UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

Or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-35817

CANCER GENETICS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 04-3462475 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

201 Route 17 North 2nd Floor

Rutherford, NJ 07070

(201) 528-9200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.0001 par value per share | NASDAQ Capital Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes: ¨ No: ý

Indicate by check mark if the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes: ý No: ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website; if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes: ý No: ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark if the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

Large accelerated filer | ¨ | Accelerated filer | ý | |||

Non-accelerated filer | ¨ (do not check if a smaller reporting company) | Smaller reporting company | ý | |||

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes: ¨ No: ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $83.2 million on June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of $11.30 on that date.

Indicate the number of shares outstanding of each of the registrant’s classes of common equity, as of March 1, 2015:

Class | Number of Shares | |

Common Stock, $.0001 par value | 9,821,169 | |

Documents incorporated by reference

Portions of the registrant’s proxy statement for the 2015 annual meeting of stockholders to be filed pursuant to Regulation 14A within 120 days after the registrant’s fiscal year ended December 31, 2014, are incorporated by reference in Part III of this Form 10-K.

EXPLANATORY NOTE

The Registrant meets the "accelerated filer" requirements as of the end of its 2014 fiscal year pursuant to Rule 12b-2 of the Securities Exchange Act of 1934, as amended. However, pursuant to Rule 12b-2 and SEC Release No. 33-8876, the Registrant (as a smaller reporting company transitioning to the larger reporting company system based on its public float as of June 30, 2014) is not required to satisfy the larger reporting company requirements until its first quarterly report on Form 10-Q for the 2015 fiscal year and thus is eligible to check the "Smaller Reporting Company" box on the cover of this Form 10-K.

TABLE OF CONTENTS

PART I | 1. | |||||

1A. | ||||||

1B. | ||||||

2. | ||||||

3. | ||||||

4. | ||||||

PART II | 5. | |||||

6. | ||||||

7. | ||||||

7A. | ||||||

8. | ||||||

9. | ||||||

9A. | ||||||

9B. | ||||||

PART III | 10. | |||||

11. | ||||||

12. | ||||||

13. | ||||||

14. | ||||||

PART IV | 15. | |||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential,” or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties including those set forth below under Part I, Item 1A, “Risk Factors” in this annual report on Form 10-K. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this annual report on Form 10-K and, except as required by law, we undertake no obligation to update or review publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this annual report on Form 10-K. You should read this annual report on Form 10-K and the documents referenced in this annual report on Form 10-K and filed as exhibits completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Such statements may include, but are not limited to, statements concerning the following:

• | our ability to achieve profitability by increasing sales of our laboratory tests and services and to continually develop and commercialize novel and innovative genomic-based diagnostic tests and services for cancer patients; |

• | our ability to raise additional capital to meet our liquidity needs; |

• | our ability to clinically validate our pipeline of genomic microarray tests currently in development; |

• | our ability to execute on our marketing and sales strategy for our genomic tests and gain acceptance of our tests in the market; |

• | our ability to keep pace with rapidly advancing market and scientific developments; |

• | our ability to satisfy U.S. (including FDA) and international regulatory requirements with respect to our tests and services, many of which are new and still evolving; |

• | our ability to obtain reimbursement from governmental and other third-party payors for our tests and services; |

• | competition from clinical laboratory services companies, genomic-based diagnostic tests currently available or new tests that may emerge; |

• | our ability to maintain our clinical collaborations and enter into new collaboration agreements with highly regarded organizations in the cancer field so that, among other things, we have access to thought leaders in the field and to a robust number of samples to validate our genomic tests; |

• | our ability to maintain our present customer base and obtain new customers; |

• | potential product liability or intellectual property infringement claims; |

• | our dependency on third-party manufacturers to supply or manufacture our products; |

• | our ability to attract and retain a sufficient number of scientists, clinicians, sales personnel and other key personnel with extensive experience in oncology, who are in short supply; |

• | our ability to obtain or maintain patents or other appropriate protection for the intellectual property in our proprietary tests and services; |

• | our dependency on the intellectual property licensed to us or possessed by third parties; |

• | our ability to expand internationally and launch our tests in emerging markets, such as India and Brazil; and |

• | our ability to adequately support future growth. |

PART I

Item 1. | Business. |

Overview

We are an oncology diagnostics company focused on developing, commercializing and providing DNA-based tests and services to improve the personalization of cancer treatment and to better inform biopharmaceutical companies of genomic factors influencing subject responses to therapeutics. Our vision is to become the oncology diagnostics partner for companies and clinicians by participating in the entire care continuum from bench to bedside. We believe the diagnostic industry is undergoing a metamorphosis in its approach to oncology testing, embracing individualized medicine as a means to drive higher standards of patient treatment and disease management. Similarly, biopharma companies are increasingly engaging companies such as ours to provide information on clinical trial participants’ DNA profiles in order to identify genomic variations that may be responsible for differing responses to pharmaceuticals, and particularly to oncology drugs, thereby increasing the efficiency of trials while lowering related costs. We believe tailored therapeutics can revolutionize oncology medicine through DNA-based testing services, enabling physicians and researchers to target the factors that make each patient and disease unique. We have created a unique position in the industry by providing targeted somatic analysis of tumor sample cells alongside germline analysis of an individuals' non-cancerous cells' DNA as we attempt to reach the next milestone in personalized medicine. Individuals are born with germline mutations and somatic mutations arise in tissues over the course of a lifetime.

Cancer is genetically-driven and constitutes a heterogeneous class of diseases characterized by uncontrollable cell growth. Many cancers are becoming increasingly understood at a molecular level and it is possible to attribute specific cancers to identifiable genetic changes in unhealthy cells. Cancer cells contain modified genetic material compared to normal human cells. Common genetic abnormalities correlated to cancer include gains or losses of genetic material on specific chromosomal regions (loci) or changes in specific genes (mutations) that ultimately result in detrimental cellular changes followed by cancerous or pre-cancerous conditions. Understanding the differences in these genomic changes helps clinicians to identify and stratify different forms of cancer in order to optimize patient treatment and patient management. Therefore, understanding and analysis of cancer at the molecular level is not only useful for diagnostic purposes, but we also believe it can play an important role in prognosis and disease management. We believe technology that can apply predictive information has the potential to dramatically improve treatment outcomes for patients fighting against cancer. Our molecular diagnostic tests for cancer aim to remove subjectivity from the diagnostic phase, and add prognostic information, thus enabling personalized treatments based on cancer analysis at its most basic genetic level.

Our business is based on demand for DNA-based diagnostic services from three main sectors, including cancer centers and hospitals, biotechnology and biopharmaceutical companies, and the research community. Clinicians and oncologists in cancer centers and hospitals seek genomic-based testing since these methods produce higher value and more accurate cancer diagnostic information than traditional analytical methods. Our unique and focused tests aim to provide actionable information that can guide patient management decisions, potentially resulting in decreased costs for cancer centers and hospitals while streamlining therapy selection. Our services are also sought by biotech and biopharma companies engaged in designing and running clinical trials for their value and efficacy in oncology treatments and therapeutics. We believe trial participants' likelihood of experiencing either favorable or adverse responses to the trial treatment can be determined by genomic testing, increasing trial efficiency, subject safety and trial success rates. We aggressively pursue the strategy of trying to demonstrate increased value and efficacy with payors who are trying to contain costs and academic collaborators seeking to develop new insights and cures.

Our go-to market strategy is organized to align with the three aforementioned industry segments. We utilize relatively the same technologies across each of these businesses to deliver results-oriented information important to cancer treatment and patient management. Our tests address the limitations of traditional cancer diagnostic approaches, including reliance on human inspection of specimens and interpretation of clinical measurements, and inter-institutional variability. Our suite of clinical and biopharma services remove subjectivity from diagnoses and additionally provide information on treatment selection that cannot be obtained from anatomic pathology and staining techniques alone. We believe the level of personalized treatment required to optimize a patient's treatment regimen and to maximize clinical trial success rates is only possible through the use of DNA-based molecular diagnostics.

The following table lists our go to market strategy by customer category:

2

Customer Category | Types of Customers | Nature of Services |

Clinical Services | • Hospitals • Cancer Centers • Clinics | Clinical services provide information on diagnosis, prognosis and theranosis of cancers to guide patient management. |

Biopharma Services | • Biopharma and Biotech companies performing clinical trials | Biopharma services provide companies customized solutions for patient stratification and treatment selection through an extensive suite of DNA-based testing services. |

Discovery Services | • Biopharma and Biotech companies • Researchers | Discovery services provide the tools and testing methods for companies and researchers seeking to identify new DNA-based biomarkers for disease. |

In 2014, we generated approximately 55% of our revenue from Biopharma Services, approximately 43% from Clinical Services and approximately 2% from Discovery Services, a new line of service launched in 2014. In 2013, we generated approximately 55% of our revenue from Clinical Services, approximately 40% from Biopharma Services and approximately 5% from government grants. During 2014 we had no government grants.

We utilize relatively the same proprietary and nonproprietary molecular diagnostic tests and technologies across our clinical services, biopharma services and discovery services businesses to deliver results-oriented information important to cancer treatment and patient management. We believe that there is significant synergy in developing and marketing a complete set of tests and services that are disease focused and delivering those tests and services in a comprehensive manner to help with treatment decisions. The insight that we develop in delivering non- proprietary services are often leveraged in the development of our proprietary programs and now increasingly in the validation of our proprietary programs (such as MatBA® and Focus::NGSTM) for clinical use.

Clinical Services

Our clinical offerings include our portfolio of proprietary tests targeting hematological, urogenital and HPV-associated cancers, in conjunction with ancillary non-proprietary tests. Our proprietary tests target cancers that are difficult to prognose and predict treatment outcomes through currently available mainstream techniques. We provide our proprietary tests and services, along with a comprehensive range of non-proprietary oncology-focused tests and laboratory services, to oncologists and pathologists at hospitals, cancer centers, and physician offices. Our proprietary tests are based principally on our expertise in specific cancer types, test development methodologies and proprietary algorithms correlating genetic events with disease specific information. Our portfolio primarily includes comparative genomic hybridization (CGH) microarrays and next generation sequencing (NGS) panels, and DNA fluorescent in situ hybridization (FISH) probes.

Our comprehensive oncology-focused testing services for cancer are utilized in the diagnosis, prognosis and predicting treatment outcomes (theranosis) of cancer patients and are growing rapidly as clinicians demand more precise and more comprehensive diagnostic evaluation of their patients. We utilize highly skilled scientists, pathologists and hematologists in our laboratory, with 35% of individuals holding advanced degrees. These individuals assist our customers in integrating and technically assessing the testing results for their patients.

The non-proprietary testing services we offer are focused in part on specific oncology categories where we are developing our proprietary arrays and probe panels. We believe that there is significant synergy in developing and marketing a complete set of tests and services that are disease- and treatment-focused and delivering those tests and services in a comprehensive manner to help with patient management decisions. The insight that we develop in delivering the non-proprietary services are often leveraged in the development of our proprietary programs and now increasingly in the validation of our proprietary programs for clinical use.

We believe that we can be successful by offering cancer professionals a fully-integrated menu of oncology- focused proprietary tests and customizable laboratory services. We believe that our proprietary tests provide superior diagnostic and prognostic values than other currently available tests and services. We believe our ability to rapidly translate research insights about the genetics and molecular mechanisms of cancer into the clinical setting will improve patient treatment and management and that this approach can become a key component in the standard of care for personalized cancer treatment.

We currently offer a range of proprietary and non-proprietary services in the following areas:

3

Proprietary Microarray based testing (MatBA®-CLL, MatBA®-SLL, MatBA®-DLBCL, MatBA®-MCL and UroGenRA®-Kidney) | Our proprietary microarray tests for the detection of chromosomal abnormalities observed in Chronic Lymphocytic Leukemia, Small Lymphocytic Lymphoma, Diffuse Large B-Cell Lymphoma, Mantle Cell Lymphoma and kidney cancer. |

Proprietary Next Generation Sequencing testing (Focus::CLL™, Focus::Myeloma™, Focus::Lymphoma™ | Our proprietary NGS tests for the diagnosis and prognosis of genomic alterations in Chronic Lymphocytic Leukemia, Myeloma, and B-Cell Non-Hodgkin's Lymphomas. |

Molecular Testing | Using quantitative methods, such as polymerase chain reaction, sequencing and mutation analysis, to analyze DNA and RNA to follow progression of disease and response to therapy at the genetic level. |

Cytogenetics Testing | A series of methods that analyze human chromosomes in order to identify malignancy. |

FISH Testing | Analysis of abnormalities at the chromosomal and gene levels using analyte specific reagents and FED-cleared probes performed on whole specimen or separated purified plasma cells. |

Histology Testing | Microscopic examination of stained tissue sections using various special staining techniques. |

Cytology Testing | Non-gynecological fluid preparation for microscopic evaluations by a pathologist. |

IHC Testing | Analysis of the distribution of tumor antigens in specific cell and tissue types. |

Our clinical services strategy is focused on direct sales to oncologists and pathologists at hospitals, cancer centers, and physician offices in the United States, and expanding our relationships with leading distributors and medical facilities in emerging markets. In addition, we intend to continue to focus on partnering with community hospitals, where nearly 85% of all cancers are initially diagnosed, through our program called Expand Dx™, which was specifically designed to meet the needs of community hospitals. We believe our proprietary tests and services will enable community hospitals to optimize and expand their oncology services to better serve their cancer patients and reduce costs associated with cancer care.

We have developed the Summation™ Report which, we believe, provides an integrated view of a patient’s test results and diagnosis in a user-friendly, visually appealing format for clinicians. Our hematopathologists and laboratory directors prepare these Summation™ Reports based on the clinical information and diagnosis provided by our laboratory professionals. All our testing technologies are integrated into a Summation™ Report to allow oncologists to efficiently arrive at a definitive diagnosis and drive complete and effective decisions.

Our principle clinical services leverage and utilize our proprietary tests and testing methods, which include the categories below:

NGS Panels

Next-Generation Sequencing performs massively parallel sequencing (over 100 reads of a selected segment of DNA in one test run) of DNA from cancer cells effectively permitting a highly sensitive analysis of not only the sequence of the genome in cancer cells to reveal mutations and other aberrations associated with a cancer, but also other genomic rearrangements previously unknown to occur in the cancer genome. Translation of these findings for clinical implementation can also be achieved with a high degree of sensitivity using deep sequencing at specific nucleotide sequences and can be translated where applicable into FISH or microarray-based assays depending on the aberrations that need to be detected, to develop more specific tests. Deep sequencing is a technique by which a selected segment of nucleotides is sequenced repeatedly in order to reveal potentially rare genetic changes that may not be discoverable by traditional sequencing methods.

CGH Microarrays

Oligonucleotide-based CGH microarrays are a multiplex technology that allows the attachment of thousands of microscopic spots of DNA onto a surface. The DNA sequences on the microarray can hybridize to multiple genetic aberrations in cancerous tissue and can yield diagnostic and prognostic information of importance to the treatment of the patient from a small amount of patient sample. We believe microarrays provide a powerful approach to distinguishing cancer types and differentiate those more or less likely to recur, progress or respond to specific treatments based upon comprehensive sequence analysis and the ability of one microarray to interrogate multiple cancer subtypes in parallel. Because thousands of individual DNA sequences are being tested by the microarray, analysis involves bioinformatics-based algorithms. Considering the current clinical and societal demand for minimally invasive procedures, we believe the diagnostic and prognostic applications of microarrays are highly desirable.

4

CompleteTM Program

Our CompleteTM program is our branded program offering a unique suite of common and proprietary tests that assist clinicians in determining the best treatment options to improve patient outcomes. Each CompleteTM program integrates the latest diagnostic and prognostic biomarkers across multiple testing methodologies. We offer CompleteTM testing for a number of hematological cancers and solid tumors, including CLL/SLL, DLBCL, MCL, MPN, colorectal, lung and breast cancers.

DNA Probes

FISH-based DNA probes are fluorescently labeled sequences of DNA complementary to a genomic region of interest, which when hybridized to chromosomes, give rise to signals revealing with high sensitivity the presence or absence of a specific genomic abnormality. One probe identifies one specific genomic region. To create higher levels of specificity, multiple probes may be required to identify multiple genomic aberrations in the same cancer cell. Depending on the color scheme and custom design of each FISH-based DNA probe, genomic gain/loss and rearrangements can be detected in cancer specimens of multiple tissue types. Our proprietary FHACT® probe panel for detection and prognostication of HPV-associated cervical cancer and precancerous lesions uses a patented four-probe set to differentiate between cervical lesions likely to progress to cancer and those likely to regress without intervention.

We expect to offer additional proprietary tests as LDTs in other areas of oncology and will seek the required CLIA and state approvals, as well as any FDA approvals that may be required for these tests.

Biopharma Services

Biopharma services include laboratory and testing services performed for biopharmaceutical companies engaged in clinical trials. Our biopharma services focus on providing pharmaceutical companies with oncology specific and non-oncology genetic testing services for phase I-III trials along with ancillary services including biorepository and trials logistics support. These services include DNA and RNA extraction and purification, genotyping, gene expression analyses and biorepository sample storage solutions.

Industry research has shown many promising drugs have produced disappointing results in clinical trials. For example, a study by Princess Margaret Hospital in Toronto estimated that 85% of the phase III trials testing new therapies for solid tumors studied over a five-year period failed to meet their primary endpoint. Given such a high failure rate of oncology drugs, combined with constrained budgets for biopharmaceutical companies, there is a significant need for drug developers to utilize molecular diagnostics to decrease these failure rates. For specific molecular-targeted therapeutics, the identification of appropriate biomarkers potentially may help to optimize clinical trial patient selection and increase trial success rates by helping clinicians identify patients that are most likely to benefit from a therapy based on their individual genomic profile.

Our Select One® offering was created specifically to help the biopharmaceutical community with clinical trials and companion diagnostic development in areas of our core expertise. Oncology drugs have the potential to be among the most personalized of therapeutics, and yet oncology trials have one of the worst approval success rates, hovering at approximately 10%. In an effort to improve the outcome of these trials, and more rapidly advanced targeted therapeutics, the biotechnology and pharmaceutical community is increasingly looking to companies that have both proprietary disease insights and comprehensive testing services as they move toward biomarker-based therapeutics.

In July 2014, the United States National Institutes of Health reported over 83,000 clinical trials were currently being conducted in the United States, and over 12,000 of these trials were actively recruiting participants for studies with oncology pharmaceuticals or biologics. Genomic testing services have been altering the clinical trials landscape by providing biopharma companies with information about trial subjects’ genetic profiles that may be able to inform researchers whether or not a subject will benefit from the trial drug or will experience adverse effects. Streamlined subject selection and stratification, and tailored therapies selected to maximally benefit each group of subjects may increase the number of trials that result in approved therapies and make conducting clinical trials more efficient and less costly for biopharma companies. In 2014, forty-one new drugs were approved by the FDA. This is the highest number of FDA approvals since 1996, and twenty of these drugs were personalized medicines, highlighting the potential value of incorporating genomic information into clinical trial design.

In addition to the tests and services provided to biopharma companies, we are developing NGS panels focused on pharmacogenomics and oncology that will inform researchers of trial subjects' drug sensitivities.

We provide the following services to biopharma companies and researchers conducting clinical trials:

Genotyping and Pharmacogenomics Testing Services

•Over 400 genotyping assays including drug metabolizing enzymes, transporters and receptors

5

•Over 30 validated gene expression assays

•Testing for the FDA’s Pharmacogenomic (PGx) Biomarkers in Drug Labels recommended panel

•Loss of heterozygosity and copy number detection assays

We also utilize our laboratories to provide clinical trial services to biopharmaceutical companies and clinical research organizations to improve the efficiency and economic viability of clinical trials. Our clinical trials services leverage our knowledge of clinical oncology and molecular diagnostics and our laboratory’s fully integrated capabilities. Our Select One® program integrates clinical information into the drug discovery process in order to provide customized solutions for patient stratification and treatment. By utilizing biomarkers, we intend to optimize the clinical trial patient selection. This may result in an improved success rate of the clinical trial and may eventually help biopharmaceutical companies to select patients that are most likely to benefit from a therapy based on their genetic profile. We believe we are one of only a few laboratories with the capability to combine somatic and germline mutational analyses in clinical trials.

Our Select One ® clinical trial services are aimed at developing customizable tests and techniques utilizing our proprietary tests and laboratory services to provide enhanced genetic signature and more comprehensive understanding of complex diseases at earlier stages. We leverage our knowledge of clinical oncology and molecular diagnostics and provide access to our genomic database and assay development capabilities for the development and validation of companion diagnostics. This potentially enables companies to reduce the costs associated with development by determining earlier in the development process if they should proceed with additional clinical studies. We have been chosen by Gilead Sciences Inc. to provide clinical trial services and molecular profiling of chronic lymphocytic leukemia (CLL) patients. We believe our clinical trial services may allow Gilead and others to improve patient responder selection, thereby potentially increasing the likelihood our customer’s product is approved by FDA. Additionally, through our services we gain further insights into disease progression and the latest drug development that we can incorporate into our proprietary tests and services.

We also provide genetic testing for drug metabolism to aid biopharmaceutical companies identify subjects’ likely responses to treatment, allowing these companies to conduct more efficient and safer clinical trials. We believe pharmacogenomics drug metabolism testing helps deliver the promise of personalized medicine by enabling researchers to tailor therapies in development to differences in patients' genomic profiles.

Discovery Services

Our discovery services provide the tools and testing methods for companies and researchers seeking to identify new DNA-based biomarkers for disease. In 2014, we added discovery services as a new revenue category and for the year ended December 31, 2014 this category accounted for approximately 2% of our total revenue. Discovery services we offer include validation of biomarkers for diseases including cancers, from which tests for diagnosis or prognosis may be established. We also provide consulting, guidance and preparation of samples and clinical trial design. We believe the ability to analyze variations in DNA and interpret these changes into meaningful predictors of disease or indicators of diagnosis is essential to discovering new biomarkers for cancer and targets for therapies.

Our Laboratory Facilities

Rutherford, New Jersey, United States

Our Rutherford location is a 17,900 square foot facility and also serves as our corporate headquarters. We offer our clinical services, biopharma services and discovery services out of our Rutherford location. This location has been accredited by the College of American Pathologists, which is an approved accreditation method under the Clinical Laboratory Improvement Amendments of 1988 (“CLIA”), to perform high complexity testing. CLIA certification and accreditation are required before any laboratory may perform clinical testing on human samples for the purpose of diagnosis, prevention, treatment of disease or assessment of health. Our Rutherford location is licensed by the appropriate state departments of health and able to receive and test patient samples from all 50 states, as well as from oversees locations. Additionally, our Rutherford laboratory is self-certified under the US-EU and US-Swiss Safe Harbor Frameworks governing use of personal information received on patients or clinical trial participants from the European Union. Our Rutherford laboratory also holds the requisite licenses from the New Jersey State Department of Health to operate and perform clinical testing on patient samples. In addition, certain states, such as New York, require out-of-state laboratories to obtain licenses in order to accept patient specimens from such states. Our Rutherford location holds clinical laboratory licenses from the New York Department of Health, Florida Department of Health, Maryland Department of Health, Pennsylvania Department of Health, and California Department of Health for all of our clinical departments.

Morrisville, North Carolina, United States

We offer our biopharma services, including biopharmaceutical trials testing services, pharmacogenomics testing, and sample

6

storage and biorepository services from our 25,000 square foot facility located in Research Triangle Park, Morrisville, North Carolina. Our facility in Morrisville is compliant under CLIA and Good Laboratory Practices (“GLP”), and has received accreditation by the College of American Pathologists (“CAP”) for its industry-leading biorepository capabilities. Our Morrisville laboratory does not require individual state licensure since it is not performing clinical testing on patient samples and is only involved in clinical trials testing. Our Morrisville laboratory is also self-certified under US-European and US-Swiss Safe Harbor frameworks.

Hyderabad, India and Shanghai, China

We also have two laboratories operating outside of the United States: one in Hyderabad, India and one in Shanghai, China. Our 10,000 square foot Hyderabad facility services government entities, academic institutions, and health and cancer centers. It is a Department of Scientific and Industrial Research (“DSIR”) recognized laboratory and is ISO9001-2008 and National Accreditation Board for Testing and Calibration Laboratories (“NABL”) certified. Our 2,700 square foot Shanghai facility is both CLIA and GLP compliant, and provides biopharma services to companies performing clinical trials in China.

Market Overview

United States Clinical Oncology Market Overview

Despite many advances in the treatment of cancer, it remains one of the greatest areas of unmet medical need. In 2012, the World Health Organization attributed 8.2 million deaths worldwide to cancer-related causes. In 2014, the World Health Organization projected that over the next two decades this number will rise to 13 million deaths per year. Within the United States, cancer is the second most common cause of death, exceeded only by heart disease, accounting for nearly one out of every four deaths. The incidence and deaths caused by the major cancer categories are staggering. The following table published by The American Cancer Society shows estimated new cases and deaths in 2014 in the United States for the major cancers:

Cancer Type | Estimated New Cases For 2014 | Estimated Deaths For 2014 | |

Breast . . . . . . . . . . . . . . . . | 235,030 | 40,430 | |

Cervical* . . . . . . . . . . . . . | 12,360 | 4,020 | |

Colorectal . . . . . . . . . . . . . | 136,830 | 50,310 | |

Endometrial . . . . . . . . . . . | 52,630 | 8,590 | |

Kidney* . . . . . . . . . . . . . . | 63,920 | 13,860 | |

Leukemia* . . . . . . . . . . . . | 52,380 | 24,090 | |

Lung** . . . . . . . . . . . . . . . | 224,210 | 159,260 | |

Melanoma . . . . . . . . . . . . | 76,100 | 9,710 | |

Multiple Myeloma** . . . . | 24,050 | 11,090 | |

Non-Hodgkin’s | |||

Lymphomas* . . . . . . . . . . | 70,800 | 18,990 | |

Ovarian . . . . . . . . . . . . . . . | 21,980 | 14,270 | |

Pancreatic . . . . . . . . . . . . . | 46,420 | 39,590 | |

Prostate . . . . . . . . . . . . . . . | 233,000 | 29,480 | |

* Areas where we have active development programs.

** Areas where we have active development programs with Oncospire Genomics, LLC.

In addition to the human toll, the financial cost of cancer is overwhelming. An independent study published in 2010 and conducted jointly by the American Cancer Society and LIVESTRONG ranked cancer as the most economically devastating cause of death in the world-estimated to be as high as $895 billion globally in 2008. According to the National Institutes of Health, the direct cost of cancer care in the United States is projected to increase from $125 billion in 2010 to $173 billion by the year 2020 taking into account the rising costs of medical care.

United States Clinical Trials Market Overview

The United States is currently the world leader in biopharmaceutical research and development and manufacturing. In 2013 it is estimated that over $50 billion dollars was spent in pharmaceutical research and development, increasing 20% from spending in 2005. The average cost to develop a drug can be as high as $1.2 billion and the approval process from development to market may be as long as 15 years. Since 1980, approximately 63% of life expectancy increases in cancer patients are due to new treatments and oncology medications.

7

While oncology drugs have the potential to be among the most personalized therapeutics, oncology clinical trials continue to have some of the poorest approval rates. The application of pharmacogenomics to oncology clinical trials enables researchers to better predict differences in drug response, efficacy and toxicity among trial participants, as well as to optimize treatment regimens based on these differences. It is estimated that by 2020, half of all pharmaceutical sales in the United States will be from specialty drugs, a category of drugs including oncology treatments tailored to patients’ genomic profiles. A study by Grand Market Research places the oncology market at 34% of revenue for molecular diagnostics services in 2013, with the pharmacogenomics market following closely at 26.3%. Pharmacogenomics is the study of genetic analysis based on a patient's response to a particular therapy or drug. We believe a growing demand for personalized medicine as a diagnostic tool is a growth driver of this market.

Our Strategy

Our strategy is to serve a diverse group of market participants - biotechnology and pharmaceutical companies, cancer centers and community hospitals, and research centers both public and private - that all require genomic assessment of cancer and biomarker based information to understand and manage the patient, their cancer and customize therapy choices. We believe that our integrated approach to testing combined with our ability to rapidly translate research insights about the genetics and molecular mechanisms of cancer into the clinical setting will improve patient treatment and management will become a key component in the standard of care for personalized cancer treatment.

Our approach is to develop and commercialize proprietary genomic tests and services to enable us to provide a full service solution to improve the diagnosis, prognosis and treatment of targeted cancers and to better predict differences in drug response, efficacy and toxicity among clinical trial participants, as well as to optimize treatment regimens based on these differences. To achieve this, we intend to:

•Continue investing in our portfolio by developing and commercializing additional proprietary genomic tests and services. We intend to continue the development of additional proprietary diagnostic and prognostic tests and services, including next generation sequencing tests, to provide information that is essential to personalized cancer treatment. These tests focus on hematological cancers and solid tumors. To facilitate the development of additional tests and further demonstrate the clinical value of our existing tests, we will continue to develop and expand our collaborations with leading universities and research centers.

•Continue investing in our portfolio by performing additional validation studies with collaborators. We intend to continue performing validation studies on our existing portfolio of proprietary diagnostic and prognostic tests with universities and research institutions. Validation studies demonstrate the clinical utility and efficacy of a test, and the results of validation studies may be used to demonstrate value to clinicians, hospitals and cancer care centers. Validation studies also provide data necessary for approval of the tests by governmental regulatory bodies, and to get our tests approved for reimbursement by third-party payors.

•Continue our focus on translational oncology and drive innovation and cost efficiency in diagnostics by continuing to develop next generation sequencing offerings independently and through our joint venture with Mayo Clinic. Translational oncology refers to our focus on bringing novel research insights that characterize cancer at the genomic level directly and rapidly into the clinical setting with the overall goal of improving value to patients and providers in the treatment and management of disease. We believe that continuing to develop our existing platforms and next generation sequencing panels will enable significant growth and efficiencies. We will continue to develop next generation sequencing panels independently as well as leverage our joint venture with Mayo to advance this diagnostic technology.

•Increase our focus on providing to biopharmaceutical companies and clinical research organizations our proprietary and non-proprietary genomic tests and services through our Select One® offerings. Oncology drugs have the potential to be among the most personalized of therapeutics, and yet oncology trials have one of the worst approval success rates, hovering at approximately 10%. In an effort to improve the outcome of these trials, and more rapidly advanced targeted therapeutics, the biotechnology and pharmaceutical community is increasingly looking to companies that have both proprietary disease insights and comprehensive testing services as they move toward biomarker-based therapeutics. Our Select One® offering was created specifically to help the biopharmaceutical community with clinical trials and companion diagnostic development in areas of our core expertise. In our core areas of disease focus, hematologic malignancies, urogenital cancers and HPV-associated cancers, there are over 4,500 active trials in the United States according to clinicaltrials.gov.

•Enhance our efforts to partner with community hospitals. According to the American Hospital Association, there are nearly 5,000 community hospitals in the United States. Community hospitals represent a large target market for our genomic

8

tests and services because approximately 85% of cancer patients in the United States are initially diagnosed in such hospitals as reported to the National Cancer Database. We intend to continue to focus on partnering with such hospitals by targeting our sales and marketing efforts on this important customer segment though our branded Expand Dx™ program. Our Expand Dx™ program for community hospitals is a suite of diagnostic and consultative services offered on a collaborative basis to expand and optimize the oncology diagnostics services and personalized cancer treatment provided by community hospitals so that such hospitals can retain their cancer patients. Our Expand Dx™ program focuses on enhancing the quality and increasing the efficiency of the community hospital’s oncology diagnostic process, including billing, turnaround time for diagnostic tests, diagnostic procedures and training and assistance in the use of additional biomarkers for their routine cancer testing. We believe that through our Expand Dx™ solution, community hospitals and laboratories can get cost-effective access to leading-edge diagnostic tests and specialized testing capabilities of our clinical reference laboratory. Our sales force works with our laboratory directors as a team to market our Expand Dx™ solution to community hospitals, geographically focused on the eastern and mid-western United States.

•Increase our geographic coverage by expanding our scalable sales and marketing capabilities. We currently have a specialized team of sales professionals with backgrounds in hematology, pathology, and laboratory services. We intend to continue expanding our sales force in order to provide increased geographic coverage throughout the United States. Additionally, we intend to develop and continue to expand both our domestic and international footprint through our recent acquisitions in North Carolina, USA and Hyderabad, India, and by focusing on emerging markets by seeking additional leading local partners to market and sell our tests and services.

•Reduce the costs associated with the development, manufacture, and interpretation of our proprietary genomic tests and services. We successfully migrated key components of our probe manufacturing to India in 2013, which reduced the labor costs involved and increased manufacturing yield and flexibility. In 2015, we will continue to assess how geographic advantage can help us improve our cost structure.

•Work with health care providers and payors to demonstrate the value of our testing in providing cost efficient and accountable care. We are actively involved in dialog with key payers, cost management organizations and insurance providers to demonstrate the value and effectiveness of our approach in genomic assessment of complex tumor systems.

•Continue offering our proprietary tests in the United States as laboratory-developed tests (“LDTs”) and internationally as CE-marked in vitro diagnostic medical devices. As part of our long-term strategy, we may seek Food and Drug Administration (“FDA”) clearance or approval to expand the commercial use of our tests to other non-affiliated laboratories and testing sites, or as may be required by developing FDA regulations. We believe it would likely take two years or more to conduct the studies and trials necessary to obtain approval from FDA to commercially launch our proprietary tests outside of our clinical laboratory.

Our Competitive Advantages

We believe that our competitive advantages are as follows:

•Our proprietary and clinically relevant genetic tests are the first to address several complex cancers that are difficult to prognose and where it is difficult to predict treatment outcomes using currently available technologies. Two of our marketed tests are the first to address several under-served, complex cancers. MatBA®-CLL is, to our knowledge based on our informal communications with New York State Department of Health personnel, the first microarray to have been approved by the New York State Department of Health for diagnostic treatment and management of CLL. In addition, in 2014 we launched Focus::CLLTM, the first NGS panel designed to specifically target genomic alterations clinically associated with CLL. FHACT®, our proprietary HPV-associated cancer test, is the first multi-region DNA probe to identify and stage HPV-associated cancers, which includes cervical, anal and oropharyngeal cancers.

•We have collaborative relationships with leading research centers, medical centers and oncology groups. Our collaborations with leading cancer centers provide us with a number of benefits, including valuable access to patient samples, data for validation studies and a pipeline of innovation. As of December 31, 2014 we have 19 active collaborations with cancer centers and academic institutions. Oncospire Genomics, our joint venture with Mayo Clinic, focuses on developing oncology diagnostic services and tests utilizing next-generation sequencing, particularly for lung cancer, multiple myeloma and follicular lymphoma. With respect to marketing, we can leverage the brand name recognition of our academic and research center collaborators when selling to our customers. With regard to research and development, our collaborations provide us with the fundamental science and research that underpin the development of our diagnostic tests and insight to maximize the utility of our tests in the clinical setting.

9

•Our tests provide more information than existing tests to enable a more personalized treatment plan and to provide more actionable information for clinical trials for development of oncology drugs. Our tests are designed to provide an earlier, more accurate and more complete diagnosis, which potentially leads to better treatment outcomes and lower health care costs. For example, MatBA®-CLL evaluates a set of five biomarkers not previously assessed in CLL and also allows a more accurate interpretation of the loss at chromosome 13q as a sole abnormality than previously possible. Our FHACT® test for HPV-associated cancers is the only four-color DNA-FISH probe that can be used for cervical cancer screening as additional triage before colposcopy. Our Focus::CLLTM NGS panel is a unique test that asses seven genes with clinical relevance to prognosis, disease management and treatment selection, and has an analytical sensitivity of 5%, allowing it to detect changes in DNA that occur at very low frequencies and may be missed by other technologies. Our proprietary tests also lead to more actionable information for clinical trials for development of oncology drugs. Through our Select One® offering and biopharma services we aim to identify genomic differences that can predict patient responses to drugs, enabling personalized oncology therapy regimens.

•Our genomic tests are not platform dependent. The biology and algorithms behind our tests are adaptable to multiple instrumentation platforms, allowing us to incorporate our tests into a variety of existing clinical laboratory infrastructures without additional capital investment. We have currently optimized our microarray tests for the Agilent platform. However, we believe that we can migrate to other similar platforms, including next gen sequencing, without significant modification. Our NGS panels are able to be run on both Illumina and Ion Torrent platforms.

•Our tests are designed for a wide range of sample types and sample preparation methods and we have the ability to test on FFPE tissue samples, which accelerates the time required to validate, develop and patent new tests. We can currently process specimen types that include blood, bone marrow and tissue, including fresh, frozen and formalin-fixed paraffin-embedded (FFPE) tissue samples. The ability to interrogate a wide variety of sample types increases clinical adoption of our tests and allows the health care provider to quickly and efficiently integrate our tests into its established workflow. This integration with existing oncology and pathology workflow and tissue analysis methods is integral to ensuring near term adoption. For several reasons, we have designed our tests for FFPE tissue samples. For decades, archival FFPE has routinely been used to preserve cancer samples and offers a wealth of information and collaboration potential in comparison with fresh or freshly prepared samples. Our use of FFPE has three important consequences. First, it significantly increases the datasets of samples that can be used to validate our products, leading to more robust and reliable diagnostic tools. Second, it permits utilization of FFPE in a clinical setting, where often it is the only specimen available for study. This is of particular importance to tumors diagnosed using minimally invasive technologies where often very small biopsy material is available for diagnostic and prognostic studies. Third, it affords enrichment, or more specific targeting within, the sample to be analyzed, increasing the probability with which genomic aberrations will be detected for any given specimen.

•We offer consultative, oncology-centered laboratory and clinical trial services. Our specimens are tested and interpreted by highly qualified oncology-focused laboratory professionals, many of whom hold MDs and PhDs. Because our clinical staff is highly specialized in oncology, we are better positioned to consult with our oncologist customers and biopharma clients to help them derive maximum value from the diagnostic and prognostic data generated by our tests.

•Our global laboratory infrastructure provides us with access to emerging clinical and biopharma markets. Access to emerging clinical and biopharma markets in India and China enables our participation in a robust and diverse client base outside of the United States. We have recently begun to provide clinical and research services to hospitals, government centers and biopharma companies in India and are engaged in clinical trials test services in China.

Our Proprietary Genomic Tests and Services

We currently develop and produce a variety of platform-independent DNA-based genomic tests: microarrays, probes and next generation sequencing panels. Each is directed at identifying specific genetic aberrations in cancer cells that serve as markers for diagnosis, prognosis and theranosis.

We offer microarrays, next generation sequencing and FISH probes because each serves a unique diagnostic or prognostic function. FISH- based tests, or probes, offer great sensitivity while microarrays provide a more comprehensive analysis of the cancer genome, and NGS panels offer a method of detecting mutations or chromosomal aberrations of lesser frequency.

FDA clearance or approval is not currently required to offer these tests in our laboratory once they have been clinically and analytically validated and approved by the appropriate regulatory bodies. We seek licenses and approvals for our laboratory facility and for our LDTs from the appropriate regulatory authorities, such as the CMS, which oversees CLIA, and various state regulatory bodies, including the New York State Department of Health. We will seek FDA clearance and approval as may be required in the future dependent upon the FDA's final guidelines in its decision to regulate LDTs. At the federal level,

10

certain proprietary tests must be part of proficiency testing programs approved under CLIA in order for us to be able to bill government payor program beneficiaries, such as Medicare patients, for such tests. In addition, certain states, such as New York, require us to obtain approval of our proprietary tests in order for us to collect patient specimens from such state.

We have obtained CE marking for FHACT®, which entitles us to market the test in the European Economic Area (which includes the 27 Member States of the EU plus Norway, Liechtenstein and Iceland). We anticipate that we will need to conduct additional developmental activities for this test and to submit it for regulatory clearance or approval by FDA or other regulatory agencies prior to commercialization outside of our reference laboratory in each of the markets where we plan to introduce them. FHACT® is our four-probe set used to detect genomic biomarkers indicative of HPV-associated precancer and cancer of several tissue types including cervix and pharynx. FHACT® has received two United States patents, covering the combination of genomic probes as well as its clinical use in patient samples.

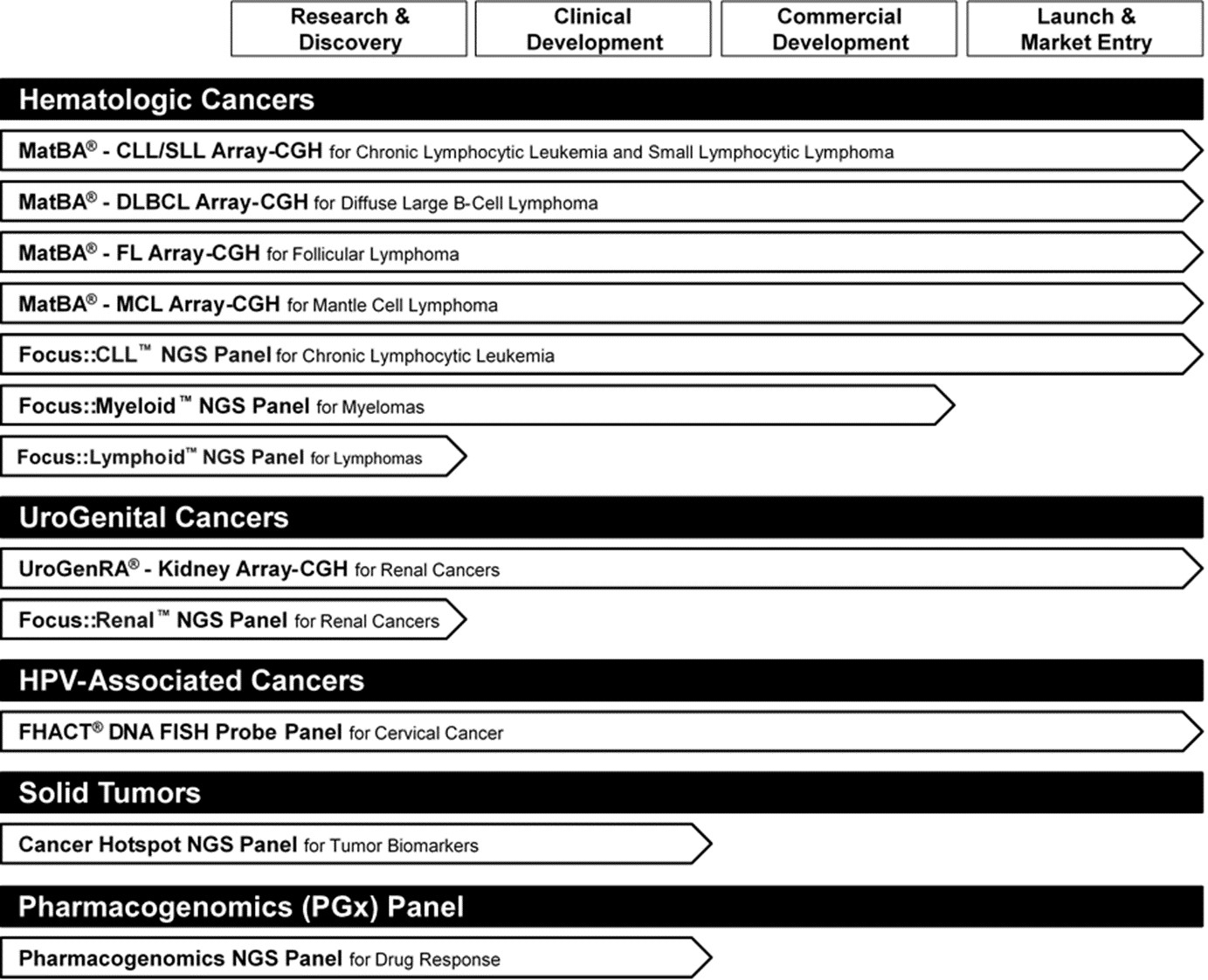

The following diagram portrays our proprietary programs:

Hematological Cancer Tests: MatBA® and Focus::NGS™

As a group, hematologic cancers (cancers of the blood, bone marrow or lymph nodes) display significant clinical, pathologic and genetic complexity. Current diagnosis relies mostly on pathologic examination, flow cytometry and detection of only a few genetic markers. Importantly, the clinical course of the six main subtypes of these neoplasms ranges from indolent (follicular lymphoma) to aggressive (diffuse large B-cell lymphoma, mantle cell lymphoma and multiple myeloma), or mixed (chronic lymphocytic leukemia/small lymphocytic lymphoma, or CLL/SLL). Currently most risk-stratification for treatment decisions is based on clinical features of the disease. Few molecular prognostic biomarkers are utilized in a clinical setting. There is unmet medical need for robust biomarkers for the diagnosis, prognosis, theranosis and overall patient management in B-cell cancers. Given the higher frequency of these malignancies in the United States than in other countries due to relatively

11

long lifespans and an aging population, we expect significant clinical demand for MatBA® and Focus::NGS™. Additionally, the increasing number of clinical trials in malignancies of blood and bone marrow is driving demand and usage of our tests and services that are focused on hematological cancers.

MatBA® is the first targeted oligonucleotide-based microarray we developed for the analysis of genomic alterations in mature B-cell neoplasms to determine prognosis and theranosis. MatBA® incorporates a common architecture of specific genomic regions that can be applied across the seven major mature B-cell neoplasms. Mature B-cell neoplasms account for approximately 7% of all cancers diagnosed in the United States annually and for approximately 6% of all estimated cancer-related deaths. An estimated 761,600 people in the United States are living with, or are in remission from, mature B-cell neoplasms. They are the fifth most common malignancy in both males and females, and the incidence is rising.

MatBA® is designed to detect genomic copy number changes in mature B-cell neoplasms either solely or in a unique combination, thus assisting the clinician in the management of a patient’s disease. The test relies on the comparative genomic hybridization of fluorescently differentially-labeled normal DNA and DNA extracted from the cancer specimen (array-CGH). Array-CGH utilizes minimal biopsy material and uses DNA as the analyte (the component whose properties are being measured), which is more stable, as compared to RNA used in other array detection methodologies. Both are important considerations for the ever increasing demand for less invasive procedures for diagnostic and prognostic purposes. Additionally, we have optimized the utility of the MatBA® array-CGH so that it can be routinely applied to the study of a range of specimen types including blood and bone marrow and FFPE biopsy specimens, which are often the only specimen available for analysis of Follicular Lymphoma (FL), Diffuse Large B-Cell Lymphoma (DLBCL) and Mantle Cell Lymphoma (MCL). With the exception of Chronic Lymphocytic Leukemia (CLL), biopsy/surgical procedures are rarely performed for B-cell neoplasms prior to the initiation of treatment, thus limiting the amount of tissue available for testing prior to deciding on the initial treatment regimen.

MatBA® was custom-designed to represent 80 regions of the human genome which have diagnostic and/or prognostic value in one or more of the mature B-cell neoplasm subtypes as identified through our research and analysis efforts. Unlike other technologies such as FISH, array-CGH using MatBA® simultaneously permits the detection of genomic gains and losses at multiple locations on a chromosome (loci) that characterize the mature B-cell neoplasm subtypes. For each subtype of B-cell neoplasm, cohorts of specimens with full clinical annotation are evaluated using MatBA® to identify novel associations between single and weighted combinations of genomic gains/losses and clinically relevant endpoints, including time to first treatment, treatment response, progression-free survival and overall survival, and to validate previously known associations. It is these associations, we believe, that provide valuable assistance to clinicians in risk stratification and guiding treatment plans for patients with these cancers. In 2014 we updated MatBA®-CLL/SLL to provide greater clarity of risk outcome for patients.

Focus::NGS™ is our family of next generation sequencing tests developed for the analysis of genomic alterations in hematological and other cancers to determine, guide and inform diagnosis, prognosis and theranosis. The tests rely on massively parallel sequencing, which is able to detect biomarker mutations and aberrations that are present at very low levels and which may be missed by other, less sensitive methodologies. In 2014, we launched our proprietary Focus::CLL™ panel for CLL and small lymphocytic leukemia (SLL). This panel is the only test that assesses 7 genes in a single test, providing clinically relevant data for prognosis, disease management and treatment selection. The panel is available both for routine clinical patient diagnosis and management, as well as for patient stratification in clinical trials for CLL or SLL. In addition to being offered for clinical use, the Focus::NGS™ panels became available in the fourth quarter of 2014 through our Select One® clinical trial offering. In 2014 Focus::CLL™ was chosen for use in a global clinical trial by a leading biotechnology company.

In addition to our Focus::CLL™ NGS panel, we are in developmental phases for two additional NGS panels for hematological cancers. Our Focus::Myeloid™ panel is designed to target 54 genes, and we believe it will provide important prognostic information for myelodysplastic syndromes (MDS) and acute myeloid leukemia (AML), as well as diagnostic and prognostic information for myeloproliferative neoplasms (MPN). MDS are a group of bone marrow disorders in which the bone marrow does not produce enough healthy blood cells. Approximately 30% of patients diagnosed with MDS will progress to AML, which is a cancer of the myeloid line of blood cells characterized by rapid growth of abnormal white blood cells which interferes with the normal production of other blood cells. MPNs consist of a group of diseases where there is an overproduction of different types of blood cells. The form of MPN is defined by the type of cell that is overproduced. MPNs also have a high possibility of progressing to AML depending on the mutations responsible for the MPN. AML is the most common acute leukemia in adults and its incidence increases with age. AML is expected to account for approximately 20,800 new leukemia cases in 2015, and its prevalence is expected to increase as the population ages.

Focus::Lymphoma™ is our NGS panel in development for B-cell lymphomas, a type of Non-Hodgkin lymphoma. The panel targets 220 genes known to be associated with diagnosis, prognosis and patient treatment response based on their mutational

12

frequency and their potential to interact with cellular pathways known to be dysregulated in these diseases and associated with treatment success and resistance. B-cell lymphomas are a group of approximately one dozen different cancers that are the result of over proliferation of B cells. B-cell lymphomas may either be indolent or aggressive, and diagnosis and staging of the cancer is essential for appropriate diseases and treatment management. In 2014, approximately 60,100 cases of B-cell lymphoma were diagnosed in the United States and the incidence of this disease is expected to rise as the population ages.

We are also actively developing two solid tumor NGS panels. We are designing a cancer HotSpot NGS panel that targets 50 genes associated with cancer development in various tissue types, and which have been identified by scientific literature to play a role in patient response to cancer treatments as well as provide information on likelihood of survival and cancer recurrence. Our pharmacogenomics (PGx) panel in development targets 1885 DNA changes associated with patient drug response. Through detection of these changes, the PGx panel can provide information about a patient's ability to metabolize pharmaceuticals, including anti-inflammatory drugs and warfarin, among others. This information is important to determining drug dosage and to avoid adverse reactions to medications.

MatBA® Microarrays and Focus::NGS™ Panels offered as LDTs

We offer the first application of MatBA® for prognostication in one subtype of mature B-cell neoplasm, CLL, where about half of patients experience indolent disease, or slow progression, and the remaining half, a relatively aggressive progression. MatBA®-CLL provides important genetic-based information to guide clinical management of this disease. The test results are reported out in a unique format that allows ease of interpretation by the hematologist or oncologist. MatBA®-CLL is included in the tests we can provide under our New York laboratory and CLIA licenses. New York is one of only a few states that separately reviews LDTs for clinical and analytical validity. To date there are only a few companies that have commercially available oncology microarrays and, to our knowledge based on our informal communications with New York State Department of Health, MatBA®-CLL was the first oncology microarray approved for commercial use by the New York State Department of Health.

We offer Focus::CLL™ for prognostication in CLL and SLL to provide genetic-based information to guide clinical management of these diseases. Similar to CLL, SLL is experienced in patients as either indolent disease or active progression, which require different approaches to treatment. Therefore, it is important for clinicians and oncologists to be able to differentiate between disease types that are likely to progress or not. Based on the Focus::CLL™ panel test results, each patient may receive the most suitable treatment tailored to their unique cancer subtype. Focus::CLL™ is included in the tests we can provide under our CLIA license, effective December 2014, and we are engaged in the application process for New York laboratory approval.

Approximately 14,600 new cases of CLL are expected to be diagnosed in the United States in 2015, and importantly, over time these cases undergo evolution, requiring risk stratification and guidance on patient management issues at multiple points during the course of the disease. Prior to the introduction of MatBA® and Focus::CLL™, clinicians relied on the assessment of the gain or loss on only four chromosomal regions and potentially one gene mutation when testing for and stratifying a CLL patient. MatBA® improves on this by identifying information on five additional chromosomal regions, providing more valuable diagnostic data and critical information about the risk of progression and overall prognosis of the patient. In particular, because MatBA® has greater resolution than that available with prior tests, we can interrogate two different regions or loci on the 13q chromosome. Loss of one specific locus or loss of both loci are in some circumstances believed to have differing prognostic value, hence the importance of being able to evaluate both loci. Also, loss of 13q as a sole abnormality is associated with a lower risk of progression and overall favorable outcome. With the increased capacity of MatBA® to assess abnormalities in multiple regions of the genome not usually assessed by other technologies, our studies have indicated that up to 23% of cases that would have shown 13q loss as a sole abnormality when assessed by FISH technologies do in fact have additional abnormalities. For these cases, the “favorable outcome” that would have been reported to the clinician was not accurate, leading to a change in the prognosis and consequently decision-making by the clinician regarding the management of these patients. In addition we have identified novel biomarkers using MatBA® that are associated with a poor outcome in CLL. These include gains at 2p, 3q and 8q and a loss at 8p. Additional prognostic regions have been identified and are undergoing validation. These will be reported, further driving the value of more comprehensive genomic assessment of the patient’s cancer. We believe this type of genomic assessment of the patient’s cancer also saves the health care system thousands of dollars per year per patient as a result of improved patient management and more targeted therapeutic intervention.

Kidney cancer: UroGenRA®-Kidney and Focus::RenalTM

There is an unmet clinical and patient need for improved diagnosis, prognosis and theranosis, including more detailed and staging information, in kidney cancers, where biopsy materials are increasingly scarce. The cumulative number of annual new

13

reported cases for kidney cancers is estimated at 61,560 for 2015 according to the American Cancer Society. Although generally characterized by early stage detections, these cancers still represent a major health risk, a significant variability in patient outcome, which can be better managed through genomic assessment of the tumor(s), and a substantial medical cost burden to the public with the high rates of incidence and ongoing patient management needs. Developing sophisticated, state-of-the-art molecular tests that enable more accurate diagnosis and/or prognosis of these cancers will not only benefit the patients by offering more appropriate treatments, but also effectively reduce the unnecessary medical cost associated with surgery, long-term follow-up surveillance, or therapy after the treatment.

The UroGenRA® microarray, which has been validated in collaboration with Memorial Sloan-Kettering Cancer Center, will provide diagnostic and prognostic analysis for kidney, bladder and prostate cancer. We launched UroGenRA® in 2013.

UroGenRA® is a proprietary CGH-based array which will serve as a platform for the diagnosis, prognosis and theranosis of kidney cancers. It was designed to detect gains and losses that frequently occur in genetic material in these cancer types and has the potential to differentially diagnose and/or stratify patients to assist and guide clinical management. It represents 101 regions of the human genome potentially with diagnostic, prognostic and/or theranostic value. UroGenRA® is specifically designed to classify renal tumors into the four main subtypes (clear cell, papillary, chromophobe and oncocytoma), which is critical to patient management and treatment protocols. This allows the clinician, especially in cases where there is limited biopsy material, to diagnose renal cancer and accurately classify it into the correct subtype, (ii) provide rationale for selection among surgical and non-surgical intervention or ablation, (iii) stratify patients based on prognostic information for the advancement of renal cancer into local or regional cancer which then guides decisions on surgical intervention, and (iv) guide drug trial decisions in those with metastatic disease or “unclassified” renal cancers.

We developed a study with two leading academic cancer centers for which we obtained and used a group of 200 specimens comprising four kidney cancer subtypes to further develop and validate the algorithm of copy number variation known to be associated with these tumors that gives the best ability to differentiate among these four subtypes. These copy number changes are already known to minimally include loss in six regions of chromosomes among these four types and gain in three other regions and we were able to define additional and specific regional copy number variations. The derived proprietary renal cancer diagnostic algorithm or decision tree based on UroGenRA® copy number alterations was validated for diagnostic potential in the IRB-approved study of over 50 image-guided needle biopsies and compared with the sensitivity and specificity obtained by our proprietary FISH-based assay for kidney cancer, FReCaD™.

UroGenRA®-Kidney is now available as a LDT available under our CLIA and New York laboratory licenses. At the current time, validation of the clinical utility of UroGenRA® is further advanced for kidney cancers than for prostate and bladder cancers, because we are able to leverage research and insights used in the clinical validation of FReCaD™ in our development activity for the UroGenRA® indication for kidney cancer.

In 2014, in a collaboration with Memorial Sloan-Kettering Cancer Center, we identified genomic signatures that can differentiate between patients with clear cell renal carcinoma (ccRCC), a type of kidney cancer, whose disease is likely to relapse or metastasize, or spread to other tissues in the body. The study analyzed 144 ccRCC samples and the genomic signatures identified by this collaborative effort have the potential to allow for better risk stratification and treatment selection for patients with metastatic ccRCC. ccRCC is the most common type of kidney cancer, with approximately 43,000 cases diagnosed in the US each year. Identifying patients whose disease is likely to relapse or metastasize is essential for planning appropriate treatment strategies and improving survival outcomes. We plan on integrating the genomic signatures identified in this study into an NGS panel for kidney cancer, Focus::RenalTM..

Proprietary DNA Probe

FHACT® HPV-Associated Cancer Test

We have developed a proprietary, 4-color FISH-based DNA probe designed to identify the gain of the three most important chromosomal regions that have been implicated in cancers associated with HPV: cervical, anal and oropharyngeal. According to the National Cancer Institute, about 55 million PAP smear tests to detect HPV are performed in the United States each year. It is estimated that approximately 2 million patients have abnormal PAP smear test results and are referred for biopsy/colposcopy as a result of such tests. However, only 0.6%, or approximately 12,000 of these patients will develop cervical cancer. It is believed that early detection of HPV-associated cancers and lesions most likely to progress to cancer could eliminate unnecessary biopsies/colposcopies and thereby reduce health care costs.

FHACT® is designed to determine copy number changes of four particular genomic regions by FISH. These regions of DNA give specific information about the progression from HPV infection to cervical cancer, in particular the stage and subtype of disease. FHACT® is designed to enable earlier detection of abnormal cells and can identify the additional genomic

14

biomarkers that allow for the prediction of cancer progression. FHACT® is designed to leverage the same PAP smear sample taken from the patient during routine screening, thus reducing the burden on the patient while delivering greater genomic-based information to the clinician. We in-license a biomarker from the National Cancer Institute that is used in our FHACT® probe.

In conjunction with the National Cancer Institute, we are performing a blinded study to evaluate the effectiveness of FHACT® for both anal and cervical cancers associated with the HPV virus that involves over 1,000 specimens. We completed study on over 300 cervical specimens and the data has been provided to National Cancer Institute. The results from this study along with the methods and values validated by this work will be used to enhance the product performance of FHACT®. Upon review of the data analysis and results, National Cancer Institute will provide additional anal tissue samples. This data has been used for validation of the assay and development of automatic analysis for the FHACT® probe. We continue to validate FHACT® for anal and oropharyngeal cancers (cancers of the mouth and throat) using specimens from the National Cancer Institute and are actively seeking additional collaborations to further validate the clinical utility of FHACT®.

We continue further clinical validations in collaborations that have been established with the University of Iowa and with Kamineni Hospital in Hyderabad, India to further strengthen the claims and data for use of FHACT® as a staging and prognostic tool for cervical cancer in both the United States and in emerging markets. The sensitivity of FHACT® was presented as a poster at the 27th International Pappillomavirus Conference in Berlin, Germany in 2011. The publication demonstrated that by using FHACT® over 90.9% sensitivity can be achieved as a screening tool for cervical intraepithelial neoplasia of 2nd degree or higher (known as CIN2+), which is a critical milestone in the development of cervical cancer, after which stage treatment choices are limited.

In 2012, we made FHACT® available outside the United States as a diagnostic tool for cervical cancer in certain emerging market countries, including India. Cervical cancer is the third most common cancer among women worldwide, with one-fifth of global cases originating in India. The World Health Organization projects that cervical cancer deaths will rise to 320,000 in 2015 and 435,000 in 2030. In many emerging economies, cervical cancer is the most common cancer that affects women, and 80% of deaths from cervical cancer occur in developing countries. We began making FHACT® available for clinical use in the United States in 2013. We actively market FHACT® to hospitals, cancer clinics and individual physicians' offices for testing cervical cell samples obtained from patients' pap smear liquid.

In October and November of 2014, we were granted U.S. Patent Nos. 8,883,414 and 8,865,883, respectively, by the United States Patent and Trademark Office for FHACT®. The '883 patent covers the 4-probe design and the '414 patent covers FHACT® for use to detect HPV-associated cancer and precancerous lesions in clinical samples.

Oncospire Genomics, LLC: Our Joint Venture with Mayo Clinic