine our ideal user profile and hone our targeting strategies, such that the Creator Acquisition Cost (CAC) for both ‘Vocal Free’ (i.e. unpaid membership) and Vocal+ (i.e. paid premium membership) naturally declines over time. Having spent over three years executing marketing campaigns to attract Vocal Free users, and refining our strategy, the CAC for Vocal+ subscribers experienced an immediate decline; costs dropped from over $1,100 to approximately $200 in the first 4 months following the launch of Vocal+. Meanwhile, the CAC for Vocal Free creators followed a similarly sharp rate of reduction, dropping from approximately $4.50 down to $2.00 in this same time frame.

-4-

Figure 2 - Vocal+ Creator Acquisition Cost (CAC)

Figure 3 - Vocal Free Creator Acquisition Cost (CAC)

-5-

Digital Landscape and Industry

From 2006 through 2016, the online and digital content industry experienced rapid growth. This era resulted in various technology companies within the digital space expanding into some of the largest and most influential companies in the United States and around the world. Even with today’s market dislocation, many of these technology companies remain the industry leaders that will solve for a new era of social distancing.

During this same period of time, countless digital publishing platforms and tools were introduced that enabled creators and their audiences to create, share, and connect. However, hyper-growth in this sector eventually introduced a new series of problems. The largest issue was that the first wave of media publishing platforms and digital communities were reliant on a single line of revenue: traditional intrusive advertising.

As these companies scaled, so did their costs of operations, which eventually compelled them not only to compromise the integrity of their relationship to users, but to bombard audiences with invasive ads and use some aggressive marketing tactics in order to generate revenues and stay solvent. An intrusive user experience is not a sustainable model.

Ad technology began experiencing rapidly declining margins and tended to require excessive traffic in order to monetize. Digital content and media asset values have deteriorated rapidly between 2016 and 2018. This compression of margins has, in recent years, led to massive layoffs at those media publishing companies that were dependent on this legacy form of advertising. There is a continued risk of future markdowns in potential asset valuations.

In designing Vocal, the Jerrick team focused on building a network of communities on a singular platform that would help people discover real stories, from authentic creators. Vocal provides for its users’ needs by always innovating and introducing new features based on two core principles: that creators and brands are our partners, and that we make money when our partners make money.

In the face of this radical disruption in the digital marketing landscape, content distribution is undergoing a significant shift.

According to Statista, every 60 seconds on the internet:

| ● | 4,300,000 videos are viewed on YouTube |

| ● | 1,440 posts are published on WordPress |

| ● | 174,000 posts are viewed on Instagram |

| ● | 481,000 tweets are sent on Twitter |

Further, content monetization has become increasingly oriented toward native and creator-based fees. Facebook, Google, and Amazon already capture nearly 70% of digital ad spending, with that number projected to increase (Source: eMarketer). With these changes, and in light of more recent developments – the shift toward remote workforces, the popularization of freelancing, and social distancing recommendations – we believe that digital content creation is at an all-time high. Additionally, we believe that this new era will see these statistics grow rapidly in this new environment of exponentially increasing online activity, resulting in an evaluation of how to support the creation of digital content for creators, readers and audiences.

At the same time, branded content (a form of native advertising) is on the rise, and experiencing continuing growth year-over-year.

According to data from Pressboard:

| ● | Consumers find branded content 22x more engaging than display advertising; |

| ● | Consumers spend 2x more money when they feel a personal connection with a brand; |

| ● | Branded content results in a 60% higher brand recall than other digital advertising; and |

| ● | Native advertising spend is projected to exceed $400 billion by 2025. |

Thus, we believe that brands are actively seeking trustworthy and safe platforms like Vocal to drive engagement through non-interruptive brand storytelling, and deliver key performance metrics that help optimize their marketing efforts. We also believe that our Vocal platform provides a needed alternative for creators to participate within a community-first environment and access sustainable revenue sources. We built Vocal on these transparent core values, which continue to inform how we work with creators, readers, brands, and partners.

-6-

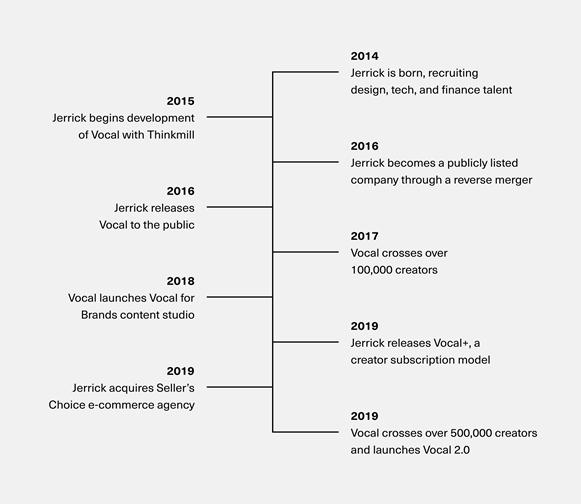

History

Jerrick was founded in 2014 by CEO Jeremy Frommer and became publicly listed in February 2016, at which point the Company was renamed Jerrick Media Holdings, Inc. Jerrick began working with its Australia-based development partners, Thinkmill, in early 2014 to begin building its flagship product. The Vocal technology platform was released to the public in December 2016 with six niche communities in its network and a small group of beta creators.

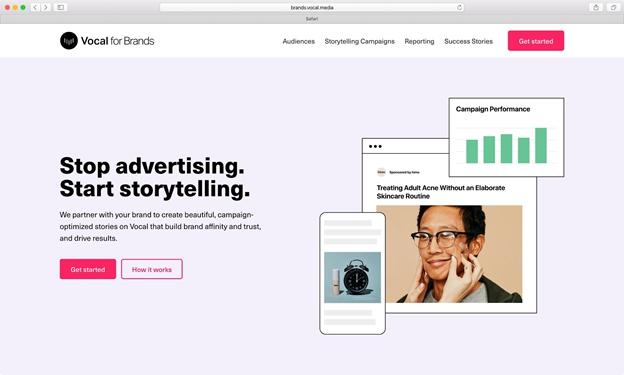

In late 2018, we introduced our in-house creative studio, Vocal for Brands, which partners with direct-to-consumer (DTC) brands to create engaging and campaign-optimized stories on Vocal that build brand affinity and trust, and drive results

2019 was marked by a series of important milestones for the Company. First, in July 2019, the Vocal+ premium membership offering was introduced on the Vocal platform. This was followed by the completion of our acquisition and integration of boutique e-commerce marketing agency, Seller’s Choice, in September 2019. Earlier that year, we successfully tendered for the majority of Jerrick’s outstanding warrants, exchanging over 90% of outstanding warrants for common stock.

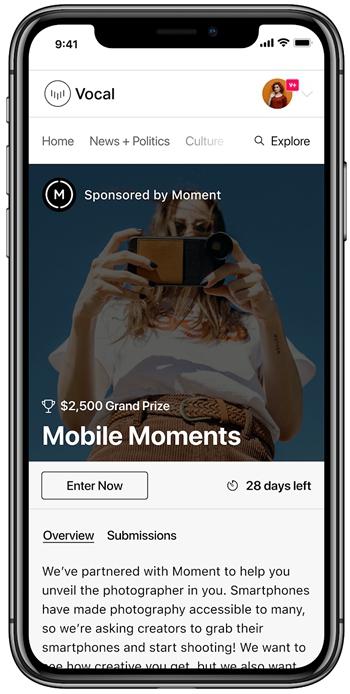

In January 2020, Vocal’s product team launched the latest feature for creators and brands, called “Creator Challenges.” Challenges (which are either internally run or sponsored by brands) are themed story contests that incentivize content submissions and engage Vocal’s user base by providing creators with the chance to win cash prizes and other rewards. The introduction of creator Challenges, which represents Vocal’s most important product update to date, showcases Jerrick’s unique ability to leverage its powerful network to host unique content experiences that drive success and value for brands, creators, and audiences simultaneously. Moreover, creator Challenges are accretive to Jerrick’s own marketing efforts; Challenges offer further incentivize for new creators to join Vocal and, in particular, to upgrade to Vocal+ (which offers members-only Challenges). As a result, since the launch of creator Challenges, we’ve seen our creator acquisition costs decrease over time.

-7-

Competition

The idea for Vocal came as a response to what Jerrick’s founders recognized as systemic flaws inherent to the digital media industry and its operational infrastructures. Depreciating value of digital media business models built on legacy technology platforms created a unique opportunity for development of a creator-centric platform that could appeal to a global community and, at the same time, be capable of acquiring undervalued complimentary technology assets.

Jerrick founders built the Vocal platform upon the general thesis that a closed and safe ecosystem utilizing first-party data to increase efficiencies could create a sustainable and defensible business model. Vocal was strategically developed to provide value for content creators, readers, and brands, and to serve as a home for the ever-increasing amount of digital content being produced and the libraries of digital assets lying dormant.

Since 2016, the ‘creator era,’ the industry has been marked by the proliferation of democratized and transparent platforms. The digital space now encompasses an online global audience of over 4.5 billion internet users and over 1.7 billion websites. The “read, write and execute” web, or Web 3.0, is a data-driven and more intelligent web that can adjust its output according to the particular needs and habits of the individual user, fostering more intelligent creation, greater personalization and, ultimately, a more satisfied end user.

In this context, legacy sites and platforms are becoming increasingly threatened by factors like fragmented content creation tools, excessive traffic and marketing dollars required to monetize content, and compressing margins for traditional digital advertising. This has led to a qualitative deterioration of online content. In addition, it means that companies operating on these models will continue to struggle with limited paths to scalable profitability.

There is limited competition that provides the specific type of resources and platform that Vocal provides the creative community. In addition, there are a limited number of digital media companies like Vocal that charge only creators and brands for publishing content, as opposed to charging the audience for accessing content. Jerrick’s management team believes that the primary competition for Vocal are other platforms that can draw attention or time from the creative community in general. These platforms can vary in scope, size, and genre. Simply put, platforms compete for the attention of the digital consumer.

Vocal’s Competitive Strengths

Digital platforms must differentiate themselves by providing executable solutions and fulfilling users’ empirical needs. Our focus on rewarding the creator for their content, partnering with them on distribution, and providing opportunities for monetization, is one of the key differentiating factors between Vocal and legacy publishing platforms.

| ● | Vocal’s proprietary technology is built on Keystone, the same underlying open-source framework used by industry-leaders such as Atlassian, a $30-billion Australian technology company. Some of the key differentiating elements of Vocal’s technology are speed, sustainability, and scalability. The Company continues to invest heavily in research and development to continuously improve and innovate its platform, with the goal of optimizing the user experience for creators. Vocal’s architecture allows it to do more with less cost, and provides a model capable of turning a profit. |

| ● | We believe that Vocal’s built-in risk management and compliance features are another one of the platform’s key strengths. Quality assurance policies enhance the reliability and integrity of the platform and ensure regulatory compliance, which fosters a trustworthy and safe environment for all of its stakeholders. Further, Vocal utilizes third-party cloud-based services to host its platform, which affords the platform an important advantage; management can focus on running and scaling its services, rather than building unnecessary infrastructure. |

| ● | Vocal’s synthesis of democratization and monetization for its content and creators is unique in the industry. Creators, influencers, and entrepreneurs seek a trustworthy platform that offers needed resources to expand their brand and reach. At the same time, brands seek a safe and reliable platform with which to engage with customers, drive conversions, and build brand awareness. Vocal’s ecosystem works to drive success simultaneously for all of its stakeholders. |

-8-

Product Revenues

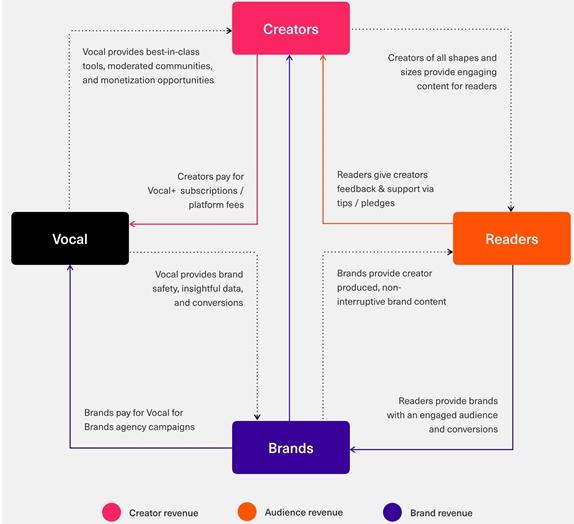

Our continually expanding network of approximately 565,000 content creators using the Vocal platform drives our primary source of revenue. Quality content submissions from creators attracts audiences and brands, the other primary stakeholders who exist within Vocal’s ecosystem. The continuous interactions between creators, audiences, and brands propel a virtuous cycle of transactions and represents an important element of Vocal’s scale and success.

-9-

The Company has designed several revenue touch-points throughout the Vocal ecosystem, ensuring a balanced portfolio of revenue streams, sustainable infrastructures, and compounding scalability.

-10-

Revenues are primarily generated through:

Creator Subscriptions:

Vocal+ is a premium subscription membership for Vocal users. Vocal+ members pay a membership fee for premium features, including receiving increased earnings for their content, reduced platform processing fees for tips received, a Vocal+ badge on their creator page, access to additional features on the Vocal Platform, and participation in exclusive programs. Creators may sign up for a Vocal+ membership when they create an account, or they can upgrade an existing Vocal Free account to a Vocal+ account at any time. The current cost of a Vocal+ membership is either $9.99 per month or $99 annually.

-11-

Brand Agency:

Our in-house creative studio, Vocal for Brands, focuses on non-interruption based advertising and engaging brand storytelling. Vocal for Brands pairs brands with active creators in the Vocal network to produce bespoke branded content campaigns, brand-sponsored creator Challenges, and other types of branded experiences on the Vocal platform that build brand engagement, trust, and drive results. With the introduction of Challenges, brands can tap into Vocal’s network of approximately 565,000 content creators and encourage them to interact with, learn about and promote their brand while benefiting from Vocal’s brand-safe, moderated, and curated environment. Brand-sponsored Challenges effectively yield a collection of crowdsourced branded content for brands and help them reach a wider audience.

Vocal’s first-party data enables our team to create highly targeted and segmented audiences for Vocal for Brands campaigns, and help the brand reach their ideal audience. Brands can access story performance data, engagement data, behavioral data, and sentiment data, all of which is used to further optimize the campaign’s success.

Fees range from $5,000 to $45,000 for bespoke Vocal for Brands campaigns, depending on duration and other key factors.

-12-

-13-

Marketing + Consulting Services:

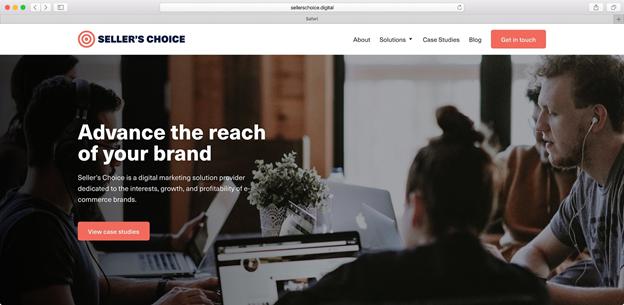

Seller’s Choice, LLC (“Seller’s Choice”), which we acquired in September 2019, is a digital marketing solution provider dedicated to the interests, growth, and profitability of e-commerce brands. Utilizing their integrative next-gen marketing platform, Seller’s Choice focuses cohesively in the four key factors of online sellers – sell-through, differentiation, community and compliance – to help e-commerce businesses establish their brand identity and realize profitable and sustainable growth while maximizing customer engagement and retention.

Through Jerrick’s acquisition of Seller’s Choice, the Company has further expanded its reach into the direct-to-consumer marketplace, while enabling Seller’s Choice’s clientele to leverage Vocal for Brand’s unique brand storytelling capabilities.

-14-

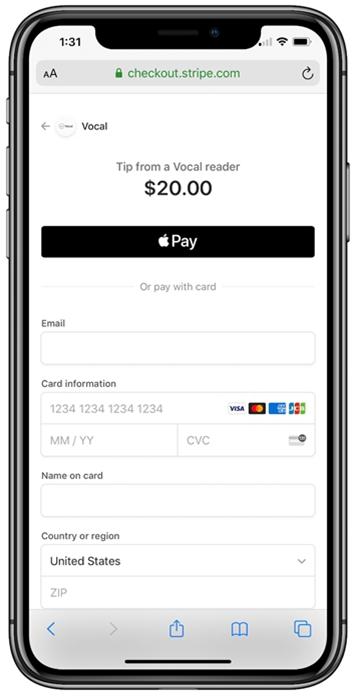

Platform Processing Fees and Microtransactions:

Creators and their audiences have the ability to send and receive tips, or microtransactions, on Vocal. Each tip sent on Vocal generates revenue for the Company in the form of platform processing fees. For Vocal Free creators, we retain a 7% platform processing fee for every tip exchanged. For Vocal+ creators, we retain a 2.9% platform processing fee.

We use the Stripe platform to process tips and payouts to creators on Vocal. Additional features such as gated premium content, recurring tips, affiliate marketing features for brands, and incentivization fees for new creator referrals are currently in development.

-15-

Affiliate sales:

We also generate revenue through our affiliate marketing relationships, which pay us a percentage of purchases made on our platform. Affiliate partnerships include Amazon, Skimlinks, Tune, and more.

E-commerce:

Our e-commerce strategy involves revitalizing archival imagery and media content in dormant legacy portfolios. Our curation and data capabilities have helped us create scalable and definable value for our internal collection of media assets through financing, trademarking, licensing, and production opportunities.

Growth Strategy

We intend to continue to grow by focusing on the following key areas:

| ● | Moderation Improvements: Constant analysis and improvement to Vocal’s moderation process enables us to reduce manpower costs and maintain a brand-safe environment. Vocal’s genre-specific community structure, which evolves based on usage data, provides brands with a more transparent and targeted community for their product. |

| ● | Creator Growth: Vocal brings new creators, their audience, and brands to its platform through organic growth, performance marketing, and brand-building campaigns that drive awareness. As the Vocal team continues to collect first-party behavioral data, we are able to further refine an ideal user profile and hone a specific targeting strategy to effectively scale the platform’s creator base. We believe the CAC (Creator Acquisition Cost) for both the Vocal Free (i.e. unpaid membership) and Vocal+ (paid premium membership) offerings will naturally decline over time by matching our internal data against third-party data. |

| ● | Brand Partnerships: We intend to continue to invest in new product offerings for brand storytelling on Vocal that provide valuable analytics, engagement, and conversion data. Products and services offered on the platform are constantly evolving to elevate brand relationships, both qualitatively and quantitatively. |

| ● | Platform Enhancements: We intend to continue to invest in research and development and explore strategic acquisitions in order to enhance our product capabilities and evolve our network of communities. With features such as Challenges, Tipping, and premium subscriptions, we believe that Vocal is consistently innovating to provide new and creative ways to expand the creator platform, and maximize both the Company’s revenues and creators’ earnings. Further, our strategic partnership with Thinkmill affords us an additional benefit in the Australian government’s research and development tax incentive program, which offers a rebate on 40% of funds spent on technology research and development within each fiscal year. |

| ● | White Label Opportunities: We intend to pursue opportunities to white-label Vocal’s underlying platform architecture for application in a range of industries. The platform’s underlying technology can be utilized by sports franchises, trade companies, education organizations, the financial sector, and beyond. |

| ● | New Geographies: Global expansion is fundamental to our growth strategy. While the U.S., U.K., and Canada represent the vast majority of our audience, we believe there will be significant demand for our product in overseas markets–including Asia, the Middle East, and South America–particularly for foreign language installations of the product. |

| ● | Acquisitions: Our acquisition of Seller’s Choice in September 2019 successfully expanded our brand product offering and client network. Future acquisition targets include creator platforms, content communities, data science companies, and digital marketing agencies. |

| ● | Licensing: In collaboration with other production and media companies, as well as with our expanding user base, we look for content that can be leveraged for adaptation to film, television, digital shorts, books, and comic series. We believe that Vocal’s ever-expanding community of creators and influencers affords us with the unique opportunity to cultivate these relationships. |

-16-

Customers

There are three primary categories of stakeholders/customers that interact within Vocal’s ecosystem: creators, brands, and readers.

Creators

Vocal provides a large stage for creators and artists to connect with fans and find new audiences. In addition to enabling access to millions of monthly visitors, we provide creators with a full suite of tools and services for content creation, discovery, distribution, and monetization, including:

| ● | Easy-to use, rich media content editor: Vocal’s content editor allows creators to easily add their rich media to their stories. From Spotify songs to Shopify products, Vocal’s open canvas content creation editor makes it easy to create high-quality and engaging stories, and is a cost effective alternative to managing a blog content management system (CMS). |

| ● | Ability to Monetize: Both Vocal Free and Vocal+ memberships provide multiple monetization opportunities for creators. Creators can earn money through visitor engagement as well as from tips received from visitors (less the payment processing fee). For Vocal Free members, content is monetized at a rate of $3.80 per 1,000 reads (calculated based on time on page, scrolling behavior, and other internal metrics), whereas Vocal+ members monetize at $6.00 per 1,000 reads. |

| ● | Designed for SEO: Creators benefit from the search engine optimization (SEO) inherent to Vocal’s architecture, and the volume of organic traffic the platform receives as a result. When creators amplify their content through their own social media channels, the optimization is further enhanced. Creators can get more views and greater discoverability by publishing content on Vocal as opposed to other sites geared toward short form content, which have limited search capabilities and discovery tools, as well as limited opportunities for content monetization. |

| ● | Transparent Performance Data: Creators can view their “Stats” at any time to view their individual performance data, such as how many Reads a given story received, how much money they have earned, and how many tips or ‘Likes’ they received. |

| ● | Valuable Audience: The nature of Vocal’s genre-specific community structure is such that it generates a positively selected audience, a quality which makes Vocal an attractive prospect for creators and brands alike. In a topic-based community, audiences are inherently more likely to be interested in the particular content housed in that community. |

Brands

Vocal for Brands leverages Vocal to produce branded stories and Challenges that build affinity and trust, while generating sales and awareness. The key value propositions for brands include:

| ● | Authentic Storytelling: Our internal data group partners brands with real Vocal creators to tell their brand’s story in a way that is both engaging and trustworthy. |

| ● | Valuable Audience: Jerrick’s first-party data provides an opportunity to create highly targeted and segmented audiences to promote branded content. Most importantly, Vocal’s technology helps brands target the right audience by utilizing and applying that first-party data. |

| ● | Transparent Analytics: For every campaign we produce, our brand clients have access to story performance data, engagement data, behavioral data, and interest data. Brands can apply this data to further increase awareness and optimize audience targeting. |

Readers

We are focused on enabling the discovery and curation of stories for our readers through a range of products and services:

| ● | Discovery: Readers benefit from our ability to help them safely navigate our network of communities. Every story published on Vocal is run through our proprietary moderation system, which synthesizes machine learning and human-touch curation. Readers know that every story on Vocal complies with our Community Guidelines, which ensures a safe environment for creators, brands, and readers alike. |

| ● | Sentiment: Readers have the option to “Like” their favorite stories, allowing them to interact directly with the creator, while providing the Vocal team with insights into their interests and behavior. Our data science team uses this data to create segmented audiences to optimize content discovery. Simply put, Vocal helps readers find stories personalized to their interests. |

| ● | Tipping: We provide readers with the opportunity to send Tips to creators to show their support and appreciation. Tips have a frictionless and secure user-experience, allowing readers to pay with digital wallets such as Apple Pay and Google Pay. |

-17-

Corporate Information

We were originally incorporated under the laws of the State of Nevada on December 30, 1999 under the name LILM, Inc. The Company changed its name on December 3, 2013 to Great Plains Holdings, Inc.

On February 5, 2016 (the “Merger Closing Date”), we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with GPH Merger Sub, Inc., a Nevada corporation and our wholly-owned subsidiary (“Merger Sub”), and Jerrick Ventures, Inc., a privately-held Nevada corporation headquartered in New Jersey (“Jerrick”), pursuant to which the Merger Sub was merged with and into Jerrick, with Jerrick surviving as our wholly-owned subsidiary (the “Merger”). Pursuant to the terms of the Merger Agreement, we acquired, through a reverse triangular merger, all of the outstanding capital stock of Jerrick in exchange for issuing Jerrick’s shareholders (the “Jerrick Shareholders”), pro-rata, a total of 28,500,000 shares of our common stock. Additionally, we assumed 33,415 shares of Jerrick’s Series A Convertible Preferred Stock (the “Jerrick Series A Preferred”) and 8,064 shares of Series B Convertible Preferred Stock (the “Jerrick Series B Preferred”).

Upon closing of the Merger on February 5, 2016, the Company changed its business plan to our current plan.

In connection with the Merger, on the Merger Closing Date, we entered into a Spin-Off Agreement with Kent Campbell (the “Spin-Off Agreement”), pursuant to which Mr. Campbell purchased (i) all of our interest in Ashland Holdings, LLC, a Florida limited liability company, and (ii) all of our interest in Lil Marc, Inc., a Utah corporation, in exchange for the cancellation of 781,818 shares of our common stock held by Mr. Campbell. In addition, Mr. Campbell assumed all of our debts, obligations and liabilities, including any existing prior to the Merger, pursuant to the terms and conditions of the Spin-Off Agreement.

Effective February 28, 2016, we entered into an Agreement and Plan of Merger (the “Statutory Merger Agreement”), pursuant to which we became the parent company of Jerrick Ventures, LLC, our wholly-owned operating subsidiary (the “Statutory Merger”).

Finally, on February 28, 2016, we changed our name to Jerrick Media Holdings, Inc. to better reflect our new business strategy.

Our corporate headquarters are located at 2050 Center Ave, Suite 640, Fort Lee, NJ 07024. As of March 30, 2020, we had 25 full-time employees. We consider our relation with our employees to be good.

-18-

You should carefully consider the risks described below, as well as general economic and business risks and the other information in this Annual Report on Form 10-K. The occurrence of any of the events or circumstances described below or other adverse events could have a material adverse effect on our business, results of operations and financial condition and could cause the trading price of our common stock to decline. Additional risks or uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to our Business

The Company is a development stage business and subject to the many risks associated with new businesses.

Our current line of business has a limited operating history and our business is subject to all of the risks inherent in the establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of a new business enterprise. We have incurred losses and may continue to operate at a net loss for at least the next several years as we execute our business plan. We had a net loss of approximately $8.0 million for the year ended December 31, 2019, and a working capital deficit and accumulated deficit of approximately $10.7 million and approximately $44.6 million, respectively.

Our financial situation creates doubt whether we will continue as a going concern.

There can be no assurances that we will be able to achieve a level of revenues adequate to generate sufficient cash flow from operations or obtain funding from this offering or additional financing through private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital and no assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available, we may be forced to discontinue operations, which would cause investors to lose their entire investment.

Based on the report from our independent auditors dated March 30, 2020, management stated that our financial statements for the period ended December 31, 2019, were prepared assuming that we would continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The accompanying financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

We are not profitable and may never be profitable.

Since inception through the present, we have been dependent on raising capital to support our working capital needs. During this same period, we have recorded net accumulated losses and are yet to achieve profitability. Our ability to achieve profitability depends upon many factors, including our ability to develop and commercialize our websites. There can be no assurance that we will ever achieve any significant revenues or profitable operations.

Our operating expenses exceed our revenues and will likely continue to do so for the foreseeable future.

We are in an early stage of our development and we have not generated sufficient revenues to offset our operating expenses. Our operating expenses will likely continue to exceed our operating income for the foreseeable future, until such time as we are able to monetize our brands and generate substantial revenues, particularly as we undertake payment of the increased costs of operating as a public company.

-19-

We have assumed a significant amount of debt and our operations may not be able to generate sufficient cash flows to meet our debt obligations, which could reduce our financial flexibility and adversely impact our operations.

Currently the Company has considerable obligations under notes, related party notes and lines of credit outstanding with various debtors. Our ability to make payments on such indebtedness will depend on our ability to generate cash flow. The Company may not generate sufficient cash flow from operations to enable us to repay this indebtedness and to fund other liquidity needs, including capital expenditure requirements. Such indebtedness could affect our operations in several ways, including the following:

| ● | a significant portion of our cash flows could be required to be used to service such indebtedness; |

| ● | a high level of debt could increase our vulnerability to general adverse economic and industry conditions; |

| ● | any covenants contained in the agreements governing such outstanding indebtedness could limit our ability to borrow additional funds, dispose of assets, pay dividends and make certain investments; |

| ● | a high level of debt may place us at a competitive disadvantage compared to our competitors that are less leveraged and, therefore, our competitors may be able to take advantage of opportunities that our indebtedness may prevent us from pursuing; and |

| ● | debt covenants to which we may agree may affect our flexibility in planning for, and reacting to, changes in the economy and in our industry. |

A high level of indebtedness increases the risk that we may default on our debt obligations. We may not be able to generate sufficient cash flows to pay the principal or interest on our debt. If we cannot service or refinance our indebtedness, we may have to take actions such as selling significant assets, seeking additional equity financing (which will result in additional dilution to stockholders) or reducing or delaying capital expenditures, any of which could have a material adverse effect on our operations and financial condition. If we do not have sufficient funds and are otherwise unable to arrange financing, our assets may be foreclosed upon which could have a material adverse effect on our business, financial condition and results of operations.

We will need additional capital, which may be difficult to raise as a result of our limited operating history or any number of other reasons.

We expect that we will have adequate financing for the next 6 months. However, in the event that we exceed our expected growth, we would need to raise additional capital. There is no assurance that additional equity or debt financing will be available to us when needed, on acceptable terms, or even at all. Our limited operating history makes investor evaluation and an estimation of our future performance substantially more difficult. As a result, investors may be unwilling to invest in us or such investment may be offered on terms or conditions that are not acceptable. In the event that we are not able to secure financing, we may have to scale back our growth plans or cease operations.

We face intense competition. If we do not provide digital content that is useful to users, we may not remain competitive, and our potential revenues and operating results could be adversely affected.

Our business is rapidly evolving and intensely competitive, and is subject to changing technologies, shifting user needs, and frequent introductions of new products and services. Our ability to compete successfully depends heavily on providing digital content that is useful and enjoyable for our users and delivering our content through innovative technologies in the marketplace.

We face competition from others in the digital content creation industry and media companies. Our current and potential competitors range from large and established companies to emerging start-ups. Established companies have longer operating histories and more established relationships with customers and users, and they can use their experience and resources in ways that could affect our competitive position, including by making acquisitions, investing aggressively in research and development, aggressively initiating intellectual property claims (whether or not meritorious) and competing aggressively for advertisers and websites. Emerging start-ups may be able to innovate and provide products and services faster than we can.

-20-

Additionally, our operating results would suffer if our digital content is not appropriately timed with market opportunities, or if our digital content is not effectively brought to market. As technology continues to develop, our competitors may be able to offer user experiences that are, or that are seen to be, substantially similar to or better than, ours. This may force us to compete in different ways and expend significant resources in order to remain competitive. If our competitors are more successful than we are in developing compelling content or in attracting and retaining users and advertisers, our revenues and operating results could be adversely affected.

If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products, our revenue, financial results, and business may be significantly harmed.

The size of our user base and our user’s level of engagement are critical to our success. Our financial performance will be significantly determined by our success in adding, retaining, and engaging active users of our products, particularly Vocal. We anticipate that our active user growth rate will generally decline over time as the size of our active user base increases, and it is possible that the size of our active user base may fluctuate or decline in one or more markets, particularly in markets where we have achieved higher penetration rates. If people do not perceive Vocal to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A number of other content management systems and publishing platforms that achieved early popularity have since seen their active user bases or levels of engagement decline, in some cases precipitously. There is no guarantee that we will not experience a similar erosion of our active user base or engagement levels. Our user engagement patterns have changed over time, and user engagement can be difficult to measure, particularly as we introduce new and different products and services. Any number of factors could potentially negatively affect user retention, growth, and engagement, including if:

| ● | users increasingly engage with other competitive products or services; |

| ● | we fail to introduce new features, products or services that users find engaging or if we introduce new products or services, or make changes to existing products and services, that are not favorably received; |

| ● | user behavior on any of our products changes, including decreases in the quality and frequency of content shared on our products and services; |

| ● | there are decreases in user sentiment due to questions about the quality or usefulness of our products or our user data practices, or concerns related to privacy and sharing, safety, security, well-being, or other factors; |

| ● | we are unable to manage and prioritize information to ensure users are presented with content that is appropriate, interesting, useful, and relevant to them; |

| ● | we are unable to obtain or attract engaging third-party content; |

| ● | users adopt new technologies where our products may be displaced in favor of other products or services, or may not be featured or otherwise available; |

| ● | there are changes mandated by legislation, regulatory authorities, or litigation that adversely affect our products or users; |

| ● | technical or other problems prevent us from delivering our products in a rapid and reliable manner or otherwise affect the user experience, such as security breaches or failure to prevent or limit spam or similar content; |

| ● | we adopt terms, policies, or procedures related to areas such as sharing, content, user data, or advertising that are perceived negatively by our users or the general public; |

| ● | we elect to focus our product decisions on longer-term initiatives that do not prioritize near-term user growth and engagement; |

| ● | we make changes in how we promote different products and services across our family of apps; |

-21-

| ● | initiatives designed to attract and retain users and engagement are unsuccessful or discontinued, whether as a result of actions by us, third parties, or otherwise; |

| ● | we fail to provide adequate customer service to users, marketers, developers, or other partners; |

| ● | we, developers whose products are integrated with our products, or other partners and companies in our industry are the subject of adverse media reports or other negative publicity, including as a result of our or their user data practices; or |

| ● | our current or future products, such as our development tools and application programming interfaces that enable developers to build, grow, and monetize mobile and web applications, reduce user activity on our products by making it easier for our users to interact and share on third-party mobile and web applications. |

If we are unable to maintain or increase our user base and user engagement, our revenue and financial results may be adversely affected. Any decrease in user retention, growth, or engagement could render our products less attractive to users, marketers, and developers, which is likely to have a material and adverse impact on our revenue, business, financial condition, and results of operations. If our active user growth rate continues to slow, we will become increasingly dependent on our ability to maintain or increase levels of user engagement and monetization in order to drive revenue growth.

We face competition from traditional media companies, and we may not be included in the advertising budgets of large advertisers, which could harm our operating results.

In addition to internet companies, we face competition from companies that offer traditional media advertising opportunities. Most large advertisers have set advertising budgets, a very small portion of which is allocated to Internet advertising. We expect that large advertisers will continue to focus most of their advertising efforts on traditional media. If we fail to convince these companies to spend a portion of their advertising budgets with us, or if our existing advertisers reduce the amount they spend on our programs, our operating results would be harmed.

Acquisitions may disrupt growth.

We may pursue strategic acquisitions in the future. Risks in acquisition transactions include difficulties in the integration of acquired businesses into our operations and control environment, difficulties in assimilating and retaining employees and intermediaries, difficulties in retaining the existing clients of the acquired entities, assumed or unforeseen liabilities that arise in connection with the acquired businesses, the failure of counterparties to satisfy any obligations to indemnify us against liabilities arising from the acquired businesses, and unfavorable market conditions that could negatively impact our growth expectations for the acquired businesses. Fully integrating an acquired company or business into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these risks or any other problems encountered with acquisitions and other strategic transactions. These risks may prevent us from realizing the expected benefits from acquisitions and could result in the failure to realize the full economic value of a strategic transaction or the impairment of goodwill and/or intangible assets recognized at the time of an acquisition. These risks could be heightened if we complete a large acquisition or multiple acquisitions within a short period of time.

Our business depends on strong brands and relationships, and if we are not able to maintain our relationships and enhance our brands, our ability to expand our base of users, advertisers and affiliates will be impaired and our business and operating results could be harmed.

Maintaining and enhancing our brands’ profiles may require us to make substantial investments and these investments may not be successful. If we fail to promote and maintain the brands’ profiles, or if we incur excessive expenses in this effort, our business and operating results could be harmed. We anticipate that, as our market becomes increasingly competitive, maintaining and enhancing our brands’ profiles may become increasingly difficult and expensive. Maintaining and enhancing our brands will depend largely on our ability to be a technology leader and to continue to provide attractive products and services, which we may not do successfully.

-22-

We depend on our key management personnel and the loss of their services could adversely affect our business.

We place substantial reliance upon the efforts and abilities of Jeremy Frommer, our Chief Executive Officer, and our other executive officers and directors. Though no individual is indispensable, the loss of the services of these executive officers could have a material adverse effect on our business, operations, revenues or prospects. We do not currently maintain key man life insurance on the lives of these individuals.

We have not adopted various corporate governance measures, and, as a result, stockholders may have limited protections against interested director transactions, conflicts of interest and similar matters.

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of corporate management and the securities markets. Because our securities are not yet listed on a national securities exchange, we are not required to adopt these corporate governance measures and have not done so voluntarily in order to avoid incurring the additional costs associated with such measures. Among these measures is the establishment of independent committees of the Board of Directors. However, to the extent a public market develops for our securities, such legislation will require us to make changes to our current corporate governance practices. Those changes may be costly and time-consuming. Furthermore, the absence of the governance measures referred to above with respect to our Company may leave our shareholders with more limited protection in connection with interested director transactions, conflicts of interest and similar matters.

If we are unable to protect our intellectual property, the value of our brands and other intangible assets may be diminished, and our business may be adversely affected.

We rely and expect to continue to rely on a combination of confidentiality, assignment, and license agreements with our employees, consultants, and third parties with whom we have relationships, as well as trademark, copyright, patent, trade secret, and domain name protection laws, to protect our proprietary rights. In the United States and internationally, we have filed various applications for protection of certain aspects of our intellectual property, and we currently hold a number of registered trademarks and issued patents in multiple jurisdictions and have acquired patents and patent applications from third parties. Third parties may knowingly or unknowingly infringe our proprietary rights, third parties may challenge proprietary rights held by us, and pending and future trademark and patent applications may not be approved. In addition, effective intellectual property protection may not be available in every country in which we operate or intend to operate our business. In any or all of these cases, we may be required to expend significant time and expense in order to prevent infringement or to enforce our rights. Although we have generally taken measures to protect our proprietary rights, there can be no assurance that others will not offer products or concepts that are substantially similar to ours and compete with our business. In addition, we regularly contribute software source code under open source licenses and have made other technology we developed available under other open licenses, and we include open source software in our products. If the protection of our proprietary rights is inadequate to prevent unauthorized use or appropriation by third parties, the value of our brands and other intangible assets may be diminished and competitors may be able to more effectively mimic our products, services, and methods of operations. Any of these events could have an adverse effect on our business and financial results.

We are subject to payment processing risk.

We accept payments using a variety of different payment methods, including credit and debit cards and direct debit. We rely on third parties to process payments. Acceptance and processing of these payment methods are subject to certain certifications, rules and regulations. To the extent there are disruptions in our or third-party payment processing systems, material changes in the payment ecosystem, failure to recertify and/or changes to rules or regulations concerning payment processing, we could be subject to fines and/or civil liability, or lose our ability to accept credit and debit card payments, which would harm our reputation and adversely impact our results of operations.

We are subject to risk as it relates to software that we license from third parties.

We license software from third parties, much of which is integral to our systems and our business. The licenses are generally terminable if we breach our obligations under the license agreements. If any of these relationships were terminated or if any of these parties were to cease doing business or cease to support the applications we currently utilize, we may be forced to spend significant time and money to replace the licensed software.

-23-

Failures or reduced accessibility of third-party software on which we rely could impair the availability of our platform and applications and adversely affect our business.

We license software from third parties for integration into our Vocal platform, including open source software. These licenses might not continue to be available to us on acceptable terms, or at all. While we are not substantially dependent upon any third-party software, the loss of the right to use all or a significant portion of our third-party software required for the development, maintenance and delivery of our applications could result in delays in the provision of our applications until we develop or identify, obtain and integrate equivalent technology, which could harm our business.

Any errors or defects in the hardware or software we use could result in errors, interruptions, cyber incidents or a failure of our applications. Any significant interruption in the availability of all or a significant portion of such software could have an adverse impact on our business unless and until we can replace the functionality provided by these applications at a similar cost. Furthermore, this software may not be available on commercially reasonable terms, or at all. The loss of the right to use all or a significant portion of this software could limit access to our platform and applications. Additionally, we rely upon third parties’ abilities to enhance their current applications, develop new applications on a timely and cost-effective basis and respond to emerging industry standards and other technological changes. We may be unable to effect changes to such third-party technologies, which may prevent us from rapidly responding to evolving customer requirements. We also may be unable to replace the functionality provided by the third-party software currently offered in conjunction with our applications in the event that such software becomes obsolete or incompatible with future versions of our platform and applications or is otherwise not adequately maintained or updated.

We need to manage growth in operations to maximize our potential growth and achieve our expected revenues and our failure to manage growth will cause a disruption of our operations, resulting in the failure to generate revenue.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our marketing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

In order to achieve the general strategies of our company we need to maintain and search for hard-working employees who have innovative initiatives, while at the same time, keep a close eye on any and all expanding opportunities in our marketplace.

We plan to generate a significant portion of our revenues from advertising and affiliate sales relationships, and a reduction in spending by or loss of advertisers and general decrease in online spending could adversely harm our business.

We plan to generate a substantial portion of our revenues from advertisers. Our advertisers may be able to terminate prospective contracts with us at any time. Advertisers will not continue to do business with us if their investment in advertising with us does not generate sales leads, and ultimately customers, or if we do not deliver their advertisements in an appropriate and effective manner. If we are unable to remain competitive and provide value to our advertisers, they may stop placing ads with us, which would adversely affect our revenues and business. In addition, expenditures by advertisers tend to be cyclical, reflecting overall economic conditions and budgeting and buying patterns. Adverse macroeconomic conditions can also have a material negative impact on the demand for advertising and cause our advertisers to reduce the amounts they spend on advertising, which could adversely affect our revenues and business.

-24-

Security breaches could harm our business.

Security breaches have become more prevalent in the technology industry. We believe that we take reasonable steps to protect the security, integrity and confidentiality of the information we collect, use, store and disclose, but there is no guarantee that inadvertent (e.g., software bugs or other technical malfunctions, employee error or malfeasance, or other factors) or unauthorized data access or use will not occur despite our efforts. Although we have not experienced any material security breaches to date, we may in the future experience attempts to disable our systems or to breach the security of our systems. Techniques used to obtain unauthorized access to personal information, confidential information and/or the systems on which such information are stored and/or to sabotage systems change frequently and generally are not recognized until launched against a target. As a result, we may be unable to anticipate these techniques or to implement adequate preventative measures.

If an actual or perceived security breach occurs, the market perception of our security measures could be harmed, and we could lose sales and customers and/or suffer other negative consequences to our business. A security breach could adversely affect the digital content experience and cause the loss or corruption of data, which could harm our business, financial condition and operating results. Any failure to maintain the security of our infrastructure could result in loss of personal information and/or other confidential information, damage to our reputation and customer relationships, early termination of our contracts and other business losses, indemnification of our customers, financial penalties, litigation, regulatory investigations and other significant liabilities. In the event of a major third-party security incident, we may incur losses in excess of their insurance coverage.

Moreover, if a high profile security breach occurs with respect to us or another digital entertainment company, our customers and potential customers may lose trust in the security of our business model generally, which could adversely impact our ability to retain existing customers or attract new ones.

The laws and regulations concerning data privacy and data security are continually evolving; our or our platform providers’ actual or perceived failure to comply with these laws and regulations could harm our business.

Customers view our content online, using third-party platforms and networks and on mobile devices. We collect and store significant amounts of information about our customers—both personally identifying and non-personally identifying information. We are subject to laws from a variety of jurisdictions regarding privacy and the protection of this player information. For example, the European Union (EU) has traditionally taken a broader view than the United States and certain other jurisdictions as to what is considered personal information and has imposed greater obligations under data privacy regulations. The U.S. Children’s Online Privacy Protection Act (COPPA) also regulates the collection, use and disclosure of personal information from children under 13 years of age. While none of our content is directed at children under 13 years of age, if COPPA were to apply to us, failure to comply with COPPA may increase our costs, subject us to expensive and distracting government investigations and could result in substantial fines.

Data privacy protection laws are rapidly changing and likely will continue to do so for the foreseeable future. The U.S. government, including the Federal Trade Commission and the Department of Commerce, is continuing to review the need for greater regulation over the collection of personal information and information about consumer behavior on the Internet and on mobile devices and the EU has proposed reforms to its existing data protection legal framework. Various government and consumer agencies worldwide have also called for new regulation and changes in industry practices. In addition, in some cases, we are dependent upon our platform providers to solicit, collect and provide us with information regarding our players that is necessary for compliance with these various types of regulations.

Customer interaction with our content is subject to our privacy policy and terms of service. If we fail to comply with our posted privacy policy or terms of service or if we fail to comply with existing privacy-related or data protection laws and regulations, it could result in proceedings or litigation against us by governmental authorities or others, which could result in fines or judgments against us, damage our reputation, impact our financial condition and harm our business. If regulators, the media or consumers raise any concerns about our privacy and data protection or consumer protection practices, even if unfounded, this could also result in fines or judgments against us, damage our reputation, and negatively impact our financial condition and damage our business.

In the area of information security and data protection, many jurisdictions have passed laws requiring notification when there is a security breach for personal data or requiring the adoption of minimum information security standards that are often vaguely defined and difficult to implement. Our security measures and standards may not be sufficient to protect personal information and we cannot guarantee that our security measures will prevent security breaches. A security breach that compromises personal information could harm our reputation and result in a loss of confidence in our products and ultimately in a loss of customers, which could adversely affect our business and impact our financial condition. This could also subject us to liability under applicable security breach-related laws and regulations and could result in additional compliance costs, costs related to regulatory inquiries and investigations, and an inability to conduct our business.

-25-

Changes to federal, state or international laws or regulations applicable to our company could adversely affect our business.

Our business is subject to a variety of federal, state and international laws and regulations, including those with respect privacy, data, and other laws. These laws and regulations, and the interpretation or application of these laws and regulations, could change. In addition, new laws or regulations affecting our business could be enacted. These laws and regulations are frequently costly to comply with and may divert a significant portion of management’s attention. If we fail to comply with these applicable laws or regulations, we could be subject to significant liabilities which could adversely affect our business.

If any of our relationships with internet search websites terminate, if such websites’ methodologies are modified or if we are outbid by competitors, traffic to our websites could decline.