Exhibit (a)(1)

This document is important and requires your immediate attention. If you are in doubt as to how to respond to the unsolicited offer made by HudBay Minerals Inc., you should consult with your investment dealer, stockbroker, lawyer or other professional advisor. Enquiries concerning the information in this document should be directed to Laurel Hill Advisory Group, the Information Agent retained by Augusta Resource Corporation, Toll-Free in North America at 1-877-452-7184, Banks and Brokers and collect calls outside North America at 416-304-0211 or via e-mail at assistance@laurelhill.com.

DIRECTORS’ CIRCULAR

RECOMMENDING

REJECTION

OF THE OFFER BY

HUDBAY MINERALS INC.

to purchase the outstanding Common Shares of

AUGUSTA RESOURCE CORPORATION

RECOMMENDATION TO SHAREHOLDERS

The Board of Directors UNANIMOUSLY recommends that Shareholders

REJECT the HudBay Offer and NOT TENDER their Common Shares.

There is no need for immediate action. The Board of Directors recommends that Shareholders not take any action until closer to the Expiry Time of the HudBay Offer to ensure that they are able to consider all of the options available to them.

HUDBAY’S OFFER IS A LOW BALL BID

Directors, officers and Shareholders of Augusta holding over

33% of the Common Shares (on a fully-diluted basis) have advised

Augusta that they WILL NOT TENDER to the HudBay Offer.

It is a virtual certainty that, as structured, the HudBay Offer CANNOT SUCCEED.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

Shareholders in the United States should read the important notice on page v of this directors’ circular.

February 24, 2014

“The [HudBay] offer undervalues [Augusta]; we would REJECT it and wait for a higher bid or allow [Augusta] to build the Rosemont project.” CIBC World Markets, February 10, 2014

February 24, 2014

Dear Augusta Shareholders:

On February 9, 2014, HudBay Minerals Inc. (“HudBay”) announced its intention to commence an unsolicited offer (the “HudBay Offer”) to purchase the outstanding common shares (the “Common Shares”) of Augusta Resource Corporation (“Augusta”) for 0.315 of a common share of HudBay for each Common Share. By now, you likely have received materials from HudBay asking you to tender your Common Shares to this bid.

The HudBay Offer is grossly inadequate, highly opportunistic and does not come close to recognizing the full and fair value of Augusta and its Rosemont project. The board of directors of Augusta (the “Board” or “Board of Directors”) recommends that you REJECT the HudBay Offer and NOT TENDER your Common Shares to the HudBay Offer. In making this recommendation, the Board of Directors consulted with legal and financial advisors and carefully considered all aspects of the HudBay Offer.

The reasons for the Board’s recommendation are detailed in the attached Directors’ Circular. As you will see, the Board considered many factors, including written opinions from Augusta’s financial advisors, Scotia Capital Inc. (“Scotiabank”) and TD Securities Inc. (“TD Securities”). Both opinions state that, as of the date of their respective opinions and based upon and subject to the assumptions, limitations and qualifications stated therein, the consideration offered pursuant to the HudBay Offer is inadequate from a financial point of view to the shareholders of Augusta other than HudBay and its affiliates. We strongly encourage you to read the Directors’ Circular carefully and in its entirety.

As described in more detail in the Directors’ Circular, the reasons for the Board of Directors’ unanimous rejection of the Offer include:

· The HudBay Offer fails to recognize the strategic value of Augusta’s Rosemont project.

(a) Rosemont is a scarce, large scale, construction ready copper asset.

(b) Rosemont is located in a safe, politically stable and highly desirable jurisdiction.

(c) Rosemont is a low capital intensity, low cost project.

(d) Rosemont offers expansion and exploration potential.

· The timing of the HudBay Offer is highly opportunistic given that permitting is nearing completion and construction at the Rosemont project is imminent.

(a) Augusta has received seven of the eight major permits for the Rosemont project and the Board is confident that the last major permit, the Army Corps of Engineers’ Clean Water Act 404 permit, will be issued by the end of the second quarter of 2014.

(b) The Board is confident that the Rosemont project will be fully financed, and that construction will commence, in mid-2014.

(c) The Board believes that the HudBay Offer is timed to deprive Augusta’s shareholders of the full and fair value of Augusta’s Rosemont project.

· The value of the HudBay Offer is significantly below implied multiples of precedent base metal transactions.

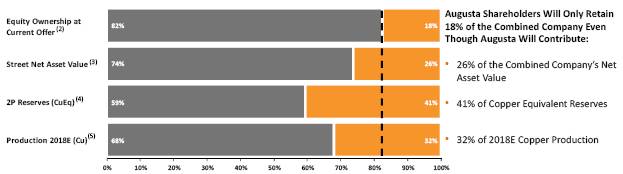

· A combination of HudBay and Augusta would be dilutive to Augusta’s shareholders. If the HudBay Offer is successful, Augusta’s shareholders (other than HudBay and its affiliates) will only hold approximately 18% of the HudBay Shares on a fully-diluted basis, but will have contributed approximately 26% of the combined company’s net asset value and approximately 41% of the combined company’s copper equivalent reserves and would account for approximately 32% of the combined company’s estimated total copper production by 2018.

· The market views the HudBay Offer as inadequate.

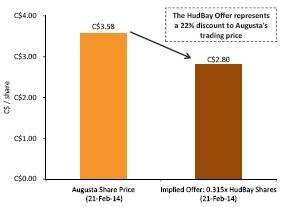

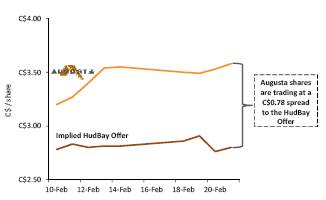

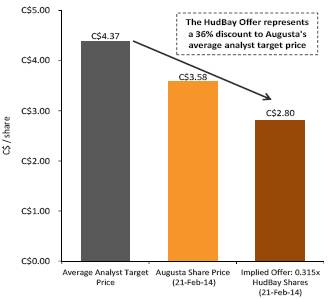

(a) The value of the HudBay Offer as of February 21, 2014 represents a DISCOUNT of 22% to the closing price of the Common Shares on the Toronto Stock Exchange on that date.

(b) The value of the HudBay Offer as of February 21, 2014 is at an approximate 36% DISCOUNT to analysts’ average target price for the Common Shares as at such date.

· Augusta’s shareholders are not being adequately compensated for the risks and uncertainties inherent in HudBay’s shares.

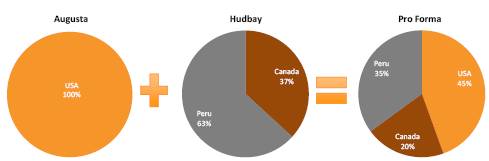

(a) HudBay’s shares carry substantial geopolitical risks due to the location of material HudBay assets in Peru.

(b) HudBay’s development projects and core competencies introduce material additional risk.

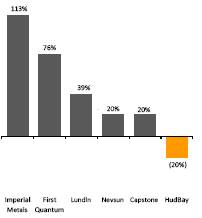

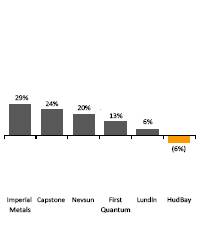

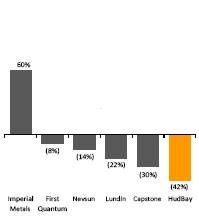

· HudBay has a track record of underperformance. Since current senior management of HudBay was appointed in June 2010, HudBay’s shares have experienced a return of -20%, while its peer group is up an average of 54% over the same period.

· Scotiabank and TD Securities have delivered written opinions to the Board of Directors that the consideration offered pursuant to the HudBay Offer is inadequate from a financial point of view to Augusta’s shareholders other than HudBay and its affiliates.

· Directors, officers and four other shareholders of Augusta holding over 33% of Augusta’s Common Shares (on a fully-diluted basis) have advised Augusta that they WILL NOT TENDER to the HudBay Offer. Amongst its numerous conditions, the HudBay Offer contains a condition that not less than 662/3% of the Common Shares, calculated on a fully-diluted basis, be tendered to that offer and not withdrawn. Given the determination of the directors, officers and these shareholders it is a virtual certainty that, as structured, the HudBay Offer CANNOT SUCCEED.

· The Board of Directors is aggressively pursuing value-maximizing alternatives to the HudBay Offer.

· The HudBay Offer is inherently coercive and is not a “Permitted Bid” under Augusta’s shareholder rights plan.

· The HudBay Offer is highly conditional. The Board of Directors is concerned that tendering Common Shares to HudBay’s offer would, in effect, constitute the grant to HudBay of an option to acquire Common Shares at a price that is grossly inadequate and does not come close to recognizing the value and potential of the Rosemont project.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

It is glaringly obvious that HudBay needs Augusta more than Augusta needs HudBay. We are confident that you will conclude, as we have, that the HudBay Offer is a LOW BALL BID that does not come close to providing full and fair value for the Common Shares.

One of the major attributes of the Rosemont project is its location in one of the most politically stable jurisdictions in the world, with easy access to infrastructure and a willing and mining savvy workforce. That brings with it a very careful and time consuming approach to permitting. Augusta has fully respected that permitting process. After six years of careful effort, Augusta fully expects the remaining permits to be in hand by the end of June 2014. Augusta is blessed with many loyal, long-standing shareholders who have waited patiently for the permitting process to be completed and understand fully the value gap that exists until the permits are in hand.

Unfortunately, HudBay has swooped in at the very last minute in an attempt to deprive Augusta’s shareholders of the value they have been waiting to unlock for many years. That would be highly beneficial to HudBay, and equally detrimental to the interests of Augusta’s shareholders. Our message to HudBay is very simple — pay our shareholders full and fair value or walk away from your low ball bid.

On behalf of the Board of Directors of Augusta, we thank you for your continued support.

|

|

Yours very truly, |

|

|

|

|

|

“Richard W. Warke” |

|

|

|

|

|

RICHARD W. WARKE |

|

|

Executive Chairman and Director |

|

|

Augusta Resource Corporation |

|

|

|

|

|

|

|

|

|

|

|

“Gilmour Clausen” |

|

|

|

|

|

GILMOUR CLAUSEN |

|

|

President, Chief Executive Officer and Director |

|

|

Augusta Resource Corporation |

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

TABLE OF CONTENTS

|

QUESTIONS AND ANSWERS ABOUT THE HUDBAY OFFER |

i |

|

FORWARD-LOOKING INFORMATION |

iii |

|

GLOSSARY OF TERMS AND CERTAIN CALCULATIONS |

iv |

|

CURRENCY AND EXCHANGE RATES |

iv |

|

NOTICE REGARDING INFORMATION |

iv |

|

NOTE CONCERNING MINERAL RESOURCE AND TECHNICAL INFORMATION |

iv |

|

NOTICE TO SHAREHOLDERS IN THE UNITED STATES |

v |

|

SUMMARY |

vi |

|

DIRECTORS’ CIRCULAR |

1 |

|

THE HUDBAY OFFER |

1 |

|

DIRECTORS’ UNANIMOUS RECOMMENDATION |

2 |

|

REASONS FOR REJECTION |

2 |

|

CONCLUSION AND RECOMMENDATION |

18 |

|

HOW TO WITHDRAW TENDERED SHARES |

19 |

|

BACKGROUND TO THE OFFER |

19 |

|

RESPONSE TO THE HUDBAY OFFER |

21 |

|

FINANCIAL ADVISORS AND OPINIONS |

22 |

|

PRIOR VALUATIONS |

22 |

|

AUGUSTA RESOURCE CORPORATION |

22 |

|

OWNERSHIP OF SECURITIES OF AUGUSTA |

23 |

|

TRADING IN SECURITIES OF AUGUSTA |

25 |

|

ISSUANCES OF SECURITIES OF AUGUSTA |

27 |

|

INTENTION WITH RESPECT TO HUDBAY OFFER |

31 |

|

ARRANGEMENTS BETWEEN AUGUSTA AND ITS DIRECTORS AND OFFICERS |

31 |

|

OWNERSHIP OF SECURITIES OF HUDBAY |

34 |

|

ARRANGEMENTS WITH HUDBAY |

34 |

|

INTERESTS OF DIRECTORS AND OFFICERS IN MATERIAL TRANSACTIONS WITH HUDBAY |

34 |

|

OTHER TRANSACTIONS |

35 |

|

MATERIAL CHANGES IN THE AFFAIRS OF AUGUSTA |

35 |

|

OTHER INFORMATION |

35 |

|

LEGAL MATTERS |

39 |

|

STATUTORY RIGHTS |

39 |

|

APPROVAL OF DIRECTORS’ CIRCULAR |

39 |

|

CONSENT OF SCOTIA CAPITAL INC. |

40 |

|

CONSENT OF TD SECURITIES INC. |

41 |

|

CONSENT OF DAVIES WARD PHILLIPS & VINEBERG LLP |

42 |

|

CONSENT OF CRAVATH, SWAINE & MOORE LLP |

43 |

|

CERTIFICATE |

44 |

|

APPENDIX “A” OPINION OF SCOTIA CAPITAL INC. |

A-1 |

|

APPENDIX “B” OPINION OF TD SECURITIES INC. |

B-1 |

|

APPENDIX “C” GLOSSARY OF TERMS |

C-1 |

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

QUESTIONS AND ANSWERS ABOUT THE HUDBAY OFFER

All capitalized terms used in this Q&A have the meanings ascribed to them in the Glossary or elsewhere in this Directors’ Circular.

Should I accept or reject the HudBay Offer?

The Board of Directors UNANIMOUSLY recommends that Shareholders REJECT the HudBay Offer and NOT TENDER their Common Shares.

A summary of the reasons for the unanimous recommendation of the Board of Directors is included on pages vi to xii of this Directors’ Circular under the Section entitled “Reasons for Rejection”.

Have other Shareholders indicated an intention to NOT tender to the HudBay Offer?

Yes. Directors, officers and four other Shareholders of Augusta, including Ross J. Beaty, holding over 33% of the Common Shares (on a fully-diluted basis) have advised Augusta, as of the date of this Directors’ Circular, that they WILL NOT TENDER to the HudBay Offer. Amongst its numerous other conditions, the HudBay Offer contains a condition that not less than 662/3% of the Common Shares, calculated on a fully-diluted basis, be tendered to that offer and not withdrawn. Given the determination of the directors, officers and these Shareholders it is a virtual certainty that, as structured, the HudBay Offer CANNOT SUCCEED.

How do I reject the HudBay Offer?

You do not need to do anything. DO NOT TENDER your Common Shares to the HudBay Offer. Do not complete any of the documents (Letter of Transmittal, Notice of Guaranteed Delivery, etc.) forwarded to you by or on behalf of HudBay.

Can I withdraw my Common Shares if I have already tendered?

Yes. According to the HudBay Offer and Circular, among other circumstances, you can withdraw your Common Shares at any time before your Common Shares have been taken up by HudBay pursuant to the HudBay Offer, which cannot occur until the expiry of the HudBay Offer.

How do I withdraw my Common Shares?

We recommend you contact your broker or dealer, or contact Laurel Hill, the Information Agent retained by Augusta, at the number listed at the end of this Q&A for information on how to withdraw your Common Shares.

What is the Board of Directors doing in response to the HudBay Offer?

The Board of Directors is pursuing and evaluating alternative strategic transactions in order to identify other options that may be in the best interests of Augusta and its Shareholders and which may result in a transaction that is superior to the HudBay Offer. If Shareholders tender their Common Shares to the HudBay Offer before the Board of Directors and its advisors have had an opportunity to fully explore all available strategic alternatives to the HudBay Offer, this may preclude the possibility of a superior alternative transaction emerging.

Do I have to decide now?

No. You do not have to take any action at this time. The HudBay Offer is scheduled to expire at 5:00 p.m. (Toronto time) on March 19, 2014, and is subject to a number of conditions that have not yet been satisfied. The Board of Directors recommends that Shareholders not take any action until closer to the expiry date to ensure that you are able to consider all of the options available to you.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

If you have already tendered your Common Shares to the HudBay Offer and decide to withdraw those Common Shares, you must allow sufficient time to complete the withdrawal process prior to the expiry of the HudBay Offer. For more information on how to withdraw your Common Shares, you should contact your broker or dealer, or contact Laurel Hill at the number set out below.

Who do I ask if I have more questions?

The Board of Directors recommends that you carefully read the information contained in this Directors’ Circular. ANY QUESTIONS OR REQUESTS FOR ASSISTANCE MAY BE DIRECTED TO THE INFORMATION AGENT:

NORTH AMERICAN TOLL-FREE

1-877-452-7184

E-MAIL: assistance@laurelhill.com

Banks and Brokers

and collect calls outside North America please call 416-304-0211

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

FORWARD-LOOKING INFORMATION

This Directors’ Circular, including the discussion of the reasons for the unanimous recommendation of the Board of Directors that Shareholders reject the HudBay Offer and not tender their Common Shares, contains information that constitutes “forward-looking statements” under United States federal securities laws or “forward-looking information” under Canadian securities laws. These statements and information relate to future events and Augusta’s future performance, business prospects or opportunities, including information concerning the HudBay Offer, which are subject to certain risks, uncertainties and assumptions. Such forward-looking statements and forward-looking information include, but are not limited to statements concerning Augusta’s plans at the Rosemont Project, including the timing for obtaining final permits, construction and estimated production, expectations surrounding future financings and refinancings, capital and operating cash flow estimates, changes in market conditions, changes or disruptions in the securities markets and market fluctuations in the prices for Augusta’s securities, the lack of any alternative transactions or the terms and conditions of any alternative transactions not being acceptable.

Forward-looking statements or information is frequently, but not always, characterized by words such as “will”, “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “budget”, “forecast”, “schedule”, “estimate” and similar expressions, or statements that certain events or conditions “may”, “should”, “could”, “might” or “will” occur. The forward-looking statements or information contained in this Directors’ Circular is based on the reasonable expectations and beliefs of management as at the date of this Directors’ Circular and involves numerous assumptions, known and unknown risks and uncertainties, both general and specific to Augusta and the industry in which the Company operates. Such assumptions, risks and uncertainties include, but are not limited to Augusta’s history of losses, requirements for additional capital, dilution, loss of material properties, interest rate increases, global economy, no history of production, speculative nature of exploration activities, periodic interruptions to exploration, development and mining activities, environmental hazards and liability, industrial accidents, failure of processing and mining equipment, labour disputes, supply problems, commodity price fluctuations, uncertainty of production and cost estimates, the interpretation of drill results and the estimation of mineral resources and reserves, legal and regulatory proceedings and community actions, title and tenure matters, regulatory restrictions, permitting and licensing, volatility of the market price of the Company’s common shares, insurance, competition, hedging activities, currency fluctuations, loss of key employees, as well as those factors disclosed in Augusta’s documents filed from time to time with the securities regulators in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick and Newfoundland and Labrador. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results, performance or achievements of the Company, or industry results, may vary materially from those described in this Directors’ Circular. For further details, reference is made to the risk factors discussed or referred to in Augusta’s annual and interim management’s discussion and analyses and Annual Information Form on file with the Canadian securities regulatory authorities and available under Augusta’s issuer profile on SEDAR at www.sedar.com.

Although Augusta has attempted to identify important factors that could cause actual actions, events, results, performance or achievements to differ materially from those described in the forward-looking statements or information contained in this Directors’ Circular, there may be other factors that cause actions, events, results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements or information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Such forward-looking statements and information are made or given as at the date of this Directors’ Circular and Augusta disclaims any intention or obligation to update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, except as required under applicable securities law. The reader is cautioned not to place undue reliance on forward- looking statements or information.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

GLOSSARY OF TERMS AND CERTAIN CALCULATIONS

Certain terms used in this Directors’ Circular have the meanings set forth in Appendix “C” hereto, unless such terms are defined elsewhere in this Directors’ Circular.

Calculations of percentage amounts or amounts per Common Share set forth in this Directors’ Circular are based on 145,364,597 Common Shares outstanding on February 21, 2014.

CURRENCY AND EXCHANGE RATES

Unless otherwise indicated, all dollar amounts in this Directors’ Circular are in Canadian dollars and references to “Cdn.$”, “$” or “dollars” in this Directors’ Circular refer to Canadian dollars. On February 21, 2014, the noon rate of exchange as reported by the Bank of Canada was Cdn.$1.00 = 0.8986 United States dollars.

NOTICE REGARDING INFORMATION

Augusta is a reporting issuer or equivalent in the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick and Newfoundland and Labrador and files its continuous disclosure documents and other documents with such provincial securities regulatory authorities. Certain information in this Directors’ Circular has been taken from or is based on documents that are expressly referred to in this Directors’ Circular. All summaries of, and references to, documents that are specified in this Directors’ Circular as having been filed, or that are contained in documents specified as having been filed, on SEDAR are qualified in their entirety by reference to the complete text of those documents as filed, or as contained in documents filed, under Augusta’s issuer profile on SEDAR at www.sedar.com. Shareholders are urged to read carefully the full text of those documents, which may also be obtained on request without charge from Augusta at Suite 555, 999 Canada Place, Vancouver, British Columbia.

Information contained in this Directors’ Circular concerning HudBay and its affiliates and the HudBay Offer, including forward-looking statements or information, is based solely upon, and the Board of Directors has relied, without independent verification, exclusively upon information contained in the HudBay Offer and Circular or that is otherwise publicly available. Neither Augusta nor any of its officers or directors assumes any responsibility for the accuracy or completeness of such information or for any failure by HudBay or its affiliates to disclose events or facts that may have occurred or may affect the significance or accuracy of any such information.

Augusta has quoted from publicly available analyst reports in this document. These analysts have not consented to the inclusion of all or any portion of their reports in this document. None of the firms employing such analyses were advisors to Augusta or HudBay in connection with the HudBay Offer as at the dates of such analysts’ reports. Subsequent to such dates, Scotiabank and TD Securities were engaged as Financial Advisors to Augusta. For more information on the engagement of the Financial Advisors see the Section of this circular entitled “Financial Advisors and Opinions”.

NOTE CONCERNING MINERAL RESOURCE AND TECHNICAL INFORMATION

Information in this Directors’ Circular and disclosure documents of Augusta that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resources” and “inferred mineral resource” and derivatives thereof. Shareholders in the United States are advised that, while such terms are recognized and required by Canadian securities laws, the SEC does not recognize them. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

legally produced or extracted at the time the reserve determination is made. Investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Therefore, investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators, which has established standards for public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource and technical information of Augusta contained in this Directors’ Circular or contained in documents referenced in this Directors’ Circular have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

This Directors’ Circular has been prepared by Augusta in accordance with disclosure requirements under applicable Canadian law. Non-resident Shareholders should be aware that these requirements may be different from those of the United States or other jurisdictions. Financial statements, if any, included in or described herein have been prepared in accordance with foreign generally accepted accounting principles and thus may not be comparable to financial statements of United States companies. The enforcement by Shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that Augusta is a corporation existing under the laws of Canada and that a majority of its officers and directors are not residents of the United States. Shareholders in the United States may not be able to sue Augusta or its officers or directors in a foreign court for violation of United States securities laws. It may be difficult to compel such parties to subject themselves to the jurisdiction of a court in the United States or to enforce judgment obtained from a court of the United States.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

SUMMARY

The information set out below is intended as a summary only and is qualified in its entirety by the more detailed information appearing elsewhere in this Directors’ Circular. This Directors’ Circular should be read carefully and in its entirety by Shareholders as it provides important information regarding Augusta, HudBay and the HudBay Offer. All capitalized terms in this summary have the meanings ascribed to such terms in the Glossary or elsewhere in this Directors’ Circular.

Directors’ Recommendation

The Board of Directors UNANIMOUSLY recommends that Shareholders

REJECT the HudBay Offer and NOT TENDER their Common Shares.

Any Shareholder who has tendered its Common Shares to the HudBay Offer should WITHDRAW those Common Shares.

The HudBay Offer

HudBay has made an unsolicited Offer to purchase all of the outstanding Common Shares of Augusta, other than any Common Shares held directly or indirectly by HudBay and its affiliates, for consideration of 0.315 of a HudBay Share per Common Share.

Based on the closing price of the HudBay Shares on the TSX on February 21, 2014, the last trading day before the Directors’ Circular, the value of the HudBay Offer is $2.80 per Common Share. That represents a DISCOUNT of 22% to the closing price of the Common Shares on the TSX on that date.

As the HudBay Offer is open for acceptance until 5:00 p.m. (Toronto time) on March 19, 2014, there is no need for Shareholders to take any action with respect to the HudBay Offer at this time. Shareholders who have tendered their Common Shares to the HudBay Offer and wish to obtain advice or assistance in withdrawing their Common Shares are urged to contact their broker or dealer, or Laurel Hill, the Information Agent retained by Augusta, at the telephone number on the back page of this Directors’ Circular.

Directors, officers and four other Shareholders of Augusta, including Ross J. Beaty, holding over 33% of the Common Shares (on a fully-diluted basis) have advised Augusta, as of the date of this Directors’ Circular, that they WILL NOT TENDER to the HudBay Offer. Amongst its numerous other conditions, the HudBay Offer contains a condition that not less than 662/3% of the Common Shares, calculated on a fully-diluted basis, be tendered to that offer and not withdrawn. Given the determination of the directors, officers and these Shareholders it is a virtual certainty that, as structured, the HudBay Offer CANNOT SUCCEED.

Reasons for Rejection

The Board of Directors has carefully reviewed and evaluated the HudBay Offer and has unanimously concluded that the HudBay Offer is grossly inadequate, highly opportunistic and does not come close the recognizing the full and fair value of Augusta and its Rosemont Project. In making its recommendation, the Board of Directors consulted with its legal and financial advisors and carefully considered all aspects of the HudBay Offer.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

The principal factors considered by the Board of Directors in recommending that Shareholders REJECT the HudBay Offer and NOT TENDER their Common Shares are as follows:

1. The HudBay Offer fails to recognize the strategic value of Augusta’s Rosemont Project.

The Rosemont Project is considered to be one of the most attractive mining projects in the world, due to its low operating costs, large reserve and resource base, and its ideal location in an established mining district and proximity to major markets for its high-quality copper concentrate production. Rosemont is located in Arizona, a safe, politically stable, highly desirable jurisdiction, with a long mining history and stable mining laws and regulatory regime. With Rosemont being only 50 kilometres southeast of Tucson, Augusta also benefits from local access to a willing, skilled and experienced labour force as well as established local infrastructure including roadways, rail lines, power facilities and water.

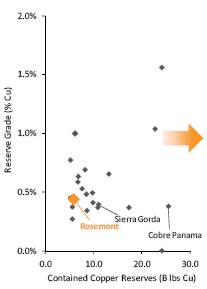

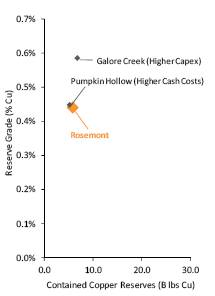

Rosemont is a scarce, large scale, construction ready copper asset

Worldwide, there are over 100 copper development projects with reserves. However, only 22 of these development projects are considered to be large scale with a reserve base of at least five billion pounds of copper. Of these 22 large scale projects, Rosemont is one of only three not majority owned by a producer or government entity. Augusta’s Board firmly believes that the Rosemont Project is the most attractive, construction ready independent copper development opportunity in the world.

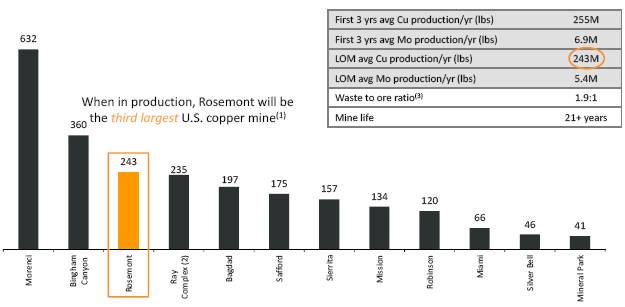

Over its 21-year mine life, the Rosemont Project is expected to have average annual copper production of 243 million pounds per year, making it the third largest copper mine in the United States and accounting for approximately 10% of total U.S. copper production.

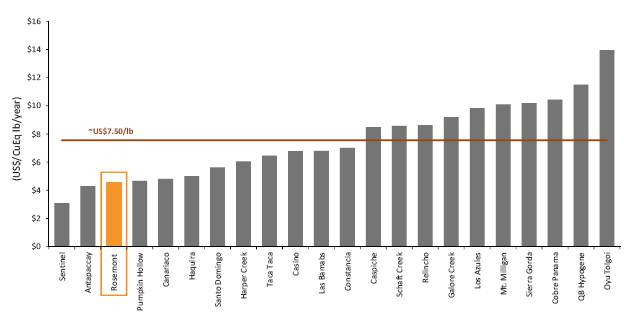

Rosemont is a low capital intensity, low cost project

The scale of the Rosemont Project is complemented by its low capital intensity. When compared to other greenfield copper projects, Rosemont is significantly below the average cost based on capital expenditures per copper equivalent pound produced per year. Rosemont will also be a low cost producer, and is expected to rank in the lowest quartile of the global copper cash cost curve.

Rosemont offers expansion potential

The existing mine plan is premised on only proven and probable reserves of approximately 5.9 billion pounds of copper. However, estimated additional mineral resources presently total about 1.9 billion pounds of copper and an additional 1.1 billion pounds of inferred copper resources. Augusta’s management believes that, if upgraded, these additional measured and indicated resources and additional inferred resources could significantly increase annual production and mine life.

Rosemont offers exploration potential

The Rosemont Project is located within an approximate 20,100 acre area which is subject to patented and unpatented claims covering approximately 18,000 acres and fee lands of approximately 1,800 acres. Augusta has completed a three-phase geophysical survey exploration program which has identified multiple IP anomalies in close proximity to the Rosemont pit which are worthy of additional exploration.

2. The timing of the HudBay Offer is highly opportunistic given permitting is nearing completion and construction at the Rosemont Project is imminent.

The Board of Directors believes that the HudBay Offer is timed to deprive Shareholders of the full value of Augusta’s world-class Rosemont Project. The receipt of all permits is generally a catalyst for an upward revaluation of a project as investors assign higher valuation multiples and lower discount rates to fully permitted assets relative to unpermitted projects. Historically, there has been a significant discount applied by the public markets to the value of the Common Shares to account for permitting risk at the Rosemont Project. However, Augusta believes that the Rosemont Project has been substantially de-risked and, after over six years of effort,

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

is on the verge of reaching key value creation milestones. The HudBay Offer validates this view and comes at a tipping point for Augusta in the mining development cycle — just before a period of expected considerable value enhancement.

Major Permitting Nearing Completion

Augusta has received seven of the eight major permits for the Rosemont Project and the Board of Directors is confident that, based on the steps currently being taken by U.S. federal and state regulatory agencies, the last major permit, the Army Corps of Engineers’ Clean Water Act 404 permit, will be issued by the end of the second quarter of 2014.

The Board of Directors believes that the timing of the HudBay Offer is motivated by HudBay’s view that the permits will be issued, and when that occurs the value of the Common Shares will increase materially. The HudBay Offer is a validation of Augusta’s permitting efforts and is a tacit acknowledgement by HudBay that this may be its last opportunity to acquire Augusta at a deeply discounted price.

Construction Ready

The Rosemont Project is construction ready. Preliminary engineering is complete and detailed engineering currently ranges from 38% to 80% complete. The remaining detailed engineering is advancing on pace to match the expected permitting timeline.

Financing on Track

Augusta’s financing plan is on track and the Board of Directors is confident that the Rosemont Project will be fully financed by mid-2014. Rosemont Copper and its joint venture partners have entered into the Mandate Letter with a syndicate of 12 international financial institutions with respect to a limited recourse loan facility. The senior secured debt that will be made available is expected to provide all of the debt required for the Rosemont Project.

3. The value of the HudBay Offer is significantly below implied multiples of precedent base metal transactions.

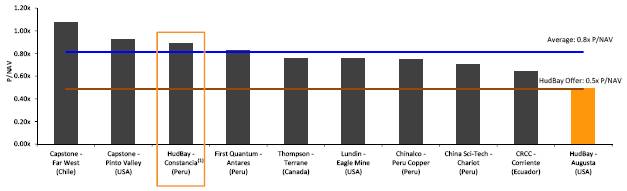

The HudBay Offer represents a price to net asset value (P/NAV) multiple (based on research analyst consensus net asset value) of 0.5x. This represents a significant discount as compared to average precedent P/NAV multiples of 0.8x for comparable base metal transactions. In 2010, HudBay paid a P/NAV multiple of approximately 0.9x when it acquired Norsemont, owner of the Constancia project, and there are a number of precedents for earlier stage projects in higher risk jurisdictions in which higher multiples have been paid.

4. A combination of HudBay and Augusta would be dilutive to Augusta’s Shareholders.

Augusta’s Shareholders currently have the benefit of having 100% exposure to Augusta’s interest in the Rosemont Project. If the HudBay Offer is successful, Shareholders of Augusta (other than HudBay and its affiliates) will only hold approximately 18% of the HudBay Shares on a fully-diluted basis, significantly reducing their exposure to the Rosemont Project and increasing their exposure to HudBay’s existing assets. In addition, Augusta’s Shareholders would disproportionately contribute to a combined Augusta/HudBay approximately 26% of the combined company’s net asset value and approximately 41% of the combined company’s copper equivalent reserves and would account for approximately 32% of the combined company’s estimated total copper production by 2018.

5. The market views the HudBay Offer as inadequate.

Since the announcement of the HudBay Offer on February 9, 2014, the Common Shares have consistently traded substantially above the value of the HudBay Offer. Between the date of announcement of the HudBay Offer and February 21, 2014, over 13 million Common Shares have traded on the TSX at prices as high as $3.64. The value of the HudBay Offer as of February 21, 2014, the last trading day prior to the date of this

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

Directors’ Circular, represents a DISCOUNT of 22% to the closing price of the Common Shares on the TSX on that date.

Analysts, including CIBC World Markets, Canaccord Genuity, National Bank Financial and Jennings Capital Inc., also support a higher value for Augusta and recommend that Shareholders reject the HudBay Offer. Comparing the value of the HudBay Offer as of February 21, 2014 to analysts’ average target price for the Common Shares reveals that the Offer value is at an approximate 36% discount.

6. Shareholders are not being adequately compensated for the risks and uncertainties inherent in the HudBay Shares.

HudBay Shares carry greater geopolitical risk

HudBay’s business carries greater geopolitical risk than Augusta’s business. The Rosemont Project is located entirely in the State of Arizona, a geopolitically stable region, whereas 63% of HudBay’s copper equivalent reserves are located in Peru. During the last several years, certain mining projects in Peru have been the target of political and community protests and other initiatives that have delayed and disrupted project development and operations. By way of example, in late 2011, construction activities at the Conga project in northern Peru were suspended at the request of the central government following increasing protests by anti-mining activists led by the regional president. To date there have been similar initiatives in respect of HudBay’s Constancia project, including an attempt to restrict access by workers, and there is the risk that more significant opposition may be mounted that may affect HudBay’s ability to develop and operate the Constancia project.

HudBay’s development projects and core competencies introduce material additional risk

HudBay has repeatedly underestimated capital costs on its Constancia project, undermining any claims on its part of being better positioned to advance the Rosemont Project. Since acquiring the Constancia project in January 2011, HudBay’s expected capital costs for the project have increased by over 85% from $920 million to over $1.7 billion as of February 2014.

HudBay currently has three on-going mining projects that are in ramp-up or construction phases. As a result, HudBay’s management has stated that it does not intend to advance the Rosemont Project on the timeline currently proposed by Augusta. Delays in the advancement of the Rosemont Project could have a negative impact on shareholder value. Any change to the development plan by HudBay would be disruptive, and would result in additional delays, all of which would result in increased costs and a deterioration of the value of the Rosemont Project. HudBay’s core expertise lies in underground mining development, with limited experience in developing or operating open pit mines such as the one proposed at Rosemont. Any claims that a significant benefit to Shareholders can be realized through HudBay’s experience or expertise is, in the view of the Board of Directors, not credible.

HudBay has also attempted to convince its shareholders that it will be able to realize more value for Rosemont than Augusta, as it intends to finance the development of Rosemont with internally generated funds. This is the same claim that HudBay made when it acquired the Constancia project; however, since 2011, HudBay has relied on, and proposes to further rely on, external sources of financing to raise over US$2.0 billion through a combination of high yield debt, precious metal streams, equipment financing, common equity and a proposed offtake debt facility.

7. HudBay has a track record of underperformance.

HudBay has consistently delivered negative returns for its shareholders. Since the current senior management team was appointed in June 2010, the HudBay Shares have experienced a return of -20%, while its peer group is up an average of 54% over the same period. Since the consideration under the HudBay Offer consists entirely of HudBay Shares, the Board of Directors is highly concerned about this underperformance.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

8. Scotiabank and TD Securities have provided written opinions to the Board of Directors that the consideration offered pursuant to the HudBay Offer is inadequate from a financial point of view to the Shareholders other than HudBay and its affiliates.

Scotiabank and TD Securities have each delivered a written opinion to the Board of Directors to the effect that, as of the date of their respective opinions and based upon and subject to the assumptions, limitations and qualifications set forth in their respective opinions, the consideration offered pursuant to the HudBay Offer is inadequate, from a financial point of view, to the Shareholders other than HudBay and its affiliates. Copies of the opinions of Scotiabank and TD Securities are attached as Appendix “A” and Appendix “B” to this Directors’ Circular, respectively. The opinions delivered by Scotiabank and TD Securities were provided for the information and assistance of the Board of Directors in connection with its consideration of the HudBay Offer. The description of these opinions in this Directors’ Circular and the opinions themselves do not constitute a recommendation to Shareholders as to whether they should or should not tender their Common Shares to the HudBay Offer. The Board of Directors recommends that you read the opinions delivered by Scotiabank and TD Securities carefully and in their entirety for a description of the procedures followed, matters considered, and limitations on the review undertaken.

9. Directors, officers and Shareholders of Augusta holding over 33% of Augusta’s Common Shares (on a fully-diluted basis) have advised Augusta that they WILL NOT TENDER to the HudBay Offer.

Amongst its numerous other conditions, the HudBay Offer contains a condition that not less than 662/3% of the Common Shares, calculated on a fully-diluted basis, be tendered to that offer and not withdrawn. Given the determination of the directors, officers and these Shareholders it is a virtual certainty that, as structured, the HudBay Offer CANNOT SUCCEED.

10. The Board of Directors is aggressively pursuing value-maximizing alternatives to the HudBay Offer.

The Board of Directors is pursuing and evaluating alternative strategic transactions in order to identify other options that may be in the best interests of Augusta and its Shareholders and which may result in a transaction that is superior to the HudBay Offer. Augusta has been approached by, and its Financial Advisors have been approached by, and/or have initiated contact with, a number of third parties. Discussions are ongoing and Augusta has established an electronic data room for purposes of providing confidential information to third parties who have entered into confidentiality agreements.

While it is impossible to predict whether any transactions will emerge from these efforts, the Board of Directors believes that Augusta and its assets are potentially very attractive to other parties in addition to HudBay.

11. The HudBay Offer is inherently coercive, and is not a Permitted Bid under Augusta’s Shareholder Rights Plan.

The Shareholder Rights Plan is intended to ensure that all Shareholders and the Board of Directors have adequate time to consider and evaluate any unsolicited take-over bid for the Common Shares, to provide the Board of Directors with adequate time to identify, solicit, develop and negotiate value-enhancing alternatives, as considered appropriate, to any unsolicited take-over bid and encourage the fair treatment of Shareholders in connection with any unsolicited take-over bid.

HudBay was able to make a Permitted Bid but chose not to do so. The HudBay Offer is open for acceptance for only 36 days and Augusta requires a longer period of time to attract competing proposals from prospective buyers than that which is currently provided for in the HudBay Offer.

The HudBay Offer is also structured such that HudBay may acquire less than all of the Common Shares, which is inherently coercive because it forces Shareholders to decide whether to accept the HudBay Offer, sell into the market or reject the HudBay Offer and maintain their position without knowing whether and to what extent other Shareholders might accept the HudBay Offer. Moreover, HudBay has expressly reserved the right in the

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

HudBay Offer and Circular not to acquire any Common Shares it does not own following a consummation of the HudBay Offer. Accordingly, a Shareholder may feel compelled to tender its Common Shares to the HudBay Offer even if the Shareholder considers the Offer price to be inadequate, out of concern that if, in failing to do so, HudBay acquires less than 100% of Augusta, the Shareholder may be left holding a minority investment at a reduced price reflective of a minority discount in a company under the control of HudBay and reduced liquidity in the market for the Common Shares.

12. The HudBay Offer is highly conditional.

The HudBay Offer is highly conditional to the benefit of HudBay. The Board of Directors is concerned that tendering Common Shares to the HudBay offer would, in effect, constitute the grant to HudBay of an option to acquire Common Shares at a price that is grossly inadequate and does not come close to recognizing the value and potential of the Rosemont Project.

More detailed reasons for the unanimous recommendation of the Board of Directors to reject the HudBay Offer are included on pages 2 to 18 of this Directors’ Circular under the section entitled “Reasons for Rejection”.

Right to Withdraw Common Shares

Shareholders may withdraw any Common Shares deposited pursuant to the HudBay Offer at any time in the following circumstances, unless otherwise permitted by applicable laws:

(a) at any time before the Common Shares have been taken up by HudBay pursuant to the HudBay Offer;

(b) if the Common Shares have not been paid for by HudBay within three business days after the Common Shares have been taken up; or

(c) at any time before the expiration of ten days from the date upon which either: (i) a notice of change relating to a change which has occurred in the information contained in the HudBay Offer and Circular, a notice of change or a notice of variation, that would reasonably be expected to affect the decision of a Shareholder to accept or reject the HudBay Offer (other than a change that is not within the control of HudBay or one of its affiliates unless it is a change in a material fact relating to the HudBay Shares), in the event that such change occurs before the Expiry Time or after the Expiry Time but before the expiry of all rights to withdraw Common Shares deposited under the HudBay Offer; or (ii) a notice of variation concerning a variation in the terms of the HudBay Offer (other than a variation in the terms of the HudBay Offer consisting only of an increase in the consideration offered for the Common Shares where the Expiry Time is not extended for more than ten days), is mailed, delivered or otherwise properly communicated, and, in each case, only if such deposited Common Shares have not been taken-up by HudBay before the date of such notice of change or notice of variation.

We recommend that Shareholders contact their broker or dealer, or contact Laurel Hill, the Information Agent retained by Augusta, at the telephone number on the back page of this Directors’ Circular for information on how to withdraw Common Shares.

The HudBay Offer is open until 5:00 p.m. (Toronto time) on March 19, 2014. There is no need for Shareholders to take any action with respect to the HudBay Offer at this time. Shareholders who, notwithstanding the Board of Directors’ recommendation to REJECT the HudBay Offer, decide to tender their Common Shares to the HudBay Offer, should only do so immediately prior to the Expiry Time in order to ensure that they are able to tender to any higher offers which may emerge after the date hereof.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

To Reject the HudBay Offer, You Should Do Nothing.

If you have already tendered your Common Shares to the HudBay Offer and wish to withdraw your Common Shares, we recommend that you contact your broker or dealer, or contact Laurel Hill, North America Toll-Free at 1-877-452-7184, Banks and Brokers and collect calls outside North America at 416-304-0211 or via e-mail at assistance@laurelhill.com.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

DIRECTORS’ CIRCULAR

This Directors’ Circular is issued by the Board of Directors of Augusta in connection with the unsolicited Offer by HudBay to purchase, for consideration of 0.315 of a HudBay Share per Common Share, all of the outstanding Common Shares of Augusta, other than any Common Shares held directly or indirectly by HudBay and its affiliates, including any Common Shares that may become outstanding after February 10, 2014 upon the exercise, exchange or conversion of any Options, Warrants, Convertible Notes or other Convertible Securities, together with the associated SRP Rights issued under the Shareholder Rights Plan, upon the terms and subject to the conditions of the HudBay Offer set forth in the HudBay Offer and Circular dated February 10, 2014.

THE HUDBAY OFFER

The consideration under the HudBay Offer consists of 0.315 of a HudBay Share for each Common Share of Augusta. The HudBay Offer is subject to multiple conditions, including, among others: (i) there having been validly deposited under the HudBay Offer and not withdrawn such number of Common Shares that, together with the Common Shares held by HudBay and its affiliates, represent at least 662/3% of the Common Shares (calculated on a fully-diluted basis); (ii) the Shareholder Rights Plan having been waived, invalidated or cease-traded; (iii) receipt of all governmental or regulatory approvals required to complete the HudBay Offer, including any necessary or advisable competition or anti-trust approvals and the expiry of any applicable waiting periods; and (iv) the absence of any Material Adverse Change (as such term is defined in the HudBay Offer and Circular) in relation to Augusta.

The HudBay Offer is only for Common Shares (including the associated SRP Rights) and is not made for any Options, Warrants, Convertible Notes or other Convertible Securities.

The HudBay Offer includes a proposal to combine the businesses of HudBay and Augusta by way of a compulsory acquisition, should the conditions for such acquisition be satisfied. If a compulsory acquisition transaction is unavailable or HudBay elects not to proceed in that manner, the HudBay Offer contemplates a subsequent acquisition transaction or another transaction to permit HudBay to acquire 100% of the outstanding Common Shares.

The Expiry Time of the HudBay Offer is stated to be 5:00 p.m. (Toronto time) on March 19, 2014, unless the HudBay Offer is withdrawn or extended. Reference is made to the HudBay Offer and Circular for full details of the additional terms and conditions of the HudBay Offer. There is no need for Shareholders to take any action with respect to the HudBay Offer at this time. Shareholders who, notwithstanding the Board of Directors’ recommendation to REJECT the HudBay Offer, decide to tender their Common Shares to the HudBay Offer, should only do so immediately prior to the Expiry Time in order to ensure that they are able to tender to any higher offer which may emerge after the date hereof.

HudBay’s head office located at 25 York Street, Suite 800, Toronto, Ontario, Canada, M5J 2V5 (tel. (416) 362-8181) and its registered office is located at 2200-201 Portage Avenue, Winnipeg, Manitoba, Canada, R3B 3L3.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

DIRECTORS’ UNANIMOUS RECOMMENDATION

The Board of Directors unanimously believes that the HudBay Offer is grossly inadequate, highly opportunistic and does not come close to recognizing the full and fair value of Augusta and its Rosemont Project.

The Board of Directors UNANIMOUSLY recommends that Shareholders

REJECT the HudBay Offer and NOT TENDER their Common Shares.

Any Shareholder who has tendered its Common Shares to the HudBay Offer should WITHDRAW those Common Shares.

REASONS FOR REJECTION

In making its recommendation, the Board of Directors carefully considered a number of factors and identified the following as being the most relevant to its recommendation to Shareholders to REJECT the HudBay Offer and NOT TENDER their Common Shares.

1. The HudBay Offer fails to recognize the strategic value of Augusta’s Rosemont Project.

The Rosemont Project is considered to be one of the most attractive mining projects in the world, due to its low operating costs, large reserve and resource base, and its ideal location in an established mining district and proximity to major markets for its high-quality copper concentrate production. Rosemont is located in Arizona, a safe, politically stable, highly desirable jurisdiction, with a long mining history and stable mining laws and regulatory regime, that produces approximately 65% of the United States’ copper supply. With the Rosemont Project being only 50 kilometres southeast of Tucson, Augusta also benefits from local access to a willing, skilled and experienced labour force as well as established local infrastructure including roadways, rail lines, power facilities and water.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

Rosemont is a scarce, large scale construction ready copper asset

Worldwide, there are over 100 copper development projects with reserves. However, only 22 of these development projects are considered to be large scale with a reserve base of at least five billion pounds of copper. Of these 22 large scale projects, Rosemont is one of only three not majority owned by a producer or government entity. Augusta’s Board firmly believes that the Rosemont Project is the most attractive, construction ready, independent copper development opportunity in the world.

|

Development Projects with Cu Reserves |

Over 5 Billion lbs Contained Cu |

Not Majority-Owned by a |

|

|

|

|

Source: Metals Economics Group

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

Over its 21-year mine life, the Rosemont Project is expected to have average annual copper production of 243 million pounds per year, making it the third largest copper mine in the United States and accounting for approximately 10% of total U.S. copper production. The Rosemont Project will also produce significant amounts of molybdenum and silver to contribute to low net cash costs.

2012A U.S. Copper Production By Mine (Mlbs)

Source: Public filings

Notes: All metrics relating to Rosemont are presented on a 100% basis.

(1) Production plan is based on the 2012 mineral reserve which is confined by a pit shell based on US$1.88/lb Cu. Based on Rosemont 2012 Feasibility Study.

(2) Does not include smelter throughput.

(3) Waste includes oxide material. If oxide minerals are excluded from waste, the waste to ore ratio would be 1.7:1.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

Rosemont is a low capital intensity, low cost project

The scale of the Rosemont Project is complemented by its low capital intensity. When compared to other greenfield copper projects, Rosemont is significantly below the average cost based on capital expenditures per copper equivalent pound produced per year.

One of the Lowest Cost Mines Relative to Annual Production

Source: Rosemont calculated based on Rosemont 2012 Feasibility Study. Other greenfield copper projects from Scotiabank GBM Research estimates February 10, 2014.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

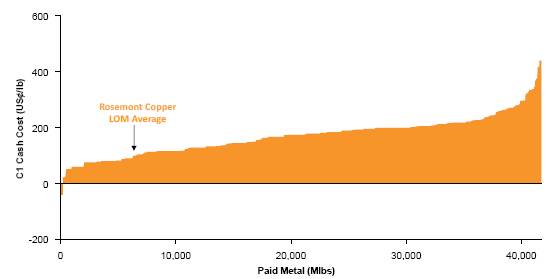

Rosemont will also be a low cost producer, and is expected to rank in the lowest quartile of the global copper cash cost curve.

Copper Industry C1 Cash Cost Curve (2018E)(1)

Source: Wood Mackenzie, Rosemont 2012 Feasibility Study

Note:

(1) Augusta plotted on copper C1 cash cost (2018E) based on Rosemont life of mine average cash costs net of by-products including giving effect to Augusta’s agreement to sell to Silver Wheaton 100% of the payable silver and gold to be produced by the Rosemont Project.

Rosemont offers production expansion potential

The Rosemont Project will deliver sulfide ore to the processing plant at an initial rate of 75,000 tons of ore per day (tpd) with plans to commence increasing production in year four of operations to 88,000 tpd by year seven and 90,000 tpd by year twelve.

The existing mine plan is premised on only proven and probable reserves of approximately 5.9 billion pounds of copper. However, estimated additional mineral resources presently total about 1.9 billion pounds of copper and an additional 1.1 billion pounds of inferred copper resources. Augusta’s management believes that, if upgraded, these additional measured and indicated resources and additional inferred resources could significantly increase annual production and mine life.

Rosemont offers exploration potential

The Rosemont Project is located within an approximate 20,100 acre area which is subject to patented and unpatented claims covering approximately 18,000 acres and fee lands of approximately 1,800 acres. Augusta has completed a three-phase geophysical survey exploration program which has identified multiple IP anomalies in close proximity to the Rosemont pit which are worthy of additional exploration.

2. The timing of the HudBay Offer is highly opportunistic given that permitting is nearing completion and construction at the Rosemont Project is imminent.

The Board of Directors believes that the HudBay Offer is timed to deprive Shareholders of the full and fair value of Augusta’s world-class Rosemont Project. The receipt of all permits is generally a catalyst for an upward revaluation of a project as investors assign higher valuation multiples and lower discount rates to fully permitted assets relative to unpermitted projects. Historically, there has been a significant discount applied by the public markets to the value

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

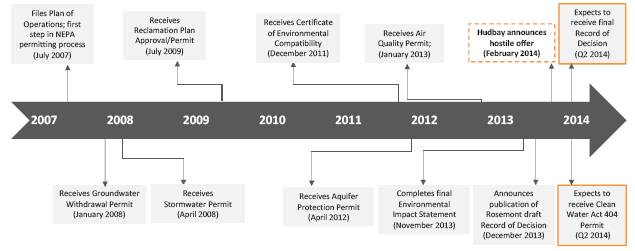

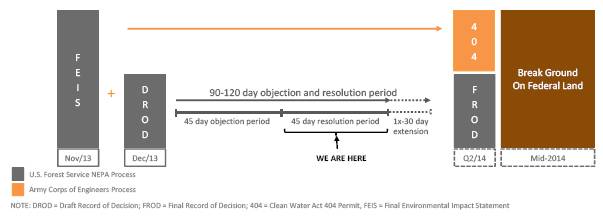

of the Common Shares to account for permitting risk at the Rosemont Project. However, Rosemont’s permitting process is in the very last stage (see timeline below) and therefore Augusta believes that the Rosemont Project has been substantially de-risked and, after over six years of effort, is on the verge of reaching key value creation milestones. The HudBay Offer validates this view and comes at a tipping point for Augusta in the mining development cycle — just before a period of expected considerable value enhancement.

Rosemont Permitting Timeline

Augusta is highly confident that it can successfully develop the Rosemont Project and deliver on this unique growth opportunity, providing significantly more value to Shareholders than the HudBay Offer.

Major Permitting Nearing Completion

In the culmination of a six year process, the U.S. Forest Service published the final Environmental Impact Statement (the “Final EIS”) for the Rosemont Project in November 2013. Subsequently, the U.S. Forest Service published the draft Record of Decision (the “Draft ROD”) for the Rosemont Project in December 2013. In determining to allow the Rosemont Project to proceed, Jim Upchurch, Forest Supervisor, Coronado National Forest, stated in the Draft ROD:

“My decision allows Rosemont Copper to develop its mineral resource while requiring a wide array of mitigation and monitoring steps that will minimize or avoid impacts on [National Forest Service] lands to the extent practicable.”

The publication of the Draft ROD triggered a 45-day objection period during which parties which had provided substantive comments during prior public comment periods were allowed to submit further comments. This 45-day objection period has expired, and the U.S. Forest Service is now engaged in a 45 to 75-day resolution period where any significant comments that were submitted during the 45-day objection period will be resolved. Augusta expects that the resolution process will be completed, and the final Record of Decision will be issued, in the second quarter of 2014.

Augusta has received seven of the eight major permits for the Rosemont Project and the Board of Directors is confident that, based on the steps currently being taken by U.S. federal and state regulatory agencies, the last major permit, the Army Corps of Engineers’ (the “Army Corps”) Clean Water Act 404 permit, will be issued by the end of the second quarter of 2014.

Negotiations with the Army Corps are presently underway to finalize mitigation for the 404 permitting process. To date, the Army Corps has completed its analysis of the impacts and has concurred with the U.S. Forest Service

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

regarding the alternatives selections. After the Final EIS was released, Rosemont worked on finalizing mitigation and has provided the Army Corps with information regarding mitigation plans. Review and comments on those plans by the Army Corps is expected to be completed early in the second quarter of 2014 with plan finalization and permit issuance later that same quarter.

Permitting Process

HudBay has stated that it has conducted extensive due diligence on the Rosemont Project, including with respect to permitting, and that it is confident that the Rosemont Project will receive all necessary permits. In commenting on Augusta’s successes in permitting the Rosemont Project, David Garofalo, President and Chief Executive Officer of HudBay, stated on February 10, 2014:

“I just want to say that Augusta has actually done an exemplary job … So there’s really nothing that we would change in terms of Augusta’s approach on the permitting.”

The Board of Directors believes that the timing of the HudBay Offer is motivated by HudBay’s view that the permits will be issued, and when that occurs the value of the Common Shares will increase materially. The HudBay Offer is a validation of Augusta’s permitting efforts and is a tacit acknowledgement by HudBay that this may be its last opportunity to acquire Augusta at a deeply discounted price.

Construction Ready

The Rosemont Project is construction ready. Preliminary engineering is complete and detailed engineering currently ranges from 38% to 80% complete. The remaining detailed engineering is advancing on pace to match the expected permitting time frame. Detailed engineering will be completed to at least the 75% level for each individual construction contract prior to letting of the contract in order to minimize change orders and thus maintain the Rosemont Project’s budget and schedule. Detailed project execution procedures have been developed and documented by Rosemont staff. M3 Engineering, CDM Smith and ScheduleCorp LLC have been engaged to provide, respectively, engineering and procurement, construction management, and project management services. Rosemont forecasts costs for such external services to total US$85 million, of which US$25 million has been expended to date.

Preparations for construction are well underway with US$97 million spent to date on mine and plant equipment, and this equipment has been delivered and is stored in Tucson. Contracts for an additional US$252 million of long lead time equipment have been placed under contracts that generally contain fixed prices subject to limited escalation indices. Many of these purchase orders were executed during 2008 and 2009 at an advantageous time for the Rosemont Project due to the effects of the global financial crisis on equipment manufacturers.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

Financing on Track

Augusta’s financing plan is on track and the Board of Directors is confident that the Rosemont Project will be fully financed by mid-2014.

On February 11, 2010, Augusta announced it signed a definitive agreement with Silver Wheaton under which Augusta agreed to sell to Silver Wheaton silver and gold ounces equal to 100% of the payable silver and gold to be produced by the Rosemont Project. Following satisfaction of certain conditions by Augusta, including completion of permitting and obtaining committed project financing, Silver Wheaton will make advance payments aggregating US$230 million, in 60 day instalments, in respect of approved project costs.

On September 16, 2010, Augusta’s wholly-owned subsidiary, Rosemont Copper, entered into an earn-in agreement with United Copper & Moly, a company formed by Korea Resources and LG International to hold its interest in the Rosemont joint venture. Pursuant to such earn-in agreement, United Copper & Moly can acquire up to a 20% interest in the Rosemont joint venture by funding US$176 million of project expenditures. To date United Copper & Moly has funded US$70 million of pre-construction costs to earn a 7.95% equity interest in the Rosemont Project. The remaining US$106 million of the total investment will be released on a pro-rata basis with Silver Wheaton’s US$230 million to fund construction.

On August 9, 2013, Rosemont Copper, together with its joint venture partners, Korea Resources and LG International, announced the signing of a project financing mandate letter (the “Mandate Letter”) with a syndicate of 12 international financial institutions (the “MLAs”). The Mandate Letter sets out an exclusive arrangement with the MLAs describing the activities needed to arrange a limited recourse loan facility for the construction of the Rosemont Project (US$890 million excluding additional financing costs such as interest during construction, upfront fees and cost overrun facility). The due diligence process that the MLAs have undertaken, which included a review of the Rosemont Project by an independent engineering firm, has been substantially completed. The senior secured debt from the MLAs is expected to provide all of the debt required for the Rosemont Project.

The value of the Rosemont Project, its development strategy, and its potential have been validated by sophisticated industry participants and investors, after completion of extensive due diligence. If the HudBay Offer is successful, Shareholders would be denied the opportunity to benefit fully from the Augusta’s development plans and the anticipated value enhancement associated with the reduction in project risk.

3. The value of the HudBay Offer is significantly below implied multiples of precedent base metal transactions.

The HudBay Offer represents a price to net asset value (P/NAV) multiple (based on research analyst consensus net asset value) of 0.5x. This represents a significant discount as compared to average precedent P/NAV multiples of 0.8x for comparable base metal transactions. In 2010, HudBay paid a P/NAV multiple of approximately 0.9x when it acquired Norsemont, the owner of the Constancia project, and there are a number of precedents for earlier stage projects in higher risk jurisdictions in which higher multiples have been paid.

REJECT THE HUDBAY OFFER AND DO NOT TENDER YOUR COMMON SHARES

If you have already tendered your Common Shares to the HudBay Offer, you can withdraw your Common Shares by contacting your broker or Laurel Hill, North America Toll-Free at 1-877-452-7184, or Bank and Brokers and collect calls outside North America at 416-304-0211 or via email at assistance@laurelhill.com.

Precedent Transactions Support Significantly Higher Values

Source: Public filings, S&P Capital IQ, Street research

Note:

(1) The Constancia project was wholly-owned by Norsemont.

4. A combination of HudBay and Augusta would be dilutive to Augusta’s Shareholders.