UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

250 West 34th Street, 3rd Floor

New York, NY 10119

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 909-9473

Date of fiscal year end: August 31

Date of reporting period: August 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Reports to Shareholders are attached herewith. |

WisdomTree Trust

Annual Report

August 31, 2023

Currency Strategy Funds:

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

WisdomTree Chinese Yuan Strategy Fund (CYB)

WisdomTree Emerging Currency Strategy Fund (CEW)

Fixed Income Funds:

WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

WisdomTree Emerging Markets Local Debt Fund (ELD)

WisdomTree Floating Rate Treasury Fund (USFR)

WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD)

WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund (AGZD)

WisdomTree Mortgage Plus Bond Fund (MTGP)

WisdomTree Voya Yield Enhanced USD Universal Bond Fund (UNIY)

WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY)

WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG)

Alternative Funds:

WisdomTree Alternative Income Fund (HYIN)

WisdomTree Efficient Gold Plus Equity Strategy Fund (GDE)

WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN)

WisdomTree Enhanced Commodity Strategy Fund (GCC)

WisdomTree Managed Futures Strategy Fund (WTMF)

WisdomTree PutWrite Strategy Fund (PUTW)

(formerly, WisdomTree CBOE S&P 500 PutWrite Strategy Fund)

WisdomTree Target Range Fund (GTR)

| 1 | ||||

| Information about Performance and Shareholder Expense Examples (unaudited) |

3 | |||

| 4 | ||||

| 23 | ||||

| Schedules of Investments | ||||

| 29 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| 41 | ||||

| 45 | ||||

| 46 | ||||

| 55 | ||||

| 83 | ||||

| 86 | ||||

| 115 | ||||

| WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund |

148 | |||

| 158 | ||||

| WisdomTree Efficient Gold Plus Equity Strategy Fund (consolidated) |

159 | |||

| WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (consolidated) |

166 | |||

| 168 | ||||

| 170 | ||||

| 172 | ||||

| 173 | ||||

| 174 | ||||

| 178 | ||||

| 182 | ||||

| 189 | ||||

| 200 | ||||

| 222 | ||||

| 224 | ||||

| 225 | ||||

| 227 | ||||

| 230 | ||||

“WisdomTree” is a registered mark of WisdomTree, Inc. (formerly, WisdomTree Investments, Inc.) and is licensed for use by the WisdomTree Trust.

(unaudited)

Global equity markets, as measured by the MSCI ACWI Index, returned 13.95% in U.S. dollar (“USD”) terms for the 12-month period ending August 31, 2023. Over the same period, U.S. equities, measured by the S&P 500 Index, returned 15.94%. Internationally, the MSCI EAFE Index, which represents equity markets in the developed world outside the U.S. and Canada, returned 17.92% in USD terms. Within the developing world, the MSCI Emerging Markets Index returned 1.25% in USD terms.

The Bloomberg U.S. Aggregate Bond Index, a measurement of broad U.S. fixed income, fell 1.19% during the period. Commodities continued to slip from their post-pandemic highs, with the Bloomberg Commodity Index, representing global commodity markets, lost 8.67%. Foreign exchange performance over the 12-month period was also mixed, but the USD generally weakened against a basket of most developed and emerging market currencies. Among Group of Ten (“G10”) currencies, only the Swiss franc, British pound, euro, and Danish krone strengthened against the USD, as their own economic outlooks suggested further interest rate hikes would be needed to quell local inflation, whereas investors grew convinced that the Federal Reserve’s (“Fed”) rate hike cycle in the U.S. was at, or near, its conclusion. The remaining G10 currencies weakened against the USD, while only a small handful of notable emerging market currencies strengthened against it. Among Asian currencies, the USD continued to strengthen against the Japanese yen due to policy rate differentials and the Chinese yuan renminbi due to economic growth concerns amid the Chinese property market crisis. The CBOE® Volatility Index, which measures options market positioning as a proxy for volatility, steadily declined over the period and exhibited brief spikes coinciding with headline risks.

Although equity markets climbed higher during the period, the first three months (from September to November 2022) got off to a slow start. U.S. inflation began to decelerate after peaking in the summertime months. Though this would ultimately lead to 75 more basis points of interest rate hikes from the Fed, finishing November at 4%, it ultimately encouraged investors that the worst had passed, and disinflation and a reduced pace of interest rate hikes would continue. Despite the economic data, developed equity markets climbed higher. The MSCI ACWI and S&P 500 indexes grew between 3-4% in USD terms. The MSCI EAFE index fared even better, returning over 6% in USD terms. Emerging markets did not participate in the equity uptrend, however, falling about 2% by November’s end. Bond market volatility remained constant during this three-month period, as the Bloomberg U.S. Aggregate Bond Index fell 2% due to pressure from rising interest rates. The U.S. 10-Year Treasury Yield illustrated the volatility well. It began September at about 3.2%, surged to over 4.2% by mid-October, and fell to 3.6% to end November. The U.S. yield curve remained deeply inverted. Commodities fell by about 4%.

The three-month period encompassing December 2022 through February 2023 exhibited mixed equity market activity as U.S. inflation rates continued to decelerate but remained stubbornly higher than investors had expected. This prompted the Fed to raise interest rates another 75 basis points to 4.75%. In USD terms, the MSCI ACWI and MSCI Emerging Markets indexes were flat while the S&P 500 lost a little more than 2%. Only the MSCI EAFE Index kept pace with the prior three-month period, returning another 6% in USD terms. The Bloomberg U.S. Aggregate Bond Index was flat, with volatility remaining a constant. Though the yield curve remained inverted, the 10-Year U.S. Treasury yield responded to changing investor perceptions about the U.S. economy. It began December at 3.6%, climbed higher to about 3.85%, then fell to under 3.4%, before it finished February over 3.9%. Commodities fell over 7.5% by the end of February as global disinflation continued.

The March through May 2023 period began to send global equities slightly higher as U.S. inflation decelerated down to 4% year-over-year, much closer to the Fed’s 2% target rate and marking twelve straight months of disinflation from a peak in June 2022. The Fed was encouraged by this, opting to raise interest rates only 50 basis points further to finish May at 5.25%. In USD terms, the MSCI ACWI Index grew almost 3.5%, while the S&P 500 climbed higher by about 6%. The MSCI EAFE and MSCI Emerging Markets Indexes were

| WisdomTree Trust | 1 |

Market Environment Overview

(unaudited) (concluded)

roughly flat in USD terms. The Bloomberg U.S. Aggregate Index grew by 2% as rates slightly fell, although the U.S. yield curve remained inverted. The U.S. 10-Year Treasury yield began March at roughly 3.9% and fell as low as 3.3% before climbing back to 3.64% by the end of May. Commodities continued to fall as inflation decelerated, with the Bloomberg Commodity Index losing 6.5%.

The final three months, from June through August 2023, exhibited most of the equity markets’ gains for the entire period. U.S. inflation stabilized in the 3% range despite ticking back up slightly in the late summer months. This did not discourage the Fed, however, who raised rates 25 basis points to 5.5% in July and kept rates there ever since. During this period the MSCI ACWI Index grew nearly 7% in USD terms, while the S&P 500 returned over 8%. The MSCI Emerging Markets and MSCI EAFE Indexes grew 3.5-4% apiece in USD terms. The Bloomberg U.S. Aggregate Bond Index remained flat, losing only 1%. Though the yield curve remained inverted, it steepened during the period and reduced the extent of inversion. The U.S. 10-Year Treasury yield steadily climbed higher from 3.65%, peaking 4.34% in late August before concluding the period at 4.1%. Commodities finally bounced back after larger than expected oil supply cuts from OPEC raised global prices, sending the Bloomberg Commodity Index higher by almost 10%.

Each WisdomTree Fund’s performance as set forth in “Management’s Discussion of Funds’ Performance” in the pages that follow should also be viewed in light of the foregoing market environment.

| 2 | WisdomTree Trust |

Information about Performance and Shareholder Expense Examples (unaudited)

Performance

The performance tables on the following pages are provided for comparative purposes and represent the period noted. Each Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the midpoint of the bid and ask price for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange traded funds (“ETFs”), NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

Fund shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Fund NAV returns are calculated using a Fund’s daily 4:00 p.m. eastern time NAV. Market price returns reflect the midpoint of the bid and ask price as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end performance information visit www.wisdomtree.com/investments.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and an index is not available for direct investment. In comparison, the Funds’ performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions. Past performance is no guarantee of future results.

Shareholder Expense Examples

Each Fund’s performance table is accompanied by a shareholder expense example. As a shareholder of a WisdomTree Fund, you incur two types of cost: (1) transaction costs, including brokerage commissions on purchases and sales of your Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from March 1, 2023 to August 31, 2023. Except where noted, expenses are calculated using each Fund’s annualized expense ratio (after the effect of contractual or voluntary fee waivers, if any), multiplied by the average account value for the period, multiplied by 184/365 (to reflect the one-half year period). The annualized expense ratio does not include acquired fund fees and expenses (“AFFEs”), which are fees and expenses incurred indirectly by a Fund through its investments in certain underlying investment companies.

Actual expenses

The first line in the shareholder expense example table shown on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical example for comparison purposes

The second line in the shareholder expense example table shown on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| WisdomTree Trust | 3 |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| U.S. Government Obligations |

93.3% | |||

| Exchange-Traded Funds |

4.5% | |||

| Other Assets less Liabilities‡ |

2.2% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Holdings*

| Description | % of Net Assets | |||

| U.S. Treasury Bills, |

24.1% | |||

| U.S. Treasury Bills, |

23.6% | |||

| U.S. Treasury Bills, |

23.2% | |||

| U.S. Treasury Bills, |

22.4% | |||

| WisdomTree Floating Rate Treasury Fund (USFR)^ |

4.5% | |||

| * | The largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| ^ | For a full list of holdings information for the underlying WisdomTree fund, please see page 45 of this report. |

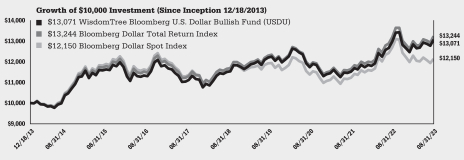

The WisdomTree Bloomberg U.S. Dollar Bullish Fund (the “Fund”) seeks to provide total returns, before fees and expenses, that exceed the performance of the Bloomberg Dollar Total Return Index (the “Index”). The Fund seeks to achieve its investment objective by investing in short-term securities and instruments designed to potentially benefit as the U.S. dollar appreciates in value relative to a basket of global currencies. Although the Fund invests in short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The Fund returned 0.71% at net asset value (“NAV”) for the fiscal year ended August 31, 2023, outperforming the Index by 0.34% (for more complete performance information please see the table below). Interest generated on the underlying investment in short-term U.S. Treasury obligations and the positive net interest differentials embedded in the forward contracts offset an overall decline in the U.S. dollar (“USD”) relative to the selected basket of global currencies. The positive influence of interest income came as the U.S. Federal Reserve continued to tighten monetary policy, lifting U.S. short-term rates to 22-year highs. After sharp appreciation in fiscal year 2022, the USD lost momentum and eventually reversed in 2023 as continued tightening by the U.S. Federal Reserve fed potential growth concerns amid extended investor positioning. Strength in late summer economic data mitigated some of these concerns, enabling the USD to recover lost ground in August.

At the end of March, the Index adopted some methodology changes, which brought it more in line with the investment approach of the Fund. The Index now tracks a collateral investment in U.S. short-term interest rates combined with currency forward positions to achieve the desired currency exposure. These positions are rolled monthly. Previously, the Index tracked changes in the spot currency of the USD relative to the basket of global currencies plus a calculated interest component reflecting both U.S. and global short-term interest rates.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Net Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,018.50 | 0.50 | %1 | $ | 2.54 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.68 | 0.50 | %1 | $ | 2.55 | ||||||||

| 1 | WisdomTree Asset Management, Inc. voluntarily waives a portion of its advisory fee, that it would otherwise charge, in an amount equal to the acquired fund fees and expenses (“AFFEs”) attributable to the Fund’s investment in the underlying WisdomTree fund. The “Annualized Net Expense Ratio” does not include the impact of AFFEs. |

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

| Fund NAV Returns |

0.71 | % | 3.64 | % | 2.58 | % | 2.80 | % | ||||||||

| Fund Market Price Returns |

0.77 | % | 3.59 | % | 2.59 | % | 2.81 | % | ||||||||

| Bloomberg Dollar Total Return Index |

0.37 | % | 3.88 | % | 2.56 | % | 2.94 | % | ||||||||

| Bloomberg Dollar Spot Index |

-4.28 | % | 2.22 | % | 0.96 | % | 2.03 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on December 18, 2013. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 4 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Chinese Yuan Strategy Fund (CYB)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| U.S. Government Obligations |

67.9% | |||

| Repurchase Agreement |

27.2% | |||

| Exchange-Traded Funds |

4.5% | |||

| Other Assets less Liabilities‡ |

0.4% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Holdings*

| Description | % of Net Assets | |||

| U.S. Treasury Bills, |

35.3% | |||

| U.S. Treasury Bills, |

32.6% | |||

| Citigroup, Inc., tri-party

repurchase agreement, |

27.2% | |||

| WisdomTree Floating Rate Treasury Fund (USFR)^ |

4.5% | |||

| * | The largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government agency securities. |

| ^ | For a full list of holdings information for the underlying WisdomTree fund, please see page 45 of this report. |

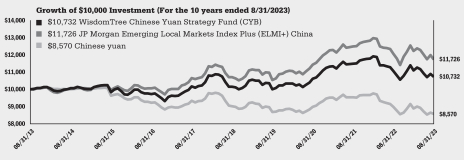

The WisdomTree Chinese Yuan Strategy Fund (the “Fund”) seeks to achieve total returns reflective of both money market rates in China available to foreign investors and changes in value of the Chinese yuan relative to the U.S. dollar (“USD”). The Fund seeks to achieve its investment objective by investing in short-term securities and instruments designed to provide exposure to Chinese currency and money market rates. The Chinese yuan is a developing market currency, which can experience periods of significant volatility. Although the Fund invests in short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The Fund returned -2.93% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). China’s re-opening since the lifting of the Zero-Covid policy in early December 2022 has not generated a robust bounce back with its economy struggling with weak growth, falling prices, a real estate bubble and an increasing unemployment rate among college graduates. The Chinese yuan continued to depreciate against the USD as the People’s Bank of China continued cutting interest rates while the U.S. Fed stayed in the quantitative tightening cycle and the USD generally appreciated after January 2023. The Fund experienced a depreciation in its onshore Chinese yuan forward position, both from spot market movement and negative carry (interest rate differential) while the offshore yuan position also depreciated but with a modest cushion from positive carry. The interest generated on the Fund’s investment in short-term U.S. Treasury obligations offset some of the negative detraction in performance.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Net Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 966.10 | 0.45 | %1 | $ | 2.23 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.94 | 0.45 | %1 | $ | 2.29 | ||||||||

| 1 | WisdomTree Asset Management, Inc. voluntarily waives a portion of its advisory fee, that it would otherwise charge, in an amount equal to the acquired fund fees and expenses (“AFFEs”) attributable to the Fund’s investment in the underlying WisdomTree fund. The “Annualized Net Expense Ratio” does not include the impact of AFFEs. |

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| Fund NAV Returns |

-2.93 | % | 0.38 | % | 1.11 | % | 0.71 | % | ||||||||

| Fund Market Price Returns |

-2.54 | % | 0.28 | % | 1.19 | % | 0.73 | % | ||||||||

| JP Morgan Emerging Local Markets Index Plus (ELMI+) China |

-2.81 | % | 0.85 | % | 1.83 | % | 1.61 | % | ||||||||

| Chinese yuan |

-4.55 | % | -1.58 | % | -1.04 | % | -1.53 | % | ||||||||

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 5 |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Emerging Currency Strategy Fund (CEW)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| U.S. Government Obligations |

97.4% | |||

| Exchange-Traded Funds |

3.9% | |||

| Repurchase Agreement |

0.7% | |||

| Other Assets less Liabilities‡ |

-2.0% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Holdings*

| Description | % of Net Assets | |||

| U.S. Treasury Bills, |

50.5% | |||

| U.S. Treasury Bills, |

46.9% | |||

| WisdomTree Floating Rate Treasury Fund (USFR)^ |

3.9% | |||

| Citigroup, Inc., tri-party

repurchase agreement, |

0.7% | |||

| * | The largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government agency securities. |

| ^ | For a full list of holdings information for the underlying WisdomTree fund, please see page 45 of this report. |

The WisdomTree Emerging Currency Strategy Fund (the “Fund”) seeks to achieve total returns reflective of both money market rates in selected emerging market countries available to foreign investors and changes to the value of these currencies relative to the U.S. dollar. The Fund seeks to achieve its investment objective by investing in short-term securities and instruments designed to provide exposure to the currencies and money market rates of selected emerging market countries. Emerging market currencies can experience periods of significant volatility. Although the Fund invests in short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The Fund returned 8.20% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). The Fund benefited from the carry or interest rate differentials embedded in emerging markets currency forwards, as well as interest income generated from the investment in the short-term U.S. government securities underpinning the forward positions. This income return offset a slight decline in the currencies within the Fund relative to the U.S. dollar over the fiscal year. The Fund modestly underperformed its performance benchmark the JP Morgan Emerging Local Market Index Plus (8.54%) by 0.34% based on the Fund’s 1-year NAV return, as the 0.21% of outperformance from the investments was less than the Fund’s expense ratio.

Returns were driven by exposures to Latin American currencies and the Polish zloty. Exposures to China, South Africa, Thailand, and Malaysia detracted from performance. Relative to the index, excess returns generated from overweights to selected Latin American currencies, such as Brazil, Chile, and Colombia, were offset by less exposure to European currencies and an underweight to the Mexican peso.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Net Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,038.20 | 0.55 | %1 | $ | 2.83 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.43 | 0.55 | %1 | $ | 2.80 | ||||||||

| 1 | WisdomTree Asset Management, Inc. voluntarily waives a portion of its advisory fee, that it would otherwise charge, in an amount equal to the acquired fund fees and expenses (“AFFEs”) attributable to the Fund’s investment in the underlying WisdomTree fund. The “Annualized Net Expense Ratio” does not include the impact of AFFEs. |

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| Fund NAV Returns |

8.20 | % | 0.73 | % | 0.71 | % | -0.54 | % | ||||||||

| Fund Market Price Returns |

8.22 | % | 0.69 | % | 0.69 | % | -0.55 | % | ||||||||

| JP Morgan Emerging Local Markets Index Plus (ELMI+) |

8.54 | % | -0.50 | % | 0.56 | % | -0.17 | % | ||||||||

| Equal-Weighted Emerging Currency Composite |

9.25 | % | -0.55 | % | 0.34 | % | -0.34 | % | ||||||||

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 6 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

Country Breakdown†

| Country | % of Net Assets | |||

| Mexico |

8.5% | |||

| South Korea |

7.2% | |||

| Brazil |

6.3% | |||

| United Kingdom |

5.8% | |||

| India |

5.3% | |||

| Colombia |

4.5% | |||

| China |

4.4% | |||

| Chile |

4.4% | |||

| Israel |

4.1% | |||

| United Arab Emirates |

3.6% | |||

| Saudi Arabia |

2.9% | |||

| Thailand |

2.7% | |||

| Mongolia |

2.6% | |||

| Turkey |

2.4% | |||

| South Africa |

2.4% | |||

| Malaysia |

2.3% | |||

| Kuwait |

1.9% | |||

| Qatar |

1.7% | |||

| United States |

1.5% | |||

| Spain |

1.5% | |||

| Poland |

1.4% | |||

| Hong Kong |

1.3% | |||

| Luxembourg |

1.3% | |||

| Panama |

1.3% | |||

| Australia |

1.2% | |||

| Guatemala |

1.2% | |||

| Indonesia |

1.1% | |||

| Ireland |

1.1% | |||

| Others^ |

8.2% | |||

| Other Assets less Liabilities‡ |

5.9% | |||

| Total |

100.0% | |||

| † | The Fund’s country breakdown may change over time. It does not include derivatives (if any). |

| ^ | Includes countries that represent less than 1% of net assets. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| Sands China Ltd., |

1.8% | |||

| HSBC Holdings PLC, |

1.5% | |||

| Saudi Arabian Oil Co., |

1.4% | |||

| Ecopetrol SA, |

1.3% | |||

| AngloGold Ashanti Holdings PLC, |

1.2% | |||

| Turkiye Sise ve Cam Fabrikalari AS, |

1.2% | |||

| JSW Steel Ltd., |

1.2% | |||

| Nexa Resources SA, |

1.2% | |||

| Engie Energia Chile SA, |

1.1% | |||

| POSCO, |

1.1% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

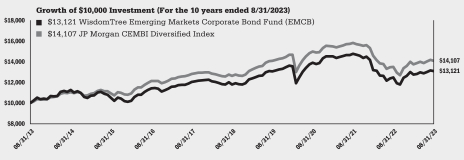

The WisdomTree Emerging Markets Corporate Bond Fund (the “Fund”) seeks a high level of total return consisting of both income and capital appreciation. The Fund attempts to achieve its objective through investments in U.S. dollar denominated debt securities issued by corporate entities that are domiciled in, or economically tied to, emerging market (“EM”) countries.

The Fund returned 5.11% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). Despite continued hawkish central bank rhetoric out of developed markets, EM remained resilient and was somewhat supported by EM central banks, which are nearing the end of their tightening cycles across countries. This has led to continued compression in the spread for EM assets. Returns were broad-based across sovereigns, quasi-sovereigns and EM corporates, as well as by region and credit ratings. The primary driver of relative performance was the Fund’s overweight to Latin America and underweight to Asia. During the fiscal year, the Fund utilized derivatives to manage interest rate risk. The Fund’s use of derivatives to shorten the portfolio’s duration contributed positively to Fund performance.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,028.90 | 0.60 | % | $ | 3.07 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.18 | 0.60 | % | $ | 3.06 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| Fund NAV Returns |

5.11 | % | -1.92 | % | 2.13 | % | 2.76 | % | ||||||||

| Fund Market Price Returns |

5.48 | % | -2.09 | % | 2.18 | % | 2.81 | % | ||||||||

| JP Morgan CEMBI Diversified Index |

4.36 | % | -1.99 | % | 2.22 | % | 3.50 | % | ||||||||

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 7 |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Emerging Markets Local Debt Fund (ELD)

Country Breakdown†

| Country | % of Net Assets | |||

| Brazil |

12.4% | |||

| Indonesia |

11.4% | |||

| Colombia |

9.0% | |||

| Malaysia |

7.5% | |||

| Supranational Bonds |

7.1% | |||

| China |

6.3% | |||

| United States |

6.2% | |||

| Poland |

4.9% | |||

| South Africa |

4.8% | |||

| Mexico |

4.8% | |||

| Thailand |

4.4% | |||

| Peru |

4.2% | |||

| India |

3.4% | |||

| Chile |

3.2% | |||

| Czech Republic |

2.5% | |||

| Hungary |

2.1% | |||

| Romania |

2.0% | |||

| Turkey |

0.7% | |||

| Egypt |

0.0% | ^ | ||

| Other Assets less Liabilities‡ |

3.1% | |||

| Total |

100.0% | |||

| † | The Fund’s country breakdown may change over time. It does not include derivatives (if any). |

| ^ | Represents less than 0.1%. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| Citigroup, Inc., tri-party

repurchase agreement, |

6.2% | |||

| Brazil Letras do Tesouro Nacional, |

2.3% | |||

| Brazil Letras do Tesouro Nacional, |

2.1% | |||

| Brazil Notas do Tesouro Nacional, |

1.9% | |||

| Brazil Notas do Tesouro Nacional, |

1.8% | |||

| China Government Bond, |

1.5% | |||

| International Finance Corp., |

1.5% | |||

| Colombian TES, |

1.3% | |||

| Brazil Notas do Tesouro Nacional, |

1.3% | |||

| Brazil Letras do Tesouro Nacional, |

1.3% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government agency securities. |

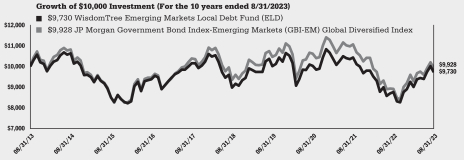

The WisdomTree Emerging Markets Local Debt Fund (the “Fund”) seeks a high level of total return consisting of both income and capital appreciation. The Fund attempts to achieve its objective through investments in fixed income instruments denominated in the local currencies of emerging market (“EM”) countries.

The Fund returned 11.83% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). Coupon, bond price, and local currency return were all positive contributors to performance, with coupon return being particularly influential. The Fund started the year under pressure, declining 7% by late October amid Fed tightening, pressure from rising U.S. rates and sharp increases in the U.S. dollar. As a more positive environment for risk assets developed, EM currency exposures within the Fund recovered, and EM rates began to decline on positive disinflation trends in many EM countries.

The Fund outperformed the JP Morgan GBI-EM Global Diversified Index (the “Index”) by 49 basis points over the fiscal year based on the Fund’s 1-year NAV return. Underweights in European and Asian exposures detracted from relative performance in the first half of the year, while strength in Latin American exposures helped the Fund recover some of the performance deficit that occurred in the last six months of the Fund’s fiscal year.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,079.60 | 0.55 | % | $ | 2.88 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.43 | 0.55 | % | $ | 2.80 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| Fund NAV Returns |

11.83 | % | -1.03 | % | 1.62 | % | -0.27 | % | ||||||||

| Fund Market Price Returns |

11.28 | % | -0.80 | % | 1.69 | % | -0.15 | % | ||||||||

| JP Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified Index |

11.34 | % | -2.25 | % | 1.20 | % | -0.07 | % | ||||||||

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 8 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Floating Rate Treasury Fund (USFR)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| U.S. Government Obligations |

99.5% | |||

| Other Assets less Liabilities‡ |

0.5% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Holdings*

| Description | % of Net Assets | |||

| U.S. Treasury Floating Rate Notes, |

26.9% | |||

| U.S. Treasury Floating Rate Notes, |

26.9% | |||

| U.S. Treasury Floating Rate Notes, |

26.8% | |||

| U.S. Treasury Floating Rate Notes, |

18.9% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

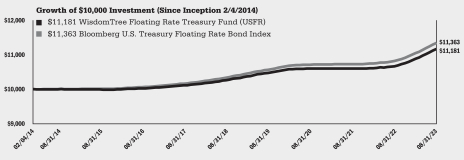

The WisdomTree Floating Rate Treasury Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury Floating Rate Bond Index (the “Index”). In seeking to track the Index, the Fund invests in floating rate public obligations of the U.S. Treasury. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the Index as a whole.

The Fund returned 4.75% at net asset value (“NAV”) compared to 4.95% for the Index for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). As a result of the U.S. Federal Reserve (“Fed”) quantitative tightening, the Fund’s overall yield and performance resumed its upward trajectory from the previous fiscal year. It is expected that the Fed will continue to hold interest rates at a high level in order to curtail inflation more and ultimately bring inflation back down toward their goal of 2%. This higher-for-longer interest rate scenario will continue to be beneficial for the Fund.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,026.70 | 0.15 | % | $ | 0.77 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.45 | 0.15 | % | $ | 0.77 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

| Fund NAV Returns |

4.75 | % | 1.77 | % | 1.73 | % | 1.17 | % | ||||||||

| Fund Market Price Returns |

4.74 | % | 1.79 | % | 1.72 | % | 1.17 | % | ||||||||

| Bloomberg U.S. Treasury Floating Rate Bond Index |

4.95 | % | 1.95 | % | 1.90 | % | 1.34 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on February 4, 2014. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares

| WisdomTree Trust | 9 |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| Corporate Bonds |

95.6% | |||

| Other Assets less Liabilities‡ |

4.4% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| Sirius XM Radio, Inc., |

1.0% | |||

| DISH DBS Corp., |

1.0% | |||

| Transocean, Inc., |

0.9% | |||

| Post Holdings, Inc., |

0.9% | |||

| Centene Corp., |

0.8% | |||

| NGL Energy Operating LLC / NGL Energy Finance Corp., |

0.8% | |||

| Tenet Healthcare Corp., |

0.8% | |||

| DaVita, Inc., |

0.8% | |||

| CHS / Community Health Systems, Inc., |

0.7% | |||

| DISH DBS Corp., |

0.7% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

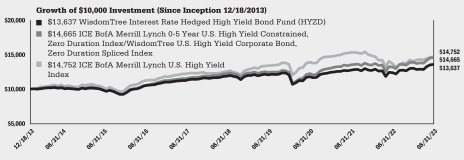

The WisdomTree Interest Rate Hedged High Yield Bond Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. High Yield Corporate Bond, Zero Duration Index (the “Index”). In seeking to track the Index, the Fund invests mainly in U.S. non-investment-grade corporate fixed income securities that are deemed to have favorable fundamental and income characteristics and obtains short exposure to U.S. Treasuries such that the Fund’s total portfolio duration approximates zero years. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the Index as a whole.

The Fund returned 9.74% at net asset value (“NAV”) compared to 10.65% for the Index, for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). During the fiscal year, interest rates climbed from the beginning of the fiscal year to recent highs during the summer of 2023, where the U.S. 10-year Treasury yield reached 4.11% after starting the fiscal year at 3.19%. The Fund’s use of short futures contracts on U.S. Treasuries to hedge interest rate risk was particularly additive to Fund performance during the fiscal year due to interest rate rises across the yield curve. The Fund’s 9.74% return compared favorably to the 7.01% generated by the broad high yield market (as measured by the ICE BofA Merrill Lynch U.S. High Yield Index). Both high-yield spread compression during the fiscal year as well as multi-decade high income offered by the asset class, helped the Fund generate a strong return in an environment where many more interest rate strategies generated losses. The Fund, given its high yield nature, relatively outperformed the investment grade credit market as the fiscal year was primarily driven by a “risk-on” widespread market rally.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,043.00 | 0.43 | % | $ | 2.21 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,023.04 | 0.43 | % | $ | 2.19 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

| Fund NAV Returns |

9.74 | % | 4.83 | % | 2.74 | % | 3.25 | % | ||||||||

| Fund Market Price Returns |

10.21 | % | 5.07 | % | 2.71 | % | 3.23 | % | ||||||||

| ICE BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained, Zero Duration Index/WisdomTree U.S. High Yield Corporate Bond, Zero Duration Spliced Index2 |

10.65 | % | 6.09 | % | 3.62 | % | 4.02 | % | ||||||||

| ICE BofA Merrill Lynch U.S. High Yield Index |

7.01 | % | 1.86 | % | 3.16 | % | 4.09 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on December 18, 2013. |

| 2 | ICE BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained, Zero Duration Index through May 31, 2020; WisdomTree U.S. High Yield Corporate Bond, Zero Duration Index thereafter. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 10 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund (AGZD)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| U.S. Government Obligations |

40.3% | |||

| U.S. Government Agencies |

28.6% | |||

| Corporate Bonds |

25.3% | |||

| Commercial Mortgage-Backed Securities |

1.7% | |||

| Supranational Bonds |

1.6% | |||

| Foreign Government Obligations |

0.9% | |||

| Municipal Bonds |

0.8% | |||

| Asset-Backed Securities |

0.4% | |||

| Foreign Government Agencies |

0.4% | |||

| U.S. Government Agencies TBA Sale Commitments |

-0.3% | |||

| Repurchase Agreement |

1.2% | |||

| Other Assets less Liabilities‡ |

-0.9% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| Citigroup, Inc., tri-party

repurchase agreement, |

1.2% | |||

| U.S. Treasury Notes, |

0.7% | |||

| U.S. Treasury Notes, |

0.6% | |||

| U.S. Treasury Notes, |

0.6% | |||

| Federal National Mortgage |

0.6% | |||

| Federal National Mortgage |

0.6% | |||

| U.S. Treasury Notes, |

0.5% | |||

| U.S. Treasury Notes, |

0.5% | |||

| U.S. Treasury Notes, |

0.5% | |||

| U.S. Treasury Notes, |

0.5% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government agency securities. |

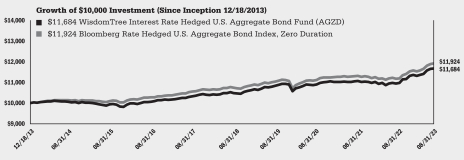

The WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Rate Hedged U.S. Aggregate Bond Index, Zero Duration (the “Index”). In seeking to track the Index, the Fund invests mainly in U.S. investment grade fixed income securities and obtains short exposure to U.S. Treasuries such that the Fund’s total portfolio duration approximates zero years. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the Index as a whole.

The Fund returned 6.35% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). The Fund outperformed the Index, by 15 basis points over the year net of fees. During the fiscal year, interest rates steadily climbed from the beginning of the fiscal year to recent highs during the summer of 2023, where the U.S. 10-year Treasury yield reached 4.11% after starting the fiscal year at 3.19%. The Fund’s use of short futures contracts on U.S. Treasuries to hedge interest rate risk was particularly additive to Fund performance during the fiscal year due to interest rate rises across the yield curve.

The U.S. Aggregate bond universe experienced largely negative performance from August to October 2022, primarily driven by “risk-on” assets selling off in the appearance of inverted yield curve, market fear of recession and uncertainty and longer duration bonds responding to interest rate hikes. However, signs of moderating inflation from below expectation in the October 2022 Consumer Price Index data improved market sentiment, bolstering values across the aggregate bond universe. While debate continues within the Fed regarding whether another rate hike is needed, restrictive monetary policy will likely continue for the foreseeable future which will continue to be beneficial for the Fund relative to strategies with longer duration.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,028.50 | 0.23 | % | $ | 1.18 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.05 | 0.23 | % | $ | 1.17 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

| Fund NAV Returns |

6.35 | % | 2.39 | % | 2.19 | % | 1.62 | % | ||||||||

| Fund Market Price Returns |

6.08 | % | 2.40 | % | 2.10 | % | 1.62 | % | ||||||||

| Bloomberg Rate Hedged U.S. Aggregate Bond Index, Zero Duration |

6.20 | % | 2.43 | % | 2.13 | % | 1.83 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on December 18, 2013. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 11 |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Mortgage Plus Bond Fund (MTGP)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| Collateralized Mortgage Obligations |

50.0% | |||

| U.S. Government Agencies |

42.6% | |||

| Commercial Mortgage-Backed Securities |

3.4% | |||

| Collateralized Loan Obligations |

2.9% | |||

| Other Assets less Liabilities‡ |

1.1% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| Federal National Mortgage Association, |

10.5% | |||

| Federal National Mortgage Association, |

4.6% | |||

| Federal Home Loan Mortgage Corp., |

3.4% | |||

| Federal Home Loan Mortgage Corp., |

2.8% | |||

| Seasoned Credit Risk Transfer Trust, |

2.7% | |||

| Government National Mortgage Association, |

2.3% | |||

| Federal National Mortgage Association, |

2.3% | |||

| Seasoned Credit Risk Transfer Trust, |

2.2% | |||

| Federal National Mortgage Association REMIC, |

1.9% | |||

| Flagstar Mortgage Trust, |

1.8% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

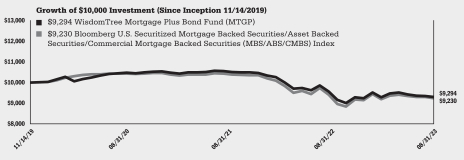

The WisdomTree Mortgage Plus Bond Fund (the “Fund”) seeks income and capital appreciation. The Fund attempts to achieve its objective through investments in mortgage-related debt and other securitized debt.

The Fund returned -2.87% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). Security selection within agency mortgages was a main source of differentiated relative performance between the Fund and the broader mortgage-backed securities (“MBS”) market. Persistent high inflation, albeit falling, and corresponding interest rates continued to keep the housing market muted, whereby new and existing home sales have remained on the lower end of the cycle. However, the low supply of existing homes available for sale has supported this market from otherwise worsening conditions. Agency MBS have been the laggard within the Bloomberg U.S. Aggregate Index this year partially due to the removal of years of stimulus and partly due to failed banks from earlier this spring. However, the Mortgage-Backed asset class was able to recover from the sell off during the regional banking crisis in March, thanks to declining interest rate volatility and improving market sentiment of the asset class. Within securitized credit sectors, Commercial Mortgage-Backed Securities (“CMBS”) continued to be directly impacted by the acute and ongoing credit pressures facing owners of commercial real estate and mortgage debt holders. The Fund’s intermediate level duration served as a headwind to performance as interest rates rose sharply over the fiscal year.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,000.80 | 0.45 | % | $ | 2.27 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.94 | 0.45 | % | $ | 2.29 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

| Fund NAV Returns |

-2.87 | % | -3.81 | % | -1.90 | % | ||||||

| Fund Market Price Returns |

-2.82 | % | -3.81 | % | -1.89 | % | ||||||

| Bloomberg U.S. Securitized Mortgage Backed Securities/Asset Backed Securities/Commercial Mortgage Backed Securities (MBS/ABS/CMBS) Index |

-1.96 | % | -3.99 | % | -2.09 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on November 14, 2019. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 12 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Voya Yield Enhanced USD Universal Bond Fund (UNIY)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| Corporate Bonds |

36.8% | |||

| U.S. Government Obligations |

30.1% | |||

| U.S. Government Agencies |

20.0% | |||

| Foreign Government Obligations |

3.5% | |||

| Commercial Mortgage-Backed Securities |

3.4% | |||

| Asset-Backed Securities |

1.2% | |||

| Foreign Government Agencies |

1.0% | |||

| Municipal Bonds |

0.8% | |||

| Supranational Bonds |

0.5% | |||

| Other Assets less Liabilities‡ |

2.7% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| U.S. Treasury Notes, |

2.5% | |||

| U.S. Treasury Notes, |

1.9% | |||

| Federal National Mortgage Association, |

1.9% | |||

| U.S. Treasury Notes, |

1.7% | |||

| U.S. Treasury Notes, |

1.7% | |||

| U.S. Treasury Notes, |

1.6% | |||

| U.S. Treasury Notes, |

1.4% | |||

| U.S. Treasury Notes, |

1.4% | |||

| U.S. Treasury Notes, |

1.3% | |||

| U.S. Treasury Notes, |

1.2% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

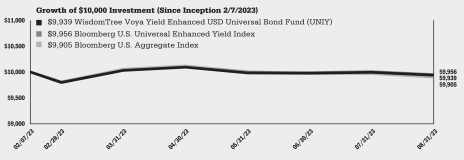

The WisdomTree Voya Yield Enhanced USD Universal Bond Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Universal Enhanced Yield Index (the “Index”). In seeking to track the Index, the Fund invests mainly in the U.S. dollar denominated bond market while enhancing yield within desired risk parameters and constraints. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the Index as a whole.

The Fund returned -0.61% at net asset value (“NAV”) for the fiscal period ended August 31, 2023 (for more complete performance information please see the table below). The Fund underperformed the Index by 17 basis points since the Fund’s inception on February 7, 2023.

The Fund benefitted from a sizable underweight to Treasuries as yields rose across the yield curve. The Fund’s overweight to corporates generated income from its short-duration, investment grade holdings due to the inverted yield curve. Given resilient strength in the economy and the labor market, the Federal Reserve (“Fed”) kept raising rates to combat inflation with the 10-year Treasury yield continuing to rise from 3.19% to 4.11% for the fiscal period ended August 31, 2023. The Fed tightening led to an extension in duration in those sectors, enabling the Fund to generate higher yields while taking less duration and interest rate risk compared to the benchmark index due to its underweighting positions in Treasury and Securitized sectors. The Fund also benefited as both high yield spread compression during the fiscal period as well as multi-decade high carry offered by the asset class from its overweight to the high yield and ex-aggregate bond universe. The negative impact from additional rate hikes started to decrease as the Fed neared the end of its rate hiking cycle and with higher yields serving as an extra cushion from price decreases.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,014.10 | 0.15 | % | $ | 0.76 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.45 | 0.15 | % | $ | 0.77 | ||||||||

Performance

| Cumulative Total Return | ||||

| Since Inception1 | ||||

| Fund NAV Returns |

-0.61 | % | ||

| Fund Market Price Returns |

-0.61 | % | ||

| Bloomberg U.S. Universal Enhanced Yield Index |

-0.44 | % | ||

| Bloomberg U.S. Aggregate Index |

-0.95 | % | ||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on February 7, 2023. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 13 |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| Corporate Bonds |

46.8% | |||

| U.S. Government Obligations |

21.4% | |||

| U.S. Government Agencies |

17.7% | |||

| Commercial Mortgage-Backed Securities |

6.7% | |||

| Asset-Backed Securities |

5.1% | |||

| Foreign Government Obligations |

2.0% | |||

| Foreign Government Agencies |

0.3% | |||

| Repurchase Agreement |

0.3% | |||

| Municipal Bonds |

0.1% | |||

| Supranational Bonds |

0.0% | ^ | ||

| U.S. Government Agencies TBA Sale Commitments |

-0.7% | |||

| Other Assets less Liabilities‡ |

0.3% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ^ | Represents less than 0.1%. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| Tennessee Valley Authority, |

0.9% | |||

| Federal Home Loan Bank, |

0.8% | |||

| Tennessee Valley Authority, |

0.7% | |||

| Uniform Mortgage-Backed Securities, |

0.7% | |||

| Uniform Mortgage-Backed Securities, |

0.5% | |||

| Federal National Mortgage Association, |

0.4% | |||

| Federal National Mortgage Association, |

0.4% | |||

| Tennessee Valley Authority, |

0.4% | |||

| Tennessee Valley Authority, |

0.4% | |||

| Tennessee Valley Authority, |

0.4% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

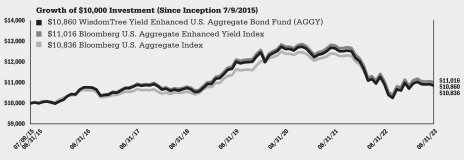

The WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Aggregate Enhanced Yield Index (the “Index”). In seeking to track the Index, the Fund invests mainly in U.S. investment grade fixed income securities. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the Index as a whole.

The Fund returned -0.66% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). The Fund underperformed its underlying, primary benchmark, the Bloomberg U.S. Aggregate Enhanced Yield Index, by 13 basis points, roughly in line with its annual expense ratio. The Fund outperformed its broader, secondary market benchmark: the Bloomberg U.S. Aggregate Index (“Agg Index”) by 53 basis points net of fees. This outperformance of the Agg Index was mainly driven by a sizable underweight to Treasuries as yields rose across the yield curve and the Fund’s overweight to corporates as income generated in the short-end, high quality paper across investment grade given the inverted yield curve. Given the resilient strength in the economy and the labor market, the Federal Reserve (“Fed”) kept raising rates to combat inflation with the 10-year Treasury yield continuing to rise from 3.19% to 4.11% for the fiscal year ended August 31, 2023. The Fed tightening led to the extension in duration in the Treasury and Securitized sectors, enabling the Fund to generate higher yields while taking less duration and interest rate risk compared to the benchmark Agg Index starting at the end of 2022 due to its underweighting positions in these sectors. The Fund outperformed the Agg Index also because of its overweight to the government agencies and industrial buckets. Allocation within these buckets added value as well.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,014.50 | 0.12 | % | $ | 0.61 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.60 | 0.12 | % | $ | 0.61 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

| Fund NAV Returns |

-0.66 | % | -4.91 | % | 0.23 | % | 1.01 | % | ||||||||

| Fund Market Price Returns |

-0.50 | % | -4.89 | % | 0.24 | % | 1.02 | % | ||||||||

| Bloomberg U.S. Aggregate Enhanced Yield Index |

-0.53 | % | -4.72 | % | 0.38 | % | 1.19 | % | ||||||||

| Bloomberg U.S. Aggregate Index |

-1.19 | % | -4.41 | % | 0.49 | % | 0.99 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on July 9, 2015. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 14 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| Corporate Bonds |

46.7% | |||

| U.S. Government Obligations |

41.8% | |||

| U.S. Government Agencies |

11.6% | |||

| Commercial Mortgage-Backed Securities |

6.3% | |||

| Foreign Government Agencies |

0.6% | |||

| Foreign Government Obligations |

0.2% | |||

| Supranational Bond |

0.1% | |||

| Asset-Backed Securities |

0.0% | ^ | ||

| Other Assets less Liabilities‡ |

-7.3% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ^ | Represents less than 0.1%. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| U.S. Treasury Notes, |

10.1% | |||

| U.S. Treasury Bills, |

8.5% | |||

| Uniform Mortgage-Backed Securities, |

5.1% | |||

| U.S. Treasury Notes, |

3.9% | |||

| U.S. Treasury Notes, |

3.0% | |||

| Uniform Mortgage-Backed Securities, |

2.8% | |||

| U.S. Treasury Notes, |

1.7% | |||

| U.S. Treasury Notes, |

1.6% | |||

| Benchmark Mortgage Trust, |

1.5% | |||

| U.S. Treasury Notes, |

1.4% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

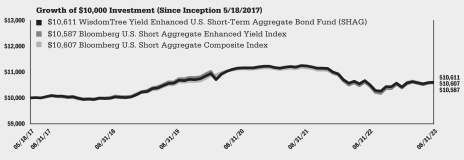

The WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Short Aggregate Enhanced Yield Index (the “Index”). In seeking to track the Index, the Fund invests mainly in short-term U.S. investment grade fixed income securities having effective maturities generally shorter than five years. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the Index as a whole.

The Fund returned 0.96% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). The Fund underperformed the Index, by 40 basis points net of fees. The Fund also underperformed the broader market benchmark the Bloomberg U.S. Short Aggregate Composite Index (“Short Agg Index”), by 10 basis points over the year, net of fees (gross of fees, the Fund’s 1-year return based on NAV was 2 basis points higher than the index). Rising rates over the fiscal year negatively affected performance due to the Fund’s slightly longer duration relative to the short Agg Index during second half of 2022 but as of August 31, 2023, the Fund had less duration and interest rate risk than the Short Agg Index. Given resilient strength in the economy and the labor market, the Federal Reserve kept raising rates to combat inflation with the 10-year Treasury yield rising from 3.19% to 4.11% for the fiscal year ended August 31, 2023. The Fund benefited from a significant underweight to longer term U.S. Treasuries as yields rose across the Treasury curve. From a sector perspective, the Fund’s overweight position to the Utilities sector corporate bonds contributed negatively to performance because of macroeconomic pressure and weak energy demand over the fiscal year.

Shareholder Expense Example (for the six-month period ended August 31, 2023)

| Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period |

|||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,018.10 | 0.12 | % | $ | 0.61 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.60 | 0.12 | % | $ | 0.61 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

| Fund NAV Returns |

0.96 | % | -1.69 | % | 1.12 | % | 0.95 | % | ||||||||

| Fund Market Price Returns |

1.01 | % | -1.70 | % | 1.08 | % | 0.94 | % | ||||||||

| Bloomberg U.S. Short Aggregate Enhanced Yield Index |

1.36 | % | -1.74 | % | 1.00 | % | 0.91 | % | ||||||||

| Bloomberg U.S. Short Aggregate Composite Index |

1.06 | % | -1.58 | % | 1.13 | % | 0.94 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on May 18, 2017. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 15 |

Management’s Discussion of Funds’ Performance

as of August 31, 2023 (unaudited)

WisdomTree Alternative Income Fund (HYIN)

Investment Breakdown†

| Investment Type | % of Net Assets | |||

| Common Stocks |

71.7% | |||

| Closed-End Mutual Funds |

27.9% | |||

| Other Assets less Liabilities‡ |

0.4% | |||

| Total |

100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

| Redwood Trust, Inc. |

3.4% | |||

| Angel Oak Mortgage REIT, Inc. |

3.3% | |||

| Arbor Realty Trust, Inc. |

3.2% | |||

| Hercules Capital, Inc. |

3.1% | |||

| Rithm Capital Corp. |

3.0% | |||

| Blackstone Mortgage Trust, Inc., Class A |

3.0% | |||

| Chimera Investment Corp. |

3.0% | |||

| FS KKR Capital Corp. |

3.0% | |||

| Golub Capital BDC, Inc. |

2.9% | |||

| Starwood Property Trust, Inc. |

2.9% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

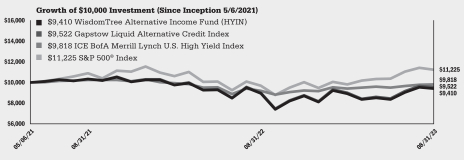

The WisdomTree Alternative Income Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Gapstow Liquid Alternative Credit Index (the “Index”), which is designed to provide diversified exposure to alternative credit sectors. Alternative credit is an asset class that includes debt and debt-based investments that have a higher expected risk, return, and yield than traditional investment grade fixed income instruments. In seeking to track the Index, the Fund invests mainly in registered closed-end investment companies (“CEFs”), including CEFs that have elected to be regulated as “business development companies” under the Investment Company Act of 1940, as amended, and real estate investment trusts that are listed and publicly traded on a major U.S. stock exchange. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the Index as a whole.

The Fund returned 5.28% at net asset value (“NAV”) for the fiscal year ended August 31, 2023 (for more complete performance information please see the table below). The Fund underperformed the Index, by 49 basis points, roughly in line with its management fee of 50 basis points. Interest rates in the U.S. continued to rise as the Federal Reserve moved along in their quantitative tightening to tame inflation, impacting many of the more interest rate sensitive strategies within the Fund. Accordingly, strategies linked to agency real estate debt (-9.5% in the Index) were the largest detractor from performance within the Fund and Index. Credit based strategies fared much better over the year as corporate fundamentals proved resilient. Private corporate lending (+16% in the Index) had the best performance among strategies in the Fund.

Shareholder Expense Example (for the six-month period ended August 31, 2023)