UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21829

BBH TRUST

On behalf of the following series:

BBH Limited Duration Fund

BBH Core Select

BBH Global Core Select

BBH International Equity Fund

BBH Intermediate Municipal Bond Fund

(Exact name of registrant as specified in charter)

140 Broadway, New York, NY 10005

(Address of principal executive offices) (Zip Code)

Corporation Services Company

2711 Centerville Road, Suite 400, Wilmington, DE 19808

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 575-1265

Date of fiscal year end: October 31

Date of reporting period: October 31, 2015

Item 1. Report to Stockholders.

Annual Report

OCTOBER 31, 2015

BBH Limited Duration Fund

| BBH LIMITED DURATION FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| October 31, 2015 |

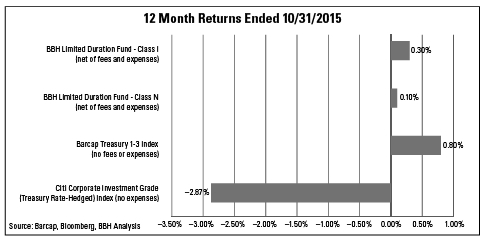

For the year ended October 31, the Fund’s I-class returned 0.30% net of all fees and expenses. BBH Limited Duration Fund’s (the “Fund”) benchmark, the Barcap 1-3 year Treasury Index1, returned 0.80% over the same period. While the Fund remains ahead of its benchmark for longer periods, the one year result is a disappointing one. It reflects both the underperformance of credit instruments this year and the effect of maintaining very low interest rate exposure. However, we are pleased that the diversification of our Fund has mitigated the credit headwinds. With the Treasury yield considerably higher, and short interest rates moving up substantially over the past few months, we are cautiously optimistic going forward.

The BBH Limited Duration Fund seeks to provide maximum total return, consistent with preservation of capital and prudent investment management. The approach we have taken with the Fund, since inception of the strategy, is to purchase a portfolio of credit instruments, ranging from floating rate to ten years maturity, and hedge most of the rate duration out of the portfolio. We wait for good value, seeking durable credits at attractive yields, and do not try to time market cycles. The Citi Investment Grade (Treasury Rate-Hedged) index2 also purchases rate-hedged credit, except with a simple index basket of investment grade corporate bonds. As you can see in the exhibit nearby, this index returned -2.87% for the year ended October, reflecting the poor returns to credit over the last few quarters. We have avoided much of this potential downside, which we attribute primarily to our investment in non-corporate credit, such as Asset-Backed Securities (“ABS”) and Commercial Mortgage-Backed Securities (“CMBS”) and Loans, all of which outperformed corporate credit quite handily.

| 1 | The Barclays Capital U.S. 1-3 Year Treasury Bond Index (“BCTSY”) measures the performance of U.S. Treasury securities that have a remaining maturity of at least one year and less than three years. The BCTSY is a short term index. Investments cannot be made in an index. |

| 2 | The Corporate Investment Grade (Treasury Rate-Hedged) Index is a U.S. Dollar-denominated index that measures the rate-hedged performance of investment-grade corporate debt. |

| 2 |

| BBH LIMITED DURATION FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2015 |

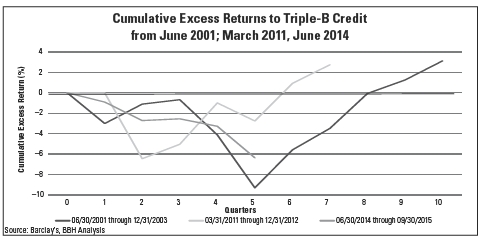

With 6 successive quarters of negative returns, this bear market in credit is already 20 months old. Historically, credit bear markets like this have tended to fully reverse within two-to-three years. This is visible in the accompanying chart comparing the markets of the early 2000s and 2011 to the pullback started last year, based on the cumulative “Excess Returns”3 (returns compared to similar duration Treasuries) of bonds rated BBB/Baa (“Triple-B”). There is no guarantee history will repeat itself, but it often rhymes. These bear market episodes have tended to last about two years.

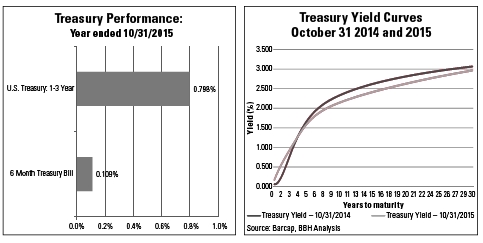

The Fund maintained duration of about 6 months throughout the year, which is approximately 25% of the index duration. Treasuries enjoyed positive returns over the year, scaling with duration. Our shorter position, while benefiting us now in the fourth quarter of 2015, cost us about 0.69% over the year.

| 3 | Excess return is defined as the investment return of a credit sector in excess of comparable duration U.S. Treasuries. |

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 3 |

| BBH LIMITED DURATION FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2015 |

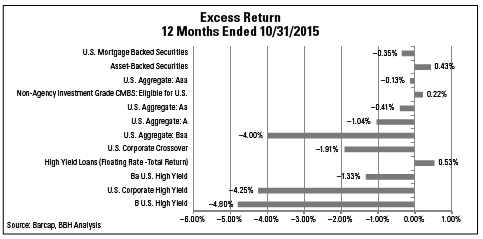

Credit instruments of all types produced negative excess returns over the fiscal year. We present these results below, roughly in order of credit quality (top to bottom). High yield and Triple-B-rated securities underperformed Treasuries by over 4 percent, with the exception of loans. Even Single-A securities underperformed by over a percentage point. There was almost no place to hide in corporate credit. Fortunately, we had increasingly been emphasizing purchases in other parts of the credit universe.

In 2014, we were finding less and less value in corporate bonds, so the majority of our purchases over the following year were ABS and CMBS, growing to approximately half of the portfolio during the year. Structured Products (ABS, CMBS and Mortgage-Backed Securities) are almost entirely domestic in risk exposure, and involve consumer or commercial loan or lease collateral. They are, therefore, fairly far removed from the most troubled spots in the corporate bond market — energy, commodities, and emerging market demand. We have developed a highly diversified portfolio of older and newer ABS types, including everything from traditional car loans and credit cards, to small-ticket equipment, airplanes, shipping containers, and, in two holdings, portfolios of drug patent royalties. In each security, there is substantial credit enhancement, consisting of over-collateralization, subordination/equity, and retention of additional interest proceeds, which will absorb loss increases first and mitigate downside risk. We aim to buy ABS with enough credit enhancement, in our judgment, to help protect us from even depression-level losses.

Credit Quality letter ratings are provided by Standard and Poor's (www.standardpoors.com) and Moody's (www.moodys.com) which are independent third parties. In order to be more conservative, when ratings differ, the lower rating is used. Quality ratings reflect the credit quality of the underlying issues in the fund portfolio and not of the fund itself. Information obtained from third parties is believed to be reliable, but cannot be guaranteed. Issuers with credit ratings of AA or better are considered to be of high credit quality, with little risk of issuer failure. Issuers with credit ratings of BBB or better are considered to be of good credit quality, with adequate capacity to meet financial commitments. Issuers with credit ratings below BBB are considered speculative in nature and are vulnerable to the possibility of issuer failure or business interruption.

| 4 |

| BBH LIMITED DURATION FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2015 |

Our portfolio of CMBS is about half office property and half hotel and retail properties. This has been an area of terrific opportunity, as a huge wave of refinancing has been depressing prices and keeping yields high. As this refinancing wave is digested over the next 18 months or so, we expect spreads to compress in this sector. Rising commercial real estate values have helped to steadily reduce leverage in our CMBS holdings.

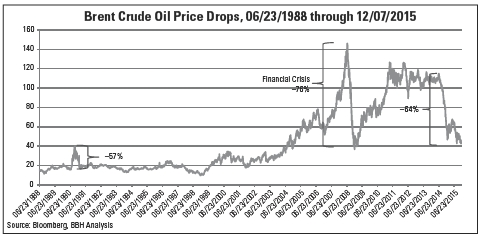

Even in corporate exposures, we have been pleased with the performance of almost every industry. Our entire negative return comes down to energy and consumer products. In energy exploration and services, an exposure of less than two percent cost us a disproportionately large 0.3% in return. One of our exposures in particular, to two drilling vessel-secured transactions with Odebrecht Oil & Gas, is marked well below 50% of par, and cost the fund 0.25% in performance over the year. As a direct result of oil prices experiencing a record drop, exploration activity has dropped precipitously. All of these companies are negotiating with creditors now, as volumes are not sufficient to meet covenanted debt service. In general, creditors seem to be taking a reasonable approach, attempting to build a bridge to a time when oil prices are a bit higher rather than attempting to liquidate assets in this environment. We have deliberately taken senior and/or secured creditor positions in our energy investments. For that reason, we view current prices for our bonds as far below expected recovery value in time.

Sectors such as utilities and pipelines have widened as well, since their profit margins also have some commodity price exposure. Global consumer companies have also taken significant profit hits to exchange rate changes, particularly companies with a large presence in emerging markets. This is both a current performance drag and an opportunity for us, as few of these companies face material credit deterioration, even given a prolonged period of lower oil prices and emerging markets demand. We’ve invested in senior secured debt of a few electricity generation credits over the last year, at floating yields greater than five percent. All of these have very limited price exposure to fossil fuels, and enjoy large, stable, contractual relationships with utilities to which they are essential.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 5 |

| BBH LIMITED DURATION FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2015 |

It was a year that left a few marks, but we are pleased with the returns to our shareholders, as well as the much broader opportunity set in which we are investing. The I-Class SEC yield4 increased from 0.96% to 2.17% (0.86% to 1.99% for Class N) from 10/31/2014 to 10/30/2015. We believe that a credit orientation brings much greater returns in the long run. We continue to invest only where we find long-term value, rather than projecting price movements, looking for durable credits when they are available at attractive yields. As ever, we are available to answer your questions, and we wish you and your families a joyous and prosperous 2016.

We are honored with your confidence and the privilege of preserving and enhancing your capital.

Past performance is no guarantee of future results.

| 4 | SEC yield is a calculation based on a 30-day period and is computed by dividing the net investment income per share earned during the period by the price per share on the last day of the reported period. |

| 6 |

| BBH LIMITED DURATION FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2015 |

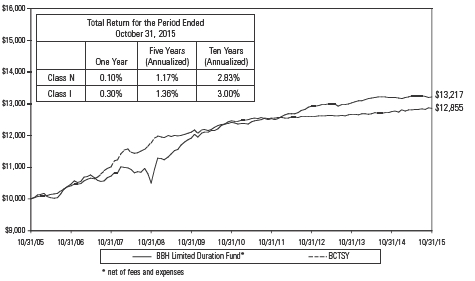

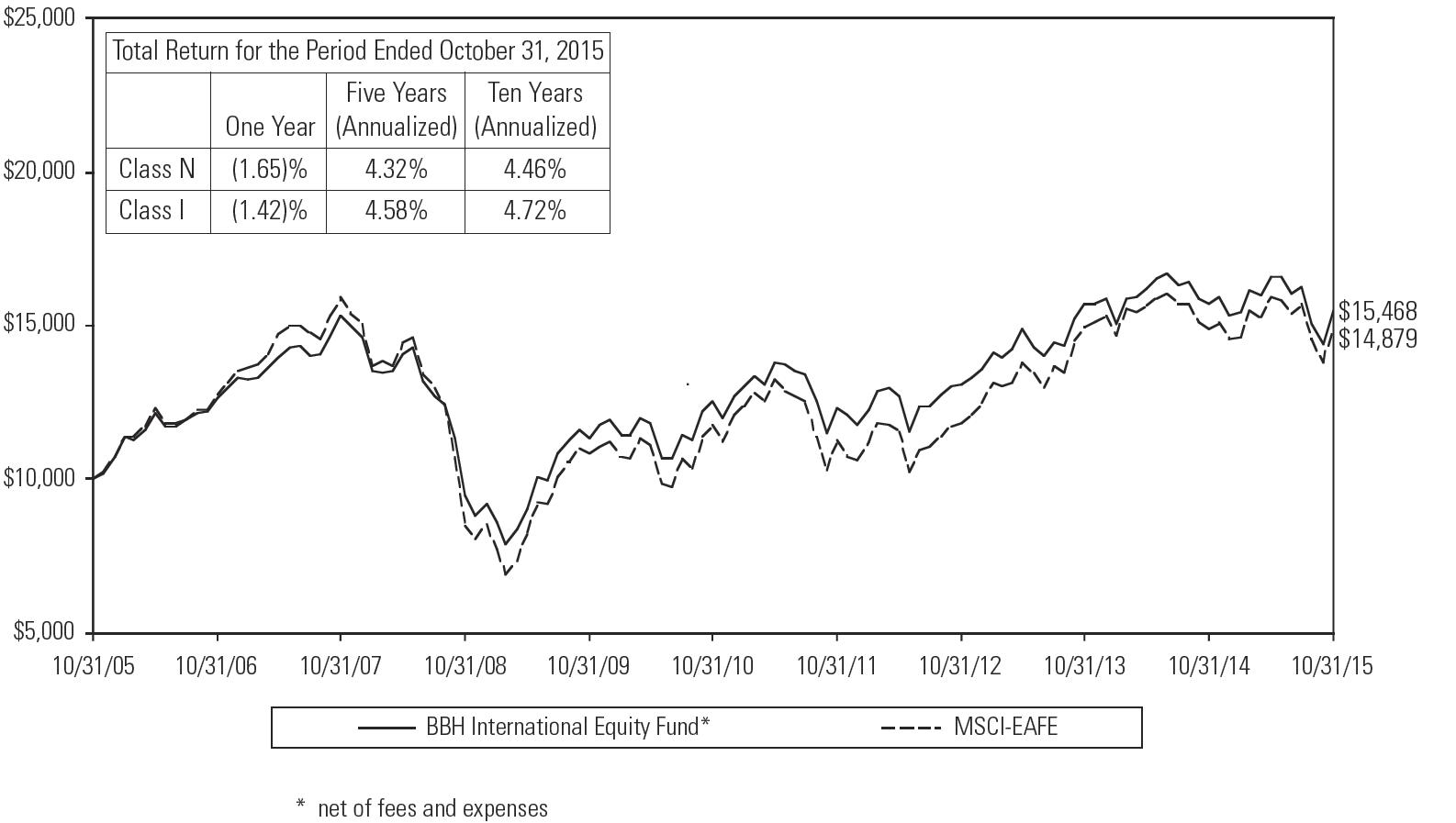

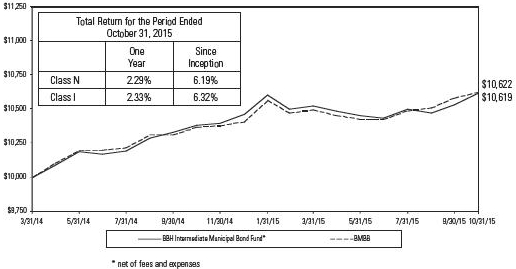

Growth of $10,000 Invested in BBH Limited Duration

The graph below illustrates the hypothetical investment of $10,0001 in the Class N shares of the Fund over the ten years ended October 31, 2015 as compared to the BCTSY.

The annualized gross expense ratios as in the March 2, 2015 prospectus for Class N and Class I shares were 0.48% and 0.29%, respectively.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund performance changes over time and current performance may be lower or higher than what is stated. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For performance current to the most recent month-end please call 1-800-575-1265.

Hypothetical performance results are calculated on a total return basis and include all portfolio income, unrealized and realized capital gains, losses and reinvestment of dividends and other earnings. No one shareholder has actually achieved these results and no representation is being made that any actual shareholder achieved, or is likely to achieve, similar results to those shown. Hypothetical performance does not represent actual trading and may not reflect the impact of material economic and market factors. Undue reliance should not be placed on hypothetical performance results in making an investment decision.

| 1 | The Fund’s performance assumes the reinvestment of all dividends and distributions. The Barclays Capital U.S. 1-3 Year Treasury Bond Index (“BCTSY”) has been adjusted to reflect reinvestment of dividends on securities in the index. The BCTSY is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged. Investments cannot be made in the index. |

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 7 |

| BBH LIMITED DURATION FUND |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Trustees of the BBH Trust and Shareholders of BBH Limited Duration Fund:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of BBH Limited Duration Fund, a series of the BBH Trust (the “Fund”) as of October 31, 2015, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2015, by correspondence with the custodian, agent banks, and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of BBH Limited Duration Fund as of October 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

December 22, 2015

| 8 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO ALLOCATION |

| October 31, 2015 |

BREAKDOWN BY SECURITY TYPE

| U.S. $ Value | Percent of Net Assets | |||||||

| Asset Backed Securities | $ | 1,949,309,342 | 41.4% | |||||

| Commercial Mortgage Backed Securities | 619,578,534 | 13.2 | ||||||

| Corporate Bonds | 1,138,466,236 | 24.2 | ||||||

| Loan Participations and Assignments | 302,469,366 | 6.4 | ||||||

| Municipal Bonds | 239,813,183 | 5.1 | ||||||

| U.S. Government Agency Obligations | 174,849,299 | 3.7 | ||||||

| U.S. Inflation Linked Debt | 10,486,624 | 0.2 | ||||||

| U.S. Treasury Notes | 30,002,340 | 0.6 | ||||||

| Certificates of Deposit | 75,000,000 | 1.6 | ||||||

| Time Deposits | 70,000,000 | 1.5 | ||||||

| U.S. Treasury Bills | 25,199,385 | 0.5 | ||||||

| Cash and Other Assets in Excess of Liabilities | 75,323,405 | 1.6 | ||||||

| NET ASSETS | $ | 4,710,497,714 | 100.0% | |||||

All data as of October 31, 2015. The Fund's sector diversification is expressed as a percentage of net assets and may vary over time.

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 9 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| ASSET BACKED SECURITIES (41.4%) | ||||||||||||||||

| $ | 31,019,048 | AIM Aviation Finance, Ltd. 2015-1A1 | 02 | /15/40 | 4.213 | % | $ | 31,064,025 | ||||||||

| 5,294,666 | Aircraft Lease Securitisation, Ltd. | |||||||||||||||

| 2007-1A1,2 | 05 | /10/32 | 0.459 | 5,268,193 | ||||||||||||

| 12,690,000 | Ally Master Owner Trust 2012-5 | 09 | /15/19 | 1.540 | 12,685,443 | |||||||||||

| 11,909,154 | Alterna Funding I LLC 2014-1A1 | 02 | /15/21 | 1.639 | 11,868,186 | |||||||||||

| 12,208,463 | AmeriCredit Automobile Receivables | |||||||||||||||

| Trust 2012-3 | 05 | /08/18 | 2.420 | 12,269,017 | ||||||||||||

| 11,300,000 | AmeriCredit Automobile Receivables | |||||||||||||||

| Trust 2013-3 | 06 | /10/19 | 2.380 | 11,416,630 | ||||||||||||

| 4,980,554 | Ascentium Equipment Receivables LLC | |||||||||||||||

| 2014-1A1 | 01 | /10/17 | 1.040 | 4,978,085 | ||||||||||||

| 20,000,000 | Ascentium Equipment Receivables LLC | |||||||||||||||

| 2015-1A1 | 07 | /10/17 | 1.150 | 19,961,806 | ||||||||||||

| 21,083,333 | Avis Budget Rental Car Funding | |||||||||||||||

| AESOP LLC 2010-5A1 | 03 | /20/17 | 3.150 | 21,186,779 | ||||||||||||

| 3,950,581 | AXIS Equipment Finance Receivables II | |||||||||||||||

| LLC 2013-1A1 | 03 | /20/17 | 1.750 | 3,947,276 | ||||||||||||

| 26,942,630 | AXIS Equipment Finance Receivables III | |||||||||||||||

| LLC 2015-1A1 | 03 | /20/20 | 1.900 | 26,909,703 | ||||||||||||

| 13,934,199 | BCC Funding VIII LLC 2014-1A1 | 06 | /20/20 | 1.794 | 13,886,266 | |||||||||||

| 50,310,000 | BCC Funding X LLC 2015-11 | 10 | /20/20 | 2.224 | 50,504,619 | |||||||||||

| 4,300,000 | Capital Auto Receivables Asset Trust | |||||||||||||||

| 2013-1 | 10 | /22/18 | 1.740 | 4,308,081 | ||||||||||||

| 8,030,000 | Capital Auto Receivables Asset Trust | |||||||||||||||

| 2013-2 | 10 | /22/18 | 1.960 | 8,063,206 | ||||||||||||

| 2,820,000 | Capital Auto Receivables Asset Trust | |||||||||||||||

| 2013-2 | 04 | /22/19 | 2.660 | 2,849,643 | ||||||||||||

| 18,140,000 | Capital Auto Receivables Asset Trust | |||||||||||||||

| 2013-21 | 01 | /20/22 | 4.060 | 18,511,250 | ||||||||||||

| 13,260,000 | Capital Auto Receivables Asset Trust | |||||||||||||||

| 2013-3 | 10 | /22/18 | 2.790 | 13,439,901 | ||||||||||||

| 38,740,000 | Carlyle Global Market Strategies | |||||||||||||||

| Commodities Funding, Ltd. | ||||||||||||||||

| 2014-1A1,2,3 | 10 | /15/21 | 2.221 | 38,739,140 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| 10 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| ASSET BACKED SECURITIES (continued) | ||||||||||||||||

| $ | 32,539,035 | Cazenovia Creek Funding I LLC | ||||||||||||||

| 2015-1A1 | 12 | /10/23 | 2.000 | % | $ | 32,594,351 | ||||||||||

| 2,055,281 | CCG Receivables Trust 2013-11 | 08 | /14/20 | 1.050 | 2,055,241 | |||||||||||

| 12,973,974 | CCG Receivables Trust 2014-11 | 11 | /15/21 | 1.060 | 12,946,248 | |||||||||||

| 5,177,950 | Chesapeake Funding LLC 2011-2A1,2 | 04 | /07/24 | 1.444 | 5,178,711 | |||||||||||

| 778,651 | Chesapeake Funding LLC 2012-1A1,2 | 11 | /07/23 | 0.944 | 775,566 | |||||||||||

| 3,890,350 | Chesapeake Funding LLC 2012-2A1,2 | 05 | /07/24 | 0.644 | 3,888,391 | |||||||||||

| 31,391,760 | Chesterfield Financial Holdings LLC | |||||||||||||||

| 2014-1A1 | 12 | /15/34 | 4.500 | 31,544,763 | ||||||||||||

| 12,780,000 | CIT Equipment Collateral 2014-VT11 | 10 | /21/19 | 1.500 | 12,739,105 | |||||||||||

| 38,080,000 | Citibank Credit Card Issuance Trust | |||||||||||||||

| 2014-A8 | 04 | /09/20 | 1.730 | 38,431,105 | ||||||||||||

| 4,076,858 | Credit Acceptance Auto Loan Trust | |||||||||||||||

| 2013-1A1 | 10 | /15/20 | 1.210 | 4,075,166 | ||||||||||||

| 7,530,000 | Credit Acceptance Auto Loan Trust | |||||||||||||||

| 2013-2A1 | 10 | /15/21 | 2.260 | 7,527,727 | ||||||||||||

| 10,040,000 | Credit Acceptance Auto Loan Trust | |||||||||||||||

| 2014-1A1 | 10 | /15/21 | 1.550 | 10,012,417 | ||||||||||||

| 11,160,000 | Credit Acceptance Auto Loan Trust | |||||||||||||||

| 2014-1A1 | 04 | /15/22 | 2.290 | 11,160,843 | ||||||||||||

| 2,720,000 | Credit Acceptance Auto Loan Trust | |||||||||||||||

| 2014-2A1 | 09 | /15/22 | 2.670 | 2,732,145 | ||||||||||||

| 10,890,000 | Credit Acceptance Auto Loan Trust | |||||||||||||||

| 2015-1A1 | 01 | /17/23 | 2.610 | 10,907,322 | ||||||||||||

| 7,070,064 | Direct Capital Funding V LLC 2013-21 | 08 | /20/18 | 1.730 | 7,078,035 | |||||||||||

| 40,760,000 | Drive Auto Receivables Trust 2015-BA1 | 07 | /15/21 | 2.760 | 40,530,970 | |||||||||||

| 14,490,000 | Eagle I, Ltd. 2014-1A1 | 12 | /15/39 | 4.310 | 14,676,018 | |||||||||||

| 38,239,619 | ECAF I Ltd. 2015-1A1 | 06 | /15/40 | 3.473 | 38,239,619 | |||||||||||

| 21,831,250 | Emerald Aviation Finance, Ltd. 2013-11 | 10 | /15/38 | 4.650 | 22,312,411 | |||||||||||

| 51,830,000 | Engs Commercial Finance Trust | |||||||||||||||

| 2015-1A1 | 10 | /22/21 | 2.310 | 51,920,531 | ||||||||||||

| 14,875 | Exeter Automobile Receivables Trust | |||||||||||||||

| 2013-1A1 | 10 | /16/17 | 1.290 | 14,873 | ||||||||||||

| 537,336 | Exeter Automobile Receivables Trust | |||||||||||||||

| 2013-2A1 | 11 | /15/17 | 1.490 | 537,288 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 11 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| ASSET BACKED SECURITIES (continued) | ||||||||||||||||

| $ | 4,331,369 | Exeter Automobile Receivables Trust | ||||||||||||||

| 2014-2A1 | 08 | /15/18 | 1.060 | % | $ | 4,319,722 | ||||||||||

| 24,561,784 | FNA Trust 2014-1A1 | 12 | /10/22 | 1.296 | 24,573,083 | |||||||||||

| 4,470,000 | Ford Credit Auto Owner Trust 2012-B | 02 | /15/18 | 2.080 | 4,510,311 | |||||||||||

| 4,000,000 | Ford Credit Auto Owner Trust 2013-C | 01 | /15/20 | 2.500 | 4,068,981 | |||||||||||

| 14,500,000 | Ford Credit Auto Owner Trust/Ford | |||||||||||||||

| Credit 2014-21 | 04 | /15/26 | 2.310 | 14,613,512 | ||||||||||||

| 18,456,054 | Foursight Capital Automobile Receivables | |||||||||||||||

| Trust 2014-11 | 03 | /23/20 | 2.110 | 18,430,952 | ||||||||||||

| 31,176,842 | Foursight Capital Automobile Receivables | |||||||||||||||

| Trust 2015-11 | 01 | /15/21 | 2.340 | 31,225,322 | ||||||||||||

| 10,891,516 | FRS I LLC 2013-1A1 | 04 | /15/43 | 1.800 | 10,817,487 | |||||||||||

| 13,527,656 | Global Container Assets, Ltd. 2013-1A1 | 11 | /05/28 | 2.200 | 13,516,681 | |||||||||||

| 36,566,667 | Global Container Assets, Ltd. 2015-1A1 | 02 | /05/30 | 2.100 | 36,504,090 | |||||||||||

| 16,510,000 | GMF Floorplan Owner Revolving Trust | |||||||||||||||

| 2015-11 | 05 | /15/20 | 1.650 | 16,455,302 | ||||||||||||

| 6,525,000 | GMF Floorplan Owner Revolving Trust | |||||||||||||||

| 2015-11 | 05 | /15/20 | 1.970 | 6,538,489 | ||||||||||||

| 10,730,000 | GMF Floorplan Owner Revolving Trust | |||||||||||||||

| 2015-11 | 05 | /15/20 | 2.220 | 10,731,792 | ||||||||||||

| 32,660,000 | Hertz Vehicle Financing LLC 2011-1A1 | 03 | /25/18 | 3.290 | 33,349,005 | |||||||||||

| 17,750,000 | Hyundai Auto Receivables Trust 2013-B | 02 | /15/19 | 1.710 | 17,843,624 | |||||||||||

| 3,738,449 | Leaf II Receivables Funding LLC 2013-11 | 10 | /15/16 | 1.330 | 3,737,769 | |||||||||||

| 8,972,000 | Leaf II Receivables Funding LLC 2013-11 | 09 | /15/21 | 1.980 | 8,985,942 | |||||||||||

| 4,470,000 | M&T Bank Auto Receivables Trust | |||||||||||||||

| 2013-1A1 | 03 | /15/19 | 2.160 | 4,486,017 | ||||||||||||

| 7,162,818 | MCA Fund I Holding LLC 2014-11,2 | 08 | /15/24 | 2.321 | 7,165,888 | |||||||||||

| 761,218 | MMAF Equipment Finance LLC 2009-AA1 | 01 | /15/30 | 3.510 | 762,587 | |||||||||||

| 13,449,048 | MMAF Equipment Finance LLC 2012-AA1 | 10 | /10/18 | 1.350 | 13,459,670 | |||||||||||

| 8,943,587 | Motor, Plc. 2014-1A1,2 | 08 | /25/21 | 0.677 | 8,942,792 | |||||||||||

| 18,011,560 | Nations Equipment Finance Funding II | |||||||||||||||

| LLC 2014-1A1 | 07 | /20/18 | 1.558 | 17,916,319 | ||||||||||||

| 3,140,000 | Nationstar Agency Advance Funding | |||||||||||||||

| Trust 2013-T2A1 | 02 | /18/48 | 1.892 | 3,104,173 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| 12 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| ASSET BACKED SECURITIES (continued) | ||||||||||||||||

| $ | 1,853,515 | Navitas Equipment Receivables LLC | ||||||||||||||

| 2013-11 | 11 | /15/16 | 1.950 | % | $ | 1,853,561 | ||||||||||

| 23,903,000 | Navitas Equipment Receivables LLC | |||||||||||||||

| 2015-11 | 11 | /15/18 | 2.120 | 23,950,409 | ||||||||||||

| 51,030,000 | NCF Dealer Floorplan Master Trust | |||||||||||||||

| 2014-1A1,2 | 10 | /20/20 | 1.674 | 50,651,465 | ||||||||||||

| 16,658,775 | New Mexico State Educational Assistance | |||||||||||||||

| Foundation 2013-12 | 01 | /02/25 | 0.893 | 16,049,063 | ||||||||||||

| 29,756,713 | Newstar Commercial Lease Funding | |||||||||||||||

| LLC 2015-1A1 | 04 | /15/19 | 3.270 | 29,680,687 | ||||||||||||

| 12,796,676 | Newtek Small Business Loan Trust | |||||||||||||||

| 2010-11,2 | 02 | /25/41 | 2.497 | 12,796,676 | ||||||||||||

| 49,190,000 | NextGear Floorplan Master Owner Trust | |||||||||||||||

| 2014-1A1 | 10 | /15/19 | 1.920 | 49,002,552 | ||||||||||||

| 22,470,000 | NextGear Floorplan Master Owner | |||||||||||||||

| Trust 2015-1A1 | 07 | /15/19 | 1.800 | 22,429,961 | ||||||||||||

| 13,740,000 | NextGear Floorplan Master Owner | |||||||||||||||

| Trust 2015-1A1,2 | 07 | /15/19 | 1.946 | 13,740,342 | ||||||||||||

| 17,300,000 | Nordstrom Private Label Credit Card | |||||||||||||||

| Master Note Trust 2011-1A1 | 11 | /15/19 | 2.280 | 17,480,740 | ||||||||||||

| 29,760,000 | NRZ Advance Receivables Trust Advance | |||||||||||||||

| Receivables Backed 2015-T21 | 08 | /17/48 | 3.302 | 29,755,536 | ||||||||||||

| 9,200,000 | Ocwen Master Advance Receivables | |||||||||||||||

| Trust 2015-11 | 09 | /17/46 | 2.537 | 9,200,000 | ||||||||||||

| 15,000,000 | OneMain Financial Issuance Trust | |||||||||||||||

| 2014-1A1 | 06 | /18/24 | 2.430 | 15,001,705 | ||||||||||||

| 15,230,000 | OneMain Financial Issuance Trust | |||||||||||||||

| 2014-2A1 | 09 | /18/24 | 3.020 | 15,217,816 | ||||||||||||

| 26,190,000 | OneMain Financial Issuance Trust | |||||||||||||||

| 2015-1A1 | 03 | /18/26 | 3.850 | 26,680,801 | ||||||||||||

| 20,010,000 | Oxford Finance Funding Trust 2014-1A1 | 12 | /15/22 | 3.475 | 19,945,418 | |||||||||||

| 5,660,449 | PFS Tax Lien Trust 2014-11 | 04 | /15/16 | 1.440 | 5,658,106 | |||||||||||

| 50,000,000 | Progreso Receivables Funding LLC | |||||||||||||||

| 2015-B1 | 07 | /28/20 | 3.000 | 50,052,905 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 13 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| ASSET BACKED SECURITIES (continued) | ||||||||||||||||

| $ | 53,872,895 | ReadyCap Lending Small Business Loan | ||||||||||||||

| Trust 2015-12 | 12 | /25/38 | 1.447 | % | $ | 53,568,465 | ||||||||||

| 12,340,000 | Santander Drive Auto Receivables Trust | |||||||||||||||

| 2013-2 | 03 | /15/19 | 1.950 | 12,405,345 | ||||||||||||

| 5,990,000 | Santander Drive Auto Receivables Trust | |||||||||||||||

| 2013-4 | 01 | /15/20 | 3.250 | 6,099,022 | ||||||||||||

| 10,980,000 | Santander Drive Auto Receivables | |||||||||||||||

| Trust 2015-3 | 04 | /15/20 | 2.070 | 11,007,502 | ||||||||||||

| 22,790,000 | Santander Drive Auto Receivables | |||||||||||||||

| Trust 2015-3 | 01 | /15/21 | 2.740 | 22,744,611 | ||||||||||||

| 23,790,000 | Shenton Aircraft Investment I, Ltd. | |||||||||||||||

| 2015-1A1 | 10 | /15/42 | 4.750 | 23,790,000 | ||||||||||||

| 9,296,388 | SMART Trust 2012-1USA1 | 12 | /14/17 | 2.010 | 9,370,759 | |||||||||||

| 253,218 | SMART Trust 2012-2USA1 | 10 | /14/16 | 1.590 | 253,380 | |||||||||||

| 670,446 | SMART Trust 2012-4US | 03 | /14/17 | 0.970 | 670,043 | |||||||||||

| 4,070,498 | SMART Trust 2013-2US | 01 | /14/17 | 0.830 | 4,069,276 | |||||||||||

| 3,630,000 | SMART Trust 2013-2US | 02 | /14/19 | 1.180 | 3,612,576 | |||||||||||

| 13,420,000 | SMART Trust 2015-1US | 09 | /14/18 | 1.500 | 13,450,415 | |||||||||||

| 2,634,699 | SNAAC Auto Receivables Trust | |||||||||||||||

| 2014-1A1 | 09 | /17/18 | 1.030 | 2,634,281 | ||||||||||||

| 33,210,000 | Spirit Master Funding LLC 2014-4A1 | 01 | /20/45 | 3.501 | 33,162,533 | |||||||||||

| 9,900,000 | Spirit Master Funding VII LLC 2013-1A1 | 12 | /20/43 | 3.887 | 10,187,279 | |||||||||||

| 16,075,941 | Springleaf Funding Trust 2013-AA1 | 09 | /15/21 | 2.580 | 16,101,905 | |||||||||||

| 9,000,000 | Springleaf Funding Trust 2014-AA1 | 12 | /15/22 | 2.410 | 8,995,144 | |||||||||||

| 17,398,431 | STORE Master Funding LLC 2013-1A1 | 03 | /20/43 | 4.160 | 17,989,233 | |||||||||||

| 12,429,052 | STORE Master Funding LLC 2013-2A1 | 07 | /20/43 | 4.370 | 12,948,318 | |||||||||||

| 20,780,684 | STORE Master Funding LLC 2013-3A1 | 11 | /20/43 | 4.240 | 21,511,973 | |||||||||||

| 4,449,698 | TAL Advantage V LLC 2014-2A1 | 05 | /20/39 | 1.700 | 4,426,495 | |||||||||||

| 21,527,500 | TAL Advantage V LLC 2014-3A1 | 11 | /21/39 | 3.270 | 21,484,863 | |||||||||||

| 37,044,000 | Textainer Marine Containers, Ltd. | |||||||||||||||

| 2014-1A1 | 10 | /20/39 | 3.270 | 36,461,465 | ||||||||||||

| 11,530,000 | Trade MAPS 1, Ltd. 2013-1A1,2 | 12 | /10/18 | 1.445 | 11,501,025 | |||||||||||

| 49,760,000 | Trafigura Securitisation Finance, Plc. | |||||||||||||||

| 2014-1A1,2 | 10 | /15/21 | 1.146 | 49,775,650 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| 14 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| ASSET BACKED SECURITIES (continued) | ||||||||||||||||

| $ | 18,330,000 | Turquoise Card Backed Securities, Plc. | ||||||||||||||

| 2012-1A1,2 | 06 | /17/19 | 0.996 | % | $ | 18,408,452 | ||||||||||

| 6,737,305 | Utah State Board of Regents 2011-12 | 05 | /01/29 | 1.150 | 6,747,479 | |||||||||||

| 11,064,022 | Westlake Automobile Receivables | |||||||||||||||

| Trust 2014-2A1 | 10 | /16/17 | 0.970 | 11,061,734 | ||||||||||||

| 41,711,977 | Westlake Automobile Receivables | |||||||||||||||

| Trust 2015-1A1 | 03 | /15/18 | 1.170 | 41,686,504 | ||||||||||||

| 10,600,000 | Westlake Automobile Receivables | |||||||||||||||

| Trust 2015-1A1 | 11 | /16/20 | 2.290 | 10,521,106 | ||||||||||||

| 21,340,000 | Westlake Automobile Receivables | |||||||||||||||

| Trust 2015-2A1 | 01 | /15/21 | 2.450 | 21,142,594 | ||||||||||||

| 32,510,000 | World Financial Network Credit Card | |||||||||||||||

| Master Trust 2014-C | 08 | /16/21 | 1.540 | 32,576,567 | ||||||||||||

| Total Asset Backed Securities | ||||||||||||||||

| (Identified cost $1,945,101,361) | 1,949,309,342 | |||||||||||||||

| COMMERCIAL MORTGAGE BACKED | ||||||||||||||||

| SECURITIES (13.2%) | ||||||||||||||||

| 15,540,000 | Aventura Mall Trust 2013-AVM1,2 | 12 | /05/32 | 3.867 | 15,970,366 | |||||||||||

| 13,860,000 | BBCMS Trust 2015-RRI1,2 | 05 | /15/32 | 2.246 | 13,668,921 | |||||||||||

| 31,807,000 | BB-UBS Trust 2012-TFT1,2 | 06 | /05/30 | 3.584 | 31,150,061 | |||||||||||

| 6,349,000 | BHMS Mortgage Trust 2014-ATLS1,2 | 07 | /05/33 | 2.644 | 6,301,399 | |||||||||||

| 32,018,000 | BHMS Mortgage Trust 2014-ATLS1,2 | 07 | /05/33 | 4.847 | 32,564,429 | |||||||||||

| 12,240,000 | BLCP Hotel Trust 2014-CLRN1,2 | 08 | /15/29 | 2.146 | 12,065,381 | |||||||||||

| 14,860,000 | Boca Hotel Portfolio Trust 2013-BOCA1,2 | 08 | /15/26 | 1.946 | 14,832,988 | |||||||||||

| 30,106,000 | BXHTL Mortgage Trust 2015-JWRZ1,2 | 05 | /15/29 | 2.346 | 29,766,669 | |||||||||||

| 28,190,000 | Carefree Portfolio Trust 2014-CARE1,2 | 11 | /15/19 | 2.596 | 28,339,773 | |||||||||||

| 42,795,000 | CDGJ Commercial Mortgage Trust | |||||||||||||||

| 2014-BXCH1,2 | 12 | /15/27 | 2.696 | 42,151,937 | ||||||||||||

| 10,500,000 | CGBAM Commercial Mortgage Trust | |||||||||||||||

| 2014-HD1,2 | 02 | /15/31 | 1.396 | 10,401,344 | ||||||||||||

| 7,457,000 | CGBAM Commercial Mortgage Trust | |||||||||||||||

| 2014-HD1,2 | 02 | /15/31 | 1.796 | 7,386,933 | ||||||||||||

| 31,329,000 | CG-CCRE Commercial Mortgage | |||||||||||||||

| Trust 2014-FL21,2 | 11 | /15/31 | 3.096 | 31,425,199 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 15 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| COMMERCIAL MORTGAGE BACKED | ||||||||||||||||

| SECURITIES (continued) | ||||||||||||||||

| $ | 7,510,000 | Citigroup Commercial Mortgage | ||||||||||||||

| Trust 2013-SMP1 | 01 | /12/30 | 2.435 | % | $ | 7,585,174 | ||||||||||

| 2,085,000 | Citigroup Commercial Mortgage | |||||||||||||||

| Trust 2013-SMP1 | 01 | /12/30 | 2.738 | 2,104,961 | ||||||||||||

| 24,520,000 | Citigroup Commercial Mortgage | |||||||||||||||

| Trust 2014-388G1,2 | 06 | /15/33 | 1.946 | 24,089,331 | ||||||||||||

| 20,676,812 | Commercial Mortgage Pass Through | |||||||||||||||

| Certificates 2013-GAM1 | 02 | /10/28 | 1.705 | 20,386,493 | ||||||||||||

| 9,690,000 | Commercial Mortgage Pass Through | |||||||||||||||

| Certificates 2013-GAM1,2 | 02 | /10/28 | 3.531 | 9,620,936 | ||||||||||||

| 11,004,713 | Commercial Mortgage Pass Through | |||||||||||||||

| Certificates 2013-SFS1 | 04 | /12/35 | 1.873 | 10,713,829 | ||||||||||||

| 42,990,000 | Commercial Mortgage Pass Through | |||||||||||||||

| Certificates 2014-KYO1,2 | 06 | /11/27 | 1.846 | 42,440,553 | ||||||||||||

| 22,660,000 | Commercial Mortgage Pass Through | |||||||||||||||

| Certificates 2014-TWC1,2 | 02 | /13/32 | 1.057 | 22,488,273 | ||||||||||||

| 14,950,000 | EQTY 2014-INNS Mortgage Trust1,2 | 05 | /08/31 | 1.795 | 14,674,183 | |||||||||||

| 16,539,771 | GTP Cellular Sites LLC1 | 03 | /15/42 | 3.721 | 16,626,535 | |||||||||||

| 9,696,976 | Hilton USA Trust 2013-HLF1,2 | 11 | /05/30 | 1.694 | 9,624,638 | |||||||||||

| 14,850,958 | Hilton USA Trust 2013-HLF1,2 | 11 | /05/30 | 2.094 | 14,740,182 | |||||||||||

| 9,410,000 | Hyatt Hotel Portfolio Trust 2015-HYT1,2 | 11 | /15/29 | 2.294 | 9,441,769 | |||||||||||

| 5,780,000 | JP Morgan Chase Commercial Mortgage | |||||||||||||||

| Securities Corp. 2011-PLSD1 | 11 | /13/28 | 3.364 | 5,894,824 | ||||||||||||

| 5,600,000 | JP Morgan Chase Commercial Mortgage | |||||||||||||||

| Securities Trust 2014-BXH1,2 | 04 | /15/27 | 1.446 | 5,592,950 | ||||||||||||

| 10,250,000 | JP Morgan Chase Commercial Mortgage | |||||||||||||||

| Securities Trust 2014-BXH1,2 | 04 | /15/27 | 1.846 | 10,234,733 | ||||||||||||

| 14,860,000 | SBA Tower Trust1 | 12 | /15/42 | 2.933 | 15,035,375 | |||||||||||

| 40,700,000 | SBA Tower Trust1 | 04 | /15/43 | 2.240 | 40,288,523 | |||||||||||

| 15,700,000 | Unison Ground Lease Funding LLC1 | 04 | /15/40 | 5.349 | 16,396,320 | |||||||||||

| 14,500,000 | Wells Fargo Commercial Mortgage Trust | |||||||||||||||

| 2014-TISH1,2 | 02 | /15/27 | 2.046 | 14,243,438 | ||||||||||||

| 20,108,443 | WFCG Commercial Mortgage Trust | |||||||||||||||

| 2015-BXRP1,2 | 11 | /15/29 | 1.318 | 19,981,305 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| 16 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| COMMERCIAL MORTGAGE BACKED | ||||||||||||||||

| SECURITIES (continued) | ||||||||||||||||

| $ | 11,468,922 | WFCG Commercial Mortgage Trust | ||||||||||||||

| 2015-BXRP1,2 | 11 | /15/29 | 1.668 | % | $ | 11,348,809 | ||||||||||

| Total Commercial Mortgage Backed Securities | ||||||||||||||||

| (Identified cost $623,598,455) | 619,578,534 | |||||||||||||||

| CORPORATE BONDS (24.2%) | ||||||||||||||||

| BANKS (4.2%) | ||||||||||||||||

| 44,000,000 | BAC San Jose DPR Funding, Ltd.1,3 | 11 | /15/21 | 4.500 | 43,006,462 | |||||||||||

| 42,443,700 | Citigroup Capital XIII2,4 | 10 | /30/40 | 6.692 | 43,122,799 | |||||||||||

| 26,315,000 | Commonwealth Bank of Australia1,2 | 03 | /12/18 | 0.736 | 26,166,189 | |||||||||||

| 3,163,335 | FNBC 1993-A Pass Through Trust | 01 | /05/18 | 8.080 | 3,309,029 | |||||||||||

| 24,760,000 | Mitsubishi UFJ Trust & Banking Corp.1 | 10 | /16/17 | 1.600 | 24,671,533 | |||||||||||

| 12,955,000 | Royal Bank of Scotland, Plc. | 03 | /16/16 | 4.375 | 13,118,881 | |||||||||||

| 19,980,000 | Svenska Handelsbanken AB | 04 | /04/17 | 2.875 | 20,352,407 | |||||||||||

| 23,285,000 | Westpac Banking Corp. | 12 | /01/17 | 1.500 | 23,241,410 | |||||||||||

| 196,988,710 | ||||||||||||||||

| COMMERCIAL SERVICES (0.5%) | ||||||||||||||||

| 19,863,000 | Experian Finance, Plc.1 | 06 | /15/17 | 2.375 | 19,937,963 | |||||||||||

| 3,250,000 | Western Union Co. | 08 | /22/18 | 3.650 | 3,362,424 | |||||||||||

| 23,300,387 | ||||||||||||||||

| COSMETICS/PERSONAL CARE (0.3%) | ||||||||||||||||

| 19,745,000 | Avon Products, Inc. | 03 | /15/20 | 6.350 | 16,042,813 | |||||||||||

| DIVERSIFIED FINANCIAL SERVICES (6.5%) | ||||||||||||||||

| 11,881,764 | AA Aircraft Financing 2013-1 LLC1 | 11 | /01/19 | 3.596 | 12,000,582 | |||||||||||

| 8,119,820 | Ahold Lease Series 2001-A-1 Pass | |||||||||||||||

| Through Trust | 01 | /02/20 | 7.820 | 8,728,807 | ||||||||||||

| 7,365,000 | Air Lease Corp. | 04 | /01/17 | 5.625 | 7,703,569 | |||||||||||

| 15,950,000 | Air Lease Corp. | 09 | /04/18 | 2.625 | 15,885,721 | |||||||||||

| 6,300,000 | Alliance Data Systems Corp.1 | 12 | /01/17 | 5.250 | 6,489,000 | |||||||||||

| 5,000,000 | Alliance Data Systems Corp.1 | 04 | /01/20 | 6.375 | 5,162,500 | |||||||||||

| 22,705,000 | Athene Global Funding1 | 10 | /23/18 | 2.875 | 22,456,698 | |||||||||||

| 24,815,000 | Caisse Centrale Desjardins1 | 09 | /12/17 | 1.550 | 24,766,412 | |||||||||||

| 19,213,710 | CIC Central America Card | |||||||||||||||

| Receivables, Ltd.3 | 11 | /05/20 | 4.500 | 19,346,570 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 17 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| CORPORATE BONDS (continued) | ||||||||||||||||

| DIVERSIFIED FINANCIAL | ||||||||||||||||

| SERVICES (continued) | ||||||||||||||||

| $ | 10,500,000 | CIC Receivables Master Trust3 | 10 | /07/21 | 4.890 | % | $ | 10,587,415 | ||||||||

| 3,000,000 | Credit Acceptance Corp. | 02 | /15/21 | 6.125 | 3,000,000 | |||||||||||

| 23,730,000 | Denali Borrower LLC1 | 10 | /15/20 | 5.625 | 25,242,787 | |||||||||||

| 12,118,836 | Doric Nimrod Air Alpha 2013-1 Pass | |||||||||||||||

| Through Trust1 | 05 | /30/25 | 5.250 | 12,603,589 | ||||||||||||

| 6,212,142 | Doric Nimrod Air Finance Alpha, Ltd. | |||||||||||||||

| 2012-1 (Class A) Pass Through Trust1 | 11 | /30/24 | 5.125 | 6,437,624 | ||||||||||||

| 49,455,000 | Drawbridge Special Opportunities | |||||||||||||||

| Fund LP1 | 08 | /01/21 | 5.000 | 48,465,900 | ||||||||||||

| 5,346,352 | LS Power Funding Corp. | 12 | /30/16 | 8.080 | 5,552,171 | |||||||||||

| 5,875,000 | Morgan Stanley Capital Trust III4 | 03 | /01/33 | 6.250 | 6,086,500 | |||||||||||

| 8,922,925 | Morgan Stanley Capital Trust VIII4 | 04 | /15/67 | 6.450 | 9,112,091 | |||||||||||

| 16,349,000 | Murray Street Investment Trust I | 03 | /09/17 | 4.647 | 16,999,069 | |||||||||||

| 38,284,000 | Seven & Seven, Ltd.1,2 | 09/11/19 | 1.539 | 38,238,251 | ||||||||||||

| 304,865,256 | ||||||||||||||||

| ELECTRIC (1.1%) | ||||||||||||||||

| 25,715,000 | Korea East-West Power Co., Ltd.1 | 11 | /27/18 | 2.625 | 26,121,425 | |||||||||||

| 22,150,000 | TransAlta Corp. | 06 | /03/17 | 1.900 | 21,877,245 | |||||||||||

| 5,580,000 | TransAlta Corp. | 05 | /15/18 | 6.650 | 5,906,793 | |||||||||||

| 53,905,463 | ||||||||||||||||

| HEALTHCARE-PRODUCTS (0.5%) | ||||||||||||||||

| 15,995,000 | Mallinckrodt International Finance S.A. | 04 | /15/18 | 3.500 | 15,495,156 | |||||||||||

| 10,000,000 | Mallinckrodt International Finance | |||||||||||||||

| S.A./Mallinckrodt CB LLC1 | 04/15/20 | 4.875 | 9,587,500 | |||||||||||||

| 25,082,656 | ||||||||||||||||

| HEALTHCARE-SERVICES (0.2%) | ||||||||||||||||

| 10,460,000 | HCA, Inc. | 03 | /15/19 | 3.750 | 10,643,050 | |||||||||||

The accompanying notes are an integral part of these financial statements.

| 18 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| CORPORATE BONDS (continued) | ||||||||||||||||

| INSURANCE (1.3%) | ||||||||||||||||

| $ | 17,985,000 | Fairfax Financial Holdings, Ltd.1 | 05/15/21 | 5.800 | % | $ | 19,009,875 | |||||||||

| 11,050,000 | Vitality Re IV, Ltd.1,2 | 01/09/18 | 2.750 | 11,136,190 | ||||||||||||

| 33,100,000 | Vitality Re V, Ltd.1,2 | 01/07/20 | 1.750 | 32,894,780 | ||||||||||||

| 63,040,845 | ||||||||||||||||

| INTERNET (0.5%) | ||||||||||||||||

| 20,335,000 | Expedia, Inc. | 08/15/20 | 5.950 | 22,537,708 | ||||||||||||

| INVESTMENT COMPANIES (1.7%) | ||||||||||||||||

| 28,840,000 | Ares Capital Corp. | 01/15/20 | 3.875 | 29,541,100 | ||||||||||||

| 27,645,000 | FS Investment Corp. | 01/15/20 | 4.250 | 27,938,065 | ||||||||||||

| 21,515,000 | PennantPark Investment Corp. | 10/01/19 | 4.500 | 21,631,783 | ||||||||||||

| 79,110,948 | ||||||||||||||||

| MEDIA (0.6%) | ||||||||||||||||

| 7,140,000 | Scripps Networks Interactive, Inc. | 11/15/19 | 2.750 | 7,027,267 | ||||||||||||

| 21,000,000 | TEGNA, Inc. | 10/15/19 | 5.125 | 21,892,500 | ||||||||||||

| 28,919,767 | ||||||||||||||||

| OIL & GAS (1.3%) | ||||||||||||||||

| 7,120,000 | Korea National Oil Corp.1 | 04/03/17 | 3.125 | 7,282,706 | ||||||||||||

| 16,935,000 | Korea National Oil Corp.1 | 01/23/19 | 2.750 | 17,186,637 | ||||||||||||

| 22,513,100 | Odebrecht Drilling Norbe VIII/IX, Ltd.1 | 06/30/22 | 6.350 | 11,031,419 | ||||||||||||

| 10,873,200 | Odebrecht Offshore Drilling | |||||||||||||||

| Finance, Ltd.1 | 10/01/23 | 6.750 | 3,637,085 | |||||||||||||

| 4,140,000 | Petrobras Global Finance BV | 05/20/16 | 2.000 | 4,079,970 | ||||||||||||

| 21,825,000 | Petrobras Global Finance BV2 | 01/15/19 | 2.461 | 17,562,578 | ||||||||||||

| 60,780,395 | ||||||||||||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 19 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| CORPORATE BONDS (continued) | ||||||||||||||||

| OIL & GAS SERVICES (0.7%) | ||||||||||||||||

| $ | 35,228,000 | Freeport-McMoran Oil & Gas LLC. | 11 | /15/20 | 6.500 | % | $ | 31,925,375 | ||||||||

| PHARMACEUTICALS (0.9%) | ||||||||||||||||

| 22,355,000 | AbbVie, Inc. | 05 | /14/18 | 1.800 | 22,372,929 | |||||||||||

| 9,000,000 | AbbVie, Inc. | 05 | /14/20 | 2.500 | 8,898,822 | |||||||||||

| 9,445,000 | Pfizer, Inc. | 03 | /30/17 | 6.050 | 10,111,524 | |||||||||||

| 41,383,275 | ||||||||||||||||

| PIPELINES (0.3%) | ||||||||||||||||

| 15,065,000 | Enbridge Energy Partners LP | 10/15/20 | 4.375 | 15,259,459 | ||||||||||||

| REAL ESTATE (1.5%) | ||||||||||||||||

| 18,035,000 | Prologis International Funding II SA1 | 02 | /15/20 | 4.875 | 19,140,221 | |||||||||||

| 17,000,000 | RXR Realty3 | 10 | /01/20 | 5.400 | 16,865,878 | |||||||||||

| 32,965,000 | Vonovia Finance BV1 | 10/02/17 | 3.200 | 33,522,043 | ||||||||||||

| 69,528,142 | ||||||||||||||||

| REAL ESTATE INVESTMENT TRUSTS (1.4%) | ||||||||||||||||

| 15,400,000 | Digital Delta Holdings LLC1 | 10 | /01/20 | 3.400 | 15,477,724 | |||||||||||

| 5,670,000 | Scentre Group Trust 1/Scentre | |||||||||||||||

| Group Trust 21 | 11 | /05/19 | 2.375 | 5,609,654 | ||||||||||||

| 25,330,000 | Select Income REIT | 02 | /01/22 | 4.150 | 24,953,267 | |||||||||||

| 22,000,000 | Senior Housing Properties Trust | 05 | /01/19 | 3.250 | 22,067,386 | |||||||||||

| 68,108,031 | ||||||||||||||||

| TELECOMMUNICATIONS (0.6%) | ||||||||||||||||

| 26,570,000 | BellSouth Corp.1 | 04/26/21 | 4.821 | 27,043,956 | ||||||||||||

| Total Corporate Bonds | ||||||||||||||||

| (Identified cost $1,167,479,109) | 1,138,466,236 | |||||||||||||||

The accompanying notes are an integral part of these financial statements.

| 20 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| LOAN PARTICIPATIONS AND | ||||||||||||||||

| ASSIGNMENTS (6.4%) | ||||||||||||||||

| $ | 12,853,417 | Aria Energy Operating LLC2 | 05 | /27/22 | 5.000 | % | $ | 12,339,280 | ||||||||

| 28,841,324 | Astoria Energy LLC Term B2 | 12 | /24/21 | 5.000 | 28,648,952 | |||||||||||

| 20,000,000 | Charter Communications Operating LLC | |||||||||||||||

| (CCO Safari LLC) Term H2 | 08 | /24/21 | 3.250 | 19,950,000 | ||||||||||||

| 3,000,000 | Charter Communications Operating LLC | |||||||||||||||

| (CCO Safari LLC) Term I2 | 01 | /24/23 | 3.500 | 2,995,770 | ||||||||||||

| 11,337,500 | Dell International LLC Term B22 | 04 | /29/20 | 4.000 | 11,331,151 | |||||||||||

| 10,825,848 | Dell International LLC Term C2 | 10 | /29/18 | 3.750 | 10,812,315 | |||||||||||

| 44,844,330 | Delos Finance S.a.r.l2 | 03 | /06/21 | 3.500 | 44,816,526 | |||||||||||

| 40,000,000 | Express Scripts Holding Company | |||||||||||||||

| (Express Scripts, Inc.) 2 | 04 | /28/17 | 1.313 | 39,825,200 | ||||||||||||

| 20,000,000 | Freeport-McMorRan Copper & Gold, Inc. | |||||||||||||||

| (PT Freeport Indonesia) 2 | 05 | /31/18 | 1.940 | 17,900,000 | ||||||||||||

| 20,829,174 | HCA, Inc. Term B52 | 03 | /31/17 | 2.938 | 20,824,383 | |||||||||||

| 14,755,349 | Mallinckrodt International Term B2 | 03 | /19/21 | 3.250 | 13,986,891 | |||||||||||

| 1,980,000 | Mallinckrodt International Term B12 | 03 | /19/21 | 3.500 | 1,892,662 | |||||||||||

| 8,076,022 | RPI Finance Trust Term B32 | 11 | /09/18 | 3.250 | 8,067,946 | |||||||||||

| 45,058,021 | RPI Finance Trust Term B42 | 11 | /09/20 | 3.500 | 44,900,318 | |||||||||||

| 605,381 | SS&C European Holdings S.a.r.l | |||||||||||||||

| Term B22 | 07 | /08/22 | 4.000 | 606,895 | ||||||||||||

| 3,912,556 | SS&C Technologies, Inc. Term B12 | 07 | /08/22 | 4.000 | 3,922,338 | |||||||||||

| 19,722,699 | TPF II Power LLC Term B2 | 10/02/21 | 5.500 | 19,648,739 | ||||||||||||

| Total Loan Participations and Assignments | ||||||||||||||||

| (Identified cost $305,653,275) | 302,469,366 | |||||||||||||||

| MUNICIPAL BONDS (5.1%) | ||||||||||||||||

| 14,250,000 | Baylor Health Care System, | |||||||||||||||

| Revenue Bonds2 | 11 | /15/25 | 0.180 | 13,420,693 | ||||||||||||

| 20,670,000 | Chicago Transit Authority, | |||||||||||||||

| Revenue Bonds | 06 | /01/20 | 5.000 | 22,843,450 | ||||||||||||

| 8,700,000 | City of Portland, Oregon, General | |||||||||||||||

| Obligation Bonds2 | 06 | /01/19 | 0.105 | 8,378,004 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 21 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| MUNICIPAL BONDS (continued) | ||||||||||||||||

| $ | 2,850,000 | City of Portland, Oregon, General | ||||||||||||||

| Obligation Bonds2 | 06 | /01/19 | 0.135 | % | $ | 2,744,502 | ||||||||||

| 8,000,000 | Michigan Finance Authority, | |||||||||||||||

| Revenue Bonds | 05 | /01/16 | 3.000 | 8,088,560 | ||||||||||||

| 16,105,000 | Michigan Finance Authority, | |||||||||||||||

| Revenue Bonds | 05 | /01/17 | 5.000 | 17,016,865 | ||||||||||||

| 8,850,000 | Michigan Finance Authority, | |||||||||||||||

| Revenue Bonds | 05 | /01/18 | 5.000 | 9,666,236 | ||||||||||||

| 5,000,000 | New Jersey Economic Development | |||||||||||||||

| Authority, Revenue Bonds2 | 02 | /01/17 | 0.910 | 4,936,350 | ||||||||||||

| 20,940,000 | New Jersey Economic Development | |||||||||||||||

| Authority, Revenue Bonds, NPFG5 | 02 | /15/17 | 0.000 | 20,330,227 | ||||||||||||

| 28,005,000 | New Jersey Economic Development | |||||||||||||||

| Authority, Revenue Bonds, AGM5 | 02 | /15/18 | 0.000 | 26,189,996 | ||||||||||||

| 4,360,000 | New Jersey Economic Development | |||||||||||||||

| Authority, Revenue Bonds | 06 | /15/20 | 5.000 | 4,715,384 | ||||||||||||

| 27,815,000 | New Jersey Economic Development | |||||||||||||||

| Authority, Revenue Bonds, XLCA5 | 07 | /01/20 | 0.000 | 22,703,437 | ||||||||||||

| 2,350,000 | New Jersey State Turnpike Authority, | |||||||||||||||

| Revenue Bonds, AMBAC | 01 | /01/16 | 4.252 | 2,364,218 | ||||||||||||

| 3,600,000 | New York State Energy Research & | |||||||||||||||

| Development Authority, | ||||||||||||||||

| Revenue Bonds, NPFG2 | 12 | /01/20 | 0.137 | 3,409,596 | ||||||||||||

| 7,140,000 | Pennsylvania Industrial Development | |||||||||||||||

| Authority, Revenue Bonds1 | 07 | /01/21 | 2.967 | 7,132,217 | ||||||||||||

| 2,375,000 | School District of Philadelphia, General | |||||||||||||||

| Obligation Bonds | 09 | /01/16 | 1.787 | 2,380,700 | ||||||||||||

| 3,445,000 | School District of Philadelphia, General | |||||||||||||||

| Obligation Bonds | 09 | /01/17 | 2.009 | 3,433,115 | ||||||||||||

| 2,330,000 | School District of Philadelphia, General | |||||||||||||||

| Obligation Bonds | 09 | /01/18 | 2.512 | 2,339,786 | ||||||||||||

| 27,090,000 | State of Illinois, General | |||||||||||||||

| Obligation Bonds | 03 | /01/16 | 4.961 | 27,412,371 | ||||||||||||

| 7,110,000 | State of Illinois, General | |||||||||||||||

| Obligation Bonds, AGM | 03 | /01/18 | 5.200 | 7,482,208 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| 22 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| MUNICIPAL BONDS (continued) | ||||||||||||||||

| $ | 17,300,000 | State of Illinois, General | ||||||||||||||

| Obligation Bonds | 07 | /01/21 | 6.200 | % | $ | 18,597,500 | ||||||||||

| 16,650,000 | Tobacco Settlement Financing Corp., | |||||||||||||||

| Revenue Bonds5 | 06/01/41 | 0.000 | 4,227,768 | |||||||||||||

| Total Municipal Bonds | ||||||||||||||||

| (Identified cost $240,445,598) | 239,813,183 | |||||||||||||||

| U.S. GOVERNMENT AGENCY | ||||||||||||||||

| OBLIGATIONS (3.7%) | ||||||||||||||||

| 25,000,000 | Fannie Mae Discount Notes5 | 12 | /23/15 | 0.000 | 24,995,306 | |||||||||||

| 25,000,000 | Federal Home Loan Bank Discount | |||||||||||||||

| Notes5 | 11 | /18/15 | 0.000 | 24,998,690 | ||||||||||||

| 25,000,000 | Federal Home Loan Bank Discount | |||||||||||||||

| Notes5 | 12 | /01/15 | 0.000 | 24,997,708 | ||||||||||||

| 30,000,000 | Federal Home Loan Bank Discount | |||||||||||||||

| Notes5 | 01 | /14/16 | 0.000 | 29,994,510 | ||||||||||||

| 35,000,000 | Federal Home Loan Bank Discount | |||||||||||||||

| Notes5 | 02 | /26/16 | 0.000 | 34,986,455 | ||||||||||||

| 231,868 | Federal Home Loan Mortgage Corp. | |||||||||||||||

| (FHLMC) Non Gold Guaranteed2 | 04 | /01/36 | 2.385 | 246,813 | ||||||||||||

| 117,054 | Federal Home Loan Mortgage Corp. | |||||||||||||||

| (FHLMC) Non Gold Guaranteed2 | 12 | /01/36 | 2.115 | 123,854 | ||||||||||||

| 72,667 | Federal Home Loan Mortgage Corp. | |||||||||||||||

| (FHLMC) Non Gold Guaranteed2 | 01 | /01/37 | 2.330 | 77,053 | ||||||||||||

| 160,311 | Federal Home Loan Mortgage Corp. | |||||||||||||||

| (FHLMC) Non Gold Guaranteed2 | 02 | /01/37 | 2.446 | 171,261 | ||||||||||||

| 14,303,194 | Federal National Mortgage Association | |||||||||||||||

| (FNMA) | 07 | /01/35 | 5.000 | 15,822,403 | ||||||||||||

| 989,832 | Federal National Mortgage Association | |||||||||||||||

| (FNMA) | 11 | /01/35 | 5.500 | 1,115,371 | ||||||||||||

| 102,347 | Federal National Mortgage Association | |||||||||||||||

| (FNMA)2 | 07 | /01/36 | 2.731 | 109,084 | ||||||||||||

| 210,316 | Federal National Mortgage Association | |||||||||||||||

| (FNMA)2 | 09 | /01/36 | 2.447 | 223,169 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 23 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | |||||||||||||

| U.S. GOVERNMENT AGENCY | ||||||||||||||||

| OBLIGATIONS (continued) | ||||||||||||||||

| $ | 165,540 | Federal National Mortgage Association | ||||||||||||||

| (FNMA)2 | 01/01/37 | 2.451 | % | $ | 176,946 | |||||||||||

| 855,855 | Federal National Mortgage Association | |||||||||||||||

| (FNMA) | 08/01/37 | 5.500 | 963,638 | |||||||||||||

| 9,593,674 | Federal National Mortgage Association | |||||||||||||||

| (FNMA) | 08/01/37 | 5.500 | 10,826,299 | |||||||||||||

| 4,372,612 | Federal National Mortgage Association | |||||||||||||||

| (FNMA) | 06/01/40 | 6.500 | 4,997,775 | |||||||||||||

| 22,228 | Government National Mortgage | |||||||||||||||

| Association (GNMA)2 | 08/20/29 | 1.625 | 22,964 | |||||||||||||

| Total U.S. Government Agency Obligations | ||||||||||||||||

| (Identified cost $173,673,005) | 174,849,299 | |||||||||||||||

| U.S. INFLATION LINKED DEBT (0.2%) | ||||||||||||||||

| 10,492,500 | U.S. Treasury Inflation Indexed Note | 04 | /15/17 | 0.125 | 10,486,624 | |||||||||||

| Total U.S. Inflation Linked Debt | ||||||||||||||||

| (Identified cost $10,739,252) | 10,486,624 | |||||||||||||||

| U.S. TREASURY NOTE (0.6%) | ||||||||||||||||

| 30,000,000 | U.S. Treasury Note | 11 | /30/15 | 0.250 | 30,002,340 | |||||||||||

| Total U.S. Treasury Note | ||||||||||||||||

| (Identified cost $30,004,531) | 30,002,340 | |||||||||||||||

| CERTIFICATES OF DEPOSIT (1.6%) | ||||||||||||||||

| 75,000,000 | DNB Bank ASA | 11 | /10/15 | 0.270 | 75,000,000 | |||||||||||

| Total Certificates of Deposit | ||||||||||||||||

| (Identified cost $75,000,000) | 75,000,000 | |||||||||||||||

| TIME DEPOSITS (1.5%) | ||||||||||||||||

| 70,000,000 | Wells Fargo | 11 | /02/15 | 0.090 | 70,000,000 | |||||||||||

| Total Time Deposits | ||||||||||||||||

| (Identified cost $70,000,000) | 70,000,000 | |||||||||||||||

The accompanying notes are an integral part of these financial statements.

| 24 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

| Principal Amount | Maturity Date | Interest Rate | Value | ||||||||||||

| U.S. TREASURY BILLS (0.5%) | |||||||||||||||

| $ | 10,200,000 | U.S. Treasury Bill5,6 | 11 | /05/15 | 0.000 | % | $ | 10,199,912 | |||||||

| 15,000,000 | U.S Treasury Bill5 | 11/12/15 | 0.000 | 14,999,473 | |||||||||||

| Total U.S. Treasury Bills | |||||||||||||||

| (Identified cost $25,199,385) | 25,199,385 | ||||||||||||||

| TOTAL INVESTMENTS (Identified cost $4,666,893,971)7 | 98.4 | % | $ | 4,635,174,309 | |||||||||||

| CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES | 1.6 | % | 75,323,405 | ||||||||||||

| NET ASSETS | 100.0 | % | $ | 4,710,497,714 | |||||||||||

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. Total market value of Rule 144A securities owned at October 31, 2015 was $2,817,460,492 or 59.81% of net assets. Unless otherwise noted, these securities are not considered illiquid. |

| 2 | Variable rate instrument. Interest rates change on specific dates (such as coupon or interest payment date). The yield shown represents the October 31, 2015 coupon or interest rate. |

| 3 | The Fund's Investment Adviser has deemed this security to be illiquid based upon the SEC definition of an illiquid security. |

| 4 | Trust preferred security. |

| 5 | Security issued with zero coupon. Income is recognized through accretion of discount. |

| 6 | All or a portion of this security is held at the broker as collateral for open futures contracts. |

| 7 | The aggregate cost for federal income tax purposes is $4,667,878,995, the aggregate gross unrealized appreciation is $22,460,024 and the aggregate gross unrealized depreciation is $55,164,710 resulting in net unrealized depreciation of $32,704,686. |

Abbreviations:

AGM – Assured Guaranty Municipal Corp.

AMBAC

– AMBAC Financial Group, Inc.

FHLMC – Federal Home Loan Mortgage Corporation.

FNMA – Federal National

Mortgage Association.

GNMA – Government National Mortgage Association.

NPFG – National Public Finance

Guarantee Corporation.

XLCA – XL Capital Assurance, Inc.

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 25 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

Fair Value Measurements

The Fund is required to disclose information regarding the fair value measurements of the Fund's assets and liabilities. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The disclosure requirement established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including, for example, the risk inherent in a particular valuation technique used to measure fair value, including the model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the Fund's own considerations about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three levels defined by the fair value hierarchy are as follows:

| — | Level 1 – unadjusted quoted prices in active markets for identical investments. |

| — | Level 2 – significant other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.). |

| — | Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). |

Inputs are used in applying the various valuation techniques and broadly refer to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, specific and broad credit data, liquidity statistics, and other factors. A financial instrument's level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires judgment by the investment adviser. The investment adviser considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the investment adviser's perceived risk of that instrument.

Financial assets within level 1 are based on quoted market prices in active markets. The Fund does not adjust the quoted price for these instruments.

The accompanying notes are an integral part of these financial statements.

| 26 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

Financial instruments that trade in markets that are not considered to be active but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within level 2. These include investment-grade corporate bonds, U.S. Treasury notes and bonds, and certain non-U.S. sovereign obligations and over-the-counter derivatives. As level 2 financial assets include positions that are not traded in active markets and/or are subject to transfer restrictions, valuations may be adjusted to reflect illiquidity and/or non-transferability, which are generally based on available market information.

Financial assets classified within level 3 have significant unobservable inputs, as they trade infrequently. Level 3 financial assets include private equity, certain corporate debt securities and asset backed securities.

Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon the actual sale of those investments.

The following table summarizes the valuation of the Fund's investments by the above fair value hierarchy levels as of October 31, 2015.

| Investments, at value | Unadjusted Quoted Prices in Active Markets for Identical Investments (Level 1)* | Significant Other Observable Inputs (Level 2)* | Significant Unobservable Inputs (Level 3)* | Balance as of October 31, 2015 | ||||||||||||

| Asset Backed Securities | $ | — | $ | 1,888,574,989 | $ | 60,734,353 | $ | 1,949,309,342 | ||||||||

| Commercial Mortgage | ||||||||||||||||

| Backed Securities | — | 619,578,534 | — | 619,578,534 | ||||||||||||

| Corporate Bonds | 58,321,390 | 1,080,144,846 | — | 1,138,466,236 | ||||||||||||

| Loan Participations and | ||||||||||||||||

| Assignments | — | 302,469,366 | — | 302,469,366 | ||||||||||||

| Municipal Bonds | — | 239,813,183 | — | 239,813,183 | ||||||||||||

| U.S. Government | ||||||||||||||||

| Agency Obligations | — | 174,849,299 | — | 174,849,299 | ||||||||||||

| U.S. Inflation Linked Debt | — | 10,486,624 | — | 10,486,624 | ||||||||||||

| U.S. Treasury Notes | — | 30,002,340 | — | 30,002,340 | ||||||||||||

| Certificates of Deposit | — | 75,000,000 | — | 75,000,000 | ||||||||||||

| Time Deposits | — | 70,000,000 | — | 70,000,000 | ||||||||||||

| U.S. Treasury Bills | — | 25,199,385 | — | 25,199,385 | ||||||||||||

| Total Investments, at value | $ | 58,321,390 | $ | 4,516,118,566 | $ | 60,734,353 | $ | 4,635,174,309 | ||||||||

| Other Financial Instruments, at value | ||||||||||||||||

| Financial Futures Contracts | $ | 1,258,765 | $ | — | $ | — | $ | 1,258,765 | ||||||||

| Other Financial Instruments, | ||||||||||||||||

| at value | $ | 1,258,765 | $ | — | $ | — | $ | 1,258,765 | ||||||||

| * | The Fund's policy is to disclose transfers between levels based on valuations at the end of the reporting period. |

There were no transfers between Levels 1, 2 or 3 as of October 31, 2015.

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 27 |

| BBH LIMITED DURATION FUND |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2015 |

The following is a reconciliation of assets for which significant unobservable inputs (Level 3) were used in determining fair value during the year ended October 31, 2015:

| Asset backed Securities | ||||

| Balance as of October 31, 2014 | $ | 9,344,313 | ||

| Purchases | 63,539,360 | |||

| Sales / Paydowns | (12,308,601 | ) | ||

| Realized gains (losses) | 72,325 | |||

| Change in unrealized appreciation (depreciation) | 80,887 | |||

| Amortization | 6,069 | |||

| Balance as of October 31, 2015 | $ | 60,734,353 | ||

The Fund's investments classified as Level 3 were valued utilizing broker quotes.

The accompanying notes are an integral part of these financial statements.

| 28 |

| BBH LIMITED DURATION FUND |

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2015 |

| ASSETS: | ||||

| Investments in securities, at value (Identified cost $4,666,893,971) | $ | 4,635,174,309 | ||

| Cash | 3,773,763 | |||

| Receivables for: | ||||

| Investments sold | 68,176,861 | |||

| Interest | 15,944,053 | |||

| Shares sold | 5,130,195 | |||

| Futures variation margin on open contracts | 227,167 | |||

| Prepaid assets | 43,596 | |||

| Total Assets | 4,728,469,944 | |||

| LIABILITIES: | ||||

| Payables for: | ||||

| Shares redeemed | 16,173,106 | |||

| Investment advisory and administrative fees | 1,050,440 | |||

| Shareholder servicing fees | 423,471 | |||

| Professional fees | 66,963 | |||

| Custody and fund accounting fees | 61,651 | |||

| Distributor fees | 5,616 | |||

| Transfer agent fees | 2,643 | |||

| Periodic distributions | 1,236 | |||

| Board of Trustees' fees | 950 | |||

| Accrued expenses and other liabilities | 186,154 | |||

| Total Liabilities | 17,972,230 | |||

| NET ASSETS | $ | 4,710,497,714 | ||

| Net Assets Consist of: | ||||

| Paid-in capital | $ | 4,782,457,528 | ||

| Undistributed net investment income | 505,783 | |||

| Accumulated net realized loss on investments in securities | ||||

| and futures contracts | (42,004,700 | ) | ||

| Net unrealized appreciation/(depreciation) on investments in | ||||

| securities and futures contracts | (30,460,897 | ) | ||

| Net Assets | $ | 4,710,497,714 | ||

| NET ASSET VALUE AND OFFERING PRICE PER SHARE | ||||

| CLASS N SHARES | ||||

| ($2,557,473,605 ÷ 252,108,967 shares outstanding) | $ | 10.14 | ||

| CLASS I SHARES | ||||

| ($2,153,024,109 ÷ 212,270,429 shares outstanding) | $ | 10.14 |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 29 |

| BBH LIMITED DURATION FUND |

| STATEMENT OF OPERATIONS |

| For the year ended October 31, 2015 |

| NET INVESTMENT INCOME: | ||||

| Income: | ||||

| Dividends | $ | 3,502,474 | ||

| Interest and other income | 110,596,658 | |||

| Total Income | 114,099,132 | |||

| Expenses: | ||||

| Investment advisory and administrative fees | 13,323,867 | |||

| Shareholder servicing fees | 5,275,703 | |||

| Custody and fund accounting fees | 400,366 | |||

| Professional fees | 82,148 | |||

| Distributor fees | 71,267 | |||

| Board of Trustees' fees | 63,085 | |||

| Transfer agent fees | 26,842 | |||

| Miscellaneous expenses | 318,507 | |||

| Total Expenses | 19,561,785 | |||

| Expense offset arrangement | (14,248 | ) | ||

| Net Expenses | 19,547,537 | |||

| Net Investment Income | 94,551,595 | |||

| NET REALIZED AND UNREALIZED LOSS: | ||||

| Net realized loss on investments in securities | (7,150,832 | ) | ||

| Net realized loss on futures contracts | (34,260,541 | ) | ||

| Net realized loss on investments in securities and futures contracts | (41,411,373 | ) | ||

| Net change in unrealized appreciation/(depreciation) on investments | ||||

| in securities | (47,865,541 | ) | ||

| Net change in unrealized appreciation/(depreciation) on | ||||

| futures contracts | 6,872,049 | |||

| Net change in unrealized appreciation/(depreciation) on | ||||

| investments in securities and futures contracts | (40,993,492 | ) | ||

| Net Realized and Unrealized Loss | (82,404,865 | ) | ||

| Net Increase in Net Assets Resulting from Operations | $ | 12,146,730 |

The accompanying notes are an integral part of these financial statements.

| 30 |

| BBH LIMITED DURATION FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the years ended October 31, | ||||||||

| 2015 | 2014 | |||||||

| INCREASE (DECREASE) IN NET ASSETS: | ||||||||

| Operations: | ||||||||

| Net investment income | $ | 94,551,595 | $ | 62,774,496 | ||||

| Net realized loss on investments in securities | ||||||||

| and futures contracts | (41,411,373 | ) | (20,355,575 | ) | ||||

| Net change in unrealized appreciation/(depreciation) | ||||||||

| on investments in securities and futures contracts | (40,993,492 | ) | 13,816,265 | |||||

| Net increase in net assets resulting | ||||||||

| from operations | 12,146,730 | 56,235,186 | ||||||

| Dividends and distributions declared: | ||||||||

| From net investment income: | ||||||||

| Class N | (46,344,802 | ) | (33,449,587 | ) | ||||

| Class I | (47,959,131 | ) | (30,303,899 | ) | ||||

| From net realized gains: | ||||||||

| Class N | — | (7,552,495 | ) | |||||

| Class I | — | (4,638,860 | ) | |||||

| Total dividends and distributions declared | (94,303,933 | ) | (75,944,841 | ) | ||||

| Share transactions: | ||||||||

| Proceeds from sales of shares* | 2,179,033,729 | 3,599,294,308 | ||||||

| Net asset value of shares issued to shareholders for | ||||||||

| reinvestment of dividends and distributions | 92,942,518 | 74,634,169 | ||||||

| Cost of shares redeemed* | (2,651,777,342 | ) | (2,099,546,354 | ) | ||||

| Net increase (decrease) in net assets resulting | ||||||||

| from share transactions | (379,801,095 | ) | 1,574,382,123 | |||||

| Total increase (decrease) in net assets | (461,958,298 | ) | 1,554,672,468 | |||||

| NET ASSETS: | ||||||||

| Beginning of year | 5,172,456,012 | 3,617,783,544 | ||||||

| End of year (including undistributed net investment | ||||||||

| income of $505,783 and $405,409, respectively) | $ | 4,710,497,714 | $ | 5,172,456,012 | ||||

| * | Includes share exchanges. See Note 5 in Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENTS OCTOBER 31, 2015 | 31 |

| BBH LIMITED DURATION FUND |

| FINANCIAL HIGHLIGHTS |

| Selected per share data and ratios for a Class N share outstanding throughout each year. |

| For the years ended October 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Net asset value, beginning of year | $ | 10.31 | $ | 10.35 | $ | 10.44 | $ | 10.34 | $ | 10.46 | ||||||||||

| Income from investment operations: | ||||||||||||||||||||

| Net investment income1 | 0.18 | 0.14 | 0.15 | 0.18 | 0.17 | |||||||||||||||

| Net realized and unrealized gain (loss) | (0.17 | ) | (0.01 | ) | (0.06 | ) | 0.14 | (0.12 | ) | |||||||||||

| Total income from investment operations | 0.01 | 0.13 | 0.09 | 0.32 | 0.05 | |||||||||||||||

| Less dividends and distributions: | ||||||||||||||||||||

| From net investment income | (0.18 | ) | (0.14 | ) | (0.15 | ) | (0.18 | ) | (0.17 | ) | ||||||||||

| From net realized gains | — | (0.03 | ) | (0.03 | ) | (0.04 | ) | — | ||||||||||||

| Total dividends and distributions | (0.18 | ) | (0.17 | ) | (0.18 | ) | (0.22 | ) | (0.17 | ) | ||||||||||

| Short-term redemption fees1 | — | — | — | — | 0.00 | 2 | ||||||||||||||

| Net asset value, end of year | $ | 10.14 | $ | 10.31 | $ | 10.35 | $ | 10.44 | $ | 10.34 | ||||||||||

| Total return | 0.10 | % | 1.32 | % | 0.82 | % | 3.13 | % | 0.52 | % | ||||||||||

| Ratios/Supplemental data: | ||||||||||||||||||||

| Net assets, end of year (in millions) | $ | 2,557 | $ | 2,625 | $ | 2,170 | $ | 1,776 | $ | 1,336 | ||||||||||

| Ratio of expenses to average net assets | ||||||||||||||||||||

| before reductions | 0.48 | % | 0.48 | % | 0.49 | % | 0.50 | % | 0.49 | % | ||||||||||

| Expense offset arrangement | 0.00 | %3 | 0.00 | %3 | 0.00 | %3 | 0.00 | %3 | 0.00 | %3 | ||||||||||

| Ratio of expenses to average net assets | ||||||||||||||||||||

| after reductions | 0.48 | % | 0.48 | % | 0.49 | % | 0.50 | % | 0.49 | % | ||||||||||

| Ratio of net investment income to average | ||||||||||||||||||||

| net assets | 1.75 | % | 1.36 | % | 1.44 | % | 1.75 | % | 1.66 | % | ||||||||||

| Portfolio turnover rate | 46 | % | 35 | % | 48 | % | 38 | % | 28 | % | ||||||||||

| 1 | Calculated using average shares outstanding for the year. |

| 2 | Less than $0.01. |

| 3 | Less than 0.01%. |

The accompanying notes are an integral part of these financial statements.

| 32 |

| BBH LIMITED DURATION FUND |

| FINANCIAL HIGHLIGHTS (continued) |

| Selected per share data and ratios for a Class I share outstanding throughout each year. |

| For the years ended October 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Net asset value, beginning of year | $ | 10.31 | $ | 10.35 | $ | 10.44 | $ | 10.34 | $ | 10.46 | ||||||||||

| Income from investment operations: | ||||||||||||||||||||

| Net investment income1 | 0.20 | 0.16 | 0.17 | 0.20 | 0.19 | |||||||||||||||

| Net realized and unrealized gain (loss) | (0.17 | ) | (0.01 | ) | (0.06 | ) | 0.14 | (0.12 | ) | |||||||||||

| Total income from investment operations | 0.03 | 0.15 | 0.11 | 0.34 | 0.07 | |||||||||||||||

| Less dividends and distributions: | ||||||||||||||||||||

| From net investment income | (0.20 | ) | (0.16 | ) | (0.17 | ) | (0.20 | ) | (0.19 | ) | ||||||||||

| From net realized gains | — | (0.03 | ) | (0.03 | ) | (0.04 | ) | — | ||||||||||||

| Total dividends and distributions | (0.20 | ) | (0.19 | ) | (0.20 | ) | (0.24 | ) | (0.19 | ) | ||||||||||

| Short-term redemption fees1 | — | — | — | — | 0.00 | 2 | ||||||||||||||

| Net asset value, end of year | $ | 10.14 | $ | 10.31 | $ | 10.35 | $ | 10.44 | $ | 10.34 | ||||||||||

| Total return | 0.30 | % | 1.52 | % | 1.01 | % | 3.31 | % | 0.67 | % | ||||||||||