BUSINESS COOPERATION AGREEMENT

Dated as of December 6, 2011

between

7L Capital Partners Emerging Europe LP

(7LCPEELP)

Karlo Vlah

Đurđa Vlah

Josip Vlah

and

VelaTel Global Communications, Inc.

(“Investor”)

With respect to the participation of the Investor in the Share Capital of

Herlong Investments Limited

(“Company”)

1

BUSINESS COOPERATION AGREEMENT

THIS BUSINESS COOPERATION AGREEMENT, is entered into as of December 5, 2011 by and between

1. VelaTel Global Communications, Inc., a United States (“US”) corporation, organized under the laws of the state of Nevada, with a principal place of business at 12526 High Bluff Drive, Suite 155, San Diego, California duly and legally represented by George Alvarez, its Chief Executive Officer (hereinafter “Investor or “VelaTel”), which terms shall also refer to VelaTel’s wholly owned subsidiary, Gulfstream Capital Partners, Ltd., a Seychelles corporation (“Gulfstream”) to the extent VelaTel elects to acquire the Investor’s Shares through Gulfstream, in which case all obligations, representations and warranties of Investor set forth in this Agreement and the Schedules thereof shall apply jointly and severally to both VelaTel and Gulfstream);

2. 7L Capital Partners Emerging Europe LP a limited partnership incorporated in Guernsey, having its registered office in Guernsey, Carinthia House, 9-12 The Grange, St. Peter Port, GY1 4BF, duly and legally represented by Mr. Salvator Levis (hereinafter “Founder” or “7LCPEELP”);

3. Herlong Investments Limited, a company incorporated in Cyprus and having its registered office in Cyprus (Agapinoros 2, Iris Tower, 7th Floor Flat/Office 702 Nicosia) duly and legally represented by Mr. Salvator Levis (hereinafter “the Company” or “Herlong”)”);

4. Karlo Vlah resident of Croatia, Merhatovec 5, HR-40314 Selnica, OIB: 5891406711 (Shareholder 1);

5. Đurđa Vlah resident of Croatia Merhatovec 5, HR-40314 Selnica, OIB: 55417661185 (Shareholder 2); and

6. Josip Vlah resident of Croatia Merhatovec 5, HR-40314 Selnica, OIB: 24162783756 (Shareholder 3);

(all of the parties mentioned under number 2, 4, 5 and 6 hereinafter referred to jointly as Shareholders).

(Each and all of the aforementioned referred to individually as a “Party” and collectively as the “Parties”).

RECITALS

A. The Company is a limited liability company incorporated under the laws of Cyprus (registered under registration number no 261909). The authorized and issued share capital of the Company at the time of execution of this Agreement amounts to EUR 3,900 divided into 3,900 Common Shares of EUR 1 each. All Common Shares have been issued and are fully paid or credited as fully paid.

B. 7LCPEELP owns approximately 76.9% of Herlong’s Common Shares.

C. Karlo Vlah owns approximately 11.5% of Herlong’s Common Shares.

D. Each of Đurđa Vlah and Josip Vlah owns approximately 5.8% of Herlong’s Common Shares.

E. The Company is the sole owner of Novi-Net, D.O.O. (“Novi-Net”) and Montenegro Connect D.O.O. (“Montenegro Connect”).

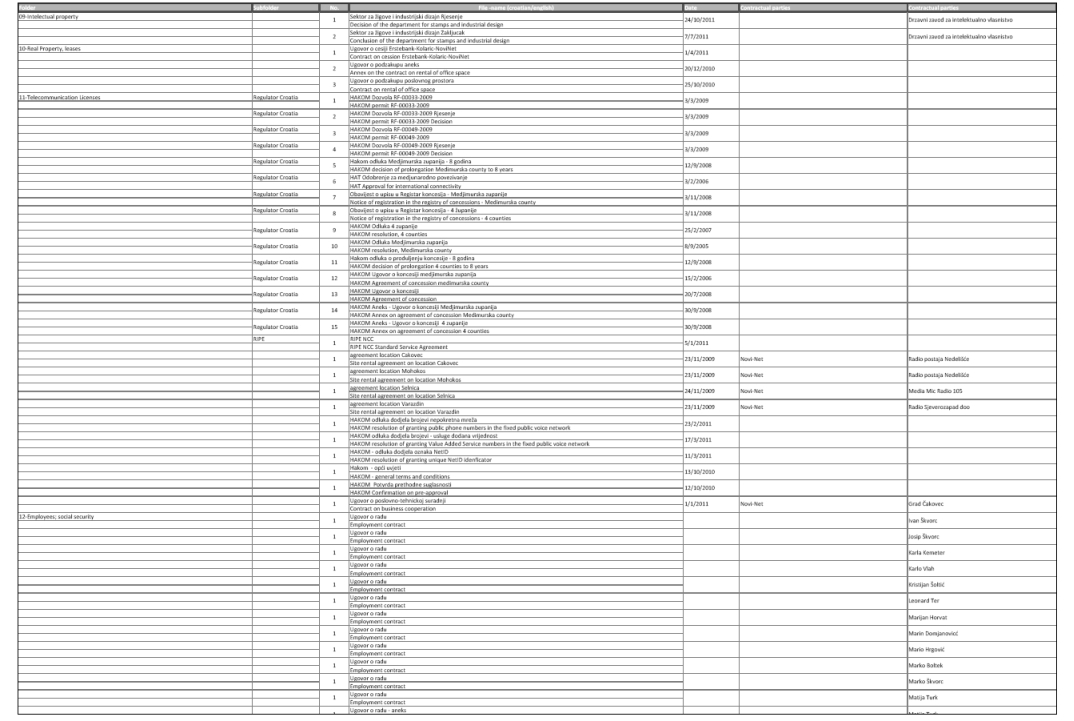

F. Novi-Net d.o.o. is a company organized under the laws of the Republic of Croatia. Novi-Net has been granted one or more Wireless Broadband Access and related telecommunications services (“WBA”) Licenses by Governmental Entities in Croatia covering the bandwidth 3427.500 MHz through 3548.500 MHz (in total 2x21 MHz), suitable for delivery of WBA to household, business enterprise and government subscribers in the following counties of Croatia: Medimurska zupanija, Varazdinska zupanija, Krapinsko-zagorska zupanija, Koprivnicko-krizevacka zupanija, and Viroviticko-podravska zupanija. Novi-Net owns certain infrastructure equipment and is currently offering WBA to subscribers. Novi-Net has been approved for issuance of nationwide WBA Licenses covering the same bandwidth as above, subject only to payment of the applicable license fees.

2

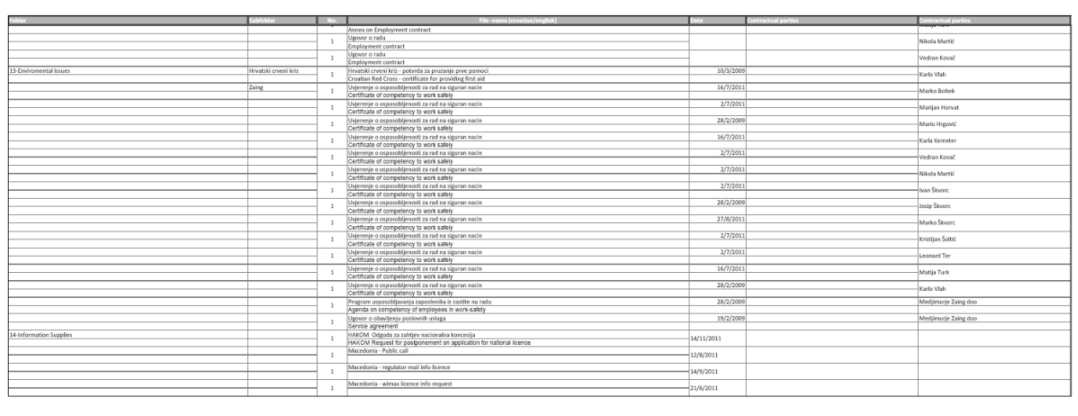

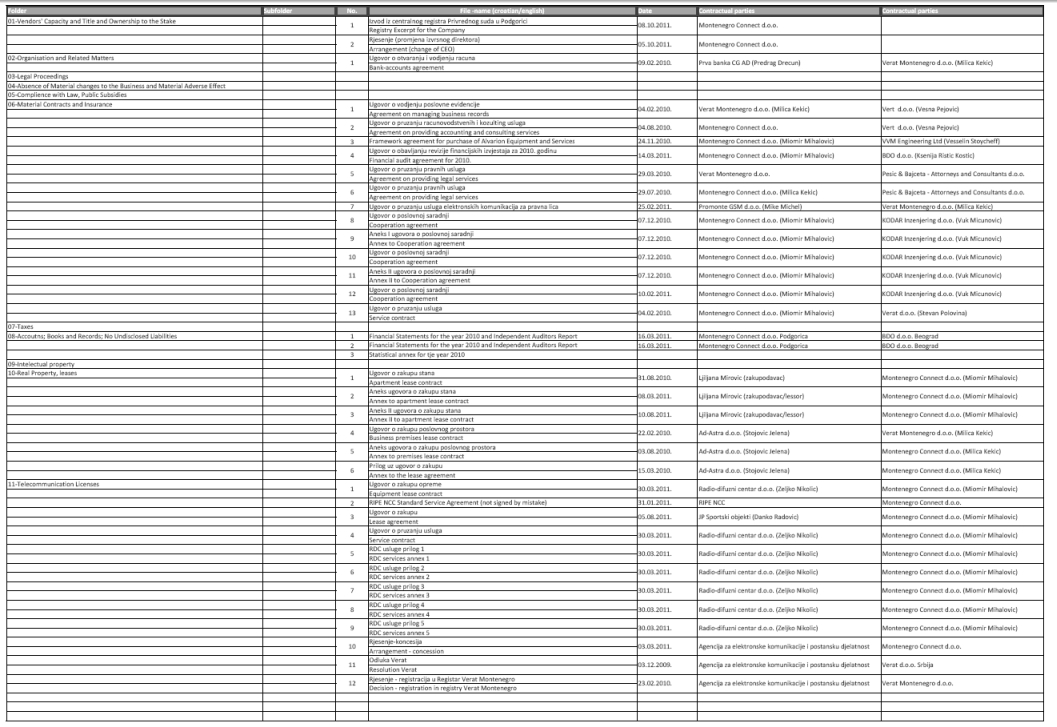

G. Montenegro Connect d.o.o. is a company organized under the laws of the Republic of Montenegro. Montenegro Connect has been granted one National WBA License by Governmental Entities in Montenegro covering the bandwidth 3410.000 MHz through 3425.000 MHz and 3500.000 MHz through 3525.000 MHz (in total 15+25 MHz), suitable for delivery of WBA to household, business enterprise and government subscribers nationwide . Montenegro Connect owns certain infrastructure assets, but has no subscribers, or other revenue generating operations.

H. Investor’s Share Capital is publicly traded on the US Over-The-Counter Service under the symbol OTCQB:VELA. Investor is in the business of designing, building, deploying, expanding and operating WBA networks in key markets throughout the world. Investor has access to investment capital and relationship with vendors advantageous to Investor’s business.

I. The Company wishes to raise capital to implement the Investment (as described below), by including strategic partners in its shareholding base.

J. The Investor intends to become a shareholder of the Company by contributing EUR 2,800,000 and any additional amount that will be required for financing and implementing the Investment as equity in the latter’s Share Capital and undertakes to implement the Investment pursuant to the provisions of this Agreement.

K. The Parties have valued their respective contributions towards the expansion and organic growth of the Company and its Subsidiaries as follows: Investor’s interest in the Share Capital of the Company will represent 75% of the Company’s Common Shares and the Shareholders interest will represent collectively 25% of the Company’s Common Shares (specifically 23.6% by 7LCPEELP, 0.7% by Shareholder 1, and 0.35% each by Shareholder 2 and 3).

L. Investor shall be entitled to a preferred return on the entire amount actually invested by it in the Company, including the reasonable value of services provided directly by Investor’s personnel (which shall not exceed 10% of the value of equipment contributed), and including finance charges paid to others, but excluding any internal rate of return on Investor’s Commitment. In this respect Investor shall receive Redeemable Preference Shares, as per provisions of Section 7, at a par value of EUR 1.00 per Redeemable Preference Share for each EUR 1.00 that the Investor will actually invest from time to time.

M. Forthwith after execution of this Agreement the Company, further to 7LCPEELP’s Investment, will issue to 7LCPEELP 12,381 new Common Shares at a nominal and issuance price of EUR 1 each, following which 7LCPEELP will own 15,381 Common Shares in the Company. 7LCPEELP shall be entitled to a preferred return on the entire amount of 7LCPEELP’s Investment. In this respect 7LCPEELP shall also receive at or before Closing 3,230,000 Redeemable Preference Shares. 7LCPEELP shall also receive Redeemable Preference Shares, as per the provisions of Section 7, at a par value of EUR 1.00 per Redeemable Preference Share for each EUR 1.00 that 7LCPEELP will actually invest from time to time.

N. The Parties now wish to regulate their mutual prospective relationship as shareholders of the Company, by means of the present Agreement as aforesaid.

NOW, THEREFORE, in consideration of the foregoing premises and the respective representations and warranties, covenants and agreements contained herein and the sufficiency of which is hereby acknowledged by the parties, the Parties hereto agree as follows:

1. DEFINITIONS

1.1 Definitions. As used in this Agreement, in Schedule 1 to this Agreement containing representations and warranties of Seller, and/or in the Disclosure Schedule, the following terms shall have the meanings assigned to them in this Section.

Affiliate: means, with respect to any Person, any other Person directly or indirectly controlling, controlled by or under common control with such specified Person.

3

Annual Operating Budget: means monthly projections of revenues, cost of service, operating expenses, working capital requirement, leases and any and all other cash or cash equivalents as prepared by the Company on an annual basis, as approved by the Board of Directors.

Agreement: means this Agreement and all schedules, exhibits and instruments and amendments or confirmation of them.

Articles of Association: means the articles of association of the Company to be adopted by the shareholders of the Company before or at Closing, which will include certain important provisions hereof that pursuant to Cyprus legislation and common practice should be incorporated in the articles of association.

Business Day: means any day of the year, other than a Saturday, Sunday on which banks are normally open for general business in Cyprus, Croatia and Montenegro.

Company: means Herlong Investments Limited.

Companies: means Herlong Investments Limited, Novi-Net d.o.o and Montenegro Connect d.o.o.

Closing Date: means the date of Closing determined in accordance with Section 3.

Conditions: means the conditions pursuant to Section 2.

Common Shares: The Company’s ordinary shares.

Companies’ Intellectual Property: means all patents, patent applications, trademarks, trademark applications, service marks, tradenames, copyrights, trade secrets, licenses, domain names, mask works, information and proprietary rights and processes as are necessary to the conduct of the business of the Company or any Subsidiary as now conducted and as presently proposed to be conducted.

Contract: means any agreement, contract, lease, commitment, arrangement or understanding, written or oral, including any sales order or purchase order.

Damages: has the meaning given to it in Section 11.1.

Disclosure Schedule: Schedule 2 to this Agreement listing disclosures of matters required to qualify the Shareholders Warranties. The copies of documents that are referred in the Disclosure Schedule have been previously delivered by the Shareholders to Investor.

Encumbrance: means a mortgage, charge, pledge, lien, option, restriction, third party right or interest or other security interest of any kind.

Environmental Laws: means all applicable Laws and agreements or arrangement with Governmental Authorities and all other statutory requirements relating to public health or the protection of environment, prevention of pollution, remediation of contamination or restoration of environmental quality, protection of human health or the environment (including natural resources), or workplace health and safety, including all applicable Laws relating to the management, containment, manufacture, possession, presence, use, processing, generation, transportation, treatment, storage, disposal, release, abatement, removal, remediation or handling of or exposure to any hazardous materials, and all authorizations issued pursuant to such Laws, agreements, arrangements or statutory requirements.

EUR: means euro, the single currency of participating member states of the European Union.

Escrow Agent: means Inter Jura Cy (Trusts) Limited, a private limited liability company incorporated under the laws of Cyprus, with registration number 19433, having its registered office at 1 Lampousas street, 1095, Nicosia, Cyprus, a service company affiliated with Dr. K. Chrysostomides & Co LLC, a law firm in Cyprus.

FATCA: means the US law Foreign Account Tax Compliance Act.

Financial Statements: means the balance sheets, profit and loss statements, and statements of cash flows for the Companies prepared in accordance with accounting regulations and requirements of the applicable legislation for the relevant country as at the fiscal year ending 31 December 2010, and management accounts for the nine month period ending September 30, 2011.

4

Governmental Authority: means any executive, judicial, legislative, political, regulatory, governmental, public or administrative entity, institution or organization, autonomous institution, central, regional, provincial, municipal or local government or authority, municipality, central bank, tax agency, court, commission, board, bureau, agency or instrumentality of the country, state, department, province or similar geographic or political circumscription having jurisdiction over any Person referred to in the context in which such word is used, including any: (i) subdivision or authority of any of the foregoing; (ii) quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of the above; and (iii) other entities and agencies that perform administrative duties, which are authorized under any applicable Law, to issue or construe rules, decisions, general regulations or private administrative acts, with binding effect on the parties subject to the scope thereof.

IFRS: International Financial Reporting Standards applicable or appropriate to the competent jurisdiction;

Independent Accountant: KPMG or alternatively PWC or such other accountant as the parties may agree.

Investment: The finance of the growth and expansion of the Company’s Subsidiaries which will result to combine the WBA Licenses and other assets and resources of the Subsidiaries with equipment, services and other resources to be provided by Investor to the Company or its Subsidiaries in a manner that will allow the Company or its Subsidiaries to deploy and operate WBA networks to an expanded subscriber base in Croatia and Montenegro. More specifically:

(a) The financing, designing, purchasing, installing, deploying and operating WBA network(s) in regions of Croatia and Montenegro covered by the WBA Licenses of the Subsidiaries, including CAPEX, OPEX, debt service, and other negative cash flow through the date the overall operations of the Companies become cash flow positive, consisting of at least the following minimum components of equipment and service levels;

(b) Seventy-five (75) fully installed base transceiver stations (BTS), including antennae, radios and back-up batteries, lease payments on sites, and all civil works and towers required to make the sites legally and structurally amendable to installation of the BTS equipment;

(c) Core network equipment, switches and software necessary to provide Wi-MAX, LTE or dual band Wi-MAX/LTE triple play (voice, data, video) WBA service to at least 150,000 total subscribers based on no more than a 300% over-subscription level (i.e. as many as 50,000 subscribers online simultaneously);

(d) Provision for national transport of internet connectivity between core network equipment and remote cities, plus point-to-point backhaul via fiber or microwave;

(e) Administrative, sales, marketing and customer support staff, office space and office equipment required to operate the WBA network(s);

(f) Consumer premises equipment (CPE), dongles, tablets, handsets, Mi-Fi cards and other devices offered for sale to subscribers to enable connection to the WBA network(s) and carried as inventory for sale;

(g) Taxes, license fees and other amounts accruing to Governmental Authorities in connection with operations of the WBA network(s); and

(h) Debt service on any amounts borrowed from banks to finance any of the foregoing items or other elements of CAPEX or OPEX, as well as debt service on pre-existing debt, to be retired in the ordinary course and according to their various terms.

Investor: has the meaning set forth in the preamble to this Agreement.

Investor’s Commitment: The amount of EUR 2,800,000 or such greater amount as is actually required to fulfill the Investment until the total operations of the Companies become cash flow positive as this will be determined by the Independent Accountant based on the audited consolidated financial statements of the Company.

5

Investor’s Common Shares: means 48,843 Common Shares of the share capital of the Company, which shall represent 75% of the total Common Shares of the Company’s share Capital that shall have been issued and are outstanding as of the Closing of this Agreement.

Investor’s Shares: means (a) the Investor’s Common Shares (defined above) and (b) such number of Redeemable Preference Shares that will be issued to the Investor as per the provisions of this Agreement.

Investor’s Warranties: means the warranties of the Investor contained in this Agreement and "Investor's Warranty" means any one such warranty.

IPO: means an initial public floatation of equity shares of the relevant corporation under applicable securities legislation or the stock exchange requirements of any Major Stock Exchange.

Knowledge of Shareholders: or any similar phrase means, with respect to any fact or matter, the actual knowledge of 7LCPEELP and Shareholders and the directors and executive officers of 7LCPEELP, the Company and the Subsidiaries and any other employee of 7LCPEELP, the Company and the Subsidiaries with a title of Vice-President, General Manager or above, together with such knowledge that such directors, executive officers or other employees could be expected to discover after due investigation concerning the existence of the fact or matter in question.

Law or Laws: means any statute, law (including common law), constitution, treaty, ordinance, code, order, decree, case law, judgment, resolution, decision, rule, regulation, supreme decree, legislative decree, provision or principle of any kind that is a part a legal system in force, and any other binding requirement or determination of any Governmental Authority.

Major Stock Exchange: means with regard to the (i) Company: NASDAQ, AMEX, NYSE, the stock exchange of Toronto, Frankfurt, Amsterdam, Hong Kong or London and (ii) with regard to VelaTel: NASDAQ, AMEX or NYSE.

Material, Materially, Adversely, Material Adverse Change, or Material Adverse Effect means any action, omission or change with a significant impact or essential to any Person or to the business, operations, assets, financials, performance of the activities, or fulfillment of the purpose of any such Person. Any such action, omission or change shall only be considered to produce a significant impact or to be essential to any such Person if its effects, consequences or results are likely to imply or involve more than EUR 100,000 (One Hundred Thousand and 00/100 Euros). The effects, consequences or results derived from or arising out of: (i) any act or omission by such Person taken with the prior consent or at the direction of the other Parties hereto; or (ii) any Act of God or Force Majeure impacting any of the Parties, provided that the effects of the Act of God or Force Majeure event prevent performance of an obligation under this Agreement were not foreseeable and could not have been prevented or diminished by the Party affected by the Act of God or Force Majeure, shall not be considered within this definition.

Montenegro Connect d.o.o: a limited liability company incorporated under the laws of Montenegro, having its registered office at 65 Dzordza Vasingtona Street 81000 Podgorica, engaged in internet based services provision;

Novi-Net d.o.o: A limited liability company incorporated under the laws of Croatia having its registered office at Merhatovec 5, 40314 Selnica, engaged in internet based services provision and voice through internet transmission service provision;

Official: means: (i) any governmental official; (ii) any political party or official thereof; (iii) any candidate for political office; (iv) any member of the judiciary or an administrative tribunal; (v) any member of, or official of, any public international organization; or (vi) any employee of any of the foregoing;

Order: means any award, injunction, judgment, resolution, decision, decree, order, ruling, subpoena or verdict or other decision issued promulgated or entered by or with any Governmental Authority of competent jurisdiction.

Redeemable Preference Shares: 3,230,000 Redeemable Preference Shares issued and allotted to 7LCPEELP at or before Closing (at a nominal and issuance price of EUR 0.801 each) and 1,028,086 Redeemable Preference Shares issued and allotted to the Investor at Closing (at a nominal price of EUR 0.801 and an issuance price of 0.9525 each), and such number of Redeemable Preference Shares to be issued from time to time and allotted to the Investor or 7LCPEELP at an issuance price of EUR 1.00 per share for each EUR 1.00 that the Investor or 7LCPEELP actually invests from time to time, the rights, preferences, privileges, and restrictions granted to and imposed on which are as set forth in Section 7 below.

6

Shareholders’ Damages: has the meaning given to it in Section 14.1.

Share Capital: means (a) in the case of a corporation, (i) its issued shares of the common stock or other class of stock which confers voting power to elect the board of directors or others performing similar functions with respect to such corporation, and the right to receive the profits and losses, or distribution of assets, of the corporation, each in the proportion that the shares owned by any Person bear to the total shares issued and (ii) its issued shares of redeemable preference shares, (b) in the case of a partnership or limited liability company, its partnership or membership interests or units (whether general or limited), and (c) in the case of any other entity, the instruments that confer the same rights as applicable to a corporation as described above.

Subsidiaries: Novi-Net d.o.o and Montenegro Connect d.o.o.

Tax or Taxes: means all forms of tax, duties, imposts, contributions, withholdings, deductions, charges, levies and sums payable on account of the foregoing whatsoever imposed, charged or demanded by a Tax Authority in the nature of tax (including without limitation any amount payable as a result of counteraction, adjustment or set off by a Tax Authority in relation to any liability to tax, interest on unpaid tax, repayment of tax or interest or repayment supplement in respect of a repayment of tax), and all amounts recoverable by a Tax Authority as if they were tax and shall be deemed to include the cost of removing any charge over assets imposed by any Tax Authority and in each case all charges, interest, fines, penalties and surcharges arising from, incidental to, or relating to, the same.

Tax Authority: means any Governmental Authority competent to impose, administer or collect Tax.

VelaTel’s Series A Common Stock: Shares of Investor’s stock currently publicly traded via quotation through the Over The Counter Service, Inc. under the symbol “OTCQB:VELA.”

WBA: means wireless broadband access and related telecommunications services.

WBA License: means any combination of rights granted by one or more appropriate Governmental Authorities for private ownership or exclusive right to use specific radio frequency bandwidth within a defined geographic area and suitable for delivery of WBA, including and subject to all licenses, concessions and other Laws regulating the granted rights.

ZTE: means ZTE Corporation, a leading global provider of telecommunications equipment and network solutions headquartered in the Peoples Republic of China, with whom Investor has several contractual relationships including a global strategic memorandum of understanding whereby ZTE agrees to offer VelaTel a favorable vendor financing proposal for each project identified and use its best efforts to facilitate VelaTel’s applications for debt financing by banks with which ZTE has relationships.

7LCPEELP’s Common Shares: means 15,381 Common Shares which will be owned by 7LCPEELP after Closing and will represent 23.6% of the Company’s share capital.

7LCPEELP’s Investment: The amount of EUR (3,230,000) three million two hundred thirty euros already invested by 7LCPEELP in the Company.

Shareholders Warranties: means the warranties of the Shareholders contained in Schedule 1 and "Shareholders' Warranty" means any one such warranty.

1.2 Other Definitions. Other terms defined in this Agreement and indicated as such by capitalized terms in quotation marks shall have the meaning ascribed thereto next to the definition, throughout the text of this Agreement.

1.3 Language. This Agreement has been entered into in English language and, notwithstanding any translation thereof, the English language version shall control the construction and interpretation of this Agreement. All material communications between the Parties with respect to this Agreement shall be in the English language.

7

2. CONDITIONS TO CLOSING

a. Conditions to Obligations of Investor, and the Shareholders. The obligations of Investor and of the Shareholders to consummate the Transaction are subject to the satisfaction on or prior to the Closing Date of the following conditions:

(a) No temporary restraining order, preliminary or permanent injunction or other Order preventing the consummation of the Transaction shall be in effect.

(b) No Law shall have been enacted or shall be deemed applicable to the Transaction which makes the consummation of the Transaction illegal.

(c) Calendar year 2011 shall have ended.

b. Conditions to Obligation of Investor. The obligation of Investor to consummate the Transaction is subject to the satisfaction (or waiver by Investor in its sole discretion) of the following further conditions, which are for the exclusive benefit of Investor:

(a) Shareholders Warranties set forth in Schedule 1 of this Agreement shall have been true and correct at and as of the date of this Agreement and shall be true and correct at and as of the Closing Date as if made at and as of the Closing Date, and the Shareholders shall have executed and delivered or cause to be delivered a certificate to Investor to that effect. The receipt of such certificate at the Closing Date shall not constitute a waiver by Investor of any of the representation and warranties of the Shareholders which are contained in this Agreement.

(b) Shareholders shall have performed or complied with all obligations and covenants required by this Agreement to be performed or complied with by the Shareholders with at or prior to the Closing Date, and the Shareholders shall have executed and delivered or cause to be delivered a certificate to Investor to that effect. The receipt of such certificate at the Closing Date shall not constitute a waiver by Investor of any of the covenants of the Shareholders which are contained in this Agreement.

(c) There shall have been no Material Adverse Change in the condition (financial or otherwise), operations, prospects or results of operations of the Company taken as a whole.

(d) No Action shall be pending or threatened before any court, judge, arbitrator, arbitration panel or other Governmental Authority or other Person: (i) seeking to prevent consummation of any of the transactions contemplated by this Agreement; (ii) seeking to impose any Material limitation on the right of Investor to own the Investor’s Shares.

c. Conditions to Obligation of the Shareholders. The obligation of the Shareholders to consummate the Transaction is subject to the satisfaction (or waiver by 7LCPEELP in its sole discretion), of the following further conditions, which are for the Shareholders’ exclusive benefit:

(a) The representations and warranties of Investor set forth in this Agreement shall have been true and correct at and as of the date of this Agreement and shall be true and correct at and as of the Closing Date as if made at and as of the Closing Date, and Investor shall have executed and delivered or cause to be delivered a certificate to the Shareholders to that effect. The receipt of such certificate at the Closing Date shall not constitute a waiver by the Shareholders of any of the representation and warranties of Investor which are contained in this Agreement.

(b) Investor shall have performed or complied in all Material respects with all obligations and covenants required by this Agreement to be performed or complied with by Investor at or prior to the Closing Date, and Investor shall have executed and delivered or cause to be delivered a certificate to the Shareholders to that effect. The receipt of such certificate at the Closing Date shall not constitute a waiver by the Shareholders of any of the covenants of Investor which are contained in this Agreement.

(c) No Action shall be pending or threatened before any court, judge, arbitrator or arbitration panel or other Governmental Authority or other Person wherein an unfavorable Order would: (i) prevent consummation of any of the transactions contemplated by this Agreement; or (ii) cause any of the transactions contemplated by this Agreement to be rescinded following consummation. No such Order shall be in effect.

8

3. CLOSING

3.1 Closing shall take place at the offices of Dr. K. Chrysostomides & Co LLC, 1 Lampousas Str, Nicosia Cyprus as soon as possible after satisfaction of the Conditions and in any event on the date which is no later than five (5) days after the date on which the last of the Conditions to be satisfied or waived is satisfied or waived, or such other date as the parties may agree in writing. The date upon which the Closing occurs is herein referred to as the "Closing Date."

3.2 At Closing: The Shareholders shall deliver to the Investor or the Escrow Agent as appropriate the following:

3.2.1 Evidence satisfactory to the Investor (acting reasonably) of the fulfillment of the Conditions set forth in Section 2.b;

3.2.2 Evidence, to the Investor’s satisfaction, of the authority of any person or persons executing or attesting the execution of this Agreement and any other document on behalf of the Shareholders and the Company;

3.2.3 A certified copy of the duly executed resolutions of the board of directors of the Company and the Shareholders of the Company as may reasonably be required by the Investor in order to give effect to the valid issue and allotment to the Investor of (i) 48,843 new Common Shares at a nominal and issuance price of EUR 1 and (ii) 1,028,086 new Redeemable Preference Shares at a nominal value of EUR 0.801 and at an issuance price of ΕUR 0.9525 (“Investor’s Common Shares and Redeemable Preference Shares”), and the registration of the Investor as a shareholder of the Company in respect of Investor’s Common Shares and Redeemable Preference Shares;

3.2.4 A unanimous consent of the shareholders of the Company waiving any and all pre-emptive rights which they may have in relation to the issue and allotment of Investor’s Common Shares and Redeemable Preference Shares to the Investor;

3.2.5 Shares certificates in respect of Investor’s Common Shares and Redeemable Preference Shares;

3.2.6 Duly executed Share Pledge Agreement I, Share Pledge Agreement II, Escrow Agreement I and Escrow Agreement II;

3.2.7 Duly signed resignations of all members of the Board of Directors from their positions as directors of the Companies and of all officers from their positions as officers of the Companies, provided that 7LCPEELP shall have the right to appoint one of no less than five members and no more than nine members of the Board of Directors of the Company as per the provisions of Section 16;

3.2.8 A unanimous consent of the Shareholders confirming election of new directors and officers of the Companies and authorized signatories on each of the Companies’ bank accounts; and

3.2.9 All other documents, instruments or certificates required to be delivered by the Shareholders at or prior to the Closing pursuant to this Agreement.

3.3 At Closing: the Investor shall deliver to 7LCPEELP on behalf of the Shareholders the following:

3.3.1 Evidence, to 7LCPEELP’s satisfaction, of the authority of any person or persons executing or attesting the execution of this Agreement and any other document on behalf of the Investor;

3.3.2 Duly executed Share Pledge Agreement I, Share Pledge Agreement II, Escrow Agreement I and Escrow Agreement II;

3.3.3 Evidence to 7LCPEELP’s satisfaction that the Investor has ordered in the name and on behalf of the Company, from its supplier i.e. ZTE, the 75 base stations and the core equipment described under sub-paragraphs (b) and (c) of the Investment Definition;

9

3.3.4 Evidence to 7LCPEELP’s satisfaction (i.e. a comfort letter signed by the authorized signatory of ZTE) that the Investor has paid to ZTE in the name and on behalf of the Company the 15% down payment, which amounts to EUR 528,086 on the equipment ordered to ZTE and described in par. 3.3.3 above;

3.3.5 Evidence to 7LCPEELP’s satisfaction that the Investor has paid by wire transfer to the Company’s bank account with Bank of Cyprus (account no CY81002001550000000114285600) the amount of EUR 500,000;

3.3.6 Evidence to 7LCPEELP’s satisfaction that employment contracts between the Company and or Companies and Key Employees (as defined in section 16 below) are executed on terms satisfactory to 7LCPEELP

4. POST CLOSING SHAREHOLDING STRUCTURE OF THE COMPANY

4.1 Following the above, the Company’s Share Capital shall amount to EUR 3,475,851 and a reserve fund shall be formed due to the issuance of shares above par, amounting to 970,838. The shareholding structure of the Company will be formed as follows:

|

Shareholder

|

Common Shares

|

(%)

|

Redeemable Preference Shares

|

|

INVESTOR

|

48,843

|

75%

|

1,028,068

|

|

7LCPEELP

|

15,381

|

23.6%

|

3,230,000

|

|

Karlo Vlah

|

450

|

0.7%

|

---

|

|

Đurđa Vlah

|

225

|

0.35%

|

---

|

|

Josip Vlah

|

225

|

0.35%

|

---

|

|

TOTAL

|

65,124

|

100.0%

|

5,228,906

|

4.2 Any tax, stamp duties, fees, bank charges or other costs payable in relation to the issue of the new shares and to the execution of this Agreement shall be paid by the Company.

5. INVESTMENT AND INVESTOR’S RIGHTS AND UNDERTAKINGS

5.1 Investor may, in its discretion (subject to sound business judgment in its capacity as majority shareholder of the Company), increase the amount of equipment and other CAPEX, OPEX and other investment beyond the minimum components and service levels described in the definition of Investment, either during the initial phase of deployment or as an expansion into future phase(s), either before the financial results of any initial phase(s) are generating free cash flow, or the result of which would be to exhaust all positive cash flow and return financial performance to a negative cash flow position, under the condition that 7LCPEELP’s and the Shareholders post-Closing 25% interest of Common Shares in the Share Capital of the Company shall not be subject to dilution.

5.2 All equipment and other fixed assets representing the Investment shall be contracted for purchase, titled and financed in the name of the Company or any of its Subsidiaries, with any down payments or other cash requirement that exceed the free cash flow of the Company or applicable Subsidiary paid by Investor and the full purchase price guaranteed by Investor to the extent required by any lender. Investor shall be entitled to a security interest for the entire value of such equipment that is paid for or its financing is guaranteed by Investor.

10

6. SHAREHOLDERS ANTI DILUTION RIGHTS

The Shareholders' post-Closing shareholding which will jointly represent 25% of Common Shares in the Share Capital of the Company shall not be subject to dilution and these anti-dilution rights shall be incorporated in the Articles of Association of the Company. It is clarified that, subject to enforcement of any indemnity obligation pursuant to the Share Pledge Agreement I as described in Section 12, the Shareholders' ownership in the Company with respect to their Common Shares will not be diluted and will always represent 25% in the Share Capital of the Company’s Common Shares in case the Investor or any other strategic investor makes after Closing any contribution to the Company’s Share Capital. In this respect the Investor or any other strategic investor will be entitled to receive for any capital or in kind contribution to the Company’s share capital only Redeemable Preference Shares.

7. REDEEMABLE PREFERENCE SHARES

7.1 In addition to the Redeemable Preference Shares issued at or before Closing to 7LCPEELP and the Investor, the Company will also issue from time to time and allot to the Investor or 7LCPEELP Redeemable Preference Shares at an issuance price of EUR1.00 per share for each EUR1.00 that Investor or 7LCPEELP actually invests from time to time.

7.2 Redeemable Preference Shares shall only be owned by the Investor and 7LCPEELP, whereas Shareholders 1, 2 and 3 shall at any time own only Common Shares

7.3 The rights, preferences, privileges, and restrictions granted to and imposed on the Redeemable Preference Shares are as set forth below:

7.4 Redeemable Preference Shares will only have redemption rights.

7.5 Redeemable Preference Shares will have no voting rights, no conversion rights and no dividend rights.

7.6 Redemption:

(i) Subject to compliance by the Company with the Cyprus Companies Law Cap. 113 (as amended), at the end of each financial year, the Company shall commission the Independent Accountant to determine the amount of available positive cash flow (if any) after due allowance and reserves for taxes, working capital, and other contingent liabilities projected through the end of the Company’s fiscal year to which the issue of positive cash flow relates (“Legally Available Funds”).

(ii) Within 60 calendar days of the end of each financial year, the Directors of the Company shall consider the relevant report from the Independent Accountant at a Board meeting and if pursuant to such determination there are Legally Available Funds, the Company shall inform in writing the holders of Redeemable Preference Shares (the "Redemption Dates").

(iii) Within 10 Business days from each Redemption Date any of the holders of such shares may at its sole discretion deliver to the Company a request in writing (the “Redemption Request”) to proceed with the redemption in accordance with the terms of this Section 7.6, of such number of outstanding Redeemable Preference Shares as is given by dividing the Legally Available Funds by the redemption price of each outstanding Redeemable Preference Share, this redemption price being 1 EUR.

(iv) The number of Redeemable Preference Shares held by each holder of such shares which shall be redeemed each year shall be pro rata to the total number of Redeemable Preference Shares outstanding at such time and held by each holder.

(v) Following redemption of all outstanding Redeemable Preference Shares, all profits shall be distributed, after due allowance and reserves for taxes, working capital, and other contingent liabilities, pro rata as dividends to the holders of the Company’s Common Shares.

11

8. PRE-CLOSING UNDERTAKINGS

8.1 During the period between the date of this Agreement and the Closing Date, the Shareholders, so far as they are able, shall ensure that each of the Companies will:

8.1.1 Operate its business in the ordinary course in accordance with its business plans, budgets, all applicable legal and administrative requirements so as to maintain it as a going concern, and not do anything which is out of the ordinary course consistent with past practice without the prior written consent of the Investor; and

8.1.2 Take all reasonable steps to preserve and protect its business and assets, and not, without the prior written consent of the Investor, acquire or dispose of or transfer an asset, incur a liability, obligation or expense, other than in the ordinary course of business in accordance with past practice and on normal arm’s length terms.

8.2 To the extent permitted by applicable law, the Shareholders also agree to ensure that:

8.2.1 Each of the Companies cooperates with any reasonable requests by the Investor for information about the business, the assets and the ongoing affairs of such company; and

8.2.2 The Investor is given reasonable access during ordinary business hours to the legal and financial advisors and auditors, documents and premises of the Companies to the extent reasonably requested by the Investor or its advisors in preparation for Closing, provided, however, that such access shall not unreasonably interfere with the business and operations of the Companies.

9. REPRESENTATIONS AND WARRANTIES

Each Party acknowledges that the other Party has been induced to enter into this Agreement on the basis of and in reliance upon the following representations, the accuracy of which each Party warrants to the other Party as of the date of this Agreement and as of the Closing.

(a) Such Party is a corporation or limited partnership or limited liability company, as the case may be, duly organized, validly existing and in good standing under the laws of the country and state described as applicable to such Party in the Recitals, and has all requisite power to own, lease and operate its properties and to carry on its business as currently conducted and as proposed to be conducted in this Agreement. No order has been made or petition presented (or is pending) or resolution passed for the winding up of Such Party. Such Party is not insolvent or unable to pay its debts as they fall due.

(b) Such Party has all requisite capacity, power and authority, and has taken all necessary corporate or other actions to enter into this Agreement.

(c) Such Party has done or will promptly do all such further acts, including necessary filings with appropriate governmental authorizes, required in order to give full force and effect to this Agreement.

(d) The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated by this Agreement will not result in any violation or be in conflict with or constitute, with or without the passage of time and giving of notice, either: (a) a default under any provision, instrument, judgment, order, writ, decree, contract or agreement or (b) an event which results in the creation of any lien, charge or encumbrance upon any assets of such Party (except as expressly stated in this Agreement) or the suspension, revocation, forfeiture, or non-renewal of any material permit or license applicable to such Party.

(e) No broker, finder or investment banker is entitled to any brokerage, finder's or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of such Party.

12

10. SHAREHOLDERS' WARRANTIES

10.1 Shareholders represent and warrant to the Investor that each Shareholders' Warranty is true and accurate in all material respects as at the date of this Agreement and as at Closing.

10.2 The Shareholders shall procure that each Shareholders' Warranty is true and accurate at Closing, and for this purpose the Shareholders are deemed to repeat each Shareholders' Warranty at Closing.

10.3 The Shareholders undertake to immediately notify the Investor in writing of any circumstance arising after the date of this Agreement which could cause any Shareholders’ Warranty to become untrue or inaccurate. Any such notification shall not have the effect of remedying any breach of Shareholders’ Warranty concerned.

10.4 Each of the Shareholders’ Warranties shall be construed as a separate and independent warranty and (except where this Agreement provides otherwise) shall not be limited or restricted in its scope by reference to or inference from any other term of another Shareholders’ Warranty or this Agreement.

11. INDEMNIFICATION BY THE SHAREHOLDERS

11.1 The Shareholders, pro rata to their shareholding, with respect to Common Shares in the Company, shall indemnify, hold harmless and defend the Investor from and against any and all claims and/or liabilities, damages, penalties, judgments, assessments, losses, costs and expenses ("Damages") incurred by the Investor, the Company, Novi-Net d.o.o or Montenegro Connect d.o.o arising out of, relating to or based upon allegations of any breach of any Shareholders’ Warranty.

11.2 Subject to Sections 11.4 through 11.6, the Shareholders shall only be required to indemnify the Investor for any Damages arising under Section 11.1, up to the total value of the Shareholders’ Common Shares as such value is defined in Cause 11.7.

11.3 Subject to Section 11.6, the Investor's right to bring a claim for indemnification under Section 5.1 shall survive until the date falling 2 years after the Closing Date in the case of any Damages resulting from a breach of any Shareholders’ Warranty.

11.4 For the avoidance of doubt, the parties agree that the Shareholders shall not be liable in respect of any Damages to the extent that the matter or matters giving rise to such Damages have been fairly and accurately disclosed in the Disclosure Schedule.

11.5 The Shareholders shall not be liable for any Damages (i) unless and until the aggregate amount of all Damages incurred by the Investor, the Company, Novi-Net d.o.o or Montenegro Connect d.o.o exceeds One Hundred Thousand and 00/100 euros (EUR 100,000), in which event the Shareholders shall be jointly liable for all Damages from the first Euro; provided that nothing contained in this Section shall be deemed to limit or restrict in any manner any rights or remedies which the Investor has, or might have, at Law, in equity or otherwise, based on fraud or a willful misrepresentation.

11.6 The provisions of Sections 11.2 and 11.3 shall not apply in relation to any Damages resulting from a breach of the Shareholders’ Warranty set out in Paragraph 6 of Schedule 1 (Title and Assets) in respect of which:

11.6.1 The Shareholders’ liability shall be unlimited;

11.6.2 Such Damages shall not be included in the calculation of the aggregate amount referred to in Section 11.2; and

11.6.3 A claim for such Damages may be made at any time after the Closing Date.

11.7 Any Damages payable to the Investor pursuant to this Section 11 may be paid only out of the Shareholders Common Shares. For the purpose of determining the number of the Shareholders Common Shares to be comprised in such Damages, the total value of all the Shareholders Common Shares shall be deemed to be Euro 3,200,000 (i.e. 25% x the current valuation of the Company amounting to Euro 12,800,000).

13

11.8 The Shareholders shall have no obligation to indemnify the Investor for any breach of any Shareholders’ Warranty unless they have received within the period specified in Section 11.3 or 11.6 above, as the case may be, a notice in good faith and in writing of a claim the amount of which will be determined from the Independent Accountant. Any matter as to which a claim has been asserted by written notice setting forth in reasonable detail the nature of such claim to the other party that is pending or the subject of an arbitration, litigation or other proceeding hereunder shall continue to be covered by the provisions of this Section until such matter is finally terminated by a court or tribunal of competent jurisdiction or otherwise and any amounts payable hereunder are finally determined and paid.

11.9 Procedure

11.9.1 Notice. The Investor (the “Indemnified Party”) shall give notice to the Shareholders with respect to any Damages.

11.9.2 Defense. The Indemnified Party shall have the right to control the defense of any claim, demand, lawsuit, allegation, proceeding or liability is asserted by any third party against such Indemnified Party in respect of matters embraced by the indemnity. Notwithstanding the foregoing, the Shareholders (or any of them) may, at its own expense, participate in such defense with counsel of its own choice. In addition, the Shareholders and the Indemnified Party shall, to the extent in such Party’s possession, make available to the other Party and its respective attorneys, accountants and other representatives all books, records and other information relating to such claim, demand, lawsuit, allegation, proceeding or liability and shall co-operate with such other party and shall render as much assistance as they may reasonably request to ensure a proper and adequate defense. Each of the Indemnified Party and the Shareholders shall, from time to time, and as reasonably requested by the other Party, advise such other Party of, and make available records and information relating to, the progress of such claim, demand, lawsuit, allegation, proceeding or liability. The Indemnified Party shall not consent or cause the Companies, as appropriate, to enter into any settlement of any claim, demand, lawsuit, allegation, proceeding or liability asserted by any third party against the Indemnified Party (either directly or through the Companies), except with the written consent of 7LCPEELP, which consent shall not be unreasonably withheld, delayed or conditioned.

12. INVESTOR’S SECURITY

As a security for the fulfillment by the Shareholders of their obligations pursuant to Section 11 of this Agreement, the parties shall enter at Closing into a share pledge agreement and an escrow agreement substantially in the form of Schedules 3 and 4 attached hereto (the “Share Pledge Agreement I” and “Escrow Agreement I”) pursuant to the terms and conditions of which, the Shareholders shall pledge, mortgage and charge to the Investor the total of their Common Shares in the Company i.e. 16,281 Common Shares and related shares certificates. The Share Pledge Agreement I shall terminate and the Escrow Agent shall release and deliver the pledged shares to 7LCPEELP on behalf of the Shareholders, when either (i) the Investor, as the pledgee directs the Escrow Agent in writing, or (ii) two years from the date of execution of the Share Pledge Agreement I, whichever is earlier. The Shareholders’ liability to indemnify the Investor for any Damages resulting from a breach of the Shareholders’ Warranty set out in Section 6 of Schedule 1 (Title and Assets) will survive the termination of the Share Pledge Agreement I.

13. INVESTOR’S WARRANTIES

13.1 The Investor represents and warrants to the Shareholders that it has the requisite knowledge and means for the due and proper implementation of the Investment.

13.2 Investor undertakes to the Shareholders that it will pay to the Company or on its behalf all amounts associated with the financing and implementation of the Investment. For avoidance of doubt, the Investor undertakes to the Shareholders the following:

I. On or before Closing to provide the evidence described in Subsection 3.3.4 of payment (i) on behalf and in the name of the Company the amount of EUR 528,086, which represents the credit with respect to the 15% down payment for the purchase of the equipment described under sub-paragraphs (b) and (c) of the Investment Definition and (ii) to the Company at least EUR 500,000;

14

II. Within 90 days following Closing (i) to pay to the Company at least another EUR 500,000, bringing the total to at least EUR 1,000,000;

III. Within 180 days following Closing to deliver to the Company the 75 base stations and the core equipment (which will be purchased in the name and on behalf of the Company) described under sub-paragraphs (b) and (c) of the Investment Definition;

IV. Within 180 days following Closing to pay to the Company at least another EUR 500,000, bringing the total to at least EUR 1,500,000;

V. Within 270 days following Closing to pay to the Company at least another EUR 500,000, bringing the total to at least EUR 2,000,000;

VI. Within 360 days following Closing (i) to pay to the Company EUR 271,914 and (ii) at least 50 of the initial 75 base stations and the core equipment included in the Investment Definition will have been fully installed and will be operational for delivery of broadband service to subscribers, including certification by ZTE and the Company that such equipment has satisfied preliminary acceptance testing;

VII. To proceed to all other actions required for the due finance and implementation of the Investment until the total operations of the Companies become cash flow positive as this will be confirmed by the Independent Accountant based on the audited consolidated financial statements of the Company.

13.3 The Investor shall cause the Company to utilize in full the amount paid by the Investor for the implementation of the Investment.

13.4 The Investor represents and warrants to the Shareholders that each Investor’s Warranty is true and accurate in all material respects as at the date of this Agreement and as at Closing.

13.5 The Investor shall procure that each Investor's Warranty is true and accurate at Closing, and for this purpose the Investor is deemed to repeat each Investor’s Warranty at Closing.

13.6 The Investor undertakes to immediately notify the Shareholders in writing of any circumstance arising after the date of this Agreement which could cause any Investor's Warranty to become untrue or inaccurate. Any such notification shall not have the effect of remedying any breach of the Ιnvestor's Warranty concerned.

13.7 Each of the Investor's Warranties shall be construed as a separate and independent warranty and (except where this Agreement provides otherwise) shall not be limited or restricted in its scope by reference to or inference from any other term of another Investor's Warranty or this Agreement.

14. INDEMNIFICATION BY INVESTOR

14.1 The Investor shall indemnify, hold harmless and defend the Shareholders from and against any and all claims and/or liabilities, damages, penalties, judgments, assessments, losses, costs and expenses ("Shareholders’ Damages") incurred by the Shareholders, the Company, Novi-Net d.o.o or Montenegro Connect d.o.o arising out of, relating to or based upon allegations of the failure of or any breach of any Investor’s Warranty.

14.2 The Investor shall only be required to indemnify the Shareholders for any 7LCPEELP’s and the Shareholders’ Damages arising under Section 14.1, up to the total value of the Investor’s Common Shares as such value is defined in Cause 14.5.

14.3 7LCPEELP’s and the Shareholders right to bring a claim for indemnification under Section 14.1 shall survive until the date both conditions under (i) and (ii) herein are fulfilled: (i) the Shareholders have received satisfactory evidence that the Investor has paid to the Company the Investor’s Commitment and has fulfilled its obligations as such are detailed in Section 13.2 I-VI and (ii) the Independent Accountant will have confirmed that the Company and its Subsidiaries have achieved positive cash flow, after due allowance for reserves for taxes, working capital and other contingent liabilities.

15

14.4 The Investor shall not be liable for any Shareholders Damages (i) unless and until the aggregate amount of all Damages incurred by the Shareholders, the Company, Novi-Net d.o.o or Montenegro Connect d.o.o exceeds One Hundred Thousand and 00/100 Euros (EUR 100,000), in which event the Investor shall be liable for all Shareholders Damages from the first Euro; provided that nothing contained in this Section shall be deemed to limit or restrict in any manner any rights or remedies which the Shareholders have, or might have, at Law, in equity or otherwise, based on fraud or a willful misrepresentation.

14.5 Any Shareholders’ Damages payable to the Shareholders pursuant to this Section may be paid only out of the Investor’s Common Shares. For the purpose of determining the number of the Investor’s Common Shares to be comprised in such Damages, the total value of all the Investor’s Common Shares shall be deemed to be EUR 9,600,000 (i.e. 75% x the current valuation of the Company amounting to EUR 12,800,000).

14.6 The Investor shall have no obligation to indemnify the Shareholders for any breach of any Investor’s Warranty unless they have received a notice in good faith and in writing of a claim. Any matter as to which a claim has been asserted by written notice setting forth in reasonable detail the nature of such claim to the other Party that is pending or the subject of an arbitration, litigation or other proceeding hereunder shall continue to be covered by the provisions of this Section until such matter is finally terminated by a court or tribunal of competent jurisdiction or otherwise and any amounts payable hereunder are finally determined and paid.

15. 7LCPEELP’s SECURITY

As a security for the fulfillment by the Investor of its obligations pursuant to Sections 13 and 14 of this Agreement and especially its undertakings for the proper financing and implementation of the Investment the Parties shall enter at Closing into a share pledge agreement and an escrow agreement substantially in the form of Schedule 5 and 6 attached hereto (the “Share Pledge Agreement II” and the “Escrow Agreement II”) pursuant to the terms and conditions of which, the Investor shall pledge, mortgage and charge to 7LCPEELP the total of the Investor’s Common Shares in the Company i.e. 48,843 Common Shares and related shares certificates. The Share Pledge Agreement II shall terminate and Escrow Agent shall release and deliver to Investor all of the Investor’s Common Shares, which amount shall equal 75% of the total Common Shares issued and outstanding as of Closing, when 7LCPEELP (acting reasonably) directs the Escrow Agent in writing that it has obtained satisfactory proof that the Investor has fulfilled its obligations and has paid to the Company the amounts described in Section 13.2 I-VI. It is explicitly acknowledged that should the Investor fail to comply with any of its above mentioned undertakings pursuant to Section 13.2 I-VI, then the Share Pledge Agreement II shall become immediately enforceable for the total pledged shares of the Investor. The Investor’s liability to indemnify the Shareholders for any Damages resulting from a breach of the Investor’s Warranty set out in Section 13.2 VII will survive the termination of the Share Pledge Agreement II.

16. MANAGEMENT OF THE COMPANY POST CLOSING

16.1 Board of Directors. The senior management and administration of the Company shall be carried out by its Board of Directors, which shall be comprised of no fewer than five and no more than nine directors, of which 7LCPEELP shall have the right to elect or appoint one director. It is also hereby agreed that only at the initiative of 7LCPEELP may a director appointed by it be removed or replaced by a new director appointed by it. In the event of vacancy, for any reason whatsoever, in the position of a director appointed by 7LCPEELP, such vacancy shall be filled by a new director appointed by 7LCPEELP.

16

16.2 Decision Making: The Investor, the Company and each of the Shareholders hereby covenant with and undertake to 7LCPEELP that for so long as 7LCPEELP is a shareholder of the Company, the Company shall not without the prior consent in writing of 7LCPEELP (which consent shall not be unreasonably withheld and may be furnished in writing by the director of 7LCPEELP at meetings of the Board of Directors or otherwise) proceed with or approve any of the following matters:

|

·

|

Changes in Company’s objectives, or Memorandum or Articles of Association or legal status;

|

|

·

|

Increasing and or changing the authorized or issued Share Capital of the Company; authorization and/or issuance of shares of any class or any class of securities convertible into shares;

|

|

·

|

Approving any management or employee stock option award, grant or plan;

|

|

·

|

Declaring and distributing dividends;

|

|

·

|

Approving any proposal to list the Company and or the Subsidiaries on a stock exchange;

|

|

·

|

Purchasing shares or acquiring an entity, business or an ownership interest in any other company;

|

|

·

|

Establishing any subsidiary, entering any new business areas or changing substantially the nature of the Company’s business and its subsidiaries;

|

|

·

|

Establishing any joint venture or partnership;

|

|

·

|

Merging, dissolving, liquidating or selling the subsidiaries of the Company or any major part thereof;

|

|

·

|

Amending the Business Plan (including the R&D program and the Annual Operating Budget);

|

|

·

|

Replacing any of the Companies’ Key Employees as set forth in Schedule 7 of this Agreement, who will continue to render their services to the Companies pursuant to Section 16.3;

|

|

·

|

Approving the Company’s accounts, financial statements and Annual Report;

|

|

·

|

Appointing and removing the Company’s auditors;

|

|

·

|

Entering into, guaranteeing or amending any credit, loan, debt facility or lease agreement, in excess of EUR 100,000 or combined facilities exceeding more than EUR 300,000 in any given year, unless included in the current Annual Operating Budget;

|

|

·

|

The sale, disposition, lease or encumbrance of any of substantially all the Company’s and the Subsidiaries’ assets, including the licenses that the Subsidiaries’ own;

|

|

·

|

Commencement of a voluntary bankruptcy or insolvency proceedings;

|

|

·

|

Any contract between the Company or any of the Subsidiaries and the Investor or companies controlled by the Investor which exceeds in isolation or in the aggregate EUR 200,000 per year in payment value to the Investor or company controlled by the Investor (“Related Party Transactions”);

|

|

·

|

All the above issues in connection with any subsidiaries or affiliates of the Company.

|

16.3 Officers and Other Management. The officers and other managerial personnel of the Company and its Subsidiaries as reflected on Schedule 7 (“Key Employees”) shall continue in their current job descriptions, duties and compensation levels, and shall also be offered participation in VelaTel’s stock option plan and future awards pursuant to such plan on the same basis as employees of similar tenure and responsibility employed by VelaTel and its other Affiliates from time to time. Key Employees identified as such on Schedule 7 shall have executed on Closing employment contracts substantially in the form attached as Schedule 8, to enhance the ability of the Company and its Subsidiaries to retain the services of such employees. Any such employment contract, subject to applicable laws shall authorize the Company or Subsidiary to terminate an employee for good cause, including willful dishonesty causing financial harm to any of the Companies, conviction of a serious criminal offense, or willful refusal to perform job duties which remains uncorrected following reasonable written notice from the Company’s Board of Directors.

17

17. PREEMPTIVE RIGHTS AND TRANSFER OF SHARES – TAG ALONG AND DRAG ALONG RIGHTS -EXIT

17.1 No Dilution of Shareholders’ Equity. Subject to the provisions of (i) Section 6 according to which the Shareholders' shareholding of 25% of Common Shares shall not be subject to dilution and (ii) Section 7, according to which only the Investor and 7LCPEELP have the right to acquire Redeemable Preference Shares, all the shareholders of the Company shall have the right to participate pro rata in the Company’s subsequent capital increases for the issuance of any class of stock, option, warrant, or any kind of security whatsoever, other than Redeemable Preference Shares and Common Shares, provided that such right shall not apply for any issuance pursuant to an employee stock option plan, any issuance pursuant to an IPO or following an IPO and any issuance in consideration for the acquisition by the Company of another entity or business, by way of contributions in kind from the shareholders of the entity or business to be acquired.

17.2 Restrictions on Transfer of Investor’s Common Shares

17.2.1 The Investor is forbidden to transfer, pledge or in any other way encumber (except pursuant to the Pledge Agreement II) its Common Shares in the Company, without the prior written consent of 7LCPEELP, save for the following exception: The Investor will be entitled to sell part of its Common Shares without 7LCPEELP’s consent, in which case paragraph 17.3 will not apply, provided that (i) the Investor’s shareholding percentage in the Company following transfer of the above part will not fall below 50.9% of the Company’s Common Shares and (ii) should the transfer of the said Investor’s Common Shares occur before termination of the Share Pledge Agreement II, the transferred shares will continue to be pledged in favor of 7LCPEELP and the Investor shall procure that the transferee executes in favor of 7LCPEELP a pledge agreement in form and substance similar to Share Pledge Agreement II, over the Investor’s Common Shares which the Transferee is willing to acquire.

17.2.2 Transfer or encumbering of shares, in breach of the provisions of this Section, is to be considered as null and void; the registration in the shareholders’ registry of the Company, as well as the issuance of new shares in the name of the party to which the transfer has been effected are prohibited and if realized shall be considered as null and void.

17.3 Right of First Refusal. Subject to paragraph 17.2.1 above and paragraph 17.4.1 below, in case that any of the shareholders of the Company (for the purpose of this paragraph “Transferring Shareholder(s)”), intends to sell its shares or part of them, to a third party, the following procedure shall be observed:

17.3.1 The Transferring Shareholder who intends to transfer his shares, (the Transferor) shall give written notice (Statement of Transfer) to the other shareholders, specifying the number of shares to be transferred (the Transferred Shares), the identity of the candidate Transferee, the purchase price and all material terms regarding the purchase price (e.g. taxes) ("Transfer Price") and shall invite the other shareholders to exercise, if they so wish, their first refusal rights.

17.3.2 If, upon the expiry of thirty (30) days from the date of receipt of the Statement of Transfer, the other shareholders have not accepted in writing to purchase the Transferred Shares on the terms stated in the Statement of Transfer, then the Transferor may within 30 days, transfer the Transferred Shares to the candidate Transferee upon the same or more favorable to the Transferor, terms and conditions and at the Transfer Price or at a higher price. It is agreed that the Transferor is not obliged to transfer his shares to the other shareholders if the latter do not intend to acquire the total number of the Transferred Shares.

17.3.3 Insofar as more than one of the other shareholders exercises their first refusal rights prescribed above, these shareholders shall acquire the Transferred Shares, pro-rata to their shareholding of Common Shares in the Company. The transfer of the Transferred Shares to the other shareholders and the depositing of the Transfer Price must take place within ten (10) days from the date of receipt of the last notification from the other shareholders of their intention to exercise their first refusal rights.

18

17.4 Obligations of New Shareholders

17.4.1 The Shareholders will be entitled to transfer all the Common Shares they hold in the Company to a new holding company (“NewCo”) they will establish, in which case (i) paragraph 17.3 will not apply, (ii) all obligations, representations and warranties of the Shareholders set forth in this Agreement and the Schedules thereof shall apply jointly and severally to both the Shareholders and NewCo; and (iii) NewCo shall enjoy the rights and bear the obligations of the Shareholders, pursuant to this Agreement, the Schedules thereof, the Share Pledge Agreements and Escrow Agreements, as if NewCo were an original contracting party hereto. The Shareholders shall procure that NewCo will execute in favor of the Investor such an amending pledge agreement in form and substance similar to Share Pledge Agreement I.

17.4.2 In the event of capital increase of the Company, through which a new shareholder acquires shares, and in each case of a transfer of shares to a third party who is not a shareholder of the Company, the existing shareholders (in the event of increase) and the transferring shareholder (in the event of transfer) undertake the obligation to ensure the unconditional and written adherence to this Agreement by the party acquiring the shares of the Company. The adherence document shall obligatorily be submitted to the Company during the registration of the new shareholder in the shareholders’ registry.

17.5 Tag along right

17.5.1 Subject to the provisions of Sections 17.2.1 and 17.3 above, in the event that the Investor wishes to sell any of its Common Shares in the Company to a third party (Prospective Transferee), then the Investor shall cause the Prospective Transferee to execute and deliver to the Shareholders (the “Tag Along Shareholders”) an offer (the “Tag–along Offer”) by registered post, registered email or courier (the "Tag Along Notice") specifying in reasonable detail the identity of the Prospective Transferee, the number of the Investor’s Common Shares to be transferred, the price, the proposed date of Transfer and the other terms and conditions of the Transfer.

17.5.2 Election to Participate A Tag Along Shareholder may elect to participate in the contemplated Transfer by delivering written notice by fax and courier (the "Election Notice") to the Investor within 20 days after delivery of the Tag Along Notice in accordance with Subsection 17.5.1 in which event such Shareholder shall be entitled, in accordance with the following provisions of this Section 17, to transfer the same proportion of its Common Shares as is equal, as near as possible, to the proportion which the Investor’s Common Shares which are the subject of the Tag Along Notice bears to the total Investor’s Common Shares at that time. A Tag Along Shareholder that has delivered an Election Notice may withdraw such Election Notice by delivery of written notice to the Investor by fax and courier no later than 3 Business Days prior to the proposed date of Transfer if there is any material change in the terms and conditions of the Transfer set out in the Tag Along Notice or notified to it pursuant to Subsection 17.5.1.

17.5.3 Consideration Any Transfer pursuant to this Section 17.5 shall be on the same terms and conditions as those terms and conditions applicable to the Investor.

17.5.4 Prospective Transferees. The Investor shall not Transfer all or any part of its Common Shares to any Prospective Transferee pursuant to this Section 17.5 unless:

(i) Simultaneously with the Transfer, such Prospective Transferee purchases from the Tag Along Shareholders which have delivered an Election Notice in accordance with Subsection 17.5.2 which has not been withdrawn, all of the Common Shares which those Tag Along Shareholders are entitled to sell to the Prospective Transferee pursuant to this Section 17.5 on the same terms and conditions; or

(ii) If such Prospective Transferee declines to allow the participation of such Tag Along Shareholders, simultaneously with such Transfer, the Investor purchases (on the same terms and conditions, subject to Subsection 17.5.5, on which its own Common Shares are being sold to such Prospective Transferee) the equivalent number of Common Shares from such Tag Along Shareholders which those Tag Along Shareholders would have been entitled to sell pursuant to this Section 17.5.

19

17.5.5 Indemnities and Representations. In respect of any Transfer of Common Shares pursuant to this Section 17.5, the Tag Along Shareholders shall not be required to give any representations, indemnities or similar assurances, other than with respect to title to, and ownership of, their respective Common Shares (on terms consistent with those provided by the Investor in respect of its Common Shares).

17.6 Drag Along Right

Subject to the provisions of Sections 17.2.1 and 17.3 above the Investor will have the right to drag along the Shareholders from the third anniversary from Closing and onwards.

17.6.1 Delivery of Drag Along Notice At least 60 days prior to the date of any Transfer of all but not less than all of the Investor’s Common Shares by the Investor to a third party purchaser the Investor may deliver a written notice by fax and courier (the "Drag Along Notice") to the Shareholders (in this Section the "Drag Along Shareholders"), specifying in reasonable detail the identity of the Prospective Transferee, the price, the proposed date of Transfer and the other terms and conditions of the Transfer.

17.6.2 Requirement to Participate. Upon receipt of the Drag Along Notice, the Drag Along Shareholders shall subject to the provisions of Subsection 17.6.3 as to the consideration, be obliged to participate in the contemplated Transfer by selling all of their respective Common Shares in accordance with the following provisions of this Section 17.6.

17.6.2 Consideration. Any Transfer pursuant to this Subsection 17.6 shall be on the same terms and conditions as those terms and conditions applicable to the Investor provided however that the Drag Along Shareholders will not be obliged to participate in the contemplated Transfer if the price agreed to be received by them for their Common Shares is less than the higher of the following:

(i) the amount which arises from the product of the number “8” (eight) multiplied by the consolidated and combined EBITDA of the Companies, for the year prior to the exercise by the Investor of its Drag Along Right, and further multiplied by the percentage which the Drag Along Shareholders hold in the Share Capital of the Company with respect to Common Shares, or

(ii) the amount which arises from the product of the number “1.5” (one point five) multiplied by the consolidated and combined revenues of the Companies, for the year prior to the exercise by the Investor of its Drag Along Right, and further multiplied by the percentage which the Drag Along Shareholders hold in the Share Capital of the Company with respect to Common Shares.

17.6.3 Time of Transfer. The Drag Along Shareholders shall Transfer all of their respective Common Shares to the Prospective Transferee on the same terms and conditions on which the Investor’s Common Shares are being sold to the Prospective Transferee and simultaneously with the Transfer of all of the Investor’s Common Shares to such Prospective Transferee.

17.6.4 Indemnities and Representations. In respect of any Transfer of Common Shares pursuant to this Section 17.6, the Drag Along Shareholders shall not be required to give any representations, indemnities or similar assurances, other than with respect to title to, and ownership of, their respective Common Shares (on terms consistent with those provided by the Investor in respect of its Common Shares).

17.7 Exit

17.7.1 Common goal of the contracting parties is either

(i) The listing of the Company’s Common Shares on a Major Stock Exchange; or

(ii) A share swap of the Shareholders’ Common Shares in the Company into VelaTel’s Series A Common Stock followed by the listing of VelaTel’s Series A common shares on a Major Stock Exchange. Such exchange of the Shareholders’ Common Shares in the Company with VelaTel’s Series A Common Stock shall be based on the following valuation with respect to the Company and VelaTel:

20

(a) The Shareholders Common Shares will be valued at the higher of the following:

|

·

|

The amount which arises from the product of the number “8” (eight) multiplied by the consolidated and combined EBITDA of the Companies, for the year prior to the roll up and further multiplied by the percentage which the Shareholders hold in the Share Capital of the Company with respect to Common Shares, or

|

|

·

|

The amount which arises from the product of the number “1.5” (one point five) multiplied by the consolidated and combined revenues of the Companies, for the year prior to the roll up, and further multiplied by the percentage which the Shareholders hold in the Share Capital of the Company with respect to Common Shares.

|

(b) Each share of VelaTel’s Series A Common Stock will be valued as following:

|

·

|

The amount which equals to the volume-weighted average of the closing price of shares being traded on any Major Exchange upon which VelaTel’s Series A Common Stock is listed from time to time, for the ten-day trading period immediately preceding the date of the roll up as detailed in Subsection 17.7.1 (ii) above.

|

VelaTel shall procure that the Shareholders will be entitled to demand and piggyback registration rights, with respect to VelaTel’s Series A Common Stock that the Shareholders will own on terms at least equal to those granted Isaac Organization, provided that the Shareholders’ right to exercise their piggyback registration rights shall be contingent upon Isaac Organization also exercising its piggyback registration rights.

17.7.2 If Investor has not provided 7LCPEELP an exit based on either 17.7.1 (i) or (ii) above by December 31, 2016, then 7LCPEELP will have the right to drag along the Investor pursuant to the provisions of this Subsection 17.7.2. If Investor has provided 7LCPEELP an exit based on either (i) or (ii) above by December 31, 2016 but 7LCPEELP declines to exercise its option to exit, then 7LCPEELP’s drag along rights shall expire.

(i) Delivery of Drag Along Notice At least 60 days prior to the date of any Transfer of all but not less than all of the Shareholders’ Common Shares by the Shareholders to a third party purchaser, 7LCPEELP may deliver a written notice by fax and/or courier (the "Drag Along Notice") to the Investor specifying in reasonable detail the identity of the Prospective Transferee, the price, the proposed date of Transfer and the other terms and conditions of the Transfer.