1.362.2400.510.490.410.050.056700000One year or morefalse--12-31FY2019000134512623620003754000P15YP10YP9YP8Y99950001480000050000000059900000599000005990000059900000One vote per share0000005000000050000000400000040000000400000040000004600000400000040000000400000040000004600000Shorter of useful life or lease termP8YP25YP15YP2YP6YP2Y

0001345126

2019-01-01

2019-12-31

0001345126

2020-02-21

0001345126

2019-12-31

0001345126

codi:SharesRepresentingBeneficialInterestsInCompassDiversifiedHoldingsMember

2019-01-01

2019-12-31

0001345126

codi:SeriesAPreferredSharesRepresentingSeriesATrustPreferredInterestInCompassDiversifiedHoldingsMember

2019-01-01

2019-12-31

0001345126

codi:SeriesBPreferredSharesRepresentingSeriesBTrustPreferredInterestInCompassDiversifiedHoldingsMember

2019-01-01

2019-12-31

0001345126

codi:SeriesCPreferredSharesRepresentingSeriesCTrustPreferredInterestInCompassDiversifiedHoldingsMemberDomain

2019-01-01

2019-12-31

0001345126

2018-12-31

0001345126

us-gaap:SeriesBPreferredStockMember

2018-12-31

0001345126

us-gaap:SeriesCPreferredStockMember

2019-12-31

0001345126

us-gaap:SeriesBPreferredStockMember

2019-12-31

0001345126

us-gaap:SeriesAPreferredStockMember

2019-12-31

0001345126

us-gaap:SeriesAPreferredStockMember

2018-12-31

0001345126

us-gaap:SeriesCPreferredStockMember

2018-12-31

0001345126

2018-01-01

2018-12-31

0001345126

2017-01-01

2017-12-31

0001345126

us-gaap:NoncontrollingInterestMember

2017-01-01

2017-12-31

0001345126

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2019-12-31

0001345126

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0001345126

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-12-31

0001345126

us-gaap:ParentMember

2018-01-01

2018-12-31

0001345126

us-gaap:CommonStockMember

us-gaap:ParentMember

2018-01-01

2018-12-31

0001345126

us-gaap:PreferredStockMember

us-gaap:ParentMember

2019-01-01

2019-12-31

0001345126

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0001345126

us-gaap:ParentMember

2019-01-01

2019-12-31

0001345126

2017-12-31

0001345126

us-gaap:CommonStockMember

us-gaap:ParentMember

2019-01-01

2019-12-31

0001345126

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0001345126

us-gaap:PreferredStockMember

2018-01-01

2018-12-31

0001345126

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0001345126

codi:NonControllingInterestOfDiscontinuedOperationsMember

2017-12-31

0001345126

codi:NonControllingInterestOfDiscontinuedOperationsMember

2019-01-01

2019-12-31

0001345126

us-gaap:ParentMember

2017-12-31

0001345126

us-gaap:CommonStockMember

2017-01-01

2017-12-31

0001345126

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2017-12-31

0001345126

us-gaap:CommonStockMember

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0001345126

us-gaap:RetainedEarningsMember

2019-12-31

0001345126

codi:ErgobabyMember

us-gaap:NoncontrollingInterestMember

2017-01-01

2017-12-31

0001345126

us-gaap:RetainedEarningsMember

2016-12-31

0001345126

us-gaap:ParentMember

2016-12-31

0001345126

us-gaap:PreferredStockMember

2017-01-01

2017-12-31

0001345126

us-gaap:NoncontrollingInterestMember

2019-01-01

2019-12-31

0001345126

codi:NonControllingInterestOfDiscontinuedOperationsMember

2017-01-01

2017-12-31

0001345126

us-gaap:CommonStockMember

2018-12-31

0001345126

codi:CleanEarthMember

2019-01-01

2019-12-31

0001345126

codi:LibertyMember

us-gaap:NoncontrollingInterestMember

2019-01-01

2019-12-31

0001345126

codi:CleanEarthMember

codi:NonControllingInterestOfDiscontinuedOperationsMember

2019-01-01

2019-12-31

0001345126

codi:CrosmanMember

us-gaap:NoncontrollingInterestMember

2017-01-01

2017-12-31

0001345126

us-gaap:ParentMember

2018-12-31

0001345126

us-gaap:ParentMember

2019-12-31

0001345126

us-gaap:CommonStockMember

us-gaap:ParentMember

2017-01-01

2017-12-31

0001345126

codi:ManitobaHarvestMember

2017-01-01

2017-12-31

0001345126

us-gaap:RetainedEarningsMember

2017-12-31

0001345126

us-gaap:NoncontrollingInterestMember

2018-12-31

0001345126

codi:ManitobaHarvestMember

codi:NonControllingInterestOfDiscontinuedOperationsMember

2019-01-01

2019-12-31

0001345126

us-gaap:PreferredStockMember

us-gaap:ParentMember

2018-01-01

2018-12-31

0001345126

codi:NonControllingInterestOfDiscontinuedOperationsMember

2018-01-01

2018-12-31

0001345126

us-gaap:PreferredStockMember

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0001345126

us-gaap:NoncontrollingInterestMember

2018-01-01

2018-12-31

0001345126

us-gaap:ParentMember

2017-01-01

2017-12-31

0001345126

codi:NonControllingInterestOfDiscontinuedOperationsMember

2016-12-31

0001345126

codi:ManitobaHarvestMember

2019-01-01

2019-12-31

0001345126

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-12-31

0001345126

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2017-12-31

0001345126

us-gaap:SeriesAPreferredStockMember

2016-12-31

0001345126

us-gaap:CommonStockMember

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0001345126

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-01-01

2017-12-31

0001345126

codi:NonControllingInterestOfDiscontinuedOperationsMember

2018-12-31

0001345126

2016-12-31

0001345126

us-gaap:PreferredStockMember

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0001345126

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2019-01-01

2019-12-31

0001345126

us-gaap:CommonStockMember

2017-12-31

0001345126

us-gaap:PreferredStockMember

us-gaap:ParentMember

2017-01-01

2017-12-31

0001345126

us-gaap:CommonStockMember

2016-12-31

0001345126

us-gaap:RetainedEarningsMember

2018-12-31

0001345126

codi:CrosmanMember

2019-01-01

2019-12-31

0001345126

us-gaap:PreferredStockMember

2019-01-01

2019-12-31

0001345126

us-gaap:CommonStockMember

2019-12-31

0001345126

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0001345126

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2019-12-31

0001345126

us-gaap:NoncontrollingInterestMember

2019-12-31

0001345126

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0001345126

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2019-12-31

0001345126

us-gaap:PreferredStockMember

2018-01-01

2018-12-31

0001345126

us-gaap:NoncontrollingInterestMember

2017-12-31

0001345126

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-12-31

0001345126

us-gaap:NoncontrollingInterestMember

2016-12-31

0001345126

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-12-31

0001345126

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2018-12-31

0001345126

codi:CrosmanMember

2017-01-01

2017-12-31

0001345126

us-gaap:CommonStockMember

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0001345126

us-gaap:PreferredStockMember

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0001345126

codi:CrosmanMember

2018-01-01

2018-12-31

0001345126

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2018-12-31

0001345126

codi:NonControllingInterestOfDiscontinuedOperationsMember

2019-12-31

0001345126

us-gaap:CommonStockMember

2018-01-01

2018-12-31

0001345126

2006-04-25

2006-04-25

0001345126

srt:SubsidiariesMember

us-gaap:GeographicDistributionForeignMember

2018-12-31

0001345126

2019-01-01

0001345126

codi:Seniornotesdue2026Member

2019-12-31

0001345126

srt:SubsidiariesMember

us-gaap:GeographicDistributionForeignMember

2019-12-31

0001345126

srt:MaximumMember

us-gaap:MachineryAndEquipmentMember

2019-01-01

2019-12-31

0001345126

srt:MinimumMember

us-gaap:MachineryAndEquipmentMember

2019-01-01

2019-12-31

0001345126

srt:MaximumMember

codi:OfficeFurnitureComputersAndSoftwareMember

2019-01-01

2019-12-31

0001345126

srt:MinimumMember

codi:OfficeFurnitureComputersAndSoftwareMember

2019-01-01

2019-12-31

0001345126

srt:MinimumMember

us-gaap:BuildingAndBuildingImprovementsMember

2019-01-01

2019-12-31

0001345126

srt:MaximumMember

us-gaap:BuildingAndBuildingImprovementsMember

2019-01-01

2019-12-31

0001345126

us-gaap:LeaseholdImprovementsMember

2019-01-01

2019-12-31

0001345126

codi:CleanEarthMember

2019-01-01

2019-06-28

0001345126

codi:CleanEarthMember

2017-01-01

2017-12-31

0001345126

codi:CleanEarthMember

2018-01-01

2018-12-31

0001345126

codi:ManitobaHarvestMember

2018-01-01

2018-12-31

0001345126

codi:ManitobaHarvestMember

2019-01-01

2019-02-28

0001345126

codi:ManitobaHarvestMember

2018-12-31

0001345126

codi:CleanEarthMember

2018-12-31

0001345126

codi:ManitobaHarvestMember

2019-12-31

0001345126

codi:ManitobaHarvestMember

2017-01-01

2017-12-31

0001345126

codi:CleanEarthMember

2019-04-01

2019-06-30

0001345126

codi:ManitobaHarvestMember

2019-01-01

2019-09-30

0001345126

2019-07-01

2019-09-30

0001345126

2019-01-01

2019-03-31

0001345126

currency:USD

2019-02-28

2019-02-28

0001345126

2019-02-18

0001345126

2019-08-31

0001345126

2019-06-28

0001345126

2019-02-28

2019-02-28

0001345126

2019-02-28

0001345126

codi:CleanEarthMember

2019-06-28

2019-06-28

0001345126

2019-02-19

0001345126

codi:RimportsMember

us-gaap:CustomerRelationshipsMember

2018-02-26

2018-02-26

0001345126

codi:RimportsMember

2018-02-26

2018-02-26

0001345126

codi:RimportsMember

us-gaap:TradeNamesMember

2018-02-26

2018-02-26

0001345126

codi:CrosmanMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2017-06-02

2017-06-02

0001345126

codi:CrosmanMember

2017-06-02

2017-06-02

0001345126

codi:CrosmanMember

us-gaap:CustomerRelationshipsMember

2017-06-02

2017-06-02

0001345126

codi:CrosmanMember

us-gaap:TradeNamesMember

2017-06-02

2017-06-02

0001345126

codi:FoamFabricatorsMember

2018-12-31

0001345126

codi:FoamFabricatorsMember

2018-02-15

2018-02-15

0001345126

codi:FoamFabricatorsMember

us-gaap:CustomerRelationshipsMember

2018-02-15

2018-02-15

0001345126

codi:FoamFabricatorsMember

us-gaap:TradeNamesMember

2018-02-15

2018-02-15

0001345126

codi:CrosmanMember

2017-01-01

2017-12-31

0001345126

codi:RimportsMember

2018-12-31

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

us-gaap:TradeNamesMember

2018-12-31

0001345126

codi:RimportsMember

2018-02-26

0001345126

codi:FoamFabricatorsMember

2018-02-15

0001345126

codi:FoamFabricatorsMember

2018-01-01

2018-03-31

0001345126

codi:RimportsMember

2019-07-01

2019-09-30

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

2019-12-31

0001345126

codi:BabyTulaLLCMember

codi:ErgobabyMember

2018-12-31

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

2018-01-01

2018-12-31

0001345126

codi:CrosmanMember

2017-06-02

0001345126

codi:CrosmanMember

us-gaap:NoncontrollingInterestMember

2017-06-02

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

us-gaap:CustomerRelationshipsMember

2018-12-31

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

2018-09-04

2018-09-04

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

2018-09-04

0001345126

codi:CrosmanMember

2017-12-31

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2018-12-31

0001345126

codi:VelocityOutdoorMember

codi:RavinCrossbowsLLCMember

2018-01-01

2018-12-31

0001345126

codi:VelocityOutdoorHoldingsMember

codi:RavinCrossbowsLLCMember

2018-12-31

0001345126

codi:RimportsMember

2018-01-01

2018-03-31

0001345126

codi:CrosmanMember

2017-04-01

2017-06-30

0001345126

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

codi:RimportsMember

2018-01-01

2018-12-31

0001345126

codi:A5.11TacticalandManitobaHarvestMember

2017-01-01

2017-12-31

0001345126

codi:A5.11TacticalandManitobaHarvestMember

2018-01-01

2018-12-31

0001345126

codi:RimportsMember

2018-04-01

2018-06-30

0001345126

country:US

codi:AdvancedCircuitsMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

codi:AdvancedCircuitsMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:AdvancedCircuitsMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

codi:SternoProductsMember

2017-01-01

2017-12-31

0001345126

country:CA

codi:ArnoldMember

2017-01-01

2017-12-31

0001345126

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

country:CA

codi:AdvancedCircuitsMember

2017-01-01

2017-12-31

0001345126

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

country:CA

2017-01-01

2017-12-31

0001345126

country:US

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

codi:SternoProductsMember

2017-01-01

2017-12-31

0001345126

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

2017-01-01

2017-12-31

0001345126

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

country:US

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

codi:ArnoldMember

2017-01-01

2017-12-31

0001345126

codi:AdvancedCircuitsMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:SternoProductsMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

country:CA

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

2017-01-01

2017-12-31

0001345126

country:US

codi:ArnoldMember

2017-01-01

2017-12-31

0001345126

country:US

codi:SternoProductsMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

codi:AdvancedCircuitsMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

country:CA

codi:SternoProductsMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

country:CA

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

country:CA

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:ArnoldMember

2017-01-01

2017-12-31

0001345126

codi:ArnoldMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

country:US

2017-01-01

2017-12-31

0001345126

country:US

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

codi:OtherInternationalMember

codi:ArnoldMember

2017-01-01

2017-12-31

0001345126

country:CA

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

srt:EuropeMember

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

country:US

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

codi:SternoProductsMember

2017-01-01

2017-12-31

0001345126

srt:AsiaPacificMember

codi:ArnoldMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

country:CA

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

codi:SternoProductsMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:AdvancedCircuitsMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:AdvancedCircuitsMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

country:CA

2019-01-01

2019-12-31

0001345126

country:US

codi:AdvancedCircuitsMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:ArnoldMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

codi:AdvancedCircuitsMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

country:US

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

country:US

2019-01-01

2019-12-31

0001345126

country:CA

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

country:CA

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

country:US

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

country:CA

codi:AdvancedCircuitsMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

country:CA

codi:ArnoldMember

2019-01-01

2019-12-31

0001345126

country:US

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

country:CA

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

country:US

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:SternoProductsMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

country:US

codi:ArnoldMember

2019-01-01

2019-12-31

0001345126

codi:AdvancedCircuitsMember

2019-01-01

2019-12-31

0001345126

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

codi:ArnoldMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

2019-01-01

2019-12-31

0001345126

country:CA

codi:SternoProductsMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:ArnoldMember

2019-01-01

2019-12-31

0001345126

srt:EuropeMember

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

country:CA

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

srt:AsiaPacificMember

codi:SternoProductsMember

2019-01-01

2019-12-31

0001345126

country:US

codi:SternoProductsMember

2019-01-01

2019-12-31

0001345126

country:US

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

codi:OtherInternationalMember

codi:SternoProductsMember

2019-01-01

2019-12-31

0001345126

country:US

codi:SternoProductsMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:VelocityOutdoorMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:VelocityOutdoorMember

2018-01-01

2018-12-31

0001345126

country:CA

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

country:US

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:AdvancedCircuitsMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:SternoProductsMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:SternoProductsMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:ArnoldMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:AdvancedCircuitsMember

2018-01-01

2018-12-31

0001345126

country:CA

codi:VelocityOutdoorMember

2018-01-01

2018-12-31

0001345126

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:AdvancedCircuitsMember

2018-01-01

2018-12-31

0001345126

country:CA

codi:AdvancedCircuitsMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

country:CA

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

country:CA

codi:ArnoldMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

codi:ArnoldMember

2018-01-01

2018-12-31

0001345126

country:US

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

country:CA

2018-01-01

2018-12-31

0001345126

country:CA

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

country:US

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:ArnoldMember

2018-01-01

2018-12-31

0001345126

country:US

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

2018-01-01

2018-12-31

0001345126

country:US

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:VelocityOutdoorMember

2018-01-01

2018-12-31

0001345126

codi:VelocityOutdoorMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:ArnoldMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

country:US

codi:VelocityOutdoorMember

2018-01-01

2018-12-31

0001345126

codi:AdvancedCircuitsMember

2018-01-01

2018-12-31

0001345126

country:US

codi:AdvancedCircuitsMember

2018-01-01

2018-12-31

0001345126

country:CA

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

codi:OtherInternationalMember

codi:SternoProductsMember

2018-01-01

2018-12-31

0001345126

srt:EuropeMember

2018-01-01

2018-12-31

0001345126

srt:AsiaPacificMember

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

country:CA

codi:SternoProductsMember

2018-01-01

2018-12-31

0001345126

codi:SternoProductsMember

2018-01-01

2018-12-31

0001345126

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

country:US

codi:ArnoldMember

2018-01-01

2018-12-31

0001345126

srt:MinimumMember

codi:ArnoldMagneticsMember

2019-01-01

2019-12-31

0001345126

us-gaap:GeographicDistributionForeignMember

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

country:CA

us-gaap:SalesRevenueNetMember

2018-01-01

2018-12-31

0001345126

codi:ArnoldMagneticsMember

2017-01-01

2017-12-31

0001345126

country:CA

us-gaap:SalesRevenueNetMember

2019-01-01

2019-12-31

0001345126

country:CA

us-gaap:SalesRevenueNetMember

2017-01-01

2017-12-31

0001345126

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

us-gaap:MaterialReconcilingItemsMember

us-gaap:CorporateAndOtherMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:ArnoldMagneticsMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:ArnoldMagneticsMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:AciMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:SternoCandleLampMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:FoamFabricatorsMember

2017-01-01

2017-12-31

0001345126

us-gaap:MaterialReconcilingItemsMember

us-gaap:CorporateAndOtherMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:AciMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:VelocityOutdoorMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:SternoCandleLampMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

us-gaap:MaterialReconcilingItemsMember

us-gaap:CorporateAndOtherMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:ArnoldMagneticsMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:SternoCandleLampMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:AciMember

2018-01-01

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:VelocityOutdoorMember

2017-01-01

2017-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

us-gaap:MaterialReconcilingItemsMember

2017-01-01

2017-12-31

0001345126

us-gaap:MaterialReconcilingItemsMember

2018-01-01

2018-12-31

0001345126

us-gaap:MaterialReconcilingItemsMember

2019-01-01

2019-12-31

0001345126

codi:ArnoldMember

2018-12-31

0001345126

codi:SternoProductsMember

2018-12-31

0001345126

codi:ErgobabyMember

2018-12-31

0001345126

codi:ArnoldMember

2019-12-31

0001345126

us-gaap:CorporateMember

2018-12-31

0001345126

codi:AciMember

2018-12-31

0001345126

codi:FoamFabricatorsMember

2018-12-31

0001345126

codi:FoamFabricatorsMember

2019-12-31

0001345126

codi:ErgobabyMember

2019-12-31

0001345126

codi:AciMember

2019-12-31

0001345126

codi:LibertyMember

2019-12-31

0001345126

codi:SternoProductsMember

2019-12-31

0001345126

codi:A5.11TacticalMember

2018-12-31

0001345126

codi:LibertyMember

2018-12-31

0001345126

codi:A5.11TacticalMember

2019-12-31

0001345126

codi:CrosmanMember

2018-12-31

0001345126

codi:CrosmanMember

2019-12-31

0001345126

us-gaap:CorporateMember

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

srt:EuropeMember

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:NonUnitedStatesMember

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

codi:NonUnitedStatesMember

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

country:CA

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

country:US

2018-12-31

0001345126

us-gaap:OperatingSegmentsMember

country:US

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

srt:EuropeMember

2019-12-31

0001345126

us-gaap:OperatingSegmentsMember

country:CA

2019-12-31

0001345126

codi:AciMember

2018-01-01

2018-12-31

0001345126

codi:AciMember

2017-01-01

2017-12-31

0001345126

codi:FoamFabricatorsMember

2017-01-01

2017-12-31

0001345126

us-gaap:CorporateMember

2019-01-01

2019-12-31

0001345126

us-gaap:CorporateMember

2018-01-01

2018-12-31

0001345126

us-gaap:CorporateMember

2017-01-01

2017-12-31

0001345126

codi:AciMember

2019-01-01

2019-12-31

0001345126

codi:OfficeFurnitureComputersAndSoftwareMember

2018-12-31

0001345126

us-gaap:MachineryAndEquipmentMember

2019-12-31

0001345126

us-gaap:LandAndBuildingMember

2018-12-31

0001345126

us-gaap:LeaseholdImprovementsMember

2018-12-31

0001345126

us-gaap:LandAndBuildingMember

2019-12-31

0001345126

us-gaap:MachineryAndEquipmentMember

2018-12-31

0001345126

codi:OfficeFurnitureComputersAndSoftwareMember

2019-12-31

0001345126

us-gaap:LeaseholdImprovementsMember

2019-12-31

0001345126

us-gaap:CorporateNonSegmentMember

2019-01-01

2019-12-31

0001345126

us-gaap:CorporateNonSegmentMember

2018-12-31

0001345126

us-gaap:CorporateNonSegmentMember

2019-12-31

0001345126

codi:AdvancedCircuitsMember

2018-12-31

0001345126

codi:AdvancedCircuitsMember

2019-12-31

0001345126

codi:DistributorRelationsAndOtherMember

2018-12-31

0001345126

codi:LicensingAndNonCompeteAgreementsMember

2018-12-31

0001345126

codi:DistributorRelationsAndOtherMember

2019-12-31

0001345126

codi:TechnologyAndPatentsMember

2018-12-31

0001345126

us-gaap:TradeNamesMember

2018-12-31

0001345126

codi:TechnologyAndPatentsMember

2019-12-31

0001345126

codi:TechnologyAndPatentsMember

2019-01-01

2019-12-31

0001345126

us-gaap:TradeNamesMember

2019-12-31

0001345126

us-gaap:CustomerRelationshipsMember

2019-12-31

0001345126

codi:LicensingAndNonCompeteAgreementsMember

2019-12-31

0001345126

us-gaap:TradeNamesMember

2019-01-01

2019-12-31

0001345126

codi:DistributorRelationsAndOtherMember

2019-01-01

2019-12-31

0001345126

us-gaap:CustomerRelationshipsMember

2018-12-31

0001345126

codi:LicensingAndNonCompeteAgreementsMember

2019-01-01

2019-12-31

0001345126

us-gaap:CustomerRelationshipsMember

2019-01-01

2019-12-31

0001345126

codi:ErgobabyMember

2017-12-31

0001345126

codi:SternoProductsMember

2017-12-31

0001345126

us-gaap:CorporateNonSegmentMember

2018-01-01

2018-12-31

0001345126

us-gaap:CorporateNonSegmentMember

2017-12-31

0001345126

codi:FoamFabricatorsMember

2017-12-31

0001345126

codi:AdvancedCircuitsMember

2017-12-31

0001345126

codi:ArnoldMember

2017-12-31

0001345126

codi:A5.11TacticalMember

2017-12-31

0001345126

codi:CrosmanMember

2017-12-31

0001345126

codi:LibertyMember

2017-12-31

0001345126

codi:VelocityOutdoorMember

2019-01-01

2019-09-30

0001345126

codi:FlexmagMember

2018-01-01

2018-03-31

0001345126

codi:ArnoldMember

2012-03-05

2012-03-05

0001345126

codi:LibertyMember

2019-01-01

2019-09-30

0001345126

codi:ArnoldMember

2018-01-01

2018-03-31

0001345126

us-gaap:LineOfCreditMember

codi:NewLineOfCreditMember

2014-06-06

0001345126

codi:Seniornotesdue2026Member

2018-01-01

2018-09-30

0001345126

us-gaap:LetterOfCreditMember

2019-12-31

0001345126

codi:NewInterestRateSwapMember

2014-09-16

0001345126

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2018-04-18

0001345126

codi:Seniornotesdue2026Member

2018-04-18

0001345126

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

us-gaap:BaseRateMember

2018-04-18

0001345126

srt:MaximumMember

us-gaap:LetterOfCreditMember

codi:NewLineOfCreditMember

2014-06-06

2014-06-06

0001345126

srt:MinimumMember

us-gaap:LetterOfCreditMember

codi:NewLineOfCreditMember

2014-06-06

2014-06-06

0001345126

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

codi:TermLoanMember

2018-04-18

0001345126

us-gaap:InterestRateSwapMember

2019-12-31

0001345126

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2018-04-18

0001345126

2019-10-01

2019-12-31

0001345126

us-gaap:LetterOfCreditMember

2018-12-31

0001345126

codi:TermLoanMember

us-gaap:LoansPayableMember

2018-04-18

2018-04-18

0001345126

us-gaap:LetterOfCreditMember

codi:NewLineOfCreditMember

2014-06-06

0001345126

codi:TermLoanMember

2019-10-01

2019-12-31

0001345126

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

us-gaap:BaseRateMember

2018-04-18

0001345126

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

us-gaap:LineOfCreditMember

2018-04-18

0001345126

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

codi:TermLoanMember

2018-04-18

2018-04-18

0001345126

codi:NewLineOfCreditMember

codi:TermLoanMember

2018-04-18

0001345126

codi:A2016IncrementalTermLoanMember

us-gaap:LoansPayableMember

2016-08-31

2016-08-31

0001345126

codi:OriginalIssueDiscountMember

2019-10-01

2019-12-31

0001345126

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

us-gaap:FederalFundsEffectiveSwapRateMember

2018-04-18

0001345126

us-gaap:RevolvingCreditFacilityMember

codi:A2014RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2014-06-06

0001345126

codi:A2014TermLoanMember

us-gaap:LoansPayableMember

2014-06-06

0001345126

us-gaap:LetterOfCreditMember

2017-12-31

0001345126

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

codi:NewLineOfCreditMember

us-gaap:BaseRateMember

2018-04-18

0001345126

us-gaap:OtherNoncurrentLiabilitiesMember

2018-12-31

0001345126

us-gaap:OtherNoncurrentAssetsMember

2018-12-31

0001345126

us-gaap:OtherNoncurrentAssetsMember

2019-12-31

0001345126

us-gaap:OtherNoncurrentLiabilitiesMember

2019-12-31

0001345126

us-gaap:RevolvingCreditFacilityMember

2019-12-31

0001345126

codi:TermLoanFacilityMember

2019-12-31

0001345126

us-gaap:RevolvingCreditFacilityMember

2018-12-31

0001345126

codi:TermLoanFacilityMember

2018-12-31

0001345126

codi:NewInterestRateSwapMember

2018-01-01

2018-12-31

0001345126

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:InterestRateSwapMember

2018-12-31

0001345126

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:InterestRateSwapMember

2018-12-31

0001345126

us-gaap:HedgeFundsEquityMember

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0001345126

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0001345126

us-gaap:FixedIncomeSecuritiesMember

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0001345126

codi:CertificatesOfDepositAndCashAndCashEquivalentsMember

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0001345126

us-gaap:RealEstateMember

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0001345126

us-gaap:EquityMethodInvestmentsMember

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0001345126

srt:MinimumMember

us-gaap:SeriesAPreferredStockMember

2017-06-28

0001345126

srt:MinimumMember

us-gaap:SeriesAPreferredStockMember

2017-06-28

2017-06-28

0001345126

us-gaap:SeriesAPreferredStockMember

2017-06-28

0001345126

us-gaap:PreferredStockMember

2017-01-01

2017-12-31

0001345126

srt:MinimumMember

us-gaap:SeriesCPreferredStockMember

2019-01-01

2019-12-31

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

codi:ManitobaHarvestMember

2019-04-01

2019-06-30

0001345126

us-gaap:SeriesAPreferredStockMember

2019-01-01

2019-12-31

0001345126

2019-11-20

0001345126

2018-03-13

0001345126

us-gaap:SeriesCPreferredStockMember

2019-12-02

0001345126

us-gaap:SeriesCPreferredStockMember

2019-01-01

2019-12-31

0001345126

us-gaap:SeriesBPreferredStockMember

2019-01-01

2019-12-31

0001345126

srt:MinimumMember

us-gaap:SeriesBPreferredStockMember

2018-03-13

2018-03-13

0001345126

srt:MinimumMember

us-gaap:SeriesCPreferredStockMember

2019-12-31

0001345126

us-gaap:SeriesCPreferredStockMember

2019-11-20

0001345126

us-gaap:SeriesBPreferredStockMember

2018-03-13

2018-03-13

0001345126

us-gaap:SeriesAPreferredStockMember

2017-06-28

2017-06-28

0001345126

us-gaap:SeriesCPreferredStockMember

2019-11-20

2019-11-20

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

codi:ManitobaHarvestMember

2019-10-01

2019-12-31

0001345126

srt:MinimumMember

us-gaap:SeriesBPreferredStockMember

2018-03-13

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

codi:CleanEarthMember

2019-07-01

2019-09-30

0001345126

us-gaap:SeriesBPreferredStockMember

2018-03-13

0001345126

us-gaap:RetainedEarningsMember

2016-10-01

2016-12-31

0001345126

us-gaap:RetainedEarningsMember

2017-04-01

2017-06-30

0001345126

2018-10-25

0001345126

2018-01-25

2018-01-25

0001345126

us-gaap:SeriesBMember

us-gaap:SubsequentEventMember

2020-01-30

2020-01-30

0001345126

us-gaap:SeriesAPreferredStockMember

2018-01-30

2018-01-30

0001345126

2018-10-25

2018-10-25

0001345126

2017-04-27

0001345126

2018-07-26

2018-07-26

0001345126

2017-10-26

0001345126

us-gaap:SeriesBMember

2019-07-30

2019-07-30

0001345126

2019-04-25

0001345126

us-gaap:SeriesBMember

2018-07-30

2018-07-30

0001345126

us-gaap:SeriesAPreferredStockMember

2019-07-30

2019-07-30

0001345126

us-gaap:SeriesBMember

2018-10-30

2018-10-30

0001345126

2018-01-25

0001345126

2019-07-25

0001345126

us-gaap:SeriesAPreferredStockMember

2019-01-30

2019-01-30

0001345126

us-gaap:SeriesBMember

2019-01-30

2019-01-30

0001345126

us-gaap:SeriesAPreferredStockMember

2018-10-30

2018-10-30

0001345126

2018-07-26

0001345126

us-gaap:SeriesCPreferredStockMember

us-gaap:SubsequentEventMember

2020-01-30

2020-01-30

0001345126

us-gaap:SubsequentEventMember

2020-01-23

0001345126

2017-07-27

2017-07-27

0001345126

2018-04-26

0001345126

us-gaap:SeriesAPreferredStockMember

us-gaap:SubsequentEventMember

2020-01-30

2020-01-30

0001345126

us-gaap:SubsequentEventMember

2020-01-23

2020-01-23

0001345126

2019-04-25

2019-04-25

0001345126

us-gaap:SeriesBMember

2019-04-30

2019-04-30

0001345126

us-gaap:SeriesAPreferredStockMember

2017-10-30

2017-10-30

0001345126

us-gaap:SeriesAPreferredStockMember

2018-04-30

2018-04-30

0001345126

2017-07-27

0001345126

2019-01-24

2019-01-24

0001345126

2017-10-26

2017-10-26

0001345126

us-gaap:SeriesAPreferredStockMember

2018-07-30

2018-07-30

0001345126

us-gaap:SeriesAPreferredStockMember

2019-04-30

2019-04-30

0001345126

2019-10-24

2019-10-24

0001345126

us-gaap:SeriesAPreferredStockMember

2019-10-30

2019-10-30

0001345126

us-gaap:SeriesBMember

2019-10-30

2019-10-30

0001345126

2019-07-25

2019-07-25

0001345126

2018-04-26

2018-04-26

0001345126

2019-01-24

0001345126

2017-04-27

2017-04-27

0001345126

2019-10-24

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2017-01-01

2017-12-31

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2018-01-01

2018-12-31

0001345126

2017-10-01

2017-12-31

0001345126

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001345126

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2019-12-31

0001345126

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2019-12-31

0001345126

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001345126

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2019-12-31

0001345126

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001345126

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001345126

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2019-12-31

0001345126

codi:RavinMember

codi:CrosmanMember

2018-09-04

0001345126

codi:RimportsMember

codi:SternoProductsMember

2018-02-26

0001345126

codi:RimportsMember

codi:SternoProductsMember

2018-02-26

2018-02-26

0001345126

codi:RavinMember

codi:CrosmanMember

2019-01-01

2019-12-31

0001345126

codi:RavinMember

codi:CrosmanMember

2018-09-04

2018-09-04

0001345126

codi:RavinMember

codi:CrosmanMember

2018-01-01

2018-12-31

0001345126

codi:BabyTulaLLCMember

2018-01-01

2018-12-31

0001345126

codi:RavinMember

2018-01-01

2018-12-31

0001345126

codi:RavinMember

2019-01-01

2019-12-31

0001345126

codi:NorthernInternationalInc.Member

2018-01-01

2018-12-31

0001345126

codi:NorthernInternationalInc.Member

2019-01-01

2019-12-31

0001345126

codi:BabyTulaLLCMember

2019-01-01

2019-12-31

0001345126

codi:RimportsMember

2019-01-01

2019-12-31

0001345126

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:ArnoldMember

2017-12-31

0001345126

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:ArnoldMember

2017-12-31

0001345126

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:ArnoldMember

2017-01-01

2017-12-31

0001345126

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:ArnoldMember

2017-12-31

0001345126

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:ArnoldMember

2017-12-31

0001345126

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

codi:BusinessAcquisitionMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2018-12-31

0001345126

codi:BusinessAcquisitionMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:InterestRateSwapMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2018-12-31

0001345126

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

codi:BusinessAcquisitionMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2018-12-31

0001345126

codi:BusinessAcquisitionMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001345126

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:PutOptionMember

2018-12-31

0001345126

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:VelocityOutdoorMember

2019-12-31

0001345126

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:VelocityOutdoorMember

2019-12-31

0001345126

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:VelocityOutdoorMember

2019-12-31

0001345126

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:VelocityOutdoorMember

2019-01-01

2019-12-31

0001345126

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:FairValueMeasurementsNonrecurringMember

us-gaap:GoodwillMember

codi:VelocityOutdoorMember

2019-12-31

0001345126

codi:SternoCandleLampMember

2019-12-31

0001345126

codi:ArnoldMagneticsMember

2019-12-31

0001345126

codi:AllocationInterestsMember

2019-12-31

0001345126

codi:ArnoldMagneticsMember

2018-12-31

0001345126

codi:SternoCandleLampMember

2018-12-31

0001345126

codi:AllocationInterestsMember

2018-12-31

0001345126

codi:SternoProductsMember

2019-01-01

2019-12-31

0001345126

codi:SternoProductsMember

2018-01-01

2018-01-31

0001345126

codi:SternoProductsMember

2018-01-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:AciMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:A5.11TacticalMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:A5.11TacticalMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:LibertyMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:LibertyMember

2017-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:FoamFabricatorsMember

2019-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:ErgobabyMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:AciMember

2017-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:SternoCandleLampMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:AciMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:CrosmanMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:ErgobabyMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:ErgobabyMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:ErgobabyMember

2017-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:SternoCandleLampMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:ErgobabyMember

2019-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:ErgobabyMember

2017-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:A5.11TacticalMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:CrosmanMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:ArnoldMagneticsMember

2017-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:FoamFabricatorsMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:CrosmanMember

2017-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:A5.11TacticalMember

2017-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:ArnoldMagneticsMember

2019-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:FoamFabricatorsMember

2019-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:AciMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:A5.11TacticalMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:CrosmanMember

2017-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:LibertyMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:ArnoldMagneticsMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:CrosmanMember

2019-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:SternoCandleLampMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:ArnoldMagneticsMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:FoamFabricatorsMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:ArnoldMagneticsMember

2017-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:ArnoldMagneticsMember

2018-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:AciMember

2017-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:SternoCandleLampMember

2017-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:LibertyMember

2019-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:SternoCandleLampMember

2017-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:LibertyMember

2019-12-31

0001345126

codi:PercentageOwnershipPrimaryMember

codi:LibertyMember

2017-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:AciMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:CrosmanMember

2018-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:SternoCandleLampMember

2019-12-31

0001345126

codi:PercentageOwnershipFullyDilutedMember

codi:A5.11TacticalMember

2017-12-31

0001345126

codi:ArnoldMagneticsMember

us-gaap:CorporateJointVentureMember

2019-12-31

0001345126

codi:FoxMember

2016-12-31

0001345126

2017-01-01

2017-03-31

0001345126

codi:FoxMember

2017-01-01

2017-03-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:FoamFabricatorsMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

us-gaap:CorporateMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:SternoCandleLampMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:ErgobabyMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:SternoCandleLampMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:CrosmanMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:ErgobabyMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

us-gaap:CorporateMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:AdvancedCircuitsMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

us-gaap:CorporateMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:CrosmanMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:ArnoldMagneticsMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:ArnoldMagneticsMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:CrosmanMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:AdvancedCircuitsMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:A5.11TacticalMember

2018-01-01

2018-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:AdvancedCircuitsMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:SternoCandleLampMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:ErgobabyMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:A5.11TacticalMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:ArnoldMagneticsMember

2017-01-01

2017-12-31

0001345126

codi:FoxMember

2016-11-30

0001345126

codi:FoundingPartnerMember

2019-01-01

2019-12-31

0001345126

2014-07-10

2014-07-10

0001345126

codi:CrosmanMember

2018-01-01

2018-12-31

0001345126

srt:SubsidiariesMember

codi:SecondaryOfferingMember

2014-07-10

2014-07-10

0001345126

2014-07-10

0001345126

codi:A5.11TacticalMember

2018-12-31

0001345126

codi:VelocityOutdoorMember

2018-12-31

0001345126

codi:PurchaseofRawMaterialsMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

srt:ParentCompanyMember

codi:SecondaryOfferingMember

2014-07-10

2014-07-10

0001345126

codi:A5.11TacticalMember

codi:VendorMember

2018-01-01

2018-12-31

0001345126

codi:A5.11TacticalMember

codi:VendorMember

2019-01-01

2019-12-31

0001345126

codi:PurchaseofRawMaterialsMember

us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember

codi:LibertyMember

2017-01-01

2017-12-31

0001345126

codi:PurchaseofRawMaterialsMember

us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember

codi:LibertyMember

2018-01-01

2018-12-31

0001345126

codi:A5.11TacticalMember

codi:VendorMember

2017-01-01

2017-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

2006-05-16

2006-05-16

0001345126

codi:FoamFabricatorsMember

2019-01-01

2019-12-31

0001345126

codi:ManagementServiceAgreementWithCgmMember

codi:CrosmanMember

2018-07-01

2018-09-30

0001345126

codi:FoxMember

2019-01-01

2019-12-31

0001345126

codi:A5.11TacticalMember

codi:VendorMember

2019-12-31

0001345126

2014-07-01

2014-07-31

0001345126

codi:FoamFabricatorsMember

2019-12-31

0001345126

srt:BoardOfDirectorsChairmanMember

2019-01-01

2019-12-31

0001345126

codi:EmployeesandPartnersoftheManagerMember

2019-01-01

2019-12-31

0001345126

codi:A5.11TacticalMember

2017-01-01

2017-12-31

0001345126

codi:A5.11TacticalMember

srt:ExecutiveOfficerMember

codi:VendorMember

2019-01-01

2019-12-31

0001345126

codi:CGIDiversifiedHoldingsLPMember

2019-01-01

2019-12-31

0001345126

srt:ExecutiveOfficerMember

codi:PurchaseofRawMaterialsMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

codi:PurchaseofRawMaterialsMember

us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember

codi:LibertyMember

2019-01-01

2019-12-31

0001345126

srt:BoardOfDirectorsChairmanMember

2018-01-01

2018-12-31

0001345126

codi:FoundingPartnerMember

2018-01-01

2018-12-31

0001345126

codi:EmployeesandPartnersoftheManagerMember

2018-01-01

2018-12-31

0001345126

codi:CGIDiversifiedHoldingsLPMember

2018-01-01

2018-12-31

0001345126

codi:ManitobaHarvestMember

2019-01-01

2019-03-31

0001345126

2018-10-01

2018-12-31

0001345126

2018-01-01

2018-03-31

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2018-10-01

2018-12-31

0001345126

2018-07-01

2018-09-30

0001345126

2018-04-01

2018-06-30

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2018-04-01

2018-06-30

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2018-07-01

2018-09-30

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2018-01-01

2018-03-31

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2019-10-01

2019-12-31

0001345126

2019-04-01

2019-06-30

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2019-04-01

2019-06-30

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2019-07-01

2019-09-30

0001345126

us-gaap:DiscontinuedOperationsDisposedOfBySaleMember

2019-01-01

2019-03-31

0001345126

us-gaap:AllowanceForCreditLossMember

2017-01-01

2017-12-31

0001345126

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2018-12-31

0001345126

us-gaap:AllowanceForCreditLossMember

2017-12-31

0001345126

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2017-12-31

0001345126

us-gaap:AllowanceForCreditLossMember

2019-12-31

0001345126

us-gaap:AllowanceForCreditLossMember

2019-01-01

2019-12-31

0001345126

us-gaap:AllowanceForCreditLossMember

2018-01-01

2018-12-31

0001345126

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2017-01-01

2017-12-31

0001345126

us-gaap:AllowanceForCreditLossMember

2018-12-31

0001345126

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2019-01-01

2019-12-31

0001345126

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2016-12-31

0001345126

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2019-12-31

0001345126

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2018-01-01

2018-12-31

0001345126

us-gaap:AllowanceForCreditLossMember

2016-12-31

xbrli:shares

iso4217:CAD

codi:Segment

xbrli:pure

iso4217:USD

iso4217:USD

xbrli:shares

codi:Facility

codi:client

codi:Reporting_Unit

utreg:sqft

codi:executive

codi:vendor

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-34927

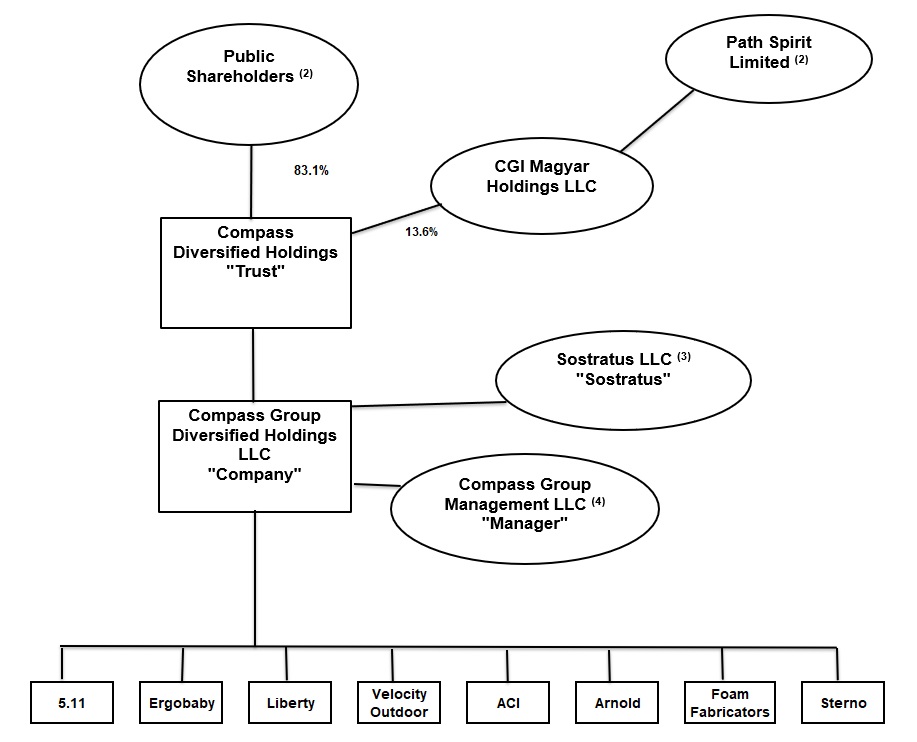

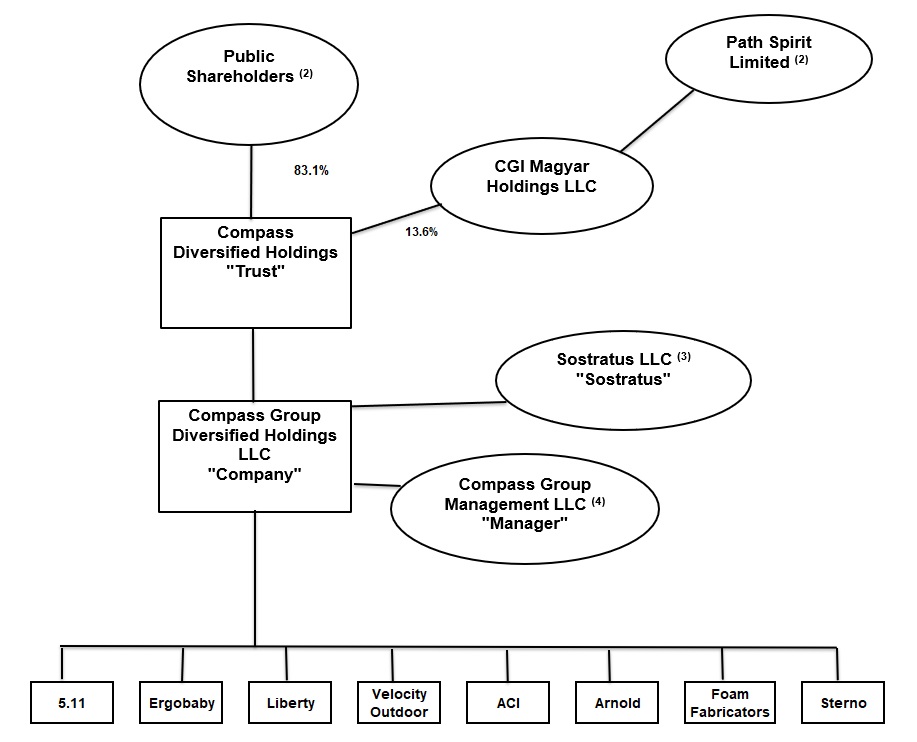

Compass Diversified Holdings

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 57-6218917 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Commission File Number: 001-34926

Compass Group Diversified Holdings LLC

(Exact name of registrant as specified in its charter)

|

| | | |

Delaware | | | 20-3812051 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

301 Riverside Avenue, Second Floor, Westport, CT 06880

(Address, including zip code of registrant’s principal executive offices)

(203) 221-1703

(Registrants’ telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Shares representing beneficial interests in Compass Diversified Holdings (“common shares”) | | CODI | | New York Stock Exchange |

Series A Preferred Shares representing Series A Trust Preferred Interest in Compass Diversified Holdings ("Series A Preferred Shares") | | CODI PR A | | New York Stock Exchange |

Series B Preferred Shares representing Series B Trust Preferred Interest in Compass Diversified Holdings ("Series B Preferred Shares") | | CODI PR B | | New York Stock Exchange |

Series C Preferred Shares representing Series C Trust Preferred Interest in Compass Diversified Holdings ("Series C Preferred Shares") | | CODI PR C | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrants are collectively a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrants are collectively not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit such files). Yes þ No ¨