UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number 001-33169

Creative Realities, Inc.

(Exact name of registrant as specified in its charter)

| Minnesota | 41-1967918 | |

| State or other jurisdiction of incorporation or organization |

I.R.S. Employer Identification No. | |

| 13100 Magisterial Drive, Suite 100, Louisville KY | 40223 | |

| Address of principal executive offices | Zip Code |

(502) 791-8800

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name

of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | CREX | The Nasdaq Stock Market LLC | ||

| Warrants to purchase Common Stock | CREXW | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company ☒ | |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates was $9,379,858 as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of March 11, 2020, the registrant had 9,794,971 shares of common stock outstanding.

TABLE OF CONTENTS

| i |

| ITEM 1 | BUSINESS |

(All currency is rounded to the nearest thousands, except share and per share amounts.)

Our Company

Creative Realities, Inc. is a Minnesota corporation (the “Company”) that provides innovative digital marketing technology and solutions to retail companies, individual retail brands, enterprises and organizations throughout the United States and in certain international markets. The Company has expertise in a broad range of existing and emerging digital marketing technologies, as well as the related media management and distribution software platforms and networks, device management, product management, customized software service layers, systems, experiences, workflows, and integrated solutions. Our technology and solutions include: digital merchandising systems and omni-channel customer engagement systems, interactive digital shopping assistants, advisors and kiosks, and other interactive marketing technologies such as mobile, social media, point-of-sale transactions, beaconing and web-based media that enable our customers to transform how they engage with consumers. We have expertise in a broad range of existing and emerging digital marketing technologies, as well as the following related aspects of our business: content, network management, and connected device software and firmware platforms; customized software service layers; hardware platforms; digital media workflows; and proprietary processes and automation tools. We believe we are one of the world’s leading interactive marketing technology companies that focuses on the retail shopper experience by helping retailers and brands use the latest technologies to create better shopping experiences.

On November 20, 2018, we closed on our acquisition of Allure Global Solutions, Inc. (the “Allure Acquisition”). While the Allure Acquisition expanded our operations, geographical footprint and customer base and also enhanced our current product offerings, the core business of Allure is consistent with the operations of Creative Realties, Inc.

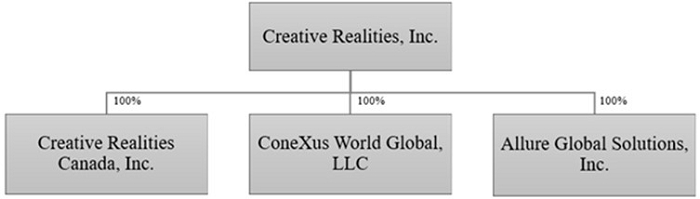

Our main operations are conducted directly through Creative Realities, Inc., and under our wholly owned subsidiaries Allure Global Solutions, Inc., a Georgia corporation, Creative Realities Canada, Inc., a Canadian corporation, and ConeXus World Global, LLC, a Kentucky limited liability company. Our other wholly owned subsidiary Creative Realities, LLC, a Delaware limited liability company, has been effectively dormant since October 2015, the date of the merger with ConeXus World Global, LLC.

We generate revenue in this business by:

| ● | consulting with our customers to determine the technologies and solutions required to achieve their specific goals, strategies and objectives; |

| ● | designing our customers’ digital marketing experiences, content and interfaces; |

| ● | engineering the systems architecture delivering the digital marketing experiences we design – both software and hardware – and integrating those systems into a customized, reliable and effective digital marketing experience; |

| ● | managing the efficient, timely and cost-effective deployment of our digital marketing technology solutions for our customers; |

| ● | delivering and updating the content of our digital marketing technology solutions using a suite of advanced media, content and network management software products; and |

| ● | maintaining our customers’ digital marketing technology solutions by: providing content production and related services; creating additional software-based features and functionality; hosting the solutions; monitoring solution service levels; and responding to and/or managing remote or onsite field service maintenance, troubleshooting and support calls. |

These activities generate revenue through: bundled-solution sales; consulting services, experience design, content development and production, software development, engineering, implementation, and field services; software license fees; and maintenance and support services related to our software, managed systems and solutions.

We currently market and sell our technology and solutions primarily through our sales and business development personnel, but we also utilize agents, strategic partners, and lead generators who provide us with access to additional sales, business development and licensing opportunities.

1

Our digital marketing technology solutions have application in a wide variety of industries. The industries in which we sell our solutions are established and include automotive, apparel & accessories, banking, baby/children, beauty, CPG, department stores, digital out-of-home (“DOOH”), electronics, fashion, fitness, foodservice/quick service restaurant (“QSR”), financial services, gaming, luxury, mass merchants, mobile operators, and pharmacy retail; however, the planning, development, implementation and maintenance of technology-enabled experiences involving combinations of digital marketing technologies is relatively new and evolving. Moreover, a number of participants in these industries have only recently started considering or expanding the adoption of these types of technologies, solutions and experiences as part of their overall marketing strategies. As a result, we remain without an established history of profitability.

We believe that the adoption and evolution of digital marketing technology solutions will increase substantially in years to come both in the industries in which we currently focus and in others. We also believe that adoption of our solutions depends not only upon the services and solutions that we provide but also upon the cost of hardware used to process and display content. While the costs of hardware configurations and software media players have historically decreased and we believe they will continue to do so at an accelerating rate, flat panel displays and players typically constitute a large portion of the expenditure customers make relative to the entire cost of implementing a digital marketing system implementation and can be a barrier to customer deployment. As a result, we believe that the broader adoption of digital marketing technology solutions is likely to increase, although we cannot predict the rate at which such adoption will occur.

Another key component of our business strategy, given the evolving dynamics of the industry in which we operate, is to acquire and integrate other operating companies in the industry in conjunction with pursuing our organic growth objectives. We believe that the selective acquisition and successful integration of certain companies will: accelerate our growth in targeted vertical and operating markets; enable us to cost-effectively aggregate multiple customer bases onto a single business and technology platform; provide us with greater operating scale on a consolidated basis; enable us to leverage a common set of processes and tools, and cost efficiencies company-wide; and ultimately result in higher operating profitability and cash flow from operations. Our management team evaluates acquisition opportunities on an ongoing basis. Our management team and Board of Directors have broad experience with the execution, integration and financing of acquisitions. We believe that, based on the foregoing, we can successfully serve as a consolidator of multiple business and technology platforms serving similar markets.

You may read and copy any materials we file with the SEC at the SEC’s public reference room at 100 F Street NE, Washington, DC 20549. The public may obtain information about the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The website of the SEC is www.sec.gov. Additional information about the Company and its public disclosures is available on our website at www.cri.com.

Corporate Organization

Our principal offices are located at 13100 Magisterial Drive, Ste 100, Louisville, Kentucky 40223, and our telephone number at that office is (502) 791-8800.

We originally incorporated and organized as a Minnesota corporation under the name Wireless Ronin Technologies, Inc. in March 2003. Our business initially focused on the provision of expertise in digital media marketing solutions to customers, including digital signage, interactive kiosks, mobile, social media and web-based media solutions. We acquired the assets and business of Broadcast International, Inc., a Utah corporation and public registrant, through a merger transaction that was effective as of August 1, 2014. Then on August 20, 2014, we consummated a merger transaction with Creative Realities, LLC, a privately owned Delaware limited liability company, in which we issued a majority of our issued and outstanding shares of common stock. In that merger transaction, we acquired the interactive marketing technology business of Creative Realities that we currently operate. Shortly after that merger, we changed our corporate name from Wireless Ronin Technologies, Inc. to “Creative Realities, Inc.” On October 15, 2015, we acquired the assets and business of ConeXus World Global, LLC, a privately-owned Kentucky limited liability company for which we issued preferred and common stock. In that merger transaction, we acquired the systems integration and marketing technology business of ConeXus World that we currently operate. On May 23, 2016, we dissolved Broadcast International, Inc. On November 20, 2018, we acquired Allure Global Solutions, Inc. (“Allure”), an enterprise software development company (as further described below).

2

Our corporate structure, including our principal operating subsidiaries, is as follows:

Our fiscal year ends December 31. Neither we nor any of our predecessors have been in bankruptcy, receivership or any similar proceeding.

Business Strategy

We believe that our existing business model is highly scalable and can be expanded successfully as we continue to grow organically and integrate our recent merger transactions, acquire and integrate other companies which operate directly in our target markets, strengthen our operational practices and procedures, further streamline our administrative office functions, and continue to capitalize on various marketing programs and activities.

Industry Background

Over approximately the past 18-36 months, we believe certain digital marketing technology industry trends are creating the opportunity for retailers, brands, venue-operators, enterprises, non-profits and other organizations to create innovative shopping, marketing, and informational experiences for their customers and other stakeholders in various venues worldwide. These trends include: (i) the expectations of technology-savvy consumers; (ii) addressing on-line competitors by improving physical experiences; (iii) accelerating decline in the cost of hardware configurations (primarily flat panel displays) and software media players; (iv) the continued evolution of mobile, social, software and hardware technologies, applications and tools; (v) increasing sophistication of social networking platforms; (vi) increasingly complex customer requirements related to their specific digital marketing technology and solution objectives; and (vii) customers challenging service providers with the delivery of a satisfactory consumer experience with the traditional pressure on reducing installation and ongoing operating costs.

3

As a result, a growing number of retailers, brands, venue-operators and other organizations have identified the need and opportunity to implement increasingly cost-effective and “sales-lifting” digital marketing, and interactive experiences to market to their customers. These experiences include creating unique and customized experiences for targeted, timely offerings and relevant promotions; improving engagement resulting in increased sales; and increasing shopping basket size. We believe our clients consider capitalizing on these industry trends to be increasingly critical to any successful “store of the future” retail and brand sales environment, especially where sales staff turnover is high, training outcomes are inconsistent and product knowledge is low.

Companies are accomplishing their strategies by implementing various digital marketing technology solutions, which: are implemented in multiple forms and types of configurations and locations; attempt to achieve any of a broad range of individual or combination of objectives; contain various levels of targeting; have the ability to instantly manage single or multiple locations remotely from a customer’s desktop or other connected device at each location; and are built to deliver or contain a standard or customized experience unique to and within the customer’s environment. Examples of such solutions include:

| ● | Digital Merchandising Systems, which aim to inform and interact with customers through various types of content in an integrated experience, improve in-store customer experiences and increase overall sales, upsells, and/or cross-sales; | |

| ● | Digital Sales Assistants, which aim to replace or augment existing sales resources and the level of interactive and informational sales assistance inside the store; | |

| ● | Digital Way-Finders, which aim to help customers navigate their way around individual retail stores and multi-store locations or venues, or within individual brand categories; | |

| ● | Digital Kiosks, which aim to provide data, specialized and customized broadcasts, promotional information and coupons, train, and other forms of information and interaction with customers in a variety of deployment forms, types, configurations and experiences;

| |

|

● | Digital Menu-Board Systems, which aim to enable various types of restaurant operators the ability to remotely and on a scheduled basis, update and modify menu information, promotions, and other forms of content dynamically; |

| ● | Dynamic Digital Signage which aims to deliver and manage in-store marketing and advertising campaigns, specialized and customized broadcasts, and various other forms of messaging targeting customers in a particular experience or environment. |

Our Markets

We currently market and sell our marketing technology solutions through our direct sales force, inside sales team, and word-of-mouth referrals from existing customers. Select strategic partnerships and lead generation programs also drive business to the Company through targeted business development initiatives. We market to companies that seek digital marketing solutions across multiple connected devices and who specifically seek or could benefit from enhancements to the customer experience offered in their stores, venues, brands or organizations.

Our digital marketing technology solutions have application in a wide variety of industries. The industries in which we sell our solutions are established and include automotive, apparel & accessories, banking, baby/children, beauty, CPG, department stores, digital out-of-home (“DOOH”), electronics, fashion, fitness, foodservice/quick service restaurant (“QSR”), financial services, gaming, luxury, mass merchants, mobile operators, and pharmacy retail; however, the planning, development, implementation and maintenance of technology-enabled experiences involving combinations of digital marketing technologies is relatively new and evolving. Moreover, a number of participants in these industries have only recently started considering or expanding the adoption of these types of technologies, solutions and experiences as part of their overall marketing strategies.

4

Seasonality

A portion of our customer activity is influenced by seasonal effects related to traditional end of calendar year peak retail sales periods and certain other factors that arise from our target customer base. Nevertheless, our revenues can be materially affected by the launch of new markets, the timing of production rollouts, and other factors, any of which have the ability to reduce or outweigh certain seasonal effects.

Effect of General Economic Conditions on our Business

We believe that demand for our services will increase in part as a result of new construction and remodeling activities of pre-existing retail, convenience store, stadium and event venues. While we do see reductions in retail footprints across the U.S., we see a continued focus on integration of digital into the retail marketplace and a focus on digital refreshes within the retail space to stay relevant in an evolving e-commerce marketplace. Recent general economic improvements generally make it easier for our customers to justify decisions to invest in digital marketing technology solutions. A change in the macroeconomic trend in the U.S. could have a negative impact on our customers’ ability and/or willingness to advance their digital initiatives.

Regulation

We are subject to regulation by various federal and state governmental agencies. Such regulation includes radio frequency emission regulatory activities of the U.S. Federal Communications Commission, the consumer protection laws of the U.S. Federal Trade Commission, product safety regulatory activities of the U.S. Consumer Product Safety Commission, and environmental regulation in areas in which we conduct business. Some of the hardware components that we supply to customers may contain hazardous or regulated substances, such as lead. A number of U.S. states have adopted or are considering “takeback” bills addressing the disposal of electronic waste, including CRT style and flat panel monitors and computers. Electronic waste legislation is developing. Some of the bills passed or under consideration may impose on us, or on our customers or suppliers, requirements for disposal of systems we sell and the payment of additional fees to pay costs of disposal and recycling. Presently, we do not believe that any such legislation or proposed legislation will have a materially adverse impact on our business.

Competition

While we believe there is presently no direct competitor with the comprehensive offering of technologies, solutions and services we provide to our customers, there are multiple individual competitors who offer pieces of our solutions. These include digital signage software companies such as Stratacache, Four Winds Interactive, and Reflect Systems; marketing services companies such as Sapient Nitro or digital signage systems integrators such as Convergent Media Systems. Some of these competitors may have significantly greater financial, technical and marketing resources than we do and may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. We believe that our sales and business development capabilities, network operations / field service management capabilities, our comprehensive offering of digital marketing technology and solutions, brand awareness, and proprietary processes are the primary factors affecting our competitive position.

Major Customers

We had one (1) and two (2) customers that accounted for 18.5% and 48.3% of revenue for the years ended December 31, 2019 and 2018, respectively.

Decisions by one or more of these key customers to not renew, terminate or substantially reduce their use of our products, technology, services, and platform could substantially slow our revenue growth and lead to a decline in revenue. Our business plan assumes continued growth in revenue, and it is unlikely that we will become profitable without a continued increase in revenue.

For the years ended December 31, 2019 and 2018, we had sales of $1,103 (3.5% of consolidated sales) and $1,566 (6.9% of consolidated sales), respectively, with 33 Degrees Convenience Connect, Inc., a related party that is approximately 17.5% owned by a member of our senior management (“33 Degrees”).

Territories

We sell products and services primarily throughout North America.

Employees

We have approximately 100 employees as of March 12, 2020. We do not have any employees that operate under collective-bargaining agreements.

5

| ITEM 1A | RISK FACTORS |

Our business involves a high degree of risk. In evaluating our business, you should carefully consider the specific risks described below, and any risks described in our other filings with the Securities and Exchange Commission, pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934. Any of the risks we describe below could cause our business, financial condition, results of operations or future prospects to be materially adversely affected. In addition, some of the following statements are forward-looking statements. For more information about forward-looking statements, please see the “Forward-Looking Statements” section included in Item 7 of this Annual Report. Amounts within the “Risk Factors” section are stated in thousands with the exception of share information.

RISKS RELATED TO OUR BUSINESS AND OUR INDUSTRY

We have generally incurred losses, and may never become or remain profitable.

Except for the second, third and fourth quarters of 2019, we have incurred historical net losses. As of and for the year-ended December 31, 2019 we have a working capital deficit and have had negative cash flows from operations. We incurred a net loss for the year ended December 31, 2018. While we have been able to achieve profitability in recent periods, it is uncertain whether we will be able to sustain or increase our profitability in successive periods.

We have formulated our business plans and strategies based on certain assumptions regarding the acceptance of our business model and the marketing of our products and services. Nevertheless, our assessments regarding market size, market share, market acceptance of our products and services and a variety of other factors may prove incorrect. Our future success will depend upon many factors, including factors beyond our control and those that cannot be predicted at this time.

Our digital marketing business is evolving in a rapidly changing market, and we cannot ensure the long-term successful operation of our business or the execution of our business plan.

Our digital marketing technology and solutions are an evolving business offering and the markets in which we compete are rapidly changing. As a result, our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by growing companies in new and rapidly evolving markets. We may be unable to accomplish any of the following, which would materially impact our ability to implement our business plan:

| ● | establishing and maintaining broad market acceptance of our technology, solutions, services, and platforms, and converting that acceptance into direct and indirect sources of revenue; |

| ● | establishing and maintaining adoption of our technology, solutions, services, and platforms in and on a variety of environments, experiences, and device types; |

| ● | timely and successfully developing new technology, solution, service, and platform features, and increasing the functionality and features of our existing technology, solution, service, and platform offerings; |

| ● | developing technology, solutions, services, and platforms that result in a high degree of customer satisfaction and a high level of end-customer usage; |

| ● | successfully responding to competition, including competition from emerging technologies and solutions; |

| ● | developing and maintaining strategic relationships to enhance the distribution, features, content and utility of our technology, solutions, services, and platforms; |

| ● | identifying, attracting and retaining talented engineering, network operations, program management, technical services, creative services, and other personnel at reasonable market compensation rates in the markets in which we employ such personnel; and |

| ● | integration of acquisitions. |

Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable to successfully accomplish these tasks, our business will be harmed.

6

Adequate funds for our operations may not be available, requiring us to raise additional financing or else curtail our activities significantly.

We will likely be required to raise additional funding through public or private financings, including equity financings, through 2020. Any additional equity financings may be dilutive to shareholders and may be completed at a discount to the then-current market price of our securities. Debt financing, if available, would likely involve restrictive covenants on our operations or pertaining to future financing arrangements. Nevertheless, we may not successfully complete any future equity or debt financing. Adequate funds for our operations, whether from financial markets, collaborative or other arrangements, may not be available when needed or on terms attractive to us. If adequate funds are not available, our plans to operate our business may be adversely affected and we could be required to curtail our activities significantly and/or cease operating.

We are reliant on the continued support of a related party for adequate financing of our operations.

As of the date of this filing, our majority shareholder and investor, Slipstream Communications LLC (“Slipstream”) is the holder of 79.3% of our outstanding debt instruments including a term loan, secured revolving promissory note, secured escrow disbursement note, and secured special promissory note and has beneficial ownership of approximately 39.28% of our common stock (on an as-converted, fully diluted basis including conversion of outstanding warrants, and assuming no other convertible securities, options and warrants are converted or exercised by other parties) as of December 31, 2019. Slipstream has also provided us with a continued support letter through March 31, 2021. If we are unable to extend the maturity or replace our existing financing agreements in the future, our plans to operate our business may be adversely affected and we could be required to curtail our activities significantly and/or cease operating.

We may be unable to implement our business plan if we cannot raise sufficient capital and may be required to pay a high price for capital.

We need to obtain additional capital to implement our business plan and meet our financial obligations as they become due. We may not be able to raise the additional capital needed or may be required to pay a high price for capital. Factors affecting the availability and price of capital may include the following:

| ● | the availability and cost of capital generally; |

| ● | our financial results; |

| ● | the experience and reputation of our management team; |

| ● | market interest, or lack of interest, in our industry and business plan; |

| ● | the trading volume of, and volatility in, the market for our common stock and warrants; |

| ● | our ongoing success, or failure, in executing our business plan; |

| ● | the amount of our capital needs; and |

| ● | the amount of debt, options, warrants, and convertible securities we have outstanding. |

We may be unable to meet our current or future obligations or to adequately exploit existing or future opportunities if we cannot raise sufficient capital. If we are unable to obtain capital for an extended period of time, we may be forced to discontinue operations.

7

We expect that there will be significant consolidation in our industry. Our failure or inability to lead that consolidation would have a severe adverse impact on our access to financing, customers, technology, and human resources.

Our industry is currently composed of a large number of relatively small businesses, no single one of which is dominant or which provides integrated solutions and product offerings incorporating much of the available technology. Accordingly, we believe that substantial consolidation may occur in our industry in the near future. If we do not play a positive role in that consolidation, either as a leader or as a participant whose capability is merged in a larger entity, we may be left out of this process, with product offerings of limited value compared with those of our competitors. Moreover, even if we lead the consolidation process, the market may not validate the decisions we make in that process.

Our success depends on our interactive marketing technologies achieving and maintaining widespread acceptance in our targeted markets.

Our success will depend to a large extent on broad market acceptance of our interactive marketing technologies among our current and prospective customers. Our prospective customers may still not use our solutions for a number of other reasons, including preference for static advertising, lack of familiarity with our technology, preference for competing technologies or perceived lack of reliability. We believe that the acceptance of our interactive marketing technologies by prospective customers will depend primarily on the following factors:

| ● | our ability to demonstrate the economic and other benefits attendant to our interactive marketing technologies; |

| ● | our customers becoming comfortable with using our interactive marketing technologies; and |

| ● | the reliability of our interactive marketing technologies. |

Our interactive technologies are complex and must meet stringent user requirements. Some undetected errors or defects may only become apparent as new functions are added to our technologies and products. The need to repair or replace products with design or manufacturing defects could temporarily delay the sale of new products and adversely affect our reputation. Delays, costs and damage to our reputation due to product defects could harm our business.

Our financial condition and potential for continued net losses may negatively impact our relationships with customers, prospective customers and third-party suppliers.

Our financial condition and potential for continued net losses may cause current and prospective customers to defer placing orders with us, to require terms that are less favorable to us, or to place their orders with our competitors, which could adversely affect our business, financial condition and results of operations. On the same basis, third-party suppliers may refuse to do business with us, or may do so only on terms that are unfavorable to us, which also could cause our expenses to increase.

Because we do not have long-term purchase commitments from our customers, the failure to obtain anticipated orders or the deferral or cancellation of commitments could have adverse effects on our business.

Our business is characterized by short-term purchase orders and contracts that do not require that purchases be made by our customers. This makes forecasting our sales difficult. The failure to obtain anticipated orders and deferrals or cancellations of purchase commitments because of changes in customer requirements, or otherwise, could have a material adverse effect on our business, financial condition and results of operations. We have experienced such challenges in the past and may experience such challenges in the future.

8

Our continued growth and financial performance could be adversely affected by the loss of several key customers, including a significant related party customer.

Our largest customers account for a significant portion of our total revenue on a consolidated basis. We had one (1) and two (2) customers that accounted for 18.5% and 48.3% of revenue for the years ended December 31, 2019 and 2018, respectively.

Decisions by one or more of these key customers to not renew, terminate or substantially reduce their use of our products, technology, services, and platform could substantially slow our revenue growth and lead to a decline in revenue. Our business plan assumes continued growth in revenue, and it is unlikely that we will become profitable without a continued increase in revenue.

Most of our contracts are terminable by our customers with limited notice and without penalty payments, and early terminations could have a material effect on our business, operating results and financial condition.

Most of our contracts are terminable by our customers following limited notice and without early termination payments or liquidated damages due from them. In addition, each stage of a project often represents a separate contractual commitment, at the end of which the customers may elect to delay or not to proceed to the next stage of the project. We cannot assure you that one or more of our customers will not terminate a material contract or materially reduce the scope of a large project. The delay, cancellation or significant reduction in the scope of a large project or a number of projects could have a material adverse effect on our business, operating results and financial condition.

It is common for our current and prospective customers to take a long time to evaluate our products, most especially during economic downturns that affect our customers’ businesses. The lengthy and variable sales cycle makes it difficult to predict our operating results.

It is difficult for us to forecast the timing and recognition of revenue from sales of our products and services because our actual and prospective customers often take significant time to evaluate our products before committing to a purchase. Even after making their first purchases of our products and services, existing customers may not make significant purchases of those products and services for a long period of time following their initial purchases, if at all. The period between initial customer contact and a purchase by a customer may be years with potentially an even longer period separating initial purchases and any significant purchases thereafter. During the evaluation period, prospective customers may decide not to purchase or may scale down proposed orders of our products for various reasons, including:

| ● | reduced need to upgrade existing visual marketing systems; |

| ● | introduction of products by our competitors; |

| ● | lower prices offered by our competitors; and |

| ● | changes in budgets and purchasing priorities. |

Our prospective customers routinely require education regarding the use and benefit of our products. This may also lead to delays in receiving customers’ orders.

9

Our industry is characterized by frequent technological change. If we are unable to adapt our products and services and develop new products and services to keep up with these rapid changes, we will not be able to obtain or maintain market share.

The market for our products and services is characterized by rapidly changing technology, evolving industry standards, changes in customer needs, heavy competition and frequent new product and service introductions. If we fail to develop new products and services or modify or improve existing products and services in response to these changes in technology, customer demands or industry standards, our products and services could become less competitive or obsolete.

We must respond to changing technology and industry standards in a timely and cost-effective manner. We may not be successful in using new technologies, developing new products and services or enhancing existing products and services in a timely and cost-effective manner. Furthermore, even if we successfully adapt our products and services, these new technologies or enhancements may not achieve market acceptance.

A portion of our business involves the use of software technology that we have developed or licensed. Industries involving the ownership and licensing of software-based intellectual property are characterized by frequent intellectual-property litigation, and we could face claims of infringement by others in the industry. Such claims are costly and add uncertainty to our operational results.

A portion of our business involves our ownership and licensing of software. This market space is characterized by frequent intellectual property claims and litigation. We could be subject to claims of infringement of third-party intellectual-property rights resulting in significant expense and the potential loss of our own intellectual property rights. From time to time, third parties may assert copyright, trademark, patent or other intellectual property rights to technologies that are important to our business. Any litigation to determine the validity of these claims, including claims arising through our contractual indemnification of our business partners, regardless of their merit or resolution, would likely be costly and time consuming and divert the efforts and attention of our management and technical personnel. If any such litigation resulted in an adverse ruling, we could be required to:

| ● | pay substantial damages; |

| ● | cease the development, use, licensing or sale of infringing products; |

| ● | discontinue the use of certain technology; or |

| ● | obtain a license under the intellectual property rights of the third party claiming infringement, which license may not be available on reasonable terms or at all. |

Our proprietary platform architectures and data tracking technology underlying certain of our services are complex and may contain unknown errors in design or implementation that could result in system performance failures or inability to scale.

The platform architecture, data tracking technology and integration layers underlying our proprietary platforms, our contract administration, procurement, timekeeping, content and network management, network services, device management, virtualized services, software automation and other tools, and back-end services are complex and include software and code used to generate customer invoices. This software and code are developed internally, licensed from third parties, or integrated by in-house personnel and third parties. Any of the system architecture, system administration, integration layers, software or code may contain errors, or may be implemented or interpreted incorrectly, particularly when they are first introduced or when new versions or enhancements to our tools and services are released. Consequently, our systems could experience performance failure, or we may be unable to scale our systems, which may:

| ● | adversely impact our relationship with customers and others who experience system failure, possibly leading to a loss of affected and unaffected customers; |

| ● | increase our costs related to product development or service delivery; or |

| ● | adversely affect our revenues and expenses. |

10

Our business may be adversely affected by malicious applications that interfere with, or exploit security flaws in, our products and services.

Our business may be adversely affected by malicious applications that make changes to our customers’ computer systems and interfere with the operation and use of our products or products that impact our business. These applications may attempt to interfere with our ability to communicate with our customers’ devices. The interference may occur without disclosure to or consent from our customers, resulting in a negative experience that our customers may associate with our products and services. These applications may be difficult or impossible to uninstall or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. The ability to provide customers with a superior interactive marketing technology experience is critical to our success. If our efforts to combat these malicious applications fail, or if our products and services have actual or perceived vulnerabilities, there may be claims based on such failure or our reputation may be harmed, which would damage our business and financial condition.

We compete with other companies that have more resources, which puts us at a competitive disadvantage.

The market for interactive marketing technologies is generally highly competitive and we expect competition to increase in the future. Some of our competitors or potential competitors may have significantly greater financial, technical and marketing resources than us. These competitors may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. They may also devote greater resources to the development, promotion and sale of their products than us.

We expect competitors to continue to improve the performance of their current products and to introduce new products, services and technologies. Successful new product and service introductions or enhancements by our competitors could reduce sales and the market acceptance of our products and services, cause intense price competition or make our products and services obsolete. To be competitive, we must continue to invest significant resources in research and development, sales and marketing and customer support. If we do not have sufficient resources to make these investments or are unable to make the technological advances necessary to be competitive, our competitive position will suffer. Increased competition could result in price reductions, fewer customer orders, reduced margins and loss of market share. Our failure to compete successfully against current or future competitors could adversely affect our business and financial condition.

Our future success depends on key personnel and our ability to attract and retain additional personnel.

Our key personnel include our:

| ● | Chief Executive Officer; |

| ● | Chief Financial Officer; and | |

| ● | Vice President of Operations |

If we fail to retain our key personnel or to attract, retain and motivate other qualified employees, our ability to maintain and develop our business may be adversely affected. Our future success depends significantly on the continued service of our key technical, sales and senior management personnel and their ability to execute our growth strategy. The loss of the services of our key employees could harm our business. We may be unable to retain our employees or to attract, assimilate and retain other highly qualified employees who could migrate to other employers who offer competitive or superior compensation packages.

Unpredictability in financing markets could impair our ability to grow our business through acquisitions.

We anticipate that opportunities to acquire similar businesses will materially depend on, among other things, the availability of financing alternatives with acceptable terms. As a result, poor credit and other market conditions or uncertainty in financial markets could materially limit our ability to grow through acquisitions since such conditions and uncertainty make obtaining financing more difficult.

11

We are subject to cyber security risks and interruptions or failures in our information technology systems and will likely need to expend additional resources to enhance our protection from such risks. Notwithstanding our efforts, a cyber incident could occur and result in information theft, data corruption, operational disruption and/or financial loss.

We depend on digital technologies to process and record financial and operating data and rely on sophisticated information technology systems and infrastructure to support our business, including process control technology. At the same time, cyber incidents, including deliberate attacks, have increased. The U.S. government has issued public warnings that indicate that energy assets might be specific targets of cyber security threats. Our technologies, systems and networks and those of our vendors, suppliers and other business partners may become the target of cyberattacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss or destruction of proprietary and other information, or other disruption of business operations. In addition, certain cyber incidents, such as surveillance, may remain undetected for an extended period. Our systems for protecting against cyber security risks may not be sufficient. As the sophistication of cyber incidents continues to evolve, we will likely be required to expend additional resources to continue to modify or enhance our protective measures or to investigate and remediate any vulnerability to cyber incidents. Additionally, any of these systems may be susceptible to outages due to fire, floods, power loss, telecommunications failures, usage errors by employees, computer viruses, cyber-attacks or other security breaches or similar events. The failure of any of our information technology systems may cause disruptions in our operations, which could adversely affect our revenues and profitability.

Our reliance on information management and transaction systems to operate our business exposes us to cyber incidents and hacking of our sensitive information if our outsourced service provider experiences a security breach.

Effective information security internal controls are necessary for us to protect our sensitive information from illegal activities and unauthorized disclosure in addition to denial of service attacks and corruption of our data. In addition, we rely on the information security internal controls maintained by our outsourced service provider. Breaches of our information management system could also adversely affect our business reputation. Finally, significant information system disruptions could adversely affect our ability to effectively manage operations or reliably report results.

Because our technology, products, platform, and services are complex and are deployed in and across complex environments, they may have errors or defects that could seriously harm our business.

Our technology, proprietary platforms, products and services are highly complex and are designed to operate in and across data centers, large and complex networks, and other elements of the digital media workflow that we do not own or control. On an ongoing basis, we need to perform proactive maintenance services on our platform and related software services to correct errors and defects. In the future, there may be additional errors and defects in our software that may adversely affect our services. We may not have in place adequate reporting, tracking, monitoring, and quality assurance procedures to ensure that we detect errors in our software in a timely manner. If we are unable to efficiently and cost-effectively fix errors or other problems that may be identified, or if there are unidentified errors that allow persons to improperly access our services, we could experience loss of revenues and market share, damage to our reputation, increased expenses and legal actions by our customers.

We may have insufficient network or server capacity, which could result in interruptions in our services and loss of revenues.

Our operations are dependent in part upon: network capacity provided by third-party telecommunications networks; data center services provider owned and leased infrastructure and capacity; our dedicated and virtualized server capacity located at its data center services provider partner and a geo-redundant micro-data center location; and our own infrastructure and equipment. Collectively, this infrastructure, equipment, and capacity must be sufficiently robust to handle all of our customers’ web-traffic, particularly in the event of unexpected surges in high-definition video traffic and network services incidents. We (and our service providers) may not be adequately prepared for unexpected increases in bandwidth and related infrastructure demands from our customers. In addition, the bandwidth we have contracted to purchase may become unavailable for a variety of reasons, including payment disputes, outages, or such service providers going out of business. Any failure of these service providers or our own infrastructure to provide the capacity we require, due to financial or other reasons, may result in a reduction in, or interruption of, service to our customers, leading to an immediate decline in revenue and possible additional decline in revenue as a result of subsequent customer losses.

12

We do not have sufficient capital to engage in material research and development, which may harm our long-term growth.

In light of our limited resources in general, we have made no material investments in research and development over the past several years. This conserves capital in the short term. In the long term, as a result of our failure to invest in research and development, our technology and product offerings may not keep pace with the market, and we may lose any current existing competitive advantage. Over the long term, this may harm our revenues growth and our ability to become profitable.

Our business operations are susceptible to interruptions caused by events beyond our control.

Our business operations are susceptible to interruptions caused by events beyond our control. We are vulnerable to the following potential problems, among others:

| ● | our platform, technology, products, and services and underlying infrastructure, or that of our key suppliers, may be damaged or destroyed by events beyond our control, such as fires, earthquakes, floods, power outages or telecommunications failures; |

| ● | we and our customers and/or partners may experience interruptions in service as a result of the accidental or malicious actions of Internet users, hackers or current or former employees; |

| ● | we may face liability for transmitting viruses to third parties that damage or impair their access to computer networks, programs, data or information. Eliminating computer viruses and alleviating other security problems may require interruptions, delays or cessation of service to our customers; and |

| ● | failure of our systems or those of our suppliers may disrupt service to our customers (and from our customers to their customers), which could materially impact our operations (and the operations of our customers), adversely affect our relationships with our customers and lead to lawsuits and contingent liability. |

The occurrence of any of the foregoing could result in claims for consequential and other damages, significant repair and recovery expenses and extensive customer losses and otherwise have a material adverse effect on our business, financial condition and results of operations.

General global market and economic conditions may have an adverse impact on our operating performance and results of operations.

Our business has been and could continue to be affected by general global economic and market conditions. Any downturn in the United States and worldwide economy could have a negative effect on our operating results, including a decrease in revenue and operating cash flow. To the extent our customers are unable to profitably leverage various forms of digital marketing technology and solutions, and/or the content we create, deliver and publish on their behalf, they may reduce or eliminate their purchase of our products and services. Such reductions in traffic would lead to a reduction in our revenues. Additionally, in a down-cycle economic environment, we may experience the negative effects of increased competitive pricing pressure, customer loss, slowdown in commerce over the Internet and corresponding decrease in traffic delivered over our network and failures by our customers to pay amounts owed to us on a timely basis or at all. Suppliers on which we rely for equipment, field services, servers, bandwidth, co-location and other services could also be negatively impacted by economic conditions that, in turn, could have a negative impact on our operations or revenues. Flat or worsening economic conditions may harm our operating results and financial condition.

In addition, our business could be adversely affected by the effects of a widespread outbreak of contagious disease, including the recent outbreak of the COVID-19 respiratory illness first identified in Wuhan, Hubei Province, China. A significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could affect demand for our products, our ability to collect against existing trade receivables and our operating results. Specifically, such event may cause us, our customers or suppliers to temporarily suspend operations in the affected city or country, and customers may suspend or terminate capital improvements including in-store digital deployments or refresh projects, all of which may have a material adverse effect on our business.

13

The markets in which we operate are rapidly emerging, and we may be unable to compete successfully against existing or future competitors to our business.

The market in which we operate is becoming increasingly competitive. Our current competitors generally include general digital signage companies, specialized digital signage operators targeting certain vertical markets (e.g., financial services), content management software companies, or integrators and vertical solution providers who develop single implementations of content distribution, digital marketing technology, and related services. These competitors, including future new competitors who may emerge, may be able to develop a comparable or superior solution capabilities, software platform, technology stack, and/or series of services that provide a similar or more robust set of features and functionality than the technology, products and services we offer. If this occurs, we may be unable to grow as necessary to make our business profitable.

Whether or not we have superior products, many of these current and potential future competitors have a longer operating histories in their current respective business areas and greater market presence, brand recognition, engineering and marketing capabilities, and financial, technological and personnel resources than we do. Existing and potential competitors with an extended operating history, even if not directly related to our business, have an inherent marketing advantage because of the reluctance of many potential customers to entrust key operations to a company that may be perceived as new, inexperienced or unproven. In addition, our existing and potential future competitors may be able to use their extensive resources to:

| ● | develop and deploy new products and services more quickly and effectively than we can; |

| ● | develop, improve and expand their platforms and related infrastructures more quickly than we can; |

| ● | reduce costs, particularly hardware costs, because of discounts associated with large volume purchases and longer-term relationships and commitments; |

| ● | offer less expensive products, technology, platform, and services as a result of a lower cost structure, greater capital reserves or otherwise; |

| ● | adapt more swiftly and completely to new or emerging technologies and changes in customer requirements; |

| ● | take advantage of acquisition and other opportunities more readily; and |

| ● | devote greater resources to the marketing and sales of their products, technology, platform, and services. |

If we are unable to compete effectively in our various markets, or if competitive pressures place downward pressure on the prices at which we offer our products and services, our business, financial condition and results of operations may suffer.

Risks Related to Our Securities and Our Company

Because of our limited resources, we may not have in place various processes and protections common to more mature companies and may be more susceptible to adverse events.

We have limited resources as a result of, among other things, significant restructuring and integration costs incurred in connection with prior acquisition activities. As a result, we may not have in place systems, processes and protections that many of our competitors have or that may be essential to protect against various risks. For example, we have in place only limited resources and processes addressing human resources, timekeeping, data protection, business continuity, personnel redundancy, and knowledge institutionalization concerns. As a result, we are at risk that one or more adverse events in these and other areas may materially harm our business, balance sheet, revenues, expenses or prospects.

14

Our controlling shareholder possesses controlling voting power with respect to our common stock, which will limit your influence on corporate matters.

Our controlling shareholder, Slipstream Communications, LLC, has beneficial ownership of 6,322,858 shares of common stock, including common shares that are beneficially owned by its affiliate Slipstream Funding, LLC. These shares represent beneficial ownership of approximately 39.28% of our common stock (on an as-converted basis including conversion of outstanding warrants, and assuming no other convertible securities, options and warrants are converted or exercised by other parties) as of December 31, 2019. As a result, Slipstream Funding, LLC has the ability to strongly influence our management and affairs, including the election and removal of our Board of Directors and all other matters requiring shareholder approval, including the future merger, consolidation or sale of all or substantially all of our assets. This concentrated control could discourage others from initiating any potential merger, takeover or other change-of-control transaction that may otherwise be beneficial to our shareholders. Furthermore, this concentrated control will limit the practical effect of your participation in Company matters, through shareholder votes and otherwise.

Our Articles of Incorporation grant our Board of Directors the power to issue additional shares of common and preferred stock and to designate other classes of preferred stock, all without shareholder approval.

Our authorized capital consists of 250 million shares of capital stock, 50 million of which is undesignated preferred stock. Pursuant to authority granted by our Articles of Incorporation, our Board of Directors, without any action by our shareholders, may designate and issue shares in such classes or series (including other classes or series of preferred stock) as it deems appropriate and establish the rights, preferences and privileges of such shares, including dividends, liquidation and voting rights, provided it is consistent with Minnesota law. The rights of holders of other classes or series of stock that may be issued could be superior to the rights of holders of our common shares. The designation and issuance of shares of capital stock having preferential rights could adversely affect other rights appurtenant to shares of our common stock. Furthermore, any issuances of additional stock (common or preferred) will dilute the percentage of ownership interest of then-current holders of our capital stock and may dilute our book value per share.

Significant issuances of our common stock, or the perception that significant issuances may occur in the future, could adversely affect the market price for our common stock.

Significant actual or perceived potential future issuance of our common stock could adversely affect the market price of our common stock. Generally, issuances of substantial amounts of common stock in the public market, and the availability of shares for future sale, could adversely affect the prevailing market price of our common stock and could cause the market price of our common stock to remain low for a substantial amount of time.

We cannot foresee the impact of potential securities issuances of common shares on the market for our common stock, but it is possible that the market for our shares may be adversely affected, perhaps significantly. It is also unclear whether or not the market for our common stock could absorb a large number of attempted sales in a short period of time, regardless of the price at which they might be offered.

There is not now and there may not ever be an active market for shares of our common stock.

In general, there has been minimal trading volume in our common stock. The small trading volume will likely make it difficult for our shareholders to sell their shares as and when they choose. Furthermore, small trading volumes are generally understood to depress market prices. As a result, you may not always be able to resell shares of our common stock publicly at the time and prices that you feel are fair or appropriate.

15

We do not intend to pay dividends on our common stock for the foreseeable future.

We do not plan to pay dividends on our common stock for the foreseeable future. Earnings of the business will be reinvested in future growth strategies or utilized to repay outstanding debt.

We do not have significant tangible assets that could be sold upon liquidation.

We have nominal tangible assets. As a result, if we become insolvent or otherwise must dissolve, there will be no tangible assets to liquidate and no corresponding proceeds to disburse to our shareholders. If we become insolvent or otherwise must dissolve, shareholders will likely not receive any cash proceeds on account of their shares.

We can provide no assurance that our securities will continue to meet Nasdaq listing requirements. If we fail to comply with the continuing listing standards of the Nasdaq, our securities could be delisted.

If we fail to comply with the continuing listing standards of the Nasdaq, our securities could be delisted. A failure to remain listed on Nasdaq could have a material adverse effect on the liquidity and price of our common stock.

Risks Related to Our Recently Completed Acquisition of Allure Global Solutions, Inc.

We may not realize the growth opportunities that are anticipated from our acquisition of Allure.

The benefits we expect to achieve as a result of the Allure acquisition will depend, in part, on our ability to realize anticipated growth opportunities. Our success in realizing these growth opportunities, and the timing of this realization, depends largely on the successful integration of Allure’s business and operations with our business and operations. Even if we are able to integrate our business with Allure’s business successfully, this integration may not result in the realization of the full benefits of the growth opportunities we currently expect from this integration within the anticipated time frame or at all. While we anticipate that certain expenses will be incurred, such expenses are difficult to estimate accurately, and may exceed current estimates. Accordingly, the benefits from the proposed acquisition may be offset by costs incurred or delays in integrating the companies, which could cause our revenue assumptions to be inaccurate.

16

The assumption of unknown liabilities in the Allure acquisition may harm our financial condition and results of operations.

Because we acquired all of the capital stock of Allure, we obtained ownership of Allure subject to all of its liabilities, including contingent and unknown liabilities. Although the Purchase Agreement includes representations and warranties and indemnity covenants from the seller of Allure that may offer us some contractual remedies for breaches or certain other undisclosed or unknown liabilities, there are limitations and conditions to our ability to recoup any liabilities, and there may be other unknown obligations for which we have no contractual remedy. In such a case, our business could be materially and adversely affected. We may learn additional information about Allure’s business that adversely affects us, such as the existence of unknown liabilities, or issues that could affect our ability to comply with applicable laws. We are currently engaged in a dispute involving Allure and its legacy customer based upon alleged deficient products and services provided by Allure prior to our acquisition. The alleged claim seeks $3,200 in damages that, if successful, would materially adversely affect our business. We have also tendered an indemnity claim against the seller for the claimed damages in such dispute. There is no guarantee that we will prevail on any matter.

If Allure’s liabilities are greater than expected, or if there are material obligations of which we do not become aware until after the acquisition or we have no recourse against the Seller, our business could be materially and adversely affected. If we become responsible for substantial uninsured liabilities, such liabilities may have a material adverse effect on our financial condition and results of operations.

We have incurred and will continue to incur significant transaction and integration costs in connection with the Allure Acquisition.

We have incurred significant costs associated with completing the Allure Acquisition, and expect to incur additional significant costs integrating the operations of the two companies. The substantial majority of these costs will be non-recurring expenses and will consist of transaction costs (e.g., legal, accounting), facilities and systems consolidation costs and employment-related costs. Additional unanticipated costs may be incurred in the integration of our businesses. Although we expect that the elimination of duplicative costs, as well as the realization of other efficiencies related to the integration of the businesses, may offset incremental transaction and acquisition costs over time, this net benefit may not be achieved in the near term, or at all.

The variable sales cycle of some of the combined company’s products will likely make it difficult to predict operating results.

Our revenues in any quarter depend substantially upon contracts signed and the related shipment and installation or delivery of hardware and software products in that quarter. It is therefore difficult for us to accurately predict revenues and this difficulty also will affect the combined company. It is difficult to forecast the timing of large individual hardware and software sales with a high degree of certainty due to the extended length of the sales cycle and the generally more complex contractual terms that may be associated with our products that could result in the deferral of some or all of the revenue to future periods.

Accordingly, large individual sales have sometimes occurred in quarters subsequent to when we anticipated or not at all. If the combined company receives any significant cancellation or deferral of customer orders, or it is unable to conclude license negotiations by the end of a fiscal quarter, its operating results may be lower than anticipated. In addition, any weakening or uncertainty in the economy may make it more difficult for it to predict quarterly results in the future, and could negatively impact the combined company’s business, operating results and financial condition for an indefinite period of time.

17

| ITEM 2 | PROPERTIES |

(All currency is rounded to the nearest thousands, except share and per share amounts.)

Our headquarters is located at 13100 Magisterial Drive, Suite 100, Louisville, KY 40223. There, we have approximately 17,500 square-feet of office space and 6,500 square-feet of warehouse space, which we believe is sufficient for our projected near-term future growth. The monthly lease amount is currently $30 and escalates 1% annually through the end of the lease term in December 2023. The corporate phone number is (502) 791-8800.

We lease office space of approximately 10,000 square feet to support our Canadian operations at a facility located at 4510 Rhodes Drive, Suite 800, Windsor, Ontario under a lease that expired June 30, 2018 and operates month-to-month with a monthly rental of $6 CAD per month.

We lease office space of approximately 11,000 square feet to support our Atlanta operations at a facility known as Embassy Row 400 and having as its street address 6600 Peachtree Dunwoody Road, Atlanta, Georgia 30328. This property is under lease until September 30, 2020 with a monthly rental of $22.

We also lease 3,650 square feet of office space in Dallas, Texas, and 4,100 square feet of office space and 5,100 square feet of warehouse space in El Segunda, California for monthly lease payments of $4 and $4 per month, respectively. The lease term for Dallas expires on December 31, 2021 and the term for California expired on June 30, 2019 and operates month-to-month.

| ITEM 3 | LEGAL PROCEEDINGS |

On August 2, 2019, the Company filed suit in Jefferson Circuit Court, Kentucky, against a supplier of Allure for breach of contract, breach of warranty, and negligence with respect to equipment installations performed by such supplier for an Allure customer.

On October 10, 2019, the Allure customer that is the basis of our claim above sent a demand to the Company for payment of $3,200 as settlement for an alleged breach of contract related to hardware failures of equipment installations performed by Allure between November 2017 and August 2018, before our acquisition of Allure. The suits filed by and against Allure were consolidated in the Jefferson Circuit Court, Kentucky in January 2020. These consolidated cases remain in the early stages of litigation and, as a result, the outcome of each and the allocation of liability, if any, remain unclear, so the Company is unable to reasonably estimate the possible liability, recovery, or range of magnitude for either the liability or recovery, if any, at the time of this filing.

The Company has notified its insurance company of potential claims and continues to evaluate both the claim made by the customer and potential avenues for recovery against third parties should the customer prevail.

On February 20, 2020, the Company and Allure filed a demand for arbitration against Seller (Christie Digital Systems, Inc.) for breach of contract, indemnification, and fraudulent misrepresentation under the Purchase Agreement. This demand included a claim for the right to offset the amounts owing under the Amended and Restated Seller Note due February 20, 2020. On February 27, 2020, Seller sent the Company a notice of breach for failure to pay the Amended and Restated Seller Note on the maturity date of February 20, 2020 and demanding immediate payment. We continue to assert the offset right under the Purchase Agreement and Amended and Reseller Note.

Information regarding legal proceeding can be found in Note 10 Commitments and Contingencies to the Company’s Consolidated Financial Statements.

| ITEM 4 | MINE SAFETY DISCLOSURES |

Not applicable.

18

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

(All currency is rounded to the nearest thousands, except share and per share amounts.)

Market Information

Our common stock is listed for trading on the Nasdaq Capital Markets (“Nasdaq”) under the symbol “CREX”. Trading of our common stock on Nasdaq commenced on November 19, 2018. Prior to November 19, 2018, our common stock was listed for trading on the OTC Bulletin Board, the “OTCQX,” under the symbol “CREX.” The transfer agent and registrar for our common stock is Computershare Limited, 401 2nd Avenue North, Minneapolis, Minnesota 55401.

Shareholders

As of February 27, 2020, we had 371 holders of record of our common stock. The actual number of stockholders is greater than this number of record holders, and includes stockholders who are beneficial owners, but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

Dividend Policy

We have never declared or paid cash dividends on our common stock. We currently intend to retain future earnings, if any, to operate and expand our business and to finance the development and expansion of our business. We do not anticipate paying cash dividends on our common stock in the foreseeable future. Any payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, earnings, capital requirements, contractual restrictions and other factors deemed relevant by our Board of Directors.

Holders of our common stock are entitled to share pro rata in dividends and distributions with respect to the common stock when, as and if declared by our Board of Directors out of funds legally available therefor. Our future dividend policy is subject to the sole discretion of our Board of Directors and will depend upon a number of factors, including future earnings, capital requirements and our financial condition.

Recent Sales of Unregistered Securities

On December 30, 2019, the Company entered into a Seventh Amendment to Loan and Security Agreement (the “Seventh Amendment”) with its subsidiaries and Slipstream Communications, LLC (“Lender”). Pursuant to the Seventh Amendment, Lender made a $2,000 loan to the Company (the “Special Loan”) under the terms of the Company’s existing Loan and Security Agreement with Lender (as amended by the Seventh Amendment, the “Loan Agreement”). The Special Loan is evidenced by a Secured Convertible Special Loan Promissory Note (the “Note”). The Note bears simple interest at 8% per annum, of which 6% is payable in cash (the “Interest”) and 2% is payable in kind as additional principal under the Note (“Additional Principal”), which is payable monthly commencing February 1, 2020. The entire unpaid principal balance of the Note (including the Additional Principal) together with all accrued but unpaid interest is due on June 30, 2021 (the “Maturity Date”). The Company may prepay the Note, in whole or in part, at any time and from time to time, without penalty or premium. The principal (including the Additional Principal) and accrued but unpaid interest will be converted into a new class of senior preferred stock of the Company upon any event of default or in the event that the Company does not refinance the Note prior to October 1, 2020, with such class of senior preferred stock of the Company to be created in advance of such conversion, having those rights and preferences set forth in the Loan Agreement and as otherwise agreed to by the Company and Lender. For this issuance, we relied on the statutory exemptions from registration under Section 4(a)(2) of the Securities Act, including Rule 506 promulgated thereunder. We relied on this exemption based on the fact that the investor was an accredited investor.

19

| ITEM 6 | SELECTED FINANCIAL DATA |

Not applicable.

| ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

(All currency is rounded to the nearest thousands, except share and per share amounts.)