2014.12.31 10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2014

OR

|

| |

£ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-33459

Genesis Healthcare, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

| | |

Delaware | | 20-3934755 |

(State of Incorporation) | | (I.R.S. Employer Identification Number) |

| |

101 East State Street Kennett Square, Pennsylvania | | 19348 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number: (610) 444-6350

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Class A Common Stock, $0.001 par value per share | | New York Stock Exchange |

(Title of each class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

|

| | | | |

Large accelerated filer | ¨ | | Accelerated filer | þ |

| | | |

Non-accelerated filer | ¨ | | Smaller Reporting Company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of June 30, 2014, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the shares of Class A common stock, par value $0.001 per share, and Class B common stock, par value $0.001 per share, held by non-affiliates of the registrant, computed based on the closing sale price of $6.29 per share on June 30, 2014, as reported by The New York Stock Exchange, was approximately $155.7 million. The aggregate number of shares held by non-affiliates is calculated by excluding all shares held by executive officers, directors and holders known to hold 5% or more of the voting power of the registrant’s common stock. As of February 18, 2015, there were 73,592,083 shares of the registrant’s Class A common stock issued and outstanding, 15,511,603 shares of the registrant’s Class B common stock issued and outstanding, and 64,449,380 shares of the registrants Class C common stock, par value $0.001 per share, issued and outstanding. The Class C common stock did not exist as of June 30, 2014.

Documents Incorporated by Reference:

The information called for by Part III is incorporated by reference to the Definitive Proxy Statement for the 2015 Annual Meeting of Stockholders of the Registrant which will be filed with the U.S. Securities and Exchange Commission not later than April 30, 2015.

Genesis Healthcare, Inc.

Annual Report

Index

|

| | |

| | Page |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

Item 15. | | |

| |

| |

PART I

Overview

Genesis Healthcare, Inc. ("Genesis") is a holding company with subsidiaries that, on a combined basis, as of the date of this report, comprise one of the nation's largest post-acute care providers with more than 500 skilled nursing centers and assisted/senior living communities in 34 states nationwide. Genesis subsidiaries also supply rehabilitation and respiratory therapy to more than 1,800 healthcare providers in 47 states and the District of Columbia. In addition, Genesis subsidiaries provide a full complement of administrative and consultative services to our affiliated operators and third-party operators with whom we contract to better focus on delivery of healthcare services. There were 25 such service agreements with unaffiliated or jointly owned skilled nursing facility operators. All of our healthcare operating subsidiaries focus on providing high-quality care to the people we serve, and our skilled nursing facility subsidiaries, which comprise the largest portion of our consolidated business, have a strong commitment to treating patients who require a high level of skilled nursing care and extensive rehabilitation therapy, whom we refer to as high-acuity patients.

On February 2, 2015, Genesis completed the previously announced combination transaction (the "Combination") with FC-GEN Operations Investment, LLC ("FC-GEN"). FC-GEN, now a subsidiary of Genesis, offers inpatient services through its network of 416 skilled nursing and assisted living facilities across 28 states, consisting of 382 skilled nursing facilities and 34 assisted living facilities. Of the 416 facilities, 389 are leased, 18 are managed, six are joint ventures and three are owned. Collectively, these skilled nursing and assisted living facilities have 49,123 licensed beds, approximately 49% of which are concentrated in the states of Massachusetts, Maryland, New Jersey, Pennsylvania and West Virginia. See "Note 18 - Combination with FC-GEN and Item 7 - Management’s Discussion and Analysis of Financial Conditions and Results of Operations - Liquidity and Capital Resources," for further details.

The disclosures in this report generally relate to a period prior to the February 2, 2015 closing of the Combination. As a result, the terms "Skilled," "we," "us," "our" and the "Company," and similar terms used in this report, refer collectively to Genesis prior to the Combination (then named "Skilled Healthcare Group, Inc.") and its then consolidated wholly-owned subsidiaries and do not give effect to the Combination, unless the context requires otherwise.

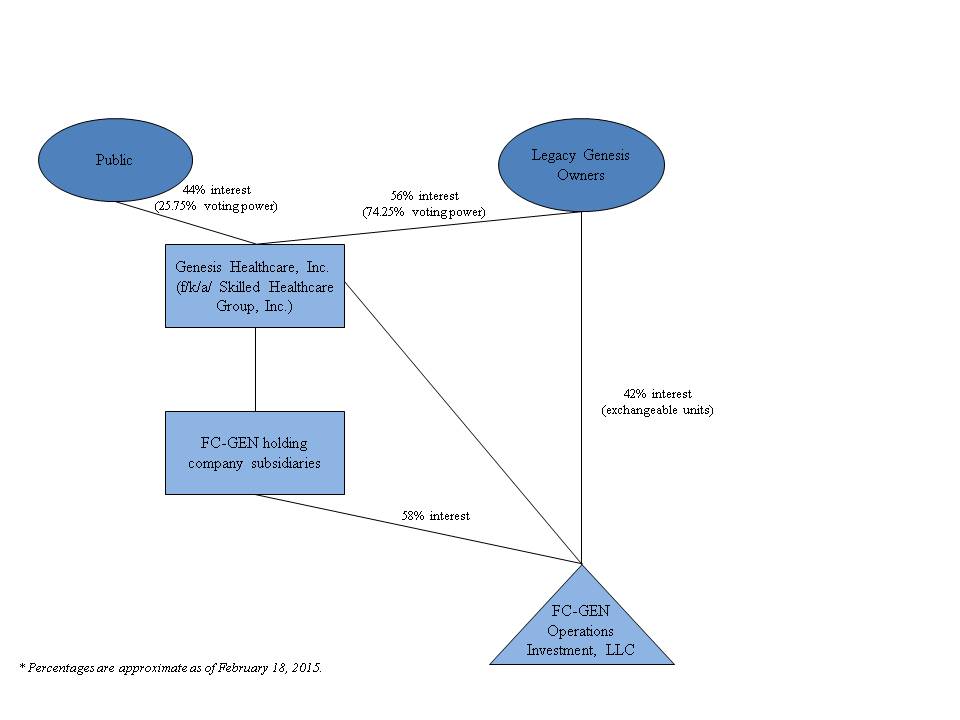

Genesis is a holding company and substantially all of its assets are its controlling equity interests in FC-GEN. The following diagram depicts the current organizational structure of Genesis subsequent to the Combination:

Operations

As of December 31, 2014, we owned or leased 73 skilled nursing facilities and 22 assisted living facilities, together comprising 10,275 licensed beds. We also lease five skilled nursing facilities in California to an unaffiliated third party operator. Our skilled nursing and assisted living facilities are located in California, Texas, Iowa, Kansas, Missouri, Nebraska, Nevada and New Mexico, and are generally clustered in large urban or suburban markets. We owned 77.0% of these facilities as of December 31, 2014. As of December 31, 2014, we provided hospice and home health services in Arizona, Idaho, Montana, Nevada, and New Mexico. We also provided private duty care services in Arizona, Idaho, Montana, and Nevada. For the year ended December 31, 2014, we generated approximately 75.2% of our revenue from our skilled nursing facilities, including our integrated rehabilitation therapy services at these facilities. The remainder of our revenue is generated from our assisted living services, rehabilitation therapy services provided to third-party facilities, hospice care and home health services.

Our services focus primarily on the medical and physical issues facing elderly patients and are provided by our skilled nursing companies, assisted living companies, integrated and third-party rehabilitation therapy business, hospice business and home health business. We have a strong commitment to treating patients who require a high level of skilled nursing care and extensive rehabilitation therapy, whom we refer to as high-acuity patients.

As of December 31, 2014, we had three reportable operating segments: (1) long-term care ("LTC"), which includes the operation of skilled nursing facilities and assisted living facilities and is the largest portion of our business; (2) therapy services, which includes our integrated and third-party rehabilitation therapy services; and (3) hospice and home health services, which includes our hospice and home health businesses. Our administrative and consultative services that are attributable to the reportable operating segments are allocated among the segments accordingly. For the twelve months ended December 31, 2014, the LTC operating segment generated approximately 79.3% of our revenue, with the therapy services segment and hospice and home health services segment accounting for 10.8% and 9.9% of our revenue, respectively. For additional information regarding the financial performance of our reportable operating segments, see Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations—Revenue and Note 6, "Business Segments," in the notes to our consolidated financial statements included elsewhere in this report.

Long-Term Care Services Segment

Skilled Nursing Facilities

As of December 31, 2014, our skilled nursing companies provided skilled nursing care at 73 regionally clustered facilities, having 9,063 licensed beds, in California, Texas, Iowa, Kansas, Missouri, Nebraska, Nevada and New Mexico. We have developed programs for, and actively market our services to, high-acuity patients who are typically admitted to our facilities as they recover from strokes, other neurological conditions, cardiovascular and respiratory ailments, joint replacements and other muscular or skeletal disorders. As of December 31, 2014, we employed approximately 8,816 active employees in our skilled nursing business.

We use interdisciplinary teams of experienced medical professionals, including therapists, to provide services prescribed by physicians. These teams include registered nurses, licensed practical nurses, certified nursing assistants and other professionals who provide individualized comprehensive nursing care 24 hours a day. Many of our skilled nursing facilities are equipped to provide specialty care, such as chemotherapy, enteral/parenteral nutrition, tracheotomy care and ventilator care. We also provide standard services to each of our skilled nursing patients, including room and board, special nutritional programs, social services, recreational activities and related healthcare and other services.

Our Express Recovery™ program uses a dedicated unit within a skilled nursing facility to deliver a comprehensive rehabilitation regimen in accommodations specifically designed to serve high-acuity patients. Each Express Recovery™ unit can typically be entered without using the main facility entrance, permitting residents to bypass portions of the facility dedicated to the traditional nursing home patient. Each Express Recovery™ unit typically has 12 to 36 beds and provides skilled nursing care and rehabilitation therapy for patients recovering from conditions such as joint replacement surgery, and cardiac and respiratory ailments. We believe that having an Express Recovery™ unit at a facility enables the facility to more effectively attract higher acuity patients and achieve a higher skilled mix than it would be able to without the unit, which in turn results in higher reimbursement rates. Skilled mix is the average daily number of Medicare and managed care patients we serve at our skilled nursing facilities divided by the average daily number of total patients we serve at our skilled nursing facilities. As of December 31, 2014, we operated 64 Express Recovery™ units with 2,307 beds. We have substantially completed the build out of our Express Recovery™ units at our skilled nursing facilities. We will continue to add and modify Express Recovery™ units in the future as warranted.

Our administrative service company provides a full complement of administrative and consultative services that allows our affiliated operators and unaffiliated third-party operators with whom we contract to better focus on delivery of healthcare services. We currently have one such service agreement with an unaffiliated facility operator. The income associated with the services our administrative service company provides to the third-party facility operator is included in LTC in our segment reporting as services are performed primarily by personnel supporting the LTC segment. Each of our facilities operates as a

distinct company to better focus on service delivery and is supported by the administrative service company for efficient delivery of non-healthcare support services.

Assisted Living Facilities

We complement our skilled nursing care business by providing assisted living services at 22 facilities with 1,212 beds as of December 31, 2014. Our assisted living companies, which are mostly in Kansas, provide residential accommodations, activities, meals, security, housekeeping and assistance in the activities of daily living to seniors who are independent or who require some support, but not the level of nursing care provided in a skilled nursing facility. Our independent living units are non-licensed independent living apartments in which residents are independent and require no support with the activities of daily living. As of December 31, 2014, we employed approximately 640 active employees in our assisted and independent living businesses.

Equity Investment in Pharmacy Joint Venture

We have a 50% equity interest in APS - Summit Care Pharmacy, LLC, or APS - Summit Care, which is a joint venture that serves the pharmaceutical needs of a limited number of our Texas operations, as well as a number of other unaffiliated customers. The remaining 50% equity interest in APS - Summit Care is owned by an unaffiliated third party. APS - Summit Care operates a pharmacy in Austin, Texas, through which we pay market value for prescription drugs and receive a 50% share of the net income related to the joint venture. For additional information regarding the joint venture, see Note 15, "Investment in Unconsolidated Joint Venture."

Therapy Services Segment

Rehabilitation Therapy Services

As of December 31, 2014, we provided rehabilitation therapy services to a total of 175 healthcare facilities, including 63 facilities owned by us. In addition, we have contracts to manage the rehabilitation therapy services for our 10 healthcare facilities in New Mexico. We provide rehabilitation therapy services at our skilled nursing facilities as part of an integrated service offering in connection with our skilled nursing care. We believe that an integrated approach to treating high-acuity patients enhances our ability to achieve successful patient outcomes and enables us to identify and treat patients who can benefit from our rehabilitation therapy services. We believe hospitals and physician groups often refer high-acuity patients to our skilled nursing facilities because they recognize the value of an integrated approach to providing skilled nursing care and rehabilitation therapy services.

We believe that we have also established a strong reputation as a premium provider of rehabilitation therapy services to third-party skilled nursing operators in our local markets, with a recognized ability to provide these services to high-acuity patients. Our approach to providing rehabilitation therapy services for third-party operators emphasizes high-quality treatment and successful clinical outcomes. As of December 31, 2014, we employed approximately 2,448 active employees (primarily therapists) in our rehabilitation therapy business.

Hospice and Home Health Services Segment

Hospice Care

As of December 31, 2014, we provided hospice care services in Arizona, California, Nevada, Idaho, Montana, and New Mexico. Hospice services focus on the physical, spiritual and psychosocial needs of terminally ill individuals and their families, and consist primarily of palliative and clinical care, education and counseling. As of December 31, 2014, we employed approximately 679 active employees in our hospice services business.

Home Health

As of December 31, 2014, we provided home health care services in Arizona, Nevada, Idaho, Montana and New Mexico. Our home health care services generally consist of providing some combination of the services of registered nurses, speech, occupational and physical therapists, medical social workers and certified home health aides. Home health care is often a cost-effective solution for patients, and can also increase their quality of life and allow them to receive quality medical care in the comfort and convenience of a familiar setting. As of December 31, 2014, we employed approximately 442 active employees in our home health business.

Revenue Sources

Within our skilled nursing facilities, we generate our revenue from Medicare, Medicaid, managed care providers, insurers, private pay and other sources. Within our assisted living facilities, we generate revenue primarily from private pay sources, with a small portion earned from Medicaid or other state-specific programs. With respect to our rehabilitation therapy services business, it receives payment from the third-party facilities that it serves based on negotiated patient per diem rates or a

negotiated fee schedule based on the type of services rendered. Our rehabilitation therapy business also similarly negotiates rates and fees with our affiliated facilities that it services, but the revenue it generates from those facilities is included in our revenue from our skilled nursing facilities. We derive substantially all of the revenue from our hospice business from Medicare and managed care reimbursement. We derive the majority of our revenue from our home health business from Medicare and managed care. For additional information regarding the revenue we generate by service offering, our revenue sources, and regulatory and other governmental actions affecting revenue, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operation - Revenue Sources."

Industry Trends

Medicare and Medicaid Reimbursement

Rising healthcare costs due to a variety of factors, including an aging population and increasing life expectancies, has in recent years increased demand for post-acute healthcare services, such as skilled nursing, assisted living, home health care, hospice care and rehabilitation therapy. In an effort to mitigate the cost of providing healthcare benefits, third party payors including Medicare, Medicaid, managed care providers, insurance companies and others have increasingly encouraged the treatment of patients in lower-cost care settings. As a result, in recent years skilled nursing facilities, which typically have significantly lower cost structures than acute care hospitals and certain other post-acute care settings, have generally been serving larger populations of higher-acuity patients than in the past. Despite this growth in demand, uncertainty over Medicare and Medicaid reimbursement rates persists as rates have often been reduced or been increased in lesser amounts than expected. Medicare and Medicaid reimbursement rates are subject to change from time to time and, because revenue derived directly or indirectly from Medicare and Medicaid reimbursement has historically comprised the most significant portion of our consolidated revenue, a reduction or slow growth in rates could materially and adversely impact our revenue, particularly in times of increased regulation and related expenses.

Medicare reimburses our skilled nursing facilities under a prospective payment system ("PPS") for certain inpatient covered services. Under the PPS, facilities are paid a predetermined amount per patient, per day, for certain services based on the anticipated costs of treating patients. The amount to be paid is determined by classifying each patient into a resource utilization group ("RUG") category that is based upon each patient's acuity level. In October 2010, the number of RUG categories was expanded from 53 to 66 as part of the implementation of the RUGs IV system and the introduction of a revised and substantially expanded patient assessment tool called the minimum data set (MDS) version 3.0.

On July 29, 2011, the Centers for Medicare & Medicaid Services ("CMS") issued a final rule providing for, among other things, a net 11.1% reduction in PPS payments to skilled nursing facilities for CMS's fiscal year 2012 (which began October 1, 2011) as compared to PPS payments in CMS's fiscal year 2011 (which ended September 30, 2011). The 11.1% reduction was on a net basis, after the application of a 2.7% market basket increase, and reduced by a 1.0% multi-factor productivity adjustment required by the Patient Protection and Affordable Care Act of 2010 ("PPACA"). The final CMS rule also adjusted the method by which group therapy is counted for reimbursement purposes, and changed the timing in which patients who are receiving therapy must be reassessed for purposes of determining their RUG category.

The Budget Control Act of 2011, enacted on August 2, 2011, increased the United States debt ceiling in connection with deficit reductions over the next ten years. Under the Budget Control Act of 2011, $1.2 trillion in domestic and defense spending reductions were automatically set to begin February 1, 2013, split evenly between domestic and defense spending. Payments to Medicare providers are subject to these automatic spending reductions, subject to a 2% cap. As discussed below, the American Taxpayer Relief Act of 2012 (the “ATRA”), enacted on January 2, 2013, subsequently delayed by two months the automatic budget sequestration cuts established by the Budget Control Act of 2011. The automatic 2% reduction on each claim submitted to Medicare began on April 1, 2013. Reductions to Medicare and Medicaid reimbursement resulting from the Budget Control Act of 2011 could have a material adverse effect on the Company's business, financial position, results of operations and liquidity.

The Middle Class Tax Relief and Job Creation Act of 2012 was signed into law on February 22, 2012, extending the Medicare Part B outpatient therapy cap exceptions process through December 31, 2012. As noted below, the exceptions process was further extended for an additional year through the end of 2013. The statutory Medicare Part B outpatient therapy cap for occupational therapy (OT) was $1,900 for 2013, and the combined cap for physical therapy (PT) and speech-language pathology services (SLP) was also $1,900 for 2013. This is the annual per beneficiary therapy cap amount determined for each calendar year. Similar to the therapy cap, the law requires an exceptions process to the therapy cap that allows providers to receive payment from Medicare for medically necessary therapy services above the therapy cap amount. Congress established a threshold of $3,700 for PT and SLP services combined and another threshold of $3,700 for OT services. All therapy services rendered above the $3,700 are subject to manual medical review ("MMR") and may be denied unless approved by the provider's Medicare Administrative Contractor (or "MAC").

On July 27, 2012, CMS issued a final rule providing for, among other things, a net 1.8% increase in PPS payments to skilled nursing facilities for CMS's fiscal year 2013 (which began October 1, 2012 and runs through September 30, 2013) as compared to PPS payments in CMS's fiscal year 2012 (which ended September 30, 2012). The 1.8% increase was on a net basis, after the application of a 2.5% market basket increase, and reduced by a 0.7% multi-factor productivity adjustment required by Patient Protection and Affordable Care Act of 2010 ("PPACA"). After our wage index adjustment, our net increase was 1.7%.

In July 2012, CMS issued its final rule for hospice services for its 2013 fiscal year. The rule included a market basket increase of 2.6% less a 0.3% reduction in the market basket as a result of the PPACA and a 0.7% reduction due to productivity adjustment. After our wage index adjustment, our net increase was 0.9%.

On July 31, 2013, CMS issued its final rule providing for, among other things, a net increase of 1.3% in PPS payments to skilled nursing facilities for CMS's fiscal year 2014 (which began October 1, 2013) as compared to the PPS payments in CMS's fiscal year 2013 (which ended September 30, 2013). The 1.3% increase is on a net basis, after the application of a 2.3% market basket increase reduced by a 0.5% forecast error correction and further reduced by 0.5% multi-factor productivity adjustment required by the PPACA.

On July 31, 2014, CMS issued its final rule providing for, among other things, a net increase of 2.0% in PPS payments to skilled nursing facilities for CMS fiscal year 2015 (which began October 1, 2014) as compared to the PPS payments in CMS fiscal year 2014 (which ended September 30, 2014). The 2.0% increase is on a net basis, after the application of a 2.5% market basket increase reduced by a 0.5% multi-factor productivity adjustment required by the PPACA. There was no forecast error adjustment.

On August 4, 2014, CMS issued its final rule providing for a net increase of 1.4% for payments to hospices serving Medicare beneficiaries for CMS' fiscal year 2015. The hospice payment increase would be the net result of a proposed payment update to the hospice per diem rates of 2.1% market basket increase less a 0.7% decrease in payments to hospices due to updated wage data and the sixth year of CMS' seven-year-phase-out of its wage index budget neutrality adjustment factor.

The ATRA delayed by two months the automatic budget sequestration cuts established by the Budget Control Act of 2011. The ATRA also extended the therapy cap exception process for one year. The ATRA also made additional changes to the Multiple Procedure Payment Reduction ("MPPR") previously implemented in 2011. The existing discount to the practice component of multiple therapy procedures performed in an outpatient environment during a single day was 25%. Effective April 1, 2013, ATRA increased the discount by an additional 25% to 50%. The new rules related to MPPR have reduced our revenue for the fiscal year ended December 31, 2014.

Should future changes in PPS include further reduced rates or increased standards for reaching certain reimbursement levels (including as a result of automatic cuts tied to federal deficit cut efforts or otherwise), our Medicare revenues derived from our skilled nursing facilities (including rehabilitation therapy services provided at our skilled nursing facilities) could be reduced, with a corresponding adverse impact on our financial condition and results of operation. Our rehabilitation therapy, hospice and home health care businesses are also to a large degree directly or indirectly dependent on (and therefore affected by changes in) Medicare and Medicaid reimbursement rates. For example, our rehabilitation therapy business may have difficulty increasing or maintaining the rates it has negotiated with third party nursing facilities in light of the reduced PPS reimbursement rates that took effect on October 1, 2011 as discussed above or future reductions in reimbursement rates.

We also derive a substantial portion of our consolidated revenue from Medicaid reimbursement, primarily through our skilled nursing business. Medicaid programs are administered by the applicable states and financed by both state and federal funds. Medicaid spending nationally has increased substantially in recent years, becoming an increasingly significant component of state budgets. This, combined with slower state revenue growth and other state budget demands, has led both the federal government and many states, including California and other states in which we operate, to institute measures aimed at controlling the growth of Medicaid spending (and in some instances reducing it).

Historically, adjustments to reimbursement under Medicare and Medicaid have had a significant effect on our revenue and results of operations. Recently enacted, pending and proposed legislation and administrative rulemaking at the federal and state levels could have similar effects on our business. Efforts to impose reduced reimbursement rates, greater discounts and more stringent cost controls by government and other payors are expected to continue for the foreseeable future and could adversely affect our business, financial condition and results of operations. Additionally, any delay or default by the federal or state governments in making Medicare and/or Medicaid reimbursement payments could materially and adversely affect our business, financial condition and results of operations.

Federal Health Care Reform

In addition to the matters described above affecting Medicare and Medicaid participating providers, PPACA enacted several reforms with respect to skilled nursing facilities, home health agencies and hospices, including payment measures to realize significant savings of federal and state funds by deterring and prosecuting fraud and abuse in both the Medicare and

Medicaid programs. While many of the provisions of PPACA will not take effect for several years or are subject to further refinement through the promulgation of regulations, some key provisions of PPACA are presently effective.

| |

• | Enhanced CMPs and Escrow Provisions. PPACA includes expanded civil monetary penalty ("CMP") and related provisions applicable to all Medicare and Medicaid providers. CMS rules adopted to implement applicable provisions of PPACA also provide that assessed CMPs may be collected and placed in whole or in part into an escrow pending final disposition of the applicable administrative and judicial appeals processes. To the extent our businesses are assessed large CMPs that are collected and placed into an escrow account pending lengthy appeals, such actions could adversely affect our liquidity and results of operations. |

| |

• | Nursing Home Transparency Requirements. In addition to expanded CMP provisions, PPACA imposes new transparency requirements for Medicare-participating nursing facilities. In addition to previously required disclosures regarding a facility's owners, management and secured creditors, PPACA expanded the required disclosures to include information regarding the facility's organizational structure, additional information on officers, directors, trustees and "managing employees" of the facility (including their names, titles, and start dates of services), and information regarding certain parties affiliated with the facility. The transparency provisions could result in the potential for greater government scrutiny and oversight of the ownership and investment structure for skilled nursing facilities, as well as more extensive disclosure of entities and individuals that comprise part of skilled nursing facilities' ownership and management structure. |

| |

• | Face-to-Face Encounter Requirements. PPACA imposes new patient face-to-face encounter requirements on home health agencies and hospices to establish a patient's ongoing eligibility for Medicare home health services or hospice services, as applicable. A certifying physician or other designated health care professional must conduct the face-to-face encounters within specified timeframes, and failure of the face-to-face encounter to occur and be properly documented during the applicable timeframes could render the patient's care ineligible for reimbursement under Medicare. |

| |

• | Suspension of Payments During Pending Fraud Investigations. PPACA provides the federal government with expanded authority to suspend Medicare and Medicaid payments if a provider is investigated for allegations or issues of fraud. This suspension authority creates a new mechanism for the federal government to suspend both Medicare and Medicaid payments for allegations of fraud, independent of whether a state exercises its authority to suspend Medicaid payments pending a fraud investigation. To the extent the suspension of payments provision is applied to one of our businesses for allegations of fraud, such a suspension could adversely affect our liquidity and results of operations. |

| |

• | Overpayment Reporting and Repayment; Expanded False Claims Act Liability. PPACA enacted several important changes that expand potential liability under the federal False Claims Act. Overpayments related to services provided to both Medicare and Medicaid beneficiaries must be reported and returned to the applicable payor within specified deadlines, or else they are considered obligations of the provider for purposes of the federal False Claims Act. This new provision substantially tightens the repayment and reporting requirements generally associated with operations of health care providers to avoid False Claims Act exposure. |

| |

• | Home and Community Based Services. PPACA provides that states can provide home and community-based attendant services and supports through the Community First Choice State plan option. States choosing to provide home and community based services under this option must make them available to assist with activities of daily living, instrumental activities of daily living and health related tasks under a plan of care agreed upon by the individual and his/her representative. PPACA also includes additional measures related to the expansion of community and home based services and authorizes states to expand coverage of community and home-based services to individuals who would not otherwise be eligible for them. The expansion of home-and-community based services could reduce the demand for the facility based services that we provide. |

| |

• | Health Care-Acquired Conditions. PPACA provides that the Secretary of Health and Human Services must prohibit payments to states for any amounts expended for providing medical assistance for certain medical conditions acquired during the patient's receipt of health care services. The CMS regulation implementing this provision of PPACA prohibits states from making payments to providers under the Medicaid program for conditions that are deemed to be reasonably preventable. It uses Medicare's list of preventable conditions in inpatient hospital settings as the base (adjusted for the differences in the Medicare and Medicaid populations) and provides states the flexibility to identify additional preventable conditions and settings for which Medicaid payment will be denied. |

| |

• | Value-Based Purchasing. PPACA requires the Secretary of Health and Human Services to develop a plan to implement a value-based purchasing (“VBP”) program for payments under the Medicare program for skilled nursing facilities and to submit a report containing the plan to Congress. The intent of the provision is to potentially reconfigure how Medicare pays for health care services, moving the program towards rewarding better value, outcomes, and innovations, instead of volume. According to the plan submitted to Congress in June 2012, the funding for the VBP program could come from payment withholds from poor-performing skilled nursing facilities or by holding back a portion of the base payment rate or the annual update for all skilled nursing facilities. If a VBP program is ultimately implemented, it is uncertain what effect it would have upon skilled nursing facilities, but its funding or other provisions could negatively affect skilled nursing facilities. |

| |

• | Anti-Kickback Statute Amendments. PPACA amended the Anti-Kickback Statute so that (i) a claim that includes items or services violating the Anti-Kickback Statute also would constitute a false or fraudulent claim under the federal False Claims Act and (ii) the intent required to violate the Anti-Kickback Statute is lowered such that a person need not have actual knowledge or specific intent to violate the Anti-Kickback Statute in order for a violation to be deemed to have occurred. These modifications of the Anti-Kickback Statute could expose us to greater risk of inadvertent violations of the statute and to related liability under the federal False Claims Act. |

The provisions of PPACA discussed above are examples of recently enacted federal health reform provisions that we believe may have a material impact on the long-term care profession generally and on our business. However, the foregoing discussion is not intended to constitute, nor does it constitute, an exhaustive review and discussion of PPACA. It is possible that other provisions of PPACA may be interpreted, clarified, or applied to our businesses in a way that could have a material adverse impact on our business, financial condition and results of operations. Similar federal and/or state legislation that may be adopted in the future could have similar effects.

Government Regulation

General

Healthcare is an area of extensive and frequent regulatory change. Our subsidiaries that provide healthcare services must comply with federal, state and local laws relating to, among other things, licensure, delivery and adequacy of medical care, distribution of pharmaceuticals, personnel and operating policies. Changes in the law or new interpretations of existing laws may have a significant impact on our methods and costs of doing business.

Governmental and other authorities periodically inspect our skilled nursing facilities, assisted living facilities, hospice agencies and home health agencies to verify that we continue to comply with their various standards. We must pass these inspections to continue our licensing under state law, to obtain certification under the Medicare and Medicaid programs, and, in some instances, to continue our participation in the Veterans Administration program. We can only participate in these third-party programs if inspections by regulatory authorities reveal that our facilities are in substantial compliance with applicable standards. In addition, regulatory authorities periodically inspect our recordkeeping and inventory control of controlled narcotics. From time to time, we, like others in the healthcare industry, may receive notices from federal and state regulatory authorities alleging that we failed to comply with applicable standards. These notices may require us to take corrective action, and may impose civil monetary penalties and other operating restrictions on us. If our facilities or agencies fail to comply with these directives or otherwise fail to comply substantially with licensure and certification laws, rules and regulations, they could lose their certification as a Medicare or Medicaid provider or lose their state operating licenses.

Civil and Criminal Fraud and Abuse Laws and Enforcement

Federal and state healthcare fraud and abuse laws regulate both the provision of services to government program beneficiaries and the methods and requirements for submitting claims for services rendered to such beneficiaries. Under these laws, individuals and organizations can be penalized for submitting claims for services that are not provided, that have been inadequately provided, billed in an incorrect manner or other than as actually provided, not medically necessary, provided by an improper person, accompanied by an illegal inducement to utilize or refrain from utilizing a service or product, or billed or coded in a manner that does not otherwise comply with applicable governmental requirements. Penalties also may be imposed for violation of anti-kickback and patient referral laws.

Federal and state governments have a range of criminal, civil and administrative sanctions available to penalize and remediate healthcare fraud and abuse, including exclusion of the provider from participation in the Medicare and Medicaid programs, fines, criminal and civil monetary penalties and suspension of payments and, in the case of individuals, imprisonment.

We have internal policies and procedures, including a compliance program designed to facilitate compliance with and to reduce exposure for violations of these and other laws and regulations. However, because enforcement efforts presently are

widespread within the industry and may vary from region to region, there can be no assurance that our internal policies and procedures will significantly reduce or eliminate exposure to civil or criminal sanctions or adverse administrative determinations.

Anti-Kickback Statute

Federal law commonly referred to as the Anti-Kickback Statute prohibits the knowing and willful offer, payment, solicitation or receipt of anything of value, directly or indirectly, in return for the referral of patients or arranging for the referral of patients, or in return for the recommendation, arrangement, purchase, lease or order of items or services that are covered by a federal healthcare program such as Medicare or Medicaid. Violation of the Anti-Kickback Statute is a felony, and sanctions for each violation include imprisonment of up to five years, significant criminal fines, significant civil monetary penalties plus three times the amount claimed or three times the remuneration offered, and exclusion from federal healthcare programs (including Medicare and Medicaid). Many states have adopted similar prohibitions against kickbacks and other practices that are intended to induce referrals applicable to all payors.

We are required under the Medicare conditions of participation and some state licensing laws to contract with numerous healthcare providers and practitioners, including physicians, hospitals and nursing homes, and to arrange for these individuals or entities to provide services to our patients. In addition, we have contracts with other suppliers, including pharmacies, ambulance services and medical equipment companies. Some of these individuals or entities may refer, or be in a position to refer, patients to us, and we may refer, or be in a position to refer, patients to these individuals or entities. Certain safe harbor provisions have been created, and compliance with a safe harbor ensures that the contractual relationship will not be found in violation of the Anti-Kickback Statute. We attempt to structure these arrangements in a manner that falls within one of the safe harbors. Some of these arrangements may not ultimately satisfy the applicable safe harbor requirements, but failure to meet the safe harbor does not necessarily mean an arrangement is illegal.

We believe that our arrangements with providers, practitioners and suppliers are in compliance with the Anti-Kickback Statute and similar state laws. However, if any of our arrangements with third parties were to be challenged and found to be in violation of the Anti-Kickback Statute, we could be subject to civil and criminal penalties, and we could be excluded from participating in federal and state healthcare programs such as Medicare and Medicaid. The occurrence of any of these events could significantly harm our business and financial condition.

Stark Law

Federal law commonly known as the Stark Law prohibits a physician from making referrals for particular healthcare services to entities with which the physician (or an immediate family member of the physician) has a financial relationship if the services are payable by Medicare or Medicaid. If an arrangement is covered by the Stark Law, the requirements of a Stark Law exception must be met for the physician to be able to make referrals to the entity for designated health services and for the entity to be able to bill for these services. Although the term “designated health services” does not include long-term care services, some of the services provided at our skilled nursing facilities and other related business units are classified as designated health services, including physical, speech and occupational therapy, as well as pharmacy and hospice services. The term “financial relationship” is defined very broadly to include most types of ownership or compensation relationships. The Stark Law also prohibits the entity receiving the referral from seeking payment from the patient or the Medicare and Medicaid programs for services rendered pursuant to a prohibited referral.

The Stark Law contains exceptions for certain physician ownership or investment interests in, and certain physician compensation arrangements with, certain entities. If a compensation arrangement or investment relationship between a physician, or immediate family member, and an entity satisfies the applicable requirements for a Stark Law exception, the Stark Law will not prohibit the physician from referring patients to the entity for designated health services. The exceptions for compensation arrangements cover employment relationships, personal services contracts and space and equipment leases, among others.

If an entity violates the Stark Law, it could be subject to significant civil penalties. The entity also may be excluded from participating in federal and state healthcare programs, including Medicare and Medicaid. If the Stark Law were found to apply to our relationships with referring physicians and no exception under the Stark Law were available, we would be required to restructure these relationships or refuse to accept referrals for designated health services from these physicians. If we were found to have submitted claims to Medicare or Medicaid for services provided pursuant to a referral prohibited by the Stark Law, we would be required to repay any amounts we received from Medicare or Medicaid for those services and could be subject to civil monetary penalties. Further, we could be excluded from participating in Medicare and Medicaid and other federal and state healthcare programs. If we were required to repay any amounts to Medicare or Medicaid, subjected to fines, or excluded from the Medicare and Medicaid Programs, our business and financial condition would be harmed significantly.

As directed by PPACA, in 2010 CMS released a self-referral disclosure protocol (“SRDP”) for potential or actual violations of the Stark Law. Under SRDP, CMS states that it may, but is not required to, reduce the amounts due and owing for a Stark Law violation, and will consider the following factors in deciding whether to grant a reduction: (1) the nature and extent

of the improper or illegal practice; (2) the timeliness of the self-disclosure; (3) the cooperation in providing additional information related to the disclosure; (4) the litigation risk associated with the matter disclosed; and (5) the financial position of the disclosing party.

Many states have physician relationship and referral statutes that are similar to the Stark Law. These laws generally apply regardless of the payor. We believe that our operations are structured to comply with the Stark Law and applicable state laws with respect to physician relationships and referrals. However, any finding that we are not in compliance with these laws could require us to change our operations or could subject us to penalties. This, in turn, could significantly harm our business and financial condition.

False Claims

Federal and state laws prohibit the submission of false claims and other acts that are considered fraudulent or abusive. The submission of claims to a federal or state healthcare program for items and services that are “not provided as claimed” may lead to the imposition of significant civil monetary penalties, significant criminal fines and imprisonment, and/or exclusion from participation in state and federally-funded healthcare programs, including the Medicare and Medicaid programs. Allegations of poor quality of care can also lead to false claims suits as prosecutors allege that the provider has represented to the government healthcare program that adequate care is provided and the lack of quality care causes the service to be “not provided as claimed.”

Under the federal False Claims Act ("FCA"), actions against a provider can be initiated by the federal government or by a private party on behalf of the federal government. These private parties, who are often referred to as “qui tam relators” or “relators,” are entitled to share in any amounts recovered by the government. Both direct enforcement activity by the government and qui tam relator actions have increased significantly in recent years. The use of private enforcement actions against healthcare providers has increased dramatically, in part because the relators are entitled to share in a portion of any settlement or judgment. This development has increased the risk that a healthcare company will have to defend a false claims action, pay fines or settlement amounts or be excluded from the Medicare and Medicaid programs, and other federal and state healthcare programs as a result of an investigation arising out of false claims laws. Many states have enacted similar laws providing for imposition of civil and criminal penalties for the filing of fraudulent claims.

Because we submit thousands of claims to Medicare each year, and there is a relatively long statute of limitations under the FCA, there is a risk that intentional, or even negligent or recklessly submitted claims that prove to be incorrect, or even billing errors, cost reporting errors or lapses in statutory or regulatory compliance with regard to the provision of health care services (including, without limitation the Anti-Kickback Statue and the federal self-referral law discussed above), could result in significant civil or criminal penalties against us. For example, see Note 13, "Commitment and Contingencies - Legal Matters," for information regarding matters in which the government is pursuing, or has expressed an intent to pursue, legal remedies against us under the FCA and similar state laws. In addition to FCA concerns, federal law makes it a felony to fail to disclose to the government an overpayment once the recipient has knowledge of the overpayment.

We believe that our operations comply with the FCA and similar state laws. However, if our claims practices were challenged and found to violate the applicable laws, any finding that we are not in compliance with these laws could require us to change our operations or could subject us to penalties or make us ineligible to participate in certain government funded healthcare programs, which could in turn significantly harm our business and financial condition.

Patient Privacy and Security Laws

There are numerous legislative and regulatory requirements at the federal and state levels addressing patient privacy and security of health information. The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) contains provisions that require us to adopt and maintain business procedures designed to protect the privacy, security and integrity of patients' individual health information. States also have laws that apply to the privacy of healthcare information. We must comply with these state privacy laws to the extent that they are more protective of healthcare information or provide additional protections not afforded by HIPAA.

HIPAA's security standards were designed to protect electronic information against reasonably anticipated threats or hazards to the security or integrity of the information and to protect the information against unauthorized use or disclosure. These standards have had and are expected to continue to have a significant impact on the health care industry because they impose extensive requirements and restrictions on the use and disclosure of identifiable patient information. In addition, HIPAA established uniform standards governing the conduct of certain electronic healthcare transactions and protecting the privacy and security of certain individually identifiable health information.

The Health Information Technology for Clinical Health Act of 2009 ("HITECH Act"), and predecessor laws in California, expanded the requirements and noncompliance penalties under HIPAA and California privacy law and require correspondingly intensive compliance efforts by companies such as ours, including self-disclosures of breaches of unsecured health information to affected patients, federal officials, and, in some cases, the media. These laws make unauthorized access (i.e., “snooping”) by

our employees illegal and subject to self-disclosure and penalties. Other states may adopt similar or more extensive breach notice and privacy requirements. Compliance with these regulations could require us to make significant investments of money and other resources. We believe that we are in substantial compliance with applicable state and federal regulations relating to privacy and security of patient information. However, if we fail to comply with the applicable regulations, we could be subject to significant penalties and other adverse consequences.

Federal Health Care Reform

In addition to the provisions described above affecting Medicare and Medicaid participating providers, the PPACA enacted several reforms with respect to skilled nursing facilities and hospices, including payment measures to realize significant savings of federal and state funds by deterring and prosecuting fraud and abuse in both the Medicare and Medicaid programs. See “Industry Trends-Federal Health Care Reform” above for additional information regarding PPACA.

Certificates of Need and Other Regulatory Matters

Certain states administer a certificate of need program, which applies to the incurrence of capital expenditures, the offering of certain new institutional health services, the cessation of certain services and the acquisition of major medical equipment. Such legislation also stipulates requirements for such programs, including that each program be consistent with the respective state health plan in effect pursuant to such legislation and provide for penalties to enforce program requirements. To the extent that certificates of need or other similar approvals are required for expansion of our operations, either through acquisitions, expansion or provision of new services or other changes, such expansion could be affected adversely by the failure or inability to obtain the necessary approvals, changes in the standards applicable to such approvals or possible delays and expenses associated with obtaining such approvals.

State Operating License Requirements

Nursing homes, assisted living facilities, pharmacies, hospice agencies and home health agencies are required to be individually licensed or certified under applicable state law and as a condition of participation under the Medicare program. In addition, healthcare professionals and practitioners are required to be licensed in most states. We believe that our operating companies and personnel that provide these services have all required regulatory approvals necessary for our current operations. The failure to obtain, retain or renew any required license could adversely affect our operations, including our financial results.

Rehabilitation License Requirements

Our rehabilitation therapy services operations are subject to various federal and state regulations, primarily regulations of individual practitioners. Therapists and other healthcare professionals employed by us are required to be individually licensed or certified under applicable state law. We take measures to ensure that our therapists and other healthcare professionals are properly licensed and participate in required continuing education programs. The failure to obtain, retain or renew any required license or certifications by therapists or other healthcare professionals could adversely affect our operations, including our financial results.

Regulation of our Joint Venture Institutional Pharmacy

Our joint venture institutional pharmacy operations, which include medical equipment and supplies, are subject to extensive federal, state and local regulation relating to, among other things, operational requirements, reimbursement, documentation, licensure, certification and regulation of pharmacies, pharmacists, drug compounding and manufacture and controlled substances.

Under federal law, dispensers of controlled substances must register with the Drug Enforcement Administration, file reports of inventories and transactions and provide adequate security measures. Failure to comply with such requirements or other laws applicable to pharmacies could result in significant civil or criminal penalties. The Medicare and Medicaid programs also establish certain requirements for participation of pharmacy suppliers.

Competition

Our skilled nursing facilities compete primarily on a local and regional basis with many long-term care providers, from national and regional chains to smaller providers owning as few as a single nursing center. We also compete under certain circumstances with inpatient rehabilitation facilities and long-term acute care hospitals. Our ability to compete successfully varies from location to location and depends on a number of factors, including the number of competing facilities in the local market, the types of services available, our local reputation for quality care of patients, the commitment and expertise of our caregivers, our local service offerings and treatment programs, the cost of care in each locality, and the physical appearance, location, age and condition of our facilities.

We seek to compete effectively in each market by establishing a reputation within the local community for quality of care, attractive and comfortable facilities, and providing specialized healthcare with an emphasized focus on high-acuity patients. Programs targeting high-acuity patients, including our Express Recovery™ units, generally have a higher staffing level per patient than our other inpatient facilities and compete more directly with inpatient rehabilitation facilities and long-term acute-care hospitals. We believe that the average cost to a third-party payor for the treatment of our typical high-acuity patient is lower if that patient is treated in one of our skilled nursing facilities than if that same patient were to be treated in an inpatient rehabilitation facility or long-term acute-care hospital.

Our other services, such as assisted living facilities, rehabilitation therapy provided to third-party facilities, hospice care and home health services, and institutional pharmacy services, also compete with local, regional, and national companies. The primary competitive factors in these businesses are similar to those for our skilled nursing facilities and include reputation, cost of services, quality of clinical services, responsiveness to patient/resident needs, location and the ability to provide support in other areas such as third-party reimbursement, information management and patient recordkeeping.

Increased competition could limit our ability to attract and retain patients, maintain or increase rates or to expand our business. Some of our competitors have greater financial and other resources than we have, may have greater brand recognition and may be more established in their respective communities than we are. Competing companies may also offer newer facilities or different programs or services than we do and may as a result be more attractive to our current patients, to potential patients and to referral sources. Some of our competitors may accept lower profit margins than we do, which could present significant price competition, particularly for managed care and private pay patients.

With respect to hospice services, while non-profit organizations have historically operated a significant majority of all hospice programs, for-profit companies have begun to occupy a larger share of the hospice market. Increasing public awareness of hospice services, the aging of the U.S. population and favorable reimbursement by Medicare, which is the primary payor for hospice services, have contributed to the recent growth in the hospice care market. As more companies enter the market to provide hospice services, we will face increasing competitive pressure.

Labor

Our most significant operating cost is labor. We seek to manage our labor costs by improving staffing retention, maintaining competitive labor rates, and reducing reliance on overtime compensation and temporary staffing services.

As of December 31, 2014, we had approximately 13,025 active employees and had eight collective bargaining agreements with unions covering approximately 531 active employees at seven of our skilled nursing facilities. Labor costs accounted for approximately 69.5%, 67.3% and 68.5% of our operating expenses (excluding impairment charges) from continuing operations for the years ended December 31, 2014, 2013 and 2012, respectively. Following the Combination with FC-GEN, the combined company had approximately 95,000 employees. We generally consider our relationship with our employees to be good.

Risk Management

We have developed a risk management program intended to stabilize our insurance and professional liability costs. As part of this program, we have implemented an arbitration agreement system at each of our nursing facilities under which, upon admission, patients are requested (but not required) to execute an agreement that requires disputes to be arbitrated instead of litigated in court. We believe that this program accelerates resolution of disputes and has significantly reduced our liability exposure and related costs. We have also established an incident reporting process that involves periodic follow-up with our facility administrators to monitor the progress of claims and losses. We believe that our emphasis on providing high-quality care and our attention to monitoring quality of care indicators has also helped to reduce our liability exposure and related costs.

Insurance

We maintain a variety of types of insurance, including general and professional liability, workers' compensation, employee benefits liability, property, casualty, directors' and officers' liability, crime, boiler and machinery, automobile, employment practices liability and earthquake and flood. We believe that our insurance programs are adequate and where there has been a direct transfer of risk to the insurance carrier, we do not recognize a liability in our consolidated financial statements. We self-insure a significant portion of our potential liabilities for several risks, including certain types of general and professional liability, workers' compensation, and employee benefit insurance. To the extent our insurance coverage is insufficient or unavailable to cover losses that we incur that would otherwise be insurable, or to the extent that our estimates of anticipated liabilities that we self-insure are significantly lower than the actual self-insured liabilities that we incur, our financial condition and results of operations could be materially and adversely affected. For additional information regarding our insurance programs, see Note 13, “Commitments and Contingencies - Insurance,” in the financial statements included elsewhere in this report.

Environmental Matters

We are subject to a wide variety of federal, state and local environmental and occupational health and safety laws and regulations. As a healthcare provider, we face regulatory requirements in areas of air and water quality control, medical and low-level radioactive waste management and disposal, asbestos management, response to mold and lead-based paint in our facilities and employee safety.

In our role as owner and/or operator of our facilities (including our leased facilities), we also may be required to investigate and remediate hazardous substances that are located on the property, including any such substances that may have migrated off, or discharged or transported from the property. Part of our operations involves the handling, use, storage, transportation, disposal and/or discharge of hazardous, infectious, toxic, flammable and other hazardous materials, wastes, pollutants or contaminants. These activities may result in damage to individuals, property or the environment; may interrupt operations and/or increase costs; may result in legal liability, damages, injunctions or fines; may result in investigations, administrative proceedings, penalties or other governmental agency actions; and may not be covered by insurance. We believe that we are in material compliance with applicable environmental and occupational health and safety requirements. However, there can be no assurance that we will not incur environmental liabilities in the future, and such liabilities may result in material adverse consequences to our operations and financial condition.

Customers

No individual customer or client accounts for a significant portion of our revenue. We do not expect that the loss of a single customer or client would have a material adverse effect on our business, results of operations or financial condition.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are filed with the U.S. Securities and Exchange Commission ("SEC"). Such reports and other information filed by us with the SEC are available free of charge at the investor relations section of our website at www.genesishcc.com as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. Copies are also available, without charge, by writing to Genesis Healthcare, Inc. Investor Communications, 101 East State Street, Kennett Square, PA 19348. Reports filed with the SEC may be viewed at www.sec.gov or obtained at the SEC Public Reference Room located at 100 F Street, NE, Washington, D.C. 20549. Information regarding the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The inclusion of our website address in this annual report does not include or incorporate by reference the information on our website into this annual report.

Company History

Genesis Healthcare, Inc. was incorporated as SHG Holding Solutions, Inc. in Delaware in October 2005. Our predecessor company acquired Summit Care Corporation, a publicly traded long-term care company with nursing facilities in California, Texas and Arizona, in 1998. In October 2001, our predecessor and 19 of its subsidiaries filed voluntary petitions for protection under Chapter 11 of the U.S. Bankruptcy Code and in November 2001, our remaining three companies also filed voluntary petitions for protection under Chapter 11. In August 2003, we emerged from bankruptcy, paying or restructuring all debt holders in full, paying all accrued interest expenses and issuing 5.0% of our common stock to former bondholders.

In February 2007, we effected the merger of our predecessor company, which was our wholly-owned subsidiary, with and into us. We were the surviving company in the merger and changed our name from SHG Holding Solutions, Inc. to Skilled Healthcare Group, Inc. As a result of the merger, we assumed all of the rights and obligations of our predecessor company.

In June 2009, the United States Bankruptcy Court for the Central District of California granted entry of a final decree closing the aforementioned Chapter 11 cases.

On February 2, 2015, we completed the previously announced Combination with FC-GEN and changed the company name from "Skilled Healthcare Group, Inc." to "Genesis Healthcare, Inc." See "Note 18 - Combination with FC-GEN and Item 7 - Management’s Discussion and Analysis of Financial Conditions and Results of Operations - Liquidity and Capital Resources," for further details.

Item 1A. Risk Factors

Statements made by us in this report and in other reports and statements released by us that are not historical facts constitute "forward-looking statements" within the meaning of Section 21 of the Exchange Act. Statements that use words such as "believe," "anticipate," "estimate," "intend," "could," "plan," "expect," "project" or the negative of these, as well as similar expressions, are intended to identify forward-looking statements. These forward-looking statements are necessarily estimates and expectations reflecting the best judgment of our senior management based on our current estimates, expectations, forecasts and projections, and include comments that express our current opinions about trends and factors that may impact future

operating results. Such statements rely on a number of assumptions concerning future events, many of which are outside of our control, and involve known and unknown risks and uncertainties that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements, expressed or implied by such forward-looking statements. Any such forward-looking statements, whether made in this report or elsewhere, should be considered in the context of the various disclosures made by us about our business and other matters including, without limitation, the risk factors discussed below. We expressly disclaim any duty to update the forward-looking statements and other information contained in this report, except as required by law.

We operate in a rapidly changing and highly regulated environment that involves a number of risks and uncertainties, some of which are highlighted below and others are discussed elsewhere in this report. In addition, we may be exposed to risks relating to our Combination with FC-GEN. These risks and uncertainties could materially and adversely affect our business, financial condition, prospects, operating results or cash flows. The following risk factors are not the only ones facing us. Our business is also subject to the risks that affect many other companies, such as employment relations, natural disasters, general economic conditions and geopolitical events. Further, additional risks not currently known to us or that we currently believe are immaterial may in the future materially and adversely affect our business, operations, liquidity and stock price.

Risks Related to Our Business

Reductions in Medicare reimbursement rates, or changes in the rules governing the Medicare program could have a material adverse effect on our revenue, financial condition and results of operations.

We receive a significant portion of our revenue from Medicare, which accounted for 28.4% of our consolidated revenue during 2014 and 30.9% in 2013. In addition, many private payors base their reimbursement rates on the published Medicare rates or, in the case of our rehabilitation therapy services customers, are themselves reimbursed by Medicare for the services we provide. Accordingly, if Medicare reimbursement rates are reduced or fail to increase as quickly as our costs, or if there are changes in the rules governing the Medicare program that are disadvantageous to our business or industry, our business and results of operations will be adversely affected.

The Medicare program and its reimbursement rates and rules are subject to frequent change. These include statutory and regulatory changes, rate adjustments (including retroactive adjustments), administrative or executive orders and government funding restrictions, all of which may materially adversely affect the rates at which Medicare reimburses us for our services. For example, CMS implemented a net 11.1% reduction in its reimbursement rates to skilled nursing facilities effective October 1, 2011. Furthermore, due to the federal sequestration, an automatic 2% reduction in Medicare spending took effect beginning in April 2013 and will remain in effect unless Congress takes action to terminate the automatic reduction or authorize spending increases. Budget pressures often lead the federal government to reduce or place limits on reimbursement rates under Medicare. Implementation of these and other types of measures has in the past and could in the future result in substantial reductions in our revenue and operating margins. Prior reductions in governmental reimbursement rates partially contributed to our predecessor's bankruptcy filing under Chapter 11 of the United States Bankruptcy Code in October 2001.

In addition, the federal government often changes the rules governing the Medicare program, including those governing reimbursement. Changes that could adversely affect our business include:

| |

• | administrative or legislative changes to base rates or the bases of payment; |

| |

• | limits on the services or types of providers for which Medicare will provide reimbursement; |

| |

• | changes in methodology for patient assessment and/or determination of payment levels; |

| |

• | the reduction or elimination of annual rate increases; or |

| |

• | an increase in co-payments or deductibles payable by beneficiaries. |

Given the history of frequent revisions to the Medicare program and its reimbursement rates and rules, we may not continue to receive reimbursement rates from Medicare that sufficiently compensate us for our services or, in some instances, cover our operating costs. Limits on reimbursement rates or the scope of services being reimbursed could have a material adverse effect on our revenue, financial condition and results of operations. Additionally, any delay or default by the federal or state governments in making Medicare and/or Medicaid reimbursement payments could materially and adversely affect our business, financial condition and results of operations.

We expect the federal and state governments to continue their efforts to contain growth in Medicaid expenditures, which could adversely affect our revenue and profitability.

Medicaid is our largest source of revenue, accounting for 34.1% of our consolidated revenue for the twelve months ended December 31, 2014 and 31.6% for the twelve months ended December 31, 2013. Medicaid is a state-administered program financed by both state funds and matching federal funds. Medicaid spending has increased rapidly in recent years, becoming a significant component of state budgets. This, combined with slower state revenue growth, has led both the federal government and many states (including California and Texas, where significant portions of our Medicaid-related business is located) to

institute measures aimed at controlling the growth of Medicaid spending, and in some instances reducing aggregate Medicaid spending. We expect these state and federal efforts to continue for the foreseeable future. Furthermore, not all of the states in which we operate, most notably Texas, have elected to expand Medicaid as part of federal healthcare reform legislation. Additionally, certain of our subsidiaries in Texas participate in a state inter-governmental payment program that provides supplemental Medicaid payments with federal matching funds for skilled nursing facilities that are affiliated with county owned hospital districts. There can be no assurance that the program, or the Company's participation in it, on the current terms or otherwise, will continue for any particular period of time beyond the foreseeable future. If Medicaid reimbursement rates are reduced or fail to increase as quickly as our costs, or if there are changes in the rules governing the Medicaid program that are disadvantageous to our businesses, our business and results of operations could be materially and adversely affected.

Recent federal government proposals could limit the states' use of provider tax programs to generate revenue for their Medicaid expenditures, which could result in a reduction in our reimbursement rates under Medicaid.

To generate funds to pay for the increasing costs of the Medicaid program, many states utilize financial arrangements commonly referred to as "provider taxes." Under provider tax arrangements, states collect taxes from healthcare providers and then use the revenue to pay the providers as a Medicaid expenditure, which allows the states to then claim additional federal matching funds on the additional reimbursements. Current federal law provides for a cap on the maximum allowable provider tax as a percentage of the provider's total revenue. There can be no assurance that federal law will continue to provide matching federal funds on state Medicaid expenditures funded through provider taxes, or that the current caps on provider taxes will not be reduced. Any discontinuance or reduction in federal matching of provider tax-related Medicaid expenditures could have a significant and adverse effect on states' Medicaid expenditures, and as a result could have a material and adverse effect on our financial condition and results of operations.

Revenue we receive from Medicare and Medicaid is subject to potential retroactive reduction.