UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35444

YELP INC.

(Exact name of Registrant as specified in its charter)

Delaware | 20-1854266 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

140 New Montgomery Street, 9th Floor

San Francisco, California 94105

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (415) 908-3801

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $0.000001 per share | New York Stock Exchange LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | |

Non-accelerated filer (Do not check if a smaller reporting company) ¨ | Smaller reporting company ¨ | |

Emerging growth company ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $2,335,398,905 as of June 30, 2017, the last day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price of the registrant’s common stock on the New York Stock Exchange LLC reported for June 30, 2017. Excludes an aggregate of 3,958,230 shares of the registrant’s common stock held by officers, directors, affiliated stockholders and The Yelp Foundation as of June 30, 2017. For purposes of determining whether a stockholder was an affiliate of the registrant at June 30, 2017, the registrant assumed that a stockholder was an affiliate of the registrant if such stockholder (i) beneficially owned 10% or more of the registrant’s capital stock, as determined based on public filings, and/or (ii) was an executive officer or director, or was affiliated with an executive officer or director, of the registrant at June 30, 2017. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

As of February 20, 2018, there were 83,474,973 shares of the registrant’s common stock, par value $0.000001 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2018 Annual Meeting of Stockholders to be filed with the U.S. Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

YELP INC.

2017 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Page | ||||

PART I | ||||

PART II | ||||

PART III | ||||

PART IV | ||||

FINANCIAL STATEMENTS | ||||

___________________________________

Unless the context suggests otherwise, references in this Annual Report on Form 10-K (the “Annual Report”) to “Yelp,” the “Company,” “we,” “us” and “our” refer to Yelp Inc. and, where appropriate, its subsidiaries.

i

Unless the context otherwise indicates, where we refer in this Annual Report to our “mobile application” or “mobile app,” we refer to all of our applications for mobile-enabled devices; references to our “mobile platform” refer to both our mobile app and the versions of our website that are optimized for mobile-based browsers. Similarly, references to our “website” refer to versions of our website dedicated to both desktop- and mobile-based browsers, as well as the U.S. and international versions of our website.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that involve risks, uncertainties and assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this Annual Report that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would” and similar expressions or variations intended to identify forward-looking statements. These statements are based on the beliefs and assumptions of our management, which are in turn based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitled “Risk Factors” included under Part I, Item 1A below. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

NOTE REGARDING METRICS

We review a number of performance metrics to evaluate our business, measure our performance, identify trends in our business, prepare financial projections and make strategic decisions. Please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Metrics” for information on how we define our key metrics. Unless otherwise stated, these metrics do not include metrics from Yelp Eat24, Yelp Reservations, Yelp Nowait, Yelp WiFi Marketing or from our business owner products.

While our metrics are based on what we believe to be reasonable calculations, there are inherent challenges in measuring usage across our large user base. Certain of our performance metrics, including the number of unique devices accessing our mobile app, are tracked with internal company tools, which are not independently verified by any third party and have a number of limitations. For example, our metrics may be affected by mobile applications that automatically contact our servers for regular updates with no discernible user action involved; this activity can cause our system to count the device associated with the app as an app unique device in a given period.

Our metrics that are calculated based on data from third parties — the number of desktop and mobile website unique visitors — are subject to similar limitations. Our third-party providers periodically encounter difficulties in providing accurate data for such metrics as a result of a variety of factors, including human and software errors. In addition, because these traffic metrics are tracked based on unique cookie identifiers, an individual who accesses our website from multiple devices with different cookies may be counted as multiple unique visitors, and multiple individuals who access our website from a shared device with a single cookie may be counted as a single unique visitor. As a result, the calculations of our unique visitors may not accurately reflect the number of people actually visiting our website.

Our measures of traffic and other key metrics may also differ from estimates published by third parties (other than those whose data we use to calculate such metrics) or from similar metrics of our competitors. We are continually seeking to improve our ability to measure these key metrics, and regularly review our processes to assess potential improvements to their accuracy. From time to time, we may discover inaccuracies in our metrics or make adjustments to improve their accuracy, including adjustments that may result in the recalculation of our historical metrics. We believe that any such inaccuracies or adjustments are immaterial unless otherwise stated.

ii

PART I

Item 1. Business.

Company Overview

Yelp is the leading local business review site in the United States, offering consumers unmatched local business information and businesses a variety of opportunities to connect with purchase-intent driven consumers. Our mission is to connect consumers with great local businesses of all sizes and to provide a convenient platform for each stage of their interaction, from discovery and engagement through the completion of a transaction and beyond:

• | Content. Yelp brings “word of mouth” online through consumer reviews, tips, photos and videos that share their everyday business experiences. Business representatives are also able to provide information about their businesses and respond to reviews, among other things, by registering for a free account and “claiming” the business listing page for each of their locations. As of December 31, 2017, consumers had contributed approximately 148.3 million cumulative reviews of almost every type of local business, and business representatives had claimed approximately 4.2 million business listing pages on Yelp. These contributions drive a powerful network effect whereby the expanded content draws in more consumers (and more prospective contributors), which in turn improves the value proposition of our products to local businesses. |

• | Discovery. Each day, millions of consumers take advantage of our wide-ranging content in their search for great local businesses by visiting Yelp's website and mobile app, as well as through third-party services like Apple’s Siri and Amazon’s Alexa personal assistant programs, which access Yelp content to respond to local search queries. Businesses that want to promote themselves to our large audience of purchase-intent driven consumers can pay for premium services such as targeted search advertising and further enhancements to their business listing pages. |

• | Engagement. Yelp provides multiple channels for consumers and businesses to engage directly with each other. In addition to writing and responding to reviews, consumers and businesses can communicate through our Request-A-Quote and Message the Business features. We also facilitate consumer engagement with businesses in our restaurants and nightlife categories through Yelp Reservations, our online reservations product, and Yelp Nowait, the waitlist system we acquired in February 2017, which allows consumers to check wait times at restaurants and join waitlists remotely. Our Yelp WiFi Marketing product, which we acquired in April 2017, allows businesses to connect with their customers by offering them access to a free in-store wifi network. |

• | Transactions. The Yelp Platform allows consumers to transact with local businesses directly through our website and mobile app, primarily through integrations with partners ranging from RepairPal (auto repair booking), to GolfNow (tee time booking), to BloomNation (flower ordering). Online food ordering constitutes the largest category of transactions by revenue and volume on the Yelp Platform and is currently available through partners including Eat24, which we sold to Grubhub Holdings Inc., a wholly-owned subsidiary of Grubhub Inc. (“Grubhub”), in October 2017. Concurrently with the closing of our sale of Eat24, we entered into a strategic partnership with Grubhub to expand our online ordering capabilities by integrating Grubhub’s restaurant network onto the Yelp Platform. |

• | Retention and Analytics. In addition to being a point of engagement between consumers and businesses, our Yelp WiFi Marketing product includes an analytics platform that provides wifi as a digital marketing tool to retain and reward customers. The Yelp Cash Back program, which allows consumers receive up to 10% cash back when they shop at participating businesses, provides another tool for businesses to attract and retain loyal customers. We also offer business owners local analytics and insights based on our historical data and other proprietary content through our Yelp Knowledge program, as well as tools to measure the effectiveness of our products, including reporting and advertising-management features, through the Yelp for Business Owners app. |

We generate revenue primarily from the sale of advertising on our website and mobile app to businesses and, to a lesser extent, from fees on transactions completed on our platform and subscription fees for our non-advertising products. During the year ended December 31, 2017, we generated net revenue of $846.8 million, representing 19% growth over 2016, net income of $152.9 million, which includes a pre-tax gain of $164.8 million on the sale of Eat24, and adjusted EBITDA of $156.6 million. For information on how we define and calculate adjusted EBITDA and a reconciliation of this non-GAAP financial measure to net income (loss), see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures” in this Annual Report.

Our Products and Services

1

Advertising

We provide a range of free and paid advertising products to businesses of all sizes, including the ability to deliver targeted search advertising to large local audiences through our website and mobile app. As in past years, advertising accounted for the vast majority of our revenue during the year ended December 31, 2017, accounting for 91% of our revenue, as compared to approximately 90% for the year ended December 31, 2016 and approximately 86% for the year ended December 31, 2015. We recognize revenue from our business listing and advertising products, including advertising sold by partners, as advertising revenue.

Free Online Business Account | We enable businesses to create a free online business account and claim the listing page for each of their business locations. With their free business accounts, businesses can view trends (e.g. statistics and charts of the performance of their pages on our platform), use the Revenue Estimator tool (e.g. to quantify the revenue opportunity Yelp provides), message customers (e.g. by replying to messages or reviews either publicly or directly), update listing information (e.g. address, hours of operation) and offer Yelp Deals and Gift Certificates (as described below). | |

Branded Profile | Our Branded Profile product provides businesses with access to premium features in connection with their business listing pages, such as the ability to update listing information and select photos or videos to highlight on the page through a slideshow feature. Businesses can also promote a desired transaction of their choosing — such as scheduling an appointment or printing a coupon — directly on their business listing pages with our Call to Action feature. This feature transfers consumers from a business’s listing page to the business’s own website to complete the action. Account support is available via phone and email for businesses that purchase a Branded Profile program. | |

Enhanced Profile | In addition to providing businesses with the same premium features and support options as our Branded Profile product, our Enhanced Profile product restricts how ads from other businesses appear on the their business listing pages. | |

Search and Other Ads | We allow businesses to promote themselves as a sponsored search result on our platform, on the listing pages of related businesses and as suggested “additional businesses” for consumers using our Request-A-Quote feature. We now sell ads primarily on a per-click basis, though we also offer impression-based ads. | |

Ad Resales | We also generate revenue through the resale of our advertising products by certain agencies and partners, such as DexYP, as well as monetization of remnant advertising inventory through third-party ad networks. | |

Transactions

In addition to our advertising products, we also offer several features and consumer-interactive tools to facilitate transactions between consumers and the local businesses they find on Yelp. We recognize revenue from these sources on a net basis as transactions revenue.

2

Yelp Platform | The Yelp Platform allows consumers to transact with businesses directly on our website or mobile app through partner integrations. Consumers can order flowers, purchase event tickets, and book spa and salon appointments, among many other transaction opportunities, all without leaving Yelp. | |

Eat24 and the Grubhub Partnership | Prior to our sale of Eat24 to Grubhub on October 10, 2017, we generated revenue from our Yelp Eat24 business through arrangements with restaurants in which restaurants paid a commission percentage fee on orders placed through the Yelp Eat24 platform. Following the sale, Eat24’s restaurant network remains integrated on the Yelp Platform and, pursuant to our strategic partnership, we are currently integrating Grubhub’s restaurant network, which we expect to be complete by mid-2018. When implemented, we expect this partnership to provide consumers with a wider selection of restaurants and better delivery options, while improving our per-order profitability. | |

Yelp Deals | Our Yelp Deals product allows local business owners to create promotional discounted deals for their products and services, which are marketed to consumers through our platform. We typically earn a fee based on the discounted price of each deal sold. We process all customer payments and remit to the business the revenue share of any Yelp Deal purchased. | |

Gift Certificates | Our Gift Certificates product allows local business owners to sell full-price gift certificates directly to consumers through their business listing pages. The business chooses the price point to offer (from $10 to $500), and consumers may purchase Gift Certificates denominated in such amounts. We earn a fee based on the amount of the Gift Certificate sold. We process all consumer payments and remit to the business the revenue share of any Gift Certificate purchased. | |

Other Services

We generate other revenue through subscription services, licensing payments for access to Yelp data and other non-advertising, non-transaction arrangements, such as certain partnerships. We recognize revenue from these sources as other services revenue.

Yelp Reservations | We provide restaurants, nightlife and certain other venues with the ability to offer online reservations directly from their Yelp business listing pages through our Yelp Reservations product, which also includes front-of-house management tools. We offer this product as a monthly subscription service. As of December 31, 2017, approximately 4,500 restaurants nationwide were bookable through Yelp Reservations. | |

Yelp Nowait | Yelp Nowait is a subscription-based waitlist management solution that allows consumers to check wait times and join waitlists remotely and businesses to efficiently manage seating and server rotation. As with Yelp Reservations, Yelp Nowait is available directly on business listing pages. | |

Yelp WiFi Marketing | Our Yelp WiFi Marketing product provides businesses with the ability to create easy on-premises wifi access for customers, advertise products on the wifi log-in page, and collect contact and social media information from customers who access wifi for use in marketing campaigns. We offer this product as a monthly subscription service. | |

Yelp Knowledge | Through partnerships with companies such as Sprinklr, InMoment and Chatmeter, our Yelp Knowledge program offers business owners local analytics and insights through access to our historical data and other proprietary content. Our Yelp Knowledge partners pay us program fees for access to Yelp Knowledge content. | |

Other Partnerships | Other non-advertising partner arrangements include content licensing and allowing third-party data providers to update and manage business listing information on behalf of businesses. | |

Brand Advertising

Through the end of 2015, we also offered advertising solutions for national brands in the form of display advertisements and brand sponsorships. We phased out these products over the second half of 2015 and redeployed the associated internal resources elsewhere within our organization. We recognized revenue from these products as brand revenue through the end of 2015.

Revenue by Product

The following table provides a breakdown of our revenue by product for the years indicated (in thousands):

3

Year Ended December 31, | |||||||||||

2017 | 2016 | 2015 | |||||||||

Net revenue by product: | |||||||||||

Advertising | $ | 771,644 | $ | 645,241 | $ | 471,416 | |||||

Transactions | 60,251 | 62,495 | 43,854 | ||||||||

Other services | 14,918 | 5,333 | 3,429 | ||||||||

Brand advertising | — | — | 31,012 | ||||||||

Total net revenue | $ | 846,813 | $ | 713,069 | $ | 549,711 | |||||

Consumer Engagement

At the heart of our business are the vibrant communities of contributors that contribute the content on our platform. These contributors provide rich, firsthand information about local businesses in the form of reviews and ratings, tips, photos and videos. Each review, tip, photo and video expands the breadth and depth of the content on our platform, which drives a powerful network effect: the expanded content draws in more consumers and more prospective contributors. Although measures of our content (including our cumulative review metric) and traffic (including our desktop and mobile unique visitors and app unique device metrics) do not factor directly into the advertising arrangements we have with our advertising customers, this network effect underpins our ability to deliver clicks and ad impressions to advertisers. Increases in these metrics improve our value proposition to local businesses as they seek easy-to-use and effective advertising solutions.

Community Management

For the above reasons, we foster and support communities of contributors and make the consumer experience our highest priority. We have a team of Community Managers and Community Ambassadors based across the United States and Canada whose primary goals are to support and grow their local communities of contributors, raise brand awareness and engage with their surrounding communities through:

• | planning and executing fun and engaging events for the community, such as parties, outings and activities at restaurants, museums, hotels and other local places of interest; |

• | getting to know community members and helping them get to know one another to foster an offline community experience that can be transferred online; |

• | promoting Yelp, including guest appearances on local television and radio, and at local events such as concerts and street fairs; and |

• | writing weekly e-mail newsletters to share information with the community about local businesses, events and activities. |

Through these activities, we believe our community management team helps us increase awareness of our platform and grow avid communities who are willing to contribute content to our platform. These active contributors may be invited to attend sponsored social events, but do not receive compensation for their contributions. This community growth drives the network effect whereby contributed reviews expand the breadth and depth of our content base. This expansion draws an increasing number of consumers to access the content on our platform, thus inspiring new and existing contributors to create additional reviews that can be shared with this growing audience.

In general, the communities we entered into earlier are more populous than those we entered into later, and we have already entered many of the largest cities in the United States and Canada. For these and other reasons, launching additional communities may not yield results similar to those of our existing communities. As a result, we continue to believe that development of our existing communities currently provides the greatest opportunity for growth, and plan to focus our community development efforts on existing communities in 2018.

Reviews

As of December 31, 2017, our communities had contributed approximately 148.3 million cumulative reviews of almost every type of local business. Of the approximately 148.3 million cumulative reviews our contributors had submitted through December 31, 2017, approximately 106.1 million were recommended and available on business listing pages; approximately 31.7 million were not recommended and available on secondary pages; and approximately 10.6 million had been removed from our platform.

4

Although they do not factor into a business’s overall star rating, we provide access to reviews that are not recommended because they provide additional perspectives and information on reviewed businesses, as well as transparency of the efficacy of our automated recommendation software.

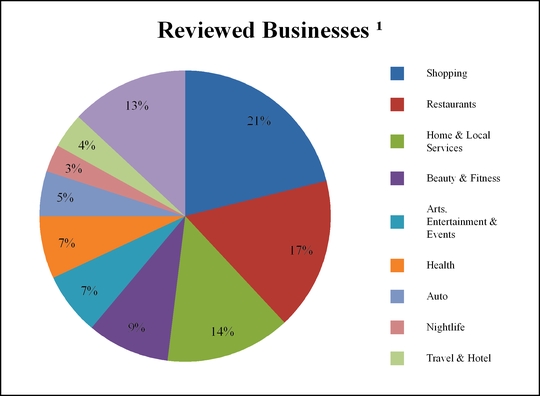

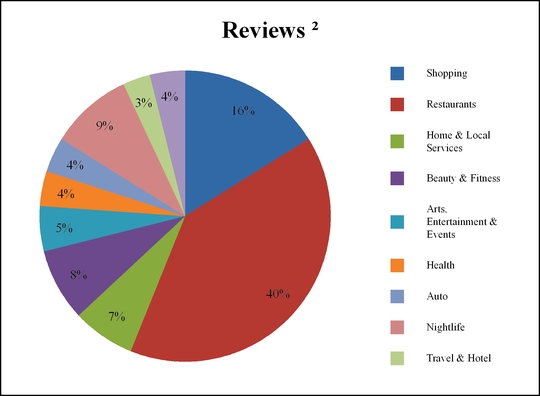

The reviews contributed to our platform cover a wide set of local business categories, including restaurants, shopping, beauty and fitness, arts, entertainment and events, home and local services, health, nightlife, travel and hotel, auto and other categories. In the charts below, we highlight the breakdown by category of local businesses that have received reviews on our platform and the breakdown by category of the cumulative reviews contributed to our platform through December 31, 2017.

(1) | The above chart provides a breakdown of the categories of businesses that had received reviews that were available on our platform — i.e., including reviews that were recommended or not recommended, but not including reviews that had been removed from our platform — as of December 31, 2017, including some businesses that had received only reviews that were not recommended. The categories reflect Yelp's category definitions as of December 31, 2017. |

5

(2) | The above chart provides a breakdown of our cumulative reviews as of December 31, 2017, including reviews that had been removed from our platform. The categories of the businesses associated with these reviews reflect Yelp's category definitions as of December 31, 2017. |

We believe that the concentration of reviews in the restaurant and shopping categories in particular is primarily due to the frequency with which individuals visit specific businesses or engage in certain activities versus others. For example, an individual may eat at a restaurant three times in one week or go shopping once a week, but the same individual is unlikely to visit a mechanic, get a haircut or use a home or local service with the same frequency. The top five industry categories accounted for an aggregate of 77% of our advertising revenue (excluding advertising sold by partners) for the quarter ended December 31, 2017, broken down as follows: Home & Local Services, 31%; Restaurants, 14%; Beauty & Fitness, 12%; Health, 11%; and Shopping, 9%.

Our Strategy

Our strategy looks to leverage our competitive advantages — our brand, our content and the network dynamics in Yelp communities — to increase the value we provide to consumers and businesses, while continuing to drive efficiency in our business model:

Consumers

Consumers drive the network dynamics on which our value proposition is based: growing consumer traffic and content contribution further benefits consumers and underpins our ability to create value for businesses through our products and services. For this reason, we believe that our approach of making the consumer experience our highest priority has been essential to our success in attracting users with low acquisition costs, and remain committed to this approach by:

• | Fostering Yelp Communities. While organic growth driven by our community development efforts, as described above, continues to be the primary driver of our traffic, we will continue investing in marketing in 2018 to leverage our brand and help fuel the network dynamics on our platform. As in 2017, we expect to focus our advertising budget on performance advertising with the goal of increasing consumer usage of our mobile app, among others. We will also look to provide additional, and refine existing, in-app messaging opportunities and social features to better facilitate sharing content on our platform. |

6

• | Maintaining and Enhancing Our High-Quality Content. Consumer trust in our content is essential to our business, and we will continue our consumer protection efforts to maintain and enhance the quality of our content. In 2017, for example, we increased our efforts to discourage business owners from soliciting reviews to help ensure that consumers have access to unbiased content on our platform. We also expanded the public health information available on our platform by partnering with the California Health Care Foundation and Cal Hospital Compare to display maternity care measures for the approximately 250 hospitals that deliver babies in California, and made information on businesses with gender neutral bathrooms available. |

• | Designing Features with Consumers in Mind. By continuing to develop a feature-rich platform for consumers and leveraging consumer trends in use of our platform, we believe we can increase the number of visits and searches per user. For example, in 2017, we expanded our product offerings in food and restaurants, the categories on our platform that receive the most traffic, through our acquisition of a remote waitlist system in Yelp Nowait and our strategic partnership with Grubhub, which, when fully implemented, we expect to increase the number of order-enabled restaurants available to consumers on the Yelp Platform from approximately 42,000 to approximately 80,000. We also plan to continue to invest in developing our mobile platform, and our mobile app in particular, to take advantage of the growing number of consumers accessing Yelp through their mobile devices. For example, we redesigned our mobile business listing pages in 2017 to better showcase photos, which consumers are increasingly viewing. |

Businesses

Our business depends on our ability to maintain and expand our customer base. To do so, we must convince existing and prospective customers alike that our products offer a material benefit to their businesses by:

• | Expanding Our Portfolio of Products. We believe that offering business owners compelling products and comprehensive tools to engage with customers will encourage businesses to use our services. We plan to continue to grow and develop products and partner arrangements that provide incremental value to our advertisers and business partners to encourage them to increase their budgets allocated to our platform and otherwise integrate their product offerings with Yelp. For example, as a result of our 2017 acquisition of Turnstyle Analytics Inc. ("Turnstyle"), we now offer businesses location-based marketing and analytics to help them attract, retain and reward customers. We also introduced our Yelp Cash Back program in 2017 to provide businesses with another tool to attract and retain loyal customers. |

• | Enhancing Our Existing Product Offerings. We are also working to continue expanding and improving our existing product offerings to increase their value to our business customers. In 2017, for example, we began offering our advertisers the ability to start and stop their campaigns at any time, began offering advertisers more options to customize their ads, expanded the availability of our Request-A-Quote feature and upgraded our Yelp Reservations product with improvements to the floor view for restaurant management. In addition, we partnered with companies like Inmoment and Yext, among others, to expand our Yelp Knowledge program and offer businesses local analytics and insights based on historical Yelp data. |

• | Enabling Connections. As we explore opportunities to monetize our products, we must balance customer demands against our commitment to providing a good user experience; we will not incorporate products or features that we believe may excessively degrade the consumer experience and potentially alienate users, even if they might result in increased short-term monetization. We believe that investing in products that facilitate connections between businesses and consumers — as distinct from advertising products, which are more likely to be disruptive to consumers — provides a significant opportunity to balance these competing considerations successfully. For example, we believe the continued expansion of our transaction, messaging and customer retention offerings will not only drive further consumer engagement, but also attract additional business customers. To that end, in 2017, we expanded Request-A-Quote, resulting in the volume of requests more than doubling in 2017 compared to 2016, acquired and began scaling our Yelp WiFi Marketing and Yelp Nowait products and launched our Yelp Cash Back program. By the end of 2017, nearly 14,000 businesses were connected to Yelp Reservations, Yelp Nowait or Yelp WiFi Marketing, and we plan to increase our investment in these products in 2018 to strengthen our competitive position in the Restaurants category. While we expect that our advertising products will continue to drive the vast majority of our revenue for the foreseeable future, we believe tools like these will be increasingly important over the long term. |

7

• | Communicating Our Value. Our ability to compete effectively for our customers’ budgets depends on their perceptions regarding our platform and products, particularly regarding their ability to generate a competitive return relative to other alternatives. For example, we plan to continue to develop and refine comprehensive business owner tools to measure the effectiveness of our products, including the advertising-management features for our Yelp for Business Owners app. We will also continue our local business outreach efforts, including educating local businesses on how Yelp provides value to them. In addition, we expect that the transactions and other types of connections we are investing in, as described above, will also allow business owners to attribute customer leads to Yelp more clearly than ad clicks. |

Operating Efficiencies

Our success depends on our ability to maintain adequate revenue growth while effectively managing our expenses through strategies including:

• | Improving Sales Performance. Our core strength is our advertising business, which has a significant and growing base of revenue. In addition to increasing sales headcount in this business, we also plan to continue pursuing initiatives to increase sales force performance. For example, our sales force recently began selling the flexible-term contracts already available to our self-serve customers, which we believe will result in a more efficient sales process and improved productivity. In 2017, we began utilizing machine learning to help sales team members choose the most promising customer leads to contact. We also adjusted the standard compensation package offered to incoming sales representatives to help address employee turnover and increase the average tenure of sales representatives. Because more tenured sales representatives are generally more successful than less tenured representatives, we believe this and other retention efforts help improve overall sales performance. |

• | Broadening Our Sales Strategy. While we will continue to invest in sales resources, we are also pursuing a broader sales strategy to address the revenue opportunity from existing customers and new advertisers. For example, in 2017, we continued to expand our customer success team (previously referred to as our account management team), which led to improved revenue retention rates in 2017 compared to 2016. We also plan to continue investing in evolving sales channels, such as our self-serve advertising channel and partnerships with select marketing agencies and resellers that provide large and medium-sized advertisers with greater access to our products. The convenience and flexible contract term lengths of our self-serve channel helped increase revenue from this channel by nearly 50% in the fourth quarter of 2017 compared to the same period in 2016. We plan to build on these developments in 2018 by extending the flexibility of our self-serve ad campaigns to our full-service advertising customers. |

• | Maintaining a Rational Approach to Product, Business and Corporate Development. Our success will depend, in part, on our ability to expand our product offerings and grow our business in response to changing technologies, consumer and advertiser demands, and competitive pressures. We may accomplish this through internal development efforts, entering into partnerships with third parties, or the acquisition of complementary businesses or technologies, and choosing the most efficient method will be critical to managing our expenses effectively. In 2017, for example, we disposed of our Yelp Eat24 food ordering business and entered into a long-term, strategic partnership with Grubhub in its place, which we believe will improve our per-order profitability in addition to providing significantly more options to consumers when fully implemented. By contrast, we elected to acquire Nowait, Inc. ("Nowait") instead of continuing our partnership arrangement with it based on our determination that the expected benefits of fully integrating and scaling its waitlist system outweighed the more limited benefits available through the partnership arrangement. |

• | Investing in High-Monetization Categories. Although our Restaurants category receives more traffic than any other category, our most highly monetized and fastest growing revenue categories are Home & Local Services, Automotive and Health, where businesses tend to engage in higher margin and higher dollar value transactions. We plan to continue investing in products and features that help draw users of our highly trafficked categories to our highly monetized categories, such as our Request-A-Quote feature, which consumers were using to generate more than one million requests each month as of December 31, 2017. While Request-A-Quote is currently generating revenue as inventory for our existing advertising products, we are also exploring new ways to monetize this feature that better reflect the value of these high-converting leads. |

8

Sales

We sell our products directly through our sales force, indirectly through partners and online through our website. Our sales force consisted of 3,400 employees as of December 31, 2017 and is located across our offices in San Francisco, California; Scottsdale, Arizona; New York, New York; Chicago, Illinois; Washington, D.C.; and Toronto, Ontario. From 2012 to 2016, we also had sales operations in Europe, including in Dublin, Ireland and Hamburg, Germany. In the fourth quarter of 2016, however, we wound down our sales activities in markets outside the United States and Canada, where we believe the long-term return on continued investment to be lower than opportunities for Yelp within our core markets.

Direct Sales. A large majority of our sales force — 3,300 employees as of December 31, 2017 — is dedicated to selling our advertising products, with a significantly smaller component responsible for selling Yelp WiFi Marketing, Yelp Reservations and Yelp Nowait products. Our sales force primarily sells cost-per-click advertising; only a small percentage of ads continue to be impression-based. Sales representatives are primarily responsible for generating qualified sales leads by identifying and contacting businesses through direct engagement, direct marketing campaigns and weekly e-mails to claimed local businesses. Our direct sales force is focused on increasing revenue by adding new customers, and sales representatives are typically compensated on the basis of advertising sold in a given period.

Sales Partnerships. Since 2014, we have allowed our partners, such as DexYP, to sell certain of our advertising products as part of a package with their own advertising products to their advertiser bases. The products covered by these arrangements include our enhanced profile and cost-per-click advertising. We continue to explore additional partnerships for the sale or bundling of our products, as well as with select marketing agencies.

Self-Serve Ads. Our online, or self-serve, sales channel allows businesses to purchase advertising solutions directly from our website. Businesses can purchase performance-based cost-per-click sponsored search advertising directly through this channel. The convenience and flexible terms of our self-serve sales channel helped us attract thousands of new advertisers in 2017, and we are continuing to test approaches to this sales channel, including by offering advertisers more options to customize their ads.

Customer Success. While the focus of our sales force has historically been on adding new customers, we also see opportunity to deepen our relationships with existing customers. To this end, our customer success team supports existing business advertisers through account management, cross-selling and retention initiatives. In 2017, we grew our customer success team and focused on streamlining our customer success processes, which we believe will give us a greater ability to respond to changes in revenue retention that may emerge from the increasing portion of our customers who are able to cancel their advertising commitments at any time.

Technology

Product development and innovation are core pillars of our strategy. We devote a substantial portion of our resources to researching and developing new solutions and enhancing existing solutions, conducting product testing and quality assurance testing, improving core technology and strengthening our technological expertise. In addition, we acquired talent and technology through our acquisitions of Nowait and Turnstyle in 2017. For the years ended December 31, 2017, 2016 and 2015, product development expenses totaled $175.8 million, $138.5 million and $107.8 million, respectively.

We aim to delight our users and business partners with our products. We provide our web-based and mobile services using a combination of in-house and third-party technology solutions and products:

• | Search and Ranking Technology. We leverage the data stored on our platform and our proprietary indexing and ranking techniques to provide our users with contextual, relevant and up-to-date results to their search queries. For example, a consumer desiring environmentally friendly carpet cleaners does not have to call individual cleaners to inquire about their use of chemical-based cleaning solutions. Instead, the consumer can search for “environmentally-friendly carpet cleaners” on Yelp and discover cleaners with the best service and “green” cleaning products that serve a specific neighborhood. |

• | Recommendation Software. We employ our proprietary automated recommendation software to analyze and screen all reviews submitted to our platform. We believe our recommendation technology is one of the key contributors to the quality and integrity of the reviews on our platform and the success of our service. See “—Consumer Protection Efforts” below for additional details regarding our recommendation software. |

9

• | Mobile Solutions. We have seen substantial growth in consumers accessing information about local businesses through mobile devices, and anticipate that growth in use of our mobile platform will be the driver of our growth for the foreseeable future. Our most engaged users are on our mobile app, making it particularly critical to our continued success. For example, in the quarter ended December 31, 2017, mobile devices accounted for approximately 79% of all searches and approximately 70% of all ad clicks on our platform, compared to 73% and approximately 66%, respectively, in the quarter ended December 31, 2016. |

To take advantage of this trend, we have invested significant resources into the development of our comprehensive mobile platform for consumers supporting the major smartphone operating systems available today, iOS and Android. Over time, we have enhanced the functionality of our mobile platform, such that it provides similar and, in some areas, greater functionality than our website. Some of the innovations we introduced through our mobile platform include “check-ins,” “tips,” “comments,” “Nearby” and “Monocle,” our augmented reality feature. We also offer a mobile app for business owners, designed to make it easier for them to engage with their customers and manage their Yelp profiles. The Yelp for Business Owners app is currently available for iOS and Android.

• | Advertising Technologies. We use proprietary ad targeting and delivery technologies designed to provide relevant local advertisements to consumers viewing our content. Our proprietary ad delivery system leverages our unique repository of data to provide useful ads to users and high value leads to advertisers. |

• | Infrastructure. Our web and mobile platforms are currently hosted from multiple locations, primarily through Amazon Web Services. We also host parts of our infrastructure within shared data environments in California and Virginia, as well as with third-party leased server providers. Our web and mobile platforms are designed to have high availability, from the Internet connectivity providers we choose, to the servers, databases and networking hardware that we deploy. We design our systems such that the failure of any individual component is not expected to affect the overall availability of our platform. We also leverage other third-party Internet-based (cloud) services such as rich-content storage, map-related services, ad serving and bulk processing. |

• | Network Security. Computer viruses, malware, phishing attacks, denial-of-service and other attacks and similar disruptions from unauthorized use of computer systems have become more prevalent in our industry, have occurred on our systems in the past and we expect them to occur periodically on our systems in the future. For this reason, our platform includes a host of encryption, antivirus, firewall and patch-management technologies designed to help protect and maintain the systems located at data centers as well as other systems and computers across our business. |

Consumer Protection Efforts

Our success depends on our ability to maintain consumer trust in our solutions and in the quality and integrity of the user content and other information found on our platform. We dedicate significant resources to the goal of maintaining and enhancing the quality, authenticity and integrity of the reviews on our platform, primarily through the following methods:

Automated Recommendation Software. We use proprietary software to analyze the relevance, reliability and utility of each review submitted to our platform. The software applies the same objective standards to each review based on a wide range of data associated with the review and reviewer, regardless of whether the business being reviewed advertises on Yelp. These objective standards include various measures of relevance, reliability and utility, such as the reviewer’s type and level of activity with Yelp (which might correspond to the reviewer’s reliability or suggest reviewer biases) and whether certain reviews originate from related Internet Protocol addresses (which might mean the reviews were submitted by the same person). The results of this analysis can change over time as the software factors in new information, which may result in reviews that were previously recommended becoming not recommended, and reviews that were previously not recommended being restored to recommended status. Reviews that the software deems to be the most useful and reliable are published directly on business listing pages, though neither we nor the software purport to establish whether or not any individual review is authentic. As of December 31, 2017, our software was recommending approximately 72% of the reviews submitted to our platform. Reviews that are not recommended are published on secondary pages and do not factor into a business’s overall star rating. As of December 31, 2017, approximately 21% of the reviews submitted to our platform were not recommended but still accessible on our platform.

Education. We provide businesses with information and materials regarding our stance against review solicitation and work with businesses to ensure that any they are aware that Yelp does not work with third-party review solicitation companies that offer to artificially inflate search rankings and online reputations. By working to educate businesses about why review solicitation harms consumers and can undermine a business’ reputation, we believe we can reduce the frequency with businesses engage in such activities.

10

Sting Operations. We routinely conduct sting operations to identify businesses and individuals who offer or receive cash, discounts or other benefits in exchange for reviews. For example, we may respond to advertisements offering to pay for reviews that are posted on Craigslist, Facebook and other platforms. We also receive and investigate tips from our users about potential paid reviews. If we identify or confirm any such issues through our investigations, we typically pursue one or more of the courses of action described below (each of which we may also employ on a stand-alone basis).

Consumer Alerts Program. We issue consumer alert warnings on business listing pages from time to time when we encounter suspicious activity that we believe is indicative of attempts to deceive or mislead consumers. For example, we may issue a consumer alert if we encounter a business attempting to purchase favorable reviews, or if a large number of favorable reviews are submitted from the same Internet Protocol address. Consumer alerts generally remain in effect for 90 days, or longer if the deceptive practices continue.

Coordination with Law Enforcement. We regularly cooperate with law enforcement and consumer protection agencies to investigate and identify businesses and individuals who may be engaged in false advertising or deceptive business practices relating to reviews. For example, in 2013, we assisted the New York Attorney General with “Operation Clean Turf,” an undercover investigation targeting review manipulation that resulted in 19 companies agreeing to pay more than $350,000 in fines to the State of New York. In 2016, in a continuation of this investigation, the New York Attorney General announced settlements with six additional businesses that tried to mislead consumers, resulting in the businesses agreeing to pay fines and to take measures to increase the honesty and transparency of their online reviews.

Legal Action. Our terms of service prohibit the buying and selling of reviews, as well as writing fake reviews. In egregious cases, we take legal action against businesses we believe to be engaged in deceptive practices based on these prohibitions.

Removal of Reviews. We regularly remove reviews from our platform that we believe violate our terms of service, including, without limitation: fake or defamatory reviews; content that has been bought, sold or traded; threatening, harassing or lewd content, as well as hate speech and other displays of bigotry; and content that violates the rights of any third party or any applicable law. Consumers can access information about reviews that we have removed for a particular business by clicking on a link on the business’s listing page. As of December 31, 2017, approximately 7% of the reviews submitted to our platform had been removed.

Intellectual Property

We rely on federal, state, common law and international rights, as well as contractual restrictions, to protect our intellectual property. We control access to our proprietary technology and algorithms by entering into confidentiality and inventions assignment agreements with our employees and contractors, as well as confidentiality agreements with third parties.

In addition to these contractual arrangements, we also rely on a combination of patent, trade secrets, copyrights, trademarks, service marks and domain names to protect our intellectual property. We pursue the registration of our copyrights, trademarks, service marks and domain names in the United States and in certain locations internationally. Our registration efforts have focused on gaining protection of our trademarks for Yelp and the Yelp burst logo, among others. These marks are material to our business and essential to our brand identity as they enable others to easily identify us as the source of the services offered under these marks. We currently have limited patent protection for our core business, which may make it more difficult to assert certain of our intellectual property rights. For example, the contractual restrictions and trade secrets that protect our proprietary technology and algorithms provide only a limited safeguard against infringement.

Circumstances outside our control could pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in the United States or other countries in which we operate. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Protecting our intellectual property rights is also costly and time consuming. Any unauthorized disclosure or use of our intellectual property could make it more expensive to do business and harm our operating results.

Companies in the Internet, technology and media industries own large numbers of patents and other intellectual property rights, and frequently request license agreements or threaten to enter into litigation based on allegations of infringement or other violations of such rights. From time to time, we receive notice letters from patent holders alleging that certain of our products and services infringe their patent rights. We are also currently subject to, and expect to face in the future, allegations that we have infringed the trademarks, copyrights, patents and other intellectual property rights of third parties, including our competitors and non-practicing entities. As we face increasing competition and as our business grows, we will likely face more claims of infringement.

11

Competition

The market for information regarding local businesses and advertising is intensely competitive and rapidly changing. We compete for consumer traffic with traditional, offline local business guides and directories as well as online providers of local and web search. We also compete for a share of businesses’ overall advertising budgets with traditional, offline media companies and other Internet marketing providers. Our competitors include the following types of businesses:

• | Offline. Competitors include offline media companies and service providers, many of which have existing relationships with businesses. Services provided by competitors range from yellow pages listings to direct mail campaigns to advertising and listing services in local newspapers, magazines, television and radio. |

• | Online. Competitors also include Internet search engines, such as Google and Bing, review and social media websites, such as Facebook, as well as various other online service providers. These include regional websites that may have strong positions in particular markets. |

Our competitors may enjoy competitive advantages, such as greater name recognition, longer operating histories, substantially greater market share, established marketing relationships with, and access to, large existing user bases and substantially greater financial, technical and other resources. These companies may use these advantages to offer products similar to ours at a lower price, develop different products to compete with our current solutions and respond more quickly and effectively than we do to new or changing opportunities, technologies, standards or client requirements. Certain competitors could also use strong or dominant positions in one or more markets to gain competitive advantage against us in markets in which we operate.

We compete on the basis of a number of factors. We compete for consumer traffic on the basis of factors including: the quality and reliability of our content; the breadth, depth and timeliness of information; and the strength and recognition of our brand. We compete for businesses’ advertising budgets on the basis of factors including: the size of our consumer audience; the effectiveness of our advertising solutions; our pricing structure; and recognition of our brand.

Government Regulation

As a company conducting business on the Internet, we are subject to a variety of laws in the United States and abroad that involve matters central to our business, including laws regarding privacy, data retention, distribution of user-generated content, consumer protection and data protection, among others. For example:

• | Privacy. Because we receive, store and process personal information and other user data, including credit card information in certain cases, we are subject to numerous federal, state and local laws around the world regarding privacy and the storing, sharing, use, processing, disclosure and protection of personal information and other user data. |

• | Liability for Third-Party Action. We rely on laws limiting the liability of providers of online services for activities of their users and other third parties. |

• | Advertising. We are subject to a variety of laws, regulations and guidelines that regulate the way we distinguish paid search results and other types of advertising from unpaid search results. |

• | Information Security and Data Protection. The laws in many jurisdictions require companies to implement specific information security controls to protect certain types of information. Likewise, many jurisdictions have laws in place requiring companies to notify users if there is a security breach that compromises certain categories of their information. |

Many of these laws and regulations are still evolving and could be interpreted in ways that harm our business. The application and interpretation of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate. They may be interpreted and applied inconsistently from country to country and inconsistently with our current policies and practices. For example, laws providing immunity to websites that publish user-generated content are currently being tested by a number of claims, including actions based on invasion of privacy and other torts, unfair competition, copyright and trademark infringement and other theories based on the nature and content of the materials searched, the ads posted or the content provided by users.

Similarly, new legislation and regulations may significantly impact our business. There have been various Congressional efforts to restrict the scope of the protections available to online platforms under Section 230 of the Communications Decency Act, and our current protections from liability for third-party content in the United States could decrease or change as a result. Regulatory frameworks for privacy issues in particular are also currently in flux worldwide, and are likely to remain so for the

12

foreseeable future. For example, the European Union’s General Data Protection Regulation ("GDPR") is expected to come into force in or around May 2018, and will include operational requirements for companies like us that receive or process personal data of residents of the European Union that are different from those currently in place.

Changes in existing laws or regulations or their interpretations, as well as new legislation or regulations, may be costly to comply with and may delay or impede the development of new products, increase our operating costs and require significant management time and attention. Such changes could also make it more difficult for consumers to use our platform, resulting in less traffic and revenue, or make it more difficult for us to provide effective advertising tools to businesses on our platform, resulting in fewer advertisers and less revenue. As our business grows and evolves, we will also become subject to additional laws and regulations, including in jurisdictions outside of the United States. Foreign data protection, privacy and other laws and regulations can be more restrictive than those in the United States, as is the case with GDPR. Any failure on our part to comply with these laws may subject us to significant liabilities.

Our Culture and Employees

We take great pride in our company culture and consider it to be one of our competitive strengths. Our culture is at the foundation of our success, and it continues to help drive our business forward as a pivotal part of our everyday operations. It allows us to attract and retain a talented group of employees, create an energetic work environment and continue to innovate in a highly competitive market. As of December 31, 2017, we had 5,196 salaried employees and 127 non-salaried support staff globally.

Our culture extends beyond our offices and into the local communities in which people use Yelp. Our community management team’s responsibilities include supporting the sharing of experiences by consumers in the local markets that they serve and increasing brand awareness. We organize events several times a year to recognize our most important contributors, facilitating face-to-face interactions, building the Yelp brand and fostering the sense of true community in which we believe so strongly. We also engage with small businesses. For example, we established the Yelp Small Business Advisory Council as a way to interact with and get feedback from our core community of local business owners. We also work with the U.S. Small Business Administration and other partners to educate small business owners across the United States on best practices for online marketing.

In addition, The Yelp Foundation, a non-profit organization established by our board of directors in November 2011 (the "Foundation"), directly supports consumers and local businesses in the communities in which we operate. In 2011, our board of directors approved the contribution and issuance to the Foundation of 520,000 shares of our common stock, of which the Foundation had sold 187,500 shares as of December 31, 2017. The Foundation uses the proceeds from the sale of its shares of our common stock to make grants to local non-profit organizations that are actively engaged in supporting community and small business growth. As of December 31, 2017, the Foundation held 332,500 shares of common stock, representing less than 1% of our outstanding capital stock.

Information About Segment and Geographic Revenue

Information about segment and geographic revenue is set forth in Note 18 of the Notes to Consolidated Financial Statements included elsewhere in this Annual Report.

Seasonality

Our business is affected both by cyclicality in business activity and by seasonal fluctuations in Internet usage and advertising spending. We believe our rapid growth has masked most of the cyclicality and seasonality of our business. As our business matures, we expect that the cyclicality and seasonality in our business may become more pronounced, causing our operating results to fluctuate. In particular, based on historical trends, we expect traffic numbers to be weakest in the fourth quarter of the year in connection with end of the year holidays.

Corporate and Available Information

We were incorporated in Delaware on September 3, 2004 under the name Yelp, Inc. We changed our name to Yelp! Inc. in late September 2004 and to Yelp Inc. in February 2012. Our principal executive offices are located at 140 New Montgomery Street, 9th Floor, San Francisco, California 94105, and our telephone number is (415) 908-3801. Our website is located at www.yelp.com, and our investor relations website is located at www.yelp-ir.com.

We file or furnish electronically with the U.S. Securities and Exchange Commission ("SEC") annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. We make copies of these reports available free of charge through our investor relations

13

website as soon as reasonably practicable after we file or furnish them with the SEC. All materials we file with the SEC are available at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

We webcast our earnings calls and certain events we participate in or host with members of the investment community on our investor relations website. Additionally, we provide notifications of news or announcements regarding our financial performance, including filings with the SEC, investor events, press and earnings releases, and blogs as part of our investor relations website. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for e-mail alerts and RSS feeds.

Information contained on or accessible through our websites is not incorporated into, and does not form a part of, this Annual Report or any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

14

Item 1A. Risk Factors.

Risks Related to Our Business and Industry

If we are unable to increase traffic to our mobile app and website, or user engagement on our platform declines, our revenue, business and operating results may be harmed.

We derive substantially all of our revenue from the sale of our advertising products. Because traffic to our platform determines the number of ads we are able to show, affects the value of those ads to businesses and influences the content creation that drives further traffic, slower traffic growth rates may harm our business and financial results. Our traffic could be adversely affected by factors including:

• | Reliance on Internet Search Engines. As discussed in greater detail below, we rely on Internet search engines to drive traffic to our platform. However, the display, including rankings, of unpaid search results can be affected by a number of factors, many of which are not in our direct control, and may change frequently. Although Internet search engine results have allowed us to attract a large audience with low organic traffic acquisition costs to date, if they fail to drive sufficient traffic to our platform in the future, we may need to increase our marketing spend to acquire additional traffic. We cannot assure you that the value we ultimately derive from any such additional traffic would exceed the cost of acquisition, and any increase in marketing expense may harm our operating results as a result. |

• | Quality of Our Content. Our ability to attract consumer traffic depends on the quantity and quality of the content contributed by our users. Our ability to provide consumers with valuable content may be harmed: |

◦ | if our users do not contribute content that is helpful or reliable; |

◦ | if our users remove content they previously submitted; and |

◦ | as a result of user concerns that they may be harassed or sued by the businesses they review, instances of which have occurred in the past and may occur again in the future. |

In addition, if our platform does not provide current information about local businesses or users do not perceive reviews on our platform as relevant, our business could be harmed. For example, we do not phase out or remove dated reviews, and consumers may view older reviews as less relevant, helpful or reliable than more recent reviews.

• | Increasing Competition. The market for information regarding local businesses is intensely competitive and rapidly changing. If the popularity, usefulness, ease of use, performance and reliability of our products and services do not compare favorably to those of our competitors, traffic may decline. |

• | Our Recommendation Software. If our automated software does not recommend helpful content or recommends unhelpful content, consumers may reduce or stop their use of our platform. While we have designed our technology to avoid recommending content that we believe to be unreliable or otherwise unhelpful, we cannot guarantee that our efforts will be successful. For example, if robots, shills or other spam accounts are able to contribute a significant amount of recommended content, or consumers perceive a significant amount of our recommended content to be from such accounts, our traffic and revenue could be negatively affected. Although we do not believe content from these sources has had a material impact to date, if our automated software recommends a substantial amount of such content in the future, our ability to provide high quality content would be harmed and the consumer trust essential to our success could be undermined. |

• | Content Scraping. From time to time, other companies copy information from our platform without our permission, through website scraping, robots or other means, and publish or aggregate it with other information for their own benefit. This may make them more competitive and may decrease the likelihood that consumers will visit our platform to find the local businesses and information they seek. This may also result in increases to our reported traffic metrics that do not represent increases in consumer usage of our platform. For example, we discovered that a portion of our reported desktop traffic from the third quarter of 2016 through the first quarter of 2017 was attributable to a single robot, which did not represent valid consumer traffic. Though we strive to detect and prevent this third-party conduct, we may not be able to detect it in a timely manner and, even if we could, may not be able to prevent it. In some cases, particularly in the case of third parties operating outside of the United States, our available remedies may be inadequate to protect us against such conduct. |

15

• | Macroeconomic Conditions. Consumer purchases of discretionary items generally decline during recessions and other periods in which disposable income is adversely affected. As a result, adverse economic conditions may impact consumer spending, particularly with respect to local businesses, which in turn could adversely impact the number of consumers visiting our platform. |

• | Review Concentration. Our restaurant and shopping categories together accounted for approximately 38% of the businesses that had received reviews and approximately 56% of the reviews available on our platform as of December 31, 2017. Although these categories generate a substantial portion of our traffic, if the high concentration of reviews generates a perception that our platform is primarily limited to these categories, our traffic may not increase to the extent otherwise possible. |

• | Internet Access. The adoption of any laws or regulations that adversely affect the growth, popularity or use of the Internet, including the recent repeal of Internet neutrality regulations in the United States, could decrease the demand for our services. Similarly, any actions by companies that provide Internet access that degrade, disrupt or increase the cost of user access to our platform could undermine our operations and result in the loss of traffic. |

• | High Penetration Rates. We have already entered most major geographic markets within the United States and Canada, and we do not expect to pursue expansion in other international markets in the foreseeable future. Further expansion in smaller markets may not yield similar results or sustain our growth. |

We anticipate that our traffic growth rate will continue to slow over time, and potentially decrease in certain periods, as our business matures. As our traffic growth rate slows, our success will become increasingly dependent on our ability to increase levels of user engagement on our platform, which may be negatively impacted if:

• | users engage with other products, services or activities as an alternative to our platform; |

• | there is a decrease in the perceived quality of the content contributed by our users; |

• | we fail to introduce new and improved products or features, or we introduce new products or features that do not effectively address consumer needs or otherwise alienate consumers; |

• | technical or other problems negatively impact the availability and reliability of our platform or otherwise affect the user experience; |

• | users have difficulty installing, updating or otherwise accessing our platform as a result of actions by us or third parties that we rely on to distribute our products; |

• | users believe that their experience is diminished as a result of the decisions we make with respect to the frequency, relevance and prominence of the advertising we display; and |

• | we do not maintain our brand image or our reputation is damaged. |

We generate substantially all of our revenue from advertising. If we fail to maintain and expand our base of advertisers, our revenue and our business will be harmed.

Our ability to maintain and expand our advertiser base depends on factors including:

• | Acceptance of Online Advertising. We believe that the continued growth and acceptance of our online advertising products will depend on the perceived effectiveness and acceptance of online advertising models generally, which is outside of our control. Many advertisers still have limited experience with online advertising and, as a result, may continue to devote significant portions of their advertising budgets to traditional, offline advertising media, such as newspapers or print yellow pages directories. |

• | Competitiveness of Our Products. We must deliver ads in an effective manner at prices that compare favorably to those of our competitors. The widespread adoption of any technologies that make it more difficult for us to deliver ads, such as ad-blocking programs, could decrease our value proposition to businesses and reduce demand for our products. We may also be unable to attract new advertisers if our products are not compelling or we fail to innovate and introduce enhanced products meeting advertiser expectations. For example, in their current form, our ad products may be most attractive to businesses with higher than average ratings and numbers of reviews. As a result, businesses with lower ratings and fewer reviews may not purchase our ad products, or may abandon them if they do not believe our ad products are effective. |

16

• | Availability and Accuracy of Analytics. We must convince existing and prospective advertisers alike that our advertising products offer them a material benefit and can generate a competitive return relative to other alternatives. To do so, we must provide accurate analytics and measurement solutions that demonstrate the effectiveness and value of our advertising products compared to those of our competitors. |