Form N-CSR

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21869

NEXPOINT CREDIT

STRATEGIES FUND

(Exact name of registrant as specified in charter)

200 Crescent Court

Suite 700

Dallas, Texas 75201

(Address of

principal executive offices) (Zip code)

NexPoint Advisors, L.P.

200 Crescent Court

Suite 700

Dallas, Texas 75201

(Name and Address

of Agent for Service)

Registrant’s telephone number, including area code: (877) 665-1287

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

Item 1. Reports to Stockholders.

A copy of the Report to Shareholders transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is attached herewith.

NexPoint Credit Strategies Fund

Annual Report

December 31, 2013

NexPoint Credit Strategies Fund

TABLE OF CONTENTS

Economic and market conditions change frequently.

There is no assurance that the trends described in this report will continue or commence.

Privacy Policy

We recognize and respect your privacy expectations, whether you are a visitor to our web site, a potential shareholder, a current shareholder or

even a former shareholder.

Collection of Information. We may collect nonpublic personal information about you from the following

sources:

| |

Ÿ |

|

Account applications and other forms, which may include your name, address and social security number, written and electronic correspondence and telephone

contacts; |

| |

Ÿ |

|

Web site information, including any information captured through the use of “cookies”; and |

| |

Ÿ |

|

Account history, including information about the transactions and balances in your accounts with us or our affiliates. |

Disclosure of Information. We may share the information we collect with our affiliates. We may also disclose this information as otherwise

permitted by law. We do not sell your personal information to third parties for their independent use.

Confidentiality and Security

of Information. We restrict access to nonpublic personal information about you to our employees and agents who need to know such information to provide products or services to you. We maintain physical, electronic and procedural safeguards that

comply with federal standards to guard your nonpublic personal information, although you should be aware that data protection cannot be guaranteed.

PORTFOLIO MANAGER COMMENTARY (unaudited)

|

|

|

| December 31, 2013 |

|

NexPoint Credit Strategies Fund |

2013: A Step in the Right Direction

We

are pleased to report strong 2013 results for the Fund’s shareholders. As discussed in our letter last year, we refocused the priorities in NexPoint Credit Strategies Fund (the “Fund”) beginning in the summer of 2012. We believe we

can consistently outperform the DJ Credit Suisse Hedge Fund Index and the HFRX Global Hedge Fund Index. The Fund had the best NAV performance of all closed-end funds in 201311, up 61.55%, and was one of only 43 credit oriented funds to increase its dividend during the year, increasing it three times for

a total increase of 43%. For the month of February 2014, the Trustees approved an additional dividend increase of 10%. The Fund now pays a monthly dividend of $.055 per share. As of December 31, 2013, the Fund had an undistributed net investment

income balance of $6.4 million or $.100 per share, representing income that has been earned but not paid out to shareholders. This balance provides a cushion to maintain the current monthly dividend if the portfolio suffers defaults or losses of

income in the future. The annualized earn rate on assets as of January 31, 2014, is $.684 per share; the current monthly distribution is $.055 per share, or $.66 per share annually.

2013 Performance

In 2013, the Fund (NAV) returned 61.55% and the stock price was up 52.03%, including

reinvested dividends. The Fund’s performance compared very favorably to the Fund’s two benchmarks, the DJ Credit Suisse Hedge Fund Index (+ 9.73%) and the HFRX Global Hedge Fund Index (+6.72%) as well as to other credit focused closed-end

funds. In 2013, 43 credit funds increased their dividend, 93 credit funds decreased their dividend and 8 credit funds left their dividend unchanged (source: Morningstar, includes only credit oriented funds). The Fund increased its regular monthly

dividend three times during 2013 for a total increase of 43%.

For the year, the top five performing investments in the portfolio were American Airlines

Group common stock, Media General/New Young Broadcasting common stock, Communications Corporation of America common stock, American Express Co. common stock, and Metro-Goldwyn-Mayer Inc common stock. The top five underperforming investments in the

portfolio in 2013 were ProShares Ultra Silver ETF, Celtic Pharma Phinco bond, LLV Holding Co. equity and debt, ProShares UltraShort Russell 2000 ETF, Oracle Corporation equity short and Chesapeake Energy Corporation equity short. In 2013, the

Fund’s equity investments outperformed all other asset classes contributing 51.8% to the Fund’s NAV. CLOs were the second best performing asset class contributing 5.7% to the Fund’s NAV.

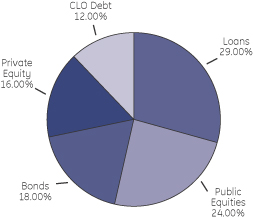

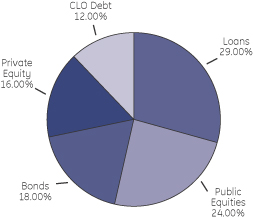

As of December 31, 2012, the Fund’s investments were allocated among the following asset classes:

As of December 31, 2013, the Fund’s investments were allocated among the following asset classes:

PORTFOLIO MANAGER COMMENTARY (unaudited)

|

|

|

| December 31, 2013 |

|

NexPoint Credit Strategies Fund |

During 2013, the Fund increased its allocation to CLOs. We feel CLOs are a more efficient way to gain exposure to syndicated floating rate bank debt. Beginning in

the summer of 2013, we also began allocating a portion of the portfolio to real estate through a wholly-owned private REIT subsidiary that invests directly in real estate. The allocation to private equity increased through additional market gains

not purchases.

The Fund’s Strategy

The Fund

is managed as an asset allocation strategy that attempts to exceed the return of the Fund’s two benchmarks in a transparent, registered fund format, paying a stable monthly dividend. We consider the Fund similar to a hedge fund and position the

portfolio accordingly. We will typically allocate the Fund’s investments in the following asset classes: public equities, private equity investments, collateralized loan obligation (CLOs) debt, high yield bonds, syndicated floating rate bank

loans, real estate assets, CLO equity and will hedge exposure where necessary.

Our View of the Year Ahead

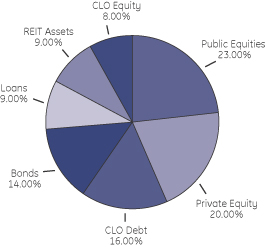

In 2014, we believe the equity markets will encounter significant head winds compared to 2013, especially in emerging markets. Based on our research, we believe

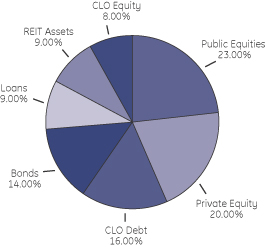

equities may be poised for a significant pullback of 10% or more and that choppy and/or declining markets may last longer than some expect. Specifically we notice that on an historical basis the US equity market appears to be overvalued measured as

a percentage of US GDP. As the chart below shows, the two previous times the total capitalization of the U.S. equity market hit 140% of U.S. GDP (2000 and 2008), the S&P 500 suffered a pullback of over 20%, with 2008 being the worst decline

since the Great Depression.

Source: Ron Griess, www.thechartstore.com

PORTFOLIO MANAGER COMMENTARY (unaudited)

|

|

|

| December 31, 2013 |

|

NexPoint Credit Strategies Fund |

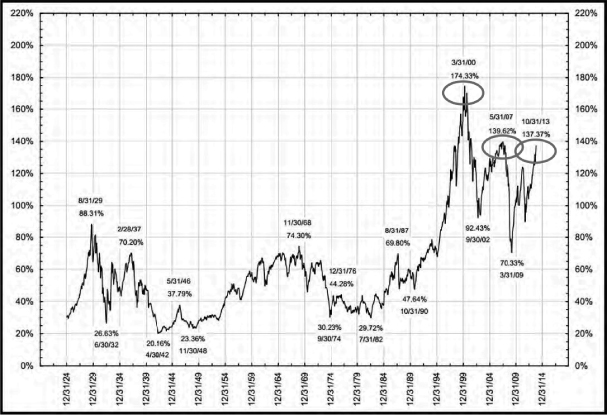

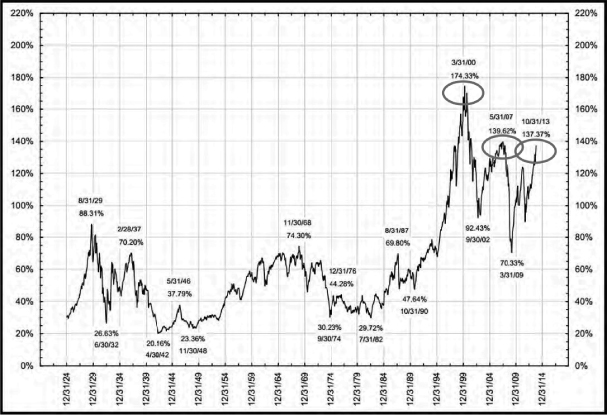

Of equal concern to us is the high level of margin debt shown in the chart below. Again, the last two times margin debt was at current levels (2000 and 2008), the

S&P 500 suffered a pullback of over 20%.

Source: Alan Newman, www.cross-currents.net

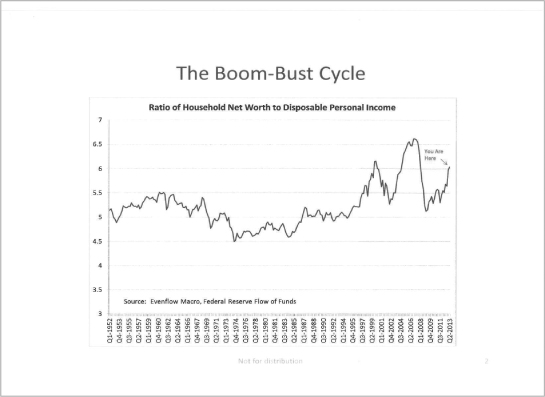

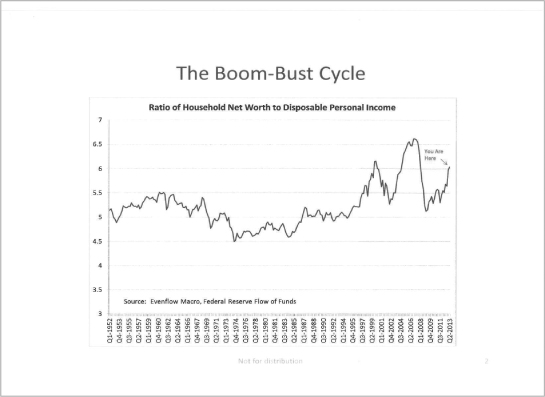

Finally, we are concerned about the disparity between household net worth and disposable personal income, as shown in the chart below. Household net worth in the U.S. is driven largely by gains in the equity and

housing markets, which we believe have been artificially inflated by easy money policies by the Federal Reserve and is not sustainable in the long-term. The same factors were present in 2000 and 2008 and a severe decline in the equity markets

followed.

PORTFOLIO MANAGER COMMENTARY (unaudited)

|

|

|

| December 31, 2013 |

|

NexPoint Credit Strategies Fund |

Reviewing these observations, U.S. equity market capitalization to U.S. GDP, margin debt and household net worth to disposable income together, we believe a 20%

pullback in the broader equity markets is possible. However, we are not “bears” long-term and feel any correction will be a healthy clearing of the market and then it will resume its upward trajectory. We believe it will be a stock pickers

market with opportunities among downtrodden and misunderstood situations. Although we feel some are overly optimistic regarding GDP and employment growth in the U.S., we do feel both will continue to improve. We believe the Federal Reserve will be

slow to increase rates or remove tapering, erring on the side of accommodation. We will watch emerging markets carefully, and move in to these markets if we see a bottom forming in 2014.

As for credit markets, our view is that credit still provides attractive risk-adjusted returns and yields. Given the importance of yield in today’s environment, particularly in the closed-end fund universe, we

intend to have high allocations to credit and credit alternatives. Although we are weary of long duration fixed income investments, we still see value in high yield investments, including bonds, with maturities of less than five years. Our opinion

is that the Federal Reserve will work to keep the short end of the yield curve low until there is a reduction in the unemployment rate below 5.5%. GDP growth has been anemic for a recovery in its sixth year and lower unemployment rates mask a drop

in workforce participation. We see rates remaining lower thru 2015.

As always, the Federal Reserve’s actions will be a major determinant in how the

equity and credit markets fare this year.

Portfolio Allocation

As a result of our views of the equity and credit markets we intend to have large allocations to low duration credit investments and credit alternatives with opportunistic allocations to value equities. The Fund

will be cautious in its allocations to equities in 2014. Our focus with regard to equities will be on undervalued stocks with catalysts to the upside. We will continue to hedge our overall equity exposure and short more single names we feel are

overvalued with a downside risk. On the credit side, we anticipate our allocations to liquid syndicated floating rate bank debt and high yield bonds will remain largely unchanged. However, our allocation to CLO debt and equity tranches will

increase. We see the strongest risk-adjusted returns and yields in this asset class.

Although not a large contributor to returns in 2013, the Fund began

to allocate to real estate investments in mid-2013. The Fund set up a private REIT subsidiary and is funding the purchase of real estate, predominantly class B multi-family properties but also opportunistic retail investments. Both categories

provide high cash flow. We view these real estate investments as credit alternatives. They pay a healthy and stable yield, while offering strong collateral, and a low correlation versus credit and equity markets. We intend to allocate 15-20% of the

Fund’s total assets to this private REIT in 2014.

As is our philosophy, we will continue to diversify the portfolio across asset classes and

sectors but will continue to make large allocations to our highest conviction ideas in an effort to generate meaningful alpha and outperformance against relevant indices and competing funds.

Shareholder Loyalty Program

In July 2012, we developed and implemented a unique and creative Dividend

Reinvestment Plan (the “DRIP Program”) that we believe rewards long-term shareholders while aligning the interests of the portfolio manager and other employees of the manager with those of the Fund’s shareholders. The primary purpose

of the DRIP Program is to promote shareholder loyalty. The DRIP Program offers shareholders a 2% gross-up on all new purchases made through accounts held by the DRIP Program’s administrator that are held for at least 12-months after initial

purchase date. The DRIP Program was offered to employees of NexPoint and affiliates beginning in July 2012 and has increased direct employee ownership in the Fund from less than 1% of outstanding shares to 7% as of January, 2014. As of February 15,

2014, the DRIP Program had accumulated 5.7 million shares of the Fund’s stock, representing 8.3% of the outstanding shares or $61.6 million in value. All costs of the program, including the cost of the gross-up on purchases and dividend

reinvestments, are paid by the manager, not by the Fund.

We believe over time the DRIP Program will prove an effective means of increasing liquidity and

ultimately reducing the market price discount to NAV.

James Dondero

President and Portfolio Manager

FUND PROFILE

|

|

|

|

|

NexPoint Credit Strategies Fund |

The NexPoint Credit Strategies Fund (the “Fund”) seeks to provide both current income and capital appreciation.

Total Net Assets of Common Shares as of December 31, 2013

$724.5 million

Portfolio Data as of December 31, 2013

The information below provides a snapshot of the Fund at the end of the reporting period. The Fund is actively managed and the composition of its

portfolio will change over time.

|

|

|

|

|

| Quality Breakdown as of 12/31/2013

(%)(1)(2) |

|

| AAA |

|

|

1.3 |

|

| AA |

|

|

0.2 |

|

| A |

|

|

0.9 |

|

| BBB |

|

|

10.5 |

|

| BB |

|

|

15.7 |

|

| B |

|

|

30.4 |

|

| CCC |

|

|

24.0 |

|

| C |

|

|

1.3 |

|

| D |

|

|

0.1 |

|

| Not Rated |

|

|

15.6 |

|

|

|

|

|

|

| Top 5 Sectors as of 12/31/2013

(%)(1)(2) |

|

| Asset-Backed Securities |

|

|

22.1 |

|

| Media & Telecommunications |

|

|

19.0 |

|

| Transportation |

|

|

14.8 |

|

| Real Estate Investment Trust |

|

|

12.3 |

|

| Financial |

|

|

11.3 |

|

|

|

|

|

|

| Top 10 Holdings as of 12/31/2013

(%)(1)(2) |

|

| Media General, Inc. (Common Stocks) |

|

|

15.4 |

|

| AAL (Rights) |

|

|

14.7 |

|

| Freedom REIT (Private REIT) |

|

|

5.9 |

|

| ComCorp Broadcasting, Inc. (U.S. Senior Loans) |

|

|

4.9 |

|

| ProShares Ultra Silver, ETF (Exchange-Traded Funds) |

|

|

4.8 |

|

| K12, Inc. (Common Stocks) |

|

|

4.5 |

|

| Fortinet, Inc. (Common Stocks) |

|

|

3.6 |

|

| Spirit Realty Capital, Inc. (Common Stocks) |

|

|

3.6 |

|

| Nokia OYJ (Foreign Corporate Bonds & Notes) |

|

|

3.3 |

|

| Texas Competitive Electric Holdings Co. LLC (U.S. Senior Loans) |

|

|

3.2 |

|

| (1) |

Quality is calculated as a percentage of total senior loans, asset-backed securities and corporate bonds & notes. Sectors and holdings are calculated as a percentage of

total net assets. The quality ratings reflected were issued by Standard & Poor’s, a nationally recognized statistical rating organization. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Quality

ratings reflect the credit quality of the underlying bonds in the Fund’s portfolio and not that of the Fund itself. Quality Ratings are subject to change. |

| (2) |

Excludes the Fund’s investment in an investment company purchased with cash collateral from securities lending. |

FINANCIAL STATEMENTS

|

|

|

| December 31, 2013 |

|

NexPoint Credit Strategies Fund |

A guide to understanding the Fund’s financial statements

|

|

|

| Investment Portfolio |

|

The Investment Portfolio details all of the Fund’s holdings and their value as of the last day of the reporting period. Portfolio holdings are organized by type of asset and industry to

demonstrate areas of concentration and diversification. |

|

|

| Statement of Assets and Liabilities |

|

This statement details the Fund’s assets, liabilities, net assets and common share price as of the last day of the reporting period. Net assets are calculated by subtracting all the

Fund’s liabilities (including any unpaid expenses) from the total of the Fund’s investment and non-investment assets. The net asset value per common share is calculated by dividing net assets by the number of common shares outstanding as

of the last day of the reporting period. |

|

|

| Statement of Operations |

|

This statement reports income earned by the Fund and the expenses accrued by the Fund during the reporting period. The Statement of Operations also shows any net gain or loss the Fund

realized on the sales of its holdings during the period as well as any unrealized gains or losses recognized over the period. The total of these results represents the Fund’s net increase or decrease in net assets from operations applicable to

common shareholders. |

|

|

| Statements of Changes in Net Assets |

|

These statements detail how the Fund’s net assets were affected by its operating results, distributions to common shareholders and shareholder transactions from common shares (e.g.,

subscriptions, redemptions and distribution reinvestments) during the reporting period. The Statements of Changes in Net Assets also detail changes in the number of common shares outstanding. |

|

|

| Statement of Cash Flows |

|

This statement reports net cash and foreign currency provided or used by operating, investing and financing activities and the net effect of those flows on cash and foreign currency during

the period. |

|

|

| Financial Highlights |

|

The Financial Highlights demonstrate how the Fund’s net asset value per common share was affected by the Fund’s operating results. The Financial Highlights also disclose the

Fund’s performance and certain key ratios (e.g., net expenses and net investment income as a percentage of average net assets). |

|

|

| Notes to Financial Statements |

|

These notes disclose the organizational background of the Fund, its significant accounting policies (including those surrounding security valuation, income recognition and distributions to

shareholders), federal tax information, fees and compensation paid to affiliates and significant risks and contingencies. |

INVESTMENT PORTFOLIO

|

|

|

| As of December 31, 2013 |

|

NexPoint Credit Strategies Fund |

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

|

| |

U.S. Senior Loans (a) - 19.1% |

|

|

| |

BROADCASTING - 5.0% |

|

| |

35,950,043 |

|

|

ComCorp Broadcasting, Inc.

Term Loan B

9.00%, 04/03/2014 (b) |

|

|

35,809,838 |

|

|

|

|

|

|

|

|

|

|

|

| |

CHEMICALS - 1.0% |

|

| |

750,000 |

|

|

Arysta LifeScience SPC LLC

Second Lien Term Loan

8.25%, 11/30/2020 |

|

|

763,819 |

|

| |

1,597,107 |

|

|

W.R. Grace & Co.

5-Year Revolver (c) |

|

|

3,353,924 |

|

| |

1,597,107 |

|

|

Revolver Credit Loan (c) |

|

|

3,353,924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,471,667 |

|

|

|

|

|

|

|

|

|

|

|

| |

CONSUMER DISCRETIONARY - 0.1% |

|

| |

332,483 |

|

|

Bass Pro Group LLC New

Term Loan 11/20/2019 (d) |

|

|

334,907 |

|

|

|

|

|

|

|

|

|

|

|

| |

FOREST PRODUCTS & CONTAINERS - 0.0% |

|

| |

200,000 |

|

|

Berlin Packaging LLC Second Lien

Term Loan 8.75%, 04/02/2020 |

|

|

205,250 |

|

|

|

|

|

|

|

|

|

|

|

| |

GAMING & LEISURE - 0.5% |

|

| |

3,937,249 |

|

|

Ginn LA Conduit Lender, Inc.

First Lien Tranche A (c) |

|

|

118,117 |

|

| |

8,438,203 |

|

|

First Lien Tranche B

Term Loan (c) |

|

|

253,146 |

|

| |

7,879,521 |

|

|

LLV Holdco LLC Exit Revolving

Loan 5.00%, 02/28/2017 (b)(e) |

|

|

3,519,782 |

|

| |

7,000,000 |

|

|

WAICCS Las Vegas 3 LLC

Second Lien Term Loan (b)(c) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,891,045 |

|

|

|

|

|

|

|

|

|

|

|

| |

HEALTHCARE - 0.3% |

|

| |

2,000,000 |

|

|

Onex Carestream Finance LP

Second Lien Term Loan

9.50%, 06/07/2019 |

|

|

2,042,500 |

|

|

|

|

|

|

|

|

|

|

|

| |

HOUSING - 0.0% |

|

| |

2,498,819 |

|

|

LBREP/L-Suncal Master I LLC

First Lien Term Loan (b)(c) |

|

|

189,410 |

|

|

|

|

|

|

|

|

|

|

|

| |

INFORMATION TECHNOLOGY - 1.9% |

|

| |

4,697,834 |

|

|

Avaya, Inc.

Term Loan B-5 8.00%, 03/30/2018 |

|

|

4,775,348 |

|

| |

4,000,000 |

|

|

Kronos, Inc. Second Lien

Initial Term Loan 9.75%, 04/30/2020 |

|

|

4,147,500 |

|

| |

5,000,000 |

|

|

Vertafore, Inc.

Second Lien Term Loan

9.75%, 10/27/2017 |

|

|

5,093,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,016,598 |

|

|

|

|

|

|

|

|

|

|

|

| |

MANUFACTURING - 0.3% |

|

| |

2,000,000 |

|

|

Doncasters U.S. Finance LLC

Second Lien Term Loan

9.50%, 10/09/2020 |

|

|

2,035,000 |

|

| |

240,000 |

|

|

Filtration Group Corp.

Second Lien Term Loan

11/22/2021 (d) |

|

|

246,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,281,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

|

| |

MEDIA & TELECOMMUNICATIONS - 0.2% |

|

| |

300,000 |

|

|

Aufinco Pty, Ltd.

Second Lien Term Loan

8.25%, 11/20/2020 |

|

|

304,875 |

|

| |

8,920,151 |

|

|

Broadstripe LLC

First Lien Term Loan (b)(c) |

|

|

115,070 |

|

| |

886,042 |

|

|

Revolver (b)(c) |

|

|

11,430 |

|

| |

3,373,813 |

|

|

Endurance Business Media, Inc.

Term Loan 6.50%, 12/15/2014 |

|

|

775,977 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,207,352 |

|

|

|

|

|

|

|

|

|

|

|

| |

RETAIL - 1.5% |

|

| |

7,766,060 |

|

|

Guitar Center, Inc.

Extended Term Loan

6.25%, 04/10/2017 |

|

|

7,596,178 |

|

| |

3,395,935 |

|

|

JC Penney Corp., Inc.

Term Loan 6.00%, 05/22/2018 |

|

|

3,328,016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,924,194 |

|

|

|

|

|

|

|

|

|

|

|

| |

SERVICE - 1.1% |

|

| |

500,000 |

|

|

Spin Holdco Inc. 11/14/2019 (d) |

|

|

504,375 |

|

| |

7,044,219 |

|

|

Travelport LLC Tranche 1

Term Loan 9.50%, 01/29/2016 |

|

|

7,310,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,814,971 |

|

|

|

|

|

|

|

|

|

|

|

| |

UTILITY - 7.2% |

|

| |

25,003,843 |

|

|

Entegra TC LLC Third Lien

Term Loan 6.25%, 10/19/2015 |

|

|

15,627,402 |

|

| |

17,000,000 |

|

|

Texas Competitive Electric

Holdings Co. LLC

Non Extended Term Loan

3.73%, 10/10/2014 |

|

|

12,082,750 |

|

| |

33,329,417 |

|

|

2017 Extended

Term Loan 10/10/2017 (d) |

|

|

23,136,281 |

|

| |

1,125,000 |

|

|

TGGT Holdings, LLC Term Loan 11/15/2018 (d) |

|

|

1,133,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51,979,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Senior Loans

(Cost $169,451,234) |

|

|

138,168,603 |

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount |

|

|

|

|

| |

Foreign Denominated or Domiciled |

|

| |

Senior Loans (a) - 0.1% |

|

|

| |

LUXEMBOURG - 0.0% |

|

| |

USD |

|

| |

222,222 |

|

|

AI Chem & Cy SCA Second Lien

Term Loan 8.25%, 04/03/2020 |

|

|

228,751 |

|

|

|

|

|

|

|

|

|

|

|

| |

UNITED KINGDOM - 0.1% |

|

| |

GBP |

|

|

|

|

|

|

|

| |

930,744 |

|

|

Henson No. 4, Ltd.

Term Loan Facility B (b)(c) |

|

|

78,497 |

|

| |

934,584 |

|

|

Term Loan Facility C (b)(c) |

|

|

79,261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Foreign Denominated or Domiciled Senior Loans

(Cost $1,810,438) |

|

|

386,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| See accompanying Notes to Financial Statements. |

|

|

|

|

|

7 |

INVESTMENT PORTFOLIO (continued)

|

|

|

| As of December 31, 2013 |

|

NexPoint Credit Strategies Fund |

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

|

| |

Asset-Backed Securities - 22.1% |

|

| |

2,000,000 |

|

|

ABCLO, Ltd.

Series 2007-1A, Class C

2.09%, 04/15/2021 (f)(g) |

|

|

1,884,400 |

|

| |

3,000,000 |

|

|

ACA CLO, Ltd.

Series 2007-1A, Class D

2.59%, 06/15/2022 (f)(g) |

|

|

2,797,500 |

|

| |

2,000,000 |

|

|

Apidos CLO

Series 2013-12A, Class D

3.29%, 04/15/2025 (f)(g) |

|

|

1,878,200 |

|

| |

1,000,000 |

|

|

Series 2013-12A, Class F

5.14%, 04/15/2025 (f)(g) |

|

|

870,100 |

|

| |

3,227,559 |

|

|

ARES XII CLO, Ltd.

Series 2007-12A, Class E

5.99%, 11/25/2020 (f)(g) |

|

|

3,165,913 |

|

| |

1,000,000 |

|

|

Babson Mid-Market CLO, Inc.

Series 2007-2A, Class D

1.94%, 04/15/2021 (f)(g) |

|

|

946,000 |

|

| |

1,250,000 |

|

|

BlueMountain CLO, Ltd.

Series 2013-2A, Class D

3.82%, 01/22/2025 (f)(g) |

|

|

1,200,375 |

|

| |

950,000 |

|

|

Series 2013-2A, Class E

5.32%, 01/22/2025 (f)(g) |

|

|

898,510 |

|

| |

2,500,000 |

|

|

Brentwood CLO Corp.

Series 2006-1A, Class B

1.06%, 02/01/2022 (f)(g) |

|

|

2,213,750 |

|

| |

2,000,000 |

|

|

Carlyle High Yield Partners X, Ltd.

Series 2007-10A, Class E

3.44%, 04/19/2022 (f)(g) |

|

|

1,800,000 |

|

| |

3,000,000 |

|

|

Catamaran CLO, Ltd.

Series 2013-1A, Class E

5.28%, 01/27/2025 (f)(g) |

|

|

2,788,500 |

|

| |

250,000 |

|

|

Series 2012-1A, Class E

5.50%, 12/20/2023 (f)(g) |

|

|

236,250 |

|

| |

1,500,000 |

|

|

Series 2013-1A, Class F

5.97%, 01/27/2025 (f)(g) |

|

|

1,341,750 |

|

| |

2,000,000 |

|

|

Cent CDO, Ltd.

Series 2007-15A, Class C

2.49%, 03/11/2021 (f)(g) |

|

|

1,840,200 |

|

| |

2,000,000 |

|

|

ColumbusNova CLO, Ltd.

Series 2007-1A, Class D

1.59%, 05/16/2019 (f)(g) |

|

|

1,832,600 |

|

| |

742,733 |

|

|

CSAM Funding II

Series 2A, Class B1

7.05%, 10/15/2016 (f) |

|

|

747,189 |

|

| |

457,922 |

|

|

Del Mar CLO, Ltd.

Series 2006-1A, Class E

4.24%, 07/25/2018 (f)(g) |

|

|

443,040 |

|

| |

1,500,000 |

|

|

Diamond Lake CLO, Ltd.

Series 2006-1A, Class B2L

4.24%, 12/01/2019 (f)(g) |

|

|

1,422,450 |

|

| |

1,000,000 |

|

|

Dryden XXV Senior Loan Fund

Series 2012-25A, Class E

5.74%, 01/15/2025 (f)(g) |

|

|

977,500 |

|

| |

750,000 |

|

|

Dryden XXVI Senior Loan Fund

Series 2013-26A, Class F

4.74%, 07/15/2025 (f)(g) |

|

|

633,750 |

|

| |

11,010,000 |

|

|

Eastland CLO, Ltd.

Series 2007-1A, Class C

1.74%, 05/01/2022 (f)(g) |

|

|

9,468,600 |

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

| |

2,006,825 |

|

|

Series 2007-1A, Class D

3.84%, 05/01/2022 (f)(g) |

|

|

1,720,853 |

|

| |

1,000,000 |

|

|

Eaton Vance CDO IX, Ltd.

Series 2007-9A, Class D

1.74%, 04/20/2019 (f)(g) |

|

|

947,500 |

|

| |

2,000,000 |

|

|

Fraser Sullivan CLO II, Ltd.

Series 2006-2A, Class D

1.75%, 12/20/2020 (f)(g) |

|

|

1,906,200 |

|

| |

2,100,000 |

|

|

Galaxy CLO, Ltd.

Series 2007-8A, Class D

1.54%, 04/25/2019 (f)(g) |

|

|

1,965,180 |

|

| |

1,000,000 |

|

|

Gannett Peak CLO, Ltd.

Series 2006-1A, Class C

1.76%, 10/27/2020 (f)(g) |

|

|

956,000 |

|

| |

2,000,000 |

|

|

Golden Knight CDO, Ltd.

Series 2007-2A, Class D

1.64%, 04/15/2019 (f)(g) |

|

|

1,859,200 |

|

| |

847,661 |

|

|

Goldman Sachs Asset Management CLO PLC

Series 2007-1A, Class E

5.24%, 08/01/2022 (f)(g) |

|

|

830,708 |

|

| |

3,000,000 |

|

|

Grayson CLO, Ltd.

Series 2006-1A, Class B

0.94%, 11/01/2021 (f)(g) |

|

|

2,667,000 |

|

| |

2,000,000 |

|

|

Series 2006-1A, Class C

1.79%, 11/01/2021 (f)(g) |

|

|

1,667,000 |

|

| |

2,915,407 |

|

|

Series 2006-1A,

Class D 3.84%, 11/01/2021 (f)(g) |

|

|

2,364,395 |

|

| |

5,487,000 |

|

|

Greenbriar CLO, Ltd.

Series 2007-1A, Class C

1.99%, 11/01/2021 (f)(g) |

|

|

4,984,391 |

|

| |

1,000,000 |

|

|

Series 2007-1A, Class D

2.99%, 11/01/2021 (f)(g) |

|

|

895,000 |

|

| |

814,466 |

|

|

Greywolf CLO, Ltd.

Series 2007-1A, Class E

4.19%, 02/18/2021 (f)(g) |

|

|

773,743 |

|

| |

850,000 |

|

|

Series 2013-1A, Class E

5.29%, 04/15/2025 (f)(g) |

|

|

754,035 |

|

| |

1,000,000 |

|

|

Gulf Stream - Sextant CLO, Ltd.

Series 2006-1A, Class D

1.84%, 08/21/2020 (f)(g) |

|

|

963,800 |

|

| |

2,000,000 |

|

|

HarbourView CLO

Series 6A, Class D

3.95%, 12/27/2019 (f)(g) |

|

|

1,870,000 |

|

| |

2,127,119 |

|

|

Hewett’s Island CDO, Ltd.

Series 2007-1RA, Class E

6.99%, 11/12/2019 (f)(g) |

|

|

2,105,847 |

|

| |

2,000,000 |

|

|

Hewett’s Island CLO V, Ltd.

Series 2006-5A, Class D

1.69%, 12/05/2018 (f)(g) |

|

|

1,927,000 |

|

| |

762,824 |

|

|

Highland Loan Funding V, Ltd.

Series 1A, Class B

1.51%, 08/01/2014 (f)(g) |

|

|

719,877 |

|

| |

14,639,941 |

|

|

Highland Park CDO, Ltd.

Series 2006-1A, Class A1

0.57%, 11/25/2051 (f)(g) |

|

|

12,938,780 |

|

| |

538,553 |

|

|

Series 2006-1X, Class A1

0.57%, 11/25/2051 (f)(g) |

|

|

475,973 |

|

| |

7,375,000 |

|

|

Series 2006-1A, Class A2

0.64%, 11/25/2051 (f)(g) |

|

|

2,281,825 |

|

|

|

|

|

|

|

|

| 8 |

|

|

|

|

|

See accompanying Notes to Financial Statements. |

INVESTMENT PORTFOLIO (continued)

|

|

|

| As of December 31, 2013 |

|

NexPoint Credit Strategies Fund |

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

|

| |

Asset-Backed Securities (continued) |

|

| |

3,000,000 |

|

|

Hillmark Funding

Series 2006-1A, Class C

1.94%, 05/21/2021 (f)(g) |

|

|

2,822,100 |

|

| |

2,142,361 |

|

|

Series 2006-1A, Class D

3.84%, 05/21/2021 (f)(g) |

|

|

1,913,128 |

|

| |

1,000,000 |

|

|

Inwood Park CDO, Ltd.

Series 2006-1A, Class D

1.64%, 01/20/2021 (f)(g) |

|

|

937,300 |

|

| |

500,000 |

|

|

Katonah CLO, Ltd.

Series 2006-9A, Class B1L

1.64%, 01/25/2019 (f)(g) |

|

|

465,000 |

|

| |

848,153 |

|

|

Series 7A, Class D

2.09%, 11/15/2017 (f)(g) |

|

|

812,107 |

|

| |

2,000,000 |

|

|

Landmark VIII CDO, Ltd.

Series 2006-8A, Class E

3.84%, 10/19/2020 (f)(g) |

|

|

1,905,000 |

|

| |

1,000,000 |

|

|

Liberty CLO, Ltd.

Series 2005-1A, Class A3

0.74%, 11/01/2017 (f)(g) |

|

|

958,100 |

|

| |

1,500,000 |

|

|

Madison Park Funding I, Ltd.

Series 2007-5A, Class D

3.74%, 02/26/2021 (f)(g) |

|

|

1,391,250 |

|

| |

1,000,000 |

|

|

Marquette U.S./European CLO LLC

Series 2006-1A, Class D1

1.99%, 07/15/2020 (f)(g) |

|

|

930,700 |

|

| |

835,038 |

|

|

Navigator CDO, Ltd.

Series 2006-2A, Class D

3.75%, 09/20/2020 (f)(g) |

|

|

781,846 |

|

| |

3,500,000 |

|

|

Neuberger Berman CLO, Ltd.

Series 2012-13A, Class E

5.34%, 01/23/2024 (f)(g) |

|

|

3,248,000 |

|

| |

5,000,000 |

|

|

Newmark Capital Funding

Series 2013-1A, Cass A1

1.18%, 06/02/2025 (f)(g) |

|

|

4,850,000 |

|

| |

3,500,000 |

|

|

Newmark Capital Funding CLO, Ltd.

Series 2013-1A, Class E

4.89%, 06/02/2025 (f)(g) |

|

|

3,115,000 |

|

| |

750,000 |

|

|

NYLIM Flatiron CLO, Ltd.

Series 2006-1A, Class D

3.69%, 08/08/2020 (f)(g) |

|

|

697,500 |

|

| |

1,000,000 |

|

|

OHA Credit Partners, Ltd.

Series 2012-7A, Class D

4.24%, 11/20/2023 (f)(g) |

|

|

990,800 |

|

| |

1,000,000 |

|

|

Palmer Square CLO, Ltd.

Series 2013-2A, Class C

3.88%, 10/17/2025 (f)(g) |

|

|

952,000 |

|

| |

1,300,000 |

|

|

Series 2013-1A, Class C

4.29%, 05/15/2025 (f)(g) |

|

|

1,292,590 |

|

| |

1,000,000 |

|

|

Series 2013-2A, Class D

5.60%, 10/17/2025 (f)(g) |

|

|

947,200 |

|

| |

386,129 |

|

|

Pam Capital Funding LP

Series 1998-1A, Class B2

1.59%, 05/01/2014 (b)(f)(g) |

|

|

349,447 |

|

| |

772,258 |

|

|

Series 1998-1A, Class B1

7.47%, 05/01/2014 (b)(f) |

|

|

697,581 |

|

| |

1,000,000 |

|

|

PPM Grayhawk CLO, Ltd.

Series 2007-1A, Class C

1.65%, 04/18/2021 (f)(g) |

|

|

896,800 |

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

| |

5,000,000 |

|

|

Primus CLO II, Ltd.

Series 2007-2A, Class D

2.64%, 07/15/2021 (f)(g) |

|

|

4,730,500 |

|

| |

4,000,000 |

|

|

Rampart CLO, Ltd.

Series 2006-1A, Class C

1.70%, 04/18/2021 (f)(g) |

|

|

3,798,000 |

|

| |

3,972,238 |

|

|

Red River CLO, Ltd.

Series 1A, Class E

3.99%, 07/27/2018 (f)(g) |

|

|

3,506,294 |

|

| |

6,000,000 |

|

|

Rockwall CDO II, Ltd.

Series 2007-1A, Class A3L

1.24%, 08/01/2024 (f)(g) |

|

|

4,680,000 |

|

| |

2,752,426 |

|

|

Series 2007-1A, Class B2L

4.49%, 08/01/2024 (f)(g) |

|

|

2,312,038 |

|

| |

1,955,796 |

|

|

San Gabriel CLO, Ltd.

Series 2007-1A, Class B2L

4.49%, 09/10/2021 (f)(g) |

|

|

1,862,895 |

|

| |

500,000 |

|

|

Stanfield Azure CLO, Ltd.

Series 2006-1A, Class B1L

1.94%, 05/27/2020 (f)(g) |

|

|

483,050 |

|

| |

1,000,000 |

|

|

Stanfield Bristol CLO, Ltd.

Series 2005-1A, Class C

2.29%, 10/15/2019 (f)(g) |

|

|

972,400 |

|

| |

1,070,000 |

|

|

Stanfield Daytona CLO, Ltd.

Series 2007-1A, Class A3L

0.91%, 04/27/2021 (f)(g) |

|

|

952,300 |

|

| |

1,200,000 |

|

|

Series 2007-1A, Class B1L

1.59%, 04/27/2021 (f)(g) |

|

|

1,110,960 |

|

| |

4,000,000 |

|

|

Stanfield McLaren CLO Delaware Corp.

Series 2007-1A, Class B1L

2.64%, 02/27/2021 (f)(g) |

|

|

3,673,600 |

|

| |

10,300,000 |

|

|

Stratford CLO, Ltd.

Series 2007-1A, Class C 2.24%, 11/01/2021 (f)(g) |

|

|

9,398,750 |

|

| |

1,397,789 |

|

|

Series 2007-1A, Class E 4.24%, 11/01/2021 (f)(g) |

|

|

1,235,366 |

|

| |

1,500,000 |

|

|

Valhalla CLO, Ltd.

Series 2004-1A, Class EIN 0.00%, 08/01/2016 (f) |

|

|

435,000 |

|

| |

2,000,000 |

|

|

Venture IX CDO, Ltd.

Series 2007-9A, Class D 4.39%, 10/12/2021 (f)(g) |

|

|

1,960,000 |

|

| |

1,000,000 |

|

|

Westbrook CLO, Ltd.

Series 2006-1A, Class D 1.95%, 12/20/2020 (f)(g) |

|

|

952,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Asset-Backed Securities

(Cost $145,609,751) |

|

|

159,977,786 |

|

|

|

|

|

|

|

|

|

|

|

| |

Corporate Bonds & Notes - 14.4% |

|

|

| |

CHEMICALS - 2.2% |

|

| |

2,025,000 |

|

|

Momentive Performance Materials, Inc.

9.00%, 01/15/2021 (h) |

|

|

1,787,063 |

|

| |

3,000,000 |

|

|

9.50%, 01/15/2021 |

|

|

3,513,771 |

|

| |

10,000,000 |

|

|

TPC Group, Inc.

8.75%, 12/15/2020 (f) |

|

|

10,675,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,975,834 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| See accompanying Notes to Financial Statements. |

|

|

|

|

|

9 |

INVESTMENT PORTFOLIO (continued)

|

|

|

| As of December 31, 2013 |

|

NexPoint Credit Strategies Fund |

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

|

| |

Corporate Bonds & Notes (continued) |

|

|

| |

ENERGY - 1.3% |

|

| |

2,785,000 |

|

|

Calumet Specialty Products Partners LP/Calumet Finance Corp.

9.38%, 05/01/2019 (h) |

|

|

3,105,275 |

|

| |

300,000 |

|

|

9.63%, 08/01/2020 (i) |

|

|

338,250 |

|

| |

1,000,000 |

|

|

Penn Virginia Corp.

7.25%, 04/15/2019 (h) |

|

|

1,030,000 |

|

| |

5,000,000 |

|

|

Venoco, Inc.

8.88%, 02/15/2019 (h) |

|

|

4,950,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,423,525 |

|

|

|

|

|

|

|

|

|

|

|

| |

FOOD & DRUG - 0.1% |

|

| |

1,000,000 |

|

|

SUPERVALU, Inc.

6.75%, 06/01/2021 |

|

|

992,500 |

|

|

|

|

|

|

|

|

|

|

|

| |

GAMING & LEISURE - 0.6% |

|

| |

5,000,000 |

|

|

Caesars Entertainment Operating Co., Inc.

10.75%, 02/01/2016 |

|

|

4,075,000 |

|

|

|

|

|

|

|

|

|

|

|

| |

HOUSING - 0.2% |

|

| |

1,125,000 |

|

|

Building Materials Holding Corp.

9.00%, 09/15/2018 (f)(h) |

|

|

1,217,812 |

|

|

|

|

|

|

|

|

|

|

|

| |

HEALTHCARE - 0.5% |

|

| |

10,320,366 |

|

|

Azithromycin Royalty Sub LLC

16.00%, 05/15/2019 (b) |

|

|

1,379,833 |

|

| |

93,180,348 |

|

|

Celtic Pharma Phinco BV, PIK (b)(c) |

|

|

2,367,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,747,536 |

|

|

|

|

|

|

|

|

|

|

|

| |

INFORMATION TECHNOLOGY - 4.6% |

|

| |

10,500,000 |

|

|

Avaya, Inc.

7.00%, 04/01/2019 (f)(h) |

|

|

10,342,500 |

|

| |

23,971,250 |

|

|

10.50%, 03/01/2021 (f)(h) |

|

|

23,012,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33,354,900 |

|

|

|

|

|

|

|

|

|

|

|

| |

MEDIA & TELECOMMUNICATIONS - 0.4% |

|

| |

3,500,000 |

|

|

DISH DBS Corp. 5.00%, 03/15/2023 (h) |

|

|

3,281,250 |

|

|

|

|

|

|

|

|

|

|

|

| |

RETAIL - 0.8% |

|

| |

7,000,000 |

|

|

JC Penney Corp., Inc. 5.65%, 06/01/2020 (h) |

|

|

5,547,500 |

|

|

|

|

|

|

|

|

|

|

|

| |

SERVICE - 1.6% |

|

| |

4,500,000 |

|

|

Sabre, Inc.

8.50%, 05/15/2019 (f) |

|

|

5,011,875 |

|

| |

5,990,773 |

|

|

Travelport LLC, PIK (f) |

|

|

6,380,173 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,392,048 |

|

|

|

|

|

|

|

|

|

|

|

| |

TELECOMMUNICATIONS - 0.4% |

|

| |

3,000,000 |

|

|

MetroPCS Wireless, Inc. 6.63%, 11/15/2020 (h) |

|

|

3,191,250 |

|

|

|

|

|

|

|

|

|

|

|

| |

TRANSPORTATION - 0.1% |

|

| |

3,750,000 |

|

|

DPH Holdings Corp. (c) |

|

|

121,875 |

|

| |

3,933,000 |

|

|

DPH Holdings Corp. (c) |

|

|

127,823 |

|

| |

8,334,000 |

|

|

DPH Holdings Corp. (c) |

|

|

270,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

520,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value

($) |

|

|

| |

UTILITY - 1.6% |

|

| |

5,000,000 |

|

|

Edison Mission Energy (c) |

|

|

3,812,500 |

|

| |

5,000,000 |

|

|

Texas Competitive Electric Holdings Co. LLC

11.50%, 10/01/2020 (f) |

|

|

3,700,000 |

|

| |

14,000,000 |

|

|

15.00%, 04/01/2021 (h) |

|

|

3,920,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,432,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Corporate Bonds & Notes

(Cost $170,858,250) |

|

|

104,152,208 |

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount |

|

|

|

|

| |

Foreign Corporate Bonds & Notes - 4.7% |

|

|

| |

CANADA - 1.4% |

|

| |

USD |

|

|

|

|

|

|

|

| |

10,069,000 |

|

|

Tervita Corp.

8.00%, 11/15/2018 (f) |

|

|

10,446,587 |

|

|

|

|

|

|

|

|

|

|

|

| |

FINLAND - 3.3% |

|

| |

USD |

|

|

|

|

|

|

|

| |

23,000,000 |

|

|

Nokia OYJ

5.38%, 05/15/2019 (h) |

|

|

23,977,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Foreign Corporate Bonds & Notes

(Cost $31,084,123) |

|

|

34,424,087 |

|

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

|

|

|

| |

Common Stocks - 54.4% |

|

|

| |

BROADCASTING - 2.2% |

|

| |

2,010,616 |

|

|

Communications Corp. of

America (b)(k)(j) |

|

|

16,084,928 |

|

|

|

|

|

|

|

|

|

|

|

| |

CONSUMER DISCRETIONARY - 10.4% |

|

| |

73,550 |

|

|

Apollo Group, Inc., Class A (k)(l) |

|

|

2,009,386 |

|

| |

11,050 |

|

|

Big Lots, Inc. (k)(l) |

|

|

356,804 |

|

| |

2,050 |

|

|

Coca-Cola Enterprises, Inc. (h) |

|

|

90,467 |

|

| |

52,035 |

|

|

DeVry, Inc. |

|

|

1,847,242 |

|

| |

5,050 |

|

|

Family Dollar Stores, Inc. (h)(l) |

|

|

328,099 |

|

| |

4,600 |

|

|

GameStop Corp., Class A (h) |

|

|

226,596 |

|

| |

6,425 |

|

|

Garmin, Ltd. (h) |

|

|

296,964 |

|

| |

1,512,721 |

|

|

K12, Inc. (k)(l) |

|

|

32,901,682 |

|

| |

1,103,100 |

|

|

Sony Corp. ADR (h)(l) |

|

|

19,072,599 |

|

| |

1,167,650 |

|

|

Staples, Inc. (l) |

|

|

18,553,958 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

75,683,797 |

|

|

|

|

|

|

|

|

|

|

|

| |

CONSUMER STAPLES - 0.1% |

|

| |

9,400 |

|

|

Colgate-Palmolive Co. (l) |

|

|

612,974 |

|

| |

2,650 |

|

|

Dr. Pepper Snapple Group, Inc. (l) |

|

|

129,108 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

742,082 |

|

|

|

|

|

|

|

|

|

|

|

| |

ENERGY - 0.4% |

|

| |

14,910 |

|

|

Hess Corp. (h) |

|

|

1,237,530 |

|

| |

204,000 |

|

|

Nordic American Tankers, Ltd. (m) |

|

|

1,978,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,216,330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 10 |

|

|

|

|

|

See accompanying Notes to Financial Statements. |

INVESTMENT PORTFOLIO (continued)

|

|

|

| As of December 31, 2013 |

|

NexPoint Credit Strategies Fund |

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

Value

($) |

|

|

| |

Common Stocks (continued) |

|

|

| |

FINANCIAL - 0.7% |

|

| |

1,000,000 |

|

|

Adelphia Recovery Trust (k) |

|

|

2,000 |

|

| |

46,601 |

|

|

American Banknote Corp. (b)(k) |

|

|

342,517 |

|

| |

2,500 |

|

|

Automatic Data Processing, Inc. (l) |

|

|

202,025 |

|

| |

3,900 |

|

|

Chubb Corp. (The) (l) |

|

|

376,857 |

|

| |

571,712 |

|

|

SWS Group, Inc. (k)(l) |

|

|

3,476,009 |

|

| |

12,100 |

|

|

Torchmark Corp. (l) |

|

|

945,615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,345,023 |

|

|

|

|

|

|

|

|

|

|

|

| |

GAMING & LEISURE - 0.0% |

|

| |

13 |

|

|

LLV Holdco LLC - Litigation Trust Units (b)(k)(j) |

|

|

— |

|

| |

26,712 |

|

|

LLV Holdco LLC - Series A, Membership Interest (b)(k)(j) |

|

|

— |

|

| |

144 |

|

|

LLV Holdco LLC - Series B, Membership Interest (b)(k)(j) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

| |

HEALTHCARE - 2.2% |

|

| |

13,639 |

|

|

Akorn, Inc. (h)(k) |

|

|

335,929 |

|

| |

22,600 |

|

|

Edwards Lifesciences Corp. (k)(l) |

|

|

1,486,176 |

|

| |

24,000,000 |

|

|

Genesys Ventures IA, LP (b)(k) |

|

|

13,992,000 |

|

| |

8,685 |

|

|

Myriad Genetics, Inc. (k) |

|

|

182,211 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,996,316 |

|

|

|

|

|

|

|

|

|

|

|

| |

HOUSING - 0.2% |

|

| |

368,150 |

|

|

CCD Equity Partners LLC (b)(k) |

|

|

1,126,539 |

|

|

|

|

|

|

|

|

|

|

|

| |

INFORMATION TECHNOLOGY - 5.7% |

|

| |

21,579 |

|

|

CommVault Systems, Inc. (k)(l) |

|

|

1,615,836 |

|

| |

1,098,398 |

|

|

Compuware Corp. (l) |

|

|

12,313,042 |

|

| |

16,135 |

|

|

Corning, Inc. (l) |

|

|

287,526 |

|

| |

1,360,200 |

|

|

Fortinet, Inc. (k)(l) |

|

|

26,020,626 |

|

| |

1 |

|

|

Magnachip Semiconductor Corp. (k) |

|

|

19 |

|

| |

15,050 |

|

|

Microsoft Corp. (l) |

|

|

563,321 |

|

| |

14,700 |

|

|

NetApp, Inc. (l) |

|

|

604,758 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41,405,128 |

|

|

|

|

|

|

|

|

|

|

|

| |

MEDIA & TELECOMMUNICATIONS - 18.4% |

|

| |

6,480 |

|

|

Endurance Business Media, Inc., Class A (b)(k)(j) |

|

|

— |

|

| |

18,000 |

|

|

Gray Television, Inc., Class A (k) |

|

|

232,380 |

|

| |

4,938,971 |

|

|

Media General, Inc. (k)(j) |

|

|

111,620,744 |

|

| |

308,875 |

|

|

Metro-Goldwyn-Mayer, Inc., Class A (k) |

|

|

20,771,844 |

|

| |

5,160 |

|

|

Time Warner, Inc. (l) |

|

|

359,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

132,984,723 |

|

|

|

|

|

|

|

|

|

|

|

| |

METALS & MINERALS - 0.4% |

|

| |

69,900 |

|

|

Allegheny Technologies, Inc. (l) |

|

|

2,490,537 |

|

| |

3,200 |

|

|

Reliance Steel & Aluminum Co. (l) |

|

|

242,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,733,225 |

|

|

|

|

|

|

|

|

|

|

|

| |

REAL ESTATE INVESTMENT TRUST - 12.3% |

|

| |

631,160 |

|

|

Corrections Corp. of America, REIT (l) |

|

|

20,241,301 |

|

| |

2,845,299 |

|

|

Freedom REIT (b)(j) |

|

|

42,964,014 |

|

| |

2,630,627 |

|

|

Spirit Realty Capital, Inc., REIT (l) |

|

|

25,859,064 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

89,064,379 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

Value

($) |

|

|

| |

TELECOMMUNICATIONS - 0.1% |

|

| |

45,168 |

|

|

Fairpoint Communications, Inc. (k) |

|

|

510,850 |

|

|

|

|

|

|

|

|

|

|

|

| |

TRANSPORTATION - 0.0% |

|

| |

1 |

|

|

American Airlines Group, Inc. (k) |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

| |

UTILITY - 0.7% |

|

| |

1,272,973 |

|

|

Entegra TC LLC (k) |

|

|

127,297 |

|

| |

172,263 |

|

|

NRG Energy, Inc. |

|

|

4,947,394 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,074,691 |

|

|

|

|

|

|

|

|

|

|

|

| |

WIRELESS COMMUNICATIONS - 0.6% |

|

| |

2,260,529 |

|

|

Pendrell Corp. (k) |

|

|

4,543,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks

(Cost $381,079,961) |

|

|

394,511,687 |

|

|

|

|

|

|

|

|

|

|

|

| |

Preferred Stocks (k) - 10.9% |

|

|

| |

FINANCIAL - 10.9% |

|

| |

14,500 |

|

|

Aberdeen Loan Funding, Ltd. (f) |

|

|

6,742,500 |

|

| |

1,200 |

|

|

Brentwood CLO, Ltd. (f) |

|

|

750,000 |

|

| |

3,800 |

|

|

Brentwood CLO, Ltd. (f) |

|

|

2,375,000 |

|

| |

25,250 |

|

|

Eastland CLO, Ltd. (f) |

|

|

15,564,100 |

|

| |

5,000 |

|

|

Eastland Investors Corp. (f) |

|

|

3,082,000 |

|

| |

33,500 |

|

|

Grayson CLO, Ltd., Series II (f) |

|

|

19,095,001 |

|

| |

11,000 |

|

|

Greenbriar CLO, Ltd. (f) |

|

|

8,030,000 |

|

| |

8,500 |

|

|

Red River CLO, Ltd., Series PS-2 (f) |

|

|

4,800,460 |

|

| |

10,500 |

|

|

Rockwall CDO, Ltd. (f) |

|

|

5,985,000 |

|

| |

6,000 |

|

|

Southfork CLO, Ltd. (f) |

|

|

3,000,000 |

|

| |

13,000 |

|

|

Stratford CLO, Ltd. (f) |

|

|

9,418,370 |

|

|

|

|

|

|

|

|

|

|

|

| |

REAL ESTATE - 0.0% |

|

| |

50,675 |

|

|

Allenby (b) |

|

|

— |

|

| |

660,498 |

|

|

Claymore (b) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

78,842,431 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Preferred Stocks

(Cost $81,610,247) |

|

|

78,842,431 |

|

|

|

|

|

|

|

|

|

|

|

| |

Exchange-Traded Funds (k) - 7.2% |

|

| |

23,400 |

|

|

Direxion Daily Gold Miners Bull 3x Shares, ETF (l) |

|

|

641,394 |

|

| |

27,200 |

|

|

ProShares Ultra Gold, ETF |

|

|

1,122,272 |

|

| |

2,218,215 |

|

|

ProShares Ultra Silver, ETF |

|

|

34,914,704 |

|

| |

1,294,500 |

|

|

ProShares UltraShort Russell 2000, ETF (h)(l) |

|

|

15,572,835 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Exchange-Traded Funds

(Cost $87,909,767) |

|

|

52,251,205 |

|

|

|

|

|

|

|

|

|

|

|

|

| Units |

|

|

|

|

| |

Rights (k) - 14.7% |

|

|

| |

TRANSPORTATION - 14.7% |

|

| |

4,104,743 |

|

|

AAL, expires 04/11/14 |

|

|

106,846,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Rights

(Cost $24,303,039) |

|

|

106,846,449 |

|

|

|

|

|

|

|

|

|

|

|

| |

Warrants (b)(k) - 0.0% |

|

|

| |

GAMING & LEISURE - 0.0% |

|

| |

602 |

|

|

LLV Holdco LLC - Series C, Membership Interest, expires 07/15/15 |

|

|

— |

|

|

|

|

|

|

|

|

| See accompanying Notes to Financial Statements. |

|

|

|

|

|

11 |

INVESTMENT PORTFOLIO (continued)

|

|

|

| As of December 31, 2013 |

|

NexPoint Credit Strategies Fund |

|

|

|

|

|

|

|

|

|

|

|

| Units |

|

Value

($) |

|

|

| |

Warrants (continued) |

|

|

| |

GAMING & LEISURE (continued) |

|

| |

828 |

|

|

LLV Holdco LLC - Series D, Membership Interest, expires 07/15/15 |

|

|

— |

|

| |

925 |

|

|

LLV Holdco LLC - Series E, Membership Interest, expires 07/15/15 |

|

|

— |

|

| |

1,041 |

|

|

LLV Holdco LLC - Series F, Membership Interest, expires 07/15/15 |

|

|

— |

|

| |

1,179 |

|

|

LLV Holdco LLC - Series G, Membership Interest, expires 07/15/15 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Gaming/Leisure

(Cost $—) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Warrants (Cost $—) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

|

|

|

| |

Investment Companies (n) - 0.3% |

|

| |

1,919,814 |

|

|

State Street Navigator Prime Securities Lending Portfolio |

|

|

1,919,814 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investment Companies

(Cost $1,919,814) |

|

|

1,919,814 |

|

|

|

|

|

|

|

|

|

|

| |

Total Investments - 147.9% |

|

|

1,071,480,779 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Cost $1,095,636,624) (o) |

|

|

|

|

|

|

| |

Securities Sold Short (p) - (12.8)% |

|

|

|

|

|

|

| |

Common Stocks - (9.7)% |

|

|

|

|

|

|

| |

INFORMATION TECHNOLOGY - (7.8)% |

|

|

|

|

| |

1,162,850 |

|

|

Oracle Corp. |

|

|

(44,490,641 |

) |

| |

268,200 |

|

|

Teradata Corp. (q) |

|

|

(12,200,418 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(56,691,059 |

) |

|

|

|

|

|

|

|

|

|

|

| |

HEALTHCARE - (0.3)% |

|

| |

16,000 |

|

|

Alexion Pharmaceuticals, Inc. (q) |

|

|

(2,128,960 |

) |

|

|

|

|

|

|

|

|

|

|

| |

ENERGY - (1.6)% |

|

| |

434,800 |

|

|

Chesapeake Energy Corp. |

|

|

(11,800,472 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks

(Proceeds $62,268,984) |

|

|

(70,620,491 |

) |

|

|

|

|

|

|

|

|

|

|

| |

Exchange-Traded Funds (q) - (3.1)% |

|

| |

152,100 |

|

|

iShares Russell 2000 Index Fund, ETF |

|

|

(17,538,651 |

) |

| |

141,050 |

|

|

ProShares Ultra DJ-UBS Crude Oil, ETF |

|

|

(4,544,631 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Exchange-Traded Funds

(Proceeds $19,233,745) |

|

|

(22,083,282 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Securities Sold Short

(Proceeds $81,502,729) |

|

|

(92,703,773 |

) |

|

|

|

|

|

|

|

|

|

| |

Other Assets & Liabilities, Net – (35.1)% |

|

|

(254,292,010 |

) |

|

|

|

|

|

|

|

|

|

| |

Net Assets – 100.0% |

|

|

724,484,996 |

|

|

|

|

|

|

|

|

|

|

| (a) |

Senior loans (also called bank loans, leveraged loans, or floating rate loans) in which the Fund invests generally pay interest at rates which are periodically determined by

reference to a base lending rate plus a spread (unless otherwise identified, all senior loans carry a variable rate of interest). These base lending rates are generally (i) the Prime Rate offered by one or more major United States banks,

(ii) the lending rate offered by one or more European banks such as the London Interbank Offered Rate (“LIBOR”) or (iii) the Certificate of Deposit rate. Rate shown represents the weighted average rate at December 31, 2013.

Senior loans, while exempt from registration under the Securities Act of 1933 (the “1933 Act”), contain certain restrictions on resale and cannot be sold publicly. Senior secured floating rate loans often require prepayments from excess

cash flow or permit the borrower to repay at its election. The degree to which borrowers repay, whether as a contractual requirement or at their election, cannot be predicted with accuracy. As a result, the actual remaining maturity may be

substantially less than the stated maturity shown. |

| (b) |

Represents fair value as determined by the Fund’s Board of Trustees (the “Board”), or its designee in good faith, pursuant to the policies and procedures approved

by the Board. Securities with a total aggregate value of $119,107,851, or 16.4% of net assets, were fair valued under the Fund’s valuation procedures as of December 31, 2013. |

| (c) |

The issuer is, or is in danger of being, in default of its payment obligation. Income is not being accrued. |

| (d) |

All or a portion of this position has not settled. Full contract rates do not take effect until settlement date. |

| (e) |

Fixed rate senior loan. |

| (f) |

Securities exempt from registration under Rule 144A of the 1933 Act. These securities may only be resold in transactions exempt from registration to qualified institutional

buyers. At December 31, 2013, these securities amounted to $309,606,563, or 42.7% of net assets. |

| (g) |

Variable or floating rate security. The interest rate shown reflects the rate in effect December 31, 2013. |

| (h) |

All or part of the security is pledged as collateral for the Committed Facility Agreement with BNPP PB, Inc. The market value of the securities pledged as collateral was

$257,949,624. See Note 6. |

| (i) |

Step coupon bond. The interest rate shown reflects the rate in effect December 31, 2013 and will reset at a future date. |

| (j) |

Affiliated issuer. Assets with a total aggregate market value of $170,669,686, or 23.6% of net assets, were affiliated with the Fund as of December 31, 2013.

|

| (k) |

Non-income producing security. |

| (l) |

All or part of this security is pledged as collateral for short sales. The market value of the securities pledged as collateral was $105,001,041. |

| (m) |

Securities (or a portion of securities) on loan. As of December 31, 2013, the market value of securities loaned was $1,909,969. The loaned securities were secured with cash

collateral of $1,919,814. Collateral is calculated based on prior day’s prices. See Note 4. |

| (n) |

Represents investments of cash collateral received in connection with securities lending. |

| (o) |

Cost for U.S. federal income tax purposes is $1,104,139,219. |

| (p) |

As of December 31, 2013, $75,438,228 in cash was segregated or on deposit with the brokers to cover investments sold short and is included in “Other Assets &

Liabilities, Net.” |

| (q) |

No dividend payable on security sold short. |

Currency

Abbreviations:

|

|

|

| EUR |

|

Euro Currency |

| GBP |

|

British Pound |

|