UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Rule 14a-12 |

Lexaria Corp.

Name of the

Registrant as Specified In Its Charter

N/A

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. |

Title of each class of securities to which transaction applies: | |

| 2. |

Aggregate number of securities to which transaction applies: | |

| 3. |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. |

Proposed maximum aggregate value of transaction: | |

| 5. |

Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. |

|

[ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. |

Amount Previously Paid: |

| 2. |

Form, Schedule or Registration Statement No.: |

| 3. |

Filing Party: |

| 4. |

Date Filed: |

Table of Contents

LEXARIA CORP.

950-1130 West Pender Street

Vancouver, BC, Canada V6E 4A4

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 23, 2016

NOTICE IS HEREBY GIVEN that Lexaria Corp., a Nevada corporation ("we", "us", or "our"), will hold an annual general and special meeting of stockholders (the "Meeting") at Suite 400, 570 Granville Street, Vancouver, BC, Canada, V6C 3P1, at 1:00 p.m., local time, on Wednesday, March 23, 2016 for the following purposes:

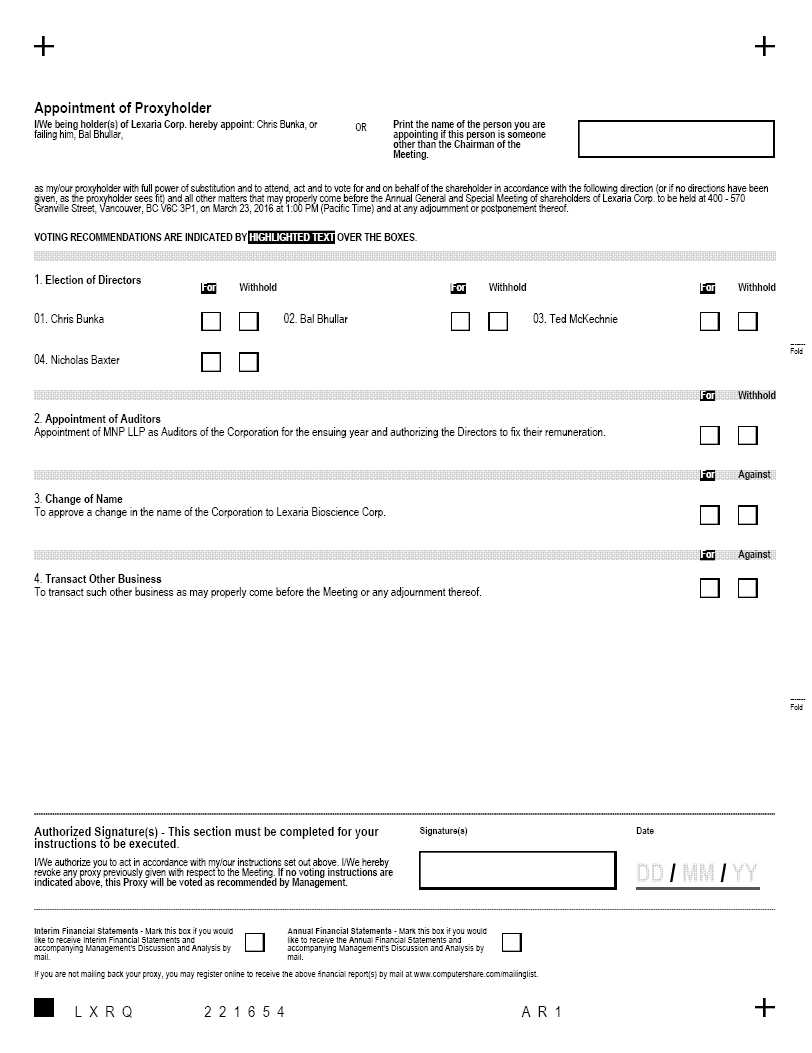

| 1. |

to elect Bal Bhullar, Christopher Bunka, Ted McKechnie and Nicholas Baxter as Directors to serve our company for the ensuing year and until their successors are elected; |

| 2. |

to ratify MNP LLP our independent registered public accounting firm for the fiscal year ending October 31, 2016 and to allow Directors to set the remuneration; |

| 3. |

to approve a change of name of our company; and |

| 4. |

to transact such other business as may properly come before the Meeting or any adjournment of postponement thereof. |

These items of business are more fully described in the proxy statement accompanying this notice.

Our Board of Directors has fixed the close of business on February 17, 2016 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Meeting or any adjournment thereof. Only the stockholders of record on the record date are entitled to vote at the Meeting.

Whether or not you plan on attending the Meeting, we ask that you vote by proxy by following instructions provided in the enclosed proxy card as promptly as possible. If your shares are held of record by a broker, bank, or other nominee, please follow the voting instruction sent to you by your broker, bank, or other nominee in order to vote your shares.

Even if you have voted by proxy, you may still vote in person if you attend the Meeting. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the Meeting, you must obtain a valid proxy issued in your name from that record holder.

Sincerely,

By Order of the Board of Directors

| Per: | Christopher Bunka |

|

Christopher Bunka | |

| Chairman of the Board |

Date: February 4, 2016

Page | 1

LEXARIA CORP.

950-1130 West Pender Street

Vancouver, BC, Canada V6E 4A4

Telephone: (604) 602-1633

PROXY STATEMENT

ANNUAL GENERAL AND SPECIAL MEETING OF

STOCKHOLDERS

TO BE HELD ON MARCH 23, 2016

QUESTIONS AND ANSWERS ABOUT THE MEETING OF STOCKHOLDERS

Why am I receiving these materials?

The Board of Directors of Lexaria Corp. (“we”, “us” or “our”) is soliciting proxies for use at the Annual General and Special Meeting of Stockholders to be held at Suite 400, 570 Granville Street, Vancouver, BC, Canada, at 1:00 p.m., local time, on Wednesday, March 23, 2016 or at any adjournment of the Annual General and Special Meeting (the "Meeting"). These materials were first sent or given to our stockholders on or about February 25, 2016.

What is included in these materials?

These materials include:

|

• |

the notice of Meeting of Stockholders; |

|

• |

this proxy statement for the Meeting of Stockholders; |

|

• |

the proxy card; and |

|

• |

our Annual Report on Form 10-K for the year ended August 31, 2015 as filed with the Securities and Exchange Commission on November 27, 2015 and our Annual Report on Form 10-K for the transition period from October 31, 2013 to August 31, 2014 as filed with the Securities and Exchange Commission on November 27, 2015. |

Important Notice Regarding the Availability of Proxy

Materials

for the Meeting to be Held on MARCH 23, 2016

The above materials are also available at www.lexariaenergy.com.

The Annual Reports on Form 10-K accompany this proxy statement, but do not constitute a part of the proxy soliciting material.

What items will be voted at the Meeting?

Our stockholders will vote:

| 1. |

to elect Bal Bhullar, Christopher Bunka, Ted McKechnie and Nicholas Baxter as Directors to serve our company for the ensuing year and until their successors are elected; |

| 2. |

to ratify MNP LLP our independent registered public accounting firm for the fiscal year ending August 31, 2016 and to allow Directors to set the remuneration; |

| 3. |

to approve a change of name of our company; and |

| 4. |

to transact such other business as may properly come before the Meeting or any adjournment of postponement thereof. |

We urge you to carefully read and consider the information contained in this proxy statement. We request that you cast your vote on each of the proposals described in this proxy statement. You are invited to attend the Meeting, but you do not need to attend the Meeting in person to vote your shares. Even if you do not plan to attend the Meeting, please vote by proxy by following instructions provided in the proxy card.

Page | 2

Who can vote at the Meeting?

Our Board of Directors has fixed the close of business on February 17, 2016 as the record date (the "Record Date") for the determination of the stockholders entitled to notice of, and to vote at, the Meeting or any adjournment. If you were a stockholder of record on the Record Date, you are entitled to vote at the Meeting.

As of the Record Date, 44,553,286 shares of our common stock were issued and outstanding and no other voting securities were issued and outstanding. Therefore, a total of 44,553,286 votes are entitled to be cast at the Meeting.

How many votes do I have?

On each proposal to be voted upon, you have one vote for each share of our common stock that you owned on the Record Date. There is no cumulative voting.

How can you Vote?

Shares of common stock cannot be voted at our Meeting unless the holder of record is present in person or is represented by proxy. A stockholder has the right to attend our Meeting at the time and place set forth in the Notice of Meeting and to vote their securities directly at the meeting. In the alternative, a stockholder may appoint a person to represent such stockholder at our Meeting by completing the enclosed Form of Proxy, which authorizes a person other than the holder of record to vote on behalf of the stockholder, and returning it to our transfer agent, Computershare Investor Services Inc., 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1. All stockholders are urged to complete, sign, date and promptly return the proxy by mail in the enclosed postage-paid envelope, or by fax If you do not wish to vote in person or if you will not be attending the Meeting, you may vote by proxy by mail, by telephone or via the Internet by following instructions provided in the proxy card.

Valid proxies will be voted at our Meeting and at any postponements or adjournments thereof as you direct in the proxy, provided that they are received by our transfer agent at least 24 hours prior to the scheduled time of the meeting, or any adjournment thereof, or deposited with the Chair of the meeting on the day of the meeting or any adjournment thereof prior to the time of voting.

The shares of common stock represented by the proxy will be voted, or withheld from voting, as directed in the proxy. If no direction is given and the proxy is validly executed, the proxy will be voted: (1) FOR the election of the nominees for our Board of Directors; (2) to approve, ratify, and appoint MNP LLP as our company’s auditors for the 2106 fiscal year and to allow directors to set the remuneration; and (3) FOR a change of name of our company. If any other matters properly come before our Meeting, the persons authorized under the proxies will vote upon such other matters in accordance with their best judgment, pursuant to the discretionary authority conferred by the proxy.

ADVICE TO BENEFICIAL HOLDERS OF SHARES OF COMMON STOCK

THE INFORMATION SET FORTH IN THIS SECTION IS OF SIGNIFICANT IMPORTANCE TO MANY STOCKHOLDERS OF OUR COMPANY, AS A SUBSTANTIAL NUMBER OF STOCKHOLDERS DO NOT HOLD SHARES IN THEIR OWN NAME.

Stockholders who do not hold their shares in their own name (referred to in this Proxy Statement as “beneficial stockholders”) should note that only proxies deposited by stockholders whose names appear on the records of our company as the registered holders of shares of common stock can be recognized and acted upon at our Meeting. If shares of common stock are listed in an account statement provided to a stockholder by a broker, then in almost all cases those shares of common stock will not be registered in the stockholder's name on the records of our company. Such shares of common stock will more likely be registered under the names of the stockholder's broker or an agent of that broker. In the United States, the vast majority of such shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depository for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee and custodian for many Canadian brokerage firms). Beneficial stockholders should ensure that instructions respecting the voting of their shares of common stock are communicated to the appropriate person, as without specific instructions, brokers/nominees are prohibited from voting shares for their clients.

Page | 3

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from beneficial stockholders in advance of stockholders' meetings, unless the beneficial stockholders have waived the right to receive meeting materials. Every intermediary/broker has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by beneficial stockholders in order to ensure that their shares of common stock are voted at our Meeting. The Form of Proxy supplied to a beneficial stockholder by its broker (or the agent of the broker) is similar to the Form of Proxy provided to registered stockholders by our company. However, its purpose is limited to instructing the registered stockholder (the broker or agent of the broker) how to vote on behalf of the beneficial stockholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”) (formerly, ADP Investor Communication Services in the United States and Independent Investor Communications Company in Canada). Broadridge typically applies a special sticker to proxy forms, mails those forms to the beneficial stockholders and the beneficial stockholders return the proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at our Meeting. A beneficial stockholder receiving a Broadridge proxy cannot use that proxy to vote shares of common stock directly at our Meeting - the proxy must be returned to Broadridge well in advance of our Meeting in order to have the shares of common stock voted.

Although a beneficial stockholder may not be recognized directly at our Meeting for the purposes of voting shares of common stock registered in the name of his broker (or agent of the broker), a beneficial stockholder may attend at our Meeting as proxyholder for the registered stockholder and vote the shares of common stock in that capacity. Beneficial stockholders who wish to attend at our Meeting and indirectly vote their shares of common stock as proxyholder for the registered stockholder should enter their own names in the blank space on the instrument of proxy provided to them and return the same to their broker (or the broker's agent) in accordance with the instructions provided by such broker (or agent), well in advance of our Meeting.

Alternatively, a beneficial stockholder may request in writing that his or her broker send to the beneficial stockholder a legal proxy which would enable the beneficial stockholder to attend at our Meeting and vote his or her shares of common stock.

There are two kinds of beneficial owners – those who object to their name being made known to the issuers of securities which they own (called OBOs for Objecting Beneficial Owners) and those who do not object to the issuers of the securities they own knowing who they are (called NOBOs for Non-Objecting Beneficial Owners). Pursuant to National Instrument 54-101, issuers can obtain a list of their NOBOs from intermediaries for distribution of proxy-related materials directly to NOBOs.

Quorum

A quorum of stockholders is necessary to take action at our Meeting. The holders of at least 10% of our shares entitled to vote as at the Record Date, present in person or by proxy, shall constitute a quorum for the transaction of business at our Meeting. However, if a quorum is not present, then the holders of a majority of the shares of common stock of our company who are present at the Meeting, in person or by proxy, may adjourn such meeting from time to time until holders of a majority of the shares of the capital stock shall attend. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the original meeting. Broker non-votes occur when a nominee holding shares of common stock for a beneficial owner of those shares of common stock has not received voting instructions from the beneficial owner with respect to a particular matter and such nominee does not possess or choose to exercise discretionary authority with respect thereto. Broker non-votes and abstentions will be included in the determination of the number of shares of common stock present at our Meeting for quorum purposes but will not be counted as votes cast on any matter presented at our Meeting.

Page | 4

YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE ASKED TO MARK, DATE, SIGN AND RETURN THE ACCOMPANYING FORM OF PROXY WHETHER OR NOT YOU PLAN TO ATTEND OUR MEETING. IF YOU PLAN TO ATTEND OUR MEETING TO VOTE IN PERSON AND YOUR SHARES ARE REGISTERED WITH OUR TRANSFER AGENT IN THE NAME OF A BROKER OR BANK, YOU MUST SECURE A PROXY FROM THE BROKER OR BANK ASSIGNING VOTING RIGHTS TO YOU FOR YOUR SHARES OF COMMON STOCK.

Dissenting Stockholder Rights

Dissenting stockholders have no appraisal rights under Nevada law or under our Articles of Incorporation or bylaws in connection with the matters to be voted on at the Meeting.

How do I vote my shares?

If you are a stockholder of record, you may vote in person at the Meeting or by proxy.

| • | To vote in person, come to the Meeting, and we will give you a ballot when you arrive. | |

|

• |

If you do not wish to vote in person or if you will not be attending the Meeting, you may vote by proxy by mail, by telephone or via the Internet following instructions provided in the proxy card. |

If you hold your shares in “street name” and:

|

• |

you wish to vote in person at the Meeting, you must obtain a valid proxy from your broker, bank, or other nominee that holds your shares giving you the right to vote the shares at the Meeting. Please follow the instructions from your broker, bank or other nominee, or contact your broker, bank or other nominee to request a proxy card. | |

|

|

|

|

|

• |

you do not wish to vote in person or you will not be attend the Meeting, you must vote your shares in the manner prescribed by your broker, bank or other nominee. Your broker, bank or other nominee should have enclosed or otherwise provided a voting instruction card for you to use in directing the broker, bank or nominee how to vote your shares. |

In all cases please ensure that the Proxy is received at least 48 hours (excluding Saturdays, Sundays and statutory holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with our transfer agent, Computershare Investor Services Inc., then you are a stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, or other nominee, then the broker, bank, or other nominee is the stockholder of record with respect to those shares. However, you still are the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, or other nominee how to vote their shares. Street name holders are also invited to attend the Meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one name or in different accounts. To ensure that all of your shares are voted, please vote by proxy by following instructions provided in each proxy card. If some of your shares are held in “street name,” you should have received voting instruction with these materials from your broker, bank or other nominee. Please follow the voting instruction provided to ensure that your vote is counted.

Page | 5

What vote is required for the election of Directors or for the approval of a proposal?

The vote of a majority in interest of our stockholders present in person or represented by proxy and entitled to vote at the Meeting will be sufficient to elect Directors or to approve a proposal.

For the election of Directors, the nominees who receive more “For” votes than the combined votes of “Against” votes and votes that are abstained will be elected as Directors. There is no cumulative voting in the election of Directors.

Counting of Votes

All votes will be tabulated by the inspector of election appointed for the Meeting, who will separately tabulate affirmative and negative votes and abstentions. Shares represented by proxies that reflect abstentions as to a particular proposal will be counted as present and entitled to vote for purposes of determining a quorum. An abstention is counted as a vote against that proposal. Shares represented by proxies that reflect a broker "non-vote" will be counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" will be treated as not-voted for purposes of determining approval of a proposal and will not be counted as "for" or "against" that proposal. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary authority or does not have instructions from the beneficial owner.

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before the final vote at the Meeting. If you are a stockholder of record, you may vote again on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Meeting will be counted), by signing and returning a new proxy card with a later date, or by attending the Meeting and voting in person. Your attendance at the Meeting will not automatically revoke your proxy unless you vote again at the Meeting or specifically request in writing that your prior proxy be revoked. You may also request that your prior proxy be revoked by delivering to our company, at the address on the Notice of Meeting, Attention: President, a written notice of revocation prior to the Meeting being held at the offices of Macdonald Tuskey, our corporate counsel.

If you hold your shares in the street name, you will need to follow the voting instruction provided by your broker, bank or other nominee regarding how to revoke or change your vote.

How can I attend the Meeting?

You may call us at 604-602-1675 if you want to obtain directions to be able to attend the Meeting and vote in person.

You may be asked to present valid picture identification, such as a driver’s license or passport, before being admitted to the Meeting. If you hold your shares in street name, you will also need proof of ownership to be admitted to the Meeting. A recent brokerage statement or letter from your broker, bank or other nominee is an example of proof of ownership.

Who pays for the cost of proxy preparation and solicitation?

We will pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokers, banks or other nominees for forwarding proxy materials to street name holders.

We are soliciting proxies primarily by mail. In addition, our Directors, officers and regular employees may solicit proxies by telephone, facsimile, mail, other means of communication or personally. These individuals will receive no additional compensation for such services. We will ask brokers, banks, and other nominees to forward the proxy materials to their principals and to obtain their authority to execute proxies and voting instructions. We will reimburse them for their reasonable charges and expenses, however we will not be paying for delivery to OBOs.

Page | 6

FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements. These statements relate to future events. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our company’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Voting Securities and Principal Holders Thereof

We are authorized to issue 220,000,000 shares of common stock with a par value of $0.001. As of the Record Date a total of 44,553,286 shares of common stock were issued and outstanding. Each share of common stock carries the right to one vote at the Meeting.

Only registered stockholders as of the Record Date are entitled to receive notice of, and to attend and vote at, the Meeting or any adjournment or postponement of the Meeting.

To the best of our knowledge, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, shares of common stock carrying more than 10% of the voting rights attached to the outstanding Common Shares of our company other than set forth in the section “Security Ownership of Certain Beneficial Owners and Management” below.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of the Record Date, certain information with respect to the beneficial ownership of our shares of common stock by each stockholder known by us to be the beneficial owner of more than 5% of our common shares, as well as by each of our current Directors and executive officers as a group. Each person has sole voting and investment power with respect to the shares of common stock, except as otherwise indicated. Beneficial ownership consists of a direct interest in the shares of common stock, except as otherwise indicated.

| Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership |

Percentage of Class(2) |

| Christopher Bunka Kelowna BC Canada |

13,136,658 (3) | 28.71 |

| Bal Bhullar

Vancouver, BC |

1,007,875(4) | 2.22 |

| Nicholas Baxter

Aberdeenshire, UK |

495,000(5) | 1.10 |

| Ted McKechnie

Toronto, ON |

220,000 (6) | * |

| John Docherty

Toronto, ON |

1,298,000(7) | 2.87 |

| Tom Ihrke Charleston, South Carolina |

330,000(8) | * |

| Directors and Executive Officers as a Group | 16,437,533 | 36.13% |

Page | 7

| Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership |

Percentage of Class(2) |

| David DeMartini Houston, TX |

3,609,375 | 8.10% |

| Total as a Group | 19,718,783 | 41.07% |

* denotes a holding of less than 1%

Notes:

| 1) |

Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on the Record Date. | |

| 2) |

Percentage of ownership is based on 44,553,286 shares of common stock issued and outstanding as of the Record Date. Except as otherwise indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished by such owners, have sole investment and voting power with respect to such shares. | |

| 3) |

Includes 4,971,844 shares held in the name of C.A.B. Financial Services and 6,960,314 shares held directly by Christopher Bunka. Includes 1,017,500 options and 187,000 Warrants held in the name of C.A.B. Financial Services all of which are exercisable 60 days of the Record Date. | |

| 4) |

Includes 852,500 options which are exercisable within 60 days of the Record Date. | |

| 5) |

Includes 275,000 options which are exercisable within 60 days of the Record Date. | |

| 6) |

Includes 110,000 options which are exercisable within 60 days of the Record Date. | |

| 7) |

Includes 605,000 shares held in the name of Docherty Management Ltd., 550,000 options and 143,000 warrants held in the name of Docherty Management Ltd. which are exercisable within 60 days of the Record Date. | |

| 8) |

Includes 330,000 options which are exercisable within 60 days of the Record Date. |

Changes in Control

We are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change in control of our company.

Proposal 1

Election of

Directors

Our Board of Directors has nominated the persons named below as candidates for Directors at the Meeting. These nominees are all of our current Directors. Unless otherwise directed, the proxy holders will vote the proxies received by them for the five nominees named below.

Each Director who is elected will hold office until the next Meeting of Stockholders and until his or her successor is elected and qualified. Any Director may resign his or her office at any time and may be removed at any time by the majority of vote of the stockholders given at a special meeting of our stockholders called for that purpose.

Our company’s management proposes to nominate the persons named in the table below for election by the stockholders as Directors of the company. Information concerning such persons, as furnished by the individual nominees, is as follows:

Page | 8

Our Board of Directors recommends that you vote FOR the nominees.

Nominees

As at the Record Date, our Directors and executive officers, their age, positions held, and duration of term, are as follows:

| Name | Position Held with our Company | Age | Date First Elected Or Appointed |

| Bal Bhullar | CFO and Director | 46 | May 2009 |

| Christopher Bunka | Chairman, Chief Executive Officer and Director | 54 | November 2004 |

| Nicholas Baxter | Director | 62 | July 8, 2011 |

| Ted McKechnie | Director | 68 | September 16, 2015 |

Business Experience

The following is a brief account of the education and business experience of the nominees during at least the past five years, indicating their principal occupation during the period, and the name and principal business of the organization by which they were employed.

Bal Bhullar

Ms. Bhullar brings over 23 years of diversified financial and risk management experience in both private and public companies, in the industries of technology, film, mining, marine, oil & gas, energy, transport, and health and wellness industries.

Among some of the areas of experience, Ms. Bhullar brings expertise in financial & strategic planning, operational & risk management, regulatory compliance reporting, business expansion, start-up operations, financial modeling, program development, corporate financing, and corporate governance/internal controls.

Previously, Ms. Bhullar has held various positions as President of BC Risk Management Association of BC, and served as Director and CFO of private and public companies. Currently, Ms. Bhullar served as a former Director and CFO for Bare Elegance Medspa, CFO and Director for public company Enertopia Corp. (symbol ENRT-OTC; TOP-CSE) and former CFO for ISEE3D Inc. (symbol ICT-TSXV).

Ms. Bhullar is a Chartered Professional Accountant, Certified General Accountant and as well holds a CRM designation from Simon Fraser University and a diploma in Financial Management from British Columbia Institute of Technology.

Christopher Bunka

Mr. Bunka has served as our director, chairman, president and chief executive officer since October 26, 2006. From February 14, 2007 until May 12, 2009 he was the chief financial officer of our company. Since October 26, 2006 Mr. Bunka has successfully completed both equity and debt financings for our company, completed the acquisition of additional oil & gas assets, disposed of other oil & gas assets, and restructured our company. He has refocused our company from one of natural gas exploration to that of development of existing oil reserves, and has engaged additional geophysical expertise in an attempt to better understand its exploration and development opportunities. Mr. Bunka has privately evaluated numerous oil and gas properties and investment opportunities for his private investments during the past 10 years.

Since 1988, Mr. Bunka has been the CEO of CAB Financial Services Ltd., a private holding company located in Kelowna, Canada. He is a venture capitalist and corporate consultant.

Page | 9

Mr. Bunka was formerly Chairman/CEO of Enertopia Corp, (symbol ENRT-OTC) but resigned in 2013. Mr. Bunka was formerly a director of Defiance Capital Corp., (symbol DEF-TSXV) a Canadian resource company, but resigned in 2014.

Nicholas Baxter

Mr. Baxter has been in the oil & gas business for 30 years. Mr. Baxter received a Bachelor of Science (Honors) from the University of Liverpool in 1975. Mr. Baxter has worked on geophysical survey and exploration projects in the U.K., Europe, Africa and the Middle East. From 1981 to 1985, Mr. Baxter worked for Resource Technology plc, a geophysical equipment sales/services company that went public on the USM in London in 1983 and graduated to the London Stock Exchange in 1984. Mr. Baxter established his own company in 1985 as a co-founder of Addison & Baxter Limited, a private geophysical/geological sales and services company which was acquired by A&B Geoscience Corporation in 1992. Mr. Baxter was Chief Operating Officer and a director of A&B Geoscience Corporation from 1992 to 2002. Mr. Baxter worked as an independent upstream oil and gas consultant from 2002 to 2004. He joined Eurasia Energy Ltd in 2005, where he is currently President and Chief Executive Officer.

Ted McKechnie

An entrepreneurial executive with extensive Board and Senior Management Experience in the consumer goods industry with a proven track record for achieving corporate financial and growth objectives. He is the former President and COO of Maple Leaf Foods, which in 2014 had revenue of over CDN $3.1 billion dollars. Mr. McKechnie also has held executive positions with Kraft, Frito Lay, General Foods, PepsiCo, and Philip Morris Companies. He is the Founder, Chairman and CEO of Canada’s Technology For Food. Mr. McKechnie is an energetic leader experienced in building teams in marketing, sales and supply chain management. Ted is the recipient of the Philip Morris Chairman’s Award for “recognition of extraordinary contributions having a significant and lasting impact on the Corporation”.

Executive Officers

Our executive officers are appointed by our Board of Directors and serve at the pleasure of our Board of Directors.

The names of our executive officers, their ages, positions held, and durations of are as follows:

| Name | Position Held with our Company | Age | Date First Elected Or Appointed |

| Bal Bhullar | CFO and Director | 46 | May 12, 2009 |

| Christopher Bunka | Chairman, Chief Executive Officer and Director | 54 | October 26, 2006 |

| John Docherty | President | 45 | April 15, 2015 |

| Tom Irkhe | Vice-President, US Operations (Lexaria), President, PoViva Tea, LLC | 48 | December 22, 2014 |

Mr. John Docherty

Mr. Docherty was appointed President of Lexaria effective April 15, 2015. Prior to Lexaria Mr. Docherty was former President and Chief Operating officer of Helix BioPharma Corp. (TSX: HBP), where he led the company’s pharmaceutical development programs for its plant and recombinantly derived therapeutic protein product candidates. Mr. Docherty is a senior operations and management executive with over 20 years experience in the pharmaceutical and biopharmaceutical sectors. He has worked with large multinational companies and emerging, private and publicly held start-ups. At Helix, Mr. Docherty was also instrumental in the areas of investor/stakeholder relations, capital raising, capital markets development, strategic partnering, regulatory authority interactions and media relations, and he also served as a management member of its board of directors. Prior to this, Mr. Docherty was President and a board member of PharmaDerm Laboratories Ltd., a Canadian drug delivery company that developed unique microencapsulation formulation technologies for use with a range of active compounds.

Page | 10

Mr. Docherty has also held positions with companies such as Astra Pharma Inc., Nu-Pharm Inc. and PriceWaterhouseCoopers’ former global pharmaceutical industry consulting practice. He is a named inventor on issued and pending patents and he has a M.Sc. in pharmacology and a B.Sc. in Toxicology from the University of Toronto.

Mr. Tom Ihrke

Mr. Ihrke first began working as a consultant to Lexaria in 2008 and, since December 22, 2014 has served as Executive Vice President of Lexaria, and President of our majority-owned subsidiary company, PoViva Tea, LLC. Tom has an extensive background in the financial and capital markets, including as a Senior Investment Banker, Senior Trader and Market Maker for Morgan Keegan and Company. Mr. Ihrke was also co-founder and Managing Partner of a successful hedge fund. Mr. Ihrke received his MBA from the University of Tennessee and his BSc of Science from Texas Christian University.

For information regarding Messrs Bunka and Bhullar, see “Nominees” beginning on page 9.

Family Relationships

There are no family relationships between any director or executive officer.

Involvement in Certain Legal Proceedings

We know of no material proceedings in which any of our Directors, officers, affiliates or any stockholder of more than 5% of any class of our voting securities, or any associate thereof is a party adverse to our company.

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

| 1. |

been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

| 2. |

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| 3. |

been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| 4. |

been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| 5. |

been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 6. |

been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Page | 11

Corporate Governance

Public Availability of Corporate Governance Documents

Our key corporate governance document is our Code of Ethics which is:

| • | available in print to any stockholder who requests it from our President; and | |

| • | filed on EDGAR as an exhibit to our Annual Report on Form 10-KSB filed on January 29, 2008. |

Code of Ethics

We adopted a Code of Ethics applicable to our senior financial officers and certain other finance executives, which is a "code of ethics" as defined by applicable rules of the SEC. Our Code of Ethics is attached as an exhibit to our Annual Report on Form 10-KSB filed on January 29, 2008. If we make any amendments to our Code of Ethics other than technical, administrative, or other non-substantive amendments, or grant any waivers, including implicit waivers, from a provision of our Code of Ethics to our Chief Executive Officer, chief financial officer, or certain other finance executives, we will disclose the nature of the amendment or waiver, its effective date and to whom it applies in a Current Report on Form 8-K filed with the SEC.

Meetings

Our Board of Directors held no formal meetings during the year ended August 31, 2015. All proceedings of the Board of Directors were conducted by resolutions consented to in writing by all the Directors and filed with the minutes of the proceedings of the Directors. Such resolutions consented to in writing by the Directors entitled to vote on that resolution at a meeting of the Directors are, according to the Nevada Revised Statutes and our Bylaws, as valid and effective as if they had been passed at a meeting of the Directors duly called and held.

It is our policy to invite Directors to attend the Meeting of stockholders. Two Directors are expected to attend the Meeting.

Committees of the Board of Directors

We currently do not have a nominating or compensation committee or committees performing similar functions. There has not been any defined policy or procedure requirements for stockholders to submit recommendations or nomination for Directors.

Audit Committee and Audit Committee Financial Expert

Currently our audit committee consists of our entire Board of Directors.

Our audit committee operates pursuant to a written charter adopted by our Board of Directors, a copy of which is attached as Schedule A to this Proxy Statement.

We believe that the members of our Board of Directors are collectively capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. We believe that retaining an independent Director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the early stages of our development and the fact that we have not generated any material revenues to date. In addition, we currently do not have nominating, compensation or audit committees or committees performing similar functions nor do we have a written nominating, compensation or audit committee charter. Our Board of Directors does not believe that it is necessary to have such committees because it believes the functions of such committees can be adequately performed by our Board of Directors.

Page | 12

Director Independence

We currently act with four Directors, consisting of Christopher Bunka, Bal Bhullar, Ted McKechnie and Nicholas Baxter.

We have determined that Ted McKechnie and Nicholas Baxter are each an “independent director” as defined in Rule 5605(a) of the Nasdaq Listing Rules.

Stockholder Communications with Our Board of Directors

Because of our company’s small size, we do not have a formal procedure for stockholder communication with our Board of Directors. In general, members of our Board of Directors and executive officers are accessible by telephone or mail. Any matter intended for our Board of Directors, or for any individual member or members of our Board of Directors, should be directed to our President with a request to forward the communication to the intended recipient.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and Directors, and persons who own more than 10% of our common stock, to file reports regarding ownership of, and transactions in, our securities with the Securities and Exchange Commission and to provide us with copies of those filings. Based solely on our review of the copies of such forms received by us, or written representations from certain reporting persons, we believe that during fiscal year ended August 31, 2015, all filing requirements applicable to our executive officers, Directors and persons who own more than 10% of our common stock were complied with.

Executive Compensation

The following table sets forth all compensation received during the year ended August 31, 2015 and the transition period from October 31, 2013 to August 31, 2014 by our Chief Executive Officer, Chief Financial Officer and each of the other most highly compensated executive officers whose total compensation exceeded $100,000 in such fiscal year. These officers are referred to as the “named executive officers” in this proxy statement.

Summary Compensation

The particulars of compensation paid to the following persons:

| (a) |

our principal executive officer; | |

| (b) |

each of our two most highly compensated executive officers who were serving as executive officers at the end of the year ended August 31, 2015 and the transition period from October 31, 2013 to August 31, 2014; and | |

| (c) |

up to two additional individuals for whom disclosure would have been provided under (b) but for the fact that the individual was not serving as our executive officer at the end of the most recently completed financial year, |

who we will collectively refer to as the named executive officers, for our fiscal year ended August 31, 2015 and the transition period from October 31, 2013 to August 31, 2014, are set out in the following summary compensation table:

Page | 13

| SUMMARY COMPENSATION TABLE | |||||||||

| Name and Principal Position |

Year | Salary

($) |

Bonus

($) |

Stock

Awards ($) |

Option Awards ($)(1) |

Non-

Equity Incentive Plan Compensa tion ($) |

Nonqualified

Deferred Compensa tion Earnings ($) |

All Other

Compensa - tion ($) |

Total

($) |

| Christopher

Bunka(2) Chairman, Chief Executive Officer |

2015 2014 |

119,700 80,000 |

Nil Nil |

Nil Nil |

49,750 Nil |

Nil Nil |

Nil Nil |

Nil Nil |

163,750 80,000 |

| Bal

Bhullar(3) Chief Financial Officer |

2015

2014 |

73,020 63,324 |

Nil

Nil |

Nil

Nil |

49,750 Nil |

Nil

Nil |

Nil

Nil |

Nil

Nil |

122,770 63,324 |

| Tom

Irkhe(4) Vice President |

2015

2014 |

42,000 5,000 |

Nil

Nil |

Nil

Nil |

29,850 Nil |

Nil

Nil |

Nil

Nil |

Nil

Nil |

71,850 5,000 |

| John Docherty(5) President |

2015 2014 |

60,983 N/A |

Nil N/A |

Nil N/A |

39,722 N/A |

Nil N/A |

Nil N/A |

Nil N/A |

84,705 N/A |

Notes:

| 1) |

The fair value of the option award was estimated using the Black-Scholes pricing model with the following assumptions: expected volatility of 142.25%, risk–free interest rate of 1.93%, expected life of 5 years, and dividend yield of 0.0%. | |

| 2) |

Mr. Bunka was appointed president and chief executive officer on October 26, 2006, and was chief financial officer of our company from February 14, 2007 until May 12, 2009. Mr. Bunka resigned as president on April 15, 2015. | |

| 3) |

Ms. Bhullar was appointed chief financial officer on May 12, 2009. | |

| 4) |

Mr. Irkhe was appointed vice president on December 22, 2014. | |

| 5) |

Mr. Docherty was appointed president on April 15, 2015. |

Employment and Consulting Agreements

On November 27, 2008, our company entered into a Consulting Agreement with CAB Financial Services Ltd. for consulting services of CAB on a continuing basis for a consideration of US$8,000 per month plus GST. Effective December 1, 2014, our company entered into a new consulting agreement with the consulting services at $10,000 per month plus GST.

On May 12, 2009 our company entered into a consulting agreement with BKB Management Ltd. to act as the chief financial officer for an initial period of six months for consideration of CAD $4,500 per month plus GST. This agreement replaces the September 1, 2008, Controller Agreement with CAB Financial Services Ltd. Subsequent to October 31, 2010, effective January 1, 2011, the consideration was increased to CAD$5,500 per month plus GST/HST. Effective December 1, 2014, our company entered into a new consulting agreement with the consulting services at CAD$7,500 per month plus GST.

On March 26, 2015, our company announced the appointment John Docherty as president of Our company effective April 15, 2015. Our company executed a twenty four month consulting contract with Docherty Management Limited, solely owned by Mr. John Docherty with a monthly compensation of CAD$12,500 and shall increase to a total of CAD$15,000 per month effective at that time when our company has US$1,000,000 or more in cash in its bank accounts, and continue at CAD$15,000 per month from that moment until the termination or completion of the contract.

Other than as set out above, we have not entered into any employment or consulting agreements with any of our current officers, Directors or employees.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth for each named executive officer certain information concerning the outstanding equity awards as of August 31, 2015:

Page | 14

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |||||||||

| OPTION AWARDS | STOCK AWARDS | ||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable (b) |

Number of Securities Underlying Unexercised Options (#) Unexercisable (c) |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) (d) |

Option Exercise Price ($) (e) |

Option

Expiration Date (f) |

Number of Shares or Units of Stock That Have Not Vested (#) (g) |

Market Value of Shares or Units of Stock That Have Not Vested ($) (h) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) (i) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) (j) |

| Christopher Bunka |

500,000 200,000 225,000 |

- - - |

- - - |

$0.20 $0.35 $0.10 |

2015/01/20 2016/07/11 2018/06/18 |

- - - |

- - - |

- - - |

- - - |

| Bal Bhullar | 300,000 100,000 175,000 |

- - - |

- - - |

$0.20 $0.35 $0.10 |

2015/01/20 2016/07/11 2018/06/18 |

- - - |

- - - |

- - - |

- - - |

| Tom Irkhe | 300,000 | - | - | $0.11 | 2019/12/22 | - | - | - | - |

| John Docherty |

500,000 | - | - | $0.10 | 2020/03/26 | - | - | - | - |

Option Exercises

During our fiscal year ended August 31, 2015, no options were exercised by our named officers.

Compensation of Directors

We do not have any agreements for compensating our directors for their services in their capacity as directors, although such directors are expected in the future to receive stock options to purchase shares of our common stock as awarded by our board of directors.

Securities Authorized for Issuance under Equity Compensation Plans

We have no long-term incentive plans other than the stock option plans described below.

Stock Option Plans

Equity Compensation Plan Information

The following table sets forth certain information concerning all equity compensation plans previously approved by stockholders and all previous equity compensation plans not previously approved by stockholders, as of the most recently completed fiscal year.

| EQUITY COMPENSATION PLAN INFORMATION | |||

| Plan category | # of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | # of securities available for issuance under equity compensation plans (excluding securities in column (a)) |

| Equity compensation plans not approved by shareholders | Nil | Nil | Nil |

Page | 15

| EQUITY COMPENSATION PLAN INFORMATION | |||

| Plan category | # of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | # of securities available for issuance under equity compensation plans (excluding securities in column (a)) |

| Equity compensation plans approved by shareholders: | |||

| 2007 Equity compensation plan | Nil | Nil | Nil |

| 2010 Equity compensation plan | 900,000 | $0.24 | 1,200,000 |

| 2014 Stock Option plan approved by security holders | 2,800,000 | $0.25 | 700,000 |

| Total | 3,700,000 | $0.24 | 1,900,000 |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended August 31, 2015.

Transactions with Related Persons

Except as disclosed herein, no Director, executive officer, shareholder holding at least 5% of shares of our common stock, or any family member thereof, had any material interest, direct or indirect, in any transaction, or proposed transaction since the year ended August 31, 2015, in which the amount involved in the transaction exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets at the yearend for the last two completed fiscal years.

Employment Agreements

For information regarding compensation for our executive officers and Directors, see “Summary Compensation” beginning on page 13.

Proposal 2

Ratification of the Continued

Appointment of the Independent Registered Public Accounting Firm

Our Board of Directors is asking our stockholders to ratify the continued appointment of MNP LLP, as our independent registered public accounting firm for the fiscal year ending August 31, 2016 at a remuneration to be fixed by the Board.

Stockholder ratification of the continued appointment of MNP LLP is not required under the Nevada corporate law, our bylaws or otherwise. However, our Board of Directors is submitting the continued appointment of MNP LLP as our independent registered public accounting firm to our stockholders for ratification as a matter of corporate practice. If our stockholders fail to ratify the continued appointment, our Board of Directors will reconsider whether or not to retain the firm. Even if the appointment is ratified, our Board of Directors in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if our Board of Directors determines that such a change would be in the best interest of our company and our stockholders.

Representatives of MNP LLP are not expected to be present at the Meeting. However, we will provide contact information for MNP LLP to any stockholders who would like to contact the firm with questions.

Unless otherwise directed, the proxy holders will vote the proxies received by them for the ratification of the continued appointment of MNP LLP as our independent registered public accounting firm for the fiscal year ending August 31, 2016.

Page | 16

At the Meeting the stockholders will be asked to approve the following resolution:

RESOLVED THAT the continued appointment of MNP LLP as our independent registered public accounting firm is ratified, approved and confirmed and that the remuneration be fixed by the Board.

Our Board of Directors recommends that you vote FOR the ratification of the continued appointment of MNP LLP as our independent registered public accounting firm as our auditors for the fiscal year ending August 31, 2016 at a remuneration to be fixed by the Board.

Fees Paid to Our Independent Registered Public Accounting Firm

Audit fees

The aggregate fees billed for the most recently completed fiscal year ended August 31, 2015 and for the transition period from October 31, 2013 to August 31, 2014 for professional services rendered by the principal accountant for the audit of our annual financial statements and review of the financial statements included in our quarterly reports on Form 10-Q and services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for these fiscal periods were as follows:

| Year Ended | ||

| August 31, 2015 | August 31, 2014 | |

| Audit Fees | 30,953 | 26,036 |

| Audit Related Fees | 16,454 | 19,677 |

| Tax Fees | Nil | Nil |

| All Other Fees | Nil | Nil |

| Total | 47,407 | 45,713 |

Audit Fees

Audit fees consist of fees billed for professional services rendered for the audits of our financial statements, reviews of our interim financial statements included in quarterly reports, services performed in connection with filings with the Securities and Exchange Commission and related comfort letters and other services that are normally provided by MNP LLP for the fiscal years ended August 31, 2015 and for the transition period from October 31, 2013 to August 31, 2014 in connection with statutory and regulatory filings or engagements.

Audit related Fees

There were $16,454 audit related fees paid to MNP LLP for the fiscal year ended August 31, 2015 and $19,677 for the transition period from October 31, 2013 to August 31, 2014.

Tax Fees

Tax fees consist of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal, state and local tax compliance and consultation in connection with various transactions and acquisitions. For the fiscal year ended August 31, 2015 and the transition period from October 31, 2013 to August 31, 2014, we did not use MNP LLP for non-audit professional services or preparation of corporate tax returns. We do not use MNP LLP for financial information system design and implementation. These services, which include designing or implementing a system that aggregates source data underlying the financial statements or generates information that is significant to our financial statements, are provided internally or by other service providers. We do not engage MNP LLP to provide compliance outsourcing services.

Page | 17

Effective May 6, 2003, the Securities and Exchange Commission adopted rules that require that before our independent auditors are engaged by us to render any auditing or permitted non-audit related service, the engagement be:

| • | approved by our audit committee (which consists of our entire Board of Directors); or | |

|

• |

entered into pursuant to pre-approval policies and procedures established by the Board of Directors, provided the policies and procedures are detailed as to the particular service, the Board of Directors is informed of each service, and such policies and procedures do not include delegation of the Board of Directors’ responsibilities to management. |

Our Board of Directors (audit committee) pre-approves all services provided by our independent auditors. All of the above services and fees were reviewed and approved by the Board of Directors either before or after the respective services were rendered.

Our Board of Directors has considered the nature and amount of fees billed by our independent auditors and believes that the provision of services for activities unrelated to the audit is compatible with maintaining our independent auditors’ independence.

Proposal 3

Change of Name

Our board of directors have executed a written consent authorizing and recommending that our stockholders approve a proposal to change our name from "Lexaria Corp." to "Lexaria Bioscience Corp." or such other similar name as may be available. Our board of directors believes that the new name, Lexaria Bioscience Corp., will more accurately reflect our current business activities in the area of food science and food supplement sector.

Effectiveness of the Name Change

If approved by our stockholders, the change in our name will become effective upon the filing of Certificate of Amendment with the Secretary of State of Nevada. We intend to file the Certificate of Amendment as soon as practicable once stockholder approval is obtained and in connection with a submission to Financial Industry Regulatory Authority, Inc. (FINRA) for the change of name.

Changing the name of our company will not have any effect on the rights of existing shareholders. The proposed name change will not affect the validity or transferability of currently outstanding stock certificates, and shareholders will not be requested to surrender for exchange any stock certificates they hold.

Our management believes the name change is in the best interests of our company and recommends that the stockholders approve the name change. The name change will be approved if the affirmative vote of at least a majority of the common stock present or represented at the Meeting and entitled to vote thereat are voted in favour of approving the name change. Accordingly, at the Meeting, the stockholders will be asked to pass the following resolution:

At the Meeting the stockholders will be asked to approve the following resolution:

RESOLVED THAT:

| 1. |

The name of the Company be changed to "Lexaria Bioscience Corp.", or such other similar name as may be acceptable by the board of directors and the Nevada Secretary of State and the applicable securities regulatory authorities. |

| 2. |

The preparation and filing of a Certificate of Amendment be and is hereby approved. |

Page | 18

| 3. |

Any one director or officer of the Company be and is hereby authorized to do all things as may be necessary or advisable to effect the foregoing resolutions on behalf of the Company and to take such steps as may be necessary or advisable to give effect to the change of name, including preparing and filing the Certificate of Amendment with the Nevada Secretary of State. |

| 4. |

Notwithstanding the foregoing, the board of directors of the Company shall have sole and complete discretion to determine whether or not to carry out the change of the Company’s name and, notwithstanding shareholder approval of the proposed change of name, there shall be no obligation to proceed with such name change. |

Our board of directors recommends that you vote FOR the approval of the name change.

A copy of the form of Certificate of Amendment, is attached as Exhibit "B" to this Proxy Statement.

Dissenters Rights

Under the General Corporation Law of the State of Nevada, shareholders of our common stock are not entitled to dissenter's rights of appraisal with respect to our proposed Amendment.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as set out below, no Director, executive officer, or nominee for election as a Director of the Company and no associate of any of the foregoing persons has any substantial interest, direct or indirect, by security holding or otherwise, in any matter to be acted upon at the Meeting, other than elections to office:

“HOUSEHOLDING” OF PROXY MATERIALS

The Securities and Exchange Commission permits companies and intermediaries such as brokers to satisfy the delivery requirements for proxy statements and Annual Reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement or Annual Report, as applicable, addressed to those stockholders. This process, which is commonly referred to as “householding”, potentially provides extra conveniences for stockholders and cost savings for companies.

Although we do not intend to household for our stockholders of record, some brokers household our proxy materials and Annual Reports, delivering a single copy of proxy statement or Annual Report to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate copy of proxy statement or Annual Report, or if you are receiving multiple copies of either document and wish to receive only one, please notify your broker. Stockholders who currently receive multiple copies of the proxy statement at their address from their brokers and would like to request “householding” of their communications should contact their brokers.

STOCKHOLDER PROPOSALS

Pursuant to Rule 14a-8 under the Exchange Act, stockholders may present proper proposals for inclusion in our proxy statement and for consideration at our next meeting of stockholders. To be eligible for inclusion in our 2017 proxy statement, your proposal must be received by us no later than 120 days before March 23, 2017 and must otherwise comply with Rule 14a-8 under the Exchange Act. Further, if you would like to nominate a Director or bring any other business before the stockholders at the 2017 Meeting, you must comply with the procedures contained in the bylaws and you must notify us in writing and such notice must be delivered to or received by the Secretary no later than 120 days before March 23, 2017. While the Board will consider stockholder proposals, we reserve the right to omit from our proxy statement relating to our 2017 meeting stockholder proposals that it is not required to include under the Exchange Act, including Rule 14a-8 of the Exchange Act.

Page | 19

All stockholder proposals, notices and requests should be made in writing and sent via registered, certified or express mail, to our company, at the address on the first page of this Proxy Statement to the attention of the President.

With respect to business to be brought before the Meeting, we have received no notices from our stockholders that we were required to include in this proxy statement.

WHERE YOU CAN FIND MORE INFORMATION

We file annual and other reports, proxy statements and other information with the United States Securities and Exchange Commission. The documents filed with the Securities and Exchange Commission are available to the public from the United States Securities and Exchange Commission’s website at www.sec.gov. Additional information regarding our company and our business activities is available on the SEDAR website located at www.sedar.com and at our company’s website located at http://www.lexariaenergy.com. Our company’s financial information is provided in our company’s audited financial statements and related management discussion and analysis for its most recently completed financial year end may be viewed on the SEDAR website.

OTHER MATTERS

Our Board of Directors does not intend to bring any other business before the Meeting, and so far as is known to our Board of Directors, no matters are to be brought before the Meeting except as specified in the notice of the Meeting. If any other matters are properly brought before the Meeting, it is the intention of the persons named on the proxy to vote the shares represented by the proxy on such matters in accordance with their judgment.

BY ORDER OF THE BOARD OF DIRECTORS

| /s/ Christopher Bunka |

| Christopher Bunka |

| Chairman of the Board |

February 4, 2016

Page | 20

Schedule A

LEXARIA CORP.

AUDIT COMITTEE CHARTER

Page | 21

THE AUDIT COMMITTEE'S CHARTER

The primary function of the audit committee (the "Committee") is to assist the Company’s Board of Directors in fulfilling its financial oversight responsibilities by reviewing the financial reports and other financial information provided by the Company to regulatory authorities and shareholders, the Company’s systems of internal controls regarding finance and accounting and the Company’s auditing, accounting and financial reporting processes. Consistent with this function, the Committee will encourage continuous improvement of, and should foster adherence to, the Company’s policies, procedures and practices at all levels. The Committee’s primary duties and responsibilities are to:

|

• |

serve as an independent and objective party to monitor the Company’s financial reporting and internal control system and review the Company’s financial statements; | |

|

|

|

|

|

|

• |

review and appraise the performance of the Company’s external auditors; and |

|

|

|

|

|

• |

provide an open avenue of communication among the Company’s auditors, financial and senior management and the Board of Directors. |

Composition

The Committee shall be comprised of a minimum three directors as determined by the Board of Directors. If the Company ceases to be a “venture issuer” (as that term is defined in National Instrument 52-110), then all of the members of the Committee shall be free from any relationship that, in the opinion of the Board of Directors, would interfere with the exercise of his or her independent judgment as a member of the Committee.

If the Company ceases to be a “venture issuer” (as that term is defined in National Instrument 52-110), then all members of the Committee shall have accounting or related financial management expertise. All members of the Committee that are not financially literate will work towards becoming financially literate to obtain a working familiarity with basic finance and accounting practices. For the purposes of the Company's Audit Committee Charter, the definition of “financially literate” is the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can presumably be expected to be raised by the Company's financial statements.

The members of the Committee shall be elected by the Board of Directors at its first meeting following the annual shareholders’ meeting. Unless a Chair is elected by the full Board of Directors, the members of the Committee may designate a Chair by a majority vote of the full Committee membership.

Meetings

The Committee shall meet a least twice annually, or more frequently as circumstances dictate. As part of its job to foster open communication, the Committee will meet at least annually with the Chief Financial Officer and the external auditors in separate sessions.

Responsibilities and Duties

To fulfill its responsibilities and duties, the Committee shall:

DOCUMENTS/REPORTS REVIEW

|

|

• |

review and update this Audit Committee Charter annually; and |

|

|

|

|

|

|

• |

review the Company's financial statements, MD&A and any annual and interim earnings press releases before the Company publicly discloses this information and any reports or other financial information (including quarterly financial statements), which are submitted to any governmental body, or to the public, including any certification, report, opinion, or review rendered by the external auditors. |

Page | 22

EXTERNAL AUDITORS

|

• |

review annually, the performance of the external auditors who shall be ultimately accountable to the Company’s Board of Directors and the Committee as representatives of the shareholders of the Company; | |

|

|

|

|

|

• |

obtain annually, a formal written statement of external auditors setting forth all relationships between the external auditors and the Company, consistent with Independence Standards Board Standard 1; | |

|

|

|

|

|

• |

review and discuss with the external auditors any disclosed relationships or services that may impact the objectivity and independence of the external auditors; | |

|

|

|

|

|

• |

take, or recommend that the Company’s full Board of Directors take appropriate action to oversee the independence of the external auditors, including the resolution of disagreements between management and the external auditor regarding financial reporting; | |

|

|

|

|

|

• |

recommend to the Company’s Board of Directors the selection and, where applicable, the replacement of the external auditors nominated annually for shareholder approval; | |

|

|

|

|

|

|

• |

recommend to the Company’s Board of Directors the compensation to be paid to the external auditors; |

|

|

|

|

|

• |

at each meeting, consult with the external auditors, without the presence of management, about the quality of the Company’s accounting principles, internal controls and the completeness and accuracy of the Company's financial statements; | |

|

|

|

|

|

• |

review and approve the Company's hiring policies regarding partners, employees and former partners and employees of the present and former external auditors of the Company; | |

|

|

|

|

|

• |

review with management and the external auditors the audit plan for the year-end financial statements and intended template for such statements; and | |

|

|

|

|

|

• |

review and pre-approve all audit and audit-related services and the fees and other compensation related thereto, and any non-audit services, provided by the Company’s external auditors. The pre-approval requirement is waived with respect to the provision of non-audit services if: |

|

o |

the aggregate amount of all such non-audit services provided to the Company constitutes not more than five percent of the total amount of revenues paid by the Company to its external auditors during the fiscal year in which the non-audit services are provided, | |

|

o |

such services were not recognized by the Company at the time of the engagement to be non-audit services, and | |

|

o |

such services are promptly brought to the attention of the Committee by the Company and approved prior to the completion of the audit by the Committee or by one or more members of the Committee who are members of the Board of Directors to whom authority to grant such approvals has been delegated by the Committee. |

Provided the pre-approval of the non-audit services is presented to the Committee's first scheduled meeting following such approval such authority may be delegated by the Committee to one or more independent members of the Committee.

Page | 23

FINANCIAL REPORTING PROCESSES

|

• |

in consultation with the external auditors, review with management the integrity of the Company's financial reporting process, both internal and external; | |

|

|

|

|

|

• |

consider the external auditors’ judgments about the quality and appropriateness of the Company’s accounting principles as applied in its financial reporting; | |

|

|

|

|

|

• |

consider and approve, if appropriate, changes to the Company’s auditing and accounting principles and practices as suggested by the external auditors and management; | |

|

|

|

|

|

• |

review significant judgments made by management in the preparation of the financial statements and the view of the external auditors as to appropriateness of such judgments; | |

|

|

|

|

|

• |

following completion of the annual audit, review separately with management and the external auditors any significant difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information; | |

|

|

|

|

|

• |

review any significant disagreement among management and the external auditors in connection with the preparation of the financial statements; | |

|

|

|

|

|

• |

review with the external auditors and management the extent to which changes and improvements in financial or accounting practices have been implemented; | |

|