Table of Contents

Exhibit 99.1

, 2006

Dear Cendant Corporation Stockholder:

I am pleased to inform you that on , 2006, the Board of Directors of Cendant Corporation approved the distribution of all of the shares of common stock of Realogy Corporation, a wholly owned subsidiary of Cendant, to Cendant stockholders. Realogy holds all of the assets and liabilities associated with Cendant’s Real Estate Services businesses and is one of the preeminent providers of real estate and relocation services in the world.

This distribution is being made pursuant to a plan preliminarily approved by our Board on October 23, 2005 to separate Cendant into four independent, publicly traded companies—one for each of Cendant’s Real Estate Services, Travel Distribution Services, Hospitality Services (including Timeshare Resorts) and Vehicle Rental businesses. Upon each distribution, Cendant stockholders will own 100% of the common stock of the company being distributed. On April 24, 2006, we announced that as an alternative to distributing shares of the Travel Distribution Services company to Cendant stockholders, Cendant is also exploring the sale of that company. Cendant’s Board of Directors believes that creating four focused companies is the best way to unlock the full value of Cendant’s businesses for the benefit of Cendant, our stockholders and each of the businesses, in both the short and long term. The Cendant Board received an opinion from Evercore Group L.L.C. to the effect that, as of the date of such opinion, the distribution is fair, from a financial point of view, to the stockholders of Cendant. A copy of the opinion that Evercore delivered to the Cendant Board is attached to this information statement as Annex A.

The distribution of Realogy common stock will occur on , 2006 by way of a pro rata dividend to Cendant stockholders. Each Cendant stockholder will be entitled to receive one share of Realogy common stock (and a related preferred stock purchase right) for every four shares of Cendant common stock held by such stockholder at the close of business on , 2006, the record date of the distribution. The dividend will be issued in book-entry form only, which means that no physical stock certificates will be issued. No fractional shares of Realogy common stock will be issued. If you would otherwise have been entitled to a fractional share of Realogy common stock in the distribution, you will receive the net cash value of such fractional share instead.

Stockholder approval of the distribution is not required, and you are not required to take any action to receive your Realogy common stock.

Following the distribution, you will own shares in both Cendant and Realogy. Cendant’s common stock will continue to trade on the New York Stock Exchange under the symbol “CD.” We applied to have Realogy’s common stock listed on the New York Stock Exchange under the symbol “H.”

The enclosed information statement, which is being mailed to all Cendant stockholders, describes the distribution in detail and contains important information about Realogy. We urge you to read the information statement carefully.

I want to thank you for your continued support of Cendant and we look forward to your support of Realogy in the future.

Sincerely,

Henry R. Silverman

Chairman of the Board and Chief Executive Officer

Table of Contents

, 2006

Dear Realogy Corporation Stockholder:

It is our pleasure to welcome you as a stockholder of our company, Realogy Corporation. We are one of the preeminent and most integrated providers of real estate and relocation services in the world. Our operations include real estate brokerage franchise systems operating under the CENTURY 21®, COLDWELL BANKER®, ERA®, SOTHEBY’S INTERNATIONAL REALTY® and COLDWELL BANKER COMMERCIAL® brands; real estate brokerage operations owned and operated by our NRT Incorporated subsidiary under the COLDWELL BANKER®, ERA®, THE CORCORAN GROUP® and SOTHEBY’S INTERNATIONAL REALTY® brands; employee relocation services; and title and settlement services. We are the world’s largest real estate brokerage franchisor, the largest U.S. residential real estate brokerage firm, the largest U.S. provider and a leading global provider of outsourced employee relocation services and a provider of title and settlement services.

We applied to have our common stock listed on the New York Stock Exchange under the symbol “H” in connection with the distribution of our company’s common stock by Cendant Corporation.

We invite you to learn more about Realogy by reviewing the enclosed information statement. We look forward to our future as an independent, publicly traded company and to your support as a holder of Realogy common stock.

Sincerely,

| Henry R. Silverman |

Richard A. Smith | |

| Chairman of the Board and Chief Executive Officer |

Vice Chairman of the Board and President |

Table of Contents

Preliminary Information Statement

(Subject to Completion, Dated June 26, 2006)

Information Statement

Distribution of

Common Stock of

REALOGY CORPORATION

by

CENDANT CORPORATION

to Cendant Corporation Stockholders

This information statement is being furnished in connection with the distribution by Cendant Corporation to its stockholders of all of its shares of common stock of Realogy Corporation, a wholly owned subsidiary of Cendant that holds the assets and liabilities associated with Cendant’s Real Estate Services businesses. To implement the distribution, Cendant will distribute all of its shares of Realogy common stock on a pro rata basis to the holders of Cendant common stock. Each of you, as a holder of Cendant common stock, will receive one share of Realogy common stock (and a related preferred stock purchase right) for every four shares of Cendant common stock that you held at the close of business on , 2006, the record date for the distribution. The distribution will be effective as of , 2006. Immediately after the distribution is completed, Realogy will be an independent public company.

No vote of Cendant stockholders is required in connection with this distribution. We are not asking you for a proxy and you are requested not to send us a proxy. Cendant stockholders will not be required to pay any consideration for the shares of our common stock they receive in the distribution, and they will not be required to surrender or exchange shares of their Cendant common stock or take any other action in connection with the distribution.

All of the outstanding shares of our common stock are currently owned by Cendant. Accordingly, there currently is no public trading market for our common stock. We filed an application to list our common stock under the ticker symbol “H” on the New York Stock Exchange. Assuming that our common stock is approved for listing, we anticipate that a limited market, commonly known as a “when-issued” trading market, for our common stock will develop on or shortly before the record date for the distribution and will continue up to and including through the distribution date, and we anticipate that “regular-way” trading of our common stock will begin on the first trading day following the distribution date.

In reviewing this information statement, you should carefully consider the matters described under the caption “ Risk Factors” beginning on page 26 of this information statement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of any of the securities of Realogy Corporation, or determined whether this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is , 2006.

This information statement was first mailed to Cendant stockholders on or about , 2006.

Table of Contents

Table of Contents

| 1 | ||

| 26 | ||

| 45 | ||

| 46 | ||

| 66 | ||

| 67 | ||

| 69 | ||

| 72 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

81 | |

| 107 | ||

| 138 | ||

| Security Ownership of Certain Beneficial Owners and Management |

158 | |

| 160 | ||

| 179 | ||

| 185 | ||

| 187 | ||

| F-1 | ||

| A-1 | ||

| B-1 |

TRADEMARKS AND SERVICE MARKS

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights to use that appear in this information statement include the CENTURY 21®, COLDWELL BANKER®, ERA®, THE CORCORAN GROUP®, COLDWELL BANKER COMMERCIAL® and SOTHEBY’S INTERNATIONAL REALTY® marks, which may be registered in the United States and other jurisdictions. Each trademark, trade name or service mark of any other company appearing in this information statement is owned by such company.

INDUSTRY DATA

This information statement includes industry and trade association data, forecasts and information that we have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other information available to us. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. The primary sources for third-party industry data and forecasts were The National Association of Realtors and other industry reports and articles. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, and that the publications and surveys can give no assurance as to the accuracy or completeness of such information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions on which such data is based. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

Table of Contents

This summary highlights selected information from this information statement relating to our company, our separation from Cendant and the distribution of our common stock by Cendant to its stockholders. For a more complete understanding of our business and the separation and distribution, you should carefully read the entire information statement.

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement, including the combined financial statements of the Realogy businesses of Cendant, which are comprised of the assets and liabilities used in managing and operating the Real Estate Services businesses of Cendant, assumes the completion of all the transactions referred to in this information statement in connection with the separation and distribution. Except as otherwise indicated or unless the context otherwise requires, “Realogy Corporation,” “Realogy,” “we,” “us,” “our” and “our company” refer to Realogy Corporation and its combined subsidiaries and “Cendant Corporation” and “Cendant” refer to Cendant Corporation and its consolidated subsidiaries.

Our Company

We are one of the preeminent and most integrated providers of real estate and relocation services in the world. We operate in four segments: Real Estate Franchise Services, Company Owned Real Estate Brokerage Services, Relocation Services and Title and Settlement Services. Through our portfolio of leading brands and the broad range of services we offer, we have established our company as a leader in the residential real estate industry, with operations that are dispersed throughout the United States and around the world. We are the world’s largest real estate brokerage franchisor, the largest U.S. residential real estate brokerage firm, the largest U.S. provider and a leading global provider of outsourced employee relocation services and a provider of title and settlement services.

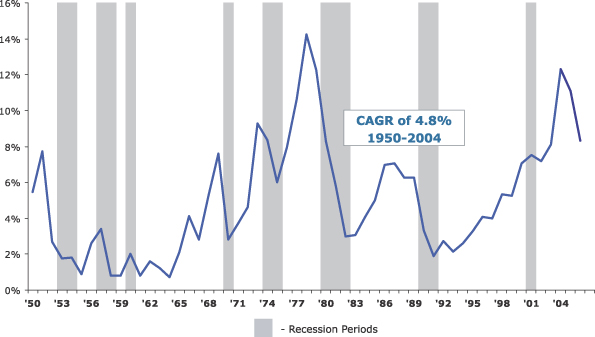

According to the National Association of Realtors (“NAR”), since 1985, the value of existing homesales in the U.S. has grown at a compounded annual growth rate (“CAGR”) of 10% per year to approximately $1.8 trillion in 2005. We believe that the value of existing homesales will continue to grow at a positive rate in future years. Furthermore, we believe that our strong brand recognition, our geographic diversity and our complementary real estate and relocation services position us to capitalize on this growth. For the three months ended March 31, 2006 and the full year ended December 31, 2005, we had revenues of $1.4 billion and $7.1 billion and net income of $54 million and $627 million, respectively.

Real Estate Franchise Services. We are a franchisor of five of the most recognized brands in the real estate industry. We have approximately 15,000 offices and 310,000 sales associates operating under our franchise brands in the U.S. and other countries and territories around the world, which includes over 1,000 of our company owned and operated brokerage offices. In the U.S. during 2005, we estimate, based on publicly available information, that brokers operating under one of our franchised brands represented the buyer and/or the seller in approximately one out of every four single family homesale transactions that involved a broker, and we believe our franchisees and company owned brokerage operations received approximately 25% of all brokerage commissions paid in such transactions. We believe that the geographic diversity of our franchisees reduces our risk of exposure to local or regional changes in the real estate market. In addition, we have over 5,000 franchisees, none of which represented more than 1% of our franchise royalties (other than our NRT Incorporated subsidiary, which operates our company owned brokerage operations). We believe this minimizes our exposure to any one franchisee. Our franchise revenues include intercompany royalties paid by our company owned brokerage operations. In 2005, our real estate franchise business contributed 14% to our revenues (before

1

Table of Contents

intercompany eliminations) and 63% to our EBITDA. We define EBITDA as net income before interest expense (other than interest relating to secured obligations), income taxes, depreciation, amortization and minority interest. Our 2005 franchise revenues included $369 million of royalties paid by our company owned brokerage operations, or approximately 37% of total franchise revenues which eliminate in consolidation. Our real estate franchise brands are:

| • | CENTURY 21®—one of the world’s largest residential real estate brokerage franchisors, with approximately 7,900 franchise offices and approximately 143,200 sales associates located in 42 countries and territories; |

| • | COLDWELL BANKER®—one of the world’s leading brands for the sale of million-dollar-plus homes and one of the largest residential real estate brokerage franchisors, with approximately 4,000 franchise and company owned offices and approximately 126,400 sales associates in the United States, Canada and 28 other countries and territories; |

| • | ERA®—a leading residential real estate brokerage franchisor, with approximately 2,800 franchise and company owned offices and approximately 36,600 sales associates located in 30 countries and territories; |

| • | SOTHEBY’S INTERNATIONAL REALTY®—a luxury real estate brokerage brand. In February 2004, we acquired from Sotheby’s Holdings, Inc. the brand’s company owned offices and the exclusive license for the rights to the Sotheby’s Realty and Sotheby’s International Realty trademarks. Since that time, we have grown the brand from 15 company owned offices to 220 franchise and company owned offices and approximately 5,100 sales associates in the United States and four other countries and territories; and |

| • | COLDWELL BANKER COMMERCIAL®—a leading commercial real estate brokerage franchisor. Our commercial franchise system has approximately 160 franchise offices and approximately 1,400 sales associates worldwide. The number of offices and sales associates in our commercial franchise system does not include our residential franchise and company owned brokerage offices and the sales associates who work out of those brokerage offices that also conduct commercial real estate brokerage business using the Coldwell Banker Commercial marks. |

We derive substantially all of our real estate franchising revenues from royalty fees received under long-term (typically ten year) franchise agreements with our franchisees. The royalty fee is based on a percentage of the franchisees’ gross commission income that they earn from real estate transactions. Our franchisees pay us fees for the right to operate under one of our trademarks and to enjoy the benefits of the systems and tools provided by our real estate franchise operations. These fees enable us to enjoy stable, recurring revenue streams and high operating margins. In exchange, we provide our franchisees with world-class service and support that is designed to facilitate our franchisees in growing their business and increasing their revenue and profitability. We support our franchisees with dedicated national marketing and servicing programs, technology, training and education. We believe that one of our strengths is the strong relationships that we have with our franchisees, as evidenced by our 99% retention rate of gross revenues in our franchise system during 2005.

Company Owned Real Estate Brokerage Services. Through our subsidiary, NRT Incorporated (“NRT”), we own and operate a full-service real estate brokerage business in more than 35 of the largest metropolitan areas of the U.S. Our company owned real estate brokerage business operates under our franchised brands as well as proprietary brands that we own, but do not currently franchise to third parties, such as THE CORCORAN GROUP®. We have nearly 1,100 company owned brokerage offices, approximately 9,000 employees and over 64,000 independent contractor sales associates working with these company owned offices. From the date of Cendant’s acquisition of 100% of NRT in April 2002 through 2005, we acquired over 90 brokerage companies. Such acquisitions are part of our strategy and have been a substantial contributor to the growth of our company owned brokerage business. We believe that the geographic diversity of our company owned brokerage business could mitigate some of the impact of local or regional changes in the real estate market. In 2005, our company owned real estate brokerage business contributed 80% to our revenues (before intercompany eliminations) and 21% to our EBITDA, and paid royalties to our real estate franchise services segment of $369 million.

2

Table of Contents

Our company owned real estate brokerage business derives revenues primarily from sales commissions, which are received at the closing of real estate transactions, which we refer to as gross commission income. Sales commissions usually range from 5% to 7% of the home’s sale price. In transactions in which we act as a broker for solely the buyer or the seller, the seller’s broker typically instructs the closing agent to pay a portion of the sales commission to the broker for the buyer. In addition, as a full-service real estate brokerage company, in compliance with applicable laws and regulations, we actively promote the services of our relocation and title and settlement services businesses, as well as the products offered by PHH Home Loans, LLC, our home mortgage venture with PHH Corporation that is the exclusive recommended provider of mortgages for our real estate brokerage and relocation service customers. All mortgage loans originated by PHH Home Loans are sold to PHH or other third party investors, and PHH Home Loans does not hold any mortgage loans for investment purposes or perform servicing functions for any loans it originates. Accordingly, our home mortgage venture structure insulates us from mortgage servicing risk. We own 49.9% of PHH Home Loans and PHH Corporation owns the remaining 50.1%. As a result, our financial results only reflect our proportionate share of the venture’s results of operations which are recorded on the equity method.

Relocation Services. Through our subsidiary, Cartus Corporation (“Cartus”), we offer a broad range of world-class employee relocation services designed to manage all aspects of an employee’s move and facilitate a smooth transition in what otherwise may be a difficult process for that employee. We assist in over 120,000 relocations in over 140 countries annually for over 1,200 active clients including nearly two-thirds of the Fortune 50, as well as government agencies and membership organizations that offer their members discounted pricing on goods and services, which we refer to as affinity organizations. Our relocation services business operates in five global service centers on three continents and is the largest U.S. and a leading global provider of outsourced employee relocation services. Our relocation services business is a driver of significant revenue to our other businesses because the clients of our relocation services business often utilize the services of our franchisees and company owned brokerage offices as well as our title and settlement services. In 2005, our relocation services business contributed 7% to our revenues (before intercompany eliminations) and 11% to our EBITDA.

Our relocation services business primarily offers its clients employee relocation services such as homesale assistance, home finding and other destination services, expense processing, relocation policy counseling and other consulting services, arranging household moving services, visa and immigration support, intercultural and language training and group move management services. Clients pay a fee for the services performed and we also receive commissions from third-party service providers, such as real estate brokers and household goods moving service providers. The majority of our clients pay interest on home equity advances and reimburse all costs associated with our services, including, where required, repayment of home equity advances and reimbursement of losses on the sale of homes purchased. We believe we provide our relocation clients with exceptional service which leads to client retention. Our top 25 relocation clients have an average tenure of 15 years with us.

Title and Settlement Services. In most real estate transactions, a buyer will choose, or will be required, to purchase title insurance that will protect the purchaser and/or the mortgage lender against loss or damage in the event that title is not transferred properly. Our title and settlement services business, which we refer to as Title Resource Group, assists with the closing of a real estate transaction by providing full-service title and settlement (i.e., closing and escrow) services to real estate companies and financial institutions. In addition, we are an underwriter of title insurance policies in connection with residential and commercial real estate transactions. Our title and settlement services business was formed in 2002 in conjunction with Cendant’s acquisition of 100% of NRT to take advantage of the nationwide geographic presence of our company owned brokerage and relocation services businesses. In 2005, our title and settlement services business contributed 4% to our revenues (before intercompany eliminations) and 5% to our EBITDA.

Our title and settlement services business earns revenues through fees charged in real estate transactions for rendering title and other settlement and non-settlement related services as well as a commission on each title

3

Table of Contents

insurance policy sold. We provide many of these services in connection with transactions in which our company owned real estate brokerage and relocation services businesses are participating. The majority of our title and settlement service operations are located in or around our company owned brokerage locations, and during 2005, approximately 50% of the customers of our company owned brokerage offices where we provide coverage also utilized our title and settlement services. Fees for escrow and closing services are generally separate and distinct from premiums paid for title insurance and other real estate services. Our title underwriter generally earns revenues through the collection of premiums on policies that it issues.

Our Strengths

We believe that the following competitive strengths differentiate us from our competitors:

| • | Strong portfolio of leading real estate brands. Our brands are among the most well known and established real estate brokerage brands in the world. The strong image and familiarity of our brands attract potential real estate buyers and sellers to seek out brokers affiliated with our brands. We believe that brand recognition is important in the real estate business because home buyers and sellers are generally infrequent users of brokerage services and typically rely on reputation as well as word-of-mouth recommendations. |

| • | Significant scale and diversity. We believe that the strong presence of each of our businesses in their respective industries and the broad range of real estate and relocation services that we offer provide us with advantages in the residential real estate market relative to our competitors. We believe that our size and scale reduces our operational risk and improves our operating efficiencies, profit margins and service levels. We also believe that our size enables us to access capital at a relatively low cost to fund strategic acquisitions to grow our business, which has contributed to our revenues and returns over time. |

| • | Strong business model with stable cash flows. We believe that our established role as an intermediary in the homesale process and the integrated business model that we have developed enable us to achieve profitability and stable cash flows. Our franchise operations have a recurring revenue base. Our company owned brokerage business provides significant revenues through the payment of royalties to our real estate franchise business, and has a relatively large variable cost component. While having certain fixed costs associated with its office locations, the principal cost of the company owned brokerage business consists of agents’ shares of commissions that fluctuate with revenue. Our business model and strong cash flow allow us the flexibility to grow through multiple avenues and focus on the areas that will maximize our return on capital. |

| • | Revenue enhancing “value circle” among our complementary businesses. Each one of our businesses, as well as our interest in PHH Home Loans, provides an opportunity to cross-sell additional services to a customer and capture revenue from the different service components associated with residential real estate transactions. For instance, through Cartus and the over 120,000 individual relocations that we manage annually, we are able to capture incremental business opportunities through cross-selling many of our related products and services throughout our company. In addition, we are growing our title and settlement services business by leveraging the strong geographic presence of our company owned brokerage business and franchisees and increasing the percentage of our customers that use our title and settlement services business. We refer to this ability to capture revenues on several aspects of a real estate transaction as our “value circle.” We believe that our value circle uniquely positions us to generate additional revenue growth opportunities in all of our businesses and enhance the customer’s overall experience. |

| • | Strong and experienced management team. Our executive officers have extensive experience in the real estate industry, which we believe is an essential component to our future growth as a stand-alone real estate and relocation services company. Our experienced senior management team combines a deep knowledge of the real estate markets, an understanding of industry trends and a proven ability to identify, effect and integrate acquisitions. |

4

Table of Contents

| • | Innovative technology. We believe that we effectively use innovative technology to attract more customers, enhance sales associates’ productivity and improve our profitability. We believe that our continued use and marketing of innovative technology, together with our aggressive Internet search engine marketing campaign, assisted in generating over 78 million visitors to our company owned real estate brokerage websites during 2005. |

Our Strategy

Our goal is to be the leading provider of a broad range of world-class real estate and relocation services to our customers while increasing revenues and profitability across all of our businesses. Our business strategy is focused on the following initiatives:

| • | Expand and grow our real estate franchise business. We intend to grow our real estate franchise business by selling new franchises, establishing and/or purchasing new brands, assisting current franchisees with their acquisitions and helping franchisees recruit productive sales associates. According to NAR, approximately 50% of sales associates in the U.S. work at brokerages that are unaffiliated with a national or regional franchise system. We believe our franchise sales force can effectively market our franchise systems to these unaffiliated brokerages. We will also continue to expand our international presence through the sale of international master franchise rights and by providing consulting services to the international master franchisors to facilitate growth in each respective territory. |

| • | Effectively grow our company owned real estate brokerage business. We will continue to grow our company owned real estate brokerage business both organically and through strategic acquisitions. To grow our business organically, our management will focus on working with office managers to recruit, retain and develop effective sales associates that can successfully engage and earn fees from new clients. We also intend to selectively open new offices and monitor existing offices to reduce strorefront costs while increasing operating efficiency. We will continue to be opportunistic and identify and make acquisitions in markets where there is potential for growth or that otherwise serve our overall long-term strategy and goals. |

| • | Increase our relocation services client base and service offerings. We intend to grow our relocation services business through a combination of adding new clients, providing additional services to existing clients and providing new product offerings. We also will continue to be a leader in providing global relocation services in existing and growing markets where our clients are placing employees, by expanding our global network presence with third party agents. We believe our comprehensive suite of services enables us to meet all of our clients’ global relocation needs. |

| • | Expand our title and settlement services geographic coverage and capture rate. We intend to grow our title and settlement services business through the completion of additional acquisitions, increasing the number of title and settlement services offices that are located in or around our company owned brokerage offices and through entering into contracts and ventures with our franchisees that will enable them to participate in the title and settlement services business. We will also continue to provide exceptional service to increase capture rates of available business at our existing locations. |

| • | Utilize new technology. According to NAR, over 70% of all real estate purchasers currently use the Internet in their search for a new home. In addition, many potential new customers use the Internet to perform research on real estate brokers. Recognizing this trend, we are increasing the percentage of our advertising dollars that are spent on Internet based advertising relative to print ads and other traditional forms of advertising. In addition, we intend to continue to identify, acquire and market new technologies that will be more responsive to our customers’ needs and should help our sales associates to become more efficient and successful. |

5

Table of Contents

| • | Increase cross-selling opportunities arising from the value circle. We will continue to take full advantage of our value circle and to increase revenues in all of our businesses by increasing our cross-selling opportunities. For example, we will seek to increase the percentage of successful referrals that our relocation services business makes to franchised and company owned brokerage offices through enhanced coordination as well as by maintaining a referral network that covers the entire United States. |

Our Risks

We face a number of risks and uncertainties relating to our business and our separation from Cendant. Examples of the risks and uncertainties that we face include:

| • | A decline in the number of homesales and/or home prices could adversely affect our revenues and profitability. In recent years, based on information published by NAR, existing homesale unit volumes have risen to their highest levels in history. Federal National Mortgage Association (“FNMA”) is forecasting, as of May 2006, 10% and NAR is forecasting, as of June 2006, 7% decreases, respectively, in the number of existing home sales during 2006 compared to 2005. Our recent indicators confirm this trend as evidenced by continuing homesale unit volume declines in our real estate franchise services and company owned brokerage services businesses during 2006 compared to 2005. We expect to see continued weakness in the number of closed homesale sides in 2006 due primarily to the disparity between home sellers’ expectations on price and home buyers’ access to greater inventory allowing them to be more patient. We also expect to see slower growth in the average price of homes sold in 2006 compared to 2005 as industry-wide inventory levels increase and the balance between supply and demand returns to more normalized levels. |

| • | We are sensitive to general business and economic conditions in the United States and worldwide, including short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets and the general condition of the U.S. and world economy. We are affected by the current rising interest rate environment because as mortgage rates rise, potential home buyers may be less likely to purchase a home or may choose to purchase a less expensive home. |

| • | We have not operated as an independent company and have in the past relied on Cendant for certain services. We may be unable to make the changes necessary to operate as an independent company or to obtain these services from unrelated third parties on reasonable terms or at all. |

| • | As part of our separation from Cendant, we will be responsible for certain of Cendant’s contingent and other corporate liabilities. Assuming our separation from Cendant occurred on March 31, 2006, we would have recorded liabilities of $648 million, which represents a 50% share of such Cendant contingent and other corporate liabilities, or, assuming a sale of Travelport by Cendant (as more fully described elsewhere in this information statement), of $810 million, which represents a 62.5% share of such contingent and other corporate liabilities. |

| • | At the time of our separation from Cendant, we expect to incur approximately $2,225 million of debt with external lenders to repay a portion of Cendant’s debt. In the event of a sale of Travelport (as more fully described elsewhere in this information statement), which could only occur after our separation, we expect to receive cash proceeds of $1,500 million to $1,800 million from Cendant which we will use to reduce and/or repay our outstanding indebtedness. Following any such reduction of our indebtedness, if our Board of Directors deems it appropriate, we may incur additional debt and use the proceeds from such additional debt for general corporate purposes, such as to repurchase shares of our common stock. There can be no assurance that the Travelport sale will occur or if it does occur that the actual amount of cash proceeds we receive will be within the range provided above. |

For further discussion of these risks and other risks and uncertainties that we face, see “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

6

Table of Contents

The Separation

Overview

On October 23, 2005, the Board of Directors of Cendant preliminarily approved a plan to separate Cendant into four independent, publicly traded companies—one for each of Cendant’s Real Estate Services, Travel Distribution Services, Hospitality Services (including Timeshare Resorts) and Vehicle Rental businesses. The separation will occur through distributions to Cendant stockholders of all of the shares of common stock of three subsidiaries of Cendant that hold or will hold the assets and liabilities, including the entities holding substantially all of the assets and liabilities, of the businesses other than the Vehicle Rental business which will remain after the distributions. Following each distribution, Cendant stockholders will own 100% of the common stock of the subsidiary being distributed. The distribution to Cendant stockholders of all of the shares of common stock of Realogy Corporation, a wholly owned subsidiary of Cendant that holds or will hold the assets and liabilities associated with Cendant’s Real Estate Services businesses, is expected to be the first in the series of distributions to effectuate the plan to separate Cendant into four companies. The second distribution is expected to be of Wyndham Worldwide Corporation (“Wyndham Worldwide”), the Cendant subsidiary that holds or will hold the assets and liabilities associated with Cendant’s Hospitality (including Timeshare Resorts) businesses and the third and final distribution is expected to be of Travelport Inc. (“Travelport”), the Cendant subsidiary that holds or will hold the assets and liabilities associated with Cendant’s Travel Distribution Services businesses. As explained more fully below, on April 24, 2006, Cendant announced that as an alternative to distributing shares of Travelport to Cendant stockholders, Cendant is also exploring the sale of Travelport. On May 30, 2006, Cendant announced progress in its alternative plan to sell Travelport, making a sale of Travelport more likely than a distribution of the common stock of Travelport to Cendant stockholders. On June 8, 2006, Cendant announced that it was exploring simultaneous distributions of Realogy and Wyndham Worldwide common stock. Following completion of the separation plan, it is expected that Cendant will change its name to Avis Budget Group, Inc.

Before our separation from Cendant, we will enter into a Separation and Distribution Agreement and several other agreements with Cendant and Cendant’s other businesses to effect the separation and distribution and provide a framework for our relationships with Cendant and Cendant’s other businesses after the separation. These agreements will govern the relationships among us, Cendant, Wyndham Worldwide and Travelport subsequent to the completion of the separation plan and provide for the allocation among us, Cendant, Wyndham Worldwide and Travelport of Cendant’s assets, liabilities and obligations (including employee benefits and tax-related assets and liabilities) attributable to periods prior to our separation from Cendant. The Separation and Distribution Agreement, in particular, requires us to assume 50% of certain contingent and other corporate liabilities of Cendant or its subsidiaries which are not primarily related to our business or the businesses of Wyndham Worldwide, Travelport or Cendant’s Vehicle Rental business, and Wyndham Worldwide and Travelport will each assume 30% and 20%, respectively, of such contingent and other corporate liabilities. The parties to the Separation and Distribution Agreement agreed that following completion of the separation plan, Cendant, which will consist of the Vehicle Rental business, will not retain any contingent or other corporate liabilities incurred prior to the completion of the separation plan that are not primarily related to the Vehicle Rental business because the Vehicle Rental company is expected to have more total debt, both secured and unsecured, and/or lower credit ratings, than us, Wyndham Worldwide and Travelport. These contingent and other corporate liabilities of Cendant or its subsidiaries include liabilities relating to (i) Cendant’s terminated or divested businesses, (ii) in the event of a sale of Travelport (as described below), liabilities relating to the Travelport sale, if any, (iii) certain litigation matters as more fully described in the section “Business—Legal Proceedings—Legal—Cendant Corporate Litigation” and (iv) generally any actions with respect to the separation plan or the distributions brought by any third party. We will generally act as managing party and will manage and assume control of most legal matters related to the contingent and other corporate liabilities of Cendant.

Pursuant to the Separation and Distribution Agreement, we expect to incur approximately $2,225 million of debt, all the proceeds of which will be transferred to Cendant to repay a portion of Cendant’s corporate debt. In addition, prior to the separation of Wyndham Worldwide from Cendant, each of Wyndham Worldwide and

7

Table of Contents

Travelport will incur debt and will transfer such proceeds to Cendant. With the aggregate proceeds received from each of us, Wyndham Worldwide and Travelport, along with cash on hand at Cendant (available to be utilized to repay its corporate debt), Cendant has agreed to repay its corporate debt and, with respect to the amount transferred by Travelport, to repay other corporate obligations and to fund the actual and estimated cash expenses borne by Cendant relating to the separation. The actual amount of debt that we incur at the time of our separation may be more or less than $2,225 million depending upon the actual operating performance of Cendant and a more refined calculation of the cash outlays relating to the separation plan. See “The Separation—Incurrence of Debt.” The amount of debt we will incur was based on future estimates of our ability to service the debt relative to the other separated companies and our ability to maintain an investment grade credit rating. In addition, the Separation and Distribution Agreement provides for a post-separation adjustment, in the event that (i) the aggregate amount of cash provided to Cendant by us, Wyndham Worldwide and Travelport from the proceeds of each company’s respective borrowings, together with Cendant’s cash, is greater or less than (ii) the amount necessary for Cendant to repay its corporate debt and, with respect to the amount transferred by Travelport, to repay other corporate obligations and to fund the actual and estimated cash expenses borne by Cendant relating to the separation (other than those primarily related to its Vehicle Rental business, but including costs and expenses related to the plan of separation incurred through that date and estimated to be incurred prior to the completion of the plan of separation). In the event that such amounts are less than the amount necessary to enable Cendant to repay its outstanding corporate debt and, with respect to the amount transferred by Travelport, to repay other corporate obligations and to fund the actual and estimated cash expenses borne by Cendant relating to the separation, Wyndham Worldwide would be required to incur additional indebtedness equal to such insufficiency up to $100 million and transfer such additional amounts to Cendant. To the extent the insufficiency is in excess of $100 million, we would be required to make a payment to Cendant (or, if our separation occurs at the same time as Wyndham Worldwide’s, we will be required to incur additional indebtedness for transfer to Cendant) equal to 62.5% of such excess and Wyndham Worldwide would be required to incur additional indebtedness equal to 37.5% of such excess. However, if at the time of Wyndham Worldwide’s separation a definitive agreement relating to a sale of Travelport has been executed, any such insufficiency will result in an upward adjustment in the amount of indebtedness incurred by Travelport, but only to the extent that Travelport is able to obtain such additional debt financing on commercially reasonable terms. Thereafter, if there is still an insufficiency, Wyndham Worldwide will be responsible for the first $100 million (as described above) and we and Wyndham Worldwide would be responsible for 62.5% and 37.5%, respectively, of any excess over $100 million (as described above). See “The Separation—Incurrence of Debt.”

The announcement of the proposed separation plan indicated that the Cendant Board believes that the separation is the best way to unlock the full value of Cendant’s businesses in both the short and long term, which the Cendant Board does not believe has been fully recognized by the investment community. Cendant believes that the separation into four independent, publicly traded companies should not only enhance their strength, but will also improve each company’s strategic, operational and financial flexibility. Although there can be no assurance, Cendant believes that over time following the separation, the common stock of the separated companies should have a higher aggregate market value, on a fully distributed basis and assuming the same market conditions, than if Cendant were to remain under its current configuration. Cendant expects that such value increase in the common stock should enhance the value of equity-based compensation for the employees of the separated companies and should permit the separated companies to effect future acquisitions with their own common stock in a manner that preserves capital with less dilution of the existing stockholders’ interests than would occur by issuing pre-distribution Cendant common stock, in each case, resulting in a real and substantial benefit for the companies. Further, the Cendant Board believes that the separation should allow each separated company to maintain a sharper focus on its core business and growth opportunities, which should allow each separated company to be better able to make the changes to its business necessary for it to respond to developments in the industry in which it operates. See “The Separation—Reasons for the Separation,” included elsewhere in this information statement.

The Cendant Board has received an opinion from Evercore Group L.L.C. to the effect that, as of the date of such opinion, the distribution is fair, from a financial point of view, to the stockholders of Cendant. The Cendant

8

Table of Contents

Board also received an opinion from Duff & Phelps, LLC to the effect that Realogy and Cendant will each be solvent and adequately capitalized immediately after the distribution and that Cendant has sufficient surplus under Delaware law to declare the dividend of Realogy common stock.

The distribution of our common stock as described in this information statement is subject to the satisfaction or waiver of certain conditions. See “The Separation—Conditions to the Distribution,” included elsewhere in this information statement. Furthermore, we cannot provide any assurances that the distribution of either Wyndham Worldwide or Travelport will be completed, or that the more likely scenario of the sale of Travelport will occur, nor can we provide information at this time with respect to the terms on which such other distributions will be consummated. The other distributions are subject to certain conditions precedent, including final approval of the Cendant Board.

We are a newly formed holding company that will, prior to the distribution, hold all of the assets and liabilities of Cendant’s Real Estate Services businesses as a result of an internal reorganization implemented by Cendant. Our headquarters is located at One Campus Drive, Parsippany, New Jersey 07054 and our general telephone number is (973) 496-6700. We maintain an Internet site at http://www.realogy.com. Our website and the information contained on that site, or connected to that site, are not incorporated by reference into this information statement.

Potential Sale of Travelport

On April 24, 2006, Cendant announced a modification to its previously announced separation plan. As an alternative to pursuing its original plan to distribute the shares of common stock of Travelport to Cendant stockholders, Cendant is also exploring the possible sale of Travelport. This modification does not affect Cendant’s plan to distribute our shares and the shares of Wyndham Worldwide to Cendant stockholders. Since this announcement, Cendant, together with its financial advisors, has actively pursued the potential sale of Travelport, while at the same time continuing preparations for the distribution of Travelport’s shares to Cendant stockholders (expected in October 2006). On May 30, 2006, Cendant announced progress in pursuing its alternative plan to sell Travelport rather than distributing Travelport’s shares to Cendant stockholders, making a sale the more likely alternative. While Cendant is engaged in preliminary discussions with several interested parties, there can be no assurance that a sale of Travelport will be completed or as to the terms of any such sale. We do not anticipate that Cendant will enter into a definitive agreement with respect to a sale of Travelport prior to our separation from Cendant.

Pursuant to the Separation and Distribution Agreement, Cendant has agreed to use its reasonable best efforts to effect the sale of Travelport and Cendant will be required to effect such a sale if it is able to receive an opinion from a nationally-recognized investment bank to the effect that the proposed purchase price in connection with a sale of Travelport is fair from a financial point of view to Cendant (without considering the use of proceeds of such a sale). Subject to the foregoing sentence and limited rights of consultation that we and Wyndham Worldwide will have, Cendant will have the sole right and authority to control the sale process and potential sale of Travelport. However, Cendant will be required to distribute the shares of common stock of Travelport to Cendant stockholders as originally planned if Cendant has not signed a definitive agreement to sell Travelport by September 30, 2006 or, if a sale agreement has been entered into prior to September 30, 2006, if the sale of Travelport has not been completed by December 31, 2006. In addition, the Separation and Distribution Agreement will contain certain other requirements relating to a Travelport sale, including that the definitive sale agreement contain terms and provisions reasonably customary for a transaction of this kind.

Unless and until Cendant enters into a definitive agreement for a sale of Travelport and such a sale is completed, the implications of a sale on our separation from Cendant cannot be fully determined. However, if Cendant were to sell Travelport, the terms of our separation, as well as Wyndham Worldwide’s separation, from

9

Table of Contents

Cendant would be impacted. If there were a sale of Travelport, which may not occur until after our separation from Cendant, a portion of the cash proceeds from the sale (after giving effect to certain tax liabilities and other expenses incurred by Cendant in connection with the sale and the repayment of any Travelport indebtedness) would be contributed to us and Wyndham Worldwide and such proceeds would be utilized to reduce and/or repay the indebtedness incurred by us and Wyndham Worldwide in connection with our separations (for a detailed discussion of our planned borrowings in connection with our separation, see “Description of Material Indebtedness”). Accordingly, assuming gross cash proceeds in a Travelport sale in the range of $4,300 million to $4,800 million (which represents an estimate of expected gross cash sale proceeds based on non-binding indications of interest received to date), we estimate that following our receipt and utilization of such cash proceeds to reduce and/or repay the $2,225 million of indebtedness we incurred at the time of our separation, our indebtedness would range from $450 million to $750 million. The actual amount of our remaining indebtedness may be more or less than the range provided above depending on the following:

| • | the actual sale price of Travelport; |

| • | the form of the consideration, including any non-cash proceeds; |

| • | the amount of expenses, estimated taxes and other payments incurred in connection with such sale; |

| • | the amount of projected lost tax attributes of Cendant as a result of such sale; and |

| • | the application of sale proceeds that have priority over contributions to us. |

See “Certain Relationships and Related Party Transactions—Agreements with Cendant, Wyndham Worldwide and Travelport—Separation and Distribution Agreement—Potential Sale of Travelport.”

In the event Travelport is not sold, we will not receive any proceeds and therefore our indebtedness will not be reduced. In addition, in the event that a Travelport sale includes non-cash consideration, we could not use such non-cash consideration to reduce our indebtedness.

In addition, if a sale of Travelport were to occur, the Separation and Distribution Agreement provides that Cendant’s contingent and other corporate liabilities (which would include any liabilities of Cendant incurred in connection with a Travelport sale) and assets (which would include any non-cash or deferred cash proceeds received in connection with a Travelport sale) will be reallocated such that:

| • | we will assume 62.5% and Wyndham Worldwide will assume 37.5% of these contingent and other corporate liabilities of Cendant and its subsidiaries; |

| • | we will be entitled to 62.5% and Wyndham Worldwide will be entitled to 37.5% of these contingent and other corporate assets of Cendant and its subsidiaries; and |

| • | Travelport will no longer have any responsibility for or rights with respect to any of these contingent corporate or other liabilities and assets of Cendant and its subsidiaries. |

We will continue to act as managing party for most legal matters related to the contingent and other corporate liabilities of Cendant and upon a sale of Travelport, we will have control of most decisions relating to the settlement, resolution or disposition of most of these legal matters.

Assuming our separation from Cendant occurred on March 31, 2006 and assuming a sale of Travelport, we would have recorded liabilities of $810 million resulting from the reallocation of our and Wyndham Worldwide’s assumption of a portion of Cendant’s contingent and other corporate liabilities to our assumption of 62.5% (instead of 50%) and Wyndham Worldwide’s assumption of 37.5% (instead of 30%) of Cendant’s contingent and other corporate liabilities, respectively. In the event Travelport is not sold, in which case our allocable portion of Cendant’s contingent and other corporate liabilities would remain at 50%, we would have recorded liabilities of $648 million on March 31, 2006.

10

Table of Contents

Questions and Answers about Realogy and the Separation

| Why is the separation of Realogy structured as a distribution? |

Cendant believes that a tax-free distribution of shares of Realogy and of the entities that hold or will hold substantially all of the assets and liabilities of the other Cendant businesses is a tax-efficient way to separate the businesses in a manner that will create benefits and/or value for us and Cendant and long-term value for us and Cendant stockholders. |

| How will the separation of Realogy work? |

The separation will be accomplished through a series of transactions in which the equity interests of the entities that hold all of the assets and liabilities of Cendant’s Real Estate Services businesses will be transferred to Realogy and the common stock of Realogy will be distributed by Cendant to its stockholders on a pro rata basis. |

| When will the distribution occur? |

We expect that Cendant will distribute the shares of Realogy common stock on , 2006 to holders of record of Cendant common stock on , 2006, the record date. |

| What do stockholders need to do to participate in the distribution? |

Nothing, but we urge you to read this entire document carefully. Stockholders who hold Cendant common stock as of the record date will not be required to take any action to receive Realogy common stock in the distribution. No stockholder approval of the distribution is required or sought. We are not asking you for a proxy and you are requested not to send us a proxy. You will not be required to make any payment, surrender or exchange your shares of Cendant common stock or take any other action to receive your shares of our common stock. If you own Cendant common stock as of the close of business on the record date, Cendant, with the assistance of Mellon Investor Services, the distribution agent, will electronically issue shares of our common stock to you or to your brokerage firm on your behalf by way of direct registration in book-entry form. Mellon Investor Services will mail you a book-entry account statement that reflects your shares of Realogy common stock, or your bank or brokerage firm will credit your account for the shares. If you sell shares of Cendant common stock in the “regular-way” market up to and including through the distribution date, you will be selling your right to receive shares of Realogy common stock in the distribution. Following the distribution, stockholders whose shares are held in book-entry form may request that their shares of Realogy common stock held in book-entry form be transferred to a brokerage or other account at any time, without charge. |

| Can Cendant decide to cancel the distribution of the common stock even if all the conditions have been met? |

Yes. The distribution is subject to the satisfaction or waiver of certain conditions. See “The Separation—Conditions to the Distribution,” included elsewhere in this information statement. Cendant has the right to terminate the distribution, even if all of the conditions are satisfied, if at any time the Board of Directors of Cendant determines that the distribution is not in the best interests of Cendant and its stockholders or that market conditions are such that it is not advisable to separate the Real Estate Services business from Cendant. |

| Does Realogy plan to pay dividends? |

The declaration and payment of any future dividends by us will be subject to the discretion of our Board of Directors and will depend |

11

Table of Contents

| upon many factors, including our financial condition, earnings, capital requirements of our operating subsidiaries, covenants associated with certain of our debt obligations, legal requirements, regulatory constraints and other factors deemed relevant by our Board. |

| Will Realogy have any debt? |

Yes. At the time of our separation, we expect to incur approximately $2,225 million of debt. The actual amount of debt that we incur at the time of our separation may be more or less than $2,225 million depending upon the actual operating performance of Cendant and a more refined calculation of the cash outlays relating to the separation plan. In addition, the Separation and Distribution Agreement provides for a post-separation adjustment in the event that (i) the aggregate amount of cash provided to Cendant by us, Wyndham Worldwide and Travelport from the proceeds of each company’s respective borrowings, together with Cendant’s cash, is greater or less than (ii) the amount necessary for Cendant to repay its corporate debt and, with respect to the amount transferred by Travelport, to repay other corporate obligations and to fund the actual and estimated cash expenses borne by Cendant relating to the separation. In the event that such amounts are less than the amount necessary to enable Cendant to repay its outstanding corporate debt and, with respect to the amount transferred by Travelport, to repay other corporate obligations and to fund the actual and estimated cash expenses borne by Cendant relating to the separation (other than those primarily related to its Vehicle Rental business, but including costs and expenses related to the plan of separation incurred through that date and estimated to be incurred prior to the completion of the plan of separation), Wyndham Worldwide would be required to incur additional indebtedness equal to such insufficiency up to $100 million and transfer such additional amounts to Cendant. To the extent the insufficiency is in excess of $100 million, we would be required to make a payment to Cendant (or, if our separation occurs at the same time as Wyndham Worldwide’s, we will be required to incur additional indebtedness for transfer to Cendant) equal to 62.5% of such excess and Wyndham Worldwide would be required to incur additional indebtedness equal to 37.5% of such excess. However, if at the time of Wyndham Worldwide’s separation a definitive agreement relating to a sale of Travelport has been executed, any such insufficiency will result in an upward adjustment in the amount of indebtedness incurred by Travelport, but only to the extent that Travelport is able to obtain such additional debt financing on commercially reasonable terms. Thereafter, if there is still an insufficiency, Wyndham Worldwide will be responsible for the first $100 million (as described above) and we and Wyndham Worldwide would be responsible for 62.5% and 37.5%, respectively, of any excess over $100 million (as described above). Our borrowing facilities consist of a $600 million term loan facility, a $1,050 million revolving credit facility and a $1,325 million interim loan facility. At or prior to the distribution, we intend to draw the entire amount of the term loan facility and the interim loan facility and $300 million of the revolving credit facility and will transfer this $2,225 million in proceeds to Cendant solely for the purpose of repaying certain indebtedness of Cendant. However, in the event of a |

12

Table of Contents

| sale of Travelport, which sale may only occur after our separation, we expect to receive cash proceeds of $1,500 million to $1,800 million which we will use to reduce and/or repay our outstanding indebtedness. The actual amount of cash proceeds we receive may be more or less than the range provided above depending on (i) the actual sale price of Travelport, (ii) the form of consideration including any non-cash proceeds, (iii) the amount of expenses, estimated taxes and other payments incurred in connection with such sale, (iv) the amount of projected lost tax attributes of Cendant as a result of such sale and (v) the application of sale proceeds that have priority over contributions to us. Following any such reduction of our indebtedness, if our Board of Directors deems it appropriate, we may incur additional debt and use the proceeds from such additional debt for general corporate purposes, such as to repurchase shares of our common stock. Historical Cendant debt has not been and will not be assigned to the Realogy businesses. The remaining availability under the revolving credit facility will be used to provide liquidity for ongoing working capital and for letters of credit issuance and other general corporate needs. We intend to replace the interim loan facility with permanent financing primarily through the issuance of debt securities, or partially or wholly repay the facility with proceeds we receive from the sale of Travelport, if any. |

| Cartus, our relocation services subsidiary, has three pre-existing securitization programs to monetize certain relocation related assets. These programs will remain in place following the separation. As of March 31, 2006, $743 million was outstanding under these programs and $826 million of assets secured this indebtedness. |

| For additional information relating to our planned financing arrangements, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition, Liquidity and Capital Resources” and “Description of Material Indebtedness” included elsewhere in this information statement. |

| What will the separation cost? |

Cendant expects to incur pre-tax separation costs of approximately $990 million to $1,140 million in connection with the consummation of the separation plan, which costs are expected to consist of, among other things, corporate debt repayment costs, severance and retention costs, and legal, accounting and other advisory fees. Over the 12 months following our separation, the portion of these pre-tax costs expected to be recorded in our financial statements is approximately $105 million to $130 million. A majority of our separation costs are expected to be non-cash. |

| What are the U.S. federal income tax consequences of the distribution to Cendant stockholders? |

The distribution is conditioned upon Cendant’s receipt of an opinion of Skadden, Arps, Slate, Meagher & Flom LLP substantially to the effect that the distribution, together with certain related transactions, should qualify as a reorganization for U.S. federal income tax purposes under Sections 368(a)(1)(D) and 355 of the Internal Revenue Code of 1986, as amended (the “Code”). Assuming the distribution so qualifies, for U.S. federal income tax purposes, no gain or loss will be recognized by you, and no amount will be included in your income, upon the receipt of shares of our common stock pursuant to the distribution. You generally will recognize gain or loss |

13

Table of Contents

| with respect to any cash received in lieu of a fractional share of our common stock. See “The Separation—Certain U.S. Federal Income Tax Consequences of the Distribution,” included elsewhere in this information statement. |

| How will I determine the tax basis I will have in the Realogy shares I receive in the distribution? |

Shortly after the distribution is completed, Cendant will provide United States taxpayers with information to enable them to compute their tax bases in both Cendant and Realogy shares and other information they will need to report their receipt of Realogy common stock on their 2006 U.S. federal income tax returns as a tax-free transaction. Generally, your aggregate tax basis in the stock you hold in Cendant and Realogy shares received in the distribution (including any fractional share interest in Realogy common stock for which cash is received) will equal your tax basis in your Cendant common stock immediately before the distribution, allocated between the Cendant common stock and Realogy common stock (including any fractional share interest of Realogy common stock for which cash is received) in proportion to their relative fair market values on the date of the distribution. |

| You should consult your tax advisor about the particular consequences of the distribution to you, including the application of state, local and foreign tax laws. |

| What will the relationships between Cendant and Realogy be following the separation? |

Before the separation, we will enter into a Separation and Distribution Agreement and several other agreements with Cendant and Cendant’s other businesses to effect the separation and provide a framework for our relationships with Cendant and Cendant’s other businesses after the separation. These agreements will govern the relationships among us, Cendant, Wyndham Worldwide and Travelport subsequent to the completion of the separation plan and provide for the allocation among us, Cendant, Wyndham Worldwide and Travelport of Cendant’s assets, liabilities and obligations (including employee benefits and tax-related assets and liabilities) attributable to periods prior to our separation from Cendant. The Separation and Distribution Agreement, in particular, requires Realogy to assume or retain the liabilities of Cendant or its subsidiaries primarily related to Realogy’s business and 50%, or 62.5% in the event of a sale of Travelport, of certain contingent and other corporate liabilities of Cendant which are not primarily related to the businesses of Realogy, Wyndham Worldwide, Travelport or the Vehicle Rental business, and establishes the amount of the debt that each separated company will initially incur to repay Cendant’s corporate debt and with respect to the amount transferred by Travelport, to repay other corporate obligations and to fund the actual and estimated cash expenses borne by Cendant relating to the separation. We cannot assure you that these agreements will be on terms as favorable to us as agreements with unaffiliated third parties. See “Certain Relationships and Related Party Transactions,” included elsewhere in this information statement. |

| Our Chairman of the Board and Chief Executive Officer will continue to serve as Cendant’s Chairman of the Board and Chief Executive Officer until the distribution of Wyndham Worldwide and the distribution or sale of Travelport have been completed. One of our independent directors is |

14

Table of Contents

| expected to serve as a director of Cendant. In addition, four of our independent directors will continue to serve as directors of Cendant until the completion of Cendant’s separation plan. |

| Will I receive physical certificates representing shares of Realogy common stock following the separation? |

No. Following the separation, neither Cendant nor Realogy will be issuing physical certificates representing shares of Realogy common stock. Instead, Cendant, with the assistance of Mellon Investor Services, the distribution agent, will electronically issue shares of our common stock to you or to your bank or brokerage firm on your behalf by way of direct registration in book-entry form. Mellon |

| Investor Services will mail you a book-entry account statement that reflects your shares of Realogy common stock, or your bank or brokerage firm will credit your account for the shares. A benefit of issuing stock electronically in book-entry form is that there will be none of the physical handling and safekeeping responsibilities that are inherent in owning physical stock certificates. |

| What if I want to sell my Cendant common stock or my Realogy common stock? |

You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. Neither Cendant nor Realogy makes any recommendations on the purchase, retention or sale of shares of Cendant common stock or the Realogy common stock to be distributed. |

| If you decide to sell any shares before the distribution, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your Cendant common stock or the Realogy common stock you will receive in the distribution or both. |

| Where will I be able to trade shares of Realogy common stock? |

There is not currently a public market for our common stock. We applied to list our common stock on the New York Stock Exchange, or NYSE, under the symbol “H.” We anticipate that trading in shares of our common stock will begin on a “when-issued” basis on or shortly before the record date and will continue up to and including through the distribution date and that “regular-way” trading in shares of our common stock will begin on the first trading day following the distribution date. If trading begins on a “when-issued” basis, you may purchase or sell our common stock up to and including through the distribution date, but your transaction will not settle until after the distribution date. We cannot predict the trading prices for our common stock before, on or after the distribution date. |

| Will the number of Cendant shares I own change as a result of the distribution? |

No. The number of shares of Cendant common stock you own will not change as a result of the distribution. However, it is anticipated that Cendant will seek to effect a reverse stock split after the completion of the distributions of both Wyndham Worldwide and Travelport. |

| What will happen to the listing of Cendant common stock? |

Nothing. It is expected that after the distribution of Realogy common stock, Cendant common stock will continue to be traded on the NYSE under the symbol “CD.” After completion of the separation plan, Cendant, which will comprise the Vehicle Rental business, is expected to change its name to Avis Budget Group, Inc. and its trading symbol to “CAR,” and the Cendant name and trading symbol are expected to be retired. |

15

Table of Contents

| Will the distribution affect the market price of my Cendant shares? |

Yes. As a result of the distribution, we expect the trading price of shares of Cendant common stock immediately following the distribution to be lower than immediately prior to the distribution because the trading price will no longer reflect the value of the Real |

| Estate Services businesses. Furthermore, until the market has fully analyzed the value of Cendant without the Real Estate Services businesses, the price of Cendant shares may fluctuate significantly. In addition, although Cendant believes that over time following the separation, the common stock of the separated companies should have a higher aggregate market value, on a fully distributed basis and assuming the same market conditions, than if Cendant were to remain under its current configuration, there can be no assurance, and thus the combined trading prices of Cendant common stock and Realogy common stock after the distribution may be equal to or less than the trading price of shares of Cendant common stock before the distribution. |

| Are there risks to owning Realogy common stock? |

Yes. Our business is subject to both general and specific risks relating to our business, our leverage, our relationship with Cendant and our being a separate publicly traded company. Our business is also subject to risks relating to the separation. These risks are described in the “Risk Factors” section of this information statement beginning on page 26. We encourage you to read that section carefully. |

| Where can Cendant stockholders get more information? |

Before the separation, if you have any questions relating to the separation, you should contact: |

| Cendant Corporation |

| Investor Relations |

| 9 West 57th Street |

| New York, New York 10019 |

| Tel: (212) 413-1800 |

| Fax: (212) 413-1909 |

| www.cendant.com |

| After the separation, if you have any questions relating to our |

| common stock, you should contact: |

| Realogy Corporation |

| Investor Relations |

| 1 Campus Drive |

| Parsippany, New Jersey 07054 |

| Tel: (973) 496-6700 |

| Fax: (973) 496-6799 |

| www.realogy.com |

| After the separation, if you have any questions relating to the distribution of our shares, you should contact: |

| Mellon Investor Services LLC |

| 480 Washington Boulevard |

| Jersey City, New Jersey 07310 |

| www.melloninvestor.com |

16

Table of Contents

Summary of the Separation

The following is a summary of the material terms of the separation and other related transactions.

| Distributing company |

Cendant Corporation. After the distribution, Cendant will not own any shares of our common stock. |

| Distributed company |

Realogy Corporation, a Delaware corporation and a wholly owned subsidiary of Cendant that was formed to hold all of the assets and liabilities of Cendant’s Real Estate Services businesses. After the distribution, Realogy will be an independent public company. However, our Chairman of the Board and Chief Executive Officer will continue to serve as Chairman of the Board and Chief Executive Officer of Cendant until the completion of the separation plan. |

| Distribution ratio |

Each holder of Cendant common stock will receive one share of our common stock (and a related preferred stock purchase right) for every four shares of Cendant common stock held on , 2006. Cash will be distributed in lieu of fractional shares, as described below. |

| Distributed securities |

All of the shares of Realogy common stock owned by Cendant, which will be 100% of our common stock outstanding immediately prior to the distribution. Based on the approximately one billion shares of Cendant common stock outstanding on May 22, 2006, and applying the distribution ratio of one share of Realogy common stock for every four shares of Cendant common stock, approximately 250 million shares of our common stock will be distributed to Cendant stockholders who hold Cendant common stock as of the record date. The number of shares that Cendant will distribute to its stockholders will be reduced to the extent that cash payments are to be made in lieu of the issuance of fractional shares of our common stock. |

| Our Board of Directors is expected to adopt a stockholder rights plan prior to the distribution date. The stockholder rights plan is designed to protect our stockholders from coercive or otherwise unfair takeover tactics. You will receive one preferred stock purchase right for every share of Realogy common stock you receive in the distribution. Unless the context otherwise requires, references herein to our common stock include the related preferred stock purchase rights. See “Description of Capital Stock—Rights Plan.” |

| Fractional shares |

Cendant will not distribute any fractional shares of our common stock to its stockholders. Instead, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate net cash proceeds of the sales pro rata to each holder who otherwise would have been entitled to receive a fractional share in the distribution. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares. The receipt of cash in lieu of fractional shares |

17

Table of Contents