REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

The | ||||

The | ||||

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ | ||||||

Emerging growth company |

||||||||||

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other | ☐ |

Page |

||||||

| | ||||||

| ITEM 1. |

8 |

|||||

| ITEM 2. |

8 |

|||||

| ITEM 3. |

8 |

|||||

| ITEM 4. |

46 |

|||||

| ITEM 4A. |

74 |

|||||

| ITEM 5. |

74 |

|||||

| ITEM 6. |

98 |

|||||

| ITEM 7. |

109 |

|||||

| ITEM 8. |

110 |

|||||

| ITEM 9. |

111 |

|||||

| ITEM 10. |

112 |

|||||

| ITEM 11. |

127 |

|||||

| ITEM 12. |

128 |

|||||

| | ||||||

| ITEM 13. |

129 |

|||||

| ITEM 14. |

129 |

|||||

| ITEM 15. |

129 |

|||||

| ITEM 16A. |

131 |

|||||

| ITEM 16B. |

131 |

|||||

| ITEM 16C. |

131 |

|||||

| ITEM 16D. |

132 |

|||||

| ITEM 16E. |

132 |

|||||

| ITEM 16F. |

132 |

|||||

| ITEM 16G. |

132 |

|||||

| ITEM 16H. |

133 |

|||||

| | ||||||

| ITEM 17. |

134 |

|||||

| ITEM 18. |

134 |

|||||

| ITEM 19. |

135 |

|||||

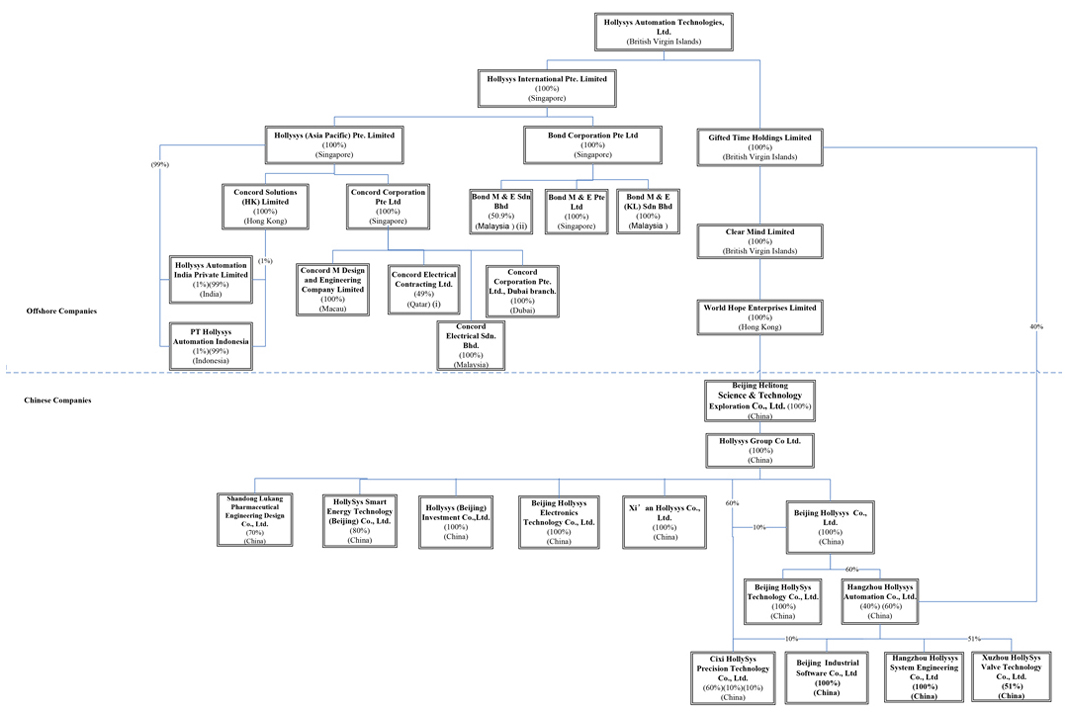

| • |

“Hollysys,” “we,” “us,” or “our,” and the “Company,” refer to the combined business of Hollysys Automation Technologies Ltd., a BVI company, and its consolidated subsidiaries, HI, HAP, HAIP, PTHAI, Bond Group, Concord Group, CSHK, GTH, Clear Mind, World Hope, Helitong, Hollysys Group, Hangzhou Hollysys, Hangzhou System, Hollysys Industrial Software, Beijing Hollysys, Hollysys Electronics, Xi’an Hollysys, Hollysys Investment, HollySys Smart Energy, Cixi HollySys, Shandong Lukang and Xuzhou HollySys; |

| • |

“HI” refers to Hollysys International Pte. Limited, a Singapore company; |

| • |

“HAP” refers to Hollysys (Asia Pacific) Pte. Limited, a Singapore company; |

| • |

“HAIP” refers to Hollysys Automation India Private Limited, an India Company; |

| • |

Bond Group” refers to a group of our subsidiaries, including Bond Corporation Pte. Ltd., a Singapore company (“BCPL”), Bond M&E Pte. Ltd., a Singapore Company (“BMSG”), Bond M&E Sdn. Bhd., a Malaysia company (“BMJB”), and Bond M&E (K.L.) Sdn. Bhd., a Malaysia company (“BMKL”); |

| • |

“Concord Group” refers to a group of our subsidiaries, including Concord Corporation Pte. Ltd. (“CCPL”), a Singapore company, and CCPL’s subsidiaries, Concord Electrical Sdn. Bhd., a Malaysia company (“CESB”), Concord Corporation Pte. Ltd, Dubai Branch (“CCPL Dubai”) Concord Electrical Contracting Ltd., a Qatar company(“CECL”), and Concord M Design and Engineering Company Ltd, a Macau company(“CMDE”); |

| • |

“CSHK” refers to Concord Solutions (HK) Limited, a Hong Kong company; |

| • |

“PTHAI” refers to PT Hollysys Automation Indonesia, an Indonesian company |

| • |

“GTH” refers to Gifted Time Holdings Limited, a BVI company; |

| • |

“Clear Mind” refers to Clear Mind Limited, a BVI company; |

| • |

“World Hope” refers to World Hope Enterprises Limited, a Hong Kong company; |

| • |

“Helitong” refers Beijing Helitong Science & Technology Exploration Co., Ltd., a PRC company; |

| • |

“Hollysys Group” refers to Hollysys Group Co., Ltd., formerly known as Beijing Hollysys Science & Technology Co., Ltd, a PRC company; |

| • |

“Hangzhou Hollysys” refers to Hangzhou Hollysys Automation Co., Ltd., a PRC company; |

| • |

“Hangzhou System” refers to Hangzhou Hollysys System Engineering Co., Ltd., a PRC company; |

| • |

“Hollysys Industrial Software” refers to Beijing Hollysys Industrial Software Company Ltd., a PRC company; |

| • |

“Beijing Hollysys” refers to Beijing Hollysys Co., Ltd., a PRC company; |

| • |

“Hollysys Electronics” refers to Beijing Hollysys Electronics Technology Co., Ltd., a PRC company; |

| • |

“Xi’an Hollysys” refers to Xi’an Hollysys Co., Ltd, a PRC company; |

| • |

“Hollysys Investment” refers to Hollysys (Beijing) Investment Co., Ltd., a PRC company; |

| • |

“HollySys Smart Energy” refers to HollySys Smart Energy Technology (Beijing) Co., Ltd., a PRC company; |

| • |

“Cixi HollySys” refers to Cixi HollySys Precision Technology Co., Ltd., a PRC company; |

| • |

“RMB” and “CNY” refer to Renminbi, the legal currency of China; “SGD” and “S$” refer to the Singapore dollar, the legal currency of Singapore; “US dollar,” “$” and “US$” refer to the legal currency of the United States; “MYR” refers to the Malaysian Ringgit, the legal currency of Malaysia; “AED” refers to the United Arab Emirates Dirham, the legal currency of United Arab Emirates; “HKD” refers to the Hong Kong dollar, the legal currency of Hong Kong; “MOP” refers to the Macau Pataca, the legal currency of Macau; “INR” refers to the Indian Rupee, the legal currency of India; and “QAR” refers to the Qatar Riyal, the legal currency of Qatar; “IDR” refers to Indonesia Rupiah, the legal currency of Indonesia. |

| • |

“BVI” refers to the British Virgin Islands; |

| • |

“China” and “PRC” refer to the People’s Republic of China; |

| • |

“Hong Kong” and “Hong Kong SAR” refer to the Hong Kong Special Administrative Region of China; |

| • |

“Macau” refers to the Macau Special Administrative Region of China; |

| • |

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended; and |

| • |

“Securities Act” refers to the Securities Act of 1933, as amended. |

| • |

CTCS-2: Chinese Train Control System Level 2 |

| • |

CTCS-3: Chinese Train Control System Level 3 |

| • |

DCS: Distributed Control System |

| • |

DEH: Digital Electro-Hydraulic |

| • |

GW: Gigawatt |

| • |

IIoT: Industrial Internet of Things |

| • |

MW: Megawatt |

| • |

PaaS: Platform as a Service |

| • |

PLC: Programmable Logic Controller |

| • |

SaaS: Software as a Service |

| • |

SCADA: Supervisory Control and Data Acquisition |

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

| ITEM 3. |

KEY INFORMATION |

(In USD thousands, except share numbers and per share data) |

||||||||||||||||||||

Years ended June 30, |

||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||

| Statement of Comprehensive Income Data |

||||||||||||||||||||

| Revenue |

544,325 |

431,943 |

540,768 |

570,341 |

503,327 |

|||||||||||||||

| Operating income |

120,583 |

60,270 |

120,244 |

123,626 |

69,428 |

|||||||||||||||

| Income before income taxes |

137,742 |

83,355 |

129,642 |

143,723 |

97,497 |

|||||||||||||||

| Net income attributable to Hollysys |

118,471 |

68,944 |

107,161 |

125,261 |

79,396 |

|||||||||||||||

| Non-GAAP net income attributable to Hollysys |

121,497 |

70,120 |

108,891 |

126,156 |

80,106 |

|||||||||||||||

| Weighted average ordinary shares: |

||||||||||||||||||||

| Basic |

59,170,050 |

60,189,004 |

60,434,019 |

60,456,524 |

60,478,717 |

|||||||||||||||

| Diluted |

60,611,456 |

61,011,510 |

61,248,565 |

61,273,884 |

60,609,242 |

|||||||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic |

2.00 |

1.15 |

1.77 |

2.07 |

1.31 |

|||||||||||||||

| Diluted |

1.97 |

1.14 |

1.75 |

2.05 |

1.31 |

|||||||||||||||

| Non-GAAP earnings per share: |

||||||||||||||||||||

| Basic |

2.05 |

1.16 |

1.80 |

2.09 |

1.32 |

|||||||||||||||

| Diluted |

2.02 |

1.16 |

1.78 |

2.07 |

1.32 |

|||||||||||||||

| Balance Sheet Data |

||||||||||||||||||||

| Total current assets |

827,310 |

865,356 |

1,000,898 |

1,109,478 |

1,174,494 |

|||||||||||||||

| Total assets |

1,004,156 |

1,058,254 |

1,210,128 |

1,309,417 |

1,360,835 |

|||||||||||||||

| Total current liabilities |

297,326 |

302,978 |

333,054 |

341,499 |

327,302 |

|||||||||||||||

| Total liabilities |

321,471 |

334,714 |

367,775 |

362,257 |

371,949 |

|||||||||||||||

| Net assets |

682,685 |

723,540 |

842,353 |

947,160 |

988,886 |

|||||||||||||||

| Non-controlling interests |

8,529 |

21 |

301 |

1,774 |

4,403 |

|||||||||||||||

| Stockholders’ equity |

674,156 |

723,519 |

842,052 |

945,386 |

984,483 |

|||||||||||||||

(In USD thousands, except share numbers and per share data) |

||||||||||||||||||||

Years ended June 30, |

||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||

| Cost of integrated solutions contracts |

310,545 |

277,476 |

314,233 |

325,523 |

281,818 |

|||||||||||||||

| Less: Amortization of intangible assets |

818 |

623 |

598 |

311 |

300 |

|||||||||||||||

| Non-GAAP cost of integrated solutions contracts |

309,727 |

276,853 |

313,635 |

325,212 |

281,518 |

|||||||||||||||

| G&A expenses |

45,832 |

44,297 |

46,323 |

40,701 |

39,114 |

|||||||||||||||

| Less: Share-based compensation expenses |

3,860 |

464 |

1,207 |

238 |

410 |

|||||||||||||||

| Non-GAAP G&A expenses |

41,972 |

43,833 |

45,116 |

40,463 |

38,704 |

|||||||||||||||

| Other income (expenses), net |

4,061 |

1,722 |

4,349 |

2,710 |

4,683 |

|||||||||||||||

| Add: Acquisition-related incentive share contingent consideration fair value adjustments |

(1,745 |

) |

— |

— |

— |

— |

||||||||||||||

| Add: Fair value adjustments of a bifurcated derivative |

93 |

89 |

(75 |

) |

346 |

— |

||||||||||||||

| Non-GAAP other income, net |

2,409 |

1,811 |

4,274 |

3,056 |

4,683 |

|||||||||||||||

| Net income attributable to Hollysys |

118,471 |

68,944 |

107,161 |

125,261 |

79,396 |

|||||||||||||||

| Add: Share-based compensation expenses |

3,860 |

464 |

1207 |

238 |

410 |

|||||||||||||||

| Amortization of intangible assets |

818 |

623 |

598 |

311 |

300 |

|||||||||||||||

| Acquisition-related consideration fair value adjustments |

(1,745 |

) |

— |

— |

— |

— |

||||||||||||||

| Fair value adjustments of a bifurcated derivative |

93 |

89 |

(75 |

) |

346 |

— |

||||||||||||||

| Non-GAAP net income attributable to Hollysys |

121,497 |

70,120 |

108,891 |

126,156 |

80,106 |

|||||||||||||||

| Weighted average number of ordinary shares outstanding used in computation: |

||||||||||||||||||||

| Basic |

59,170,050 |

60,189,004 |

60,434,019 |

60,456,524 |

60,478,717 |

|||||||||||||||

| Diluted |

60,611,456 |

61,011,510 |

61,248,565 |

61,273,884 |

60,609,242 |

|||||||||||||||

| GAAP earnings per share: Basic |

2.00 |

1.15 |

1.77 |

2.07 |

1.31 |

|||||||||||||||

| Add: Share-based compensation expenses |

0.07 |

0.01 |

0.02 |

— |

0.01 |

|||||||||||||||

| Amortization of intangible assets |

0.01 |

— |

0.01 |

0.01 |

— |

|||||||||||||||

| Acquisition-related consideration fair value adjustments |

(0.03 |

) |

— |

— |

— |

— |

||||||||||||||

| Fair value adjustments of a bifurcated derivative |

— |

— |

— |

0.01 |

— |

|||||||||||||||

| Non-GAAP earnings per share: Basic |

2.05 |

1.16 |

1.80 |

2.09 |

1.32 |

|||||||||||||||

| GAAP earnings per share: Diluted |

1.97 |

1.14 |

1.75 |

2.05 |

1.31 |

|||||||||||||||

| Add: Share-based compensation expenses |

0.06 |

0.01 |

0.02 |

— |

0.01 |

|||||||||||||||

| Amortization of intangible assets |

0.01 |

0.01 |

0.01 |

0.01 |

— |

|||||||||||||||

| Acquisition-related consideration fair value adjustments |

(0.02 |

) |

— |

— |

— |

— |

||||||||||||||

| Fair value adjustments of a bifurcated derivative |

— |

— |

— |

0.01 |

— |

|||||||||||||||

| Non-GAAP earnings per share: Diluted |

2.02 |

1.16 |

1.78 |

2.07 |

1.32 |

|||||||||||||||

| • |

Research and development activities on existing and potential product solutions; |

| • |

Additional engineering and other technical personnel; |

| • |

Advanced design, production and test equipment; |

| • |

Manufacturing services that meet changing customer needs; |

| • |

Technological changes in manufacturing processes; |

| • |

Expansion of manufacturing capacity; and |

| • |

Acquiring technology through licensing and acquisitions. |

| • |

uncertain political and economic climates; |

| • |

lack of familiarity and burdens of complying with foreign laws, accounting and legal standards, regulatory requirements, tariffs and other barriers; |

| • |

unexpected changes in regulatory requirements, taxes, trade laws, tariffs, export quotas, custom duties or other trade restrictions; |

| • |

lack of experience in connection with the localization of our applications, including translation into foreign languages and adaptation for local practices, and associated expenses and regulatory requirements; |

| • |

difficulties in adapting to differing technology standards; |

| • |

longer sales cycles and accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| • |

difficulties in managing and staffing international operations, including differing legal and cultural expectations for employee relationships and increased travel, infrastructure and legal compliance costs associated with international operations; |

| • |

fluctuations in exchange rates that may increase the volatility of our foreign-based revenue and expenses; |

| • |

potentially adverse tax consequences, including the complexities of foreign value-added tax, goods and services tax and other transactional taxes; |

| • |

reduced or varied protection for intellectual property rights in some countries; |

| • |

difficulties in managing and adapting to differing cultures and customs; |

| • |

data privacy laws which require that customer data be stored and processed in a designated territory subject to laws different from those of the PRC; |

| • |

new and different sources of competition as well as laws and business practices favoring local competitors and local employees; |

| • |

compliance with anti-bribery laws, including compliance with the Foreign Corrupt Practices Act; |

| • |

increased financial accounting and reporting burdens and complexities; and |

| • |

restrictions on the repatriation of earnings. |

| • |

unidentified or unforeseeable liabilities or risks may exist in the potential assets or business to be acquired; |

| • |

failure to assimilate acquired business and personnel into our operations or failure to realize anticipated cost savings or other synergies from the acquisition; |

| • |

incurring additional debts which could reduce our available funds for operations and other purposes as a result of increased debt repayment obligations; |

| • |

inability to retain employees; |

| • |

loss of customers; and |

| • |

diverting efforts of management and other resources. |

| • |

our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; |

| • |

changes in financial estimates by us or by any securities analysts who might cover our share; |

| • |

speculation about our business in the press or the investment community; |

| • |

significant developments relating to our relationships with our customers or suppliers; |

| • |

stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; |

| • |

customer demand for our services and products; |

| • |

investor perceptions of our industry in general and our company in particular; |

| • |

the operating and share performance of comparable companies; |

| • |

general economic conditions and trends; |

| • |

major catastrophic events; |

| • |

announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; |

| • |

changes in accounting standards, policies, guidance, interpretation or principles; |

| • |

loss of external funding sources; |

| • |

sales of our ordinary shares, including sales by our directors, officers or significant shareholders; |

| • |

additions or departures of key personnel; and |

| • |

investor perception of litigation, investigation or other legal proceedings involving us or certain of our individual shareholders or their family members. |

| • |

have a majority of the board be independent (although all of the members of the audit committee must be independent under the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act); |

| • |

have a compensation committee and a nominating committee to be comprised solely of “independent directors; and |

| • |

hold an annual meeting of shareholders no later than one year after the end of the Company’s fiscal year-end. |

| ITEM 4. |

INFORMATION ON THE COMPANY |

| • |

We have implemented necessary measures to ensure the health and safety of our employees and made appropriate adjustments to our business operations in response to the pandemic’s impact. Since late January 2020 and during the early period of the pandemic, we conducted regular monitoring of the health condition of our employees through online survey. In early February, we were implementing work-from-home scheme based on the development of pandemic containment. During such time, staff was selectively arranged for on-site work in accordance with the healthcare guidance to undertake particular urgent projects covering R&D, production and engineering. Prior to the returning of our employees to normal on-site work, comprehensive healthcare guidance was established in each of our bases in China to be strictly followed by, including mandated mask wearing, health QR code checking at the entrance, daily temperature measurement, and distancing policy for particular areas, etc. As of June 30, 2020, all of our employees in China have returned to their workplace. |

| • |

During the last two quarters of fiscal year 2020, the pandemic has led to delay of project execution and contract bidding, while marketing events were also adversely affected due to restriction on on-site communication. Such has negatively impacted our financial performance. For instance, our total revenue in fiscal year 2020 decreased by 11.7% to $503.3 million and our total amount of new contracts won in fiscal year 2020 decreased by 24.2% to $549.2 million. |

| • |

While we have seen gradual recovery of our overall business resulting from improving health statistics in China since March 2020, the pandemic continued to have an adverse effect on our overseas business, especially in South East Asia and South Asia. In overseas workplace, we have implemented the policy requesting non-essential employees to work remotely. As a result of the pandemic, tenders and projects have also been delayed. In addition, the pandemic is also one of the triggers for evaluating whether there is goodwill impairment of Bond Group and long-lived asset impairment. |

| • |

Proprietary and core technologies |

| • |

In-depth understanding of our clients’ industrial processes |

| • |

Dedicated pursuit of customer satisfaction |

| • |

Compliant with international standards |

| • |

Leading functionality and quality |

| • |

Strong product safety and reliability |

| • |

Highly flexible customization |

| • |

Cost-effective solutions |

| • |

Comprehensive service capability |

| • |

Solution planning |

| • |

Solution design |

| • |

Solution implementation |

| • |

Generating synergy and improving efficiency of our customers through integrating communications, marketing and service functions; |

| • |

Utilizing our industry and process knowledge to develop customized solutions that improve the efficiency of our customers; |

| • |

Providing a software platform for the optimization of management operations, which provides real-time automation and information solutions throughout a business; and |

| • |

Offering maintenance and training services to our customers, which help to cut costs and improve operating efficiency. |

| • |

Solution planning and design . |

| • |

System manufacturing and installation re-configuring the software embedded in the hardware, and fabricating the integrated hardware into cabinets, on-site installation and testing, and training customer’s personnel about how to use the automation and total solution. |

| • |

Customer acceptance |

| • |

Warranty period |

| • |

Market leadership with strong reputation |

| • |

1st domestic DCS with practical application (1993); |

| • |

1st domestic nuclear power station computing system to enter operation (1997); |

| • |

1st domestic railway transportation SCADA (2002); |

| • |

1st proprietary domestic large-scale PLC system (2007); |

| • |

1st passenger line with CTCS-2 Train Control System (2008); |

| • |

1st GW Nuclear Power Station Digital Instrumentation Control System (2011); |

| • |

1st to introduce CTCS-3 category high-speed rail control system in an overseas market (2012); |

| • |

1st domestic SIS (2012); and |

| • |

1st and only Chinese company to provide DEH control system for gigawatt power plant (as of 2018). |

| • |

Led or participated in the formulation of national standards including industrial enterprise information integration system standards, urban rail transit integrated supervision and control system design specifications, industrial-process measurement, and reference model for control and automation production facility (digital factory). |

| • |

Obtained national-level recognitions including PRC State Council’s State Science and Technology Progress Award, National Development and Reform Commission’s State Accredited Enterprise Technology Center, Ministry of Science and Technology’s Technology Innovation Demonstration Enterprise, and the Ministry of Industry and Information Technology’s designation as an Intelligent Manufacturing System Solutions Provider (among the first to receive the designation) and award for excellence in Industrial Internet App Solutions in 2018. |

| • |

Received product and service quality awards from Hong Kong’s Mass Transit Railway (MTR) for five consecutive years, including the Gold Quality Award in 2016, the highest honor given by MTR in respect to project quality management. |

| • |

Proven credentials with high barriers to entry |

| • |

Integrated, customized solutions leading to high customer satisfaction and stickiness. |

| • |

Strong technology, engineering and R&D capabilities |

| • |

Visionary and professional board and management team |

| • |

Strengthening market leadership and expanding market shares |

| • |

Further expanding our comprehensive automation solutions matrix |

| • |

Continuing to optimize our operations and enhance profitability |

| • |

Investing in research and development, and our talent |

| • |

Exploring international business opportunities and expanding overseas presence strategically. |

| • |

publishing internal research reports and customer newsletters; |

| • |

conducting seminars and conferences; |

| • |

conducting ongoing public relations programs; and |

| • |

creating and placing advertisements |

|

| (i) |

On November 24, 2015, the Company established CECL to explore the market in Qatar. CCPL has a 49% direct ownership of CECL and the remaining 51% equity interest is held by a nominee shareholder. Through a series of contractual arrangements, CCPL is entitled to appoint majority of directors of CECL who have the power to direct the activities that significantly impact CECL’s economic performance. Further, CCPL is entitled to 95% of the variable returns from CECL’s operations. As a result, despite of its minority direct ownership of CECL arrangements, CCPL is considered the primary beneficiary of CECL. |

| (ii) |

In July 2017, BCPL, a wholly-owned Singapore subsidiary of the Company, and a Malaysian citizen (the “Trustee”) entered into a trust deed, under which, 49.1% of BCPL’s equity interests in BMJB, a Malaysian company, which previously was a 100% subsidiary of BCPL, was transferred to the Trustee. According to the trust deed, all of the beneficial interests in BMJB belong to BCPL and the Trustee shall hold the legal title of the transferred shares on trust for and act on behalf of BCPL absolutely. Any dividend, interest and other benefits received or receivable by the Trustee will be transferred to BCPL. The Trustee shall exercise the managerial rights and voting power in a manner directed by a prior written notice from BCPL. The Trustee shall be obligated to vote in the same manner as BCPL in the absence of any written notice. In addition, an undated Form of Transfer of Securities with the transferee’s name left blank was duly executed by the Trustee and delivered to BCPL. Therefore, BCPL can transfer the 49.1% of equity interests to any party at any time without further approval by the Trustee. Accordingly, the Company believes it holds all beneficial rights, obligation and the power of the 100% equity interest in BMJB, and therefore consolidates 100% of equity interests in BMJB into its financial statements. |

| (iii) |

In August 2018, the Company agreed and transferred 100% of their equity interest in Hollysys Intelligent, a wholly owned subsidiary, to Ningbo Hollysys” in exchange for a 40% equity interest in Ningbo Hollysys. Upon the transfer of the equity interest, the Company lost control of Hollysys Intelligent and therefore, deconsolidated the subsidiary. |

| Location |

Approximate Sq. Meters |

|||

| Beijing |

120,000 | |||

| Hangzhou |

25,000 | |||

| Singapore |

1,200 | |||

| Malaysia |

3,400 | |||

| ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

| ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

Years Ended June 30, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Number of new contracts won during the year |

3,277 |

4,637 |

4,784 |

|||||||||

| Total amount of new contracts (million) |

$ |

634.0 |

$ |

724.9 |

$ |

549.2 |

||||||

| Average price per contract |

$ |

193,470 |

$ |

156,330 |

$ |

114,790 |

||||||

Years Ended June 30, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Backlog Situation: |

||||||||||||

| Contracts newly entered and unfinished (million) |

$ |

321.6 |

$ |

348.3 |

$ |

262.3 |

||||||

| Contracts entered in prior years and unfinished (million) |

$ |

247.4 |

$ |

245.9 |

$ |

309.5 |

||||||

| Total amount of backlog (million) |

$ |

569.0 |

$ |

594.2 |

$ |

571.8 |

||||||

| • |

The ability in developing and acquiring new products and systems in order to improve competitiveness, which can increase both sales revenue and margins. The success of our business depends in great measure on our ability to keep pace with or even lead changes that occur in our industry. |

| • |

The success in expanding our business in targeted emerging markets and overseas markets, which may require us to overcome domestic competition and trade barriers. |

| • |

Our ability to retain our existing customers and to obtain additional business opportunities. Since we do not have long-term purchase commitments from customers, our customers can shift to other competitors for future projects. It is important to maintain our customer base in order to sustain and expand our business. |

| • |

The success of our business also depends on securing a steady stream of new customers. In order for our business to continue to succeed and grow, it is vital to secure contracts with new customers on a regular basis. |

| • |

The ability to secure adequate engineering resources and relatively low cost engineering staff can increase our profitability and potential business prospects. One of the competitive advantages that we enjoy is the access to lower cost engineering staff as compared to those of our Western and Japan-based competitors. The plentiful supply of affordable engineering talent in China is a key element of our overall business strategy. |

| • |

Further improvement in product design and maintaining high standard of quality control, which can reduce or avoid product defects. Any product defects will result in additional costs and cause damage to our business reputation. |

| • |

The ability to secure and protect our intellectual property rights is critical, as our business is based on a number of proprietary products and systems, and we strive to strengthen and differentiate our product portfolio by developing new and innovative products and product improvements. |

| • |

The success in penetrating into the railway, conventional and nuclear power market sectors can develop revenue streams and improve margins. In addition to the traditional industrial automation business, our plan for future growth includes an increasing emphasis on rail control systems, power generation control systems and mechanical and electrical solutions both in China and internationally. |

| • |

The ability to obtain greater financial resources to match or even exceed our major competitors, in order to compete effectively with them, and to weather any extended weaknesses in the automation and control market. |

| • |

The continued growth in the Chinese and Southeast Asia industry in general. This continued growth will create more business opportunities for us, because industrial companies in Asia are our principal source of revenues. |

| • |

The ability to maintain key personnel and senior management, who will have significant impact and contribution to our future business. The ability to attract and retain additional qualified management, technical, sales and marketing personnel will be vital. |

| • |

The continuation of the preferential tax treatment and subsidies currently available to our PRC subsidiaries will be critical to our future operating results. If governmental subsidies were reduced or eliminated, our after-tax income would be adversely affected. |

| • |

The exchange rate fluctuation of RMB and SGD against US dollars will result in future translation gain or loss as most of our assets are denominated in RMB and SGD. In addition, some of our raw materials, components and major equipment are imported from overseas. In the event that the RMB and SGD appreciate against other foreign currencies, our costs will decrease and our profitability will increase. However, the impact will be the other way around if RMB and SGD depreciate against other foreign currencies. |

| • |

The COVID-19 pandemic has adversely impacted our business since the third quarter of fiscal year 2020. Among other things, the product manufacturing, logistics and fulfillment of us and certain third-party merchants and brands that cooperated with us were adversely affected due to various travel restrictions and quarantine measures imposed in the countries in which we operate . We have implemented preventative measures to protect the health and safety of our employees and made appropriate adjustments to our business operations in response to the pandemic’s impact. We have seen gradual recovery of our overall business resulting from improving health statistics in China since March 2020, however, the pandemic continued to have an adverse effect on our overseas business, especially in South East Asia and South Asia. We anticipate the negative impact of the pandemic may continue on our overseas business. The duration and magnitude of the impact from the pandemic on our business will depend on numerous evolving factors that cannot be accurately predicted or assessed. For additional details on the impact of the COVID-19 outbreak, see “Item 3. Key Information—D. Risk Factors— An Outbreak of Disease or Similar Public Health Threat, or Fear of Such an Event, Could Have a Material Adverse Impact on the Company’s Business, Operating Results and Financial Condition.” |

| A. |

Operating Results |

| • |

Total assets increased by $51.4 million, from $1,309.4 million as of June 30, 2019, to $1,360.8 million as of June 30, 2020. The increase was mainly due to an increase of $179.8 million in time deposits with original maturities over three months, which was partially offset by $43.7 million decrease in cash and cash equivalents, $40.1 million decrease in accounts receivables and $35.6 million decrease in goodwill. |

| • |

Cash and cash equivalents decreased by $43.7 million, from $332.5 million as of June 30, 2019, to $288.8 million as of June 30, 2020. The decrease was mainly due to $187.6 million net cash used in investing activities and $18.2 million net cash used in financing activities, partially offset by $175.1 million cash generated from operating activities. |

| • |

Accounts receivables at June 30, 2020 were $242.4 million, a decrease of $40.1 million, or 14.2%, compared to $282.6 million at June 30, 2019. |

| • |

Cost and estimated earnings in excess of billings as of June 30, 2020, were $186.9 million compared to $198.0 million as of June 30, 2019, representing a decrease of $11.1 million, or 5.6%. |

| • |

Inventory increased by $5.2 million, or 12.2%, from $43.0 million as of June 30, 2019, to $48.2 million as of June 30, 2020. |

| • |

Property, plant and equipment increased by $2.0 million, or 2.7%, from $76.0 million as of June 30, 2019, to $78.1 million as of June 30, 2020. |

| • |

Investments in equity investees increased by $0.7 million, or 1.8%, from $40.4 million as of June 30, 2019, to $41.1 million as of June 30, 2020. |

| • |

Total liabilities increased by $9.7 million or 2.7% from $362.3 million at June 30, 2019, to $371.9 million as of June 30, 2020. The increase in liabilities was mainly due to an increase of $7.1 million in accounts payable, an increase of $5.8 million in operating lease liability and an increase of $2.3 million in construction costs payable, offset by $14.8 million decreased in long-term bank loans. |

| • |

Short-term bank loans decreased by $1.9 million, from $1.9 million at June 30, 2019, to nil at June 30, 2020. |

| • |

Accounts payables increased by $7.1 million, or 6.4% from $110.4 million at June 30, 2019, to $117.5 million at June 30, 2020. |

| • |

Deferred revenue decreased by $2.1 million, or 1.5%, from $141.4 million at June 30, 2019, to $139.2 million at June 30, 2020. |

| • |

Deferred tax assets were $8.9 million as of June 30, 2020. Based on the Company’s historical operating results and order backlog, the Company believes that it is more than likely that the deferred tax assets net of valuation allowance would be realized. |

| (In USD millions) |

||||||||||||||||

Fiscal year ended June 30, |

||||||||||||||||

2019 |

2020 |

|||||||||||||||

$ |

% of Revenues |

$ |

% of Revenues |

|||||||||||||

| Industrial Automation |

233.8 |

41.0 |

% |

240.0 |

47.7 |

% | ||||||||||

| Rail Transportation |

208.9 |

36.6 |

% |

201.3 |

40.0 |

% | ||||||||||

| Mechanical and Electrical Solution |

127.6 |

22.4 |

% |

62.0 |

12.3 |

% | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

570.3 |

100.0 |

% |

503.3 |

100.0 |

% | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (In USD millions) |

||||||||||||||||

Fiscal year ended June 30, |

||||||||||||||||

2018 |

2019 |

|||||||||||||||

$ |

% of Revenues |

$ |

% of Revenues |

|||||||||||||

| Industrial Automation |

224.8 |

41.6 |

% |

233.8 |

41.0 |

% | ||||||||||

| Rail Transportation |

190.6 |

35.2 |

% |

208.9 |

36.6 |

% | ||||||||||

| Mechanical and Electrical Solution |

125.4 |

23.2 |

% |

127.6 |

22.4 |

% | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

540.8 |

100.0 |

% |

570.3 |

100.0 |

% | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| B. |

Liquidity and Capital Resources |

| Cash Flow Item |

Fiscal Years Ended June 30 |

|||||||||||

2018 |

2019 |

2020 |

||||||||||

| Net cash provided by operating activities |

$ |

105,719 |

$ |

100,521 |

$ |

175,124 |

||||||

| Net cash used in investing activities |

$ |

(49,748 |

) |

$ |

(9,888 |

) |

$ |

(187,580 |

) | |||

| Net cash used in financing activities |

$ |

(12,197 |

) |

$ |

(10,155 |

) |

$ |

(18,213 |

) | |||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

$ |

5,839 |

$ |

(9,400 |

) |

$ |

(8,621 |

) | ||||

| Net increase (decrease) in cash, cash equivalents and restricted cash |

$ |

49,613 |

$ |

71,078 |

$ |

(39,290 |

) | |||||

| Cash, cash equivalents and restricted cash, beginning of year |

$ |

237,696 |

$ |

287,309 |

$ |

358,387 |

||||||

| Cash, cash equivalents and restricted cash, end of year |

$ |

287,309 |

$ |

358,387 |

$ |

319,097 |

||||||

| C. |

Research and Development, Patents and Licenses |

| • |

Study phase |

| • |

Requirement phase |

| • |

Designing phase |

| • |

Implementation phase |

| • |

Testing phase |

| • |

Inspection phase |

| • |

Maintaining phase |

| • |

Transportation Automation; |

| • |

Manufacturing Automation; and |

| • |

Process Automation. |

| D. |

Trend Information |

| E. |

Off-Balance Sheet Arrangements |

| F. |

Tabular Disclosure of Contractual Obligations |

| (In USD thousands) |

Total |

Less than 1 year |

1-3 years |

3-5 years |

More than 5 years |

|||||||||||||||

| Long-term Loans |

||||||||||||||||||||

| -Principal |

16,265 |

310 |

15,576 |

255 |

124 |

|||||||||||||||

| -Interest |

1,049 |

502 |

462 |

19 |

66 |

|||||||||||||||

| Operating Lease Obligations (1) |

6,618 |

3,038 |

3,195 |

385 |

— |

|||||||||||||||

| Purchase Obligations (2) |

233,484 |

187,749 |

28,584 |

11,434 |

5,717 |

|||||||||||||||

| Capital Obligations (3) |

14,359 |

14,359 |

— |

— |

— |

|||||||||||||||

| Standby Letters of Credit (4) |

1,850 |

1,850 |

— |

— |

— |

|||||||||||||||

| Performance Guarantees (5) |

42,117 |

29,141 |

10,648 |

2,328 |

— |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

315,742 |

236,949 |

58,465 |

14,421 |

5,907 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) |

Operating lease obligations |

| (2) |

Purchase obligations |

| (3) |

Capital obligations |

| (4) |

Standby letters of credit |

| (5) |

Performance guarantees |

| G. |

Safe Harbor |

| ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| A. |

Directors and Senior Management |

| Name |

Age |

Position | ||||

| Chit Nim (Colin) SUNG |

54 | Chief Executive Officer and Director | ||||

| Steven Wang |

52 | Chief Financial Officer | ||||

| Lei FANG |

44 | Co-Chief Operating Officer | ||||

| Yue XU |

59 | Co-Chief Operating Officer | ||||

| Chunming HE |

52 | Chief Technology Officer | ||||

| Hongyuan SHI |

51 | Chief Human Resource Officer | ||||

| Li QIAO |

63 | Chairwoman | ||||

| Jianyun CHAI |

59 | Director | ||||

| Kok Peng TEH |

72 | Director | ||||

| Khiaw Ngoh TAN |

63 | Director | ||||

| B. |

Compensation |

| C. |

Board Practices |

| • |

selecting our independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by our independent auditors; |

| • |

reviewing with our independent auditors any audit problems or difficulties and management’s response; |

| • |

reviewing and approving all proposed related-party transactions; |

| • |

discussing the annual audited financial statements with management and our independent auditors; |

| • |

reviewing major issues as to the adequacy of our internal controls and any special audit steps adopted in light of significant internal control deficiencies; |

| • |

annually reviewing and reassessing the adequacy of our audit committee charter; |

| • |

such other matters that are specifically delegated to our audit committee by our board of directors from time to time; |

| • |

meeting separately and periodically with management and our internal and independent auditors; and |

| • |

reporting regularly to the full board of directors. |

| • |

approving and overseeing the compensation package for our chief executive officer and the other senior executive officers; |

| • |

reviewing and approving corporate goals and objectives relevant to the compensation of our chief executive officer, evaluating the performance of our chief executive officer in light of those goals and objectives, and setting the compensation level of our chief executive officer based on this evaluation; |

| • |

reviewing and making recommendations in respect of director compensation; |

| • |

engaging and overseeing compensation consultants; |

| • |

reviewing periodically and making recommendations to the Board regarding any long-term incentive compensation or equity plans, programs or similar arrangements, annual bonuses, employee pension and welfare benefit plans and the administration of those plans; and |

| • |

reviewing and making recommendations to the Board regarding succession plans for the chief executive officer and other senior officers. |

| • |

identifying and recommending to the Board nominees for election or re-election to the board, or for appointment to fill any vacancy; |

| • |

reviewing annually with the board the current composition of the board in light of the characteristics of independence, age, skills, experience and availability of service to us; |

| • |

identifying and recommending to the board the directors to serve as members of the board’s committees; and |

| • |

monitoring compliance with our Corporate Governance Guidelines |

| D. |

Employees |

| Category |

China |

Overseas |

Total |

|||||||||

| Sales & Marketing |

492 |

31 |

523 |

|||||||||

| Research and development |

713 |

— |

713 |

|||||||||

| Engineering |

1,010 |

482 |

1,492 |

|||||||||

| Production |

368 |

— |

368 |

|||||||||

| Management |

362 |

140 |

502 |

|||||||||

| |

|

|

|

|

|

|||||||

| Total |

2,945 |

653 |

3,598 |

|||||||||

| |

|

|

|

|

|

|||||||

| E. |

Share Ownership |

| Name & Address of Beneficial Owner |

Office, if Any |

Title of Class |

Amount & Nature of Beneficial Ownership (1) |

Percent of Class (2) |

||||||||

| Officers and Directors |

| |||||||||||

| Chit Nim (Colin) SUNG |

Chief Executive Officer and Director |

Ordinary Shares |

90,000 | (3) |

* | |||||||

| Steven WANG |

Chief Financial Officer |

Ordinary Shares |

* | * | ||||||||

| Lei FANG |

Co-Chief Operating Officer |

Ordinary Shares |

681,471 | (4) |

1.13 | % | ||||||

| Yue XU |

Co-Chief Operating Officer |

Ordinary Shares |

* | * | ||||||||

| Chunming HE |

Chief Technology Officer |

Ordinary Shares |

* | * | ||||||||

| Hongyuan SHI |

Chief Human Resource Officer |

Ordinary Shares |

* | * | ||||||||

| Li QIAO |

Chairwoman |

Ordinary Shares |

558,088 | (5) |

* | |||||||

| Jianyun CHAI |

Director |

Ordinary Shares |

60,000 | (6) |

* | |||||||

| Kok Peng TEH |

Director |

Ordinary Shares |

* | * | ||||||||

| Khiaw Ngoh TAN |

Director |

Ordinary Shares |

* | * | ||||||||

| 5% Securities Holder |

| |||||||||||

| Davis Selected Advisers, L.P. |

Ordinary Shares |

6,602,765 | (7) |

10.91 | % | |||||||

| Eastspring Investments (Singapore) Limited |

Ordinary Shares |

5,953,707 | (8) |

9.83 | % | |||||||

| Ace Lead Profits Limited. |

Ordinary Shares |

4,144,223 | (9) |

6.85 | % | |||||||

| * |

Less than 1%. |

| (1) |

Beneficial Ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Except as otherwise indicated, each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to our ordinary shares. |

| (2) |

As of September 21, 2020, a total of 60,537,099 ordinary shares are outstanding pursuant to SEC Rule 13d-3(d)(1). For each beneficial owner above, any options exercisable within 60 days have been included in the denominator. |

| (3) |

Including 90,000 restricted shares granted and issued, among which 18,750 restricted shares are not yet vested. |

| (4) |

The securities reported as held indirectly by Mr. Lei FANG through Golden Result Enterprises Limited. The foregoing entity is a BVI entity that is wholly-owned and controlled by Mr. Lei Fang therefore he may be deemed to be the beneficial owner of the ordinary shares held by it. |

| (5) |

Including 528,088 ordinary shares held directly by Acclaimed Insight Investments Ltd, Glory Pearl International Ltd and Time Keep Investment Ltd., each owned and controlled by Ms. Qiao, who is the sole director of each entity as well as 30,000 restricted shares granted and issued, among which 12,500 restricted shares are not yet vested. |

| (6) |

Including 60,000 restricted shares granted and issued, among which 13,750 restricted shares are not yet vested. |

| (7) |

Based on information provided by Davis Selected Advisers, L.P. in Amendment No. 3 to Schedule 13G filed with the SEC on February 13, 2020 |

| (8) |

Based on information provided by Eastspring Investments (Singapore) Limited in Amendment No. 4 to Schedule 13G filed with the SEC on February 18, 2020. |

| (9) |

Based on information provided by Ace Lead Profits Limited in Schedule 13D filed on September 26, 2016. See “Risk Factors—Risks Related to Our Business— Our business could be negatively affected by the dispute in connection with the ownership of Ace Lead Profits Limited (“Ace Lead”).” |

| ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

| A. |

Major Shareholders |

| B. |

Related Party Transactions |

| C. |

Interests of Experts and Counsel |

| ITEM 8. |

FINANCIAL INFORMATION |

| A. |

Consolidated Statements and Other Financial Information |

| B. |

Significant Changes |

| ITEM 9. |

THE OFFER AND LISTING |

| A. |

Offer and Listing Details |

| B. |

Plan of Distribution |

| C. |

Markets |

| D. |

Selling Shareholders |

| E. |

Dilution |

| F. |

Expenses of Issue |

| ITEM 10. |

ADDITIONAL INFORMATION |

| A. |

Share Capital |

| B. |

Memorandum and Articles of Association |

| C. |

Material Contracts |

| D. |

Exchange Controls |

| E. |

Taxation |

| • |

banks, insurance companies or other financial institutions; |

| • |

persons subject to the alternative minimum tax; |

| • |

tax-exempt organizations; |

| • |

corporations that accumulate earnings to avoid United States federal income tax; |

| • |

certain former citizens or long-term residents of the United States; |

| • |

dealers in securities or currencies; |

| • |

traders in securities that elect to use a mark-to-market |

| • |

persons that own, or are deemed to own, more than five percent of our capital stock; |

| • |

holders who acquired our ordinary shares as compensation or pursuant to the exercise of a stock option; |

| • |

persons who hold our ordinary shares as a position in a hedging transaction, “straddle,” or other risk reduction transaction; or |

| F. |

Dividends and Paying Agents |

| G. |

Statement by Expert |

| H. |

Documents on Display |

| I. |

Subsidiary Information |

| ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

| ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

| ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

| ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITIES HOLDERS AND USE OF PROCEEDS |

| ITEM 15. |

CONTROLS AND PROCEDURES |

| ITEM 16A. |

AUDIT COMMITTEE FINANCIAL EXPERT |

| ITEM 16B. |

CODE OF ETHICS |

| ITEM 16C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

| ITEM 16D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

| ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

| ITEM 16F. |

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT |

| ITEM 16G. |

CORPORATE GOVERNANCE |

| ITEM 16H. |

MINE SAFETY DISCLOSURE |

| ITEM 17. |

FINANCIAL STATEMENTS |

| ITEM 18. |

FINANCIAL STATEMENTS |

| ITEM 19. |

EXHIBITS |

Number |

Description | |

| 1.1 |

||

| 2.1 |

||

| 2.2 |

||

| 4.1 |

||

| 8.1 |

||

| 11.1 |

||

| 12.1 |

||

| 12.2 |

||

| 13.1* |

||

| 13.2* |

||

| 15.1 |

||

| 99.1 |

||

| 101.INS |

XBRL Instant Document | |

| 101.SCH |

XBRL Taxonomy Extension Schema Document | |

| 101.CAL |

XBLR Taxonomy Extension Calculation Linkbase Document | |

| 101.DEF |

XBRL Taxonomy Extension Definition Linkbase | |

| 101.LAB |

XBRL Taxonomy Extension Label Linkbase | |

| 101.PRE |

XBRL Taxonomy Extension Presentation Linkbase | |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

| * |

Furnished with this annual report on Form 20-F |

| HOLLYSYS AUTOMATION TECHNOLOGIES LTD. | ||||||

| /s/ Chit Nim (Colin) Sung | ||||||

| |

Chit Nim (Colin) Sung | |||||

| Chief Executive Officer | ||||||

| Date: September 28, 2020 |

||||||

Page |

||||

F-2 |

||||

F-8 |

||||

F-11 |

||||

F-13 |

||||

F-16 |

||||

F-17 |

||||

| Estimation of expected total costs of integrated solutions contracts | ||

| Description of the Matter |

During the year ended June 30, 2020, the Company recognized revenue generated from integrated solutions contracts of US$414,272 thousands. As discussed in Note 2 of the consolidated financial statements, revenues generated from integrated solutions contracts are recognized over time based on a cost-to-cost method. The extent of progress towards completion is determined by dividing costs incurred to date by the total amount of costs expected to be incurred for the integrated solutions contracts. The Company reviews and updates the estimated total costs of the contracts at least annually. Revisions to contract revenue and estimated total costs of the contracts are made in the period in which the facts and circumstances that cause the revision become known and are accounted for as changes in estimates. | |

| Auditing the estimated total costs of integrated solutions contracts was complex due to the significant estimation uncertainty in management’s determination of the expected total costs, which is principally comprised of the following significant assumptions regarding the Company’s future efforts or inputs: direct costs of equipment and materials and direct labor costs. The significant estimation uncertainty is primarily due to the long construction periods and the sensitivity of these assumptions to the determination of the extent of progress towards completion and estimated total costs of integrated solutions contracts, as they both impact revenue and gross profit realization. The significant assumptions are forward-looking and could be affected by future economic and market conditions and changes in the level of effort and costs required to complete the integrated solutions contracts. The total costs incurred may not always be proportionate to the entity’s progress in satisfying their performance obligations. Changes in the estimated total costs affects the revenue recognized in the current period and in future periods. | ||

| How We Addressed the Matter in Our Audit |

We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over management’s process to determine the estimated total costs of integrated solutions contracts. For example, we tested controls over management’s review of the key assumptions and inputs used to determine the estimated total costs at initial set up of the contract and management’s review of the subsequent revisions made to the estimated total costs. | |

| To test estimated total costs of the integrated solutions contracts, our audit procedures included, among others, reviewing the key terms and conditions of a sample of contracts, and evaluating the reasonableness of management’s assumptions discussed above by comparing the inputs to the Company’s historical data or experience for similar contracts and customer specifications. In addition, we recalculated estimated total costs and the extent of progress towards completion as of year-end for a sample of integrated solution contracts and compared them to the Company’s computations. For revisions made to the estimated total costs, we evaluated the reasonableness of the subsequent changes by comparing the revised inputs to the approved changed orders and/or supplemental contracts and recalculated the revised estimated costs. | ||

| Valuation of goodwill for the Bond Group reporting unit | ||

| Description of the Matter |

At June 30, 2020, the Company’s consolidated goodwill, net of impairment charge, was US$1,460 thousands. As discussed in Notes 2 and 10 of the consolidated financial statements, goodwill is tested for impairment at least annually at the reporting unit level, or more frequently if indicators of impairment exist. Due to downward revision of forecasted future profits of the Bond Group reporting unit to reflect the impact of COVID-19, the Company determined it was more-likely-than-not that an impairment existed and performed a quantitative goodwill impairment test as of June 30, 2020. The Company performed the two-step quantitative goodwill impairment test with the assistance of an independent third-party appraiser and estimated the fair value of the reporting unit using a discounted cash flow approach. As a result, the Company recorded a full impairment charge of US$35,767 thousands attributable to its Bond Group reporting unit. Auditing management’s annual goodwill impairment test for the Bond Group reporting unit was complex and highly judgmental due to the significant estimation required by management in forecasting the amount and timing of expected future cash flows and the underlying assumptions used in the discounted cash flow approach to determine the fair value of the Bond Group reporting unit. In particular, the fair value estimate was sensitive to significant assumptions, such as forecasted revenue growth rates, gross profit margins and discount rates. These significant assumptions are forward looking and could be materially affected by future market or global economic conditions. | |

| How We Addressed the Matter in Our Audit |

We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the Company’s goodwill impairment review process, including controls over management’s review of the significant assumptions described above and its cash flow forecasts. To test the estimated fair value of the Bond Group reporting unit, we performed audit procedures that included, among others, involving our valuation specialists to assist in assessing the Company’s valuation methodology and benchmarking the discount rates used by management to comparable companies. We assessed the reasonableness of the Company’s assumptions around forecasted revenue growth rates and gross profit margins, by comparing those assumptions to recent historical performance and current economic and industry trends. We recalculated the reporting unit’s fair value based on management’s significant assumptions and compared it to the carrying value. We also performed sensitivity analyses of the significant assumptions to evaluate the impact on the change in the implied fair value of goodwill for the reporting unit that would result from changes in the significant assumptions. | |

Beijing, The People’s Republic of China

September 28, 2020

June 30, |

||||||||||||

Notes |

2019 |

2020 |

||||||||||

| ASSETS |

||||||||||||

| Current assets: |

||||||||||||

| Cash and cash equivalents |

$ |

$ |

||||||||||

| Time deposits with original maturities over three months |

||||||||||||

| Restricted cash |

||||||||||||

| Accounts receivable, net of allowance for doubtful accounts of $ |

4 |

|||||||||||

| Costs and estimated earnings in excess of billings, net of allowance for doubtful accounts of $ |

5 |

|||||||||||

| Accounts receivable retention |

6 |

|||||||||||

| Other receivables, net of allowance for doubtful accounts of $ |

||||||||||||

| Advances to suppliers |

||||||||||||

| Amounts due from related parties |

22 |

|||||||||||

| Inventories |

3 |

|||||||||||

| Prepaid expenses |

||||||||||||

| Income tax recoverable |

||||||||||||

| |

|

|

|

|||||||||

| Total current assets |

||||||||||||

| |

|

|

|

|||||||||

| Non-current assets: |

||||||||||||

| Restricted cash |

||||||||||||

| Costs and estimated earnings in excess of billings |

— |

|||||||||||

| Accounts receivable retention |

6 |

|||||||||||

| Prepaid expenses |

||||||||||||

| Property, plant and equipment, net |

7 |

|||||||||||

| Prepaid land leases |

8 |

|||||||||||

| Intangible assets, net |

9 |

|||||||||||

| Investments in equity investees |

11 |

|||||||||||

| |

|

|

|

|

|

|

June 30, |

||||||

| |

|

|

Notes |

|

|

|

2019 |

|

|

2020 |

|||

| Investments securities |

11 |

||||||||||||

| Goodwill |

10 |

||||||||||||

| Deferred tax assets |

19 |

||||||||||||

| Operating lease right-of-use assets |

20 |

— |

|||||||||||

| |

|

|

|

||||||||||

| Total non-current assets |

|||||||||||||

| |

|

|

|

||||||||||

| Total assets |

$ |

$ |

|||||||||||

| |

|

|

|

||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|||||||||||||

| Current liabilities $ |

|||||||||||||

| Derivative financial liability |

15 |

$ |

$ |

||||||||||

| Short-term bank loans |

13 |

— |

|||||||||||

| Current portion of long-term loans |

14 |

||||||||||||

| Accounts payable |

|||||||||||||

| Construction costs payable |

|||||||||||||

| Deferred revenue |

|||||||||||||

| Accrued payroll and related expenses |

|||||||||||||

| Income tax payable |

|||||||||||||

| Warranty liabilities |

12 |

||||||||||||

| Other tax payables |

|||||||||||||

| Accrued liabilities |

|||||||||||||

| Amounts due to related parties |

22 |

||||||||||||

| Operating lease liabilities |

20 |

— |

|||||||||||

| |

|

|

|

||||||||||

| Total current liabilities |

|||||||||||||

| |

|

|

|

||||||||||

| Non-current liabilities |

|||||||||||||

| Accrued liabilities |

|||||||||||||

| Long-term loans |

14 |

||||||||||||

| Accounts payable |

— |

||||||||||||

| Deferred tax liabilities |

19 |

||||||||||||

| Warranty liabilities |

12 |

||||||||||||

| Operating lease liabilities |

20 |

— |

|||||||||||

| |

|

|

|

||||||||||

| Total non-current liabilities |

|||||||||||||

| |

|

|

|

||||||||||

| |

|

|

|

June 30, |

| ||||||||

| |

|

|

Notes |

|

|

|

2019 |

|

|

2020 |

|||

| Total liabilities |

|||||||||||||

| |

|

|

|

||||||||||

| Commitments and contingencies |

23 |

||||||||||||

| Stockholders’ equity: |

16 |

||||||||||||

| Ordinary shares, par value $ |

|||||||||||||

| Additional paid-in capital |

|||||||||||||

| Statutory reserves |

|||||||||||||

| Retained earnings |

|||||||||||||

| Accumulated other comprehensive income |

( |

) |

( |

) | |||||||||

| |

|

|

|

||||||||||

| Total Hollysys Automation Technologies Ltd. stockholders’ equity |

|||||||||||||

| Non-controlling interests |

|||||||||||||

| |

|

|

|

||||||||||

| Total equity |

|||||||||||||

| |

|

|

|

||||||||||

| Total liabilities and equity |

$ |

$ |

|||||||||||

| |

|

|

|

||||||||||

Year ended June 30, |

||||||||||||||||

Notes |

2018 |

2019 |

2020 |

|||||||||||||

| Net revenues |

||||||||||||||||

| Integrated solutions contracts revenue (including revenue from related parties of $ |

$ |

$ |

$ |

|||||||||||||

| Product sales (including revenue from related parties of $ |

||||||||||||||||

| Revenue from services |

||||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Total net revenues |

||||||||||||||||

| Costs of integrated solutions contracts (including purchases from related parties of $ |

||||||||||||||||

| Costs of products sold (including purchases from related parties of $ |

||||||||||||||||

| Costs of services rendered |

||||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Gross profit |

||||||||||||||||

| Operating expenses |

||||||||||||||||

| Selling |

||||||||||||||||

| General and administrative |

||||||||||||||||

| Goodwill impairment charge |

— |

|||||||||||||||

| Research and development (including resea from related parties of rch and development |

||||||||||||||||

| VAT refunds and government subsidies |

( |

) |

( |

) |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Total operating expenses |

||||||||||||||||

| |

|

|

|

|

|

|||||||||||

| Income from operations |

||||||||||||||||

| Other income, net (including other income from related parties of $ |

||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

|

|

|

Year ended June 30, |

| |||||||||

Notes |

2018 |

2019 |

2020 |

|||||||||||

| Foreign exchange (loss) gain |

( |

) |

( |

) |

||||||||||

| Gains on deconsolidation of subsidiaries where the Company retains an equity interest |

— |

— |

||||||||||||

| Gains on disposal of an investment in an equity investee |

— |

— |

||||||||||||

| Share of net (losses) income of equity investees |

( |

) |

||||||||||||

| Interest income |

||||||||||||||

| Interest expenses |

( |

) |

( |

) |

( |

) | ||||||||

| Dividend income from equity investments |

||||||||||||||

| |

|

|

|

|

|

|||||||||

| Income before income taxes |

||||||||||||||

| Income tax expenses |

19 |

|||||||||||||

| |

|

|

|

|

|

|||||||||

| Net income |

||||||||||||||

| Less: Net income (losses) attributable to non-controlling interests |

( |

) | ||||||||||||

| |

|

|

|

|

|

|||||||||

| Net income attributable to Hollysys Automation Technologies Ltd. |

$ |

$ |

$ |

|||||||||||

| |

|

|

|

|

|

|||||||||

| Other comprehensive income, net of tax of nil |

||||||||||||||

| Translation adjustments |

$ |

$ |

( |

) |

$ |

( |

) | |||||||

| |

|

|

|

|

|

|||||||||

| Comprehensive income |

||||||||||||||

| |

|

|

|

|

|

|||||||||

| Less: Comprehensive income (loss) attributable to non-controlling interests |

( |

) | ||||||||||||

| |

|

|

|

|

|

|||||||||

| Comprehensive income attributable to Hollysys Automation Technologies Ltd. |

$ |

$ |

$ |

|||||||||||

| |

|

|

|

|

|

|||||||||

| Net income per share: |

||||||||||||||

| Basic |

21 |

$ |

||||||||||||

| Diluted |

21 |

$ |

||||||||||||

| Shares used in net income per share computation: |

||||||||||||||

| Basic |

||||||||||||||

| Diluted |

||||||||||||||

Year ended June 30, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Cash flows from operating activities: |

||||||||||||

| Net income |

$ |

$ |

$ |

|||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

| Depreciation of property, plant and equipment |

||||||||||||

| Amortization of prepaid land leases |

||||||||||||

| Amortization of intangible assets |

||||||||||||

| Allowance for doubtful accounts |

||||||||||||

| (Gain) loss on disposal of long-lived assets |

( |

) |

( |

) | ||||||||

| Impairment loss on property, plant and equipment |

— |

— |

||||||||||

| Goodwill impairment charge |

— |

|||||||||||

| Share of net loss (income) of equity investees |

( |

) |

( |

) | ||||||||

| Dividends received from an equity investee |

— |

— |

||||||||||

| Gains on deconsolidation of subsidiaries where the Company retains an equity interest |

— |

( |

) |

— |

||||||||

| Gains on disposal of an investment of an equity investee |

— |

— |

( |

|||||||||

| Share-based compensation expenses |

||||||||||||

| Deferred income tax (benefit) expenses |

( |

) |

( |

) |

||||||||

| Accretion of convertible bond |

||||||||||||

| Fair value adjustments of a bifurcated derivative |

( |

) |

— |

|||||||||

| Changes in operating assets and liabilities: |

||||||||||||

| Accounts receivable and retention |

( |

) |

( |

) |

||||||||

| Costs and estimated earnings in excess of billings |

( |

) |

||||||||||

| Inventories |

( |

) |

( |

) |

( |

) | ||||||

| Advances to suppliers |

( |

) |

( |

) | ||||||||

| Other receivables |

( |

) |

( |

) | ||||||||

| Prepaid expenses |

( |

) |

( |

) | ||||||||

| Due from related parties |

||||||||||||

| |

|

|

Year ended June 30, |

| ||||||||

| |

|

|

2018 |

|

|

|

2019 |

|

|

|

2020 |

|

| Accounts payable |

( |

) |

||||||||||

| Deferred revenue |

||||||||||||

| Accruals and other payable |

( |

) |

( |

) | ||||||||

| Due to related parties |

( |

) |

( |

) | ||||||||

| Income tax payable |

( |

) |

||||||||||

| Other tax payables |

( |

) |

( |

) |

||||||||

| |

|

|

|

|

|

|||||||

| Net cash provided by operating activities |

$ |

$ |

$ |

|||||||||

| Cash flows from investing activities: |

||||||||||||

| Time deposits placed with banks |

( |

) |

( |

) |

( |

) | ||||||

| Maturity of time deposits |

||||||||||||

| Purchases of property, plant and equipment |

( |

) |

( |

) |

( |

) | ||||||

| Prepayments for land lease |

— |

( |

) |

— |

||||||||

| Proceeds from disposal of property, plant and equipment |

||||||||||||

| Investments made in equity investees |

( |

) |

— |

— |

||||||||

| Dividends received in excess of cumulative equity in earnings from an equity investee |

— |

— |

||||||||||

| Deconsolidation of subsidiary, disposed |

— |

( |

) |

— |

||||||||

| Acquisition of a subsidiary, acquir ed |

( |

) |

— |

( |

) | |||||||

| Purchase of equity investments |

— |

( |

) |

— |

||||||||

| Proceeds received from disposal of equity investments |

— |

|||||||||||

| |

|

|

|

|

|

|||||||

| Net cash used in investing activities |

( |

) |

( |

) |

( |

) | ||||||

| Cash flows from financing activities: |

||||||||||||

| Proceeds from short-term bank loans |

$ |

$ |

$ |

|||||||||

| Repayments of short-term bank loans |

( |

) |

( |

) |

( |

) | ||||||

| Proceeds from long-term bank loans |

||||||||||||

| Repayments of long-term bank loans |

( |

) |

( |

) |

( |

) | ||||||

| Capital contributions from a subsidiaries’ non-controlling interest shareholders |

— |

|||||||||||

| Payment of dividends |

( |

) |

( |

) |

( |

) | ||||||

| Principal repayment of convertible bond |

— |

— |

( |

) | ||||||||

| |

|

|

|

|||||||||

| |

|

|

Year ended June 30, |

| ||||||||

| |

|

|

2018 |