united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21872

Mutual Fund Series Trust

(Exact name of Registrant as specified in charter)

4221 North 203rd Street, Suite 100, Elkhorn, NE 68022

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions

80 Arkay Drive, Suite 100, Hauppauge, NY 1788

(Name and address of agent for service)

Registrant's telephone number, including area code: 402-895-1600

Date of fiscal year end: 6/30

Date of reporting period: 6/30/23

ITEM 1. REPORTS TO SHAREHOLDERS.

ANNUAL REPORT

Catalyst Insider Buying Fund

(INSAX, INSCX, INSIX)

Catalyst Energy Infrastructure Fund

(MLXAX, MLXCX, MLXIX)

Catalyst/MAP Global Equity Fund

(CAXAX, CAXCX, CAXIX)

Catalyst/Lyons Tactical Allocation Fund

(CLTAX, CLTCX, CLTIX)

Catalyst Dynamic Alpha Fund

(CPEAX, CPECX, CPEIX)

June 30, 2023

Mutual Fund Series Trust

CATALYST FUNDS

ANNUAL REPORT

TABLE OF CONTENTS

| Portfolio Review | Page 1 |

| Schedules of Investments | Page 20 |

| Statements of Assets and Liabilities | Page 35 |

| Statements of Operations | Page 37 |

| Statements of Changes in Net Assets | Page 39 |

| Financial Highlights | Page 41 |

| Notes to Financial Statements | Page 51 |

| Supplemental Information | Page 63 |

| Expense Example | Page 79 |

| Privacy Notice | Page 80 |

June 30, 2023

Catalyst Insider Buying Fund (INSAX, INSCX, INSIX) (unaudited)

Dear Shareholders,

The Catalyst Insider Buying Fund (the “Fund”) invests in large-capitalization U.S. companies that are experiencing corporate insider buying. Over the past year, we have witnessed diverse insider buying across sectors. With a wide range of insider buying opportunities to choose from, we focused on the insider buying at companies that have the highest quality earnings growth potential and revenue growth potential. During FY 2023, the Fund outperformed the S&P500 Total Return Index1 benchmark. The outperformance relative to the benchmark was driven by strong performance from secular, high growth companies amid a resilient market.

Investment Strategy

The Fund’s strategy uses a quantitative methodology that ranks insider activity based on the strength of the signals that insiders are generating relative to how many executives are buying and how many shares they are purchasing. We believe that corporate insiders understand their own firm better than any outside investor possibly could.

The advisor uses public information that is filed with the Securities and Exchange Commission (SEC) on corporate insider and large shareholder buying and selling activity for its investment decisions. Numerous academic studies and our own research of insider trading data over long periods of time have resulted in the development of a proprietary method of analyzing activity that we believe can provide long-term capital appreciation. When looking at SEC filings, we focus on the insider identity (position in the company), potential motivations for buying, insider trading trends, trading volumes, firm size, and other factors to select stocks for the portfolio. We sell stocks when the relevant insider trading trends reverse or when portfolio positions achieve or no longer provide the targeted risk-adjusted return.

Fund Performance

The Fund outperformed its S&P500 Total Return Index benchmark during FY 2023. The Fund saw relative outperformance from holdings in the healthcare and consumer discretionary sectors and relative underperformance in the information technology and communication services sectors.

At the start of FY 2023, we believed that the Fund held several companies that were undervalued by the market. The largest holdings of the Fund were tilted heavily towards companies that we believed were intrinsically underpriced relative to their fundamentals and growth prospects. Despite daunting headlines, including the collapse of five banks, continued geopolitical uncertainty, and concerns related to the U.S. debt crisis, domestic markets have remained resilient. Given our positioning at the start of the fiscal year, we were able to capture significant gains in companies that have moved back into favor with investors. As information technology companies have accounted for much of the gains in 2023 thus far in broader equity markets, we feel comfortable positioning ourselves in risk-on assets that have high revenue growth, strong margins, and disruptive business models.

We are optimistic heading into the second half of 2023 and believe that the Fund is well-positioned. There are still questions regarding how far the Fed will go with their interest rate hiking cycle and the impact that will have on the equity market. During times of uncertainty, we think it is even more important to look at the insider buying actions of corporate executives as they are the people who are the most well-informed about their company’s prospects for the future. We follow a long- term strategy that invests in companies whose insiders believe their own shares are undervalued.

1

The Fund’s total returns for the fiscal year ended 06/30/23 and for the period since inception through 06/30/23 as compared to the S&P500 Total Return Index were as follows:

| Fiscal Year | 5 Years | 10 Years | Since Inception 2 | |

| Class A | 32.57% | -4.11% | 2.25% | 4.77% |

| Class C | 31.52% | -4.83% | 1.48% | 4.20% |

| S&P 500 Total Return Index | 19.59% | 12.31% | 12.86% | 13.13% |

| Class A with Sales Charge | 24.95% | -5.24% | 1.64% | 4.25% |

| Fiscal Year | 5 Years | 10 Years | Since Inception 2 | |

| Class I | 32.87% | -3.87% | N/A | 0.15% |

| S&P 500 Total Return Index | 19.59% | 12.31% | N/A | 11.62% |

Inception Date: 07/29/2011 for Class A and Class C, 6/6/14 for Class I

Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-866-447-4228. You can also obtain a prospectus at www.CatalystMF.com.

Summary

The Fund holds a relatively concentrated portfolio of large-capitalization U.S. companies experiencing significant insider buying—situations where those who know the most about the company are taking their own money and putting it back in the company through open market purchases. By reviewing numerous academic studies and performing our own historical research, we’ve found that this strategy can outperform the S&P 500 Total Return Index over the long run. Successful investing requires a long-term outlook focused on objective criteria that create value. We have adopted this outlook for the Fund, and we are pleased that you have decided to share in our vision.

Sincerely,

David Miller

Senior Portfolio Manager

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.CatalystMF.com or call 1-866-447-4228. Please read the prospectus carefully before investing.

| 1 | The S&P500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Fund may or may not purchase the types of securities represented by the S&P500 Total Return Index. |

| 2 | Since inception returns assume inception date of 07/29/2011 for Class A and Class C shares and 06/06/2014 for the Class I shares. The performance information quoted in this Annual Report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. An investor’s return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Updated performance data to the most recent month-end can be obtained by calling the Fund at 1-866-447-4228. There is a maximum sales load of 5.75% (“sales load”) on certain Class A subscriptions. A 1% Contingent Deferred Sales Charge (“CDSC fee”) is imposed on certain redemptions of Class A shares held less than two years after the date of purchase (excluding shares purchased with reinvested dividends and/or distributions). The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. |

5549-NLD-7/19/2023

2

June 30, 2023

Catalyst Energy Infrastructure Fund (MLXAX, MLXCX, MLXIX)

Dear Fellow Shareholders,

The Catalyst Energy Infrastructure Fund (the “Fund”) (MLXAX, MLXCX & MLXIX) returned +22.42% for the fiscal year ended June 30, 2023 (Class I share). This performance (for Class I) was 8.09% behind our benchmark, the Alerian MLP Total Return Index. Since inception, the Fund has returned -0.12%, and its benchmark has returned 0.11%. The Fund invests in the securities of corporations and master limited partnerships (MLPs) that derive a majority of their revenue from energy infrastructure activities. The manager believes that valuations are compelling, and the Fund has attractive upside potential.

Investment Strategy

The Fund seeks to achieve its investment objective by primarily investing in the publicly listed equity securities of U.S. and Canadian companies that generate a majority of their cash flow from midstream energy infrastructure activities. The Fund’s strategy aims to achieve current income and capital appreciation over the long-term. The Fund may also invest in the equity securities of MLPs (publicly traded partnerships) engaged in energy-related businesses. Most of the entities in which the Fund will invest derive a majority of their revenue from “midstream” energy infrastructure-related activities, including the treatment, gathering, compression, processing, transportation, transmission, fractionation, storage, and terminaling of natural gas, natural gas liquids, crude oil, and refined products. Under normal conditions, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in companies that derive a majority of their revenue from energy infrastructure activities. The Fund may invest in U.S. and foreign issuers of any market capitalization. The Fund intends to be taxed as a regulated investment company (“RIC”) and comply with all RIC-related restrictions, including limiting its investment in entities taxed as limited partnerships, including MLPs, to 25%.

The Fund seeks to pay a monthly distribution of no less than $0.10 per share. To the extent that this exceeds the distribution yield on the underlying portfolio, a portion of the Fund’s distribution may be classified as a return of capital for tax purposes.

Fiscal Year 2023 Performance

The fiscal year 2023 performance was a continuation of the sector’s recovery following the Covid low of March 2020. MLPs outperformed corporations as increased risk tolerance among investors led some to favor smaller companies. Since the Alerian MLP Total Return Index is 100% MLPs, the Fund lagged with its 25% limit on MLP holdings. Global demand for hydrocarbons continued to grow and energy companies generally maintained fiscal discipline regarding growth investments. We believe the Fund is well positioned to achieve long term outperformance and believe that midstream energy infrastructure will generate attractive returns for investors.

The Fund’s total returns for the period since inception1 and YTD through 06/30/23 as compared to the Alerian MLP Total Return Index2 were as follows (unaudited):

| YTD

2023 (06/30/23) |

1

Year (06/30/23) |

Since

Inception (12/22/14)1 | |

| Class A | 9.46% | 22.08% | --0.38% |

| Class C | 9.02% | 21.15% | -1.10% |

| Class I | 9.61% | 22.42% | -0.12% |

| Alerian MLP Total Return Index2 | 9.70% | 30.51% | 0.11% |

| Class A with Sales Charge | 3.15% | 15.06% | -1.07% |

The Fund’s maximum sales charge for Class A shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-866-447-4228. You can also obtain a prospectus at www.CatalystMF.com.

3

Portfolio Holdings

We emphasize securities with exposure to midstream infrastructure, predominantly fee-based cash flows, better than average visibility around future earnings, and attractive growth prospects. As of June 30, 2023, we held 24 names.

As of June 30, 2023, the Fund’s top five holdings were as follows (unaudited):

| Fund’s Top 5 Holdings | % of Total Investments |

| NextDecade Corp | 9.4% |

| Cheniere Energy, Inc | 9.3% |

| Energy Transfer | 9.1% |

| Williams Companies | 8.1% |

| Equitrans Corp | 6.4% |

Percentages in the above table are based on market value of the Fund’s portfolio as of June 30, 2023. Holdings are subject to change and should not be considered investment advice.

As of June 30, 2023, the Fund’s equity holdings were divided among economic industries as follows (unaudited):

| Industry Common Stock | |

| Gathering & Processing | 19.2% |

| LNG Transportation & Storage | 18.7% |

| Canadian Energy Infrastructure | 11.9% |

| Natural Gas Transportation & Storage | 11.9% |

| NGL Energy Infrastructure | 9.3% |

| Mixed Energy Infrastructure MLP | 9.1% |

| NGL Energy Infrastructure MLP | 4.4% |

| Crude Transportation & Storage | 4.4% |

| Refined Products Transportation & Storage MLP | 3.4% |

| Canadian Natural Gas Transportation & Storage | 1.8% |

| Gathering & Processing MLP | 1.8% |

| Canadian Crude Transportation & Storage | 1.7% |

| Liquids Transportation & Storage MLP | 1.7% |

| Refining | 0.5% |

| Cash | 0.3% |

Percentages in the above table are based on market value (excluding collateral) of the Fund’s portfolio as of June 30, 2023.

Summary

We believe that investing in U.S. midstream energy infrastructure represents a way to seek to benefit from the development of shale oil and gas resources in the U.S. Moreover, the Fund is structured as a pass-through vehicle and as such incurs no tax liability of its own. Consequently, the tax characteristics of the cash flows received from its holdings are passed through to investors in the Fund, unlike many other RICs that invest in MLPs.

The continued strength in global energy demand and Europe’s pivot away from Russian natural gas supplies represent a very positive environment for midstream energy infrastructure companies. We believe the sector continues to offer attractive upside. We are glad you share in this vision, and we value your investment with us. Your portfolio management team is currently invested in the strategy alongside you.

4

Sincerely,

Simon Lack

Portfolio Manager

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.CatalystMF.com or call 1-866-447-4228. Please read the prospectus carefully before investing.

| 1 | Since inception returns assume inception date of 12/22/2014. The performance information quoted in this Annual Report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. An investor’s return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Updated performance data to the most recent month- end can be obtained by calling the Fund at 1-866-447-4228. There is a maximum sales load of 5.75% (“sales load”) on certain Class A subscriptions. A 1% Contingent Deferred Sales Charge (“CDSC fee”) is imposed on certain redemptions of Class A shares held less than two years after the date of purchase (excluding shares purchased with reinvested dividends and/or distributions). The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. |

| 2 | The Alerian MLP Total Return Index is the leading gauge of large- and mid-cap energy MLPs. The float-adjusted, capitalization-weighted index includes 50 prominent companies and captures approximately 75% of available market capitalization. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Catalyst Energy Infrastructure Fund may or may not purchase the types of securities represented by the Alerian MLP Total Return Index. |

5587-NLD-8/2/2023

5

June 30, 2023

Catalyst/MAP Global Equity Fund (CAXAX, CAXCX, CAXIX) (unaudited)

Dear Fellow Shareholders:

The Catalyst/MAP Global Equity Fund’s (the “Fund”) total returns for the one-year, five-year, ten-year and since inception periods through 06/30/2023 as compared to the MSCI All Country World Stock Index1 and the MSCI All Country World Stock Value Index 2 were as follows (unaudited):

| Fund vs. Index Performance | Current YTD | 1 Year | 5 Years | 10 Years | Since Inception3 |

| Class A without sales charge | 7.10% | 7.65% | 5.12% | 7.37% | 7.32% |

| Class A with sales charge | 0.94% | 1.46% | 3.88% | 6.73% | 6.79% |

| Class C | 6.65% | 6.79% | 4.33% | 6.56% | 6.51% |

| MSCI All Country World Stock Index1 | 14.26% | 17.13% | 8.64% | 9.31% | 8.79% |

| MSCI All Country World Stock Value Index2 | 4.71% | 10.83% | 5.94% | 6.96% | 6.91% |

| Class I (Inception Date – 6/6/14) | 7.22% | 7.90% | 5.39% | n/a | 5.76% |

| MSCI All Country World Stock Index1 | 14.26% | 17.13% | 8.64% | n/a | 7.86% |

| MSCI All Country World Stock Value Index2 | 4.71% | 10.83% | 5.94% | n/a | 5.29% |

The Fund’s maximum sales charge for Class A shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus, please call the Fund, toll-free at 1-866-447-4228. You can also obtain a prospectus at www. CatalystMF.com.

Markets reached peak valuations in 2021, which left them exposed to sharp drawdowns when market dynamics changed. Valuations at the index level are already above their historical averages and are reaching levels they were at in 2020/2021. This implies that growth needs to reach a level larger than is currently expected or interest rates need to decline. Both factors are heavily exposed to the economic environment and cause us to tread carefully. So far this year, corporate results have exceeded expectations. Some of these gains can be attributable to the fact that many companies have been able to successfully pass along higher costs to consumers. However, somewhat alarmingly, profits have also been aided by some companies adopting looser accounting practices. A recent study published in the Journal of Financial Economics found that the aggregate Beneish M-score for U.S. companies was at its highest level in 40 years. The Beneish M-score is a mathematical model that utilizes eight financial ratios to identify potential earnings manipulation. While elevated readings don’t necessarily signal a market top, high readings have historically coincided with tops of economic cycles and therefore suggest that investors exercise caution.

Relative fund performance for the year was capricious in nature. Strong outperformance during the second half of 2022 was eclipsed by underperformance in the first half of 2023 due to outsized performance in technology-related stocks, particularly those involved with Artificial Intelligence (AI). Top contributors to Fund performance for the year were Meta Platforms (META), contributing 156 basis points to the Fund’s overall return, up nearly 78% for the year; Applied Materials (AMAT), contributing 116 basis points to the Fund’s overall return, up over 62% for the year; Novartis (NVS), contributing 100 basis points to the Fund’s overall return, up nearly 25% for the year; Microsoft (MSFT), contributing 95 basis points to the Fund’s overall return, up almost 34% for the year; and Holcim, Ltd. (HOLN SW), contributing 94 basis points to the Fund’s overall return, up almost 65% for the year. While not top contributors,

6

our covered call positions in The Mosaic Company (MOS) and Nokia contributed 11 and 14 basis points, respectively, to the Fund’s performance for the year. Top detractors to Fund performance for the year were MOS , detracting 82 basis points from the Fund’s overall return, down nearly 24% for the year; Vodafone Group (VOD), detracting 80 basis points from the Fund’s overall return, down over 35% for the year; National Fuel Gas (NFG), detracting 62 basis points from the Fund’s overall return, down nearly 20% for the year; UGI Corporation (UGI), detracting 60 basis points from, the Fund’s overall return, down almost 28% for the year; and Intel (INTC), detracting 46 basis points from the Fund’s overall return, down almost 29% for the year.

In terms of portfolio activity, turnover remains relatively low for the Fund. We did, however, make several changes to the portfolio during the year. We exited shares of Campbell Soup (CPB) after the shares nearly hit our target price and a lack of additional catalysts remained visible at the time of sale. We also exited shares of Grupo Herdez (HERDEZ* MM), as the shares no longer met our required liquidity constraints. United Malt (UMG AU) shares were sold as the company received a takeover offer from Malterie Soufflet (a subsidiary of InVivo). We sold our remaining positions in South Africa (JSE and Multichoice) as the geopolitical/economic environment was becoming increasingly uncertain. And we also sold shares of Koninklijke Philips (PHG) and Intel (INTC), as our projected catalysts failed to emerge. With these sales, also came new additions to the portfolio. We added shares in consumer staple company Unilever (ULVR LN), energy companies Chevron (CVX) and Hess Corp (HES), consumer discretionary company Kering (KER PA), and materials company Grupo Mexico (GMEXICOB MM). Additionally, we received shares of construction materials company Knife River (KNF) from a planned spinoff of MDU Resources (MDU), which was one of the expected catalysts of owning MDU. After the spinoff, we added to our shares of MDU in order to position ourselves positively for the next expected catalysts from the company. Finally, we added to our position in health care company Medtronic (MDT), and re-entered technology company Intel (INTC), as we believed the company had made progress towards delivering on its financial/product goals and felt it was a prudent time to re-enter the name.

Looking ahead, there remains considerable debate about the Federal Reserve’s actions for the second half of 2023. While headline inflation numbers have dropped substantially from where they were a year ago as supply chain constraints stemming from the COVID-19 pandemic have largely been resolved coupled with the Fed’s tightening action, it remains well above the Fed’s stated two percent target. Additionally, sticky inflation (dubbed so because even as prices in the U.S. come down for items such as food and energy, they remain elevated for services such as airfares, rent, and education) remains little changed from its peak. This is because sticky inflation responds slowly to changing economic conditions. With that said, it seems that everyone on Wall Street is a momentum player these days. Since inflation has been trending lower for the past year, many investors believe it will continue downward until it reaches the Fed’s target. We are skeptical of that belief and contend it will be more difficult to bring inflation down from its current five percent level to the Fed’s two percent goal than it was to lower it from the nine percent plus to where it is currently.

As we have stated previously, we believe the Fed is between a rock and a hard place in terms of fulfilling its two official mandates (stable prices and full employment) as well as its unofficial mandate (stabilizing markets during periods of financial duress). Historically, Fed tightening cycles have resulted in breakage of financial markets. The 1929 and 1987 crashes occurred while the Fed was tightening, as did the 2001 recession, and the Great Financial Crisis of 2008, among others. Most recently, the Fed’s tightening actions resulted in the failures of Silicon Valley Bank (SVB), First Republic Bank (FRB) and Signature Bank, as well as the ultimate sale of Credit Suisse to UBS Group AG in the first quarter of 2023, as rising interest rates and jittery depositors pressured banks with extended maturity bonds on their balance sheets. Against this seemingly treacherous backdrop and with some economic indicators, such as those related to manufacturing, signaling a lackluster economy, we question if the Fed will hike rates twice more this year, despite their implied pledge to do so.

While a downturn appears possible, our economic views remain much the same. We expect growth will be hard to come by, hence our continued overweighting towards the consumer staples (which people tend to buy regardless of economic strength) and healthcare sectors (which should benefit from a post-pandemic recovery). We own the technology sector selectively, as we do have high expectations for AI. We also believe select names in the materials

7

sector should benefit from persistent inflation. We emphasize that our material stocks (such as Grupo Mexico - mentioned above) and Mosaic (MOS)) each have catalysts, such as an increasing need for copper stemming from a projected increase in demand for electric vehicles, and fertilizer as farmers try to increase yield in a volatile global climate environment.

Kindest Regards,

Michael S. Dzialo, Peter J. Swan and Karen M. Culver

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.CatalystMF.com or call 1-866-447-4228. Please read the prospectus carefully before investing.

| 1 | The MSCI All Country World Stock Index is a market capitalization-weighted index designed to provide a broad measure of equity-market performance throughout the world. The MSCI ACWI is maintained by Morgan Stanley Capital International and is comprised of stocks from both developed and emerging markets. The Fund may or may not purchase the types of securities represented by the MSCI All Country World Stock Index. |

| 2 | The MSCI All Country World Stock Value Index captures large- and mid-cap securities exhibiting overall value style characteristics across 23 developed markets (DM) countries. The MSCI ACWI Value is maintained by Morgan Stanley Capital International. The Fund may or may not purchase the types of securities represented by the MSCI All Country World Stock Value Index. |

| 3 | Since inception returns assume inception date of 7/29/11. Class I has inception date of 7/29/11. The performance information quoted in this Annual Report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. An investor’s return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Updated performance data to the most recent month-end can be obtained by calling the Fund at 1-866-447-4228. There is a maximum sales load of 5.75% (“sales load”) on certain Class A subscriptions. A 1% Contingent Deferred Sales Charge (“CDSC fee”) is imposed on certain redemptions of Class A shares held less than two years after the date of purchase and Class C shares held less than one year after the date of purchase (excluding in each case, shares purchased with reinvested dividends and/or distributions). The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. |

5615-NLD-8/11/2023

8

June 30, 2023

Catalyst/Lyons Tactical Allocation Fund (CLTAX, CLTCX, CLTIX) (unaudited)

Dear Fellow Shareholders,

We are pleased to provide our annual report for the Catalyst/Lyons Tactical Allocation Fund (the “Fund”), with a discussion of highlights and performance for the fiscal year ended June 30, 2023 (“FY2023”).

Performance Discussion

The Fund returned +3.84% (class A shares) for the fiscal year ending 6/30/2023, compared with +8.84% for the benchmark Lipper Flexible Portfolio Funds Index and +5.08% for the Morningstar Tactical Allocation category. Since inception, CLTAX has returned +140.84% compounded (+8.32% annually), compared with +108.10% for the benchmark (+6.89% annually) and +53.64% for the peer group (+3.98% annually).

| Class

I Shares Inception: 6/6/2014 |

1

Year As of 06/30/23 |

5

Years As of 06/30/23 |

Since

Inception1 (6/6/2014 – 6/30/23) |

| Class I | 4.05% | 2.56% | 5.35% |

| Lipper Flexible Portfolio Funds Index2 | 8.84% | 5.92% | 5.28% |

| Class

A & C Shares Inception: 7/2/2012 |

1

Year As of 06/30/23 |

5

Years As of 06/30/23 |

10

Years As of 06/30/23 |

Since

Inception1 (07/02/12 – 06/30/23) |

| Class A | 3.84% | 2.32% | 6.95 | 8.32% |

| Class C | 3.05% | 1.55% | 6.16 | 7.52% |

| Lipper Flexible Portfolio Funds Index2 | 8.84% | 5.92% | 6.46 | 6.89% |

| Class A with Sales Charge | -2.13% | 1.11% | 6.32 | 7.74% |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-866-447-4228. You can also obtain a prospectus at www.CatalystMF.com.

The market weakness in the first half of calendar year 2022, paired with a record drop in consumer sentiment, triggered the Catalyst/Lyons Tactical Allocation Fund to make a defensive tactical shift to U.S. Treasuries to start FY2023 on July 1st, with an accompanying whipsaw hedge intended to participate in any potential market reversal against the allocation change. The market rallied fiercely in July on speculation that the Federal Reserve would need to pivot on its hawkish interest rate policy. While our portfolio of 1-10 year Treasury securities was essentially flat for the month of July, gaining +0.33%, our whipsaw hedge quickly kicked into gear, leading the Fund to a +4.00% July gain. Strength continued into August until midway through the month when the Fed reaffirmed its stance. Just before the mid-month top in equity markets, we rolled the hedge to take meaningful profits, and reduce the hedge delta (sensitivity to market moves) to mitigate the potential drag from a market reversal downward. This defensive positioning allowed the Fund to largely avoid the market weakness in the 3rd quarter that led to equity index declines.

9

The remainder of 2023 saw resilient equity market strength and a break in the positive correlation between stock and Treasury prices that had marked a roughly six-month period through the middle of 2022. Markets climbed a wall of worry in the face of relentless hawkishness from Fed officials, cuts to corporate earnings expectations, and persistent inflation. Fund performance remained relatively flat during this period while equity markets rose.

The Fund remained on defense to start 2023, owing to depressed momentum and consumer sentiment factors. The new year brought a new narrative on inflation. Optimism began to take hold of policy expectations as inflation data showed a slight reduction from its record pace, however still high in absolute terms. This new disinflation narrative fueled hopes that the pace of the Federal Reserve’s interest rate increases would cool off quid pro quo, increasing bets that both inflation and policy tightening had peaked. However, the shift from the fervent goods spending that took place during Covid restrictions, back toward services that suffered during the same period, continues leading a shift in the trends underpinning strong inflation. The Fed remained devoted to its overarching “higher for longer” and “raise and hold” messaging, though began to show cracks after the December CPI reading on January 10th triggered an acknowledgment of cooling inflation by policymakers, and a concession that a slowdown in the pace of rate hikes is coming. Projections for the February FOMC meeting quickly priced in a reduction to a 25 bps rate hike, which was all but telegraphed when the Fed made it official on February 1st. Investors were enthusiastic in their takeaways. The S&P 500 rallied over 6% for the month of January. The strength was attributed in large part to depressed positioning and short covering, with some of the most heavily shorted stocks among January’s biggest winners. Improved sentiment surrounding inflation and rate policy also led to gains in fixed income, with Treasury yields declining across most of the curve. Signaling, however, remained recessionary as the short end rose and curve inversion continued.

Conflicting signals and competing dynamics had equity markets largely consolidating the remainder of Q1. February was mostly a cool-off period for investors to digest the implications of the modest rate of disinflation after the prior month’s enthusiastic celebration. March’s bank failures kept the bulls in check, and quick action by regulators, the Fed, and Treasury held the bears at bay. Treasury prices resumed their positive correlation to stocks during the quarter while markets worked through the mixed signals around inflation and the Fed’s policy path. Despite a brief risk-off flight to safety during the handful of bank failures in March, the positive cross asset correlation remained in place and allowed the Fund to trend with markets but with less volatility. The Fund posted a +1.56% in Q1, trailing its benchmark and market indexes that largely held onto January’s gains.

In the 2nd quarter of 2023 and the final quarter of the Fund’s fiscal year, fears over the debt ceiling as the June 1st deadline approached (and headlines ramped up heavily) undeservingly stole the spotlight from improving inflation expectations. A late month debt ceiling deal took a notable tail risk off the table. Though market reaction was relatively subdued, the S&P 500 broke free of its recent trading range and above the 4,200 level for the first time since August 2022, shortly after the Fund made a tactical shift to the safe haven asset of U.S. Treasuries. The rising longer-term trends in equity markets and consumer sentiment delivered a positive signal from our risk indicators. The Fund tactically shifted its portfolio allocation back to U.S. equities to start June after an 11-month defensive positioning that held investor capital steady. Concurrent with the allocation shift, the Fund implemented a whipsaw hedge with options on equity market indexes intended to mitigate the risk of a potential reversal in market strength over the coming months. This hedge provided a great degree of protection for Fund investors during the COVID market crash in February-March 2020, resulting in a drawdown approximately half the degree of the broader market.

Equity markets rolled momentum through June, building on the late May debt ceiling resolution that removed a key tail risk. The S&P 500 posted its best month of the year with a 6.47% gain. The disinflation trend gained traction with the release of May CPI data that showed the slowest annual increase in headline inflation since early 2021. Thus, the Fed’s June pause in rate hikes was expected and priced in. Recession odds worked their way down, with increased calls for a soft landing being the more likely scenario in the event that recession

10

strikes. These positive dynamics culminated in a large increase in consumer sentiment (+9%) as measured by the University of Michigan’s final reading for the month of June, reflecting rapid improvement in economic and inflation expectations.

The Catalyst/Lyons Tactical Allocation Fund tactically shifted its portfolio allocation back to U.S. equities in early June. The Fund gained +3.76% for the month, compared with +3.23% for the benchmark Lipper Flexible Portfolio Funds Index and +3.74% for the Morningstar Tactical Allocation peer group. It must be noted that due to the timing of our allocation change (the Fund held its defensive portfolio of U.S. Treasuries at the close of May 31st and through June 1st) equities were not yet owned during the market’s 1-2% rally that kick-started the month. A more representative measurement period to compare portfolio performance accounts for this timing. The Fund’s equity portfolio gained +5.21% from initial allocation. Across the same time period, the S&P 500 gained +5.43% if measured from the June 1st market close, and approximately +5.00% when excluding the early day gains on June 2nd as the Fund began its shift to equities. Leadership came from selections in the Industrials sector, led by Grainger (NYSE:GWW, +4.33%) gaining +16.35% for June, and Consumer Discretionary, led by Penske Automotive Group (NYSE:PAG, +4.24%) with a +13.85% gain. With a median gain of +4.97% and 22 out of 25 stocks gaining, portfolio strength was led by a concentrated group of stocks (much like the S&P 500), with an average +12.88% gain among the top 5 winners and just a -0.63% average loss from the three decliners. The portfolio boasts a slight value stock tilt, with value stocks generating the highest outperformance relative to their respective style index.

Closing

Markets have remained strong due in part to resilient economic activity in the face of high inflation. With the rate of price growth slowing meaningfully in recent months, and a resilient consumer, tail risks of a hard landing have dissipated. Downside risks do remain, with the lagged effect of Fed rate policy decisions. The Fund is positioned to grow with continued equity market strength, while also providing a buffer against large near-term declines. We thank you for your continued support.

Sincerely,

Matthew N. Ferratusco, CIPM

Portfolio Manager

Lyons Wealth Management, LLC, Fund Sub-Adviser

Alexander Read

CEO

Lyons Wealth Management, LLC, Fund Sub-Adviser

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.CatalystMF.com or call 1-866-447-4228. Please read the prospectus carefully before investing.

| 1 | Since inception returns assume inception date of 07/02/2012 The performance information quoted in this Annual Report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. An investor’s return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Updated performance data to the most recent month-end can be obtained by calling the Fund at 1-866-447-4228. There is a maximum sales load of 5.75% (“sales load”) on certain Class A subscriptions. A 1% Contingent Deferred Sales Charge (“CDSC fee”) is imposed on certain redemptions of Class A shares held less than two years after the date of purchase (excluding shares purchased with reinvested dividends and/or distributions). The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. |

| 2 | Lipper Flexible Portfolio Funds Index measures the unweighted average total return performance of the thirty largest share classes (as available) of funds in the Flexible Portfolio Funds classification. The full list of Lipper Index components is available directly from Lipper. Lipper Indices are unmanaged. The Thomson Reuters Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Lipper Fund Award. For more information, see www.lipperfundawards.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. There is no assurance that the Fund will achieve its investment objective. |

5654-NLD-8/28/2023

11

June 30, 2023

Catalyst Dynamic Alpha Fund (CPEAX, CPECX, CPEIX) (unaudited)

Dear Fellow Shareholders,

We are pleased to provide you with the annual report for the Catalyst Dynamic Alpha Fund (the “Fund”). Since collaborating with Catalyst Funds more than a decade ago to offer our flagship equity investment strategy as a mutual fund, we have made numerous significant accomplishments. We have leveraged the distribution advantages afforded through our partnership, vastly expanded the accessibility of the strategy, and produced noteworthy investment results for our investors. We continue to build upon our prior successes and are confident in our future.

The Fund’s total returns through 06/30/23 as compared to the S&P 500 Total Return Index1 are as follows:

| Fund vs Index Performance | Fiscal

Year (06/30/22-06/30/23) |

Since

Inception (12/22/11-06/30/23)2 |

| Class A without sales charge | 16.55% | 12.74% |

| Class A with sales charge | 9.85% | 12.16% |

| Class C | 15.65% | 11.90% |

| Class I (Inception Date – 6/6/14) | 16.85% | 10.33% |

| S&P 500 Total Return Index1 | 19.59% | 13.81% |

The Fund’s maximum sales charge for Class A shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-866-447-4228. You can also obtain a prospectus at www.CatalystMF.com.

The Fund seeks to achieve long-term capital appreciation by investing in what we believe to be outperforming securities from industries that are displaying emerging strength. Our security selection methodology is built upon proprietary quantitative algorithms, which are applied to both individual securities and custom industry groupings. This highly replicable selection approach is paired with an open architecture portfolio construction mandate that affords the portfolio management team the freedom to create and tactically shift portfolio exposures as market dynamics dictate. This style-agnostic approach, we believe, results in a nimble portfolio, which has produced a performance history that often displays a lower correlation to the broad equity market than more traditional institutional strategies.

The Fund modestly underperformed the broad equity market over the trailing one-year timeframe, but that masks the highly bifurcated nature of results in the Fund and the stock market over that time. For the first half of the period, equities struggled under the pressure of ever higher interest rates as the Federal Reserve aimed to tamp out inflationary pressures. However, as the calendar flipped, stocks quickly shifted to rally mode. Investments which performed well in one half of the period largely underperformed in the other half. The Fund navigated the first six months of the past year in top form but struggled to keep up with the advance in the most recent six-month period. This dynamic is well illustrated by the performance of the Fund’s investments in the Technology sector. Selections in the space produced robust outperformance of the benchmark and the sector from June 2022 through December 2022 but gave back all that advantage over the six months ending in June 2023 as leadership trends acutely switched. As a result of these factors, portfolio positioning in the Fund has adjusted. Investments in the Consumer Discretionary sector have risen from zero one year ago to benchmark weight today while Finance investments have been cut in half.

12

As of June 30, 2023, the portfolio was allocated in the following fashion.

| Sector Allocation | % Assets |

| Information Technology | 28.0% |

| Industrials | 20.7% |

| Health Care | 16.1% |

| Consumer Discretionary | 12.2% |

| Consumer Staples | 11.0% |

| Financials | 7.2% |

| Real Estate | 2.4% |

| Materials | 1.7% |

| Communication Services | 0.0% |

| Energy | 0.0% |

| Utilities | 0.0% |

Percentages in the above table are based on market value of the Fund’s portfolio as of June 30, 2023 and are subject to change.

Two of the Fund’s most significant contributors to performance over the past year hail from the Industrial sector and were mentioned in last year’s Annual Letter to Shareholders. Quanta Services, (PWR, 6.9% of the portfolio) and Builders FirstSource (BLDR, 5.9% of the portfolio) have risen over 50% and 150%, respectively, since the start of the measurement period. Quanta, an infrastructure construction services provider, exceeded earnings expectations each quarter over the past year while growing their bottom line by double digits. Builders FirstSource, a manufacturer and distributor of building products to professional builders, continued to deliver strong operating results and could continue to benefit from a recovery in the homebuilding industry. The most significant detractor from performance within the Fund was the severe underweight exposure to mega-capitalization technology firms. Simply lacking investments in Apple, Inc. and NVIDIA Corp during the period detracted significantly from the relative performance of the Fund, the totality of which accrued during the last six months.

As of June 30, 2023, the top five holdings in the Fund as a percentage of market value were:

| Company | Weight |

| Quanta Services, Inc. | 6.9% |

| ON Semiconductor Corp. | 6.5% |

| Builders FirstSource, Inc. | 5.9% |

| AmerisourceBergen, Corp. | 4.3% |

| Hershey Co. | 3.9% |

Holdings are subject to change and should not be considered investment advice.

After stumbling early in the period, stocks have rallied throughout 2023 as the recovery toward all-time high equity levels persists. The advance has been propagated by better than feared economic news, investor enthusiasm around the prospects for artificial intelligence and a quick recovery in the banking industry from the chaos induced by Silicon Valley Bank’s collapse. Just three months ago, investors were grappling with the potential implications of stress in the banking system. As largely anticipated, this crisis of confidence quickly waned as the Treasury and the Federal Reserve took steps to backstop the system which allowed a relief rally in risk assets to occur. Stock prices have been further boosted by economic reports indicative of above expectation growth and modestly declining inflationary pressures. This combination could translate to a coveted “soft landing” scenario where growth moderates just sufficiently to reduce price pressures, but not so much to meaningfully detract from growth. For now, market participants would appear to believe the probability of this confluence is growing, thus the continued rally in equity prices.

13

With little in the way of near-term corporate earnings growth anticipated, the rally in stock prices has come by way of expanding earnings multiples. The price to earnings ratio of the S&P 500 now stands at more than 19 times the next four quarters’ earnings, meaningfully above the 15.5 average of the past 20 years. The extended nature of valuation is not, however, proportionate across all segments of the market. Small and mid-capitalization stocks trade at or below their historic norms and value stocks, irrespective of capitalization, cast a similar profile. Where valuation is most skewed relative to the past is in the aspect of the market which has rallied most acutely in 2023, large capitalization growth stocks. With their outsized year to date performance, the top 10 largest firms in the S&P 500 now account for more than 30% of the total weight of the index (an all-time high) and trade at a 50% premium to the overall index. While it would be difficult to argue that any broad aspect of the current equity market is priced at a discount, mega capitalization, growth stocks appear priced for future perfection. However, lofty valuation is unlikely to immediately derail the current stock market advance in the absence of a larger catalyst. Stocks can persist at elevated (and discounted) levels for significant time periods before transitioning to a reflection of their more intrinsic value. Nonetheless, the current risk versus reward relationship for these stocks appears skewed, at least modestly, unfavorably.

With the market just a few percentage points away from all-time highs, the recovery from last year’s rate-induced selloff has been swift. It is especially noteworthy given that interest rates today, at all points on the curve, stand far higher than at most any time in the past decade. While enthusiasm for the prospects of rate cuts by the Federal Reserve remains high, investors may ultimately find disappointment in both the terminal level of the curve and the catalysts for the inflection. In this environment, discretion is prudent. Maintaining an overall investment allocation which aligns with one’s goals is paramount, while equity exposures should be managed to balance opportunity and risk. Growth-style investments are being rewarded in the short run but come with the potential of facing falling multiples. Value stocks have fallen out of favor but could ballast a portfolio by offering support in the face of higher rates. With investors having routinely underestimated the strength of economic momentum since the pandemic, it seems appropriate to favor the continuation of this trend. The domestic economy is likely to slow as a lagged effect of the Fed’s policy of higher rates, but current data support the thesis that the slowdown is likely to be mostly benign. If this can be orchestrated in concert with moderating price pressures, the current ascent of the market could be supported. If either metric, inflation or growth, skews unfavorably, volatility in the equities is likely to reemerge. A tactical, flexible investment method, like the approach of CooksonPeirce, is appropriate for this environment and could prove valuable as greater economic clarity emerges.

Sincerely,

Cory Krebs

President and Chief Executive Officer, Cookson, Peirce & Co., Sub-Advisor to the Fund

Portfolio Manager

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.CatalystMF.com or call 1-866-447-4228. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (2) | Since inception returns assume an inception date of 12/22/2011. The performance information quoted in this Annual Report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. An investor’s return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Updated performance data to the most recent month-end can be obtained by calling the Fund at 1-866-447-4228. There is a maximum sales load of 5.75% (“sales load”) on certain Class A subscriptions. A 1% Contingent Deferred Sales Charge (“CDSC fee”) is imposed on certain redemptions of Class A shares held less than two years after the date of purchase and Class C shares held less than one year after the date of purchase (excluding in each case, shares purchased with reinvested dividends and/or distributions). The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. |

6364-NLD-08022023

14

Catalyst Insider Buying Fund

PORTFOLIO REVIEW (Unaudited)

June 30, 2023

The Fund’s performance figures* for each of the periods ended June 30, 2023, compared to its benchmark:

| Annualized | Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | Ten Year Return | Since Inception** | Since Inception*** | |

| Class A | 32.57% | (4.11)% | 2.25% | 4.77% | N/A |

| Class A with load | 24.95% | (5.24)% | 1.64% | 4.25% | N/A |

| Class C | 31.52% | (4.83)% | 1.48% | 4.20% | N/A |

| Class I | 32.87% | (3.87)% | N/A | N/A | 0.15% |

| S&P 500 Total Return Index(a) | 19.59% | 12.31% | 12.86% | 13.13% | 11.62% |

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for the Class A maximum applicable sales charge of 5.75%. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Class A shares may be subject to a 1.00% maximum deferred sales charge. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. As disclosed in the Fund’s prospectus dated November 1, 2022, the Fund’s total gross annual operating expenses are 1.81% for Class A, 2.56% for Class C and 1.56% for Class I shares. Please review the Fund’s most recent prospectus for more detail on the expense waiver. For performance information current to the most recent month-end, please call toll-free 1-866-447-4228. |

| (a) | The S&P 500 Total Return Index, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| ** | Inception date is July 29, 2011 for Class A, Class C and the benchmark. |

| *** | Inception date is June 6, 2014 for Class I and the benchmark. |

Comparison of the Change in Value of a $10,000 Investment

| Top Ten Holdings by Industry or Asset Type | % of Net Assets | |||

| Software | 26.0 | % | ||

| Metals & Mining | 9.6 | % | ||

| Asset Management | 8.6 | % | ||

| Medical Equipment & Devices | 7.8 | % | ||

| Healthcare Facilities & Services | 6.8 | % | ||

| Automotive | 6.7 | % | ||

| Electrical Equipment | 6.6 | % | ||

| Technology Services | 6.6 | % | ||

| Wholesale - Discretionary | 5.2 | % | ||

| Semiconductors | 4.7 | % | ||

| Other/Cash & Equivalents | 11.4 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments for a more detailed listing of the Fund’s assets.

15

| Catalyst Energy Infrastructure Fund |

| PORTFOLIO REVIEW (Unaudited) |

| June 30, 2023 |

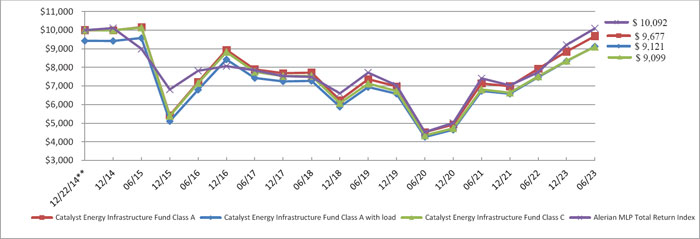

The Fund’s performance figures* for each of the periods ended June 30, 2023, compared to its benchmark:

| 1 Year Return | Annualized

5 Year Return |

Annualized

Since Inception** | |

| Class A | 22.08% | 4.63% | (0.38)% |

| Class A with load | 15.06% | 3.41% | (1.07)% |

| Class C | 21.15% | 3.83% | (1.10)% |

| Class I | 22.42% | 4.87% | (0.12)% |

| Alerian MLP Total Return Index(a) | 30.51% | 6.16% | 0.11% |

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for the Class A maximum applicable sales charge of 5.75%. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Class A shares may be subject to a 1.00% maximum deferred sales charge. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods less than 1 year are not annualized. As disclosed in the Fund’s prospectus dated November 1, 2022, the Fund’s total gross annual operating expenses are 1.73% for Class A, 2.48% for Class C, and 1.48% for Class I shares. Please review the Fund’s most recent prospectus for more detail on the expense waiver. For performance information current to the most recent month-end, please call toll-free 1-866-447-4228. |

| (a) | The Alerian MLP Total Return Index is the leading gauge of large-cap and mid-cap energy Master Limited Partnerships. Investors cannot invest directly in an index. |

| ** | Inception date is December 22, 2014. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Industry | % of Net Assets | |||

| Oil & Gas Producers | 99.7 | % | ||

| Other/Cash & Equivalents | 0.3 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments for a more detailed listing of the Fund’s assets.

16

| Catalyst/MAP Global Equity Fund |

| PORTFOLIO REVIEW (Unaudited) |

| June 30, 2023 |

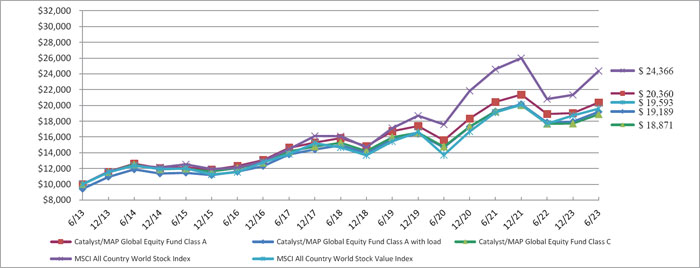

The Fund’s performance figures* for each of the periods ended June 30, 2023, compared to its benchmarks:

| Annualized | Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | Ten Year Return | Since Inception** | Since Inception*** | |

| Class A | 7.65% | 5.12% | 7.37% | 7.32% | N/A |

| Class A with load | 1.46% | 3.88% | 6.73% | 6.79% | N/A |

| Class C | 6.79% | 4.33% | 6.56% | 6.51% | N/A |

| Class I | 7.90% | 5.39% | N/A | N/A | 5.76% |

| MSCI All Country World Stock Index(a) | 17.13% | 8.64% | 9.31% | 8.79% | 7.86% |

| MSCI All Country World Stock Value Index(b) | 10.83% | 5.94% | 6.96% | 6.91% | 5.29% |

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for the Class A maximum applicable sales charge of 5.75%. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Class A shares may be subject to a 1.00% maximum deferred sales charge. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. As disclosed in the Fund’s prospectus dated November 1, 2022, the Fund’s total gross annual operating expenses, including the cost of underlying funds, are 1.59% for Class A, 2.34% for Class C, and 1.34% for Class I shares. Please review the Fund’s most recent prospectus for more detail on the expense waiver. For performance information current to the most recent month-end, please call toll-free 1-866-447-4228. |

| (a) | The MSCI All Country World Stock Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance consisting of 24 developed market country indices. Investors cannot invest directly in an index. |

| (b) | The MSCI All Country World Stock Value Index captures large and mid cap securities exhibiting overall value style characteristics across 23 Developed Markets countries and 27 Emerging Markets countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. Investors cannot invest directly in an index. |

| ** | Inception date is July 29, 2011 for Class A, Class C and the benchmark. |

| *** | Inception date is June 6, 2014 for Class I and the benchmark. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Industry or Asset Type | % of Net Assets | |||

| Biotech & Pharma | 13.1 | % | ||

| Technology Hardware | 8.0 | % | ||

| Exchange-Traded Funds | 7.9 | % | ||

| Semiconductors | 5.7 | % | ||

| Telecommunications | 5.2 | % | ||

| Construction Materials | 4.8 | % | ||

| Entertainment Content | 4.8 | % | ||

| Food | 4.4 | % | ||

| Software | 3.8 | % | ||

| Engineering & Construction | 3.7 | % | ||

| Tobacco & Cannabis | 3.6 | % | ||

| Other/Cash & Equivalents | 35.0 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments for a more detailed listing of the Fund’s assets.

17

| Catalyst/Lyons Tactical Allocation Fund |

| PORTFOLIO REVIEW (Unaudited) |

| June 30, 2023 |

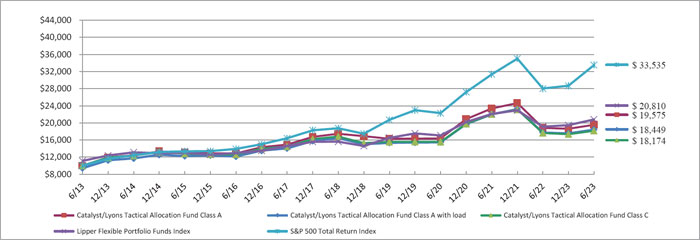

The Fund’s performance figures* for each of the periods ended June 30, 2023, compared to its benchmarks:

1 Year Return |

Annualized 5 Year Return |

Annualized Ten Year Return |

Annualized Since Inception** |

Annualized Since Inception*** | |

| Class A | 3.84% | 2.32% | 6.95% | 8.32% | N/A |

| Class A with load | (2.13)% | 1.11% | 6.32% | 7.74% | N/A |

| Class C | 3.05% | 1.55% | 6.16% | 7.52% | N/A |

| Class I | 4.05% | 2.56% | N/A | N/A | 5.35% |

| Lipper Flexible Portfolio Funds Index(a) | 8.84% | 5.92% | 6.46% | 6.89% | 5.28% |

| S&P 500 Total Return Index(b) | 19.59% | 12.31% | 12.86% | 13.53% | 11.62% |

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for the Class A maximum applicable sales charge of 5.75%. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Class A shares may be subject to a 1.00% maximum deferred sales charge. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. As disclosed in the Fund’s prospectus dated November 1, 2022, the Fund’s total gross annual operating expenses are 1.90% for Class A, 2.65% for Class C, and 1.65% for Class I shares. Please review the Fund’s most recent prospectus for more detail on the expense waiver. For performance information current to the most recent month-end, please call toll-free 1-866-447-4228. |

| (a) | The Lipper Flexible Portfolio Funds Index, is an index that, by portfolio practice, allocates its investments across various asset classes, including both domestic and foreign stocks, bonds, and money market instruments, with a focus on total return. At least 25% of its portfolio is invested in securities traded outside of the United States. Investors cannot invest directly in an index. |

| (b) | The S&P 500 Total Return Index, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| ** | Inception date is July 2, 2012 for Class A, Class C and the benchmarks. |

| *** | Inception date is June 6, 2014 for Class I and the benchmarks. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Industry or Asset Type | % of Net Assets | |||

| Health Care Facilities & Service | 15.2 | % | ||

| Retail - Discretionary | 12.3 | % | ||

| Oil & Gas | 10.4 | % | ||

| Technology Services | 7.9 | % | ||

| Retail - Consumer Staples | 7.5 | % | ||

| Industrial Support Services | 4.4 | % | ||

| Steel | 4.1 | % | ||

| Electrical Equipment | 4.1 | % | ||

| Technology Hardware | 3.9 | % | ||

| Chemicals | 3.8 | % | ||

| Other/Cash & Equivalents | 26.4 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments for a more detailed listing of the Fund’s assets.

18

| Catalyst Dynamic Alpha Fund |

| PORTFOLIO REVIEW (Unaudited) |

| June 30, 2023 |

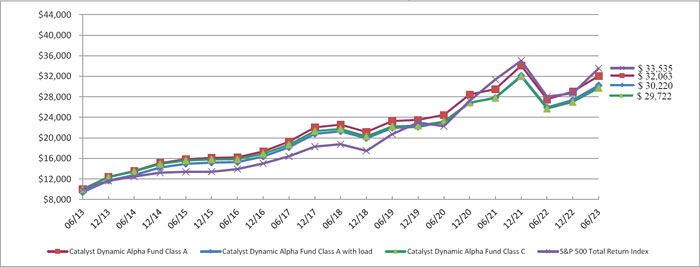

The Fund’s performance figures* for each of the periods ended June 30, 2023, compared to its benchmark:

| Annualized | Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | Ten Year Return | Since Inception** | Since Inception*** | |

| Class A | 16.55% | 7.26% | 12.36% | 12.74% | N/A |

| Class A with load | 9.85% | 5.99% | 11.69% | 12.16% | N/A |

| Class C | 15.65% | 6.45% | 11.51% | 11.90% | N/A |

| Class I | 16.85% | 7.52% | N/A | N/A | 10.33% |

| S&P 500 Total Return Index(a) | 19.59% | 12.31% | 12.86% | 13.81% | 11.62% |

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for the Class A maximum applicable sales charge of 5.75%. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Class A shares may be subject to a 1.00% maximum deferred sales charge. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. As disclosed in the Fund’s prospectus dated November 1, 2022, the Fund’s total gross annual operating expenses are 1.49% for Class A, 2.24% for Class C and 1.24% for Class I shares. Please review the Fund’s most recent prospectus for more detail on the expense waiver. For performance information current to the most recent month-end, please call toll-free 1-866-447-4228. |

| (a) | The S&P 500 Total Return Index, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| ** | Inception date is December 22, 2011 for Class A, Class C and the benchmark. |

| *** | Inception date is June 6, 2014 for Class I and the benchmark. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Industry or Asset Type | % of Net Assets | |||

| Semiconductors | 12.4 | % | ||

| Biotech & Pharma | 9.4 | % | ||

| Food | 8.8 | % | ||

| Retail - Discretionary | 8.1 | % | ||

| Engineering & Construction | 6.9 | % | ||

| Software | 6.6 | % | ||

| Technology Hardware | 6.5 | % | ||

| Aerospace & Defense | 5.7 | % | ||

| Health Care Facilities & Services | 4.3 | % | ||

| Asset Management | 2.9 | % | ||

| Other/Cash & Equivalents | 28.4 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments for a more detailed listing of the Fund’s assets.

19

| CATALYST INSIDER BUYING FUND |

| SCHEDULE OF INVESTMENTS |

| June 30, 2023 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 99.5% | ||||||||

| ASSET MANAGEMENT - 8.6% | ||||||||

| 9,030 | Apollo Global Management, Inc. | $ | 693,594 | |||||

| 5,540 | Ares Management Corporation, Class A | 533,779 | ||||||

| 420 | KKR & Company, Inc. (b) | 23,520 | ||||||

| 1,250,893 | ||||||||

| AUTOMOTIVE - 6.7% | ||||||||

| 2,325 | Tesla, Inc.(a) | 608,615 | ||||||

| 4,270 | XPEL, Inc.(a) (b) | 359,619 | ||||||

| 968,234 | ||||||||

| BIOTECH & PHARMA - 4.5% | ||||||||

| 4,050 | Novo Nordisk A/S - ADR | 655,412 | ||||||

| ELECTRICAL EQUIPMENT - 6.6% | ||||||||

| 3,065 | Amphenol Corporation, Class A | 260,372 | ||||||

| 4,435 | Atkore International Group, Inc.(a) (b) | 691,594 | ||||||

| 951,966 | ||||||||

| HEALTH CARE FACILITIES & SERVICES - 6.8% | ||||||||

| 3,590 | Ensign Group, Inc. (The) (b) | 342,701 | ||||||

| 1,150 | HCA Healthcare, Inc. | 349,003 | ||||||

| 605 | UnitedHealth Group, Inc. | 290,787 | ||||||

| 982,491 | ||||||||

| MEDICAL EQUIPMENT & DEVICES - 7.8% | ||||||||

| 2,675 | Danaher Corporation | 642,000 | ||||||

| 935 | Thermo Fisher Scientific, Inc. | 487,836 | ||||||

| 1,129,836 | ||||||||

| METALS & MINING - 9.6% | ||||||||

| 3,570 | Alpha Metallurgical Resources, Inc. (b) | 586,765 | ||||||

| 17,340 | Peabody Energy Corporation(b) | 375,584 | ||||||

| 11,150 | Warrior Met Coal, Inc. | 434,293 | ||||||

| 1,396,642 | ||||||||

| RETAIL - DISCRETIONARY - 2.0% | ||||||||

| 600 | Ulta Beauty, Inc.(a) | 282,357 | ||||||

The accompanying notes are an integral part of these financial statements.

20

| CATALYST INSIDER BUYING FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2023 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 99.5% (Continued) | ||||||||

| SEMICONDUCTORS - 4.7% | ||||||||

| 1,400 | KLA Corporation | $ | 679,028 | |||||

| SOFTWARE - 26.0% | ||||||||

| 358,220 | Hims & Hers Health, Inc.(a) (b) | 3,367,268 | ||||||

| 1,190 | Microsoft Corporation(b) | 405,243 | ||||||

| 3,772,511 | ||||||||

| TECHNOLOGY HARDWARE - 4.4% | ||||||||

| 3,900 | Arista Networks, Inc.(a) | 632,034 | ||||||

| TECHNOLOGY SERVICES - 6.6% | ||||||||

| 40 | Fair Isaac Corporation(a) | 32,368 | ||||||

| 160 | Jack Henry & Associates, Inc. | 26,773 | ||||||

| 800 | Mastercard, Inc., Class A | 314,640 | ||||||

| 480 | MSCI, Inc. | 225,259 | ||||||

| 4,325 | Pagseguro Digital Ltd., Class A(a) (b) | 40,828 | ||||||

| 1,310 | Visa, Inc., Class A(b) | 311,099 | ||||||

| 950,967 | ||||||||

| WHOLESALE - DISCRETIONARY - 5.2% | ||||||||

| 7,370 | Copart, Inc.(a) | 672,218 | ||||||

| 220 | Pool Corporation | 82,420 | ||||||

| 754,638 | ||||||||

| TOTAL COMMON STOCKS (Cost $11,717,990) | 14,407,009 | |||||||

| Shares | Fair Value | |||||||

| SHORT-TERM INVESTMENTS — 34.2% | ||||||||

| COLLATERAL FOR SECURITIES LOANED – 33.6% | ||||||||

| 4,863,034 | Mount Vernon Liquid Assets Portfolio, LLC, 5.22% (Cost $4,863,034)(c)(d)(e) | 4,863,034 | ||||||

The accompanying notes are an integral part of these financial statements.

21

| CATALYST INSIDER BUYING FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2023 |

| Shares | Fair Value | |||||||

| SHORT-TERM INVESTMENTS — 34.2% (Continued) | ||||||||

| MONEY MARKET FUND - 0.6% (Continued) | ||||||||

| 85,679 | First American Treasury Obligations Fund, Class X, 5.03% (Cost $85,679)(c) | $ | 85,679 | |||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $4,948,713) | 4,948,713 | |||||||

| TOTAL INVESTMENTS – 133.7% (Cost $16,666,703) | $ | 19,355,722 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (33.7)% | (4,877,703 | ) | ||||||

| NET ASSETS - 100.0% | $ | 14,478,019 | ||||||

| ADR | - American Depositary Receipt |

| A/S | - Anonim Sirketi |

| LLC | - Limited Liability Company |

| LTD | - Limited Company |

| MSCI | - Morgan Stanley Capital International |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is on loan. The Total fair value of the securities on loan as of June 30, 2023 was $4,789,675. |

| (c) | Rate disclosed is the seven day effective yield as of June 30, 2023. |

| (d) | Mutual Fund Series Trust’s securities lending policies and procedures require that the borrower: (i) deliver cash or U.S. Government securities as collateral with respect to each new loan of U.S. securities, equal to at least 102% of the value of the portfolio securities loaned, and (ii) at all times thereafter mark-to-market the collateral on a daily basis so that the market value of such collateral is at least 100% of the value of securities loaned. From time to time the collateral may not be 102% due to end of day market movement. The next business day additional collateral is obtained/received from the borrower to replenish/reestablish 102%. |

| (e) | Security was purchased with cash received as collateral for securities on loan at June 30, 2023. Total collateral had a value of $4,863,034 at June 30, 2023. |

See accompanying notes which are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

22

| CATALYST ENERGY INFRASTRUCTURE |

| SCHEDULE OF INVESTMENTS |

| June 30, 2023 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 99.7% | ||||||||

| OIL & GAS PRODUCERS - 99.7% | ||||||||

| 145,531 | Cheniere Energy, Inc. | $ | 22,173,103 | |||||

| 159,072 | Crestwood Equity Partners, L.P. | 4,212,227 | ||||||

| 121,199 | DT Midstream, Inc. | 6,007,834 | ||||||

| 244,477 | Enbridge, Inc. | 9,082,321 | ||||||

| 1,702,332 | Energy Transfer, L.P. | 21,619,615 | ||||||

| 1,043,866 | EnLink Midstream, LLC | 11,064,980 | ||||||

| 394,693 | Enterprise Products Partners, L.P. | 10,400,161 | ||||||

| 1,588,189 | Equitrans Midstream Corporation | 15,183,087 | ||||||

| 263,581 | Gibson Energy, Inc. | 4,144,537 | ||||||

| 181,427 | Hess Midstream, L.P., Class A | 5,566,180 | ||||||

| 189,256 | Keyera Corporation | 4,364,490 | ||||||

| 516,367 | Kinder Morgan, Inc. | 8,891,840 | ||||||

| 103,859 | Kinetik Holdings, Inc. | 3,649,605 | ||||||

| 51,538 | Magellan Midstream Partners, L.P. | 3,211,848 | ||||||

| 10,245 | Marathon Petroleum Corporation | 1,194,567 | ||||||

| 118,275 | MPLX, L.P. | 4,014,254 | ||||||

| 2,714,755 | NextDecade Corporation(a) | 22,288,138 | ||||||

| 280,821 | NuStar Energy, L.P. | 4,813,272 | ||||||

| 177,954 | ONEOK, Inc. | 10,983,321 | ||||||

| 311,796 | Pembina Pipeline Corporation | 9,802,866 | ||||||

| 700,578 | Plains GP Holdings, L.P., Class A | 10,389,572 | ||||||

| 146,201 | Targa Resources Corporation | 11,125,896 | ||||||

| 234,752 | TC Energy Corporation | 9,486,328 | ||||||

| 158,177 | Western Midstream Partners, L.P. | 4,194,854 | ||||||

| 592,471 | Williams Companies, Inc. (The) | 19,332,329 | ||||||

| 237,197,225 | ||||||||

| TOTAL COMMON STOCKS (Cost $183,781,495) | 237,197,225 | |||||||

The accompanying notes are an integral part of these financial statements.

23

| CATALYST ENERGY INFRASTRUCTURE |