UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

| ☒ | Quarterly Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Quarterly Period Ended March 31, 2018

Or

| ☐ | Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 001-33672

NEURALSTEM, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 52-2007292 | |

| State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization | Identification No.) | |

| 20271 Goldenrod Lane | ||

| Germantown, Maryland | 20876 | |

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number, including area code (301)-366-4841 | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a small reporting company) | Smaller reporting company ☒ |

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐ Yes ☒ No

As of April 30, 2018, there were 15,160,014 shares of common stock, $.01 par value, issued and outstanding.

Neuralstem, Inc.

Table of Contents

| 1 |

FINANCIAL INFORMATION

| ITEM 1. | UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

Neuralstem, Inc.

Unaudited Condensed Consolidated Balance Sheets

| March 31, 2018 | December 31, 2017 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 9,724,248 | $ | 6,674,940 | ||||

| Short-term investments | - | 5,000,000 | ||||||

| Trade and other receivables | 137,372 | 312,802 | ||||||

| Current portion of related party receivable, net of discount | - | 58,784 | ||||||

| Prepaid expenses | 346,995 | 402,273 | ||||||

| Total current assets | 10,208,615 | 12,448,799 | ||||||

| Property and equipment, net | 149,668 | 172,886 | ||||||

| Patents, net | 839,314 | 883,462 | ||||||

| Related party receivable, net of discount and current portion | 334,303 | 365,456 | ||||||

| Other assets | 18,048 | 13,853 | ||||||

| Total assets | $ | 11,549,948 | $ | 13,884,456 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and accrued expenses | $ | 1,169,736 | $ | 875,065 | ||||

| Accrued bonuses | - | 418,625 | ||||||

| Other current liabilities | 109,266 | 220,879 | ||||||

| Total current liabilities | 1,279,002 | 1,514,569 | ||||||

| Warrant liabilities | 3,662,663 | 3,852,882 | ||||||

| Other long term liabilities | 1,172 | 1,876 | ||||||

| Total liabilities | 4,942,837 | 5,369,327 | ||||||

| Commitments and contingencies (Note 5) | ||||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Preferred stock, 7,000,000 shares authorized, $0.01 par value; 1,000,000 shares issued and outstanding at both March 31, 2018 and December 31, 2017 | 10,000 | 10,000 | ||||||

| Common stock, $0.01 par value; 300 million shares authorized, 15,160,014 shares issued and outstanding at both March 31, 2018 and December 31, 2017 | 151,600 | 151,600 | ||||||

| Additional paid-in capital | 217,289,009 | 217,050,174 | ||||||

| Accumulated other comprehensive income | 2,746 | 2,631 | ||||||

| Accumulated deficit | (210,846,244 | ) | (208,699,276 | ) | ||||

| Total stockholders' equity | 6,607,111 | 8,515,129 | ||||||

| Total liabilities and stockholders' equity | $ | 11,549,948 | $ | 13,884,456 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

| 2 |

Neuralstem, Inc.

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss

| Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Revenues | $ | 2,500 | $ | 2,500 | ||||

| Operating expenses: | ||||||||

| Research and development expenses | 1,169,441 | 2,902,086 | ||||||

| General and administrative expenses | 1,182,054 | 1,332,421 | ||||||

| Total operating expenses | 2,351,495 | 4,234,507 | ||||||

| Operating loss | (2,348,995 | ) | (4,232,007 | ) | ||||

| Other income (expense): | ||||||||

| Interest income | 17,749 | 20,883 | ||||||

| Interest expense | (1,920 | ) | (138,732 | ) | ||||

| Change in fair value of derivative instruments | 190,219 | (2,741,314 | ) | |||||

| Warrant inducement and other expenses | (4,021 | ) | (476,084 | ) | ||||

| Total other income (expense) | 202,027 | (3,335,247 | ) | |||||

| Net loss | $ | (2,146,968 | ) | $ | (7,567,254 | ) | ||

| Net loss per share - basic and diluted | $ | (0.14 | ) | $ | (0.68 | ) | ||

| Weighted average common shares outstanding - basic and diluted | 15,116,937 | 11,140,898 | ||||||

| Comprehensive loss: | ||||||||

| Net loss | $ | (2,146,968 | ) | $ | (7,567,254 | ) | ||

| Foreign currency translation adjustment | 115 | (171 | ) | |||||

| Comprehensive loss | $ | (2,146,853 | ) | $ | (7,567,425 | ) | ||

See accompanying notes to unaudited condensed consolidated financial statements.

| 3 |

Neuralstem, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

| Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (2,146,968 | ) | $ | (7,567,254 | ) | ||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Depreciation and amortization | 67,374 | 112,205 | ||||||

| Share-based compensation expense | 238,835 | 522,439 | ||||||

| Amortization of deferred financing fees and debt discount | - | 47,654 | ||||||

| Change in fair value of liability classified warrants | (190,219 | ) | 2,741,314 | |||||

| Warrant inducement expense | - | 476,084 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Trade and other receivables | 175,430 | (4,224 | ) | |||||

| Related party receivable | 89,937 | 84,481 | ||||||

| Prepaid expenses | 56,241 | 221,649 | ||||||

| Other assets | (4,000 | ) | (159 | ) | ||||

| Accounts payable and accrued expenses | 293,119 | (227,650 | ) | |||||

| Accrued bonuses | (418,625 | ) | (852,963 | ) | ||||

| Other current liabilities | (7,369 | ) | 12,542 | |||||

| Other long term liabilities | (704 | ) | (2,080 | ) | ||||

| Net cash used in operating activities | (1,846,949 | ) | (4,435,962 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Maturity of short-term investments | 5,000,000 | - | ||||||

| Net cash provided by investing activities | 5,000,000 | - | ||||||

| Cash flows from financing activities: | ||||||||

| Proceeds from issuance of common stock from warrants exercised, net of issuance costs | - | 2,200,004 | ||||||

| Proceeds from sale of common stock | - | 50,000 | ||||||

| Payments of fees related to prior financing | - | (11,596 | ) | |||||

| Payments of long-term debt | - | (1,222,519 | ) | |||||

| Payments of short-term notes payable | (104,244 | ) | (94,193 | ) | ||||

| Net cash (used in ) provided by financing activities | (104,244 | ) | 921,696 | |||||

| Effects of exchange rates on cash | 501 | (184 | ) | |||||

| Net increase (decrease) in cash and cash equivalents | 3,049,308 | (3,514,450 | ) | |||||

| Cash and cash equivalents, beginning of period | 6,674,940 | 15,194,949 | ||||||

| Cash and cash equivalents, end of period | $ | 9,724,248 | $ | 11,680,499 | ||||

| Supplemental disclosure of cash flows information: | ||||||||

| Cash paid for interest | $ | 1,920 | $ | 136,718 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

| 4 |

NEURALSTEM, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2018 AND 2017

Note 1. Organization, Business and Financial Condition

Nature of business

Neuralstem, Inc. and its subsidiary are referred to as “Neuralstem,” the “Company,” “us,” or “we” throughout this report. The operations of our wholly-owned and controlled subsidiary located in China are consolidated in our unaudited condensed consolidated financial statements and all intercompany activity has been eliminated. The Company operates in one business segment.

Neuralstem is a clinical stage biopharmaceutical company that is utilizing its proprietary human neural stem cell technology to create a comprehensive platform of therapies for the treatment of central nervous system diseases. The Company has utilized this technology as a tool for small-molecule drug discovery and to create cell therapy biotherapeutics to treat central nervous system diseases. The Company was founded in 1997 and currently has laboratory and office space in Germantown, Maryland and laboratory facilities in the People’s Republic of China. Our operations to date have been directed primarily toward developing business strategies, raising capital, research and development activities, and conducting pre-clinical testing and human clinical trials of our product candidates.

Liquidity and Going Concern

The Company has incurred losses since its inception and has not demonstrated an ability to generate significant revenues from the sales of its therapies or services and have not yet achieved profitable operations. There can be no assurance that profitable operations will ever be achieved, or if achieved, could be sustained on a continuing basis. In addition, development activities, clinical and pre-clinical testing, and commercialization of our products will require significant additional financing. These factors create substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the consolidated financial statements are issued. The consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. Accordingly, the consolidated financial statements have been prepared on a basis that assumes the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities and commitments in the ordinary course of business.

In making this assessment the Company performed a comprehensive analysis of its current circumstances including: its financial position at March 31, 2018, its cash flow and cash usage forecasts for the period covering one-year from the issuance date of this Quarterly Report filed on Form 10-Q, its current capital structure including outstanding warrants and other equity-based instruments.

We expect that our existing cash and cash equivalents will be sufficient to enable us to fund our anticipated level of operations based on our current operating plans into the first quarter of 2019. Accordingly, we will require additional capital to further develop our pre-clinical and clinical development programs. To continue to fund our operations and the development of our product candidates, we anticipate raising additional cash through the private and public sales of equity or debt securities, collaborative arrangements, licensing agreements or a combination thereof. Although management believes that such funding sources will be available, there can be no assurance that any such collaborative or licensing arrangements will be entered into or that financing will be available to us when needed in order to allow us to continue our operations, or if available, on terms acceptable to us. If we do not raise sufficient funds in a timely manner, among other things, we may be forced to delay, scale back or eliminate some or all of our research and product development programs, planned clinical trials, and/or our capital expenditures or to license our potential products or technologies to third parties on unfavorable terms. We currently do not have commitments for future funding from any source.

Our independent registered public accounting firm issued an emphasis of matter in their audit report regarding substantial doubt over our ability to continue as a going concern in our audited financial statements as of and for the year ended December 31, 2017.

We have spent and will continue to spend substantial funds in the research, development, pre-clinical and clinical testing of our small molecule and stem cell product candidates with the goal of ultimately obtaining approval from the United States Food and Drug Administration (the “FDA”) and its international equivalents, to market and sell our products. No assurance can be given that (i) FDA or other regulatory agency approval will ever be granted for us to market and sell our product candidates, or (ii) if regulatory approval is granted, that we will ever be able to sell our proposed products or be profitable.

Note 2. Significant Accounting Policies and Basis of Presentation

Basis of Presentation

In management’s opinion, the accompanying interim unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly our financial position, results of operations and cash flows. The unaudited condensed consolidated balance sheet at December 31, 2017, has been derived from audited financial statements as of that date. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with generally accepted accounting principles in the United States of America (U.S. GAAP) have been condensed or omitted pursuant to instructions, rules and regulations prescribed by the U.S. Securities and Exchange Commission (SEC). We believe that the disclosures provided herein are adequate to make the information presented not misleading when these unaudited condensed consolidated financial statements are read in conjunction with the Financial Statements and Notes included in our Annual Report on Form 10-K for the year ended December 31, 2017, filed with the SEC, and as may be amended.

| 5 |

Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The unaudited condensed consolidated financial statements include significant estimates for the expected economic life and value of our licensed technology and related patents, our net operating loss and related valuation allowance for tax purposes, the fair value of our liability classified warrants and our share-based compensation related to employees and directors, consultants and advisors, among other things. Because of the use of estimates inherent in the financial reporting process, actual results could differ significantly from those estimates.

Fair Value Measurements

The carrying amounts of our short-term financial instruments, which primarily include cash and cash equivalents, short-term investments, accounts payable and accrued expenses, approximate their fair values due to their short maturities. The fair value of our long-term indebtedness was estimated based on the quoted prices for the same or similar issues or on the current rates offered to the Company for debt of the same remaining maturities and approximates the carrying value. The fair values of our liability classified warrants were estimated using Level 3 unobservable inputs. See Note 3 for further details.

Foreign Currency Translation

The functional currency of our wholly owned foreign subsidiary is its local currency. Assets and liabilities of our foreign subsidiary are translated into United States dollars based on exchange rates at the end of the reporting period; income and expense items are translated at the weighted average exchange rates prevailing during the reporting period. Translation adjustments for subsidiary are accumulated in other comprehensive income or loss, a component of stockholders' equity. Transaction gains or losses are included in the determination of net loss.

Cash, Cash Equivalents, Short-Term Investments and Credit Risk

Cash equivalents consist of investments in low risk, highly liquid money market accounts and certificates of deposit with original maturities of 90 days or less. Cash deposited with banks and other financial institutions may exceed the amount of insurance provided on such deposits. If the amount of a deposit at any time exceeds the federally insured amount at a bank, the uninsured portion of the deposit could be lost, in whole or in part, if the bank were to fail.

Short-term investments consist entirely of fixed income certificates of deposit (“CDs”) with original maturities of greater than 90 days but not more than one year.

Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash equivalents and short-term investments. Our investment policy, approved by our Board of Directors, limits the amount we may invest in any one type of investment issuer, thereby reducing credit risk concentrations. In addition, our certificates of deposit are typically invested through the Certificate of Deposit Account Registry Service (“CDARS”) program which reduces or eliminates our risk related to concentrations of investments above FDIC insurance levels. We attempt to limit our credit and liquidity risks through our investment policy and through regular reviews of our portfolio against our policy. To date, we have not experienced any loss or lack of access to cash in our operating accounts or to our cash equivalents and short-term investments.

Revenue

On January 1, 2018, the Company adopted Topic 606, Revenue from Contracts with Customer using the modified retrospective method applied to those contracts which were not completed as of January 1, 2018. The Company analyzes contracts to determine the appropriate revenue recognition using the following steps: (i) identification of contracts with customers; (ii) identification of distinct performance obligations in the contract; (iii) determination of contract transaction price; (iv) allocation of contract transaction price to the performance obligations; and (v) determination of revenue recognition based on timing of satisfaction of the performance obligation. The Company recognizes revenues upon the satisfaction of its performance obligation (upon transfer of control of promised goods or services to customers) in an amount that reflects the consideration to which it expects to be entitled to in exchange for those goods or services. Deferred revenue results from cash receipts from or amounts billed to customers in advance of the transfer of control of the promised services to the customer and is recognized as performance obligations are satisfied. When sales commissions or other costs to obtain contracts with customers are considered incremental and recoverable, those costs are deferred and then amortized as selling and marketing expenses on a straight-line basis over an estimated period of benefit.

Research and Development

Research and development costs are expensed as they are incurred. Research and development expenses consist primarily of costs associated with the pre-clinical development and clinical trials of our product candidates. We record cost reimbursements under our SBIR grant as an offset to research and development expenses. For the three months ended March 31, 2018, we recorded approximately $84,000 of such cost reimbursements as an offset to research and development expenses. No reimbursements were recorded in the three months ended March 31, 2017.

| 6 |

Income (Loss) per Common Share

Basic income (loss) per common share is computed by dividing total net income (loss) available to common stockholders by the weighted average number of common shares outstanding during the period.

For periods of net income when the effects are dilutive, diluted earnings per share is computed by dividing net income available to common stockholders by the weighted average number of shares outstanding and the dilutive impact of all dilutive potential common shares. Dilutive potential common shares consist primarily of convertible preferred stock, stock options, restricted stock units and common stock purchase warrants. The dilutive impact of potential common shares resulting from common stock equivalents is determined by applying the treasury stock method. Our unvested restricted shares contain non-forfeitable rights to dividends, and therefore are considered to be participating securities; the calculation of basic and diluted income per share excludes net income attributable to the unvested restricted shares from the numerator and excludes the impact of the shares from the denominator.

For all periods of net loss, diluted loss per share is calculated similarly to basic loss per share because the impact of all dilutive potential common shares is anti-dilutive due to the net losses; accordingly, diluted loss per share is the same as basic loss per share for the three months ended March 31, 2018 and 2017. A total of approximately 9.5 and 8.3 million potential dilutive shares have been excluded in the calculation of diluted net income per share for the three months ended March 31, 2018 and 2017, respectively as their inclusion would be anti-dilutive.

Share-Based Compensation

We account for share-based compensation at fair value. Share-based compensation cost for stock options and stock purchase warrants granted to employees and board members is generally determined at the grant date while awards granted to non-employee consultants are generally valued at the vesting date using an option pricing model that uses Level 3 unobservable inputs; share-based compensation cost for restricted stock and restricted stock units is determined at the grant date based on the closing price of our common stock on that date. The value of the award is recognized as expense on a straight-line basis over the requisite service period or based on probability of vesting for performance-based awards.

Intangible and Long-Lived Assets

We assess impairment of our long-lived assets using a "primary asset" approach to determine the cash flow estimation period for a group of assets and liabilities that represents the unit of accounting for a long-lived asset to be held and used. Long-lived assets to be held and used are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. No significant impairment losses were recognized during the three months ended March 31, 2018 or 2017.

Income Taxes

We account for income taxes using the asset

and liability approach, which requires the recognition of future tax benefits or liabilities on the temporary differences between

the financial reporting and tax bases of our assets and liabilities. A valuation allowance is established when necessary to reduce

deferred tax assets to the amounts expected to be realized. We also recognize a tax benefit from uncertain tax positions only if

it is “more likely than not” that the position is sustainable based on its technical merits. Our policy is to recognize

interest and penalties on uncertain tax positions as a component of income tax expense.

Corporate tax rate changes resulting from the impacts of the Tax Cuts and Jobs Act of 2017 (the “Tax Act”) are reflected in deferred tax assets and liabilities as of December 31, 2017 and March 31, 2018.

Significant New Accounting Pronouncements

Recently Adopted Guidance

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”), No. 2014-09, Revenue from Contracts with Customers. This ASU consists of a comprehensive revenue recognition standard that superseded nearly all existing revenue recognition guidance under U.S. GAAP. The guidance is effective for interim and annual periods beginning after December 15, 2017. Either full retrospective adoption or modified retrospective adoption is permitted. In addition to expanded disclosures regarding revenue, this pronouncement may impact timing of recognition in some arrangements with variable consideration or contracts for the sale of goods or services. We adopted this guidance effective January 1, 2018 on a modified retrospective basis and it did not have a material impact on the consolidated financial statements.

| 7 |

In May 2017, the FASB issued ASU No. 2017-09, Compensation – Stock Compensation. This ASU provides clarification regarding when changes to the terms or conditions of share-based payment awards should be accounted for as modifications. This guidance is effective for fiscal years beginning after December 15, 2017 and early adoption is permitted. This guidance must be applied prospectively to awards modified after the adoption date. We adopted this guidance effective January 1, 2018 and it did not have a material impact on the consolidated financial statements.

In July 2017, the FASB issued ASU No. 2017-11, I. Accounting for Certain Financial Instrument with Down Round Features II. Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception. Part I of this guidance simplifies the accounting for certain equity-linked financial instruments and embedded features with down round features that reduce the exercise price when the pricing of a future round of financing is lower (“down round protection”). Current accounting guidance provides that instruments with down round protection be classified as derivative liabilities with changes in fair value recorded through earnings. The updated guidance provides that instruments with down round protection are no longer precluded from being classified as equity. This guidance is effective for fiscal years beginning after December 15, 2018 and early adoption is permitted. This guidance must be applied retrospectively. We adopted this guidance on January 1, 2018, and it did not have a material impact on the financial statements.

Unadopted Guidance

In February 2016, the FASB issued ASU, No. 2016-02, Leases. This ASU consists of a comprehensive lease accounting standard. The guidance requires lessees to recognize assets and liabilities related to long-term leases on the balance sheet and expands disclosure requirements regarding leasing arrangements. The guidance is effective for reporting periods beginning after December 15, 2018 and early adoption is permitted. The guidance must be adopted on a modified retrospective basis and provides for certain practical expedients. We currently expect that the adoption of this guidance will likely change the way we account for our operating leases and will likely result in recording the future benefits of those leases and the related minimum lease payments on our consolidated balance sheets. We have not yet begun to evaluate the specific impacts of this guidance.

In June 2016, the FASB issued ASU No. 2016-13, Financial Instrument’s – Credit Losses. This ASU relates to measuring credit losses on financial instruments, including trade receivables. The guidance eliminates the probable initial recognition threshold that was previously required prior to recognizing a credit loss on financial instruments. The credit loss estimate can now reflect an entity's current estimate of all future expected credit losses. Under the previous guidance, an entity only considered past events and current conditions. The guidance is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Early adoption is permitted for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The adoption of certain amendments of this guidance must be applied on a modified retrospective basis and the adoption of the remaining amendments must be applied on a prospective basis. We currently expect that the adoption of this guidance will likely change the way we assess the collectability of our receivables and recoverability of other financial instruments. We have not yet begun to evaluate the specific impacts of this guidance nor have we determined the manner in which we will adopt this guidance.

We have reviewed other recent accounting pronouncements and concluded that they are either not applicable to our business, or that no material effect is expected on the consolidated financial statements as a result of future adoption.

Note 3. Fair Value Measurements

Fair value is the price that would be received from the sale of an asset or paid to transfer a liability assuming an orderly transaction in the most advantageous market at the measurement date. U.S. GAAP establishes a hierarchical disclosure framework which prioritizes and ranks the level of observability of inputs used in measuring fair value. These levels are:

| • | Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets. |

| • | Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques (e.g. the Black-Scholes model) for which all significant inputs are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Where applicable, these models project future cash flows and discount the future amounts to a present value using market-based observable inputs including interest rate curves, foreign exchange rates, and forward and spot prices for currencies and commodities. |

| • | Level 3 – inputs are generally unobservable and typically reflect management's estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques, including option pricing models and discounted cash flow models. |

Financial Assets and Liabilities Measured at Fair Value on a Recurring Basis

We have segregated our financial assets and liabilities that are measured at fair value on a recurring into the most appropriate level within the fair value hierarchy based on the inputs used to determine the fair value at the measurement date.

| 8 |

At March 31, 2018 and December 31, 2017, we had certain common stock purchase warrants that were originally issued in connection with our May 2016 and August 2017 offerings (See Note 4) that are accounted for as liabilities whose fair value was determined using Level 3 inputs. The following table identifies the carrying amounts of such liabilities:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities | ||||||||||||||||

| Liability classified stock purchase warrants | $ | - | $ | - | $ | 3,852,882 | $ | 3,852,882 | ||||||||

| Balance at December 31, 2017 | $ | - | $ | - | $ | 3,852,882 | $ | 3,852,882 | ||||||||

| Liability classified stock purchase warrants | $ | - | $ | - | $ | 3,662,663 | $ | 3,662,663 | ||||||||

| Balance at March 31, 2018 | $ | - | $ | - | $ | 3,662,663 | $ | 3,662,663 | ||||||||

The following table presents the activity for those items measured at fair value on a recurring basis using Level 3 inputs for the three months ended March 31, 2018:

| Mark-to-market liabilities - stock purchase warrants | ||||

| Balance at December 31, 2017 | $ | 3,852,882 | ||

| Change in fair value - gain | (190,219 | ) | ||

| Balance at March 31, 2018 | $ | 3,662,663 | ||

The following table presents the activity for those items measured at fair value on a recurring basis using Level 3 inputs for the three months ended March 31, 2017:

| Mark-to-market liabilities - stock purchase warrants | ||||

| Balance at December 31, 2016 | $ | 3,921,917 | ||

| Exercise of warrants | (2,778,259 | ) | ||

| Change in fair value - loss | 2,741,314 | |||

| Balance at March 31, 2017 | $ | 3,884,972 | ||

The (gains) losses resulting from the changes in the fair value of the liability classified warrants are classified as other income or expense in the accompanying unaudited condensed consolidated statements of operations. The fair value of the common stock purchase warrants is determined based on the Black-Scholes option pricing model or other option pricing models as appropriate and includes the use of unobservable inputs such as the expected term, anticipated volatility and expected dividends. Changes in any of the assumptions related to the unobservable inputs identified above may change the embedded conversion options’ fair value; increases in expected term, anticipated volatility and expected dividends generally result in increases in fair value, while decreases in these unobservable inputs generally result in decreases in fair value.

Note 4. Stockholders’ Equity

We have granted share-based compensation awards to employees, board members and service providers. Awards may consist of common stock, restricted common stock, restricted common stock units, common stock purchase warrants, or common stock purchase options. Our stock options and stock purchase warrants have lives of up to ten years from the grant date. Awards vest either upon the grant date or over varying periods of time. The common stock purchase options provide for exercise prices equal to or greater than the fair value of the common stock at the date of the grant. Restricted stock units grant the holder the right to receive fully paid common shares with various restrictions on the holder’s ability to transfer the shares. As of March 31, 2018, we have approximately 6.3 million shares of common stock reserved for issuance upon the exercise of such awards.

| 9 |

We typically record share-based compensation expense on a straight-line basis over the requisite service period. Share-based compensation expense included in the statements of operations is as follows:

| Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Research and development expenses | $ | 64,583 | $ | 372,466 | ||||

| General and administrative expenses | 174,252 | 149,973 | ||||||

| Total | $ | 238,835 | $ | 522,439 | ||||

Stock Options

A summary of stock option activity and related information for the three months ended March 31, 2018 follows:

| Number of Options | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Life (in years) | Aggregate Intrinsic Value | |||||||||||||

| Outstanding at January 1, 2018 | 1,894,077 | $ | 19.76 | 4.7 | $ | 108,000 | ||||||||||

| Granted | - | $ | - | |||||||||||||

| Exercised | - | $ | - | |||||||||||||

| Forfeited | (325,444 | ) | $ | 46.32 | ||||||||||||

| Outstanding at March 31, 2018 | 1,568,633 | $ | 14.25 | 5.3 | $ | 94,000 | ||||||||||

| Exercisable at March 31, 2018 | 1,305,205 | $ | 16.37 | 4.6 | $ | 15,300 | ||||||||||

| Range of Exercise Prices | Number of Options Outstanding | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Life (in years) | Aggregate Intrinsic Value | ||||||||||||||

| $1.00 | - | $3.50 | 200,000 | $ | 1.18 | 9.6 | $ | 94,000 | ||||||||||

| $3.51 | - | $13.00 | 751,346 | $ | 9.48 | 5.8 | - | |||||||||||

| $13.01 | - | $26.00 | 368,112 | $ | 15.27 | 3.9 | - | |||||||||||

| $26.01 | - | $39.00 | 146,675 | $ | 32.50 | 1.4 | - | |||||||||||

| $39.01 | - | $56.00 | 102,500 | $ | 45.03 | 5.3 | - | |||||||||||

| 1,568,633 | $ | 14.25 | 5.3 | $ | 94,000 | |||||||||||||

The Company uses the Black-Scholes option pricing model for “plain vanilla” options and other pricing models as appropriate to calculate the fair value of options. There were no options granted in the three months ended March 31, 2018 or 2017.

Unrecognized compensation cost for unvested stock option awards outstanding at March 31, 2018 was approximately $598,000 to be recognized over approximately 2.0 years.

RSUs

We have granted restricted stock units (RSUs) to certain employees and board members that entitle the holders to receive shares of our common stock upon vesting and subject to certain restrictions regarding the exercise of the RSUs. The grant date fair value of RSUs is based upon the market price of the underlying common stock on the date of grant.

There were no RSUs granted in the three months ended March 31, 2018 or 2017. RSUs vesting in the three months ended March 31, 2018 had a total value of approximately $12,500.

At March 31, 2018, we had 11,235 outstanding RSUs with a weighted average grant date fair value of $11.77 and a total intrinsic value of approximately $18,500. No RSUs were converted in the three months ended March 31, 2018. Unrecognized compensation cost for unvested RSUs at March 30, 2018 was approximately $13,000 to be recognized over approximately 0.3 years.

| 10 |

Restricted Stock

We have granted restricted stock to certain board members that vest quarterly over the board year. The grant date fair value of the restricted stock is based upon the market price of the common stock on the date of grant. No restricted stock was granted in either the three months ended March 31, 2018 or 2017.

Restricted stock vesting in the three months ended March 31, 2018 had a weighted average grant date fair value of $3.00 and a total intrinsic value of approximately $41,000

At March 31, 2018, we had 24,979 shares of restricted stock outstanding with a weighted average grant date fair value of $3.00. Unrecognized compensation cost for unvested restricted stock awards at March 31, 2018 was approximately $75,000 to be recognized over approximately 0.3 years.

Stock Purchase Warrants.

We have issued warrants to purchase common stock to certain officers, directors, stockholders and service providers as well as in conjunction with debt and equity offerings and at various times replacement warrants were issued as an inducement for warrant exercises.

In May 2016 and August 2017, we issued a total of 1,746,173 and 2,250,000 common stock purchase warrants, respectively in conjunction with our offerings. Such warrants are classified as liabilities due to the existence of certain net cash settlement provisions contained in the warrants. At March 31, 2018, after giving effect to exercises, 2,982,709 common stock purchase warrants remain outstanding and are recorded at fair value as mark-to-market liabilities (see Note 3).

No warrants were issued in the three months ended March 31, 2018.

A summary of outstanding warrants at March 31, 2018 follows:

| Range of Exercise Prices | Number of Warrants Outstanding | Range of Expiration Dates | ||||||

| $2.00 | - | $3.90 | 2,994,248 | May 2021 - August 2024 | ||||

| $5.79 | - | $5.80 | 11,539 | July 2022 | ||||

| $12.80 | - | $12.90 | 39,296 | January 2022 | ||||

| $16.20 | - | $16.30 | 174,544 | March 2020 | ||||

| $18.60 | - | $19.80 | 11,539 | June 2018 | ||||

| $22.10 | - | $27.90 | 153,755 | March 2019 - January 2021 | ||||

| $34.50 | - | $39.00 | 159,639 | August 2018 - October 2019 | ||||

| $39.10 | - | $39.20 | 230,772 | October 2020 - October 2021 | ||||

| $47.30 | - | $52.20 | 275,897 | January 2019 - July 2019 | ||||

| 4,051,229 | ||||||||

Preferred and Common Stock

We have outstanding 1,000,000 shares of Series A 4.5% Convertible Preferred Stock issued in December 2016. Shares of the Series A 4.5% Convertible Preferred Stock are convertible into 3,887,387 shares of the Company’s common stock subject to certain ownership restrictions.

Note 5. Commitments and Contingencies

We currently operate one facility located in the United States and one facility located in China. Our corporate offices and primary research facilities are located in Germantown, Maryland, where we lease approximately 1,500 square feet. This lease provides for monthly payments of approximately $5,600 per month with the term expiring on December 31, 2018.

In 2015, we entered into a lease consisting of approximately 3,100 square feet of research space in San Diego, California. This lease provides for current monthly payments of approximately $11,600 and expires on August 31, 2019. In May 2017, we ceased-use of this property and recognized a loss of approximately $92,000 representing the present value of the expected remaining net payments due under such lease and the costs to vacate the property. We are currently exploring opportunities to sub-lease the unused research space.

| 11 |

We also lease a research facility in People’s Republic of China. This lease expires on September 30, 2018 with lease payments of approximately $3,200 per month.

From time to time, we are parties to legal proceedings that we believe to be ordinary, routine litigation incidental to the business. We are currently not a party to any litigation or legal proceeding.

Note 6. Related Party Receivable

On August 10, 2016, we entered into a reimbursement agreement with a former executive officer. Pursuant to the reimbursement agreement, the former officer agreed to repay the Company, over a six-year period, approximately $658,000 in expenses that the Company determined to have been improperly paid under the Company's prior expense reimbursement policies. In addition to this reimbursement agreement, the Company has implemented and is continuing to implement enhanced policies and procedures for travel expense reimbursements and disbursements.

The $658,000 non-interest-bearing receivable was recorded net of a $199,000 discount to reflect the net present value of the future cash payments. The discount is being amortized through interest income using the effective interest method. The principal amount of $458,000 remains outstanding at March 31, 2018 and is payable in $100,000 annual installments with a final payment due July 2022.

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Statements in this Quarterly Report that are not strictly historical are forward-looking statements and include statements about products in development, results and analyses of pre-clinical studies, clinical trials and studies, research and development expenses, cash expenditures, and alliances and partnerships, among other matters. You can identify these forward-looking statements because they involve our expectations, intentions, beliefs, plans, projections, anticipations, or other characterizations of future events or circumstances. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that may cause actual results to differ materially from those in the forward-looking statements as a result of any number of factors. These factors include, but are not limited to, risks relating to our ability to conduct and obtain successful results from ongoing pre-clinical and clinical trials, commercialize our technology, obtain regulatory approval for our product candidates, contract with third parties to adequately test and manufacture our proposed therapeutic products, protect our intellectual property rights and obtain additional financing to continue our development efforts. Some of these factors are more fully discussed, as are other factors, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed with the SEC, as well as in the section of this Quarterly Report entitled “Risk Factors” and elsewhere herein. We do not undertake to update any of these forward-looking statements or to announce the results of any revisions to these forward-looking statements except as required by law.

We urge you to read this entire Quarterly Report on Form 10-Q, including the “Risk Factors” section, the financial statements, and related notes. As used in this Quarterly Report, unless the context otherwise requires, the words “we,” “us,” “our,” “the Company” and “Neuralstem” refers to Neuralstem, Inc. and its subsidiaries. Also, any reference to “common shares” or “common stock,” refers to our $.01 par value common stock. Any reference to “Series A Preferred Stock” refers to our Series A 4.5% Convertible Preferred Stock. The information contained herein is current as of the date of this Quarterly Report (March 31, 2018), unless another date is specified. We prepare our interim financial statements in accordance with U.S. GAAP. Our financials and results of operations for the three- month period ended March 31, 2018 are not necessarily indicative of our prospective financial condition and results of operations for the pending full fiscal year ending December 31, 2018. The interim financial statements presented in this Quarterly Report as well as other information relating to our Company contained in this Quarterly Report should be read in conjunction and together with the reports, statements and information filed by us with the United States Securities and Exchange Commission or SEC.

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations or MD&A, is provided in addition to the accompanying financial statements and notes to assist readers in understanding our results of operations, financial condition and cash flows. Our MD&A is organized as follows:

| • | Executive Overview — Discussion of our business and overall analysis of financial and other highlights affecting the Company in order to provide context for the remainder of MD&A. |

| • | Trends & Outlook — Discussion of what we view as the overall trends affecting our business and overall strategy. |

| • | Critical Accounting Policies— Accounting policies that we believe are important to understanding the assumptions and judgments incorporated in our reported financial results and forecasts. |

| • | Results of Operations— Analysis of our financial results comparing the three-month period ended March 31, 2018 to the comparable period of 2017. |

| • | Liquidity and Capital Resources— An analysis of cash flows and discussion of our financial condition and future liquidity needs. |

| 12 |

Executive Overview

We are focused on the research and development of nervous system therapies based on our proprietary human neural stem cells and our small molecule compounds with the ultimate goal of gaining approval from the United States Food and Drug Administration or FDA, and its international counterparts, to market and commercialize such therapies. We are headquartered in Germantown, Maryland.

Our patented technology platform has three core components:

| 1. | Over 300 lines of human, regionally specific neural stem cells, some of which have the potential to be used to treat serious or life-threatening diseases through direct transplantation into the central nervous system; | |

| 2. | Proprietary screening capability – our ability to generate human neural stem cell lines provides a platform for chemical screening and discovery of novel compounds against nervous system disorders; and | |

| 3. | Small molecules that resulted from Neuralstem’s neurogenesis screening platform that may have the potential to treat wide variety of nervous system conditions | |

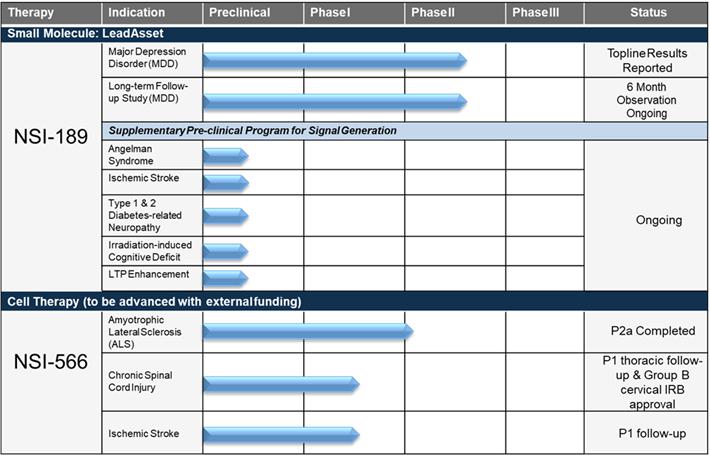

Our technology platform to date has produced two lead assets in clinical development: our NSI-189 phosphate small molecule program and NSI-566 stem cell therapy program.

We have developed and maintain what we believe is a strong portfolio of patents and patent applications that form the proprietary base for our research and development efforts. We own or exclusively license over 10 U.S. issued and pending patents and over 70 foreign issued and pending patents related to our stem cell technologies for use in treating disease and injury. We own over 15 U.S. issued and pending patents and over 70 foreign issued and pending patents related to our small molecule compounds.

We believe our technology, in combination with our expertise, and established collaborations with major research institutions, could facilitate the development and commercialization of products for use in the treatment of a wide array of nervous system disorders including neurodegenerative conditions and regenerative repair of acute and chronic disease.

Recent Clinical & Business Highlights

| • | On May 3, 2018, we announced the results from a study published in the Annals of Clinical and Translational Neurology in a manuscript entitled “Long-term Phase 1/2 Intraspinal Stem Cell Transplantation Outcomes in Amyotrophic Lateral Sclerosis” that support the potential of transplanted human spinal cord-derived neural stem cells (HSSC) to stabilize functioning of ALS patients. The study evaluated the impact of HSSC transplantation on functional outcomes, as measured using the ALSFRS-R scale, and on a composite statistic that combined functional and survival outcomes. Results were evaluated against matched controls derived from two historical datasets and showed significantly better ALSFRS-R scores at 24 months, as well as the composite functional/survival score in subjects receiving HSSC. The ALS Functional Rating Scale-Revised (ALSFRS-R) is a validated questionnaire that measures physical function in performing activities of daily living (ADLs). The manuscript was published on May 3, 2018. | |

| • | On April 10, 2018, we announced that we completed the first surgery in the second, cervical injury cohort of a Phase 1 clinical trial in patients with chronic spinal cord injury (cSCI). The subject was dosed with NSI-566, Neuralstem’s lead stem cell therapy asset. This cohort involves complete injury patients with no motor or sensory function below injury. The clinical trial is being conducted at the University of California San Diego, Division of Neurosurgery. |

The clinical trial was expanded to include a new cohort of four qualifying patients with AIS-A complete, quadriplegic, cervical injuries involving C5-C7 of their spinal cord, after promising results were observed with the first cohort. The clinical trial is evaluating the safety and feasibility of using NSI-566 spinal cord-derived neural stem cells to repair cSCI.

| • | On July 25, 2017, we announced top-line results from our exploratory Phase 2 clinical trial examining the efficacy of NSI-189 compared to placebo for the treatment of major depressive disorder (MDD). The study did not meet its primary efficacy endpoint of a statistically significant reduction in depression symptoms on the Montgomery-Asberg Depression Rating Scale (MADRS). However, the study results were directionally positive with regard to MADRS. |

| o | Of two secondary efficacy endpoints in the Phase 2 MDD trial results analyzed so far, the patient-rated Symptoms of Depression Questionnaire (SDQ) achieved statistical significance (p=0.044) with NSI-189 40 mg once daily does (“QD”) compared to placebo. Results were also directionally positive on the Hamilton Depression Rating Scale (HAM-D17) at both the 40 mg QD and 40 mg twice daily doses (“BID”). Both doses were well-tolerated with no serious adverse events reported. |

| o | The company plans to announce the results of the analysis of the secondary endpoints at the 55th Annual Meeting of the American College of Neuropsychopharmacology (ACNP) meeting to be held December 4-8, 2017. |

| 13 |

Clinical Development Program Review

We have devoted substantially all of our efforts and financial resources to the pre-clinical and clinical development of our small molecule compounds and our stem cell therapeutics. Below is a description of our most advanced clinical programs, their intended indication and current stage of development.

Clinical Pipeline

Pipeline Summary

NSI-189 Phase 2 randomized, placebo-controlled, double-blind clinical trial for the treatment of MDD

| • | In July 2017, the company announced, top-line results from its exploratory Phase 2 clinical trial examining the efficacy of NSI-189 at 40 mg QD and 40 mg BID compared to placebo for the treatment of MDD. The study, which utilized the two-staged sequential parallel comparison design (SPCD), did not meet its primary efficacy endpoint of a statistically significant reduction in depression symptoms on the MADRS. However, the 40 mg QD dose was directionally positive on the MADRS. Of secondary efficacy endpoints analyzed so far, the patient-rated SDQ achieved statistical significance (p=0.044) with NSI-189 40 mg QD compared to placebo in the overall SPCD analysis. Results were also directionally positive on the Hamilton Depression Rating Scale (HAM-D17) at both doses. Both the 40 mg QD and 40 mg BID doses were well-tolerated with no serious adverse events reported. | |

| • | The clinical trial was initiated in May 2016 and the last subject completed the study in May 2017. 220 subjects were randomized for a 12-week interventional study with NSI-189 or placebo. The study was conducted under the direction of Principal Investigator (PI) Maurizio Fava, MD, Executive Vice Chair, Department of Psychiatry and Executive Director, Clinical Trials Network and Institute, Massachusetts General Hospital. |

NSI-566 Phase 1 and 2 safety trials for the treatment of Amyotrophic Lateral Sclerosis (ALS)

| • | On May 3, 2018, we announced the results from a study published in the Annals of Clinical and Translational Neurology in a manuscript entitled “Long-term Phase 1/2 Intraspinal Stem Cell Transplantation Outcomes in Amyotrophic Lateral Sclerosis” that support the potential of transplanted human spinal cord-derived neural stem cells (HSSC) to stabilize functioning of ALS patients. The study evaluated the impact of HSSC transplantation on functional outcomes, as measured using the ALSFRS-R scale, and on a composite statistic that combined functional and survival outcomes. Results were evaluated against matched controls derived from two historical datasets and showed significantly better ALSFRS-R scores at 24 months, as well as the composite functional/survival score in subjects receiving HSSC. The ALS Functional Rating Scale-Revised (ALSFRS-R) is a validated questionnaire that measures physical function in performing activities of daily living (ADLs). The manuscript was published on May 3, 2018. | |

| • | In September 2015, we presented data from our ALS trials at the American Neurological Association Meeting. The data was presented by Principal Investigator Eva Feldman, MD, PhD, Director of the A. Alfred Taubman Medical Research Institute and Director of Research of the ALS Clinic at the University of Michigan Health. The data showed that the intraspinal transplantation of the cells was safe and well tolerated. Subjects from both the Phase 1 and Phase 2 studies continue to be monitored for long-term follow-up evaluations. Long-term follow-up data on subjects from both the Phase 1 and Phase 2 safety trials showed an encouraging signal of continued therapeutic benefit versus a historical control database, PRO-ACT. These data were presented by Dr. Feldman at the 2017 International Society for Stem Cell Research (ISSCR) Conference in June 2017. |

| 14 |

NSI-566 Phase 1 safety trial for the treatment of motor deficits in stroke

| • | In March 2016, we completed dosing the final planned cohort, for a total of nine subjects. Subjects are currently being monitored through their 24-month observational follow-up period. The trial is being conducted by Suzhou Neuralstem, a wholly owned subsidiary of Neuralstem in China. |

NSI-566 Phase 1 safety trial for the treatment of chronic Spinal Cord Injury (cSCI)

| • | In January 2016, we reported on the interim status of the Phase 1 safety data on all four subjects with stable thoracic spinal cord injuries; the stem cell treatment demonstrated feasibility and safety. A self-reported ability to contract some muscles below the level of injury was confirmed via clinical and electrophysiological follow-up examinations in one of the four subjects treated. All subjects will be followed for five years. This study is being conducted with support from the University of California, San Diego (UCSD) School of Medicine. |

Pre-Clinical Development Pipeline

Our preclinical research on NSI-189 is focused on identifying its mechanism of action and investigating its potential utility as a neuroregenerative drug that can prevent or reverse various types of central and peripheral nerve degeneration and that may have significant cognitive benefit in diseases that impact memory and cognition. Recent preclinical data support the potential benefits of NSI-189 in other indications beyond MDD.

Our preclinical studies with NSI-566 have served to provide a solid foundation for our ongoing clinical trials by demonstrating performance and efficacy of this cell line in animal models for ALS, spinal cord injury, and ischemic stroke, and demonstrated safety in large animals. Additional studies involving NSI-566 are directed at identifying new therapeutic indications.

In addition to NSI-566 we have developed an inventory of over 300 unique stem cell lines. These stem cell lines include cortex, hippocampus, midbrain, hindbrain, cerebellum, and spinal cord. We believe these lines possess unique properties and represent candidates for both transplantation-based strategies to treat disease and for screening of compound libraries to discover novel drug therapies.

Our Technologies

Small Molecule Pharmaceutical Compounds.

Utilizing our proprietary stem cell-based screening capability, we have discovered and patented a series of small molecule compounds. We believe our low molecular weight organic compounds can efficiently cross the blood/brain barrier. In mice, research indicated that the small molecule compounds both stimulate neurogenesis of the hippocampus and increase its volume. We believe the small molecule compounds may promote synaptogenesis and neurogenesis in the human hippocampus thereby providing therapeutic benefits in indications such as MDD, and may also provide clinical benefit in indications such as Angelman Syndrome, Diabetic Neuropathy, Cognition, Stroke and Radiation Induced Cognitive Deficit.

Our portfolio of small molecule compounds which includes NSI-189 are covered by 10 U.S. exclusively owned issued and pending patents and over 60 exclusively owned foreign issued and pending patents.

Stem Cells.

Our stem cell based technology has both therapeutic and screening characteristics.

From a therapeutic perspective, our stem cell based technology enables the isolation and large-scale expansion of regionally specific, human neural stem cells from all areas of the developing human brain and spinal cord thus enabling the generation of physiologically relevant human neurons of different types. We believe that our stem cell technology will enable the replacement or supplementation of malfunctioning or dead cells thereby creating a neurotrophic environment that offers protection to neural tissue as a way to treat disease and injury. Many significant and currently untreatable human diseases arise from the loss or malfunction of specific cell types in the body. Our focus is the development of effective methods to generate replacement cells from neural stem cells. We believe that creating a neurotrophic environment by replacing damaged, malfunctioning or dead neural cells with fully functional ones may be a useful therapeutic strategy in treating many diseases and conditions of the central nervous system.

| 15 |

Our Proprietary and Novel Screening Platform

Our human neural stem cell lines form the foundation for functional cell-based assays used to screen for small molecule compounds that can impact biologically relevant outcomes such as neurogenesis, synapse formation, and protection against toxic insults. We have developed over 300 unique stem cell lines representing multiple different regions of the developing brain and spinal cord at multiple different time points in development, enabling the generation of physiologically relevant human neural cells for screening, target validation, and mechanism-of-action studies. This platform provides us with a unique and powerful tool to identify new chemical entities to treat a broad range of nervous system conditions. NSI-189 was discovered using our stem cell-based screening platform.

Intellectual Property

We have developed and maintain what we believe is a strong portfolio of patents and patent applications that form the basis for our research and development efforts. We own or exclusively license over 10 U.S. issued and pending patents and over 70 foreign issued and pending patents related to our stem cell technologies for use in treating disease and injury. We own over 10 U.S. issued and pending patents and over 60 foreign issued and pending patents related to our small molecule compounds. Our issued patents have expiration dates ranging from 2017 through 2035. Two of our original patents covering methods and composition of matter associated with our stem cell technologies expired in 2016. In our opinion, the expiration of these patents is not material to our intellectual property.

Operating Strategy

We generally employ an outsourcing strategy where we outsource our preclinical and clinical development activities to contract research organizations and academic partners. Manufacturing of our small molecule portfolio is also outsourced to organizations with approved facilities and manufacturing practices. Manufacturing of our stem cells is proprietary and we operate a closed, in-house system to ensure the protection of all critical know-how associated with the technology. All non-critical corporate functions are outsourced as well. This model allows us to better manage cash on hand and minimize non-vital expenditures. It also allows for us to operate with relatively fewer employees and lower fixed costs than that required by other companies conducting similar business.

Employees

As of April 30, 2018, we had six (6) full-time employees. Of these full-time employees, four (4) work on research and development and clinical operations and two (2) work in administration. We also use the services of numerous outside consultants in business and scientific matters.

Our Corporate Information

We were incorporated in Delaware in 2001. Our principal executive offices are located at 20271 Goldenrod Lane, Germantown, Maryland 20876, and our telephone number is (301) 366-4841. Our website is located at www.neuralstem.com.

We have not incorporated by reference into this report the information in, or that can be accessed through, our website and you should not consider it to be a part of this report.

Trends & Outlook

Revenue

We generated no revenues from the sale of our proposed therapies for any of the periods presented.

We have historically generated minimal revenue from the licensing of our intellectual property to third parties.

On a long-term basis, we anticipate that our revenue will be derived primarily from licensing fees and sales of our small molecule compounds and licensing fees and royalties from our cell-based therapies. Because we are at such an early stage in the clinical trials process, we are not yet able to accurately predict when we will have a product ready for commercialization, if ever.

Research and Development Expenses

Our research and development expenses consist primarily of clinical trial expenses, including; payments to clinical trial sites that perform our clinical trials and clinical research organizations (CROs) that help us manage our clinical trials, manufacturing of small molecule drugs and stem cells for both human clinical trials and for pre-clinical studies and research, personnel costs for research and clinical personnel, and other costs including research supplies and facilities.

| 16 |

We focus on the development of treatment candidates with potential uses in multiple indications and use employee and infrastructure resources across several projects. Accordingly, many of our costs are not attributable to a specifically identified product and we do not account for internal research and development costs on a project-by-project basis.

We expect that research and development expenses, which include expenses related to our ongoing clinical trials, will increase in the future as funding allows and as we proceed later stage clinical trials.

We have a wholly owned subsidiary in the People’s Republic of China. We anticipate that this subsidiary will primarily: (i) conduct pre-clinical research with regard to proposed stem cells therapies, and (ii) oversee our approved future clinical trials in China, including the current trial to treat motor deficits due to ischemic stroke.

In August 2017, we were awarded a Small Business Innovation Research (“SBIR”) grant by the National Institutes of Health (“NIH”) to evaluate in preclinical studies the potential of NSI-189, a novel small molecule compound, for the prevention and treatment of diabetic neuropathy. The award of approximately $1 million will be paid over a two-year period, if certain conditions are met as mid-term. Proceeds from such award will be recorded as a reduction of our gross research and development expenses.

General and Administrative Expenses

General and administrative expenses are primarily comprised of salaries, benefits and other costs associated with our operations including, finance, human resources, information technology, public relations and costs associated with maintaining a public company listing, legal, audit and compliance fees, facilities and other external general and administrative services.

Critical Accounting Policies

Our unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Note 2 of the Notes to Unaudited Condensed Consolidated Financial Statements included elsewhere herein describes the significant accounting policies used in the preparation of the financial statements. Certain of these significant accounting policies are considered to be critical accounting policies, as defined below.

A critical accounting policy is defined as one that is both material to the presentation of our financial statements and requires management to make difficult, subjective or complex judgments that could have a material effect on our financial condition and results of operations. Specifically, critical accounting estimates have the following attributes: (1) we are required to make assumptions about matters that are highly uncertain at the time of the estimate; and (2) different estimates we could reasonably have used, or changes in the estimate that are reasonably likely to occur, would have a material effect on our financial condition or results of operations.

Estimates and assumptions about future events and their effects cannot be determined with certainty. We base our estimates on historical experience and on various other assumptions believed to be applicable and reasonable under the circumstances. These estimates may change as new events occur, as additional information is obtained and as our operating environment changes. These changes have historically been minor and have been included in the financial statements as soon as they became known. Based on a critical assessment of our accounting policies and the underlying judgments and uncertainties affecting the application of those policies, management believes that our financial statements are fairly stated in accordance with U.S. GAAP and present a meaningful presentation of our financial condition and results of operations. We believe the following critical accounting policies reflect our more significant estimates and assumptions used in the preparation of our consolidated financial statements:

Use of Estimates - The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The unaudited condensed consolidated financial statements include significant estimates for the expected economic life and value of our licensed technology and related patents, our net operating loss and related valuation allowance for tax purposes, the fair value of our liability classified warrants and our share-based compensation related to employees and directors, consultants and advisors, among other things. Because of the use of estimates inherent in the financial reporting process, actual results could differ significantly from those estimates.

Long Lived Intangible Assets - Our long lived intangible assets consist of our intellectual property patents including primarily legal fees associated with the filings and in defense of our patents. The assets are amortized on a straight-line basis over the expected useful life which we define as ending on the expiration of the patent group. These assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. We assess this recoverability by comparing the carrying amount of the asset to the estimated undiscounted future cash flows to be generated by the asset. If an asset is deemed to be impaired, we estimate the impairment loss by determining the excess of the asset’s carrying amount over the estimated fair value. These determinations use assumptions that are highly subjective and include a high degree of uncertainty. During the three months ended March 31, 2018 and 2017, no significant impairment losses were recognized.

| 17 |

Fair Value Measurements - The fair value of our short-term financial instruments, which primarily include cash and cash equivalents, other short-term investments, accounts payable and accrued expenses, approximate their carrying values due to their short maturities. The fair value of our long-term indebtedness was estimated based on the quoted prices for the same or similar issues or on the current rates offered to the Company for debt of the same remaining maturities which approximates the carrying value. The fair values of our liability classified warrants are estimated using Level 3 unobservable inputs.

Share-Based Compensation - We account for share-based compensation at fair value; accordingly, we expense the estimated fair value of share-based awards over the requisite service period. Share-based compensation cost for stock options and warrants issued to employees and board members is determined at the grant date while awards granted to non-employee consultants are generally valued at the vesting date using an option pricing model. Option pricing models require us to make assumptions, including expected volatility and expected term of the options. If any of the assumptions we use in the model were to significantly change, share-based compensation expense may be materially different. Share-based compensation cost for restricted stock and restricted stock units issued to employees and board members is determined at the grant date based on the closing price of our common stock on that date. The value of the award that is ultimately expected to vest is recognized as expense on a straight-line basis over the requisite service period.

RESULTS OF OPERATIONS

Comparison of Three Months Ended March 30, 2018 and 2017

Revenue

During each of the three months ended March 30, 2018 and 2017 we recognized revenue of $2,500 related to ongoing fees pursuant to certain licenses of our intellectual property to third parties.

Operating Expenses

Operating expenses for the three months ended March 31, 2018 and 2017 were as follows:

| Three Months Ended March 31, | Increase (Decrease) | |||||||||||||||

| 2018 | 2017 | $ | % | |||||||||||||

| Operating Expenses | ||||||||||||||||

| Research and development expenses | $ | 1,169,441 | $ | 2,902,086 | $ | (1,732,645 | ) | (60 | %) | |||||||

| General and administrative expenses | 1,182,054 | 1,332,421 | (150,367 | ) | (11 | %) | ||||||||||

| Total operating expenses | $ | 2,351,495 | $ | 4,234,507 | $ | (1,883,012 | ) | (44 | %) | |||||||

Research and Development Expenses

The decrease of approximately $1,733,000 or 60% in research and development expenses for the three months ended March 31, 2018 compared to the comparable period of 2017 was primarily attributable to a $1,143,000 decrease in clinical trial and related costs due to the completion of our NS-189 Phase 2 clinical trial, a $197,000 decrease in our personnel and facility expenses due to our ongoing corporate restructuring and cost reduction efforts and a $308,000 decrease in our non-cash share-based compensation expense.

General and Administrative Expenses

The decrease of approximately $150,000 or 11% in general and administrative expenses for the three months ended March 31, 2018 compared to the comparable period of 2017 was primarily attributable to a $138,000 decrease in payroll and related expenses coupled with a $48,000 decrease in consulting and professional service expenses due to our corporate restructuring and cost reduction efforts partially offset by a $24,000 increase in non-cash share-based compensation expense.

Other expense

Other income (expense), net totaled approximately $202,000 and ($3,335,000) for the three months ended March 31, 2018 and 2017, respectively.

Other income, net in 2018 consisted primarily of approximately $190,000 of non-cash gains related to the fair value adjustment of our liability classified stock purchase warrants and $18,000 of interest income.

| 18 |

Other expense, net in 2017 consisted of approximately $2,741,000 of non-cash losses related to the fair value adjustment of our liability classified warrants, $476,000 of expense related to the issuance of inducement warrants and $139,000 of interest expense primarily related to our long-term debt, partially offset by$21,000 of interest income.

Liquidity and Capital Resources

Financial Condition

Since our inception, we have financed our operations through the sales of our securities, issuance of long-term debt, the exercise of investor warrants, and to a lesser degree from grants and research contracts as well as the licensing of our intellectual property to third parties.

We had cash and cash equivalents of approximately $9.7 million at March 31, 2018.

Based on our expected operating cash requirements, we anticipate our average monthly cash burn rate will decrease and our current cash and investments on hand will be sufficient to fund our operations, into the first quarter of 2019. As explained in Note 1 to our financial statements there is substantial doubt about our ability to continue as a going concern.

We will require additional capital to continue to develop our pre-clinical and clinical development operations. To continue to fund our operations and the development of our product candidates we anticipate raising additional cash through the private and public sales of equity or debt securities, collaborative arrangements, licensing agreements or a combination thereof. Although management believes that such funding sources will be available, there can be no assurance that any such collaborative arrangement will be entered into or that financing will be available to us when needed in order to allow us to continue our operations, or if available, on terms acceptable to us. If we do not raise sufficient funds in a timely manner, we may be forced to curtail operations, delay or stop our ongoing clinical trials, cease operations altogether, or file for bankruptcy. We currently do not have commitments for future funding from any source. We cannot assure you that we will be able to secure additional capital or that the expected income will materialize. Several factors will affect our ability to raise additional funding, including, but not limited to market conditions, interest rates and, more specifically, our progress in our exploratory, preclinical and future clinical development programs.

Cash Flows – 2018 compared to 2017

| Three Months Ended March 31, | Increase (Decrease) | |||||||||||||||

| 2018 | 2017 | $ | % | |||||||||||||

| Net cash used in operating activities | $ | (1,846,949 | ) | $ | (4,435,962 | ) | $ | 2,589,013 | (58 | %) | ||||||