Exhibit 4

AMENDMENT NO. 2 TO THE

FOURTH AMENDED AND RESTATED

DECLARATION OF TRUST AND TRUST AGREEMENT

OF

POWERSHARES DB G10 CURRENCY HARVEST FUND

This Amendment No. 2 dated as of May 10, 2013 (“Amendment No. 2”) to the Fourth Amended and Restated Declaration of Trust and Trust Agreement, dated as of November 12, 2012 (the “Declaration of Trust”), of PowerShares DB G10 Currency Harvest Fund (the “Fund”) by and between DB Commodity Services LLC (the “Managing Owner”) and Wilmington Trust Company.

WHEREAS, the Managing Owner has deemed it advisable for the Fund to amend the Declaration of Trust by replacing Exhibit B (Description of the Deutsche Bank G10 Currency Future Harvest Index – Excess ReturnTM) to the Declaration of Trust with the amended Exhibit B, as provided by section 1 below;

WHEREAS, the Managing Owner wishes to amend the Declaration of Trust pursuant to Section 11.1(b)(iii) thereof to give effect to the foregoing.

NOW, THEREFORE, in consideration of the premises and of other good and valuable consideration, the receipt and sufficiency of all of which are hereby acknowledged, the Declaration of Trust is amended as follows:

| 1. | Exhibit B to the Declaration of Trust shall be replaced in its entirety with Exhibit A attached hereto. |

| 2. | This Amendment No. 2 shall be governed by, and construed in accordance with, the laws of the State of Delaware. |

| 3. | Terms used but not otherwise defined herein shall have the meaning ascribed to such term in the Declaration of Trust, as amended. |

Remainder of page left blank intentionally.

IN WITNESS WHEREOF, this Amendment No. 2 has been executed for and on behalf of the undersigned as of the 10th day of May, 2013.

| DB COMMODITY SERVICES LLC, as Managing Owner | ||

| By: | /s/ Martin Kremenstein | |

| Name: | Martin Kremenstein | |

| Title: | Chief Executive Officer | |

| By: | /s/ Alex Depetris | |

| Name: | Alex Depetris | |

| Title: | Chief Operating Officer | |

| Acknowledged: | ||

| WILMINGTON TRUST COMPANY, not in its individual capacity but solely as Trustee of the Fund | ||

| By: | /s/ Patrick J. Donahue | |

| Name: Patrick J. Donahue | ||

| Title: Vice President | ||

2

EXHIBIT A

Exhibit B

DESCRIPTION OF THE

Deutsche Bank G10 Currency Future Harvest Index – Excess Return™

Amended as of May 10, 2013

Deutsche Bank G10 Currency Future Harvest Index® is a registered trademark of Deutsche Bank AG. All rights reserved. Any use of this mark must be with the consent of or under license from the Index Sponsor.

General

The Deutsche Bank G10 Currency Future Harvest Index – Excess Return™ (the “Index”) is designed to reflect the return from investing in long currency futures positions for certain currencies associated with relatively high yielding interest rates and in short currency futures positions for certain currencies associated with relatively low yielding interest rates. The Index is designed to exploit the trend that currencies associated with relatively high interest rates, on average, tend to rise in value relative to currencies associated with relatively low interest rates. The Index exploits this trend using both long and short futures positions, which is expected to provide more consistent and less volatile returns than could be obtained by taking long positions only or short positions only. The use of long and short positions in the construction of the Index causes the Index to rise as a result of any upward price movement of Index Currencies (as defined below) expected to gain relative to the USD and to rise as a result of any downward price movement of Index Currencies expected to fall relative to the USD. The inclusion of both long and short positions is also expected to reduce the country specific foreign exchange risk of the Index relative to a directional (outright long or short) exposure to any or all of the Index Currencies.

Chicago Mercantile Exchange FX Futures are used in the index calculation. FX Futures based on the G10 currencies vs. USD are eligible for selection in the Index. The G10 currencies, or Eligible Index Currencies, are United States Dollar (USD), Euro (EUR), Japanese Yen (JPY), Canadian Dollar (CAD), Swiss Franc (CHF), British Pound (GBP), Australian Dollar (AUD), New Zealand Dollar (NZD), Norwegian Krone (NOK) and Swedish Krona (SEK). The Index is published as provided below.

The sponsor of the Index, or the Index Sponsor, is Deutsche Bank AG London. The composition of the Index may be adjusted in the Index Sponsor’s discretion.

The Index Sponsor calculates the Closing Level (as defined below) of the Index on both an excess return basis and a total return basis. The excess return index reflects the return of the applicable underlying currencies. The total return is the sum of the return of the applicable underlying currencies plus the return of 3-month U.S. Treasury bills.

For the purposes of this Description:

“Closing Level” means, in respect of an Index Business Day (as defined below), the closing level of the Index for such Index Business Day.

A general description of the Index (including, but not limited to, the underlying formulae and all other Index terms and conditions) (the “General Descriptions”) are included on the Index Sponsor’s website at index.db.com, or any successor thereto. The information included in this Index description (the “Description”) may be provided in greater detail than that which is included in the General Descriptions. Any material changes to the terms and conditions of the Index as disclosed in future versions of the General Descriptions will be deemed to amend such corresponding terms and conditions that are included in this Description, unless otherwise determined at the sole discretion of the Index Sponsor. The Index Sponsor may, in its sole discretion and for housekeeping purposes, amend and restate this Description to conform it to reflect material changes to the General Descriptions.

- 1 -

Index Calculation and Rules

Currency Future Selection

The Index will include six of the Eligible Index Currencies, or Index Currencies. The composition of the Index may be adjusted in the event that the Index Sponsor is not able to calculate the closing prices of the Index Currencies.

In order to determine which Eligible Index Currencies to include in the Index from time-to-time, the Index Sponsor will review the composition of the Index on a quarterly basis five Index Business Days (as defined below) prior to the applicable IMM Date.

The Index Sponsor will review the three month Libor rate for each Eligible Index Currency other than NZD, SEK, NOK, CAD and AUD. The Index Sponsor will review the 3 month rate of the New Zealand Bank Bill for NZD. The Index Sponsor will review the three month Stibor rate and the three month Nibor rate of the SEK and NOK, respectively. The Index Sponsor will review the 3 month Canada Bankers Acceptance Rate for CAD. The Index Sponsor will review the Australian Bank Bill Short Term Rate 3 Month Mid for AUD. The Libor, Stibor and Nibor rates for the Eligible Index Currencies, as applicable, mean the London, Stockholm and Norway interbank offered rates for overnight deposits, respectively, each of which is published by Reuters on pages libor01 and libor02 with respect to Libor and pages SIDE and NIBR with respect to Stibor and Nibor. The Eligible Index Currencies are then ranked according to yield. The three highest yielding and three lowest yielding are selected as Index Currencies for inclusion in calculating the Index. If two Index Currencies have the same yield, then the previous quarter’s ranking will be used.

The Index is re-weighted quarterly. Upon re-weighting, the high yielding Index Currencies are allocated a base weight of 33 1/3% and the low yield Index Currencies are allocated a base weight of -33 1/3%. These new weights are applied during the Index Re-Weighting Period.

For the purposes of this Description:

“Index Re-Weighting Period” takes place between the fourth and third Index Business Days prior to the applicable IMM Date.

“IMM Date” means the third Wednesday of March, June, September and December, a traditional settlement date in the International Money Market.

Excess Return Index Calculation

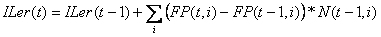

The CME-traded futures contract of each applicable Index Currency that is closest to expiration is used in the Index calculation. The futures contracts on the Index Currencies are rolled during the Index Re-Weighting Period. The new futures contract on an Index Currency that has the next closest expiration date is selected. The calculation of the Index on an excess return basis is the weighted return of the change in price of the futures contracts on the Index Currencies. The excess return index is calculated as follows:

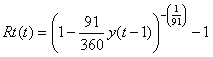

3-month U.S. Treasury Bill Return Calculation

A 3-month U.S. Treasury bill return is used in the calculation of the Index on a total return basis. The return for the 3-month U.S. Treasury bill investment is calculated on a daily basis using:

- 2 -

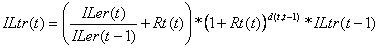

Total Return Index Calculation

The calculation of the Index on a total return basis represents the return from investing in both currency futures contracts and 3-month U.S. Treasury bills and is calculated as follows:

Index Re-Weighting

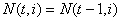

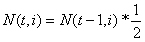

Currency futures positions on the Index Currencies are adjusted during the Index Re-Weighting Period. The notional value of the currency futures positions on the Index Currencies remains constant on all other days that do not fall within the Index Re-Weighting Period. This constant notional value is expressed as:

Index Re-Weighting Period

On each day during the Index Re-Weighting Period, a new notional value of each Index Currency futures position is calculated. The calculations for the old futures that are leaving the index and the new futures that are entering are different.

Notional Value Calculations of Index Currencies to be Removed from the Index

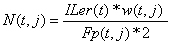

The notional value of the Index Currency futures position on the first day of Index Re-Weighting Period (which is four Index Business Days prior to the IMM Date) is expressed as:

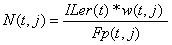

The notional value of the Index Currency futures position on the second day of Index Re-Weighting Period (which is three Index Business Days prior to the IMM Date) is expressed as:

Notional Value Calculations of Index Currencies to be Added to the Index

The notional value of the Index Currency futures position on the first day of Index Re-Weighting Period (which is four Index Business Days prior to the IMM Date) is expressed as:

The notional value of the Index Currency futures position on the second day of Index Re-Weighting Period (which is three Index Business Days prior to the IMM Date) is expressed as:

- 3 -

Initial Index Notional Value

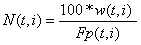

On the index inception date of March 12, 1993, the initial notional value of the Index Currency futures positions were calculated using:

Where:

| i | = Index Currency | |

| t | = Index calculation date | |

| r | = Last index re-weighting date | |

| Fp(t,i) | = Currency future price for old currency future i on index calculation day t | |

| Fp(t,j) | = Currency future price for new currency future j on index calculation day t | |

| y(t) | = T-bill yield on day t | |

| Rt(t) | = T-bill return on day t | |

| ILer(t) | = DBCFH Excess Return Index level on day t | |

| ILtr(t) | = DBCFH Total Return Index level on day t | |

| w(t,i) | = Weight of old currency future i on index calculation day t | |

| w(t,j) | = Weight of new currency future j on index calculation day t | |

| d(t,t-1) | = Number of calendar days between day t and index calculation day t-1 excluding day t | |

| N(t,i) | = Notional holding of old currency future i on index calculation day t | |

| N(t,j) | = Notional holding of new currency future j on index calculation day t |

Index Disruption Event

If an Index Disruption Event in relation to an Index Currency or an Exchange Instrument on such Index Currency continues for a period of five successive Exchange Business Days, the Index Sponsor will, in its discretion, either (i) continue to calculate the relevant Closing Price by reference to the Closing Price of the Exchange Instrument on such Index Currency on the immediately preceding Valid Date (as provided in the definition of the relevant Closing Price) for a further period of five successive Exchange Business Days or (ii) select:

| (a) | an Exchange Traded Instrument relating to the relevant Index Currency or in the determination of the Index Sponsor a currency substantially similar to the relevant Index Currency published in U.S. Dollars; or |

| (b) | if no Exchange Traded Instrument as described in (a) above is available or the Index Sponsor determines that for any reason (including, without limitation, the liquidity or volatility of such Exchange Traded Instrument at the relevant time) the inclusion of such Exchange Traded Instrument in the Index would not be appropriate, an Exchange Traded Instrument relating to the relevant Index Currency or in the determination of the Index Sponsor a currency substantially similar to the relevant Index Currency published in a currency other than U.S. Dollars; |

in each case to replace the Exchange Instrument relating to the relevant Index Currency, all as determined by the Index Sponsor.

- 4 -

In the case of (a) above, if an Index Disruption Event in relation to the relevant Exchange Instrument on an Index Currency continues for the further period of five successive Exchange Business Days referred to therein, on the expiry of such period the provisions of (b) above shall apply.

In the case of a replacement of an Exchange Traded Instrument as described in (b) above, the Index Sponsor will make such adjustments to the methodology and calculation of the Index as it determines to be appropriate to account for the relevant replacement and will publish such adjustments in accordance with the section “Publication of Closing Levels and Adjustments” below.

For the purposes of this Description:

“Valid Date” means, in respect of an Index Currency, a day which is an Exchange Business Day in respect of such Index Currency and a day on which an Index Disruption Event in respect of such Index Currency or a related Exchange Instrument on such Index Currency does not occur.

“Exchange Business Day” means, in respect of a futures contract on an Index Currency, a day that is (or, but for the occurrence of an Index Disruption Event or Force Majeure Event would have been) a trading day for such Index Currency on the CME.

“Closing Price” means, in respect of an Index Business Day, the closing price on CME of the relevant Exchange Instrument, as published by CME for that Index Business Day or, if in the determination of the Index Sponsor such Index Business Day is not a Valid Date, the closing price on CME of the relevant Exchange Instrument published by CME for the immediately preceding Valid Date, subject as provided in the sections “Index Disruption Event” and “Force Majeure.”

“Exchange Instrument” means, in respect of each Index Currency, an instrument for future delivery of that Index Currency on a specified delivery date traded on the CME.

“Exchange Traded Instrument” means, in respect of an Index Currency, an instrument for future delivery of that Index Currency on a specified delivery date traded on an exchange.

“Index Business Day” means a day (other than a Saturday or Sunday) on which commercial banks and foreign exchange markets settle payments and are open for general business (including dealings in foreign exchange and foreign currency deposits) in New York City.

“Index Disruption Event” means, in respect of an Index Currency or a Exchange Instrument on such Index Currency, an event (other than a Force Majeure Event) that would require the Index Sponsor to calculate the Closing Price in respect of the relevant Exchange Instrument on such Index Currency on an alternative basis were such event to occur or exist on a day that is an Exchange Business Day (or, if different, the day on which the Closing Price for such Exchange Instrument on such Index Currency for the relevant Index Business Day would, in the ordinary course, be published or announced by the CME).

Force Majeure

If a Force Majeure Event occurs on an Index Business Day, the Index Sponsor may in its discretion:

| (i) | make such determinations and/or adjustments to the terms of this Description of the Index as it considers appropriate to determine any Closing Level on any such Index Business Day; and/or |

| (ii) | defer publication of the information relating to the Index, until the next Index Business Day on which it determines that no Force Majeure Event exists; and/or |

| (iii) | permanently cancel publication of the information relating to the Index. |

- 5 -

For the purposes of this Description:

“Force Majeure Event” means an event or circumstance (including, without limitation, a systems failure, natural or man-made disaster, act of God, armed conflict, act of terrorism, riot or labour disruption or any similar intervening circumstance) that is beyond the reasonable control of the Index Sponsor and that the Index Sponsor determines affects the Index, any Index Currency or any Exchange Instrument.

Change in the Methodology of the Index

The Index Sponsor will, subject as provided below, employ the methodology described above and its application of such methodology shall be conclusive and binding. While the Index Sponsor currently intends to employ the above described methodology to calculate the Index, no assurance can be given that fiscal, market, regulatory, juridical or financial circumstances (including, but not limited to, any changes to or any suspension or termination of or any other events affecting any Index Currency or a futures contract) will not arise that would, in the view of the Index Sponsor, necessitate a modification of or change to such methodology and in such circumstances the Index Sponsor may make any such modification or change as it determines appropriate. The Index Sponsor may also make modifications to the terms of the Index in any manner that it may deem necessary or desirable, including (without limitation) to correct any manifest or proven error or to cure, correct or supplement any defective provision contained in this Description of the Index. The Index Sponsor will publish notice of any such modification or change and the effective date thereof in accordance with Publication of Closing Levels and Adjustments below.

Publication of Closing Levels and Adjustments

In order to calculate the indicative Index level, the Index Sponsor will poll Reuters every 15 seconds to determine the real time price of each underlying futures contract with respect to each Index Currency of the Index. The Index Sponsor will then apply a set of rules to these values to create the indicative level of the Index. These rules are consistent with the rules which the Index Sponsor applies at the end of each trading day to calculate the closing level of the Index. A similar polling process is applied to the U.S. Treasury bills to determine the indicative value of the U.S. Treasury bills held by the Fund every 15 seconds throughout the trading day.

The Index Sponsor will publish the closing level of the Index daily. Additionally, the Index Sponsor will publish the intra-day Index level once every fifteen seconds throughout each trading day.

All of the foregoing information will be published as follows:

The intra-day level of the Index (symbol: DBCFHX) (quoted in USD) will be published once every fifteen seconds throughout each trading day on the consolidated tape, Reuters and/or Bloomberg and on Deutsche Bank’s website at http://www.dbfunds.db.com, or any successor thereto.

The most recent end-of-day Index closing level (symbol: DBCFHX) will be published as of the close of business for the Amex each trading day on the consolidated tape, Reuters and/or Bloomberg and on Deutsche Bank’s website at http://www.dbfunds.db.com, or any successor thereto.

The Index Sponsor will publish any adjustments made to the Index on Deutsche Bank’s website http:// www.dbfunds.db.com, or any successor thereto.

All of the foregoing information with respect to the Index also will be published at http://index.db.com.

Historical Closing Levels

The Description incorporates herein the historical closing levels of the Index as published and amended from time-to-time.

- 6 -

[Remainder of page left blank intentionally.]

- 7 -