UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

[ ] |

Preliminary Proxy Statement |

|

[ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

[X] |

Definitive Proxy Statement |

|

[ ] |

Definitive Additional Materials |

|

[ ] |

Soliciting Material under §210.14a-12 |

PGT INNOVATIONS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

[X] |

No fee required. |

|

[ ] |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|

[ ] |

Fee paid previously with preliminary materials: |

|

[ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

April 27, 2020

Dear Fellow Stockholder:

I am pleased to invite you to attend our 2020 annual meeting of stockholders (the “Meeting”), to be held on June 15, 2020, at 2:00 p.m., Eastern time. In light of the coronavirus/COVID-19 outbreak, related public health concerns, and federal and state government recommendations and requirements regarding limiting public gatherings, and to assist in protecting the health and well-being of the Company’s stockholders, employees and other representatives, our Meeting will be conducted exclusively online by remote communication.

To participate in the Meeting, visit www.virtualshareholdermeeting.com/PGTI2020 and enter the 16-digit control number included on your Important Notice Regarding the Availability of Proxy Materials, on your proxy card, or on the instructions that accompanied your proxy materials. You may log into the Meeting platform beginning at 1:45 p.m. Eastern time on June 15, 2020.

You may vote during the Meeting by following the instructions available on the Meeting website during the meeting. If you wish to submit a question, you may do so during the Meeting by logging into the virtual Meeting platform , typing your question into the “Ask a Question” field, and clicking “Submit.” Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered at once. If you encounter any technical difficulties with the virtual meeting platform on the meeting day, please call the technical support numbers shown on the Meeting website. Technical support will be available beginning at 1:30 p.m. Eastern time on June 15, 2020 and will remain available until the Meeting has ended.

This document includes the notice of the Meeting and the proxy statement. The proxy statement is important to our corporate governance process. It describes the various proposals to be voted upon during the Meeting, solicits your vote on those proposals, provides you with information about our Board of Directors and executive officers and provides other information concerning PGT Innovations, Inc. that we believe you should be aware of when you vote your shares.

Your vote is important to us. If you hold your shares through a broker, your broker cannot vote on certain proposals without your instruction. Please use your proxy card or voter instruction form to inform us, or your broker, how you would like to vote your shares on the proposals in the proxy statement.

On behalf of the Board of Directors of PGT Innovations, Inc., I would like to express our appreciation for your ownership and continued interest in the affairs of PGT Innovations, Inc. and I hope you will choose to participate in our Meeting.

Sincerely,

Rodney Hershberger

Chair of the Board

1070 TECHNOLOGY DRIVE

NORTH VENICE, FLORIDA 34275

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

On-Line Meeting Only by Remote Communication – No Physical Meeting Location

The PGT Innovations, Inc. (the “Company”) 2020 annual meeting of stockholders (the “Meeting”) will be held on June 15, 2020, beginning at 2:00 p.m. Eastern time, for the purposes of considering and voting on the following matters:

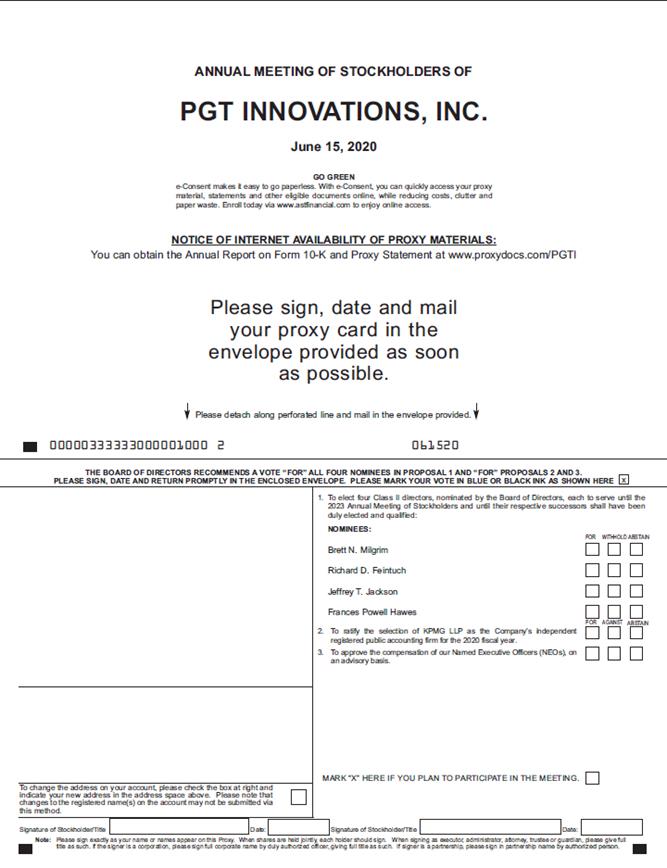

1.To elect four directors, nominated by our Board of Directors, to serve until our 2023 annual meeting of stockholders and until their respective successors shall have been duly elected and qualified;

2.To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the 2020 fiscal year;

3.To approve the compensation of our Named Executive Officers (“NEOs”), on an advisory basis; and,

4.To act on any other matter that may properly come before the Meeting or any adjournment or postponement thereof.

Information relating to these items, including our Board of Director’s recommendations for how you should vote on them, is provided in the accompanying proxy statement. Only stockholders of record at the close of business on April 27, 2020 are entitled to receive notice of and to vote during the Meeting.

In light of the coronavirus/COVID-19 outbreak, related public health concerns, and federal and state government recommendations and requirements regarding limiting public gatherings, and to assist in protecting the health and well-being of the Company’s stockholders, employees and other representatives, our Meeting will be conducted exclusively online by remote communication. To participate in the Meeting, visit www.virtualshareholdermeeting.com/PGTI2020 and enter the 16-digit control number included on your Important Notice Regarding the Availability of Proxy Materials, on your proxy card, or on the instructions that accompanied your proxy materials. You may log into the Meeting platform beginning at 1:45 p.m. Eastern time on June 15, 2020. If you encounter any technical difficulties with the virtual meeting platform on the meeting day, please call the technical support numbers shown on the Meeting website. Technical support will be available beginning at 1:30 p.m. Eastern time on June 15, 2020 and will remain available until the Meeting has ended.

You may vote during the Meeting by following the instructions available on the Meeting website during the meeting. If you wish to submit a question, you may do so during the meeting by logging into the virtual Meeting platform , typing your question into the “Ask a Question” field, and clicking “Submit.” Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered at once.

If you were a stockholder of record on April 27, 2020, you are encouraged to vote in one of the following ways, whether or not you plan to participate in the Meeting: (1) by telephone; (2) via the Internet; or (3) by completing, signing and dating a written proxy card and returning it promptly to the address indicated on the proxy card.

|

|

By Order of the Board of Directors,

|

|

|

Jeffrey T. Jackson |

|

|

Chief Executive Officer and President |

North Venice, Florida

April 27, 2020

|

|

35 |

|

|

|

36 |

|

|

|

38 |

|

|

|

40 |

|

|

|

41 |

|

|

|

42 |

|

|

|

43 |

|

|

|

44 |

|

|

|

44 |

|

|

|

44 |

|

|

|

45 |

|

|

|

45 |

|

|

|

45 |

|

|

|

46 |

|

|

|

47 |

|

|

|

48 |

|

|

|

48 |

|

|

|

49 |

|

|

|

50 |

|

|

|

50 |

|

|

|

50 |

|

|

STOCKHOLDER PROPOSALS OR NOMINATIONS FOR THE 2021 ANNUAL MEETING |

|

51 |

|

|

51 |

|

|

|

51 |

|

|

|

51 |

|

|

|

51 |

|

|

|

52 |

PGT INNOVATIONS, INC.

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

The 2020 annual meeting of stockholders (the “Meeting”) of PGT Innovations, Inc., a Delaware corporation (“we,” “us,” “our,” or the “Company”) will be held on June 15, 2020, beginning at 2:00 p.m., Eastern time. In light of the coronavirus/COVID-19 outbreak, related public health concerns, and federal and state government recommendations and requirements regarding limiting public gatherings, and to assist in protecting the health and well-being of the Company’s stockholders, employees and other representatives, our Meeting will be conducted exclusively online by remote communication. To participate in the Meeting, visit www.virtualshareholdermeeting.com/PGTI2020 and enter the 16-digit control number included on your Important Notice Regarding the Availability of Proxy Materials, on your proxy card, or on the instructions that accompanied your proxy materials. You may log into the Meeting platform beginning at 1:45 p.m. Eastern time on June 15, 2020. If you encounter any technical difficulties with the virtual meeting platform on the meeting day, please call the technical support numbers shown on the Meeting website. Technical support will be available beginning at 1:30 p.m. Eastern time on June 15, 2020 and will remain available until the Meeting has ended.

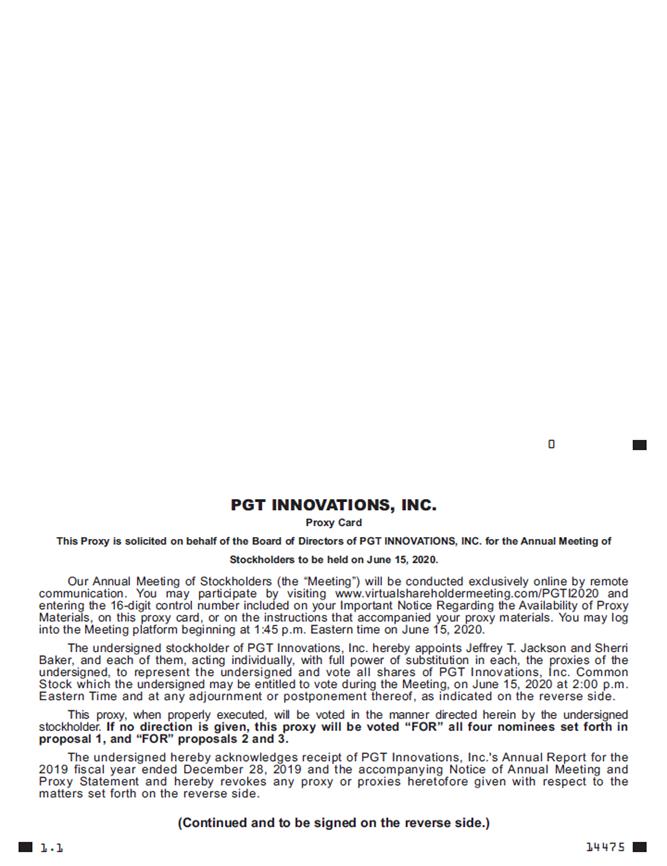

Our Board of Directors does not intend to bring any matter before the Meeting except as specifically indicated in the notice of annual meeting of stockholders and does not know of anyone else who intends to do so. If any other matters properly come before the Meeting, however, the persons named in the enclosed proxy, or their duly constituted proxy substitutes, will be authorized to vote or otherwise act thereon in accordance with their judgment on such matters. If the enclosed proxy is properly executed and returned to, and received by, the Company prior to voting at the Meeting, the shares of our common stock represented thereby will be voted in accordance with the instructions marked thereon. In the absence of instructions, the shares of our common stock will be voted “FOR” each of the four director nominees in Proposal 1, to serve until our 2023 annual meeting of stockholders and until their respective successors shall have been duly elected and qualified, “FOR” Proposal 2, the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the 2020 fiscal year, and “FOR” Proposal 3, approval of our NEO compensation, on an advisory basis. Any proxy may be revoked at any time before its exercise by notifying the Chief Financial Officer, who is our acting Secretary, in writing, by delivering a duly executed proxy bearing a later date, or by participating in the Meeting and voting.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to Be Held on June 15, 2020:

The Proxy Statement for the Meeting, our Annual Report to Stockholders and our

Annual Report on Form 10-K for the Fiscal Year Ended December 28, 2019

are available at www.proxydocs.com/PGTI.

QUESTIONS AND ANSWERS ABOUT VOTING AND THE ANNUAL MEETING

The following questions and answers about voting during the Meeting include those relating to participation in and voting during the Meeting, which will be conducted solely online by remote communication.

What is the purpose of this Proxy Statement?

This Proxy Statement provides information regarding matters to be voted on during the Meeting. Additionally, it contains certain information that the Securities and Exchange Commission (the “SEC”) requires us to provide annually to our stockholders. This Proxy Statement is also used by our Board of Directors to solicit proxies to be used during the Meeting so that all stockholders of record have an opportunity to vote on the matters to be presented during the Meeting, even if they cannot virtually attend the meeting. Our Board of Directors has designated Jeffrey T. Jackson and Sherri Baker to vote the shares of our common stock represented by valid proxies during the Meeting.

Who is entitled to vote on the matters discussed in the Proxy Statement?

You are entitled to vote if you were a stockholder of record of our common stock as of the close of business on April 27, 2020, the “record date” for the Meeting. Your shares of our common stock can be voted during the Meeting only if you are present virtually or represented by a valid proxy during the Meeting.

What constitutes a quorum for the Meeting?

The holders of a majority of the issued and outstanding shares of our common stock as of the close of business on the record date must be present, either virtually or represented by valid proxy, to constitute a quorum necessary to conduct the Meeting. On the record date, 59,920,456 shares of our common stock were issued and outstanding. Shares of our common stock represented by valid proxies received but marked as abstentions or as withholding voting authority for any or all director nominees, and shares of our common stock represented by valid proxies received but reflecting broker nonvotes, will be counted as present during the Meeting for purposes of establishing a quorum.

How many votes am I entitled to for each share of common stock I hold?

Each share of our common stock represented during the Meeting virtually or by valid proxy is entitled to one vote for each director nominee with respect to the proposal to elect directors and one vote for each of the proposals presented at the meeting.

What proposals will require my vote?

You are being asked to vote on the following proposals:

|

|

1. |

to elect four directors to serve until our 2023 annual meeting of stockholders and until their respective successors shall have been duly elected and qualified; |

|

|

2. |

to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2020 fiscal year; and, |

|

|

3. |

to approve the compensation of our NEOs, on an advisory basis. |

What vote is required to elect directors or approve or vote on each proposal, and how will my vote be counted?

Proposal 1-Election of Directors

Stockholders may vote “FOR”, “WITHHOLD” or “ABSTAIN” for each of the four director nominees being considered pursuant to Proposal 1. Director nominees named in Proposal 1 are elected by a plurality of the votes cast, and the director nominees who receive the greatest number of votes during the Meeting (up to the number of directors to be elected) will be elected. However, the Company’s Corporate Governance Guidelines provide for a “Plurality Plus” voting standard with respect to the election of directors. Any director nominee who receives a greater number of “WITHHOLD” votes than “FOR” votes in an uncontested election, such as this election, is required to promptly submit an offer of resignation for consideration by the Governance Committee of the Board of Directors. “ABSTAIN” votes are not counted for purposes of determining whether a director is required to submit an offer of resignation.

1

Shares of our common stock represented by a validly executed proxy will be voted, if authority to do so is not withheld, for the election of director nominees named in Proposal 1. Only votes “FOR” are counted in determining whether a plurality has been cast in favor of a director nominee. Broker non-votes are not counted as an “ABSTAIN,” “WITHHOLD” or a “FOR” vote for these purposes. Further information about our Plurality Plus voting standard is included under the heading “Corporate Governance Guidelines and Code of Conduct and Ethics.”

Proposal 2-Ratification of the Appointment of the Independent Registered Public Accounting Firm

Stockholders may vote “FOR,” “AGAINST” or “ABSTAIN” with respect to the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 2020 fiscal year. The proposal to ratify the appointment of our independent registered public accounting firm will be approved by the vote of “FOR” of the holders of the majority of shares of our common stock present virtually or represented by valid proxy during the Meeting. A vote to “ABSTAIN” will count as a vote “AGAINST” the proposal to ratify the appointment of our independent registered public accounting firm.

Proposal 3-Approve the compensation of our NEOs on an advisory basis

Stockholders may vote “FOR,” “AGAINST” or “ABSTAIN” with respect to the approval of the compensation of our NEOs on an advisory basis. Pursuant to the Company’s Bylaws, approval of this proposal requires a vote “FOR” the proposal by the holders of a majority of the total number of votes of our common stock represented and entitled to vote on the proposal. Therefore, a vote to “ABSTAIN” will count as a vote “AGAINST” the approval of the compensation of our NEOs, on an advisory basis. The vote on Proposal 3 is advisory and not binding on the Company, but the Board of Directors values stockholder opinion and will consider the outcome of the vote in determining our executive compensation programs. As such, our Board of Directors seeks the opinion of our stockholders by requesting that our stockholders vote on the compensation of our NEOs, pursuant to Section 14A of the Securities Exchange Act of 1934, as disclosed in this proxy statement, which includes the Compensation Discussion and Analysis, the Summary Compensation Table and the supporting tabular and narrative disclosure on executive compensation.

How does our Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote:

|

|

• |

“FOR” the election of each of the four director nominees named in Proposal 1 to serve until our 2023 annual meeting of stockholders and until their respective successors shall have been duly elected and qualified (Proposal 1); |

|

|

• |

“FOR” the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2020 fiscal year (Proposal 2); and, |

|

|

• |

“FOR” the proposal to approve the compensation of our NEOs on an advisory basis (Proposal 3). |

How can I vote my shares without participating in the Meeting?

Whether you hold shares of our common stock directly as the stockholder of record or beneficially in street name, you may direct your vote without participating in the Meeting. You may vote by granting a proxy or, for shares of our common stock held in street name, by submitting voting instructions to your broker, bank or nominee.

Please refer to the summary instructions below and those included on your proxy card or, for shares of our common stock held in street name, the voting instruction card included by your broker, bank or nominee.

BY INTERNET OR TELEPHONE – If you hold shares of our common stock directly as the stockholder of record, you may vote by the internet or telephone or according to the instructions included on your proxy card. For shares of our common stock held in street name, you may be able to vote by the internet or telephone as permitted by your broker, bank or nominee. The availability of internet and telephone voting for beneficial owners will depend on the voting process of your broker, bank or nominee. Therefore, for shares of our common stock held through a broker, bank or nominee in street name, we recommend that you follow the voting instructions you receive by your broker, bank or nominee.

2

BY MAIL – If you hold shares of our common stock directly as the stockholder of record, you may vote by mail by completing, signing and dating your proxy card and mailing it in the accompanying enclosed, pre-addressed envelope. For shares of our common stock held in street name, you may vote by mail by completing, signing and dating the voting instruction card included by your broker, bank or nominee and mailing it in the accompanying enclosed, pre-addressed envelope. If you provide specific voting instructions, your shares of our common stock will be voted as you instruct. If the pre-addressed envelope is missing, please mail your completed proxy card to American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, New York 11219, Attn: Proxy Department.

If you cast your vote in any of the alternatives set forth above, your shares of our common stock will be voted in accordance with your voting instructions, unless you properly revoke your proxy. If you are a stockholder of record and you complete, sign, date and return your proxy card or complete the internet or telephone voting procedures, but you do not specify how you want to vote your shares of our common stock, we will vote them “FOR” each of the four director nominees named in Proposal 1, and “FOR” Proposals 2 and 3. We do not currently anticipate that any other matters will be presented for action during the Meeting. If any other matters are properly presented for action during the meeting, the persons named on your proxy will vote your shares of our common stock on these other matters in their discretion, under the discretionary authority you have granted to them in your proxy.

If you own shares of our common stock in “street name” through a broker, bank or nominee and you do not provide instructions to your broker, bank or nominee on how to vote your shares, your broker, bank or nominee has discretion to vote your shares of our common stock on certain “routine” matters, including the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 2020 fiscal year. However, on “non-routine” matters such as the election of directors, and the approval of our NEO compensation on an advisory basis, your broker, bank or nominee must receive voting instructions from you since it does not have discretionary voting power for these proposals. So long as the broker, bank or nominee has discretion to vote on at least one proposal, these “broker non-votes” are counted toward establishing a quorum. Therefore, it is important for you to provide voting instructions to your broker, bank or nominee.

How can I vote my shares during the Meeting?

Shares of our common stock held directly in your name as the stockholder of record may be voted during the Meeting. To vote your shares during the meeting, visit www.virtualshareholdermeeting.com/PGTI2020 and enter the 16-digit control number included on your Important Notice Regarding the Availability of Proxy Materials, on your proxy card, or on the instructions that accompanied your proxy materials. You may then vote during the Meeting by following the instructions available on the aforementioned Meeting website. SHARES OF OUR COMMON STOCK HELD BENEFICIALLY IN STREET NAME MAY BE VOTED VIRTUALLY BY YOU DURING THE MEETING ONLY IF YOU OBTAIN A SIGNED PROXY FROM THE RECORD HOLDER GIVING YOU THE RIGHT TO VOTE THE SHARES. EVEN IF YOU CURRENTLY PLAN TO PARTICIPATE IN THE MEETING, WE RECOMMEND THAT YOU ALSO SUBMIT YOUR PROXY AS DESCRIBED BELOW SO THAT YOUR VOTE WILL BE COUNTED IF YOU LATER DECIDE NOT TO PARTICIPATE IN THE MEETING.

Can I change my vote after I submit my proxy?

Yes. Even after you have submitted your proxy, you may change your vote at any time prior to the close of voting during the Meeting by:

|

|

• |

filing with our Chief Financial Officer, who is our acting Secretary at 1070 Technology Drive, North Venice, Florida 34275 a signed, original written notice of revocation dated later than the proxy you submitted, |

|

|

• |

submitting a duly executed proxy bearing a later date, |

|

|

• |

voting by telephone or internet on a later date, or |

|

|

• |

participating in the Meeting and voting online during the meeting. |

3

If you grant a proxy, you are not prevented from participating in the Meeting and voting during the Meeting. However, your participation in during the Meeting will not by itself revoke a proxy that you have previously granted. You must vote during the Meeting to revoke your proxy.

If your shares of our common stock are held in a stock brokerage account or by a bank, broker or other nominee, you may revoke your proxy by following the instructions provided by your bank, broker, or other nominee.

All shares of our common stock represented by a valid proxy and not properly revoked will be voted during the Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of our stockholders hold their shares through a broker, bank or nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares of our common stock are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote online during the Meeting by following the instructions for voting on the Meeting website. We have enclosed or sent a proxy card for you to use.

Beneficial Owner

If your shares of our common stock are held in a stock brokerage account or by a broker, bank or nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee, which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote your shares of our common stock and are also invited to participate in the Meeting. However, because you are not the stockholder of record, you may not vote these shares yourself during the Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. Your broker, bank or nominee has enclosed or provided a voting instruction card for you to use in directing the broker, bank or nominee how to vote your shares of our common stock. If you do not provide the stockholder of record with voting instructions, your shares of our common stock may constitute broker non-votes. The effect of broker non-votes is more specifically described in the section of this Proxy Statement entitled “What vote is required to approve each proposal or elect directors, and how will my vote be counted?” above.

I am a beneficial holder. How will my shares be voted if I do not return voting instructions?

Your shares of our common stock may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. Under the rules of the New York Stock Exchange (“NYSE”), brokerage firms have the authority to vote shares on certain routine matters for which their customers do not provide voting instructions by the tenth day before the Meeting. The proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2020 fiscal year is considered a routine matter.

The election of directors and say-on-pay advisory votes are not considered routine matters under the rules of the NYSE. If a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial holder of the shares of our common stock with respect to that proposal, then the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.” In tabulating the voting result for any non-routine proposal, shares of our common stock that are subject to broker non-votes with respect to that proposal will not be considered votes either for or against the proposal, but will be counted as present for determining whether a quorum exists. Accordingly, it is very important that you provide voting instructions to your brokerage firm if you want your shares of our common stock to be voted during the Meeting on a non-routine matter.

4

How will a proposal or other matter that was not included in this Proxy Statement be handled for voting purposes if it is raised during the Meeting?

If any matter that is not described in this Proxy Statement should properly come before the Meeting, then Jeffrey T. Jackson and Sherri Baker, or any one of them, as proxies will vote the shares of our common stock represented by valid proxies in accordance with their best judgment. Such matters will be approved by the vote of the holders of a majority of shares of our common stock present virtually or represented by valid proxy during the Meeting, unless a greater vote is required by law, our Amended and Restated Certificate of Incorporation or our Amended and Restated By-Laws (our “By-Laws”). At the time this Proxy Statement was mailed to stockholders, management was unaware of any other matters that might be presented for stockholder action during the Meeting.

What happens if I abstain from voting?

Abstentions with respect to a proposal are counted for purposes of establishing a quorum. If a quorum is present, then abstentions will have the effect described in the section of this Proxy Statement entitled “What vote is required to approve each proposal or elect directors, and how will my vote be counted?” above.

What do I need to do if I want to participate in the Meeting?

Only stockholders, our Board of Directors, director nominees, management of the Company and management’s invited guests are permitted to participate in the Meeting, which is being conducted exclusively online by remote communication. To participate in the Meeting, visit www.virtualshareholdermeeting.com/PGTI2020 and enter the 16-digit control number included on your Important Notice Regarding the Availability of Proxy Materials, on your proxy card, or on the instructions that accompanied your proxy materials. You may log into the Meeting platform beginning at 1:45 p.m. Eastern Time on June 15, 2020.

How will proxies be solicited and what is the cost?

We bear all expenses incurred in connection with the solicitation of proxies. We have engaged MacKenzie Partners, Inc. to assist with the solicitation of proxies for a fee estimated to be up to $7,500 for the initial solicitation services, plus reimbursement of out-of-pocket expenses.

In addition to solicitation by mail and the Internet, certain officers, directors and employees of the Company may solicit proxies by telephone, email, and facsimile or in person, although no additional compensation will be paid for such solicitation. The Company may also request brokers, banks and nominees to solicit their customers who have a beneficial interest in our common stock registered in their names and will reimburse such brokers, banks and nominees for their reasonable out-of-pocket expenses.

What does it mean if I receive more than one proxy or voting instruction card?

It means your shares of our common stock are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

Where can I find the voting results of the Meeting?

We will announce preliminary voting results during the Meeting and will publicly disclose results in a Current Report on Form 8-K within four business days of the date of the Meeting.

Who will count the votes?

A representative of MacKenzie Partners, Inc., our proxy solicitor, will tabulate the votes, serve as the independent inspector of elections for the Meeting, and certify the final vote on all matters considered during the Meeting

5

How can I access the Company’s proxy materials and annual report electronically?

A copy of our 2019 Annual Report to Stockholders is being mailed or otherwise made available concurrently with this Proxy Statement to all stockholders entitled to notice of and to vote during the Meeting. A copy of our 2019 Annual Report to Stockholders and this Proxy Statement are available without charge at www.proxydocs.com/PGTI.

References to our website in this Proxy Statement are not intended to function as hyperlinks, and the information contained on our website is not incorporated into this Proxy Statement. These proxy materials are also available in print to stockholders without charge and upon request, addressed to PGT Innovations, Inc., 1070 Technology Drive, North Venice, Florida 34275, Attention: Chief Financial Officer, who is our acting Secretary. You are encouraged to access and review all the important information contained in the enclosed proxy materials before voting.

May I propose actions for consideration at the 2021 annual meeting of stockholders?

Yes. For a stockholder to propose any matter for consideration at the 2021 annual meeting of stockholders, you should follow the requirements set forth in our By-Laws, as discussed in the section of this Proxy Statement entitled “Other Business – Stockholder Proposals or Director Nominations for the 2021 Annual Meeting.”

6

PROPOSAL 1 –

ELECTION OF DIRECTORS

There are currently nine members of our Board of Directors. Pursuant to the Company’s Amended and Restated Certificate of Incorporation, our Board of Directors is “classified,” which means it is divided into three classes of directors based on the expiration of their terms. Under this arrangement, directors are elected to terms that expire on the annual meeting date three years following the annual meeting at which they were elected, and the terms are “staggered”.

Our Board of Directors has nominated Mr. Milgrim, Mr. Feintuch, Mr. Jackson, and Ms. Powell Hawes to be elected during the Meeting to serve again as Class II directors until our 2023 annual meeting of stockholders and until their respective successors shall have been duly elected and qualified.

Each director nominee has consented to continue to serve as a director if elected during the Meeting. Should a nominee become unavailable to accept election as a director, the persons named in the enclosed proxy will vote the shares of our common stock that such proxy represents for the election of such other person as our Board of Directors may nominate. We have no reason to believe that any of the nominees will be unable to serve.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE ELECTION OF THESE

FOUR CLASS II DIRECTOR NOMINEES.

Set forth below is certain information concerning each nominee for election as a director during the Meeting and each director whose current term of office will continue after the Meeting. Each of our directors brings to our Board of Directors a wealth of varied experience derived from service as executives, financial experts, subject experts and/or industry leaders. Specific factors considered by our Board of Directors in the process undertaken in searching for and recommending qualified director candidates are described below under “Governance of the Company – Assessment of Director Candidates and Required Qualifications”. The specific individual qualifications, experience, and skills of each of our directors that led to the conclusion that the individual should serve as a director of ours in light of our business and structure are described in the following paragraphs, and we believe that such qualifications, experience, and skills contribute to the Board of Directors’ effectiveness as a whole.

|

Name |

Age |

Class and Position |

Date Elected or Appointed Director |

|

Alexander R. Castaldi* |

70 |

Class I Director |

2004 |

|

William J. Morgan* |

73 |

Class I Director |

2007 |

|

Brett N. Milgrim* |

51 |

Class II Director |

2003 |

|

Richard D. Feintuch* |

67 |

Class II Director |

2006 |

|

Jeffrey T. Jackson |

54 |

Class II Director |

2016 |

|

Frances Powell Hawes* |

65 |

Class II Director |

2019 |

|

Floyd F. Sherman * |

80 |

Class III Director |

2005 |

|

Rodney Hershberger |

63 |

Class III Director |

2004 |

|

64 |

Class III Director |

2016 |

* Denotes director whom our Board of Directors has affirmatively determined to be independent.

Class II - Directors with Terms Expiring in 2020

Brett N. Milgrim. Mr. Milgrim became a director in 2003. Mr. Milgrim is a director of Builders FirstSource, Inc., and is the Co-Chair of the Board of Directors of Loar Group, Inc., a business specializing in the design and manufacture of aerospace components. Effective April 4, 2019, Mr. Milgrim was appointed to the Board of Directors of Horizon Global Corporation, one of the world's leading manufacturers of branded towing and trailering equipment. He was a Managing Director of JLL Partners, Inc., which he joined in 1997, until his retirement in 2011. Our Board of Directors believes that Mr. Milgrim is extremely knowledgeable regarding all aspects of corporate finance and the capital markets, and that this knowledge is important to the Company and its stockholders.

7

Richard D. Feintuch. Mr. Feintuch became a director in 2006. Mr. Feintuch was a partner of the law firm Wachtell, Lipton, Rosen & Katz from 1984 until his retirement in 2004, specializing in mergers and acquisitions, corporate finance, and the representation of creditors and debtors in large restructurings. Mr. Feintuch earned a Bachelor of Science in Economics from the Wharton School of the University of Pennsylvania and a J.D. from New York University School of Law. Mr. Feintuch also is a member of the board of directors of J. Crew Group, Inc., an internationally recognized multi-brand apparel and accessories retailer. The Board believes that Mr. Feintuch’s significant knowledge, and the experience he obtained as a partner of a leading international law firm, brings not only legal skills but practical know-how into the board room, and such skills are useful in the discussion and evaluation of all corporate affairs.

Jeffrey T. Jackson. Mr. Jackson has served as the Company’s President and Chief Executive Officer since his appointment to that role effective January 1, 2018. He joined PGT Innovations in November 2005 as Vice President and Chief Financial Officer. In 2006, Mr. Jackson helped lead the Company's IPO, and was later named Executive Vice President. In 2014, Mr. Jackson became President and Chief Operating Officer with responsibilities overseeing the Company’s strategic direction, as well as all aspects of operations. In 2016, Mr. Jackson was appointed to the Board of Directors. Prior to joining PGT Innovations, Mr. Jackson held various executive management roles. In 2004, he joined The Hershey Company as Vice President and Corporate Controller. Prior to Hershey, Mr. Jackson served in positions of increasing responsibility with Schwan’s Bakery, including Senior Vice President - General Manager of Emerging Channels, and Senior Vice President and CFO. In addition, Mr. Jackson worked for Flowers Foods, Inc., The Coca-Cola Company, and KPMG. Mr. Jackson earned a Bachelor of Business Administration from the University of West Georgia and is a Certified Public Accountant in the State of Georgia. Mr. Jackson serves on the Board of Directors for Smith Douglas Homes, a private home builder based in Atlanta, Georgia, and Children First, a nonprofit organization in Sarasota County in the State of Florida.

Frances Powell Hawes. Ms. Powell Hawes joined our Board of Directors effective on January 1, 2019. Ms. Powell Hawes has served in senior finance and accounting positions with public and private companies for more than thirty years, including as Chief Financial Officer of NCI Building Systems, Inc., a manufacturer of metal products for the construction industry, and Grant Prideco, Inc., a supplier of premium drill pipe and drill stem accessories. In addition to her extensive finance and accounting experience, Ms. Powell Hawes also has significant mergers and acquisitions experience. Ms. Powell Hawes serves on the boards of directors of two other public companies, Archrock, Inc. and Laredo Petroleum, Inc., and served on the board of Energen Corporation from 2013 until November 2018. Our Board of Directors believes that Ms. Powell Hawes’ extensive experience, including her roles in executive finance and accounting leadership, strengthens our Board of Directors’ ability to provide financial and accounting-related oversight and make other significant contributions to the Company.

Class I - Directors with Terms Expiring in 2022

Alexander R. Castaldi, Mr. Castaldi became a director in 2004. Mr. Castaldi was a Managing Director of JLL Partners, Inc., which he joined in 2003, until his retirement in August 2018, and was previously a chief financial officer of three management buyouts. He was most recently Executive Vice President, Chief Financial Officer and Administration Officer of Remington Products Company. Previously, Mr. Castaldi was Vice President and Chief Financial Officer at Uniroyal Chemical Company. From 1990 until 1995, he was Senior Vice President and Chief Financial Officer at Kendall International, Inc. During the 1980s, Mr. Castaldi was also Vice President, Controller of Duracell, Inc. and Uniroyal, Inc. From 2004 to February 2006, Mr. Castaldi served as a director of Builders FirstSource, Inc. The Board recognizes the vast experience at the senior executive management level which Mr. Castaldi possesses and deems it to be of great value to the Company and its stockholders.

8

William Morgan. Mr. Morgan became a director in 2007. Mr. Morgan is a retired partner of the accounting firm KPMG LLP (“KPMG”) where he served clients in the industrial and consumer market practices. From 2004 until 2006, he was the Chairman of KPMG’s Audit Quality Council and, from 2002 until 2006, he was a member of its Independence Disciplinary Committee. Mr. Morgan was the Lead Partner for the Chairman’s 25 Partner Leadership Development Program and continued through 2009 to provide services to KPMG as an independent consultant to its leadership development group and as Dean of the then current Chairman’s 25 Partner Leadership Development Program. He previously served as the Managing Partner of the Stamford, Connecticut office and as a member of the board of directors for KPMG LLP and KPMG Americas. Mr. Morgan is a member of the board of directors of Barnes Group, Inc. and is the Chairman of its Audit Committee and is also a member of the Executive and Corporate Governance Committees. Mr. Morgan was a member of the Board of Directors and Audit Committee of The J.G. Wentworth Company from 2014 until January 2018. The Board identified Mr. Morgan’s extensive experience in public accounting (39 years, 29 as a partner), where he worked closely with client management and audit committees on matters relating to accounting, auditing, control, corporate governance, and risk management, as providing significant value to the Company and its stockholders. The Board also recognizes Mr. Morgan’s significant Board and Audit Committee experience and qualifications as a “financial expert” on the Audit Committee.

Class III – Directors with Terms Expiring in 2021

Floyd F. Sherman. Mr. Sherman became a director in 2005. Mr. Sherman served as Chief Executive Officer of Builders FirstSource, Inc., a leading supplier and manufacturer of structural and related building products for residential new construction, until his retirement as CEO effective January 1, 2018. Mr. Sherman also served as a director of Builders FirstSource, Inc. during that time, and continues to do so following his retirement as CEO. Before joining Builders FirstSource, Mr. Sherman spent 28 years at Triangle Pacific/Armstrong Flooring, the last nine of which he served as Chairman and Chief Executive Officer. Mr. Sherman has over 50 years of experience in the building products industry. A native of Kerhonkson, New York and a veteran of the U.S. Army, Mr. Sherman is a graduate of the New York State College of Forestry at Syracuse University. He also holds a Master of Business Administration degree from Georgia State University. The Board understands that Mr. Sherman’s 50 years of experience in the building products industry provide him with the knowledge to make significant contributions to the development of the Company’s business strategy.

Rodney Hershberger. Mr. Hershberger serves as the Company’s non-employee Chairman of the Board, effective as of January 1, 2018. He retired as our Chief Executive Officer effective December 31, 2017. Mr. Hershberger, a co-founder of the Company, has served the Company for nearly 40 years. He was named President, and appointed to our Board of Directors, in 2004, and became our Chief Executive Officer in March 2005. In 2003, Mr. Hershberger became Executive Vice President and Chief Operating Officer, and oversaw the Company’s Florida and North Carolina Operations, sales, marketing, and engineering groups. Previously, Mr. Hershberger led the manufacturing, transportation, and logistics operations in Florida, and served as Vice President of Customer Service. The Board of Directors recognizes Mr. Hershberger’s nearly 40 years of experience with the Company in the Florida market and the position of respect he has earned throughout the industry in which the Company operates through his thoughtful and honest leadership, and further recognizes his knowledge, skills, reputation and service to the community as a member of the board of directors of Gulf Coast Community Foundation, a public charity serving the needs of the local Sarasota community, as driving great value to the Company and its stockholders.

Sheree L. Bargabos, Ms. Bargabos became a director in 2016. Ms. Bargabos is a seasoned executive whose career spans over 35 years at Owens Corning, a global maker of building and composite material systems, until her retirement in 2015. Prior to her most recent transition role as Vice President, Customer Experience, she spent a decade as the President of Owens Corning’s $2 billion Roofing and Asphalt division. In October 2018, Ms. Bargabos was appointed to the Board of Directors of Steel Dynamics, Inc., one of the largest domestic steel producers and metals recyclers in the United States. Ms. Bargabos earned a Bachelor of Science in Chemistry from McGill University and a Master of Business Administration from Babson College. The Board of Directors recognizes Ms. Bargabos’ experience in various roles of increasing responsibility in the building materials industry, which the Board believes is an asset to the Company and its stockholders.

9

Board of Directors and Committees

The Audit Committee assists our Board of Directors in fulfilling its responsibilities with respect to the oversight of the accounting and financial reporting practices of the Company, including oversight of the integrity of our financial statements and compliance with legal and regulatory requirements, and the qualifications, independence and performance of our independent registered public accounting firm. The Audit Committee also reviews the adequacy of staff and management performance and procedures in connection with financial and disclosure controls, including our system to monitor and manage business risks and legal and ethical compliance programs. The Audit Committee also is charged with preparation of an audit committee report, retention and termination of our independent registered public accounting firm, annual review of the report of our independent registered public accounting firm, and discussion with our independent registered public accounting firm of the audited annual and unaudited quarterly financial statements of the Company and any audit problems or difficulties and management’s response thereto. The Audit Committee charter can be obtained without charge in the “Investors” section of our Company website at www.pgtinnovations.com in the section titled “Corporate Governance.”

The Audit Committee is comprised of three independent directors (as that term is defined by the NYSE Listed Company Manual (the “NYSE Rules”) and SEC rules and regulations), Messrs. Feintuch and Morgan, and Ms. Powell Hawes. Mr. Morgan serves as Chair of the Audit Committee. The Audit Committee met six times during 2019. During several of those meetings, the Audit Committee met privately with the Company’s independent registered public accounting firm. The Audit Committee also met in executive session multiple times with the Company’s Chief Financial Officer, and with its Director of Internal Audit. Our Board of Directors has: (i) affirmatively determined that all Audit Committee members are financially literate as required by the NYSE Rules; (ii) has designated Mr. Morgan, and Ms. Powell Hawes as audit committee “financial experts” as defined by SEC rules and regulations; and (iii) determined that Messrs. Feintuch and Morgan, and Ms. Powell Hawes meet the heightened independence standards of both the NYSE Rules and SEC rules and regulations for Audit Committee members.

The Compensation Committee determines the compensation of our executive officers, including our Chief Executive Officer. The Compensation Committee also reviews and reassesses the compensation paid to members of our Board of Directors for their service on our Board of Directors and Board committees and recommends any changes in compensation to the full Board for its approval. In addition, the Compensation Committee authorizes all stock option and other equity-based awards to employees and non-employee directors under our stock option and equity incentive plans. The Compensation Committee met three times in 2019, and members of the Compensation Committee participated in numerous calls and various other interactions discussing compensation issues with members of management, compensation consultants, other members of the Compensation Committee, and our Board of Directors, as well as acting through unanimous written consent. For information about our compensation program, the role of the Compensation Committee and the engagement of compensation consultants in setting executive compensation, see “Executive Compensation - Compensation Discussion and Analysis.” The Compensation Committee charter can be obtained without charge in the “Investors” section of our Company website at www.pgtinnovations.com in the section titled “Corporate Governance.”

The Compensation Committee is comprised of three directors, Messrs. Castaldi, Milgrim, and Sherman, all of whom meet the heightened independence standards of both the NYSE Rules and SEC rules and regulations for Compensation Committee members. Mr. Castaldi serves as Chair of the Compensation Committee.

The Governance Committee advises our Board of Directors on corporate governance matters and, among other things, assists our Board of Directors in identifying and recommending qualified director candidates. The Governance Committee also reviews and makes recommendations to our Board of Directors on the size and composition of our Board of Directors, independence determinations with respect to continuing and prospective directors, assignments to committees of our Board of Directors and resignations of directors, when appropriate.

10

The Governance Committee also oversees the evaluation of our Board of Directors, the committees and individual directors. The Governance Committee met one time during 2019, and members of the Governance Committee participated in calls and various other interactions discussing governance issues with members of management, external professional advisors, other members of the Governance Committee, and our Board of Directors, as well as acting through unanimous written consent. The Governance Committee charter can be obtained without charge in the “Investors” section of our Company website at www.pgtinnovations.com in the section titled “Corporate Governance.”

The Governance Committee is comprised of three directors, Ms. Bargabos, and Messrs. Feintuch and Morgan, all of whom meet the independence standards of both the NYSE Rules and SEC rules and regulations. Mr. Feintuch serves as Chair of the Governance Committee.

A summary of the current members of each committee of our Board of Directors is identified in the table below:

|

Name |

|

Audit Committee |

|

Compensation Committee |

|

Governance Committee |

|

Sheree L. Bargabos |

|

|

|

|

|

Member |

|

Alexander R. Castaldi |

|

|

|

Chair |

|

|

|

Richard D. Feintuch |

|

Member |

|

|

|

Chair |

|

Franses Powell Hawes |

|

Member |

|

|

|

|

|

Brett N. Milgrim |

|

|

|

Member |

|

|

|

William J. Morgan |

|

Chair |

|

|

|

Member |

|

Floyd F. Sherman |

|

|

|

Member |

|

|

For 2019, each of our directors attended 75% or more of the aggregate of all meetings of our Board of Directors and its committees on which he or she served. Pursuant to our Policy on Director Attendance at the Annual Meeting of Stockholders, which can be obtained without charge in the “Investors” section of our Company website at www.pgtinnovations.com in the section titled “Corporate Governance,” all directors are strongly encouraged to attend each of our annual meetings of stockholders in person, or, this year in light of COVID-19 related health concerns, all directors are strongly encouraged to attend virtually. Any director who is unable to attend an annual meeting of stockholders in person is expected to notify the Chair of our Board of Directors in advance of such meeting. All members of our Board of Directors attended our 2019 annual meeting of stockholders.

Board Leadership and Structure

Mr. Hershberger serves as Chair of our Board of Directors and is the Company’s former Chief Executive Officer. Mr. Hershberger retired effective on December 31, 2017. Mr. Jackson serves as both a director and the Company’s President and Chief Executive Officer. Our Board of Directors has not designated a lead independent director. Our Board of Directors believes that currently there are several important advantages for the Company having the position of Chair held by the retired, former Chief Executive Officer. Mr. Hershberger is especially familiar with the Company’s business and industry and capable of assisting the Board in evaluating strategic priorities and discussing execution of strategy. The Company’s independent directors bring experience, oversight and expertise from outside the Company and its industry, while Mr. Hershberger and Mr. Jackson bring Company-specific experience and expertise. Our Board of Directors believes that the role of Chair being held by our recently-retired, former Chief Executive Officer facilitates information flow between management and our Board of Directors, which are essential to effective governance. Our Board of Directors additionally believes that having a director position filled by a member of the Company’s executive management, specifically the role of President and Chief Executive Officer, adds additional industry and Company-specific experience and expertise and further enhances our Board of Directors’ ability to obtain information and evaluate the effectiveness of the Company’s leadership and operating strategies, and allows Mr. Jackson to serve as a bridge between management and our Board of Directors.

11

The Company’s senior management is responsible for day-to-day risk management, while our Board of Directors has an active role, as a whole and at the committee level, in overseeing management of the Company’s risks. Our Board of Directors regularly receives information regarding the Company’s credit, liquidity and operations from senior management. During its review of such information, our Board of Directors discusses, reviews and analyzes risks associated with each area, as well as risks associated with new business ventures and those relating to the Company’s executive compensation plans and arrangements. As a result of such discussion, review and analysis, and considering input from the Compensation Committee, our Board of Directors has determined that risks arising from the Company’s compensation policies and practices are not reasonably likely to have a material adverse effect on the Company or its results. The Audit Committee oversees management of financial and compliance risks and potential conflicts of interest, and the entire Board of Directors is regularly informed through committee reports about such risks. Our Governance Committee oversees and is responsible for assessing certain risks specifically in connection with corporate governance principles and guidelines and management of risks associated with the independence of our Board of Directors.

Our Board of Directors and management team recognize that environmental responsibility by public companies is of increasing importance to investors and believe that being a responsible corporate citizen in this area helps drive shareholder value. We are committed to making a positive impact on the environment, including in the communities where our customers and employees live and work. We have undertaken steps to proactively and positively impact the environment, including programs to reduce waste and encourage recycling, reduce energy consumption, and improve the fuel efficiency of our vehicle fleet. Those steps and related accomplishments have included:

|

|

• |

Implementing a comprehensive scrap/waste audit and reduction program at our largest Florida manufacturing facilities, which resulted in the amount of scrap materials those production facilities generated in 2019 being approximately 44% lower than the amount generated in 2017; |

|

|

• |

Adopting waste recycling programs that resulted in us identifying and recycling more than 78% of the production scrap materials we generated during 2019, with a goal of recycling approximately 83% of those materials in 2020; |

|

|

• |

Recycling approximately 19 million pounds of materials in 2019 (which otherwise would have been disposed of in landfills), including approximately 11 million pounds of glass, nearly 6 million pounds of aluminum, and more than 2 million pounds of vinyl materials, excluding our NewSouth Window Solutions facility, which we acquired on January 31, 2020; |

|

|

• |

Hiring a full-time environmental specialist in 2019 to work as part of our Environmental, Health and Safety team to gather data and identify other opportunities to further decrease our environmental impacts; and |

|

|

• |

Installing electric car charging stations at our Venice, Florida facility, which is our largest location, and exploring opportunities to install them at other locations as well. |

Electricity is the primary form of energy used by our production facilities. During 2019, our facilities used a total of approximately 23 million kilowatt hours of electricity, as compared to approximately 26.5 million kilowatt hours in 2018, excluding our NewSouth Window Solutions facility, which we acquired on January 31, 2020, and our Western Window Systems facility, which we acquired on August 13, 2018. This 13% reduction in electricity use in 2019, as compared to 2018 was due in part to initiatives such as becoming more efficient when manufacturing our products (including by using only our more energy efficient production lines and idling less efficient production lines, whenever possible), replacing older, less efficient equipment with newer, more energy-efficient equipment and technologies, and installing LED lighting in certain locations.

12

We expect to continue our efforts to improve the energy efficiency of our operations because we believe it is good for our business and for the environment. We did not directly utilize any renewable energy sources in 2019, but we intend to explore the possibility of doing so in 2020 and future years, including through possibly entering into renewable power purchase agreements, that are accompanied by renewable energy certifications or guarantees of origin.

As part of our effort to reduce our carbon footprint, we have focused on making our fleet of delivery vehicles more fuel efficient. For example, almost all of our existing fleet of tractor-trucks, and all new trucks we purchase, utilize the injection of an aqueous urea solution diesel exhaust fluid, as an element of a selective catalytic reduction process, to help convert nitrogen oxide emissions into nitrogen gas and water vapor before being released into the environment, to reduce the amount of air pollution created. In addition, we have installed regulators or similar control mechanisms on our fleet of tractor-trucks that do not allow them to exceed a speed of sixty miles per hour, which further conserves fuel and reduces the amount of emissions they generate. We also have systems in place to monitor and correct any excessive acceleration, stopping-and-starting, or other driver behavior that decreases fuel efficiency. Finally, we are partnering with a large, internationally-known tractor-truck manufacturer to beta-test electric trucks that we may utilize in the future.

How Our Products Promote Energy Efficiency

We believe our products, which have some of the best energy efficiency ratings in North America, promote energy conservation and efficiency, and thus, help decrease greenhouse gas emissions and global warming. For example, during 2019, our new, energy-efficient windows and doors were used in the replacement of older, less energy-efficient windows and doors in more than 35,000 residences. We believe that the replacement of those older windows and doors with our products will result in those homes utilizing approximately 71 million fewer kilowatt hours of electricity on an annual basis. In addition, because our products last much longer than wooden windows and doors, the use of our products helps conserve trees, reducing the number that must be cut and processed each year for use in windows and doors.

The safety of our team members is our top priority, and we have taken significant steps in recent years to drive improvements in this area. Specifically, our Total Recordable Incident Rate -- a measurement of the number of OSHA recordable incidents per 100 full-time workers during a one-year period -- was 5.64 in 2019, an improvement of more than 30% since 2017. As of the end of the first quarter of 2020, our TRIR had improved to 3.91. We believe these improvements in worker safety are due to the workplace safety initiatives we have taken, including:

|

|

• |

Increasing the size, experience and other qualifications of our environment, health and safety, or “E&HS”, staff; |

|

|

• |

Adopting a new incident management system that records workplace injuries based on type and other classifications to provide the data to drive targeted corrective and preventative actions to address and mitigate actual and potential causes of injuries; |

|

|

• |

Implementing a “Serious Six” OSHA compliance training program; |

|

|

• |

Implementing ergonomics-related safety improvements, using an experience and risk-based approach to prioritize those improvements; |

|

|

• |

Partnering with vendors to obtain high quality personal protective equipment and related training on how to appropriately utilize that equipment; |

|

|

• |

Increasing in-person workplace safety training, including through the use of frequent small-group meetings, designed to drive workplace safety awareness through all levels of the organization; |

|

|

• |

Training team members to identify and quickly address potentially unsafe activities and practices; |

13

|

|

• |

Increasing the frequency, number and types of internal workplace safety audits, inspections and walk-throughs conducted by the Company’s EH&S staff. |

Labor Practices and Human Rights

All of our employees earn more than the federal minimum wage and we believe our hourly wages are competitive with the local communities in which our facilities operate. The average hourly wage, excluding incentive compensation, of a full-time hourly employee of the Company was approximately $15.58 as of December 31, 2019, with approximately one-half of those hourly employees earning an average hourly wage of $15 or more. The average total compensation, including incentive compensation and benefits, for a full-time hourly employee of our Company in 2019 was nearly $40,000.

We strive to help our employees maintain job stability, so they are encouraged to stay with the Company and positioned to grow their skills and knowledge on the job. The 2019 annualized voluntary turnover rate in our workforce generally was flat as compared to 2018. In an effort to reduce employee turnover, we engage in annual surveys with employees, we maintain an open-door policy that enables us to help identify any issues before they cause an employee to leave the Company, and we review exit interview data, hotline calls and root cause analysis to help deter turnover. We also assign dedicated Company human resources representatives to each department so that we can better monitor employee morale within each department. In addition, in 2018 and 2019, we made equity grants to hundreds of hourly employees, as well as to those salaried employees who do not participate in our annual long-term equity incentive plan, to further improve employee morale and retention.

PGTI respects the rights of workers of other companies who provide products and services to PGTI. We communicate our expectations to suppliers on compliance with applicable federal, state and local laws, including with respect to compensation and safety, through the terms of our written agreements and policies with our suppliers.

Workforce Diversity and Inclusion and Human Capital Management

We believe in being an inclusive workplace for all of our employees and are committed to having a diverse workforce that is representative of the communities in which we operate and sell our products. A variety of perspectives enriches our culture, leads to innovative solutions for our business and enables us to better meet the needs of a diverse customer base and reflects the communities we serve. Our aim is to develop inclusive leaders and an inclusive culture, while also recruiting, developing, mentoring, training, and retaining a diverse workforce, including a diverse group of management-level employees. For example, currently one-third of our senior leadership is comprised of female executives, including our Senior Vice President and Chief Financial Officer, Senior Vice President of Human Resources, and the Chief Marketing Officer for our Southeastern Business Unit. Our diversity and inclusion initiatives include:

|

|

• |

PGT Innovations Leading Ladies, a program designed to identify, develop and mentor female employees who have demonstrated potential for serving as leaders within our organization; |

|

|

• |

Annual Diversity & Inclusion Training; and |

|

|

• |

Dale Carnegie, a program that helps our managers understand how to appreciate, respect and value individual differences and behaviors. |

We believe in offering career opportunities, resources, programs and tools to help employees grow and develop, as well as competitive wages and benefits to retain them. Our efforts in these areas include:

|

|

• |

Offering platforms, including on-line and in-person professional growth and development training, to help employees develop their skills and grow their careers at the Company; |

|

|

• |

Providing management development training to all of our management-level employees in 2019, including compliance, ethics and leadership training; |

14

|

|

• |

Conducting formal feedback sessions quarterly between our employees and their supervisors on their collaboration and development, and informal sessions on a weekly basis; |

|

|

• |

Providing employees with recurring training on critical issues such as safety and security, compliance, ethics and integrity and information security; |

|

|

• |

Gathering engagement feedback from our employees on a regular basis and responding to that feedback in a variety of ways including personal, one-on-one interactions, team meetings, leadership communications, and town hall meetings with employees, led by senior executives; |

|

|

• |

Offering a tuition reimbursement program that provides eligible employees up to $50,000 lifetime for courses related to current or future roles at the Company; |

|

|

• |

Offering health benefits for all eligible employees, including our eligible hourly employees; |

|

|

• |

Providing confidential counseling for employees through our Employee Assistance Program; |

|

|

• |

Providing paid time off to eligible employees; |

|

|

• |

Matching employees’ 401(k) plan contributions of up to 3% of eligible pay after one year of service; |

|

|

• |

Making one-time equity grants in 2018 and 2019 to all employees, including hourly employees, with at least one year of tenure who do not participate in the Company’s equity and incentive compensation plan; |

|

|

• |

Offering an employee stock purchase program for eligible employees; and |

|

|

• |

Providing a Company-subsidized childcare center for the employees of our Venice, Florida facility, which is our largest location. |

From time to time, we are party to legal proceedings relating to employment matters. During 2019, the total amount we paid to resolve proceedings alleging employment discrimination was immaterial to our earnings, and we did not make any payments to resolve allegations of wage-and-hour violations, nor did we have any such claims made against us. In our efforts to have all of our employees comply with federal and state employment-related laws, we provide non-discrimination and anti-harassment training as part of the Company’s mandatory compliance training, including for the hourly employees in our call centers, fulfillment centers and stores.

We believe the members of our Board of Directors have the diverse experience, skills and expertise, from both within and outside of our industry, to provide valuable insight and leadership to, and oversight of, our management team as it leads the Company through the opportunities and challenges facing us as a publicly traded building products company that has experienced significant growth both organically and through several acquisitions in recent years.

Our Board of Directors recognizes the importance of corporate governance practices that continually align the Company’s leadership with our stockholders. To that end, we and our Governance Committee regularly monitor “best practices” and engage with our stockholders to consider potential changes to our governance and leadership practices and structure. For example, when Mr. Hershberger retired from the Company at the end of 2017, the Board of Directors chose to separate the roles of Board Chair and President & CEO, appointing Mr. Hershberger as Board Chair, in order to capitalize on his familiarity with the Company’s business and our industry, while also having a Board Chair who is not an employee of the Company. Later in 2018, in response to feedback from our stockholder engagement efforts, the Board of Directors revised our Corporate Governance Guidelines to include a “Plurality Plus” voting standard for uncontested director elections. We will continue to monitor and evaluate developments in corporate governance going forward, to determine which approaches and practices are in the best interest of the Company.

15

The Company’s common stock trades on the NYSE and, accordingly, we are subject to the NYSE Rules.

Our Corporate Governance Guidelines require that at least a majority of our Board of Directors be independent, consistent with the NYSE Rules. Our Board of Directors applies standards in affirmatively determining whether a director is “independent,” in compliance with the NYSE Rules and SEC rules and regulations. Our Board of Directors, in applying the above-referenced standards, has affirmatively determined that Messrs. Castaldi, Feintuch, Milgrim, Morgan, and Sherman, Ms. Bargabos, and Ms. Powell Hawes are “independent” directors. As part of our Board of Directors’ process in making such determination, it also determined that each such director has no other “material relationship” with the Company that could interfere with his or her ability to exercise independent judgment.

Our Board of Directors includes one management director, Mr. Jackson, who serves as both a director and the Company’s President and Chief Executive Officer. Our Board of Directors has determined that Mr. Jackson is not independent under the NYSE Rules and SEC rules and regulations. In addition, our Board of Directors has determined that Mr. Hershberger, who served as the Company’s Chief Executive Officer until his retirement, effective December 31, 2017, and who continues to serve as a paid consultant to the Company, is not independent under such rules.

As part of its annual evaluation of director independence, our Board of Directors examined (among other things) whether any transactions or relationships exist currently (or existed during the past three years) between each director and the Company, its subsidiaries, affiliates, equity investors, or independent auditors and the nature of those relationships under the NYSE Rules and SEC rules and regulations. No transactions, relationships or arrangements, other than those described under “Certain Relationships and Related Transactions” were presented to, or considered by, our Board of Directors. Our Board of Directors also examined whether there are (or have been within the past year) any transactions or relationships between each director and any executive officer of the Company or its affiliates. As a result of this evaluation, our Board of Directors has affirmatively determined that each independent director named above is independent under those criteria. Independent directors meet in regularly scheduled executive sessions outside the presence of other directors and management representatives. Interested parties, including stockholders, may communicate with the Chair of our Board of Directors or the independent directors as a group by sending a communication, addressed to PGT Innovations, Inc., 1070 Technology Drive, North Venice, Florida 34275, Attention: Chief Financial Officer, who is our acting Secretary.

Executive Sessions of Non-Management Directors

In accordance with the NYSE Rules, our Board of Directors typically holds an executive session of non-management and independent directors as a part of every regularly scheduled meeting of our Board of Directors. These executive sessions are chaired by a member of our independent directors.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Upon the advice and recommendation of our Governance Committee and in accordance with the NYSE Rules, our Board of Directors has adopted Corporate Governance Guidelines. The Corporate Governance Guidelines address an array of governance issues and principles, including director qualifications and responsibilities, annual performance evaluations of our Board of Directors and meetings of independent directors.

In response to feedback from our shareholder engagement efforts, the Board of Directors revised the Corporate Governance Guidelines in 2018 to include a “Plurality Plus” voting standard for uncontested director elections. Under our Plurality Plus voting standard, any director nominee who receives a greater number of “WITHHOLD” votes than “FOR” votes in an uncontested election is required to tender his or her resignation promptly after certification of the election results for consideration by the Governance Committee of the Board of Directors. Broker non-votes, if any, are not counted as either a “WITHHOLD” or a “FOR” vote for these purposes. The Governance Committee will consider the resignation offer, considering all facts and circumstances it deems relevant, and recommend to the Board of Directors whether to accept or reject the resignation offer, or whether other action should be taken. The Board of Directors will consider the recommendation of the Governance Committee and will determine whether to accept the resignation offer within ninety days of certification of the election results. Full details of this policy are set forth in our Corporate Governance Guidelines, which are available in the “Investors” section of our Company website at www.pgtinnovations.com in the section titled “Corporate Governance.

16