Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission file number: 000-52170

INNERWORKINGS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 20-5997364 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

600 West Chicago Avenue, Suite 850, Chicago, IL 60654 | | (312) 642-3700 |

(Address of principal executive offices) (Zip Code) | | (Registrants’ telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $0.0001 par value | | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer ¨ | | Accelerated filer ý | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes: ¨ No: ý

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 30th, 2017 the last business day of the registrant’s most recent completed second quarter, was $524,995,340 (based on the closing sale price of the registrant’s common stock on that date as reported on the Nasdaq Global Market).

As of March 12, 2018, the registrant had 54,336,258 shares of common stock, par value $0.0001 per share, outstanding which includes 749,482 shares of unvested restricted stock awards that have voting rights and are held by members of the Board of Directors and the Company’s employees.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file with the Securities and Exchange Commission a proxy statement pursuant to Regulation 14A within 120 days of the end of its fiscal year ended December 31, 2017. Portions of such proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

| | |

| | |

| | |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

| | |

| | |

| | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

| | |

| | |

| | |

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

| | |

| | |

| | |

Item 15. | Exhibits, Financial Statement Schedules | |

| | |

Signatures | | |

PART I

Unless otherwise indicated or the context otherwise requires, references in this Annual Report on Form 10-K to “InnerWorkings, Inc.,” “InnerWorkings,” the "Company” “we,” “us” or “our” are to InnerWorkings, Inc., a Delaware corporation and its subsidiaries.

Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements involve a number of risks, uncertainties and other factors that could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors which could materially affect such forward-looking statements can be found in Part I, Item 1A entitled “Risk Factors” and Part II, Item 7 entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K. Investors are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date hereof. Except as expressly required by federal securities laws, we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or changed circumstances.

Our Company

We are a leading global marketing execution firm for some of the world's most marketing intensive companies, including those listed in the Fortune 1000. As a comprehensive outsourced global solution, we leverage proprietary technology, an extensive supplier network and deep domain expertise to streamline the creation, production and distribution of marketing and promotional materials, signage and displays, retail experiences, events and promotions and product packaging across every major market worldwide. The items we source generally are procured through the marketing supply chain and we refer to these items collectively as marketing materials. Through our network of more than 8,000 global suppliers, we offer a full range of fulfillment and logistics services that allow us to procure marketing materials of virtually any kind. The breadth of our product offerings and services and the depth of our supplier network enable us to fulfill the marketing materials procurement needs of our clients.

Our proprietary software applications and databases create a fully-integrated solution that stores, analyzes and tracks the production capabilities of our supplier network, as well as detailed pricing data. As a result, we believe we have one of the largest independent repositories of supplier capabilities and pricing data for suppliers of marketing materials around the world. We leverage our supplier capabilities and pricing data to match our orders with suppliers that are optimally suited to meet the client’s needs at a highly competitive price. Our technology and databases of product and supplier information are designed to capitalize on excess manufacturing capacity and other inefficiencies in the traditional marketing materials supply chain to obtain favorable pricing while delivering high-quality products and services for our clients.

By leveraging our technology and data, our clients are able to reduce overhead costs, redeploy internal resources and obtain favorable pricing and service terms. In addition, our ability to track individual transactions and provide customized reports detailing procurement activity on an enterprise-wide basis provides our clients with greater visibility and control of their marketing materials expenditures.

We generate revenue by procuring and purchasing marketing materials from our suppliers and selling those products to our clients. We procure products for clients across a wide range of industries, such as retail, financial services, hospitality, consumer packaged goods, non-profits, healthcare, pharmaceuticals, food and beverage, broadcasting and cable and transportation.

We were formed in 2001, commenced operations in 2002 and converted from a limited liability company to a Delaware corporation in January 2006. Our corporate headquarters are located in Chicago, Illinois. For the year ended December 31, 2017, our annual revenues were $1.1 billion and we operated in 68 global office locations.

We organize our operations into two segments based on geographic regions: North America and International. The North America segment includes operations in the United States and Canada; the International segment includes operations in Mexico, South America, Central America, Europe, the Middle East, Africa and Asia. We believe the opportunity exists to expand our business

into new geographic markets. Our objective is to continue to increase our sales in the major markets in the United States and internationally. We intend to hire or acquire more account executives within close proximity to these large markets.

Industry Overview

Our business of providing marketing execution solutions primarily includes the procurement of marketing materials, branded merchandise, product packaging and retail displays. Based on external sources we estimate the global market for marketing materials, product packaging and retail displays, in aggregate, to be approximately $600 billion annually.

Procurement of marketing materials is often dispersed across several areas of a business, including sales, marketing, communications and finance. The traditional process of procuring, designing and producing an order often requires extensive collaboration by manufacturers, designers, agencies, brokers, fulfillment and other middlemen, which is highly inefficient for the customer, who typically pays a mark-up at each intermediate stage of the supply chain. Consolidating marketing activities across the organization represents an opportunity to reduce total expenditure and decrease the number of vendors in the marketing supply chain.

To become more competitive, many large corporations seek to focus on their core competencies and outsource non-core business functions, which typically include marketing execution. According to a recent industry report the global business process outsourcing market for managed procurement is more than $250 billion and growing at about 12% annually.

We seek to capitalize on the trends impacting the marketing supply chain and the movement towards outsourcing of non-core business functions by leveraging our propriety technology, deep domain expertise, extensive supplier network and purchasing power.

Our Solution

Utilizing our proprietary technology and data, we provide our clients a global solution to procure and deliver marketing materials at favorable prices. Our network of more than 8,000 global suppliers offers a wide variety of products and a full range of print, fulfillment and logistics services.

Our procurement software and database seeks to capitalize on excess manufacturing capacity and other inefficiencies in the traditional supply chain for marketing materials. We believe that the most competitive prices we obtain from our suppliers are offered by the suppliers with the most unused capacity. We utilize our technology to:

| |

• | greatly increase the number of suppliers that our clients can access efficiently; |

| |

• | obtain favorable pricing and deliver high quality products and services for our clients; and |

| |

• | aggregate our purchasing power. |

Our proprietary technology and data streamline the procurement process for our clients by eliminating inefficiencies within the traditional marketing supply chain and expediting production. However, our technology cannot manage all of the variables associated with procuring marketing materials, which often involves extensive collaboration among numerous parties. Effective management of the procurement process requires that dedicated and experienced personnel work closely with both clients and suppliers. Our account executives and production managers perform that critical function.

Account executives act as the primary sales staff to our clients. Production managers manage the entire procurement process for our clients to ensure timely and accurate delivery of the finished product. For each order we receive, a production manager uses our technology to gather specifications, solicit bids from the optimal suppliers, establish pricing with the client, manage production and purchase and coordinate the delivery of the finished product.

Each client is assigned an account executive and one or more production managers, who develop relationships with client personnel responsible for authorizing and making purchases. Our largest clients often are assigned multiple production managers. In certain cases, our production managers function on-site at the client's offices. Whether on-site or off-site, a production manager functions as a virtual employee of the client. As of December 31, 2017, we had approximately 650 production managers and account executives, including over 275 working on-site at our client's offices.

Our Proprietary Technology

Our proprietary technology is a fully-integrated solution that stores equipment profiles for our supplier network and price data for orders we quote and execute. Our technology allows us to match orders with the suppliers in our network that are optimally suited

to produce an order at a highly competitive price. Our technology also allows us to efficiently manage the critical aspects of the procurement process, including gathering order specifications, identifying suppliers, establishing pricing, managing production and coordinating purchase and delivery of the finished product.

Our database stores the production capabilities of our supplier network, as well as price and quote data for bids we receive and transactions we execute. As a result, we maintain one of the largest independent repositories of equipment profiles and price data for suppliers of marketing materials. Our production managers use this data to discover excess manufacturing capacity, select optimal suppliers, negotiate favorable pricing and efficiently procure high-quality products and services for our clients. We rate our suppliers based on product quality, customer service and overall satisfaction. This data is stored in our database and used by our production managers during the supplier selection process.

We believe our proprietary technology allows us to procure marketing materials more efficiently than traditional manual or semi-automated systems used by many manufacturers in the marketplace. Our technology includes the following features:

| |

• | Customized order management. Our solution automatically generates customized data entry screens based on product type and guides the production manager to enter the required job specifications. For example, if a production manager selects “envelope” in the product field, the screen will automatically prompt the production manager to specify the size, paper type, window size and placement and display style. |

| |

• | Cost management. Our solution reconciles supplier invoices to executed orders to ensure the supplier adhered to the pricing and other terms contained in the order. In addition, it includes checks and balances that allow us to monitor important financial indicators relating to an order, such as projected gross margin and significant job alterations. |

| |

• | Standardized reporting. Our solution generates transaction reports that contain quote, supplier capability, price and customer service information regarding the orders the client has completed with us. These reports can be customized, sorted and searched based on a specified time period or the type of product, price or supplier. In addition, the reports give our clients insight into their spend for each individual job and on an enterprise-wide basis, which allows the client to track the amounts it spends on job components such as paper, production and logistics. |

| |

• | Task-tracking. Our solution creates a work order checklist that sends e-mail reminders to our production managers regarding the time elapsed between certain milestones and the completion of specified deliverables. These automated notifications enable our production managers to focus on more critical aspects of the process and eliminate delays. |

| |

• | Historical price baseline. Some of our larger clients provide us with pricing data for orders they completed before they began to use our solution. For these clients, our solution automatically compares our current price for a job to the price obtained by the client for a comparable historical job, which enables us to demonstrate on an ongoing basis the cost savings we provide. |

We have created customized e-commerce stores on our client and third party platforms to order pre-selected products, such as personalized stationery, marketing brochures and promotional products. Automated order processes can send requests to our vendors for fulfillment or printing of variable print on demand products.

Our Clients

We procure marketing materials for corporate clients across a wide range of industries, such as retail, financial services, hospitality, consumer packaged goods, non-profits, healthcare, food and beverage, broadcasting and cable and transportation. Our clients also include manufacturers that outsource jobs to us because they do not have the requisite capabilities or capacity to complete an order. For the years ended December 31, 2017, 2016 and 2015, our largest customer accounted for 5%, 5% and 5% of our revenue, respectively. Revenue from our top ten clients accounted for 28%, 27% and 27% of our revenue in 2017, 2016 and 2015, respectively.

We generate revenue by procuring and purchasing marketing materials from our suppliers and selling those products to our clients. Our services are provided under long-term contracts, purchase orders, or other contractual arrangements, and the scope and terms of these contracts vary by client.

Our Products and Services

We offer a full range of solutions to support the marketing execution needs of our clients. Our outsourced print management solution encompasses the design, sourcing and delivery of printed marketing materials such as direct mail, in-store signage and marketing collateral. We provide a similar outsourced solution for the design, sourcing and delivery of other categories in the marketing supply chain, such as branded merchandise and product packaging. We also assist clients with the management of events and promotions spending and related procurement needs. Our retail environments solution involves the design, sourcing and installation

of point of sale displays, permanent retail fixtures and overall store design. We also offer on-site outsourced creative studio services, digital marketing services, as well as on-demand creative services.

We offer comprehensive fulfillment and logistics services, such as kitting and assembly, inventory management and pre-sorting postage. These services are often essential to the completion of the finished product. For example, we assemble multi-level direct mailings, insurance benefits packages and coupons and promotional incentives that are included with credit card and bank statements. We also provide creative services, including copywriting, graphics and website design, identity work and marketing collateral development and pre-media services, such as image and print-ready page processing and proofing capabilities. Our e-commerce and online collaboration technology empowers our clients with branded self-service ecommerce websites that prompt quick and easy online ordering, fulfillment, tracking and reporting.

We agree to provide our clients with products that conform to the industry standard of a “commercially reasonable quality” and our suppliers in turn agree to provide us with products of the same quality. The contracts we execute with our clients typically include customary provisions that limit the amount of our liability for product defects. To date, we have not experienced significant claims or liabilities relating to defective products.

Our Supplier Network

Our global network of more than 8,000 suppliers includes graphic designers, paper mills and merchants, digital imaging companies, specialty binders, finishing and engraving firms, fulfillment and distribution centers and manufacturers of displays and promotional items.

These suppliers have been selected from among thousands of potential suppliers worldwide on the basis of price, quality, delivery and customer service. We direct requests for quotations to potential suppliers based on historical pricing data, quality control rankings and geographic proximity to a client or other criteria specified by our clients. In 2017, our top ten suppliers accounted for approximately 12% of our cost of goods sold and no supplier accounted for more than 2% of our cost of goods sold.

We have established a quality control program that is designed to ensure that we deliver high-quality products and services to our clients through the suppliers in our network.

Sales and Marketing

Our account executives sell our marketing execution solutions to corporate clients. As of December 31, 2017, we had approximately 350 sales and account executives. Our agreements with our account executives require them to market and sell our solutions on an exclusive basis and contain non-compete and non-solicitation provisions that apply during and for a specified period after the term of their service.

We expect to continue our growth by recruiting and retaining highly qualified account executives and providing them with the tools to be successful in the marketplace. There are a large number of experienced sales representatives globally and we believe that we will be able to identify additional qualified account executives from this pool of individuals. We also expect to augment our sales force through selective acquisitions of other businesses that offer marketing execution services, including brokers that employ experienced sales personnel with established client relationships.

We believe that we offer account executives an attractive opportunity because they can utilize our vast supplier network, proprietary pricing data and customized order management solution to sell virtually any type of marketing materials at a highly competitive price. In addition, the diverse production and service capabilities of the suppliers in our network provide our account executives the opportunity to deliver a more complete product and service offering to our clients. We believe we can better attract and retain experienced account executives than our competitors because of the breadth of products offered by our supplier network.

To date, we have been successful in attracting and retaining qualified account executives. The on-boarding process consists of training with our sales management, as well as access to a variety of sales and educational resources that are available on our intranet.

Competition

Our marketing execution solutions compete with in-house procurement departments in large marketing intensive companies, creative agencies that purchase marketing materials on behalf of their clients in connection with the agencies’ marketing campaign and brand strategy services and companies in several manufacturing industries, including design, graphics art, digital imaging and

fulfillment and logistics. As a result, we compete on some level with virtually every company that is involved in printing, from graphic designers to pre-press firms and fulfillment companies.

Our competitors include manufacturers that employ traditional methods of marketing and selling their printed materials. The manufacturers with which we compete generally own and operate their own manufacturing equipment and typically serve clients only within the specific product categories that their equipment produces.

We also compete with manufacturing management firms and brokers. These competitors generally do not own or operate printing equipment and typically work with a limited number of suppliers and have minimal financial investment in the quality of the products produced for their clients. Our industry experience indicates that several of these competitors offer print procurement services or enterprise software applications for the print industry.

The principal elements of competition in marketing materials procurement are price, product quality, customer service, technology and reliability. Although we believe our business delivers products and services on competitive terms, our business and the marketing execution industry are relatively new and are evolving rapidly.

Intellectual Property

We rely primarily on a combination of copyright, patent, trademark and trade secret laws to protect our intellectual property rights. We also protect our proprietary technology through confidentiality and non-disclosure agreements with our employees and independent contractors.

Our IT infrastructure provides a high level of security for our proprietary database. The storage system for our proprietary data is designed to ensure that power and hardware failures do not result in the loss of critical data. The proprietary data is protected from unauthorized access through a combination of physical and logical security measures, including firewalls, antivirus software, intrusion detection software, password encryption and physical security, with access limited to authorized IT personnel. In addition to our security infrastructure, our system data is backed up and stored in a redundant facility on a daily basis to prevent the loss of our proprietary data due to catastrophic failures or natural disasters. We test our overall IT recovery ability and co-location facility semi-annually and test our back-up processes quarterly to verify that we can recover our business critical systems in a timely fashion.

Employees

As of December 31, 2017, we had approximately 2,000 employees and independent contractors in more than 26 countries. We consider our employee relations to be strong.

Our Website

Our website is http://www.inwk.com. We make available, free of charge through our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including exhibits and any amendments to those reports, filed with or furnished to the Securities Exchange Commission ("SEC"). We make these reports available through our website as soon as reasonably practicable after our electronic filing of such materials with or the furnishing of them to, the SEC. The information contained on our website is not a part of this Annual Report on Form 10-K and shall not be deemed incorporated by reference into this Annual Report on Form 10-K or any other public filing made by us to the SEC.

Set forth below are certain risk factors that could harm our business, results of operations and financial condition. You should carefully read the following risk factors, together with the financial statements, related notes and other information contained in this Annual Report on Form 10-K. Our business, financial condition and operating results may suffer if any of the following risks are realized. If any of these risks or uncertainties occur, the trading price of our common stock could decline and you might lose all or part of your investment. This Annual Report on Form 10-K contains forward-looking statements that contain risks and uncertainties. Please refer to the discussion of “forward-looking statements” on page four of this Annual Report on Form 10-K in connection with your consideration of the risk factors and other important factors that may affect future results described below.

Risks Related to Our Business

Competition could substantially impair our business and our operating results

We compete with companies in the manufacturing of marketing related products, including printed materials, in-store displays, packaging materials, graphics art and digital imaging and fulfillment and logistics. Competition in these industries is intense. Our primary competitors are manufacturers that employ traditional methods of marketing and selling their marketing materials. Some of these manufacturers have larger client bases and significantly more resources than we do. Buyers may prefer to utilize the traditional services offered by the manufacturers with whom we compete. Alternatively, some of these manufacturers may elect to offer outsourced print procurement services or enterprise software applications and their well-established client relationships, industry knowledge, brand recognition, financial and marketing capabilities, technical resources and pricing flexibility may provide them with a competitive advantage over us.

We also compete with a number of management firms and brokers. Several of these competitors offer outsourced procurement services or enterprise software applications for the marketing industry. These competitors or new competitors that enter the market, may also offer procurement services similar to and competitive with or superior to, our current or proposed offerings and may achieve greater market acceptance. In addition, a software solution and database similar to our proprietary technology could be created over time by a competitor with sufficient financial resources and comparable industry experience. If our competitors are able to offer comparable services, we could lose clients and our market share could decline.

Our competitors may also establish cooperative relationships to increase their ability to address client needs. Increased competition may lead to revenue reductions, reduced gross margins or a loss of market share, any one of which could harm our business and our operating results.

If our services do not achieve widespread commercial acceptance, our business will suffer.

Most companies currently coordinate the procurement and management of their marketing materials with their own employees using a combination of telephone, e-mail, their own technology platforms and the Internet. Growth in the demand for our services depends on the adoption of our outsourcing model for marketing related procurement services. We may not be able to persuade prospective clients to change their traditional procurement processes. Our business could suffer if our services are not accepted or are not perceived by the marketplace to be effective or valuable.

If our suppliers do not meet our needs or expectations or those of our clients, our business would suffer.

The success of our business depends to a large extent on our relationships with our clients and our reputation for high quality marketing materials and marketing execution services. We do not own manufacturing equipment. Instead, we rely on third-party suppliers to deliver the products and services that we provide to our clients. As a result, we do not directly control the products manufactured or the services provided by our suppliers. If our suppliers do not meet our needs or expectations or those of our clients, our professional reputation may be damaged, our business would be harmed and we could be subject to legal liability.

A significant portion of our revenue is derived from a relatively limited number of large clients and any loss or decrease in sales to these clients could harm our results of operations.

A significant portion of our revenue is derived from a relatively limited number of large clients. Revenue from our top ten clients accounted for 28%, 27% and 27% of our revenue during the years ended December 31, 2017, 2016 and 2015, respectively. Our largest client accounted for 5%, 5% and 5% of our revenue in 2017, 2016 and 2015, respectively. We are likely to continue to

experience ongoing client concentration, particularly if we are successful in attracting large clients. Moreover, there may be a loss or reduction in business from one or more of our large clients. It is also possible that revenue from these clients, either individually or as a group, may not reach or exceed historical levels in any future period. The loss or significant reduction of business from our major clients would adversely affect our results of operations.

A significant or prolonged economic downturn or a dramatic decline in the demand for marketing materials, could adversely affect our revenue and results of operations.

Our results of operations are affected directly by the level of business activity of our clients, which in turn is affected by the level of economic activity and cyclicality in the industries and markets that they serve. Certain of our products are sold to industries, including the advertising, retail, consumer products, housing, financial and pharmaceutical industries, that experience significant fluctuations in demand based on general economic conditions, cyclicality and other factors beyond our control. Continued economic uncertainty or an economic downturn could result in a reduction of the marketing budgets of our clients or a decrease in the number of marketing materials that our clients order from us. Reduced demand from one of these industries or markets could negatively affect our revenues, operating income and profitability.

A significant decrease in the number of our suppliers could adversely affect our business.

Our suppliers are not contractually required to continue to accept orders from us. If production capacity at a significant number of our suppliers becomes unavailable, we will be required to use fewer suppliers, which could significantly limit our ability to serve our clients on competitive terms. In addition, we rely on price bids provided by our suppliers to populate our database. If the number of our suppliers decreases significantly, we may not be able to obtain sufficient pricing information for our database, which could adversely affect our ability to obtain favorable pricing for our clients and negatively impact our operating income and profitability.

We may face difficulties as we expand our operations into countries in which we have limited operating experience.

Aggregate revenue from our International segment represented 32%, 33% and 31% of total revenue for the years ended December 31, 2017, 2016 and 2015, respectively. We intend to expand our global footprint, which may involve expanding into countries other than those in which we currently operate or increasing our operations in countries where we currently have limited operations and resources. Our business outside of the United States is subject to various risks, including:

| |

• | changes in economic and political conditions; |

| |

• | changes in and compliance with international and domestic laws and regulations, including anti-corruption laws such as the U.S. Foreign Corrupt Practices Act and the U.K. Anti-Bribery Act; |

| |

• | wars, civil unrest, acts of terrorism and other conflicts; |

| |

• | compliance with and changes in tariffs, trade restrictions, trade agreements and taxation; |

| |

• | difficulties in managing or overseeing foreign operations; |

| |

• | limitations on the repatriation of funds because of foreign exchange controls; |

| |

• | political and economic corruption; |

| |

• | less developed and less predictable legal systems than those in the United States; and |

| |

• | intellectual property laws of countries which do not protect our intellectual property rights to the same extent as the laws of the United States. |

The occurrence or consequences of any of these factors may lead to significant legal or compliance expenses and may restrict our ability to operate in the affected region or result in the loss of clients in the affected region or other regions, which could adversely affect our revenue, operating income and profitability.

As we expand our business in foreign countries, we will become exposed to increased risk of loss from foreign currency fluctuations and exchange controls, particularly the strengthening of the U.S. dollar against major currencies, as well as longer accounts receivable payment cycles. We have limited control over these risks and if we do not correctly anticipate changes in international economic and political conditions, we may not alter our business practices in time to avoid adverse effects.

The European economy continues to experience overall weakness as a result of lingering high unemployment, sovereign debt issues and tightening of government budgets. Continued weak economic conditions in Europe could adversely affect our results of operations in the European countries in which we conduct business. Additionally, concerns persist regarding the debt burden of certain of the countries that have adopted the Euro currency (the “Euro zone”) and their ability to meet future financial obligations, as well as concerns regarding the overall stability of the Euro to function as a single currency among the diverse economic, social

and political circumstances within the Euro zone. We conduct a portion of our business in Euro. Although it remains uncertain whether significant changes in the utilization of the Euro will occur or what the potential impact of such changes in the Euro zone or globally might be, a material shift in circulation of the Euro could result in disruptions to our business and negatively impact our results of operations.

The United Kingdom’s referendum to leave the European Union or “Brexit,” has and may continue to cause disruptions to capital and currency markets worldwide. The full impact of the Brexit decision, however, remains uncertain. A process of negotiation will determine the future terms of the United Kingdom’s relationship with the European Union. During this period of negotiation, our results of operations and access to capital may be negatively affected by interest rate, exchange rate and other market and economic volatility, as well as regulatory and political uncertainty. Brexit may also have a detrimental effect on our customers, distributors and suppliers, which would, in turn, adversely affect our financial condition.

We are subject to taxation related risks in multiple jurisdictions.

We are a U.S.-based multinational company subject to tax in multiple U.S. and foreign tax jurisdictions. Significant judgment is required in determining our global provision for income taxes, deferred tax assets or liabilities and in evaluating our tax positions on a worldwide basis. While we believe our tax positions are consistent with the tax laws in the jurisdictions in which we conduct our business, it is possible that these positions may be overturned by jurisdictional tax authorities, which may have a significant impact on our global provision for income taxes. Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are issued or applied. We are also subject to ongoing tax audits. These audits can involve complex issues, which may require an extended period of time to resolve and can be highly subjective. Tax authorities may disagree with certain tax reporting positions taken by us and, as a result, assess additional taxes against us. We regularly assess the likely outcomes of these audits in order to determine the appropriateness of our tax provision.

On December 22, 2017, the U.S. government enacted comprehensive Federal tax legislation commonly referred to as the Tax Cuts and Jobs Act of 2017 (the “Act”). The newly enacted Act, makes changes to the corporate tax rate, business-related deductions and taxation of foreign earnings, among others, that will generally be effective for taxable years beginning after December 31, 2017.

The changes effected by the Act required us to remeasure existing deferred tax assets and liabilities using our new statutory rate and to include a provisional one time transition tax expense related to the deemed repatriation of certain foreign earnings and profits. This amount is payable over eight years. We have not completed our accounting for the income tax effects of certain elements of the Act, including the new GILTI and BEAT taxes. Due to the complexity of these new tax rules, we are continuing to evaluate these provisions of the Act. As a result, we have not included an estimate of the tax expense/benefit related to these items for the period ended December 31, 2017.

In addition, governmental tax authorities are increasingly scrutinizing the tax positions of companies. Many countries in the European Union, as well as a number of other countries and organizations such as the Organization for Economic Cooperation and Development, are actively considering changes to existing tax laws that, if enacted, could increase our tax obligations in countries where we do business. The impact of tax reform in the US or other foreign tax law changes could result in an overall tax rate increase to our business.

If we are unable to retain and expand the number of our account executives or if a significant number of our account executives leave InnerWorkings, our ability to increase our revenues could be negatively impacted.

Our ability to expand our business will depend largely on our ability to attract and retain account executives with established client relationships. Competition for qualified account executives can be challenging and we may be unable to hire such individuals. Any difficulties we experience in expanding or retaining the number of our account executives could have a negative impact on our ability to expand our client base, increase our revenue and continue our growth.

In addition, we must properly incentivize our account executives to obtain new clients and maintain existing client relationships. If a significant number of our account executives leave InnerWorkings and take their clients with them, our revenue could be negatively impacted. Although we have entered into non-competition agreements with our account executives, we may need to litigate to enforce our rights under these agreements, which could be time-consuming, expensive and ineffective. A significant increase in the turnover rate among our current account executives could also increase our recruiting costs and decrease our operating efficiency and productivity, which could lead to a decline in the demand for our services.

If we are unable to expand our client base, our revenue growth rate may be negatively impacted.

As part of our growth strategy, we seek to attract new clients and expand relationships with existing clients. If we are unable to attract new clients or expand our relationships with our existing clients, our ability to grow our business will be hindered.

Most of our clients may terminate their relationships with us on short notice with no or limited penalties.

Many of our clients use our services on an order-by-order basis rather than under long-term contracts. These clients have no obligation to continue using our services and may stop purchasing from us at any time. We have entered into long-term contracts and contract renewals with many of our clients, which are generally for three to five year initial terms. Most of these contracts, however, permit the clients to terminate our engagements upon prior notice, typically ranging from 90 days to 12 months with limited or no penalties.

The volume and type of services we provide our clients may vary from year to year and could be reduced if a client were to change its outsourcing or procurement strategy. If a significant number of our clients elect to terminate or not to renew their engagements with us or if the volume of their orders decreases, our business, operating results and financial condition could suffer.

We may not be able to develop or implement new systems, procedures and controls that are required to support the continued growth in our operations.

Our business continues to grow in size and complexity, and continued growth could place a significant strain on our ability to:

| |

• | recruit, motivate and retain qualified account executives, production managers and management personnel; |

| |

• | preserve our culture, values and entrepreneurial environment; |

| |

• | develop and improve our internal administrative infrastructure and execution standards; and |

| |

• | maintain high levels of client satisfaction. |

To manage our growth, we must implement and maintain proper operational and financial controls and systems. Further, we will need to manage our relationships with various clients and suppliers. We cannot give any assurance that we will be able to develop and implement, on a timely basis, the systems, procedures and controls required to support the growth in our operations or effectively manage our relationships with various clients and suppliers. If we are unable to manage our growth, our business, operating results and financial condition could be adversely affected.

Our business and stock price may be adversely affected if our internal controls over financial reporting are not effective.

Section 404 of the Sarbanes-Oxley Act of 2002 requires companies to conduct a comprehensive evaluation of their internal control over financial reporting. To comply with this statute, each year we are required to document and test our internal control over financial reporting; our management is required to assess and issue a report concerning our internal control over financial reporting; and our independent registered public accounting firm is required to report on the effectiveness of our internal control over financial reporting.

In this Annual Report on Form 10-K, we reported that management identified material weaknesses in our internal controls over financial reporting as of December 31, 2017. See “Item 9A. Controls and Procedures.”

We cannot assure that we will not discover other material weaknesses in the future. The existence of one or more material weaknesses could result in errors to our financial statements and substantial costs and resources may be required to correct and remediate internal control deficiencies and to defend litigation. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information, the market price of our common stock could decline significantly, we may be unable to obtain additional financing to operate and expand our business and our business and financial results could deteriorate.

We adopted the new required revenue recognition standard, which took effect as of January 1, 2018, and we may have difficulties implementing this standard.

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Codification (“ASC”) Update No. 2014-09, Revenue from Contracts with Customers (“ASC 606”), which has been subsequently updated. We adopted the provisions in ASC 606, as amended, on January 1, 2018 under the modified retrospective method and will only apply this method to contracts that are not completed as of the date of adoption. To comply with the requirements of ASC 606 as of January 1, 2018, we are continuing to update and enhance our internal accounting systems, operational processes and our internal controls over financial reporting. If we are not successful in updating our policies, procedures, information systems and internal controls over financial reporting, the revenue that we recognize and the related disclosures that we provide under ASC 606 may not be complete or accurate,

which could harm our operating results or cause us to fail to meet our reporting obligations. This implementation work has required, and will continue to require, additional investments by us, which could increase our operating costs in future periods. Further, the regulatory guidance for ASC 606 will likely evolve over time, which could adversely impact our financial results (including potentially results reported prior to such evolution) and require changes to our disclosures and internal systems, processes, and controls.

The global integration of our technology platform may result in business interruptions.

We are currently implementing a common technology platform across our global operations. The implementation of and such changes to our technology platform and related software carry risks such as cost overruns, project delays and business interruptions and delays. If we experience a material business interruption as a result of this process, it could have a material adverse effect on our business, financial position and results of operations.

Security and privacy breaches may damage client relations and inhibit our growth.

The secure and uninterrupted operation of our information technology systems is critical to our business. Despite the security measures that we have implemented, including those measures related to cybersecurity, our systems, as well as those of our customers, suppliers and other service providers could be breached or damaged by computer viruses, malware, phishing attacks, denial-of-service attacks, natural or man-made incidents or disasters, or unauthorized physical or electronic access. These types of incidents have become more prevalent and pervasive across industries, including in our industry, and are expected to continue in the future. A breach could result in business disruption, theft of our intellectual property, trade secrets or customer information and unauthorized access to personnel information. Although cybersecurity and the continued development and enhancement of our controls, processes and practices designed to protect our information technology systems from attack, damage or unauthorized access are a high priority for us, our activities and investment may not be deployed quickly enough or successfully protect our systems against all vulnerabilities, including technologies developed to bypass our security measures. In addition, outside parties may attempt to fraudulently induce employees or customers to disclose access credentials or other sensitive information in order to gain access to our secure systems and networks. There are no assurances that our actions and investments to improve the maturity of our systems, processes and risk management framework or remediate vulnerabilities will be sufficient or completed quickly enough to prevent or limit the impact of any cyber intrusion. Moreover, because the techniques used to gain access to or sabotage systems often are not recognized until launched against a target, we may be unable to anticipate the methods necessary to defend against these types of attacks and we cannot predict the extent, frequency or impact these problems may have on us. To the extent that our business is interrupted or data is lost, destroyed or inappropriately used or disclosed, such disruptions could adversely affect our competitive position, relationships with our customers, financial condition, operating results and cash flows. In addition, we may be required to incur significant costs to protect against the damage caused by these disruptions or security breaches in the future.

We are also dependent on security measures that some of our third-party customers, suppliers and other service providers take to protect their own systems and infrastructures. Some of these third parties store or have access to certain of our sensitive data, as well as confidential information about their own operations, and as such are subject to their own cybersecurity threats.

Any security breach of any of these third-parties’ systems could result in unauthorized access to our information technology systems, cause us to be non-compliant with applicable laws or regulations, subject us to legal claims or proceedings, disrupt our operations, damage our reputation, and cause a loss of confidence in our products and services, any of which could adversely affect our financial performance.

A decrease in levels of excess capacity in the commercial print industry could have an adverse impact on our business.

We believe that for the past several years the U.S. commercial print industry has experienced significant levels of excess capacity. Our business seeks to capitalize on imbalances between supply and demand in the print industry by obtaining favorable pricing terms from suppliers in our network with excess capacity. Reduced excess capacity in the print industry generally and in our supplier network specifically, could have an adverse impact on our ability to execute our business strategy and on our business results and growth prospects.

Our inability to protect our intellectual property rights may impair our competitive position.

If we fail to protect our intellectual property rights adequately, our competitors could replicate our proprietary technology and processes and offer similar services, which would harm our competitive position. We rely primarily on a combination of copyright, patent, trademark and trade secret laws and confidentiality and nondisclosure agreements to protect our proprietary technology. We cannot be certain that the steps we have taken to protect our intellectual property rights will be adequate or that third parties will not infringe or misappropriate our rights or imitate or duplicate our services and methodologies. We may need to litigate to enforce our

intellectual property rights or determine the validity and scope of the rights of others. Any such litigation could be time-consuming and costly.

If we are unable to maintain our proprietary technology, demand for our services and therefore our revenue could decrease.

We rely heavily on our proprietary technology to procure marketing materials for our clients. To keep pace with changing technologies and client demands, we must correctly interpret and address market trends and enhance the features and functionality of our technology in response to these trends, which may lead to significant research and development costs. We may be unable to accurately determine the needs of buyers or the trends in the marketing industry or to design and implement the appropriate features and functionality of our technology in a timely and cost-effective manner, which could result in decreased demand for our services and a corresponding decrease in our revenue.

In addition, we must protect our systems against physical damage from fire, earthquakes, power loss, telecommunications failures, computer viruses, hacker attacks, physical break-ins and similar events. Any software or hardware damage or failure that causes interruption or an increase in response time of our proprietary technology could reduce client satisfaction and decrease usage of our services.

If the key members of our management team do not remain with us in the future, our business, operating results and financial condition could be adversely affected.

Our future success will depend to a significant extent on the successful transition of Chief Executive Officer responsibilities from Eric Belcher, our current Chief Executive Officer, to Rich Stoddart, whose appointment as successor Chief Executive Officer takes effect on April 5, 2018. Following the Chief Executive Officer succession, our future success will depend to a significant extent on the continued services of Rich Stoddart, Charles Hodgkins, our Interim Chief Financial Officer, Robert Burkart, our Chief Information Officer and Ron Provenzano, our General Counsel. The loss of the services of these individuals could adversely affect our business, operating results and financial condition and could divert other senior management time in searching for their replacements.

We may not be able to identify suitable acquisition candidates, effectively integrate newly acquired businesses or achieve expected profitability from acquisitions.

Part of our growth strategy is to increase our revenue and the markets that we serve through the acquisition of additional businesses. We are actively considering certain acquisitions and will likely consider others in the future. There can be no assurance that suitable candidates for acquisitions can be identified or, if suitable candidates are identified, that acquisitions can be completed on acceptable terms, if at all. Even if suitable candidates are identified, any future acquisitions may entail a number of risks that could adversely affect our business and the market price of our common stock, including the integration of the acquired operations, diversion of management’s attention, risks of entering markets in which we have limited experience, adverse short-term effects on our reported operating results, the potential loss of key employees of acquired businesses and risks associated with unanticipated liabilities.

We have used and expect to continue to use, shares of our common stock to pay for all or a portion of our acquisitions. If the owners of potential acquisition candidates are not willing to receive our common stock in exchange for their businesses, our acquisition prospects could be limited. Future acquisitions could also result in accounting charges, potentially dilutive issuances of equity securities and increased debt and contingent liabilities, including liabilities related to unknown or undisclosed circumstances, any of which could have a material adverse effect on our business and the market price of our common stock.

Our business is subject to seasonal sales fluctuations, which could result in volatility or have an adverse effect on the market price of our common stock.

Our business is subject to some degree of sales seasonality. Historically, the percentage of our annual revenue earned during the third and fourth fiscal quarters has been higher due, in part, to a greater number of orders for marketing materials in anticipation of the year-end holiday season. If our business continues to experience seasonality, we may incur significant additional expenses during our third and fourth quarters, including additional staffing expenses. Consequently, if we were to experience lower than expected revenue during any future third or fourth quarter, whether from a general decline in economic conditions or other factors beyond our control, our expenses may not be offset, which would have a disproportionate impact on our operating results and financial condition for that year. Such fluctuations in our operating results could result in volatility or have an adverse effect on the market price of our common stock.

Price fluctuations in raw materials costs could adversely affect the margins on our orders.

Our business relies on a constant supply of various raw materials, including paper and ink. Prices within the print industry are directly affected by the cost of paper, which is purchased in a price sensitive market that has historically exhibited price and demand cyclicality. Prices are also affected by the cost of ink. Our profit margin and profitability are largely a function of the rates that our suppliers charge us compared to the rates that we charge our clients. If our suppliers increase the price of our orders and we are not able to find suitable or alternative suppliers, our profit margin may decline.

If any of our products cause damages or injuries, we may experience product liability claims.

Clients and third parties who claim to suffer damages or an injury caused by our products may bring lawsuits against us. Defending lawsuits arising out of any of the products we provide to our clients could be costly and absorb substantial amounts of management attention, which could adversely affect our financial performance. A significant product liability judgment against us could harm our reputation and business.

If any of our key clients fails to pay for our services, our profitability would be negatively impacted.

In general, we take full title and risk of loss for the products we procure from our suppliers. Our obligation to pay our suppliers is not contingent upon receipt of payment from our clients. In 2017, 2016 and 2015, our revenue was $1,136.3 million, $1,090.7 million and $1,029.4 million, respectively and our top ten clients accounted for 28%, 27% and 27%, respectively, of such revenue. If any of our key clients fails to pay for our services, our profitability would be negatively impacted.

Our ability to raise capital in the future may be limited and our failure to raise capital when needed could prevent us from growing.

We may in the future be required to raise capital through public or private financing or other arrangements. Such financing may not be available on acceptable terms or at all and our failure to raise capital when needed could harm our business. Additional equity financing may be dilutive to the holders of our common stock and debt financing, if available, may involve restrictive covenants and could reduce our profitability. If we cannot raise funds on acceptable terms, we may not be able to grow our business or respond to competitive pressures.

Risks Related to Ownership of Our Common Stock

The trading price of our common stock has been and may continue to be volatile.

The trading prices of many small and mid-cap companies are highly volatile. Since our initial public offering in August 2006 through December 31, 2017, the closing sale price of our common stock as reported by the Nasdaq Global Market has ranged from a low of $1.92 on March 2, 2009 to a high of $18.69 on October 9, 2007.

Certain factors may continue to cause the market price of our common stock to fluctuate, including:

| |

• | fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us; |

| |

• | changes in market valuations of similar companies; |

| |

• | changes in economic and political conditions in the United States or abroad; |

| |

• | success of competitive products or services; |

| |

• | changes in our capital structure, such as future issuances of debt or equity securities; |

| |

• | announcements by us, our competitors, our clients or our suppliers of significant products or services, contracts, acquisitions or strategic alliances; |

| |

• | regulatory developments in the United States or foreign countries; |

| |

• | litigation involving our company, our general industry or both; |

| |

• | additions or departures of key personnel; |

| |

• | investors’ general perception of us; and |

| |

• | changes in general industry and market conditions. |

In addition, if the stock market experiences a loss of investor confidence, then the trading price of our common stock could decline for reasons unrelated to our business, financial condition or results of operations. If any of the foregoing occurs, it could cause our stock price to fall and may expose us to class action lawsuits that could be costly to defend and a distraction to management. As a result, you could lose all or part of your investment.

Our quarterly results are difficult to predict and may vary from quarter to quarter, which may result in our failure to meet the expectations of investors and increased volatility of our stock price.

The continued use of our services by our clients depends, in part, on the business activity of our clients and our ability to meet their cost saving needs, as well as their own changing business conditions. The time between our payment to the supplier and our receipt of payment from our clients varies with each job and client. In addition, a significant percentage of our revenue is subject to the discretion of our clients, who may stop using our services at any time, subject, in the case of most of our clients, to advance notice requirements. Therefore, the number, size and profitability of jobs may vary significantly from quarter to quarter. As a result, our quarterly operating results are difficult to predict and may fall below the expectations of current or potential investors in some future quarters, which could lead to significant variations in the market price of our stock. The factors that are likely to cause these variations include:

| |

• | the demand for our marketing execution solutions; |

| |

• | the use of outsourced enterprise solutions; |

| |

• | clients’ business decisions regarding the quantities of marketing materials they purchase; |

| |

• | the number, timing and profitability of our jobs, unanticipated contract terminations and job postponements; |

| |

• | new product introductions and enhancements by our competitors; |

| |

• | changes in our pricing policies; |

| |

• | our ability to manage costs, including personnel costs; and |

| |

• | costs related to possible acquisitions of other businesses. |

We do not currently intend to pay dividends, which may limit the return on your investment.

We have not declared or paid any cash dividends on our common stock. We currently intend to retain all available funds and any future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

If our board of directors authorizes the issuance of preferred stock, holders of our common stock could be diluted and harmed.

Our board of directors has the authority to issue up to 5,000,000 shares of preferred stock in one or more series and to establish the preferred stock’s voting powers, preferences and other rights and qualifications without any further vote or action by the stockholders. The issuance of preferred stock could adversely affect the voting power and dividend liquidation rights of the holders of common stock. In addition, the issuance of preferred stock could have the effect of making it more difficult for a third party to acquire or discouraging a third party from acquiring, a majority of our outstanding voting stock or otherwise adversely affect the market price of our common stock. It is possible that we may need to raise capital through the sale of preferred stock in the future.

|

| |

Item 1B. | Unresolved Staff Comments |

None.

Properties

Our principal executive offices are located in Chicago, Illinois. We have 26 other office locations in the United States and 41 office locations in 26 other countries around the world. These other offices are located in Canada, Chile, Brazil, Peru, Mexico, Argentina, the United Kingdom, France, Czech Republic, Germany, Ireland, Russia, China, Hong Kong, Japan, Australia and various other countries and are principally used for sales, operations, finance, administration and warehousing. We believe that our facilities are generally suitable to meet our needs for the foreseeable future; however, we will continue to seek additional space as needed to satisfy our growth. All of the properties where we conduct our business are leased. The terms of the leases vary and have expiration dates ranging from December 31, 2017 to December 22, 2026.

We are party to various legal proceedings incidental to our business. Certain claims, suits and complaints arising in the ordinary course of business have been filed or are pending against us. Based on facts now known, we believe all such matters are adequately provided for, covered by insurance, are without merit, and/or involve such amounts that would not materially adversely affect our consolidated results of operations, cash flows or financial position.

For information on our non-ordinary course legal proceedings, see Note 9 to the Consolidated Financial Statements included in this Annual Report on Form 10-K.

|

| |

Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

|

| |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

Our common stock is listed and traded on the Nasdaq Global Select Market under the symbol “INWK”. The following table sets forth the high and low sales prices for our common stock as reported by the Nasdaq Global Select Market for each of the periods listed.

|

| | | | | | | |

| High | | Low |

2017 | |

| | |

|

First Quarter | $ | 11.00 |

| | $ | 9.08 |

|

Second Quarter | $ | 11.94 |

| | $ | 9.55 |

|

Third Quarter | $ | 11.92 |

| | $ | 10.08 |

|

Fourth Quarter | $ | 12.03 |

| | $ | 9.81 |

|

| | | |

2016 | |

| | |

|

First Quarter | $ | 8.02 |

| | $ | 6.06 |

|

Second Quarter | $ | 8.87 |

| | $ | 7.59 |

|

Third Quarter | $ | 10.08 |

| | $ | 8.08 |

|

Fourth Quarter | $ | 10.08 |

| | $ | 8.07 |

|

Holders

As of March 16, 2018, there were 26 holders of record of our common stock, which does not include stockholders who held their shares through brokers or other nominees in "street name." The holders of our common stock are entitled to one vote per share.

Dividends

We currently do not and do not intend to pay any dividends on our common stock. We intend to retain all available funds and any future earnings for use in the operation and expansion of our business. Any determination in the future to pay dividends will depend upon our financial condition, capital requirements, operating results and other factors deemed relevant by our board of directors, including any contractual or statutory restrictions on our ability to pay dividends.

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

On February 12, 2015, we announced that our Board of Directors approved a share repurchase program providing us authorization to repurchase up to an aggregate of $20.0 million of our common stock through open market and privately negotiated transactions over a two-year period. On November 2, 2016, the Board of Directors approved a two-year extension to the share repurchase program through February 28, 2019.

Additionally, on May 4, 2017, the Board of Directors authorized the repurchase of up to an additional $30.0 million of our common stock through open market and privately negotiated transactions over a two-year period ending May 31, 2019. The timing and amount of any share repurchases will be determined based on market conditions, share price and other factors, and the program may be discontinued or suspended at any time. Repurchases will be made in compliance with SEC rules and other legal requirements. As of December 31, 2017, an aggregate of $34.1 million remained available for repurchase under these repurchase authorizations.

During the twelve months ended December 31, 2017, the Company repurchased 1,121,928 shares of the Company's common stock for $11.0 million in the aggregate at an average cost of $9.78 per share under its repurchase program. An additional 183,529 shares of its common stock were withheld to satisfy the mandatory tax withholding requirements upon vesting of restricted stock for $1.9 million at an average cost of $10.57 per share.

The following table provides information relating to our purchase of shares of our common stock in the fourth quarter of 2017 (in thousands, except per share amounts):

|

| | | | | | | | | | | | |

Period | Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs(1) |

10/1/17-10/31/17 | — |

| | $ | — |

| | — |

| | 3,259 |

|

11/1/17-11/30/17 | 4 |

| | 10.32 |

| | — |

| | 3,232 |

|

12/1/17-12/31/17 | 170 |

| | 10.07 |

| | 93 |

| | 3,402 |

|

Total | 174 |

| | $ | 10.07 |

| | 93 |

| | |

| |

(1) | The share repurchase plan authorized by our Board of Directors allows repurchases of up to $50 million of our common stock. The maximum number of shares that may yet be repurchased under the plan is estimated using the closing share price on the last day of each period presented. |

Stock Performance Graph

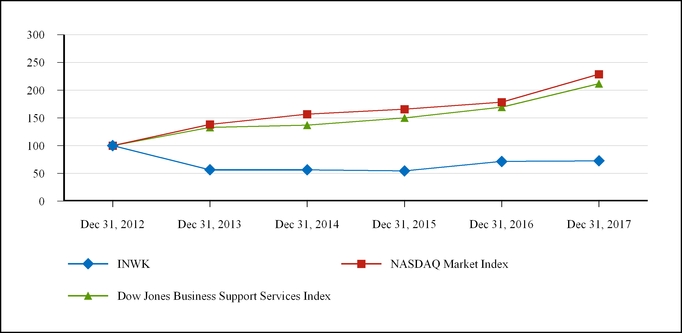

The information contained in the following chart is not considered to be “soliciting material,” or “filed,” or incorporated by reference in any past or future filing by the Company under the Securities Act or Exchange Act unless and only to the extent that, the Company specifically incorporates it by reference.

The following graph assumes $100 was invested on December 31, 2012 in the common stock of the Company and each of the following indices and assumes reinvestment of any dividends. The stock price performance on the graph below is not necessarily indicative of future stock price performance.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Dec 31, 2012 | | Dec 31, 2013 | | Dec 31, 2014 | | Dec 31, 2015 | | Dec 31, 2016 | | Dec 31, 2017 |

INWK | | $ | 100 |

| | $ | 57 |

| | $ | 57 |

| | $ | 54 |

| | $ | 71 |

| | $ | 73 |

|

NASDAQ Market Index | | $ | 100 |

| | $ | 138 |

| | $ | 157 |

| | $ | 166 |

| | $ | 178 |

| | $ | 229 |

|

Dow Jones Business Support Services Index | | $ | 100 |

| | $ | 133 |

| | $ | 137 |

| | $ | 150 |

| | $ | 169 |

| | $ | 212 |

|

|

| |

Item 6. | Selected Financial Data |

The following table presents selected consolidated financial and other data as of and for the periods indicated. You should read the following information together with the more detailed information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes.

|

| | | | | | | | | | | | | | | | | | | |

| Year ended December 31, |

| 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

| (in thousands, except per share amounts) |

Consolidated statements of operations data: | | | | | | | | | |

Revenue | $ | 1,136,256 |

| | $ | 1,090,704 |

| | $ | 1,029,353 |

| | $ | 1,000,133 |

| | $ | 890,960 |

|

Cost of goods sold | 857,921 |

| | 827,156 |

| | 789,159 |

| | 770,674 |

| | 688,934 |

|

Gross profit | 278,335 |

| | 263,548 |

| | 240,194 |

| | 229,459 |

| | 202,026 |

|

Selling, general and administrative expenses | 225,738 |

| | 209,967 |

| | 197,291 |

| | 196,190 |

| | 183,600 |

|

Depreciation and amortization | 13,390 |

| | 17,916 |

| | 17,472 |

| | 17,723 |

| | 13,664 |

|

Change in fair value of contingent consideration | 677 |

| | 10,417 |

| | (270 | ) | | (37,873 | ) | | (31,331 | ) |

Goodwill impairment charge | — |

| | — |

| | 37,539 |

| | — |

| | 37,908 |

|

Intangible asset impairment charges | — |

| | 70 |

| | 202 |

| | 2,710 |

| | — |

|

Restructuring charges | — |

| | 5,615 |

| | 1,053 |

| | — |

| | 4,322 |

|

Income (loss) from operations | 38,530 |

| | 19,563 |

| | (13,093 | ) | | 50,708 |

| | (6,137 | ) |

Interest income | 97 |

| | 86 |

| | 69 |

| | 57 |

| | 76 |

|

Interest expense | (4,729 | ) | | (4,171 | ) | | (4,612 | ) | | (4,428 | ) | | (2,954 | ) |

Other, net | (1,788 | ) | | (153 | ) | | (3,135 | ) | | (747 | ) | | (357 | ) |

Total other expense | (6,420 | ) | | (4,238 | ) | | (7,678 | ) | | (5,118 | ) | | (3,235 | ) |

Income (loss) before income taxes | 32,110 |

| | 15,325 |

| | (20,771 | ) | | 45,590 |

| | (9,372 | ) |

Income tax expense (benefit) | 13,131 |

| | 10,955 |

| | 12,292 |

| | 1,855 |

| | (612 | ) |

Net income (loss) | $ | 18,979 |

| | $ | 4,370 |

| | $ | (33,063 | ) | | $ | 43,735 |

| | $ | (8,760 | ) |

Net income (loss) per share of common stock: | |

| | |

| | |

| | |

| | |

Basic | $ | 0.35 |

| | $ | 0.08 |

| | $ | (0.63 | ) | | $ | 0.84 |

| | $ | (0.17 | ) |

Diluted | $ | 0.35 |

| | $ | 0.08 |

| | $ | (0.63 | ) | | $ | 0.82 |

| | $ | (0.17 | ) |

Shares used in per share calculations: | | | |

| | |

| | |

| | |

|

Basic | 53,851 |

| | 53,607 |

| | 52,791 |

| | 52,096 |