Registration No. 333-132783

File No. 811-21881

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. ____ [ ]

Post-Effective Amendment No. _4_ [ X ]

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY

ACT OF 1940 [X]

Amendment No. 5 [ ]

OPPENHEIMER ROCHESTER MINNESOTA MUNICIPAL FUND

(Exact Name of Registrant as Specified in Charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of Principal Executive Offices) (Zip Code)

(303) 768-3200

(Registrant’s Telephone Number, including Area Code)

Robert G. Zack, Esq.

OppenheimerFunds, Inc.

Two World Financial Center, 225 Liberty Street –New York, New York 10281-1008

(Name and Address of Agent for Service)

It is proposed that this filing will become effective (check appropriate box):

[ ] Immediately upon filing pursuant to paragraph (b)

[X] On July 29, 2010 pursuant to paragraph (b)

[ ] 60 days after filing pursuant to paragraph (a)(1)

[ ] On _______________ pursuant to paragraph (a)(1)

[ ] 75 days after filing pursuant to paragraph (a)(2)

[ ] On _______________ pursuant to paragraph (a)(2) of Rule 485.

If appropriate, check the following box:

[ ] This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

| Oppenheimer |

|

Rochester™ Minnesota Municipal Fund |

|

NYSE Ticker Symbols |

|

|

Class A |

OPAMX |

|

Class B |

OPBMX |

|

Class C |

OPCMX |

| Prospectus dated July 29, 2010 |

| As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved the Fund's securities nor has it determined that this prospectus is accurate or complete. It is a criminal offense to represent otherwise. |

| Oppenheimer Rochester Minnesota Municipal Fund is a mutual fund that seeks a high level of current interest income exempt from federal and Minnesota state income taxes for individual investors as is consistent with preservation of capital. |

| This prospectus contains important information about the Fund's objective, investment policies, strategies and risks. It also contains important information about how to buy and sell shares of the Fund and other account features. Please read this prospectus carefully before you invest and keep it for future reference about your account. |

|

|

| Table of contents | |

|

3 |

|

|

3 |

|

|

4 |

|

|

5 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

Payments to Broker-Dealers and Other Financial Intermediaries |

10 |

|

12 |

|

|

20 |

|

|

23 |

|

|

24 |

|

|

29 |

|

|

31 |

|

|

43 |

|

|

46 |

To Summary Prospectus

THE FUND SUMMARY

Investment Objective. The Fund seeks a high level of current interest income exempt from federal and Minnesota state income taxes for individual investors as is consistent with preservation of capital.

Fees and Expenses of the Fund. This table describes the fees and expenses that you may pay if you buy and hold or redeem shares of the Fund. You may qualify for sales charge discounts if you (or you and your spouse) invest, or agree to invest in the future, at least $50,000 in certain funds in the Oppenheimer family of funds. More information about these and other discounts is available from your financial professional and in the section "About Your Account" beginning on page 23 of the prospectus and in the sections "How to Buy Shares" beginning on page 79 and "Appendix A" in the Fund's Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment) |

||||

|

Class A Shares |

Class B Shares |

Class C Shares |

||

|

Maximum Sales Charge (Load) imposed on purchases (as % of offering price) |

4.75% |

None |

None |

|

|

Maximum Deferred Sales Charge (Load) (as % of the lower of the original offering price or redemption proceeds) |

None |

5% |

1% |

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

|||

|

Class A Shares |

Class B Shares |

Class C Shares |

|

|

Management Fees |

0.55% |

0.55% |

0.55% |

|

Distribution and/or Service (12b-1) Fees |

0.21% |

0.99% |

1.00% |

|

Total Other Expenses |

0.57% |

0.70% |

0.67% |

|

Interest and Fees from Borrowing |

0.29% |

0.29% |

0.29% |

|

Interest and Related Expenses from Inverse Floaters |

0.00% |

0.00% |

0.00% |

|

Other Expenses |

0.28% |

0.41% |

0.38% |

|

Total Annual Fund Operating Expenses |

1.33% |

2.24% |

2.22% |

|

Fee Waiver and Expense Reimbursement* |

(0.30%) |

(0.44%) |

(0.40%) |

|

Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement |

1.03% |

1.80% |

1.82% |

* Prior to July 1, 2009, the Manager voluntarily waived management fees and/or reimbursed Fund expenses so that "Total Annual Fund Operating Expenses," excluding interest and related expenses from inverse floaters, would not exceed 0.80% of average annual net assets for Class A shares and 1.55% of average annual net assets for Class B and Class C shares. Effective July 1, 2009, the Manager amended this voluntary undertaking so the waiver would also exclude interest and fees from borrowings. This undertaking may be amended or withdrawn after one year from the date of this prospectus.

Example. The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows:

|

If shares are redeemed |

If shares are not redeemed |

|||||||||||||||||

|

1 Year |

3 Years |

5 Years |

10 Years |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||

|

Class A Shares |

$ |

576 |

$ |

851 |

$ |

1,146 |

$ |

1,985 |

$ |

576 |

$ |

851 |

$ |

1,146 |

$ |

1,985 |

||

|

Class B Shares |

$ |

685 |

$ |

965 |

$ |

1,372 |

$ |

2,118 |

$ |

185 |

$ |

665 |

$ |

1,172 |

$ |

2,118 |

||

|

Class C Shares |

$ |

287 |

$ |

663 |

$ |

1,166 |

$ |

2,551 |

$ |

187 |

$ |

663 |

$ |

1,166 |

$ |

2,551 |

||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the examples, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 14% of the average value of its portfolio.

Principal Investment Strategies. The Fund invests mainly in municipal securities issued by Minnesota. Under normal market conditions, as a fundamental policy, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from both federal and Minnesota state income tax. These securities are generally issued by the state and its political subdivisions (such as cities, towns, counties, agencies and authorities) and primarily include municipal bonds (long-term (more than one-year) obligations), municipal notes (short-term obligations) and interests in municipal leases. They may also include securities of issuers located outside of Minnesota, such as U.S. territories, commonwealths and possessions, if the interest on such securities is not subject to federal or Minnesota state income tax. These securities are "Minnesota municipal securities" for purposes of this prospectus.

While the Minnesota Fund is required under normal market conditions to invest at least 80% of its net assets in securities the income from which is exempt from both federal and Minnesota individual income tax, the Fund intends to invest its assets so that at least 95% of the exempt-interest dividends that it pays, including any exempt-interest dividends exempt from state taxation under federal law, are derived from Minnesota municipal obligations as required for state tax exemption under Minnesota law.

Securities whose interest is exempt from Minnesota taxes are included for purposes of the Fund's 80% requirement discussed above, even if the issuer is located outside of Minnesota. Securities that generate income subject to alternative minimum tax (AMT) will count towards the Fund's 80% requirement. The Fund selects investments without regard to this type of tax treatment.

Most of the securities the Fund buys must be "investment-grade" (rated in one of the four highest rating categories of a nationally recognized statistical rating organization, such as Standard & Poor's), although the Fund also can invest as much as 25% of its total assets in below-investment-grade securities (sometimes called "junk bonds"). The Fund may also invest in unrated securities, in which case the Fund's investment adviser, OppenheimerFunds, Inc., internally assigns ratings to those securities, after assessing their credit quality and other factors, in categories similar to those of nationally recognized rating organizations.

The Fund does not limit its investments to securities of a particular maturity range, and may hold both short- and long-term securities. However, the Fund currently focuses on longer-term securities to seek higher yields. This portfolio strategy is subject to change.

The Fund also borrows for leverage and invests in inverse floaters, a variable rate obligation and form of derivative, to seek increased income and return. The Fund can expose up to 20% of its total assets to the effects of leverage from its investments in inverse floaters. The Fund also can borrow money to purchase additional securities, another form of "leverage". Although the amount of borrowing will vary from time to time, the amount of leveraging from borrowings will not exceed one-third of the Fund's total assets.

In selecting investments for the Fund, the portfolio managers look at a wide range of Minnesota municipal securities from different issuers that provide high current income, including unrated bonds, that have favorable credit characteristics and that provide opportunities for value. The portfolio managers may consider selling a security if any of these factors no longer applies to a security purchased for the Fund, but are not required to do so.

Principal Risks. The price of the Fund's shares can go up and down substantially. The value of the Fund's investments may change because of broad changes in the markets in which the Fund invests or from poor security selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment objective. When you redeem your shares, they may be worth more or less than what you paid for them. These risks mean that you can lose money by investing in the Fund.

Main Risks of Investing in Municipal Securities. Municipal securities may be subject to credit risk, credit spread risk, interest rate risk and reinvestment risk. Credit risk is the risk that the municipal issuer of a security might not make interest and principal payments on the security as they become due. If an issuer fails to pay interest or to repay principal, the Fund's income or share value might be reduced. A downgrade in an issuer's credit rating can reduce the market value of the issuer's securities. Credit spread risk is a risk based on the difference (or credit spread) between the market yields of two different investments of different credit quality. When spreads widen between bonds with different quality ratings, it implies that the market is factoring more risk of default on lower-grade bonds. A widening in credit spreads may result in a fall in the values of the Fund's securities. Interest rate risk is the risk that the value of a municipal security might fall due to a change in interest rates. When prevailing interest rates rise, the values of already-issued debt securities generally fall, and they may sell at a lower price than their face amount or from the amount the Fund paid for them. When prevailing interest rates fall, the values of already-issued debt securities generally rise. The values of longer-term debt securities usually change more than the values of shorter-term debt securities. Reinvestment risk is the risk that when interest rates fall the Fund may be required to reinvest the proceeds from a security's sale or redemption at a lower interest rate. Callable bonds are generally subject to greater reinvestment risk than non-callable bonds.

Special Risks of Below-Investment-Grade Securities. Below-investment-grade debt securities may be subject to greater price fluctuations and have a greater risk that the issuer might not be able to pay interest and principal when due. The market for below-investment-grade securities may be less liquid and they may be harder to value or to sell at an acceptable price, especially during times of market volatility or decline.

Because the Fund can invest up to 25% of its assets in below-investment-grade securities, the Fund's credit risks are greater than those of funds that buy only investment-grade securities.

Special Risks of Minnesota Municipal Securities. Because the Fund invests primarily in Minnesota municipal securities, the value of its portfolio investments will be highly sensitive to events affecting the financial stability of the State of Minnesota and its municipalities, agencies, authorities and other instrumentalities that issue those securities. Budgetary stress on the state or its municipalities, changes in legislation or policy, erosion of the tax base, the effects of natural disasters, or other economic, legislative or political, or social issues may have a significant negative impact on the value of state or local securities. These risks also apply to securities of issuers of U.S. territories, commonwealths or possessions, such as Puerto Rico, Guam, the Northern Mariana Islands and the Virgin Islands.

Taxability Risk. The Fund's investments in municipal securities rely on the opinion of the issuer's bond counsel that the interest paid on those securities will not be subject to federal and state income tax. Tax opinions are generally provided at the time the municipal security is initially issued. However, after the Fund buys a security, the Internal Revenue Service may determine that a bond issued as tax-exempt should in fact be taxable and the Fund's dividends with respect to that bond might be subject to federal income tax.

Bond Market Volatility and Illiquidity. The municipal bond market can be susceptible to unusual volatility, particularly for lower-rated and unrated debt securities. Under those conditions, liquidity can be reduced in response to overall economic conditions and credit tightening. It is not possible to predict when such circumstances could occur. During times of reduced market liquidity, the Fund may not be able to readily sell bonds at the prices at which the bonds are carried on the Fund's books. The Fund may need to sell large blocks of bonds to meet shareholder redemption requests or to raise cash in connection with its investments in inverse floaters. Sales of large blocks of bonds can further reduce bond prices.

Municipal Sector Concentration. While the Fund does not invest more than 25% of its total assets in a single industry, certain types of municipal securities (such as general obligation, government appropriation, municipal leases, special assessment and special tax bonds) are not considered a part of any "industry" for purposes of this policy. Therefore, the Fund may invest more than 25% of its total assets in these types of municipal securities. These types of municipal securities may finance, or pay interest from the revenues of, projects that tend to be impacted in the same way by economic, business or political developments which would increase credit risk. For example, legislation on the financing of a project or a declining economic need for the project would likely affect all similar projects.

Risks of Non-Diversification. The Fund may invest a greater portion of its assets in the securities of a single issuer than if it were a "diversified" fund. To the extent that the Fund invests a higher percentage of its assets in the securities of a single issuer, the Fund is more subject to the risks associated with and developments affecting that issuer.

Risks of Tobacco Related Bonds. In 1998, the largest U.S. tobacco manufacturers reached an out of court agreement, known as the Master Settlement Agreement (the "MSA"), to settle claims against them by 46 states and six other U.S. jurisdictions. The tobacco manufacturers agreed to make annual payments to the government entities in exchange for the release of all litigation claims. A number of the states have sold bonds that are backed by those future payments.

The Fund may invest in two types of those bonds: (i) bonds that make payments only from a state's interest in the MSA and (ii) bonds that make payments from both the MSA revenue and from an "appropriation pledge" by the state. An "appropriation pledge" requires the state to pass a specific periodic appropriation to make the payments and is generally not an unconditional guarantee of payment by a state.

The settlement payments are based on factors, including, but not limited to, annual domestic cigarette shipments, cigarette consumption, inflation and the financial capability of participating tobacco companies. Payments could be reduced if consumption decreases, if market share is lost to non-MSA manufacturers, or if there is a negative outcome in litigation regarding the MSA.

The Fund can invest up to 25% of its total assets in tobacco-related bonds without an appropriation pledge that makes payments only from a state's interest in the MSA.

Risks of Land-Secured or "Dirt" Bonds. These special assessment or special tax bonds are issued to promote residential, commercial or industrial growth and redevelopment. They are exposed to real estate development-related risks. The bonds could default if the developments failed to progress as anticipated or if taxpayers failed to pay the assessments, fees and taxes specified in the financing plans for a project.

Borrowing and Leverage. The Fund can borrow up to one-third of the Fund's assets (including the amount borrowed) from banks. It can use those borrowings for a number of purposes, including for purchasing securities. That is referred to as "leverage." In that case, changes in the value of the Fund's investments will have a larger effect on its share price than if it did not borrow. Borrowing results in interest payments to the lenders and related expenses. The costs of borrowing for investment purposes might reduce the Fund's return if the yield on the securities purchased is less than the borrowing costs. The Fund may also borrow to meet redemption obligations, for temporary and emergency purposes, or to unwind or contribute to trusts in connection with the Fund's investment in inverse floaters. The Fund currently participates in a line of credit with other Oppenheimer funds for its borrowing.

Risks of Derivatives. A "derivative" is an investment whose value depends on (or is derived from) the value of an underlying security, asset, interest rate, index or currency. Derivatives may be volatile and involve significant risks. Derivative transactions may require the payment of premiums and can increase portfolio turnover. Certain derivative investments may be illiquid. The underlying security or other reference on which a derivative is based, or the derivative itself, may not perform the way the Fund expects it to. The Fund could realize little or no income or lose principal from a derivative investment or a hedge might be unsuccessful. The Fund may also lose money if the issuer of a derivative fails to pay the amount due.

Inverse Floaters. The Fund invests in inverse floaters because, under ordinary circumstances, they tend to benefit from higher yields and thus provide higher income than fixed rate bonds of comparable maturity and credit quality. An inverse floater is a derivative instrument, typically created by a trust established by a counterparty, that divides a municipal security into two securities: a short-term floating rate security and a long-term floating rate security which is referred to as an "inverse floater." The inverse floater pays interest at rates that move in the opposite direction of those on the short-term floating rate security. Inverse floaters produce less income when short-term interest rates rise (and may pay no income) and more income when short-term interest rates fall. Thus, if short-term interest rates rise after the issuance of the floater, any yield advantage is reduced or eliminated. Under certain circumstances a trust may be collapsed and the Fund may be required to repay the principal amount due on the short-term securities or the difference between the liquidation value of the underlying municipal bond and the principal amount due on those securities. Inverse floaters can be more volatile than conventional fixed-rate bonds. They also entail a degree of leverage and certain inverse floaters may require the Fund to provide collateral for payments on the short-term securities or to "unwind" the transaction.

Who Is The Fund Designed For? The Fund is designed for investors seeking income exempt from federal and Minnesota state personal income taxes. The Fund does not seek capital gains or growth. Because it invests in tax-exempt securities, the Fund is not appropriate for retirement plan accounts or for investors seeking capital growth. The Fund is not a complete investment program. You should carefully consider your own investment goals and risk tolerance before investing.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

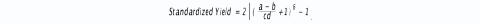

The Fund's Past Performance. The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fund's past investment performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. More

recent performance information is available by calling the toll-free number on the back of this prospectus and on the Fund's website at:

https://www.oppenheimerfunds.com/fund/RochesterMinnesotaMunicipalFund.

|

|

Sales charges and taxes are not included and the returns would be lower if they were. During the period shown, the highest return for a calendar quarter was 14.75% (3rd qtr 09) and the lowest return was -22.04% (4th qtr 08). For the period from January 1, 2010 through June 30, 2010 the cumulative return before sales charges and taxes was 5.89%.

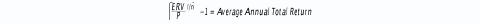

The following table shows the average annual total returns for each class of the Fund's shares. After-tax returns are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Your actual after-tax returns, depending on your individual tax situation, may differ from those shown and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for only one class and after-tax returns for other classes will vary.

|

Average Annual Total Returns for the periods ended December 31, 2009 |

1 Year |

Life of Class |

|

Class A Shares (inception 11/07/06) |

||

|

Return Before Taxes |

34.05% |

(1.33%) |

|

Return After Taxes on Distributions |

34.05% |

(1.32%) |

|

Return After Taxes on Distributions and Sale of Fund Shares |

24.67% |

(0.41%) |

|

Class B Shares (inception 11/07/06) |

34.74% |

(1.39%) |

|

Class C Shares (inception 11/07/06) |

38.73% |

(0.58%) |

|

Barclays Capital Municipal Bond Index |

12.91% |

4.33%* |

|

(reflects no deduction for fees, expenses or taxes) |

||

|

Consumer Price Index |

2.72% |

2.16%* |

|

(reflects no deduction for fees, expenses or taxes) |

* From 10/31/06.

Investment Adviser. OppenheimerFunds, Inc. is the Fund's investment adviser (the "Manager").

Portfolio Managers. Daniel G. Loughran, Scott S. Cottier, Troy E. Willis and Mark R. DeMitry are each a Vice President of the Fund and each has been a portfolio manager of the Fund since its inception. Marcus V. Franz has been a portfolio manager of the Fund since its inception. Michael L. Camarella is Vice President of the Fund and has been a portfolio manager for the Fund since January 2008.

Purchase and Sale of Fund Shares. In most cases, you can buy Fund shares with a minimum initial investment of $1,000 and make additional investments with as little as $50. For certain investment plans and retirement accounts, the minimum initial investment is $500 and, for some, the minimum additional investment is $25. For certain fee based programs the minimum initial investment is $250.

Shares may be purchased through a financial intermediary or the Distributor and redeemed through a financial intermediary or the Transfer Agent on days the New York Stock Exchange is open for trading. Shareholders may purchase or redeem shares by mail, through the website at www.oppenheimerfunds.com or by calling 1-800-225-5677. Share transactions may be paid by check, by Federal Funds wire or directly from or into your bank account.

Taxes. Dividends paid from net investment income on tax-exempt municipal securities will be excludable from gross income for federal income tax purposes. Dividends that are derived from interest paid on certain "private activity bonds" may be an item of tax preference if you are subject to the federal alternative minimum tax. The tax treatment of dividends is the same whether they are taken in cash or reinvested. Distributions may be taxable as ordinary income or as capital gains.

Payments to Broker-Dealers and Other Financial Intermediaries. If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund, the Manager, or their related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

MORE ABOUT THE FUND

The allocation of the Fund's portfolio among different types of investments will vary over time and the Fund's portfolio might not always include all of the different types of investments described below. The Statement of Additional Information contains more detailed information about the Fund's investment policies and risks.

THE FUND'S PRINCIPAL INVESTMENT STRATEGIES AND RISKS. The strategies and types of investments discussed in the Fund Summary are the ones that the Fund considers to be the most important in seeking to achieve its investment objective. Additionally, the following strategies and risks are those the Fund expects its portfolio to be subject to as a whole.

The Manager tries to reduce risks by selecting a wide variety of municipal investments and by carefully researching securities before they are purchased. However, changes in the overall market prices of municipal securities and the income they pay can occur at any time. The yield and share prices of the Fund will change daily based on changes in interest rates and market conditions and in response to other economic events.

Unless this prospectus or the Statement of Additional Information states that an investment percentage restriction applies on an ongoing basis, it applies only at the time the Fund makes an investment (except for borrowing and investments in illiquid securities).

MUNICIPAL SECURITIES. Municipal securities are issued to raise money for a variety of public or private purposes, including financing state or local governments, financing specific projects or financing public facilities. These debt obligations are issued by the state governments, as well as their political subdivisions (such as cities, towns, and counties) and their agencies and authorities. The Fund buys municipal bonds and notes, tax-exempt commercial paper, certificates of participation in municipal leases and other debt obligations. Municipal securities generally are classified as general or revenue obligations. General obligations are secured by the issuer's pledge of its full faith, credit and taxing power for the payment of principal and interest. Revenue obligations are bonds whose interest is payable only from the revenues derived from a particular facility or class of facilities, or a specific excise tax or other revenue source. Some revenue obligations are private activity bonds that pay interest that may be a tax preference item for investors subject to the federal alternative minimum tax. The Fund selects investments without regard to this type of tax treatment.

Additionally, there are times when an issuer will pledge its taxing power to offer additional security to a revenue bond. These securities are sometimes called "double-barreled bonds." See, for example, tobacco bonds with an appropriation pledge as discussed earlier in this prospectus.

The Fund can buy both long-term and short-term municipal securities. Long-term securities have a maturity of more than one year. The Fund generally focuses on longer-term securities to seek higher income.

Minnesota municipal securities are municipal securities that are not subject (in the opinion of bond counsel to the issuer at the time they are issued) to a Fund's respective state individual income tax. The term "Minnesota municipal securities" also includes debt securities of the governments of certain possessions, territories and commonwealths of the United States if the interest is not subject to state individual income tax. Some debt securities, such as zero-coupon securities, do not pay current interest. Other securities may be subject to calls by the issuer (to redeem the debt) or to prepayment prior to their stated maturity.

Tax-Exempt Commercial Paper. Tax-exempt commercial paper is a short-term obligation with a stated maturity of usually 270 days or less. It is issued by state and local governments or their agencies to finance seasonal working capital needs or as short-term financing in anticipation of longer-term financing. While tax-exempt commercial paper is intended to be repaid from general revenues or refinanced, it frequently is backed by a letter of credit, lending arrangement, note, repurchase agreement or other credit facility agreement offered by a bank or financial institution. Because tax-exempt issuers may constantly reissue their commercial paper and use the proceeds (or other sources) to repay maturing paper, the commercial paper of a tax-exempt issuer that is unable to continue to obtain liquidity in that manner may default. There may be a limited secondary market for issues of tax-exempt commercial paper.

Municipal Lease Obligations. Municipal leases are used by state and local governments to obtain funds to acquire land, equipment or facilities. The Fund can invest in certificates of participation that represent a proportionate interest in payments made under municipal lease obligations. Most municipal leases, while secured by the leased property, are not general obligations of the issuing municipality. They often contain "non-appropriation" clauses under which the municipal government has no obligation to make lease or installment payments in future years unless money is appropriated on a yearly basis.

If the municipal government stops making payments or transfers its payment obligations to a private entity, the obligation could lose value or become taxable. Although the obligation may be secured by the leased equipment or facilities, the disposition of the property in the event of non-appropriation or foreclosure might prove difficult, time consuming and costly, and may result in a delay in recovering or the failure to recover the original investment. Some lease obligations may not have an active trading market, making it difficult for the Fund to sell them quickly at an acceptable price.

Municipal Sector Concentration. While the Fund's fundamental policies do not allow it to concentrate its investments (that is, to invest more than 25% of its total assets) in a single industry, certain types of municipal securities are not considered a part of any "industry" under that policy. Examples of these types of municipal securities include: general obligation, government appropriation, municipal leases, special assessment and special tax bonds. Therefore, the Fund may invest more than 25% of its total assets in these types of municipal securities, which may finance similar types of projects or from which the interest is paid from revenues of similar types of projects. "Similar types of projects" are projects that are related in such a way that economic, business or political developments tend to have the same impact on each similar project. For example, a change that affects one project, such as proposed legislation on the financing of the project, a shortage of the materials needed for the project, or a declining economic need for the project, would likely affect all similar projects, thereby increasing market risk. Thus, market or economic changes that affect a security issued in connection with one project also would affect securities issued in connection with similar types of projects.

Although these types of municipal securities may be related to certain industries, because they are issued by governments or their political subdivisions, these types of municipal securities are not considered a part of any industry for purposes of the Fund's industry concentration policy.

Special Tax or Special Assessment Bonds (Land-Secured or "Dirt" Bonds). The Fund can invest more than 25% of its total assets in municipal securities for similar types of projects that are issued in connection with special taxing districts that are organized to plan and finance infrastructure development to induce residential, commercial and industrial growth and redevelopment. The bonds financed by these methods, such as tax assessment, special tax or tax increment financing generally are payable solely from taxes or other revenues attributable to the specific projects financed by the bonds without recourse to the credit or taxing power of related or overlapping municipalities. These projects often are exposed to real estate development-related risks and can have more taxpayer concentration risk than general tax-supported bonds, such as general obligation bonds. Further, the fees, special taxes, or tax allocations and other revenues that are established to secure such financings generally are limited as to the rate or amount that may be levied or assessed and are not subject to increase pursuant to rate covenants or municipal or corporate guarantees. The bonds could default if development failed to progress as anticipated or if larger taxpayers failed to pay the assessments, fees and taxes as provided in the financing plans of the projects.

Ratings of Municipal Securities the Fund Buys. The Manager may rely to some extent on credit ratings by nationally recognized statistical rating organizations in evaluating the credit risk of securities selected for the Fund's portfolio. Credit ratings evaluate the expectation that scheduled interest and principal payments will be made in a timely manner. They do not reflect any judgment of market risk.

Rating agencies might not always change their credit rating of an issuer in a timely manner to reflect events that could affect the issuer's ability to make timely payments on its obligations. In selecting securities for its portfolio and evaluating their income potential and credit risk, the Fund does not rely solely on ratings by rating organizations but evaluates business, economic and other factors affecting issuers as well. Many factors affect an issuer's ability to make timely payments, and the credit risk of a particular security may change over time. The Manager also may use its own research and analysis. If a bond is insured, it will usually be rated by the rating agencies based on the financial strength of the insurer. The rating categories are described in an Appendix to the Statement of Additional Information.

Unrated Securities. Because the Fund may purchase securities that are not rated by any nationally recognized statistical rating organization, the Manager may internally assign ratings to those securities, after assessing their credit quality and other factors, in categories similar to those of nationally recognized statistical rating organizations. Unrated securities are considered "investment-grade" or "below-investment-grade" if

judged by the Manager to be comparable to rated investment-grade or below-investment-grade securities. However, the Manager's rating does not constitute a guarantee of the credit quality. Some unrated securities may not have an active trading market, which means that the Fund might have difficulty selling them promptly at an acceptable price.

In evaluating the credit quality of a particular security, whether rated or unrated, the Manager will normally take into consideration a number of factors. Among them are the financial resources of the issuer, or the underlying source of funds for debt service on a security, the issuer's sensitivity to economic conditions and trends, any operating history of the facility financed by the obligation and the degree of community support for it, the capabilities of the issuer's management

and regulatory factors affecting the issuer and particular facility.

A reduction in the rating of a security after the Fund buys it will not automatically require the Fund to dispose of the security. However, the Manager will evaluate such downgraded securities to determine whether to keep them in the Fund's portfolio.

The Fund can invest as much as 25% of its total assets in securities that are not "investment-grade" (measured at the time of purchase) to seek higher income.

Borrowing and Leverage. The Fund can borrow from banks, a technique referred to as "leverage," in amounts up to one-third of the Fund's total assets (including the amount borrowed) less all liabilities and indebtedness other than borrowings. The Fund can use those borrowings for investment-related purposes such as purchasing securities believed to be desirable by the Manager when available, funding amounts necessary to unwind or "collapse" trusts that issued "inverse floaters" to the Fund (an investment vehicle used by the Fund as described in this prospectus), or to contribute to such trusts to enable them to meet tenders of their other securities by the holders. The Fund currently participates in a line of credit with other Oppenheimer funds for those purposes. The Fund may also borrow to meet redemption obligations or for temporary and emergency purposes.

Borrowing for leverage will subject the Fund to greater costs (for interest payments to the lender, origination fees and related expenses) than funds that do not borrow for leverage and these other purposes. The interest on borrowed money is an expense that might reduce the Fund's yield, especially if the cost of borrowing to buy securities exceeds the yield on the securities purchased with the proceeds of a loan. Using leverage may also make the Fund's share price more sensitive, i.e. volatile, to interest rate changes than if the Fund did not use leverage due to the tendency to exaggerate the effect of any increase or decrease in the value of the Fund's portfolio securities. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or meet segregation requirements under the Investment Company Act.

Special Risks of Derivative Investments. The Fund can invest in different types of "derivative" investments that are consistent with its investment strategies. A derivative is an investment whose value depends on (or is derived from) the value of an underlying security, asset, interest rate, index or currency. Inverse floaters are the primary type of derivative the Fund can use.

The Fund may use derivatives to seek income or capital gain or to hedge against the risks of other investments. Derivatives may allow the Fund to increase or decrease its exposure to certain markets or risks very quickly. Examples include, but are not limited to, interest rate swaps or municipal bond swaps. While the Fund may use derivatives for hedging purposes, it typically does not use hedging instruments, such as options, to hedge investment risks.

Derivatives may be volatile and may involve significant risks. Derivative transactions may require the payment of premiums. Certain derivative investments held by the Fund may be illiquid, making it difficult to close out an unfavorable position. The underlying security or other reference rate on which a derivative is based, or the derivative itself, may not perform as expected. As a result, the Fund could realize little or no income or lose principal from the investment, or a hedge might be unsuccessful. The Fund may also lose money on a derivative investment if the issuer fails to pay the amount due.

Inverse Floaters. The Fund may invest in inverse floaters to seek greater income and total return. Inverse floaters, under ordinary circumstances, tend to benefit from higher yields and thus provide higher income than fixed rate bonds of comparable maturity and credit quality. An inverse floater is a derivative instrument, typically created by a trust, that divides a municipal security into two securities: a short-term tax-exempt floating rate security (sometimes referred to as a "tender option bond") and a long-term tax-exempt floating rate security (referred to as a "residual certificate" or "inverse floater") that pays interest at rates that move in the opposite direction of the yield on the short-term floating rate security. The purchaser of a "tender option bond" has the right to tender the security periodically for repayment of the principal value. As short-term interest rates rise, inverse floaters produce less current income (and, in extreme cases, may pay no income) and as short-term interest rates fall, inverse floaters produce more current income. Thus, if short-term interest rates rise after the issuance of the floater, any yield advantage is reduced or eliminated.

To facilitate the creation of inverse floaters, the Fund may purchase a municipal security and subsequently transfer it to a broker-dealer (the sponsor), which deposits the municipal security in a trust. The trust issues the residual certificates and short-term floating rate securities. The trust documents enable the Fund to withdraw the underlying bond to unwind or "collapse" the trust (upon tendering the residual certificate and paying the value of the short-term bonds and certain other costs). The Fund may also purchase inverse floaters created by municipal issuers directly or by other parties that have deposited municipal bonds into a sponsored trust.

The Fund's investments in inverse floaters involve certain risks. The market value of an inverse floater residual certificate can be more volatile than that of a conventional fixed-rate bond having similar credit quality, maturity and redemption provisions. Typically, inverse floater residual certificates tend to underperform fixed-rate bonds when long-term interest rates are rising but tend to outperform fixed-rate bonds when long-term interest rates are stable or falling. Inverse floater residual certificates entail a degree of leverage because the trust issues short-term securities in a ratio to the residual certificates with the underlying long-term bond providing collateral for the obligation to pay the principal value of the short-term securities if and when they are tendered. If the Fund has created the inverse floater by depositing a long-term bond into a trust, it may be required to provide additional collateral for the short-term securities if the value of the underlying bond deposited in the trust falls.

An inverse floater that has a higher degree of leverage is typically more volatile with respect to its price and income than an inverse floater having a lower degree of leverage. Under inverse floater arrangements, if the remarketing agent that offers the short-term securities for sale is unable to sell them, or if the holders tender (or put) them for repayment of principal and the remarketing agent is unable to remarket them, the remarketing agent may cause the trust to be collapsed, and in the case of floaters created by the Fund, the Fund will then be required to repay the principal amount of the tendered securities. During times of market volatility, illiquidity or uncertainty, the Fund could be required to sell other portfolio holdings at a disadvantageous time to raise cash to meet that obligation.

Some inverse floaters may have a "cap," so that if interest rates rise above the cap, the security pays additional interest income. If rates do not rise above the cap, the Fund will have paid an additional amount for that feature that has proved worthless.

The Fund may also enter into "shortfall and forbearance" agreements with respect to inverse floaters. Under those agreements, upon liquidation of the trust, the Fund is committed to pay the trust the difference between the liquidation value of the underlying municipal bond on which the inverse floater is based and the principal amount payable to the holders of the short-term floating rate security that is based on the same underlying municipal security. Although the Fund has the risk that it may be required to make such additional payment, these agreements may offer higher interest payments than a standard inverse floater.

Accounting Treatment of Inverse Floaters. Because of the accounting treatment for inverse floaters created by the Fund's transfer of a municipal bond to a trust, the Fund's financial statements will reflect these transactions as "secured borrowings," which affects the Fund's expense ratios, statements of income and assets and liabilities and causes the Fund's Statement of Investments to include the underlying municipal bond. The Fund's annual fund operating expenses, shown earlier in this prospectus, include certain expenses and fees related to the Fund's investments in inverse floaters. Some of those expenses are liabilities with respect to interest paid on short-term floating rate notes issued by the trusts whose inverse floater certificates are held by the Fund. Under accounting rules, the Fund also recognizes additional income in an amount that directly corresponds to these expenses and, as a result the Fund's net asset values per share and total returns have not been affected by these additional expenses.

Floating Rate/Variable Rate Obligations. Some municipal securities have variable or floating interest rates. Variable rates are adjustable at stated periodic intervals. Floating rates are automatically adjusted according to a specified market rate for those investments, such as, for example, the percentage of LIBOR, the SIFMA Municipal Swap Index or the percentage of the prime rate of a bank. These obligations may be secured by bank letters of credit or other credit support arrangements. Inverse floaters, discussed in this prospectus, are a type of variable rate obligation.

When-Issued and Delayed-Delivery Transactions. The Fund may purchase municipal securities on a "when-issued" basis and may purchase or sell such securities on a "delayed-delivery" basis. "When-issued" or "delayed-delivery" refers to securities whose terms and indenture are available and for which a market exists, but which are not available for immediate delivery. Between the purchase and settlement date, no payment is made for the security and no interest accrues to the buyer from the investment. There is a risk of loss to the Fund if the value of the security declines prior to the settlement date.

The securities are subject to changes in value from market fluctuations during the period until settlement and the value of the security on the delivery date may be more or less than the Fund paid. The Fund may lose money if the value of the security declines below the purchase price.

OTHER INVESTMENT STRATEGIES AND RISKS. The Fund can also use the investment techniques and strategies described below. The Fund might not use all of these techniques or strategies or might only use them from time to time.

Percentage of LIBOR Notes (PLNs). The Fund may invest in Percentage of LIBOR Notes ("PLNs") which are variable rate municipal securities based on the London Interbank Offered Rate ("LIBOR"), a widely used benchmark for short-term interest rates and used by banks for interbank loans with other banks. A PLN typically pays interest based on a percentage of a LIBOR rate for a specified time plus an established yield premium. Due to their variable rate features, PLNs will generally pay higher levels of income in a rising short-term interest rate environment and lower levels of income as short-term interest rates decline. In times of substantial market volatility, however, PLNs may not perform as anticipated. The value of a PLN also may decline due to other factors, such as changes in credit quality of the underlying bond.

Because the market for PLNs is relatively new and still developing, the Fund's ability to engage in transactions using such instruments may be limited. There is no assurance that a liquid secondary market will exist for any particular PLN or at any particular time, and so the Fund may not be able to close a position in a PLN when it is advantageous to do so. The Fund may also transfer a PLN to a sponsor to create an inverse floater, which may further increase the volatility of the market value of a PLN or the inverse floater.

Zero-Coupon Securities. The Fund can invest without limit in zero-coupon securities. These debt obligations do not pay interest prior to their maturity date or else they do not start to pay interest at a stated coupon rate until a future date. They are issued and traded at a discount from their face amount. The discount varies as the securities approach their maturity date (or the date interest payments are scheduled to begin). When interest rates change, zero-coupon securities are subject to greater fluctuations in their value than securities that pay current interest. The Fund accrues the discount on zero-coupon bonds as tax-free income on a current basis. The Fund may have to pay out the imputed income on zero-coupon securities without receiving actual cash payments currently.

Illiquid Securities. Investments may be illiquid because they do not have an active trading market, making it difficult to value them or dispose of them promptly at an acceptable price. The Manager monitors holdings of illiquid securities on an ongoing basis to determine whether to sell any holdings.

The Fund will not invest more than 15% of its net assets in illiquid securities.

Taxable Investments. The Fund can invest up to 20% of its net assets (plus borrowings for investment purposes) in investments that generate income subject to income taxes. Taxable investments include, for example, hedging instruments, repurchase agreements, and many of the types of securities the Fund would buy for temporary defensive purposes. The Fund does not anticipate investing substantial amounts of its assets in taxable investments under normal market conditions or as part of its normal trading strategies and policies.

Temporary Defensive and Interim Investments. For temporary defensive purposes in times of adverse or unstable market, economic or political conditions, the Fund can invest up to 100% of its assets in investments that may be inconsistent with the Fund's principal investment strategies. Generally, the Fund would invest in short-term municipal securities, but could also invest in U.S. Government securities or highly-rated corporate debt securities. The Fund might also hold these types of securities as interim investments pending the investment of proceeds from the sale of Fund shares or the sale of Fund portfolio securities or to meet anticipated redemptions of Fund shares. The income from some temporary defensive investments may not be tax-exempt, and therefore to the extent the Fund invests in these securities, it might not achieve its investment objective.

Portfolio Turnover. A change in the securities held by the Fund is known as "portfolio turnover." The Fund may engage in active and frequent trading to try to achieve its investment objective and may have a portfolio turnover rate of over 100% annually. Increased portfolio turnover may result in higher brokerage fees or other transaction costs, which can reduce performance. However, the Fund ordinarily incurs little or no brokerage expense because most of the Fund's portfolio transactions are principal trades that do not require payment of brokerage commission. If the Fund realizes capital gains when it sells investments, it generally must pay those gains to shareholders, increasing its taxable distributions. The Financial Highlights table at the end of this prospectus shows the Fund's portfolio turnover rates during past fiscal years.

Conflicts of Interest. The investment activities of the Manager and its affiliates in regard to other funds and accounts they manage may present conflicts of interest that could disadvantage the Fund and its shareholders. The Manager or its affiliates may provide investment advisory services to other funds and accounts that have investment objectives or strategies that differ from, or are contrary to, those of the Fund. That may result in another fund or account holding investment positions that are adverse to the Fund's investment strategies or activities. Other funds or accounts advised by the Manager or its affiliates may have conflicting interests arising from investment objectives that are similar to those of the Fund. Those funds and accounts may engage in, and compete for, the same types of securities or other investments as the Fund or invest in securities of the same issuers that have different, and possibly conflicting, characteristics. The trading and other investment activities of those other funds or accounts may be carried out without regard to the investment activities of the Fund and, as a result, the value of securities held by the Fund or the Fund's investment strategies may be adversely affected. The Fund's investment performance will usually differ from the performance of other accounts advised by the Manager or its affiliates and the Fund may experience losses during periods in which other accounts advised by the Manager or its affiliates achieve gains. The Manager has adopted policies and procedures designed to address potential conflicts of interest identified by the Manager; however, such policies and procedures may also limit the Fund's investment activities and affect its performance.

CHANGES TO THE FUND'S INVESTMENT POLICIES. The Fund's fundamental investment policies cannot be changed without the approval of a majority of the Fund's outstanding voting shares; however, the Fund's Board can change non-fundamental policies without a shareholder vote. Significant policy changes will be described in supplements to this prospectus. The Fund's investment objective is a fundamental policy. Other investment restrictions that are fundamental policies are listed in the Fund's Statement of Additional Information. An investment policy is not fundamental unless this prospectus or the Statement of Additional Information states that it is.

PORTFOLIO HOLDINGS

The Fund's portfolio holdings are included in its semi-annual and annual reports that are distributed to its shareholders within 60 days after the close of the applicable reporting period. The Fund also discloses its portfolio holdings in its Statements of Investments on Form N-Q, which are public filings that are required to be made with the Securities and Exchange Commission within 60 days after the end of the Fund's first and third fiscal quarters. Therefore, the Fund's portfolio holdings are made publicly available no later than 60 days after the end of each of its fiscal quarters.

A description of the Fund's policies and procedures with respect to the disclosure of its portfolio holdings is available in the Fund's Statement of Additional Information.

THE MANAGER. OppenheimerFunds, Inc., the Manager, chooses the Fund's investments and handles its day-to-day business. The Manager carries out its duties, subject to the policies established by the Fund's Board of Trustees, under an investment advisory agreement that states the Manager's responsibilities. The agreement sets the fees the Fund pays to the Manager and describes the expenses that the Fund is responsible to pay to conduct its business.

The Manager has been an investment adviser since 1960. The Manager managed funds with approximately 6 million shareholder accounts as of June 30, 2010. The Manager is located at Two World Financial Center, 225 Liberty Street, 11th Floor, New York, New York 10281-1008.

Advisory Fees. Under the Fund's investment advisory agreement, the Fund pays the Manager an advisory fee, calculated on the daily net assets of the Fund, at an annual rate that declines on additional assets as the Fund's assets grow: 0.55% of the first $500 million of average annual net assets, 0.50% of the next $500 million, 0.45% of the next $500 million and 0.40% of average annual net assets over $1.5 billion. The Fund's management fee for its last fiscal year ended March 31, 2010 was 0.55% of average annual net assets for each class of shares.

Prior to July 1, 2009, the Manager voluntarily waived management fees and/or reimbursed the Fund for certain expenses so that the "Total Annual Fund Operating Expenses", excluding expenses attributable to the Fund's investment in inverse floaters, would not exceed 0.80% of average annual net assets for Class A shares and 1.55% of average annual net assets for Class B and Class C shares. Effective July 1, 2009, the Manager amended this voluntary undertaking so that the Fund's "Total Annual Fund Operating Expenses," excluding expenses attributable to the Fund's investments in inverse floaters and interest and fees from borrowings, will not exceed 0.80% of average annual net assets for Class A shares and 1.55% of average annual net assets for Class B and Class C shares. This undertaking may be amended or withdrawn after one year from the date of this prospectus.

The Fund's transfer agent has voluntarily agreed to limit its fees to 0.35% of average annual net assets per fiscal year for all classes. This undertaking may be amended or withdrawn at any time. For the Fund's fiscal year ended March 31, 2010, the transfer agent's fees did not exceed this expense limitation. Actual total annual fund operating expenses for the fiscal year ended March 31, 2010 were those shown in the Annual Fund Operating Expenses table earlier in this prospectus. The Fund's management fee and other annual operating expenses may vary in future years.

A discussion regarding the basis for the Board of Trustees' approval of the investment advisory contract for the Fund is available in the Fund's Semi-Annual Report to shareholders for the period ended September 30, 2009.

Portfolio Managers. The Fund's portfolio is managed by a team of investment professionals, including Daniel G. Loughran, Scott S. Cottier, Troy E. Willis, Mark R. DeMitry, Marcus V. Franz and Michael L. Camarella, who are primarily responsible for the day-to-day management of the Fund's investments. Messrs. Loughran, Cottier, Willis, DeMitry and Franz have been portfolio managers of the Fund since its inception. Mr. Camarella has been a portfolio manager of the Fund since January 2008.

Mr. Loughran has been a Senior Vice President of the Manager since July 2007 and a Senior Portfolio Manager of the Manager since December 2001. He was a Vice President of the Manager from April 2001 to June 2007. Mr. Loughran is a team leader, a portfolio manager, an officer, and a trader for the Fund and other Oppenheimer funds.

Mr. Cottier has been a Vice President and Senior Portfolio Manager of the Manager since September 2002. He is a portfolio manager, an officer, and a trader for the Fund and other Oppenheimer funds.

Mr. Willis has been a Vice President of the Manager since July 2009 and a Senior Portfolio Manager of the Manager since January 2006. He was an Assistant Vice President of the Manager from July 2005 to June 2009 and a Portfolio Manager of the Manager from June 2003 to December 2005. Mr. Willis is a portfolio manager, an officer, and a trader for the Fund and other Oppenheimer funds.

Mr. DeMitry has been a Vice President and Senior Portfolio Manager of the Manager since July 2009. He was a Portfolio Manager with the Manager from September 2006 to June 2009. He was a research analyst from June 2003 to August 2006. Mr. DeMitry is a portfolio manager, an officer and a trader for the Fund and other Oppenheimer funds.

Mr. Franz has been a Vice President and Senior Portfolio Manager of the Manager since July 2009. He was a Portfolio Manager with the Manager from October 2006 to June 2009. He was a research analyst with the Manager from June 2003 to September 2006. Mr. Franz is a portfolio manager and a trader for the Fund and other Oppenheimer funds.

Mr. Camarella has been an Assistant Vice President of the Manager since July 2009. He has been an Associate Portfolio Manager of the Manager since January 2008. He was a research analyst with the Manager from April 2006 to December 2007. He was a credit analyst with the Manager from June 2003 to March 2006. Mr. Camarella is a portfolio manager, an officer and a trader for the Fund and other Oppenheimer funds.

The Statement of Additional Information provides additional information about the portfolio managers' compensation, other accounts they manage and their ownership of Fund shares.

MORE ABOUT YOUR ACCOUNT

Where Can You Buy Fund Shares? Oppenheimer funds may be purchased either directly or through a variety of "financial intermediaries" that offer Fund shares to their clients. Financial intermediaries include securities dealers, financial advisers, brokers, banks, trust companies, insurance companies and the sponsors of fund "supermarkets," fee-based advisory or wrap fee programs.

WHAT CLASSES OF SHARES DOES THE FUND OFFER? The Fund offers investors three different classes of shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different expenses and will usually have different share prices. When you buy shares, be sure to specify the class of shares you wish to purchase. If you do not choose a class, your investment will be made in Class A

shares.

Class A Shares. If you buy Class A shares, you will pay an initial sales charge on investments up to $1 million for regular accounts or lesser amounts if you qualify for certain fee waivers. The amount of the sales charge will vary depending on the amount you invest. The sales charge rates for different investment amounts are listed in "About Class A Shares" below.

Class B Shares. If you buy Class B shares, you will pay no sales charge at the time of purchase, but you will pay an annual asset-based sales charge (distribution fee) over a period of approximately six years. If you sell your shares within six years after buying them, you will normally pay a contingent deferred sales charge. The amount of the contingent deferred sales charge varies depending on how long you own your shares, as described in "About Class B Shares" below.

Class C Shares. If you buy Class C shares, you will pay no sales charge at the time of purchase, but you will pay an ongoing asset-based sales charge. If you sell your shares within 12 months after buying them, you will normally pay a contingent deferred sales charge of 1.0%, as described in "About Class C Shares" below.

Certain sales charge waivers may apply to purchases or redemptions of Class A, Class B, or Class C shares. More information about those waivers is available in the Fund's Statement of Additional Information, or by clicking on the hyperlink "Sales Charge Waivers" under the heading "Fund Information" on the OppenheimerFunds website at "www.oppenheimerfunds.com."

WHAT IS THE MINIMUM INVESTMENT? In most cases, you can buy Fund shares with a minimum initial investment of $1,000 and make additional investments with as little as $50. The minimum additional investment requirement does not apply to reinvested dividends from the Fund or from other Oppenheimer funds or to omnibus account purchases. A $25 minimum applies to additional investments through an Asset Builder Plan, an Automatic Exchange Plan or a government allotment plan established before November 1, 2002. Reduced initial minimums are available in certain circumstances, including under the following investment plans:

- For an Asset Builder Plan or Automatic Exchange Plan or a government allotment plan, the minimum initial investment is $500.

- For certain fee based programs that have an agreement with the Distributor, a minimum initial investment of $250 applies.

- The minimum purchase amounts listed do not apply to omnibus accounts.

Minimum Account Balance. A $12 annual "minimum balance fee" is assessed on Fund accounts with a value of less than $500. The fee is automatically deducted from each applicable Fund account annually in September. See the Statement of Additional Information for information about the circumstances under which this fee will not be assessed. Small accounts may be involuntarily redeemed by the Fund if the value has fallen below $500 for reasons other than a decline in the market value of the shares.

CHOOSING A SHARE CLASS. Once you decide that the Fund is an appropriate investment for you, the decision as to which class of shares is best suited to your needs depends on a number of factors that you should discuss with your financial adviser. The Fund's operating costs that apply to a share class and the effect of the different types of sales charges on your investment will affect your investment results over time. For example, the net asset value and the dividends of Class B and Class C shares will be reduced by additional expenses borne by those classes such as the asset-based sales charge.

Two of the factors to consider are how much you plan to invest and, while future financial needs cannot be predicted with certainty, how long you plan to hold your investment. For example, with larger purchases that qualify for a reduced initial sales charge on Class A shares, the effect of paying an initial sales charge on purchases of Class A shares may be less over time than the effect of the asset-based sales charges on Class B or Class C shares. If your goals and objectives change over time and you plan to purchase additional shares, you should re-evaluate each of the factors to see if you should consider a different class of shares.

The discussion below is not intended to be investment advice or a recommendation, because each investor's financial considerations are different. The discussion below assumes that you will purchase only one class of shares and not a combination of shares of different classes. These examples are based on approximations of the effects of current sales charges and expenses projected over time, and do not detail all of the considerations in selecting a class of shares. You should analyze your options carefully with your financial adviser before making that choice.

- Investing for the Shorter Term. While the Fund is meant to be a long-term investment, if you have a relatively short-term investment horizon (that is, if you do not plan to hold your shares for six years or more), you should consider investing in Class C shares. That is because of the effect of the initial sales charge on Class A shares or the Class B contingent deferred sales charge if you redeem within six years.

- Investing for the Longer Term. If you are investing less than $100,000 for the longer term and do not expect to need access to your money for six years or more, Class B shares may be appropriate.

- Amount of Your Investment. Your choice will also depend on how much you plan to invest. For shorter-term investments of less than $100,000, Class C shares might be the appropriate choice because there is no initial sales charge on Class C shares, and the contingent deferred sales charge does not apply to shares you redeem after holding them for one year or more. However, if you plan to invest more than $100,000, and as your investment horizon increases toward six years, Class C shares might not be as advantageous as Class A shares. That is because over time the ongoing asset-based sales charge on Class C shares will have a greater impact on your account than the reduced front-end sales charge available for Class A share purchases of $100,000 or more. If you invest $1 million or more, in most cases Class A shares will be the most advantageous choice, no matter how long you intend to hold your shares.

The Distributor normally will not accept purchase orders from a single investor for more than $100,000 of Class B shares or for $1 million or more of Class C shares. Dealers or other financial intermediaries are responsible for determining the suitability of a particular share class for an investor.

Are There Differences in Account Features That Matter to You? Some account features may not be available for all share classes. Other features may not be advisable because of the effect of the contingent deferred sales charge. Therefore, you should carefully review how you plan to use your investment account before deciding which class of shares to buy.

How Do Share Classes Affect Payments to Your Financial Intermediary? The Class B and Class C contingent deferred sales charges and asset-based sales charges have the same purpose as the front-end sales charge or contingent deferred sales charge on Class A shares: to compensate the Distributor for concessions and expenses it pays to brokers, dealers and other financial intermediaries for selling Fund shares. Those financial intermediaries may receive different compensation for selling different classes of shares. The Manager or Distributor may also pay dealers or other financial intermediaries additional amounts from their own resources based on the value of Fund shares held by the intermediary for its own account or held for its customers accounts. For more information about those payments, see "Payments to Financial Intermediaries and Service Providers" below.

ABOUT CLASS A SHARES. Class A shares are sold at their offering price, which is the net asset value of the shares (described below) plus, in most cases, an initial sales charge. The Fund receives the amount of your investment, minus the sales charge, to invest for your account. In some cases, Class A purchases may qualify for a reduced sales charge or a sales charge waiver, as described below and in the Statement of Additional Information.

The Class A sales charge rate varies depending on the amount of your purchase. A portion or all of the sales charge may be retained by the Distributor or paid to your broker, dealer or other financial intermediary as a concession. The current sales charge rates and concessions paid are shown in the table below. There is no initial sales charge on Class A purchases of $1 million or more, but a contingent deferred sales charge (described below) may apply.

|

Amount of Purchase |

Front-End Sales Charge As a Percentage of Offering Price |

Front-End Sales Charge As a Percentage of Net Amount Invested |

Concession As a Percentage of Offering Price |

|

Less than $50,000 |

4.75% |

4.98% |

4.00% |

|

$50,000 or more but less than $100,000 |

4.50% |

4.71% |

4.00% |

|

$100,000 or more but less than $250,000 |

3.50% |

3.63% |

3.00% |

|

$250,000 or more but less than $500,000 |

2.50% |

2.56% |

2.25% |

|

$500,000 or more but less than $1 million |

2.00% |

2.04% |

1.80% |

Due to rounding, the actual sales charge for a particular transaction may be higher or lower than the rates listed above.

Reduced Class A Sales Charges. Under a "Right of Accumulation" or a "Letter of Intent" you may be eligible to buy Class A shares of the Fund at the reduced sales charge rates that would apply to a larger purchase. The Fund reserves the right to modify or to cease offering these programs at any time.

- Right of Accumulation. To qualify for the reduced Class A sales charge that would apply to a larger purchase than you are currently making, you can add the value of shares that you and your spouse currently own, and other purchases that you are currently making, to the value of your Class A share purchase of the Fund. You may count Class A, Class B and Class C shares of the Fund and other Oppenheimer funds and Class A, Class B, Class C, Class G and Class H units in adviser sold Section 529 plans, for which the Manager or the Distributor serves as the "Program Manager" or "Program Distributor." The Distributor or the financial intermediary through which you are buying shares will determine the value of the shares you currently own based on the greater of their current offering price or the amount you paid for the shares. For purposes of calculating that value, the Distributor will only take into consideration the value of shares owned as of December 31, 2007 and any shares purchased subsequently. The value of any shares that you have redeemed and the value of Class A shares of Oppenheimer Money Market Fund, Inc. or Oppenheimer Cash Reserves on which you have not paid a sales charge will not be counted for this purpose.

In totaling your holdings, you may count shares held in:

- your individual accounts (including IRAs, 403(b) plans and eligible 529 plans),

- your joint accounts with your spouse,

- accounts you or your spouse hold as trustees or custodians on behalf of your children who are minors.

A fiduciary can apply rights of accumulation to all shares purchased for a trust, estate or other fiduciary account that has multiple accounts (including employee benefit plans for the same employer and Single K plans for the benefit of a sole proprietor).

If you are buying shares directly from the Fund, you must inform the Distributor of your eligibility and holdings at the time of your purchase in order to qualify for the Right of Accumulation. If you are buying shares through a financial intermediary you must notify the intermediary of your eligibility for the Right of Accumulation at the time of your purchase.

To count eligible shares held in accounts at other firms, you may be requested to provide the Distributor or your current financial intermediary with a copy of account statements showing your current holdings of the Fund, other eligible Oppenheimer funds or qualifying 529 plans. Shares purchased under a Letter of Intent may also qualify as eligible holdings under a Right of Accumulation.

- Letter of Intent. You may also qualify for reduced Class A sales charges by submitting a Letter of Intent to the Distributor. A Letter of Intent is a written statement of your intention to purchase a specified value of Class A, Class B or Class C shares of the Fund or other Oppenheimer funds or Class A, Class B, Class C, Class G or Class H unit purchases in adviser sold Section 529 plans, for which the Manager or Distributor serves as the Program Manager or Program Distributor, over a 13-month period. The total amount of your intended purchases will determine the reduced sales charge rate that will apply to your Class A share purchases during that period. You must notify the Distributor or your financial intermediary of any qualifying 529 plan purchases or purchases through other financial intermediaries.

Purchases of Class N or Class Y shares, purchases made by reinvestment of dividends or capital gains distributions from other Oppenheimer funds, purchases of Class A shares with redemption proceeds under the "reinvestment privilege" described below, and purchases of Class A shares of Oppenheimer Money Market Fund, Inc. or Oppenheimer Cash Reserves on which a sales charge has not been paid do not count as "qualified shares" for satisfying the terms of a Letter.