UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

| x | Quarterly Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Quarterly Period Ended March 31, 2017

Or

| ¨ | Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 001-33672

NEURALSTEM, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 52-2007292 | |

| State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization | Identification No.) | |

| 20271 Goldenrod Lane | ||

| Germantown, Maryland | 20876 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (301)-366-4841

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). xYes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a small reporting company) | Smaller reporting company x |

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ¨ Yes x No

As of April 30, 2017, there were 11,899,453 shares of common stock, $.01 par value, issued and outstanding.

| 1 |

Neuralstem, Inc.

Table of Contents

| 2 |

FINANCIAL INFORMATION

| ITEM 1. | UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

Neuralstem, Inc.

Unaudited Condensed Consolidated Balance Sheets

| March 31, 2017 | December 31, 2016 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 11,680,499 | $ | 15,194,949 | ||||

| Short-term investments | 5,000,000 | 5,000,000 | ||||||

| Trade and other receivables | 14,715 | 10,491 | ||||||

| Current portion of related party receivable, net of discount | - | 53,081 | ||||||

| Prepaid expenses | 477,072 | 646,195 | ||||||

| Total current assets | 17,172,286 | 20,904,716 | ||||||

| Property and equipment, net | 242,810 | 269,557 | ||||||

| Patents, net | 904,732 | 990,153 | ||||||

| Related party receivable, net of discount and current portion | 392,840 | 424,240 | ||||||

| Other assets | 15,824 | 15,662 | ||||||

| Total assets | $ | 18,728,492 | $ | 22,604,328 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and accrued expenses | $ | 2,167,615 | $ | 2,343,936 | ||||

| Accrued bonuses | - | 852,963 | ||||||

| Current portion of long-term debt, net of fees and discount | 2,530,922 | 3,705,787 | ||||||

| Other current liabilities | 349,087 | 430,738 | ||||||

| Total current liabilities | 5,047,624 | 7,333,424 | ||||||

| Derivative instruments | 3,884,972 | 3,921,917 | ||||||

| Other long-term liabilities | 16,129 | 18,209 | ||||||

| Total liabilities | 8,948,725 | 11,273,550 | ||||||

| Commitments and contingencies (Note 6) | ||||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Convertible preferred stock, 7,000,000 shares authorized, $0.01 par value; 1,000,000 shares issued and outstanding at March 31, 2017 and December 31, 2016 respectively | 10,000 | 10,000 | ||||||

| Common stock, $0.01 par value; 300 million shares authorized, 11,743,244 and 11,032,858 shares outstandingat March 31, 2017 and December 31, 2016 respectively | 117,432 | 110,329 | ||||||

| Additional paid-in capital | 210,249,148 | 204,239,837 | ||||||

| Accumulated other comprehensive income | 3,734 | 3,905 | ||||||

| Accumulated deficit | (200,600,547 | ) | (193,033,293 | ) | ||||

| Total stockholders' equity | 9,779,767 | 11,330,778 | ||||||

| Total liabilities and stockholders' equity | $ | 18,728,492 | $ | 22,604,328 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

| 3 |

Neuralstem, Inc.

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Revenues | $ | 2,500 | $ | 2,500 | ||||

| Operating expenses: | ||||||||

| Research and development expenses | 2,902,086 | 3,065,590 | ||||||

| General and administrative expenses | 1,332,421 | 3,170,522 | ||||||

| Total operating expenses | 4,234,507 | 6,236,112 | ||||||

| Operating loss | (4,232,007 | ) | (6,233,612 | ) | ||||

| Other income (expense): | ||||||||

| Interest income | 20,883 | 11,136 | ||||||

| Interest expense | (138,732 | ) | (386,506 | ) | ||||

| Change in fair value of derivative instruments | (2,741,314 | ) | - | |||||

| Warrant inducement and other expenses | (476,084 | ) | 3,199 | |||||

| Total other income (expense) | (3,335,247 | ) | (372,171 | ) | ||||

| Net loss | $ | (7,567,254 | ) | $ | (6,605,783 | ) | ||

| Net loss per share - basic and diluted | $ | (0.68 | ) | $ | (0.93 | ) | ||

| Weighted average common shares outstanding - basic and diluted | 11,140,898 | 7,077,676 | ||||||

| Comprehensive loss: | ||||||||

| Net loss | $ | (7,567,254 | ) | $ | (6,605,783 | ) | ||

| Foreign currency translation adjustment | (171 | ) | (1,773 | ) | ||||

| Comprehensive loss | $ | (7,567,425 | ) | $ | (6,607,556 | ) | ||

See accompanying notes to unaudited condensed consolidated financial statements.

| 4 |

Neuralstem, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (7,567,254 | ) | $ | (6,605,783 | ) | ||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Depreciation and amortization | 112,205 | 85,467 | ||||||

| Share-based compensation expense | 522,439 | 1,470,886 | ||||||

| Amortization of deferred financing fees and debt discount | 47,654 | 189,462 | ||||||

| Change in fair value of derivative instruments | 2,741,314 | - | ||||||

| Warrant inducement expense | 476,084 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Trade and other receivables | (4,224 | ) | (1,851 | ) | ||||

| Related party receivable | 84,481 | - | ||||||

| Prepaid expenses | 221,649 | 82,020 | ||||||

| Other assets | (159 | ) | 14,029 | |||||

| Accounts payable and accrued expenses | (227,650 | ) | 1,170,334 | |||||

| Accrued bonuses | (852,963 | ) | 125,684 | |||||

| Other current liabilities | 12,542 | 49,177 | ||||||

| Other long term liabilities | (2,080 | ) | (67,646 | ) | ||||

| Net cash used in operating activities | (4,435,962 | ) | (3,488,221 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Maturity of short-term investments | - | 7,517,453 | ||||||

| Patent costs | - | (12,747 | ) | |||||

| Purchase of property and equipment | - | (14,598 | ) | |||||

| Net cash provided by investing activities | - | 7,490,108 | ||||||

| Cash flows from financing activities: | ||||||||

| Proceeds from issuance of common stock from warrants exercised, net | 2,200,004 | - | ||||||

| Proceeds from sale of common stock, net | 50,000 | - | ||||||

| Payment of fees related to prior financing | (11,596 | ) | ||||||

| Payments of long-term debt | (1,222,519 | ) | (1,096,951 | ) | ||||

| Payments of short-term notes payable | (94,193 | ) | - | |||||

| Net cash provided by (used in) financing activities | 921,696 | (1,096,951 | ) | |||||

| Effects of exchange rates on cash | (184 | ) | (723 | ) | ||||

| Net increase (decrease) in cash and cash equivalents | (3,514,450 | ) | 2,904,213 | |||||

| Cash and cash equivalents, beginning of period | 15,194,949 | 4,716,533 | ||||||

| Cash and cash equivalents, end of period | $ | 11,680,499 | $ | 7,620,746 | ||||

| Supplemental disclosure of cash flows information: | ||||||||

| Cash paid for interest | $ | 136,718 | $ | 205,827 | ||||

| Supplemental schedule of non cash investing and financing activities: | ||||||||

| Issuance of common stock for cashless exercise of options, warrants and RSUs | $ | - | $ | 38,337 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

| 5 |

NEURALSTEM, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2017AND 2016

Note 1. Business, Basis of Presentation and Liquidity

Neuralstem is a clinical stage biopharmaceutical company that is utilizing its proprietary human neural stem cell technology to create a comprehensive platform of therapies for the treatment of central nervous system diseases. The Company has utilized this technology as a tool for small-molecule drug discovery and to create cell therapy biotherapeutics to treat central nervous system diseases. The Company was founded in 1997 and currently has laboratory and office space in Germantown, Maryland and laboratory facilities in San Diego, California, and in the People’s Republic of China. Our operations to date have been directed primarily toward developing business strategies, raising capital, research and development activities, and conducting pre-clinical testing and human clinical trials of our product candidates.

Neuralstem, Inc. and its subsidiary are referred to as “Neuralstem,” the “Company,” “us,” or “we” throughout this report. The operations of our wholly-owned and controlled subsidiary located in China are consolidated in our condensed consolidated financial statements and all intercompany activity has been eliminated. The Company operates in one business segment.

In management’s opinion, the accompanying interim condensed financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly our financial position, results of operations and cash flows. The condensed consolidated balance sheet at December 31, 2016, has been derived from audited financial statements as of that date. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with generally accepted accounting principles in the United States of America (U.S. GAAP) have been condensed or omitted pursuant to instructions, rules and regulations prescribed by the U.S. Securities and Exchange Commission (SEC). We believe that the disclosures provided herein are adequate to make the information presented not misleading when these condensed financial statements are read in conjunction with the Financial Statements and Notes included in our Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC, and as may be amended. Certain prior period amounts have been reclassified to conform to current year classifications.

The Board of Directors approved a 1-for-13 reverse stock split of the Company’s common stock effective January 6, 2017. Stockholders' equity and all references to share and per share amounts in the accompanying consolidated financial statements have been retroactively adjusted to reflect the 1-for-13 reverse stock split for all periods presented.

Liquidity

The Company has incurred losses since its inception and has not demonstrated an ability to generate significant revenues from the sales of its therapies or services and have not yet achieved profitable operations. There can be no assurance that profitable operations will ever be achieved, or if achieved, could be sustained on a continuing basis. In addition, development activities, clinical and pre-clinical testing, and commercialization of our products will require significant additional financing.

Our cash, cash equivalents and short term investments balance at March 31, 2017 was approximately $16.7 million. We expect that our existing cash and cash equivalents will be sufficient to enable us to fund our anticipated level of operations based on our current operating plans, including final payment on our long-term debt in April 2017, into the third quarter of 2018. In the event we are not able to secure additional capital by such date we may not be able to continue as a going concern. Accordingly, we will require additional capital to continue to develop our pre-clinical and clinical development operations. To continue to fund our operations and the development of our product candidates, we anticipate raising additional cash through the private or public sales of equity or debt securities, collaborative arrangements, licensing agreements or a combination thereof. Although management believes that such funding sources will be available, there can be no assurance that any such collaborative or licensing arrangements will be entered into or that financing will be available to us when needed in order to allow us to continue our operations, or if available, on terms acceptable to us. If we do not raise sufficient funds in a timely manner, among other things, we may be forced to delay, scale back or eliminate some or all of our research and product development programs, planned clinical trials, and/or our capital expenditures or to license our potential products or technologies to third parties. We currently do not have commitments for future funding from any source.

We have spent and will continue to spend substantial funds in the research, development, pre-clinical and clinical testing of our small molecule and stem cell product candidates with the goal of ultimately obtaining approval from the United States Food and Drug Administration (the “FDA”) and its international equivalents, to market and sell our products. No assurance can be given that (i) FDA or other regulatory agency approval will ever be granted for us to market and sell our product candidates, or (ii) if regulatory approval is granted, that we will ever be able to sell our proposed products or be profitable.

| 6 |

Note 2. Significant Accounting Policies and Recent Accounting Pronouncements

Use of Estimates

The preparation of financial statements in accordance with United States of America generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The condensed consolidated financial statements include significant estimates for the expected economic life and value of our licensed technology and related patents, our net operating loss and related valuation allowance for tax purposes, the fair value of our derivative instruments and our stock-based compensation related to employees and directors, consultants and investment banks, among other things. Because of the use of estimates inherent in the financial reporting process, actual results could differ significantly from those estimates.

Fair Value Measurements

The carrying amounts of our short-term financial instruments, which primarily include cash and cash equivalents, short-term investments, accounts payable and accrued expenses, approximate their fair values due to their short maturities. The fair value of our long-term indebtedness is estimated based on the quoted prices for the same or similar issues or on the current rates offered to the Company for debt of the same remaining maturities and approximates the carrying value. The fair values of our derivative instruments were estimated using Level 3 unobservable inputs. See Note 3 for further details.

Foreign Currency Translation

The functional currency of our wholly owned foreign subsidiary is its local currency. Assets and liabilities of our foreign subsidiary are translated into United States dollars based on exchange rates at the end of the reporting period; income and expense items are translated at the weighted average exchange rates prevailing during the reporting period. Translation adjustments for subsidiaries that have not been sold, substantially liquidated or otherwise disposed of are accumulated in other comprehensive income or loss, a component of stockholders' equity. Transaction gains or losses are included in the determination of net loss.

Cash, Cash Equivalents, Short-Term Investments and Credit Risk

Cash equivalents consist of investments in low risk, highly liquid money market accounts and certificates of deposit with original maturities of 90 days or less. Cash deposited with banks and other financial institutions may exceed the amount of insurance provided on such deposits. If the amount of a deposit at any time exceeds the federally insured amount at a bank, the uninsured portion of the deposit could be lost, in whole or in part, if the bank were to fail.

Short-term investments consist entirely of fixed income certificates of deposit (“CDs”) with original maturities of greater than 90 days but not more than one year.

Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash equivalents and short-term investments. Our investment policy, approved by our Board of Directors, limits the amount we may invest in any one type of investment issuer, thereby reducing credit risk concentrations. In addition, our certificates of deposit are typically invested through the Certificate of Deposit Account Registry Service (“CDARS”) program which reduces or eliminates our risk related to concentrations of investments above FDIC insurance levels. We attempt to limit our credit and liquidity risks through our investment policy and through regular reviews of our portfolio against our policy. To date, we have not experienced any loss or lack of access to cash in our operating accounts or to our cash equivalents and short-term investments.

Research and Development

Research and development costs are expensed as they are incurred. Research and development expenses consist primarily of costs associated with the pre-clinical development and clinical trials of our product candidates.

Income (Loss) per Common Share

Basic income (loss) per common share is computed by dividing total net income (loss) available to common shareholders by the weighted average number of common shares outstanding during the period.

For periods of net income when the effects are dilutive, diluted earnings per share is computed by dividing net income available to common shareholders by the weighted average number of shares outstanding and the dilutive impact of all potential dilutive common shares. Potential dilutive common shares consist primarily of stock options, restricted stock units and common stock purchase warrants. The dilutive impact of potential dilutive common shares resulting from common stock equivalents is determined by applying the treasury stock method. Our unvested restricted shares contain non-forfeitable rights to dividends, and therefore are considered to be participating securities; the calculation of basic and diluted income per share excludes net income attributable to the unvested restricted shares from the numerator and excludes the impact of the shares from the denominator.

For all periods of net loss, diluted loss per share is calculated similarly to basic loss per share because the impact of all potential dilutive common shares is anti-dilutive due to the net losses; accordingly, diluted loss per share is the same as basic loss per share for the three-month periods ended March 31, 2017 and 2016. A total of approximately 8.3 million and 3.1 million potential dilutive shares have been excluded in the calculation of diluted net income per share for the three--month periods ended March 31, 2017 and 2016, respectively, as their inclusion would be anti-dilutive.

| 7 |

Share-Based Compensation

We account for share-based compensation at fair value. Share-based compensation cost for stock options and stock purchase warrants granted to employees and board members is generally determined at the grant date while awards granted to non-employee consultants are generally valued at the vesting date using an option pricing model that uses Level 3 unobservable inputs; share-based compensation cost for restricted stock and restricted stock units is determined at the grant date based on the closing price of our common stock on that date. The value of the award that is ultimately expected to vest is recognized as expense on a straight-line basis over the requisite service period.

Intangible and Long-Lived Assets

We assess impairment of our long-lived assets using a "primary asset" approach to determine the cash flow estimation period for a group of assets and liabilities that represents the unit of accounting for a long-lived asset to be held and used. Long-lived assets to be held and used are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. No significant impairment losses were recognized during the three months ended March 31, 2017 or 2016.

Income Taxes

We account for income taxes using the asset and liability approach, which requires the recognition of future tax benefits or liabilities on the temporary differences between the financial reporting and tax bases of our assets and liabilities. A valuation allowance is established when necessary to reduce deferred tax assets to the amounts expected to be realized. We also recognize a tax benefit from uncertain tax positions only if it is “more likely than not” that the position is sustainable based on its technical merits. Our policy is to recognize interest and penalties on uncertain tax positions as a component of income tax expense.

Significant New Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”), No. 2014-09, Revenue from Contracts with Customers. This ASU consists of a comprehensive revenue recognition standard that will supersede nearly all existing revenue recognition guidance under U.S. GAAP. The issuance of ASU No. 2015-14 in August 2015 delays the effective date of the standard to interim and annual periods beginning after December 15, 2017. Either full retrospective adoption or modified retrospective adoption is permitted. In addition to expanded disclosures regarding revenue, this pronouncement may impact timing of recognition in some arrangements with variable consideration or contracts for the sale of goods or services. We have not yet begun to evaluate the specific impacts of this guidance nor have we determined the manner in which we will adopt this guidance.

In February 2016, the FASB issued ASU, No. 2016-02, Leases. This ASU consists of a comprehensive lease accounting standard. The guidance requires lessees to recognize assets and liabilities related to long-term leases on the balance sheet and expands disclosure requirements regarding leasing arrangements. The guidance is effective for reporting periods beginning after December 15, 2018 and early adoption is permitted. The guidance must be adopted on a modified retrospective basis and provides for certain practical expedients. We currently expect that the adoption of this guidance will likely change the way we account for our operating leases and will likely result in recording the future benefits of those leases and the related minimum lease payments on our consolidated balance sheets. We have not yet begun to evaluate the specific impacts of this guidance.

In June 2016, the FASB issued ASU No. 2016-13, Financial Instrument’s – Credit Losses. This ASU relates to measuring credit losses on financial instruments, including trade receivables. The guidance eliminates the probable initial recognition threshold that was previously required prior to recognizing a credit loss on financial instruments. The credit loss estimate can now reflect an entity's current estimate of all future expected credit losses. Under the previous guidance, an entity only considered past events and current conditions. The guidance is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Early adoption is permitted for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The adoption of certain amendments of this guidance must be applied on a modified retrospective basis and the adoption of the remaining amendments must be applied on a prospective basis. We currently expect that the adoption of this guidance will likely change the way we assess the collectability of our receivables and recoverability of other financial instruments. We have not yet begun to evaluate the specific impacts of this guidance nor have we determined the manner in which we will adopt this guidance.

In November 2015, the FASB issued ASU No. 2015-17, Balance Sheet Classification of Deferred Taxes. This ASU eliminates the requirement for separate presentation of current and non-current portions of deferred tax. Subsequent to adoption, all deferred tax assets and deferred tax liabilities are presented as non-current on the balance sheet. The ASU became effective for us on January 1, 2017 and had no material effect on our consolidated financial statements.

In March 2016, the FASB issued ASU No. 2016-09, Improvements to Employee Share Based Payment Accounting. This guidance simplifies the accounting for and financial statement disclosure of stock-based compensation awards, consisting of changes in the accounting for excess tax benefits and tax deficiencies, and changes in the accounting for forfeitures associated with share-based awards, among other things. The ASU became effective for us on January 1, 2017. We no longer record estimated forfeitures on share-based awards. This adoption had no material effect on our consolidated financial statements.

| 8 |

We have reviewed other recent accounting pronouncements released during the year and concluded that they are either not applicable to our business, or that no material effect is expected on the consolidated financial statements as a result of future adoption.

Note 3. Fair Value Measurements

Fair value is the price that would be received from the sale of an asset or paid to transfer a liability assuming an orderly transaction in the most advantageous market at the measurement date. U.S. GAAP establishes a hierarchical disclosure framework which prioritizes and ranks the level of observability of inputs used in measuring fair value. These levels are:

| · | Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets. |

| · | Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques (e.g. the Black-Scholes model) for which all significant inputs are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Where applicable, these models project future cash flows and discount the future amounts to a present value using market-based observable inputs including interest rate curves, foreign exchange rates, and forward and spot prices for currencies and commodities. |

| · | Level 3 – inputs are generally unobservable and typically reflect management's estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques, including option pricing models and discounted cash flow models. |

Financial Assets and Liabilities Measured at Fair Value on a Recurring Basis

We have segregated our financial assets and liabilities that are measured at fair value on a recurring into the most appropriate level within the fair value hierarchy based on the inputs used to determine the fair value at the measurement date.

The inputs used in measuring the fair value of cash and cash equivalents are considered to be Level 1 in accordance with the three-tier fair value hierarchy. The fair value of all other financial instruments (prepaid expenses, accounts payable, accrued expenses and long-term debt) approximate their carrying values because of their short-term nature.

At March 31, 2017 and December 31, 2016, we had certain common stock purchase warrants issued in connection with our May 2016 capital raises (See Note 5) that are accounted for as derivative instruments whose fair value was determined using Level 3 inputs. The following table identifies the carrying amounts of such assets and liabilities:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities | ||||||||||||||||

| Derivative instruments - stock purchase warrants | $ | - | $ | - | $ | 3,921,917 | $ | 3,921,917 | ||||||||

| Balance at December 31, 2016 | $ | - | $ | - | $ | 3,921,917 | $ | 3,921,917 | ||||||||

| Derivative instruments - stock purchase warrants | $ | - | $ | - | $ | 3,884,972 | $ | 3,884,972 | ||||||||

| Balance at March 31, 2017 | $ | - | $ | - | $ | 3,884,972 | $ | 3,884,972 | ||||||||

| 9 |

The following table presents the activity for those items measured at fair value on a recurring basis using Level 3 inputs for the three months ended March 31, 2017:

| Derivative instruments - stock purchase warrants | ||||

| Balance at December 31, 2016 | $ | 3,921,917 | ||

| Exercise of warrants | (2,778,259 | ) | ||

| Change in fair value | 2,741,314 | |||

| Balance at March 31, 2017 | $ | 3,884,972 | ||

We had no financial assets or liabilities measured at fair value using Level 3 inputs on a recurring basis during the three months ended March 31, 2016.

The (gains) losses resulting from the changes in the fair value of the derivative instruments are classified as the “change in the fair value of derivative instruments” in the accompanying condensed consolidated statements of operations. The fair value of the common stock purchase warrants is determined based on the Black-Scholes option pricing model for “plain vanilla” stock options and other option pricing models as appropriate, and includes the use of unobservable inputs such as the expected term, anticipated volatility and expected dividends. Changes in any of the assumptions related to the unobservable inputs identified above may change the embedded conversion options’ fair value; increases in expected term, anticipated volatility and expected dividends generally result in increases in fair value, while decreases in these unobservable inputs generally result in decreases in fair value.

Nonfinancial assets and liabilities measured at fair value

We do not have any non-financial assets and liabilities that are measured at fair value on a recurring basis.

We measure our long-lived assets, including property, plant, and equipment, and patents, at fair value on a non-recurring basis. These assets are recognized at fair value when they are deemed to be other-than-temporarily impaired. No such fair value impairment was recognized in the three months ended March 31, 2017 and 2016.

Note 4. Debt

In October 2014, we entered into an agreement to refinance and amend the terms of our March 2013 loan and security agreement. The amended loan provided for refinancing of approximately $5.6 million of outstanding balance of the initial loan along with approximately $4.4 million of new principal for a total of $10 million in principal. The amended loan provides for a variable interest rate based on prime with a floor of 10% and matured in April 2017. The loan provided for interest only payments through September 2015; payments of principal and interest of approximately $461,000 from October 2015 through December 2015, approximately $435,000 from January, 2016 through December, 2016, approximately $437,000 from January, 2017 through March 2017 and a final balloon payment of approximately $2.8 million in April 2017. The loan amendment generated approximately $4.3 million in net proceeds after fees and expenses. The loan amendment was accounted for as a debt extinguishment in accordance with guidance provided for in ASC 470, Debt resulting in a loss on extinguishment of approximately $446,000. In conjunction with the loan amendment we recorded a debt discount relating to the beneficial conversion feature. Such discount is being amortized as interest expense over the term of the debt using the effective interest method.

In conjunction with the loan amendment, we issued the lender a five-year common stock purchase warrant to purchase 5,784 shares of common stock at an exercise price of $34.58 per share. The warrant contains standard anti-dilution protection but does not contain any anti-dilution price protection for subsequent offerings. The value of the warrant was accounted for in calculating the loss on extinguishment, and is classified in equity.

We also incurred expenses with various third parties in connection with the loan amendment, consisting of approximately $86,000 in cash, 2,163 shares of common stock valued at approximately $80,000, and a three-year common stock purchase warrant to purchase 4,474 shares at an exercise price of $34.58 per share. The warrant has terms substantially similar to the lender warrant and is classified as equity. The fees related to the loan amendment are recorded as a deferred financing fees netted against the carrying amount of the loan and are being amortized as interest expense over the term of the debt using the effective interest method.

At March 31, 2017, we had a remaining principal balance of $2,543,048, which was paid in its entirety on April 1, 2017 pursuant to its terms.

Note 5. Stockholders’ Equity

We have granted share-based compensation awards to employees, board members and service providers. Awards may consist of common stock, restricted common stock, restricted common stock units, common stock purchase warrants, or common stock options. Our stock options and stock purchase warrants have lives of up to ten years from the grant date. Awards vest either upon the grant date or over varying periods of time. The stock options provide for exercise prices equal to or greater than the fair value of the common stock at the date of the grant. Restricted stock units grant the holder the right to receive fully paid common shares with various restrictions on the holder’s ability to transfer the shares. As of March 31, 2017, we have approximately 4.7 million shares of common stock reserved for issuance upon the exercise of such awards.

| 10 |

We record share-based compensation expense on a straight-line basis over the requisite service period. Share-based compensation expense included in the statements of operations is as follows:

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Research and development expenses | $ | 372,466 | $ | 709,416 | ||||

| General and administrative expenses | 149,973 | 761,470 | ||||||

| Total | $ | 522,439 | $ | 1,470,886 | ||||

Included in the general and administrative expense for the three months ended March 31, 2016 is approximately $407,000 related to the acceleration of the vesting of options for the previous CEO whose employment was terminated during the first quarter of 2016.

Stock Options

A summary of stock option activity and related information for the three months ended March 31, 2017 follows:

| Number of Options | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Life (in years) | Aggregate Intrinsic Value | |||||||||||||

| Outstanding at January 1, 2017 | 1,691,987 | $ | 22.60 | 5.1 | $ | - | ||||||||||

| Granted | - | $ | - | |||||||||||||

| Exercised | - | $ | - | |||||||||||||

| Forfeited | (7,693 | ) | $ | 31.20 | ||||||||||||

| Outstanding at March 31, 2017 | 1,684,294 | $ | 22.57 | 4.9 | $ | 200,928 | ||||||||||

| Exercisable at March 31, 2017 | 1,394,323 | $ | 25.36 | 4.1 | $ | 1,604 | ||||||||||

| Range of Exercise Prices | Number of Options Outstanding | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Life (in years) | Aggregate Intrinsic Value | ||||||||||||||

| $3.50 | - | $13.00 | 718,072 | $ | 9.72 | 7.0 | $ | 200,928 | ||||||||||

| $13.01 | - | $26.00 | 379,774 | $ | 15.30 | 4.8 | - | |||||||||||

| $26.01 | - | $39.00 | 155,339 | $ | 32.52 | 2.4 | - | |||||||||||

| $39.01 | - | $65.00 | 431,109 | $ | 46.77 | 2.1 | - | |||||||||||

| 1,684,294 | $ | 22.57 | 4.9 | $ | 200,928 | |||||||||||||

| 11 |

The Company uses the Black-Scholes option pricing model for “plain vanilla” options and other pricing models as appropriate to calculate the fair value of options. Significant assumptions used in these models include:

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Annual dividend | - | - | ||||||

| Expected life (in years) | - | 6.0 | - | 7.0 | ||||

| Risk free interest rate | - | 1.35% | - | 1.75% | ||||

| Expected volatility | - | 69.0% | - | 80.2% | ||||

The were no options granted in the three months ended March 31, 2017 and the options granted in the three months ended March 31, 2016 had a weighted average grant date fair value of $10.01 per share.

Unrecognized compensation cost for unvested stock option awards outstanding at March 31, 2017 was approximately $1,732,000 to be recognized over approximately 1.7 years.

RSUs

We have granted restricted stock units (RSUs) to certain employees and board members that entitle the holders to receive shares of our common stock upon vesting and subject to certain restrictions regarding the exercise of the RSUs. The grant date fair value of RSUs is based upon the market price of the underlying common stock on the date of grant.

A summary of our restricted stock unit activity for the three months ended March 31, 2017 is as follows:

| Number of RSU's | Weighted- Average Grant Date Fair Value | |||||||

| Outstanding at January 1, 2017 | 6,863 | $ | 30.70 | |||||

| Granted | - | |||||||

| Exercised and converted to common shares | (653 | ) | $ | 15.46 | ||||

| Forfeited | - | $ | - | |||||

| Outstanding at March 31, 2017 | 6,210 | $ | 32.29 | |||||

| Exercisable at March 31, 2017 | 6,210 | $ | 32.29 | |||||

The total intrinsic value of the outstanding restricted stock units at March 31, 2017 was approximately $33,000. No shares vested in the three-month periods ended March 31, 2017 or 2016. The total value of all restricted stock units that were converted in the three months ended March 31, 2017 was approximately $2,000.

Stock Purchase Warrants.

In the past, we have issued warrants to purchase common stock to certain officers, directors, stockholders and service providers as well as in conjunction with debt and equity offerings and at various times replacement warrants were issued as an inducement for warrant exercises.

In May 2016, we issued 1,746,172 common stock purchase warrants in conjunction with our capital raising transactions. Such warrants were classified as derivative liabilities due to the existence of non-standard anti-dilution conditions contained in the warrants. At March 31, 2017, after giving effect of the exercise below, 1,053,863 remain outstanding and are recorded at fair value as derivative liabilities (see Note 3).

In March 2017, we entered into a letter agreement with an investor pursuant to which the investor agreed to exercise certain of their warrants to purchase 692,309 shares of the Company’s common stock; such warrants were originally issued on May 6, 2016 in the Company’s registered offering and contained a current exercise price of $3.25 per share. In exchange for and to induce the investor to exercise the warrants, we issued to the investors an inducement warrant to purchase 230,771 shares of the Company’s common stock.

The inducement warrants are exercisable through March 20, 2018 at an exercise price equal to $5.80 per share, and contain provisions providing for an adjustment in the underlying number of shares and exercise price in the event of stock splits or dividends, subsequent rights offerings, pro rata distributions, and fundamental transactions. The Company is obligated to file a resale registration statement for the resale of the shares underlying the inducement warrants and have it declared effective prior to the release of Phase II data related to the Company’s current clinical trial for NSI-189. In the event that the registration statement is not declared effective by such time, the Company will pay liquidated cash damages in an amount equal to 2% of the exercise price per month for each month until the registration statement is declared effective. In the event that the shares underlying the inducement warrants are not subject to an effective registration statement at the time of exercise, the inducement warrants may be exercised on a cashless basis at any time after six (6) months from the issuance date. The inducement warrants are classified in equity. The fair value of the inducement warrants of $476,084 was expensed as inducement expense in the accompanying condensed consolidated statement of operations for the three-months ended March 31, 2017.

| 12 |

In April 2017, we executed a similar agreement with a different investor pursuant to which the investor agreed to exercise certain of their stock purchase warrants to purchase 153,847 shares of the Company’s common stock; such warrants were originally issued on May 6, 2016 in the Company’s registered offering and contained a current exercise price of $3.25 per share. In exchange for and to induce the investor to exercise the warrants, we issued to the investors an inducement warrant to purchase 51,283 shares of the Company common stock at $5.80 per share (the “Inducement Warrants”). The terms of the inducement warrants issued in April 2017 are substantially similar to the terms of the inducement warrants issued in March 2017, including the registration rights. The transaction will be recorded in the second quarter of 2017.

A summary of outstanding warrants at March 31, 2017 follows:

| Range of Exercise Prices | Number of Warrants Outstanding | Range of Expiration Dates | ||||||||

| $3.25 | - | $3.90 | 1,065,403 | May 2021 - July 2021 | ||||||

| $5.80 | - | $6.50 | 266,830 | June 2017 - March 2018 | ||||||

| $12.80 | - | $12.90 | 39,296 | January 2022 | ||||||

| $13.20 | - | $13.30 | 314,246 | August 2017 | ||||||

| $16.20 | - | $16.30 | 174,544 | March 2020 | ||||||

| $18.60 | - | $19.80 | 12,309 | March 2018 - June 2018 | ||||||

| $22.10 | - | $27.90 | 153,755 | March 2019 - January 2021 | ||||||

| $34.50 | - | $39.00 | 164,114 | November 2017 - October 2019 | ||||||

| $39.10 | - | $39.20 | 230,772 | October 2020 - October 2021 | ||||||

| $47.30 | - | $52.20 | 275,897 | January 2019 - July 2019 | ||||||

| 2,697,166 | ||||||||||

Preferred and Common Stock

We have outstanding 1,000,000 shares of Series A 4.5% Convertible Preferred Stock issued in December 2016. Shares of the Series A 4.5% Convertible Preferred Stock are convertible into 3,888,568 shares of the Company’s common stock subject to certain ownership restrictions.

In March 2017, we issued 692,309 shares of our common stock upon the exercise of certain outstanding common stock purchase warrants. The warrants were exercised at $3.25 per share and we received approximately $2,200,000 in net proceeds. The exercise was pursuant to an inducement agreement entered into with the investor. In conjunction with the exercise we issued certain inducement warrants to the investor. (See “Stock Purchase Warrants” section of Note 5).

In April 2017, we issued 153,847 shares of our common stock upon the exercise of certain outstanding common stock purchase warrants. The warrants were exercised at $3.25 per share and we received approximately $500,000 in net proceeds. The exercise was pursuant to an inducement agreement entered into with the investor. In conjunction with the exercise we issued certain inducement warrants to the investor. (See “Stock Purchase Warrants” section of Note 5).

During the three months ended March 31, 2016, we issued 653 shares of our common stock upon the conversion of 653 outstanding restricted stock units.

Note 6. Commitments and Contingencies

We currently operate two facilities located in the United States and one facility located in China. Our corporate offices and primary research facilities are located in Germantown, Maryland, where we license approximately 1,500 square feet. This license provides for monthly payments of approximately $5,500 per month with the term expiring on December 31, 2017.

| 13 |

In 2015, we entered into a lease consisting of approximately 3,100 square feet of research space in San Diego, California. This lease provides for current monthly payments of approximately $11,600 and expires on August 31, 2019.

We also lease a research facility in People’s Republic of China. This lease expires on September 30, 2018 with lease payments of approximately $3,200 per month.

From time to time, we are parties to legal proceedings that we believe to be ordinary, routine litigation incidental to the business. We are currently not a party to any litigation or legal proceeding.

Note 7. Related Party Receivable

On August 10, 2016, we entered into a reimbursement agreement with a former executive officer. Pursuant to the reimbursement agreement, the former officer agreed to repay the Company, over a six-year period, approximately $658,000 in expenses that the Company determined to have been improperly paid under the Company's prior expense reimbursement policies. In addition to this reimbursement agreement, the Company has implemented and is continuing to implement enhanced policies and procedures for travel expense reimbursements and disbursements.

The $658,000 non-interest bearing receivable is recorded net of a $199,000 discount to reflect the net present value of the future cash payments. The Company recorded a non-operating gain of $459,000 for the year ended December 31, 2016. The discount will be amortized through interest income using the effective interest method. The amount of $558,000, excluding discount remains outstanding at March 31, 2017 and is payable in $100,000 annual installments with a final balloon payment due six years from issuance.

Note 8. Subsequent Events

In April 2017, we entered into a letter agreement with certain shareholders with respect to the issuance of one (1) inducement warrant for every three (3) shares purchased upon exercise of outstanding common stock purchase warrants issued in our May 6, 2016 registered offering. Under the agreement, and subject to certain conditions, the shareholders agreed to exercise their outstanding warrants to purchase 153,847 shares of common stock at an exercise price of $3.25 per share. The exercise generated approximately $500,000 proceeds to Neuralstem. We agreed to issue the shareholders additional warrants to purchase 51,283 shares of common stock at an exercise price of $5.80 per share, such warrants expire on March 30, 2018.

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Statements in this Quarterly Report that are not strictly historical are forward-looking statements and include statements about products in development, results and analyses of pre-clinical studies, clinical trials and studies, research and development expenses, cash expenditures, and alliances and partnerships, among other matters. You can identify these forward-looking statements because they involve our expectations, intentions, beliefs, plans, projections, anticipations, or other characterizations of future events or circumstances. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that may cause actual results to differ materially from those in the forward-looking statements as a result of any number of factors. These factors include, but are not limited to, risks relating to our ability to conduct and obtain successful results from ongoing clinical trials, commercialize our technology, obtain regulatory approval for our product candidates, contract with third parties to adequately test and manufacture our proposed therapeutic products, protect our intellectual property rights and obtain additional financing to continue our development efforts. Some of these factors are more fully discussed, as are other factors, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC, as well as in the section of this Quarterly Report entitled “Risk Factors” and elsewhere herein. We do not undertake to update any of these forward-looking statements or to announce the results of any revisions to these forward-looking statements except as required by law.

We urge you to read this entire Quarterly Report on Form 10-Q, including the “Risk Factors” section, the financial statements, and related notes. As used in this Quarterly Report, unless the context otherwise requires, the words “we,” “us,” “our,” “the Company” and “Neuralstem” refers to Neuralstem, Inc. and its subsidiaries. Also, any reference to “common shares” or “common stock,” refers to our $.01 par value common stock. Any reference to “Series A Preferred Stock” refers to our Series A 4.5% Convertible Preferred Stock. The information contained herein is current as of the date of this Quarterly Report (March 31, 2017), unless another date is specified. We prepare our interim financial statements in accordance with U.S. GAAP. Our financials and results of operations for the three-month period ended March 31, 2017 are not necessarily indicative of our prospective financial condition and results of operations for the pending full fiscal year ending December 31, 2017. The interim financial statements presented in this Quarterly Report as well as other information relating to our Company contained in this Quarterly Report should be read in conjunction and together with the reports, statements and information filed by us with the United States Securities and Exchange Commission or SEC.

| 14 |

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations or MD&A, is provided in addition to the accompanying financial statements and notes to assist readers in understanding our results of operations, financial condition and cash flows. Our MD&A is organized as follows:

| · | Executive Overview — Discussion of our business and overall analysis of financial and other highlights affecting the Company in order to provide context for the remainder of MD&A. |

| · | Trends & Outlook — Discussion of what we view as the overall trends affecting our business and overall strategy. |

| · | Critical Accounting Policies— Accounting policies that we believe are important to understanding the assumptions and judgments incorporated in our reported financial results and forecasts. |

| · | Results of Operations— Analysis of our financial results comparing the three-month period ended March 31, 2017 to the comparable period of 2016. |

| · | Liquidity and Capital Resources— An analysis of cash flows and discussion of our financial condition and future liquidity needs. |

Executive Overview

We are focused on the research and development of nervous system therapies based on our proprietary human neural stem cells and our small molecule compounds with the ultimate goal of gaining approval from the United States Food and Drug Administration or FDA, and its international counterparts, to market and commercialize such therapies. We are headquartered in Germantown, Maryland.

Our technology has produced three primary assets: our NSI-189 small molecule program, our NSI-566 stem cell therapy program and our novel and proprietary chemical entity screening platform.

Our patented technologies enable the commercial-scale production of multiple types of central nervous system stem cells, which are under development for the potential treatment of nervous system diseases and conditions. In addition, this ability to generate human neural stem cell lines provides a platform for chemical screening and discovery of novel compounds that we believe may be used to stimulate the brain's capacity to regenerate neurons, thereby potentially treating or reversing pathologies associated with certain nervous system conditions.

We have developed and maintain what we believe is a strong portfolio of patents and patent applications that form the proprietary base for our research and development efforts. We own or exclusively license over 20 U.S. issued and pending patents and over 120 foreign issued and pending patents in the field of regenerative medicine, related to our stem cell technologies as well as our small molecule compounds.

We believe our technology, in combination with our expertise, and established collaborations with major research institutions, could facilitate the development and commercialization of products for use in the treatment of a wide array of nervous system disorders including neurodegenerative conditions and regenerative repair of acute and chronic disease.

Recent Clinical & Business Highlights

| · | NSI-189 Phase 2 Major Depressive Disorder (MDD) study results expected 4 months ahead of schedule in 3Q17. Neuralstem’s Phase 2 clinical study evaluating NSI-189 for the indication of MDD was initiated in May 2016. The company announced 50% enrollment in September 2016 and last subject enrolled in February 2017. 220 subjects were randomized for a 12-week interventional study with NSI-189 or placebo. Subjects completing the study are eligible to enroll in a 24-week non-interventional, observation-only durability study, from which the results are expected in the first half of 2018. |

| · | NSI-189 preclinical data published in the Journal of Cellular Physiology showed oral administration of NSI-189 in rats with ischemic stroke led to a significant recovery from motor deficit. The improvements were maintained post cessation of dosing for the additional 12-week observational period. The sustained improvement suggests that NSI-189 initiated a host brain repair mechanism enabling tissue remodeling of the stroke brain. |

| · | In April 2017, a new cohort (Group B) of four subjects with stable cervical injuries was added for recruitment to the Phase 1 chronic spinal cord injury (cSCI) human clinical trial evaluating the safety and feasibility of treatment with NSI-566. The amended protocol was approved by the U.S. Food and Drug Administration and the Institutional Review Board at the study site, University of California San Diego (UCSD). |

| · | NSI-566 preclinical data in a rat model of penetrating ballistic-like brain injury (PBBI) was published in the Journal of Neurotrauma. These data showed robust engraftment and long-term survival of NSI-566 post transplantation. |

| 15 |

| · | In January 2017, the Company executed a 1-for-13 reverse stock split of the Company’s common stock. The reverse stock split enabled Neuralstem to regain compliance with the $1.00 minimum bid price condition and thereby fulfill all of the NASDAQ Capital Market continued listing requirements. |

| · | In March and April 2017, we received approximately $2,750,000 upon the exercise of 846,156 common stock purchase warrants issued in our May 2016 registered offering at an exercise price of $3.25 per share. We expect that our existing cash and cash equivalents will be sufficient to enable us to fund our anticipated level of operations based on our current operating plans, into the third quarter of 2018. |

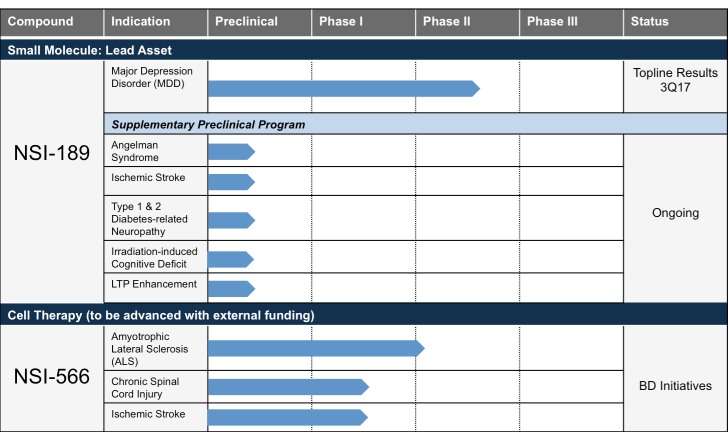

Clinical Development Program Review

We have devoted substantially all of our efforts and financial resources to the pre-clinical and clinical development of our small molecule compounds and our stem cell therapeutics. Below is a description of our most advanced clinical programs, their intended indication and current stage of development.

Clinical Pipeline:

Pipeline Summary

NSI-189 Phase 2 randomized, placebo-controlled, double-blind clinical trial for the treatment of MDD

- In February 2017, the company announced the last subject enrolled and results expected four months ahead of schedule in 3Q17. The first subject enrolled in May 2016 and 50% enrollment was achieved in September 2016. The Phase 2 trial randomized 220 subjects for a 12-week interventional study with NSI-189 across three arms (40mg QD, 40mg BID or placebo), at 12 select trial sites, all in the U.S. Eligible subjects are given the opportunity to enroll in a separate 24-week observational study to assess durability of effect defined as the time until the start of a new antidepressant treatment (ADT). Both the interventional and observational studies are being conducted and under the direction of study Principal Investigator (PI) Maurizio Fava, MD, Executive Vice Chair, Department of Psychiatry and Executive Director, Clinical Trials Network and Institute, Massachusetts General Hospital.

| 16 |

NSI-566 Phase 1 and 2 safety trials for the treatment of Amyotrophic Lateral Sclerosis (ALS)

- In September 2015, nine-month Phase 2 and combined Phase 1 and Phase 2 data from our ALS trials were presented at the American Neurological Association Meeting by Principal Investigator Eva Feldman, MD, PhD, Director of the A. Alfred Taubman Medical Research Institute and Director of Research of the ALS Clinic at the University of Michigan Health. The data showed that the intraspinal transplantation of the cells was safe and well tolerated. Subjects from both the Phase 1 and Phase 2 continue to be monitored for long-term follow-up evaluations.

NSI-566 Phase 1 safety trial for the treatment of motor deficits in stroke

- In March 2016, we completed dosing the final planned cohort, for a total of nine subjects. Subjects are currently being monitored through their 24-month observational follow-up period. The trial is being conducted by Suzhou Neuralstem, a wholly owned subsidiary of Neuralstem in China.

NSI-566 Phase 1 safety trial for the treatment of chronic Spinal Cord Injury (cSCI)

- In April 2017, the company announced that it had received FDA approval to recruit a new cohort (Group B) of four subjects with stable AISA-A complete, quadriplegic, cervical injuries to the ongoing Phase 1 human clinical trial evaluating the safety and feasibility of using NSI-566 spinal cord-derived neural stem cells to repair chronic cSCI. In January 2016, we reported on the interim status of the Phase 1 safety data on all four subjects with stable thoracic spinal cord injuries; the stem cell treatment demonstrated feasibility and safety. A self-reported ability to contract some muscles below the level of injury was confirmed via clinical and electrophysiological follow-up examinations in one of the four subjects treated. All subjects will be followed for five years. This study is being conducted with support from the University of California, San Diego (UCSD) School of Medicine.

Pre-Clinical Development Pipeline

Our preclinical research on NSI-189 is focused on identifying its mechanism of action and investigating its potential utility as a broad neuroregenerative drug that can prevent or reverse various types of central and peripheral nerve degeneration and that may have significant cognitive benefit in diseases that impact memory and cognition. Recent preclinical data support the potential benefits of NSI-189 in other indications beyond MDD.

Our preclinical studies with NSI-566 have served to provide a solid foundation for our ongoing clinical trials by demonstrating performance and efficacy of this cell line in animal models for ALS, spinal cord injury, and ischemic stroke, and demonstrated safety in large animals. Additional studies involving NSI-566 are directed at identifying new therapeutic indications.

In addition to NSI-566 we have developed an inventory of over 300 unique stem cell lines. These stem cell lines include cortex, hippocampus, midbrain, hindbrain, cerebellum, and spinal cord. We believe these lines possess unique properties and represent candidates for both transplantation-based strategies to treat disease and for screening of compound libraries to discover novel drug therapies.

Our Technologies

Our technology has produced three primary assets: our NSI-189 small molecule program, our NSI-566 stem cell therapy program and our novel and proprietary chemical entity screening platform.

Small Molecule Pharmaceutical Compounds.

Utilizing our proprietary stem cell-based screening capability, we have discovered and patented a series of small molecule compounds. We believe our low molecular weight organic compounds can efficiently cross the blood/brain barrier. In mice, research indicated that the small molecule compounds both stimulate neurogenesis of the hippocampus and increase its volume. We believe the small molecule compounds may promote synaptogenesis and neurogenesis in the human hippocampus in indications such as MDD.

Our portfolio of small molecule compounds which includes NSI-189 are covered by 10 U.S. exclusively owned issued and pending patents and over 60 exclusively owned foreign issued and pending patents.

| 17 |

Stem Cells.

Our stem cell based technology has both therapeutic and screening characteristics.

From a therapeutic perspective, our stem cell based technology enables the isolation and large-scale expansion of regionally specific, human neural stem cells from all areas of the developing human brain and spinal cord thus enabling the generation of physiologically relevant human neurons of different types. We believe that our stem cell technology will enable the replacement of malfunctioning or dead cells or the protection of neurons as a way to treat disease and injury. Many significant and currently untreatable human diseases arise from the loss or malfunction of specific cell types in the body. Our focus is the development of effective methods to generate replacement cells from neural stem cells. We believe that replacing damaged, malfunctioning or dead neural cells with fully functional ones may be a useful therapeutic strategy in treating many diseases and conditions of the central nervous system.

Our Proprietary and Novel Screening Platform

Our human neural stem cell lines form the foundation for functional cell-based assays used to screen for small molecule compounds that can impact biologically relevant outcomes such as neurogenesis, synapse formation, and protection against toxic insults. We have developed over 300 unique stem cell lines representing multiple different regions of the developing brain and spinal cord at multiple different time points in development, enabling the generation of physiologically relevant human neural cells for screening, target validation, and mechanism-of-action studies. This platform provides us with a unique and powerful tool to identify new chemical entities to treat a broad range of nervous system conditions. NSI-189 was discovered using our stem cell-based screening platform.

Intellectual Property

We have developed and maintain what we believe is a strong portfolio of patents and patent applications that form the basis for our research and development efforts. We own or exclusively license over 10 U.S. issued and pending patents and over 60 foreign issued and pending patents related to our stem cell technologies for use in treating disease and injury. We own over 10 U.S. issued and pending patents and over 60 foreign issued and pending patents related to our small molecule compounds. Our issued patents have expiration dates ranging from 2017 through 2035. Two of our original patents covering methods and composition of matter associated with our stem cell technologies expired in 2016. In our opinion the expiration of these patents is not material to our intellectual property.

Operating Strategy

We generally employ an outsourcing strategy where we outsource our preclinical and clinical development activities to contract research organizations and academic partners. Manufacturing is also outsourced to organizations with approved facilities and manufacturing practices. All non-critical corporate functions are outsourced as well. This model allows us to better manage cash on hand and minimize non-vital expenditures. It also allows for us to operate with relatively fewer employees and lower fixed costs than that required by other companies conducting similar business.

Employees

As of April 30, 2017, we had ten (10) full-time employees. Of these full-time employees, seven (7) work on research and development and clinical operations and three (3) work in administration. We also use the services of numerous outside consultants in business and scientific matters.

Our Corporate Information

We were incorporated in Delaware in 2001. Our principal executive offices are located at 20271 Goldenrod Lane, Germantown, Maryland 20876, and our telephone number is (301) 366-4841. Our website is located at www.neuralstem.com.

We have not incorporated by reference into this report the information in, or that can be accessed through, our website and you should not consider it to be a part of this report.

Trends & Outlook

Revenue

We generated no revenues from the sale of our proposed therapies for any of the periods presented. We are mainly focused on successfully managing our current clinical trials related to our small molecule compounds and seeking potential partnerships for our stem cell product candidates. We are also pursuing pre-clinical studies on other central nervous system indications in preparation for potential future clinical trials.

During the three months ended March 31, 2017 and 2016, we recognized approximately $2,500 of revenue in each period related to ongoing fees pursuant to certain licenses of our intellectual property to third parties.

| 18 |

On a long-term basis, we anticipate that our revenue will be derived primarily from licensing fees and sales of our small molecule compounds and licensing fees and royalties from our cell based therapies. Because we are at such an early stage in the clinical trials process, we are not yet able to accurately predict when we will have a product ready for commercialization, if ever.

Research and Development Expenses

Our research and development expenses consist primarily of clinical trial expenses, including; payments to clinical trial sites that perform our clinical trials and clinical research organizations (CROs) that help us manage our clinical trials, manufacturing of small molecule drugs and stem cells for both human clinical trials and for pre-clinical studies and research, personnel costs for research and clinical personnel, and other costs including research supplies and facilities.

We focus on the development of treatment candidates with potential uses in multiple indications, and use employee and infrastructure resources across several projects. Accordingly, many of our costs are not attributable to a specifically identified product and we do not account for internal research and development costs on a project-by-project basis.

We expect that research and development expenses, which include expenses related to our ongoing clinical trials, will increase in the future, as funding allows and we proceed later stage clinical trials.

We have formed a wholly owned subsidiary in the People’s Republic of China. We anticipate that this subsidiary will primarily: (i) conduct pre-clinical research with regard to proposed stem cells therapies, and (ii) oversee our approved future clinical trials in China, including the current trial to treat motor deficits due to ischemic stroke.

General and Administrative Expenses

General and administrative expenses are primarily comprised of salaries, benefits and other costs associated with our operations including, finance, human resources, information technology, public relations and costs associated with maintaining a public company listing, legal, audit and compliance fees, facilities and other external general and administrative services.

Critical Accounting Policies

Our condensed consolidated financial statements have been prepared in accordance with U.S. GAAP. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Note 2 of the Notes to Unaudited Condensed Consolidated Financial Statements included elsewhere herein describes the significant accounting policies used in the preparation of the financial statements. Certain of these significant accounting policies are considered to be critical accounting policies, as defined below.

A critical accounting policy is defined as one that is both material to the presentation of our financial statements and requires management to make difficult, subjective or complex judgments that could have a material effect on our financial condition and results of operations. Specifically, critical accounting estimates have the following attributes: (1) we are required to make assumptions about matters that are highly uncertain at the time of the estimate; and (2) different estimates we could reasonably have used, or changes in the estimate that are reasonably likely to occur, would have a material effect on our financial condition or results of operations.

Estimates and assumptions about future events and their effects cannot be determined with certainty. We base our estimates on historical experience and on various other assumptions believed to be applicable and reasonable under the circumstances. These estimates may change as new events occur, as additional information is obtained and as our operating environment changes. These changes have historically been minor and have been included in the financial statements as soon as they became known. Based on a critical assessment of our accounting policies and the underlying judgments and uncertainties affecting the application of those policies, management believes that our financial statements are fairly stated in accordance with U.S. GAAP, and present a meaningful presentation of our financial condition and results of operations. We believe the following critical accounting policies reflect our more significant estimates and assumptions used in the preparation of our consolidated financial statements:

Use of Estimates - Our financial statements prepared in accordance with U.S. GAAP require us to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Specifically, we have estimated the expected economic life and value of our patent technology, our net operating loss carryforward and related valuation allowance for tax purposes the fair value of our derivative instruments and our stock-based compensation expenses related to employees, directors, consultants and investment banks. Actual results could differ from those estimates.

| 19 |

Long Lived Intangible Assets - Our long lived intangible assets consist of our intellectual property patents including primarily legal fees associated with the filings and in defense of our patents. The assets are amortized on a straight-line basis over the expected useful life which we define as ending on the expiration of the patent group. These assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. We assess this recoverability by comparing the carrying amount of the asset to the estimated undiscounted future cash flows to be generated by the asset. If an asset is deemed to be impaired, we estimate the impairment loss by determining the excess of the asset’s carrying amount over the estimated fair value. These determinations use assumptions that are highly subjective and include a high degree of uncertainty. During the three months ended March 31, 2017 and 2016, no significant impairment losses were recognized.

Fair Value Measurements - The fair value of our short-term financial instruments, which primarily include cash and cash equivalents, other short-term investments, accounts payable and accrued expenses, approximate their carrying values due to their short maturities. The fair value of our long-term indebtedness is estimated based on the quoted prices for the same or similar issues or on the current rates offered to the Company for debt of the same remaining maturities which approximates the carrying value. The fair values of our derivative instruments are estimated using Level 3 unobservable inputs.

Share-Based Compensation - We account for share-based compensation at fair value; accordingly we expense the estimated fair value of share-based awards over the requisite service period. Share-based compensation cost for stock options and warrants issued to employees and board members is determined at the grant date while awards granted to non-employee consultants are generally valued at the vesting date using an option pricing model. Option pricing models require us to make assumptions, including expected volatility and expected term of the options. If any of the assumptions we use in the model were to significantly change, stock based compensation expense may be materially different. Share-based compensation cost for restricted stock and restricted stock units issued to employees and board members is determined at the grant date based on the closing price of our common stock on that date. The value of the award that is ultimately expected to vest is recognized as expense on a straight-line basis over the requisite service period.

RESULTS OF OPERATIONS

Comparison of Three Months Ended March 31, 2017 and 2016

Revenue

During each of the three months ended March 31, 2017 and 2016 we recognized approximately $2,500 of revenue related to ongoing fees pursuant to certain licenses of our intellectual property to third parties.

Operating Expenses

Operating expenses for the three months ended March 31, 2017 and 2016 were as follows:

| Three Months Ended March 31, | Increase (Decrease) | |||||||||||||||

| 2017 | 2016 | $ | % | |||||||||||||

| Operating Expenses | ||||||||||||||||

| Research and development expenses | $ | 2,902,086 | $ | 3,065,590 | $ | (163,504 | ) | (5 | %) | |||||||

| General and administrative expenses | 1,332,421 | 3,170,522 | (1,838,101 | ) | (58 | %) | ||||||||||

| Total operating expenses | $ | 4,234,507 | $ | 6,236,112 | $ | (2,001,605 | ) | (32 | %) | |||||||

Research and Development Expenses

The decrease of approximately $163,000 or 5% in research and development expenses for the period ended March 31, 2017 compared to the comparable period of 2016 was primarily attributable to a $1.8 million reduction in employment costs, internal and external research expenditures associated with our May, 2016 restructuring partially offset by a $1.6 million increase in clinical trial costs associated with our ongoing Phase 2 MDD study.

General and Administrative Expenses

The decrease of approximately $1,838,000 or 58% in general and administrative expenses for the period ended March 31, 2017 compared to the comparable period of 2016 was primarily attributable to employment costs savings associated with our May, 2016 restructuring.

Other expense

Other expense, net totaled approximately $3,335,000 and $372,000 for the three months ended March 31, 2017 and 2016, respectively.

| 20 |

Other expense, net in 2017 consisted of approximately $2,741,000 of losses related to the fair value adjustment of our derivative instruments, $476,000 of expense related to the issuance of inducement warrants and $139,000 of interest expense primarily related to our long-term debt, partially offset by $21,000 of interest income.

Other expenses, net in 2016 consisted primarily of approximately $387,000 of interest expense principally related to our long-term debt partially offset by approximately $11,000 of interest income.

Liquidity and Capital Resources

Financial Condition

Since our inception, we have financed our operations through the sales of our securities, issuance of long-term debt, the exercise of investor warrants, and to a lesser degree from grants and research contracts as well as the licensing of our intellectual property to third parties.