UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended March 31, 2024

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 001-35518

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

(301 ) 838-2500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Securities registered pursuant to Section 12(b) of the Exchange Act

| Title of each class | Outstanding at May 1, 2024 | Trading Symbol | Name of each exchange on which registered | |||||||||||||||||

1

SUPERNUS PHARMACEUTICALS, INC.

FORM 10-Q — QUARTERLY REPORT

FOR THE QUARTERLY PERIOD ENDED March 31, 2024

| Page No. | |||||

2

PART I — FINANCIAL INFORMATION

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share data)

| March 31, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Marketable securities | |||||||||||

| Accounts receivable, net | |||||||||||

| Inventories, net | |||||||||||

| Prepaid expenses and other current assets | |||||||||||

| Total current assets | |||||||||||

| Long-term marketable securities | |||||||||||

| Property and equipment, net | |||||||||||

| Intangible assets, net | |||||||||||

| Goodwill | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and stockholders’ equity | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable and accrued liabilities | $ | $ | |||||||||

| Accrued product returns and rebates | |||||||||||

| Contingent consideration, current portion | |||||||||||

| Other current liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Contingent consideration, long-term | |||||||||||

| Operating lease liabilities, long-term | |||||||||||

| Deferred income tax liabilities, net | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

Commitments and contingencies (Note 15) | |||||||||||

| Stockholders’ equity | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive loss, net of tax | ( | ( | |||||||||

| Retained earnings | |||||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

See accompanying notes.

3

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Earnings

(in thousands, except share and per share data)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Revenues | |||||||||||

| Net product sales | $ | $ | |||||||||

| Royalty and licensing revenues | |||||||||||

| Total revenues | |||||||||||

| Costs and expenses | |||||||||||

Cost of goods sold(a) | |||||||||||

| Research and development | |||||||||||

| Selling, general and administrative | |||||||||||

| Amortization of intangible assets | |||||||||||

| Contingent consideration gain | ( | ( | |||||||||

| Total costs and expenses | |||||||||||

| Operating earnings (loss) | ( | ||||||||||

| Other income (expense) | |||||||||||

| Interest and other income, net | |||||||||||

| Interest expense | ( | ||||||||||

| Total other income (expense) | |||||||||||

| Earnings before income taxes | |||||||||||

| Income tax expense (benefit) | ( | ||||||||||

| Net earnings | $ | $ | |||||||||

| Earnings per share | |||||||||||

| Basic | $ | $ | |||||||||

| Diluted | $ | $ | |||||||||

| Weighted average shares outstanding | |||||||||||

| Basic | |||||||||||

| Diluted | |||||||||||

(a) Excludes amortization of acquired intangible assets

See accompanying notes.

4

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Comprehensive Earnings

(in thousands)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Net earnings | $ | $ | |||||||||

| Other comprehensive gain | |||||||||||

| Unrealized gain on marketable securities, net of tax | |||||||||||

| Other comprehensive gain | |||||||||||

| Comprehensive earnings | $ | $ | |||||||||

See accompanying notes.

5

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Changes in Stockholders’ Equity

Three Months Ended March 31, 2024 and 2023

(unaudited, in thousands, except share data)

| j | Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Earnings (Loss) | Retained Earnings | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||

| Share-based compensation expense related to employee stock purchase plan and share-based awards | — | — | — | — | |||||||||||||||||||||||||||||||

| Issuance of common stock related to employee stock purchase plan and share-based awards, net of taxes withheld | — | — | — | ||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | |||||||||||||||||||||||||||||||

| Unrealized gain on marketable securities, net of tax | — | — | — | — | |||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Earnings (Loss) | Retained Earnings | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||

| Share-based compensation expense related to employee stock purchase plan and share-based awards | — | — | — | — | |||||||||||||||||||||||||||||||

| Issuance of common stock related to employee stock purchase plan and share-based awards, net of taxes withheld | — | — | — | ||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | |||||||||||||||||||||||||||||||

| Unrealized gain on marketable securities, net of tax | — | — | — | — | |||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||

See accompanying notes.

6

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Cash flows from operating activities | |||||||||||

| Net earnings | $ | $ | |||||||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Amortization of deferred financing costs and debt discount | |||||||||||

| Amortization of premium/discount on marketable securities | ( | ||||||||||

| Change in fair value of contingent consideration | ( | ( | |||||||||

| Other noncash adjustments, net | |||||||||||

| Share-based compensation expense | |||||||||||

| Deferred income tax benefit | ( | ( | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | ( | ||||||||||

| Inventories | ( | ||||||||||

| Prepaid expenses and other assets | ( | ( | |||||||||

| Accrued product returns and rebates | ( | ||||||||||

| Accounts payable and other liabilities | ( | ||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities | |||||||||||

| Purchases of marketable securities | ( | ||||||||||

| Sales and maturities of marketable securities | |||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Net cash provided by (used in) investing activities | ( | ||||||||||

| Cash flows from financing activities | |||||||||||

| Proceeds from Credit Line | |||||||||||

| Payments on Credit Line | ( | ||||||||||

| Proceeds from issuance of common stock | |||||||||||

| Employee taxes paid related to net share settlement of equity awards | ( | ( | |||||||||

| Net cash provided by financing activities | |||||||||||

| Net change in cash, cash equivalents, and restricted cash | ( | ||||||||||

| Cash and cash equivalents at beginning of year | |||||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | $ | |||||||||

| Supplemental cash flow information | |||||||||||

| Cash paid for income taxes | $ | $ | |||||||||

| Cash paid for operating leases | |||||||||||

| Noncash operating and investing activities | |||||||||||

| Lease assets obtained for new operating leases | $ | $ | |||||||||

See accompanying notes.

7

Supernus Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

1. Business Organization

Supernus Pharmaceuticals, Inc. (the "Company", see Note 2, Consolidation) is a biopharmaceutical company focused on developing and commercializing products for the treatment of central nervous system (CNS) diseases. The Company's diverse neuroscience portfolio includes approved treatments for epilepsy, migraine, attention-deficit hyperactivity disorder (ADHD), hypomobility in Parkinson’s Disease (PD), cervical dystonia, chronic sialorrhea, dyskinesia in PD patients receiving levodopa-based therapy, and drug-induced extrapyramidal reactions in adult patients. The Company is developing a broad range of novel CNS product candidates including new potential treatments for hypomobility in PD, epilepsy, depression, and other CNS disorders.

The Company has eight commercial products that it markets: Qelbree®, GOCOVRI®, Oxtellar XR®, Trokendi XR®, APOKYN®, XADAGO®, MYOBLOC®, and Osmolex ER®. In addition, SPN-830 (apomorphine infusion device) is a late-stage drug/device combination product candidate for the continuous treatment of motor fluctuations ("OFF" episodes) in PD patients that are not adequately controlled with oral levodopa and one or more adjunct PD medications.

In December 2023, the Company submitted to the U.S. Food and Drug Administration (FDA) a notification of discontinuance to withdraw Osmolex ER from distribution, stating that manufacturing has been discontinued and distribution of the product will cease by April 1, 2024.

2. Summary of Significant Accounting Policies

Basis of Presentation

The Company’s unaudited condensed consolidated financial statements have been prepared in accordance with the requirements of the U.S. Securities and Exchange Commission (SEC) for interim financial information. As permitted under Generally Accepted Accounting Principles in the United States (U.S. GAAP), certain notes and other information have been omitted from the interim unaudited condensed consolidated financial statements presented in this Quarterly Report on Form 10-Q. Therefore, these unaudited condensed consolidated financial statements should be read in conjunction with the Company’s most recent Annual Report on Form 10-K, for the year ended December 31, 2023, filed with the SEC.

In management’s opinion, the unaudited condensed consolidated financial statements include all normal and recurring adjustments necessary for a fair presentation of the Company’s financial position, results of operations, and cash flows. The results of operations for any interim period are not necessarily indicative of the Company’s future quarterly or annual results.

The Company, which is primarily located in the U.S., operates in one operating segment.

Reclassifications

The prior year amount related to the caption Employee taxes paid related to net share settlement of equity awards in the condensed consolidated statements of cash flows has been reclassified to conform to current year presentation. The reclassification did not affect the other condensed consolidated financial statements.

Consolidation

The Company's unaudited condensed consolidated financial statements include the accounts of Supernus Pharmaceuticals, Inc. and its wholly owned subsidiaries. These are collectively referred to herein as "Supernus" or "the Company." Supernus Pharmaceuticals, Inc. and each of its subsidiaries are distinct legal entities. All material intercompany transactions and balances have been eliminated in consolidation.

The unaudited condensed consolidated financial statements reflect the consolidation of entities in which the Company has a controlling financial interest. In determining whether there is a controlling financial interest, the Company considers if it has a majority of the voting interests of the entity, or if the entity is a variable interest entity (VIE) and if the Company is the primary beneficiary. In determining the primary beneficiary of a VIE, the Company evaluates whether it has both: the power to direct the activities of the VIE that most significantly impact the VIE's economic performance; and the obligation to absorb losses of, or the right to receive benefits from the VIE that could potentially be significant to that VIE. The Company's judgment with respect to its level of influence or control of an entity involves the consideration of various factors, including the form of an ownership interest; representation in the entity's governance; the size of the investment; estimates of future cash flows; the ability to participate in policymaking decisions; and the rights of the other investors to participate in the decision making process, including

8

the right to liquidate the entity, if applicable. If the Company is not the primary beneficiary of the VIE, and an ownership interest is maintained in the entity, the interest is accounted for under the equity or cost methods of accounting, as appropriate.

The Company continuously assesses whether it is the primary beneficiary of a VIE as changes to existing relationships or future transactions may affect its conclusions.

Use of Estimates

The Company bases its estimates on: historical experience; forecasts; information received from its service providers; information from other sources, including public and proprietary sources; and other assumptions that the Company believes are reasonable under the circumstances. Actual results could differ materially from the Company’s estimates. The Company periodically evaluates the methodologies employed in making its estimates.

Advertising Expense

Advertising expense includes the cost of promotional materials and activities, such as printed materials and digital marketing, marketing programs and speaker programs. The cost of the Company's advertising efforts is expensed as incurred.

The Company incurred approximately $24.3 million and $25.9 million in advertising expense for the three months ended March 31, 2024 and 2023, respectively. These expenses are recorded as a component of Selling, general and administrative expenses in the unaudited condensed consolidated statements of earnings.

Restricted Cash

The Company had a restricted cash balance of $403.8 million as of March 31, 2023 which was held in an escrow account with Wilmington Trust, Trustee, in connection with the payoff of the 0.625 % Convertible Senior Notes Due 2023 (2023 Notes) which occurred on April 1, 2023.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same amounts shown in the condensed consolidated statements of cash flows:

| Three Months Ended March 31, 2023 | |||||||||||

| End of period | Beginning of period | ||||||||||

| (unaudited) | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Total cash, cash equivalents, and restricted cash per statements of cash flows | $ | $ | |||||||||

Recently Issued Accounting Pronouncements and Disclosure Rules

New Accounting Pronouncements Not Yet Adopted

Accounting Standards Update (ASU) 2023-07, Improvements to Reportable Segment Disclosures (Topic 280) - The new standard, issued in November 2023, improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses that are regularly provided to the chief operating decision maker. ASU 2023-07 also clarifies that entities with a single reportable segment are subject to both new and existing reporting requirements under Topic 280. The standard is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, on a retrospective basis, with early adoption permitted. The Company plans to adopt the guidance for the fiscal year ending December 31, 2024. We expect ASU 2023-07 to require additional disclosures in the notes to our consolidated financial statements. The Company is currently evaluating the effects the adoption of this guidance will have on the consolidated financial statements.

ASU 2023-09, Improvements to Income Tax Disclosures (Topic 740) - The new standard, issued in December 2023, requires entities to disclose additional information with respect to the effective tax rate reconciliation and to disclose the disaggregation by jurisdiction of income tax expense and income taxes paid. The standard is effective with annual periods beginning after December 15, 2024, with early adoption permitted. The standard is to be applied on a prospective basis, although optional retrospective application is permitted. The Company plans to adopt the guidance for the fiscal year ending December 31,

9

2025. We expect ASU 2023-09 to require additional disclosures in the notes to our consolidated financial statements. The Company is currently evaluating the effects the adoption of this guidance will have on the consolidated financial statements.

SEC Final Climate Rule

3. Disaggregated Revenues

The following table summarizes the disaggregation of revenues by product or source, (dollars in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Net product sales | |||||||||||

| Qelbree | $ | $ | |||||||||

| Oxtellar XR | |||||||||||

| GOCOVRI | |||||||||||

| APOKYN | |||||||||||

| Trokendi XR | |||||||||||

Other(1) | |||||||||||

| Total net product sales | $ | $ | |||||||||

| Royalty and licensing revenues | |||||||||||

| Total revenues | $ | $ | |||||||||

___________________________________________

(1) Includes net product sales of MYOBLOC, XADAGO and Osmolex ER.

The Company recognized noncash royalty revenue of $2.3 million for the three months ended March 31, 2023. The Company no longer recognizes noncash royalty revenue as ownership of the royalty rights reverted back to the Company during the second quarter of 2023.

The following table shows the percentage of net product sales to total net product sales:

| Percentage of Net Product Sales | |||||||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Qelbree | |||||||||||

| Oxtellar XR | |||||||||||

| GOCOVRI | |||||||||||

| APOKYN | |||||||||||

| Trokendi XR | |||||||||||

Other(1) | |||||||||||

| Total | |||||||||||

___________________________________________

(1) Includes net product sales of MYOBLOC, XADAGO and Osmolex ER.

10

Each of our three major customers, Cencora, Inc., Cardinal Health, Inc. and McKesson Corporation, individually accounted for more than 20 70

4. Investments

Marketable Securities

Unrestricted available-for-sale marketable securities held by the Company are as follows, (dollars in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Corporate, U.S. government agency and municipal debt securities | |||||||||||

| Amortized cost | $ | $ | |||||||||

| Gross unrealized gains | |||||||||||

| Gross unrealized losses | ( | ( | |||||||||

| Total fair value | $ | $ | |||||||||

The contractual maturities of the unrestricted available-for-sale marketable securities held by the Company are as follows, (dollars in thousands):

| March 31, 2024 | |||||

| (unaudited) | |||||

| Less than 1 year | $ | ||||

| 1 year to 2 years | |||||

| Total | $ | ||||

5. Fair Value of Financial Measurements

The fair value of an asset or liability represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between unrelated market participants.

The Company reports the fair value of assets and liabilities using a three level measurement hierarchy that prioritizes the inputs used to measure fair value. Fair value hierarchy consists of the following three levels:

•Level 1—Valuations based on unadjusted quoted prices in active markets that are accessible at measurement date for identical assets.

•Level 2—Valuations based on quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active and model-based valuations in which all significant inputs are observable in the market, either directly or indirectly (e.g., interest rates; yield curves).

•Level 3—Valuations using significant inputs that are unobservable in the market and inputs that reflect the Company’s own assumptions. These are based on the best information available, including the Company’s own data.

11

Financial Assets and Liabilities Recorded at Fair Value

The Company’s financial assets and liabilities that are required to be measured at fair value on a recurring basis are as follows (dollars in thousands):

| Fair Value Measurements as of March 31, 2024 (unaudited) | |||||||||||||||||||||||

| Total Fair Value as of March 31, 2024 | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Cash and cash equivalents | |||||||||||||||||||||||

| Cash | $ | $ | $ | $ | |||||||||||||||||||

| Money market funds | |||||||||||||||||||||||

| Marketable securities | |||||||||||||||||||||||

| Corporate, U.S. government agency and municipal debt securities | |||||||||||||||||||||||

| Long-term marketable securities | |||||||||||||||||||||||

| Corporate and municipal debt securities | |||||||||||||||||||||||

| Other noncurrent assets | |||||||||||||||||||||||

| Marketable securities - restricted (SERP) | |||||||||||||||||||||||

| Total assets at fair value | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Contingent consideration | $ | $ | $ | $ | |||||||||||||||||||

| Total liabilities at fair value | $ | $ | $ | $ | |||||||||||||||||||

| Fair Value Measurements as of December 31, 2023 | |||||||||||||||||||||||

| Total Fair Value as of December 31, 2023 | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Cash and cash equivalents | |||||||||||||||||||||||

| Cash | $ | $ | $ | $ | |||||||||||||||||||

| Money market funds | |||||||||||||||||||||||

| Marketable securities | |||||||||||||||||||||||

| Corporate, U.S. government agency and municipal debt securities | |||||||||||||||||||||||

| Long-term marketable securities | |||||||||||||||||||||||

| Corporate and municipal debt securities | |||||||||||||||||||||||

| Other noncurrent assets | |||||||||||||||||||||||

| Marketable securities - restricted (SERP) | |||||||||||||||||||||||

| Total assets at fair value | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Contingent consideration | $ | $ | $ | $ | |||||||||||||||||||

| Total liabilities at fair value | $ | $ | $ | $ | |||||||||||||||||||

The fair value of restricted marketable securities is recorded in Other assets on the condensed consolidated balance sheets. There have been no transfers of assets or liabilities into or out of Level 3 of the fair value hierarchy.

Other Financial Instruments

12

6. Contingent Consideration

The following table provides the current and long-term portions related to the contingent consideration for the USWM Acquisition and Adamas Acquisition (as defined below) (dollars in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||

| Reported under the following captions in the condensed consolidated balance sheets: | (unaudited) | ||||||||||

| Contingent consideration, current portion | $ | $ | |||||||||

| Contingent consideration, long-term | |||||||||||

| Total | $ | $ | |||||||||

The Company's contingent consideration liabilities are related to the USWM Acquisition in 2020 and the Adamas Acquisition in 2021. The contingent consideration liabilities are measured at fair value using either a Monte Carlo simulation or the income approach. The Company classifies its contingent consideration liabilities as Level 3 fair value measurements based on the significant unobservable inputs used to estimate fair value. These reflect the inputs and assumptions the Company believes would be made by market participants. Changes in any of those inputs together or in isolation may result in significantly lower or higher fair value measurement. The change in fair value is reported on the condensed consolidated statement of earnings in Contingent consideration (gain) expense.

USWM Contingent Consideration

On June 9, 2020 (the USWM Closing Date), the Company completed its acquisition of all the outstanding equity of USWM Enterprises, LLC (USWM Enterprises) (USWM Acquisition). The USWM Acquisition included potential additional contingent consideration payments for regulatory and development milestones and sales-based milestones. As of March 31, 2024, the remaining potential contingent consideration payments are up to $55 million in regulatory and development milestones comprised of (1) $25 million related to the FDA's approval of the SPN-830 NDA and (2) $30 million related to the subsequent commercial product launch.

The key assumptions considered in estimating the fair value include the estimated probability and timing of milestone achievement, such as the probability and timing of obtaining regulatory approval, timing of projected revenues, and the discount rate.

Adamas Contingent Consideration

On November 24, 2021 (the Adamas Closing Date), the Company completed its acquisition of all the outstanding equity of Adamas (Adamas Acquisition). The Adamas Acquisition included payment of two non-tradable contingent value rights (CVRs) each of which represents the contractual right to receive a contingent payment upon the achievement of the applicable aggregate worldwide net product sales of GOCOVRI.

Each CVR represents the contractual right to receive a contingent payment of $0.50 per share in cash, less any applicable withholding taxes and without interest, upon the achievement of the applicable milestone (each such amount, a Milestone Payment) in accordance with the terms of a Contingent Value Rights Agreement entered into between the Company and American Stock Transfer & Trust Company, LLC, as rights agent, as further defined in the CVR agreement. One Milestone Payment is payable (subject to certain terms and conditions) upon the first occurrence of the achievement of aggregate worldwide net sales of GOCOVRI in excess of $150 million during any consecutive 12-month period ending on or before December 31, 2024 (Milestone 2024). Another Milestone Payment is payable (subject to certain terms and conditions) upon the first occurrence of the achievement of aggregate worldwide net sales of GOCOVRI in excess of $225 million during any consecutive 12-month period ending on or before December 31, 2025 (Milestone 2025 and, together with Milestone 2024, the Milestones). Each Milestone may only be achieved once. The possible outcomes for the contingent consideration range from $0 to $50.9 million on an undiscounted basis.

The key assumptions considered in estimating the fair value of the Adamas sales-based milestones include the estimated revenue projections, volatility, estimated discount rates and risk-free interest rate.

13

Change in the Fair Value of Contingent Consideration

The following tables provide a reconciliation of the beginning and ending balances related to the contingent consideration for the USWM Acquisition and Adamas Acquisition (dollars in thousands):

| USWM Acquisition | Adamas Acquisition | Total | |||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | ||||||||||||||

| Change in fair value recognized in earnings | ( | ( | |||||||||||||||

| Balance at March 31, 2024 (unaudited) | $ | $ | $ | ||||||||||||||

| USWM Acquisition | Adamas Acquisition | Total | |||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ||||||||||||||

| Change in fair value recognized in earnings | ( | ( | |||||||||||||||

| Balance at March 31, 2023 (unaudited) | $ | $ | $ | ||||||||||||||

The Company recorded the following changes in fair value of the contingent consideration liability for the USWM milestones:

•The Company recorded a $0.7 million expense due to the change in fair value of contingent consideration liabilities for the USWM milestones for the three months ended March 31, 2024. The change in fair value of contingent consideration for the USWM milestones was primarily due to passage of time.

•The Company recorded a $1.7 million gain due to the change in the fair value of the contingent consideration liabilities for the USWM milestones for the three months ended March 31, 2023. The change in the fair value of contingent consideration for the USWM milestones was primarily due to the change in timing of the regulatory and developmental milestone achievement and estimated discount rates.

The Company recorded the following changes in fair value of the contingent consideration liabilities for the Adamas CVRs:

•The Company recorded a $1.8 million gain due to the change in fair value of the contingent consideration liabilities for the Adamas CVRs for the three months ended March 31, 2024. The change in fair value of contingent consideration was primarily due to passage of time.

•The Company recorded a $0.1 million expense due to the change in fair value of the contingent consideration liabilities for the Adamas CVRs for the three months ended March 31, 2023. The change in fair value was primarily due to the passage of time and estimated discount rates.

7. Intangibles Assets, Net

The following table sets forth the gross carrying amounts and related accumulated amortization of intangibles assets (dollars in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||

| Remaining Weighted Average Life (Years) | Carrying Amount, Gross | Accumulated Amortization | Carrying Amount, Net | Carrying Amount, Gross | Accumulated Amortization | Carrying Amount, Net | |||||||||||||||||||||||||||||||||||

| Acquired in-process research and development | $ | $ | — | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||

| Intangible assets subject to amortization: | |||||||||||||||||||||||||||||||||||||||||

| Acquired developed technology and product rights | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Capitalized patent defense costs | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Total intangible assets | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||

14

Amortization expense for intangible assets was $20.1 million and $20.0 million, for the three month periods ended March 31, 2024 and 2023, respectively.

U.S. patents covering Trokendi XR and Oxtellar XR will expire no earlier than 2027. The Company entered into settlement agreements that allowed third parties to enter the Trokendi XR market on January 1, 2023. The Company entered into settlement and license agreements that allows a third party to enter the Oxtellar XR market in September 2024, or sooner under certain conditions.

8. Debt

Uncommitted Demand Secured Line of Credit

On February 8, 2023, the Company entered into a credit line agreement with UBS (the "Credit Line"). The Credit Line provides for a revolving line of credit of up to $150 million, which can be drawn at any time. Any fixed rate borrowing will bear interest at a fixed interest rate, equal to the sum of (i) the UBS Fixed Funding Rate (as defined in the Credit Line) plus (ii) the applicable Percentage Spread established in the Credit Line. Any variable rate borrowing will bear interest at a variable interest rate, equal to the sum of (i) the UBS Variable Rate (as defined in the Credit Line) plus (ii) the applicable Percentage Spread established in the Credit Line.

The Credit Line is secured by a first priority lien and security interest in certain of the Company’s assets, including each account of the Company at UBS Financial Services Inc. (the “Collateral Account”), and other such collateral (collectively, the Collateral), as further defined in the Credit Line. The Company may be required to post additional collateral if the value of the Collateral declines below the required collateral maintenance requirements.

Upon certain customary events of default, all amounts due under the Credit Line will become immediately due and payable without demand, and UBS has the right, in its discretion, to liquidate, transfer, withdraw or sell all or any part of the Collateral and apply the proceeds to repay any borrowings pursuant to the Credit Line.

The Company has the right to repay any variable rate advance under the Credit Line at any time, in whole or in part, without penalty. The Company may repay any fixed rate advance in whole, but may not repay any fixed rate advance in part. In its discretion and without cause, UBS has the right at any time to demand full or partial payment of amounts borrowed pursuant to the Credit Line and terminate the Credit Line.

9. Share-Based Payments

Share-based compensation expense is as follows (dollars in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Research and development | $ | $ | |||||||||

| Selling, general and administrative | |||||||||||

| Total | $ | $ | |||||||||

15

Stock Option and Stock Appreciation Rights

The following table summarizes stock option and stock appreciation rights (SAR) activities:

| Number of Options | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in years) | |||||||||||||||

| Outstanding, December 31, 2023 | $ | ||||||||||||||||

| Granted | $ | ||||||||||||||||

| Exercised | ( | $ | |||||||||||||||

| Forfeited | ( | $ | |||||||||||||||

| Outstanding, March 31, 2024 (unaudited) | $ | ||||||||||||||||

| As of March 31, 2024 (unaudited): | |||||||||||||||||

| Vested and expected to vest | $ | ||||||||||||||||

| Exercisable | $ | ||||||||||||||||

| As of December 31, 2023: | |||||||||||||||||

| Vested and expected to vest | $ | ||||||||||||||||

| Exercisable | $ | ||||||||||||||||

Restricted Stock Units

The following table summarizes restricted stock unit (RSU) activities:

| Number of RSUs | Weighted Average Grant Date Fair Value per Share | ||||||||||

| Nonvested, December 31, 2023 | $ | ||||||||||

| Granted | $ | ||||||||||

| Vested | ( | $ | |||||||||

| Forfeited | ( | $ | |||||||||

| Nonvested, March 31, 2024 | $ | ||||||||||

Performance Share Units

The following table summarizes performance share unit (PSU) activities:

| Performance-Based Units | Market-Based Units | Total PSUs | |||||||||||||||||||||||||||||||||

| Number of PSUs | Weighted Average Grant Date Fair Value per Share | Number of PSUs | Weighted Average Grant Date Fair Value per Share | Number of PSUs | Weighted Average Grant Date Fair Value per Share | ||||||||||||||||||||||||||||||

| Nonvested, December 31, 2023 | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Vested | ( | $ | $ | ( | $ | ||||||||||||||||||||||||||||||

| Forfeited | ( | $ | $ | ( | $ | ||||||||||||||||||||||||||||||

| Nonvested, March 31, 2024 | $ | $ | $ | ||||||||||||||||||||||||||||||||

16

10. Earnings per Share

The following table sets forth the computation of basic and diluted EPS for the three months ended March 31, 2024 and 2023 (dollars in thousands, except share and per share amounts):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Numerator: | |||||||||||

| Net earnings | $ | $ | |||||||||

| After-tax interest expense for 2023 Notes | |||||||||||

| Numerator for dilutive earnings per share | $ | $ | |||||||||

| Denominator: | |||||||||||

| Weighted average shares outstanding, basic | |||||||||||

| Effect of dilutive securities: | |||||||||||

| Stock options, RSUs and SARs | |||||||||||

| Convertible notes | |||||||||||

| Weighted average shares outstanding, diluted | |||||||||||

| Earnings per share, basic | $ | $ | |||||||||

| Earnings per share, diluted | $ | $ | |||||||||

The following table sets forth the common stock equivalents of outstanding stock-based awards excluded in the calculation of diluted EPS because their inclusion would be anti-dilutive:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Stock options, RSUs, PSUs | |||||||||||

11. Income Tax Expense (Benefit)

The following table provides information regarding the Company’s income tax expense (benefit) for the three months ended March 31, 2024 and 2023 (dollars in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

Income tax expense (benefit) | $ | $ | ( | ||||||||

| Effective tax rate | % | ( | % | ||||||||

17

12. Leases

Operating lease assets and lease liabilities as reported on the condensed consolidated balance sheets are as follows (dollars in thousands):

| Balance Sheet Classification | March 31, 2024 | December 31, 2023 | |||||||||||||||

| (unaudited) | |||||||||||||||||

| Assets | |||||||||||||||||

| Operating lease assets | $ | $ | |||||||||||||||

| Total lease assets | $ | $ | |||||||||||||||

| Liabilities | |||||||||||||||||

| Operating lease liabilities, current portion | $ | $ | |||||||||||||||

| Operating lease liabilities, long-term | |||||||||||||||||

| Total lease liabilities | $ | $ | |||||||||||||||

13. Composition of Other Balance Sheet Items

The following details the composition of other balance sheet items (dollars in thousands for amounts in tables):

Accounts Receivables, Net

As of March 31, 2024 and December 31, 2023, the Company has reduced accounts receivable by approximately $12.0 million and $10.7 million, respectively for prompt pay discounts and contractual service fees, which were originally recorded as a reduction to revenues and represent estimated amounts not expected to be paid by our customers. The Company's customers are primarily pharmaceutical wholesalers and distributors and specialty pharmacies.

Inventories, Net

| March 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Raw materials | $ | $ | |||||||||

| Work in process | |||||||||||

| Finished goods | |||||||||||

| Total | $ | $ | |||||||||

Property and Equipment, Net

| March 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Lab equipment and furniture | $ | $ | |||||||||

| Leasehold improvements | |||||||||||

| Software | |||||||||||

| Computer equipment | |||||||||||

| Less accumulated depreciation and amortization | ( | ( | |||||||||

| Property and equipment, net | $ | $ | |||||||||

Depreciation and amortization expense on property and equipment was approximately $0.6 million and $0.6 million for the three months ended March 31, 2024, and 2023, respectively.

18

Accounts Payable and Accrued Liabilities

| March 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued compensation, benefits, & related accruals | |||||||||||

| Accrued sales & marketing | |||||||||||

| Accrued manufacturing expenses | |||||||||||

| Accrued R&D expenses | |||||||||||

Operating lease liabilities, current portion (2) | |||||||||||

Accrued royalties (1) | |||||||||||

| Other accrued expenses | |||||||||||

| Total | $ | $ | |||||||||

_______________________________

(1) Refer to Note 15, Commitments and Contingencies.

(2) Refer to Note 12, Leases.

Accrued Product Returns and Rebates

| March 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Accrued product rebates | $ | $ | |||||||||

| Accrued product returns | |||||||||||

| Total | $ | $ | |||||||||

14. Interest Expense

The following details the composition of interest expense (dollars in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (unaudited) | |||||||||||

| Interest expense | $ | $ | ( | ||||||||

| Interest expense on nonrecourse liability related to sale of future royalties | ( | ||||||||||

| Noncash interest expense on debt | ( | ||||||||||

| Total | $ | $ | ( | ||||||||

Noncash interest expense on debt is related to amortization of deferred financing costs on the 2023 Notes. The Company fully amortized the deferred financing costs on the 2023 Notes in the first quarter of 2023.

15. Commitments and Contingencies

Product Licenses

The Company has obtained exclusive licenses from third parties for proprietary rights to support the product candidates in the Company's CNS portfolio. Under these license agreements, the Company may be required to pay certain amounts upon the achievement of defined milestones. If these products are ultimately commercialized, the Company is also obligated to pay royalties to third parties, computed as a percentage of net product sales, for each respective product under a license agreement.

Through the USWM Acquisition, the Company acquired licensing agreements with other pharmaceutical companies for APOKYN, XADAGO, and MYOBLOC. The Company is obligated to pay royalties to third parties, computed as a percentage of net product sales, for each of the products under the respective license agreements. The royalty expense incurred for these acquired products is recognized as Cost of goods sold in the condensed consolidated statements of earnings.

19

USWM Enterprise Commitments Assumed

As part of the USWM Acquisition, the Company assumed the remaining commitments of USWM Enterprises and its subsidiaries, which are discussed below.

The Company assumed the annual minimum purchase requirement of MYOBLOC, amounting to an estimated €3.9 million annually, under the contract manufacturing agreement with Merz for manufacture and supply.

MDD US Operations, LLC (formerly US WorldMeds, LLC) and its subsidiary, Solstice Neurosciences, LLC (US) (collectively, the MDD Subsidiaries) entered into a Corporate Integrity Agreement (CIA) with the Office of Inspector General of the U.S. Department of Health and Human Services which was effective in April 2019. Under the CIA, the MDD Subsidiaries agreed to and paid $17.5 million to resolve U.S. Department of Justice allegations that it violated the False Claims Act and committed to the establishment and ongoing maintenance of an effective compliance program. The fine was paid by the MDD Subsidiaries prior to closing of the USWM Acquisition. As part of the USWM Acquisition, the Company assumed the obligations of the CIA and could become liable for payment of certain stipulated monetary penalties in the event of any CIA violations. In addition, the Company will continue to maintain a broad array of processes, policies and procedures necessary to comply with the CIA through March 2024.

Claims and Litigation

From time to time, the Company may be involved in various claims, litigation and legal proceedings. These matters may involve patent litigation, product liability and other product-related litigation, commercial and other matters, and government investigations, among others. On a quarterly basis, the Company reviews the status of each significant matter and assesses its potential financial exposure. If the potential loss from any claim, asserted or unasserted, or legal proceeding is considered probable and the amount can be reasonably estimated, the Company will accrue a liability for the estimated loss. Because of uncertainties related to claims, legal proceedings and litigation, accruals will be based on the Company's best estimates based on available information. The Company does not believe that any of these matters will have a material adverse effect on our financial position. The Company may reassess the potential liability related to these matters and may revise these estimates. The process of resolving matters through litigation or other means is inherently uncertain and it is possible that an unfavorable resolution of these matters will adversely affect the Company, its results of operations, financial condition and cash flows.

NAMENDA XR/Namzaric Qui Tam Litigation

On April 1, 2019, Adamas was served with a complaint filed in the United States District Court for the Northern District of California (the District Court) (Case No. 3:18-cv-03018-JCS) against it and several Allergan entities alleging violations of federal and state false claims acts (FCA) in connection with the commercialization of NAMENDA XR and Namzaric by Allergan. The lawsuit is a qui tam complaint brought by an individual, asserting rights of the federal government and various state governments. The lawsuit was originally filed in May 2018 under seal, and Adamas became aware of the lawsuit when it was served. The complaint alleges that patents held by Allergan and Adamas covering NAMENDA XR and Namzaric were procured through fraud on the United States Patent and Trademark Office and that these patents were asserted against potential generic manufacturers of NAMENDA XR and Namzaric to prevent the generic manufacturers from entering the market, thereby wrongfully excluding generic competition resulting in artificially high price being charged to government payors. Adamas' patents in question were licensed exclusively to Forest Laboratories Holdings Limited. The complaint includes a claim for damages of "potentially more than $2.5 billion dollars," treble damages and statutory penalties. To date the federal and state governments have declined to intervene in this action. This case is currently stayed pending Adamas's and Allergan's interlocutory appeal of the District Court's December 11, 2020 order denying Adamas's and Allergan's motion to dismiss the complaint. The appeal is pending in the United States Court of Appeals for the Ninth Circuit (Case No. 21-80005). Argument was held on January 10, 2022. On August 25, 2022, the Ninth Circuit sided with the defendants by reversing the District Court’s public disclosure bar rulings and remanding the case back to the District Court to decide certain issues in the first instance. On October 11, 2022, the plaintiff filed a petition for rehearing with the Ninth Circuit which was denied on November 3, 2022. On December 23, 2022, the defendants filed renewed motions to dismiss directed to the remaining unresolved issue. On March 20, 2023, the District Court entered an order and final judgement dismissing with prejudice the FCA claim while declining to exercise supplemental jurisdiction over the state false claims act claims which were dismissed without prejudice. On April 19, 2023, the plaintiff appealed the District Court's dismissal of the Federal False Claims Act claim. On February 20, 2024, the plaintiff filed a motion for an indicative ruling and to set aside the judgment in the District Court, based on the same arguments raised in his appeal. That motion was fully briefed and the District Court determined that the motion for an indicative ruling was suitable for determination without a hearing. On May 7, 2024, the District Court denied the plaintiff’s motion for an indicative ruling. The plaintiff’s appeal remains pending in the United States Court of Appeals for the Ninth Circuit.

20

APOKYN Litigation

On October 3, 2022, Sage Chemical, Inc. and TruPharma, LLC filed a lawsuit in the United States District Court for the District of Delaware (Case No.22-cv-1302) alleging that Supernus Pharmaceuticals, Inc., Britannia Pharmaceuticals Limited, and US WorldMeds Partners, LLC violated state and federal antitrust law in connection with APOKYN. On January 10, 2023, the Company filed motions to dismiss all claims and the lawsuit in its entirety. As of April 12, 2023, briefing on those motions is now complete. Those motions remain pending. On April 10, 2023, the Court issued a scheduling order that provides for a Pretrial Conference on March 7, 2025, and a jury trial beginning on March 24, 2025. Pretrial discovery is ongoing. The Company intends to defend itself vigorously. However, the Company can offer no assurances that it will be successful in a litigation.

16. Subsequent Events

SPN-830 Regulatory Development

In April 2024, the FDA issued a Complete Response Letter (CRL) regarding the New Drug Application (NDA) for SPN-830. The CRL mentions two areas that require additional review by the FDA or additional information to be provided to the FDA. The first area relates to product quality. Prior to the issuance of the CRL, the Company submitted additional product quality data to the FDA, which it had not yet reviewed at the time of the CRL's issuance. The second relates to the master file for the infusion device, which is proprietary to the device manufacturer. No clinical safety or efficacy issues were identified as a requirement for approval.

The Company is in the process of analyzing the CRL and determining next steps for the resubmission of the NDA. While it is too early to ascertain the full impact to our financial statements, we may identify indicators of impairment for the related IPR&D asset, which represents an estimate of the fair value of SPN-830, resulting from the receipt of the CRL. Additionally, the Company also expects to assess adjustments to the fair value of the contingent consideration liabilities related to the milestone payments due upon the achievement of certain FDA regulatory approvals and the commercial launch of SPN-830. While we are unable to estimate the anticipated financial impact at this time, any potential adjustments would be recognized and reported within the second quarter of 2024. Any material adjustments to the fair value of the IPR&D asset or the fair value of contingent consideration liabilities could impact the Company’s results of operations and financial condition.

21

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations is intended to help the reader understand the results of operations and the financial condition of Supernus Pharmaceuticals, Inc. The interim condensed consolidated financial statements included in this report and this Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our audited consolidated financial statements and notes thereto for the year ended December 31, 2023 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are contained in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 27, 2024.

In addition to historical information, this Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. These forward-looking statements may include declarations regarding the Company’s belief or current expectations of management, such as statements including the words “budgeted,” “anticipate,” “project,” “forecast,” “estimate,” “expect,” “may,” “believe,” “potential,” and similar statements or expressions, which are intended to be among the statements that are forward-looking statements, as such statements reflect the reality of risk and uncertainty that is inherent in our business. Actual results may differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which are made as of the date this report was filed with the Securities and Exchange Commission. Our actual results and the timing of events could differ materially from those discussed in our forward-looking statements because of many factors, including those set forth under the “Risk Factors” section of our Annual Report on Form 10-K and elsewhere in this report as well as in other reports and documents we file with the Securities and Exchange Commission from time to time. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of this Quarterly Report on Form 10-Q.

Unless the content requires otherwise, the words "Supernus," "we," "our" and "the Company" refer to Supernus Pharmaceuticals, Inc. and/or one or more of its subsidiaries, as the case may be. These terms are used solely for the convenience of the reader. Supernus Pharmaceuticals, Inc. and each of its subsidiaries are distinct legal entities. For example, MDD US Operations, LLC, a wholly-owned indirect subsidiary of Supernus Pharmaceuticals, Inc., is the exclusive licensee and distributor of APOKYN in the United States and its territories. Adamas Operations, LLC, a wholly-owned indirect subsidiary of Supernus Pharmaceuticals, Inc., wholly owns the patents and patent applications related to GOCOVRI and Osmolex ER and has a license agreement with Supernus Pharmaceuticals, Inc., granting Supernus Pharmaceuticals, Inc. rights to market and sell GOCOVRI and Osmolex ER.

Solely for convenience, in this Quarterly Report on Form 10-Q, the trade names are referred to without the TM symbols and the trademark registrations are referred to without the circled R, but such references should not be construed as any indicator that the Company will not assert, to the fullest extent under applicable law, our rights thereto.

22

Overview

We are a biopharmaceutical company focused on developing and commercializing products for the treatment of central nervous system (CNS) diseases. Our diverse neuroscience portfolio includes approved treatments for epilepsy, migraine, attention-deficit hyperactivity disorder (ADHD), hypomobility in Parkinson’s Disease (PD), cervical dystonia, chronic sialorrhea, dyskinesia in PD patients receiving levodopa-based therapy, and drug-induced extrapyramidal reactions in adult patients. We are developing a broad range of novel CNS product candidates including new potential treatments for hypomobility in PD, epilepsy, depression, and other CNS disorders.

We have a portfolio of commercial products and product candidates.

Commercial Products

•Qelbree® (viloxazine) extended-release capsules is a novel non-stimulant product indicated for the treatment of ADHD in adults and pediatric patients 6 years and older. The United States Food and Drug Administration (FDA) approved Qelbree for the treatment of ADHD in pediatric patients 6 to 17 years of age in April 2021, and in adult patients in April 2022. The Company launched Qelbree for pediatric patients in May 2021 and for adult patients in May 2022 in the United States (U.S.).

•GOCOVRI® (amantadine) extended-release capsules is the first and only FDA approved medicine indicated for the treatment of dyskinesia in patients with PD receiving levodopa-based therapy, with or without concomitant dopaminergic medications, and as an adjunctive treatment to levodopa/carbidopa with PD experiencing "OFF" episodes.

•Oxtellar XR® (oxcarbazepine) is indicated as therapy for the treatment of partial onset seizures in patients 6 years of age and older. It is also the first once-daily extended-release oxcarbazepine product indicated for the treatment of epilepsy in the U.S. market.

•Trokendi XR® (topiramate) is the first once-daily extended-release topiramate product indicated for the treatment of epilepsy in patients 6 years of age and older in the U.S. market. It is also indicated for the prophylaxis of migraine headache in adults and adolescents 12 years and older.

•APOKYN® (apomorphine hydrochloride injection) is a product indicated for the acute, intermittent treatment of hypomobility, "OFF" episodes ("end-of-dose wearing off" and unpredictable "ON/OFF" episodes) in patients with advanced PD.

•XADAGO® (safinamide) is a once-daily product indicated as adjunctive treatment to levodopa/carbidopa in patients with PD experiencing "OFF" episodes.

•MYOBLOC® (rimabotulinumtoxinB injection) is a product indicated for the treatment of cervical dystonia and chronic sialorrhea in adults. It is the only botulinum toxin type B available on the market.

•Osmolex ER® (amantadine) extended-release tablets is for the treatment of PD and drug-induced extrapyramidal reactions in adult patients. In December 2023, the Company submitted to the FDA a notification of discontinuance to withdraw Osmolex ER from distribution, stating that manufacturing has been discontinued and distribution of the product will cease by April 1, 2024.

23

Research and Development

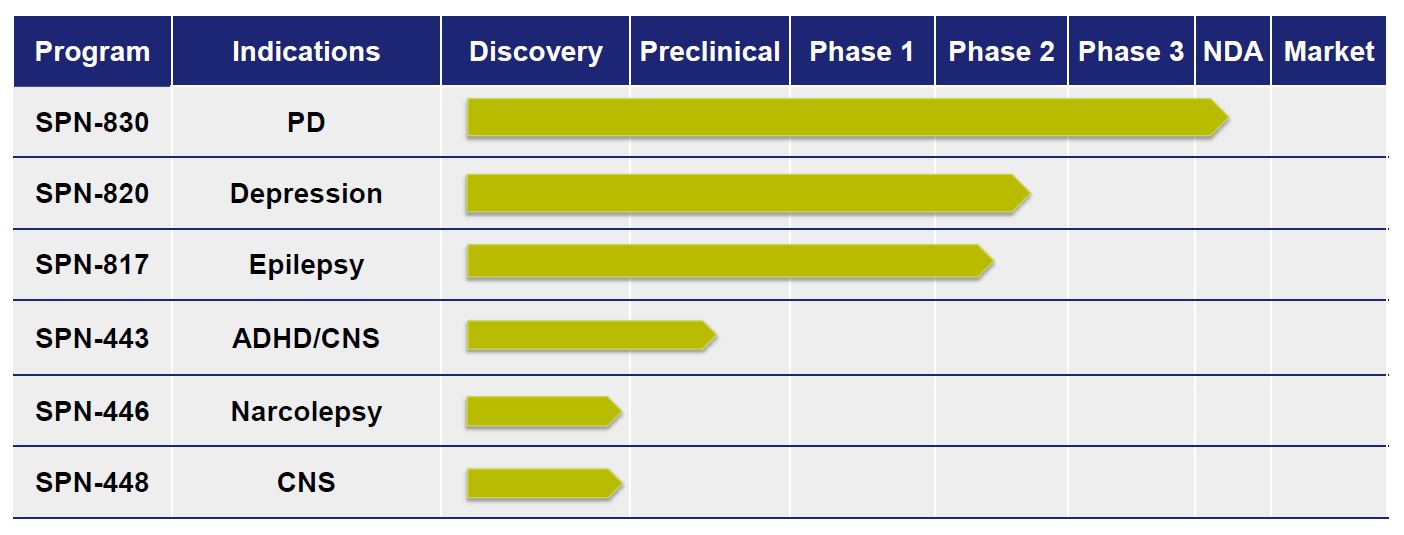

We are committed to the development of innovative product candidates in neurology and psychiatry, including the following:

SPN-830 (apomorphine infusion device)

SPN-830 is a late-stage drug/device combination product candidate for the continuous treatment of motor fluctuations ("OFF" episodes) in PD patients that are not adequately controlled with oral levodopa and one or more adjunct PD medications. If approved, it would be the only continuous infusion of apomorphine available in the U.S. and an important step for PD patients that would have otherwise been candidates for potentially invasive surgical procedures, such as deep brain stimulation. Continuous slow infusion may also limit some of the side effects of a bolus injection of apomorphine.

In October 2023, we resubmitted the New Drug Application (NDA) for SPN-830 to the FDA. In November 2, 2023, the Company announced that the FDA had acknowledged the resubmission of the NDA and assigned a Prescription Drug User Fee Act (PDUFA) date of April 5, 2024. In April 2024, the FDA issued a Complete Response Letter regarding the NDA for SPN-830. For further discussion, see Operational Highlights section below.

SPN-820 (NV-5138)

SPN-820 is a first-in-class, orally active small molecule that increases the brain mechanistic target of rapamycin complex 1 (mTORC1) mediated synaptic function intracellularly. SPN-820 does not bind to or modulate any cell surface receptors and therefore is unlikely to have abuse potential given lack of binding to targets implicated in drug abuse. In addition, unlike leucine, it is not incorporated into proteins during protein synthesis, and therefore, it is more available at the target site in the brain than leucine.

SPN-817 (huperzine A)

SPN-817 represents a novel mechanism of action (MOA) for an anticonvulsant. SPN-817 is a novel synthetic form of

huperzine A, whose MOA includes potent acetylcholinesterase inhibition, with pharmacological activities in CNS conditions such as epilepsy. The development will initially focus on the drug's anticonvulsant activity, which has been shown in preclinical models to be effective for the treatment of partial seizures and Dravet Syndrome. SPN-817 is in clinical development and has received Orphan Drug designation for several epilepsy indications from the FDA.

huperzine A, whose MOA includes potent acetylcholinesterase inhibition, with pharmacological activities in CNS conditions such as epilepsy. The development will initially focus on the drug's anticonvulsant activity, which has been shown in preclinical models to be effective for the treatment of partial seizures and Dravet Syndrome. SPN-817 is in clinical development and has received Orphan Drug designation for several epilepsy indications from the FDA.

Operational Highlights

Qelbree Update

•Total IQVIA prescriptions were 176,503 for first quarter 2024, an increase of 31% compared to the prior year period.

•Patient enrollment is ongoing in the Phase IV open-label study to assess the efficacy of Qelbree over the course of 14 weeks of treatment in approximately 500 adults with attention deficit hyperactivity disorder (ADHD) and mood

24

symptoms. The primary outcome measure is change from baseline in the Adult ADHD Investigator Symptom Rating Scale (AISRS).

Product Pipeline Update

SPN-830 (apomorphine infusion device) for treatment of Parkinson's disease (PD)

•In April 2024, the U.S. Food and Drug Administration (FDA) issued a Complete Response Letter (CRL) in response to the Company’s New Drug Application (NDA) for SPN-830. The CRL indicates that the review cycle for the application is complete, but that the application is not ready for approval in its present form.

•The Company will announce the timing for its resubmission after further discussion with the FDA, which is expected to take place in May 2024.

SPN-820 – Novel first-in-class molecule that increases mTORC1 mediated synaptic function for depression

•More than half the number of planned patients have been enrolled in the ongoing Phase IIb multi-center randomized double-blind placebo-controlled parallel design study of SPN-820 in adults with treatment-resistant depression. The study is examining efficacy and safety of SPN-820 over a course of five weeks of treatment in approximately 268 patients in up to 50 clinical sites. The primary outcome measure is the change from baseline to end of treatment period on the Montgomery-Asberg Depression Rating Scale (MADRS) Total Score. Topline data from the Phase IIb trial is expected in the first half of 2025.

•The Company has initiated a Phase II open-label study in approximately 40 subjects with major depressive disorder (MDD). The primary objective of the study is to assess efficacy in MDD, as well as onset of efficacy.

SPN-817 – Novel first-in-class highly selective AChE inhibitor for epilepsy

•The Company will hold a conference call on Thursday, May 23, 2024 to report on interim data from approximately 40 patients from the open-label Phase IIa clinical study of SPN-817 for treatment-resistant seizures (webcast details forthcoming). The study is examining the safety and tolerability of SPN-817 as adjunctive therapy in adult patients with treatment-resistant seizures, as well as assessing efficacy. Topline results for the full study are expected in the second half of 2024.

SPN-443 – Novel stimulant for ADHD/CNS

•The Company plans to initiate a Phase I single dose study in healthy adults in 2024 following submission of an Investigational New Drug application. The primary objective of the study is to assess safety and tolerability.

Critical Accounting Policies and the Use of Estimates

A summary of our significant accounting policies is included in Note 2, Summary of Significant Accounting Policies of our audited consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2023. There were no significant changes to the disclosures with respect to our critical accounting policies in our Annual Report on Form 10-K for the year ended December 31, 2023.

25

Results of Operations

Comparison of the Three Months Ended March 31, 2024 and 2023

Revenues

Revenues consist primarily of net product sales of our commercial products in the U.S., supplemented by royalty and licensing revenues from our collaborative licensing arrangements. The following table provides information regarding our revenues during the three months ended March 31, 2024 (dollars in thousands):

___________________________________________

| Three Months Ended March 31, | Change | ||||||||||||||||||||||

| 2024 | 2023 | Amount | Percent | ||||||||||||||||||||

| Net product sales | |||||||||||||||||||||||

| Qelbree | $ | 45,104 | $ | 25,782 | $ | 19,322 | 75 | % | |||||||||||||||

| Oxtellar XR | 26,943 | 28,915 | (1,972) | (7) | % | ||||||||||||||||||

| GOCOVRI | 26,562 | 26,010 | 552 | 2 | % | ||||||||||||||||||

| APOKYN | 16,649 | 17,209 | (560) | (3) | % | ||||||||||||||||||

| Trokendi XR | 15,989 | 34,790 | (18,801) | (54) | % | ||||||||||||||||||

Other(1) | 7,214 | 7,869 | (655) | (8) | % | ||||||||||||||||||

| Total net product sales | $ | 138,461 | $ | 140,575 | $ | (2,114) | (2) | % | |||||||||||||||

Royalty and licensing revenues | 5,183 | 13,189 | (8,006) | (61) | % | ||||||||||||||||||

| Total revenues | $ | 143,644 | $ | 153,764 | $ | (10,120) | (7) | % | |||||||||||||||

(1) Includes net product sales of MYOBLOC, XADAGO and Osmolex ER.

Net Product Sales

The $2.1 million and 2% decrease in net product sales for the three months ended March 31, 2024, as compared to the same period in 2023, was primarily due to the $18.8 million decline in net product sales of Trokendi XR due to generic erosion, and a decline in net product sales of Oxtellar XR, partially offset by the $19.3 million increase in net product sales from Qelbree.

Sales Deductions and Related Accruals

We record accrued product returns and accrued product rebates as current liabilities in Accrued product returns and rebates, on our condensed consolidated balance sheets. We record sales discounts as a reduction against Accounts receivable, net on the unaudited condensed consolidated balance sheets. Both amounts are generally affected by changes in gross product sales, changes in the provision for net product sales deductions, and the timing of payments/credits.

The following table provides a summary of activity with respect to accrued product returns and rebates during the periods indicated (dollars in thousands):

| Accrued Product Returns and Rebates | |||||||||||||||||||||||

| Product Returns | Product Rebates | Allowance for Sales Discounts | Total | ||||||||||||||||||||

| Balance at December 31, 2023 | $ | 57,290 | $ | 96,984 | $ | 10,719 | $ | 164,993 | |||||||||||||||

| Provision | |||||||||||||||||||||||

| Provision for current year sales | 5,640 | 100,301 | 15,812 | 121,753 | |||||||||||||||||||

| Adjustments relating to prior year sales | (1,403) | 668 | 38 | (697) | |||||||||||||||||||

| Total provision | $ | 4,237 | $ | 100,969 | $ | 15,850 | $ | 121,056 | |||||||||||||||

| Less: Actual payments/credits | (1,982) | (90,272) | (14,531) | (106,785) | |||||||||||||||||||

| Balance at March 31, 2024 | $ | 59,545 | $ | 107,681 | $ | 12,038 | $ | 179,264 | |||||||||||||||

26

| Accrued Product Returns and Rebates | |||||||||||||||||||||||

| Product Returns | Product Rebates | Allowance for Sales Discounts | Total | ||||||||||||||||||||

| Balance at December 31, 2022 | $ | 45,008 | $ | 106,657 | $ | 12,995 | $ | 164,660 | |||||||||||||||

| Provision | |||||||||||||||||||||||

| Provision for current year sales | 6,203 | 102,181 | 15,661 | 124,045 | |||||||||||||||||||

| Adjustments relating to prior year sales | (400) | 2,457 | 31 | 2,088 | |||||||||||||||||||

| Total provision | $ | 5,803 | $ | 104,638 | $ | 15,692 | $ | 126,133 | |||||||||||||||

| Less: Actual payments/credits | (1,771) | (112,483) | (16,498) | (130,752) | |||||||||||||||||||

| Balance at March 31, 2023 | $ | 49,040 | $ | 98,812 | $ | 12,189 | $ | 160,041 | |||||||||||||||

Accrued Product Returns and Rebates

The accrued product returns balance increased from $57.3 million as of December 31, 2023 to $59.5 million as of March 31, 2024 principally due to the timing of related return activity and an increase in provision for product returns primarily related to Qelbree.

The accrued product rebates balance increased from $97.0 million as of December 31, 2023 to $107.7 million as of March 31, 2024 due to timing of Medicaid billing from states.

Provision for Product Returns and Rebates

The provision for product returns decreased from $5.8 million for the three months ended March 31, 2023 to $4.2 million for the three months ended March 31, 2024. The decrease was primarily attributable to lower sales of Trokendi XR.

The provision for product rebates decreased from $104.6 million for the three months ended March 31, 2023 to $101.0 million for three months ended March 31, 2024. The decrease was primarily attributable to lower Trokendi XR sales partially offset by higher Qelbree sales.

Royalty and Licensing Revenues

Royalty and licensing revenues were $5.2 million and $13.2 million for the three months ended March 31, 2024 and 2023, respectively. The decrease was primarily due to lower royalties on generic Trokendi XR for the three months ended March 31, 2024 due to the increased number of generic entrants.

Cost of Goods Sold

Cost of goods sold was $16.3 million and $23.5 million for the three months ended March 31, 2024 and 2023, respectively. The $7.2 million decrease was primarily driven by manufacturing efficiencies, mainly related to Qelbree.

Research and Development Expenses

R&D expenses were $24.9 million and $21.2 million for the three months ended March 31, 2024 and 2023, respectively. The increase was primarily due to increased clinical program costs on SPN-820 and increased manufacturing costs of our product candidates.

Selling, General and Administrative Expenses

The following table provides information regarding our selling, general and administrative (SG&A) expenses during the periods indicated (dollars in thousands):

| Three Months Ended March 31, | Change | ||||||||||||||||||||||

| 2024 | 2023 | Amount | Percent | ||||||||||||||||||||

| Selling and marketing | $ | 59,567 | $ | 57,230 | $ | 2,337 | 4% | ||||||||||||||||

| General and administrative | 26,949 | 28,367 | (1,418) | (5)% | |||||||||||||||||||

| Total | $ | 86,516 | $ | 85,597 | $ | 919 | 1% | ||||||||||||||||

27

Selling, general and administrative expenses increased by 1% to $86.5 million for the three months ended March 31, 2024.

Amortization of Intangible Assets

Amortization of intangible assets was $20.1 million and $20.0 million for the three months ended March 31, 2024 and 2023, respectively.

Contingent Consideration (Gain) Expense

Contingent consideration was a gain of $1.1 million and a gain of $1.6 million for the three months ended March 31, 2024 and 2023, respectively. The contingent consideration gain was primarily driven by the passage of time.

Other Income (Expense)

Other income (expense) was income of $3.4 million and $3.8 million for the three months ended March 31, 2024 and 2023, respectively. The $0.4 million decrease was due to lower interest income on marketable securities largely driven by an overall lower investment balance, partially offset by the interest expense recognized in three months ended March 31, 2023 related to the 2023 Notes, which were paid off in April 2023.

Income Tax Expense (Benefit)

Income tax expense of $0.1 million for the three months ended March 31, 2024, as compared to an income tax (benefit) of $7.9 million for the three months ended March 31, 2023. The change was primarily due to almost break-even pre-tax income for the three months ended March 31, 2024 and greater full year 2024 forecasted losses as compared to the same period in 2023. The effective tax rate was 49.0% for the three months ended March 31, 2024, as compared to (88.0)% for the three months ended March 31, 2023. The effective tax rate for the three months ended March 31, 2024 was higher compared to the same period in 2023 primarily due to near break-even pretax losses forecasted for the full year 2023. The annual forecasted earnings represent the Company's best estimate as of March 31, 2024 and 2023, are subject to change and could have a material impact on the effective tax rate in subsequent periods. ASC 740, Income Taxes (ASC 740), requires an estimate of the annual effective income tax rate for the full year and apply it to pre-tax income (loss) for each interim period, taking into account year-to-date amounts and projected results for the full year.

Financial Condition, Liquidity and Capital Resources

Cash and Cash Equivalents and Marketable Securities

Cash and cash equivalents, marketable securities, and long-term marketable securities are comprised of the following (dollars in thousands):

| March 31 | December 31 | Change | |||||||||||||||||||||

| 2024 | 2023 | Amount | Percent | ||||||||||||||||||||

| Cash and cash equivalents | $ | 63,401 | $ | 75,054 | $ | (11,653) | (16)% | ||||||||||||||||

| Marketable securities | 234,335 | 179,820 | 54,515 | 30% | |||||||||||||||||||

| Long-term marketable securities | 11,662 | 16,617 | (4,955) | (30)% | |||||||||||||||||||

| Total | $ | 309,398 | $ | 271,491 | $ | 37,907 | 14% | ||||||||||||||||

We have financed our operations primarily with cash generated from product sales, supplemented by revenues from royalty and licensing arrangements, as well as proceeds from the sale of equity and debt securities. Continued cash generation is highly dependent on the success of our commercial products, as well as the success of our product candidates if approved by the FDA. While we expect continued profitability in future years, we anticipate there may be significant variability from year to year in the level of our profits particularly due to the following: continued market and payor pressures for our commercial products; the unfavorable impact of the loss of patent exclusivity for Trokendi XR in January 2023; the potential unfavorable impact of the forthcoming loss of exclusivity of Oxtellar XR and XADAGO; funding for research and development of our product candidates; and the additional funding to launch SPN-830, if approved by the FDA.

The Company believes its balances of cash, cash equivalents, restricted cash, and unrestricted marketable securities, which totaled $309.4 million as of March 31, 2024, along with cash generated from ongoing operations and continued access to debt markets, will be sufficient to satisfy its cash requirements over the next 12 months and beyond.

28