Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2019

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-32945

WNS (Holdings) Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Jersey, Channel Islands

(Jurisdiction of incorporation or organization)

Gate 4, Godrej & Boyce Complex

Pirojshanagar, Vikhroli (W)

Mumbai 400 079, India

(Address of principal executive offices)

Gopi Krishnan

General Counsel

Gate 4, Godrej & Boyce Complex

Pirojshanagar, Vikhroli (W)

Mumbai 400 079, India

(91-22) 4095-2100

gopi.krishnan@wns.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| American Depositary Shares, each represented by | WNS | The New York Stock Exchange | ||

| one Ordinary Share, par value 10 pence per share |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As at March 31, 2019, 50,051,920 ordinary shares (excluding 1,101,300 treasury shares), par value 10 pence per share, were issued and outstanding, of which 49,776,517 ordinary shares were held in the form of American Depositary Shares (“ADSs”). Each ADS represents one ordinary share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company,” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☒ |

Accelerated filer ☐ | Non-accelerated filer ☐ | ||

| Emerging growth company ☐ | ||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: ☐ Item 17 ☐ Item 18

If this report is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Table of Contents

WNS (HOLDINGS) LIMITED

| Page | ||||

| PART I |

||||

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

4 | |||

| 4 | ||||

| 4 | ||||

| 35 | ||||

| 79 | ||||

| 80 | ||||

| 137 | ||||

| 165 | ||||

| 168 | ||||

| 172 | ||||

| 173 | ||||

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

199 | |||

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

200 | |||

| PART II |

||||

| 201 | ||||

| ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

201 | |||

| 201 | ||||

| 203 | ||||

| 203 | ||||

| 203 | ||||

| ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

204 | |||

| ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

204 | |||

| 204 | ||||

| 204 | ||||

| 204 | ||||

| PART III |

||||

| 205 | ||||

| 205 | ||||

| 206 | ||||

| 208 | ||||

| INDEX TO WNS (HOLDINGS) LIMITED’S CONSOLIDATED FINANCIAL STATEMENTS |

F-1 | |||

Ex-4.10 Facility Agreement dated January 18, 2017 between WNS North America Inc. and BNP Paribas, Hong Kong.

Ex-4.11 Facility Agreement dated March 10, 2017 among WNS (Mauritius) Limited, HSBC Bank (Mauritius) Limited and Standard Chartered Bank, UK.

Ex-8.1 List of subsidiaries of WNS (Holdings) Limited

Ex-12.1 Certification by the Chief Executive Officer to 17 CFR 240, 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

Ex-12.2 Certification by the Chief Financial Officer to 17 CFR 240, 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

Ex-13.1 Certification by the Chief Executive Officer to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

Ex-13.2 Certification by the Chief Financial Officer to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

Ex-15.1 Consent of Grant Thornton India LLP, independent registered public accounting firm

1

Table of Contents

CONVENTIONS USED IN THIS ANNUAL REPORT

In this annual report, references to “US” are to the United States of America, its territories and its possessions. References to “UK” are to the United Kingdom. References to “EU” are to the European Union. References to “India” are to the Republic of India. References to “China” are to the People’s Republic of China. References to “South Africa” are to the Republic of South Africa. References to “$” or “dollars” or “US dollars” are to the legal currency of the US, references to “ ₹ ” or “Indian rupee” or “Indian rupees” are to the legal currency of India, references to “pound sterling” or “£” are to the legal currency of the UK, references to “pence” are to the legal currency of Jersey, Channel Islands, references to “Euro” or “€” are to the legal currency of the European Monetary Union, references to “South African rand” or “R” or “ZAR” are to the legal currency of South Africa, references to “A$” or “AUD” or “Australian dollars” are to the legal currency of Australia, references to “CHF” or “Swiss Franc” are to the legal currency of Switzerland, references to “PHP” or “Philippine Peso” are to the legal currency of Philippines, references to “RMB” are to the legal currency of China, references to “LKR” or “Sri Lankan rupees” are to the legal currency of Sri Lanka and references to “NZD” or “New Zealand Dollar” are to the legal currency of New Zealand. Our financial statements are presented in US dollars. Our financial statements included in this annual report are prepared in accordance with the International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). Unless otherwise indicated, references to “GAAP” in this annual report are to IFRS, as issued by the IASB.

References to a particular “fiscal” year are to our fiscal year ended March 31 of that calendar year. Any discrepancies in any table between totals and sums of the amount listed are due to rounding. Any amount stated to be $0.0 million represents an amount less than $5,000.

In this annual report, unless otherwise specified or the context requires, the term “WNS” refers to WNS (Holdings) Limited, a public company incorporated under the laws of Jersey, Channel Islands, and the terms “our company,” “we,” “our” and “us” refer to WNS (Holdings) Limited and its subsidiaries.

In this annual report, references to “Commission” are to the United States Securities and Exchange Commission.

We also refer in various places within this annual report to “revenue less repair payments,” which is a non-GAAP financial measure that is calculated as (a) revenue less (b) in our auto claims business, payments to repair centers for “fault” repair cases where we act as the principal in our dealings with the third party repair centers and our clients. This non-GAAP financial information is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP.

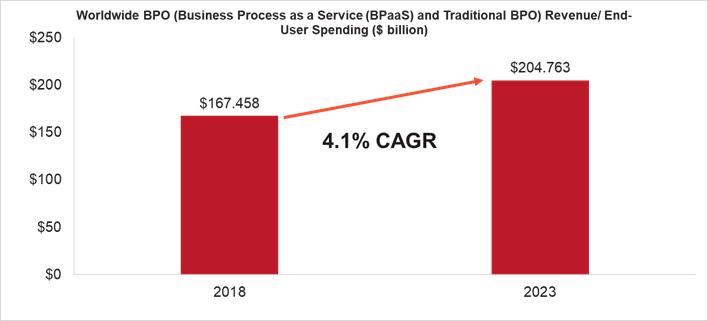

We refer to information regarding the business process management (“BPM”) industry, our company and our competitors from market research reports, analyst reports and other publicly available sources. Although we believe that this information is reliable, we have not independently verified the accuracy and completeness of the information. We caution you not to place undue reliance on this data. BPM services are also sometimes referred to as business process outsourcing (“BPO”) services.

This annual report also includes information regarding the BPM market from the “Gartner Inc., Forecast: IT Services, Worldwide, 2017-2023, 1Q19 Update” report dated March 29, 2019 by Gartner Inc. (which we refer to herein as the “Gartner Report”). The Gartner Report described herein contains data, research opinions or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and are not representations of fact. The Gartner Report speaks as of its original publication date (and not as of the date of this annual report) and the opinions expressed in the Gartner Report are subject to change without notice.

2

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” that are based on our current expectations, assumptions, estimates and projections about our company and our industry. The forward-looking statements are subject to various risks and uncertainties. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “will,” “project,” “seek,” “should” and similar expressions. Those statements include, among other things, the discussions of our business strategy and expectations concerning our market position, future operations, margins, profitability, liquidity and capital resources, tax assessment orders and future capital expenditures. We caution you that reliance on any forward-looking statement inherently involves risks and uncertainties, and that although we believe that the assumptions on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and, as a result, the forward-looking statements based on those assumptions could be materially incorrect. These risks and uncertainties include but are not limited to:

| • | worldwide economic and business conditions; |

| • | political or economic instability in the jurisdictions where we have operations; |

| • | our dependence on a limited number of clients in a limited number of industries; |

| • | regulatory, legislative and judicial developments; |

| • | increasing competition in the business process management industry; |

| • | technological innovation; |

| • | telecommunications or technology disruptions; |

| • | our ability to attract and retain clients; |

| • | our liability arising from fraud or unauthorized disclosure of sensitive or confidential client and customer data; |

| • | negative public reaction in the US or the UK to offshore outsourcing; |

| • | our ability to collect our receivables from, or bill our unbilled services to, our clients; |

| • | our ability to expand our business or effectively manage growth; |

| • | our ability to hire and retain enough sufficiently trained employees to support our operations; |

| • | the effects of our different pricing strategies or those of our competitors; |

| • | our ability to successfully consummate, integrate and achieve accretive benefits from our strategic acquisitions, and to successfully grow our revenue and expand our service offerings and market share; |

| • | future regulatory actions and conditions in our operating areas; and |

| • | volatility of our ADS price. |

These and other factors are more fully discussed in “Part I — Item 3. Key Information — D. Risk Factors”, “Part I — Item 5. Operating and Financial Review and Prospects” and elsewhere in this annual report. In light of these and other uncertainties, you should not conclude that we will necessarily achieve any plans, objectives or projected financial results referred to in any of the forward-looking statements. Except as required by law, we do not undertake to release revisions of any of these forward-looking statements to reflect future events or circumstances.

3

Table of Contents

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

Our consolidated financial statements as at and for the years ended March 31, 2019, 2018, 2017, 2016, and 2015 have been prepared in conformity with IFRS, as issued by the IASB.

The following selected financial data should be read in conjunction with “Part I — Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements included elsewhere in this annual report.

The following selected consolidated statement of income data for fiscal 2019, 2018, and 2017 and selected consolidated statement of financial position data as at March 31, 2019 and 2018 have been derived from our audited consolidated financial statements included elsewhere in this annual report. The selected consolidated statement of income data for fiscal 2016 and 2015 and selected consolidated statement of financial position data as at March 31, 2017, 2016 and 2015 have been derived from our audited consolidated financial statements which are not included in this annual report.

| For the year ended March 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (US dollars in millions, except share and per share data) | ||||||||||||||||||||

| Consolidated statement of income data: |

||||||||||||||||||||

| Revenue(2) |

$ | 809.1 | $ | 758.0 | $ | 602.5 | $ | 562.2 | $ | 533.9 | ||||||||||

| Cost of revenue(1) |

518.2 | 503.1 | 403.3 | 365.4 | 342.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

290.9 | 254.8 | 199.2 | 196.8 | 191.2 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Selling and marketing expenses(1) |

44.6 | 41.8 | 32.6 | 30.8 | 31.1 | |||||||||||||||

| General and administrative expenses(1) |

115.2 | 117.6 | 91.7 | 78.9 | 70.0 | |||||||||||||||

| Foreign exchange gains, net (2) |

(4.5 | ) | (15.0 | ) | (14.5 | ) | (11.0 | ) | (4.6 | ) | ||||||||||

| Impairment of goodwill |

— | — | 21.7 | — | — | |||||||||||||||

| Amortization of intangible assets |

15.8 | 15.5 | 20.5 | 25.2 | 24.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating profit |

119.8 | 94.9 | 47.2 | 72.9 | 70.5 | |||||||||||||||

| Other income, net |

(14.6 | ) | (11.2 | ) | (8.7 | ) | (8.5 | ) | (11.9 | ) | ||||||||||

| Finance expense |

3.2 | 4.3 | 0.5 | 0.3 | 1.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit before income taxes |

131.1 | 101.8 | 55.3 | 81.1 | 81.0 | |||||||||||||||

| Income tax expense |

25.7 | 15.4 | 17.5 | 21.2 | 22.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit after tax |

$ | 105.4 | $ | 86.4 | $ | 37.8 | $ | 59.9 | $ | 58.6 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per share of ordinary share: |

||||||||||||||||||||

| Basic |

$ | 2.10 | $ | 1.72 | $ | 0.75 | $ | 1.17 | $ | 1.14 | ||||||||||

| Diluted |

$ | 2.02 | $ | 1.63 | $ | 0.71 | $ | 1.12 | $ | 1.10 | ||||||||||

| Basic weighted average ordinary shares outstanding |

50,139,389 | 50,388,440 | 50,582,852 | 51,372,117 | 51,633,516 | |||||||||||||||

| Diluted weighted average ordinary shares outstanding |

52,278,113 | 52,915,600 | 52,940,308 | 53,639,670 | 53,428,981 | |||||||||||||||

4

Table of Contents

| As at March 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (US dollars in millions, except share and per share data) | ||||||||||||||||||||

| Consolidated statement of financial position data: |

||||||||||||||||||||

| Assets |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 85.4 | $ | 99.8 | $ | 69.8 | $ | 41.9 | $ | 32.4 | ||||||||||

| Investments |

67.9 | 121.0 | 112.0 | 133.0 | 133.5 | |||||||||||||||

| Trade receivables including unbilled revenue, net |

140.6 | 133.1 | 109.3 | 99.2 | 95.5 | |||||||||||||||

| Contract assets (3) |

4.2 | — | — | — | — | |||||||||||||||

| Other current assets(5) |

37.3 | 46.7 | 71.9 | 48.4 | 53.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

335.4 | 400.6 | 363.0 | 322.5 | 315.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Goodwill and intangible assets, net |

211.0 | 224.9 | 230.6 | 103.4 | 122.4 | |||||||||||||||

| Property and equipment, net |

61.0 | 60.6 | 54.8 | 50.4 | 48.2 | |||||||||||||||

| Deferred tax assets |

23.8 | 27.4 | 16.7 | 22.5 | 21.3 | |||||||||||||||

| Investments |

82.5 | 0.5 | 0.4 | — | — | |||||||||||||||

| Contract assets (3) |

22.0 | — | — | — | — | |||||||||||||||

| Other non-current assets (5) |

49.9 | 45.6 | 38.5 | 26.7 | 23.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-current assets |

450.2 | 359.0 | 341.1 | 203.0 | 215.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

785.6 | 759.6 | 704.1 | 525.5 | 530.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Liabilities and equity |

||||||||||||||||||||

| Current portion of long term debt |

28.0 | 27.7 | 27.6 | — | 12.8 | |||||||||||||||

| Trade payables |

17.8 | 19.7 | 14.2 | 19.9 | 22.7 | |||||||||||||||

| Other current liabilities (6) |

116.2 | 119.9 | 106.9 | 83.5 | 92.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

162.0 | 167.3 | 148.7 | 103.4 | 128.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Long-term debt |

33.4 | 61.4 | 89.1 | — | — | |||||||||||||||

| Other non-current liabilities (7) |

37.8 | 35.9 | 51.2 | 13.9 | 13.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-current liabilities |

71.2 | 97.3 | 140.3 | 13.9 | 13.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Share capital (ordinary shares $0.16 (10 pence) par value, authorized 60,000,000 shares; issued: 51,153,220, 54,834,080, 53,312,559, 52,406,304 and 51,950,662 shares each as at March 31, 2019, 2018, 2017, 2016 and 2015, respectively) |

8.1 | 8.5 | 8.3 | 8.2 | 8.1 | |||||||||||||||

| Share premium |

269.5 | 371.8 | 338.3 | 306.9 | 286.8 | |||||||||||||||

| Other shareholders’ equity (8) |

331.2 | 248.9 | 163.2 | 123.6 | 94.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total shareholders’ equity, including shares held in treasury |

608.8 | 629.2 | 509.8 | 438.7 | 389.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less: 1,101,300 shares as at March 31, 2019, 4,400,000 shares as at March 31, 2018, 3,300,000 shares as at March 31, 2017, 1,100,000 shares as at March 31, 2016 and Nil shares as at March 31, 2015, held in treasury, at cost |

(56.4 | ) | (134.2 | ) | (94.7 | ) | (30.5 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total shareholders’ equity |

552.4 | 495.0 | 415.1 | 408.2 | 389.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

$ | 785.6 | $ | 759.6 | $ | 704.1 | $ | 525.5 | $ | 530.3 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

5

Table of Contents

The following table sets forth for the periods indicated selected consolidated financial data, non-GAAP financial data and operating data:

| For the year ended March 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (US dollars in millions, except percentages and employee data) |

||||||||||||||||||||

| Other Consolidated Financial Data: |

||||||||||||||||||||

| Revenue |

$ | 809.1 | $ | 758.0 | $ | 602.5 | $ | 562.2 | $ | 533.9 | ||||||||||

| Gross profit as a percentage of revenue |

36.0 | % | 33.6 | % | 33.1 | % | 35.0 | % | 35.8 | % | ||||||||||

| Operating profit as a percentage of revenue |

14.8 | % | 12.5 | % | 7.8 | % | 13.0 | % | 13.2 | % | ||||||||||

| Non-GAAP Financial Data: |

||||||||||||||||||||

| Revenue less repair payments (non-GAAP)(9) |

$ | 794.0 | $ | 741.0 | $ | 578.4 | $ | 531.0 | $ | 503.0 | ||||||||||

| Gross profit as a percentage of revenue less repair payments (non-GAAP) |

36.6 | % | 34.4 | % | 34.4 | % | 37.1 | % | 38.0 | % | ||||||||||

| Operating profit as a percentage of revenue less repair payments (non-GAAP) |

15.1 | % | 12.8 | % | 8.2 | % | 13.7 | % | 14.0 | % | ||||||||||

| Operating Data: |

||||||||||||||||||||

| Number of employees (at year end) (10) |

39,898 | 36,540 | 34,547 | 32,388 | 28,890 | |||||||||||||||

Notes:

| (1) | Includes the following share-based compensation expense amounts: |

| For the year ended March 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (US dollars in millions) | ||||||||||||||||||||

| Cost of revenue |

$ | 4.3 | $ | 3.8 | $ | 2.8 | $ | 1.9 | $ | 0.8 | ||||||||||

| Selling and marketing expenses |

$ | 4.0 | $ | 2.6 | $ | 1.7 | $ | 1.4 | $ | 0.8 | ||||||||||

| General and administrative expenses |

$ | 22.0 | $ | 24.2 | $ | 18.5 | $ | 14.6 | $ | 7.9 | ||||||||||

| (2) | On adoption of IFRS 9 “Financial Instruments” (“IFRS 9”) with effect from April 1, 2018, cash flow hedging gains and losses, which were previously reported in foreign exchange gains or losses, net, are now reported in revenue. The comparative information has not been restated and continues to be reported in accordance with the principles of IAS 39 –“Financial Instruments: Recognition and Measurement”. |

| (3) | Disclosed separately on adoption of IFRS 15 “Revenue from Contracts with Customers” (“IFRS 15”) with effect from April 1, 2018. The comparative information has not been restated and continues to be reported in accordance with the principles of IAS 18 –“Revenue”. See note 4 to our consolidated financial statements included elsewhere in this annual report. |

| (4) | Consists of funds held for clients, derivative assets, and prepayments and other current assets. |

| (5) | Consists of non-current portion of derivative assets, and other non-current assets. |

| (6) | Consists of provisions and accrued expenses, derivative liabilities, pension and other employee obligations, contract liabilities, current taxes payable and other liabilities. |

| (7) | Consists of non-current portion of derivative liabilities, pension and other employee obligations, contract liabilities, deferred tax liabilities and other non-current liabilities. |

| (8) | Consists of retained earnings and other components of equity. |

6

Table of Contents

| (9) | Revenue less repair payments is a non-GAAP financial measure which is calculated as (a) revenue less (b) in our auto claims business, payments to repair centers for “fault” repair cases where we act as the principal in our dealings with the third party repair centers and our clients. The following table reconciles our revenue to revenue less repair payments (a non-GAAP financial measure) for the indicated periods: |

| For the year ended March 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (US dollars in millions) | ||||||||||||||||||||

| Revenue (GAAP) |

$ | 809.1 | $ | 758.0 | $ | 602.5 | $ | 562.2 | $ | 533.9 | ||||||||||

| Less: Payments to repair centers(a) |

15.2 | 17.0 | 24.1 | 31.2 | 30.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Revenue less repair payments (non-GAAP) |

$ | 794.0 | $ | 741.0 | $ | 578.4 | $ | 531.0 | $ | 503.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Note:

| (a) | Consists of payments to repair centers in our auto claims business for “fault” repair cases where we act as the principal in our dealings with the third party repair centers and our clients. |

We have two reportable segments for financial statement reporting purposes — WNS Global BPM and WNS Auto Claims BPM. In our WNS Auto Claims BPM segment, we provide both “fault” and “non-fault” repairs. For “fault” repairs, we provide claims handling and repair management services, where we arrange for automobile repairs through a network of third party repair centers. WNS Legal Assistance LLP, a subsidiary of WNS Assistance Limited, provides legal services in relation to personal injury claims. In our repair management services, where we act as the principal in our dealings with the third party repair centers and our clients, the amounts which we invoice to our clients for payments made by us to third party repair centers are reported as revenue. Where we are not the principal in providing the services, we record revenue from repair services net of repair cost. Since we wholly subcontract the repairs to the repair centers, we evaluate the financial performance of our “fault” repair business based on revenue less repair payments (non-GAAP) to third party repair centers, which is a non-GAAP financial measure. We believe that revenue less repair payments (non-GAAP) for “fault” repairs reflects more accurately the value addition of the business process management services that we directly provide to our clients.

For our “non-fault” repairs business, we generally provide a consolidated suite of accident management services including credit hire and credit repair, and we believe that measurement of such business on a basis that includes repair payments in revenue is appropriate. Revenue including repair payments is therefore used as a primary measure to allocate resources and measure operating performance for accident management services provided in our “non-fault” repairs business. Our “non-fault” repairs business, where we provide accident management services, accounts for a relatively small portion of our revenue for our WNS Auto Claims BPM segment.

This non-GAAP financial information is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP. We believe that the presentation of this non-GAAP financial measure in this annual report provides useful information for investors regarding the financial performance of our business and our two reportable segments. Our revenue less repair payments (non-GAAP) may not be comparable to similarly titled measures reported by other companies due to potential differences in the method of calculation.

| (10) | Commencing fiscal 2018, we are including in our disclosed total headcount the number of apprentices employed under the India government scheme, National Employability Enhancement Mission, pursuant to which apprentices undergo a three to 36 month apprenticeship to enhance their employability. There is no guarantee of employment with WNS following the completion of the apprenticeship. Our previously disclosed total headcount does not include apprentices. The total headcount presented for prior periods in the table above have been re-computed to include apprentices for comparative purposes. |

B. Capitalization and Indebtedness

Not applicable.

7

Table of Contents

C. Reason for the Offer and the Use of Proceeds

Not applicable.

D. Risk Factors

This annual report contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those described in the following risk factors and elsewhere in this annual report. If any of the following risks actually occur, our business, financial condition and results of operations could suffer and the trading price of our ADSs could decline.

Risks Related to Our Business

The global economic and geo-political conditions have been challenging and have had, and may continue to have, an adverse effect on the financial markets and the economy in general, which has had, and may continue to have, a material adverse effect on our business, our financial performance and the prices of our equity shares and ADSs.

Global economic conditions continue to show signs of turbulence. Although some key indicators of sustainable economic growth show signs of improvement, volatility in the domestic politics of major markets may lead to changes in the institutional framework of the international economy.

In June 2016, a majority of voters in the UK elected to withdraw from the EU in a national referendum, commonly referred to as “Brexit.” The referendum was advisory, and the terms of any withdrawal are subject to a two-year negotiation period (unless an extension is agreed), which commenced on March 29, 2017. The withdrawal of the UK from the EU was set to take place on March 29, 2019, however this date has been postponed to October 31, 2019 and ongoing uncertainty remains as to what kind of post-Brexit agreement between the UK and the EU, if any, may be approved by the UK parliament. There is the possibility that the UK will end up leaving the EU without having reached final agreement with the EU on the terms of its withdrawal. The referendum, and now the risk of a “no deal” between the UK and the EU, has created significant uncertainty regarding the future relationship between the UK and the EU, including with respect to the laws and regulations that will apply as the UK determines which EU-derived laws to replace or replicate in the event of a withdrawal. Uncertainty regarding the terms of Brexit, and its eventual effects once implemented, have had and may continue to have a material adverse effect on global economic conditions and the stability of global financial markets, and may significantly reduce global market liquidity and restrict the ability of key market participants to operate in certain financial markets. Any of these factors could depress economic activity and restrict our access to capital, which could have a material adverse effect on our business, financial condition and results of operations.

29.0% of our revenues and 27.6% of our revenue less repair payments (non-GAAP) for fiscal 2019 and 31.8% of our revenues and 30.2% of our revenue less repair payments (non-GAAP) for fiscal 2018 are denominated in pound sterling. The extent and duration of the decline in the value of the pound sterling to the US dollar and other currencies is unknown at this time. A long-term reduction in the value of the pound sterling as a result of the UK referendum or otherwise could adversely impact our earnings growth rate and profitability. We believe that our hedging program is effective and it substantially protects us against fluctuations in foreign currency exchange rates through a mix of forwards and options for this current fiscal year.

In the US, economic growth is tempered by continuing concerns over the failure to achieve a long-term solution to the issues of government spending, the increasing US national debt, and their negative impact on the US economy as well as concerns over potential increases in the cost of borrowing and reduction in availability of credit as the US Federal Reserve has, until recently, continued to raise interest rates. The policies that may be pursued by the presidential administration in the US have added further uncertainty to the global economy, and the prevailing political climate may lead to more protectionist policies. Further, there is uncertainty regarding the impact of the escalating “trade war” between China and the United States on the global economy. Globally, countries may require additional financial support, sovereign credit ratings may continue to decline, and there may be default on sovereign debt obligations of certain countries. Any of these may increase the cost of borrowing and cause credit to become more limited, which could have a material adverse effect on our business, financial condition and results of operations. Further, there continue to be signs of economic weakness, such as relatively high levels of unemployment, in major markets including Europe. Continuing conflicts and instability in various regions around the world may lead to additional acts of terrorism, and armed conflict around the world. The ongoing refugee crisis in Europe, North Africa and the Middle East may contribute to political and economic instability in those regions. A resurgence of isolationist and/or protectionist policies in North America, Europe and Asia may curtail global economic growth. China continues to have room for economic growth, but such growth opportunities remain subject to political developments, particularly with respect to a US-China trade deal, and uncertainties in the regulatory framework of the economy.

These economic and geo-political conditions may affect our business in a number of ways. The general level of economic activity, such as decreases in business and consumer spending, could result in a decrease in demand for our services, thus reducing our revenue. The cost and availability of credit has been and may continue to be adversely affected by illiquid credit markets and wider credit spreads. Continued turbulence or uncertainty in the European, US, Asian and international financial markets and economies, and the political climate in the US and the UK, may adversely affect our liquidity and financial condition, and the liquidity and financial condition of our clients. If these market conditions continue or worsen, they may limit our ability to access financing or increase our cost of financing to meet liquidity needs, and affect the ability of our clients to use credit to purchase our services or to make timely payments to us, resulting in adverse effects on our financial condition and results of operations.

8

Table of Contents

Changing economic conditions may have an effect on foreign exchange rates, which in turn may affect our business. For further information, see “— Currency fluctuations among the Indian rupee, the pound sterling, the US dollar, the Australian dollar and the South African rand could have a material adverse effect on our results of operations.”

Uncertainty about current global economic conditions could also continue to increase the volatility of our share price. We cannot predict the timing or duration of an economic slowdown or the timing or strength of a subsequent economic recovery generally or in our targeted industries, including the travel and leisure and insurance industries. If macroeconomic conditions worsen or current global economic conditions continue for a prolonged period of time, we are not able to predict the impact that such worsening conditions will have on our targeted industries in general, and our results of operations specifically.

A few major clients account for a significant portion of our revenue and any loss of business from these clients could reduce our revenue and significantly harm our business.

We have derived and believe that we will continue to derive in the near term a significant portion of our revenue from a limited number of large clients. In fiscal 2019 and 2018, our five largest clients accounted for 27.1% and 29.4% of our revenue and 27.6% and 30.1% of our revenue less repair payments (non-GAAP), respectively. In fiscal 2019 and 2018, our three largest clients accounted for 18.1% and 19.2% of our revenue and 18.5% and 19.6% of our revenue less repair payments (non-GAAP), respectively. In fiscal 2019, our largest client individually accounted for 6.9% and 7.1% of our revenue and revenue less repair payments (non-GAAP), respectively, as compared to 6.8% and 7.0% in fiscal 2018, respectively. Any loss of business from any major client could reduce our revenue and significantly harm our business.

For example, in line with our expectations, one of our top five clients by revenue contribution in fiscal 2014, an online travel agency (“OTA”), provided us with lower volume of business in fiscal 2015 as the OTA entered into a strategic marketing agreement with another OTA in August 2013, pursuant to which, it, over a period of time, from the fourth quarter of fiscal 2014 to the fourth quarter of fiscal 2015, moved its customer care and sales processes that were previously managed by us to a technology platform managed by the other OTA. As a result, we lost most of our business from that OTA and since June 2015, we ceased to provide services to that OTA. That OTA accounted for 2.5% and 6.1% of our revenue and 2.6% and 6.5% of our revenue less repair payments (non-GAAP) in fiscal 2015 and 2014, respectively. The other OTA uses several BPM vendors to manage such processes on their technology platform. We are approved as one of the other OTA’s providers of BPM services. We have managed to compete with incumbent BPM vendors for the other OTA’s business and the other OTA has become one of our large clients.

We have derived, and we expect to continue deriving for the foreseeable future, a significant portion of our revenue from Aviva Global Services (Management Services) Private Limited (“Aviva MS”). Under our master services agreement with Aviva MS (the “Aviva master services agreement”), Aviva MS is permitted to terminate the agreement without cause with 180 days’ notice upon payment of a termination fee.

In addition, the volume of work performed for specific clients is likely to vary from year to year, particularly since we may not be the exclusive outside service provider for our clients. Thus, a major client in one year may not provide the same level of revenue in any subsequent year. For example, until fiscal 2018, Aviva MS was our largest client and revenue from Aviva MS has decreased from $54.5 million in fiscal 2017 to $51.9 million in fiscal 2018 to $50.1 million in fiscal 2019. Part of this decline in revenue is attributable to revised pricing terms and part is attributable to a reduction of services due to automation performed by Aviva MS and the automation of certain services by WNS. The loss of some or all of the business of any large client could have a material adverse effect on our business, results of operations, financial condition and cash flows. A number of factors other than our performance could cause the loss of or reduction in business or revenue from a client, and these factors are not predictable. For example, a client may demand price reductions, change its outsourcing strategy or move work in-house. A client may also be acquired by a company with a different outsourcing strategy that intends to switch to another business process management service provider or return work in-house.

Our revenue is highly dependent on clients concentrated in a few industries, as well as clients located primarily in the US, the UK, Europe and Australia. Economic slowdowns or factors that affect these industries or the economic environment in the US, the UK, Europe or Australia could reduce our revenue and seriously harm our business.

A substantial portion of our clients are concentrated in the insurance industry and the travel and leisure industry. In fiscal 2019 and 2018, 26.6% and 25.7% of our revenue, respectively, and 25.2% and 24.0% of our revenue less repair payments (non-GAAP), respectively, were derived from clients in the insurance industry. During the same periods, clients in the travel and leisure industry contributed 17.4% and 18.7% of our revenue, respectively, and 17.8% and 19.2% of our revenue less repair payments (non-GAAP), respectively. Our business and growth largely depend on continued demand for our services from clients in these industries and other industries that we may target in the future, as well as on trends in these industries to outsource business processes.

9

Table of Contents

Turbulence in the global economy affects both the industries in which our clients are concentrated and the geographies in which we do business. For more information, see “ — The global economic and geo-political conditions have been challenging and have had, and may continue to have, an adverse effect on the financial markets and the economy in general, which has had, and may continue to have, a material adverse effect on our business, our financial performance and the prices of our equity shares and ADSs.” Certain of our targeted industries are especially vulnerable to crises in the financial and credit markets and potential economic downturns. A downturn in any of our targeted industries, particularly the insurance or travel and leisure industries, a slowdown or reversal of the trend to offshore business process outsourcing in any of these industries or the introduction of regulation which restricts or discourages companies from outsourcing could result in a decrease in the demand for our services and adversely affect our results of operations.

Further, any weakening of or uncertainty in worldwide economic and business conditions could result in a few of our clients reducing or postponing their outsourced business requirements, which in turn could decrease the demand for our services and adversely affect our results of operations. In particular, our revenue is highly dependent on the economic environments in the US, the UK, Europe and Australia. In fiscal 2019 and 2018, 41.5% and 40.7% of our revenue, respectively, and 42.3% and 41.6% of our revenue less repair payments (non-GAAP), respectively, were derived from clients located in the US. During the same periods, 31.4% and 34.2% of our revenue, respectively, and 30.1% and 32.6% of our revenue less repair payments (non-GAAP), respectively, were derived from clients located in the UK, 7.0% and 6.2% of our revenue, respectively, and 7.1% and 6.4% of our revenue less repair payments (non-GAAP), respectively, were derived from clients located in Europe (excluding the UK), and 9.5% and 8.8% of our revenue, respectively, and 9.7% and 9.0% of our revenue less repair payments (non-GAAP), respectively, were derived from clients located in Australia. Any weakening of or uncertainty in the US, UK, European or Australian economy will likely have a further adverse impact on our revenue.

Other developments may also lead to a decline in the demand for our services in our targeted industries. Significant changes in the financial services industry or any of the other industries on which we focus, or a consolidation in any of these industries or acquisitions, particularly involving our clients, may decrease the potential number of buyers of our services and have an adverse impact on our profitability. Any significant reduction in or the elimination of the use of the services we provide within any of these industries would result in reduced revenue and harm our business. Our clients may experience rapid changes in their prospects, substantial price competition and pressure on their profitability. Although such pressures can encourage outsourcing as a cost reduction measure, they may also result in increasing pressure on us from clients in these key industries to lower our prices which could negatively affect our business, results of operations, financial condition and cash flows.

10

Table of Contents

Currency fluctuations among the Indian rupee, the pound sterling, the US dollar, the Australian dollar, the Euro, the South African rand and the Philippine peso could have a material adverse effect on our results of operations.

Although substantially all of our revenue is denominated in pound sterling, US dollars, and to a lesser extent, Australian dollars, Euro and South African rand, a significant portion of our expenses (other than payments to repair centers, which are primarily denominated in pound sterling) are incurred and paid in Indian rupees and, to a lesser extent, in South African rand and Philippine peso. Therefore, a weakening of the rate of exchange for the pound sterling, the US dollar, Euro or the Australian dollar against the Indian rupee or, to a lesser extent, a weakening of the pound sterling against the South African rand or the Philippine peso would adversely affect our results. Furthermore, we report our financial results in US dollars and our results of operations would be adversely affected if the pound sterling, Euro or the Australian dollar depreciates against the US dollar, or if the Indian rupee or, to a lesser extent, the South African rand or the Philippine peso appreciates against the US dollar. Fluctuations between the pound sterling, the Indian rupee, the South African rand, the Australian dollar or the Philippine peso, on the one hand, and the US dollar, on the other hand, expose us to translation risk when transactions denominated in such currencies are translated to US dollars, our reporting currency. The exchange rates between each of the pound sterling, Indian rupee, South African rand, Australian dollar, Euro and the Philippine peso, on the one hand, and the US dollar, on the other hand, have changed substantially in recent years and may fluctuate substantially in the future.

The referendum in the UK regarding the UK’s withdrawal from the EU and the uncertainty regarding the terms of Brexit and its eventual effects once implemented have created uncertainty in the British and European economies and in the global economy as a whole. See “—The global economic and geo-political conditions have been challenging and have had, and may continue to have, an adverse effect on the financial markets and the economy in general, which has had, and may continue to have, a material adverse effect on our business, our financial performance and the prices of our equity shares and ADSs.” These developments have caused, and may continue to cause, volatility in the exchange rates between the pound sterling and other currencies.

The average pound sterling to US dollar exchange rate was approximately £0.76 per $1.00 in fiscal 2019, which represented a depreciation of the pound sterling by an average of 0.9% as compared with the average exchange rate of £0.75 per $1.00 in fiscal 2018, which in turn represented an appreciation of the pound sterling by an average of 1.4% as compared with the average exchange rate of £0.76 per $1.00 in fiscal 2017.

The average Indian rupee to US dollar exchange rate was approximately ₹69.92 per $1.00 in fiscal 2019, which represented a depreciation of the Indian rupee by an average of 8.5% as compared with the average exchange rate of approximately ₹64.46 per $1.00 in fiscal 2018, which in turn represented an appreciation of the Indian rupee by an average of 3.9% as compared with the average exchange rate of approximately ₹67.10 per $1.00 in fiscal 2017.

The average South African rand exchange rate was approximately R13.76 per $1.00 in fiscal 2019, which represented a depreciation of the South African rand by an average of 6.0% as compared with the average exchange rate of approximately R12.98 per $1.00 in fiscal 2018, which in turn represented an appreciation of the South African rand by an average of 7.8% as compared with the average exchange rate of approximately R14.07 per $1.00 in fiscal 2017.

The average Australian dollar exchange rate was approximately A1.37 per $1.00 in fiscal 2019, which represented a depreciation of the Australian dollar by an average of 5.8% as compared with the average exchange rate of approximately A1.29 per $1.00 in fiscal 2018, which in turn represented an appreciation of the Australian dollar by an average of 2.8% as compared with the average exchange rate of approximately A1.33 per $1.00 in fiscal 2017.

The average Euro exchange rate was approximately €1.16 per $1.00 in fiscal 2019, which represented a depreciation of the Euro by an average of 1.0% as compared with the average exchange rate of approximately €1.17 per $1.00 in fiscal 2018, which in turn represented an appreciation of the Euro by an average of 6.7% as compared with the average exchange rate of approximately €1.10 per $1.00 in fiscal 2017.

The average Philippine peso exchange rate was approximately PHP 52.91 per $1.00 in fiscal 2019, which represented a depreciation of the Philippine peso by an average of 4.2% as compared with the average exchange rate of approximately PHP 50.76 per $1.00 in fiscal 2018, which in turn represented a depreciation of the Philippine peso by an average of 5.4% as compared with the average exchange rate of approximately PHP 48.18 per $1.00 in fiscal 2017.

Our results of operations would be adversely affected if the Indian rupee appreciates significantly against the pound sterling or the US dollar or if the pound sterling or the Australian dollar depreciates against the US dollar or, to a lesser extent, the South African rand or the Philippine peso appreciates significantly against the US dollar.

For example, the depreciation of the Indian Rupee and the South African rand against the US dollar in fiscal 2019 positively impacted our results of operations whereas the depreciation of the pound sterling and the Australian dollar against the US dollar negatively impacted our results of operations during that year.

The appreciation of the Indian rupee and the South African rand against the US dollar in fiscal 2018 negatively impacted our results of operations whereas the appreciation of the pound sterling and the Australian dollar against the US dollar positively impacted our results of operations during that year.

We hedge a portion of our foreign currency exposures using options and forward contracts. We cannot assure you that our hedging strategy will be successful or will mitigate our exposure to currency risk.

11

Table of Contents

The international nature of our business exposes us to several risks, such as unexpected changes in the regulatory requirements and governmental policy changes of multiple jurisdictions.

We have operations in China, Costa Rica, India, the Philippines, Poland, Romania, South Africa, Sri Lanka, Spain, Turkey, the UK and the US, and we service clients across Asia, Europe, South Africa, Australia and North America. Our corporate structure also spans multiple jurisdictions, with our parent holding company incorporated in Jersey, Channel Islands, and intermediate and operating subsidiaries (including branch offices) incorporated in Australia, China, Costa Rica, France, India, Mauritius, the Netherlands, the Philippines, Romania, South Africa, Singapore, Sri Lanka, Spain, Turkey, the United Arab Emirates, the UK and the US. As a result, we are exposed to risks typically associated with conducting business internationally, many of which are beyond our control. These risks include:

| • | legal uncertainty owing to the overlap of different legal regimes, and problems in asserting contractual or other rights across international borders; |

| • | potentially adverse tax consequences, such as scrutiny of transfer pricing arrangements by authorities in the countries in which we operate; |

| • | potential tariffs and other trade barriers; |

| • | unexpected changes in legal regimes and regulatory requirements; |

| • | policy changes due to changes in government; |

For example, during the fourth quarter of fiscal 2017, proposed changes to the laws of the UK governing personal injury claims generated uncertainty regarding the future earnings trajectory of our legal services business in our WNS Auto Claims BPM segment, as a result of which we had expected that we would eventually exit from providing legal services in relation to personal injury claims. We also experienced a decrease in volume of and loss of business from certain clients of our traditional repair services in our WNS Auto Claims BPM segment in fiscal 2017. As a result, we had in fiscal 2017 expected the future performance of our WNS Auto Claims BPM segment to decline significantly and therefore significantly reduced our financial projections and estimates of our WNS Auto Claims BPM segment. Accordingly, we performed an impairment review of the goodwill associated with the companies we had acquired for our auto claims business and recorded an impairment charge of $21.7 million to our results of operations for fiscal 2017. The occurrence of other changes in legal regimes or regulatory requirements, or any other events associated with the risks of conducting business internationally, could have a material adverse effect on our results of operations and financial condition.

Our global operations expose us to numerous and sometimes conflicting legal and regulatory requirements. Failure to adhere to the laws and regulations that govern our business or our clients’ businesses that we are required to comply with in performing our services could harm our business.

We have operations in 12 countries and our corporate structure spans multiple jurisdictions. Further, we service clients across multiple geographic regions and multiple industries. We are required to comply with numerous, and sometimes conflicting and uncertain, laws and regulations including on matters relating to import/export controls, trade restrictions, taxation, immigration, internal disclosure and control obligations, securities regulation, anti-competition, data privacy and protection, anti-corruption, and employment and labor relations. In addition, we are required to obtain and maintain permits and licenses for the conduct of our business in various jurisdictions. Our clients’ business operations are also subject to numerous regulations in the jurisdiction in which they operate or that are applicable to their industry, and our clients may contractually require that we perform our services in compliance with regulations applicable to them or in a manner that will enable them to comply with such regulations. For example, regulations to which our clients’ business operations are subject include the Gramm-Leach-Bliley Act, the Health Insurance Portability and Accountability Act and Health Information Technology for Economic and Clinical Health Act in the US, the Financial Services Act in the UK and the General Data Protection Regulation in the EU. In addition, HealthHelp, which we acquired in March 2017, administers programs offered by the Centers for Medicare & Medicaid Services, a United States federal agency that administers Medicare and Medicaid. Regulatory changes may result in our exiting certain parts of our business.

On account of the global nature of our and our clients’ operations, compliance with diverse legal and regulatory requirements is difficult, time-consuming and requires significant resources. Further, the extent of development of legal systems varies across the countries in which we operate and local laws may not be adequately developed or be able to provide us clear guidance to sufficiently protect our rights. Specifically, in many countries including those in which we operate and/or seek to expand to, the practices of local businesses may not be in accordance with international business standards and could violate anti-corruption laws and regulations, including the UK Bribery Act 2010 and the US Foreign Corrupt Practices Act 1977. Our employees, subcontractors, agents, business partners, the companies we acquire and their employees, subcontractors and agents, and other third parties with which we associate, could act in a manner which violates policies or procedures intended to ensure compliance with laws and regulations, including applicable anti-corruption laws or regulations.

12

Table of Contents

Violations of such laws or regulations by us, our employees or any of these third parties could subject us to criminal or civil enforcement actions (whether or not we participated or were aware of the actions leading to the violations), including fines or penalties, breach of contract damages, disgorgement of profits and suspension or disqualification from work, any of which could materially and adversely affect our business, including our results of operations and our reputation. If we are unable to maintain our licenses, permits or other qualifications necessary to provide our services, we may not be able to provide services to existing clients or be able to attract new clients and could lose revenue, which could have a material adverse effect on our business.

13

Table of Contents

We face competition from onshore and offshore business process management companies and from information technology companies that also offer business process management services. Our clients may also choose to run their business processes themselves, either in their home countries or through captive units located offshore.

The market for outsourcing services is very competitive and we expect competition to intensify and increase from a number of sources. We believe that the principal competitive factors in our markets are price, service quality, sales and marketing skills, business process transformation capabilities and industry expertise. We face significant competition from our clients’ own in-house groups including, in some cases, in-house departments operating offshore or captive units. Clients who currently outsource a significant proportion of their business processes or information technology services to vendors in India may, for various reasons, including diversifying geographic risk, seek to reduce their dependence on any one country. We also face competition from onshore and offshore business process management and information technology services companies. In addition, the trend toward offshore outsourcing, international expansion by foreign and domestic competitors and continuing technological changes will result in new and different competitors entering our markets.

These competitors may include entrants from the communications, software and data networking industries or entrants in geographic locations with lower costs than those in which we operate. Technological changes include the development of complex automated systems for the processing of transactions that are formerly labor intensive, which may reduce or replace the need for outsourcing such transaction processing.

Some of these existing and future competitors have greater financial, human and other resources, longer operating histories, greater technological expertise, more recognizable brand names and more established relationships in the industries that we currently serve or may serve in the future. In addition, some of our competitors may enter into strategic or commercial relationships among themselves or with larger, more established companies in order to increase their ability to address client needs, or enter into similar arrangements with potential clients. Increased competition, our inability to compete successfully against competitors, pricing pressures or loss of market share could result in reduced operating margins which could harm our business, results of operations, financial condition and cash flows.

Changes in technology could lead to changes in our clients’ businesses as well as their requirements for business process services, which may adversely impact our business and results of operations.

Proliferation of accessible technology, such as smartphones and internet, has had an impact on the manner in which customers and businesses interact with each other. Companies are increasingly adopting social media platforms, online self-help portals and mobile applications for communicating with and servicing their customers rather than utilizing business process management companies such as ourselves to manage these interactions. Our clients also continue to invest in technology by upgrading their platforms and application capabilities towards increased automation of transactions. Advances in software, such as robotic process automation and voice recognition, have the potential to reduce dependency on human processing transactions. Such developments and other innovations, such as autonomous vehicles, have the potential to significantly change the way our clients’ businesses operate and may reduce their dependency on business process management companies, including our company, for managing their business processes. We are therefore subject to a risk of disintermediation on account of such changes in technology, which could impact our future growth prospects and may require continued investments in our business.

If we cause disruptions to our clients’ businesses, provide inadequate service or are in breach of our representations or obligations, our clients may have claims for substantial damages against us. Our insurance coverage may be inadequate to cover these claims and, as a result, our profits may be substantially reduced.

Most of our contracts with clients contain service level and performance requirements, including requirements relating to the quality of our services and the timing and quality of responses to the client’s customer inquiries. In some cases, the quality of services that we provide is measured by quality assurance ratings and surveys which are based in part on the results of direct monitoring by our clients of interactions between our employees and our client’s customers. Failure to consistently meet service requirements of a client or errors made by our associates or the software/platforms we use in the course of delivering services to our clients could disrupt the client’s business and result in a reduction in revenue or a claim for substantial damages against us. For example, some of our agreements stipulate standards of service that, if not met by us, will require us to pay penalties to our clients or result in lower payment to us. Failure to meet these service level requirements could result in the payment of significant penalties by us to our clients which in turn could have an adverse effect on our business, results of operations, financial condition and cash flows. In addition, in connection with acquiring new business from a client or entering into client contracts, our employees may make various representations, including representations relating to the quality of our services, abilities of our associates and our project management techniques. A failure or inability to meet a contractual requirement or our representations could seriously damage our reputation and affect our ability to attract new business or result in a claim for substantial damages against us.

14

Table of Contents

Our dependence on our offshore delivery centers requires us to maintain active data and voice communications between our main delivery centers in China, Costa Rica, India, the Philippines, Poland, Romania, South Africa, Sri Lanka, Spain, Turkey, the UK and the US, our international technology hubs in the UK and the US and our clients’ offices. Although we maintain redundant facilities and communications links, disruptions could result from, among other things, technical and electricity breakdowns, computer glitches and viruses and adverse weather conditions. Any significant failure of our equipment or systems, or any major disruption to basic infrastructure like power and telecommunications in the locations in which we operate, could impede our ability to provide services to our clients, have a negative impact on our reputation, cause us to lose clients, reduce our revenue and harm our business.

We depend on human resources to process transactions for our clients. Disruptive incidents, including man-made events such as civil strikes and shutdowns, may impact the ability of our employees to commute to and from our operating premises. Non-natural disasters, whether unintentional (such as those caused by accidents) or intentional (such as those caused by terrorist attacks), may also disrupt our operations. While we have implemented business continuity plans for clients where we have contractually agreed to do so, we may not always be able to provide services to our clients for the duration of such incidents.

Although under most of our contracts with our clients, our liability for breach of our obligations is limited to actual damages suffered by the client and capped at a portion of the fees paid or payable to us under the relevant contract, our liability for breach of our obligations under certain of our contracts is unlimited. With respect to those of our contracts that contain limitations on liability, such limitations may be unenforceable or otherwise may not protect us from liability for damages. In addition, certain liabilities, such as claims of third parties for which we may be required to indemnify our clients, are generally not limited under those agreements. Further, although we have professional indemnity insurance coverage, the coverage may not continue to be available on reasonable terms or in sufficient amounts to cover one or more large claims and our insurers may disclaim coverage as to any future claims. The successful assertion of one or more large claims against us that exceed available insurance coverage, or changes in our insurance policies (including premium increases or the imposition of large deductible or co-insurance requirements), could have a material adverse effect on our business, reputation, results of operations, financial condition and cash flows.

15

Table of Contents

We are liable to our clients for damages caused by unauthorized disclosure of sensitive or confidential information, whether through a breach or circumvention of our or our clients’ computer systems and processes, through our employees or otherwise. Further, cybersecurity and data privacy considerations could impact our business.

We are typically required to manage, utilize and store sensitive or confidential client data in connection with the services we provide. Under the terms of our client contracts, we are required to keep such information strictly confidential. Our client contracts do not include any limitation on our liability to them with respect to breaches of our obligation to maintain confidentiality of the information we receive from them. Although we seek to implement measures to protect sensitive and confidential client data, there can be no assurance that we would be able to prevent breaches of security. Further, some of our projects require us to conduct business functions and computer operations using our clients’ systems over which we do not have control and which may not be compliant with industry security standards. In addition, some of the client designed processes that we are contractually required to follow for delivering services to them and which we are unable to unilaterally change, could be designed in a manner that allows for control weaknesses to exist and be exploited. Any vulnerability in a client’s system or client designed process, if exploited, could result in breaches of security or unauthorized transactions and result in a claim for substantial damages against us. Although we have implemented appropriate policies, procedures and infrastructure to reduce the possibility of physical, logical and personnel security breaches, along with appropriate audit oversight for verifying continued operating effectiveness of the same through internal audits and external SSAE16 / ISAE3402, ISO27001 and PCI-DSS reviews, such measures can never completely eliminate the risk of cybersecurity attacks. If any person, including any of our employees, penetrates our or our clients’ network security or otherwise mismanages or misappropriates sensitive or confidential client data, we could be subject to significant liability and lawsuits from our clients or their customers for breaching contractual confidentiality provisions or privacy laws.

To date, although there has not been a material cybersecurity attack that has had an adverse effect on our operations, there can be no assurance that there will be no material adverse effect in the future. Rapid advancements and changes to the technological landscape may require us to make significant further investments in the domain of cybersecurity in order to protect our and our clients’ data and infrastructure. In addition, such advancements coupled with the rise in the sophisticated nature of cyber threats and attacks make it possible that certain threats or vulnerabilities may not be detected in time to prevent an attack on our or our clients’ business. On account of the interconnected nature of our business, there is an interdependency between our clients, business partners and our business to implement appropriate cybersecurity controls in order to mitigate cybersecurity risk. A failure of cybersecurity controls at our client or business partners could therefore result in a breach at our company.

While we have insurance coverage for mismanagement or misappropriation of such information by our employees, that coverage may not continue to be available on reasonable terms or in sufficient amounts to cover one or more large claims against us, and our insurers may disclaim coverage as to any future claims. Penetration of the network security of our or our clients’ data centers or computer systems or unauthorized use or disclosure of sensitive or confidential client data, whether through breach of our or our clients’ computer systems, systems failure, loss or theft of assets containing confidential information or otherwise, could also have a negative impact on our reputation which would harm our business.

We also cannot be certain that advances in criminal capabilities (including cyber-attacks or cyber intrusions over the internet, malware, computer viruses and the like), discovery of new vulnerabilities or attempts to exploit existing vulnerabilities in our or our clients’ or business partners’ systems, other data thefts, physical system or network break-ins or inappropriate access, or other developments will not compromise or breach the technology protecting our or our client’s or business partners’ computer systems and networks that access and store sensitive information. Cyber threats, such as phishing and trojans, could intrude into our or our client’s or business partners’ network to steal data or to seek sensitive information. Any intrusion into our network or our client’s or business partners’ network (to the extent attributed to us or perceived to be attributed to us) that results in any breach of security could cause damage to our reputation and adversely impact our business and financial results. A significant failure in security measures could have a material adverse effect on our business, reputation, results of operations and financial condition.

Our business could be materially and adversely affected if we do not protect our intellectual property or if our services are found to infringe on the intellectual property of others.

Our success depends in part on certain methodologies, practices, tools and technical expertise we utilize in designing, developing, implementing and maintaining applications and other proprietary intellectual property rights. In order to protect our rights in such intellectual properties, we rely upon a combination of nondisclosure and other contractual arrangements as well as trade secret, copyright and trademark laws. We also generally enter into confidentiality agreements with our employees, consultants, clients and potential clients, and limit access to and distribution of our proprietary information to the extent required for our business purpose.

India is a member of the Berne Convention, an international intellectual property treaty, and has agreed to recognize protections on intellectual property rights conferred under the laws of other foreign countries, including the laws of the United States. There can be no assurance that the laws, rules, regulations and treaties in effect in the United States, India and the other jurisdictions in which we operate and the contractual and other protective measures we take, are adequate to protect us from misappropriation or unauthorized use of our intellectual property, or that such laws will not change. We may not be able to detect unauthorized use and take appropriate steps to enforce our rights, and any such steps may not be successful. Infringement by others of our intellectual property, including the costs of enforcing our intellectual property rights, may have a material adverse effect on our business, results of operations and financial condition.

16

Table of Contents

Our clients may provide us with access to, and require us to use, third party software in connection with our delivery of services to them. Our client contracts generally require our clients to indemnify us for any infringement of intellectual property rights or licenses to third party software when our clients provide such access to us. If the indemnities under our client contracts are inadequate to cover the damages and losses we suffer due to infringement of third party intellectual property rights or licenses to third party software to which we were given access, our business and results of operations could be adversely affected. We are also generally required by our client contracts to indemnify our clients for any breaches of intellectual property rights by our services. Although we believe that we are not infringing on the intellectual property rights of others, claims may nonetheless be successfully asserted against us in the future. The costs of defending any such claims could be significant, and any successful claim may require us to modify, discontinue or rename any of our services. Any such changes may have a material adverse effect on our business, results of operations and financial condition.

Our clients may terminate contracts before completion or choose not to renew contracts, which could adversely affect our business and reduce our revenue.