As filed with the Securities and Exchange Commission on July 20 , 2016

Registration No. 333- 211973

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

AMENEMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

|

LEO MOTORS, INC.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Nevada

|

3711

|

95-3909667

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

|

3F Bokwang Bldg., Seowunro 6 Gil 14,

Seocho Gu, Seoul

Republic of Korea

06734

(070) 4699-3585

|

||

|

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

|

||

|

Shi Chul Kang, Co-Chief Executive Officer

Jun Heng Park, Co-Chief Executive Officer

Leo Motors, Inc.

3F Bokwang Bldg., Seowunro 6 Gil 14, Seocho Gu, Seoul

Republic of Korea

06734

|

||

|

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

|

||

|

Copies of all communications, including communications sent to agent for service, should be sent to:

|

||

|

Darrin M. Ocasio, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, NY 10006

Phone (212) 930-9700

Fax (212) 930-9725

|

||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☒

|

|

(Do not check if a smaller reporting company)

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

TITLE OF EACH CLASS OF

SECURITIES TO BE REGISTERED

|

AMOUNT TO BE

REGISTERED (1)

|

PROPOSED MAXIMUM OFFERING PRICE

PER SHARE (2)

|

PROPOSED MAXIMUM

AGGREGATE OFFERING PRICE (1)

|

AMOUNT OF REGISTRATION FEE

|

||||||||||||

|

Shares of common stock, $0. 001 par value

|

39,321,444(3)

|

$

|

0.25

|

$

|

9,830,361

|

$

|

989.92

|

|||||||||

|

Shares of common stock, $0. 001 par value, underlying convertible debenture

|

3,134,921(4)

|

$

|

0.25

|

$

|

783,730.25

|

$

|

78.92

|

|||||||||

|

Total

|

42,456,365

|

$

|

10,614,091.20

|

$

|

1,068.84

|

|||||||||||

|

(1)

|

Pursuant to Rule 416 under the Securities Act, the shares of common stock offered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions.

|

|

(2)

|

Estimated at $0.25 per share, the average of the high and low prices as reported on the OTCQB on June 6, 2016, for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act.

|

|

(3)

|

Represents (i) shares of the Company's common stock underlying an equity line of credit agreement ("ELOC"), which are the subject of a registration rights agreement by and between the Company and a selling stockholder listed herein; and (ii) shares issued to an individual selling shareholder listed herein.

|

| (4) | Represents shares of the Company's common stock underlying a series of convertible debentures issued to a selling stockholder listed herein. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED JULY [●], 2016

|

LEO MOTORS, INC.

42,456,365

Shares of

Common stock

This prospectus relates to the sale by the selling stockholders identified herein of up to 42,456,365 shares of common stock of Leo Motors, Inc. (the "Company").

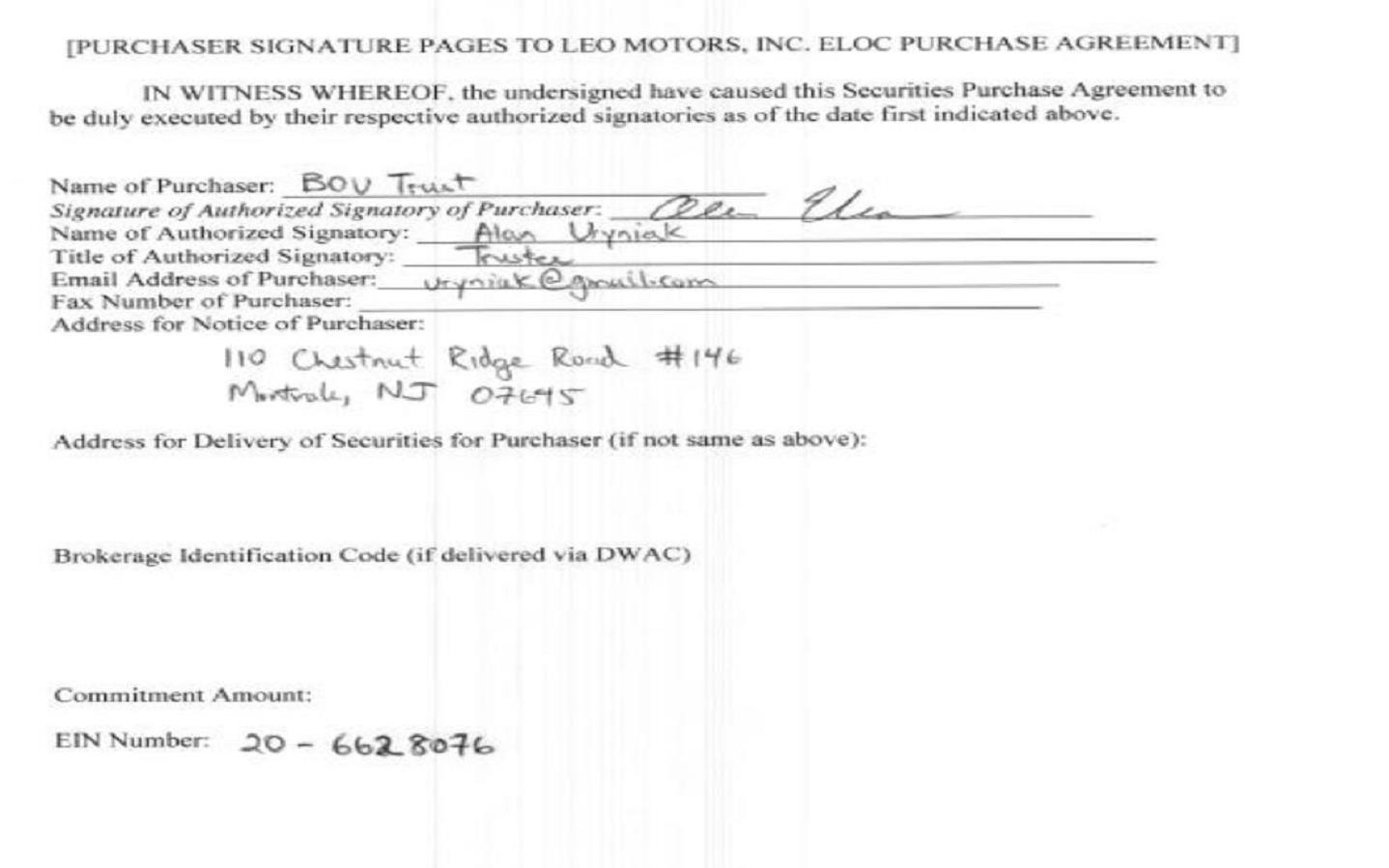

BOU Trust is deemed to be an "underwriter" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"), in connection with the resale of the 38,986,355 shares that it is offering in this prospectus, although it may not sell those shares pursuant to Rule 144 of the Securities Act. The prices at which the selling stockholders may sell shares will be determined by the prevailing market price for the shares or in privately negotiated transactions. We will not receive any proceeds from the sale of these shares by the selling stockholders. All expenses of registration incurred in connection with this offering are being borne by us, but all selling and other expenses incurred by the selling stockholders will be borne by the selling stockholders.

Our common stock is quoted on the OTCQB and trades under the symbol "LEOM." On June9, 2016, the last reported sale price of our common stock as reported on the OTCQB was $0.29 per share. All amounts herein are in thousands, except for share and per share data.

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties in the section entitled "Risk Factors" within this prospectus before making a decision to purchase our stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July [●], 2016.

TABLE OF CONTENTS

|

|

Page

|

|

Prospectus Summary

|

2 |

|

Risk Factors

|

4 |

|

Special Note Regarding Forward Looking Statements

|

10 |

|

Use of Proceeds

|

10 |

|

Market for Our Common stock and Related Stockholder Matters

|

11 |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

12 |

|

Business

|

16 |

|

Management

|

20 |

|

Executive Compensation

|

22 |

|

Certain Relationships and Related Transactions

|

23 |

|

Security Ownership of Certain Beneficial Owners and Management

|

24 |

|

Selling Stockholders

|

24 |

|

Description of Securities

|

26 |

|

Plan of Distribution

|

26 |

|

Legal Matters

|

27 |

|

Experts

|

27 |

|

Where You Can Find Additional Information

|

28 |

|

Index to Financial Statements

|

29 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States, we have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

This prospectus includes estimates, statistics and other industry and market data that we obtained from industry publications, research, surveys and studies conducted by third parties and publicly available information. Such data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. This prospectus also includes data based on our own internal estimates. We act and believe that the information provided in this prospectus is true and accurate.

Prospectus Summary

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially the section entitled "Risk Factors" and our consolidated financial statements and related notes, before deciding to buy our securities. Unless otherwise stated, all references to "us," "our," "we," "Leo Motors," "LEOM," the "Company" and similar designations refer to Leo Motors, Inc. and, depending on the context, its subsidiaries.

Leo Motors, Inc. (the "Company") is a Nevada corporation incorporated on September 8, 2004. The Company established a wholly-owned operating subsidiary in Korea named Leo Motors, Co. Ltd. ("Leozone") on July 1, 2006. Through Leozone, the Company is engaged in the research and development ("R&D") of multiple products, prototypes, and conceptualizations based on proprietary, patented and patent pending electric power generation, drive train, and storage technologies. Leozone operates through four unincorporated divisions: new product research & development ("R&D"), post R&D development (such as product testing), production, and sales.

The Company's products include (i) E-Box electric energy storage system for solar and wind power generation devices; and (ii) electric vehicle ("EV") components that integrate electric batteries with electric motors such as EV Controllers that use a mini-computer to control torque drive.

Revenues for the year ended December 31, 2015 were 4,299,187 compared to 693,096 for the year ended December 31, 2014. Revenues for the three months ended March 31, 2016 were $745,706 compared to $42,771 for the three months ended March 31, 2015, an increase of $702,935. This was the direct result of increased product line in conjunction with its acquired subsidiary sales. The net loss for the year ended December 31, 2015 was 4,490,972 compared to 4,480,544 for the year ended December 31, 2014. The net loss for the three months ending March 31, 2016 decreased to $458,166 from $595,418 for the three months ending March 31, 2015, a decrease of $137,252.

As reported in the consolidated financial statements included herewith, the Company has accumulated deficits of $25,404,609 as of December 31, 2015 and its current liabilities exceeded its current assets. These negative trends have been consistent over the last few years except for asset sales.

These factors create uncertainty about the Company's ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable and to create operations that contribute capital from normal operations. If the Company cannot obtain adequate capital it could be forced to cease operations.

In order to continue as a going concern, develop and generate revenues and achieve a profitable level of operations, the Company will need, among other things, additional capital resources. Management's plans to obtain such resources for the Company include (1) raising additional capital through sales of common stock, (2) converting promissory notes into common stock and (3) entering into acquisition agreements with profitable entities with significant operations. In addition, management is continually seeking to streamline its operations and expand the business through a variety of industries, including real estate and financial management.

However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

|

The Offering

|

|

|

Common stock offered by the selling stockholders:

|

42,456,365 shares of the Company's $0.001 par value common stock.

|

|

|

|

|

Common stock outstanding before and after this offering:

|

163,713,902(1) and 206,170,267(2)

|

|

|

|

|

Total proceeds:

|

We will not receive any proceeds from the sale of shares in this offering by the selling stockholders. We will receive proceeds from our sale of shares to BOU Trust. BOU Trust has committed to purchase up to $10,000,000 worth of shares of our common stock over a period upon receipt of an appropriate notice. The purchase price for the shares to be paid by BOU TRUST shall be the average of the lowest two (2) VWAPS during 5 consecutive Trading Days following the delivery by the Company of a notice plus a 5% discount. The amount for each purchase of the Shares as designated by the Company in the applicable draw down notices shall be equal to the lesser of (i) 4.99% of the then-current shares outstanding or (ii) the previous 10-day average trading volume of the draw down shares multiplied by 3; provided that the number of shares to be purchased by BOU Trust shall not exceed the number of such shares that, when added to the number of shares of our common stock then beneficially owned by BOU Trust, would exceed 4.99% of the number of shares of our common stock outstanding.

|

|

|

|

|

OTC Market symbol:

|

"LEOM"

|

|

|

|

|

Risk factors:

|

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the "Risk Factors" within this prospectus before deciding whether or not to invest in shares of our common stock.

|

|

Fees & Commissions

|

Pursuant to a Mutual Acknowledgement Letter between the Company and NMS Capital Advisors, LLC ("NMS"), with respect to an Engagement Agreement between the Company and NMS, upon closing of the transaction with BOU Trust, NMS is owed four percent (4%) of the total transaction value due and payable only upon receipt by the Company of the draw down amount. If the Company does not elect to take any draws, then no fees shall be due to NMS.

|

(1) The number of issued and outstanding shares of the Company's common stock as of June 6, 2016.

(2) The number of issued and outstanding shares after this offering, assuming the conversion and draw down, in full, of the shares underlying the convertible debentures and the ELOC, respectively, as they pertain to the selling stockholders.

2

The Company entered into a securities purchase agreement with an accredited investor (the "Investor") for the purchase of an equity line of credit ("ELOC"). The shares of common stock issuable under this ELOC are part of this Prospectus. Pursuant to the ELOC, the Company, at its sole and exclusive option, may issue and sell to the Investor, and the Investor shall purchase from the Company, shares of the Company's registered common stock (the "Shares") upon the Company's delivery of written notices to the Investor. The aggregate maximum amount of all purchases that the Investor shall be obligated to make under the ELOC shall not exceed $10,000,000. Once a written notice is received by the Investor, it shall not be terminated, withdrawn or otherwise revoked by the Company.

The amount for each purchase of the Shares as designated by the Company in the applicable draw down notices shall be equal to the lesser of (i) 4.99% of the then-current shares outstanding or (ii) the previous 10-day average trading volume of the draw down shares multiplied by 3. There shall be a minimum draw down investment amount of $25,000 and a maximum draw down investment amount of $1,000,000 unless otherwise agreed upon by the Company and the Investor. The purchase price for the Shares to be paid by the Investor shall be the average of the lowest two (2) VWAPS during 5 consecutive Trading Days following the delivery by the Company of a notice plus a 5% discount.

By way of example, if the share price calculated based on the average of the two lowest VWAPS was $0.075, the purchase price would be, after a 5% discount, $0.0712. Further, if the 10-day average trading volume was 300,000, the total number of shares for that purchase would be 300,000 multiplied by 3, or 900,000, assuming that this number is less than 4.99% of the shares outstanding. The drawdown amount in this example would be $64,080 or 900,000 shares at a purchase price of $0.0712 per share.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the ELOC. These risks include dilution of stockholders, significant decline in our stock price and our inability to draw sufficient funds when needed.

In order to fund a notice for funding pursuant to the ELOC (a "Drawdown Notice"), BOU Trust will periodically purchase our common stock under the ELOC and will, in turn, sell such shares to investors in the market at the market price on a best efforts basis, subject to certain conditions. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to BOU Trust to raise the same amount of funds, as our stock price declines.

Disclosure showing shares issuable if market stock price drops 25%, 50% and 75%

|

Drawdown Amount Required

|

|

|

|

||||||

|

|

|

100% of

|

25% Decrease

|

50% Decrease

|

75% Decrease

|

||||

|

Current Stock

|

in Stock Price

|

in Stock Price

|

in Stock Price

|

||||||

|

Price (1)

|

(1)

|

(1)

|

(1)

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Total No. of Shares Required to Raise $10,000,000(1)

|

|

|

41,666,667

|

|

56,179,775

|

|

83,333,336

|

|

166,666,672

|

|

(1) Based on a price of $0.25 per share.

|

|||||||||

Based on the above chart, the sale of stock under the first will be limited, resulting in significantly less capital than the $10,000,000 capital commitment. There are no assurances that the price of common stock will appreciate, depreciate, or remain at the same price as a result of stock sales under this Agreement, however, if there is a 25% to 75% decline in stock value pricing, the Company may only receive a portion of the $10,000,000 available.

The Company understands and acknowledges that the number of shares issuable upon purchases pursuant to this ELOC will increase in certain circumstances including, but not necessarily limited to, the circumstance wherein the trading price of the Common Stock declines during the Draw Down Pricing Period. The Company's executive officers and directors have studied and fully understand the nature of the transactions contemplated by this ELOC and recognize that they have a potential dilutive effect on the shareholders of the Company. The Board of Directors of the Company has concluded, in its good faith business judgment, and with full understanding of the implications, that such issuance is in the best interests of the Company. The Company specifically acknowledges that, subject to such limitations as are expressly set forth in the ELOC, its obligation to issue shares upon purchases pursuant to this ELOC is absolute and unconditional regardless of the dilutive effect that such issuance may have on the ownership interests of other shareholders of the Company. We determined the amount of $10,000,000 as we require large sums of financing for our staged growth and in order to allow the greatest possible flexibility under the ELOC.

The Company also entered into a securities purchase agreement with an accredited investor (the "Investor") for the issuance of a series of convertible debentures (each a "Debenture," collectively, the "Debentures"). The shares of common stock underlying the Debentures are part of this Prospectus. Each Debenture has a maturity date which is one year after the date of issuance and has an interest rate of ten (10%) percent per annum. Each Debenture is convertible into shares of the Company's Common Stock at any time after the sooner to occur of 180 days from the original issue date or when the shares issuable upon conversion of the Debenture have been registered on a registration statement that has been declared effective by the Securities and Exchange Commission and until the Debenture is no longer outstanding. The Debentures are convertible at a conversion price equal to the lower of (i) $0.50 per share or (ii) 70% of the lowest VWAP for the previous 20 trading days prior to conversion. The Company is permitted to prepay the Debentures at any time upon ten (10) days written notice to the Investor.

3

RISK FACTORS

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Discussion of our business and operations included in this prospectus should be read together with the risk factors set forth below. They describe various risks and uncertainties to which we are or may become subject. These risks and uncertainties, together with other factors described elsewhere in this report, have the potential to affect our business, financial condition, results of operations, cash flows, strategies or prospects in a material and adverse manner. New risks may emerge at any time, and we cannot predict those risks or estimate the extent to which they may affect our financial performance. Each of the risks described below could adversely impact the value of our securities. These statements, like all statements in this report, speak only as of the date of this prospectus (unless another date is indicated), and we undertake no obligation to update or revise the statements in light of future developments.

We cannot assure you that we will be successful in commercializing any of the Company's products or if any of our products are commercialized, that they will be profitable for the Company.

The Company generates limited revenue from operations upon which an evaluation of our prospects can be made. The Company's prospects must be considered keeping in mind the risks, expenses and difficulties frequently encountered in the establishment of a new business in a constantly changing industry. There can be no assurance that the Company will be able to achieve profitable operations in the foreseeable future, if at all.

The Company has identified a number of specific risk areas that may affect our operations and results in the future:

Investing in our Common Stock involves a high degree of risk. You should carefully consider the risks described below with all of the other information included in this prospectus before making an investment decision. If any of the possible adverse events described below actually occurs, our business, results of operations or financial condition would likely suffer. In such an event, the market price of our Common Stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

Products that fail to meet specifications, are defective, or that are otherwise incompatible with end uses could impose significant costs on us.

Products that do not meet specifications or that contain, or are perceived by our customers to contain, defects or that are otherwise incompatible with end uses could impose significant costs on us or otherwise materially adversely affect our business, results of operations or financial condition. If problems with nonconforming, defective or incompatible products occur after we have shipped such products, we could be adversely affected in several ways, including the following:

|

· we may be required to replace product or otherwise compensate customers for costs incurred or damages caused by defective or incompatible product ; and

|

|

· we may encounter adverse publicity, which could cause a decrease in sales of our products.

|

We face the risk of product liability, recalls or other claims.

Our business exposes us to the risk of product liability claims that is inherent in the testing, manufacturing and marketing of any product. We may be subject to product liability claims if our products cause, or merely appear to have caused, an injury or death. If we do not have or we are unable to obtain insurance at acceptable cost or on acceptable terms with adequate coverage or otherwise protect against potential product liability claims, we could be exposed to significant financial and other liabilities, which may materially harm our business. A product liability claim, product recall or other claim with respect to uninsured liabilities or for amounts in excess of insured liabilities could have a material adverse effect on our business, operating results and prospects. We may be subject to claims even if the apparent injury is due to the actions of others. These liabilities could prevent, delay or otherwise adversely interfere with our product commercialization efforts, as well as result in judgments, fines, damages and other financial liabilities to us which would have a material adverse effect on our business, operating results and prospects. Defending a suit, regardless of merit, could be costly, could divert management's attention from our business and might result in adverse publicity, which could result in reduced acceptance of our products in the market. In addition to adversely impacting our business and prospects, such adverse publicity could materially adversely affect the value of our stock.

The limited availability of raw materials or supplies could materially adversely affect our business, our results of operations, or our financial condition.

Our operations require raw materials that meet exacting standards. We generally have multiple sources of supply for our raw materials. However, only a limited number of suppliers are capable of delivering certain raw materials that meet our standards. Shortages may occur from time to time in the future. In addition, disruptions in transportation lines could delay our receipt of raw materials. Lead times for the supply of raw materials have been extended in the past. If our supply of raw materials is disrupted or our lead times extended, our business, results of operations or financial condition could be materially adversely affected.

Our proprietary rights may not adequately protect our intellectual property and product candidates and if we cannot obtain adequate protection of our intellectual property and product candidates, we may not be able to successfully market our product candidates.

Our commercial success will depend in part on obtaining and maintaining intellectual property protection for our technologies and product candidates. We will only be able to protect our technologies and product candidates from unauthorized use by third parties to the extent that valid and enforceable patents cover them, or that other market exclusionary rights apply.

The patent positions of companies, like ours, can be highly uncertain and involve complex legal and factual questions for which important legal principles remain unresolved. No consistent policy regarding the breadth of claims allowed in such companies' patents has emerged to date in the United States. The general patent environment outside the United States also involves significant uncertainty. Accordingly, we cannot predict the breadth of claims that may be allowed or that the scope of these patent rights would provide a sufficient degree of future protection that would permit us to gain or keep our competitive advantage with respect to these products and technology.

4

In addition, others may independently develop similar or alternative compounds and technologies that may be outside the scope of our intellectual property. Should third parties obtain patent rights to similar compounds or technology, this may have an adverse effect on our business.

If we fail to attract and retain senior management, consultants, advisors, and scientific and technical personnel, our product development and commercialization efforts could be impaired.

Our performance is substantially dependent on the performance of our senior management and key scientific and technical personnel. The loss of the services of any member of our senior management or our scientific or technical staff may significantly delay or prevent the development of our product candidates and other business objectives by diverting management's attention to transition matters and identification of suitable replacements, if any, and could have a material adverse effect on our business, operating results and financial condition.

In addition, we believe that we will need to recruit additional executive management and scientific and technical personnel. There is currently intense competition for skilled executives and employees with relevant scientific and technical expertise, and this competition is likely to continue. The inability to attract and retain sufficient scientific, technical and managerial personnel could limit or delay our product development efforts, which would adversely affect the development of our product candidates and commercialization of our potential products and growth of our business.

We expect to expand our research, development, clinical research and marketing capabilities and, as a result, we may encounter difficulties in managing our growth, which could disrupt our operations.

We expect to have significant growth in expenditures, the number of our employees and the scope of our operations, in particular with respect to those potential products that we elect to commercialize independently or together with others. To manage our anticipated future growth, we must continue to implement and improve our managerial, operational and financial systems, expand our facilities and continue to train qualified personnel. Due to our limited resources, we may not be able to effectively manage the expansion of our operations or train additional qualified personnel. The physical expansion of our operations may lead to significant costs and may divert our management and business development resources. Any inability to manage growth could delay the execution of our business plan or disrupt our operations.

We have a history of losses and expect to continue to incur losses and may not achieve or maintain profitability.

We expect to incur additional losses for at least the next several years and cannot be certain that we will ever achieve profitability. As a result, our business is subject to all of the risks inherent in the development of a new business enterprise, such as the risk that we may not obtain substantial additional capital needed to support the expenses of developing our technology and commercializing our potential products; develop a market for our potential products; and/or attract and retain qualified management, technical and scientific staff.

We qualify as an emerging growth company.

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012. An "emerging growth company" may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

- being permitted to present only two years of audited financial statements and only two years of related Management's Discussion and Analysis of Financial Condition and Results of Operations in this prospectus;

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended;

- reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

- exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We may use these provisions until the last day of our fiscal year following the fifth anniversary of the closing of our initial public offering. However, if certain events occur prior to the end of such five-year period, including if we become a "large accelerated filer," our annual gross revenue exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

The JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Risks Related to Doing Business in Korea

The movement of the Korean Won against the U.S. dollar and other currencies may have a material adverse effect on us.

The Korean Won has fluctuated significantly against major currencies in recent years, especially as a result of the recent global financial crisis and the relatively speedy recovery of Korean economy therefrom. The depreciation of the Won against U.S. dollar and other foreign currencies typically results in a material increase in the cost of fuel and equipment purchased from overseas and the cost of servicing our foreign currency-denominated debt as the prices for substantially all of the fuel materials and a significant portion of the equipment we purchase are stated in currencies other than the Won, generally in U.S. dollars. As a result, any significant depreciation of Won against the U.S. dollar or other major foreign currencies will have a material adverse effect on our profitability and results of operations

5

The movement of the Won against the U.S. dollar and other currencies may have a material adverse effect on us.

The Won has fluctuated significantly against major currencies in recent years, especially as a result of the recent global financial crisis and the relatively speedy recovery of Korean economy therefrom. The depreciation of Won against U.S. dollar and other foreign currencies typically results in a material increase in the cost of fuel and equipment purchased from overseas and the cost of servicing our foreign currency-denominated debt as the prices for substantially all of the fuel materials and a significant portion of the equipment we purchase are stated in currencies other than Won, generally in U.S. dollars. As a result, any significant depreciation of Won against the U.S. dollar or other major foreign currencies will have a material adverse effect on our profitability and results of operations.

Escalations in tensions with North Korea could have an adverse effect on us.

Relations between Korea and North Korea have been tense throughout Korea's modern history. The level of tension between the two Koreas has fluctuated and may increase abruptly as a result of current and future events. In recent years, there have been heightened security concerns stemming from North Korea's nuclear weapon and long- range missile programs and increased uncertainty regarding North Korea's actions and possible responses from the international community. In December 2002, North Korea removed the seals and surveillance equipment from its Yongbyon nuclear power plant and evicted inspectors from the United Nations International Atomic Energy Agency. In January 2003, North Korea renounced its obligations under the Nuclear Non-Proliferation Treaty. Since the renouncement, Korea, the United States, North Korea, China, Japan and Russia have held numerous rounds of six party multi-lateral talks in an effort to resolve issues relating to North Korea's nuclear weapons program.

There can be no assurance that the level of tension on the Korean peninsula will not escalate in the future. Any further increase in tensions, which may occur, for example, if North Korea experiences a leadership crisis, high-level contacts break down or military hostilities occur, could have a material adverse effect on our operations and the market value of our common stock.

You may not be able to enforce a judgment of a foreign court against us.

A significant portion of the assets of our directors and officers named in this Prospectus , and substantially all of our assets are located in Korea. As a result, it may not be possible for you to enforce judgments, against either our assets or us, obtained in United States based on the civil liability provisions of the United States federal securities laws. There is doubt as to the enforceability in Korea, either in original actions or in actions for enforcement of judgments of United States courts, of civil liabilities predicated on the United States federal securities laws.

Risks Related to Our Industry

Our competitors may develop products that are less expensive, are safer or more effective, and thus may diminish or eliminate the commercial success of any potential products that we may commercialize.

If our competitors' market products that are less expensive, safer or more effective than our future products developed from our product candidates, or that reach the market before our product candidates, we may not achieve commercial success. The market may choose to continue utilizing the existing products for any number of reasons, including familiarity with or pricing of these existing products. The failure of any of our product candidates to compete with products marketed by our competitors would impair our ability to generate revenue, which would have a material adverse effect on our future business, financial condition and results of operations.

We expect to compete with several companies and our competitors may:

|

•

|

develop and market products that are less expensive or more effective than our future products;

|

|

|

|

|

•

|

commercialize competing products before we or our partners can launch any products developed from our product candidates;

|

|

|

|

|

•

|

operate larger research and development programs or have substantially greater financial resources than we do;

|

|

|

|

|

•

|

initiate or withstand substantial price competition more successfully than we can;

|

|

|

|

|

•

|

have greater success in recruiting skilled technical and scientific workers from the limited pool of available talent;

|

|

|

|

|

•

|

more effectively negotiate third-party licenses and strategic relationships; and

|

|

|

|

|

•

|

take advantage of acquisition or other opportunities more readily than we can.

|

Risks Related to Our Common Stock

The stock market, particularly in recent years, has experienced significant volatility. Factors that could cause this volatility in the market price of our Common Stock include:

|

•

|

failure or discontinuation of any of our research;

|

|

|

|

|

•

|

delays in establishing new strategic relationships;

|

|

|

|

|

•

|

delays in the development or commercialization of our potential products;

|

|

|

|

|

•

|

market conditions and issuance of new or changed securities analysts' reports or recommendations;

|

|

|

|

|

•

|

actual and anticipated fluctuations in our financial and operating results;

|

|

|

|

|

•

|

developments or disputes concerning our intellectual property or other proprietary rights;

|

|

|

|

|

•

|

introduction of technological innovations or new commercial products by us or our competitors;

|

|

|

|

|

•

|

issues in manufacturing our potential products;

|

|

|

|

|

•

|

third-party healthcare reimbursement policies;

|

|

|

|

|

•

|

litigation or public concern about the safety of our product candidates; and

|

|

|

|

|

•

|

additions or departures of key personnel.

|

6

These and other external factors may cause the market price and demand for our Common Stock to fluctuate substantially, which may limit or prevent investors from readily selling their shares of Common Stock and may otherwise negatively affect the liquidity of our Common Stock. In the past, when the market price of a stock has been volatile, holders of that stock have instituted securities class action litigation against the company that issued the stock. If any of our stockholders brought a lawsuit against us, we could incur substantial costs defending the lawsuit. Such a lawsuit could also divert the time and attention of our management.

We have not and do not anticipate paying any dividends on our common stock.

We have paid no dividends on our common stock to date and it is not anticipated that any dividends will be paid to holders of our common stock in the foreseeable future. While our future dividend policy will be based on the operating results and capital needs of the business, it is currently anticipated that any earnings will be retained to finance our future expansion and for the implementation of our business plan. As an investor, you should take note of the fact that a lack of a dividend can further affect the market value of our stock, and could significantly affect the value of any investment in our Company.

We are subject to the reporting requirements of federal securities laws, this can be expensive and may divert resources from other projects, thus impairing its ability grow.

We are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act"). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if we had remained privately held.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our Common Stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. We have not performed an in-depth analysis to determine if historical un-discovered failures of internal controls exist, and may in the future discover areas of our internal control that need improvement.

Public company compliance may make it more difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these new rules and regulations to increase our compliance costs in 2016 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

The limited trading market for our common stock results in limited liquidity for shares of our common stock and significant volatility in our stock price.

Although prices for our shares of common stock are quoted on the OTCQB, there is little current trading and no assurance can be given that an active public trading market will develop or, if developed, that it will be sustained. The OTCQB is generally regarded as a less efficient and less prestigious trading market than other national markets. There is no assurance if or when our common stock will be quoted on another more prestigious exchange or market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. The absence of an active trading market reduces the liquidity of our common stock.

The market price of our stock is likely to be highly volatile because for some time there will likely be a thin trading market for the stock, which causes trades of small blocks of stock to have a significant impact on our stock price. As a result of the lack of trading activity, the quoted price for our common stock on the OTCQB is not necessarily a reliable indicator of its fair market value. Further, if we cease to be quoted, holders of our common stock would find it more difficult to dispose of, or to obtain accurate quotations as to the market value of, our common stock, and the market value of our common stock would likely decline.

7

Our Common Stock is currently deemed a "penny stock," which makes it more difficult for our investors to sell their shares.

Our Common Stock is subject to the "penny stock" rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or other national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than "established customers" complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number of shares of our Common Stock may cause the price of our Common Stock to decline.

If our stockholders sell substantial amounts of our Common Stock in the public market upon the expiration of any statutory holding period, under Rule 144, or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an "overhang" and in anticipation of which the market price of our Common Stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

You may experience dilution of your ownership interests because of the future issuance of additional shares of our common stock.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We may issue additional shares of our common stock or other securities that are convertible into or exercisable for our common stock in connection with hiring or retaining employees, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock may create downward pressure on the trading price of the common stock. We will need to raise additional capital in the near future to meet our working capital needs, and there can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with these capital raising efforts, including at a price (or exercise or conversion prices) below the price an investor paid for stock.

There are substantial risks associated with the ELOC with BOU Trust which could contribute to the decline of the price of our Common Shares and have a dilutive impact on our existing stockholders.

In order to obtain needed capital, we entered into the ELOC with BOU Trust. The sale of our Common Shares pursuant to the ELOC will have a dilutive impact on our stockholders. We believe BOU Trust intends to promptly re-sell the Common Shares that we sell to it under the ELOC. Such resales could cause the market price of our Common Shares to decline significantly. Any subsequent sales by us to BOU Trust under the ELOC may, to the extent of any such decline, require us to issue a greater number of Common Shares to BOU Trust in exchange for each dollar of such subsequent sale. Under these circumstances our existing stockholders would experience greater dilution. The sale of Common Shares under the ELOC could encourage short sales by third parties which could contribute to the further decline of the price of our Common Stock.

You could lose all of your investment.

An investment in our securities is speculative and involves a high degree of risk. Potential investors should be aware that the value of an investment in the Company may go down as well as up. In addition, there can be no certainty that the market value of an investment in the Company will fully reflect its underlying value. You could lose your entire investment.

Offers or availability for sale of a substantial number of shares of our common stock, for example, in connection with the 42,456,365 shares registered for resale herein, may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market, including upon the expiration of any statutory holding period under Rule 144 or registration for resale, or issued upon the exercise of warrants, it could create a circumstance commonly referred to as an "overhang" and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate. As of June 6, 2016, we have 163,713,902 shares of common stock issued and outstanding. Following the effectiveness of the registration statement of which this prospectus forms a part, 42,456,365 shares of common stock will be immediately available for resale assuming the full amount available pursuant to the equity line of credit underlying this Prospectus is drawn down. Only those shares underlying the convertible debentures and those shares already drawn down, if any, from the equity line of credit, subject to the 4.99% limitation, will be immediately available. It is possible that the full amount allowed pursuant to the equity line of credit will never be drawn down and available for resale.

Investor relations activities, nominal "float" and supply and demand factors may affect the price of our stock.

The Company may utilize various techniques such as non-deal road shows and investor relations campaigns in order to create investor awareness for the Company. These campaigns may include personal, video and telephone conferences with investors and prospective investors in which our business practices are described. The Company may provide compensation to investor relations firms and pay for newsletters, websites, mailings and email campaigns that are produced by third-parties based upon publicly-available information concerning the Company. The Company does not intend to review or approve the content of such analysts' reports or other materials based upon analysts' own research or methods. Investor relations firms should generally disclose when they are compensated for their efforts, but whether such disclosure is made or complete is not under our control. In addition, investors in the Company may, from time to time, also take steps to encourage investor awareness through similar activities that may be undertaken at the expense of the investors. Investor awareness activities may also be suspended or discontinued which may impact the trading market our common stock.

The SEC and FINRA enforce various statutes and regulations intended to prevent manipulative or deceptive devices in connection with the purchase or sale of any security and carefully scrutinize trading patterns and company news and other communications for false or misleading information, particularly in cases where the hallmarks of "pump and dump" activities may exist, such as rapid share price increases or decreases. We, and our shareholders, may be subjected to enhanced regulatory scrutiny due to the small number of holders who initially will own the registered shares of our common stock publicly available for resale. The Supreme Court has stated that manipulative action is a term of art connoting intentional or willful conduct designed to deceive or defraud investors by controlling or artificially affecting the price of securities. Often times, manipulation is associated by regulators with forces that upset the supply and demand factors that would normally determine trading prices.

8

Risks Related to the Equity Line of Credit

BOU Trust will pay less than the then-prevailing market price of our common stock, which could cause the price of our common stock to decline.

Our common stock to be issued under the ELOC will be purchased at a five percent (5%) discount to the lowest two (2) VWAPS during 5 consecutive Trading Days following the delivery by the Company of a notice.

BOU Trust has a financial incentive to sell our shares immediately upon receiving the shares to realize the profit between the discounted price and the market price. If BOU Trust sells our shares, the price of our common stock may decrease. If our stock price decreases, BOU Trust may have a further incentive to sell such shares. Accordingly, the discounted sales price may cause the price of our common stock to decline.

We are registering an aggregate of 42,456,365 shares of common stock to be issued under the equity line of credit. The sale of such shares could depress the market price of our common stock.

We are registering an aggregate of 42,456,365 shares of common stock under the registration statement of which this prospectus forms a part for issuance, a part of which is pursuant to the equity line of credit. The sale of these shares into the public market by BOU Trust could depress the market price of our common stock.

We may not have access to the full amount under the equity line of credit.

For the two consecutive trading days prior to July 19, 2016 the closing price of our common stock was $0.25. There is no assurance that the market price of our common stock will increase or remain the same substantially in the near future. The entire commitment under the equity line of credit is $10,000,000. The aggregate number of shares of common stock necessary to raise the entire $10,000,000 at $.25 per share is 40,000,000. We may not have access to the remaining commitment under the equity line of credit unless the market price of our common stock increases or remains stable. The Company's executive officers and directors fully recognize that the Company may not provide them access to the full line of credit.

Our common stock price may decline by our draw on our equity line of credit.

Pursuant to the ELOC, when we deem it necessary, we may raise capital through the private sale of our common stock to BOU Trust. Because the sales price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest will be diluted in direct proportion.

There may not be a sufficient price of our common stock to permit us to acquire adequate funds, which may adversely affect our liquidity.

The ELOC provides that the number of shares sold pursuant to each Notice plus the shares held by BOU Trust at that time shall not exceed 4.99% of the issued and outstanding shares of common stock of the Company. If the price our common stock is too low, it is possible that we may not be permitted to draw the full amount of proceeds of the drawdown request, which may not provide adequate funding for our planned operations and may materially decrease our liquidity.

We may draw on our equity line of credit to the extent that a change of control occurs.

The Company may continue to make drawdown requests while the Selling Stockholder holds shares of common stock or sells shares to a specific party, thereby causing such purchasing party to gain control of the Company. This could jeopardize the execution of the Company's business plan and may disrupt operations. The Company does not anticipate making drawdown requests under this scenario.

9

Draw Downs under the ELOC may cause dilution to existing shareholders.

BOU Trust has committed to purchase up to $10,000,000 worth of shares of our common stock. From time to time during the term of the ELOC, and at our sole discretion, we may present BOU Turst with a Draw Down Notice requiring BOU Trust to purchase shares of our common stock. The purchase price to be paid by BOU Trust will be at a 5% discount of the Market Price of our common stock. We will be entitled to put to BOU Trust on each Draw Down Notice date such number of shares of common stock as equal to the lesser of (i) 4.99% of the then-current shares outstanding or (ii) the previous 10-day average trading volume of the draw down shares multiplied by 3; provided that the number of shares to be purchased by BOU Trust shall not exceed the number of such shares that, when added to the number of shares of our common stock then beneficially owned by BOU Trust, would exceed 4.99% of the number of shares of our common stock outstanding. As a result, our existing shareholders will experience immediate dilution upon the purchase of any of the shares by BOU Trust. The issue and sale of the shares under the ELOC may also have an adverse effect on the market price of the common shares. BOU Trust may resell some, if not all, of the shares that we issue to it under the ELOC and such sales could cause the market price of the common stock to decline significantly. To the extent of any such decline, any subsequent puts would require us to issue and sell a greater number of shares to BOU Trust in exchange for each dollar of the put amount. Under these circumstances, the existing shareholders of our company will experience greater dilution. The effect of this dilution may, in turn, cause the price of our common stock to decrease further, both because of the downward pressure on the stock price that would be caused by a large number of sales of our shares into the public market by BOU Trust, and because our existing stockholders may disagree with a decision to sell shares to BOU Trust at a time when our stock price is low, and may in response decide to sell additional shares, further decreasing our stock price.

The table below illustrates an issuance of shares of common stock to BOU Turst under the ELOC for a hypothetical draw down amount of $25,000 at an assumed Market Price of $0.15.

|

Draw Down Amount

|

Price to be Paid by SBII

|

Number of Shares to be Issued

|

||||||||

|

$

|

25,000

|

$

|

0.14

|

178,571

|

||||||

By comparison, if the Market Price of our common stock was $0.12, the number of shares that we would be required to issue in order to have the same draw down amount of $25,000 would be greater, as shown by the following table:

|

Draw Down Amount

|

Price to be Paid by SBII

|

Number of Shares to be Issued

|

||||||||

|

$

|

25,000

|

$

|

0.11

|

227,273

|

||||||

Accordingly, there would be dilution of an additional 48,702 shares issued due to the lower stock price of $0.12 per share.

General market risks

We may not be able to access credit.

We face the risk that we may not be able to access credit, either from lenders or suppliers. Failure to access credit from any of these sources could have a material adverse effect on our business, financial condition, results of operations and future prospects.

We may not be able to maintain effective internal controls.

If we fail to maintain the adequacy of our internal accounting controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an on-going basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. Failure to achieve and maintain an effective internal control environment could cause us to face regulatory action and also cause investors to lose confidence in our reported financial information, either of which could have a material adverse effect on our business, financial condition, results of operations and future prospects.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Such statements include statements regarding our expectations, hopes, beliefs or intentions regarding the future, including but not limited to statements regarding our market, strategy, competition, development plans (including acquisitions and expansion), financing, revenues, operations, and compliance with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. Factors that could cause actual results to differ materially from such forward-looking statements include the risks described in greater detail in the following paragraphs. All forward-looking statements in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement. Market data used throughout this prospectus is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information.

You should review carefully the section entitled "Risk Factors" within this prospectus for a discussion of these and other risks that relate to our business and investing in shares of our common stock.

USE OF PROCEEDS

The selling stockholders will receive all of the proceeds from the sale of the shares offered by them under this prospectus. We will not receive any proceeds from the sale of the shares by the selling stockholders covered by this prospectus. We will receive proceeds from our initial sale of shares to BOU Trust.

10

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Market information

Our Common stock is traded on the OTCQB under the symbol "LEOM."

The following table sets forth the high and low last reported sales prices of our Common stock for each quarterly period to date during 2015, 2014, and 2013.

|

|

High

|

Low

|

||||||

|

2013:

|

||||||||

|

Fourth quarter

|

$

|

0.078

|

$

|

0.078

|

||||

|

Third quarter

|

0.0385

|

0.0385

|

||||||

|

Second quarter

|

0.10

|

0.072

|

||||||

|

First quarter

|

0.099

|

0.085

|

||||||

|

|

High

|

Low

|

||||||

|

2014:

|

||||||||

|

Fourth quarter

|

$

|

0.081

|

$

|

0.053

|

||||

|

Third quarter

|

0.0705

|

0.067

|

||||||

|

Second quarter

|

0.045

|

0.0375

|

||||||

|

First quarter

|

0.08

|

0.07

|

||||||

|

|

||||||||

|

2015:

|

High

|

Low

|

||||||

|

Fourth quarter

|

$

|

0.311

|

$

|

0.289

|

||||

|

Third quarter

|

0.39

|

0.37

|

||||||

|

Second quarter

|

0.43

|

0.41

|

||||||

|

First quarter

|

0.071

|

0.07

|

||||||

On June 9, 2016, the Company's Common stock closed on the OTCQB at $0.29 per share.

As of June 6, 2016, there were 957 stockholders of record of our common stock.

Dividends

We have paid no dividends on our common stock to date and it is not anticipated that any dividends will be paid to holders of our common stock in the foreseeable future. While our future dividend policy will be based on the operating results and capital needs of the business, it is currently anticipated that any earnings will be retained to finance our future expansion and for the implementation of our business plan. As an investor, you should take note of the fact that a lack of a dividend can further affect the market value of our stock, and could significantly affect the value of any investment in our Company.

Securities authorized for issuance under equity compensation plans

No option grants were issued during the year ended December 31, 2015. Further reference is made to the information contained in the Equity Compensation Plan table contained in this prospectus.

11

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

This discussion should be read in conjunction with the other sections of this prospectus, including "Risk Factors," "Description of Business" and the Financial Statements attached hereto pursuant and the related exhibits. The various sections of this discussion contain a number of forward-looking statements, all of which are based on our current expectations and could be affected by the uncertainties and risk factors described throughout this prospectus. See "Special Note on Forward-Looking Statements." Our actual results may differ materially. All amounts in this discussion are in thousands, except for share and per share data.

The following discussion and analysis of our results of operations and financial condition should be read in conjunction with (i) our unaudited interim condensed consolidated financial statements and related notes for the three months ended March 31, 2016 and 2015 (ii) audited financial statements for the fiscal years ended December 31, 2015 and 2014 and the notes thereto and (iii) the section entitled "Business," included elsewhere in this prospectus. Our condensed consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP").

Overview

Leo Motors, Inc. (the "Company") is a Nevada corporation incorporated on September 8, 2004. The Company established a wholly-owned operating subsidiary in Korea named Leo Motors, Co. Ltd. ("Leozone") on July 1, 2006. Through Leozone, the Company is engaged in the research and development ("R&D") of multiple products, prototypes, and conceptualizations based on proprietary, patented and patent pending electric power generation, drive train, and storage technologies. Leozone operates through four unincorporated divisions: new product research & development ("R&D"), post R&D development (such as product testing), production, and sales.

The Company's products include (i) E-Box electric energy storage system for solar and wind power generation devices; and (ii) electric vehicle ("EV") components that integrate electric batteries with electric motors such as EV Controllers that use a mini-computer to control torque drive.

The Company was previously actively engaged in the process of development and production of Electric Power Train Systems ("EPTS") encompassing electric scooters, electric sedans/SUVs/sports cars, and electric buses/trucks as well as several models of Electric Vehicle ("EV"). Our EPTS can replace internal combustion engines ("ICEs"). Company began sales of EPTS to auto makers and agricultural machinery manufacturers.

The Company has developed eight EPTS of increasing power rating: 3kW, 5kW, 7.5kW, 15kW, 30kW, 60kW, 120kW, and 240kW systems. Each EPTS consists of a motor, a controller, and a battery power pack with a battery management system ("BMS").

The Company has successfully converted existing models of small cars (ICEs under 2,000cc), and also a 24 seat bus. The Company has begun marketing its 60kW power train kits (for compact passenger cars and small trucks) and its 120kW kits (for ICE passenger cars, buses, and trucks under 5,000cc). The Company has developed a 240kW kit (for up to 10,000cc buses and trucks) as well, and is attempting to locate a strategic partner to fund the testing and production.

The specific goals of the Company over the next twelve months include:

|

·

|

Focus on the capitalization of the Company;

|

|

·

|

Focus on the sale of the E-Boats and E-Box;

|

|

·

|

Business development in China by establishing joint venture company in China, and in Japan;

|

|

·

|

Continue with R&D of our EV's, electric boats, and related products as capital permits.

|

The E-Box can be used as an energy supplying device in an emergency situations or as a energy storage device for use by the military; municipal and industry; corporate; solar/wind power storage; electric coolers and heaters; yachts or small ships. The E-Box is offered in three power classes: 1kw, 3kw and 5kw. E-Boxes for 10kw and 550kw will be developed in the future. The E-Box is environmentally friendly with high energy density due to the use of lithium-polymer battery. The E-Box uses a multiple cell voltage balancing system via a battery management system ("BMS").

The Company is developing new battery exchange system using its patented cartridge battery exchange system which will solve the cost barriers of the electric vehicle to make them less expensive than their Internal Combustion Engine (ICE) counterparts and to help solve battery charging problems. With evolutionary batter exchange system, the Company's EV's can exchange battery within one minute using simple and low cost equipment. This technology can be best used in fleet managed vehicles such as city buses, taxis, and garbage trucks because it can be used any road sides.

Results of operations

Three months ended March 31, 2016 and 2015

12

Revenues

Sales for the three months ended March 31, 2016 were $745,706 compared to $42,771 for the three months ended March 31, 2015, an increase of $702,935. This was the direct result of increased product line in conjunction with its acquired subsidiary sales.

General and Administrative Expenses

Expenses for the period quarter consisted of the following:

|

|

For the Three Months Ended

|

|||||||

|

|

March 31,

|

March 31,

|

||||||

|

Total General and Administrative Expenses:

|

2016

|

2015

|

||||||

|

Salaries and Benefits

|

$

|

366,121

|

$

|

126,456

|

||||

|

Consulting and Service Fees

|

155,938

|

54,324

|

||||||

|

Selling, General and Administrative

|

386,801

|

177,631

|

||||||

|

Total

|

$

|

908,860

|

$

|

358,411

|

||||

Salaries and Benefits consist of total of common stock issued to our executive officers as compensation for their services as officers of the Company and cash compensation paid to our employees during the year and the cost of all benefits provided to our employees.

Consulting and Service Fees consist of consist of accounting, legal, and professional fees.