☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under § 240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Dear Fellow Stockholders,

On behalf of our Board of Directors, we are pleased to invite you to attend the EPAM Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 2, 2023, beginning at 10:00 am EDT. Details for attending the Annual Meeting via live audio webcast are in the Notice of 2023 Annual Meeting of Stockholders following this letter.

After I concluded my 2022 stockholder letter acknowledging the events in Ukraine, we soon realized our response to this unimaginable event would become our most important priority in 2022. Without question, the war and our response mark the year as one of the most disruptive in our 30-year history. With a focus on ensuring the safety and well-being of our people and continuity of service for our customers, our teams across the world quickly mobilized to:

| • | Do everything possible to ensure the safety of our people in Ukraine, providing mobility and financial support as our people adapted and persevered through a dynamic and stressful environment. |

| • | Accelerate our geographic diversification strategy with the repurposing and scaling of our global mobility efforts to support the relocation of more than 10,000 employees and their immediate families. |

| • | Adapt our business continuity strategy to include an exit of our business from Russia. |

| • | Maintain an elevated customer focus throughout the year to ensure that even with an environment that was anything but normal, our clients continued to receive the consistently high-quality delivery and level of service expected from EPAM. |

Despite all the disruption caused by events in the impacted region, we delivered a set of strong results in 2022, which included:

| • | Revenue growth of 28% reported (32% growth on a constant currency basis), |

| • | GAAP diluted earnings per share (EPS) of $7.09, and non-GAAP diluted EPS of $10.90, and |

| • | We finished the year with a strong balance sheet and approximately $1.7 billion in cash and cash equivalents. |

Further, we continued to:

| • | Leverage our engineering DNA, as well as our innovation, digital transformation, and learning and development strengths to create a meaningful impact for our customers, our employees, and the communities in which we operate, and |

| • | Advance our progress along our sustainability journey, expanding our ESG program—whose core pillars include operating ethically, protecting the environment, and supporting our global and local communities. |

Looking forward, we are committed to accelerating our mission of becoming a true value orchestrator for our customers, and we are working every day to stay focused on our customers’ needs and demands, even while we continue evolving our geographic expansion, our capabilities, and our commercial offerings as a larger, more diversified, and more capable EPAM.

Thank you for your ongoing support of EPAM. We look forward to seeing you at this year’s Annual Meeting.

Arkadiy Dobkin

President, Chief Executive Officer and Chairman of the Board

April 21, 2023

| * | Non-GAAP EPS and revenue growth on a constant currency basis are non-GAAP financial measures. Refer to “Appendix A: Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures” for additional information. |

Notice of 2023 Annual Meeting of Stockholders

| Time and Date |

10:00 a.m. EDT - June 2, 2023 | |||||

| Place |

Live audio webcast of the Annual Meeting will be available at https://www.proxydocs.com/EPAM | |||||

|

Access |

In order to attend the live audio webcast of the Annual Meeting, you must register in advance at www.proxydocs.com/EPAM. Upon completing your registration, you will receive further instructions via email, including unique links that will allow you access to the Annual Meeting and to vote and submit questions during the meeting | |||||

|

Record Date |

The record date for the determination of the stockholders entitled to vote at the Annual Meeting (“Record Date”), or any adjournments or postponements thereof, was the close of business on April 10, 2023. | |||||

|

Additional Information |

Additional information regarding the matters to be acted on at the Annual Meeting is included in the accompanying proxy statement. | |||||

|

Proxy Voting |

PLEASE SUBMIT YOUR PROXY THROUGH THE INTERNET OR MARK, SIGN, DATE AND RETURN YOUR PROXY CARD. | |||||

| Board Recommended Vote | ||||||

|

Items of Business |

1. To elect three Class II directors to hold office for a three-year term or until their successors are elected and qualified. |

FOR | ||||

|

2. To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2023. |

FOR | |||||

|

3. To approve, on an advisory and non-binding basis, the compensation for our named executive officers as disclosed in this Proxy Statement. |

FOR | |||||

|

4. To transact such other business as may properly come before the Annual Meeting. |

N/A | |||||

|

By Order of the Board of Directors of EPAM Systems, Inc.:

Edward Rockwell Senior Vice President, General Counsel and Corporate Secretary

April 21, 2023 |

||||||

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 2, 2023. The Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2022 are available at https://www.proxydocs.com/EPAM. | ||||||

Table of Contents

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| Stockholder Recommendations and Nominations of Director Candidates |

3 | |||

| 3 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

19 | |||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 27 | ||||

| 30 | ||||

| 31 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| Stock Ownership Guidelines, Prohibition on Hedging or Pledging EPAM Stock, and Clawback Policy |

34 | |||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 44 | ||||

| 45 | ||||

| Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

46 | |||

| Proposal 3: Annual Advisory Vote to Approve Executive Compensation |

47 | |||

| 48 | ||||

| Questions and Answers About the 2023 Annual Meeting and Voting Your Shares |

49 | |||

| 54 | ||||

| 55 | ||||

| Appendix A: Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures |

A-1 |

General Information

The Board of Directors (the “Board”) of EPAM Systems, Inc., a Delaware corporation (“we” or “EPAM”), is soliciting proxies to be used at the annual meeting of stockholders of EPAM to be held on Thursday, June 2, 2023, at 10:00 a.m. EDT through a live audio webcast available via https://www.proxydocs.com/EPAM and any postponement, adjournment or continuation thereof (the “Annual Meeting”).

This Proxy Statement and the accompanying notice and form of proxy are first being distributed to stockholders on or about April 21, 2023. The Board is requesting that you permit your common stock to be represented at the Annual Meeting by the persons named as proxies for the Annual Meeting.

The proxy solicitation materials, including the Notice of 2023 Annual Meeting of Stockholders, this Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2022, which includes our audited consolidated financial statements for the year ended December 31, 2022 (the “2022 Annual Report”) and the proxy card or voting instruction card (collectively, the “Proxy Materials”), are being furnished to the holders of our common stock, par value $.001 per share (the “Common Stock”), in connection with the solicitation of proxies by the Board for use in voting at the Annual Meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

Throughout this Proxy Statement you will find links to our website. The information on our website is not incorporated by reference into this Proxy Statement or into our 2022 Annual Report. The Proxy Materials are available at https://www.proxydocs.com/EPAM on or about April 21, 2023 to all stockholders entitled to vote at the Annual Meeting.

Notice of Internet Availability of Proxy Materials

As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are making the Proxy Materials available to our stockholders primarily electronically via the Internet rather than mailing printed copies of these materials to each stockholder. We believe that this process expedites stockholders’ receipt of the Proxy Materials, lowers the costs incurred by EPAM for the Annual Meeting and helps to conserve natural resources.

On or about April 21, 2023, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) in the form of a mailing titled “Important Notice Regarding the Availability of Proxy Materials.” The Notice contains instructions on how to access the Proxy Materials, and how to vote on the Internet.

If you received the Notice by mail, you will not receive a printed copy of the Proxy Materials unless you request a printed copy, currently or on an ongoing basis. If you received a Notice by mail and would like to receive a paper or email copy of the Proxy Materials, follow the instructions on the Notice. Stockholders who requested paper copies of the Proxy Materials or previously elected electronic receipt did not receive a Notice and will receive the Proxy Materials in the format requested.

1

Board of Directors

Our certificate of incorporation and bylaws provide that the Board will consist of no fewer than three and no more than nine persons and that the exact number of members of the Board will be determined from time to time by resolution of a majority of our entire Board. The Board currently consists of nine members.

The Board is divided into three classes, with each director serving a three-year term and one class being elected at each annual meeting of stockholders.

Director Selection Process

The Nominating and Corporate Governance Committee recommends to the Board the directors to stand as nominees for election at the annual meeting of stockholders and makes recommendations to the Board for appointment of a director to fill any vacancy. The Nominating and Corporate Governance Committee evaluates the composition of the Board and its committees at each regular meeting, and considers the individual and aggregate characteristics, professional backgrounds, and areas of expertise with the goal of a well-balanced and effective Board. All of our directors and director candidates must possess integrity and high ethical standards, excellent business judgment, and be willing to commit appropriate time and effort to service on the Board. The Nominating and Corporate Governance Committee reviews feedback from the most recent Board and committee evaluations in assessing the makeup of the Board, its committees, and future needs.

The Nominating and Corporate Governance Committee assesses the appropriate size of the Board from time to time and considers new director candidates for potential expansion of the Board or to fill any vacancies. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, professional search firms engaged by the committee, stockholders, members of management, or others. The committee reviews recommendations, evaluates biographical information and considers background checks and material relating to potential candidates and, as appropriate, interviews selected candidates. A candidate may meet with our management as appropriate. These candidates may be evaluated at meetings of the committee and may be considered at any point during the year.

At this time, neither the Board nor the Nominating and Corporate Governance Committee has established any minimum qualifications or skills for directors, however the Nominating and Corporate Governance Committee will apply the criteria set forth in our Corporate Governance Guidelines.

| Corporate Governance Guidelines – Director Selection

| ||

| The Board considers several criteria when evaluating candidates for director, including a nominee’s:

| ||

| • Judgment • Diversity • Personal integrity • Skills • Actual or potential conflicts of interest • Knowledge of our business and industry • Independence |

• Background and experience • Experience in various geographies • Other board commitments • Risk oversight experience and strategy • Ability to address the needs of the Board and its committees • Financial literacy and expertise • Ability to devote time and attention to the Board and its committees | |

The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criteria is a prerequisite for, or necessarily applicable to, any prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The Board is committed to creating a diversified membership and it is the Board’s policy to include, and to instruct search firms to include, diverse candidates in the pool of potential director candidates to be considered by the Nominating and Corporate Governance Committee.

Upon recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the three director nominees identified below for election as Class II directors at the Annual Meeting. These directors will hold office until the annual

2

meeting of stockholders in 2026, or until their respective successors have been elected and qualified. The director nominees set forth below have consented to being named in this Proxy Statement as nominees for election as director and have agreed to serve as directors if elected. Stockholders are not entitled to cumulate votes in the election of directors and may not vote for a greater number of persons than the number of nominees named.

Stockholder Recommendations and Nominations of Director Candidates

The Nominating and Corporate Governance Committee utilizes a variety of methods to identify and evaluate director nominees, including nominees recommended by stockholders. Our bylaws permit stockholders to nominate directors for consideration at our annual stockholder meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials are forwarded to the Nominating and Corporate Governance Committee. The committee’s policy is to consider properly submitted stockholder nominations. In evaluating all director nominations, the committee seeks to balance an individual’s knowledge, experience, capabilities, and compliance with the membership criteria established by our Corporate Governance Guidelines and the Nominating and Corporate Governance Committee.

Our bylaws also provide for proxy access stockholder nominations of director candidates by eligible shareholders. Appropriately nominated proxy access candidates will be included in the Company’s proxy statement and ballot. A stockholder who wishes to formally nominate a candidate, whether for inclusion in our proxy statement or not, must follow the procedures described in our bylaws, which are summarized in this Proxy Statement under the heading “Stockholder Proposals for the 2024 Annual Meeting.”

Board Composition

Our Board is comprised of active and engaged experts in fields related to EPAM’s business, from a variety of professional backgrounds. Moreover, our Board believes that a diverse representation of characteristics broadens our Board’s views on issues that matter to our people, customers, and other stakeholders.

The table below summarizes the key qualifications, skills, and attributes in up to five areas of focused expertise that each director possesses. Many of our directors have more than five of these qualifications, however. Our Board and our Nominating and Corporate Governance Committee believe that the overall mix of professional qualifications and experience of our directors creates an environment for effective oversight of the business and its management.

In addition to these varied qualifications and expertise areas, our Board believes every member should possess high integrity and a commitment to EPAM’s values, an understanding of our business, and creation of stockholder value.

|

Key Qualifications

|

Dobkin

|

Vargo

|

Aguirre

|

Mayoras

|

Robb

|

Roman

|

Segert

|

Shan

|

Smart

| |||||||||||

|

|

Financial | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

|

|

Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

|

|

Global Business | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

|

|

Human Capital | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

|

|

Technology & Innovation |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

|

|

Mergers & Acquisitions | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

|

|

Sales & Marketing | ✓ | ✓ | ✓ | ||||||||||||||||

|

|

Public Company Board | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

3

| Key Qualification Definitions | ||||

|

|

Financial | Experience with complex financial management, financial reporting,

| ||

|

|

Leadership | Demonstrated executive leadership, including delivering operating results

| ||

|

|

Global Business | Experience in business enterprises in global markets, including understanding geopolitical, cultural, operational, regulatory, and other relevant aspects

| ||

|

|

Human Capital | Experience ensuring the organization has the talent (human capital) that it needs to deliver on its stated mission and outcomes by defining the talent needs, creating an inclusive and values-driven culture, and creating a value proposition to attract, develop and retain talent in competitive markets

| ||

|

|

Technology & Innovation |

Experience in relevant technology; understanding of technology trends;

| ||

|

|

Mergers & Acquisitions | Experience leading inorganic growth through acquisitions, including understanding of valuation, synergy planning, and operational integration execution

| ||

|

|

Sales & Marketing | Experience growing sales, branding, and developing market awareness

| ||

|

|

Public Company Board

|

Service as a member of a public company board of directors (other than EPAM)

| ||

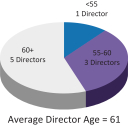

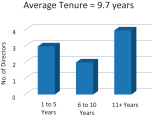

Our Board includes directors that have served a range of tenures to allow for institutional knowledge and continuity, balanced with diversity as well as refreshed perspectives. The graphic below summarizes the age, tenure, gender, and committee leadership characteristics of the Board.

|

|

|

|

Biographical information concerning the nominees and the current directors of the Board whose terms will continue after the Annual Meeting appears below. Ages are as of April 21, 2023.

| Name | Age | Position | Director Since |

Class | Board Committees | Term Ends | ||||||||||

| AC* | NGC* | CC* | ||||||||||||||

| Arkadiy Dobkin |

62 | Chairman, President and CEO | 2002 | III | 2024 | |||||||||||

| Ronald Vargo |

69 | Independent Director | 2012 | II | Member | Member | 2023 | |||||||||

| DeAnne Aguirre |

62 | Independent Director | 2023 | III | Member | 2024 | ||||||||||

| Richard Michael Mayoras |

60 | Independent Director | 2013 | I | Member | Member | 2025 | |||||||||

| Karl Robb |

60 | Independent Director | 2004 | I | 2025 | |||||||||||

| Eugene Roman |

65 | Independent Director | 2020 | II | Member | 2023 | ||||||||||

| Robert Segert |

54 | Independent Director | 2012 | III | Chair | 2024 | ||||||||||

| Helen Shan |

55 | Independent Director | 2018 | I | Chair | Member | 2025 | |||||||||

| Jill Smart |

63 | Independent Director | 2016 | II | Chair | 2023 | ||||||||||

*AC = Audit Committee; NGC = Nominating and Corporate Governance Committee; CC = Compensation Committee

4

Director Nominees (Class II Directors with Terms Expiring at the Annual Meeting in 2023 and in 2026 if elected)

The Board nominees possess specific experience, qualifications, attributes or skills that led the Nominating and Governance Committee to the conclusion that such persons should serve as directors of EPAM, in light of our business and structure.

| Eugene Roman

| ||||

|

Career Highlights

• Principal – Design AI Ltd. (2019 – Present)

• Chief Information Officer – Metrolinx (2020-2021)

• Executive Vice President – Canadian Tire Corporation (2012 – 2018)

• Nortel Networks Corporation, Bell Canada Enterprises Inc., and Open Text Corporation

○ Progressively senior business and technology roles

Board Roles and Committees

• Member – Audit Committee

|

Select Professional and Community Contributions

• Lakeland Holding Ltd. – Director

• Community Trust Co. – Director

• York University – Board of Governors

○ Finance and Audit Committee

○ Governance and Human Resources Committee

Other Public Company Boards

• Current

○ None

• Past Five Years

○ The Stars Group

| ||

| Age: 65 Birthplace: Canada Independent Director | ||||

|

| ||||

|

Our Board believes that Mr. Roman’s more than 35 years of experience as an information technology and telecommunications executive in the retail and business services industries and his financial background provide him with the necessary skills to serve as a member of our Board and enable him to provide valuable insight to the Board regarding technology, financial, and strategic issues.

| ||||

|

Jill Smart

| ||||

|

|

Career Highlights

• Founder and CEO – JBSmart Consulting, LLC (2021 – Present)

• President Emeritus – National Academy of Human Resources (2023 – Present)

○ President (2015 – 2022)

• Chief Human Resources Officer – Accenture (2004-2014)

○ Various positions of increasing authority (1981 – 2004)

Board Roles and Committees

• Chair – Compensation Committee |

Select Professional and Community Contributions

• AlixPartners – Director

• Cerity Partners – Advisory Board Member

• University of Illinois Chicago Athletic Advisory Board - Member

Other Public Company Boards

• World Fuel Services Corporation

• HireRight Holdings Corporation | ||

|

Age: 63 Birthplace: USA Independent Director | ||||

|

| ||||

|

Our Board believes Ms. Smart’s industry experience, more than 20 years of consulting experience, and human resources leadership expertise enable Ms. Smart to provide valuable insight to the Board regarding human capital, executive compensation, and strategy.

| ||||

5

| Ronald Vargo

| ||||

|

Career Highlights

• Executive Vice President and CFO – ICF International, Inc. (2010 – 2011)

• Executive Vice President and CFO – Electronic Data Systems Corporation (2006 – 2008)

○ Vice President and Treasurer (2004 – 2006)

• Vice President – TRW, Inc. (1991 – 2003)

○ Investor Relations and Treasurer (1991 – 1994, 1999 – 2002)

○ Strategic Planning and Business Development (1999 – 2002)

|

Board Roles and Committees

• Lead Independent Director

• Member – Audit Committee

• Member – Nominating and Corporate Governance Committee

Other Public Company Boards

• Current

○ Enersys

• Past Five Years

○ Ferro Corporation | ||

|

Age: 69 Birthplace: USA Independent Director | ||||

|

| ||||

|

Our Board believes Mr. Vargo’s 30-plus years of experience as a financial and business executive, and his experience serving as a member of the board of directors of other public companies, provide him with the necessary skills to serve as a member of our Board and enable him to provide valuable insight to the Board regarding strategic, financial, compliance and investor relations issues.

| ||||

Continuing Directors

Class III with Terms Expiring at the Annual Meeting in 2024

| Arkadiy Dobkin

| ||||

|

Career Highlights

• Co-Founder (1993 – Present)

• Chairman and CEO (2002 – Present)

Board Roles and Committees

• Chairman |

Select Professional and Community Contributions

• GLOBSEC Tatra Summit Business Leadership Award - 2021

• Ernst & Young World Entrepreneur of the Year Academy (Inducted 2015)

Other Public Company Boards

• None | ||

|

Age: 62 Birthplace: Belarus | ||||

|

| ||||

|

Our Board believes Mr. Dobkin’s experience as an IT professional and executive in the IT services industry coupled with his in-depth understanding of our global delivery model provide him with the necessary skills to serve as a member of our Board and will enable him to provide valuable insight to the Board and our management team regarding operational, strategic and management issues as well as general industry trends.

| ||||

6

| Robert Segert

| ||||

|

Career Highlights

• Chairman and CEO – athenahealth, Inc. (2019 – Present)

• Chairman and CEO – Virence Health Technologies (2018 – 2019)

• Executive Chairman – Aspect Software (2016-2018)

• President and CEO – Expert Global Solutions, Inc. (2014 – 2016)

• President and CEO – GXS Worldwide, Inc. (2008 – 2014)

|

Board Roles and Committees

• Chair – Nominating and Corporate Governance Committee

Other Public Company Boards

• None | ||

| Age: 54 Birthplace: USA Independent Director | ||||

|

| ||||

|

Our Board believes Mr. Segert’s 20-plus years of experience as an executive in the business services and consulting industry provide him with the necessary skills to serve as a member of our Board and enable him to provide valuable insight to the Board regarding financial and investor relations issues.

| ||||

| DeAnne Aguirre

| ||||

|

Career Highlights

• Managing Partner – PricewaterhouseCoopers (2015 – 2020)

○ North America Strategy Business

○ Health Strategy Business

○ Global Leader – Katzenbach Center

• Global and Regional Leadership Positions – Booz Allen & Hamilton, Inc./Booz & Co. (1996 – 2015)

○ Global Co-Leader – Organization & Strategic Leadership Business

○ Technology Leader – Southern Cone

○ Global Chief Human Resources Officer

|

Board Roles and Committees

• Member – Nominating and Corporate Governance Committee

Select Professional and Community Contributions

• Cisive – Director

Other Public Company Boards

• Hercules Capital, Inc. | ||

| Age: 62 Birthplace: United States Independent Director | ||||

|

| ||||

|

Our board believes Ms. Aguirre is qualified to serve as a director based more than 30 years of experience in leadership roles in the global strategy and technology consulting industry along with her experience as a member of both public and private company boards and their committees.

| ||||

7

Class I with Terms Expiring at the Annual Meeting in 2025

| Richard Michael Mayoras

| ||||

|

Career Highlights

• Executive Chairman – OnSolve, LLC (2018 – Present)

• President and CEO – RedPrairie Corporation (2007 – 2013)

○ Various executive roles (2004 – 2007)

• President – DigiTerra, Inc. (2001 – 2004)

Board Roles and Committees • Member – Compensation Committee

• Member – Nominating and Corporate Governance Committee

|

Select Professional and Community Contributions

• Softeon Inc. – Director

• Truecommerce, Inc. – Director

Other Public Company Boards

• None | ||

|

Age: 64 Birthplace: USA Independent Director | ||||

|

| ||||

|

Our Board believes that Mr. Mayoras is qualified to serve as a director based on his prior executive leadership roles in the IT services industry and his experience and prior service as a member of the boards of directors of technology companies, which enable him to provide valuable insight to the Board regarding financial and business strategy issues.

| ||||

|

Karl Robb

| ||||

|

Career Highlights

• Executive Vice President and President of EU Operations – EPAM Systems, Inc. (2004 – 2015)

• Co-Founder – Fathom Technology Kft. (2001 – 2004)

Board Roles and Committees

• None |

Select Professional and Community Contributions

• Ajax Systems – Director

• Visiquate, Inc. – Director

Other Public Company Boards

• Noventiq Holdings plc | ||

|

Age: 60 Birthplace: United Kingdom Independent Director | ||||

|

| ||||

|

Our Board believes that Mr. Robb’s extensive experience in and knowledge of the IT services industry in North America and Europe, as well as his experience starting two software companies and his extensive service and responsibilities at EPAM prior to his retirement, provide him with the necessary skills to serve as a member of our Board.

Our Board also believes this background enables Mr. Robb to provide valuable insight to the Board regarding strategy, business development, sales, operational and management issues, and general industry trends.

| ||||

8

| Helen Shan

| ||||

|

Career Highlights

• Executive Vice President and Chief Revenue Officer – FactSet (2021 – Present)

• Executive Vice President and Chief Financial Officer – FactSet (2018 – 2021)

• Chief Financial Officer – Mercer (2014 – 2018)

• Vice President and Treasurer – Marsh & McLennan Companies – (2013 – 2014)

Board Roles and Committees

• Chair – Audit Committee

• Member – Compensation Committee

|

Select Professional and Community Contributions

• S.C. Johnson College of Business, Cornell University – Member of Johnson Advisory Council

Other Public Company Boards

• None | ||

|

Age: 55 Birthplace: USA Independent Director | ||||

|

| ||||

|

Our Board believes Ms. Shan’s financial management expertise, as well as her previous experience in global strategy development and execution, provide her with the necessary skills to serve as a member of our Board and enable her to contribute valuable insight regarding financial and strategic business issues.

| ||||

9

Corporate Governance

Our corporate governance practices cultivate and support our long-term organizational achievements. Our Board brings a mix of backgrounds, experience, and other factors that are essential to strong oversight. The Board is responsible for directing and overseeing our business and affairs. In carrying out its responsibilities, the Board selects and monitors our top management, provides oversight of our financial reporting processes and determines and implements our corporate governance policies. The Board and management are committed to good corporate governance to ensure that we are managed for the long-term benefit of our stockholders, and we have a variety of policies and procedures to promote such goals.

| Corporate Governance Highlights |

| • | Eight of the Board’s nine directors are independent |

| • | The Board annually elects a Lead Independent Director |

| • | Each of the Board’s Audit, Compensation, and Nominating and Corporate Governance Committees consist of only independent directors |

| • | The independent directors regularly schedule executive sessions |

| • | The Nominating and Corporate Governance Committee conducts annual Board and committee evaluations |

| • | The “Say-On-Pay” advisory vote is conducted annually |

| • | Our bylaws provide for majority voting with a resignation policy for directors in uncontested elections and provide proxy access rights for stockholders |

| • | We do not have a shareholder rights, or “poison pill,” plan |

| • | Our stock ownership guidelines are applicable to both executives and directors |

Board Leadership Structure

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure to provide independent oversight of management. The Board understands that the optimal Board leadership structure may vary as circumstances warrant. Consistent with this understanding, our independent directors consider the Board’s leadership structure on an annual basis.

The Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of Chairman of the Board (the “Chairman”) and Chief Executive Officer in a way that is in EPAM’s best interests at a given point in time. The Board has determined that it is in the best interests of EPAM and our stockholders for both the positions of Chairman and Chief Executive Officer to be held by our co-founder, Arkadiy Dobkin, at this time. If circumstances change in the future, the Board may determine that these positions should be separated. This policy allows the Board to evaluate regularly whether EPAM is best served at any particular time by having the Chief Executive Officer or another director hold the position of Chairman. Our Board considers this issue carefully in light of the structure the Board believes will be in the best interests of EPAM and our stockholders.

The Board believes that Mr. Dobkin is best suited to serve as Chairman because, as our co-founder, he is the director most familiar with our business and industry and can lead the Board in identifying and prioritizing our strategies and initiatives. The combined role fosters greater communication between the Board and management and facilitates development and implementation of our Board-approved corporate strategy and oversight of risk management practices.

In April 2015, our Board established the position of Lead Independent Director, and appointed Ronald Vargo to serve in this role. The Lead Independent Director Charter establishes a defined set of responsibilities, including Board leadership, presiding over executive sessions of independent directors, liaising with the Chairman, and facilitating distribution of information to the Board and its committees. Annually, the Nominating and Corporate Governance Committee recommends to the Board a candidate to fill this position, selected from among the independent members of the Board. The Board considers this recommendation and elects the Lead Independent Director. Mr. Vargo has been re-elected to this position each year since his initial appointment.

10

We believe this current leadership structure is effective. Our independent directors and management have different perspectives and roles in business and strategy development. Our independent directors bring experience, oversight and expertise from outside EPAM and both from within and outside our industry.

Director Independence

Director independence is a key component of our governance standards, enabling the Board to be objective in fulfilling its responsibilities. The Board elects a Lead Independent Director each year.

Except for our Chairman and CEO, Arkadiy Dobkin, all directors are independent. In making its determinations about the independence of each Board member, the Board considered, among other things, all transactions and relationships between each director or any member of his or her immediate family and EPAM and its subsidiaries and affiliates. See “Certain Relationships and Related Transactions and Director Independence.” There are no family relationships among any of our executive officers, directors, or nominees for director.

Only independent directors serve on EPAM’s committees. The compensation consultant retained by the Compensation Committee is independent of the Company and management. At each regular meeting of the Board and each Committee, time is allocated for executive session, in which the Board or the committee meets without management present.

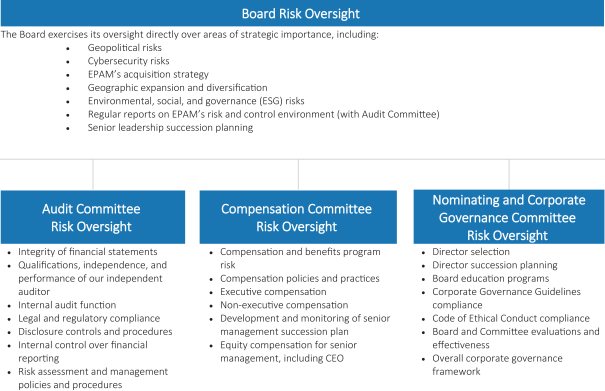

Risk Oversight and Succession Planning

The Board is responsible for oversight of EPAM’s risk management practices while management is responsible for the day-to-day risk management processes. The Board has direct oversight of EPAM’s strategic risks and other risk areas not specifically delegated to one of the Board’s committees. The Board receives and provides regular feedback on periodic reports from management regarding the most significant risks we face and receives reports from its committees on specific risk areas at each quarterly meeting. The Board exercises its oversight directly over areas of strategic importance. The specific areas of risk oversight for which the Board and each committee are responsible are summarized below:

11

Under this oversight framework, our management team has built and continuously improves our culture of risk awareness so EPAM operates at an appropriate level of risk when executing our business objectives. We have a robust enterprise risk management program, which involves a cross-functional team to identify and prioritize the mitigation of risks facing the Company. This process is also supported by the regular work of our internal audit, compliance, and legal functions at EPAM.

The additional responsibilities of the Board’s Committees, the members of each committee and the number of meetings held in 2022, and additional information about the written charter of each committee can be found later in this Proxy Statement under the heading “Committees of the Board.”

As reflected in our Corporate Governance Guidelines, the Board (with Compensation Committee input) is responsible for planning for CEO succession, as well as monitoring and advising on management’s succession planning for other senior executives. The Board’s goal is to have a long-term and continuing program for effective senior leadership development and succession. Succession planning is a regular item on the Board and Compensation Committee agendas throughout the year.

Board Meetings

The Board held 16 meetings in 2022. Each of our directors attended at least 75% of the total number of all meetings of the Board and committees on which the director served that were held during 2022.

Directors are expected to attend the meetings of the Board and of any committees on which the director serves and are encouraged, but not required, to attend our annual meetings of stockholders. All of our directors attended our annual meeting of stockholders in 2022.

Communications to the Board

Stockholders and other interested parties may communicate directly with our Lead Independent Director or our independent directors as a group by sending a written communication in an envelope addressed to: Board of Directors, Attention: Lead Independent Director, c/o General Counsel and Corporate Secretary at 41 University Drive, Suite 202, Newtown, Pennsylvania 18940.

Stockholders and other interested parties may communicate directly with the full Board by sending a written communication in an envelope addressed to: Board of Directors, c/o General Counsel and Corporate Secretary at 41 University Drive, Suite 202, Newtown, Pennsylvania 18940.

Our Audit Committee has established an anonymous, confidential process for communicating complaints regarding accounting or auditing matters or other matters that may violate EPAM’s Code of Ethical Conduct. In order to submit a complaint, you may call our hotline at the dedicated local phone number found at ethics.epam.com (+1 866 786-9137 in the U.S.) or submit a written report at the EthicsLine webpage at ethics.epam.com. Any such complaints received or submitted are reviewed with the Audit Committee in accordance with a standard escalation protocol to take such action as may be appropriate.

Code of Ethical Conduct and Corporate Governance Guidelines

EPAM has a Code of Ethical Conduct that applies to all of our directors, officers and other employees, including our principal executive officer, principal financial officer and principal accounting officer. Our Chief Compliance Officer has the responsibility of maintaining an effective ethics and compliance program and to provide updates to our ethics and compliance programs to the Nominating and Corporate Governance Committee and the Board. The foundational principles in our Code of Ethical Conduct and our core values mean that we strive for excellence and do the right things in the right way by:

| • | Respecting, valuing and supporting people |

| • | Showing integrity in our communications, records and business activities |

| • | Protecting and enhancing EPAM’s information and assets |

| • | Complying with laws |

12

The Code of Ethical Conduct is approved and reviewed annually by the Board. Any amendments (other than technical, administrative or non-substantive amendments) to, and any waivers from a provision of the Code of Ethical Conduct for directors and officers must be approved by the Board and will be promptly disclosed to our stockholders. The Board has also adopted Corporate Governance Guidelines in accordance with NYSE corporate governance rules that serve as a flexible framework within which our Board and its committees operate. These guidelines cover a number of areas including: the size and composition of the Board; Board membership criteria and director qualifications; Board diversity; director responsibilities; Board agendas; roles of the Chairman, Chief Executive Officer and Lead Independent Director; meetings of independent directors; committee responsibilities and assignments; Board member access to management and independent advisors; director communications with third parties; director compensation; director orientation and continuing education; evaluation of senior management; and management succession planning.

Our Code of Ethical Conduct and our Corporate Governance Guidelines are publicly available through the “Investor Relations – Leadership & Governance” section of our website at http://investors.epam.com/investors/leadership-and-governance/documents. A copy will be provided in print without charge upon written request to our Corporate Secretary at 41 University Drive, Suite 202, Newtown, Pennsylvania 18940.

Environmental, Social, and Governance Commitment

The Board oversees EPAM’s ongoing commitment to integrate positive and ethical environmental, social, and governance, or ESG, practices into our overall ESG strategy. The Board is regularly involved in assessing the progress and activity of individual components that make up our ESG program, including corporate social responsibility, human capital, ethics and governance, environmental footprint, data privacy and information security, and supplier sustainability. Our approach to material ESG topics is key to our continual development as a business and drives value for our employees, clients, business partners, stockholders and the community.

One important way EPAM lives out the key principles of our Code of Ethical Conduct and our core values is our commitment to making positive contributions in the communities in which we operate. Through our focused efforts in the areas of education, environment and community, we are committed to sharing the expertise and attributes of our highly skilled global workforce to effectively support the needs of the world at large and the communities in which we work and live. We sponsor and support global technology education initiatives, invest in local green initiatives that result in energy-saving and carbon-footprint reduction practices, and are strongly committed to respecting our employees’ fundamental human rights at work and ask our vendors and suppliers to do the same. More information about EPAM’s Corporate Social Responsibility, or CSR program can be found at https://www.epam.com/about/who-we-are/corporate-responsibility.

Highlights of our positive social, environmental and ethical practices include our efforts in our traditional areas of focus and additional contributions to mitigating the economic and public health impacts in the communities where we work and live and at a global level:

| • | Our social impact community includes almost 14,500 participants volunteering more than 28,000 hours in more 300 events in 50 countries. |

| • | EPAM collaborated with five different organizations across our geographic footprint to empower girls and women with the skills and confidence needed to pursue their ambitions in Science, Technology, Engineering, and Mathematics, or STEM, related opportunities. |

| • | EPAM sponsored BIMA Digital Day for the fourth consecutive year. BIMA, the United Kingdom’s digital and technology trade body, brought digital and technology companies together with students to give 11-16 year olds a view into the world of careers. |

| • | EPAM continued to support Raspberry Pi’s Coolest Projects, the world-leading technology fair where young people are empowered to show the world their technology inventions. |

| • | EPAM enhanced its own EPAM E-KIDS program by developing courses and content and delivering it through EPAM’s Learn platform to provide virtual STEM learning content to students in 25 countries. |

| • | EPAM supported its employees, their families, and their communities in Ukraine by securing internet access, providing games, activities, and comfort to displaced families and children, providing shelter and critical supplies, collecting medical and hospital supplies, and providing an employee-run support hotline for EPAM employees impacted by the war in Ukraine. |

13

| • | EPAM subsidiaries, including those located in Poland, Singapore, Ukraine, Hungary, Mexico, United States, India, Vietnam, Germany, Switzerland, and Hong Kong, each won recognition, some for the second time, for our employee experience and culture. |

| • | EPAM was named a 2022 Barron’s 100 Most Sustainable Company and was No. 94 on Investor’s Business Daily’s fourth annual Best ESG Companies List. |

| • | EPAM maintains a Supplier Code of Conduct, holding suppliers accountable for complying with certain labor practices, safety and health standards, ethical business practices and social responsibility commitments. |

Committees of the Board

The Board uses committees to work on certain issues in detail. Each committee reports the progress and results of its meetings to the Board and makes recommendations to the Board when appropriate. The Board currently has three standing committees – an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of our committees operates under a written charter that has been approved by our Board. The charters are reviewed annually by each respective committee, which recommends any proposed changes to our Board. The charters are available on the “Investor Relations – Leadership & Governance” section of our website at http://investors.epam.com/investors/leadership-and-governance/documents and will be provided in print without charge upon written request to our Corporate Secretary at 41 University Drive, Suite 202, Newtown, Pennsylvania 18940. The primary responsibilities of each of our committees, as well as the current composition of our committees and the number of committee meetings held during 2022, are described below:

|

Audit Committee |

||

| The primary responsibilities of our Audit Committee include:

• appoint, compensate, retain and oversee our independent auditors;

• pre-approve the independent auditors’ audit and non-audit services rendered, and recognize and prevent prohibited non-audit services;

• review the proposed scope and results of the audit;

• review, in conjunction with the Chief Executive Officer and Chief Financial Officer of our Company, disclosure controls and procedures and internal control over financial reporting with the independent auditors and our financial and accounting staff;

• establish procedures for complaints received by us regarding accounting, internal control over financial reporting, or auditing matters; |

Committee Members: Helen Shan (Chair) Eugene Roman Ronald Vargo

Number of Meetings in 2022: 8 | |

|

• oversee internal audit functions; and

• prepare the report of the Audit Committee that SEC rules require to be included in our annual proxy statement.

The Audit Committee currently consists exclusively of directors who are financially literate, and each of the members of the Audit Committee is considered an “audit committee financial expert” as defined under Item 407(d)(5) of Regulation S-K. The Board has determined that each of the current members of the Audit Committee is an “independent director” within the meaning of the applicable NYSE rules and as defined by Rule 10A-3 of the Exchange Act. | ||

14

|

Compensation Committee |

||

| The primary responsibilities of our Compensation Committee include:

• review and approve cash compensation arrangements, and recommend to the Board equity-based compensation arrangements, for executive officers, including for our Chief Executive Officer;

• identify corporate goals and objectives relevant to executive compensation;

• review, evaluate and recommend to the Board for approval, if applicable, any equity-based incentive plan;

• retain or obtain the advice of a compensation consultant, legal counsel or other adviser in its sole authority and be responsible for the appointment, compensation, termination and oversight of the work of any such adviser that is retained; |

Committee Members: Jill B. Smart (Chair) Richard Michael Mayoras Helen Shan

Number of Meetings in 2022: 7 | |

|

• delegate its authority to subcommittees or the chair of the Compensation Committee when it deems it appropriate and in our best interests and to delegate to one or more of our officers the authority to make grants and awards of stock rights or options to any of our non-Section 16 officers under our equity-based incentive plan as the Compensation Committee deems appropriate and in accordance with the terms of the plans;

• review, evaluate, and recommend to the Board for approval any changes in Board compensation

• consider the results of the most recent stockholder advisory vote on executive compensation; and

• prepare the report of the Compensation Committee to the extent required by SEC rules to be included in our annual proxy statement.

The Board has determined that each of the members of the Compensation Committee is an “independent director” within the meaning of the rules set forth in Rule 10C-1 and Section 303A.02(a)(ii) of the NYSE Listed Company Manual. The processes and procedures followed by our Compensation Committee in considering and determining executive compensation, including the use of consultants and other outside advisors, are described in “Compensation Discussion and Analysis.” | ||

|

Nominating and Corporate Governance Committee |

||

| The primary responsibilities of our Nominating and Corporate Governance Committee include:

• identify and nominate members for election to the Board;

• recommend to the Board a candidate for the position of Lead Independent Director of the Board from among the independent members of the Board;

• develop and recommend to the Board a set of corporate governance principles and code of conduct applicable to EPAM and to oversee compliance thereof; and

• oversee the evaluation of the Board and management. |

Committee Members: Robert Segert (Chair) Richard Michael Mayoras Ronald Vargo DeAnne Aguirre (appointed in 2023)

Number of Meetings in 2022: 5

| |

| The Board has determined that each of the members of the Nominating and Corporate Governance Committee is an “independent director” within the meaning of the applicable NYSE rules. | ||

15

Our Executive Officers

Executive officers are appointed by the Board. The following table sets forth the names, ages and positions of our executive officers as of April 21, 2023:

| Name |

Age | Position | ||

| Arkadiy Dobkin |

62 | Chairman of the Board of Directors, President and Chief Executive Officer | ||

| Balazs Fejes |

48 | President of EU and APAC markets | ||

| Viktar Dvorkin |

50 | Senior Vice President, Head of Global Delivery | ||

| Jason Peterson |

60 | Senior Vice President, Chief Financial Officer and Treasurer | ||

| Edward Rockwell |

55 | Senior Vice President, General Counsel and Corporate Secretary | ||

| Elaina Shekhter |

53 | Senior Vice President, Chief Marketing and Strategy Officer | ||

| Boris Shnayder |

66 | Senior Vice President, Co-Head of Global Business | ||

| Larry Solomon |

58 | Senior Vice President, Chief People Officer | ||

| Sergey Yezhkov |

49 | Senior Vice President, Co-Head of Global Business | ||

| Gary Abrahams |

55 | Vice President, Corporate Controller, Chief Accounting Officer | ||

Information about Mr. Dobkin is provided under “Board of Directors” in this Proxy Statement. A brief biography for each of our other executive officers follows.

| Balazs Fejes |

||

| Balazs Fejes is our President of Europe and APAC Markets, where he heads market activities across the regions and co-leads global business operations. Mr. Fejes also oversees the strategy of our Banking and Financial Services Industry business unit, helping to drive evolution of key service lines across the unit’s global portfolio. From 2015 through March 2021, Mr. Fejes was our Executive Vice President, Co-Head of Global Business, and before that, he held the position of Senior Vice President, Global Head of Banking and Financial Services business unit from 2012 to 2015. From 2004 to August 2012, Mr. Fejes served as EPAM’s Chief Technology Officer (“CTO”) and was responsible for ensuring that all global offshore and nearshore software development centers of EPAM were at the leading edge of industry standards for efficiency and quality. Mr. Fejes joined EPAM in 2004 as part of the acquisition of Fathom Technology, a Hungarian software engineering firm which he co-founded and where he served as CTO. Prior to co-founding Fathom Technology, Mr. Fejes was a chief software architect/line manager with Microsoft Great Plains (Microsoft Business Solutions). He also served as chief software architect of Scala Business Solutions. He is the recipient of numerous awards for programming excellence and has worked extensively in the US and Russia. | ||

| Viktar Dvorkin |

||

| Viktar Dvorkin is our Senior Vice President, Head of Global Delivery, and is responsible for the strategy and operation of the company’s Delivery Organization as well as our Solution Practices and Competency Centers. In his current role, Mr. Dvorkin also oversees EPAM’s Advanced Technology programs including EngineeringX and Delivery Excellence. Prior to his current role, he led the North American business unit, where he oversaw the operation of EPAM’s largest book of business, with overall responsibility for services delivered in the North American region. Mr. Dvorkin joined EPAM in 1997 and has been instrumental in driving our growth in key technology and solution practices, and in helping EPAM to build and deploy multi-disciplinary teams for successful client engagements. Having worked and lived in the United States and Eastern Europe, Mr. Dvorkin has in-depth understanding of global delivery models and brings hands-on technology experience and working knowledge of multiple industries including travel, healthcare, insurance and oil & gas. Mr. Dvorkin holds a master’s degree in Applied Mathematics from the Belarusian National Technical University. | ||

16

| Jason Peterson |

||

| Jason Peterson joined EPAM in 2017 and is our Senior Vice President, Chief Financial Officer and Treasurer. Mr. Peterson leads EPAM’s Global Finance, Corporate Development, and Procurement organizations and has over 25 years of finance experience. From 2008 to 2017, he was employed by Cognizant Technology Solutions, and in his most recent role, he was Vice President of Finance, M&A and Due Diligence, a position that he held while leading a large-scale corporate business process transformation program. Prior to that, he was CFO of the Emerging Business Accelerator and led the Corporate Financial Planning and Analysis Function. Before joining Cognizant, Mr. Peterson was the CFO for E&C Medical Intelligence, a venture-backed software and services company, and prior to that, he served in various accounting and finance roles at ATI Technologies, Philips Semiconductors, and Hewlett-Packard. Mr. Peterson holds an MBA from Columbia Business School and a Bachelor’s degree in economics from Claremont McKenna College. | ||

| Edward Rockwell |

||

| Edward Rockwell joined EPAM in October of 2018 and is our Senior Vice President, General Counsel and Corporate Secretary overseeing the legal activities of the organization and providing strategic counsel and legal guidance to senior leadership and EPAM’s Board of Directors. From June 2014 to October 2018, Mr. Rockwell served as Vice President & Assistant General Counsel at Red Hat, a leading global provider of open source, enterprise IT solutions where he led a global team of legal professionals that supported all sales and operations during a period of significant company growth. From April 2012 to January 2014, Mr. Rockwell was General Counsel and Vice President, Legal and Human Resources for DDN Storage. He previously served as Vice President and Associate General Counsel at Hewlett-Packard Company (HP) with roles that included General Counsel for HP Services, HP Americas, and HP Software. Additionally, he spent five years in Milan, Italy, where he served as Director and Managing Counsel for HP’s Outsourcing Services business in EMEA and later Senior Director and Managing Counsel for Outsourcing Services worldwide. Mr. Rockwell is a member of the board of directors of the Greater Philadelphia Chapter of the Association of Corporate Counsel. Mr. Rockwell received a BA degree in Foreign Affairs from University of Virginia and a JD from the University of Richmond School of Law. | ||

| Elaina Shekhter |

||

| Elaina Shekhter is our Senior Vice President, Chief Marketing and Strategy Officer. Ms. Shekhter had been our Chief Marketing Officer from March 2015 through March 2021. In her role, Ms. Shekhter works to integrate a variety of functions that influence EPAM’s strategy, positioning and messaging. Ms. Shekhter has been with EPAM since 2001 in a number of roles, including the Global Head of Business Development and prior to that, the Global Head of our Travel and Consumer Business Unit. Ms. Shekhter is an advisory board member for the MACH Alliance and is active in the software startup and emerging technology communities, representing EPAM in its investment in the Go Philly Fund and as a board member of the EPAM seed investment, Sigma Ledger. Additionally, Ms. Shekter takes a special interest in artificial intelligence and sustainability initiatives. Before joining EPAM, Ms. Shekhter was with the global hospitality and travel company Carlson Companies, in a number of operational and business development roles including Head of Retail and Entertainment for 24K, a spin-off of Carlson Marketing Group. Prior to Carlson, Ms. Shekhter was a Manager with Ernst & Young Consulting, specializing in CRM and analytics engagements. Ms. Shekhter holds an MS degree in Information Systems and BS/BA degrees in Economic Theory and Political Science from The American University. | ||

| Boris Shnayder |

||

| Boris Shnayder is our Senior Vice President, Co-Head of Global Business with a primary focus on operations in the Americas. Mr. Shnayder joined EPAM in July 2015 and is responsible for a portfolio of business in the region, including oversight of service programs and client acquisition. Mr. Shnayder also oversees strategy and execution of our emerging verticals portfolio. With over 20 years of experience in the IT and telecommunications industries, Mr. Shnayder brings both industry and global operations leadership. Prior to his role at EPAM, Mr. Shnayder served in a variety of roles at GlobalLogic, Inc. from 2007 to 2015, including Chief Delivery Officer, Senior Vice President, Head of Telecom & Healthcare and General Manager, and Vice President of Telecommunications. He also held senior software management positions at Motorola and Telcordia, managing teams throughout the United States, China, India and Russia. Mr. Shnayder received his MS degree in Mechanical Engineering from the Lyiv University in Ukraine. | ||

17

| Larry Solomon |

||

| Larry Solomon is our Senior Vice President, Chief People Officer, responsible for overseeing all aspects of talent management, talent acquisition, workforce planning and management, as well as other human resource related functions within EPAM globally. Mr. Solomon joined EPAM in October 2016, and prior to that he held a number of leadership positions at Accenture beginning in 1986. His most recent responsibilities as Senior Managing Director and North America Operating Officer from 2013 to 2016 included overseeing and managing the full employee life cycle of all Accenture people in the United States and Canada, resource planning, recruitment, staffing and deployment, and performance management. Prior to that, he was Accenture’s Global COO of Human Resources from 2011 to 2013, with overall responsibility for human resources operations. Mr. Solomon received a bachelor’s degree in Business Administration from the State University of New York at Albany with a Finance/MIS major and Spanish language minor. He graduated with Magna Cum Laude distinction in 1986. | ||

| Sergey Yezhkov |

||

| Sergey Yezhkov, 48, is our Senior Vice President, Co-Head of Global Business, focusing on a North American book of business. Mr. Yezhkov also oversees strategy and operation of our Life Science & Healthcare portfolio. Prior to his current role, Mr. Yezhkov served as Co-Head of Global Delivery where he oversaw delivery operations across EPAM’s diverse geographic footprint with overall responsibility for building and growing professional software engineering skills and delivery know-how. Mr. Yezhkov joined EPAM in 2006 as part of the acquisition of Vested Development Inc. (VDI), where he served as Managing Director and CTO. Through his work with EPAM’s Independent Software Vendors business unit, Mr. Yezhkov brings an in-depth understanding of commercial software product development and agile approaches as well as a working knowledge of the healthcare, life science and high-tech industries. Mr. Yezhkov has an MS in Computational Mathematics from Lomonosov Moscow State University. | ||

| Gary Abrahams |

||

| Gary Abrahams is our Vice President, Corporate Controller, and Chief Accounting Officer. Mr. Abrahams joined EPAM in June of 2016, after having served as an independent contractor for EPAM starting in March of 2016. He was named Chief Accounting Officer in April 2017. Mr. Abrahams has over 25 years of experience in global corporate financial management and public accounting. From December 2015 to March 2016, Mr. Abrahams worked as an independent contractor at CMF Associates, LLC, a management and financial services advisory firm. From June 2014 to April 2015, he served as Senior Vice President, Chief Accounting Officer at Preferred Sands, a producer of high-performance sands and proppant materials used in the oil and gas industry. From May 2006 to April 2014, Mr. Abrahams served in several senior finance roles at Shire Pharmaceuticals, a global biotechnology company, last serving as Vice President, Finance Operations - The Americas, where he was responsible for leading the Controller’s teams in North and South America and enhancing the finance infrastructure to support the growth of the multinational business. Before joining Shire, Mr. Abrahams held finance and Controller positions at Bracco Diagnostics, a subsidiary of a multinational healthcare company, from 1994 to 2006. He began his career at Arthur Andersen LLP in New York City. Mr. Abrahams holds a BBA in Accounting from Hofstra University. | ||

18

Security Ownership of Certain Beneficial Owners and Management

As of March 15, 2023, there were 57,744,129 shares of our Common Stock issued and outstanding. The following table sets forth certain information with respect to the beneficial ownership of our common stock for:

| • | each of our directors and executive officers individually; |

| • | all directors and executive officers as a group; and |

| • | each stockholder known by us to be the beneficial owner of more than 5% of our outstanding Common Stock. |

We have calculated beneficial ownership in accordance with the rules of the SEC, and such ownership includes voting and dispositive power with respect to shares. In the table below, shares of Common Stock issuable pursuant to options currently exercisable or exercisable within 60 days of March 15, 2023, shares of Common Stock issuable upon settlement of restricted stock units, and restricted Common Stock are deemed to be outstanding for calculating the percentage of outstanding shares beneficially owned by the person holding those options, but are not deemed to be outstanding for computing the percentage of shares beneficially owned by any other person.

To our knowledge, except as indicated, the stockholders named in the table have sole voting and dispositive power with respect to all shares of Common Stock beneficially owned by them, based on the information provided to us by such stockholders. Unless otherwise indicated, the address for each director and executive officer is c/o EPAM Systems, Inc., 41 University Drive, Suite 202, Newtown, Pennsylvania 18940.

| Shares Beneficially Owned |

||||||

| Name and Address of Beneficial Owner | Number | Percent | ||||

| Named Executive Officers and Directors |

||||||

| Arkadiy Dobkin(1) |

1,975,697 | 2.9% | ||||

| Jason Peterson(2) |

27,771 | * | ||||

| Balazs Fejes(3) |

35,162 | * | ||||

| Boris Shnayder(4) |

54,621 | * | ||||

| Elaina Shekhter(5) |

42,660 | * | ||||

| Larry Solomon(6) |

34,445 | * | ||||

| Viktar Dvorkin(7) |

73,062 | * | ||||

| Sergey Yezhkov(8) |

69,498 | * | ||||

| Edward Rockwell(9) |

9,790 | * | ||||

| Gary Abrahams(10) |

1,867 | * | ||||

| DeAnne Aguirre |

338 | * | ||||

| Richard Michael Mayoras |

7,394 | * | ||||

| Eugene Roman |

1,756 | * | ||||

| Karl Robb |

4,440 | * | ||||

| Robert Segert |

17,439 | * | ||||

| Helen Shan |

3,000 | * | ||||

| Jill B. Smart |

6,025 | * | ||||

| Ronald Vargo |

7,627 | * | ||||

| All executive officers and directors as a group (18 people) |

2,372,592 | 3.2% | ||||

19

| Shares Beneficially Owned |

||||||

| Name and Address of Beneficial Owner | Number | Percent | ||||

| 5% Stockholders |

||||||

| The Vanguard Group(11) |

6,493,769 | 11.29% | ||||

| Capital Research Global Investors(12) |

6,840,778 | 11.9% | ||||

| BlackRock, Inc.(13) |

4,005,541 | 7.0% | ||||

| WCM Investment Management, LLC (14) |

3,414,098 | 5.9% | ||||

| AllianceBernstein L.P. (15) |

3,489,287 | 6.1% | ||||

| * | Denotes less than 1% of the shares of Common Stock beneficially owned. |

| (1) | Includes: (i) 1,246,461 shares of Common Stock held directly by Mr. Dobkin; (ii) 293,047 shares of Common Stock issuable to Mr. Dobkin upon exercise of options exercisable within 60 days of March 15, 2023; and (iii) 436,189 shares of Common Stock held by the Arkadiy Dobkin GST Exempt Grantor Trust (the “Dobkin Grantor Trust”) for the benefit of Mr. Dobkin’s children, for which Mr. Dobkin’s spouse acts as the trustee. Mr. Dobkin may be deemed to have shared power to vote or to direct the vote, and shared power to dispose or to direct the disposition of the shares held by the Dobkin Grantor Trust and identified as beneficially owned by him above. Mr. Dobkin disclaims beneficial ownership of the securities held by the Dobkin Grantor Trust except to the extent of his pecuniary interest therein. |

| (2) | Includes 15,978 shares of Common Stock issuable to Mr. Peterson upon exercise of options exercisable within 60 days of March 15, 2023. |

| (3) | Includes 22,159 shares of Common Stock issuable to Mr. Fejes upon exercise of options exercisable within 60 days of March 15, 2023. |

| (4) | Includes 47,497 shares of Common Stock issuable to Mr. Shnayder upon exercise of options exercisable within 60 days of March 15, 2023. |

| (5) | Includes 37,807 shares of Common Stock issuable to Ms. Shekhter upon exercise of options exercisable within 60 days of March 15, 2023. |

| (6) | Includes 24,854 shares of Common Stock issuable to Mr. Solomon upon exercise of options exercisable within 60 days of March 15, 2023. |

| (7) | Includes: (i) 7,603 shares of Common Stock held directly by Mr. Dvorkin; (ii) 49,722 shares of Common Stock issuable to Mr. Dvorkin upon exercise of options exercisable within 60 days of March 15, 2023; and (iii) 15,737 shares of Common Stock held by the Dvorkin Family Trust for the benefit of Mr. Dvorkin’s children, for which Mr. Dvorkin’s spouse acts as the trustee. Mr. Dvorkin may be deemed to have shared power to vote or to direct the vote, and shared power to dispose or to direct the disposition of the shares held by the Dvorkin Family Trust and identified as beneficially owned by him above. Mr. Dvorkin disclaims beneficial ownership of the securities held by the Dvorkin Family Trust except to the extent of his pecuniary interest therein. |

| (8) | Includes 58,601 shares of Common Stock issuable to Mr. Yezhkov upon exercise of options exercisable within 60 days of March 15, 2023. |

| (9) | Includes 6,354 shares of Common Stock issuable to Mr. Rockwell upon exercise of options exercisable within 60 days of March 15, 2023. |

| (10) | Includes 341 shares of Common Stock issuable to Mr. Abrahams upon exercise of options exercisable within 60 days of March 15, 2023. |

| (11) | Information based on a Schedule 13G/A filed with the SEC on February 9, 2023. The Vanguard Group has sole voting power over 0 shares, shared voting power over 84,361 shares, sole dispositive power over 6,255,533 shares and shared dispositive power over 238,236 shares. The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

| (12) | Information based on a Schedule 13G/A filed with the SEC on February 13, 2023. Capital Research Global Investors (“CRGI”) is a division of Capital Research and Management Company (“CRMC”), as well as its investment management subsidiaries and affiliates Capital Bank and Trust Company, Capital International, Inc., Capital International Limited, Capital International Sarl, Capital International K.K., and Capital Group Private Client Services, Inc. (together with CRMC, the “investment management entities”). CRGI’s divisions of each of the investment management entities collectively provide investment management services under the name “Capital Research Global Investors.” CRGI is deemed to be the beneficial owner of 6,840,778 shares. CRGI has sole voting power over 6,836,583 shares, shared voting power over 0 shares, sole dispositive power over 6,840,778 shares, and shared dispositive power over 0 shares. The address of CRGI is 333 South Hope Street, 55th Fl, Los Angeles, CA 90071. |

| (13) | Information based on a Schedule 13G/A filed with the SEC on February 1, 2023. BlackRock, Inc., a parent holding company, reports on behalf of the following subsidiaries which hold the shares: BlackRock Life Limited, BlackRock International Limited, BlackRock Advisors, LLC, Aperio Group, LLC, BlackRock (Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock (Luxembourg) S.A., BlackRock Investment Management (Australia) Limited, BlackRock Advisors (UK) Limited, BlackRock Fund Advisors, BlackRock Asset Management North Asia Limited, BlackRock (Singapore) Limited, and BlackRock Fund Managers Ltd. BlackRock, Inc. has sole voting power over 3,601493 shares, shared voting power over 0 shares, sole dispositive power over 4,005,541 shares, and shared dispositive power over 0 shares. The address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. |

| (14) | Information based on a Schedule 13G/A filed with the SEC on February 10, 2023. WCM Investment Management, LLC has sole voting power over 3,414,098 shares, has shared voting power over 0 shares, has sole dispositive power over 3,414,098 share, and shared dispositive power over 0 shares. The address of WCM Investment Management, LLC is 281 Brooks Street, Laguna Beach, California 92651. |

| (15) | Information based on a Schedule 13G filed with the SEC on February 14, 2023. AllianceBernstein L.P. has sole voting power over 3,326,758 shares, shared voting power over 0 shares, sole dispositive power over 3,483,703 shares, and shared dispositive power over 5,584 shares. The address of AllianceBernstein L.P. is 1345 Avenue of the Americas, New York, NY 10105. |

20

Certain Relationships and Related Transactions

Our Related Person Transaction Policy

The Board first adopted EPAM’s Related Person Transaction Policy in January 2012 and reviews the policy annually. Under this policy, a “Related Person Transaction” is any transaction, arrangement or relationship involving us in which a Related Person has a direct or indirect material interest. A “Related Person” is any of our executive officers, directors or director nominees, any stockholder beneficially owning in excess of 5% of our stock or securities exchangeable for our stock and any immediate family member of any of the foregoing persons.

Pursuant to such related person transaction policy:

| • | Any Related Person Transaction must be approved or ratified by our Nominating and Corporate Governance Committee, the Board or a designated committee thereof consisting solely of independent directors (each, a “Reviewing Body”). |

| • | In determining whether to approve or ratify a transaction with a Related Person, the Reviewing Body will consider all relevant facts and circumstances, including without limitation the commercial reasonableness of the terms, the benefit and perceived benefit, or lack thereof, to us, opportunity costs of alternate transactions, the materiality and character of the Related Person’s direct or indirect interest, and the actual or apparent conflict of interest of the Related Person. |

| • | The Reviewing Body will not approve or ratify a Related Person Transaction unless it has determined that, upon consideration of all relevant information, such transaction is in, or not inconsistent with, the best interests of EPAM and our stockholders. To facilitate compliance with the policy, the Nominating and Corporate Governance Committee reviews relevant information, facts and circumstances relating to potential related parties quarterly. |

Members of our Board may be executive officers or directors of customers or vendors that receive services from or provide services to EPAM in the ordinary course from time to time. Consistent with our Related Person Transaction Policy, and in accordance with the approval or ratification process described above, the Nominating and Corporate Governance Committee (with appropriate recusals, as necessary) reviews those ordinary course service arrangements to determine if the applicable member of the Board has a direct or indirect material interest in the arrangement and if approval or ratification of the arrangement is in the best interests of EPAM and our stockholders in the given situation.

Indemnification Agreements

Our certificate of incorporation includes provisions that authorize and require us to indemnify our officers and directors to the fullest extent permitted under Delaware law, subject to limited exceptions. We have separate indemnification agreements with our directors and executive officers, which require us to indemnify these individuals to the fullest extent permitted by applicable law against liabilities that may arise by reason of their service to us, and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified.