UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21829

BBH TRUST

On behalf of the following series:

BBH Core Select

BBH Global Core Select

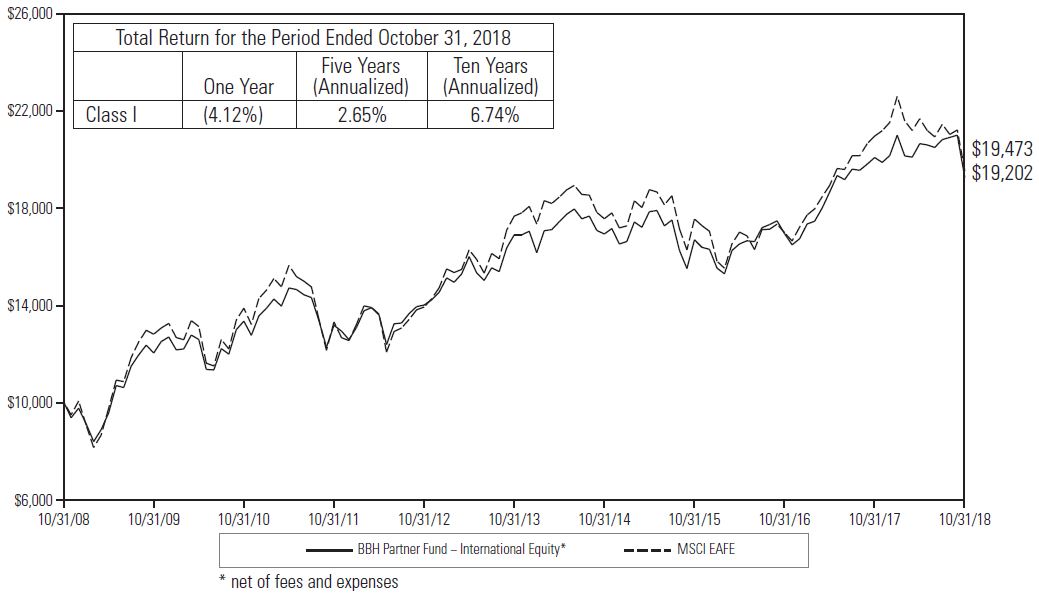

BBH Partner Fund - International Equity

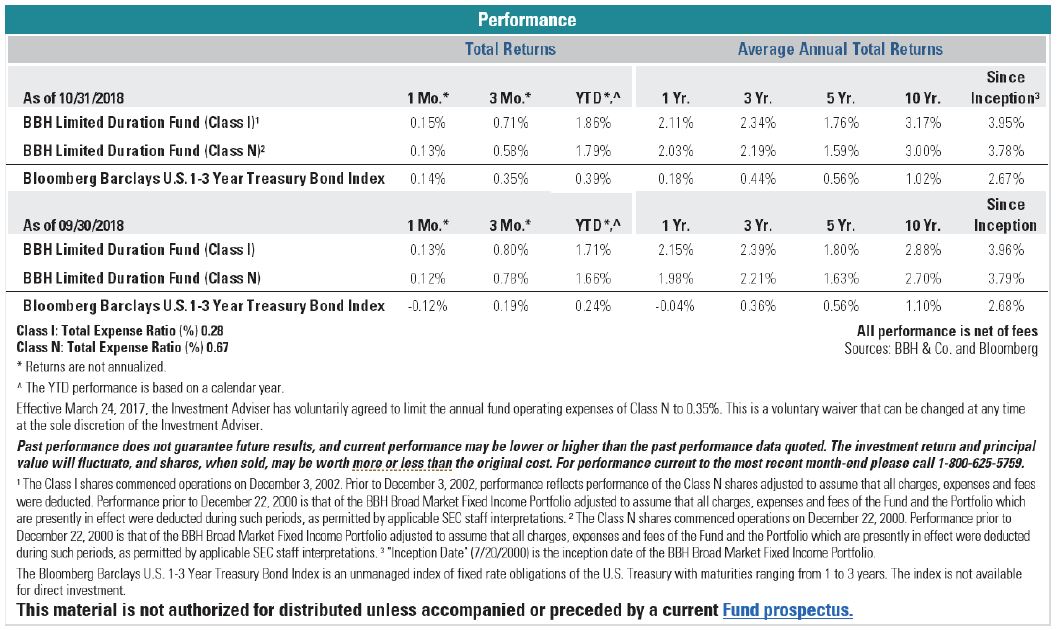

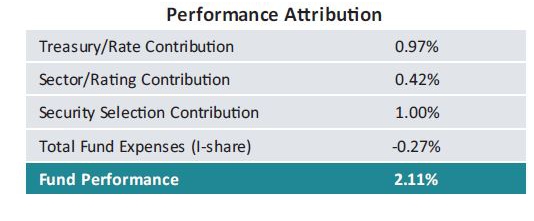

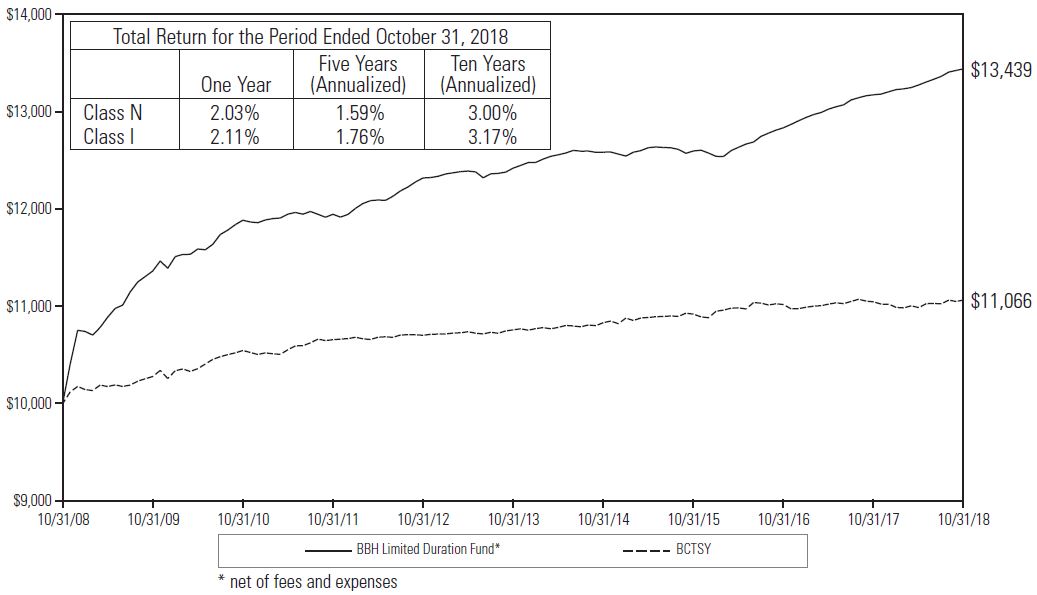

BBH Limited Duration Fund

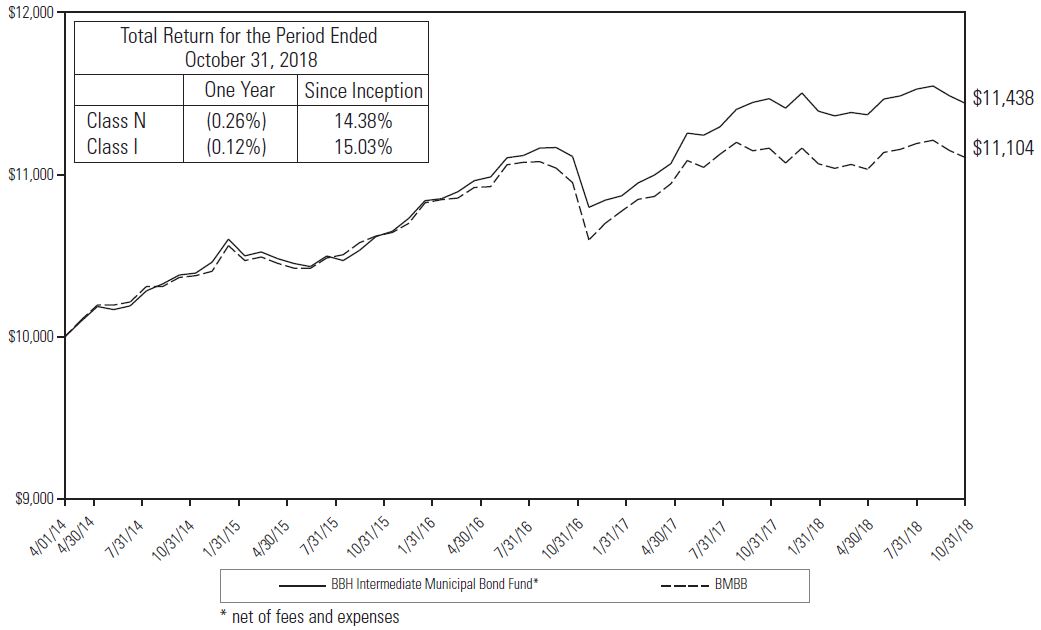

BBH Intermediate Municipal Bond Fund

BBH Income Fund

(Exact name of registrant as specified in charter)

140 Broadway, New York, NY 10005

(Address of principal executive offices) (Zip Code)

Corporation Services Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 575-1265

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

BBH CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

October 31, 2018

* |

A margin of safety exists when we believe there is a significant discount to intrinsic value at the time of purchase — we aim to purchase at 75% of our estimate to intrinsic value or less. Intrinsic value represents what we believe to be the value of a security based on our analysis of both tangible and intangible factors. |

BBH CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

|

|

BBH CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

BBH CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

|

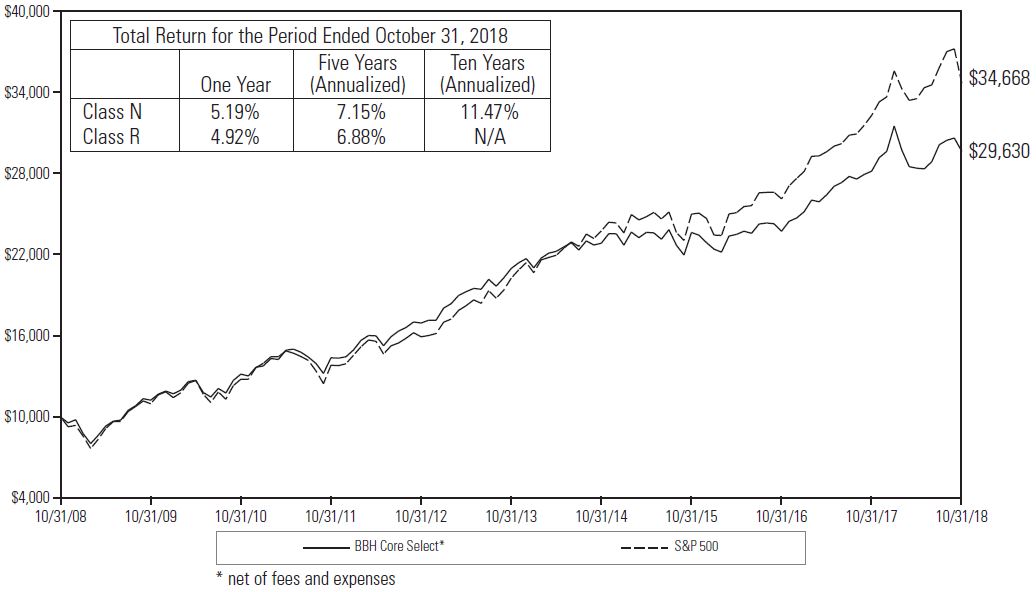

| 1 | The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500 has been adjusted to reflect reinvestment of dividends on securities. The S&P 500 is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged. Investments cannot be made in an index. |

|

|

BBH CORE SELECT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

October 31, 2018

BBH CORE SELECT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (continued)

October 31, 2018

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of October 31, 2018, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

|

December 21,

2018

|

|

BBH CORE SELECT

PORTFOLIO ALLOCATION

October 31, 2018

| U.S. $ Value |

Percent of Net Assets |

|||||||||

Common Stock: |

||||||||||

Basic Materials |

$ | 96,142,883 | 5.7 | % | ||||||

Communications |

291,308,033 | 17.2 | ||||||||

Consumer Cyclical |

105,639,115 | 6.3 | ||||||||

Consumer Non-Cyclical |

590,526,913 | 34.9 | ||||||||

Financials |

289,790,885 | 17.1 | ||||||||

Industrials |

64,286,937 | 3.8 | ||||||||

Technology |

186,833,294 | 11.0 | ||||||||

Repurchase Agreements |

63,800,000 | 3.8 | ||||||||

Cash and Other Assets in Excess of Liabilities |

4,020,844 | 0.2 | ||||||||

NET ASSETS |

$ | 1,692,348,904 | 100.0 | % | ||||||

The accompanying notes are an integral part of these

financial statements.

BBH CORE SELECT

PORTFOLIO OF INVESTMENTS

October 31, 2018

| Shares |

Value |

|||||||||

COMMON STOCK (96.0%) |

||||||||||

BASIC MATERIALS (5.7%) |

||||||||||

| 413,443 | Celanese Corp. (Series A) |

$ | 40,079,165 | |||||||

| 338,815 | Linde, Plc. (Ireland) |

56,063,718 | ||||||||

Total Basic Materials |

96,142,883 | |||||||||

COMMUNICATIONS (17.2%) |

||||||||||

| 96,806 | Alphabet, Inc. (Class C)1 |

104,237,797 | ||||||||

| 2,691,704 | Comcast Corp. (Class A) |

102,661,590 | ||||||||

| 1,715,664 | Discovery, Inc. (Class C)1 |

50,286,112 | ||||||||

| 1,362,721 | Liberty Global, Plc. (Class C) (United Kingdom)1 |

34,122,534 | ||||||||

Total Communications |

291,308,033 | |||||||||

CONSUMER CYCLICAL (6.3%) |

||||||||||

| 718,755 | Copart, Inc.1 |

35,154,307 | ||||||||

| 227,766 | Dollar General Corp. |

25,368,577 | ||||||||

| 2,056,346 | Qurate Retail, Inc. (Class A)1 |

45,116,231 | ||||||||

Total Consumer Cyclical |

105,639,115 | |||||||||

CONSUMER NON-CYCLICAL (34.9%) |

||||||||||

| 250,912 | Dentsply Sirona, Inc. |

8,689,083 | ||||||||

| 440,700 | Diageo, Plc. ADR (United Kingdom) |

60,887,112 | ||||||||

| 346,258 | FleetCor Technologies, Inc.1 |

69,261,988 | ||||||||

| 648,185 | Henry Schein, Inc.1 |

53,799,355 | ||||||||

| 2,124,650 | Kroger Co. |

63,229,584 | ||||||||

| 362,987 | Nestle SA ADR (Switzerland) |

30,592,544 | ||||||||

| 891,011 | Novartis AG ADR (Switzerland) |

77,927,822 | ||||||||

| 451,083 | PayPal Holdings, Inc.1 |

37,976,678 | ||||||||

| 682,757 | Perrigo Co., Plc. (Ireland) |

47,997,817 | ||||||||

| 1,756,928 | Sabre Corp. |

43,308,275 | ||||||||

| 649,022 | Unilever NV (NY Shares) (Netherlands) |

34,904,403 | ||||||||

| 687,213 | Zoetis, Inc. (Class A) |

61,952,252 | ||||||||

Total Consumer Non-Cyclical |

590,526,913 | |||||||||

The accompanying notes are an integral part of these

financial statements.

|

|

BBH CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

| Shares |

Value | |||||||||

COMMON STOCK (continued) |

||||||||||

FINANCIALS (17.1%) |

||||||||||

| 408 | Berkshire Hathaway, Inc. (Class A)1 |

$ | 125,543,640 | |||||||

| 1,624,224 | US Bancorp |

84,898,189 | ||||||||

| 1,490,683 | Wells Fargo & Co. |

79,349,056 | ||||||||

Total Financials |

289,790,885 | |||||||||

INDUSTRIALS (3.8%) |

||||||||||

| 424,010 | Allegion, Plc. (Ireland) |

36,350,377 | ||||||||

| 312,245 | Waste Management, Inc. |

27,936,560 | ||||||||

Total Industrials |

64,286,937 | |||||||||

TECHNOLOGY (11.0%) |

||||||||||

| 277,805 | KLA-Tencor Corp. |

25,430,270 | ||||||||

| 2,386,759 | Oracle Corp. |

116,569,309 | ||||||||

| 712,891 | QUALCOMM, Inc. |

44,833,715 | ||||||||

Total Technology |

186,833,294 | |||||||||

Total Common Stock (Identified cost $972,135,955) |

1,624,528,060 | |||||||||

The accompanying notes are an integral part of these

financial statements.

BBH CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

| Principal Amount |

Maturity Date |

Interest Rate |

Value |

|||||||||||||||

REPURCHASE AGREEMENTS (3.8%) |

||||||||||||||||||

| $63,800,000 | National Australia Bank, Ltd. (Agreement dated 10/31/18 collateralized by U.S. Treasury Notes 2.625%, due 07/31/20, original par

$64,920,000, valued at $65,076,000) |

11/01/18 | 2.170 | % | $ | 63,800,000 | ||||||||||||

Total Repurchase Agreements (Identified cost $63,800,000) |

63,800,000 | |||||||||||||||||

| TOTAL INVESTMENTS (Identified cost $1,035,935,955)2 | 99.8 | % | $ | 1,688,328,060 | ||||||||||||||

| CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES | 0.2 | % | 4,020,844 | |||||||||||||||

| NET ASSETS | 100.0 | % | $ | 1,692,348,904 | ||||||||||||||

| 1 | Non-income producing security. |

| 2 | The aggregate cost for federal income tax purposes is $1,034,628,608, the aggregate gross unrealized appreciation is $678,110,035, and the aggregate gross unrealized depreciation is $24,410,583, resulting in net unrealized appreciation of $653,699,452. |

The accompanying notes are an integral part of these

financial statements.

|

|

BBH CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

— |

Level 1 – unadjusted quoted prices in active markets for identical assets and liabilities. |

— |

Level 2 – significant other observable inputs (including quoted prices for similar assets and liabilities, interest rates, prepayment speeds, credit risk, etc.). |

— |

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of assets and liabilities). |

The accompanying notes are an integral part of these

financial statements.

BBH CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

| Investments, at value |

Unadjusted Quoted Prices in Active Markets for Identical Investments (Level 1)* |

Significant Other Observable Inputs (Level 2)* |

Significant Unobservable Inputs (Level 3)* |

Balance as of October 31, 2018 |

||||||||||||||

Common Stock: |

||||||||||||||||||

Basic Materials |

$ | 96,142,883 | $ | — | $ | — | $ | 96,142,883 | ||||||||||

Communications |

291,308,033 | — | — | 291,308,033 | ||||||||||||||

Consumer Cyclical |

105,639,115 | — | — | 105,639,115 | ||||||||||||||

Consumer Non-Cyclical |

590,526,913 | — | — | 590,526,913 | ||||||||||||||

Financials |

289,790,885 | — | — | 289,790,885 | ||||||||||||||

Industrials |

64,286,937 | — | — | 64,286,937 | ||||||||||||||

Technology |

186,833,294 | — | — | 186,833,294 | ||||||||||||||

Repurchase Agreements |

— | 63,800,000 | — | 63,800,000 | ||||||||||||||

Investments, at value |

$ | 1,624,528,060 | $ | 63,800,000 | $ | — | $ | 1,688,328,060 | ||||||||||

* |

The Fund’s policy is to disclose transfers between levels based on valuations at the end of the reporting period. There were no transfers between Levels 1, 2 or 3 during the period ended October 31, 2018. |

The accompanying notes are an integral part of these

financial statements.

|

|

BBH CORE SELECT

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2018

| ASSETS: |

||||||

Investments in securities, at value (Identified cost $972,135,955) |

$ | 1,624,528,060 | ||||

Repurchase agreements (Identified cost $63,800,000) |

63,800,000 | |||||

Cash |

2,016,289 | |||||

Receivables for: |

||||||

Dividends |

7,897,539 | |||||

Shares sold |

224,156 | |||||

Investment advisory and administrative fee waiver reimbursement |

9,339 | |||||

Interest |

3,846 | |||||

Prepaid assets |

14,058 | |||||

Total Assets |

1,698,493,287 | |||||

LIABILITIES: |

||||||

Payables for: |

||||||

Shares redeemed |

4,429,304 | |||||

Investment advisory and administrative fees |

1,207,411 | |||||

Shareholder servicing fees |

301,853 | |||||

Professional fees |

58,948 | |||||

Custody and fund accounting fees |

31,708 | |||||

Distribution fees |

31,309 | |||||

Transfer agent fees |

9,061 | |||||

Board of Trustees’ fees |

471 | |||||

Accrued expenses and other liabilities |

74,318 | |||||

Total Liabilities |

6,144,383 | |||||

NET ASSETS |

$ | 1,692,348,904 | ||||

Net

Assets Consist of: |

||||||

Paid-in capital |

$ | 675,747,080 | ||||

Retained earnings |

1,016,601,824 | |||||

Net Assets |

$ | 1,692,348,904 |

NET ASSET VALUE AND OFFERING PRICE PER SHARE |

||||||

CLASS N SHARES |

||||||

($1,616,856,063 ÷ 77,505,153 shares outstanding) |

$20.86 | |||||

RETAIL CLASS SHARES |

||||||

($75,492,841 ÷ 7,052,647 shares outstanding) |

$10.70 |

The accompanying notes are an integral part of these

financial statements.

BBH CORE SELECT

STATEMENT OF OPERATIONS

For the year ended October 31, 2018

NET INVESTMENT INCOME: |

||||||

Income: |

||||||

Dividends (net of foreign withholding taxes of $1,052,165) |

$ | 31,746,759 | ||||

Interest income |

2,650,104 | |||||

Total Income |

34,396,863 | |||||

Expenses: |

||||||

Investment advisory and administrative fees |

18,853,849 | |||||

Shareholder servicing fees |

4,713,462 | |||||

Distribution fees |

223,331 | |||||

Custody and fund accounting fees |

151,013 | |||||

Transfer agent fees |

149,567 | |||||

Professional fees |

70,281 | |||||

Board of Trustees’ fees |

52,963 | |||||

Miscellaneous expenses |

514,220 | |||||

Total Expenses |

24,728,686 | |||||

Investment advisory and administrative fee waiver |

(882,428 | ) | ||||

Expense offset arrangement |

(36,384 | ) | ||||

Net Expenses |

23,809,874 | |||||

Net Investment Income |

10,586,989 | |||||

NET REALIZED AND UNREALIZED GAIN: |

||||||

Net realized gain on investments in securities |

482,435,941 | |||||

Net change in unrealized appreciation/(depreciation) on investments in securities |

(351,225,923 | ) | ||||

Net Realized and Unrealized Gain |

131,210,018 | |||||

Net Increase in Net Assets Resulting from Operations |

$ | 141,797,007 |

The accompanying notes are an integral part of these

financial statements.

|

|

BBH CORE SELECT

STATEMENTS OF CHANGES IN NET ASSETS

| For the years ended October 31, |

|||||||||||

| 2018 |

2017 |

||||||||||

DECREASE IN NET ASSETS: |

|||||||||||

Operations: |

|||||||||||

Net investment income |

$ | 10,586,989 | $ | 13,983,608 | |||||||

Net realized gain on investments in securities |

482,435,941 | 542,225,458 | |||||||||

Net change in unrealized appreciation/(depreciation) on investments in securities |

(351,225,923 | ) | (1,648,305 | ) | |||||||

Net increase in net assets resulting from operations |

141,797,007 | 554,560,761 | |||||||||

Dividends and distributions declared: |

|||||||||||

Class N |

(385,882,439 | ) | (263,168,282 | )1 | |||||||

Retail Class |

(36,362,272 | ) | (22,162,196 | )2 | |||||||

Total dividends and distributions declared |

(422,244,711 | ) | (285,330,478 | ) | |||||||

Share transactions: |

|||||||||||

Proceeds from sales of shares3 |

288,574,533 | 263,771,524 | |||||||||

Net asset value of shares issued to shareholders for reinvestment of dividends and distributions |

288,266,495 | 204,685,714 | |||||||||

Proceeds from short-term redemption fees |

8,301 | 14,407 | |||||||||

Cost of shares redeemed3 |

(1,343,052,733 | ) | (1,579,605,854 | ) | |||||||

Net decrease in net assets resulting from share transactions |

(766,203,404 | ) | (1,111,134,209 | ) | |||||||

Total decrease in net assets |

(1,046,651,108 | ) | (841,903,926 | ) | |||||||

NET ASSETS: |

|||||||||||

Beginning of year |

2,739,000,012 | 3,580,903,938 | |||||||||

End of year |

$ | 1,692,348,904 | $ | 2,739,000,012 | 4 | ||||||

| 1 | For the year ended October 31, 2017, dividends and distributions declared from net investment income and from net realized gains for Class N were equal to $20,614,105 and $242,554,177, respectively. |

| 2 | For the year ended October 31, 2017, dividends and distributions declared from net investment income and from net realized gains for Retail Class were equal to $1,323,018 and $20,839,178, respectively. |

| 3 | Includes share exchanges. See Note 5 in Notes to Financial Statements. |

| 4 | Including undistributed net investment income of $12,701,945. |

The accompanying notes are an integral part of these

financial statements.

BBH CORE SELECT

FINANCIAL HIGHLIGHTS

Selected per share data and ratios for a Class N share outstanding throughout each

year.

| For the years ended October 31, |

|||||||||||||||||||||||

| 2018 |

2017 |

2016 |

2015 |

2014 |

|||||||||||||||||||

Net asset value, beginning of year |

$ | 23.18 | $ | 21.15 | $ | 22.79 | $ | 22.52 | $ | 21.21 | |||||||||||||

Income from investment operations: |

|||||||||||||||||||||||

Net investment income1 |

0.10 | 0.10 | 0.12 | 0.12 | 0.14 | ||||||||||||||||||

Net realized and unrealized gain (loss) |

1.09 | 3.64 | (0.08 | ) | 0.64 | 1.70 | |||||||||||||||||

Total income from investment operations |

1.19 | 3.74 | 0.04 | 0.76 | 1.84 | ||||||||||||||||||

Less dividends and distributions: |

|||||||||||||||||||||||

From net investment income |

(0.12 | ) | (0.13 | ) | (0.12 | ) | (0.14 | ) | (0.10 | ) | |||||||||||||

From net realized gains |

(3.39 | ) | (1.58 | ) | (1.56 | ) | (0.35 | ) | (0.43 | ) | |||||||||||||

Total dividends and distributions |

(3.51 | ) | (1.71 | ) | (1.68 | ) | (0.49 | ) | (0.53 | ) | |||||||||||||

Short-term redemption fees1,2 |

0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Net asset value, end of year |

$ | 20.86 | $ | 23.18 | $ | 21.15 | $ | 22.79 | $ | 22.52 | |||||||||||||

Total return |

5.19 | % | 18.70 | % | 0.40 | % | 3.47 | % | 8.90 | % | |||||||||||||

Ratios/Supplemental data: |

|||||||||||||||||||||||

Net assets, end of year (in millions) |

$ | 1,617 | $ | 2,592 | $ | 3,403 | $ | 4,970 | $ | 5,816 | |||||||||||||

Ratio of expenses to average net assets before reductions |

1.04 | % | 1.02 | % | 1.01 | % | 1.07 | % | 1.07 | % | |||||||||||||

Fee waiver |

0.04 | %3 | 0.02 | %3 | 0.01 | %3 | 0.07 | %3 | 0.07 | %3 | |||||||||||||

Expense offset arrangement |

0.00 | %4 | 0.00 | %4 | 0.00 | %4 | 0.00 | %4 | 0.00 | %4 | |||||||||||||

Ratio of expenses to average net assets after reductions |

1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | |||||||||||||

Ratio of net investment income to average net assets |

0.46 | % | 0.46 | % | 0.57 | % | 0.53 | % | 0.66 | % | |||||||||||||

Portfolio turnover rate |

14 | % | 15 | % | 12 | % | 8 | % | 8 | % | |||||||||||||

| 1 | Calculated using average shares outstanding for the year. |

| 2 | Less than $0.01. |

| 3 | The ratio of expenses to average net assets for the years ended October 31, 2018, 2017, 2016, 2015 and 2014, reflect fees reduced as result of a contractual operating expense limitation of the share class of 1.00%. The agreement is effective for all years presented and is effective through March 1, 2019 unless renewed by all parties to the agreement. For the years ended October 31, 2018, 2017, 2016, 2015 and 2014, the waived fees were $811,840, $673,403, $531,298, $3,938,986 and $4,238,260, respectively. |

| 4 | Less than 0.01%. |

The accompanying notes are an integral part of these

financial statements.

|

|

BBH CORE SELECT

FINANCIAL HIGHLIGHTS (continued)

Selected per share data and ratios for a Retail Class share outstanding throughout each

year.

| For the years ended October 31, |

|||||||||||||||||||||||

| 2018 |

2017 |

2016 |

2015 |

2014 |

|||||||||||||||||||

Net asset value, beginning of year |

$ | 13.51 | $ | 13.00 | $ | 14.65 | $ | 14.66 | $ | 13.99 | |||||||||||||

Income from investment operations: |

|||||||||||||||||||||||

Net investment income1 |

0.02 | 0.03 | 0.05 | 0.03 | 0.06 | ||||||||||||||||||

Net realized and unrealized gain (loss) |

0.64 | 2.16 | (0.07 | ) | 0.42 | 1.11 | |||||||||||||||||

Total income (loss) from investment operations . |

0.66 | 2.19 | (0.02 | ) | 0.45 | 1.17 | |||||||||||||||||

Less dividends and distributions: |

|||||||||||||||||||||||

From net investment income |

(0.08 | ) | (0.10 | ) | (0.07 | ) | (0.11 | ) | (0.07 | ) | |||||||||||||

From net realized gains |

(3.39 | ) | (1.58 | ) | (1.56 | ) | (0.35 | ) | (0.43 | ) | |||||||||||||

Total dividends and distributions |

(3.47 | ) | (1.68 | ) | (1.63 | ) | (0.46 | ) | (0.50 | ) | |||||||||||||

Short-term redemption fees1,2 |

0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Net asset value, end of year |

$ | 10.70 | $ | 13.51 | $ | 13.00 | $ | 14.65 | $ | 14.66 | |||||||||||||

Total return |

4.92 | % | 18.40 | % | 0.19 | % | 3.14 | % | 8.63 | % | |||||||||||||

Ratios/Supplemental data: |

|||||||||||||||||||||||

Net assets, end of year (in millions) |

$ | 75 | $ | 147 | $ | 178 | $ | 280 | $ | 400 | |||||||||||||

Ratio of expenses to average net assets before reductions |

1.32 | % | 1.33 | % | 1.33 | % | 1.39 | % | 1.40 | % | |||||||||||||

Fee waiver |

0.07 | %3 | 0.08 | %3 | 0.10 | %3 | 0.14 | %3 | 0.15 | %3 | |||||||||||||

Expense offset arrangement |

0.00 | %4 | 0.00 | %4 | 0.00 | %4 | 0.00 | %4 | 0.00 | %4 | |||||||||||||

Ratio of expenses to average net assets after reductions |

1.25 | % | 1.25 | % | 1.23 | % | 1.25 | % | 1.25 | % | |||||||||||||

Ratio of net investment income to average net assets |

0.16 | % | 0.21 | % | 0.37 | % | 0.24 | % | 0.40 | % | |||||||||||||

Portfolio turnover rate |

14 | % | 15 | % | 12 | % | 8 | % | 8 | % | |||||||||||||

| 1 | Calculated using average shares outstanding for the year. |

| 2 | Less than $0.01. |

| 3 | The ratio of expenses to average net assets for the years ended October 31, 2018, 2017, 2016, 2015 and 2014, reflect fees reduced as result of a contractual operating expense limitation of the share class of 1.25%. The agreement is effective for all years presented and is effective through March 1, 2019, unless renewed by all parties to the agreement. For the years ended October 31, 2018, 2017, 2016, 2015 and 2014, the waived fees were $70,588, $133,469, 234,959, $551,384 and $577,948, respectively. |

| 4 | Less than 0.01%. |

The accompanying notes are an integral part of these

financial statements.

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS

October 31, 2018

1. |

Organization. The Fund is a separate, non-diversified series of BBH Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust was originally organized under the laws of the State of Maryland on July 16, 1990 as BBH Fund, Inc. and re-organized as a Delaware statutory trust on June 12, 2007. The Fund commenced operations on November 2, 1998. The Fund offers Class N and Retail Class shares. Class N and Retail Class shares have different operating expenses. With the exception of class specific expenses, all expenses are allocated between classes based on net assets. Neither Class N shares nor Retail Class shares automatically convert to any other share class of the Fund. As of October 31, 2018, there were seven series of the Trust. |

2. |

Significant Accounting Policies. The Fund’s financial statements are prepared in accordance with Generally Accepted Accounting Principles in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services — Investments Companies. The following summarizes significant accounting policies of the Fund: |

A. |

Valuation of Investments. (1) The value of investments listed on a securities exchange is based on the last sale price on that exchange prior to the time when assets are valued, or in the absence of recorded sales, at the average of readily available closing bid and asked prices on such exchange; (2) securities not traded on an exchange are valued at the average of the quoted bid and asked prices in the over-the-counter market; (3) securities or other assets for which market quotations are not readily available are valued at fair value in accordance with procedures established by and under the general supervision and responsibility of the Board of Trustees (the “Board”); (4) short-term investments, which mature in 60 days or less are valued at amortized cost if their original maturity was 60 days or less, or by amortizing their value on the 61st day prior to maturity, if their original maturity when acquired by the Fund was more than 60 days, unless the use of amortized cost is determined not to represent “fair value” by the Board. |

B. |

Accounting for Investments and Income. Investment transactions are accounted for on the trade date. Realized gains and losses on investment transactions are determined based on the identified cost method. Dividend income and other distributions received from portfolio securities are recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of securities received at ex-date. Distributions received on securities that represent a return of capital are recorded as a reduction of cost of investments. Distributions received on securities that represent a capital gain are recorded as a realized gain. Interest income is accrued daily. Investment income is recorded net of any foreign taxes withheld where recovery of such tax is uncertain. |

|

|

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

C. |

Fund Expenses. Most expenses of the Trust can be directly attributed to a specific fund. Expenses which cannot be directly attributed to a fund are apportioned amongst each fund in the Trust on a net assets basis. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known. |

D. |

Repurchase Agreements. The Fund may enter into repurchase agreements. Repurchase agreements are transactions in which the Fund buys a security from a dealer or bank and agrees to sell the security back at a mutually agreed upon time and price. The repurchase price normally is in excess of the purchase price, reflecting an agreed upon interest rate. The rate is effective for the period of time that assets of the Fund are invested in the agreement and is not related to the coupon rate on the underlying security. The Fund will enter into repurchase agreements only with banks and other recognized financial institutions, such as securities dealers, deemed creditworthy by the investment adviser. The Fund’s custodian or sub-custodian will take possession of the securities subject to repurchase agreements. The investment adviser, custodian or sub-custodian will monitor the value of the underlying collateral each day to ensure that the value of the security always equals or exceeds the repurchase price. |

| Repurchase agreements are entered into by the Fund under Master Repurchase Agreements (“MRA”) which permit the Fund, under certain circumstances including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Fund. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of the MRA counterparty’s bankruptcy or insolvency. Lastly, the MRA does not preclude the Fund from selling, transferring, pledging or hypothecating the underlying collateral but no such transaction shall relieve the Fund of its obligation to transfer the collateral to the counterparty upon the latter’s repurchase of the securities. |

| The Fund’s repurchase agreements as of October 31, 2018 are shown on a gross basis and the required disclosures under Accounting Standards Update (“ASU”) 2013-01 are shown in the Portfolio of Investments. Repurchase agreements are subject to credit risks. |

E. |

Federal Income Taxes. It is the Trust’s policy to comply with the requirements of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Accordingly, no federal income tax provision is required. The Fund files a tax return annually using tax accounting methods required under provisions of the Code, which may differ from GAAP, which is the basis on which these financial statements are prepared. Accordingly, the amount of net investment income and net realized gain reported in these financial statements may differ from that reported on the Fund’s tax |

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

| return, due to certain book-to-tax timing differences such as losses deferred due to “wash sale” transactions and utilization of capital loss carryforwards. These differences may result in temporary over-distributions for financial statement purposes and are classified as distributions in excess of accumulated net realized gains or net investment income. These distributions do not constitute a return of capital. Permanent differences are reclassified between paid-in capital and retained earnings/(accumulated deficit) within the Statement of Assets and Liabilities based upon their tax classification. As such, the character of distributions to shareholders reported in the Financial Highlights table may differ from that reported to shareholders on Form 1099-DIV. |

| The Fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (“ASC 740”). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The Fund did not have any unrecognized tax benefits as of October 31, 2018, nor were there any increases or decreases in unrecognized tax benefits for the year then ended. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as an income tax expense in the Statement of Operations. During the year ended October 31, 2018, the Fund did not incur any such interest or penalties. The Fund is subject to examination by U.S. federal and state tax authorities for returns filed for the prior three year ends. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. |

F. |

Dividends and Distributions to Shareholders. Dividends and distributions from net investment income to shareholders, if any, are paid annually and are recorded on the ex-dividend date. Distributions from net capital gains, if any, are generally declared and paid annually and are recorded on the ex-dividend date. The Fund declared dividends in the amounts of $385,882,439 and $36,362,272 to Class N shares and Retail Class shareholders, respectively, during the year ended October 31, 2018. In addition, the Fund designated a portion of the payment made to redeeming shareholders as a distribution for income tax purposes. |

|

|

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

| The tax character of distributions paid during the years ended October 31, 2018 and 2017, respectively, were as follows: |

| Distributions paid

from: |

||||||||||||||||||||

| Ordinary income |

Net long-term capital gain |

Total taxable distributions |

Tax return of capital |

Total distributions paid |

||||||||||||||||

2018: |

$ | 14,349,099 | $ | 407,895,612 | $ | 422,244,711 | $ | — | $ | 422,244,711 | ||||||||||

2017: |

21,937,123 | 263,393,355 | 285,330,478 | — | 285,330,478 | |||||||||||||||

| As of October 31, 2018 and 2017, respectively, the components of retained earnings/(accumulated deficit) on a tax basis were as follows: |

| Components of retained

earnings/(accumulated deficit): |

||||||||||||||||||||||||||||||||

| Undistributed ordinary income |

Undistributed long-term capital gain |

Retained earnings/ (accumulated deficit) |

Accumulated capital and other losses |

Other book/tax temporary differences |

Book unrealized appreciation/ (depreciation) |

Total retained earnings/ (accumulated deficit) |

||||||||||||||||||||||||||

2018: |

$ | 4,937,659 | $ | 357,964,713 | $ | 362,902,372 | $ | — | $ | 1,307,347 | $ | 652,392,105 | $ | 1,016,601,824 | ||||||||||||||||||

2017: |

12,701,945 | 407,895,164 | 420,597,109 | — | (390,289 | ) | 1,003,618,028 | 1,423,824,848 | ||||||||||||||||||||||||

| The Fund did not have a net capital loss carryforward at October 31, 2018. |

| The Fund is permitted to carryforward capital losses for an unlimited period and they will retain their character as either short-term or long-term capital losses rather than being considered all short-term capital losses. |

| Total distributions paid may differ from amounts reported in the Statements of Changes in Net Assets because, for tax purposes, dividends are recognized when actually paid. |

| The differences between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax deferral of losses on wash sales. |

| To the extent future capital gains are offset by capital loss carryforwards, if any, such gains will not be distributed. |

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

G. |

Use of Estimates. The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increase and decrease in net assets from operations during the reporting period. Actual results could differ from these estimates. |

3. |

Fees and Other Transactions with Affiliates. |

A. |

Investment Advisory and Administrative Fees. Under a combined Investment Advisory and Administrative Services Agreement (“Agreement”) with the Trust, Brown Brothers Harriman & Co. (“BBH”) through a separately identifiable department (“SID” or “Investment Adviser”) provides investment advisory, portfolio management and administrative services to the Fund. The Fund pays a combined fee for investment advisory and administrative services calculated daily and paid monthly at an annual rate equivalent to 0.80% per annum on the first $3 billion of the Fund’s average daily net assets and 0.75% per annum on the Fund’s average daily net assets over $3 billion. For the year ended October 31, 2018, the Fund incurred $18,853,849 under the Agreement. |

B. |

Investment Advisory and Administrative Fee Waivers. Effective July 14, 2010, the Investment Adviser contractually agreed to limit the annual fund operating expenses (excluding interest, taxes, brokerage commissions, other expenditures that are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business and for Retail Class, amounts payable pursuant to any plan adopted in accordance with Rule 12b-1) of Class N and Retail Class to 1.00%. The agreement will terminate on March 1, 2019, unless it is renewed by all parties to the agreement. The agreement may only be terminated during its term with approval of the Fund’s Board of Trustees. For the year ended October 31, 2018, the Investment Adviser waived fees in the amount of $811,840 and $70,588 for Class N and Retail Class, respectively. |

C. |

Shareholder Servicing Fees. The Trust has a shareholder servicing agreement with BBH. BBH receives a fee from the Fund calculated daily and paid monthly at an annual rate of 0.20% of Class N and Retail Class shares’ average daily net assets. For the year ended October 31, 2018, the Fund incurred shareholder servicing fees in the amount of $4,504,891 and $208,571 for Class N and Retail Class, respectively. |

D. |

Distribution (12b-1) Fees. The Fund has adopted a distribution plan pursuant to Rule 12b-1 for Retail Class shares that allows the Fund to pay distribution and other fees for the sale of its shares and for distribution-related services provided to shareholders. Because these fees are paid out of the Fund’s assets continuously, over time these fees will increase the cost of investment in Retail Class shares and may cost the Retail Class shareholder more than paying other types of sales |

|

|

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

| charges. The maximum annual distribution fee for Retail Class shares is 0.25% of the average daily net assets of the Retail Class shares of the Fund. With this agreement along with the investment advisory and waiver agreements above, it is anticipated that total operating expenses for Retail Class shares will be no greater than 1.25% of the average daily net assets. For the year ended October 31, 2018, Retail Class shares of the Fund incurred $223,331 for Distribution (12b-1) Fees. This amount is presented under line item “Distribution fees” in the Statement of Operations. |

E. |

Custody and Fund Accounting Fees. BBH acts as a custodian and fund accountant and receives custody and fund accounting fees from the Fund calculated daily and incurred monthly. BBH holds all of the Fund’s cash and investments and calculates the Fund’s daily net asset value. The custody fee is an asset and transaction-based fee. The fund accounting fee is an asset-based fee calculated at 0.004% of the Fund’s net asset value. For the year ended October 31, 2018, the Fund incurred $151,013 in custody and fund accounting fees. These fees for the Fund were reduced by $36,384 as a result of an expense offset arrangement with the Fund’s custodian. The credit amount (if any) is disclosed in the Statement of Operations as a reduction to the Fund’s expenses. In the event that the Fund is overdrawn, under the custody agreement with BBH, BBH will make overnight loans to the Fund to cover overdrafts. Pursuant to their agreement, the Fund will pay the Federal Funds overnight investment rate on the day of the overdraft. The total interest incurred by the Fund for the year ended October 31, 2018, was $425. This amount is included under line item “Custody and fund accounting fees” in the Statement of Operations. |

F. |

Board of Trustees’ Fees. Each Trustee who is not an “interested person” as defined under the 1940 Act receives an annual fee as well as reimbursement for reasonable out-of-pocket expenses from the Fund. For the year ended October 31, 2018, the Fund incurred $52,963 in independent Trustee compensation and expense reimbursements. |

G. |

Officers of the Trust. Certain officers of the Trust are also employees of BBH. Such officers are paid no fees by the Trust for their services to the Trust. |

4. |

Investment Transactions. For the year ended October 31, 2018, the cost of purchases and the proceeds of sales of investment securities, other than short-term investments, were $296,194,284 and $1,344,763,297, respectively. |

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

5. |

Shares of Beneficial Interest. The Trust is permitted to issue an unlimited number of Class N and Retail Class shares of beneficial interest at no par value. Transactions in Class N and Retail Class shares were as follows: |

| For the year ended October 31, 2018 |

For the year ended October 31, 2017 |

||||||||||||||||||

| Shares |

Dollars |

Shares |

Dollars |

||||||||||||||||

Class N |

|||||||||||||||||||

Shares sold |

13,148,212 | $ | 277,541,062 | 11,338,201 | $ | 246,670,938 | |||||||||||||

Shares issued in connection with reinvestments of dividends |

12,123,335 | 252,165,359 | 8,861,662 | 182,638,860 | |||||||||||||||

Proceeds from short-term redemption fees |

N/A | 7,891 | N/A | 13,587 | |||||||||||||||

Shares redeemed |

(59,598,540 | ) | (1,252,582,575 | ) | (69,301,288 | ) | (1,503,377,696 | ) | |||||||||||

Net decrease |

(34,326,993 | ) | $ | (722,868,263 | ) | (49,101,425 | ) | $ | (1,074,054,311 | ) | |||||||||

Retail Class |

|||||||||||||||||||

Shares sold |

992,349 | $ | 11,033,471 | 1,334,628 | $ | 17,100,586 | |||||||||||||

Shares issued in connection with reinvestments of dividends |

3,373,938 | 36,101,136 | 1,831,134 | 22,046,854 | |||||||||||||||

Proceeds from short-term redemption fees |

N/A | 410 | N/A | 820 | |||||||||||||||

Shares redeemed |

(8,212,773 | ) | (90,470,158 | ) | (5,942,387 | ) | (76,228,158 | ) | |||||||||||

Net decrease |

(3,846,486 | ) | $ | (43,335,141 | ) | (2,776,625 | ) | $ | (37,079,898 | ) | |||||||||

|

|

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

6. |

Principal Risk Factors and Indemnifications. |

A. |

Principal Risk Factors. Investing in the Fund may involve certain risks, as discussed in the Fund’s prospectus, including but not limited to, those described below: |

| A shareholder may lose money by investing in the Fund (investment risk). The Fund is actively managed and the decisions by the Investment Adviser may cause the Fund to incur losses or miss profit opportunities (management risk). Price movements may occur due to factors affecting individual companies, such as the issuance of an unfavorable earnings report, or other events affecting particular industries or the equity market as a whole (equity securities risk). The value of securities held by the Fund may fall due to changing economic, political, regulatory or market conditions, or due to a company’s or issuer’s individual situation (market risk). In the normal course of business, the Fund invests in securities and enters into transactions where risks exist due to assumption of large positions in securities of a small number of issuers (non-diversification risk). There are certain risks associated with investing in foreign securities not present in domestic investments, including, but not limited to, recovery of tax withheld by foreign jurisdictions (foreign investment risk). The Fund’s shareholders may be adversely impacted by asset allocation decisions made by an investment adviser whose discretionary clients make up a large percentage of the Fund’s shareholders (shareholder concentration risk). The extent of the Fund’s exposure to these risks in respect to these financial assets is included in their value as recorded in the Fund’s Statement of Assets and Liabilities. |

| Please refer to the Fund’s prospectus for a complete description of the principal risks of investing in the Fund. |

B. |

Indemnifications. Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund, and shareholders are indemnified against personal liability for the obligations of the Trust. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote. |

7. |

Recent Pronouncements. |

A. |

ASU 2018-13. On August 28, 2018, the Financial Accounting Standards Board issued an Accounting Standards Update, ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework —Changes to the Disclosure Requirements for Fair Value Measurement (the “ASU 2018-13”). |

BBH CORE SELECT

NOTES TO FINANCIAL STATEMENTS (continued)

October 31, 2018

| ASU 2018-13 modifies the disclosure objective paragraphs of Accounting Standards Codification 820 to eliminate (1) “at a minimum” from the phrase “an entity shall disclose at a minimum” and (2) other similar “open ended” disclosure requirements to promote the appropriate exercise of discretion by entities. ASU 2018-13 also eliminates and modifies other requirements under ASU 2018-13. ASU 2018-13 is effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early application is permitted. Management does not expect the application of ASU 2018-13 will have material impact on the Fund’s financial statements. |

B. |

Regulation S-X. In October 2018, the U.S. Securities and Exchange Commission adopted amendments to certain disclosure requirements that had become “redundant, duplicative, overlapping, outdated or superseded, in light of the other Commission disclosure requirements, U.S. GAAP or changes in the information environment”. The compliance date for the amendments to Regulation S-X is November 5, 2018 (for reporting period end dates of September 30, 2018 and after). |

| The Fund’s financial statements were prepared in compliance with the new amendments to Regulation S-X. |

8. |

Subsequent Events. Management has evaluated events and transactions that have occurred since October 31, 2018 through the date the financial statements were issued and determined that there were none that would require recognition or additional disclosure in the financial statements. |

|

|

BBH CORE SELECT

DISCLOSURE OF FUND EXPENSES

October 31, 2018 (unaudited)

BBH CORE SELECT

DISCLOSURE OF FUND EXPENSES (continued)

October 31, 2018 (unaudited)

| Beginning Account Value May 1, 2018 |

Ending Account Value October 31, 2018 |

Expenses Paid During Period May 1, 2018 to October 31, 20181 |

||||||||||||

Class N |

||||||||||||||

Actual |

$ | 1,000 | $ | 1,044 | $ | 5.15 | ||||||||

Hypothetical2 |

$ | 1,000 | $ | 1,020 | $ | 5.09 | ||||||||

| Beginning Account Value May 1, 2018 |

Ending Account Value October 31, 2018 |

Expenses Paid During Period May 1, 2018 to October 31, 20181 |

||||||||||||

Retail Class |

||||||||||||||

Actual |

$ | 1,000 | $ | 1,042 | $ | 6.43 | ||||||||

Hypothetical2 |

$ | 1,000 | $ | 1,019 | $ | 6.36 | ||||||||

| 1 | Expenses are equal to the Fund’s annualized expense ratio of 1.00% and 1.25% for Class N and Retail Class shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| 2 | Assumes a return of 5% before expenses. For the purposes of the calculation, the applicable annualized expense ratio for each class of shares is subtracted from the assumed return before expenses. |

|

|

BBH CORE SELECT

CONFLICTS OF INTEREST

October 31, 2018 (unaudited)

BBH CORE SELECT

CONFLICTS OF INTEREST (continued)

October 31, 2018 (unaudited)

|

|

BBH CORE SELECT

CONFLICTS OF INTEREST (continued)

October 31, 2018 (unaudited)

servicing and fund accounting services to the Fund. BBH

may have conflicting duties of loyalty while servicing the Fund and/or opportunities to further its own interest to the detriment of the Fund. For

example, in negotiating fee arrangements with affiliated service providers, BBH may have an incentive to agree to higher fees than it would in the case

of unaffiliated service providers. BBH acting in its capacity as the Fund’s administrator is the primary valuation agent of the Fund. BBH values

securities and assets in the Fund according to the Fund’s valuation policies. Because the Investment Adviser’s advisory and

administrative fees are calculated by reference to the Fund’s net assets, BBH and its affiliates may have an incentive to seek to overvalue

certain assets.

BBH CORE SELECT

CONFLICTS OF INTEREST (continued)

October 31, 2018 (unaudited)

not provide such services. The Investment Adviser will

determine in good faith whether the amount of commission is reasonable in relation to the value of research and services provided and whether the

services provide lawful and appropriate assistance in its investment decision-making responsibilities.

|

|

BBH CORE SELECT

CONFLICTS OF INTEREST (continued)

October 31, 2018 (unaudited)

BBH CORE SELECT

CONFLICTS OF INTEREST (continued)

October 31, 2018 (unaudited)

|

|

BBH CORE SELECT

ADDITIONAL FEDERAL TAX INFORMATION

October 31, 2018 (unaudited)

TRUSTEES AND OFFICERS OF BBH CORE SELECT

(unaudited)

| Name and Birth Year |

|

Position(s) Held with the Trust |

|

Term of Office and Length of Time Served# |

|

Principal Occupation(s) During Past 5 Years |

|

Number of Portfolios in Fund Complex Overseen by Trusteeˆ |

|

Other Public Company or Investment Company Directorships held by Trustee During Past 5 Years |

Independent Trustees |

||||||||||

H.

Whitney Wagner Birth Year: 1956 |

Chairman of the Board and Trustee |

Chairman Since 2014; Trustee Since 2007 and 2006-2007 with the Predecessor Trust |

President, Clear Brook Advisors, a registered investment adviser. |

7 |

None. |

|||||

Andrew S. Frazier Birth Year: 1948 |

Trustee |

Since 2010 |

Retired. |

7 |

Director of Western World Insurance Group, Inc. |

|||||

Mark M. Collins Birth Year: 1956 |

Trustee |

Since 2011 |

Partner of Brown Investment Advisory Incorporated, a registered investment adviser. |

7 |

Chairman of Dillon Trust Company. |

|||||

John M. Tesoro Birth Year: 1952 |

Trustee |

Since 2014 |

Retired. |

7 |

Trustee, Bridge Builder Trust (8 Funds); Director of Teton Advisors, Inc. (a registered investment adviser). |

|||||

|

|

TRUSTEES AND OFFICERS OF BBH CORE SELECT

(unaudited)

| Name, Address and Birth Year |

|

Position(s) Held with the Trust |

|

Term of Office and Length of Time Served# |

|

Principal Occupation(s) During Past 5 Years |

|

Number of Portfolios in Fund Complex Overseen by Trusteeˆ |

|

Other Public Company or Investment Company Directorships held by Trustee During Past 5 Years |

Interested Trustees |

||||||||||

Susan C. Livingston+ 50 Post Office Square Boston, MA 02110 Birth Year: 1957 |

Trustee |

Since 2011 |

Partner (since 1998) and Senior Client Advocate (since 2010) for BBH&Co.; Director of BBH Luxembourg S.C.A. (since 1992). |

7 |

None. |

|||||

John A. Gehret+ 140 Broadway New York, NY 10005 Birth Year: 1959 |

Trustee |

Since 2011 |

Limited Partner of BBH&Co. (2012- present); Director of BBH Luxembourg Funds (since 2012); Director of BBH Trust Company (Cayman) Ltd. (since

2012). |

7 |

None. |

|||||

TRUSTEES AND OFFICERS OF BBH CORE SELECT

(unaudited)

| Name, Address and Birth Year |

|

Position(s) Held with the Trust |

|

Term of Office and Length of Time Served# |

|

Principal Occupation(s) During Past 5

Years |

Officers |

||||||

Jean-Pierre Paquin 140 Broadway New York, NY 10005 Birth Year: 1973 |

President and Principal Executive Officer |

Since 2016 |

Partner of BBH&Co. since 2015; joined BBH&Co. in 1996. |

|||

Daniel Greifenkamp 140 Broadway New York, NY 10005 Birth Year: 1969 |

Vice

President |

Since 2016 |

Managing Director of BBH&Co. since 2014; joined BBH&Co. in 2011. |

|||

Charles H. Schreiber 140 Broadway New York, NY 10005 Birth Year: 1957 |

Treasurer and Principal Financial Officer |

Since 2007 2006-2007 with the Predecessor Trust |

Senior Vice President of BBH&Co. since 2001; joined BBH&Co. in 1999. |

|||

Paul F. Gallagher 140 Broadway New York, NY 10005 Birth Year: 1959 |

Chief Compliance Officer (“CCO”) |

Since 2015 |

Senior Vice President of BBH&Co. since September 2015; Executive Director, Counsel, Morgan Stanley Smith Barney LLC (2009-September

2015). |

|||

Keith M. Kelley 50 Post Office Square Boston, MA 02110 Birth Year: 1983 |

Anti-Money Laundering Officer (“AMLO”) |

Since 2016 |

Vice

President of BBH&Co. since February 2016; joined BBH&Co. in 2016; Director, Legal and Compliance, Morgan Stanley Smith Barney LLC

(2014-February 2016); Compliance Manager, State Street Corporation (2013-2014). |

|

|

TRUSTEES AND OFFICERS OF BBH CORE SELECT

(unaudited)

| Name, Address and Birth Year |

|

Position(s) Held with the Trust |

|

Term of Office and Length of Time Served# |

|

Principal Occupation(s) During Past 5

Years |

Suzan M. Barron 50 Post Office Square Boston, MA 02110 Birth Year: 1964 |

Secretary |

Since 2009 |

Senior Vice President and Senior Investor Services Counsel, BBH&Co. since 2005. |

|||

Crystal Cheung 140 Broadway New York, NY 10005 Birth Year: 1974 |

Assistant Treasurer |

Since 2018 |

Assistant Vice President of BBH&Co. since 2016; joined BBH&Co. in 2014; Financial Reporting Manager, BNY Mellon Corporation

(2010-2014). |

|||

Brian J. Carroll 50 Post Office Square Boston, MA 02110 Birth Year: 1985 |

Assistant Secretary |

Since 2018 |

Associate and Investor Services Assistant Counsel of BBH&Co. since 2017; joined BBH&Co. in 2014. |

# |

All officers of the Trust hold office for one year and until their respective successors are chosen and qualified (subject to the ability of the Trustees to remove any officer in accordance with the Trust’s By-laws). Mr. Wagner previously served on the Board of Trustees of the Predecessor Trust. |

+ |

Ms. Livingston and Mr. Gehret are “interested persons” of the Trust as defined in the 1940 Act because of their positions as Partner and Limited Partner of BBH&Co., respectively. |

ˆ |

The Fund Complex consists of the Trust, which has seven series, and each is counted as one “Portfolio” for purposes of this table. |

Administrator Brown Brothers Harriman & Co. 140 Broadway New York, NY 10005 Distributor ALPS Distributors, Inc. 1290 Broadway, Suite 1100 Denver, CO 80203 Shareholder Servicing Agent Brown Brothers Harriman & Co. 140 Broadway New York, NY 10005 1-800-575-1265 |

Investment Adviser Brown Brothers Harriman Mutual Fund Advisory Department 140 Broadway New York, NY 10005 |

|||||

By telephone: |

Call

1-800-575-1265 |

|||||

By E-mail send your request to: |

bbhfunds@bbh.com |

|||||

On the internet: |

www.bbhfunds.com |

|||||

BBH GLOBAL CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

October 31, 2018

BBH GLOBAL CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

|

|

BBH GLOBAL CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

total loss frequencies. The barriers to entry are high and the industry exhibits defensive characteristics as accident frequency, vehicle value, and probability of total loss are less correlated to economic cycles.

BBH GLOBAL CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

essential service to two-sided network of fragmented counterparties enabling commercial customers to manage fuel, lodging, tolls, and corporate payments while driving traffic to fuel, lodging, and other transport service providers. Management is executing well and has a strong capital allocation track record with a demonstrated ability to improve the operating performance of acquired businesses.

|

|

BBH GLOBAL CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

investment given i) the composition and quality of its listed and non-listed assets, ii) the Company’s adherence to investment criteria that are well-aligned with our own, and iii) the significant discount to NAV at which the shares currently trade.

BBH GLOBAL CORE SELECT

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued)

October 31, 2018

|

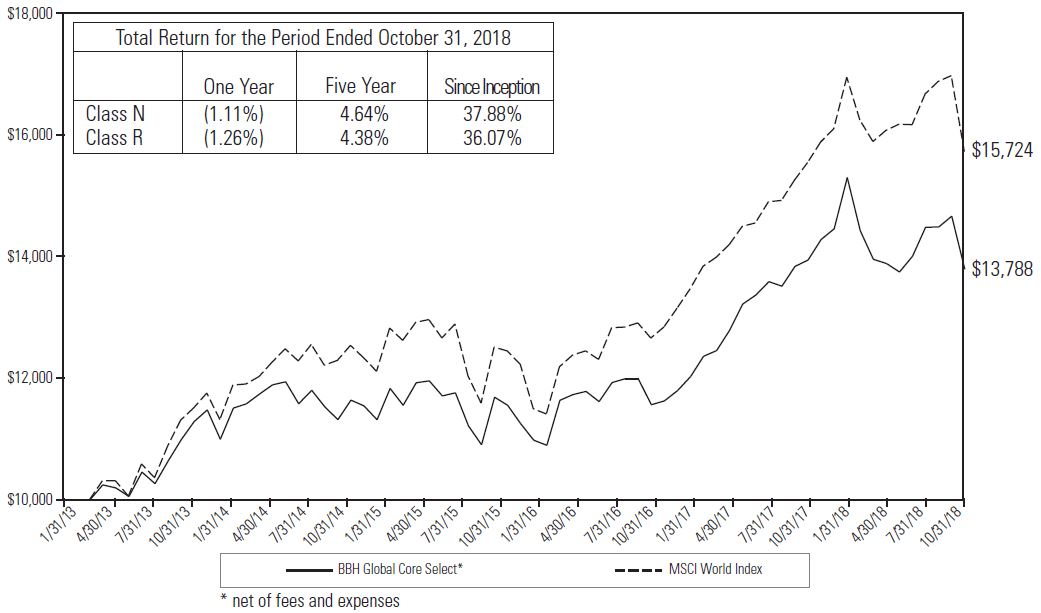

| 1 | The Fund’s performance assumes the reinvestment of all dividends and distributions. The MSCI World Index has been adjusted to reflect reinvestment of dividends on securities. The MSCI World Index is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged. Investments cannot be made in an index. |

|

|

BBH GLOBAL CORE SELECT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BBH GLOBAL CORE SELECT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (continued)

evaluating the accounting principles used and

significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our

procedures included confirmation of securities owned as of October 31, 2018, by correspondence with the custodian and brokers. We believe that our

audits provide a reasonable basis for our opinion.

|

December 21,

2018

|

|

BBH GLOBAL CORE SELECT

PORTFOLIO ALLOCATION

October 31, 2018

| U.S. $ Value |

Percent of Net Assets |

|||||||||

Common Stock: |

||||||||||

Belgium |

$ | 3,621,964 | 4.1 | % | ||||||

Canada |

4,887,659 | 5.6 | ||||||||

France |

7,466,751 | 8.5 | ||||||||

Germany |

4,541,364 | 5.2 | ||||||||

Ireland |

5,464,687 | 6.2 | ||||||||

Italy |

2,646,774 | 3.0 | ||||||||

Netherlands |

3,259,068 | 3.7 | ||||||||

Switzerland |

5,219,824 | 5.9 | ||||||||

United Kingdom |

12,416,492 | 14.1 | ||||||||

United States |

34,776,523 | 39.5 | ||||||||

Repurchase Agreements |

1,000,000 | 1.1 | ||||||||

Cash and Other Assets in Excess of Liabilities |

2,731,742 | 3.1 | ||||||||

NET ASSETS |

$ | 88,032,848 | 100.0 | % | ||||||

| U.S. $ Value |

Percent of Net Assets |

|||||||||

Common Stock: |

||||||||||

Basic Materials |

$ | 7,361,108 | 8.4 | % | ||||||

Communications |

11,434,157 | 13.0 | ||||||||

Consumer Cyclical |

7,977,716 | 9.1 | ||||||||

Consumer Non-Cyclical |

33,844,986 | 38.4 | ||||||||

Financials |

15,854,495 | 18.0 | ||||||||

Technology |

7,828,644 | 8.9 | ||||||||

Repurchase Agreements |

1,000,000 | 1.1 | ||||||||

Cash and Other Assets in Excess of Liabilities |

2,731,742 | 3.1 | ||||||||

NET ASSETS |

$ | 88,032,848 | 100.0 | % | ||||||

The accompanying notes are an integral

part of these financial statements.

BBH GLOBAL CORE SELECT

PORTFOLIO OF INVESTMENTS

October 31, 2018

| Shares |

Value |

|||||||||

COMMON STOCK (95.8%) |

||||||||||

BELGIUM (4.1%) |

||||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 25,275 | Anheuser-Busch InBev S.A. NV |

$ | 1,863,259 | |||||||

FINANCIALS |

||||||||||

| 25,530 | KBC Group NV |

1,758,705 | ||||||||

Total Belgium |

3,621,964 | |||||||||

CANADA (5.6%) |

||||||||||

CONSUMER CYCLICAL |

||||||||||

| 78,245 | Alimentation Couche-Tard, Inc. (Class B) |

3,746,868 | ||||||||

FINANCIALS |

||||||||||

| 14,400 | Intact Financial Corp. |

1,140,791 | ||||||||

Total Canada |

4,887,659 | |||||||||

FRANCE (8.5%) |

||||||||||

COMMUNICATIONS |

||||||||||

| 60,840 | JCDecaux S.A. |

2,002,365 | ||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 26,070 | Sanofi |

2,331,184 | ||||||||

FINANCIALS |

||||||||||

| 24,160 | Wendel S.A. |

3,133,202 | ||||||||

Total France |

7,466,751 | |||||||||

GERMANY (5.2%) |

||||||||||

BASIC MATERIALS |

||||||||||

| 20,975 | Brenntag AG |

1,097,143 | ||||||||

| 27,450 | Fuchs Petrolub SE |

1,190,316 | ||||||||

| 2,287,459 | ||||||||||

FINANCIALS |

||||||||||

| 17,790 | Deutsche Boerse AG |

2,253,905 | ||||||||

Total Germany |

4,541,364 | |||||||||

IRELAND (6.2%) |

||||||||||

BASIC MATERIALS |

||||||||||

| 17,460 | Linde, Plc.1 |

2,889,106 | ||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 36,637 | Perrigo Co., Plc. |

2,575,581 | ||||||||

Total Ireland |

5,464,687 | |||||||||

The accompanying notes are an integral

part of these financial statements.

|

|

BBH GLOBAL CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

| Shares |

Value | |||||||||

COMMON STOCK (continued) |

||||||||||

ITALY (3.0%) |

||||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 344,175 | Davide Campari-Milano SpA |

$ | 2,646,774 | |||||||

Total Italy |

2,646,774 | |||||||||

NETHERLANDS (3.7%) |

||||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 15,650 | Heineken Holding NV |

1,355,872 | ||||||||

| 35,335 | Unilever NV |

1,903,196 | ||||||||

Total Netherlands |

3,259,068 | |||||||||

SWITZERLAND (5.9%) |

||||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 19,330 | Nestle S.A. |

1,632,290 | ||||||||

| 41,031 | Novartis AG |

3,587,534 | ||||||||

Total Switzerland |

5,219,824 | |||||||||

UNITED KINGDOM (14.1%) |

||||||||||

COMMUNICATIONS |

||||||||||

| 72,554 | Liberty Global, Plc. (Class C)1 |

1,816,752 | ||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 112,225 | Diageo, Plc. |

3,880,329 | ||||||||

| 40,265 | Reckitt Benckiser Group, Plc. |

3,254,754 | ||||||||

| 7,135,083 | ||||||||||

FINANCIALS |

||||||||||

| 4,740,525 | Lloyds Banking Group, Plc. |

3,464,657 | ||||||||

Total United Kingdom |

12,416,492 | |||||||||

UNITED STATES (39.5%) |

||||||||||

BASIC MATERIALS |

||||||||||

| 22,535 | Celanese Corp. (Series A) |

2,184,543 | ||||||||

COMMUNICATIONS |

||||||||||

| 4,658 | Alphabet, Inc. (Class C)1 |

5,015,595 | ||||||||

| 88,688 | Discovery, Inc. (Class C)1 |

2,599,445 | ||||||||

| 7,615,040 | ||||||||||

CONSUMER CYCLICAL |

||||||||||

| 42,930 | Copart, Inc.1 |

2,099,706 | ||||||||

| 97,135 | Qurate Retail, Inc. (Class A)1 |

2,131,142 | ||||||||

| 4,230,848 | ||||||||||

The accompanying notes are an integral

part of these financial statements.

BBH GLOBAL CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

| Shares |

Value | |||||||||

COMMON STOCK (continued) |

||||||||||

UNITED STATES (continued) |

||||||||||

CONSUMER NON-CYCLICAL |

||||||||||

| 18,335 | FleetCor Technologies, Inc.1 |

$ | 3,667,550 | |||||||

| 24,640 | PayPal Holdings, Inc.1 |

2,074,441 | ||||||||

| 34,079 | Zoetis, Inc. (Class A) |

3,072,222 | ||||||||

| 8,814,213 | ||||||||||

FINANCIALS |

||||||||||

| 77,085 | Wells Fargo & Co. |

4,103,235 | ||||||||

TECHNOLOGY |

||||||||||

| 109,180 | Oracle Corp. |

5,332,351 | ||||||||

| 39,693 | QUALCOMM, Inc. |

2,496,293 | ||||||||

| 7,828,644 | ||||||||||

Total United States |

34,776,523 | |||||||||

Total Common Stock (Identified cost $68,228,874) |

84,301,106 | |||||||||

| Principal Amount |

Maturity Date |

Interest Rate |

Value |

|||||||||||||

REPURCHASE AGREEMENTS (1.1%) |

||||||||||||||||

| $1,000,000 | National Australia Bank, Ltd. (Agreement dated 10/31/18 collateralized by U.S. Treasury Note 2.625%, due 07/31/20, original par $1,020,000, valued at $1,020,000) |

11/01/18 | 2.170 | % | $ | 1,000,000 | ||||||||||

Total Repurchase Agreements (Identified cost $1,000,000) |

1,000,000 | |||||||||||||||

| TOTAL INVESTMENTS (Identified cost $69,228,874)2 | 96.9 | % | $ | 85,301,106 | |||

| CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES | 3.1 | % | 2,731,742 | ||||

| NET ASSETS | 100.0 | % | $ | 88,032,848 |

| 1 | Non-income producing security. |

| 2 | The aggregate cost for federal income tax purposes is $69,581,543, the aggregate gross unrealized appreciation is $20,583,170 and the aggregate gross unrealized depreciation is $4,863,607, resulting in net unrealized appreciation of $15,719,563. |

The accompanying notes are an integral

part of these financial statements.

|

|

BBH GLOBAL CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

— |

Level 1 – unadjusted quoted prices in active markets for identical assets and liabilities. |

— |

Level 2 – significant other observable inputs (including quoted prices for similar assets and liabilities, interest rates, prepayment speeds, credit risk, etc.). |

— |

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of assets and liabilities). |

The accompanying notes are an integral

part of these financial statements.

BBH GLOBAL CORE SELECT

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2018

| Investments, at value |

Unadjusted Quoted Prices in Active Markets for Identical Investments (Level 1)* |

Significant Other Observable Inputs (Level 2)* |

Significant Unobservable Inputs (Level 3)* |

Balance as of October 31, 2018 |

||||||||||||||

Common Stock: |

||||||||||||||||||

Basic Materials |

$ | 5,073,649 | $ | 2,287,459 | $ | — | $ | 7,361,108 | ||||||||||

Communications |

9,431,792 | 2,002,365 | — | 11,434,157 | ||||||||||||||

Consumer Cyclical |

7,977,716 | — | — | 7,977,716 | ||||||||||||||

Consumer Non-Cyclical |

11,389,794 | 22,455,192 | — | 33,844,986 | ||||||||||||||

Financials |

5,244,026 | 10,610,469 | — | 15,854,495 | ||||||||||||||

Technology |

7,828,644 | — | — | 7,828,644 | ||||||||||||||

Repurchase Agreements |

— | 1,000,000 | — | 1,000,000 | ||||||||||||||

Investments, at value |

$ | 46,945,621 | $ | 38,355,485 | $ | — | $ | 85,301,106 | ||||||||||

* |

The Fund’s policy is to disclose transfers between levels based on valuations at the end of the reporting period. There were no transfers between Levels 1, 2 or 3 during the period ended October 31, 2018. |

The accompanying notes are an integral

part of these financial statements.

|

|

BBH GLOBAL CORE SELECT

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2018

ASSETS: |

||||||

Investments in securities, at value (Identified cost $68,228,874) |

$ | 84,301,106 | ||||

Repurchase agreements (Identified cost $1,000,000) |

1,000,000 | |||||

Cash |

1,863,614 | |||||

Foreign currency at value (Identified cost $17) |

17 | |||||

Receivables for: |

||||||

Investments sold |

898,626 | |||||

Dividends |

175,127 | |||||

Investment advisory and administrative fee waiver reimbursement |

2,258 | |||||

Interest |

60 | |||||

Prepaid assets |

786 | |||||

Total Assets |

88,241,594 | |||||

LIABILITIES: |

||||||

Payables for: |

||||||

Investment advisory and administrative fees |

84,740 | |||||

Professional fees |

60,625 | |||||

Shares redeemed |

31,000 | |||||

Shareholder servicing fees |

17,840 | |||||

Transfer agent fees |

2,963 | |||||

Custody and fund accounting fees |

1,833 | |||||

Distribution fees |

736 | |||||

Board of Trustees’ fees |

260 | |||||

Accrued expenses and other liabilities |

8,749 | |||||

Total Liabilities |

208,746 | |||||

NET ASSETS |

$ | 88,032,848 | ||||

Net Assets Consist of: |

||||||

Paid-in capital |

$ | 63,412,557 | ||||

Retained earnings |

24,620,291 | |||||

Net Assets |

$ | 88,032,848 |

NET ASSET VALUE AND OFFERING PRICE PER SHARE |

||||||

CLASS N SHARES |

||||||

($86,271,951 ÷ 6,696,074 shares outstanding) |

$12.88 | |||||

RETAIL CLASS SHARES |

||||||

($1,760,897 ÷ 137,457 shares outstanding) |

$12.81 | |||||

The accompanying notes are an integral

part of these financial statements.

BBH GLOBAL CORE SELECT

STATEMENT OF OPERATIONS

For the year ended October 31, 2018

NET INVESTMENT INCOME: |

||||||

Income: |

||||||

Dividends (net of foreign withholding taxes of $147,811) |

$ | 2,140,359 | ||||

Interest income |

130,257 | |||||

Total Income |

2,270,616 | |||||

Expenses: |

||||||

Investment advisory and administrative fees |

1,218,552 | |||||

Shareholder servicing fees |

256,537 | |||||

Professional fees |

72,351 | |||||

Board of Trustees’ fees |

52,965 | |||||

Custody and fund accounting fees |

37,824 | |||||

Transfer agent fees |

36,623 | |||||

Distribution fees |

5,554 | |||||

Miscellaneous expenses |

66,724 | |||||

Total Expenses |

1,747,130 | |||||

Investment advisory and administrative fee waiver |

(102,348 | ) | ||||

Expense offset arrangement |

(36,641 | ) | ||||

Net Expenses |

1,608,141 |

|||||

Net Investment Income |

662,475 | |||||

NET REALIZED AND UNREALIZED LOSS: |

||||||

Net realized gain on investments in securities |

10,977,412 | |||||

Net realized loss on foreign exchange transactions and translations |

(82,598 | ) | ||||

Net realized gain on investments in securities and foreign exchange transactions and translations |

10,894,814 | |||||

Net change in unrealized appreciation/(depreciation) on investments in securities |

(12,271,683 | ) | ||||

Net change in unrealized appreciation/(depreciation) on foreign currency translations |

(5,932 | ) | ||||

Net change in unrealized appreciation/(depreciation) on investments in securities and foreign currency translations |

(12,277,615 | ) | ||||

Net Realized and Unrealized Loss |

(1,382,801 | ) | ||||

Net Decrease in Net Assets Resulting from Operations |

$ | (720,326 | ) |

The accompanying notes are an integral

part of these financial statements.

|

|

BBH GLOBAL CORE SELECT

STATEMENTS OF CHANGES IN NET ASSETS

| For the years ended October 31, |

|||||||||||

| 2018 |

2017 |

||||||||||

INCREASE (DECREASE) IN NET ASSETS: |

|||||||||||

Operations: |

|||||||||||

Net investment income |

$ | 662,475 | $ | 531,369 | |||||||

Net realized gain on investments in securities and foreign exchange transactions and translations |

10,894,814 | 2,885,323 | |||||||||

Net change in unrealized appreciation/(depreciation) on investments in securities and foreign currency translations |

(12,277,615 | ) | 19,192,714 | ||||||||

Net increase (decrease) in net assets resulting from operations |

(720,326 | ) | 22,609,406 | ||||||||

Dividends and distributions declared: |

|||||||||||

Class N |

(2,954,827 | ) | (593,082 | )1 | |||||||

Retail Class |

(80,202 | ) | (10,877 | )1 | |||||||

Total dividends and distributions declared |

(3,035,029 | ) | (603,959 | ) | |||||||

Share transactions: |

|||||||||||

Proceeds from sales of shares |

13,323,466 | 10,904,266 | |||||||||

Net asset value of shares issued to shareholders for reinvestment of dividends and distributions |

2,381,377 | 480,926 | |||||||||

Cost of shares redeemed |

(58,271,914 | ) | (11,071,494 | ) | |||||||

Net increase (decrease) in net assets resulting from share transactions |

(42,567,071 | ) | 313,698 | ||||||||

Total increase (decrease) in net assets |

(46,322,426 | ) | 22,319,145 | ||||||||

NET ASSETS: |

|||||||||||

Beginning of year |

134,355,274 | 112,036,129 | |||||||||

End of year |

$ | 88,032,848 | $ | 134,355,274 | 2 | ||||||

| 1 | For the year ended October 31, 2017, dividends and distributions declared were only from net investment income for Class N and Retail Class. |

| 2 | Including undistributed net investment income of $496,880. |

The accompanying notes are an integral

part of these financial statements.

BBH GLOBAL CORE SELECT

FINANCIAL HIGHLIGHTS

Selected per share data and ratios for a Class N share outstanding throughout each

year.

| For the years ended October 31, |

|||||||||||||||||||||||

| 2018 |

2017 |

2016 |

2015 |

2014 |

|||||||||||||||||||

Net asset value, beginning of year |

$ | 13.32 | $ | 11.11 | $ | 11.37 | $ | 11.27 | $ | 10.99 | |||||||||||||

Income from investment operations: |

|||||||||||||||||||||||

Net investment income1 |

0.07 | 0.05 | 0.06 | 0.06 | 0.12 | ||||||||||||||||||

Net realized and unrealized gain (loss) |

(0.21 | ) | 2.22 | (0.18 | ) | 0.30 | 0.21 | ||||||||||||||||

Total income (loss) from investment operations |

(0.14 | ) | 2.27 | (0.12 | ) | 0.36 | 0.33 | ||||||||||||||||

Less dividends and distributions: |

|||||||||||||||||||||||

From net investment income |

(0.05 | ) | (0.06 | ) | (0.07 | ) | (0.13 | ) | (0.02 | ) | |||||||||||||

From net realized gains |

(0.25 | ) | — | (0.07 | ) | (0.13 | ) | (0.03 | ) | ||||||||||||||

Total dividends and distributions |

(0.30 | ) | (0.06 | ) | (0.14 | ) | (0.26 | ) | (0.05 | ) | |||||||||||||

Short-term redemption fees1 |

— | — | 0.00 | 2 | — | 0.00 | 2 | ||||||||||||||||

Net asset value, end of year |

$ | 12.88 | $ | 13.32 | $ | 11.11 | $ | 11.37 | $ | 11.27 | |||||||||||||

Total return |

(1.11 | )% | 20.54 | % | (1.06 | )% | 3.27 | % | 3.01 | % | |||||||||||||

Ratios/Supplemental data: |

|||||||||||||||||||||||

Net assets, end of year (in millions) |

$ | 86 | $ | 130 | $ | 108 | $ | 132 | $ | 127 | |||||||||||||

Ratio of expenses to average net assets before reductions |

1.33 | % | 1.36 | % | 1.38 | % | 1.31 | % | 1.32 | % | |||||||||||||

Fee waiver |

0.05 | %3 | 0.10 | %3 | 0.13 | %3 | 0.05 | %3 | 0.07 | %3 | |||||||||||||

Expense offset arrangement |

0.03 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.00 | %4 | |||||||||||||

Ratio of expenses to average net assets after reductions |

1.25 | % | 1.25 | % | 1.24 | % | 1.25 | % | 1.25 | % | |||||||||||||

Ratio of net investment income to average net assets |

0.52 | % | 0.44 | % | 0.58 | % | 0.55 | % | 1.01 | % | |||||||||||||

Portfolio turnover rate |

19 | % | 23 | % | 19 | % | 31 | % | 40 | % | |||||||||||||