UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended | |

OR | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to . | |

OR | |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number:

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Address:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

The | ||||

The NASDAQ Global Select Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or ordinary shares as of the close of the period covered by the annual report (June 30, 2019):

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ⌧

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ◻Yes ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ⌧

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, "accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ⌧ | Accelerated filer◻ | Non-accelerated filer◻ |

Emerging growth company |

|

|

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International | Other ◻ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

◻ Item 17 ◻ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

HOLLYSYS AUTOMATION TECHNOLOGIES LTD.

ANNUAL REPORT ON FORM 20-F

FOR THE FISCAL YEAR ENDED JUNE 30, 2019

TABLE OF CONTENTS

|

| Page |

|

| |

| ||

|

| |

6 | ||

|

| |

6 | ||

|

| |

6 | ||

|

| |

37 | ||

|

| |

61 | ||

|

| |

61 | ||

|

| |

81 | ||

|

| |

89 | ||

|

| |

90 | ||

|

| |

91 | ||

|

| |

91 | ||

|

| |

103 | ||

|

| |

104 | ||

|

| |

|

| |

105 | ||

|

| |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITIES HOLDERS AND USE OF PROCEEDS | 105 | |

|

| |

105 | ||

|

| |

106 | ||

|

| |

106 | ||

|

| |

107 | ||

|

| |

107 | ||

|

| |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 107 | |

|

| |

107 | ||

|

| |

107 | ||

|

| |

108 | ||

|

| |

109 | ||

|

| |

109 | ||

|

| |

109 | ||

2

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this annual report to:

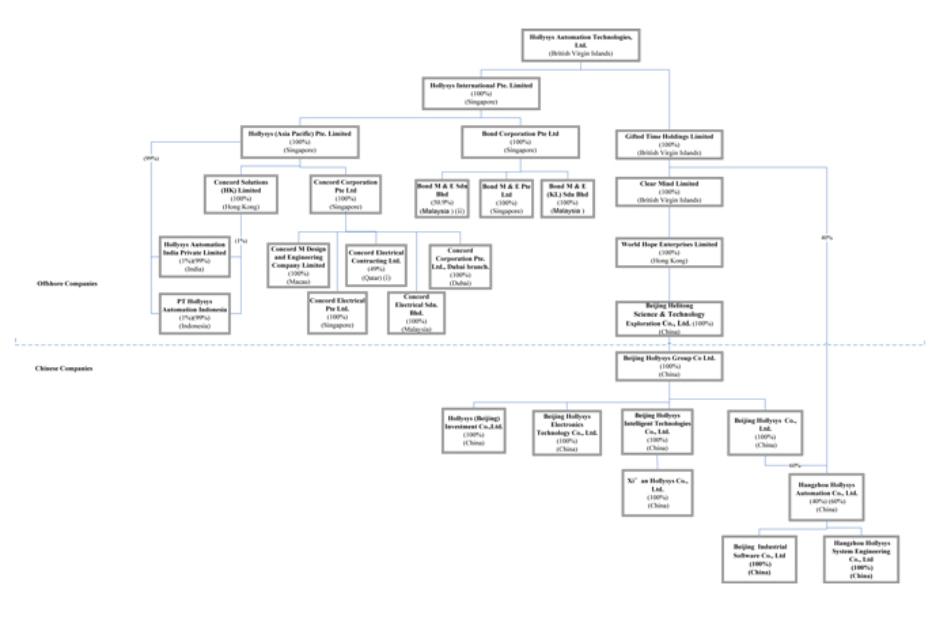

| ● | “Hollysys,” “we,” “us,” or “our,” and the “Company,” refer to the combined business of Hollysys Automation Technologies Ltd., a BVI company, and its consolidated subsidiaries, HI, HAP, HAIP, PTHAI, Bond Group, Concord Group, CSHK, GTH, Clear Mind, World Hope, Helitong, Hollysys Group, Hangzhou Hollysys, Hangzhou System, Hollysys Industrial Software, Beijing Hollysys, Hollysys Electronics, Xi’an Hollysys, Hollysys Investment, HollySys Smart Energy and Cixi HollySys; |

| ● | “HI” refers to Hollysys International Pte. Limited, a Singapore company; |

| ● | “HAP” refers to Hollysys (Asia Pacific) Pte. Limited, a Singapore company; |

| ● | “HAIP” refers to Hollysys Automation India Private Limited, an India Company; |

| ● | Bond Group” refers to a group of our subsidiaries, including Bond Corporation Pte. Ltd., a Singapore company (“BCPL”), Bond M&E Pte. Ltd., a Singapore Company (“BMSG”), Bond M&E Sdn. Bhd., a Malaysia company (“BMJB”), and Bond M&E (K.L.) Sdn. Bhd., a Malaysia company (“BMKL”); |

| ● | “Concord Group” refers to a group of our subsidiaries, including Concord Corporation Pte. Ltd. (“CCPL”), a Singapore company, and CCPL’s subsidiaries, Concord Electrical Pte. Ltd., a Singapore company (“CEPL”), Concord Electrical Sdn. Bhd., a Malaysia company (“CESB”), Concord Corporation Pte. Ltd, Dubai Branch (“CCPL Dubai”) Concord Electrical Contracting Ltd., a Qatar company(“CECL”), and Concord M Design and Engineering Company Ltd, a Macau company(“CMDE”); |

| ● | “CSHK” refers to Concord Solutions (HK) Limited, a Hong Kong company; |

| ● | “PTHAI” refers to PT Hollysys Automation Indonesia, an Indonesian company |

| ● | “GTH” refers to Gifted Time Holdings Limited, a BVI company; |

| ● | “Clear Mind” refers to Clear Mind Limited, a BVI company; |

| ● | “World Hope” refers to World Hope Enterprises Limited, a Hong Kong company; |

| ● | “Helitong” refers Beijing Helitong Science & Technology Exploration Co., Ltd., a PRC company; |

| ● | “Hollysys Group” refers to Hollysys Group Co., Ltd., formerly known as Beijing Hollysys Science & Technology Co., Ltd, a PRC company; |

| ● | “Hangzhou Hollysys” refers to Hangzhou Hollysys Automation Co., Ltd., a PRC company; |

| ● | “Hangzhou System” refers to Hangzhou Hollysys System Engineering Co., Ltd., a PRC company; |

| ● | “Hollysys Industrial Software” refers to Beijing Hollysys Industrial Software Company Ltd., a PRC company; |

| ● | “Beijing Hollysys” refers to Beijing Hollysys Co., Ltd., a PRC company; |

| ● | “Hollysys Electronics” refers to Beijing Hollysys Electronics Technology Co., Ltd., a PRC company; |

| ● | “Xi’an Hollysys” refers to Xi’an Hollysys Co., Ltd, a PRC company; |

3

| ● | “Hollysys Investment” refers to Hollysys (Beijing) Investment Co., Ltd., a PRC company; |

| ● | “HollySys Smart Energy” refers to HollySys Smart Energy Technology (Beijing) Co., Ltd., a PRC company; |

| ● | “Cixi HollySys” refers to Cixi HollySys Precision Technology Co., Ltd., a PRC company; |

| ● | “RMB” and “CNY” refer to Renminbi, the legal currency of China; “SGD” and “S$” refer to the Singapore dollar, the legal currency of Singapore; “US dollar,” “$” and “US$” refer to the legal currency of the United States; “MYR” refers to the Malaysian Ringgit, the legal currency of Malaysia; “AED” refers to the United Arab Emirates Dirham, the legal currency of United Arab Emirates; “HKD” refers to the Hong Kong dollar, the legal currency of Hong Kong; “MOP” refers to the Macau Pataca, the legal currency of Macau; “INR” refers to the Indian Rupee, the legal currency of India; and “QAR” refers to the Qatar Riyal, the legal currency of Qatar; “IDR” refers to Indonesia Rupiah, the legal currency of Indonesia. |

| ● | “BVI” refers to the British Virgin Islands; |

| ● | “China” and “PRC” refer to the People’s Republic of China; |

| ● | “Hong Kong” and “Hong Kong SAR” refer to the Hong Kong Special Administrative Region of China; |

| ● | “Macau” refers to the Macau Special Administrative Region of China; |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; and |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

In addition, we have listed below certain technical terms we use to describe our business and industry:

| ● | CTCS-2: Chinese Train Control System Level 2 |

| ● | CTCS-3: Chinese Train Control System Level 3 |

| ● | DCS: Distributed Control System |

| ● | DEH: Digital Electro-Hydraulic |

| ● | GW: Gigawatt |

| ● | IIoT: Industrial Internet of Things |

| ● | MW: Megawatt |

| ● | PaaS: Platform as a Service |

| ● | PLC: Programmable Logic Controller |

| ● | SaaS: Software as a Service |

| ● | SCADA: Supervisory Control and Data Acquisition |

4

FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements and information relating to us that are based on the current beliefs, expectations, assumptions, estimates and projections of our management regarding our company and industry. These forward-looking statements are made under the "safe harbor" provision under Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the Private Securities Litigation Reform Act of 1995. When used in this annual report, the words “may”, “will”, “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan” and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. These statements reflect management's current view of us concerning future events and are subject to certain risks, uncertainties and assumptions, including among many others: our potential inability to achieve similar growth in future periods as we did historically, a decrease in the availability of our raw materials, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, changes in economic conditions, uncertainties related to China’s legal system and economic, political and social events in China, the volatility of the securities markets, and other risks and uncertainties which are generally set forth under the heading, “Key information - Risk Factors” and elsewhere in this annual report. Should any of these risks or uncertainties materialize, or should the underlying assumptions about our business and the commercial markets in which we operate prove incorrect, actual results may vary materially from those described as anticipated, estimated or expected in this annual report.

All forward-looking statements included herein attributable to us or other parties or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we undertake no obligations to update these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

5

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Consolidated Financial Data

The following table presents selected financial data regarding our business. It should be read in conjunction with our consolidated financial statements and related notes contained elsewhere in this annual report and the information under Item 5, “Operating and Financial Review and Prospects.” The selected consolidated statement of comprehensive income data for the fiscal years ended June 30, 2017, 2018 and 2019 and the consolidated balance sheet data as of June 30, 2018 and 2019 have been derived from the audited consolidated financial statements of Hollysys that are included in this annual report beginning on page F-1. The selected statement of comprehensive income data for the fiscal years ended June 30, 2015 and 2016, and balance sheet data as of June 30, 2015, 2016 and 2017 have been derived from our audited financial statements that are not included in this annual report.

The audited consolidated financial statements for the years ended June 30, 2017, 2018 and 2019 are prepared and presented in accordance with generally accepted accounting principles in the United States, or US GAAP. The selected financial data information is only a summary and should be read in conjunction with the historical consolidated financial statements and related notes of Hollysys contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance.

6

Financial information in this report is reported in United States dollars, the reporting currency of the Company.

(In USD thousands, except share numbers and per share data) | ||||||||||

Years ended June 30, | ||||||||||

|

| 2015 |

| 2016 |

| 2017 |

| 2018 |

| 2019 |

Statement of Comprehensive Income Data |

|

|

|

|

|

|

|

|

|

|

Revenue |

| 531,379 |

| 544,325 |

| 431,943 |

| 540,768 |

| 570,341 |

Operating income |

| 130,107 |

| 120,583 |

| 60,270 |

| 120,244 |

| 123,626 |

Income before income taxes |

| 125,227 |

| 137,742 |

| 83,355 |

| 129,642 |

| 143,723 |

Net income attributable to Hollysys |

| 96,527 |

| 118,471 |

| 68,944 |

| 107,161 |

| 125,261 |

Add: Share-based compensation expenses |

| 2,492 |

| 3,860 |

| 464 |

| 1,207 |

| 238 |

Amortization of intangible assets |

| 4,454 |

| 818 |

| 623 |

| 598 |

| 311 |

Acquisition-related consideration fair value adjustments |

| (166) |

| (1,745) |

| — |

| — |

| — |

Fair value adjustments of a bifurcated derivative |

| 35 |

| 93 |

| 89 |

| (75) |

| 346 |

Non-GAAP net income attributable to Hollysys |

| 103,342 |

| 121,497 |

| 70,120 |

| 108,891 |

| 126,156 |

Weighted average ordinary shares: |

|

|

|

|

|

|

|

|

| |

Basic |

| 58,612,596 |

| 59,170,050 |

| 60,189,004 |

| 60,434,019 |

| 60,456,524 |

Diluted |

| 60,134,203 |

| 60,611,456 |

| 61,011,510 |

| 61,248,565 |

| 61,273,884 |

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

| 1.65 |

| 2.00 |

| 1.15 |

| 1.77 |

| 2.07 |

Diluted |

| 1.61 |

| 1.97 |

| 1.14 |

| 1.75 |

| 2.05 |

Non-GAAP earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

| 1.76 |

| 2.05 |

| 1.16 |

| 1.80 |

| 2.09 |

Diluted |

| 1.72 |

| 2.02 |

| 1.16 |

| 1.78 |

| 2.07 |

|

|

|

|

|

|

|

|

|

| |

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

Total current assets |

| 806,640 |

| 827,310 |

| 865,356 |

| 1,000,898 |

| 1,109,478 |

Total assets |

| 983,686 |

| 1,004,156 |

| 1,058,254 |

| 1,210,128 |

| 1,309,417 |

Total current liabilities |

| 374,596 |

| 297,326 |

| 302,978 |

| 333,054 |

| 341,499 |

Total liabilities |

| 398,301 |

| 321,471 |

| 334,714 |

| 367,775 |

| 362,257 |

|

|

|

|

|

|

|

|

|

| |

Net assets |

| 585,385 |

| 682,685 |

| 723,540 |

| 842,353 |

| 947,160 |

Non-controlling interests |

| 6,285 |

| 8,529 |

| 21 |

| 301 |

| 1,774 |

Stockholders’ equity |

| 579,100 |

| 674,156 |

| 723,519 |

| 842,052 |

| 945,386 |

Non-GAAP Measures

In evaluating our results, the non-GAAP measures of “Non-GAAP general and administrative expenses (“Non-GAAP G&A expenses”)”,“Non-GAAP cost of integrated solutions contracts”, “Non-GAAP other income (expenses), net”, “Non-GAAP interest expenses”, “Non-GAAP net income attributable to Hollysys” and “Non-GAAP earnings per share” serve as additional indicators of our operating performance and not as a replacement for other measures in accordance with US GAAP. We believe these non-GAAP measures are useful to investors as they exclude: 1) share-based compensation expenses, 2) amortization of intangible assets, 3) acquisition-related consideration fair value adjustments and 4) fair value adjustments of a bifurcated derivative. All of above will not result in any cash inflows or outflows. We believe that using non-GAAP measures help our shareholders have a better understanding of our operating results and growth prospects. In addition, given the business nature of Hollysys, it has been a common practice for investors and analysts to use such non-GAAP measures to evaluate the Company. Specifically, the non-GAAP measures excluded the following items:

| 1) | Share-based compensation expenses, which are calculated based on the number of shares or options granted and the fair value as of grant date. |

| 2) | Amortization of intangible assets, which is a non-cash expense relating primarily to acquisitions. At the time of an acquisition, the identifiable definite-lived intangible assets of the acquired company, such as customer relationships and order backlog, are valued and amortized over their estimated lives. Value is also assigned to the acquired indefinite-lived intangible assets, which comprise goodwill that are not subject to amortization. |

7

| 3) | Acquisition-related consideration fair value adjustments are accounting adjustments to report contingent share consideration liabilities at fair value and cash consideration at present value. These adjustments can be highly variable and are excluded from our assessment of performance because they are considered non-operational in nature and, therefore, are not indicative of current or future performance or ongoing costs of doing business. |

| 4) | Fair value adjustments of a bifurcated derivative are accounting adjustments to report the change of fair value of the feature bifurcated as a derivative from the underlying host instrument of a convertible bond, and accounted for as a liability at its fair value. |

The following table provides a reconciliation of U.S. GAAP measures to the non-GAAP measures for the periods indicated:

(In USD thousands, except share numbers and per share data) | ||||||||||

Years ended June 30, | ||||||||||

|

| 2015 |

| 2016 |

| 2017 |

| 2018 |

| 2019 |

Cost of integrated solutions contracts |

| 300,332 |

| 310,545 |

| 277,476 |

| 314,233 |

| 325,523 |

Less: Amortization of intangible assets |

| 4,454 |

| 818 |

| 623 |

| 598 |

| 311 |

Non-GAAP cost of integrated solutions contracts |

| 295,878 |

| 309,727 |

| 276,853 |

| 313,635 |

| 325,212 |

|

|

|

|

|

|

|

|

|

| |

G&A expenses |

| 50,786 |

| 45,832 |

| 44,297 |

| 46,323 |

| 40,701 |

Less: Share-based compensation expenses |

| 2,492 |

| 3,860 |

| 464 |

| 1,207 |

| 238 |

Non-GAAP G&A expenses |

| 48,294 |

| 41,972 |

| 43,833 |

| 45,116 |

| 40,463 |

|

|

|

|

|

|

|

|

|

| |

Other income (expenses), net |

| 2,601 |

| 4,061 |

| 1,722 |

| 4,349 |

| 2,710 |

Add: Acquisition-related incentive share contingent consideration fair value adjustments |

| (368) |

| (1,745) |

| — |

| — |

| — |

Add: Fair value adjustments of a bifurcated derivative |

| 35 |

| 93 |

| 89 |

| (75) |

| 346 |

Non-GAAP other income, net |

| 2,268 |

| 2,409 |

| 1,811 |

| 4,274 |

| 3,056 |

|

|

|

|

|

|

|

|

|

| |

Interest expenses |

| (1,821) |

| (1,404) |

| (938) |

| (692) |

| (575) |

Add: Acquisition-related cash consideration adjustments |

| 202 |

| — |

| — |

| — |

| — |

Non-GAAP interest expenses |

| (1,619) |

| (1,404) |

| (938) |

| (692) |

| (575) |

|

|

|

|

|

|

|

|

|

| |

Net income attributable to Hollysys |

| 96,527 |

| 118,471 |

| 68,944 |

| 107,161 |

| 125,261 |

Add: Share-based compensation expenses |

| 2,492 |

| 3,860 |

| 464 |

| 1,207 |

| 238 |

Amortization of intangible assets |

| 4,454 |

| 818 |

| 623 |

| 598 |

| 311 |

Acquisition-related consideration fair value adjustments |

| (166) |

| (1,745) |

| — |

| — |

| — |

Fair value adjustments of a bifurcated derivative |

| 35 |

| 93 |

| 89 |

| (75) |

| 346 |

Non-GAAP net income attributable to Hollysys |

| 103,342 |

| 121,497 |

| 70,120 |

| 108,891 |

| 126,156 |

Weighted average number of ordinary shares outstanding used in computation: |

|

|

|

|

|

|

|

|

|

|

Basic |

| 58,612,596 |

| 59,170,050 |

| 60,189,004 |

| 60,434,019 |

| 60,456,524 |

Diluted |

| 60,134,203 |

| 60,611,456 |

| 61,011,510 |

| 61,248,565 |

| 61,273,884 |

Non-GAAP earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

| 1.76 |

| 2.05 |

| 1.16 |

| 1.80 |

| 2.09 |

Diluted |

| 1.72 |

| 2.02 |

| 1.16 |

| 1.78 |

| 2.07 |

8

B. | Capitalization and Indebtedness |

Not applicable.

C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

D. | Risk Factors |

An investment in our capital stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occurs, our business, prospects, financial condition or results of operations could suffer. In that case, the trading price of our capital stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We commit substantial resources to new product and service development and acquisition opportunities in order to stay competitive and grow our business, and we may fail to offset the increased cost of such investment with a sufficient increase in net sales or margins.

The success of our business depends in great measure on our ability to keep pace with, or even lead, changes that occur in our industry and expand our product and service offerings. Traditionally, the automation and control systems business was relatively stable and slow moving. Successive generations of products offered only marginal improvements in terms of functionality and reliability. However, the emergence of computers, computer networks and electronic components as key elements of the systems that we design and build has accelerated the pace of change in our industry. Where there was formerly as much as a decade or more between successive generations of automation systems, the time between generations is now as little as two to three years. Technological advances and the introduction of new products, new designs and new manufacturing techniques by our competitors could adversely affect our business unless we are able to respond with similar advances. To remain competitive, we must continue to incur significant costs in product development, equipment and facilities and to make capital investments and seek complementary acquisitions. These costs may increase, resulting in greater fixed costs and operating expenses than we have incurred to date. As a result, we could be required to expend substantial funds for and commit significant resources to the following:

| ● | Research and development activities on existing and potential product solutions; |

| ● | Additional engineering and other technical personnel; |

| ● | Advanced design, production and test equipment; |

| ● | Manufacturing services that meet changing customer needs; |

| ● | Technological changes in manufacturing processes; |

| ● | Expansion of manufacturing capacity; and |

| ● | Acquiring technology through licensing and acquisitions. |

Our future operating results will depend to a significant extent on our ability to continue providing new product and service solutions that compare favorably on the basis of time to market, cost and performance, with competing third-party suppliers and technologies. However, we may develop new products and services that do not gain market acceptance, which would result in the failure to recover the significant costs for design and manufacturing for new product solutions or service development, thus adversely affecting operating results.

9

Our businesses and financial performance may be affected by changes in the PRC government policies promoting infrastructural development, such as high-speed rail and urban mass transit. Any decrease in the public expenditures on, or any change in the public procurement policies or industry standards relating to, such industries may affect our business.

Our business includes providing high-speed rail signaling systems that ensure operational safety of passenger trains. The development of the PRC high-speed rail signaling system industry is dependent upon state planning and investment in high-speed rail transportation projects. The nature, scale and timetable of these projects may be affected by a number of factors, including the overall state investment in high-speed rail transportation projects and approval of such new projects. By the end of the 12th Five-Year Plan published by the PRC’s State Council, which plan ended on December 31, 2015, the total length of China’s high-speed railway exceeded 19,000 kilometers. Under the 13th Five-Year Plan, which will end on December 31, 2020, the PRC government plans to increase the overall investment in transportation infrastructure by adding another 11,000 kilometers of high-speed railway by end of 2020, for a total length of 30,000 kilometers, which would cover over 80% of China’s major cities. We cannot predict whether the total annual investment in and the market size of the PRC high-speed railway industry will continue to grow in the future. If the total annual investment or the market size declines, our business and financial position may be adversely affected.

We have also provided our SCADA System, or supervisory control and data acquisition system, to a number of China’s subway lines over the past years. According to the development plan for a modern comprehensive transportation system under the 13th Five-Year Plan published by the PRC’s State Council, the total length of urban mass transit lines under operation by the end of 2020 will be 6,000 kilometers, an increase from 3,300 kilometers as of December 31, 2015. Although the PRC government has historically been supportive of the development of the urban mass transit industry, its industrial policy may change from time to time and it may adopt new policies or measures to further regulate the urban mass transit industry due to changes in macroeconomic trends or certain unexpected events.

In our rail transportation segment, we experienced revenue increases in the latter years of the 12th Five-Year Plan as Chinese policymakers ramped up spending to meet plan targets. For our fiscal years ended June 30, 2014, 2015, and 2016, our revenue from the rail transportation segment was $178.1 million, $193.3 million and $240.3 million, respectively. Revenue from this segment decreased at the beginning of 13th Five-Year plan to $155.7 million for the fiscal year ended 2017 as state bureaucracies adjusted to the new plan and state priorities. This decrease in revenue from our rail transportation segment accounted for approximately 75% of the decrease in our total net revenues in the fiscal year ended June 30, 2017, as compared to fiscal year ended June 30, 2016. In the fiscal year ended June 30, 2018, revenue from the rail transportation segment rebounded to $190.6 million, as implementation efforts for the 13th Five-Year Plan further advanced. In the fiscal year ended June 30, 2019, revenue from the rail transportation segment increased further to $208.9 million.

The spending patterns and priorities of Chinese policymakers, however, cannot be predicted with certainty. We cannot assure you that the generally favorable policies will remain in force in the future. In addition, the impact of rail transportation projects on our revenue from integrated solutions contracts was even more significant in the fiscal year ended June 30, 2017. Our overall revenue from integrated solutions contracts in the fiscal year ended June 30, 2017 decreased $92.3 million compared to the fiscal year ended June 30, 2016, primarily due to a decrease of $89.4 million from rail transportation projects, along with a decrease of $11.2 million from industrial automation projects, partially offset by an increase of $8.3 million in mechanical and electrical solutions business. If the PRC government reduces its public investment in, or changes any industrial standards relating to the high-speed railway industry, railway or urban mass transit industry in the PRC, if any of our major customers changes its procurement or bidding policy, or if our rail transportation projects face challenges, there could have a material adverse effect on our business, financial position and results of operations.

10

Our capital and human resources committed to product and service offerings may not always achieve anticipated results and we may not be able to develop new products that meet market demand or successfully introduce new products in a timely manner.

We are a technology-driven company. To maintain our leading position in the industry and meet the requirement of safety and efficiency, we have to continuously improve existing technology and products, and design and develop new technology, product and service offerings that closely follow technology development trends and customer needs. However, we cannot guarantee that our capital and human resources activities will always keep pace with market demand and technological advances or yield the anticipated results. The products and services, which we have spent substantial capital and human resources to develop, may not be able to deliver expected commercial returns when they are developed due to changing technology trends and market demands. If we encounter delays in technology development, fail to meet changing market demands, underestimate or fail to follow technological trends, or if our competitors respond more quickly than we do, our business or operating results may be materially and adversely affected. Failure to develop and introduce new product and service solutions in the areas of industrial automation, rail transportation and mechanical and electrical solutions on a timely basis or at all could adversely affect our competitiveness and profitability.

Loss of major customers or changes in their orders may have an adverse impact on our business.

We have developed significant customer relationships with several local urban mass transit providers and railway authorities in respect of the high-speed train system in China. For example, we currently have major contracts with the MTR Corporation Ltd. of Hong Kong, Land Transport Authority of Singapore, and Mitsubishi Heavy Industries, Ltd. Qatar Branch. We expect to continue to rely on our current major customers for a portion of our revenue in the future. Moreover, due to the nature of our business, the contract value of a single contract tends to be large. As such, our cash flows may become dependent on those customers’ payment practices and overall public funding policies, including the lengthening of collection times under contracts that have been performed. If our major customers significantly reduce, modify, postpone or cancel their purchase orders with us, we may not be able to get substitute orders with similar terms from other customers in a timely manner or at all. If we are not able to enter into contracts with our major customers on terms favorable to us or at all, our business and financial position may be adversely affected.

We do not have long-term purchase commitments from our customers, and we are exposed to potential volatility in our turnover.

Our business with our customers has been, and we expect it will continue to be, conducted on the basis of actual purchase orders received from time to time. Our customers are not obligated in any way to continue to place orders with us at the same or increased levels or at all. In addition, our customers may change or delay or terminate orders for products and services without notice for reasons unrelated to us, including lack of market acceptance for the products that our system was designed to control.

We cannot assure you that our customers will continue to place purchase orders with us at the same volume or same margin, as compared to prior periods, or at all. We may not be able to locate alternative customers to replace purchase orders or sales. As a result, our business, financial condition and results of operations may vary from period to period and may fluctuate significantly in the future.

11

An increase in our contract backlog may reflect our inability to perform our contracts on a timely basis instead of our ability to expand our business.

Our backlog indicates our ability to sell our products and services and increase our revenue, which represents an estimated amount of unrealized revenue of work remaining to be completed in accordance with the terms of the contract. Backlog is not a standard financial measure that has been defined by generally accepted accounting principles, and may not be indicative of future operating results. The amount of our aggregate backlog is based on the assumption that our relevant contracts will be performed in full in accordance with their terms. The termination or modification of any one or more major contracts may have a substantial and immediate effect on our backlog. We cannot guarantee that the amount estimated in our backlog will be realized in full, in a timely manner, or at all, or that, even if it is realized, such backlog will result in profits as expected. As a result, you should not rely on our backlog information presented in this report as an indicator of our future earnings.

We may face risks associated with our international expansion efforts, which could result in significant additional costs for our business operations.

A core component of our growth strategy is international expansion. As we continue to expand our international operations, we will be increasingly susceptible to the risks associated with overseas expansion. We have a limited operating history outside of the PRC and management of our international operations requires significant resources and management attention. Entering into new markets presents challenges, including, among others, the challenges of supporting a rapidly growing business in new environments with diverse cultures, languages, customs, legal systems, alternative dispute systems and economic, political and regulatory systems. We expect to incur significant costs associated with expanding our overseas operations, including hiring personnel internationally. The risks and challenges associated with overseas expansion include:

| ● | uncertain political and economic climates; |

| ● | lack of familiarity and burdens of complying with foreign laws, accounting and legal standards, regulatory requirements, tariffs and other barriers; |

| ● | unexpected changes in regulatory requirements, taxes, trade laws, tariffs, export quotas, custom duties or other trade restrictions; |

| ● | lack of experience in connection with the localization of our applications, including translation into foreign languages and adaptation for local practices, and associated expenses and regulatory requirements; |

| ● | difficulties in adapting to differing technology standards; |

| ● | longer sales cycles and accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| ● | difficulties in managing and staffing international operations, including differing legal and cultural expectations for employee relationships and increased travel, infrastructure and legal compliance costs associated with international operations; |

| ● | fluctuations in exchange rates that may increase the volatility of our foreign-based revenue and expenses; |

| ● | potentially adverse tax consequences, including the complexities of foreign value-added tax, goods and services tax and other transactional taxes; |

| ● | reduced or varied protection for intellectual property rights in some countries; |

| ● | difficulties in managing and adapting to differing cultures and customs; |

12

| ● | data privacy laws which require that customer data be stored and processed in a designated territory subject to laws different from those of the PRC; |

| ● | new and different sources of competition as well as laws and business practices favoring local competitors and local employees; |

| ● | compliance with anti-bribery laws, including compliance with the Foreign Corrupt Practices Act; |

| ● | increased financial accounting and reporting burdens and complexities; and |

| ● | restrictions on the repatriation of earnings. |

In addition, in our international business expansion to Southeast Asia, India and the Middle East, we may not be able to find adequate and qualified local engineers to bid and complete sizable rail transportation orders and industrial automation projects, and because of visa problems, we may have difficulties relocating adequate engineers from China to various foreign countries and have them stay there long enough to finish the projects, which could have an adverse impact on our international business expansion.

As a result of these factors, international expansion may be more difficult, take longer and not generate the results we anticipate, which could negatively impact our growth and business.

If we fail to accurately estimate the overall risks or costs under the contracts with our customers, or the time needed to complete the relevant projects under such contracts, we may experience cost overruns, schedule delays, lower profitability or even losses under such contracts when we perform such contracts.

We derive around 80% of our total consolidated revenues from the integrated solutions contracts that we have won through a competitive bidding process. The purpose of an integrated solutions contract is to furnish an automation system that provides the customer with a total solution for the automation or process control requirement being addressed. These contracts require us to complete projects at a fixed price, and therefore expose us to the risk of cost overruns. Cost overruns, whether due to efficiency, estimates or other reasons, could result in lower profit or losses. Other variations and risks inherent in the performance of fixed-price contracts such as delays caused by technical issues, and any inability to obtain the requisite permits and approvals, may cause our actual risk exposure and costs to differ from our original estimates.

In addition, we may be unable to deliver products or complete projects in accordance with the schedules set forth under the integrated solutions contracts. Our projects and our manufacturing and sales of products could be delayed for a number of reasons, including those relating to market conditions, policies, laws and regulations of the PRC and other relevant jurisdictions, availability of funding, transportation, disputes with business partners and subcontractors, technology and raw materials suppliers, employees, local governments, natural disasters, power and other energy supplies, and availability of technical or human resources.

We cannot guarantee that we will not encounter cost overruns or delays in our current and future delivery of products and completion of projects. If such cost overruns or delays were to occur, our costs could exceed our budget, and our profits on the relevant contracts may be adversely affected.

13

Our products may contain design or manufacturing defects that could result in product liability claims and cause us to suffer losses, and such defects could adversely affect demand for our products and services.

Our products are very complex, integrated systems, often with elements designed specifically for the particular situation of a customer. These products may have dormant design or manufacturing issues or defects that are not detected until they are put into actual use. Also, we manufacture spare parts for maintenance and replacement purposes after completion of integrated solutions contracts. While there have been no significant issues or defects identified as of the date of this prospectus supplement, any issues or defects in the design, manufacture and spare parts we provide may result in returns, claims, delayed shipments to customers or reduced or cancelled customer orders and other forms of damages asserted against us. A product issue or defect or negative publicity concerning defective products or services of ours could adversely affect our results of operations, reputation, customer satisfaction and market share.

Moreover, we are increasingly active in the conventional and nuclear power generation and railway control systems sectors. Each of these sectors poses a substantially higher risk of liability in the event of a system failure than is present in the industrial process controls markets in which we have traditionally competed. In certain jurisdictions that impose strict liability on product defects, we could be held liable for injuries or accidents involving our products even if the defects are not caused by us. We may be held liable for any damages or losses incurred in connection with or arising from defective products manufactured or designed by us, and if the damages or losses are severe, we may also be subject to administrative penalties imposed by the government. If our products or services are proven to be defective and have caused personal injury, property damage or other losses to rail passengers, we may be held responsible under liability claims under the laws of the PRC or other jurisdictions in which our products or services are sold, used or provided. We may need to devote substantial funds and other financial and administrative resources to rectifying or preventing potential product liability incidents, which could adversely affect our working capital, cash flow and results of operation.

As a practice, we generally do not carry large amounts of product liability insurance for our products, and we may not be able to obtain adequate insurance coverage in the future or may experience difficulties in obtaining the insurance coverage we need, which could negatively affect our business, financial condition and results of operations. The typical industrial practice is for the customers to obtain insurance to protect against their own operational risks. Any claims against us, regardless of their merits, could materially and adversely affect our financial condition. If we recall any of our products or are punished by governmental authorities, our business activities, financial condition and results of operations, as well as reputation, could be adversely affected.

Since we use a variety of raw materials and components in our production, shortages or price fluctuations of raw materials and the inability of key suppliers to meet our quantity or quality requirements could increase the cost of our products, undermine our product quality and adversely impact our business

Our major requirements for raw materials include bare printed circuit boards, electronic components, chips, cabinets and cables. Although we believe the sources of supply for these raw materials and components are generally adequate, any shortages or price increases could lead to higher cost of sales in the future. Our inability to pass on all or any raw material price increases to our customers or suppliers or offset the price fluctuations through commodity hedges could adversely affect our business, financial condition and results of operations.

Moreover, we procure our major raw materials, bare printed circuit boards, from suppliers based on our requirements and design considerations. Our suppliers may not be able to scale production or adjust delivery of products during times of volatile demand. In addition, we cannot guarantee that our suppliers have developed adequate and effective quality control systems. Our vendors’ inability to meet our volume requirements or quality standards may materially and adversely affect our brand and reputation, as well as our business, financial condition and results of operations.

14

We may experience material disruptions to our productions and business operations.

We primarily manufacture the hardware of our products in Beijing and Hangzhou facilities and in certain occasions outsource the production to third-party manufacturers. These facilities may be affected by natural or man-made disasters and other external events, including but not limited to fire, natural disasters, weather, manufacturing problems, diseases, strikes, transportation interruption, government regulation or terrorism. Any such disruptions or facility downtime could prevent us from meeting customer demand for our product and require us to make unexpected capital expenditures. Additionally, the lessors of some of our leased properties have defects in their titles and we may be required to cease using such leased properties if a valid claim is made against such properties. In such circumstances, we may not be able to find new leases on terms acceptable to us, or at all. Any of these disruptions may force us to cease operations, shift production to other third-party manufacturers or cease certain parts of our business operations, which could incur substantial costs or take a significant time to re-start production or operations, each of which may adversely impact our business and results of operations.

Security breaches or disruptions of our information technology systems could adversely affect our business.

We rely on information technology networks and systems, including the Internet, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities. Additionally, we collect and store certain data, including proprietary business information, and may have access to confidential or personal information in certain of our businesses, which is subject to privacy and security laws and regulations, and customer-imposed controls. These technology networks and systems may be susceptible to damage, disruptions or shutdowns due to failures during the process of upgrading or replacing software, databases or components; power outages; telecommunications or system failures; terrorist attacks; natural disasters; employee error or malfeasance; server or cloud provider breaches; and computer viruses or cyberattacks. Cybersecurity threats and incidents can range from uncoordinated individual attempts to gain unauthorized access to information technology networks and systems to more sophisticated and targeted measures, known as advanced persistent threats, directed at us, our products, customers and/or third-party service providers. Despite the implementation of cybersecurity measures (including access controls, data encryption, vulnerability assessments, continuous monitoring, and maintenance of backup and protective systems), our information technology systems may still be vulnerable to cybersecurity threats and other electronic security breaches. It is possible for such vulnerabilities to remain undetected for an extended period, up to and including several years. In addition, it is possible a security breach could result in theft of trade secrets or other intellectual property or disclosure of confidential customer, supplier or employee information. We cannot guarantee that we will be able to prevent security breaches or other damage to our information technology systems, nor can we guarantee that our internal control and compliance programs will be able to adequately address all or any of such breaches. Disruptions caused by any such breaches or damage could have an adverse effect on our operations, as well as expose us to litigation, liability or penalties under privacy laws, increased cybersecurity protection costs, reputational damage and product failure.

Our goodwill is subject to impairment review and any goodwill impairment may negatively affect our reported results.

Goodwill represents the excess of the purchase price over the estimated fair value of net tangible and identifiable intangible assets acquired. Our outstanding goodwill as of June 30, 2019 was related to the acquisition of Bond Group in 2013 and Hollysys Industrial Software in July 2017. Based on our quantitative assessment, the goodwill related to Concord Group acquisition was impaired by $11.6 million as of June 30, 2019. We performed a qualitative assessment for both Bond Group and Hollysys Industrial Software in 2019 and evaluated all relevant factors, weighed all factors in their entirety and concluded that no impairment charge for Bond Group and Hollysys Industrial Software was needed as of June 30, 2019.

15

However, there are uncertainties surrounding the amount and timing of future expected cash flows as they may be impacted by negative events such as a slowdown in the mechanical and electrical engineering sector, deteriorating economic conditions in the geographical areas Concord Group, Bond Group and Hollysys Industrial Software operate in, political, economic and social uncertainties in the Middle East, increasing competitive pressures and fewer than expected mechanical and electrical solution contracts awarded to Concord Group, Bond Group and Hollysys Industrial Software. These events can negatively impact demand for services of Concord Group, Bond Group and Hollysys Industrial Software and result in actual future cash flows being less than forecasted or delays in the timing of when those cash flows are expected to be realized. Further, the timing of when actual future cash flows are received could differ from our estimates, which are based on historical trends and do not factor in unexpected delays in project commencement or execution.

We may experience delays or defaults in payment of accounts receivables or in release of retention by our customers, which may adversely affect our cash flow and working capital, financial condition and results of operations.

In line with the industry practice, we typically have a long receivable collection cycle. We face the risk that customers may delay their settlement with us or delay or fail to pay us as scheduled. Furthermore, defaults in payments to us on projects for which we have already incurred significant costs and expenses can materially and adversely affect our results of operations and reduce our financial resources that would otherwise be available to fund other projects. We cannot assure you that payments from customers will be made in a timely manner or at all, or that delays or defaults in payments will not adversely affect our financial condition and results of operations.

Our operations require certain permits, licenses, approvals and certificates, the revocation, cancellation or non-renewal of which could significantly hinder our business and operations, and we are subject to periodic inspections, examinations, inquiries and audits by regulatory authorities.

We are required to obtain and maintain valid permits, licenses, certificates and approvals from various governmental authorities or institutions under relevant laws and regulations for our businesses of design and integration, equipment manufacturing and system implementation services. We must comply with the restrictions and conditions imposed by various levels of governmental agencies to maintain our permits, licenses, approvals and certificates. If we fail to comply with any of the regulations or meet any of the conditions required for the maintenance of our permits, licenses, approvals and certificates, our permits, licenses, approvals and certificates could be temporarily suspended or even revoked, or the renewal thereof, upon expiry of their original terms, may be delayed or rejected, which could materially and adversely impact our business, financial condition and results of operations.

We are subject to periodic inspections, examinations, inquiries and audits by regulatory authorities and may be subject to suspension or revocation of the relevant permits, licenses, approvals or certificates, or fines or other penalties due to any non-compliance identified as a result of such inspections, examinations, inquiries and audits. We cannot assure you that we will be able to maintain or renew our existing permits, licenses, approvals and certificates or obtain future permits, licenses, approvals and certificates required for our continued operation on a timely basis or at all. In the event that we fail to comply with applicable laws and regulations or fail to maintain, renew or obtain the necessary permits, licenses, approvals or certificates, our qualification to conduct various businesses may be adversely impacted.

As we expand our business outside of mainland China, we will encounter the increasing need for international certifications and compliance with the regulation of different governments, which if not obtained and complied with may adversely impact our business.

We are expanding our business outside of mainland China, including seeking business opportunities in Hong Kong SAR, Singapore, Malaysia, India, Indonesia, and the Middle East. For our marketing both in China and in other jurisdictions, we seek international certifications and have obtained certificates such as the European Safety Standard Certification Level 4. As we operate in jurisdictions other than China, we will have to comply with local laws, some of which relate to various safety and quality requirements for the kinds of products we provide. The failure to have any necessary or beneficial certifications and the failure to comply with local laws will have an adverse impact on our marketing and business, and may result in additional costs and expenses.

16

We are exposed to risks associated with public project contracts.

Due to the nature of our industry, we are exposed to risks associated with public project contracts. For example, many of our contracts are for large and high-profile high-speed railway or urban mass transit infrastructure projects, which can result in increased political and public scrutiny of our work. Certain of our customers are affiliated with government authorities. Such customers may delay making payments for our projects, and it may take a considerably longer period of time to resolve disputes with these customers than resolving disputes with customers in private sectors.

Moreover, such government-affiliated customers may require us to undertake additional obligations, change the type of our services, equipment used or other terms of service, or purchase specific equipment, or modify other contractual terms from time to time for the social benefit or other administrative purposes, resulting in additional costs incurred by us, which may not be reimbursed by such customers in full. If any early termination by any government-affiliated customers occurs or if government-affiliated customers fail to renew their contracts with us in the future, our backlog may be reduced and our investment plan may be hindered, which may have a material adverse effect on our business and financial performance.

Many of our competitors have substantially greater resources than we do, allowing them to compete on an advantageous basis.

We operate in a very competitive environment with many major international and domestic companies, such as Honeywell, General Electric, ABB, Siemens, Emerson, Yokogawa and Hitachi. Many of our competitors are much better established and more experienced than we are, have substantially greater financial resources, operate in more international markets and are much more diversified than we are. As a result, they are in a stronger position to compete effectively with us. These large competitors are also in a better position than we are to weather any extended weaknesses in the market for automation and control systems. Other emerging companies or companies in related industries may also increase their participation in our market, which would add to the competitive pressures that we face.

Our business operations are largely dependent on our senior management and our ability to attract and retain engineering talents.

The stability of our business operations and the continuing growth of our business depend on the continuing services of our senior management and engineering talents. In the industries in which we operate, industry experience, management expertise and strategic direction are crucial. If we lose the services of our senior management and engineering staff, we may not be able to recruit a suitable or qualified replacement and may incur further costs and expenses to recruit and/or train new employees. In particular, any sudden loss of a member of our senior management or engineering staff may disrupt our strategic direction and leadership. As we continue to expand our business, we will need to continue to attract and retain experienced management personnel with extensive experience in the industries in which we operate.

We believe that competition for experienced personnel in the areas of industrial automation, rail transportation and mechanical and electrical solutions is intense. Competition for such qualified personnel could lead to higher emoluments and other compensations in order to attract and retain such personnel.

This may lead to an increase in our operating costs. If we are not able to retain the members of our senior management or engineering staff required to achieve our business objectives, this may materially and adversely affect our business operations and our prospects.

17

Our control systems are used in infrastructure projects such as subway systems, surface railways and nuclear plants; to the extent that our systems do not perform as designed, we could be found responsible for the damage resulting from that failure.

We face potential responsibility for the failure of our control systems in performing the various functions for which they are designed and the damages resulting from any such problem. To the extent that we contract to provide control systems in larger scale projects, the level of damages for which we may be held responsible is likely to increase. To the extent that any of our installed control systems do not perform as designed for their intended purposes, and we are held responsible for the consequences of those performance failures and resulting damages, there may be an adverse impact on our business, business reputation, revenues and profits. We do believe our control systems have so far performed as designed, and there are no claims asserted against us based on any significant, non-performance event. Notwithstanding our record, no assurance can be given that no claims will be sought in the future based on the design and performance of our control systems.

Industry and economic conditions may adversely affect the markets and operating conditions of our customers, which in turn can affect demand for our products and services and our results of operations.

We operate in a cyclical industry that is sensitive to general economic conditions in the PRC and abroad. Rapid growth in the PRC economy and urban population could lead to an increased demand for high-speed railway, urban transportation and power plants, which could in turn foster demand for control system products and services in high-speed rail transportation, urban mass transit and power sectors. Changes in market supply and demand could also have a substantial effect on our product prices, business, revenue and financial condition. Macroeconomic conditions (such as the government’s announcement of economic stimulus policies to encourage the construction of public infrastructure or the termination of such policies), supply and demand imbalances and other factors beyond our control, including import and export policies, value-added tax and export taxes could have a major impact on our market share, and the demand for and prices of our products. Increased demand for rail transportation and increased operating margins may result in a larger amount of new investments in the relevant industries and increased production in the overall industry, which may cause supply to exceed demand and lead to a period of lower prices. This cycle of rising and falling demand may repeat itself. Any of these cyclical factors may adversely impact our business, financial condition and results of operations and prospects.

We are striving to expand our sales into the international market. Our overseas business extends to Southeast Asia and the Middle East area. Any economic downturn may result in reduced funding for public infrastructures including railway or urban mass transit infrastructures and a decreased demand for our transportation control system products and services in the international market. Moreover, any economic downturn may negatively impact the ability of our international customers to obtain financing, which may lead to their unwillingness to purchase our products. Therefore, the general demand for our products and their selling price could decline. Any adverse changes in the global market and economic conditions and any slowdown or recession of the global economy could have a material adverse effect on our business, financial condition, results of operations and prospects.

Increased competition from foreign and PRC domestic competitors within the industry where we operate could negatively impact our market share in the industry.

Our principal offering is a comprehensive suite of automation systems for a wide spectrum of industrial market clientele, ranging from power, chemical, petrochemical, to nuclear, metallurgy, building materials, food-beverage, pharmaceutical and other industries. Multi-national companies including Honeywell (US), Siemens (Germany), Emerson (US), ABB (Sweden), Rockwell (US), Yokogawa (Japan) and Hitachi (Japan) account for the majority of the global automation market share, and the market pattern is similar in China. Due to the limited number of domestic customers, if major international competitors increase their investments in the PRC or our targeted overseas markets or collaborate with our existing competitors, we may face even more intense competition. We may not be able to compete successfully with existing industry leaders in new business areas into which we intend to expand. This may in turn affect our business, operating results and financial condition.

18

We may not be able to sufficiently protect our intellectual property.

Our business primarily relies on a combination of copyright, patent, trademark and other intellectual property laws, nondisclosure agreements and other protective measures to protect our proprietary rights. As of June 30, 2019, we held 221 software copyrights, 126 authorized patents, 64 patent applications and 44 registered trademarks.

Our competitors may independently develop proprietary technology similar to ours, introduce counterfeits of our products, misappropriate our proprietary information or processes, infringe on our patents, brand name and trademarks, or produce similar products that do not infringe on our patents or successfully challenge our patents. Our efforts to defend our patents, trademarks and other intellectual property rights against competitors or other violating entities may be unsuccessful. We may be unable to identify any unauthorized use of our patents, trademarks and other intellectual property rights and may not be afforded adequate remedies for any breach. In particular, in the event that our registered patents and our applications do not adequately describe, enable or otherwise provide coverage of our technologies, samples and products, we would not be able to exclude others from developing or commercializing these technologies, samples and products.

We also utilize unpatented proprietary know-how and trade secrets and employ various methods to protect our intellectual property. We have generally entered into confidentiality agreements (which include, in the case of employees, non-competition provisions and intellectual property right ownership provisions) with our key research and development personnel. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in circumstances specified in the agreements. In the case of employees, the agreements provide that all of the technology which is conceived by the individual during the course of employment is our exclusive property. However, these agreements may not provide meaningful protection or adequate remedies in the event of unauthorized use or disclosure of our proprietary information. In addition, it is possible that third parties could independently develop information and techniques substantially similar to ours or otherwise gain access to our trade secrets.

In the event that any misappropriation or infringement of our intellectual property occurs in the future, we may need to protect our intellectual property or other proprietary rights through litigation. Litigation may divert our management’s attention from our business operations and possibly result in significant legal costs, and the outcome of any litigation is uncertain. In addition, infringement of our intellectual property rights may impair the market value and share of our products, damage our reputation and adversely affect our business, financial condition and results of operations.

Our intellectual property may become obsolete and may not be able to protect us from competition.

The markets in which our businesses operate may experience rapid and significant changes due to the introduction of innovative and disruptive technologies. Our operating results depend to a significant extent on our ability to maintain our technological leadership, anticipate and adapt to changes in our markets and to optimize our cost base accordingly. Introducing new products and technologies requires a significant commitment to research and development, which in return requires expenditure of considerable financial resources that may not always result in success. Our results of operations may suffer if we invest in technologies that may not be used or integrated as expected, or are not accepted in the marketplace, or if our products, solutions or systems are not introduced to the market in a timely manner, particularly compared to our competitors, or become obsolete. Our patents and other intellectual property may not prevent competitors from independently developing or selling products and services that are similar to or duplicate our products and services.

Our acquisition strategies may not be successful, which could adversely affect our business and increase our financial expenses.

In addition to organic growth, we may supplement our business expansion through acquisitions of an operating business or specific assets. Examples of our past acquisitions are the acquisitions of Concord Group in 2011 and Bond Group in 2013, which were undertaken to accelerate the development of our mechanical and electrical solutions business in Southeast Asia and the Middle East. Implementing our acquisition strategies may expose us to the following risks, among others, which could have adverse effects on our business, financial condition, operating results and future prospects:

| ● | unidentified or unforeseeable liabilities or risks may exist in the potential assets or business to be acquired; |

19

| ● | failure to assimilate acquired business and personnel into our operations or failure to realize anticipated cost savings or other synergies from the acquisition; |

| ● | incurring additional debts which could reduce our available funds for operations and other purposes as a result of increased debt repayment obligations; |

| ● | inability to retain employees; |

| ● | loss of customers; and |

| ● | diverting efforts of management and other resources. |

We cannot assure you that we will be able to effectively integrate businesses we acquire or that any acquisitions will generate long-term benefits for us. Any failure to effectively integrate or benefit from acquisitions we make may have material adverse effects on our business, financial condition, operating results and future prospects.

Our revenue and net income may be materially and adversely affected by any economic slowdown in China as well as globally.

The success of our business depends on consumer spending. We currently derive a substantial majority of our revenue from China and are also expanding into international markets. As a result, our revenue and net income are impacted to a significant extent by economic conditions in China and globally, as well as economic conditions specific to infrastructural development. The global economy, markets and levels of consumer spending are influenced by many factors beyond our control, including consumer perception of current and future economic conditions, political uncertainty (including the potential impact of political and regulatory uncertainties in the United States), levels of employment, inflation or deflation, real disposable income, interest rates, taxation and currency exchange rates.

The growth of the PRC economy has slowed in recent years. There have also been concerns about the relationships among China and other Asian countries, the relationship between China and the United States, and the relationship between the United States and certain Asian countries, which may result in or intensify potential conflicts in relation to territorial, regional security and trade disputes. For instance, the United States has imposed substantial tariffs on products emanating from China, which has adversely affected the trade relationship between China and the United States. Further disruptions or continuing or worsening slowdown could significantly reduce domestic commerce in China. A further decrease in economic growth rates or an otherwise uncertain economic outlook in China or any other markets in which we may operate could have a material adverse effect on consumer spending and therefore adversely affect our business, financial condition and results of operations.

Our international operations may expose us to numerous and sometimes conflicting legal and regulatory requirements. Violation of these regulations could harm our business.

With operations in Singapore, Malaysia, Indonesia, India and the Middle East, we are subject to numerous, and sometimes conflicting, legal requirements on matters as diverse as import/export controls, trade restrictions, tariffs, taxation, sanctions, government affairs, anti-corruption, whistle blowing, internal and disclosure control obligations, data protection and privacy and labor relations and regulatory requirements that are specific to our clients’ industries. Non-compliance with these regulations in the conduct of our business could result in fines, penalties, criminal sanctions against us or our officers, disgorgement of profits, prohibitions on doing business and adverse impact to our reputation. Gaps in compliance with these regulations in connection with the performance of our obligations to our clients could also result in exposure to monetary damages, fines and/or criminal prosecution, unfavorable publicity, restrictions on our ability to process information and allegations by our clients that we have not performed our contractual obligations. Many countries also seek to regulate the actions that companies take outside of their respective jurisdictions, subjecting us to multiple and sometimes competing legal frameworks in addition to our home country rules. Due to the varying degree of development of the legal systems of the countries in which we operate and plan to operate, local laws might be insufficient to defend us and preserve our rights. We could also be subjected to risks to our reputation and regulatory action on account of any unethical acts by any of our employees, partners or other related individuals.

20

We are subject to risks relating to compliance with a variety of national and local laws including multiple tax regimes, labor laws, and employee health, safety, wages and benefits laws. We may, from time to time, be subject to litigation or administrative actions resulting from claims against us by current or former employees individually or as part of class actions, including claims of wrongful terminations, discrimination, misclassification or other violations of labor law or other alleged conduct. We may also, from time to time, be subject to litigation resulting from claims against us by third parties, including claims of breach of non-compete and confidentiality provisions of our employees’ former employment agreements with such third parties or claims of breach by us of their intellectual property rights. Our failure to comply with applicable regulatory requirements could have a material adverse effect on our business, results of operations and financial condition.

The audit reports included in our annual reports filed with the SEC were prepared by auditors who are not inspected by the Public Company Accounting Oversight Board and, as such, you are deprived of the benefits of such inspection.

Our independent registered public accounting firm that issues the audit reports included in our annual report, as an auditor of companies that are traded publicly in the United States and a firm registered with the Public Company Accounting Oversight Board (United States), or the PCAOB, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. However, because we have substantial operations within the PRC, a jurisdiction where the PCAOB is currently unable to conduct inspections without the approval of the Chinese government authorities, our auditor and its audit work are not currently inspected by the PCAOB.