UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number

Invesco CurrencyShares® Japanese Yen Trust

Sponsored by Invesco Specialized Products, LLC

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

|

( (Registrant’s telephone number, including area code) |

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (d232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

☒ |

|

Smaller reporting company |

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate the number of outstanding Redeemable Capital Shares as of March 31, 2022:

INVESCO CURRENCYSHARES® JAPANESE YEN TRUST

QUARTER ENDED MARCH 31, 2022

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page |

|

PART I. |

|

|

1 |

|||

|

|

|

|

|

|

|

|

|

|

|

ITEM 1. |

|

|

1 |

|

|

|

|

|

|

|

6 |

|

|

|

|

ITEM 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

10 |

|

|

|

ITEM 3. |

|

|

13 |

|

|

|

|

ITEM 4. |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

PART II. |

|

|

14 |

|||

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

14 |

|

|

|

|

Item 1A. |

|

|

14 |

|

|

|

|

Item 2. |

|

|

14 |

|

|

|

|

Item 3. |

|

|

14 |

|

|

|

|

Item 4. |

|

|

14 |

|

|

|

|

Item 5. |

|

|

14 |

|

|

|

|

Item 6. |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

17 |

|||||

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

Invesco CurrencyShares® Japanese Yen Trust

Statements of Financial Condition

March 31, 2022 and December 31, 2021

(Unaudited)

|

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Japanese Yen deposits, interest bearing |

|

$ |

|

|

|

$ |

|

|

|

Total Assets |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

Accrued Sponsor's fee |

|

$ |

|

|

|

$ |

|

|

|

Accrued interest expense on currency deposits |

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

|

|

|

|

|

|

|

Commitments and Contingent Liabilities (Note 8) |

|

|

|

|

|

|

|

|

|

Redeemable Capital Shares and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

Redeemable Capital Shares, at redemption value, no par value, |

|

|

|

|

|

|

|

|

|

Shareholders’ Equity: |

|

|

|

|

|

|

|

|

|

Retained Earnings |

|

|

|

|

|

|

|

|

|

Total Liabilities, Redeemable Capital Shares and Shareholders’ Equity |

|

$ |

|

|

|

$ |

|

|

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

1

Invesco CurrencyShares® Japanese Yen Trust

Statements of Comprehensive Income

For the Three Months Ended March 31, 2022 and 2021

(Unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Income |

|

|

|

|

|

|

|

|

|

Interest Income |

|

$ |

|

|

|

$ |

|

|

|

Total Income |

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Sponsor’s fee |

|

|

( |

) |

|

|

( |

) |

|

Interest Expense on currency deposits |

|

|

( |

) |

|

|

( |

) |

|

Total Expenses |

|

|

( |

) |

|

|

( |

) |

|

Net Comprehensive Income (Loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Basic and Diluted Earnings (Loss) per Share |

|

$ |

( |

) |

|

$ |

( |

) |

|

Weighted-average Shares Outstanding |

|

|

|

|

|

|

|

|

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

2

Invesco CurrencyShares® Japanese Yen Trust

Statements of Changes in Shareholders’ Equity and Redeemable Capital Shares

For the Three Months Ended March 31, 2022

(Unaudited)

|

|

|

Retained Earnings |

|

|

Total Shareholders' Equity |

|

|

Shares |

|

|

Redeemable Capital Shares |

|

||||

|

Balance at December 31, 2021 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

Purchases of Shares |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Redemption of Shares |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Net Increase (Decrease) due to Share Transactions |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Net Comprehensive Income (Loss) |

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

Adjustment of Redeemable Capital Shares to Redemption Value related to Retained Earnings |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

Adjustment of Redeemable Capital Shares to Redemption Value |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Balance at March 31, 2022 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

3

Invesco CurrencyShares® Japanese Yen Trust

Statements of Changes in Shareholders’ Equity and Redeemable Capital Shares

For the Three Months Ended March 31, 2021

(Unaudited)

|

|

|

Retained Earnings |

|

|

Total Shareholders' Equity |

|

|

Shares |

|

|

Redeemable Capital Shares |

|

||||

|

Balance at December 31, 2020 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

Purchases of Shares |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Redemption of Shares |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Net Increase (Decrease) due to Share Transactions |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Net Comprehensive Income (Loss) |

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

Adjustment of Redeemable Capital Shares to Redemption Value related to Retained Earnings |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

Adjustment of Redeemable Capital Shares to Redemption Value |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Balance at March 31, 2021 |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

4

Invesco CurrencyShares® Japanese Yen Trust

Statements of Cash Flows

For the Three Months Ended March 31, 2022 and 2021

(Unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Net Comprehensive Income (Loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Adjustments to reconcile net comprehensive income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accrued Sponsor’s fee |

|

|

( |

) |

|

|

( |

) |

|

Accrued interest expense |

|

|

( |

) |

|

|

( |

) |

|

Net cash provided by (used in) operating activities |

|

|

( |

) |

|

|

( |

) |

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from purchases of redeemable capital Shares |

|

|

|

|

|

|

|

|

|

Redemptions of redeemable capital Shares |

|

|

( |

) |

|

|

( |

) |

|

Net cash provided by (used in) financing activities |

|

|

|

|

|

|

( |

) |

|

Effect of exchange rate on cash |

|

|

( |

) |

|

|

( |

) |

|

Net change in cash |

|

|

|

|

|

|

( |

) |

|

Cash at beginning of period |

|

|

|

|

|

|

|

|

|

Cash at end of period |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

|

|

|

$ |

|

|

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

5

Invesco CurrencyShares® Japanese Yen Trust

Notes to Unaudited Financial Statements

March 31, 2022

Note 1 - Background

On September 28, 2017, Guggenheim Capital, LLC (“Guggenheim”) and Invesco Ltd. entered into a Transaction Agreement (the “Transaction Agreement”), pursuant to which Guggenheim agreed to transfer all of the membership interests of Guggenheim Specialized Products, LLC (the “Sponsor”) to Invesco Capital Management LLC (“Invesco Capital Management”).

The Transaction Agreement was consummated on April 6, 2018 (the “Closing”) and immediately following the Closing, Invesco Capital Management changed the name of the Sponsor to Invesco Specialized Products, LLC.

Note 2 - Organization

The Invesco CurrencyShares® Japanese Yen Trust (the “Trust”) was formed under the laws of the State of New York on

The investment objective of the Trust is for the Trust’s shares (the “Shares”) to reflect the price in U.S. Dollars (“USD”) of the Japanese Yen plus accrued interest, if any, less the Trust’s expenses and liabilities. The Shares are intended to provide investors with a simple, cost-effective means of gaining investment benefits similar to those of holding Japanese Yen. The Trust’s assets primarily consist of Japanese Yen on demand deposit in

This Quarterly Report (the “Report”) covers the three months ended March 31, 2022 and 2021. The accompanying unaudited financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions for Form 10-Q and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). In the opinion of management, all material adjustments, consisting only of normal recurring adjustments, considered necessary for a fair statement of the interim period financial statements have been made. Interim period results are not necessarily indicative of results for a full-year period. These financial statements and the notes thereto should be read in conjunction with the Trust’s financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on February 25, 2022.

Note 3 – Summary of Significant Accounting Policies

A. Basis of Presentation

The financial statements of the Trust have been prepared using U.S. GAAP.

B. Accounting Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates by a significant amount. In addition, the Trust monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are issued.

C. Foreign Currency Translation

For Net Asset Value (“NAV”) calculation purposes, Japanese Yen deposits (cash) are translated at the Closing Spot Rate, which is the Japanese Yen/USD exchange rate as determined and published by The WM Company at 4:00 PM (London time / London fixing) on each day that NYSE Arca, Inc. (“NYSE Arca”) is open for regular trading.

The Trust maintains its books and records in Japanese Yen. For financial statement reporting purposes, the U.S. Dollar is the reporting currency. As a result, the financial records of the Trust are translated from Japanese Yen to USD. The Closing Spot Rate on the last day of the period is used for translation in the statements of financial condition. The average Closing Spot Rate for the period is used for translation in the statements of comprehensive income and the statements of cash flows. The redeemable capital Shares are adjusted to redemption value and these adjustments are recorded against retained earnings.

6

D. Interest Income

Interest on the primary deposit account, if any, accrues daily as earned and is received or paid on a monthly basis. Any interest below zero for the period is reflected as interest expense on currency deposits. The Depository may change the rate at which interest accrues, including reducing the interest rate to zero or below zero, based upon changes in market conditions or based on the Depository’s liquidity needs.

E. Distributions

To the extent that the interest earned by the Trust, if any, exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trust will distribute, as a dividend (herein referred to as dividends or distributions), the excess interest earned in Japanese Yen effective on the first business day of the subsequent month. The Trustee (as defined below) will direct that the excess Japanese Yen be converted into USD at the prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own).

F. Routine Operational, Administrative and Other Ordinary Expenses

The Sponsor is responsible for all routine operational, administrative and other ordinary expenses of the Trust, including, but not limited to, the Trustee’s monthly fee, NYSE Arca listing fees, SEC registration fees, typical maintenance and transaction fees of the Depository, printing and mailing costs, audit fees and expenses, up to $

G. Non-Recurring Fees and Expenses

In certain cases, the Trust will pay for some expenses in addition to the Sponsor’s fee. These exceptions include expenses not assumed by the Sponsor (i.e., expenses other than those identified in the preceding paragraph), expenses resulting from negative interest rates, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Trustee or the Sponsor on behalf of the Trust or action taken by the Trustee or the Sponsor to protect the Trust or the interests of Shareholders, indemnification of the Sponsor under the Depositary Trust Agreement, audit fees and legal expenses in excess of $

H. Federal Income Taxes

The Trust is treated as a “grantor trust” for federal income tax purposes and, therefore,

Shareholders generally will be treated, for U.S. federal income tax purposes, as if they directly owned a pro-rata share of the assets held in the Trust. Shareholders also will be treated as if they directly received their respective pro-rata portion of the Trust’s income, if any, and as if they directly incurred their respective pro-rata portion of the Trust’s expenses. The acquisition of Shares by a U.S. Shareholder as part of a creation of a Basket will not be a taxable event to the Shareholder.

The Sponsor’s fee accrues daily and is payable monthly. For U.S. federal income tax purposes, an accrual-basis U.S. Shareholder generally will be required to take into account as an expense its allocable portion of the USD-equivalent of the amount of the Sponsor’s fee that is accrued on each day, with such USD-equivalent being determined by the currency exchange rate that is in effect on the respective day. To the extent that the currency exchange rate on the date of payment of the accrued amount of the Sponsor’s fee differs from the currency exchange rate in effect on the day of accrual, the U.S. Shareholder will recognize a currency gain or loss for U.S. federal income tax purposes.

The Trust does not expect to generate taxable income except for interest income (if any) and gain (if any) upon the sale of Japanese Yen. A non-U.S. Shareholder generally will not be subject to U.S. federal income tax with respect to gain recognized upon the sale or other disposition of Shares, or upon the sale of Japanese Yen by the Trust, unless: (1) the non-U.S. Shareholder is an individual and is present in the United States for

A non-U.S. Shareholder’s portion of any interest income earned by the Trust generally will not be subject to U.S. federal income tax unless the Shares owned by such non-U.S. Shareholder are effectively connected with the conduct by the non-U.S. Shareholder of a trade or business in the United States.

7

Note 4 - Japanese Yen Deposits

Japanese Yen principal deposits are held in a Japanese Yen-denominated, interest-bearing demand account. The interest rate in effect as of March 31, 2022 was an annual nominal rate of -

Net interest, if any, associated with creation and redemption activity is held in a Japanese Yen-denominated non-interest-bearing account, and any balance is distributed in full as part of the monthly income distributions, if any.

Note 5 - Concentration Risk

All of the Trust’s assets are Japanese Yen, which creates a concentration risk associated with fluctuations in the price of the Japanese Yen. Accordingly, a decline in the Japanese Yen to USD exchange rate will have an adverse effect on the value of the Shares. Factors that may have the effect of causing a decline in the price of the Japanese Yen include national debt levels and trade deficits, domestic and foreign inflation rates, domestic and foreign interest rates, investment and trading activities of institutions and global or regional political, economic or financial events and situations. Substantial sales of Japanese Yen by the official sector (central banks, other governmental agencies and related institutions that buy, sell and hold Japanese Yen as part of their reserve assets) could adversely affect an investment in the Shares.

All of the Trust’s Japanese Yen are held by the Depository. Accordingly, a risk associated with the concentration of the Trust’s assets in accounts held by a single financial institution exists and increases the potential for loss by the Trust and the Trust’s beneficiaries in the event that the Depository becomes insolvent.

Note 6 - Service Providers and Related Party Agreements

The Trustee

The Bank of New York Mellon (the “Trustee”), a banking corporation with trust powers organized under the laws of the State of New York, serves as the Trustee. The Trustee is responsible for the day-to-day administration of the Trust, including keeping the Trust’s operational records.

The Sponsor

The Sponsor of the Trust generally oversees the performance of the Trustee and the Trust’s principal service providers. The Sponsor is Invesco Specialized Products, LLC, a Delaware limited liability company and a related party of the Trust. The Trust pays the Sponsor a Sponsor’s fee, which accrues daily at an annual nominal rate of

Note 7 - Share Purchases and Redemptions

Shares are issued and redeemed continuously in Baskets in exchange for Japanese Yen. Individual investors cannot purchase or redeem Shares in direct transactions with the Trust. Only Authorized Participants (as defined below) may place orders to create and redeem Baskets. An Authorized Participant is a Depository Trust Company (“DTC”) participant that is a registered broker-dealer or other institution eligible to settle securities transactions through the book-entry facilities of the DTC and which has entered into a contractual arrangement with the Trust and the Sponsor governing, among other matters, the creation and redemption process. Authorized Participants may redeem their Shares at any time in Baskets.

Due to expected continuing creations and redemptions of Baskets and the period for settlement of each creation or redemption, the Trust reflects Shares created as a receivable on the trade date. Shares redeemed are reflected as a liability on the trade date. Outstanding Shares are reflected at redemption value, which is the NAV per Share at the period end date. Adjustments to redeemable capital Shares at redemption value are recorded directly to redeemable capital shares and retained earnings.

8

The Trustee calculates the Trust’s NAV each business day. To calculate the NAV, the Trustee subtracts the Sponsor’s accrued fee through the previous day from the Japanese Yen held by the Trust (including all unpaid interest, if any, accrued through the preceding day) and calculates the value of the Japanese Yen in USD based upon the Closing Spot Rate. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent Closing Spot Rate will be used to determine the NAV of the Trust unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for the valuation. If the Trustee and the Sponsor determine that the most recent Closing Spot Rate is not an appropriate basis for valuation of the Trust’s Japanese Yen, they will determine an alternative basis for the valuation. The Trustee also determines the NAV per Share, which equals the NAV of the Trust, divided by the number of outstanding Shares. Shares deliverable under a purchase order are considered outstanding for purposes of determining NAV per Share; Shares deliverable under a redemption order are not considered outstanding for this purpose.

Note 8 - Commitments and Contingencies

The Trust’s organizational documents provide for the Trust to indemnify the Sponsor and any affiliate of the Sponsor that provides services to the Trust to the maximum extent permitted by applicable law, subject to certain exceptions for disqualifying conduct by the Sponsor or such an affiliate. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Further, the Trust has not had prior claims or losses pursuant to these contracts. Accordingly, the Sponsor expects the risk of loss to be remote.

9

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement Regarding Forward-Looking Information

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate” and other similar words. Forward-looking statements are based upon our current expectations and beliefs concerning future developments and their potential effects on us. Such forward-looking statements are not guarantees of future performance. Various factors may cause our actual results to differ materially from those expressed in our forward-looking statements. These factors include fluctuations in the price of the Japanese Yen, as the value of the Shares relates directly to the value of the Japanese Yen held by the Trust and price fluctuations could materially adversely affect an investment in the Shares. Readers are urged to review the “Risk Factors” section contained in the Trust’s most recent annual report on Form 10-K for a description of other risks and uncertainties that may affect an investment in the Shares.

Neither Invesco Specialized Products, LLC (the “Sponsor”) nor any other person assumes responsibility for the accuracy or completeness of forward-looking statements contained in this report. The forward-looking statements are made as of the date of this report, and will not be revised or updated to reflect actual results or changes in the Sponsor’s expectations or predictions.

Overview/Introduction

The Invesco CurrencyShares® Japanese Yen Trust (the “Trust”) is a grantor trust that was formed on February 1, 2007. The Shares began trading on the New York Stock Exchange under the ticker symbol “FXY” on February 13, 2007. The primary listing of the Shares was transferred to NYSE Arca, Inc. (“NYSE Arca”) on October 30, 2007. The Trust issues shares (the “Shares”) in blocks of 50,000 (a “Basket”) in exchange for deposits of Japanese Yen and distributes Japanese Yen in connection with the redemption of Baskets.

The investment objective of the Trust is for the Shares to reflect the price in USD of the Japanese Yen plus accrued interest, if any, less the expenses of the Trust’s operations. The Shares are intended to offer investors an opportunity to participate in the market for the Japanese Yen through an investment in securities. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding the Japanese Yen. The Shares are bought and sold on NYSE Arca like any other exchange-listed security. The Shares are backed by the assets of the Trust, which does not hold or use derivative products. The Trust is a passive investment vehicle and does not have any officers, directors or employees. The Trust does not engage in any activities designed to obtain profit from, or ameliorate losses caused by, changes in the price of the Japanese Yen. Investing in the Shares does not insulate the investor from certain risks, including price volatility. The value of the holdings of the Trust is reported on the Trust’s website, www.invesco.com/etfs, each business day.

Definition of Net Asset Value

The Trustee calculates, and the Sponsor publishes, the Trust’s Net Asset Value (“NAV”) each business day. To calculate the NAV, the Trustee adds to the amount of Japanese Yen in the Trust at the end of the preceding day accrued but unpaid interest, if any, Japanese Yen receivable under pending purchase orders and the value of other Trust assets, and subtracts the accrued but unpaid Sponsor’s fee, Japanese Yen payable under pending redemption orders and other Trust expenses and liabilities, if any. The NAV is expressed in USD based on the Japanese Yen/USD exchange rate as determined by The WM Company at 4:00 PM (London time / London fixing) (the “Closing Spot Rate”) on each day that NYSE Arca is open for regular trading. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent Closing Spot Rate is used to determine the NAV of the Trust unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for the valuation.

The Trustee also determines the NAV per Share, which equals the NAV of the Trust divided by the number of outstanding Shares. The NAV of the Trust and the NAV per Share are published by the Sponsor on each day that NYSE Arca is open for regular trading and are posted on the Trust’s website, www.invesco.com/etfs.

10

Movements in the Price of the Japanese Yen

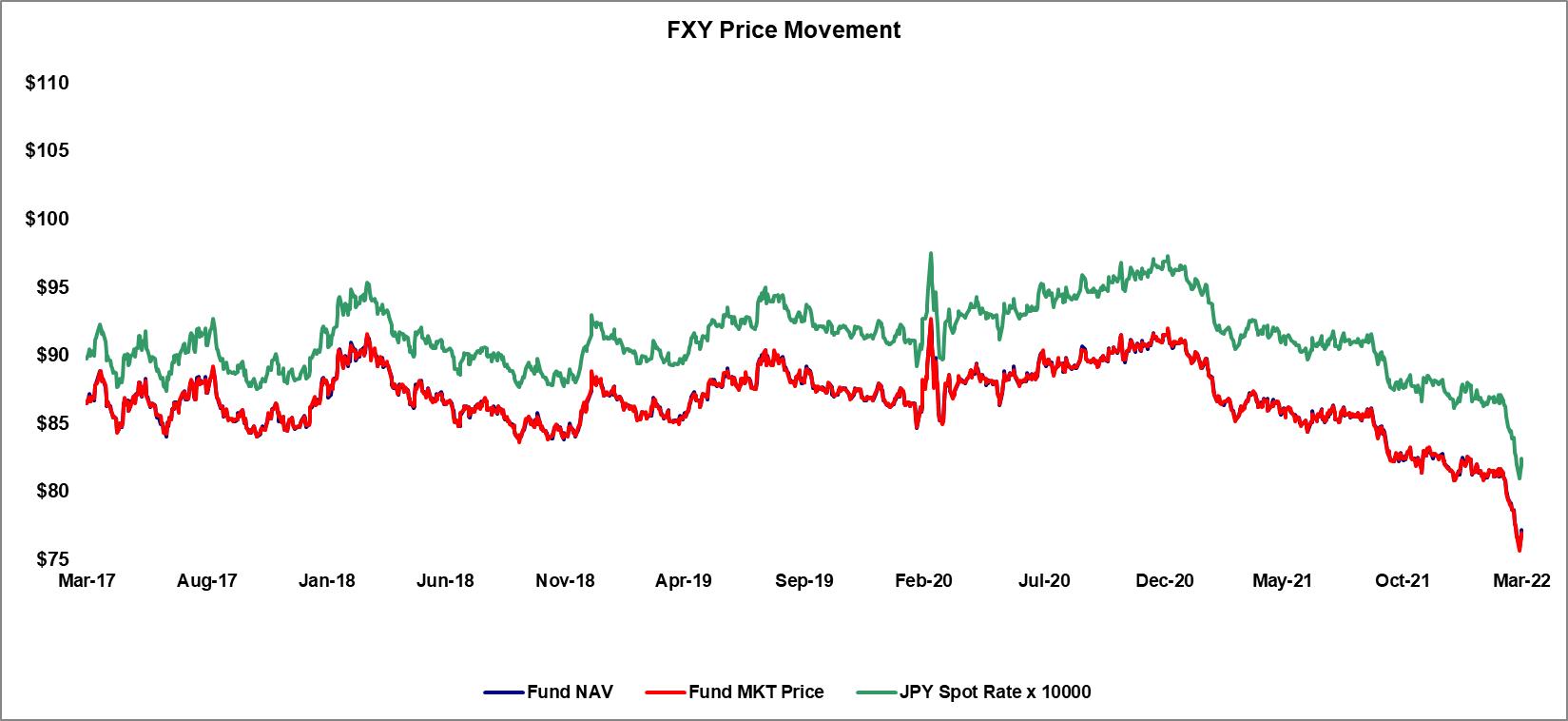

The investment objective of the Trust is for the Shares to reflect the price in USD of the Japanese Yen plus accrued interest, if any, less the expenses of the Trust’s operations. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding Japanese Yen. Each outstanding Share represents a proportional interest in the Japanese Yen held by the Trust. The following chart provides recent trends on the price of the Japanese Yen. The chart illustrates movements in the price of the Japanese Yen in USD and is based on the Closing Spot Rate:

NAV per Share; Valuation of the Japanese Yen

The following chart illustrates the movement in the price of the Shares based on (1) NAV per Share, (2) the “bid” and “ask” midpoint offered on NYSE Arca and (3) the Closing Spot Rate, expressed as a multiple of 10,000 Japanese Yen:

11

Liquidity and Capital Resources

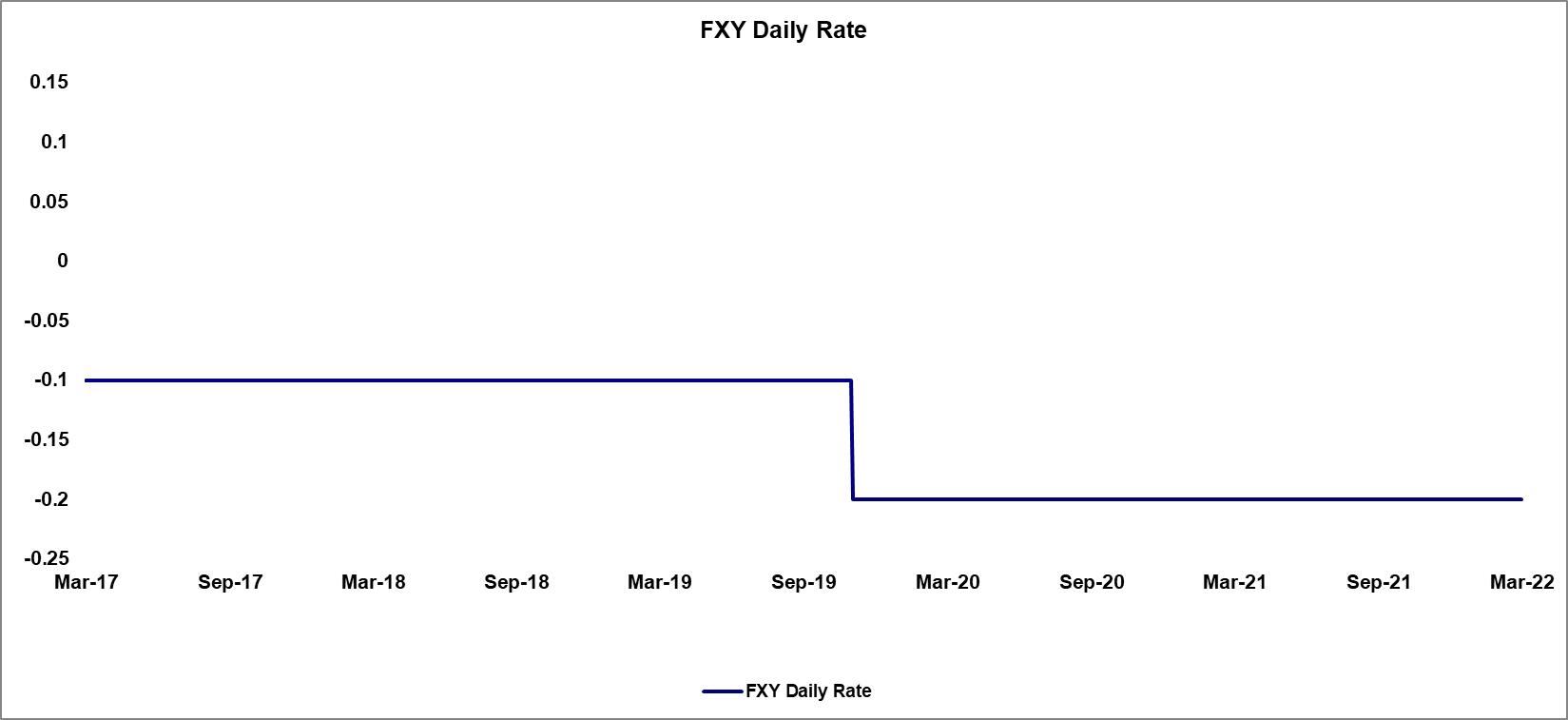

The Sponsor is not aware of any known trends, demands, commitments, events or uncertainties that will result in, or are reasonably likely to result in, material changes to the Trust’s liquidity and capital resources needs. The Trust’s Depository, JPMorgan Chase Bank, N.A., London Branch, maintains two deposit accounts for the Trust, a primary deposit account that may earn interest and a secondary deposit account that does not earn interest. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The interest rate in effect as of March 31, 2022 was an annual nominal rate of -0.20%. The following chart provides the daily rate paid by the Depository since March 31, 2017:

In exchange for a fee, the Sponsor bears most of the expenses incurred by the Trust. As a result, the only ordinary expense of the Trust during the period covered by this report was the Sponsor’s fee. Each month the Depository deposits into the secondary deposit account accrued but unpaid interest, if any, and the Trustee withdraws Japanese Yen from the secondary deposit account to pay the accrued Sponsor’s fee for the previous month plus other Trust expenses (including, without limitation, expenses resulting from negative interest rates), if any. When the interest deposited, if any, exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trustee converts the excess into USD at the prevailing market rate and distributes the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own). The Trust did not make any distributions during the quarter ended March 31, 2022.

Critical Accounting Estimates

The financial statements and accompanying notes are prepared in accordance with U.S. GAAP. The preparation of these financial statements relies on estimates and assumptions that impact the Trust’s financial position and results of operations. These estimates and assumptions affect the Trust’s application of accounting policies. In addition, please refer to Note 3 to the financial statements of the Trust for further discussion of the Trust’s accounting policies and Item 7 – Management’s Discussions and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates on Form 10-K for the year ended December 31, 2021.

Results of Operations

During the three months ended March 31, 2022 and 2021, the Trust’s net comprehensive income (loss) was, in part, impacted by market volatility and uncertainty caused by the novel coronavirus known as COVID-19, which is considered to be an unusual or infrequent event. Additionally, the Trust’s net comprehensive income (loss) during the three months ended March 31, 2022 was, in part, impacted by the Russia-Ukraine conflict, which is also considered to be an unusual or infrequent event. Although the full and direct impact of COVID-19 and the Russia-Ukraine conflict on the Trust’s net comprehensive income (loss) during the three months ended March 31, 2022 and 2021 cannot be known, it is believed that COVID-19 and the Russia-Ukraine conflict have each independently impacted the Closing Spot Rate, the interest rate paid by the Depository, and the global economy and markets generally, including the number of Shares created and redeemed by the Trust.

12

Consistent with the first quarter of 2021, the Japanese Yen (JPY/USD) was the worst performing G10 currency for the first quarter of 2022, with the Japanese Yen plunging to a seven-year low against the U.S. Dollar in March 2022. The Bank of Japan’s aggressive monetary easing diverged further from the U.S. Federal Reserve’s (and many other key central banks’) increasingly hawkish stance, pushing their interest-rate differential to the widest since 2019. In addition, given Japan is a net energy importer, surging commodity prices resulting from the Russia-Ukraine conflict further pressured the currency, eliminating some of its safe haven appeal.

The Japanese Yen (JPY/USD) ended the first quarter of 2021 as the worst performing G10 currency, slumping nearly 7% on a rebounding U.S. Dollar and dimming safe haven demand. Optimism for the U.S. economic recovery and vaccine rollouts helped to strengthen treasury yields and boosted the U.S. Dollar, while increasing expectations for a strong global economic recovery, amid easing lockdowns, and a general improvement in investor’s risk appetite reduced investor demand for safe haven currencies such as the Japanese Yen.

Additionally, the interest rate paid by the Depository has generally trended downward over the past several years to the current interest rate of -0.20%, as set forth in the FXY Rate Chart above. As long as the Sponsor’s fee and the interest expense on currency deposits, if any, exceed interest income, the Trust will incur a net comprehensive loss.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Except as described above with respect to fluctuations in the Japanese Yen/USD exchange rate and changes in the nominal annual interest rate paid by the Depository on Japanese Yen held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.

Item 4. Controls and Procedures

Under the supervision and with the participation of the management of the Sponsor, including Anna Paglia, its Principal Executive Officer, and Kelli Gallegos, its Principal Financial and Accounting Officer, Investment Pools, the Trust carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this Quarterly Report, and, based upon that evaluation, Anna Paglia, the Principal Executive Officer of the Sponsor, and Kelli Gallegos, the Principal Financial and Accounting Officer, Investment Pools, of the Sponsor, concluded that the Trust's disclosure controls and procedures were effective to provide reasonable assurance that information the Trust is required to disclose in the reports that it files or submits with the Securities and Exchange Commission (the “SEC”) under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and to provide reasonable assurance that information required to be disclosed by the Trust in the reports that it files or submits under the Exchange Act is accumulated and communicated to management of the Sponsor, including its Principal Executive Officer and Principal Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control Over Financial Reporting

There has been no change in internal control over financial reporting (as defined in the Rules 13a-15(f) and 15d-15(f) of the Exchange Act) that occurred during the Trust's quarter ended March 31, 2022 that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

13

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors

ECONOMIC CONDITIONS

The Russia-Ukraine conflict and economic sanctions against Russia in connection with such conflict could materially and adversely affect the value of the Shares.

Following Russia's invasion of Ukraine in late February 2022, various countries, including the United States, Australia, Canada, the United Kingdom, Switzerland, Germany, France, and Japan, as well as NATO and the European Union, issued broad-ranging economic sanctions against Russia and Belarus. The resulting sanctions (and potential further sanctions in response to continued military activity), the potential for military escalation and other corresponding events, have had, and could continue to have, severe negative effects on regional and global economic and financial markets, including increased volatility, reduced liquidity and overall uncertainty. Russia may take additional counter measures or retaliatory actions (including cyberattacks), which could exacerbate negative consequences on global financial markets. The duration of ongoing hostilities and corresponding sanctions and related events cannot be predicted. Impacts from the conflict and related events may result in increased volatility in the value of currencies held by the Trust and may have an adverse effect on the performance of the Trust and value of the Shares.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

(a) There have been no unregistered sales of Shares. No Shares are authorized for issuance by the Trust under equity compensation plans.

(b) Not applicable.

(c) Although the Trust did not redeem Shares directly from its shareholders, the Trust redeemed Baskets from Authorized Participants during the three months ended March 31, 2022 as follows:

|

Period of Redemption |

|

Total Number of Shares Redeemed |

|

|

Average Price Paid per Share |

|

||

|

January 1, 2022 to January 31, 2022 |

|

|

200,000 |

|

|

$ |

81.26 |

|

|

February 1, 2022 to February 28, 2022 |

|

|

100,000 |

|

|

$ |

81.38 |

|

|

March 1, 2022 to March 31, 2022 |

|

|

50,000 |

|

|

$ |

80.84 |

|

|

Total |

|

|

350,000 |

|

|

$ |

81.23 |

|

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

None.

14

Item 6. Exhibits

|

Exhibit No. |

|

Description |

|

|

|

|

|

3.1 |

|

|

|

|

|

|

|

3.2 |

|

|

|

|

|

|

|

3.3 |

|

|

|

|

|

|

|

3.4 |

|

|

|

|

|

|

|

4.1 |

|

|

|

|

|

|

|

4.2 |

|

|

|

|

|

|

|

4.3 |

|

|

|

|

|

|

|

4.4 |

|

|

|

|

|

|

|

4.5 |

|

|

|

|

|

|

|

4.6 |

|

|

|

|

|

|

|

4.7 |

|

|

|

|

|

|

|

4.8 |

|

|

|

|

|

|

|

10.1 |

|

|

|

|

|

|

|

10.2 |

|

|

|

|

|

|

|

10.3 |

|

|

|

|

|

|

|

31.1 |

|

|

|

|

|

|

|

31.2 |

|

|

|

|

|

|

|

32.1 |

|

|

|

|

|

|

|

32.2 |

|

15

|

|

|

|

|

101.INS |

|

Inline XBRL Instance Document – the instance document does not appear in the Interactive Data File because XBRL tags are embedded within the Inline XBRL document. |

|

|

|

|

|

101.SCH |

|

Inline XBRL Taxonomy Extension Schema Document. |

|

|

|

|

|

101.CAL |

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document. |

|

|

|

|

|

101.DEF |

|

Inline XBRL Taxonomy Extension Definition Linkbase Document. |

|

|

|

|

|

101.LAB |

|

Inline XBRL Taxonomy Extension Label Linkbase Document. |

|

|

|

|

|

101.PRE |

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document. |

|

|

|

|

|

104 |

|

The cover page of the Trust's Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 formatted in Inline XBRL. |

16

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Invesco CurrencyShares® Japanese Yen Trust |

||

|

|

||

|

By: |

|

Invesco Specialized Products, LLC |

|

|

|

its Sponsor |

|

|

|

|

|

Dated: May 5, 2022 |

|

By: |

|

/s/ Anna Paglia |

|

|

|

Name: |

|

Anna Paglia |

|

|

|

Title: |

|

Principal Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: May 5, 2022 |

|

By: |

|

/s/ Kelli Gallegos |

|

|

|

Name: |

|

Kelli Gallegos |

|

|

|

Title: |

|

Principal Financial and Accounting Officer, Investment Pools |

17