UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21829

BBH TRUST

On behalf of the following series:

BBH Limited Duration Fund

BBH Core Select

BBH Global Core Select

BBH International Equity Fund

(Exact name of registrant as specified in charter)

140 Broadway, New York, NY 10005

(Address of principal executive offices) (Zip Code)

Corporation Services Company

2711 Centerville Road, Suite 400, Wilmington, DE 19808

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 575-1265

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

Item 1. Report to Stockholders.

Annual Report

OCTOBER 31, 2013

BBH Core Select

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| October 31, 2013 |

BBH Core Select (the “Fund” or “Core Select”) rose by 23.78%, net of fees, during its fiscal year ended October 31, 2013. During the same twelve month period, the S&P 500 Index1 (“S&P 500”) returned 27.18%. For the five years ended October 31, 2013, Core Select has returned 15.95% per year while the S&P 500 has increased by 15.17%.

Core Select seeks to provide shareholders with long term growth of capital. Fundamental business analysis and a valuation framework that is based on intrinsic value2 are the key elements underlying each Core Select investment. We look for companies that offer all, or most, of the following business and financial attributes: (i) essential products and services, (ii) loyal customers, (iii) leadership in an attractive market niche or industry, (iv) sustainable competitive advantages, (v) high returns on invested capital, and (vi) strong free cash flow. We believe businesses possessing these traits are favorably positioned to protect and grow capital through varying economic and market environments. In addition, we seek to invest in companies whose managers have high levels of integrity, are excellent operators, and are good capital allocators. Pursuant to our goal of not losing money on any single investment, we explicitly identify key risks outside of company management’s control so that we can fully consider the range of potential outcomes for each business. When a company meets our investment criteria and desired risk profile, we will consider establishing a position if its market price reaches 75% or less of our intrinsic value estimate. We maintain a buy-and-own approach with holding periods often reaching 3-5 years or longer. We will typically sell an investment if it appreciates to a level near our estimate of intrinsic value.

Developed world equity markets performed strongly in fiscal 2013 driven by modest economic expansion, corporate earnings leverage and continued monetary accommodation by central banks. Based on our assessment of macroeconomic trends along with the steady flow of feedback we get from the management teams of our existing and prospective holdings, growth is still being suppressed by cautious behavior on the part of consumers and business decision-makers. In a broad sense, this seems consistent with what could be expected of a post-crisis period, in which de-leveraging and capital rebuilding are still important forces. In spite of this low growth setting, corporate earnings have improved disproportionately thanks to productivity gains, favorable trends on input costs, and very low interest rates. Share repurchases have also added incrementally to corporate earnings on a per-share basis.

| 1 | The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investments cannot be made in an index. |

| 2 | We prepare proprietary financial models for each Core Select company in order to determine an estimate of intrinsic value. Discounted cash flow analysis is the primary quantitative model used in our research process. We supplement our discounted cash flow work with other quantitative analyses, such as economic profit models, internal rate of return models, and free cash flow multiples. |

| 2 |

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2013 |

Despite this reasonably positive set of circumstances, central banks have continued to intervene heavily in financial markets in a concerted attempt to provide additional stimulus for growth, employment, capacity utilization and ‘benign’ inflation. We believe that aggressive monetary actions are significantly influencing the prices of financial assets and that certain equities are now trading at levels that are inconsistent with fundamentals. Accordingly, we are acting with a healthy degree of caution. Our consistent goal is to minimize both business risk and price risk by applying our demanding qualitative criteria and using an intrinsic value framework to maintain a margin of safety in our holdings.

During fiscal 2013, we added two new companies to the Core Select portfolio: Schlumberger, the global leader in providing energy services to exploration and production companies, and Bed, Bath & Beyond, the leading specialty retailer of home furnishings. While quite different in their operations, both of these companies share the common thread of being innovative, competitively advantaged businesses with attractive prospects and a large base of loyal customers. Led by capable and shareholder-oriented management teams, we believe both companies are well positioned to generate solid long-term growth in free cash flow and earn high returns on capital.

We exited several positions in fiscal 2013: Anheuser-Busch InBev, Dell, ADP and the small amount of Liberty Ventures tracking stock that was distributed to us via our position in Liberty Interactive. Anheuser-Busch and ADP were very successful investments for the Fund, having produced strong total returns during the period of our ownership. These companies will remain on our investment ‘wish list’ for potential re-investment at more attractive valuations. While we were pleased that some of the latent value we saw in Dell was realized via the recently completed leveraged buyout, it was clearly a disappointing investment for Core Select, as the heavy pressures from a structurally unattractive PC market were not adequately offset by more positive trends elsewhere in the business.

Our largest positive contributors in fiscal 2013 were Google, Berkshire Hathaway, Comcast, EOG Resources and Novartis. Google’s share price rose by more than 50% during fiscal 2013 driven by consistently strong growth in revenue and earnings along with lessened concern around the tradeoff between price and quantity in the company’s core search-advertising business. Berkshire Hathaway and Comcast, which have both been large positions in Core Select for several years, continued to benefit from strong business execution and favorable sentiment towards high quality, predictable companies that have owner-operator cultures. EOG Resources continued its remarkable run of oil production growth and reserve development and has now become one of the leading independent exploration & production companies in the U.S. Novartis has successfully navigated a recent management transition and has generated solid results despite challenging conditions in certain parts of the global healthcare market.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 3 |

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2013 |

None of the 33 securities we held in Core Select during fiscal year 2013 had a negative contribution to returns. The smallest positive contributions came from Wal-Mart, Target and Southwestern Energy. Our two discount retailers have experienced headwinds related to cautious consumer behavior, price deflation in certain categories, e-commerce competition and challenges relating to international expansion. Despite these pressures, we are confident that their scale advantages, operating improvements and overall consumer value proposition will preserve their important roles in the retail landscape and provide a base for attractive long-term free cash flow growth. Southwestern Energy’s strong financial results and consistent operational excellence have been offset by flattish commodity prices and generally poor investor sentiment toward the natural gas industry. We continue to have a very constructive assessment of Southwestern’s core operations in gas production and transportation, and we believe its New Ventures activities hold some potential for additional upside.

As of October 31, 2013, the Core Select portfolio was trading at roughly 87% of our weighted average intrinsic value estimate. This level is at the high end of the historical range that we have observed, underscoring our view that certain equities are reaching valuation levels that may assume an overly robust outlook. Our elevated cash position in the Fund (13.2% at the fiscal year’s end, including cash equivalents) reflects actions we have taken this year to trim or sell positions that have achieved our intrinsic value estimates, as well as the fact that we have not made many new purchases since most of the companies that meet our qualitative criteria are trading above 75% of our intrinsic value estimates. We do not use cash as a hedge or an expression of a macro-economic perspective. Our distinct preference is to own the equities of high quality businesses at attractive valuations.

The Core Select team remains focused on the consistent application of our investment criteria and valuation discipline. We aspire to buy and own a portfolio of well positioned, cash-generative companies that exhibit both excellent resiliency in the context of challenges and the ability to participate during periods of stronger economic expansion.

| 4 |

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2013 |

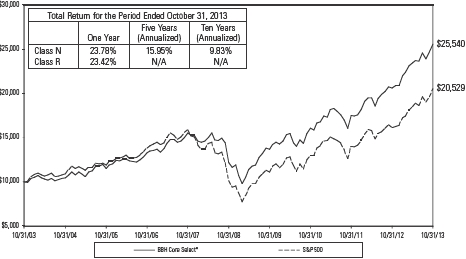

Growth of $10,000 Invested in BBH Core Select

The graph below illustrates the hypothetical investment of $10,0001 in the Class N shares of the Fund over the ten years ended October 31, 2013 as compared to the S&P 500.

* net of fees and expenses

The annualized gross expense ratios as in the February 28, 2013 prospectus for Class N and Retail Class shares were 1.12% and 1.43%, respectively.

Performance data quoted represents no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after tax returns, contact the Fund at 1-800-575-1265.

| 1 | The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500 has been adjusted to reflect reinvestment of dividends on securities. The S&P 500 is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged. Investments cannot be made in an index. |

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 5 |

BBH CORE SELECT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of the BBH Trust and Shareholders of BBH Core Select:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of BBH Core Select (a series of BBH Trust) (the “Fund”) as of October 31, 2013, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting.

Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2013, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of BBH Core Select as of October 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

December 23, 2013

| 6 |

| BBH CORE SELECT | ||||||||

| PORTFOLIO ALLOCATION | ||||||||

| October 31, 2013 | ||||||||

| SECTOR DIVERSIFICATION | ||||||||

| U.S. $ Value | Percent of Net Assets |

|||||||

| Basic Materials | $ | 238,645,607 | 4.0 | % | ||||

| Communications | 857,280,718 | 14.3 | ||||||

| Consumer Cyclical | 468,298,026 | 7.8 | ||||||

| Consumer Non-Cyclical | 1,186,739,329 | 19.7 | ||||||

| Energy | 635,073,229 | 10.6 | ||||||

| Financials | 1,244,027,859 | 20.7 | ||||||

| Industrials | 193,935,999 | 3.2 | ||||||

| Technology | 398,625,910 | 6.6 | ||||||

| Repurchase Agreements | 320,000,000 | 5.3 | ||||||

| U.S. Treasury Bills | 471,914,382 | 7.8 | ||||||

| Liabilities in Excess of Other Assets | (2,418,715 | ) | (0.0 | ) | ||||

| NET ASSETS | $ | 6,012,122,344 | 100.0 | % | ||||

All data as of October 31, 2013. The Fund’s sector diversification is expressed as a percentage of net assets and may vary over time.

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 7 |

| BBH CORE SELECT | ||||||||

| PORTFOLIO OF INVESTMENTS | ||||||||

| October 31, 2013 | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS (86.9%) | ||||||||

| BASIC MATERIALS (4.0%) | ||||||||

| 1,879,457 | Celanese Corp. (Class A) | $ | 105,268,387 | |||||

| 1,069,499 | Praxair, Inc. | 133,377,220 | ||||||

| Total Basic Materials | 238,645,607 | |||||||

| COMMUNICATIONS (14.3%) | ||||||||

| 6,550,911 | Comcast Corp. (Class A) | 311,692,345 | ||||||

| 1,367,531 | eBay, Inc.1 | 72,082,559 | ||||||

| 281,467 | Google, Inc. (Class A)1 | 290,074,261 | ||||||

| 6,803,841 | Liberty Media Corp. (Class A)1 | 183,431,553 | ||||||

| Total Communications | 857,280,718 | |||||||

| CONSUMER CYCLICAL (7.8%) | ||||||||

| 2,211,468 | Bed, Bath & Beyond, Inc.1 | 170,990,705 | ||||||

| 2,995,682 | Target Corp. | 194,090,237 | ||||||

| 1,344,848 | Wal-Mart Stores, Inc. | 103,217,084 | ||||||

| Total Consumer Cyclical | 468,298,026 | |||||||

| CONSUMER NON-CYCLICAL (19.7%) | ||||||||

| 2,956,211 | Baxter International, Inc. | 194,725,619 | ||||||

| 1,652,255 | DENTSPLY International, Inc. | 77,821,210 | ||||||

| 1,196,040 | Diageo, Plc. ADR | 152,602,744 | ||||||

| 564,249 | Henry Schein, Inc.1 | 63,438,515 | ||||||

| 1,258,982 | Johnson & Johnson | 116,594,323 | ||||||

| 3,413,195 | Nestle SA ADR | 247,149,450 | ||||||

| 3,387,124 | Novartis AG ADR | 262,671,466 | ||||||

| 853,086 | PepsiCo, Inc. | 71,736,002 | ||||||

| Total Consumer Non-Cyclical | 1,186,739,329 | |||||||

| ENERGY (10.6%) | ||||||||

| 1,062,870 | EOG Resources, Inc. | 189,616,008 | ||||||

| 1,602,818 | Occidental Petroleum Corp. | 153,998,753 | ||||||

| 1,712,369 | Schlumberger, Ltd. | 160,483,223 | ||||||

| 3,518,948 | Southwestern Energy Co.1 | 130,975,245 | ||||||

| Total Energy | 635,073,229 | |||||||

The accompanying notes are an integral part of these financial statements.

| 8 |

| BBH CORE SELECT | ||||||||

| PORTFOLIO OF INVESTMENTS (continued) | ||||||||

| October 31, 2013 | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS (continued) | ||||||||

| FINANCIALS (20.7%) | ||||||||

| 1,953 | Berkshire Hathaway, Inc. (Class A)1 | $ | 337,858,844 | |||||

| 2,386,288 | Chubb Corp. | 219,729,399 | ||||||

| 6,711,463 | Progressive Corp. | 174,296,694 | ||||||

| 7,285,341 | US Bancorp | 272,180,340 | ||||||

| 5,621,049 | Wells Fargo & Co. | 239,962,582 | ||||||

| Total Financials | 1,244,027,859 | |||||||

| INDUSTRIALS (3.2%) | ||||||||

| 4,454,203 | Waste Management, Inc. | 193,935,999 | ||||||

| Total Industrials | 193,935,999 | |||||||

| TECHNOLOGY (6.6%) | ||||||||

| 5,607,244 | Microsoft Corp. | 198,216,075 | ||||||

| 2,884,840 | QUALCOMM, Inc. | 200,409,835 | ||||||

| Total Technology | 398,625,910 | |||||||

| Total Common Stocks (Identified cost $3,990,457,621) | 5,222,626,677 | |||||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 9 |

| BBH CORE SELECT | ||||||||||||||

| PORTFOLIO OF INVESTMENTS (continued) | ||||||||||||||

| October 31, 2013 | ||||||||||||||

| Principal | Maturity | Interest | ||||||||||||

| Amount | Date | Rate | Value | |||||||||||

| REPURCHASE AGREEMENTS (5.3%) | ||||||||||||||

| $150,000,000 | BNP Paribas SA (Agreement dated | |||||||||||||

| 10/31/13 collateralized by U.S. Treasury | ||||||||||||||

| Bond 0.875%, due 11/30/16, valued at | ||||||||||||||

| $153,000,000) | 11/01/13 | 0.080 | % | $ | 150,000,000 | |||||||||

| 170,000,000 | Deutsche Bank AG (Agreement dated | |||||||||||||

| 10/31/13 collateralized by U.S. Treasury | ||||||||||||||

| Bond 0.750%, due 06/30/17, valued at | ||||||||||||||

| $173,400,000) | 11/01/13 | 0.090 | 170,000,000 | |||||||||||

| Total Repurchase Agreements | ||||||||||||||

| (Identified cost $320,000,000) | 320,000,000 | |||||||||||||

| U.S. TREASURY BILLS (7.8%) | ||||||||||||||

| 150,000,000 | U.S. Treasury Bill2,3 | 01/02/14 | 0.050 | 149,992,950 | ||||||||||

| 322,000,000 | U.S. Treasury Bill2,3 | 04/03/14 | 0.040 | 321,921,432 | ||||||||||

| Total U.S. Treasury Bills | ||||||||||||||

| (Identified cost $471,932,343) | 471,914,382 | |||||||||||||

| TOTAL INVESTMENTS (Identified cost $4,782,389,964)4 | 100.0 | % | $ | 6,014,541,059 | ||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS | (0.0 | )% | (2,418,715 | ) | ||||||||||

| NET ASSETS | 100.0 | % | $ | 6,012,122,344 | ||||||||||

| 1 | Non-income producing security. |

| 2 | Coupon represents a weighted average yield. |

| 3 | Coupon represents a yield to maturity. |

| 4 | The aggregate cost for federal income tax purposes is $4,783,414,285, the aggregate gross unrealized appreciation is $1,232,174,923 and the aggregate gross unrealized depreciation is $1,048,149, resulting in net unrealized appreciation of $1,231,126,774. |

Abbreviations:

ADR – American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

| 10 |

| BBH CORE SELECT |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2013 |

FAIR VALUE MEASUREMENTS

The Fund is required to disclose information regarding the fair value measurements of the Fund’s assets and liabilities. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The disclosure requirement established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including, for example, the risk inherent in a particular valuation technique used to measure fair value, including the model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the Fund’s own considerations about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three levels defined by the fair value hierarchy are as follows:

| — | Level 1 – unadjusted quoted prices in active markets for identical investments. |

| — | Level 2 – significant other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.). |

| — | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs are used in applying the various valuation techniques and broadly refer to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the investment adviser. The investment adviser considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the investment adviser’s perceived risk of that instrument.

Financial assets within level 1 are based on quoted market prices in active markets. The Fund does not adjust the quoted price for these instruments.

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 11 |

| BBH CORE SELECT |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2013 |

Financial instruments that trade in markets that are not considered to be active but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within level 2. These include investment-grade corporate bonds, U.S. Treasury notes and bonds, and certain non-U.S. sovereign obligations and over-the-counter derivatives. As level 2 financial assets include positions that are not traded in active markets and/or are subject to transfer restrictions, valuations may be adjusted to reflect illiquidity and/or non-transferability, which are generally based on available market information.

Financial assets classified within level 3 have significant unobservable inputs, as they trade infrequently. Level 3 financial assets include private equity and certain corporate debt securities. As observable prices are not available for these securities, valuation techniques are used to derive fair value.

Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon the actual sale of those investments.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of October 31, 2013.

| Investments, at value | Unadjusted Quoted Prices in Active Markets for Identical Investments (Level 1)* | Significant Other Observable Inputs (Level 2)* | Significant Unobservable Inputs (Level 3)* | Balance as of October 31, 2013 | ||||||||||||

| Basic Materials | $ | 238,645,607 | $ | — | $ | — | $ | 238,645,607 | ||||||||

| Communications | 857,280,718 | — | — | 857,280,718 | ||||||||||||

| Consumer Cyclical | 468,298,026 | — | — | 468,298,026 | ||||||||||||

| Consumer Non-Cyclical | 1,186,739,329 | — | — | 1,186,739,329 | ||||||||||||

| Energy | 635,073,229 | — | — | 635,073,229 | ||||||||||||

| Financials | 1,244,027,859 | — | — | 1,244,027,859 | ||||||||||||

| Industrials | 193,935,999 | — | — | 193,935,999 | ||||||||||||

| Technology | 398,625,910 | — | — | 398,625,910 | ||||||||||||

| Repurchase Agreements | — | 320,000,000 | — | 320,000,000 | ||||||||||||

| U.S. Treasury Bills | — | 471,914,382 | — | 471,914,382 | ||||||||||||

| Investments, at value | $ | 5,222,626,677 | $ | 791,914,382 | $ | — | $ | 6,014,541,059 | ||||||||

| * | The Fund's policy is to disclose transfers between levels based on valuations at the end of the reporting period. There were no transfers between Levels 1, 2 or 3 as of October 31, 2013, based on the valuation input levels on October 31, 2012. |

The accompanying notes are an integral part of these financial statements.

| 12 |

| BBH CORE SELECT | |

| STATEMENT OF ASSETS AND LIABILITIES | |

| October 31, 2013 | |

| ASSETS: | |

| Investments in securities, at value (Identified cost $4,462,389,964) | $5,694,541,059 |

| Repurchase agreements (Identified cost $320,000,000) | 320,000,000 |

| Cash | 2,289,314 |

| Receivables for: | |

| Investments sold | 6,240,079 |

| Dividends | 3,136,982 |

| Shares sold | 2,354,656 |

| Investment advisory and administrative fees waiver reimbursement | 466,837 |

| Other assets | 26,412 |

| Total Assets | 6,029,055,339 |

| LIABILITIES: | |

| Payables for: | |

| Investments purchased | 8,039,464 |

| Investment advisory and administrative fees | 4,014,566 |

| Shares redeemed | 3,015,362 |

| Shareholder servicing fees | 1,254,552 |

| Distributors fees | 85,559 |

| Custody and fund accounting fees | 54,852 |

| Transfer agent fees | 48,230 |

| Professional fees | 47,200 |

| Board of Trustees’ fees | 1,452 |

| Other liabilities | 371,758 |

| Total Liabilities | 16,932,995 |

| NET ASSETS | $6,012,122,344 |

| Net Assets Consist of: | |

| Paid-in capital | $4,634,466,566 |

| Undistributed net investment income | 22,616,601 |

| Accumulated net realized gain on investments in securities | 122,888,082 |

| Net unrealized appreciation/(depreciation) on investments in securities | 1,232,151,095 |

| Net Assets | $6,012,122,344 |

| NET ASSET VALUE AND OFFERING PRICE PER SHARE | |

| CLASS N SHARES | |

| ($5,644,769,975 ÷ 266,075,054 shares outstanding) | $21.21 |

| RETAIL CLASS SHARES | |

| ($367,352,369 ÷ 26,257,123 shares outstanding) | $13.99 |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 13 |

| BBH CORE SELECT | ||||

| STATEMENT OF OPERATIONS | ||||

| For the Year Ended October 31, 2013 | ||||

| NET INVESTMENT INCOME: | ||||

| Income: | ||||

| Dividends (net of foreign withholding taxes of $2,099,010) | $ | 81,627,775 | ||

| Interest and other income | 349,281 | |||

| Total Income | 81,977,056 | |||

| Expenses: | ||||

| Investment advisory and administrative fees | 39,672,712 | |||

| Shareholder servicing fees | 12,397,722 | |||

| Distributors fees | 928,927 | |||

| Transfer agent fees | 551,739 | |||

| Custody and fund accounting fees | 499,215 | |||

| Board of Trustees’ fees | 96,835 | |||

| Professional fees | 58,315 | |||

| Miscellaneous expenses | 797,781 | |||

| Total Expenses | 55,003,246 | |||

| Investment advisory and administrative fees waiver | (4,551,672 | ) | ||

| Expense offset arrangement | (2,555 | ) | ||

| Net Expenses | 50,449,019 | |||

| Net Investment Income | 31,528,037 | |||

| NET REALIZED AND UNREALIZED GAIN: | ||||

| Net realized gain on investments in securities | 123,026,915 | |||

| Net change in unrealized appreciation/(depreciation) | ||||

| on investments in securities | 889,161,832 | |||

| Net Realized and Unrealized Gain | 1,012,188,747 | |||

| Net Increase in Net Assets Resulting from Operations | $ | 1,043,716,784 | ||

The accompanying notes are an integral part of these financial statements.

| 14 |

| BBH CORE SELECT | ||||||||

| STATEMENTS OF CHANGES IN NET ASSETS | ||||||||

| For the years ended October 31, | ||||||||

| 2013 | 2012 | |||||||

| INCREASE IN NET ASSETS: | ||||||||

| Operations: | ||||||||

| Net investment income | $ | 31,528,037 | $ | 11,697,682 | ||||

| Net realized gain on investments in securities | 123,026,915 | 49,028,320 | ||||||

| Net change in unrealized appreciation/(depreciation) | ||||||||

| on investments in securities | 889,161,832 | 246,390,832 | ||||||

| Net increase in net assets resulting from operations | 1,043,716,784 | 307,116,834 | ||||||

| Dividends and distributions declared: | ||||||||

| From net investment income: | ||||||||

| Class N | (18,092,926 | ) | (4,275,899 | ) | ||||

| Retail Class | (1,134,306 | ) | (1,053,704 | ) | ||||

| From net realized gains: | ||||||||

| Class N | (43,389,167 | ) | (10,156,709 | ) | ||||

| Retail Class | (5,651,933 | ) | (3,114,913 | ) | ||||

| Total dividends and distributions declared | (68,268,332 | ) | (18,601,225 | ) | ||||

| Share transactions: | ||||||||

| Proceeds from sales of shares | 2,402,011,647 | 2,758,236,879 | ||||||

| Net asset value of shares issued to shareholders for | ||||||||

| reinvestment of dividends and distributions | 52,357,695 | 17,905,795 | ||||||

| Proceeds from short-term redemption fees | 34,753 | 62,466 | ||||||

| Cost of shares redeemed | (734,404,450 | ) | (742,113,834 | ) | ||||

| Net increase in net assets resulting from | ||||||||

| share transactions | 1,719,999,645 | 2,034,091,306 | ||||||

| Total increase in net assets | 2,695,448,097 | 2,322,606,915 | ||||||

| NET ASSETS: | ||||||||

| Beginning of year | 3,316,674,247 | 994,067,332 | ||||||

| End of year (including undistributed net investment | ||||||||

| income of $22,616,601 and $10,315,796, respectively) | $ | 6,012,122,344 | $ | 3,316,674,247 | ||||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 15 |

| BBH CORE SELECT |

| FINANCIAL HIGHLIGHTS |

| Selected per share data and ratios for a Class N share outstanding throughout each year. |

| For the years ended October 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Net asset value, beginning of year | $ | 17.46 | $ | 15.07 | $ | 13.91 | $ | 11.93 | $ | 10.71 | ||||||||||

| Income from investment operations: | ||||||||||||||||||||

| Net investment income1 | 0.13 | 0.10 | 0.12 | 0.07 | 0.06 | |||||||||||||||

| Net realized and unrealized gain | 3.95 | 2.54 | 1.15 | 1.96 | 1.25 | |||||||||||||||

| Total income from investment operations | 4.08 | 2.64 | 1.27 | 2.03 | 1.31 | |||||||||||||||

| Less dividends and distributions: | ||||||||||||||||||||

| From net investment income | (0.10 | ) | (0.07 | ) | (0.07 | ) | (0.05 | ) | (0.02 | ) | ||||||||||

| From net realized gains | (0.23 | ) | (0.18 | ) | (0.04 | ) | — | (0.07 | ) | |||||||||||

| Total dividends and distributions | (0.33 | ) | (0.25 | ) | (0.11 | ) | (0.05 | ) | (0.09 | ) | ||||||||||

| Short-term redemption fees2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net asset value, end of year | $ | 21.21 | $ | 17.46 | $ | 15.07 | $ | 13.91 | $ | 11.93 | ||||||||||

| Total return | 23.78 | % | 17.86 | % | 9.19 | % | 17.11 | % | 12.44 | % | ||||||||||

| Ratios/Supplemental data: | ||||||||||||||||||||

| Net assets, end of year (in millions) | $ | 5,645 | $ | 3,049 | $ | 809 | $ | 362 | $ | 237 | ||||||||||

| Ratio of expenses to average net assets | ||||||||||||||||||||

| before reductions | 1.09 | % | 1.12 | % | 1.14 | % | 1.18 | % | 1.21 | % | ||||||||||

| Fee waiver | 0.09 | %3 | 0.12 | %3 | 0.13 | %3 | 0.06 | %3 | — | % | ||||||||||

| Expense offset arrangement | 0.00 | %4 | 0.00 | %4 | 0.01 | % | 0.01 | % | 0.02 | % | ||||||||||

| Ratio of expenses to average net assets | ||||||||||||||||||||

| after reductions | 1.00 | % | 1.00 | % | 1.00 | % | 1.11 | % | 1.19 | % | ||||||||||

| Ratio of net investment income to average | ||||||||||||||||||||

| net assets | 0.65 | % | 0.63 | % | 0.85 | % | 0.55 | % | 0.61 | % | ||||||||||

| Portfolio turnover rate | 12 | % | 14 | % | 17 | % | 19 | % | 15 | % | ||||||||||

| 1 | Calculated using average shares outstanding for the year. |

| 2 | Less than $0.01. |

| 3 | The ratio of expenses to average net assets for the fiscal years ended October 31, 2013, 2012, 2011 and 2010, reflect fees reduced as result of a contractual operating expense limitation of the Fund to 1.00%. The agreement is effective for the period beginning on July 14, 2010 and will terminate on March 1, 2014, unless it is renewed by all parties to the agreement. For the fiscal years ended October 31, 2013, 2012, 2011 and 2010, the waived fees were $3,983,262, $1,853,202, $793,607 and $177,639, respectively. |

| 4 | Less than 0.01%. |

The accompanying notes are an integral part of these financial statements.

| 16 |

| BBH CORE SELECT |

| FINANCIAL HIGHLIGHTS (continued) |

| Selected per share data and ratios for a Retail Class share outstanding throughout each period. |

For the years ended October 31, | For the period from March 25, 2011 (commencement of operations) to October 31, 2011 | |||||||||||

| 2013 | 2012 | |||||||||||

| Net asset value, beginning of year | $ | 11.61 | $ | 10.11 | $ | 10.00 | ||||||

| Income from investment operations: | ||||||||||||

| Net investment income1 | 0.06 | 0.05 | 0.02 | |||||||||

| Net realized and unrealized gain | 2.60 | 1.69 | 0.09 | |||||||||

| Total income from investment operations | 2.66 | 1.74 | 0.11 | |||||||||

| Less dividends and distributions: | ||||||||||||

| From net investment income | (0.05 | ) | (0.06 | ) | — | |||||||

| From net realized gains | (0.23 | ) | (0.18 | ) | — | |||||||

| Total dividends and distributions | (0.28 | ) | (0.24 | ) | — | |||||||

| Short-term redemption fees2 | 0.00 | 0.00 | 0.00 | |||||||||

| Net asset value, end of year | $ | 13.99 | $ | 11.61 | $ | 10.11 | ||||||

| Total return | 23.42 | % | 17.64 | % | 1.10 | % | ||||||

| Ratios/Supplemental data: | ||||||||||||

| Net assets, end of year (in millions) | $ | 367 | $ | 267 | $ | 185 | ||||||

| Ratio of expenses to average net assets | ||||||||||||

| before reductions | 1.42 | % | 1.43 | % | 1.59 | %3 | ||||||

| Fee waiver | 0.17 | %4 | 0.18 | %4 | 0.33 | %3,4 | ||||||

| Expense offset arrangement | 0.00 | %5 | 0.00 | %5 | 0.01 | %3 | ||||||

| Ratio of expenses to average net assets | ||||||||||||

| after reductions | 1.25 | % | 1.25 | % | 1.25 | %3 | ||||||

| Ratio of net investment income to average | ||||||||||||

| net assets | 0.44 | % | 0.50 | % | 0.37 | %3 | ||||||

| Portfolio turnover rate | 12 | % | 14 | % | 17 | %6 | ||||||

| 1 | Calculated using average shares outstanding for the year. |

| 2 | Less than $0.01. |

| 3 | Annualized. |

| 4 | The ratio of expenses to average net assets for fiscal year ended October 31, 2013, 2012 and period ended October 31, 2011, reflect fees reduced as result of a contractual operating expense limitation of the Fund to 1.25%. The agreement is effective for the period beginning on July 14, 2010 and will terminate on March 1, 2014, unless it is renewed by all parties to the agreement. For the fiscal years ended October 31, 2013, 2012 and period ended October 31, 2011, the waived fees were $568,410, $633,118 and $133,178, respectively. |

| 5 | Less than 0.01%. |

| 6 | Represents Fund portfolio turnover for the twelve months ended October 31, 2011. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 17 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS |

| As of and for the year ended October 31, 2013 |

| 1. | Organization. The Fund is a separate, non-diversified series of BBH Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust was originally organized under the laws of the State of Maryland on July 16, 1990 as BBH Fund, Inc. and re-organized as a Delaware statutory trust on June 12, 2007. The Fund commenced operations on November 2, 1998. On February 20, 2001, the Board of Trustees (“Board”) of the Trust reclassified the Fund’s outstanding shares as “Class N”. On October 1, 2010, the Board established a new class of shares designated as “Retail Class”, which commenced operations on March 25, 2011. Neither Class N shares nor Retail Class shares convert to any other share class of the Fund. Effective November 30, 2012, subject to certain exceptions, the Fund closed to new investors. See the Fund’s prospectus for details. As of October 31, 2013, there were five series of the Trust. |

| 2. | Significant Accounting Policies. The Fund’s financial statements are prepared in accordance with Generally Accepted Accounting Principles in the United States of America (“GAAP”). The following summarizes significant accounting policies of the Fund: |

| A. | Valuation of Investments. (1) The value of investments listed on a securities exchange is based on the last sale price on that exchange prior to the time when assets are valued, or in the absence of recorded sales, at the average of readily available closing bid and asked prices on such exchange; (2) securities not traded on an exchange are valued at the average of the quoted bid and asked prices in the over-the counter market; (3) securities or other assets for which market quotations are not readily available are valued at fair value in accordance with procedures established by and under the general supervision and responsibility of the Board; (4) short-term investments, which mature in 60 days or less are valued at amortized cost if their original maturity was 60 days or less, or by amortizing their value on the 61st day prior to maturity, if their original maturity when acquired by the Fund was more than 60 days, unless the use of amortized cost is determined not to represent “fair value” by the Board. |

| B. | Accounting for Investments and Income. Investment transactions are accounted for on the trade date. Realized gains and losses on investment transactions are determined based on the identified cost method. Dividend income and other distributions received from portfolio securities are recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of securities received at ex-date. Distributions received on securities that represent a return of capital or a capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued daily. Investment income is recorded net of any foreign taxes withheld where recovery of such tax is uncertain. |

| 18 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2013 |

| C. | Fund Expenses. Most expenses of the Trust can be directly attributed to a specific fund. Expenses which cannot be directly attributed to a fund are apportioned amongst each fund in the Trust equally. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known. |

| D. | Repurchase Agreements. The Fund may enter into repurchase agreements. Repurchase agreements are transactions in which the Fund buys a security from a dealer or bank and agrees to sell the security back at a mutually agreed upon time and price. The repurchase price normally is in excess of the purchase price, reflecting an agreed upon interest rate. The rate is effective for the period of time that assets of the Fund are invested in the agreement and is not related to the coupon rate on the underlying security. The Fund will enter into repurchase agreements only with banks and other recognized financial institutions, such as securities dealers, deemed creditworthy by the investment adviser. The Fund’s custodian or sub-custodian will take possession of the securities subject to repurchase agreements. The investment adviser, custodian or sub-custodian will monitor the value of the underlying collateral each day to ensure that the value of the security always equals or exceeds the repurchase price. Repurchase agreements are subject to credit risks. Information regarding repurchase agreements held by the Fund is included in the Portfolio of Investments. |

| E. | Federal Income Taxes. It is the Trust’s policy to comply with the requirements of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Accordingly, no federal income tax provision is required. The Fund files a tax return annually using tax accounting methods required under provisions of the Code, which may differ from GAAP, which is the basis on which these financial statements are prepared. Accordingly, the amount of net investment income and net realized gain reported in these financial statements may differ from that reported on the Fund’s tax return, due to certain book-to-tax timing differences such as losses deferred due to “wash sale” transactions and utilization of capital loss carryforwards. These differences result in temporary over-distributions for financial statement purposes and are classified as distributions in excess of accumulated net realized gains or net investment income. These distributions do not constitute a return of capital. Permanent differences are reclassified in the Statement of Assets & Liabilities based upon their tax classification. As such, the character of distributions to shareholders reported in the Financial Highlights table may differ from that reported to shareholders on Form 1099-DIV. |

The Fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (“ASC 740”). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The Fund did not have any unrecognized tax benefits as of October 31, 2013, nor were there any increases or decreases in unrecognized tax benefits for the year then ended. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as an income tax expense in the Statement of Operations. During the year

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 19 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2013 |

ended October 31, 2013, the Fund did not incur any such interest or penalties. The Fund is subject to examination by U.S. federal and state tax authorities for returns filed for the prior three fiscal years. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

| F. | Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, if any, are paid annually and are recorded on the ex-dividend date. Distributions from net capital gains, if any, are generally declared and paid annually and are recorded on the ex-dividend date. The tax character of distributions paid during the fiscal years ended October 31, 2013 and 2012, respectively, were as follows: |

| Distributions paid from: | |||||||||||||||||||||

| Ordinary income | Net long-term capital gain | Total taxable distributions | Tax

return of capital | Total distributions paid | |||||||||||||||||

| 2013: | $ | 19,227,232 | $ | 49,041,100 | $ | 68,268,332 | — | $ | 68,268,332 | ||||||||||||

| 2012: | 6,132,108 | 12,469,117 | 18,601,225 | — | 18,601,225 | ||||||||||||||||

As of October 31, 2013 and 2012, respectively, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Components of accumulated earnings/(deficit): | ||||||||||||||||||||||||||||||

| Undistributed ordinary income |

Undistributed long-term capital gain |

Accumulated earnings |

Accumulated capital and other losses |

Other book/tax temporary differences |

Unrealized appreciation/ (depreciation) |

Total accumulated earnings/ (deficit) |

||||||||||||||||||||||||

| 2013: | $ | 51,311,687 | $ | 95,217,318 | $ | 146,529,005 | — | $ | (1,024,321 | ) | $ | 1,232,151,095 | $ | 1,377,655,779 | ||||||||||||||||

| 2012: | 10,315,796 | 49,024,436 | 59,340,232 | — | — | 342,867,094 | 402,207,326 | |||||||||||||||||||||||

The Fund did not have a net capital loss carry forward at October 31, 2013.

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010, for an unlimited period and they will retain their character as either short-term or long-term capital losses rather than being considered all short-term capital losses.

Total distributions paid may differ from amounts reported in the Statement of Changes in Net Assets because, for tax purposes, dividends are recognized when actually paid.

The differences between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax deferral of losses on wash sales.

| 20 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2013 |

To the extent future capital gains are offset by capital loss carry forwards; such gains will not be distributed.

| G. | Use of Estimates. The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from these estimates. |

| 3. | Recent Accounting Pronouncements. In January 2013, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update (“ASU”) No. 2013-01 “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities.” This update was issued to narrow the broad scope of ASU No. 2011-11 “Disclosures about Offsetting Assets and Liabilities,” which was issued in December 2011. This update requires an entity to disclose both gross and net information for derivatives and other financial instruments that are either offset in the statement of assets and liabilities or subject to an enforceable master netting arrangement or similar agreement. The required disclosures for both pronouncements are effective for annual reporting periods starting from January 1, 2013 and interim periods within those annual periods and apply retrospectively for all periods being reported. Management is assessing the impact of these new disclosure requirements. |

| 4. | Fees and Other Transactions with Affiliates. |

| A. | Investment Advisory and Administrative Fees. Under a combined Investment Advisory and Administrative Services Agreement (“Agreement”) with the Trust, Brown Brothers Harriman & Co. (“BBH”) through a separately identifiable department (“SID” or “Investment Adviser”) provides investment advisory and portfolio management services to the Fund. BBH also provides administrative services to the Fund. The Fund pays a combined fee for investment advisory and administrative services calculated daily and paid monthly at an annual rate equivalent to 0.80% of the Fund’s average daily net assets. For the year ended October 31, 2013, the Fund incurred $39,672,712 under the Agreement. |

| B. | Investment Advisory and Administrative Fee Waivers. Effective July 14, 2010, the Investment Adviser contractually agreed to limit the annual fund operating expenses (excluding interest, taxes, brokerage commissions, other expenditures that are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business and for Retail Class, amounts payable pursuant to any plan adopted in accordance with Rule 12b-1) of Class N and Retail Class to 1.00%. The agreement will terminate on March 1, 2014, unless it is renewed by all parties to the agreement. The agreement may only be terminated during its term with approval of the Fund’s Board of Trustees. For the year ended October 31, 2013, the Investment Adviser waived fees in the amount of $3,983,262 and $568,410 for Class N and Retail Class, respectively. |

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 21 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2013 |

| C. | Shareholder Servicing Fees. The Trust has a shareholder servicing agreement with BBH. BBH receives a fee from the Fund calculated daily and paid monthly at an annual rate of 0.25% of Class N and Retail Class shares’ average daily net assets. For the year ended October 31, 2013, the Fund incurred shareholder servicing fees in the amount of $11,541,014 and $856,708 for Class N and Retail Class, respectively. |

| D. | Distribution (12b-1) Fees. The Fund has adopted a distribution plan pursuant to Rule 12b-1 for Retail Class shares that allows the Fund to pay distribution and other fees for the sale of its shares and for services provided to shareholders. Because these fees are paid out of the Fund’s assets continuously, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. The maximum annual distribution fee for Retail Class shares is 0.25% of the average daily net assets of the Retail Class shares of the Fund. With this agreement, it is anticipated that total operating expenses for Retail Class shares will be 1.25% of the average daily net assets. For the year ended October 31, 2013, Retail Class shares of the Fund incurred $857,805 for Distribution (12b-1) Fees. |

| E. | Custody and Fund Accounting Fees. BBH acts as a custodian and fund accountant and receives custody and fund accounting fees from the Fund calculated daily and incurred monthly. BBH holds all of the Fund’s cash and investments and calculates the Fund’s daily net asset value. The custody fee is an asset and transaction based fee. The fund accounting fee is an asset based fee calculated at 0.04% per annum on the first $100,000,000 of average daily net assets and 0.02% per annum on the next $400,000,000 of average daily net assets and 0.01% per annum on all average daily net assets over $500,000,000. Effective April 1, 2013, the custody and fund accounting fee schedule was revised to reflect reduced rates. The custody fee continues to be an asset and transaction based fee. The fund accounting fee was revised from a tiered fee schedule to a single rate of 0.004% of the Fund’s net asset value. For the year ended October 31, 2013, the Fund incurred $499,215 in custody and fund accounting fees. These fees for the Fund were reduced by $2,555 as a result of an expense offset arrangement with the Fund’s custodian. The credit amount (if any) is disclosed in the Statement of Operations as a reduction to the Fund’s expenses. In the event that the Fund is overdrawn, under the custody agreement with BBH, BBH will make overnight loans to the Fund to cover overdrafts. Pursuant to their agreement, the Fund will pay the Federal Funds overnight investment rate on the day of the overdraft. The total interest incurred by the Fund for the year ended October 31, 2013, was $257. |

| F. | Board of Trustees’ Fees. Each Trustee who is not an “interested person” as defined under the 1940 Act receives an annual fee as well as reimbursement for reasonable out-of-pocket expenses from the Fund. For the year ended October 31, 2013, the Fund incurred $96,835 in non-interested Trustee compensation and reimbursements. |

| 22 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2013 |

| 5. | Investment Transactions. For the year ended October 31, 2013, the cost of purchases and the proceeds of sales of investment securities, other than short-term investments, were $1,701,866,683 and $504,888,772, respectively. |

| 6. | Shares of Beneficial Interest. The Trust is permitted to issue an unlimited number of Class N and Retail Class shares of beneficial interest at no par value. Transactions in Class N and Retail Class shares were as follows: |

| For the year ended October 31, 2013 | For the year ended October 31, 2012 | |||||||||||||||

| Shares | Dollars | Shares | Dollars | |||||||||||||

| Class N | ||||||||||||||||

| Shares sold | 120,400,382 | $ | 2,246,685,881 | 135,774,669 | $ | 2,254,711,799 | ||||||||||

| Shares issued in connection | ||||||||||||||||

| with reinvestments | ||||||||||||||||

| of dividends | 2,639,087 | 45,602,628 | 952,018 | 13,747,144 | ||||||||||||

| Proceeds from short-term | ||||||||||||||||

| redemption fees | NA | 26,513 | NA | 56,066 | ||||||||||||

| Shares redeemed | (31,580,112 | ) | (607,487,761 | ) | (15,812,605 | ) | (252,722,028 | ) | ||||||||

| Net increase | 91,459,357 | $ | 1,684,827,261 | 120,914,082 | $ | 2,015,792,981 | ||||||||||

| Retail Class | ||||||||||||||||

| Shares sold | 12,517,484 | $ | 155,325,766 | 46,672,538 | $ | 503,525,080 | ||||||||||

| Shares issued in connection | ||||||||||||||||

| with reinvestments | ||||||||||||||||

| of dividends | 591,512 | 6,755,067 | 432,292 | 4,158,651 | ||||||||||||

| Proceeds from short-term | ||||||||||||||||

| redemption fees | NA | 8,240 | NA | 6,400 | ||||||||||||

| Shares redeemed | (9,887,218 | ) | (126,916,689 | ) | (42,346,156 | ) | (489,391,806 | ) | ||||||||

| Net increase | 3,221,778 | $ | 35,172,384 | 4,758,674 | $ | 18,298,325 | ||||||||||

| 7. | Principal Risk Factors and Indemnifications. |

| A. | Principal Risk Factors. Investing in the Fund may involve certain risks, as discussed in the Fund’s prospectus, including but not limited to, those described below: |

A shareholder may lose money by investing in the Fund (investment risk). In the normal course of business, the Fund invests in securities and enters into transactions where risks exist due to assumption of large positions in securities of a small number of issuers (non-diversification risk), or

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 23 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2013 |

certain risks associated with investing in foreign securities not present in domestic investments (foreign investment risk). The value of securities held by the Fund may fall due to changing economic, political, regulatory or market conditions, or due to a company’s or issuer’s individual situation (market risk). The Fund is actively managed and the decisions by the Investment Adviser may cause the Fund to incur losses or miss profit opportunities (management risk). Price movements may occur due to factors affecting individual companies, such as the issuance of an unfavorable earnings report, or other events affecting particular industries or the equity markets as a whole (equity securities risk). The Fund’s Shareholders may be adversely impacted by asset allocation decisions made by an investment adviser whose discretionary clients make up a large percentage of the Fund’s shareholders (shareholder concentration risk). The extent of the Fund’s exposure to these risks in respect to these financial assets is included in their value as recorded in the Fund’s Statement of Assets and Liabilities.

Please refer to the Fund’s prospectus for a complete description of the principal risks of investing in the Fund.

| B. | Indemnifications. Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund, and shareholders are indemnified against personal liability for the obligations of the Trust. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote. |

| 8. | Subsequent Events. Management has evaluated events and transactions that have occurred since October 31, 2013 through the date the financial statements were issued and determined that there were none that would require recognition or additional disclosure in the financial statements. |

| 24 |

| BBH CORE SELECT |

| DISCLOSURE OF FUND EXPENSES |

| October 31, 2013 (unaudited) |

EXAMPLE

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested distributions, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution 12b-1 fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2013 to October 31, 2013).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. You may use information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% Hypothetical Example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 25 |

| BBH CORE SELECT |

| DISCLOSURE OF FUND EXPENSES (continued) |

| October 31, 2013 (unaudited) |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value May 1, 2013 | Ending Account Value October 31, 2013 | Expenses Paid During Period May 1, 2013 to October 31, 20131 | ||||||||||

| Class N | ||||||||||||

| Actual | $ | 1,000 | $ | 1,089 | $ | 5.26 | ||||||

| Hypothetical2 | $ | 1,000 | $ | 1,020 | $ | 5.09 | ||||||

| Expenses Paid | ||||||||||||

| Beginning | Ending | During Period | ||||||||||

| Account Value | Account Value | May 1, 2013 to | ||||||||||

| May 1, 2013 | October 31, 2013 | October 31, 20131 | ||||||||||

| Retail Class | ||||||||||||

| Actual | $ | 1,000 | $ | 1,088 | $ | 6.58 | ||||||

| Hypothetical2 | $ | 1,000 | $ | 1,019 | $ | 6.36 | ||||||

| 1 | Expenses are equal to the Fund’s annualized expense ratio of 1.00% and 1.25% for Class N and Retail Class shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| 2 | Assumes a return of 5% before expenses. For the purposes of the calculation, the applicable annualized expenses ratio for each class of shares is subtracted from the assumed return before expenses. |

| 26 |

| BBH CORE SELECT |

| CONFLICTS OF INTEREST |

| October 31, 2013 (unaudited) |

Conflicts of Interest

Certain conflicts of interest may arise in connection with a portfolio manager’s management of the Fund’s investments, on the one hand, and the investments of other accounts for which the portfolio manager is responsible, on the other. For example, it is possible that the various accounts managed could have different investment strategies that, at times, might conflict with one another to the possible detriment of the Fund. Alternatively, to the extent that the same investment opportunities might be desirable for more than one account, possible conflicts could arise in determining how to allocate them, For example, BBH may act as adviser to private funds with investment strategies similar to the Fund. Those private funds may pay BBH a performance fee in addition to the stated investment advisory fee. In such cases, BBH may have an incentive to allocate certain investment opportunities to the private fund rather than the Fund in order to increase the private fund’s performance and thus improve BBH’s chances of receiving the performance fee. However, BBH has implemented policies and procedures to assure that investment opportunities are allocated equitably between the Fund and other funds and accounts with similar investment strategies.

Other potential conflicts might include conflicts between the Fund and its affiliated and unaffiliated service providers (e.g. conflicting duties of loyalty). In addition to providing investment management services through the SID, BBH provides administrative, custody, shareholder servicing and fund accounting services to the Fund. BBH may have conflicting duties of loyalty while servicing the Fund and/or opportunities to further its own interest to the detriment of the Fund. For example, in negotiating fee arrangements with affiliated service providers, BBH may have an incentive to agree to higher fees than it would in the case of unaffiliated providers. Also, because its advisory fees are calculated by reference to a Fund’s net assets, the Investment Adviser and its affiliates may have an incentive to seek to overvalue certain assets.

Purchases and sales of securities for the Fund may be aggregated with orders for other BBH client accounts. BBH however is not required to aggregate orders if portfolio management decisions for different accounts are made separately, or if they determine that aggregating is not practicable, required or with cases involving client direction.

Prevailing trading activity frequently may make impossible the receipt of the same price or execution on the entire volume of securities purchased or sold. When this occurs, the various prices may be averaged, and the Fund will be charged or credited with the average price. Thus, the effect of the aggregation may operate on some occasions to the disadvantage of the Fund. In addition, under certain circumstances, the Fund will not be charged the same commission or commission equivalent rates in connection with an aggregated order.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 27 |

| BBH CORE SELECT |

| CONFLICTS OF INTEREST (continued) |

| October 31, 2013 (unaudited) |

The Investment Adviser may direct brokerage transactions and/or payment of a portion of client commissions (“soft dollars”) to specific brokers or dealers or other providers to pay for research or other appropriate services which provide, in the Investment Adviser’s view, appropriate assistance to the Investment Adviser in the investment decision-making process (including with respect to futures, fixed-price offerings and over-the-counter transactions). The use of a broker that provides research and securities transaction services may result in a higher commission than that offered by a broker who does not provide such services. The Investment Adviser will determine in good faith whether the amount of commission is reasonable in relation to the value of research and services provided and whether the services provide lawful and appropriate assistance in its investment decision-making responsibilities.

Research or other services obtained in this manner may be used in servicing any or all of the Funds and other BBH client accounts, including in connection with BBH client accounts that do not pay commissions to the broker related to the research or other service arrangements. Such products and services may disproportionately benefit other BBH client accounts relative to the Fund based on the amount of brokerage commissions paid by the Fund and such other BBH client accounts. For example, research or other services that are paid for through one client’s commissions may not be used in managing that client’s account. In addition, other BBH client accounts may receive the benefit, including disproportionate benefits, of economies of scale or price discounts in connection with products and services that may be provided to the Fund and to such other BBH client accounts. To the extent that BBH uses soft dollars, it will not have to pay for those products and services itself.

BBH may receive research that is bundled with the trade execution, clearing, and/or settlement services provided by a particular broker-dealer. To the extent that BBH receives research on this basis, many of the same conflicts related to traditional soft dollars may exist. For example, the research effectively will be paid by client commissions that also will be used to pay for the execution, clearing, and settlement services provided by the broker-dealer and will not be paid by BBH.

BBH may endeavor to execute trades through brokers who, pursuant to such arrangements, provide research or other services in order to ensure the continued receipt of research or other services BBH believes are useful in its investment decision-making process. BBH may from time to time choose not to engage in the above described arrangements to varying degrees. BBH may also enter into commission sharing arrangements under which BBH may execute transactions through a broker-dealer, and request that the broker-dealer allocate a portion of the commissions or commission credits to another firm that provides research to BBH. To the extent that BBH engages in commission sharing arrangements, many of the same conflicts related to traditional soft dollars may exist.

| 28 |

| BBH CORE SELECT |

| CONFLICTS OF INTEREST (continued) |

| October 31, 2013 (unaudited) |

Arrangements regarding compensation and delegation of responsibility may create conflicts relating to selection of brokers or dealers to execute Fund portfolio trades and/or specific uses of commissions from Fund portfolio trades, administration of investment advice and valuation of securities.

From time to time BBH may invest a portion of the assets of its discretionary investment advisory clients in the Fund. That investment by BBH on behalf of its discretionary investment advisory clients in the Fund may be significant at times. Increasing the Fund’s assets may enhance investment flexibility and diversification and may contribute to economies of scale that tend to reduce the Fund’s expense ratio. BBH reserves the right to redeem at any time some or all of the shares of the Fund acquired for its discretionary investment advisory clients’ accounts. A large redemption of shares of the Fund by BBH on behalf of its discretionary investment advisory clients could significantly reduce the asset size of the Fund, which might have an adverse effect on the Fund’s investment flexibility, portfolio diversification and expense ratio.

BBH may enter into advisory and/or referral arrangements with third parties. Such arrangements may include compensation paid by BBH to the third party. BBH may pay a solicitation fee for referrals and/or advisory or incentive fees. BBH may benefit from increased amounts of assets under management.

When market quotations are not readily available or are believed by BBH to be unreliable, the Fund’s investments may be valued at fair value by BBH pursuant to procedures adopted by the Fund’s Board of Trustees. When determining an asset’s “fair value,” BBH seeks to determine the price that a Fund might reasonably expect to receive from the current sale of that asset in an arm’s-length transaction. The price generally may not be determined based on what the Fund might reasonably expect to receive for selling an asset at a later time or if it holds the asset to maturity. While fair value determinations will be based upon all available factors that BBH deems relevant at the time of the determination, and may be based on analytical values determined by BBH using proprietary or third party valuation models, fair value represents only a good faith approximation of the value of a security. The fair value of one or more securities may not, in retrospect, be the price at which those assets could have been sold during the period in which the particular fair values were used in determining the Fund’s net asset value. As a result, the Fund’s sale or redemption of its shares at net asset value, at a time when a holding or holdings are valued by BBH (pursuant to Board-adopted procedures) at fair value, may have the effect of diluting or increasing the economic interest of existing shareholders.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 29 |

| BBH CORE SELECT |

| CONFLICTS OF INTEREST (continued) |

| October 31, 2013 (unaudited) |

BBH, including the Investment Adviser, seeks to meet its fiduciary obligation with respect to all clients including the Fund. BBH has adopted and implemented policies and procedures that seek to manage conflicts. The Investment Adviser monitors a variety of areas, including compliance with fund investment guidelines, review of allocation decisions, the investment in only those securities that have been approved for purchase by an oversight committee, and compliance with the Investment Adviser’s Code of Ethics. With respect to the allocation of investment opportunities, BBH has adopted and implemented policies designed to achieve fair and equitable allocation of investment opportunities among its clients over time. BBH has structured the portfolio managers’ compensation in a manner it believes is reasonably designed to safeguard the Fund from being negatively affected as a result of any such potential conflicts.

The Trust also manages these conflicts. For example, the Trust has designated a chief compliance officer and has adopted and implemented policies and procedures designed to manage the conflicts identified above and other conflicts that may arise in the course of the Fund’s operations in such a way as to safeguard the Fund from being negatively affected as a result of any such potential conflicts. The Trustees receive regular reports from the Investment Adviser and the Trust’s chief compliance officer on areas of potential conflict.

| 30 |

| BBH CORE SELECT |

| ADDITIONAL FEDERAL TAX INFORMATION |

| October 31, 2013 (unaudited) |

BBH Core Select (the “Fund”) hereby designates $49,041,100 as an approximate amount of capital gain dividend for the purpose of dividends paid deduction.

Under Section 854(b)(2) of the Internal Revenue Code (the “Code”), the Fund designates up to a maximum of $19,227,232 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended October 31, 2013. In January 2014, shareholders will receive Form 1099-DIV, which will include their share of qualified dividends distributed during the calendar year 2013. Shareholders are advised to check with their tax advisers for information on the treatment of these amounts on their individual income tax returns.

100% of the ordinary income dividends paid by the Fund during the year ended October 31, 2013 qualifies for the dividends received deduction available to corporate shareholders.

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 31 |

| TRUSTEES AND OFFICERS OF BBH CORE SELECT |

| (unaudited) |

Information pertaining to the Trustees of the BBH Trust (the “Trust”) and executive officers of the Trust is set forth below. The Statement of Additional Information for the BBH Core Select includes additional information about the Fund’s Trustees and is available upon request without charge by contacting the Fund at 1-800-575-1265.

| Name and Birth Date |

Position(s) Held with the Trust |

Term of Office# and Length of Time Served |

Principal

Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen By Trustee^ |

Other Directorships Held by Trustee During Past 5 Years |

| Independent Trustees | |||||

Joseph V. Shields Jr. Birth Date: |

Chairman of the Board and Trustee |

Since 2007 1990-2007 with the Predecessor Trust |

Managing Director and Chairman of Wellington Shields & Co. LLC (member of New York Stock Exchange (“NYSE”)). |

5 | Chairman of Capital Management Associates, Inc. (registered investment adviser); Director of Flowers Foods, Inc. (NYSE listed company). |

David P. Feldman Birth Date: |

Trustee | Since 2007 1990-2007 with the Predecessor Trust |

Retired. | 5 | Director of Dreyfus Mutual Funds (59 Funds). |

Arthur D. Birth Date: |

Trustee | Since 2007 1992-2007 with the Predecessor Trust |

Retired. | 5 | None. |

H. Whitney Wagner Birth Date: |

Trustee | Since 2007 2006-2007 with the Predecessor Trust |

President, Clear Brook Advisors, a registered investment advisor. |

5 | None. |

Andrew S. Frazier Birth Date: |

Trustee | Since 2010 | Consultant to Western World Insurance Group, Inc. (“WWIG”) (January 2010 to January 2012) CEO of WWIG (1992-2009). |

5 | Director of WWIG. |

| 32 |

| TRUSTEES AND OFFICERS OF BBH CORE SELECT | |||||

| (unaudited) | |||||

| Name, Birth Date and Address |

Position(s) Held with Trust |

Term of Office# and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee^ |

Other Directorships Held by Trustee During Past 5 Years |

Mark M. Collins Birth Date: |

Trustee | Since 2011 | Partner of Brown Investment Advisory Incorporated, a registered investment advisor. |

5 | Chairman of Dillon Trust Company; Chairman of Keswick Management; Director of Domaine Clarence Dillon, Bordeaux, France; and Director of Pinnacle Care International. |

| Interested Trustees | |||||

Susan C. Livingston+ Birth Date: 50 Post Office Square |

Trustee | Since 2011 | Partner (since 1998) and Senior Client Advocate (since 2010) for BBH&Co., Director of BBH Luxembourg S.C.A. (since 1992); Director of BBH Trust Company (Cayman) Ltd. (2007 to April 2011); and BBH Investor Services (London) Ltd (2001 to April 2011). |

5 | None. |

John A. Gehret+ 140 Broadway Birth Date: |

Trustee | Since 2011 | Limited Partner of BBH&Co. (2012-present); Partner of BBH&Co. (1998 to 2011); President and Principal Executive Officer of the Trust (2008-2011). |

5 | None. |

| FINANCIAL STATEMENT OCTOBER 31, 2013 | 33 |

| TRUSTEES AND OFFICERS OF BBH CORE SELECT | |||

| (unaudited) | |||

| OFFICERS | |||

| Name, Birth

Date and Address |

Position(s) Held with the Trust |

Term

of Office# and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Radford W. Klotz 140 Broadway Birth Date: |

President and Principal Executive Officer |