UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

OR |

|

|

X |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For fiscal year ended December 31, 2020 |

|

|

OR |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ____ to ______ |

|

|

OR |

|

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Date of event requiring this shell company report: |

|

Commission file number: 333-130386

GENTOR RESOURCES INC.

(Exact Name of Registrant as Specified in Its Charter)

Cayman Islands

(Jurisdiction of Incorporation of Organization)

1 First Canadian Place, 100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada

(Address of Principal Executive Offices, including Zip Code)

Contact: Arnold T. Kondrat; Phone: (416) 361-2510; Address: 1 First Canadian Place, 100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

(Title of Class)

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Common Shares

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of December 31, 2020:

38,906,742 common shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No X

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934.

Yes_ No X

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No _

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X No _

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "large accelerated filer," "accelerated filer," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer __ | Accelerated filer __ | Non-accelerated filer X |

| Emerging growth company __ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ___

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP X |

International Financial Reporting Standards as issued by the International Accounting Standards Board |

Other |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

___Item 17 Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes _ No X

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes _ No _

-ii-

GENTOR RESOURCES INC. - FORM 20-F

TABLE OF CONTENTS

Page

-iii-

TABLE OF CONTENTS

Page

-v-

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of Canadian provincial securities laws (such forward-looking statements and forward-looking information are referred to herein as "forward-looking statements"). Forward-looking statements are necessarily based on a number of estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies. All statements, other than statements which are reporting results as well as statements of historical fact, that address activities, events or developments that Gentor Resources Inc. (the "Company" or "Gentor") believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding the Company's plans and objectives) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual events or results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual events or results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: activities of the Company may be adversely impacted by the continued spread of "COVID-19" (as defined below), including the ability of the Company to secure additional financing; having relinquished its only project (the Karaburun project in Turkey) at the end of 2017, the Company currently does not have any commercial operations and has no material assets; while the Company is currently evaluating new business opportunities, the Company has only limited funds with which to identify and evaluate a potential asset or business for acquisition or participation, and no assurance can be given that a suitable asset or business will be identified and acquired on suitable terms (the continued spread of COVID-19 may also adversely impact the ability of the Company to identify and acquire a suitable asset or business); uncertainties relating to the availability and costs of financing in the future; changes in equity markets; inability to attract and retain key management; the Company's history of losses and expectation of future losses; and the other risks disclosed under the heading "Risk Factors" in this Form 20-F.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

CURRENCY

Unless stated otherwise or the context otherwise requires, all references in this Form 20-F to "US$" are to United States dollars and all references in this Form 20-F to "Cdn$" are to Canadian dollars.

PART 1

Item 1. Identity of Directors, Senior Management and Advisors

This Form 20-F is being filed as an annual report under the United States Securities Exchange Act of 1934, as amended, (the "U.S. Exchange Act") and, as such, there is no requirement to provide any information under this item.

Item 2. Offer Statistics and Expected Timetable

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

Item 3. Key Information

A. Selected Financial Data

The selected consolidated financial information set forth below, which is expressed in United States dollars (the Company prepares its consolidated financial statements in United States dollars), has been derived from the Company's audited consolidated financial statements as at and for the financial years ended December 31, 2020, 2019, 2018, 2017 and 2016. These consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States. The selected consolidated financial information should be read in conjunction with the discussion in Item 5 of this Form 20-F and the consolidated financial statements of the Company filed as part of this Form 20-F. Historical results from any prior period are not necessarily indicative of results to be expected for any future period. For the year ended December 31, 2016, the previously reported amounts have been restated to reflect the discontinuation of the Karaburun project in Turkey.

| (in US$000 except per share data) | |||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||

| Revenue | $ | - | $ | - | $ | - | $ | - | $ | - | |||||

| Net operating loss | (323 | ) | (535 | ) | (372 | ) | (254 | ) | (297 | ) | |||||

| Net loss from continuing operations | (301 | ) | (296 | ) | (41 | ) | (302 | ) | (274 | ) | |||||

| Net loss | (301 | ) | (296 | ) | (41 | ) | (315 | ) | (274 | ) | |||||

| Net loss per share | (0.01 | ) | (0.01 | ) | (0.00 | ) | (0.02 | ) | (0.02 | ) | |||||

| Current assets | 17 | 183 | 177 | 212 | 43 | ||||||||||

| Total assets | 17 | 183 | 177 | 218 | 71 | ||||||||||

| Total liabilities | 848 | 713 | 640 | 1,095 | 692 | ||||||||||

| Net assets | (831 | ) | (530 | ) | (463 | ) | (877 | ) | (621 | ) | |||||

| Additional paid-in capital | 43,325 | 43,325 | 43,101 | 42,656 | 42,605 | ||||||||||

| Shareholders' equity (deficiency) | (831 | ) | (530 | ) | (463 | ) | (877 | ) | (621 | ) | |||||

| Weighted average common shares outstanding (in thousands) (1) | 38,907 | 37,153 | 26,784 | 13,222 | 11,907 | ||||||||||

__________________________

(1) Adjusted to reflect the eight to one share consolidation effected by the Company in September 2017.

Exchange Rates

On April 15, 2021, the buying rate in New York City for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York, was US$1.00 = Cdn$1.2539. The following table sets forth, for each of the years or, as applicable, months indicated, additional information with respect to the noon buying rate for US$1.00 in Canadian dollars and are based upon the rates quoted by the Federal Reserve Bank of New York.

| Rate | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||

| Average (1) | 1.3422 | 1.3232 | 1.2999 | 1.2971 | 1.3229 |

__________________________

(1) The average rate means the average of the exchange rates on the last day of each month during the year.

|

|

November 2020 |

December 2020 |

January 2021 |

February 2021 |

March 2021 |

April 2021 (1) |

|

High |

1.3255 |

1.2958 |

1.2812 |

1.2830 |

1.2672 |

1.2614 |

|

Low |

1.2978 |

1.2715 |

1.2633 |

1.2528 |

1.2434 |

1.2512 |

__________________________

(1) Provided for the period from April 1, 2021 to April 15, 2021.

B. Capitalization and Indebtedness

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

C. Reason for the Offer and Use of Proceeds

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

D. Risk Factors

There are a number of risks that may have a material and adverse impact on the future performance of Gentor. These include widespread risks associated with any form of business and specific risks associated with Gentor's current circumstances.

In addition to the other information presented in this Form 20-F, a prospective investor should carefully consider the risk factors set out below and the other information that Gentor files with the United States Securities and Exchange Commission (the "SEC") and with Canadian securities regulators before investing in the Company's common shares. The Company has identified the following non-exhaustive list of inherent risks and uncertainties that it considers to be relevant.

The Company's activities could be adversely impacted by the outbreak of contagious diseases, including the effect of the spread of coronavirus.

The Company is susceptible to risks related to the outbreak of contagious diseases, including the ongoing widespread outbreak of respiratory illness caused by a novel strain of the coronavirus ("COVID-19"). The Company's activities could be adversely impacted by the effects of COVID-19 (as well as any other outbreak of contagious diseases). During 2019, COVID-19 emerged in China and has since spread wporldwide, including Canada, and infections have been reported globally. The extent to which COVID-19 impacts the Company's activities, including the market for its securities, will depend on future developments, which are highly uncertain and cannot be predicted at this time, and include the duration, severity and scope of the outbreak and the actions taken to contain or treat the COVID-19 outbreak (including the travel and quarantine restrictions currently being imposed by governments of affected countries). In particular, the continued spread of COVID-19 globally could materially and adversely impact Company activities including, without limitation, employee health and productivity and limitations on travel, and other factors that will depend on future developments beyond the Company's control, all of which may have a material and adverse effect on the Company. There can be no assurance that personnel of the Company will not be impacted by COVID-19 and ultimately see workforce productivity reduced or incur increased costs, including but limited to medical and insurance premiums. In addition, COVID-19 has resulted in a widespread global health crisis that has significantly adversely affected global economies and capital markets, resulting in an economic downturn that could become much worse and have an adverse effect on the Company's future prospects, including its ability to secure financing from capital markets.

Having relinquished its only project (the Karaburun project in Turkey) at the end of 2017, the Company currently does not have any commercial operations and has no material assets. An investment in the Company's common shares is highly speculative, and is suitable only to those investors who are prepared to risk the loss of their entire investment.

In November 2017, the Company announced that it intended to dispose of, for nominal consideration, its subsidiary which held the Karaburun project in Turkey (which was the Company's only project). The Company has relinquished the Karaburun project and discontinued operations in Turkey effective at the end of 2017, and is currently evaluating new business opportunities. As the Company currently does not have any commercial operations and has no material assets, an investment in the Company's common shares is considered highly speculative and involves a very high degree of risk.

While the Company is currently evaluating new business opportunities, the Company has only limited funds with which to identify and evaluate a potential asset or business for acquisition or participation, and no assurance can be given that a suitable asset or business will be identified and acquired on suitable terms (the continued spread of COVID-19 may also adversely impact the ability of the Company to identify and acquire a suitable asset or business). Further, even if a proposed transaction is identified, there can be no assurance that the Company will be able to complete the transaction. The transaction may be financed in whole, or in part, by the issuance of additional securities of the Company and this may result in further dilution to investors, which dilution may be significant and which may also result in a change of control of the Company. As well, given the current economic climate and state of capital markets, including the effects of the public health crisis resulting from COVID-19, the ability to raise funds may prove difficult.

The directors and officers of the Company will only devote a portion of their time to the business and affairs of the Company and some of them are or will be engaged in other projects or businesses such that conflicts of interest may arise from time to time.

As a result of these factors, an investment in the Company's common shares is suitable only to investors who are willing to rely solely on the management of the Corporation and who can afford to lose their entire investment. Those investors who are not prepared to do so should not invest in the Company's common shares.

The auditor's report with respect to the financial statements included in this Form 20-F contains an explanatory paragraph in respect of there being significant doubt about the Company's ability to continue as a going concern.

The auditor's report issued in respect of the Company's 2020 annual consolidated financial statements contains the following paragraph:

"We draw attention to Note 1 in the consolidated financial statements, which describe the events and conditions that indicate the existence of material uncertainties that may cast significant doubt about the Company's ability to continue as a going concern. Our opinion is not modified in respect of this matter."

Therefore, as indicated in the auditor's report for the fiscal year ended December 31, 2020, there is significant doubt about the Company's ability to continue as a going concern. The Company cannot guarantee its ability to continue as a going concern, and if it were to cease to continue as such, the Company's securities would have little or no value.

The Company expects to raise additional capital through equity financing in the future, which would cause dilution and loss of voting power with respect to the Company's existing shareholders.

The Company expects to undertake in the future additional offerings of common shares of the Company or of securities convertible into common shares of the Company. The increase in the number of common shares issued and outstanding and the possibility of sales of such common shares may depress the price of the Company's common shares. In addition, as a result of such additional common shares, the voting power and ownership interest of the Company's existing shareholders would be diluted.

Notwithstanding that the Company expects to undertake in the future additional equity fiancings, given the current economic climate and state of capital markets, including the effects of the public health crisis resulting from COVID-19, the ability to raise funds may prove difficult.

Negative market perception of junior companies could adversely affect the Company.

Market perception of junior companies such as the Company may shift such that these companies are viewed less favourably. This factor could impact the value of investors' holdings and the ability of the Company to raise further funds, which could have a material adverse effect on the Company's business, financial condition and prospects.

Various market factors, both related and unrelated to the Company's performance, could cause the market price for the Company's securities to fluctuate significantly and could have a material adverse effect on an investor's investment in the Company.

There can be no assurance that an active market for the Company's securities will be attained or sustained. The market price of the Company's securities may fluctuate significantly based on a number of factors, some of which are unrelated to the performance or prospects of the Company. These factors include macroeconomic developments in North America and globally, market perceptions of the attractiveness of particular industries, the attractiveness of alternative investments, currency exchange fluctuation, and the Company's financial condition or results of operations as reflected in its financial statements. These factors also currently include the impact of COVID-19, which has resulted in a widespread global health crisis that has significantly adversely affected global economies and capital markets, resulting in extreme volatility in capital markets. Other factors unrelated to the performance of the Company that may have an effect on the price of the securities of the Company include the following: lessening in trading volume and general market interest in the Company's securities may affect an investor's ability to trade significant numbers of securities of the Company; the size of the Company's public float may limit the ability of some institutions to invest in the Company's securities; the public's reaction to the Company's press releases, other public announcements and the Company's filings with the various securities regulatory authorities; the arrival or departure of key personnel; and a substantial decline in the price of the securities of the Company that persists for a significant period of time could cause the Company's securities to be delisted from any exchange on which they are listed at that time, further reducing market liquidity. If there is no active market for the securities of the Company, the liquidity of an investor's investment may be limited and the price of the securities of the Company may decline. If such a market does not develop, investors may lose their entire investment in the Company's securities.

The Company expects that it will be treated as a U.S. domestic corporation for U.S. federal income tax purposes.

The Company believes that it should be treated as a U.S. domestic corporation for U.S. federal income tax purposes under Section 7874 of the U.S. Internal Revenue Code and be subject to U.S. tax on its worldwide income. Treatment of the Company as a U.S. corporation for U.S. federal income tax purposes may have adverse tax consequences for non-U.S. shareholders. Holders of the Company's common shares are urged to consult their own tax advisors regarding the acquisition, ownership and disposition of the Company's common shares. This paragraph is only a brief summary of these tax rules and is qualified in its entirety by the section below entitled "Certain United States Federal Income Tax Considerations".

The Company has a history of losses and may never achieve revenues or profitability.

The Company has incurred losses since its inception, the Company expects to incur losses for the foreseeable future and there can be no assurance that the Company will ever achieve revenues or profitability. The Company incurred the following net losses during each of the following periods:

- US$301,085 for the year ended December 31, 2020 (the net operating loss for the year ended December 31, 2020 was US$322,641);

- US$295,868 for the year ended December 31, 2019 (the net operating loss for the year ended December 31, 2019 was US$534,783);

- US$40,742 for the year ended December 31, 2018 (the net operating loss for the year ended December 31, 2018 was US$371,478);

- US$314,890 for the year ended December 31, 2017; and

- US$274,424 for the year ended December 31, 2016.

The Company had an accumulated deficit of US$44,187,543 as of December 31, 2020.

The Company is a foreign corporation and the Company's directors and officers except one director are outside the United States, which may make enforcement of civil liabilities difficult.

The Company is organized under the laws of the Cayman Islands, and its principal executive office is located in Toronto, Canada. All of the Company's directors and officers except one director reside outside of the United States, and all or a substantial portion of their assets and the Company's assets are located outside of the United States. As a result, it may be difficult for investors in the United States or otherwise outside of Canada to bring an action against directors or officers who are not resident in the United States. It may also be difficult for an investor to enforce a judgment obtained in a United States court or a court of another jurisdiction of residence predicated upon the civil liability provisions of federal securities laws or other laws of the United States or any state thereof or the equivalent laws of other jurisdictions outside Canada against those persons or the Company.

Litigation may adversely affect the Company's financial position or results of operations.

The Company is subject to litigation risks. All companies are subject to legal claims, with and without merit. Defence and settlement costs of legal claims can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding to which the Company is or may become subject could have a material effect on its financial position or results of operations.

Increased sales of the Company's common shares by shareholders could lower the market price of the shares.

Sales of a large number of the Company's common shares in the public markets, or the potential for such sales, could decrease the trading price of such shares and could impair Gentor's ability to raise capital through future sales of common shares.

Fluctuations in currency could have a material impact on the Company's financial statements.

The Company uses the U.S. dollar as its functional currency. Fluctuations in the value of the U.S. dollar relative to other currencies could have a material impact on the Company's consolidated financial statements by creating gains or losses. No currency hedge policies are in place or are presently contemplated.

The loss of key management personnel or the inability to recruit additional qualified personnel may adversely affect the Company's business.

The success of the Company depends on the good faith, experience and judgment of the Company's management and advisors in supervising and providing for the effective management of the business of the Company. The Company is dependent on a small number of key personnel, the loss of any one of whom could have an adverse effect on the Company. The Company currently does not have key person insurance on these individuals. The Company may need to recruit additional qualified personnel to supplement existing management and there is no assurance that the Company will be able to attract such personnel.

The Company has never paid and does not intend to pay dividends.

The Company has not paid out any cash dividends to date and has no plans to do so in the immediate future. As a result, an investor's return on investment in the Company's common shares will be solely determined by his or her ability to sell such shares in the secondary market.

Item 4. Information on the Company

A. History and Development of the Company

Gentor Resources Inc. is a company continued under the Companies Law (2011 Revision) of the Cayman Islands on February 28, 2012. The executive office of the Company is located at 1 First Canadian Place, Suite 7070, 100 King Street West, Toronto, Ontario, M5X 1E3, Canada, and the telephone number of such office is (416) 361-2510. The registered office of the Company is located at Intertrust Corporate Services (Cayman) Limited, One Nexus Way, Camana Bay, George Town, Grand Cayman, KY1-9005, Cayman Islands.

In March 2010, the Company completed the acquisition of all of the outstanding shares of APM Mining Limited (which subsequently changed its name to Gentor Resources Limited) ("Oman Holdco"), a British Virgin Islands company, in exchange for the issuance by the Company of a total of 1,295,250 common shares. In connection with this acquisition, the Company issued an additional 312,500 common shares pursuant to an amendment to the earn-in agreement between Al Fairuz Mining Company, LLC and Oman Holdco (the "Block 5 Earn-In Agreement"), which increased from 50% to 65% the equity interest in Al Fairuz Mining Company, LLC that Oman Holdco had the right to earn. Also in connection with the acquisition of Oman Holdco, the Company reconstituted its board of directors and appointed new officers.

As a result of the acquisition of Oman Holdco, the Company, through Oman Holdco, acquired the earn-in rights to the Block 5 and Block 6 properties in Oman. Al Fairuz Mining Company, LLC held the exploration licence for the Block 5 property. Pursuant to the Block 5 Earn-In Agreement, the Company, through Oman Holdco, acquired a 65% equity position in Al Fairuz Mining Company, LLC. Pursuant to an earn-in agreement between Al Zuhra Mining Company, LLC and Oman Holdco, the Company, through Oman Holdco, had the right to earn up to a 70% equity position in Al Zuhra Mining Company, LLC, which held the exploration licence for the Block 6 property.

In April 2010, the Company completed a private placement financing for total gross proceeds of US$2,000,000.

In July 2010, Gentor commenced an initial 3,000 metre drilling program on its Oman properties. The drilling program was designed to test a portion of the 56 targets which were identified by the airborne VTEM survey flown in March/April 2010. In November 2010, Gentor announced preliminary findings from its initial drilling program at its Oman properties.

During the last three months of 2010, the Company completed private placement financings for total gross proceeds of US$8,016,505.

In January 2011, Gentor announced further findings from its initial drilling program at its Oman properties.

During the first three months of 2011, the Company completed private placement financings for total gross proceeds of US$4,887,500.

In May, July and November 2011 and January and April 2012, Gentor announced findings from its second drilling program at its Oman properties.

In November 2011, the Company's common shares commenced trading on the TSX Venture Exchange under the trading symbol "GNT". Also in November 2011, the Company completed (a) a brokered private placement financing for total gross proceeds of Cdn$2,163,000 (GMP Securities L.P. acted as the Company's agent in respect of this financing), and (b) a non-brokered private placement financing for total gross proceeds of Cdn$1,222,500.

In February 2012, Gentor completed a corporate reorganization (the "Corporate Reorganization"), as a result of which Gentor's corporate jurisdiction was moved from Florida to the Cayman Islands. The Corporate Reorganization was effected by a two-step process involving a merger of Gentor Resources, Inc. (the Florida company) with and into its wholly-owned Wyoming subsidiary, followed by a continuation of the surviving company into the Cayman Islands. Shareholders approved the Corporate Reorganization at the special meeting of shareholders held on February 24, 2012. Gentor believes that the change in its corporate jurisdiction to the Cayman Islands exposes the Company to business and financial advantages that may not otherwise have been as accessible to the Company. In particular, Gentor believes that the Corporate Reorganization resulted in simplification of the Company's compliance with regulatory requirements and an enhanced ability to raise capital in Canadian, U.S. and international markets. As the Corporate Reorganization was effected solely to change the corporate jurisdiction of the Company, it did not result in any change in the Company's daily business operations, management, location of the principal executive offices or its assets or liabilities.

As used in this document, the "Company" and "Gentor" refer to the existing Cayman Islands entity, Gentor Resources Inc., as well as the predecessor Florida entity, Gentor Resources, Inc. (incorporated on March 24, 2005).

In April 2012, the Company announced that it had entered into an agreement with a Turkish company pursuant to which the Company was granted a 12 month option period (the "Hacimeter Option") for the purposes of funding and carrying out the exploration for copper and base metals on properties (the "Hacimeter Project") located in northeastern Turkey.

In August and September 2012, the Company announced drilling results from the Hacimeter Project. This drilling program outlined significant high-grade massive sulphide extensions to the shallow stringer type volcanogenic massive sulphide ("VMS") system initially discovered at the Hacimeter Project.

In June 2012, the Company announced maiden Canadian National Instrument 43-101 mineral resource estimates for the Mahab 4 and Maqail South prospects at the Company's Block 5 property in Oman.

In October 2013, the Company announced that (a) the Company's search for Cyprus-type VMS deposits in Turkey has resulted in the identification in northern Turkey of several surface gossans in distal VMS settings and led to the signing by the Company's local subsidiary in Turkey of two new joint venture option agreements with local Turkish groups (one of these agreements relates to the Company's relinquished Karaburun project, which is discussed below), (b) having discovered further VMS mineralisation, but of insufficient size to eventually establish a commercial mining operation at the Hacimeter Project, Gentor allowed the Hacimeter Option to expire without continuing to form a joint venture, and (c) in light of continued depressed market conditions, Gentor was proposing to undertake a strategic review of its Oman properties over the coming months.

Gentor determined during fiscal 2013 that it would not continue with its molybdenum-tungsten project in east-central Idaho, U.S. and relinquished its rights in respect of this project. The Company had not carried out any exploration work at this project since fiscal 2008.

In January 2014, the Company completed a non-brokered private placement for total gross proceeds of Cdn$393,750. Arnold T. Kondrat (a director and officer of the Company) was the sole purchaser under this financing.

In February 2014, Arnold T. Kondrat was appointed President and Chief Executive Officer of the Company replacing Dr. Peter Ruxton (Mr. Kondrat was Executive Vice-President of the Company prior to this appointment), and two new directors, Richard J. Lachcik and William R. Wilson, were appointed to Gentor's board of directors, replacing David Twist and Rudolph de Bruin.

Also in February 2014, the Company completed a non-brokered arm's length private placement for total gross proceeds of Cdn$150,000.

In April 2014, the Company announced that it had entered into an agreement with Savannah Resources plc ("Savannah") to sell all of Gentor's properties in Oman to Savannah (the "Oman Sale"). The Oman Sale was completed in July 2014. The Oman Sale was effected by way of the sale to Savannah of all of Gentor's shares in Oman Holdco. The interests of Gentor in its properties in Oman were held through Oman Holdco. The Oman Sale reflected Gentor's focus on its copper exploration properties in Turkey. The consideration for the Oman Sale was comprised of a cash payment of US$800,000 paid to the Company on closing, together with the following deferred consideration (the "Deferred Consideration"):

(a) The sum of US$1,000,000, payable to the Company upon a formal final investment decision being made to proceed with the development of a mine at the Block 5 project in Oman.

(b) The sum of US$1,000,000, payable to the Company upon the production of the first saleable concentrate or saleable product from ore derived from the Block 5 project in Oman.

(c) The sum of US$1,000,000, payable to the Company within six months of the payment of the Deferred Consideration in (b) above.

Savannah could elect to pay up to 50% of the above Deferred Consideration by the issue to the Company of ordinary shares of Savannah. Where Savannah's shares were so issued in satisfaction of Deferred Consideration, the number of shares to be issued would be determined by reference to the volume weighted average price of Savannah's ordinary shares as traded on the AIM market of the London Stock Exchange plc ("AIM") for the 30 trading days prior to the date upon which the relevant Deferred Consideration was payable.

In August 2014, the Company completed a non-brokered private placement for total gross proceeds of Cdn$180,000. Arnold T. Kondrat, who is Chief Executive Officer, President and a director of the Company, was the sole purchaser under this financing.

In September 2014, Gentor announced that, as a result of a Government tender process, it had acquired a new mineral exploration licence covering the remaining portion of the Karaburun VMS project in northern central Turkey, the southern part of which was already held by the Company under an existing Turkish joint venture agreement.

In October 2014, the Company completed a non-brokered private placement for total gross proceeds of Cdn$500,000. Richard J. Lachcik (a director of the Company) purchased Cdn$100,000 of this placement and Geoffrey G. Farr (Corporate Secretary of the Company) purchased Cdn$50,000 of this placement.

In December 2014, Gentor announced that it had received the final forestry drill permit from the Ministry of Forestry and Water Resources in Turkey enabling the Company to undertake its planned phase one diamond drilling program at its Karaburun project. The drill permit allowed Gentor to prepare access roads and drill at up to 27 locations.

In May 2015, Gentor closed a non-brokered private placement for total gross proceeds of Cdn$900,000. Arnold T. Kondrat, who is Chief Executive Officer, President and a director of the Company, purchased Cdn$486,000 of this placement, Richard J. Lachcik, who is a director of the Company, purchased Cdn$60,000 of this placement, Donat K. Madilo, who is Chief Financial Officer of the Company, purchased Cdn$30,000 of this placement, and Geoffrey G. Farr, who is Corporate Secretary of the Company, purchased Cdn$30,000 of this placement.

In July 2015, Gentor reported the assay results for its phase one drilling at its Karaburun project in Turkey. Under the phase one diamond drilling program, Gentor completed seven drill holes for a total of 1,707.80 metres.

In February 2016, Gentor announced that it had signed a letter of intent ("LOI") with Lidya Madencilik Sanayi ve Ticaret A.S. ("Lidya") (a Turkish mining company) for a proposed joint venture to further explore and develop Gentor's Karaburun project. The LOI set out the intention to grant to Lidya an option ("Option") to acquire an 80% interest in the Karaburun project. The Option was subject to the negotiation and execution of a definitive agreement for the Option contemplated to be signed within 120 days from the signing of the LOI. The LOI provided that the Option period shall be 24 months from the date of signing the definitive agreement, and that upon signing the LOI Lidya shall make a cash payment to Gentor for US$50,000.

In May 2016, Gentor announced that its proposed joint venture with Lidya to further explore and develop the Karaburun project would not be proceeding, following notification from Lidya that Lidya decided to not pursue the proposed joint venture.

In September 2016, Gentor announced that Dr. Ruxton has resigned from the board of directors of the Company.

In September 2017, the Company consolidated its outstanding common shares on an eight to one basis.

In November 2017, the Company closed a non-brokered private placement of 10,000,000 units of the Company at a price of Cdn$0.05 per unit for total gross proceeds of Cdn$500,000. Each such unit consisted of one common share of the Company and one-half of one warrant of the Company, with each full warrant entitling the holder to purchase one common share of the Company at a price of Cdn$0.075 for a period of two years. Directors and officers of the Company purchased 2,500,000 of the units issued under the financing.

Also in November 2017, the Company announced that it intended to dispose of, for nominal consideration, its subsidiary which held the Karaburun project in Turkey (this was the Company's only project). The Company relinquished the Karaburun project and discontinued operations in Turkey effective at the end of 2017, and is currently evaluating new business opportunities.

In June 2018, the Company closed a non-brokered private placement of 8,000,000 common shares of the Company at a price of Cdn$0.05 per share for total gross proceeds of Cdn$400,000. Mr. Arnold T. Kondrat (who is Chief Executive Officer, President and a director of the Company) purchased all of the shares issued under this financing.

In October 2018, the Company effected an increase in the authorized share capital of the Company by changing the authorized share capital of the Company from US$50,000 divided into 62,500,000 common shares with a par value of US$0.0008 per share to US$400,000 divided into 500,000,000 common shares with a par value of US$0.0008 per share.

Also in October 2018, the Company closed a non-brokered private placement of 4,000,000 common shares of the Company at a price of Cdn$0.05 per share for total gross proceeds of Cdn$200,000. Directors and officers of the Company purchased 3,075,000 of the shares issued under this financing.

In May 2019, the Company closed a non-brokered private placement of 5,000,000 common shares of the Company at a price of Cdn$0.05 per share for gross proceeds of Cdn$250,000. Mr. Kondrat purchased 3,000,000 of the said shares.

In June 2019, the Company entered into a settlement agreement (the "Settlement Agreement") with Savannah relating to the Deferred Consideration payable to Gentor pursuant to the terms of the Oman Sale (see above). Savannah is an AIM-listed resource development company. Under the Settlement Agreement, the Company and Savannah agreed to fully settle the Deferred Consideration in exchange for (a) the payment by Savannah to the Company of US$100,000 (with US$50,000 being payable 30 days from the date of signing the Settlement Agreement and US$50,000 being payable six months from the date of signing the Settlement Agreement), and (b) the issuance to the Company by Savannah of US$200,000 worth of Savannah shares (being 3,008,025 shares). Such shares were subject to a six-month orderly market restriction.

The SEC maintains a website that contains reports, proxy and information statements and other information regarding the Company that has been filed electronically with the SEC at http://www.sec.gov. The Company's website is www.gentorresources.com.

B. Business Overview

In November 2017, the Company announced that it intended to dispose of, for nominal consideration, its subsidiary which held the Karaburun project in Turkey (this was the Company's only project). The Company relinquished the Karaburun project and discontinued operations in Turkey at the end of 2017, and is currently evaluating new business opportunities.

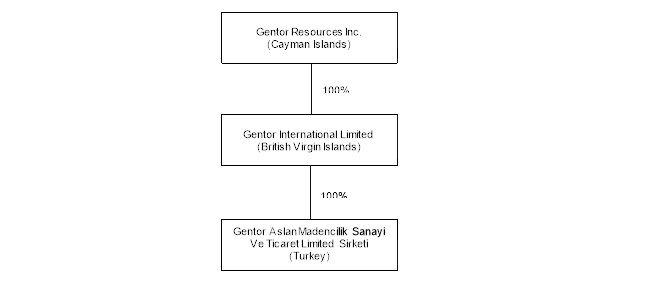

C. Organizational Structure

The following diagram presents, as of the date of this Form 20-F, the names of the Company's subsidiaries (each of which is inactive) and the jurisdiction where they are incorporated, as well as the percentage of votes attaching to all voting securities of each such subsidiary beneficially owned, or controlled or directed, directly or indirectly, by the Company:

D. Property, Plants and Equipment

The Company does not have any material tangible fixed assets.

The Company relinquished its only project, the Karaburun project in Turkey, and discontinued operations in Turkey at the end of 2017. The Company is currently evaluating new business opportunities.

Item 4A. Unresolved Staff Comments

Not applicable.

Item 5. Operating and Financial Review and Prospects

See the management's discussion and analysis of the Company for the year ended December 31, 2020 incorporated by reference into this Form 20-F as Exhibit 15.1.

A. Operating Results

See the management's discussion and analysis of the Company for the year ended December 31, 2020 incorporated by reference into this Form 20-F as Exhibit 15.1.

B. Liquidity and Capital Resources

See the management's discussion and analysis of the Company for the year ended December 31, 2020 incorporated by reference into this Form 20-F as Exhibit 15.1.

C. Research and Development, Patents and Licenses, etc.

The Company does not carry on any research and development activities. The Company does not hold any patents.

D. Trend Information

The Company relinquished its only project, the Karaburun project in Turkey, and discontinued operations in Turkey at the end of 2017. The Company is currently evaluating new business opportunities.

Additionally, any outbreaks of contagious diseases and other adverse public health developments could have a material and adverse effect on the Company. For example, the ongoing outbreak of COVID-19 has resulted in significant restrictive measures being implemented by governments of various countries to control the spread of COVID-19. Such COVID-19 related restrictions and disruptions, including for employees, experts and suppliers across different industries, may negatively impact the Company's activities. In addition, COVID-19 has resulted in a widespread health crisis that has adversely affected the economies and financial markets of many countries, resulting in an economic downturn that could affect the Company's ability to access or raise capital through issuances of the Company's securities and the ability of the Company to identify and acquire a suitable business.

E. Off-Balance Sheet Arrangements.

The Company does not have any off-balance sheet arrangements.

F. Tabular Disclosure of Contractual Obligations

The Company does not have any contractual obligations (within the meaning of Form 20-F) requiring disclosure under this item.

G. Safe Harbor

Not applicable.

Item 6. Directors, Senior Management and Employees

A. Directors and Senior Management

The directors and officers of the Company, their ages and term of continuous service are as follows:

|

Name |

Age |

Current Position(s) with the Company |

Served Since |

|

Arnold T. Kondrat (1) |

68 |

President, Chief Executive Officer and a director |

July 31, 2007 (director and officer) |

|

Donat K. Madilo |

59 |

Chief Financial Officer |

March 8, 2010 |

|

Geoffrey G. Farr |

54 |

Corporate Secretary |

April 7, 2011 |

|

Richard J. Lachcik (1) |

63 |

Director |

February 13, 2014 |

|

William R. Wilson (1) |

78 |

Director |

February 13, 2014 |

__________________________

(1) Member of the audit committee of the board of directors of the Company.

Arnold T. Kondrat - Mr. Kondrat is the Company's principal founder and has over 30 years of management experience in the resource exploration industry. During this time he has been a senior officer and director of a number of publicly-traded resource exploration companies, in both Canada and the United States, including principal founder of several of these companies. In addition to his positions with Gentor, Mr. Kondrat is also presently Chief Executive Officer and a director of Loncor Resources Inc. ("Loncor") (a gold exploration company listed on the Toronto Stock Exchange), and President of Sterling Portfolio Securities Inc. (a private venture capital firm based in Toronto). He was a senior officer of Banro Corporation ("Banro") (a mining company with gold mines in the Democratic Republic of the Congo (the "DRC")) from 1994 to 2017.

Donat K. Madilo - Mr. Madilo has over 30 years of experience in accounting, administration and finance in the DRC and North America. He held senior officer positions with Banro from 1996 to 2018 (including Senior Vice President, Commercial & DRC Affairs and Chief Financial Officer). In addition to being Chief Financial Officer of Gentor, he is also presently Chief Financial Officer of Loncor. Mr. Madilo's previous experience includes director of finance of Coocec-ceaz (a credit union chain in the DRC) and senior advisor at Conseil Permanent de la Comptabilité au Congo, the accounting regulation board in the DRC. He holds a Bachelor of Commerce (Honours) degree from Institut Supérieur de Commerce de Kinshasa, a B.Sc. (Licence) in Applied Economics from University of Kinshasa and a Masters of Science in Accounting (Honours) from Roosevelt University in Chicago.

Geoffrey G. Farr - Mr. Farr has been a partner of the law firm Dickinson Wright LLP (which acts as legal counsel to Gentor) from July 2019 to present. He practices corporate and securities law. From February 2011 to June 2019, Mr. Farr was General Counsel to and Corporate Secretary of each of Gentor and Loncor (he remains Corporate Secretary of each). From February 2011 to October 2018, Mr. Farr was Vice President, General Counsel and Corporate Secretary of Banro Corporation, and from June 2017 to January 2019, he was General Counsel to and Corporate Secretary of Kuuhubb Inc. (a company listed on the TSX Venture Exchange focused on lifestyle and mobile video game applications). Prior to February 2011, Mr. Farr practised corporate and securities law in Toronto for 17 years, which included extensive experience in representing public companies. He holds a LL.B. from the University of Ottawa and a B.Comm. from Queen's University.

Richard J. Lachcik - Prior to his retirement in 2017, Mr. Lachcik practiced corporate and securities law in Toronto, Canada for over 30 years. His practice included extensive experience in representing public companies, as well as acting for a number of investment dealers. He has been an officer and director of a number of Canadian public resource companies.

William R. Wilson - Mr. Wilson is Director, Executive Vice President and Chief Financial Officer of TUVERA Exploration Inc. TUVERA is a private holding company for the ARVENUT exploration properties in Nevada, Utah and New Mexico. He has created and managed 11 mining companies over 25 years with properties in the U.S., Canada, Russia, the DRC and Ukraine. Mr. Wilson is a Qualified Professional in Mining, Metallurgy/Processing and Environmental Compliance (Member no. 01063QP) of the Mining and Metallurgical Society of America. He has a degree in Metallurgical Engineering from the Colorado School of Mines and a Masters of Business Administration degree from the University of Southern California. Mr. Wilson has been involved in the mining industry for more than 40 years. He has been a director and senior officer of a number of public companies in both Canada and the United States, and has been a member of the audit committee of several of these companies.

There are no family relationships among any of the Company's directors or senior management.

There is no arrangement or understanding with major shareholders, customers, suppliers or others, pursuant to which any person referred to above was selected as a director or officer of the Company.

The following directors of the Company are presently directors of other issuers that are public companies:

|

Name of Director |

Names of Other Issuers |

|

Arnold T. Kondrat |

Loncor Resources Inc. |

|

Richard J. Lachcik |

Loncor Resources Inc. |

|

William R. Wilson |

Loncor Resources Inc. |

Other than the board of directors, the Company does not have an administrative, supervisory or management body.

B. Compensation

Named Officers

Summary Compensation Table

The following table sets forth certain information with respect to the compensation of the officers of the Company set out in the following table (the "Officers") for the financial year ended December 31, 2020.

|

Name and Principal |

Salary |

Share-based |

Option-based |

Non-equity Annual Incentive (US$) |

All other (US$) |

Total |

|

Arnold T. Kondrat |

$89,540 |

N/A |

Nil |

Nil |

Nil |

$89,540 |

|

Donat K. Madilo |

$50,000 |

N/A |

Nil |

Nil |

Nil |

$50,000 |

__________________________

(1) The Company did not grant any stock options in 2020.

Incentive Plan Awards

The following table provides details regarding outstanding option and share-based awards held by the Officers as at December 31, 2020:

|

Outstanding share-based awards and option-based awards |

|||||||

|

|

Option-based Awards |

Share-based Awards |

|||||

|

Name |

Option grant |

Number of |

Option |

Option |

Aggregate |

Number |

Market or |

|

Arnold T. Kondrat |

June 24, 2019 |

250,000 |

Cdn$0.065 (US$0.051) |

June 24, 2024 |

US$3,000 |

N/A |

N/A |

|

Donat K. Madilo |

June 24, 2019 |

250,000 |

Cdn$0.065 (US$0.051) |

June 24, 2024 |

US$3,000 |

N/A |

N/A |

__________________________

(1) All of the stock options granted to each Officer vested on the four month anniversary of the grant date.

(2) The exercise price of all of the stock options set out in the above table is in Canadian dollars. The U.S. dollar figures set out in this column of the table were calculated using the exchange rate on December 31, 2020 as reported by the Bank of Canada for the conversion of Canadian dollars into U.S. dollars of Cdn$1.00 = US$7854.

(3) This is based on the last closing sale price per share of the Company's common shares as at December 31, 2020 of Cdn$0.08 as reported by the TSX Venture Exchange, which is equivalent to US$0.063 using the exchange rate on December 31, 2020 as reported by the Bank of Canada for the conversion of Canadian dollars into U.S. dollars of Cdn$1.00 = US$0.7854.

The following table provides details regarding outstanding option-based awards, share-based awards and non-equity incentive plan compensation held by the Officers, which vested and/or were earned during the year ended December 31, 2020:

|

Incentive plan awards - value vested or earned during the year |

|||

|

Name |

Option-based awards - |

Share-based awards - |

Non-equity incentive plan |

|

Arnold T. Kondrat |

Nil |

N/A |

N/A |

|

Donat K. Madilo |

Nil |

N/A |

N/A |

__________________________

(1) Identifies the aggregate dollar value that would have been realized by the Officer if he had exercised all options exercisable under the option-based award on the vesting date(s) thereof.

Non-Executive Directors

The directors of the Company were not paid any fees by the Company during the financial year ended December 31, 2020 for their services in their capacity as directors.

The Company's directors are eligible to receive stock option grants under the Company's stock option plan, as determined by the board of directors of the Company (the "Board"). The exercise price of such stock options is determined by the Board, but shall in no event be less than the last closing price of the Company's common shares on the TSX Venture Exchange prior to the date the stock options are granted.

All directors of the Company are entitled to receive reimbursement for reasonable out-of-pocket expenses related to their attendance at meetings or other expenses incurred for Company purposes.

Director Summary Compensation Table

The following table sets out certain information with respect to compensation of each of the Company's directors in the year ended December 31, 2020, other than Mr. Kondrat. See "Named Officers - Summary Compensation Table" above for details regarding the compensation of Mr. Kondrat during 2020.

|

Name |

Fees earned |

Share-based |

Option-based |

Non-equity |

All other |

Total

|

|

Richard J. Lachcik |

Nil |

N/A |

Nil |

N/A |

Nil |

Nil |

|

William R. Wilson |

Nil |

N/A |

Nil |

N/A |

Nil |

Nil |

(1) The Company did not grant any stock options in 2020.

Incentive Plan Awards

The following table provides details regarding the outstanding option and share based awards held as at December 31, 2020 by the directors of the Company other than Mr. Kondrat. See "Named Officers - Incentive Plan Awards" above for details regarding the outstanding stock options held by Mr. Kondrat as at December 31, 2020.

|

Outstanding share-based awards and option-based awards |

|||||||

|

|

Option-based Awards |

Share-based Awards |

|||||

|

Name |

Option grant |

Number of (#) |

Option exercise |

Option |

Aggregate |

Number of |

Market or |

|

Richard J. Lachcik |

June 24, 2019 |

125,000 |

Cdn$0.065 (US$0.051) |

June 24, 2024 |

US$1,500 |

N/A |

N/A |

|

William R. Wilson |

June 24, 2019 |

125,000 |

Cdn$0.065 (US$0.051) |

June 24, 2024 |

US$1,500 |

N/A |

N/A |

(1) All of the stock options granted to each Officer vested on the four month anniversary of the grant date.

(2) The exercise price of all of the stock options set out in the above table is in Canadian dollars. The U.S. dollar figures set out in this column of the table were calculated using the exchange rate on December 31, 2020 as reported by the Bank of Canada for the conversion of Canadian dollars into U.S. dollars of Cdn$1.00 = US$7854.

(3) This is based on the last closing sale price per share of the Company's common shares as at December 31, 2020 of Cdn$0.08 as reported by the TSX Venture Exchange, which is equivalent to US$0.063 using the exchange rate on December 31, 2020 as reported by the Bank of Canada for the conversion of Canadian dollars into U.S. dollars of Cdn$1.00 = US$0.7854.

The following table provides details regarding outstanding option-based awards, share-based awards and non-equity incentive plan compensation in respect of the directors of the Company other than Mr. Kondrat, which vested and/or were earned during the year ended December 31, 2020. See "Named Officers - Incentive Plan Awards" above for details regarding the outstanding option-based awards, share-based awards and non-equity incentive plan compensation in respect of Mr. Kondrat, which vested and/or were earned during the year ended December 31, 2020.

|

Incentive plan awards - value vested or earned during the year |

|||

|

Name |

Option-based awards - |

Share-based awards - |

Non-equity incentive plan |

|

Richard J. Lachcik |

Nil |

N/A |

N/A |

|

William R. Wilson |

Nil |

N/A |

N/A |

__________________________

(1) Identifies the aggregate dollar value that would have been realized by the director if the director had exercised all options exercisable under the option-based award on the vesting date(s) thereof.

Other Information

Neither the Company nor its subsidiaries provides pension, retirement or similar benefits.

C. Board Practices

Each director of the Company holds office until the close of the next annual meeting of shareholders of the Company following his election or appointment, unless his office is earlier vacated in accordance with the articles of association of the Company. See Item 6.A. of this Form 20-F for the dates the directors of the Company were first elected or appointed to the Company's Board. No director of the Company has any service contract with the Company or any subsidiary of the Company providing for benefits upon termination of service. However, the terms of the Company's stock option plan accelerate the vesting of stock options granted under such plan in the event of a take-over bid in respect of the Company (see Item 6.E. of this Form 20-F). See Item 6.B. of this Form 20-F for information in respect of the stock options of the Company held by the Company's directors and officers.

The Board does not have any standing committees other than an audit committee (the "Audit Committee"). Given the size of the Company and the number of directors on the Board, the Board performs the functions of a compensation committee itself.

There is no contract, agreement, plan or arrangement that provides for payments to an officer of the Company at, following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement, a change in control of the Company or a change in an executive officer's responsibilities.

Audit Committee

The members of the Audit Committee are Arnold T. Kondrat, Richard J. Lachcik and William R. Wilson.

Summary of Terms of Reference for the Audit Committee

The Audit Committee must be comprised of at least three directors, each of whom must satisfy the financial literacy, experience and other requirements of applicable corporate and securities laws and applicable stock exchange requirements and guidelines. The Audit Committee must (a) review the annual financial statements of the Company and the related management's discussion and analysis before they are approved by the Board, and (b) review all interim financial statements of the Company and the related management's discussion and analysis and, if thought fit, approve all interim financial statements and the related management's discussion and analysis. In addition, the Audit Committee is responsible for:

- making recommendations to the Board as to the appointment or re-appointment of the external auditor;

- pre-approving all non-audit services to be provided by the external auditor to the Company;

- overseeing the work of the external auditor in performing its audit or review services and overseeing the resolution of any disagreements between management and the external auditor; and

- having direct communication channels with the Company's external auditors.

The Audit Committee is empowered to retain independent counsel and other advisors as it determines necessary to carry out its duties.

D. Employees

The following sets out the number of employees which the Company and its subsidiaries had as at December 31, 2020, December 31, 2019 and December 31, 2018:

|

|

Dec. 31, |

Dec. 31, |

Dec. 31, |

|

Gentor executive office in Toronto, Canada |

3 |

3 |

4 |

|

Totals: |

3 |

3 |

4 |

Neither the Company nor any of its subsidiaries has any unionized employees.

Neither the Company nor any of its subsidiaries employ a significant number of temporary employees.

E. Share Ownership

The following table sets out the number of common shares held by the Company's directors and officers as of April 15, 2021 (including the percentage of the Company's outstanding common shares represented by such shares) and the number of stock options of the Company held by the Company's directors and officers as of April 15, 2021 (each stock option is exercisable for one common share of the Company). As of April 15, 2021, the Company did not have outstanding any common share purchase warrants.

|

Name |

Number of Shares Owned |

Percentage of |

Number of Stock Options Held |

|

Geoffrey G. Farr |

350,000 |

0.9% |

250,000 stock options exercisable at a price of Cdn$0.065 per share until June 24, 2024. |

|

Donat K. Madilo |

212,500 |

0.55% |

250,000 stock options exercisable at a price of Cdn$0.065 per share until June 24, 2024. |

|

Arnold T. Kondrat |

20,033,188 |

51.49% |

250,000 stock options exercisable at a price of Cdn$0.065 per share until June 24, 2024. |

|

Richard J. Lachcik |

600,000 |

1.54% |

125,000 stock options exercisable at a price of Cdn$0.065 per share until June 24, 2024. |

|

William R. Wilson |

70,000 |

0.18% |

125,000 stock options exercisable at a price of Cdn$0.065 per share until June 24, 2024. |

Equity Compensation Plans

The Company has a stock option plan (the "Option Plan"). As of April 15, 2021, there are outstanding under the Option Plan 1,040,000 stock options. The following is a summary of certain terms of the Option Plan.

(a) Stock options may be granted from time to time by the Board to such directors, officers, employees and consultants of the Company or a subsidiary of the Company, and in such numbers, as are determined by the Board at the time of the granting of the stock options.

(b) The total number of common shares of the Company issuable upon the exercise of all outstanding stock options granted under the Option Plan shall not at any time exceed 10% of the total number of outstanding common shares, from time to time.

(c) The exercise price of each stock option shall be determined in the discretion of the Board at the time of the granting of the stock option, provided that the exercise price shall not be lower than the "Market Price". "Market Price" means the last closing price of the common shares on the TSX Venture Exchange prior to the date the stock option is granted.

(d) At no time shall:

(i) the number of common shares reserved for issuance pursuant to stock options granted to insiders of the Company exceed 10% of the outstanding common shares;

(ii) the number of stock options granted to insiders of the Company, within a 12 month period, exceed 10% of the outstanding common shares;

(iii) the number of common shares reserved for issuance pursuant to stock options or pursuant to any other stock purchase or option plans of the Company granted to any one optionee exceed 5% of the outstanding common shares;

(iv) the number of common shares issued pursuant to stock options to any one optionee, within a one-year period, exceed 5% of the outstanding common shares;

(v) the number of stock options granted to any one consultant in a 12 month period exceed 2% of the outstanding common shares; or

(vi) the aggregate number of stock options granted to persons employed in investor relations activities exceed 2% of the outstanding common shares in any 12 month period without the express consent of the TSX Venture Exchange.

(e) In the event a "take-over bid" (as such term is defined under Ontario securities laws) is made in respect of the Company's common shares, all unvested stock options shall become exercisable (subject to any necessary regulatory approval) so as to permit the holders of such stock options to tender the common shares received upon exercising such stock options pursuant to the take-over bid.

(f) All stock options shall be for a term determined in the discretion of the Board at the time of the granting of the stock options, provided that no stock option shall have a term exceeding five years and, unless the Board at any time makes a specific determination otherwise (but subject to the terms of the Option Plan), a stock option and all rights to purchase common shares pursuant thereto shall expire and terminate immediately upon the optionee who holds such stock option ceasing to be at least one of a director, officer or employee of or consultant to the Company or a subsidiary of the Company, as the case may be.

(g) Unless otherwise determined by the Board at the time of the granting of the stock options, one-quarter of the stock options granted to an optionee vest on each of the 6 month, 12 month, 18 month and 24 month anniversaries of the grant date.

(h) Except in limited circumstances in the case of the death of an optionee, stock options shall not be assignable or transferable.

(i) Disinterested shareholder approval is required prior to any reduction in the exercise price of a stock option if the optionee holding such stock option is an insider of the Company.

(j) The Company may amend from time to time the terms and conditions of the Option Plan by resolution of the Board. Any amendments shall be subject to the prior consent of any applicable regulatory bodies, including the TSX Venture Exchange (to the extent such consent is required).

(k) The Board has full and final discretion to interpret the provisions of the Option Plan, and all decisions and interpretations made by the Board shall be binding and conclusive upon the Company and all optionees, subject to shareholder approval if required by the TSX Venture Exchange.

(l) The Option Plan does not provide for financial assistance by the Company to an optionee in connection with an option exercise.

The following table reflects certain information about the number of securities issued and available under the Option Plan, all of which information is stated as of April 15, 2021.

|

Number of common shares to be issued upon exercise of stock options outstanding |

Exercise price of |

Number of common shares for future issuance (excluding outstanding awards) |

|

|

|

|

|

1,040,000 (1) |

Cdn$0.065 |

2,850,674 common shares |

__________________________

(1) All of these stock options vested four months after their grant date. 40,000 of these stock options were granted on July 5, 2019 and expire on July 5, 2024. The other 1,000,000 of these stock options were granted on June 24, 2019 and expire on June 24, 2024.

A copy of the Option Plan is incorporated by reference into this Form 20-F as Exhibit 4.1.

Item 7. Major Shareholders and Related Party Transactions

A. Major Shareholders

To the knowledge of management of the Company, based on a review of publicly available filings, the following is the only person or company who beneficially owns 5% or more of the outstanding common shares of the Company.

|

Name of Shareholder |

Number of Shares Beneficially Owned (1) |

Percentage of Outstanding Common Shares (1) |

|

Arnold T. Kondrat (2) |

20,033,188 (3) |

51.49% |

__________________________

(1) The information in these columns of the table is as at April 15, 2021.

(2) Mr. Kondrat is Chief Executive Officer, President and a director of the Company.

(3) With respect to the common shares of the Company currently held by Mr. Kondrat, 1,012,500 of such shares were acquired by Mr. Kondrat in 2015, 2,055,000 of such shares were acquired by Mr. Kondrat in 2017, 10,725,000 of such shares were acquired by Mr. Kondrat in 2018, and 3,000,000 of such shares were acquired by Mr. Kondrat in 2019.

The shareholder disclosed above does not have any voting rights with respect to his common shares of the Company that are different from any other holder of common shares of the Company.

As of April 15, 2021, based on the Company's shareholders' register, there were 23 shareholders of record of the Company's common shares in the United States, holding 16.74% of the outstanding common shares of the Company.

Control by Foreign Government or Other Persons

To the best of the knowledge of management of the Company, other than as disclosed in this Form 20-F, the Company is not directly or indirectly owned or controlled by another corporation, any foreign government, or any other natural or legal person, severally or jointly.

Change of Control

As of the date of this Form 20-F, there are no arrangements known to the Company which may at a subsequent date result in a change in control of the Company.

B. Related Party Transactions

See Item 4 of this Form 20-F for information with respect to the private placement financings carried out by the Company in 2018 and 2019 involving directors and officers of the Company.

C. Interests of Experts and Counsel

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

Item 8. Financial Information

A. Consolidated Statements and Other Financial Information

Consolidated Financial Statements

The consolidated financial statements of the Company are filed as part of this annual report under Item 18.

Legal or Arbitration Proceedings

The Company is not aware of any current or pending material legal or arbitration proceeding to which it is or is likely to be a party or of which any of its properties are or are likely to be the subject.

The Company is not aware of any material proceeding in which any director, member of senior management or affiliate of the Company is either a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Dividend Policy

The Company has not paid any dividend or made any other distribution in respect of its outstanding shares and management does not anticipate that the Company will pay dividends or make any other distribution in respect on its shares in the foreseeable future. The Company's Board, from time to time, and on the basis of any earnings and the Company's financial requirements or any other relevant factor, will determine the future dividend or distribution policy of the Company with respect to its shares.

B. Significant Changes

There have been no significant changes in the affairs of the Company since the date of the audited annual consolidated financial statements of the Company as at and for the year ended December 31, 2020.

Item 9. The Offer and Listing

A. Offer and Listing Details

The Company's common shares are listed for trading on the TSX Venture Exchange under the symbol "GNT", and have been so listed since November 7, 2011. The Company's common shares are also quoted in the United States on the OTC Pink tier of the OTC Link (the "OTC Pink") under the trading symbol "GNTOF", and have been so quoted since May 1, 2015. Prior to May 1, 2015, such shares were quoted in the United States on the OTCQB tier of the OTC Link.

In September 2017, the Company consolidated its outstanding common shares on an eight to one basis. The common shares commenced trading on a post-consolidation basis on the TSX Venture Exchange on September 13, 2017. The information in this item 9 has been adjusted to reflect said share consolidation.

TSX Venture Exchange ("TSX-V")

The following table discloses the annual high and low sales prices in Canadian dollars for the common shares of the Company for the five most recent financial years of the Company as traded on the TSX-V.

|

Year |

High (Cdn$) |

Low (Cdn$) |

|

2020 |

$0.08 |

$0.03 |

|

2019 |

$0.065 |

$0.045 |

|

2018 |

$0.12 |

$0.06 |

|

2017 |

$0.20 |

$0.08 |

|

2016 |

$0.20 |

$0.04 |

The following table discloses the high and low sales prices in Canadian dollars for the common shares of the Company for each quarterly period within the two most recent financial years of the Company, and for the most recently completed fiscal quarter of the Company, all as traded on the TSX-V.

|

Quarter Ended |

High (Cdn$) |

Low (Cdn$) |

|

March 31, 2021 |

$0.08 |

$0.08 |

|

December 31, 2020 |

$0.08 |

$0.045 |

|

September 30, 2020(1) |

- |

- |

|

June 30, 2020 |

$0.045 |

$0.03 |

|

March 31, 2020 |

$0.055 |

$0.045 |

|

December 31, 2019 |

$0.045 |

$0.045 |

|

September 30, 2019 |

$0.055 |

$0.055 |

|

June 30, 2019 |

$0.065 |

$0.05 |

|

March 31, 2019 |

$0.06 |

$0.045 |

__________________________

(1) The common shares of the Company did not trade on the TSX-V during this period.

The following table discloses the monthly high and low sales prices in Canadian dollars for the common shares of the Company for the most recent six months as traded on the TSX-V.

|

Month |

High (Cdn$) |

Low (Cdn$) |

|

April 2021 (to April 15)(1) |

- |

- |

|

March 2021 |

$0.08 |

$0.08 |

|

February 2021(1) |

- |

- |

|

January 2021(1) |

- |

- |

|

December 2020 |

$0.08 |

$0.045 |

|

November 2020(1) |

- |

- |

|

October 2020(1) |

- |

- |

__________________________

(1) The common shares of the Company did not trade on the TSX-V during this period.

OTC Pink

The following table discloses the annual high and low market prices in United States dollars for the common shares of the Company for the five most recent financial years of the Company as traded on the OTC Pink.

|

Year |

High (US$) |

Low (US$) |

|

2020 |

$0.07 |

$0.03 |

|

2019 |

$0.134 |

$0.034 |

|